-

Configure Bank Accounts

-

Configure Bank Accounts

- Create a bank

- Create a new bank account

- Configure Bank account Journal

-

Budget Management

-

Budget Management

- Install Budget Management app

- User access rights

-

Create the tools for managing budget

- Analytic Account

- Budgetary Positions

-

Budget Management

- Create budget

- Budget Analysis

-

Closing a fiscal year in iSuite

- Closing a fiscal year in iSuite

-

Creating Default Analytic Account

-

Creating Default Analytic Account

- Analytic Defaults Rules Configuration

- Use the Analytic Default Rules

-

Asset liquidation

-

Asset liquidation

- Case 1: Liquidize depreciating asset

- Case 2: Liquidize depreciated Asset

-

Steps to import opening balance

-

Steps to import opening balance

-

Data preparation

- Configure basic accounting information

- Prepare compatible input data for iSuite data structure

-

Import opening balance

- Import opening balance in Chart of Accounts

- Import data in bulk

- Adjust opening journal entry data

- Title

-

Process of customer invoicing, payment and reconciliation

-

Process of customer invoicing, payment and reconciliation

- Configure invoicing policies

- Create a draft invoice

- Confirm an invoice

- Send invoices to customer

- Payments

-

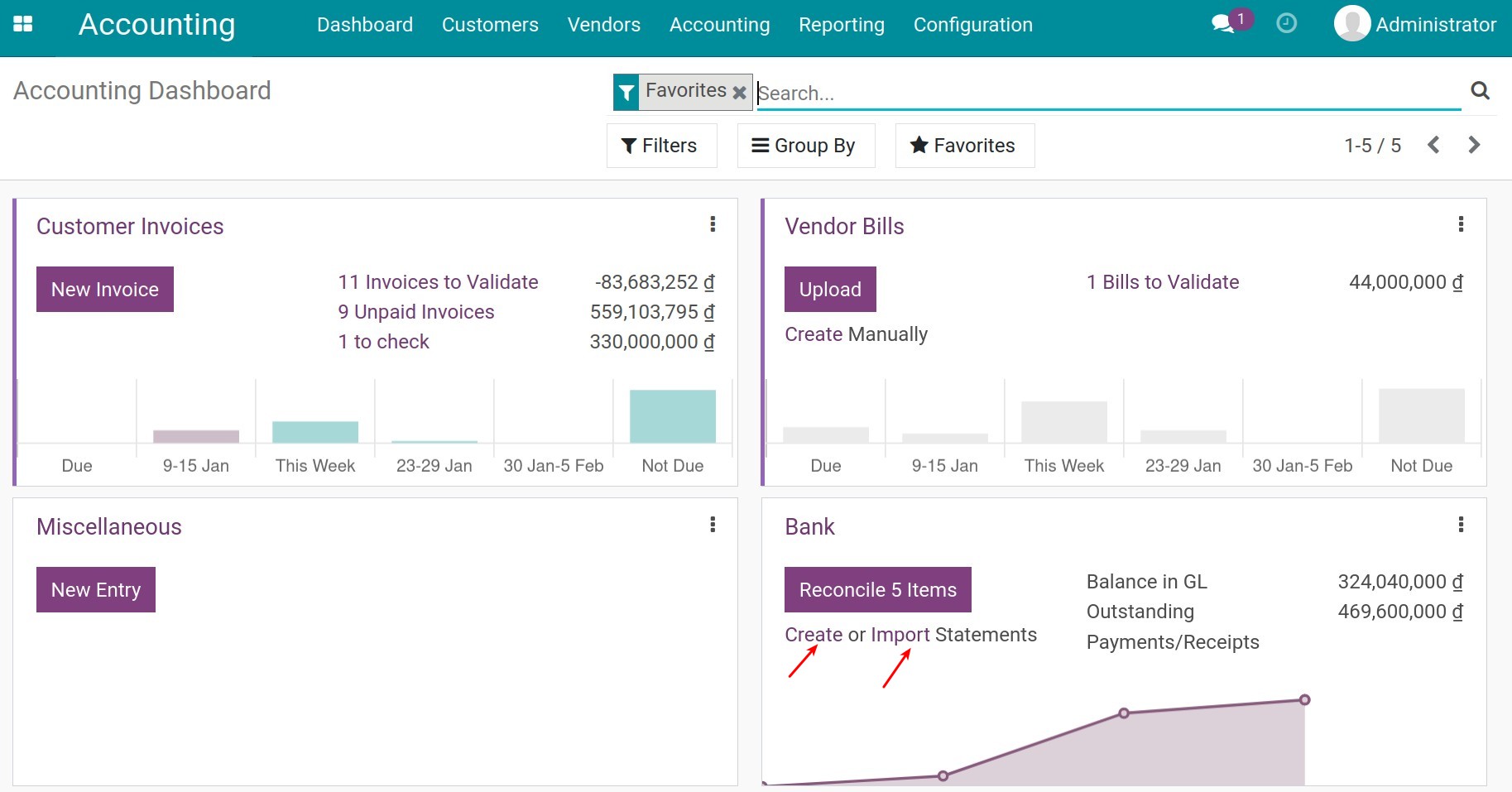

Register bank statement & payment reconciliation

- Register bank statement

- Payment Reconciliation

- Keep track of a payment

- Reporting

-

Set up Payment Service Providers in Viindoo

-

Set up Payment Service Providers in iSuite

-

Introduction

- Bank transfer

- Payment via Payment acquirers

- Payment acquirer configuration

-

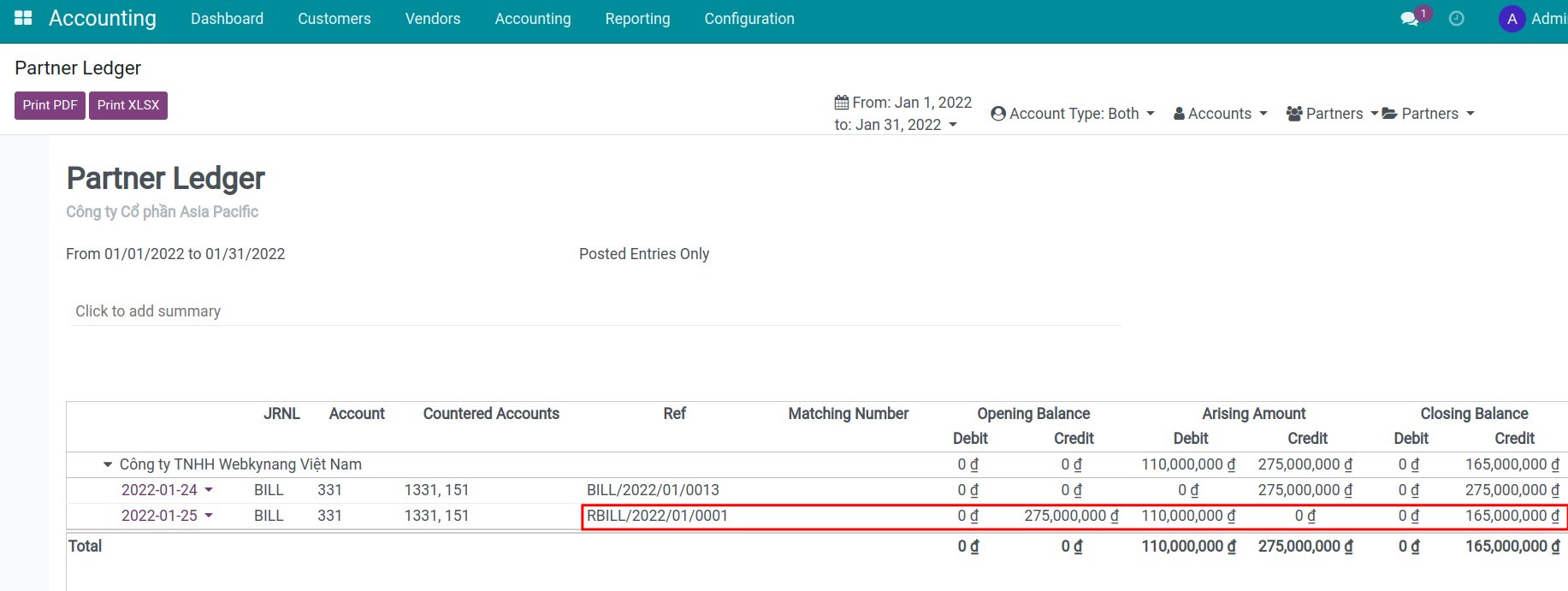

Accounting reports available in iSuite

-

Accounting reports available in iSuite

- General characteristics of the reports

-

General reports in iSuite

- Balance Sheet

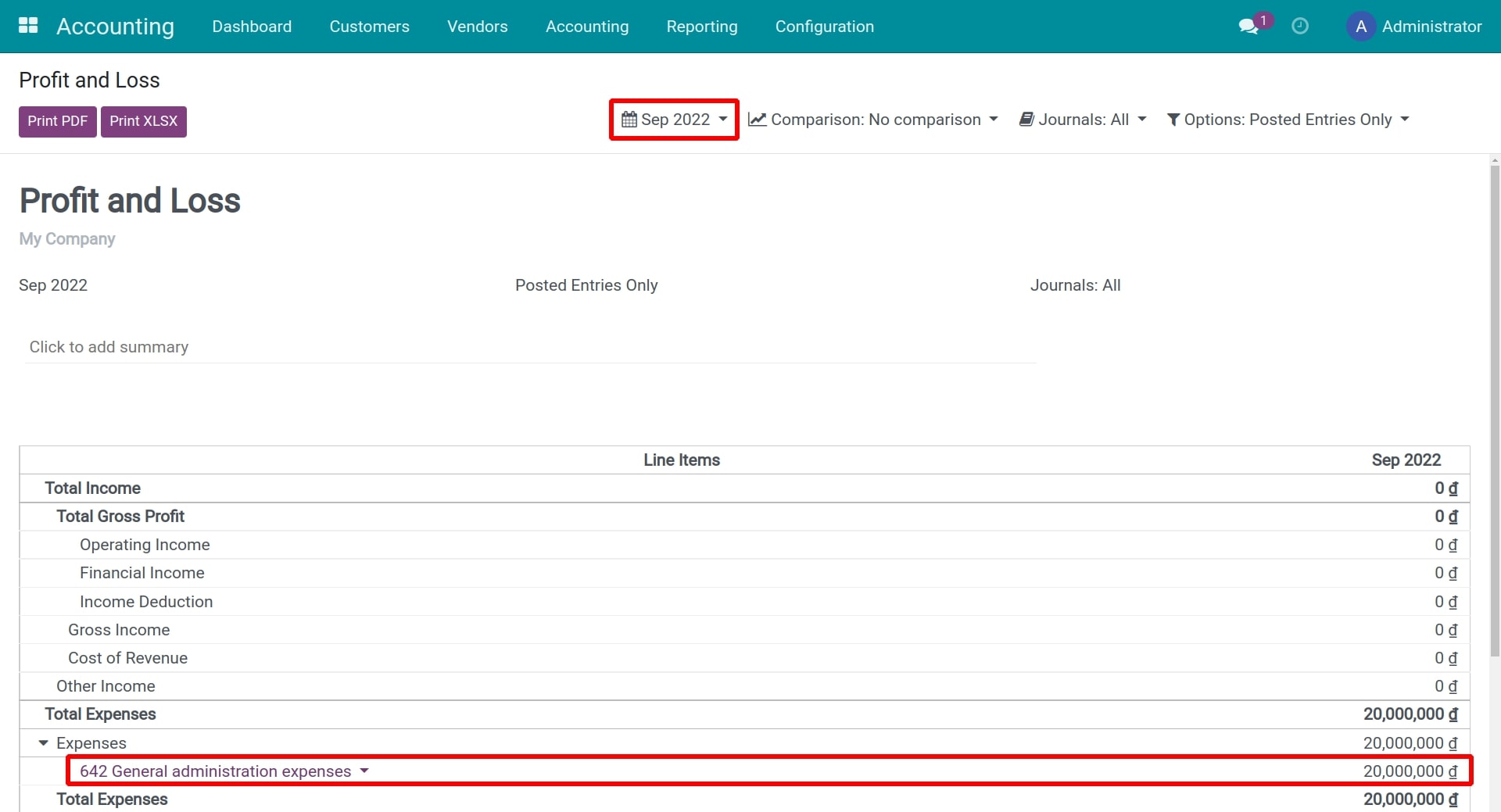

- Profit and Loss

- Cash Flow Statement

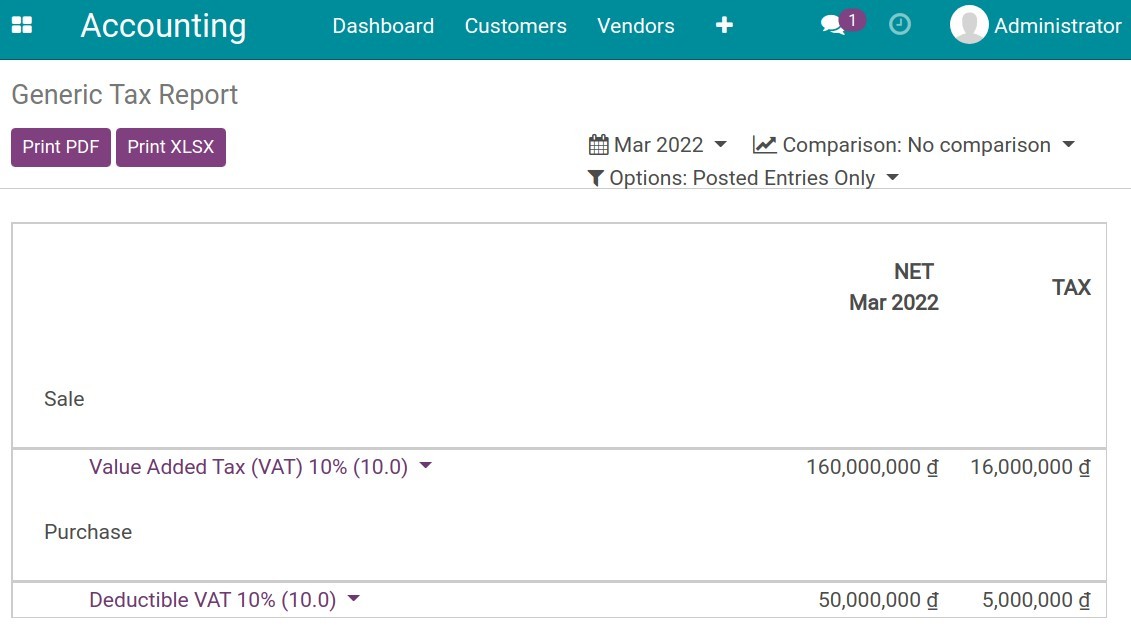

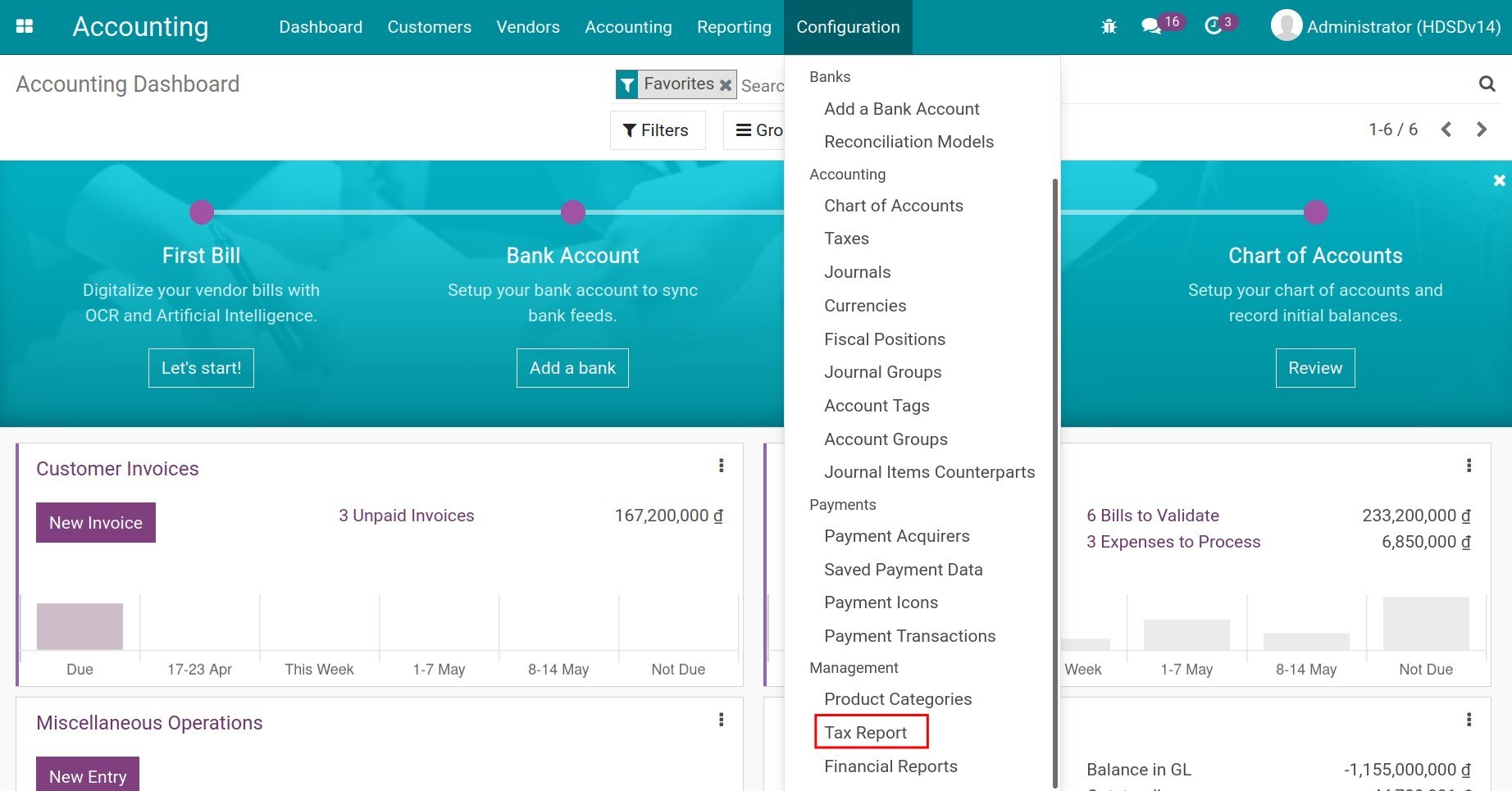

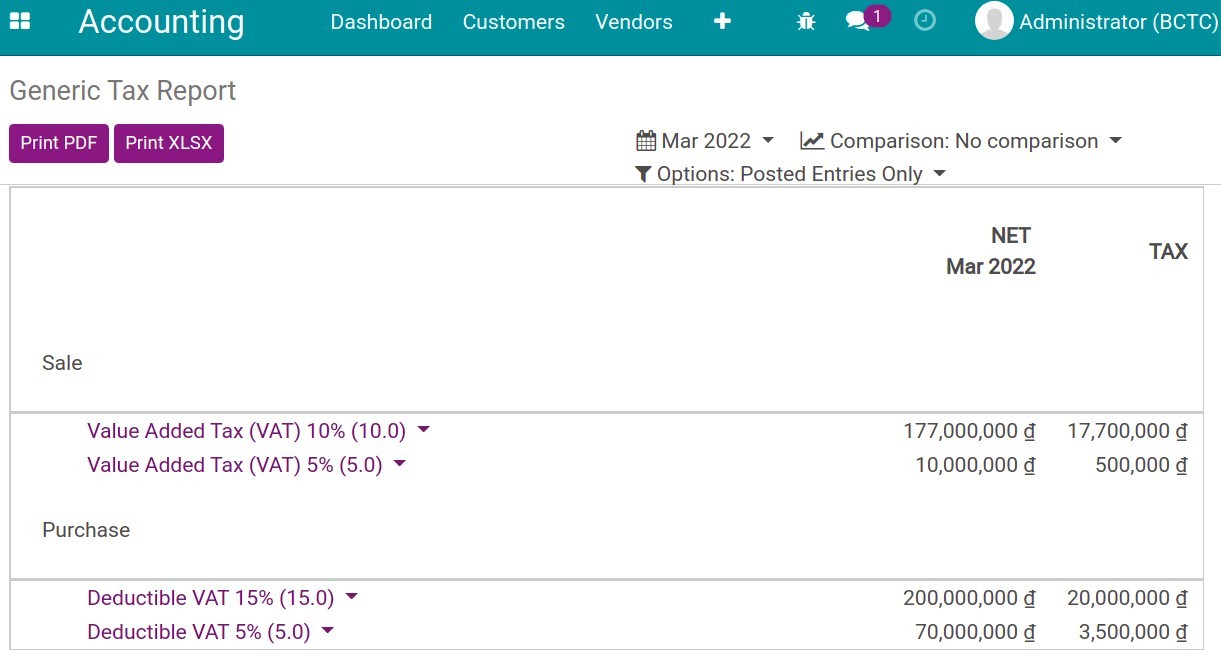

- Tax Report

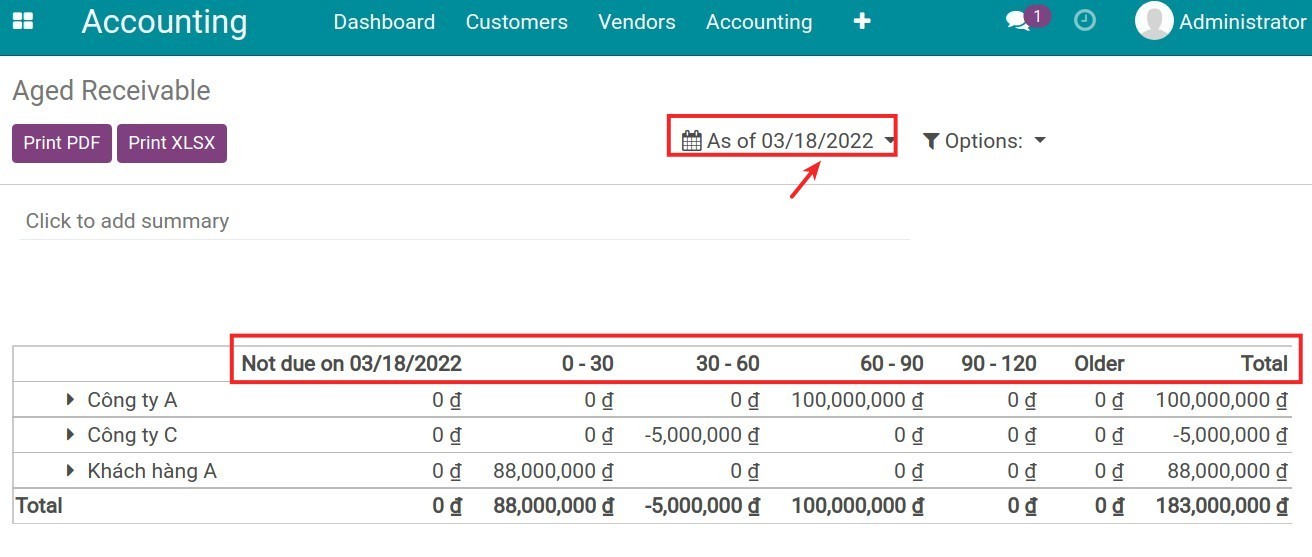

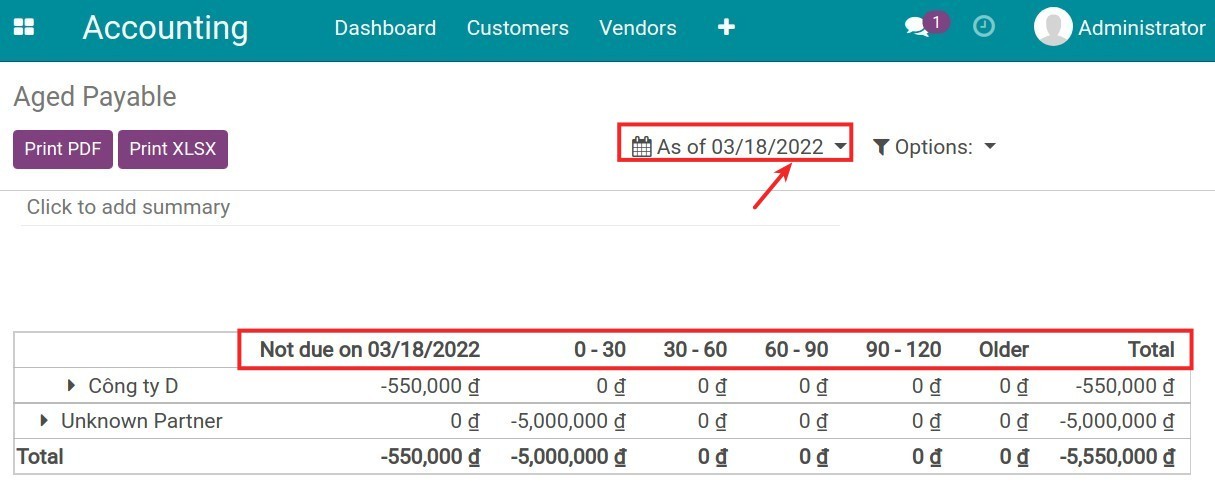

- Aged Payable/Receivable reports

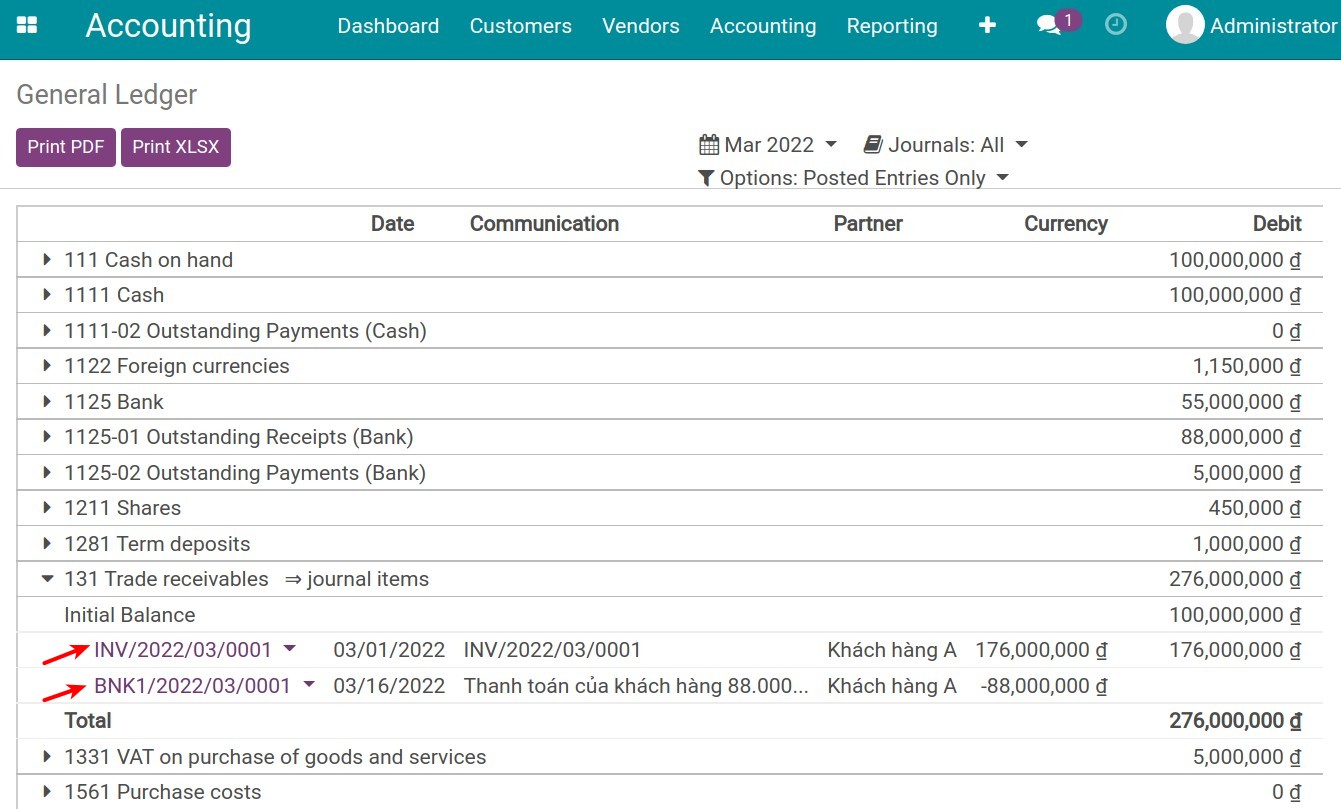

- General Ledger

-

Cash on hand management

-

Cash on hand management

- Cash statement creation

- Cash on hand Counting

- Cash receipts/payments reconciliation

-

Cases occurring when counting cash on hand

- Counting of excess funds

- Counting of shortage of funds

- The difference between the starting balance of this period and the ending balance of the previous period

- How to handle Petty Cash in Odoo

- How to delete an invoice that has already used a sequence

-

Configure charts of accounts and depreciation method for Assets Category

-

Configure Asset Category

- Asset Category

- Accounting

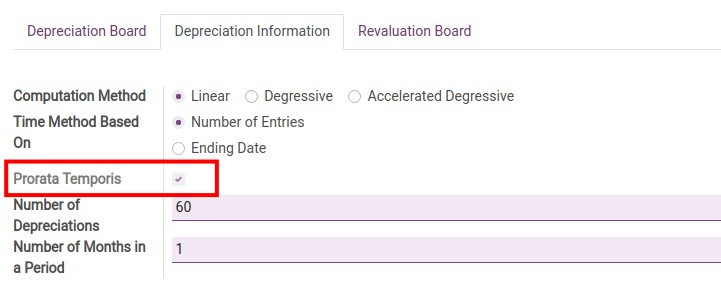

- Periodicity

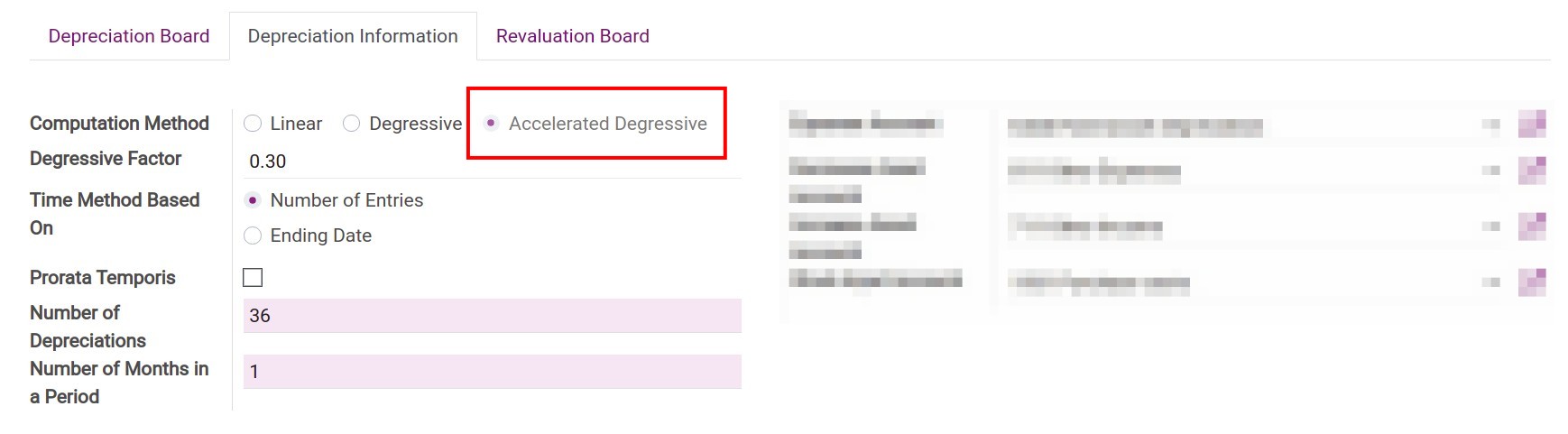

- Depreciation Methods

- Additional Options

-

Visual Accounting Analysis (with Pivot and Graph)

-

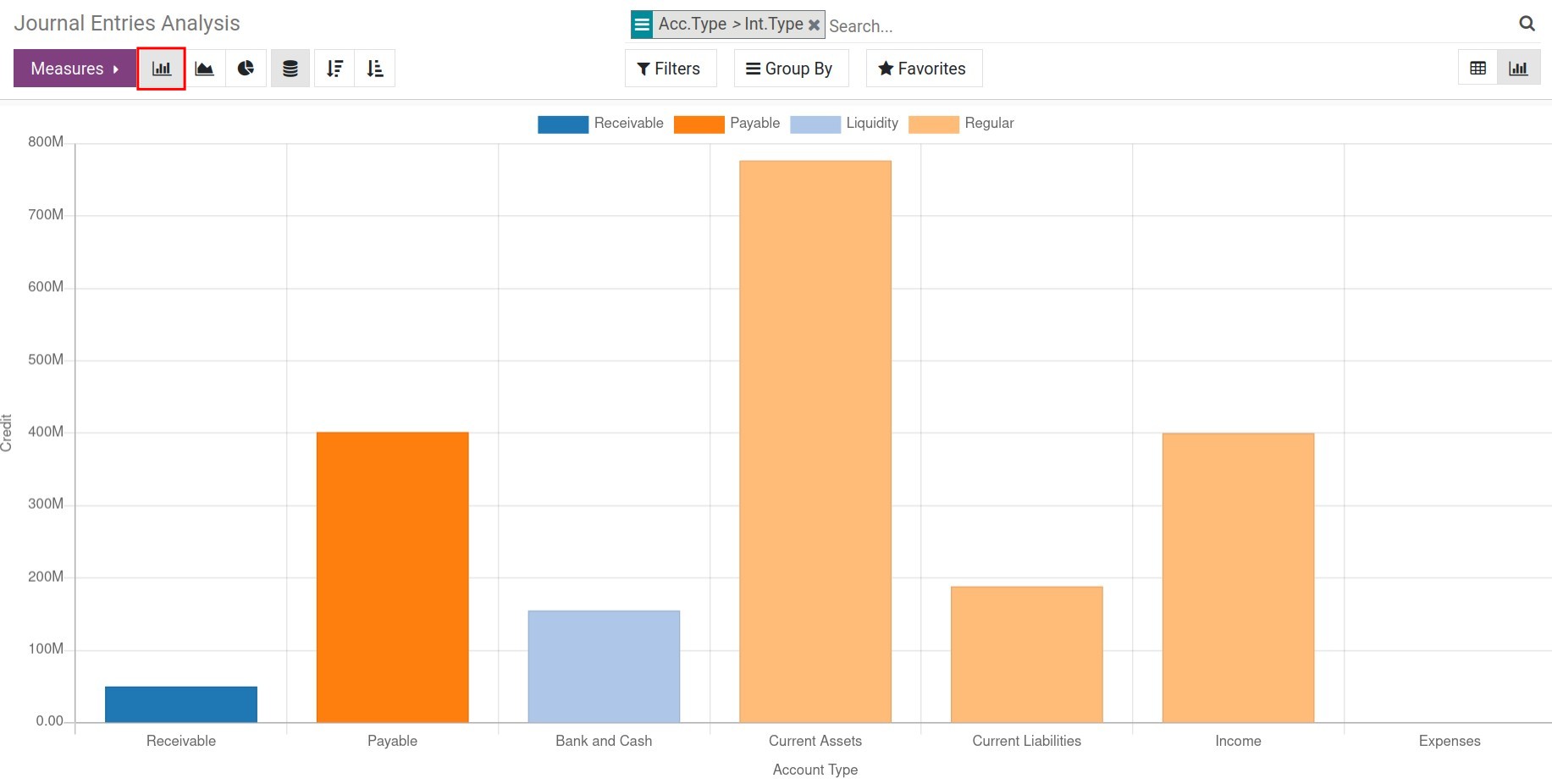

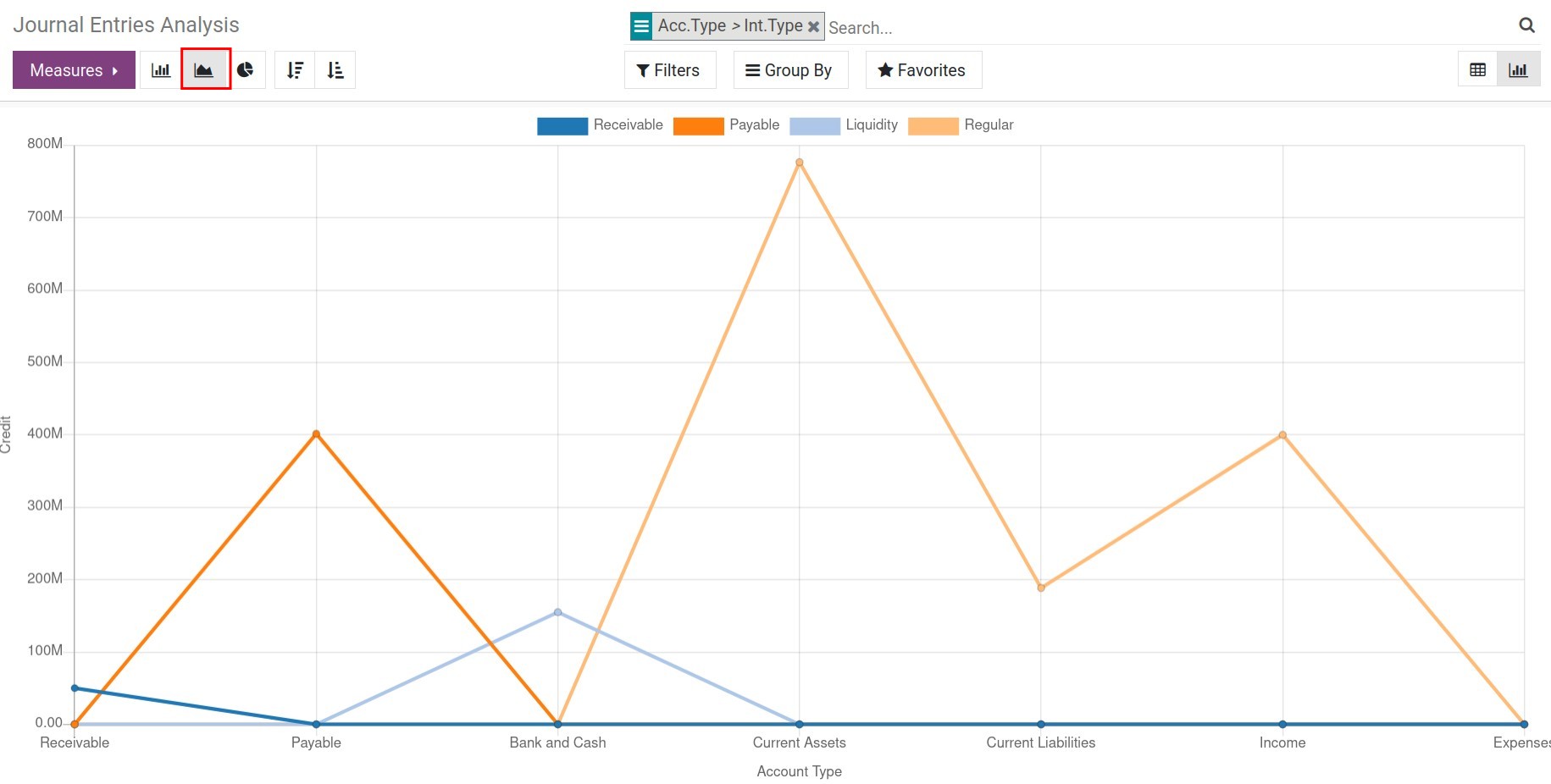

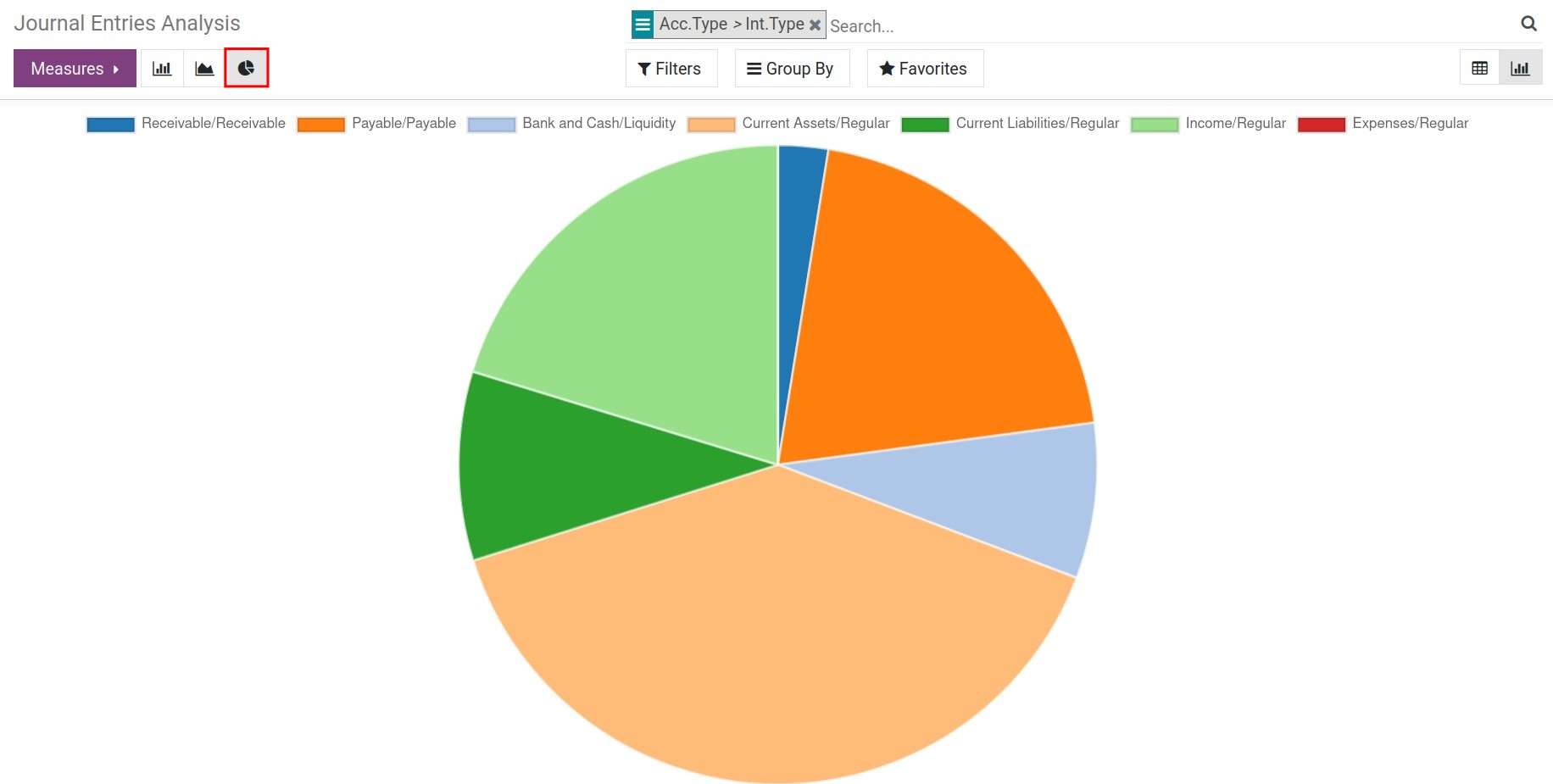

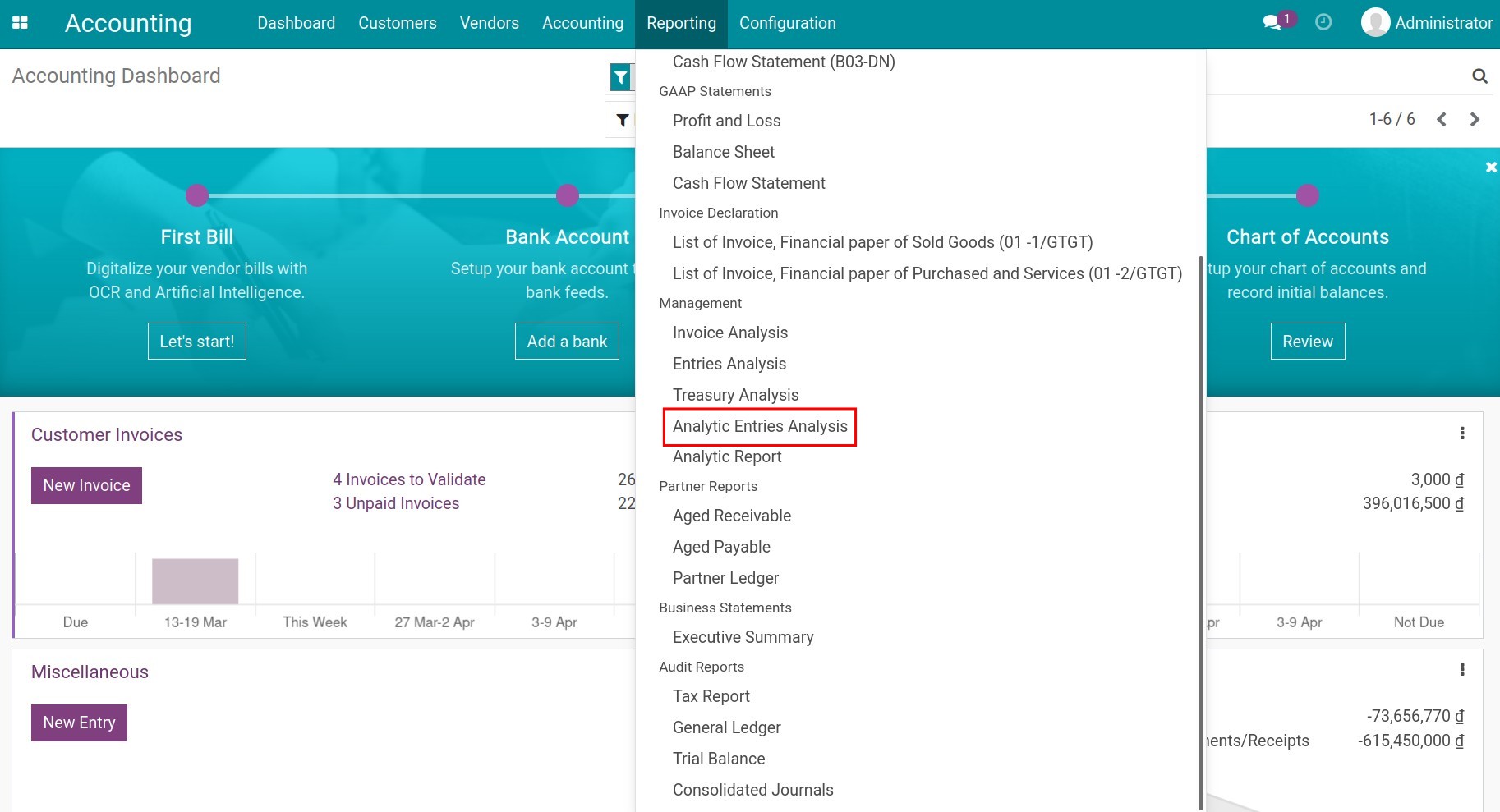

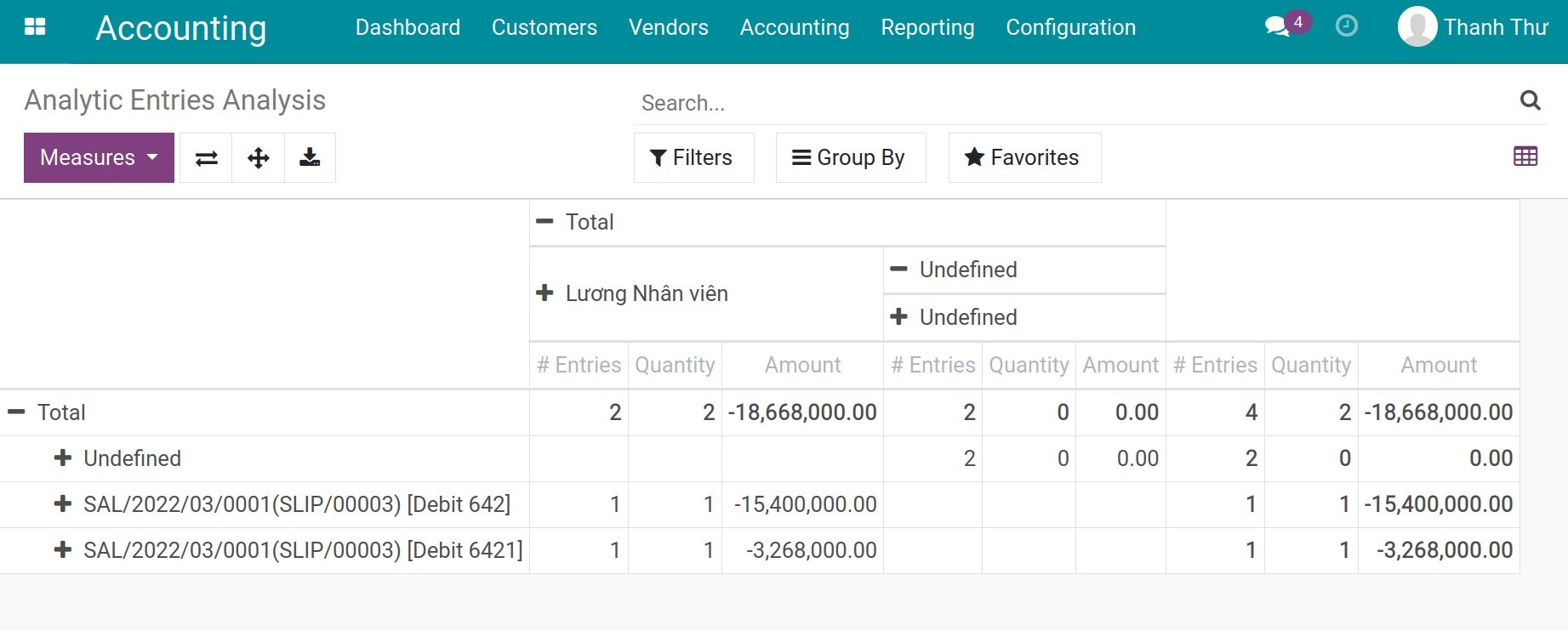

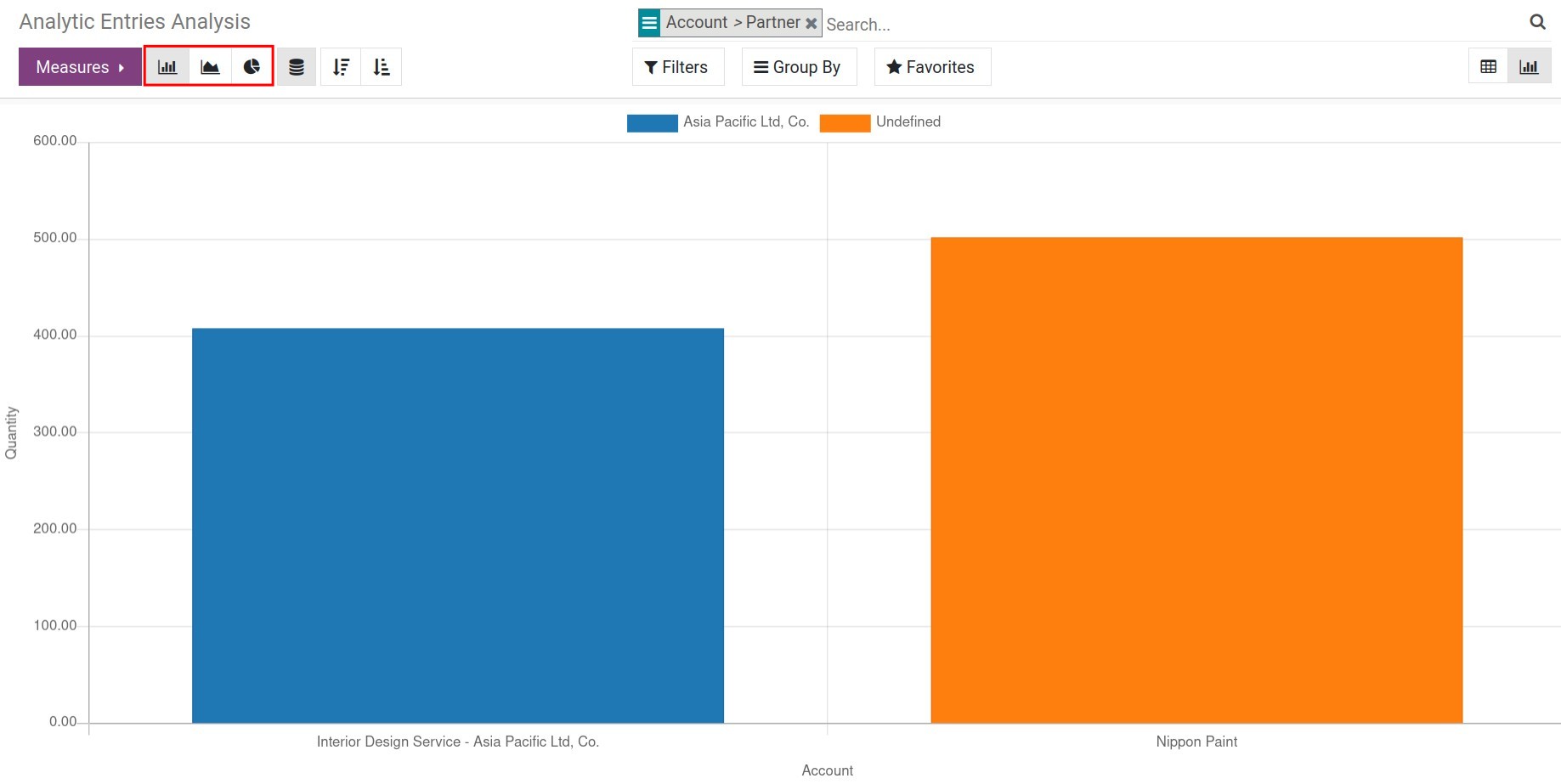

Visual Accounting Analysis (with Pivot and Graph)

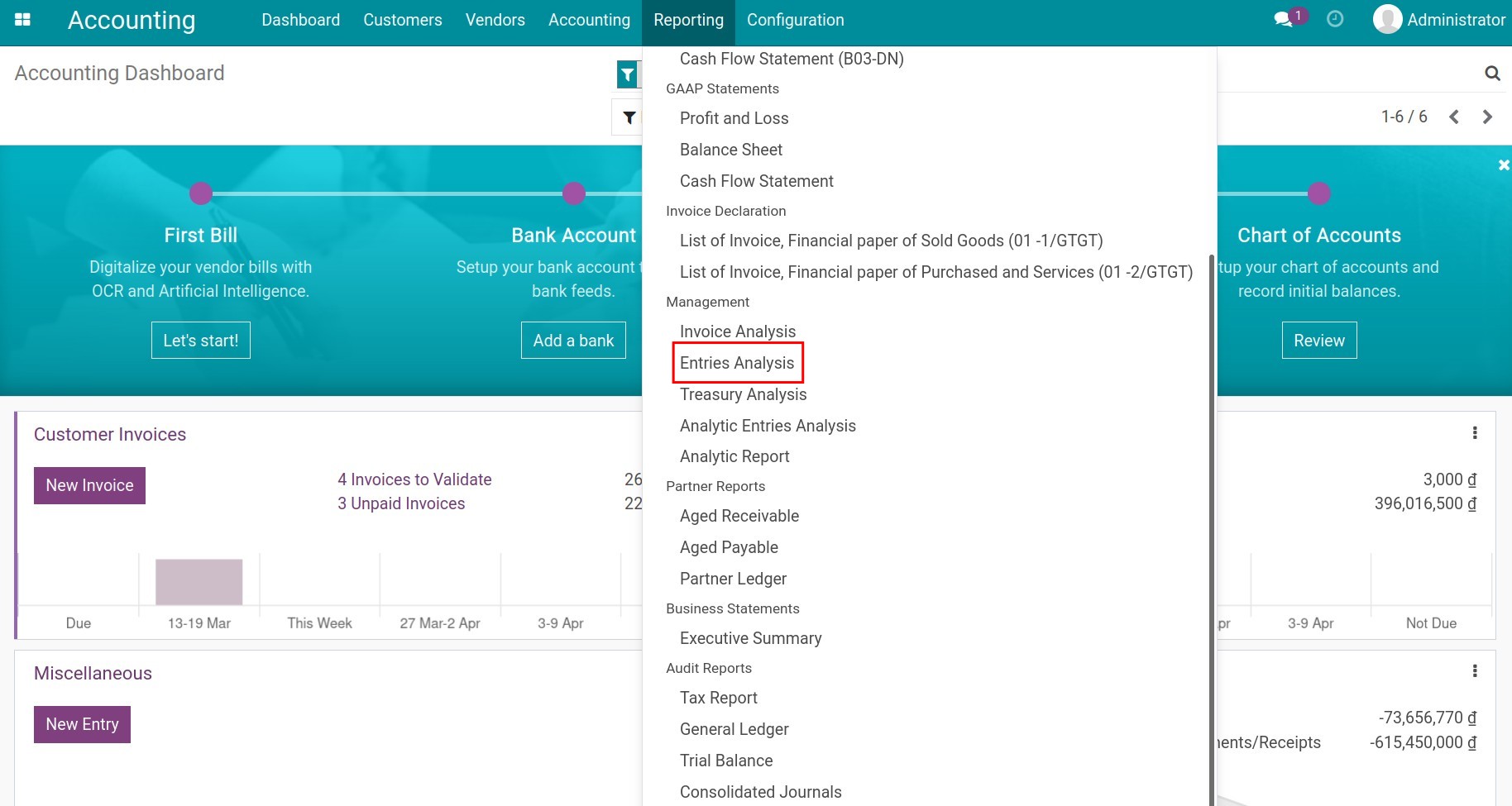

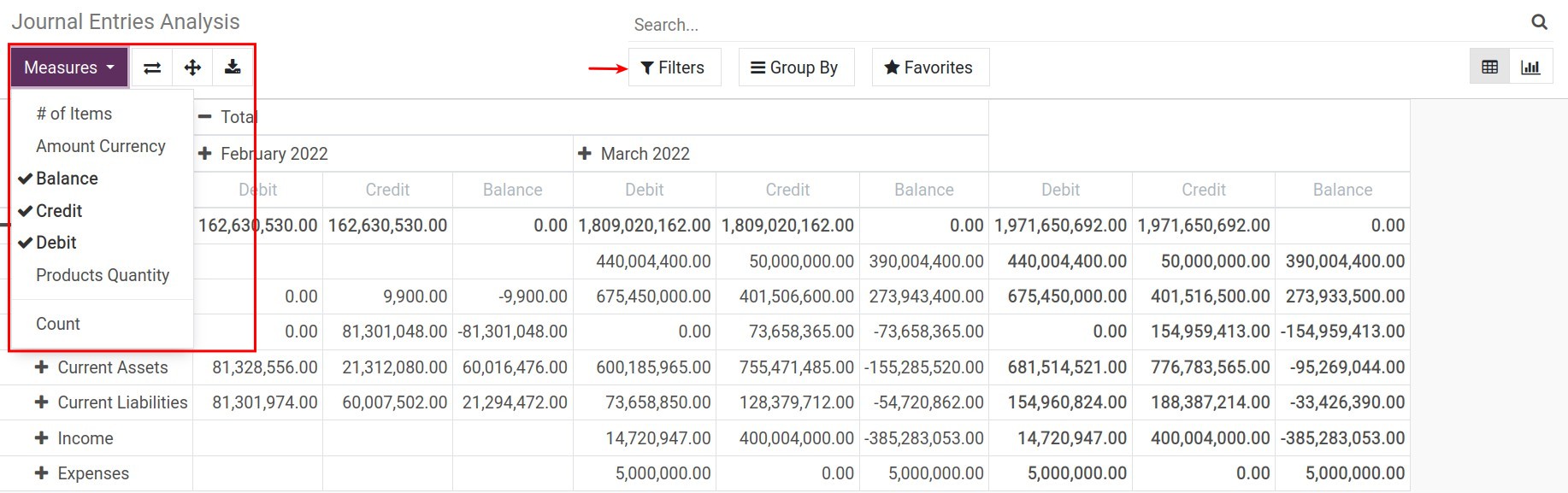

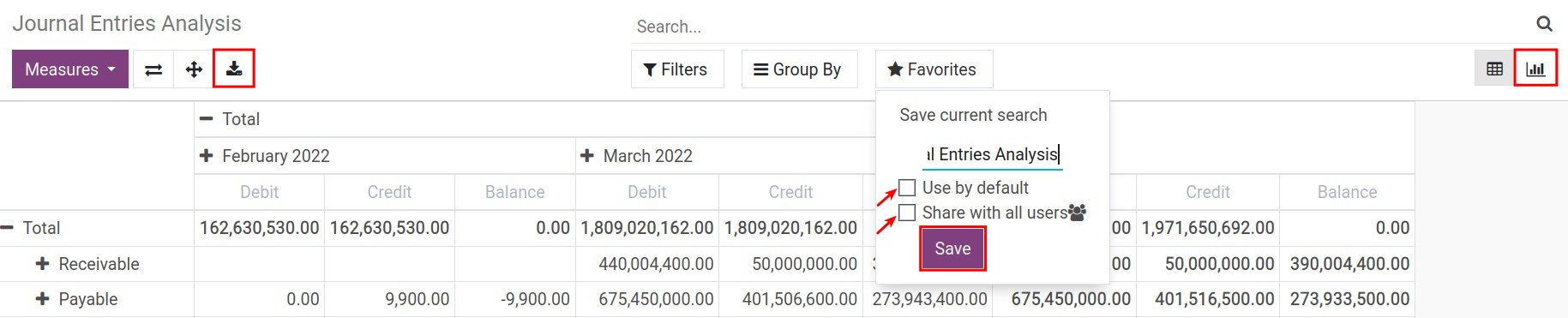

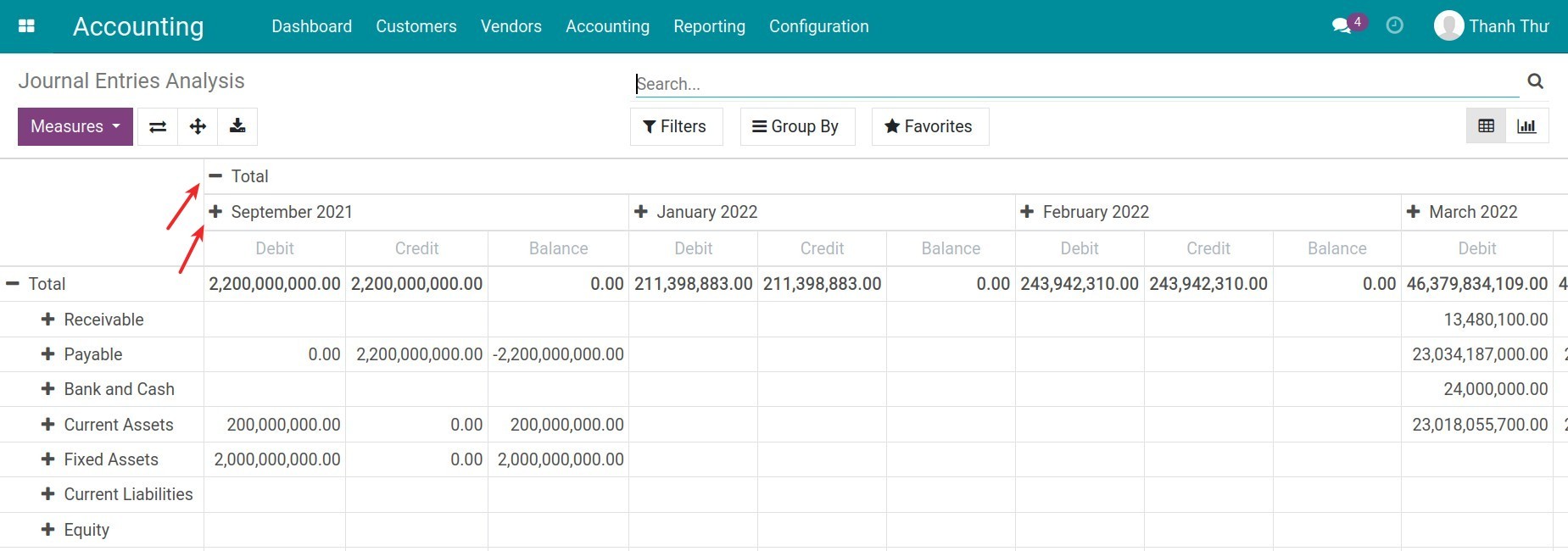

- Entries Analysis Report

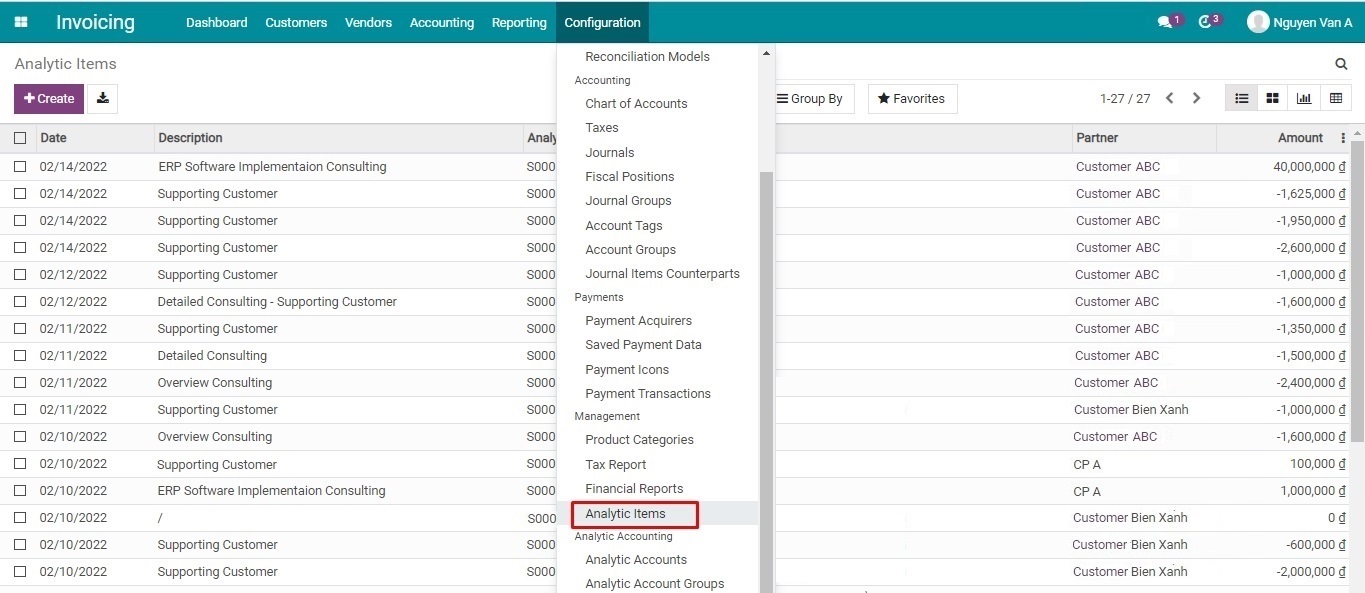

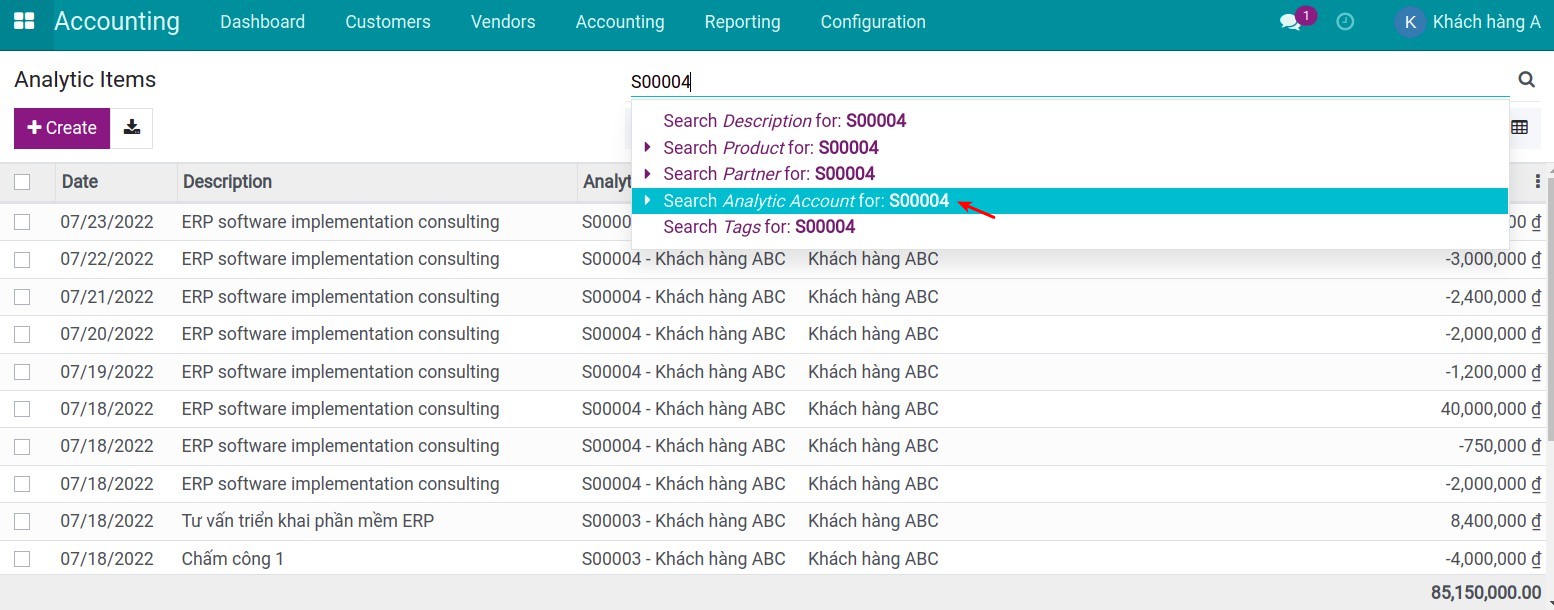

- Analytic Entries Analysis Report

-

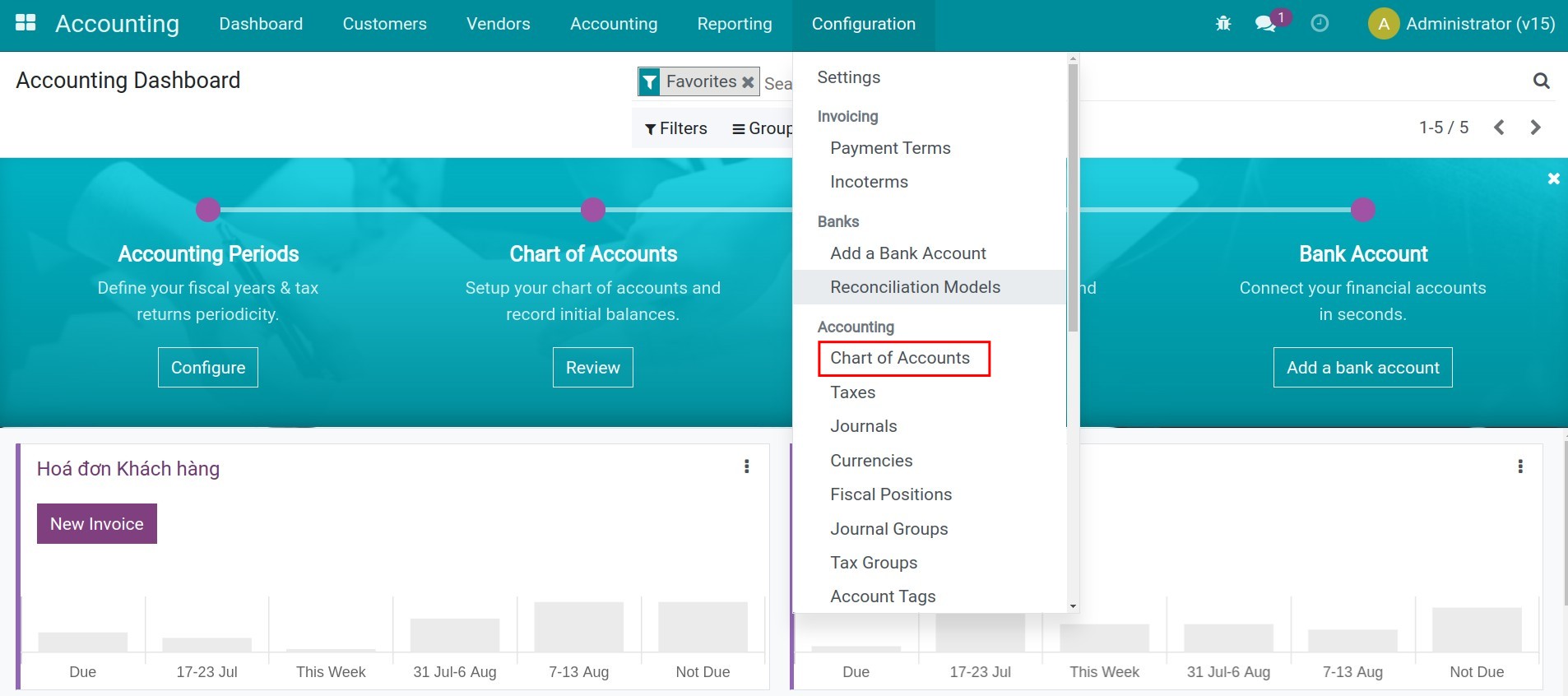

Chart of Accounts

-

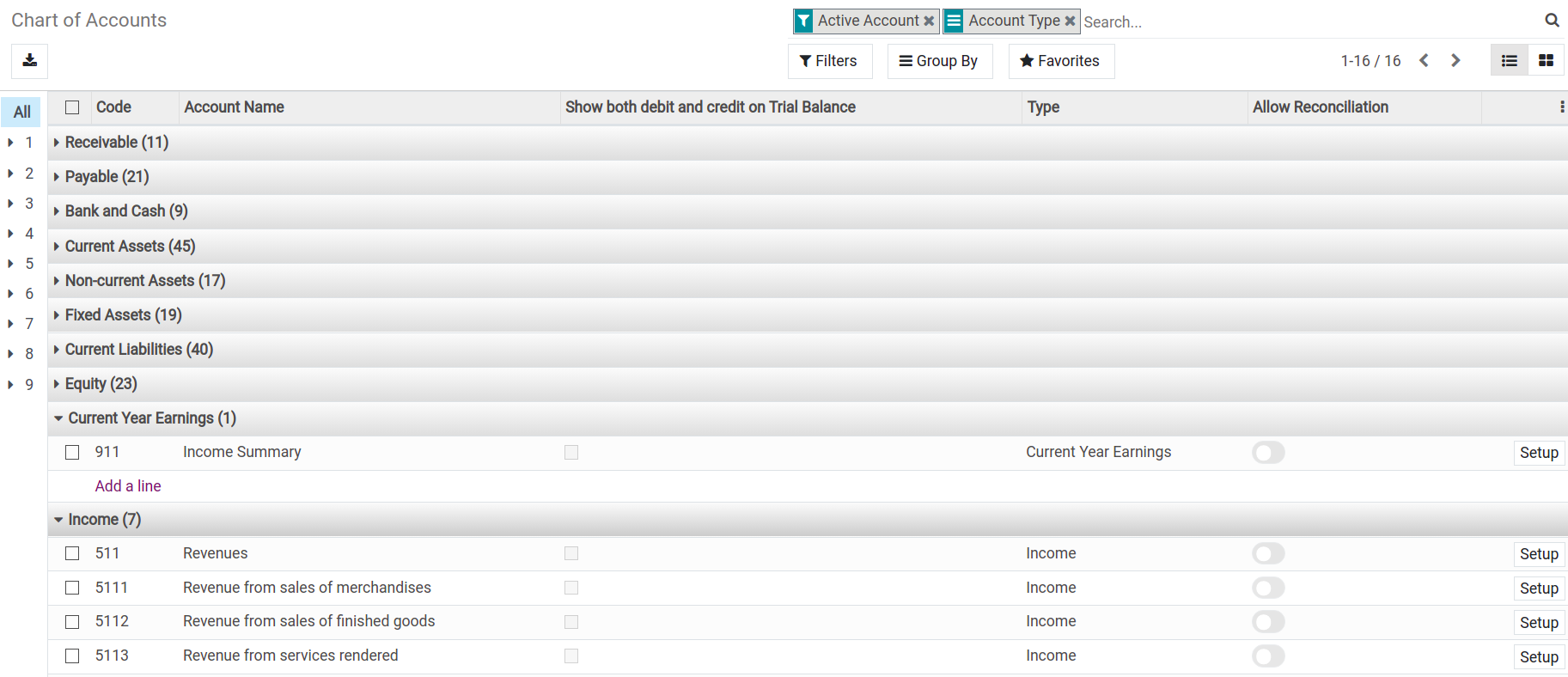

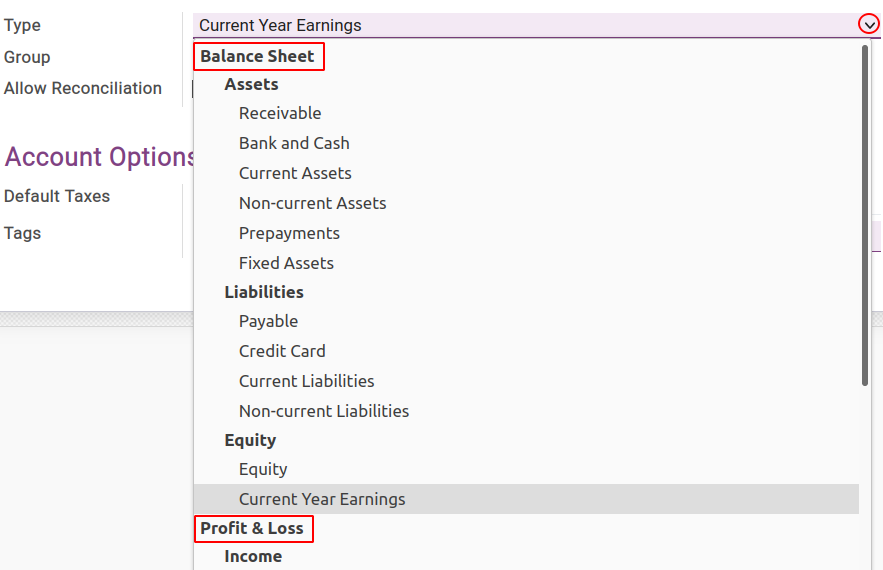

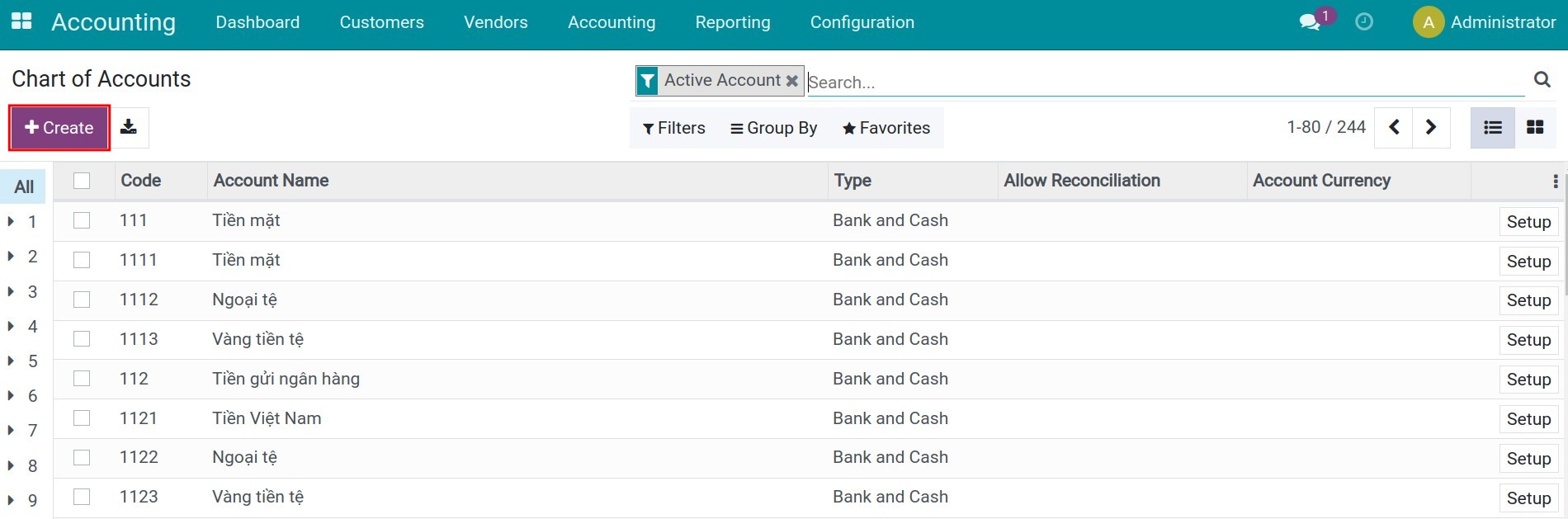

Chart of Accounts

- Select Chart of Accounts

- Configure Account

-

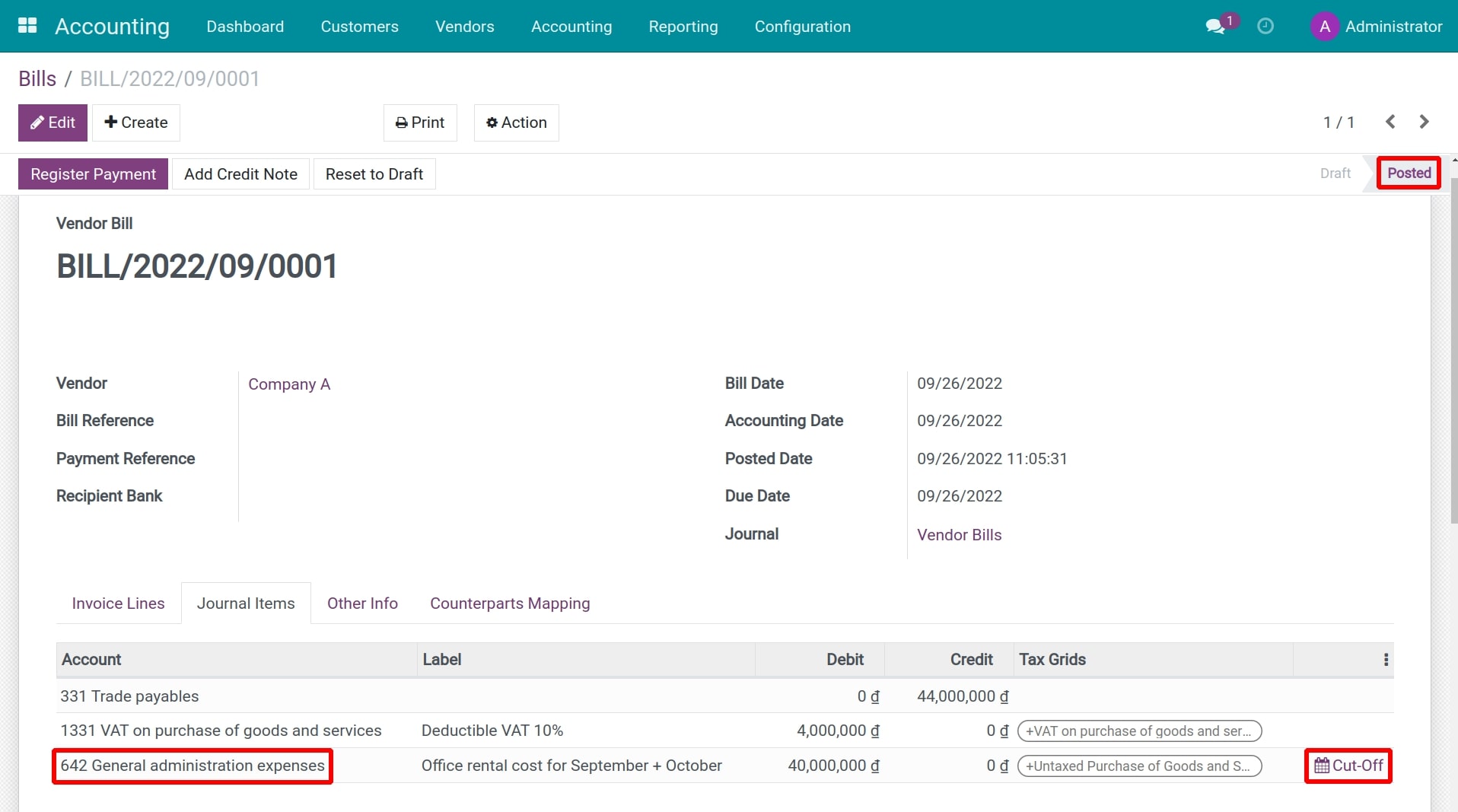

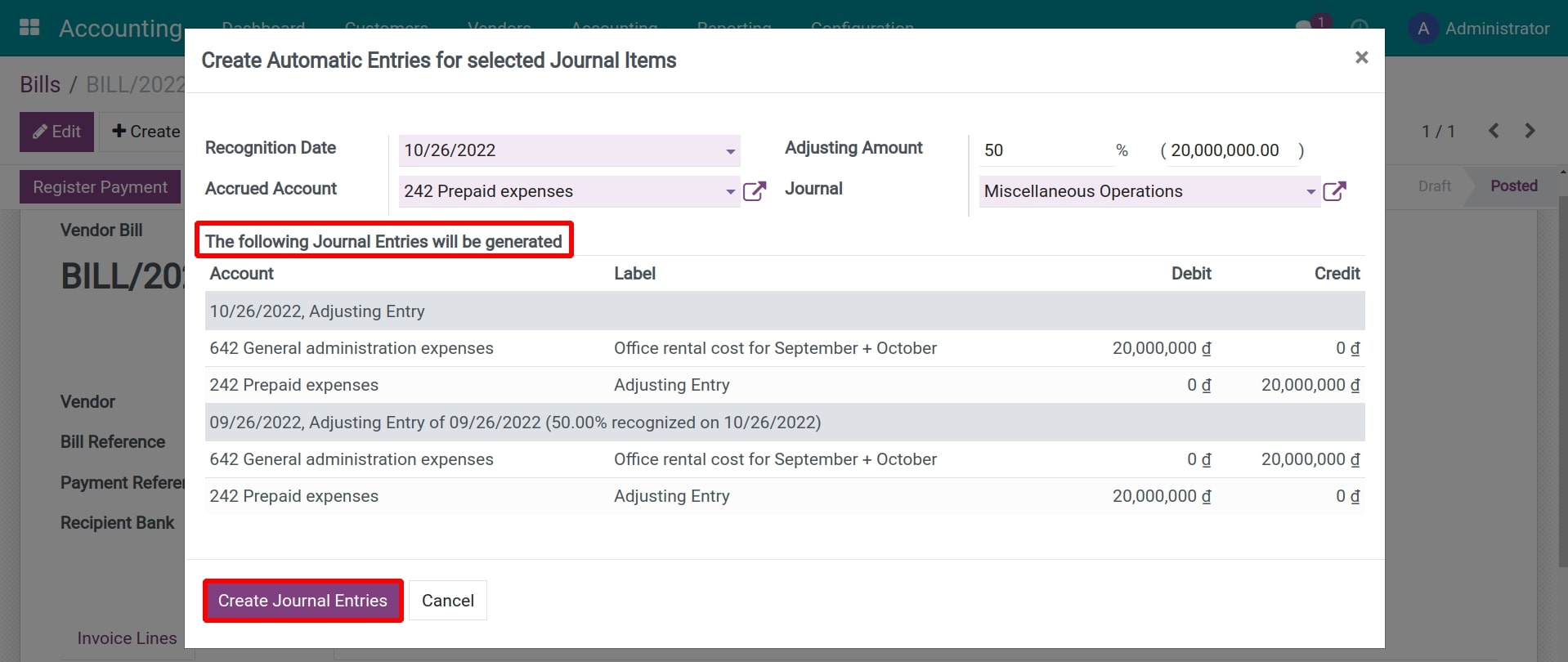

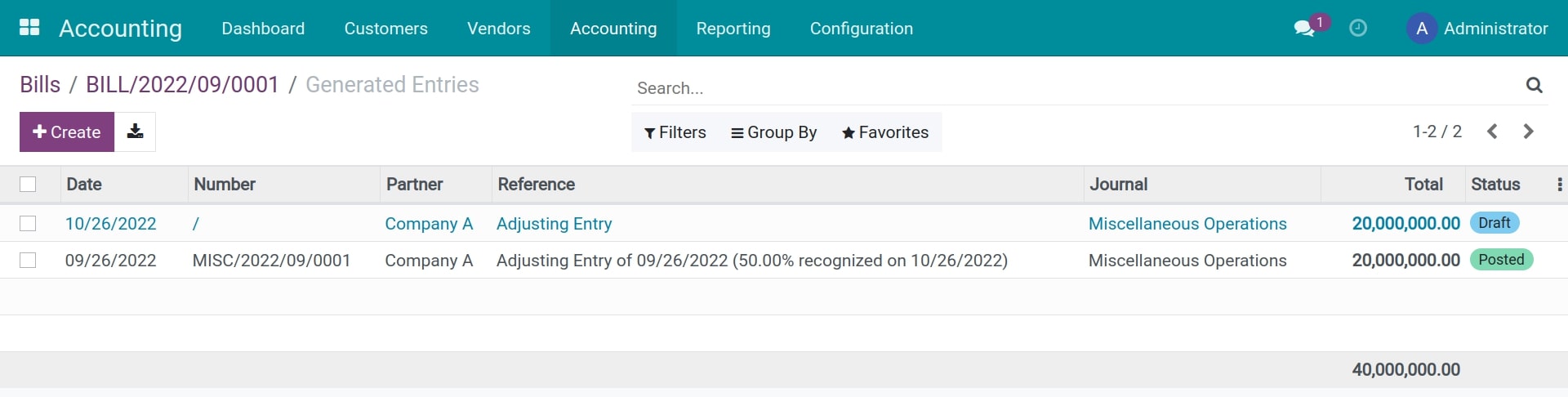

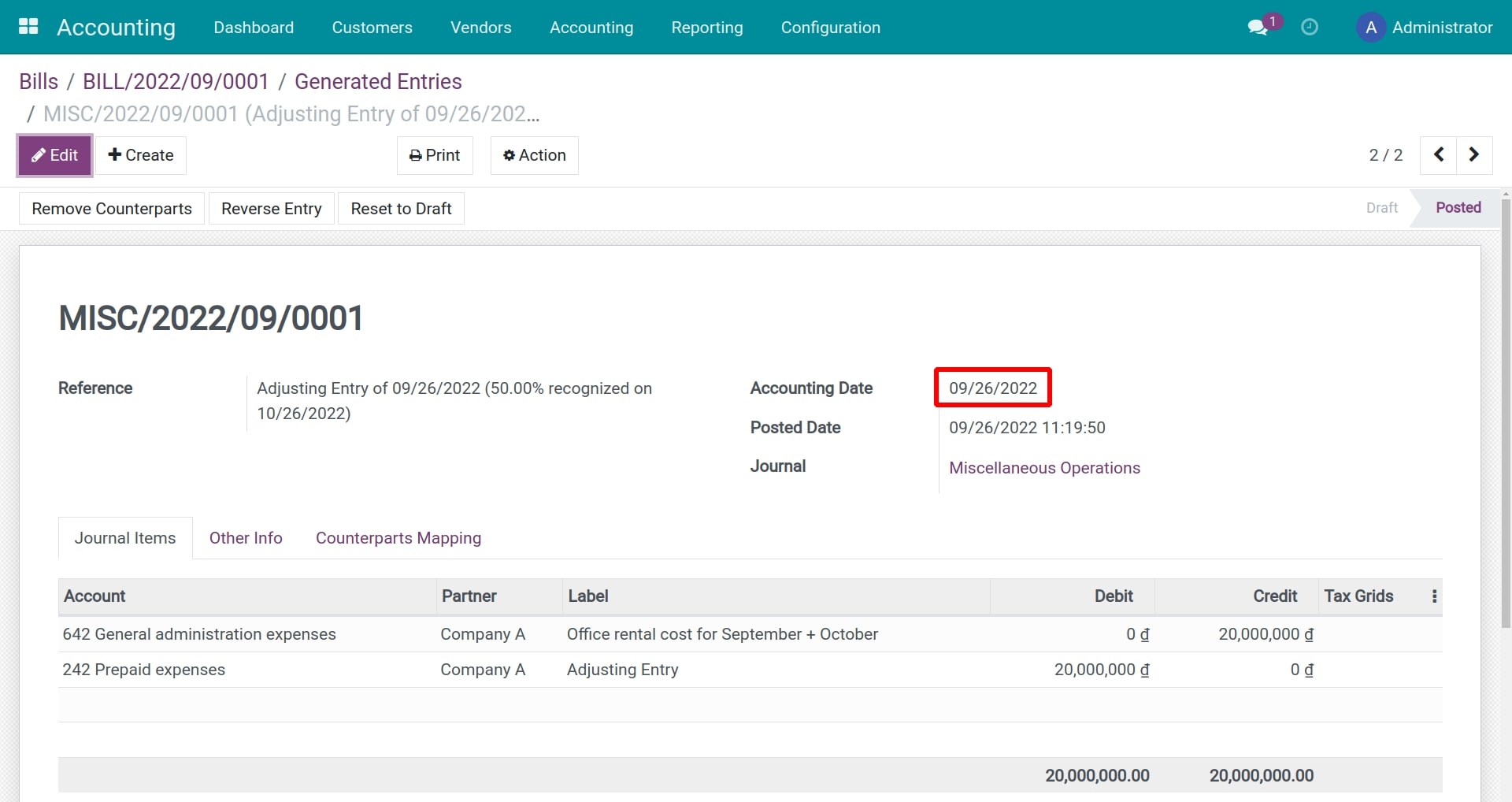

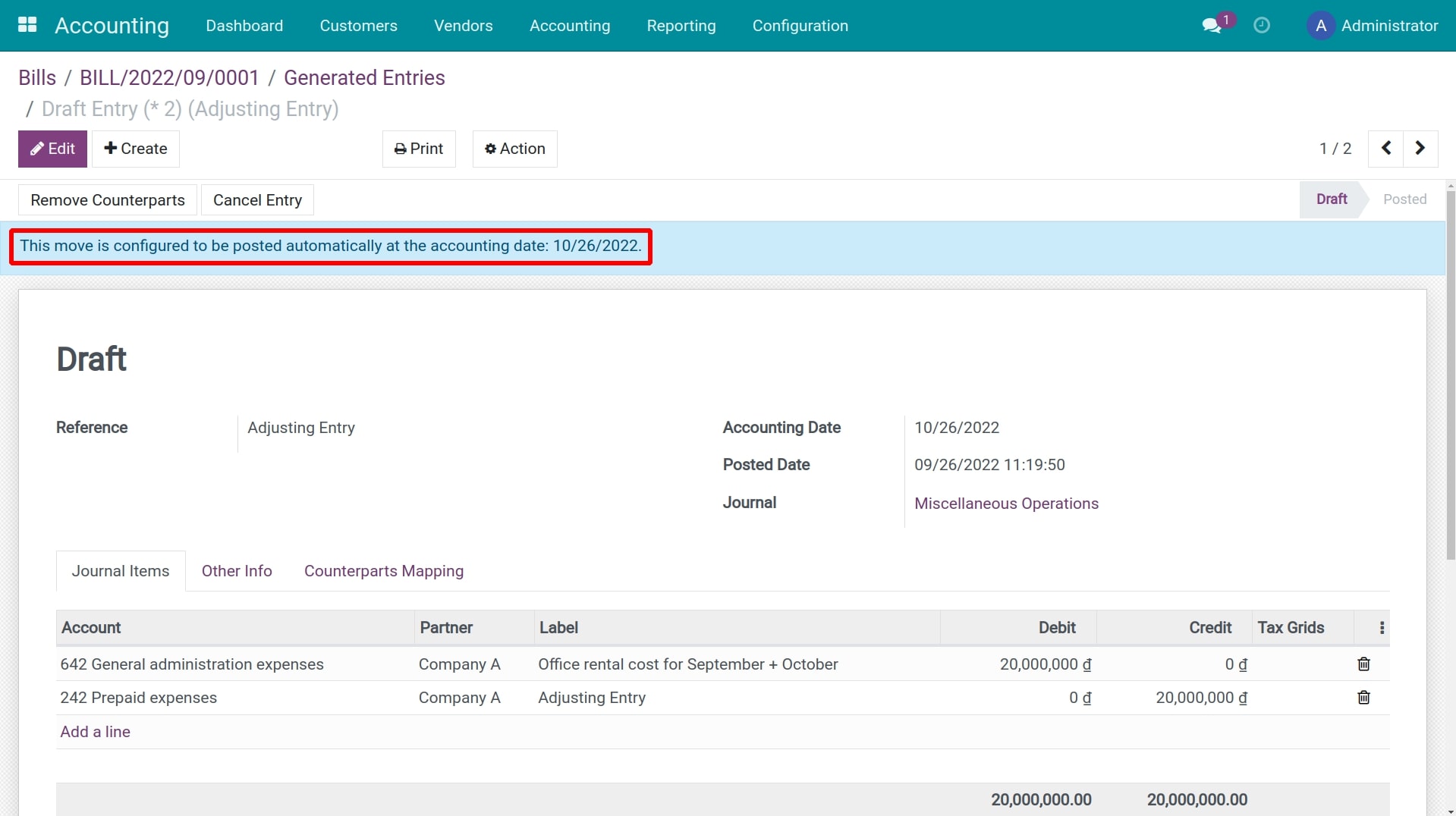

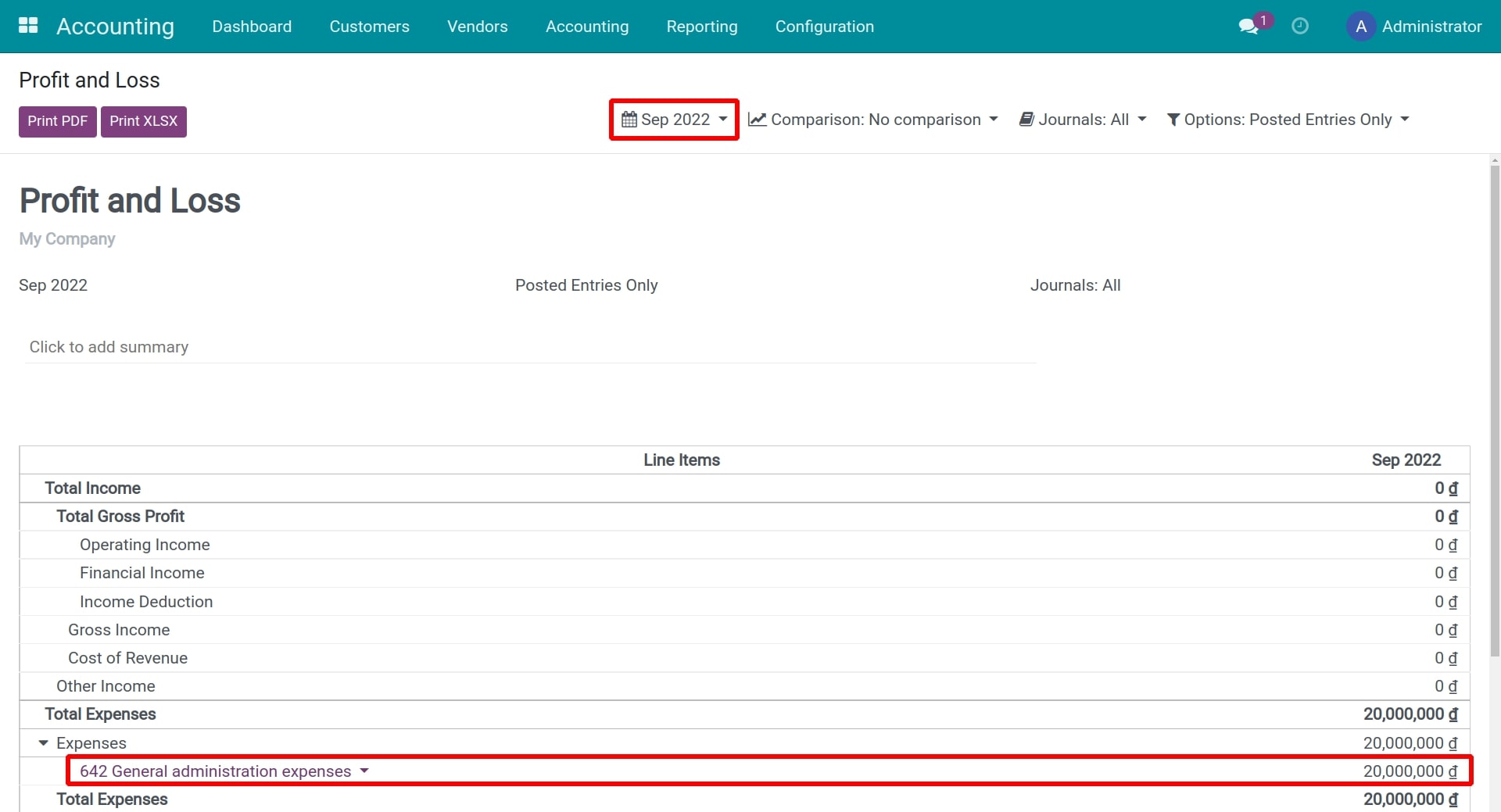

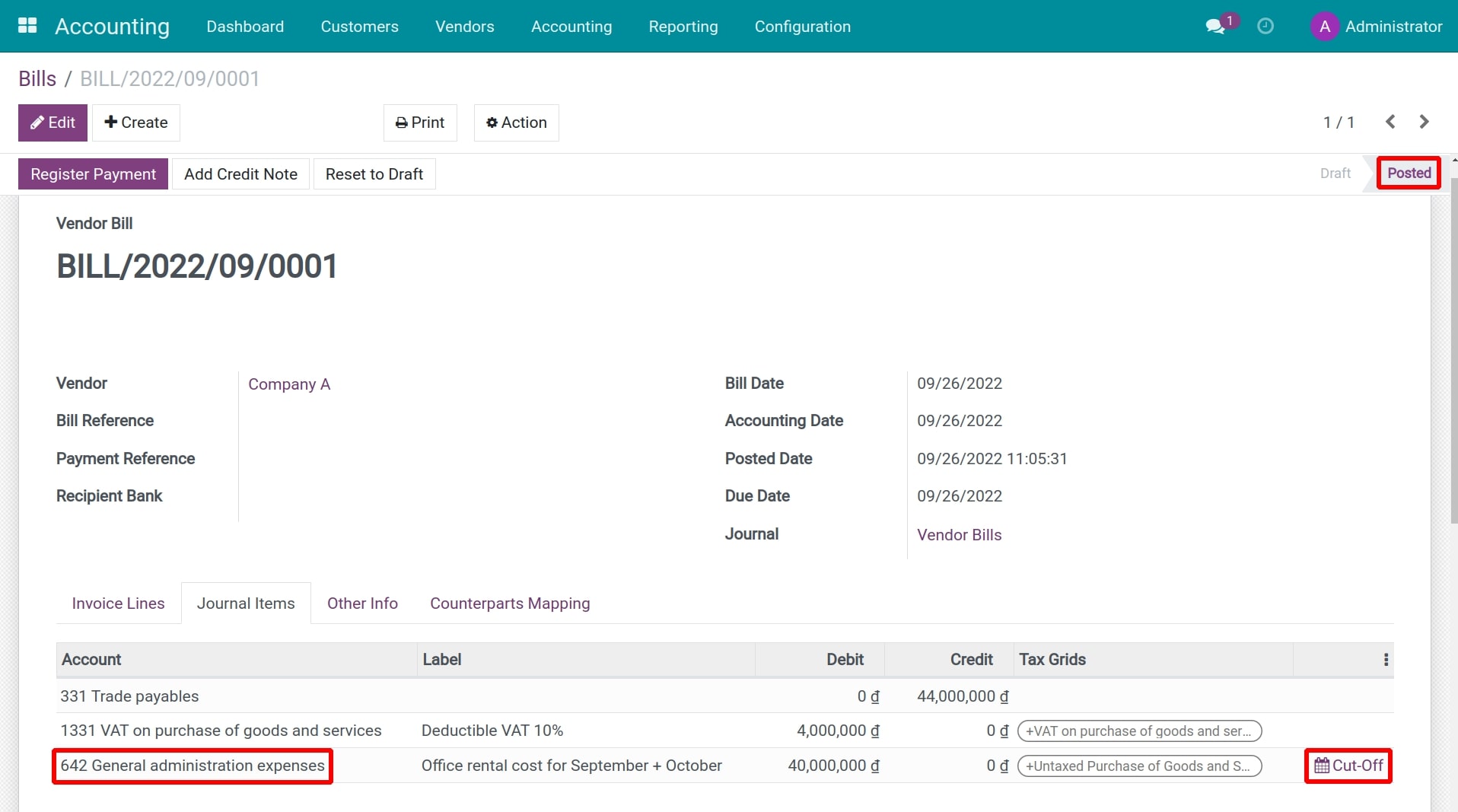

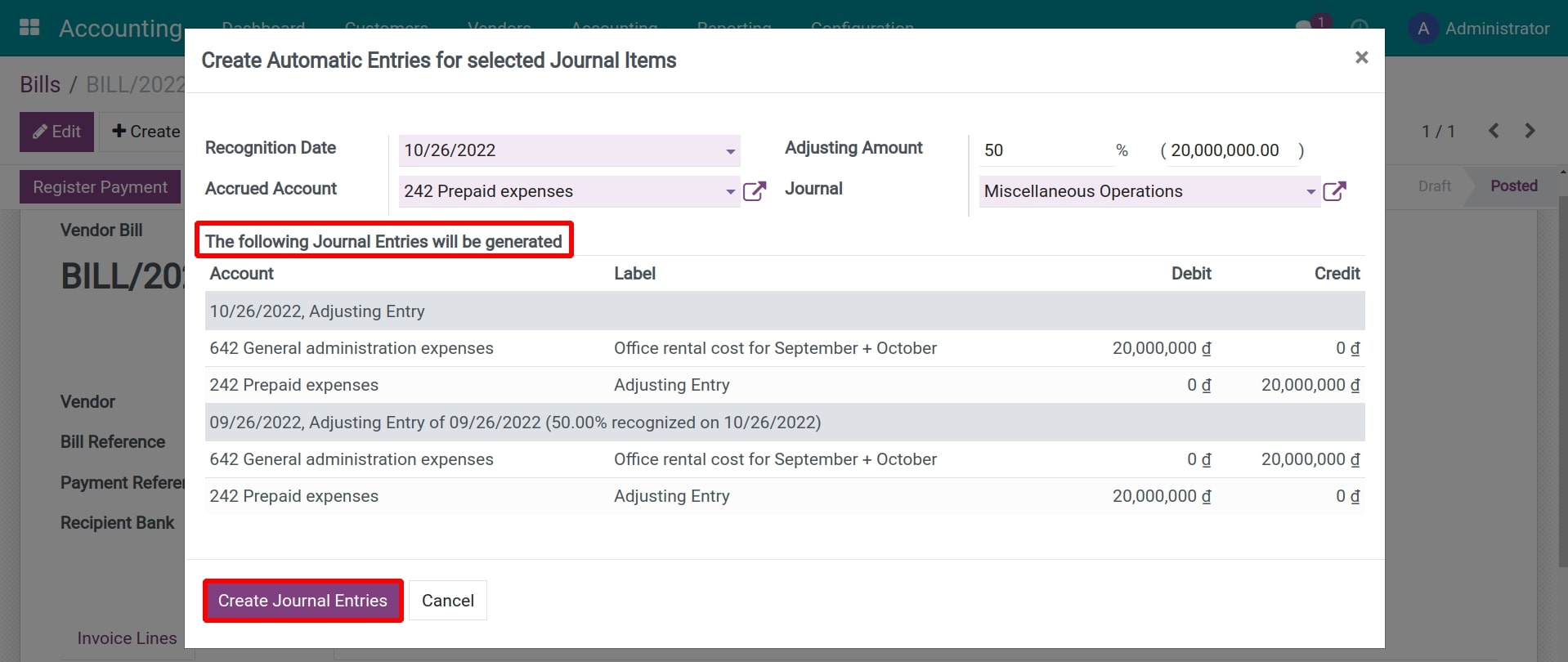

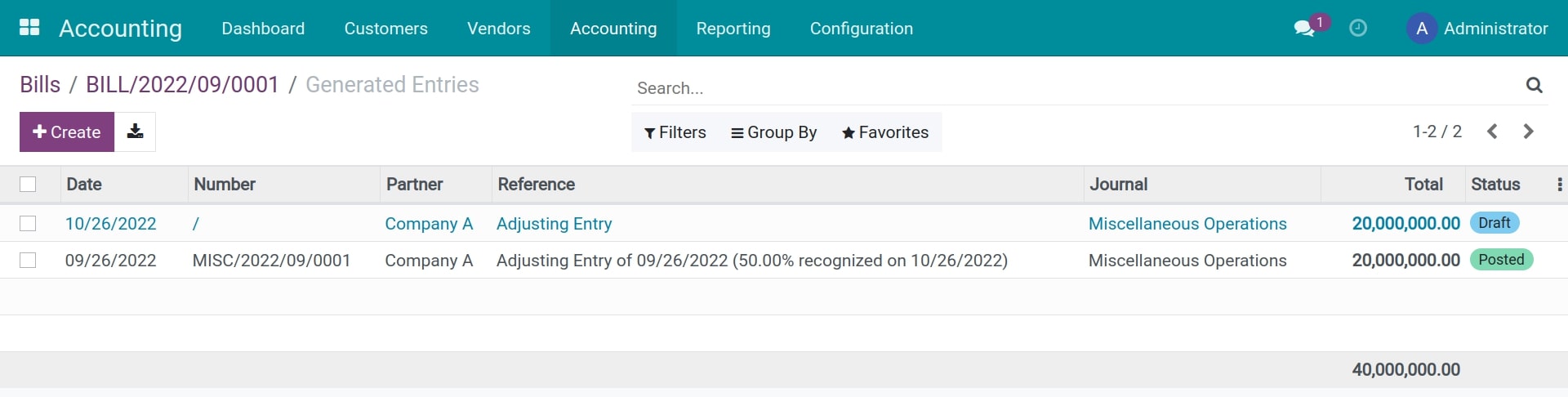

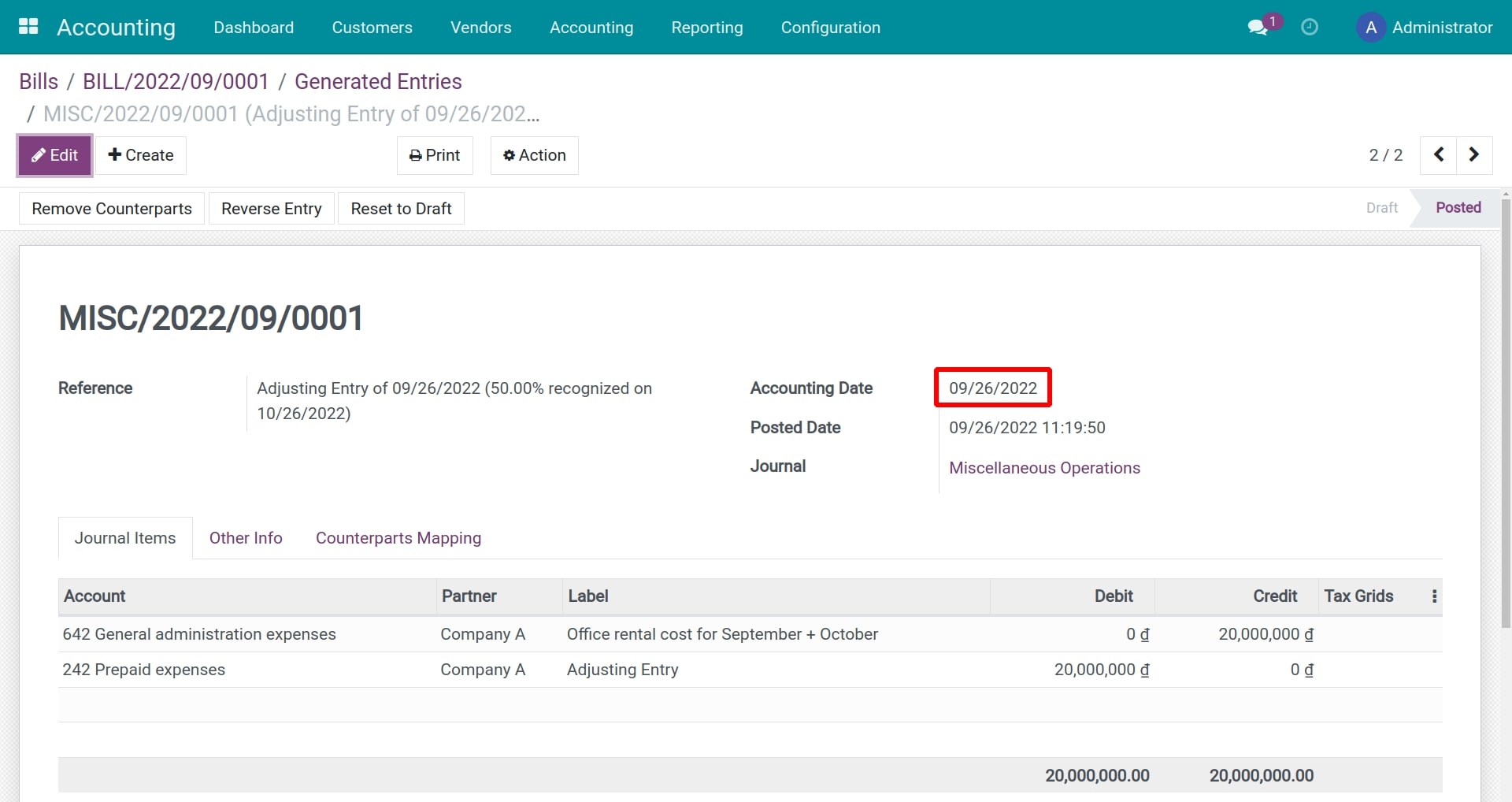

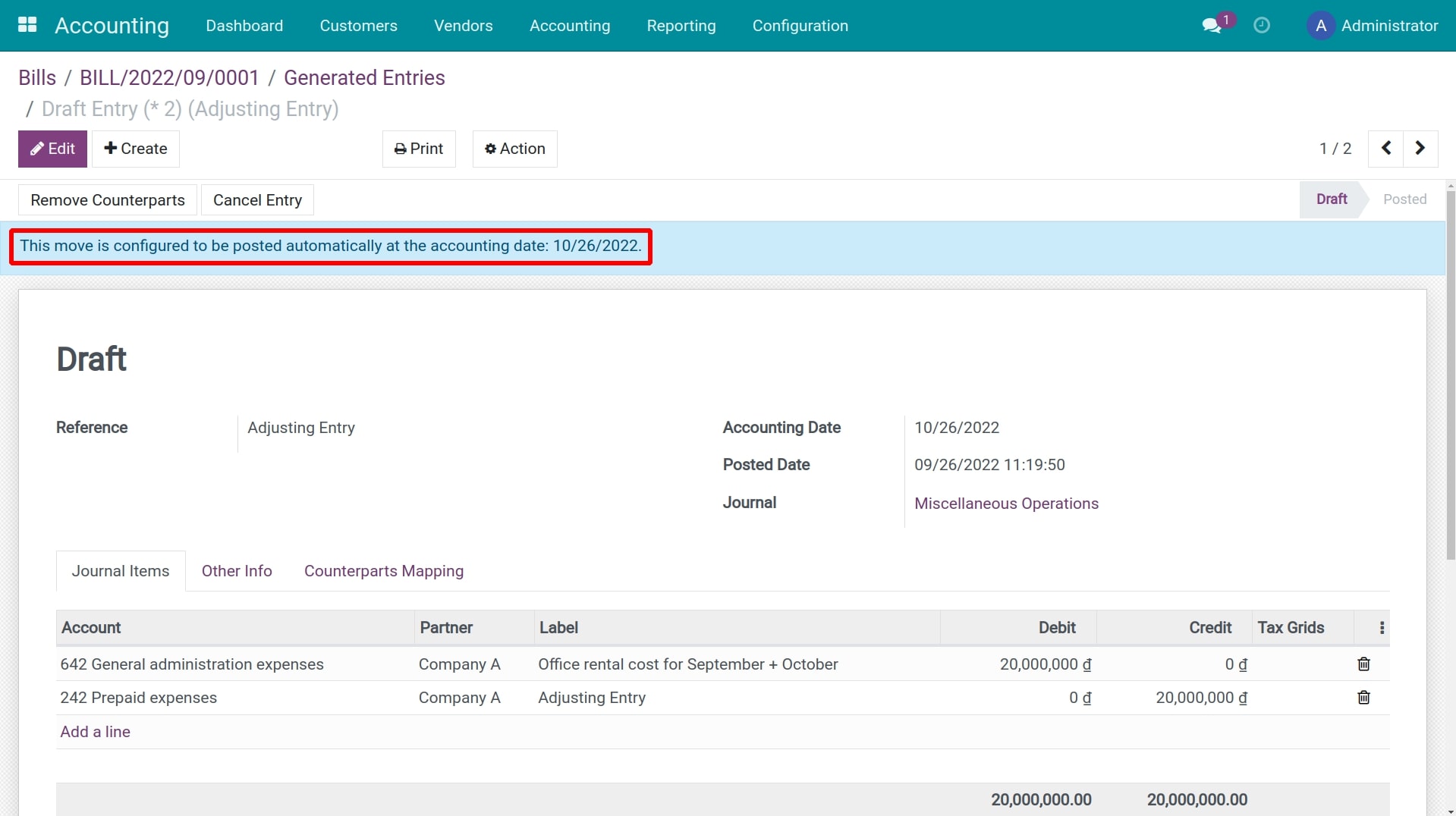

How to apply cut-off in iSuite Accounting

- How to apply cut-off in iSuite Accounting

-

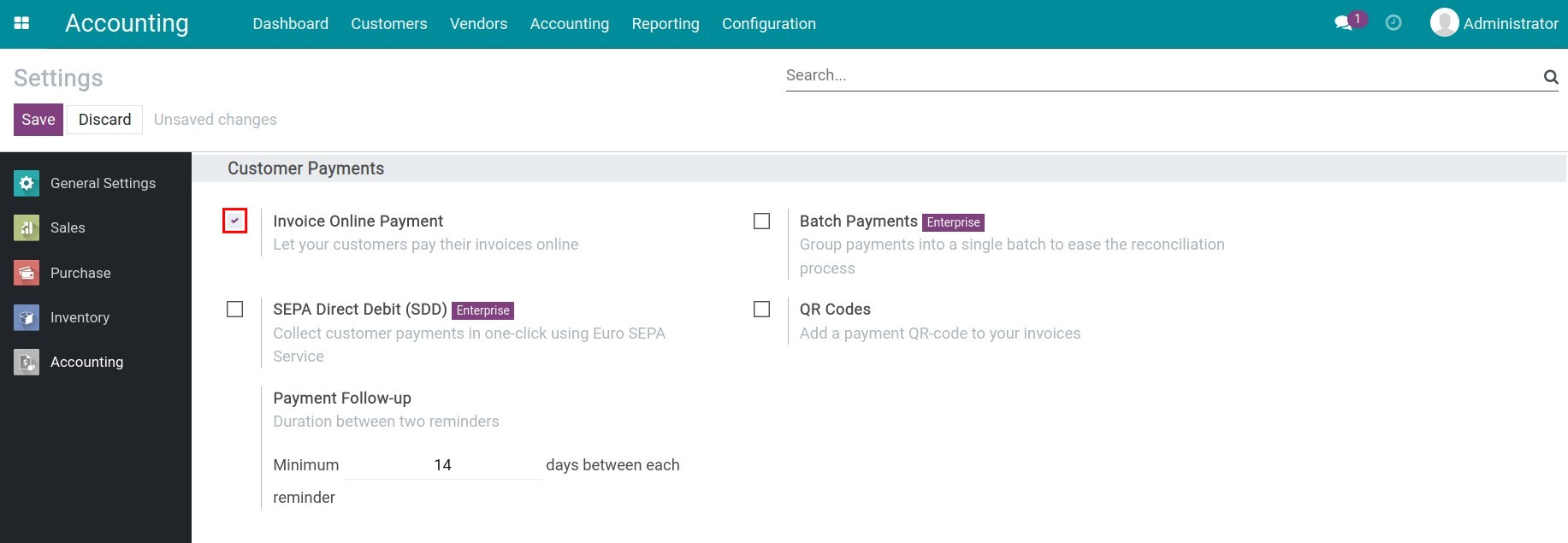

Online payment activation and usage

-

Online payment activation and usage

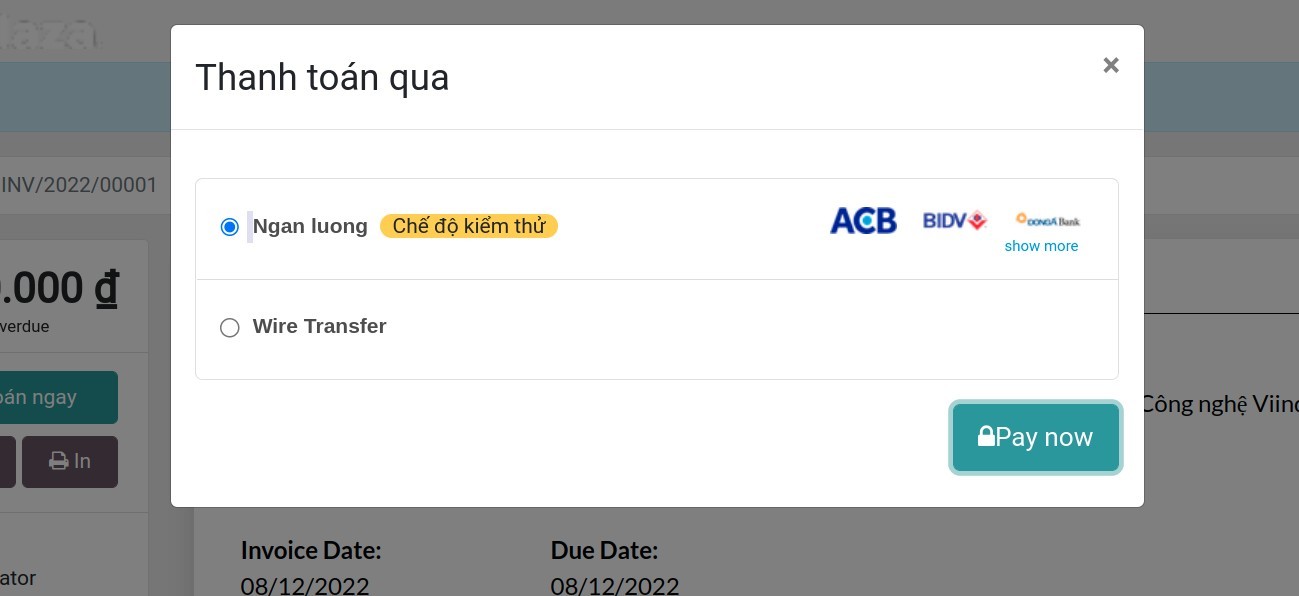

- Activate Invoice Online Payment

- Customer online payment view

-

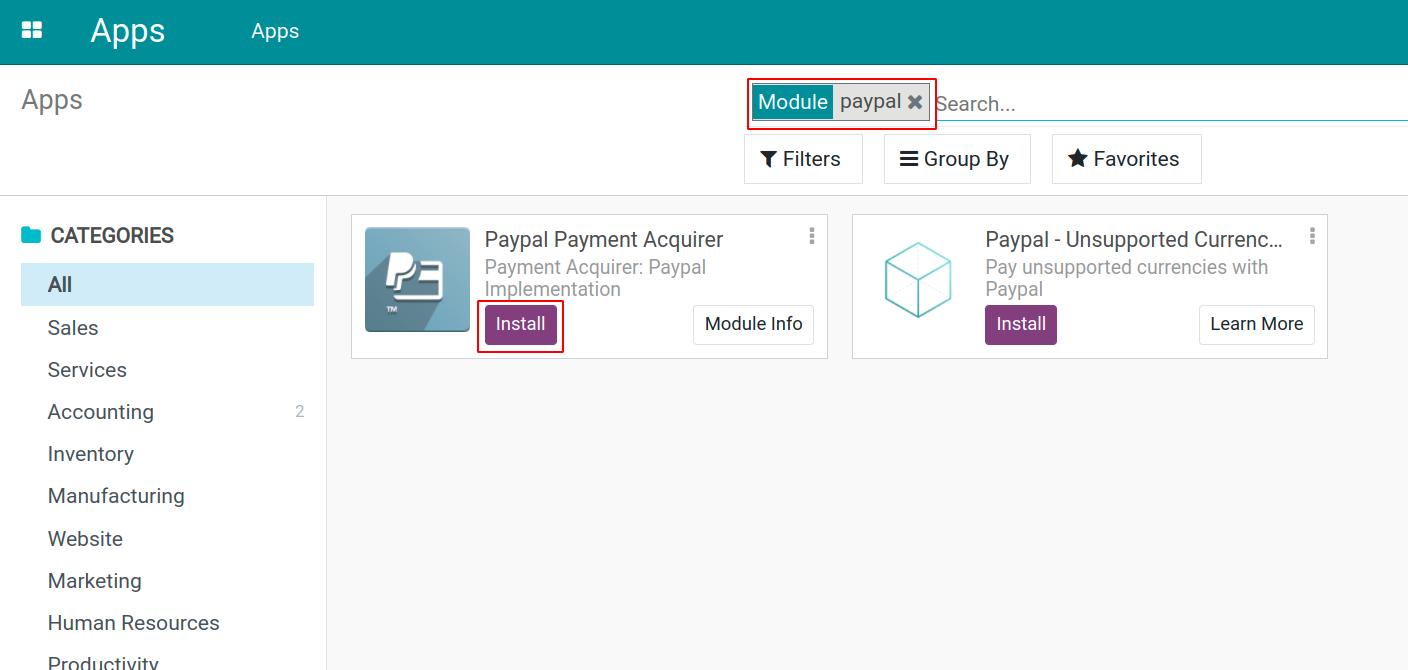

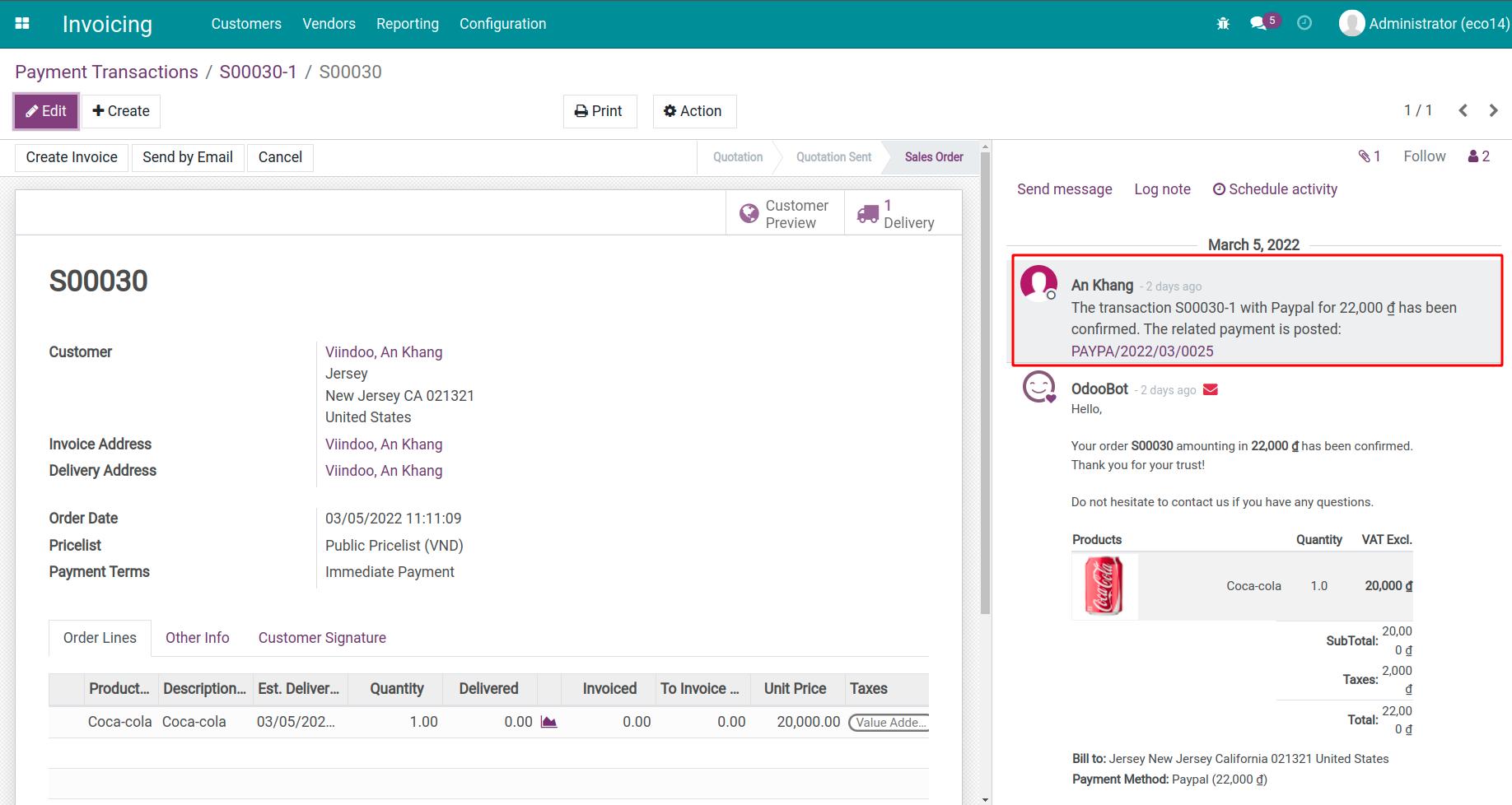

How to make a payment with Paypal

-

How to make a payment with Paypal

- Paypal payment configuration

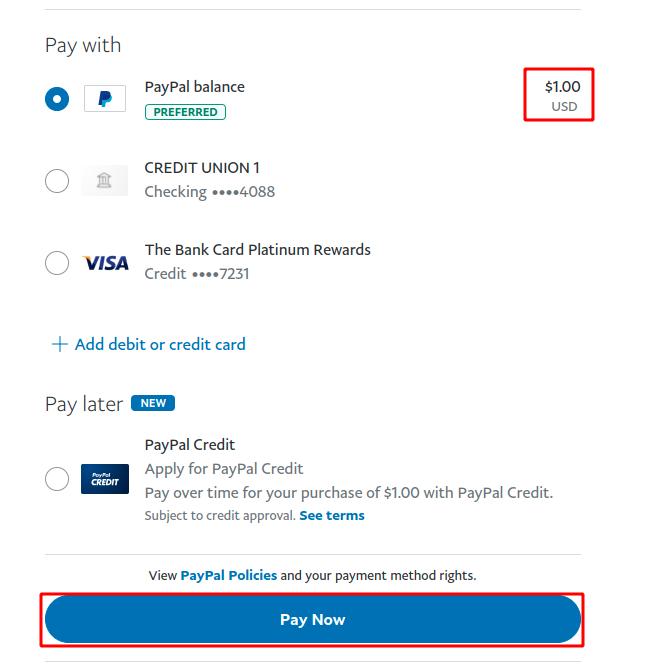

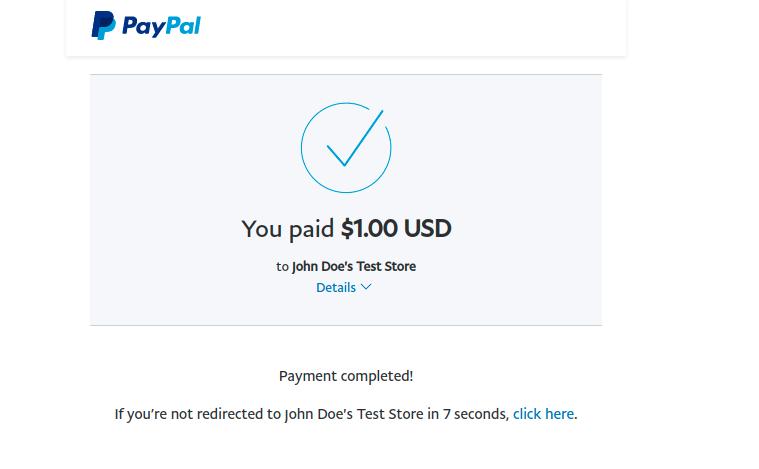

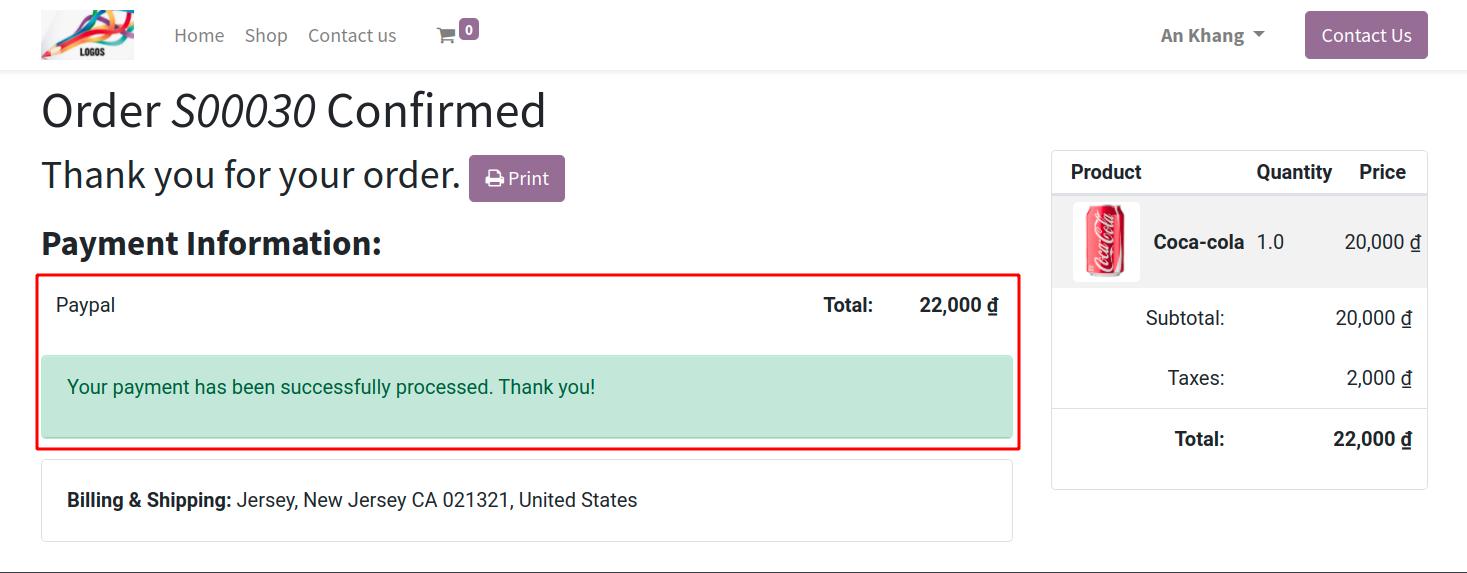

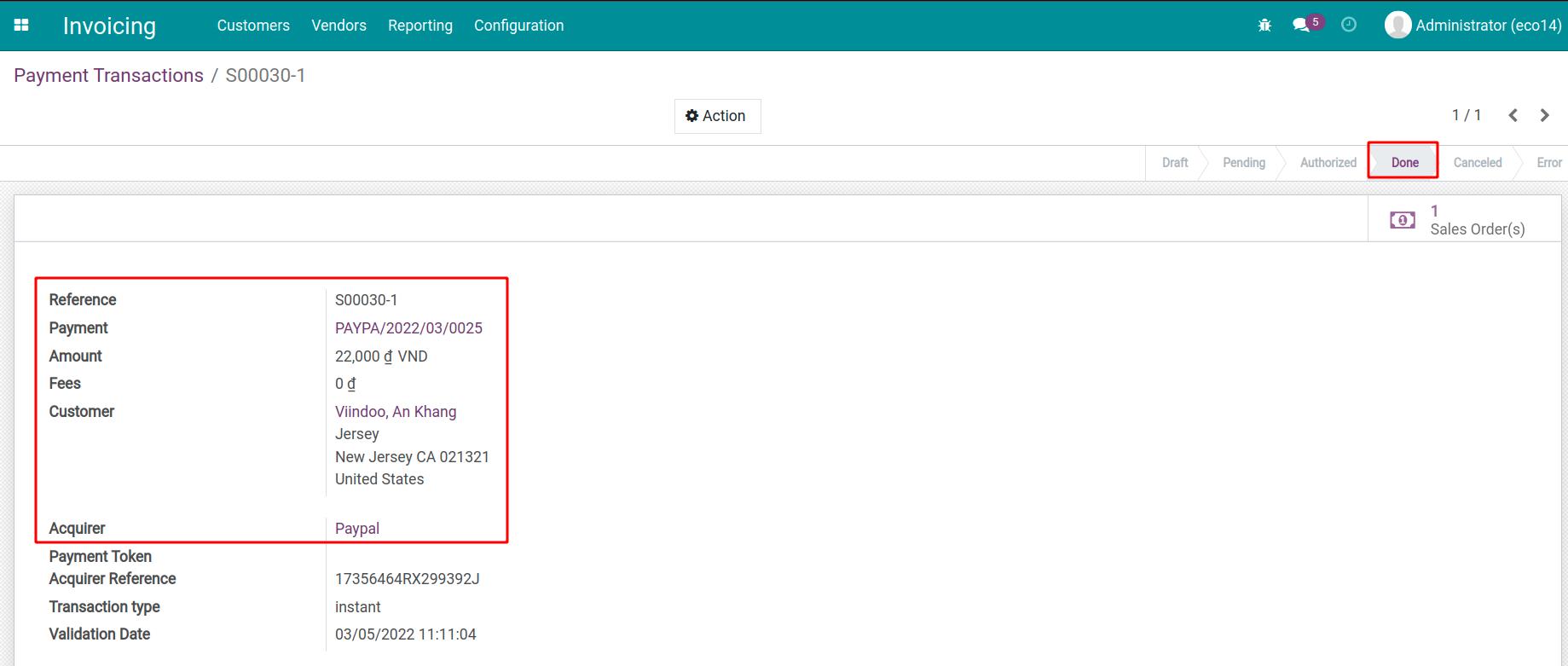

- Pay with Paypal

-

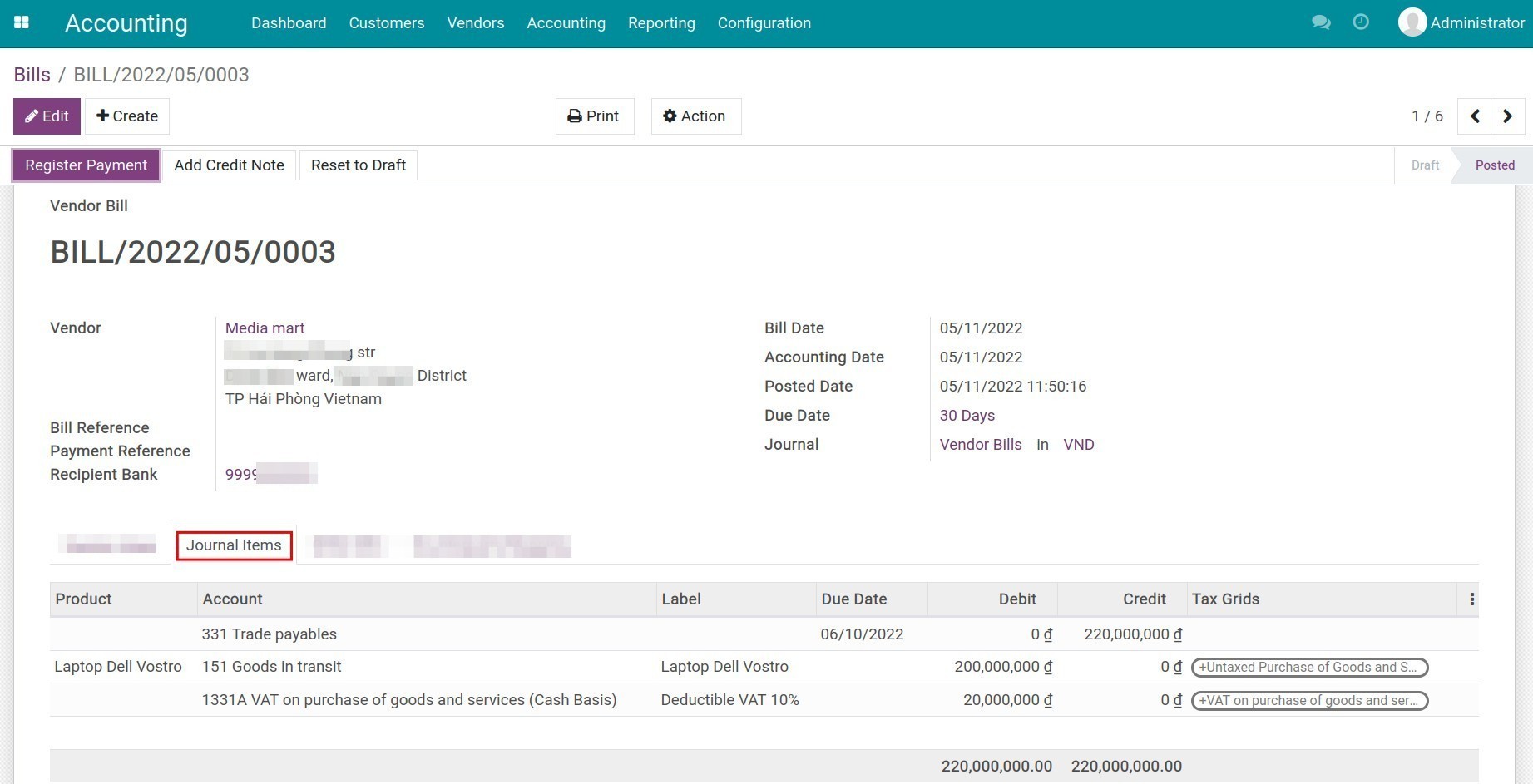

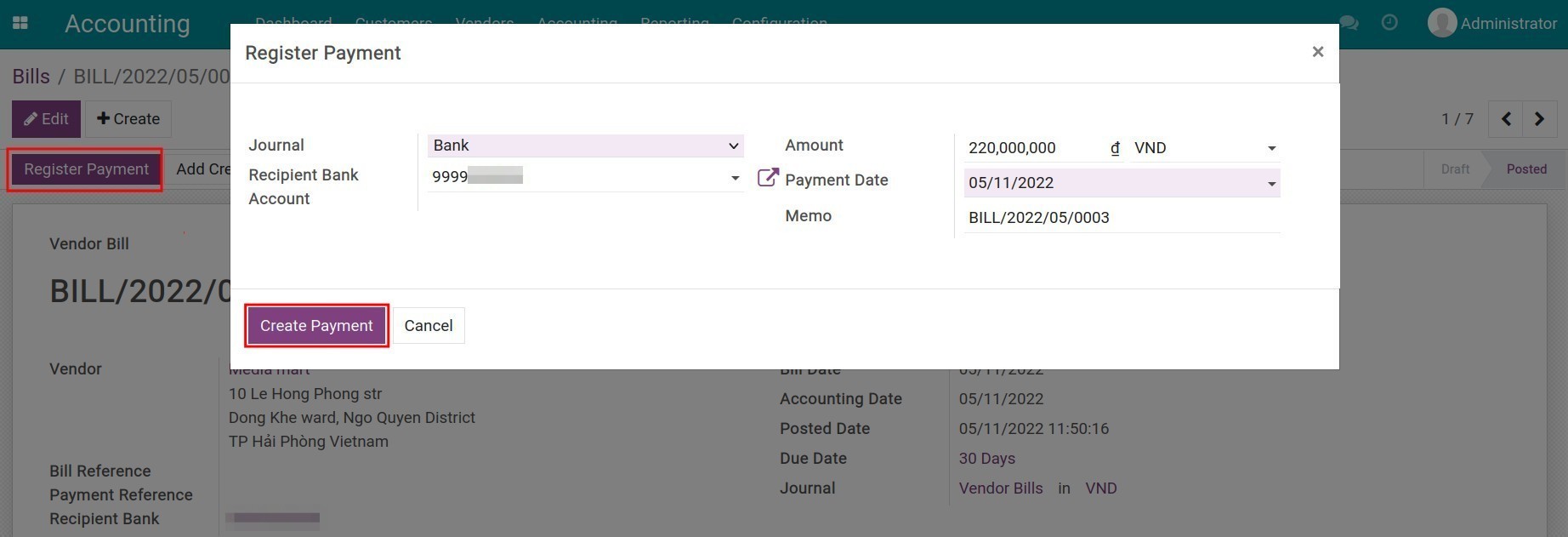

Process of vendor invoicing, payment and reconciliation

-

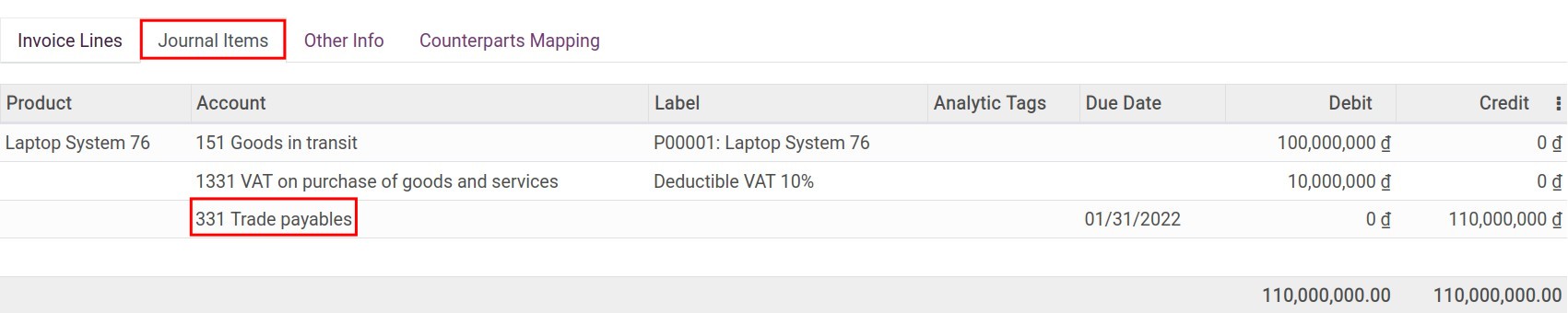

Process of vendor invoicing, payment and reconciliation

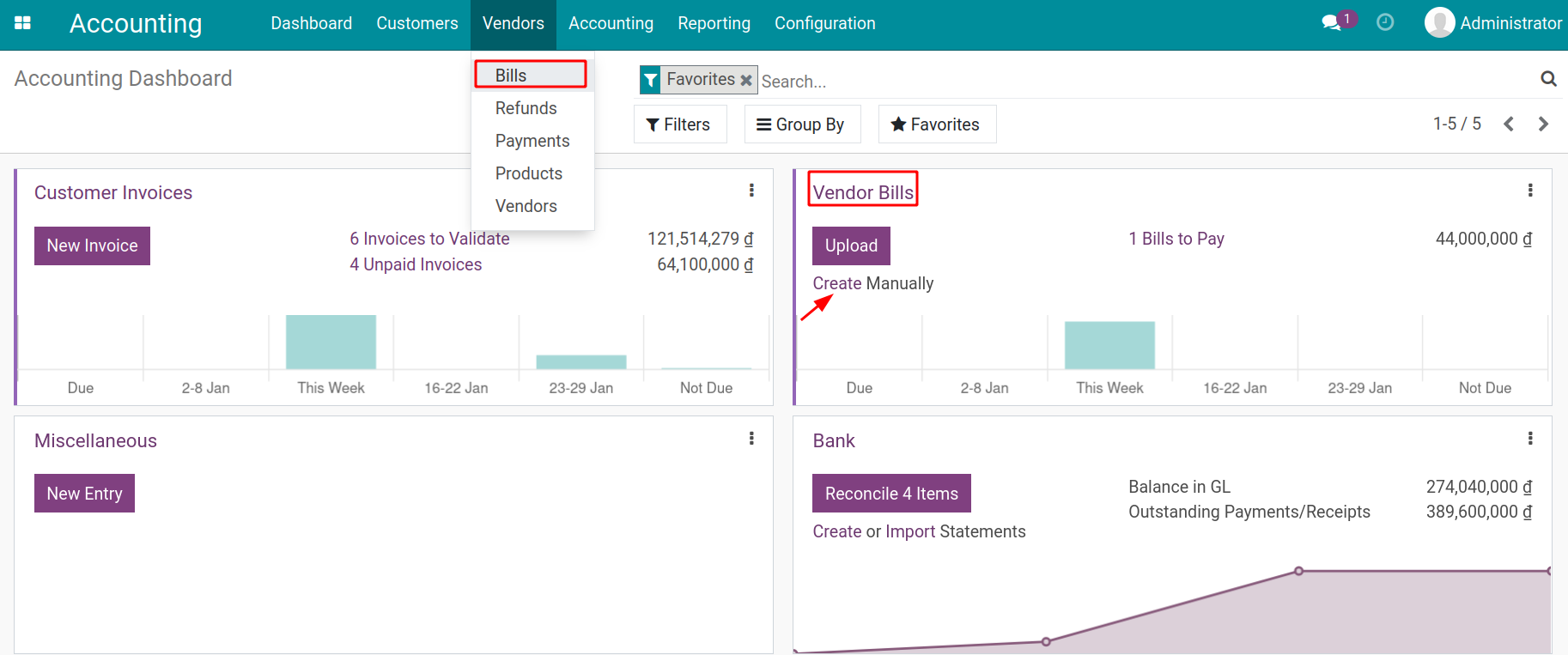

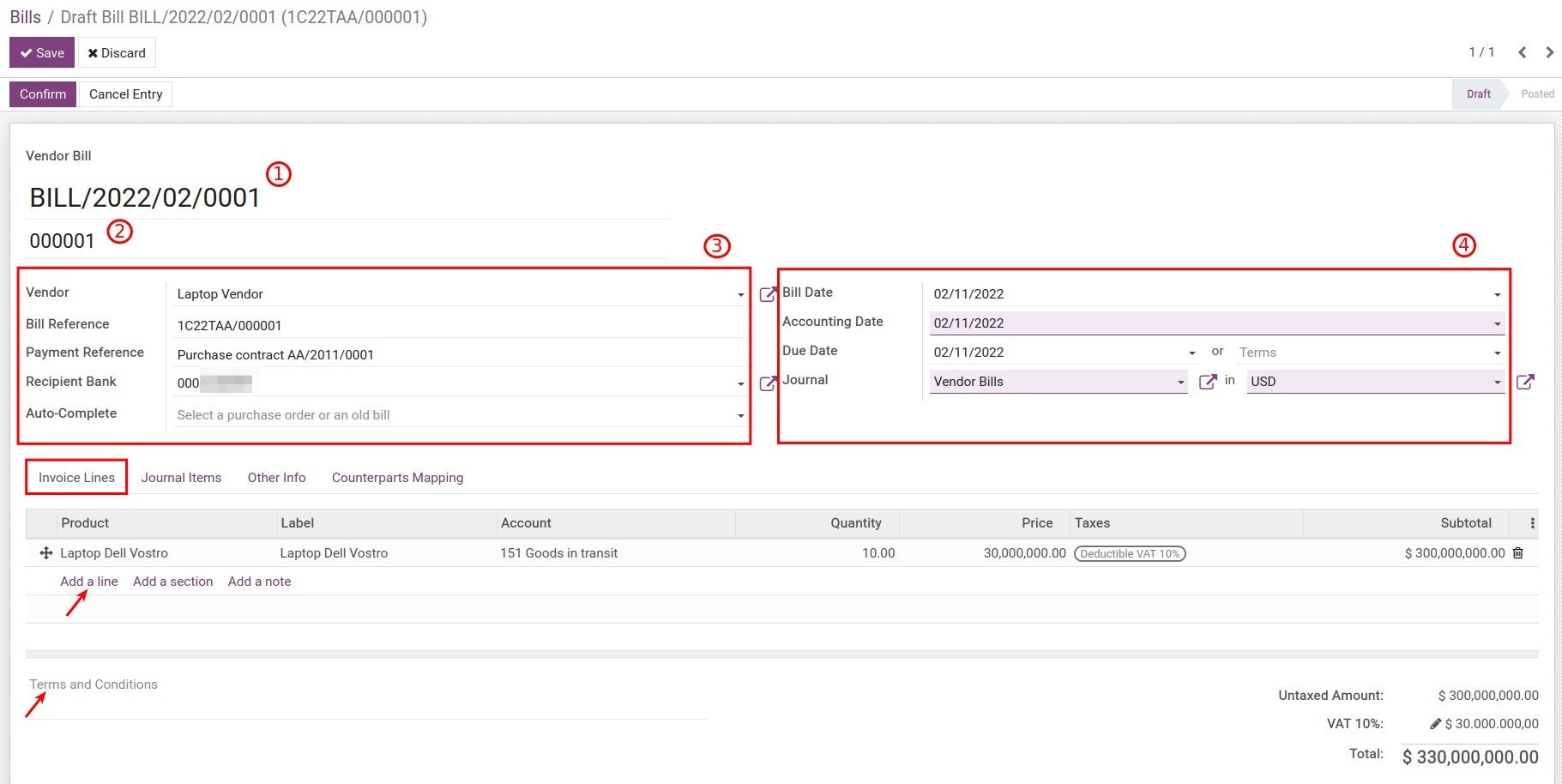

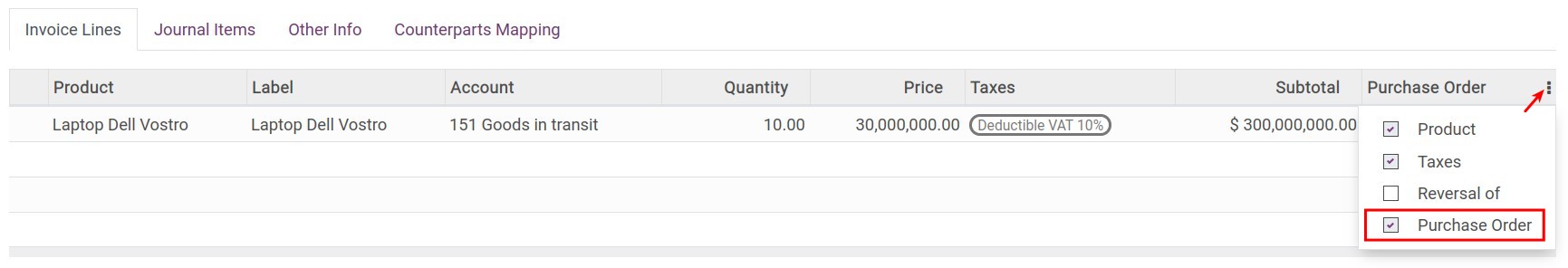

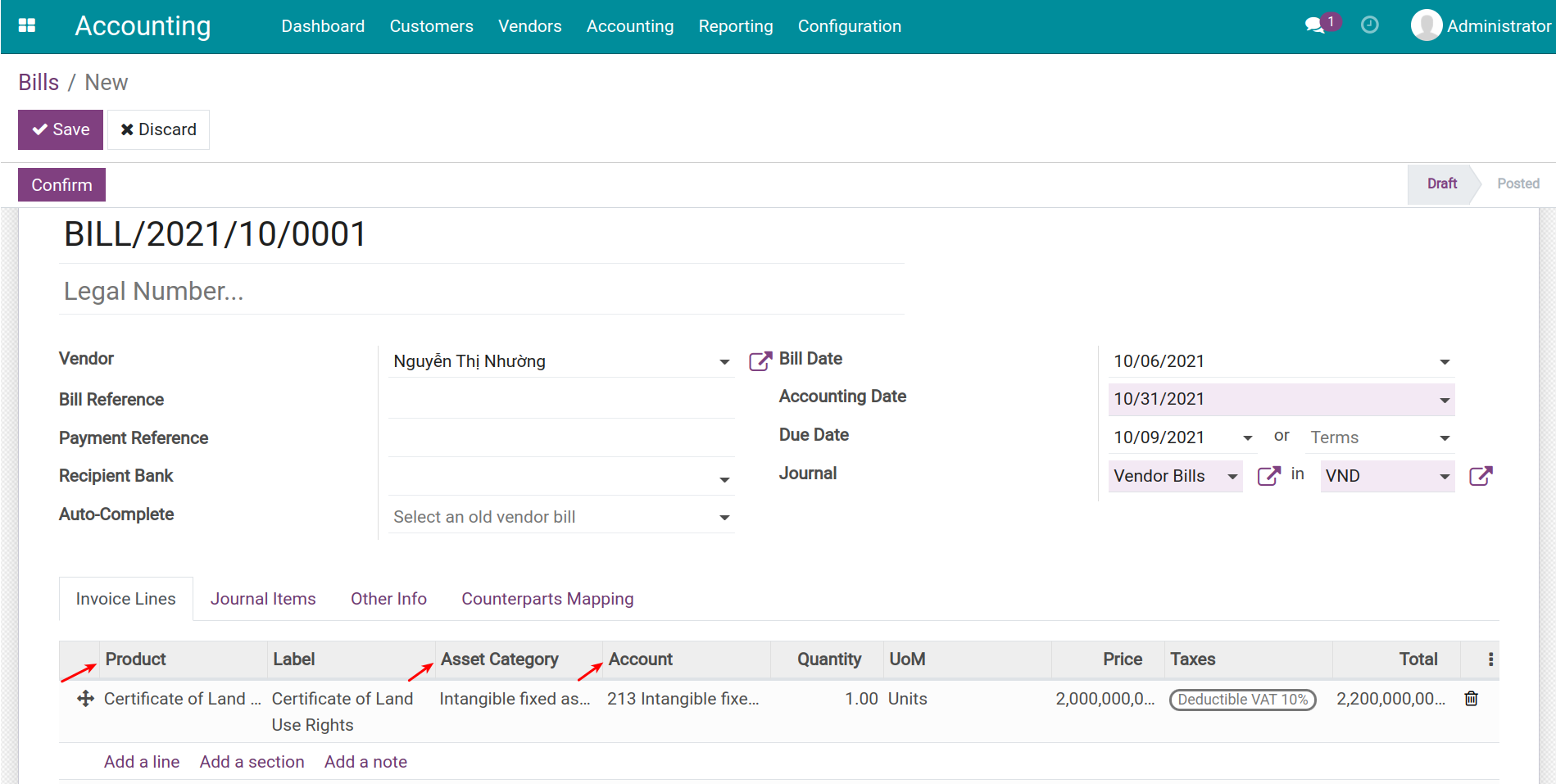

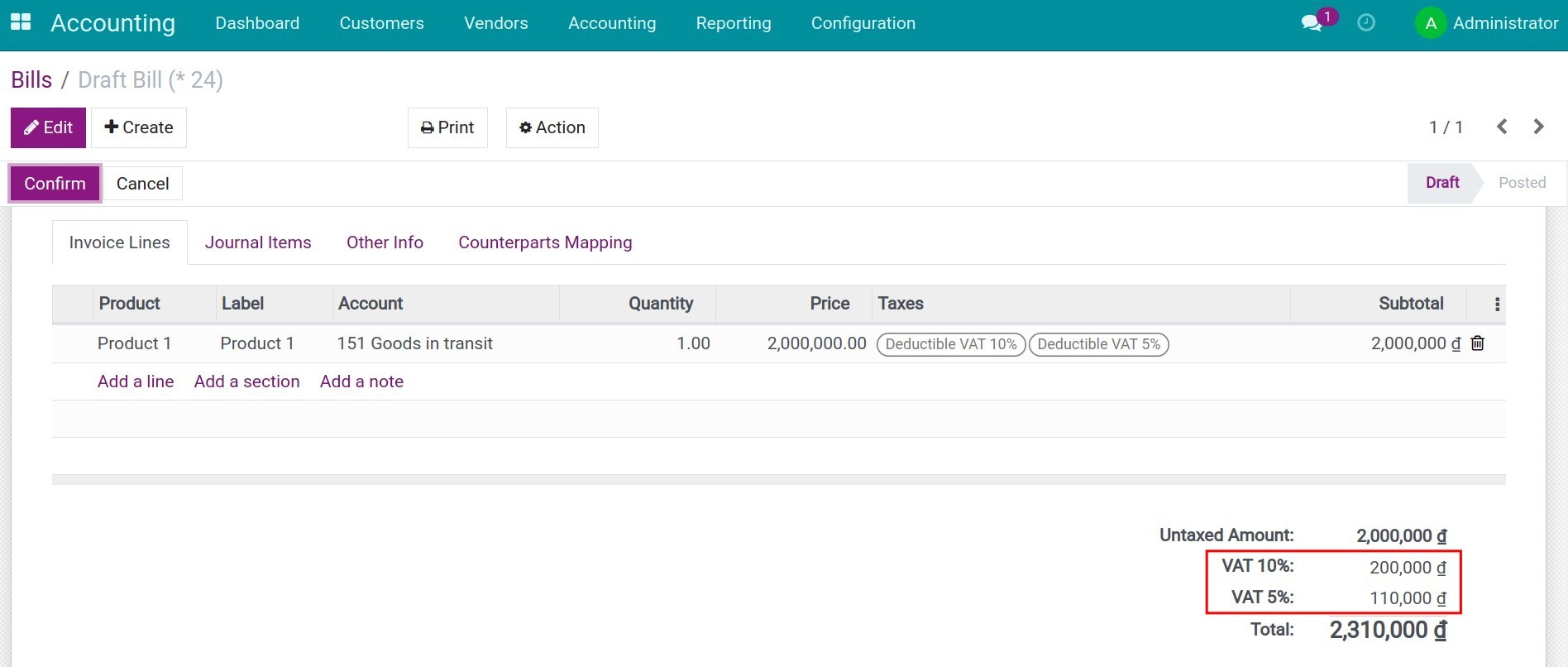

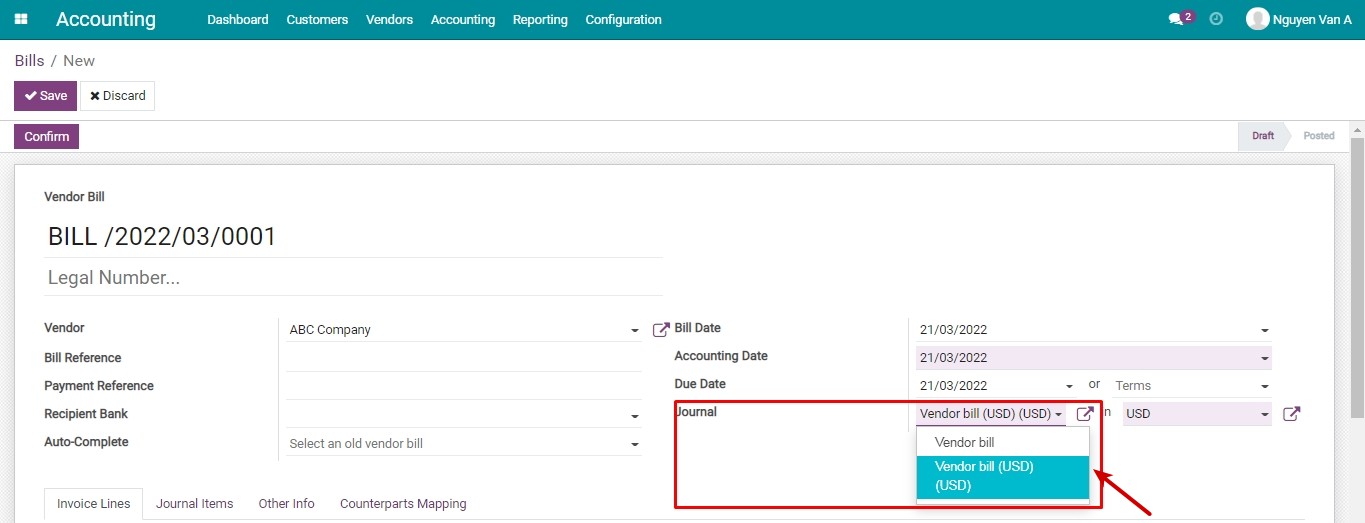

- Create a Vendor bill

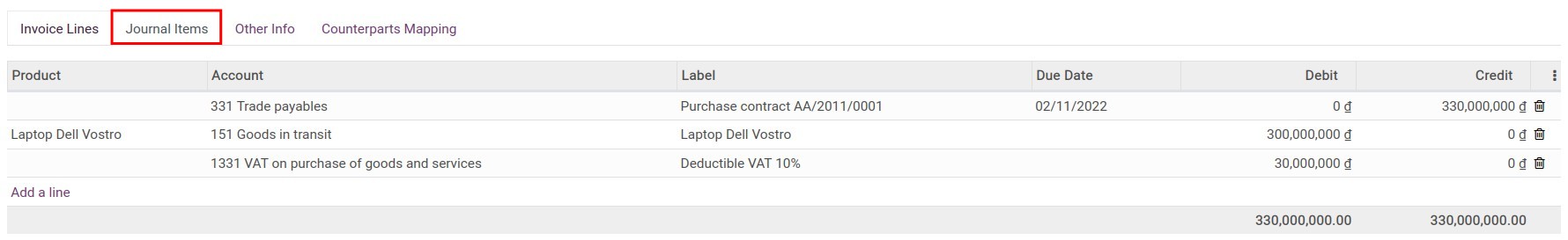

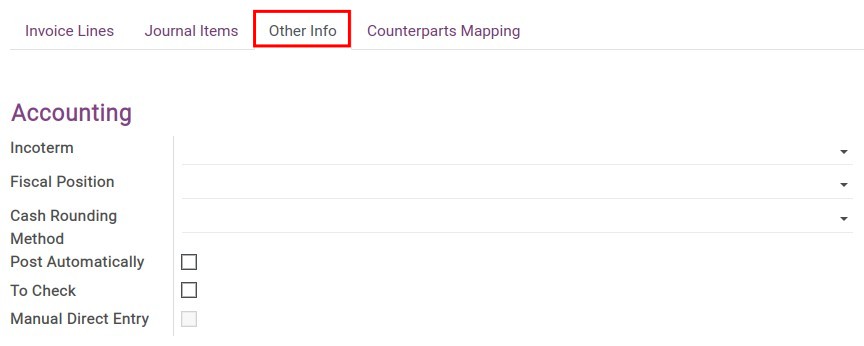

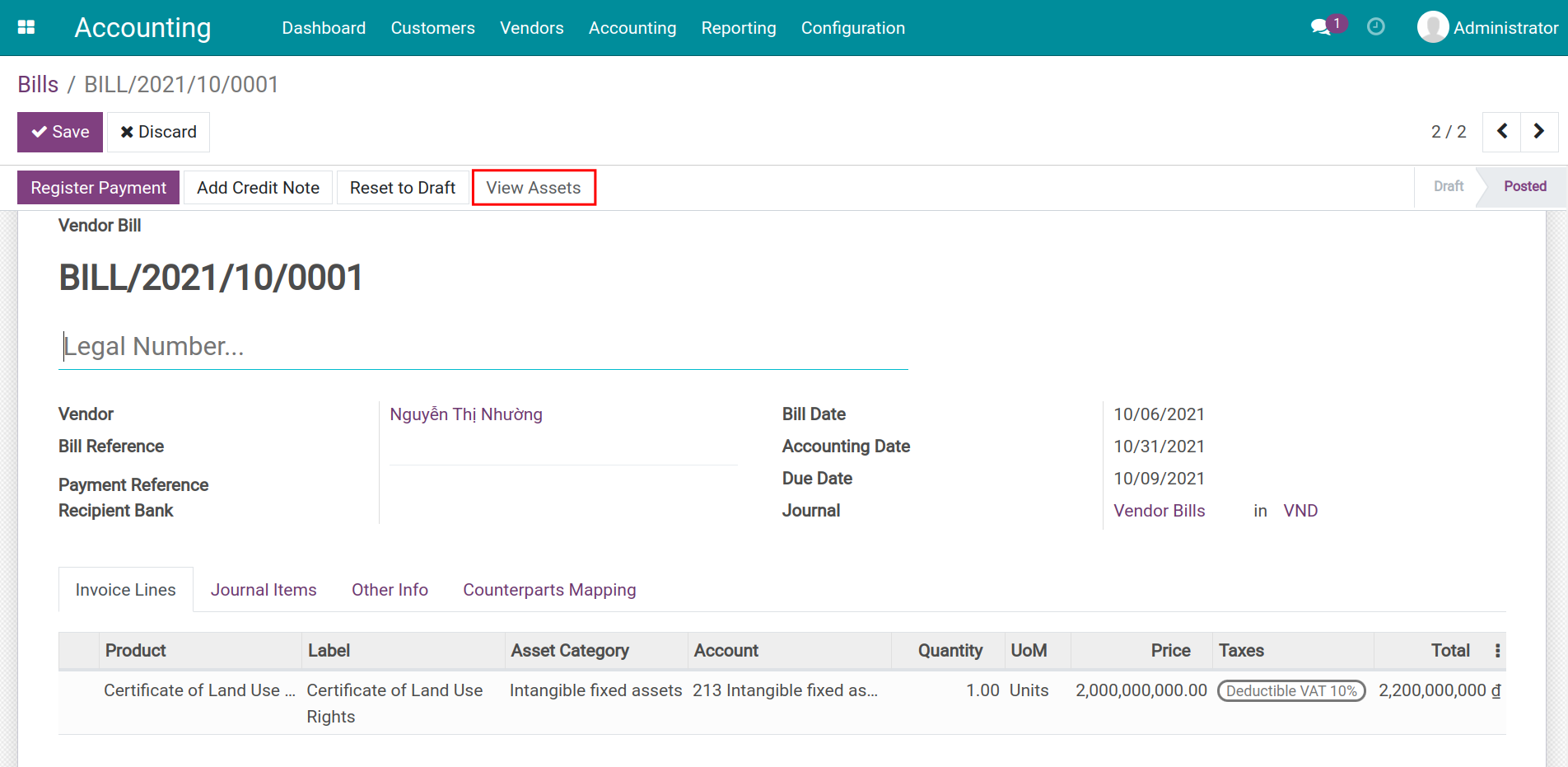

- Confirm Vendor bill

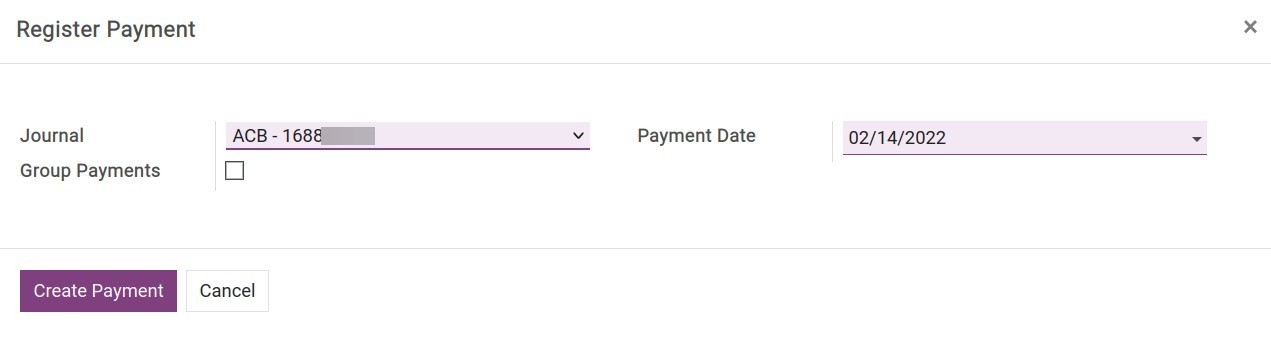

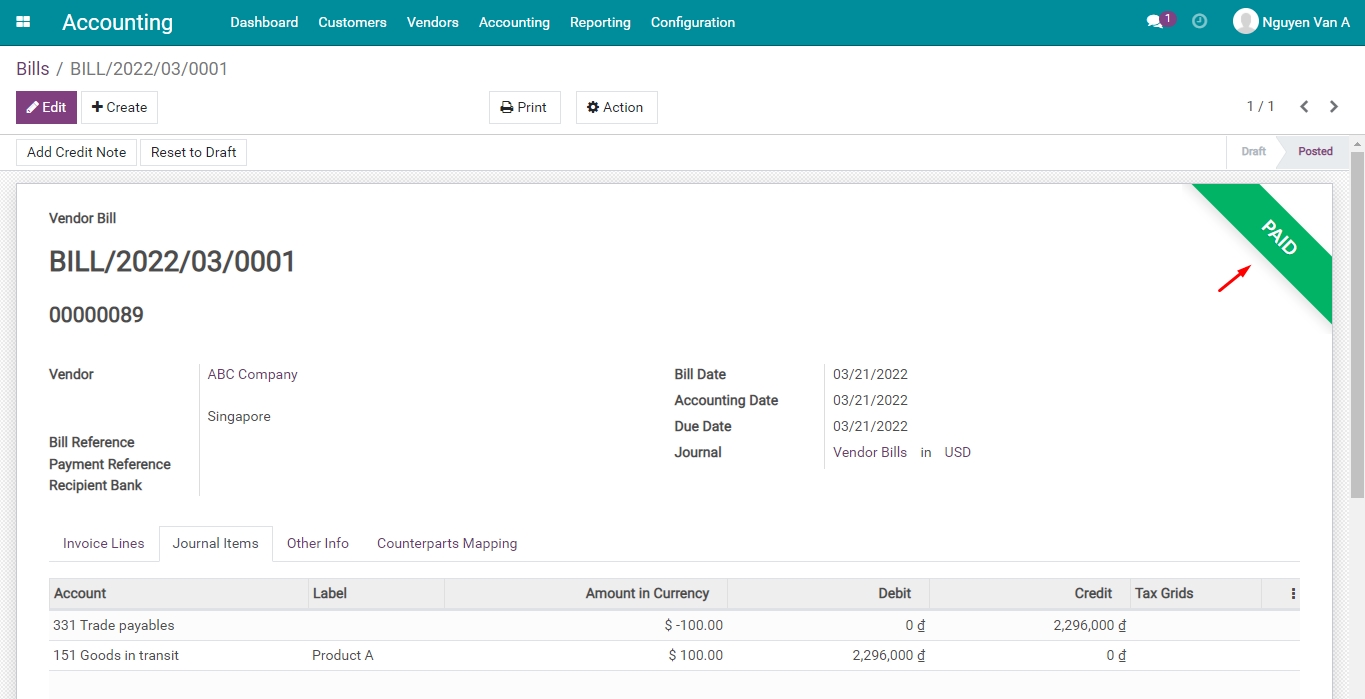

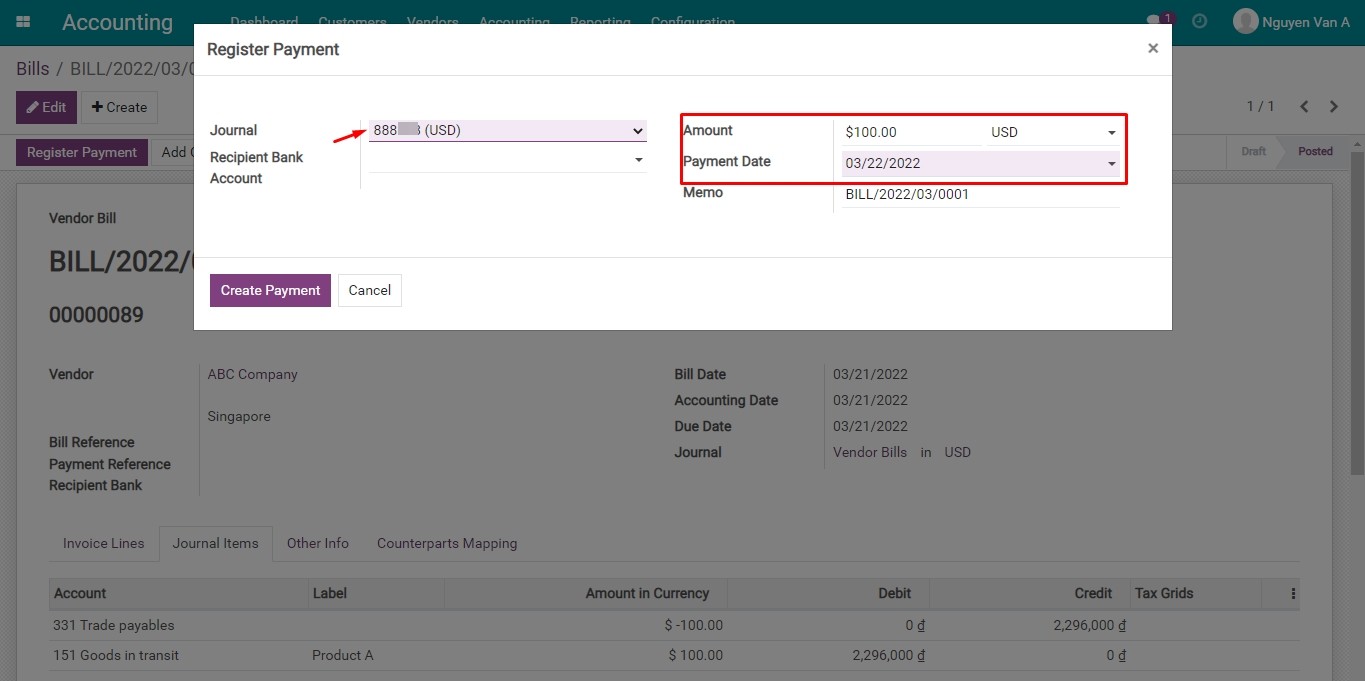

- Create Payment

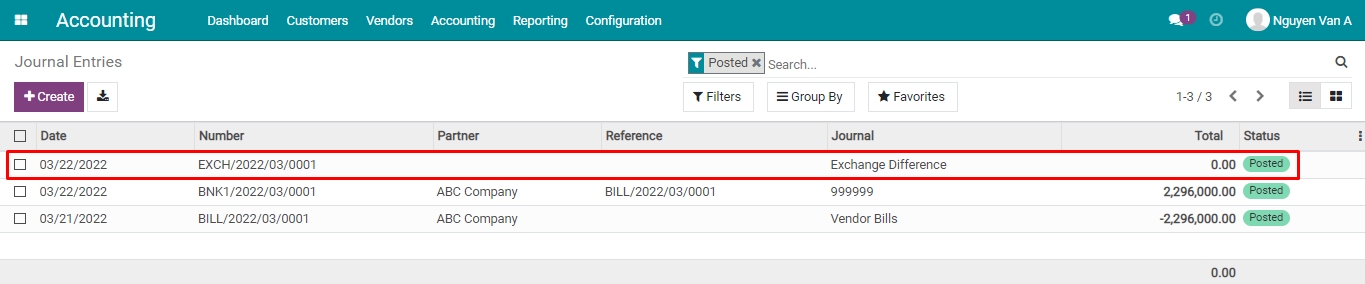

- Register bank statement & payment reconciliation

- Accounts Payable Reports

-

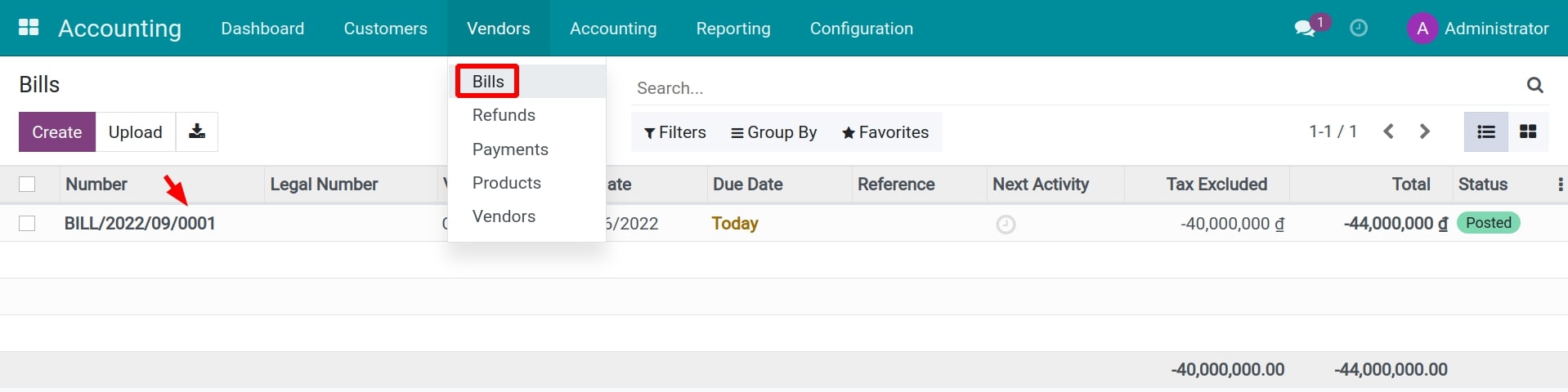

Vendor Bills Management

-

Vendor Bills Management

- Manage Vendor bills in the Purchase app

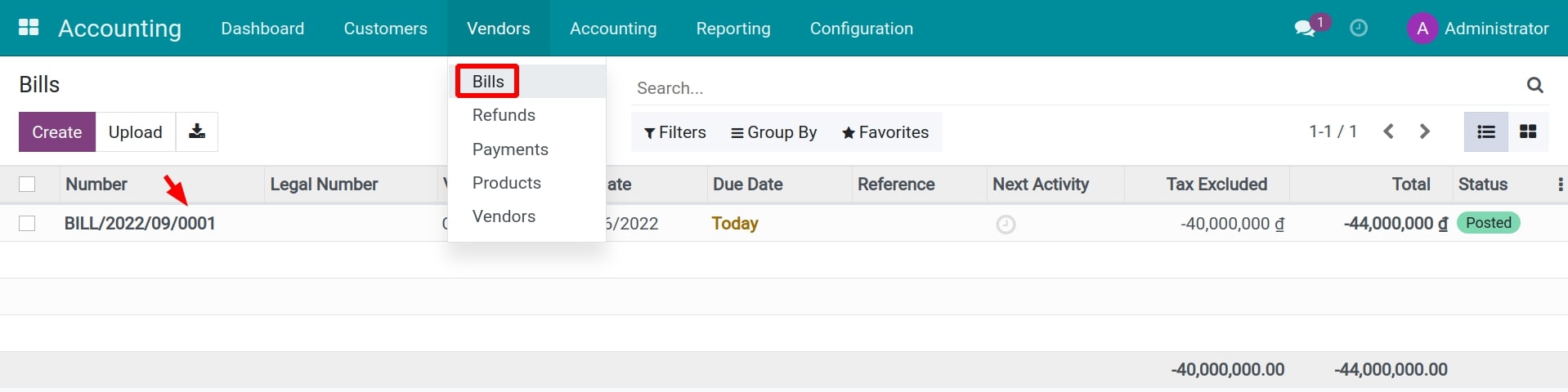

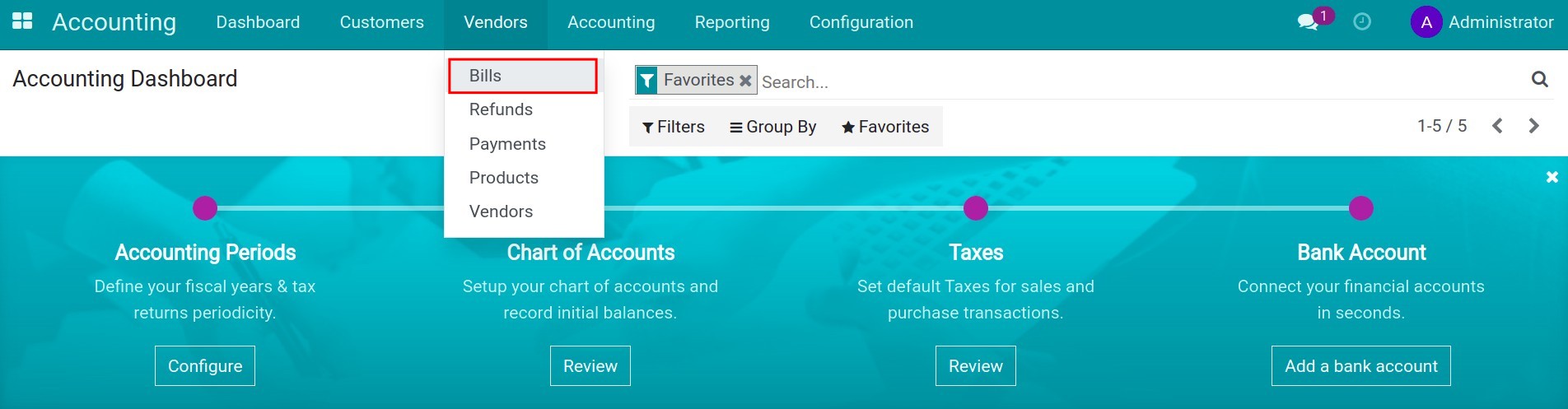

- Manage Vendor Bills in the Accounting app

-

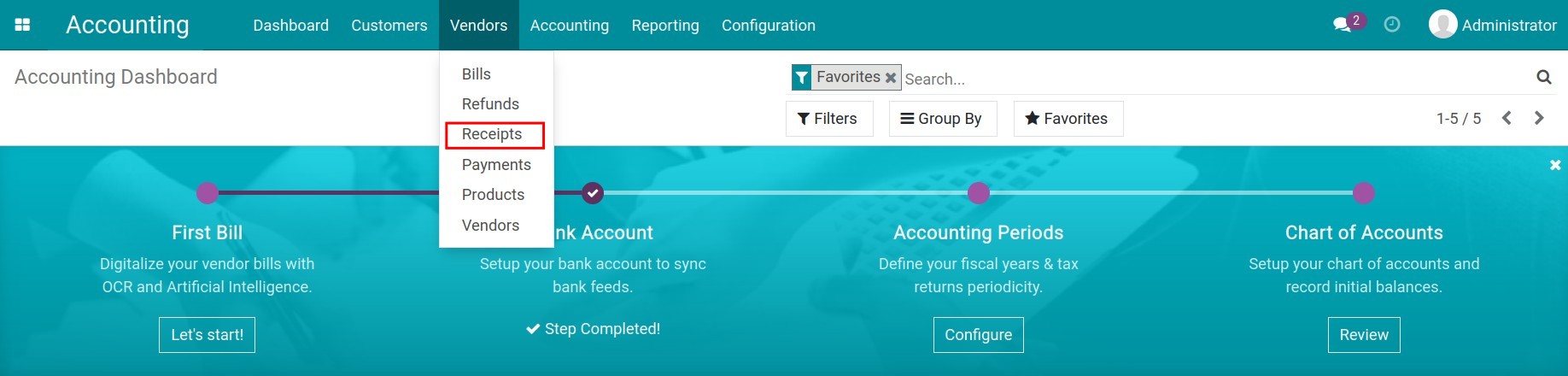

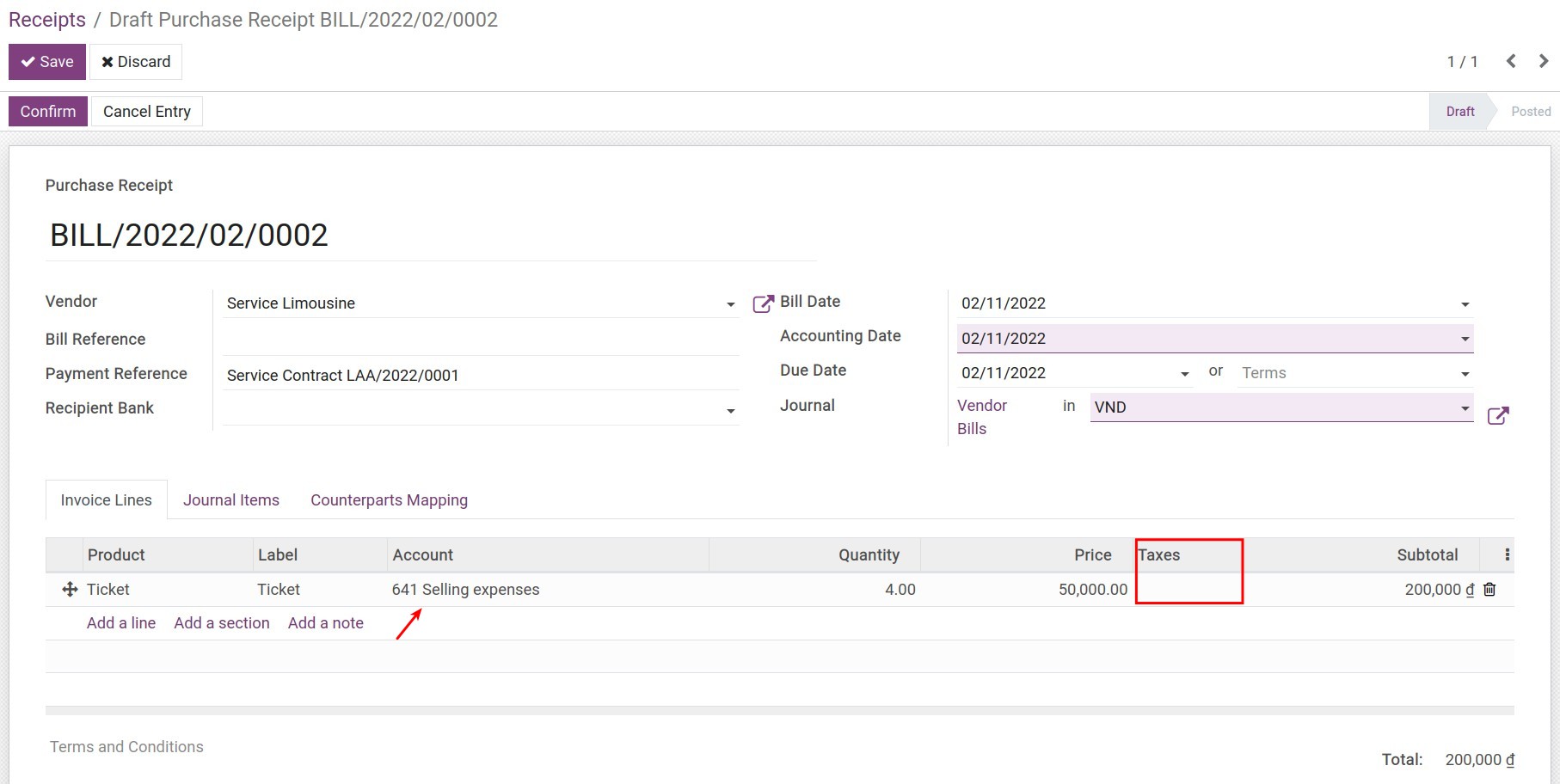

How to create Purchase Receipts

-

How to create Purchase Receipts

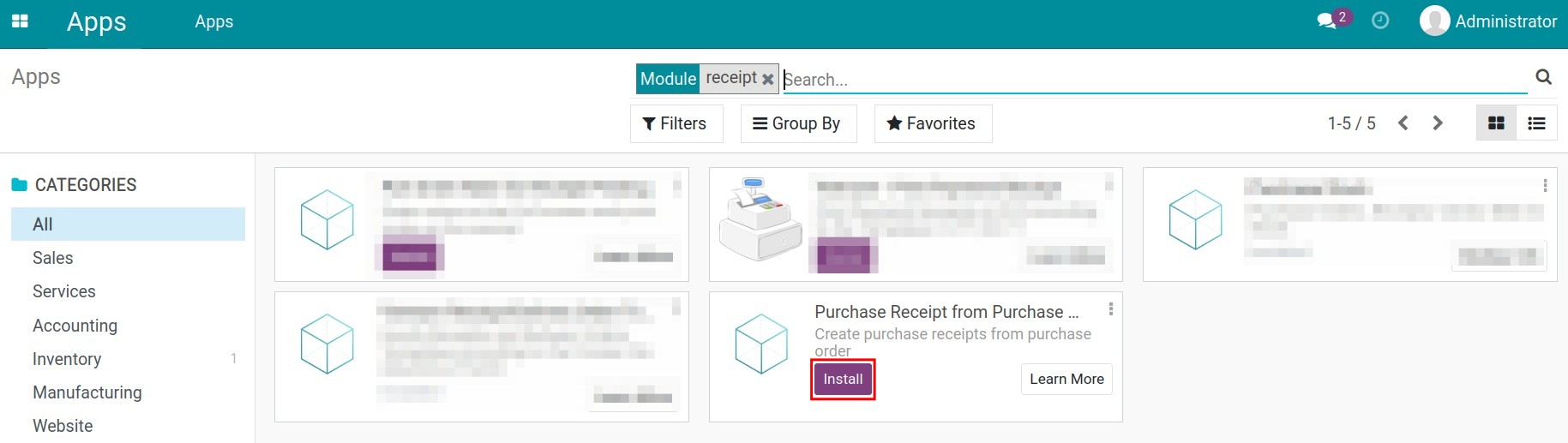

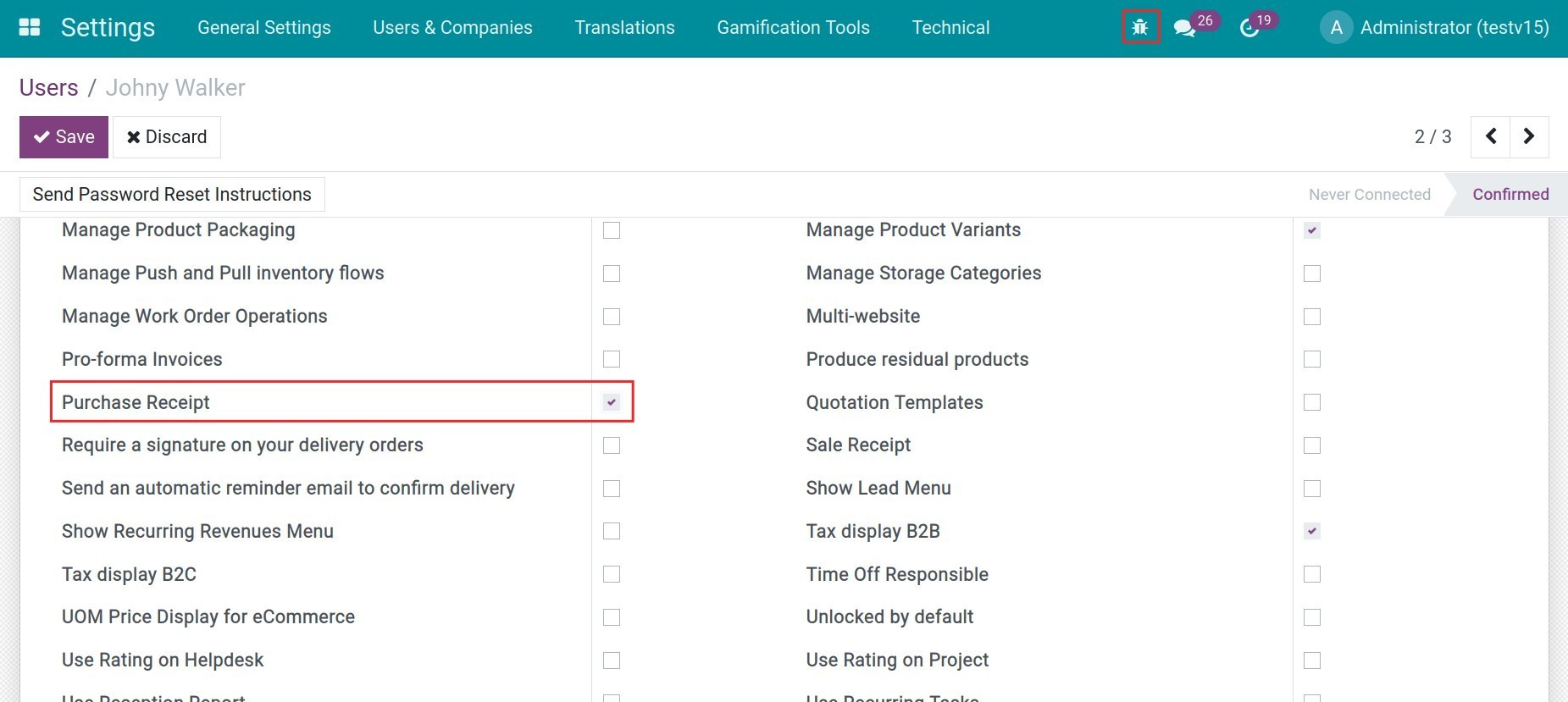

- Configure the Purchase Receipts feature

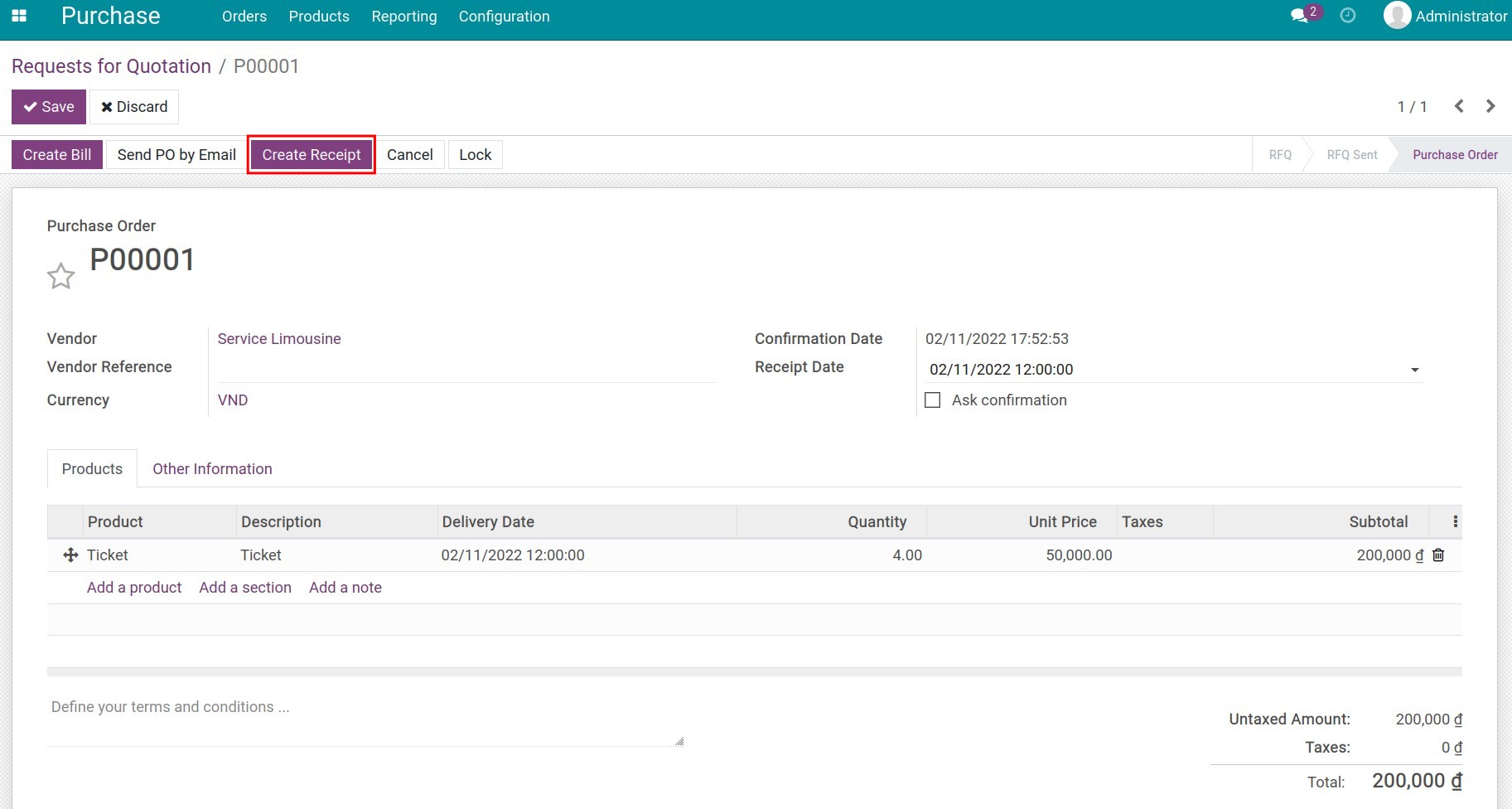

- How to use Purchase Receipt

-

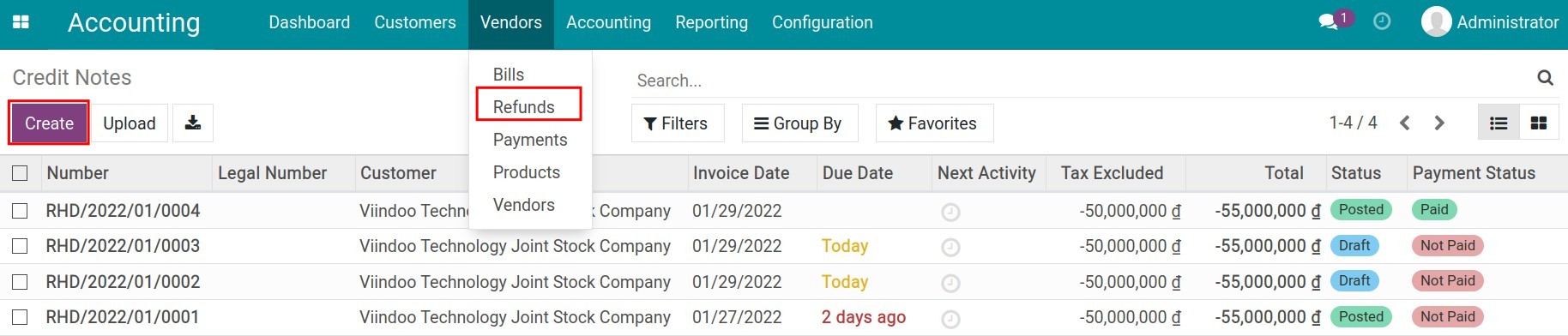

How to refund in iSuite Accounting

- How to refund in iSuite Accounting

-

How to apply cut-off in iSuite Accounting

- How to apply cut-off in iSuite Accounting

-

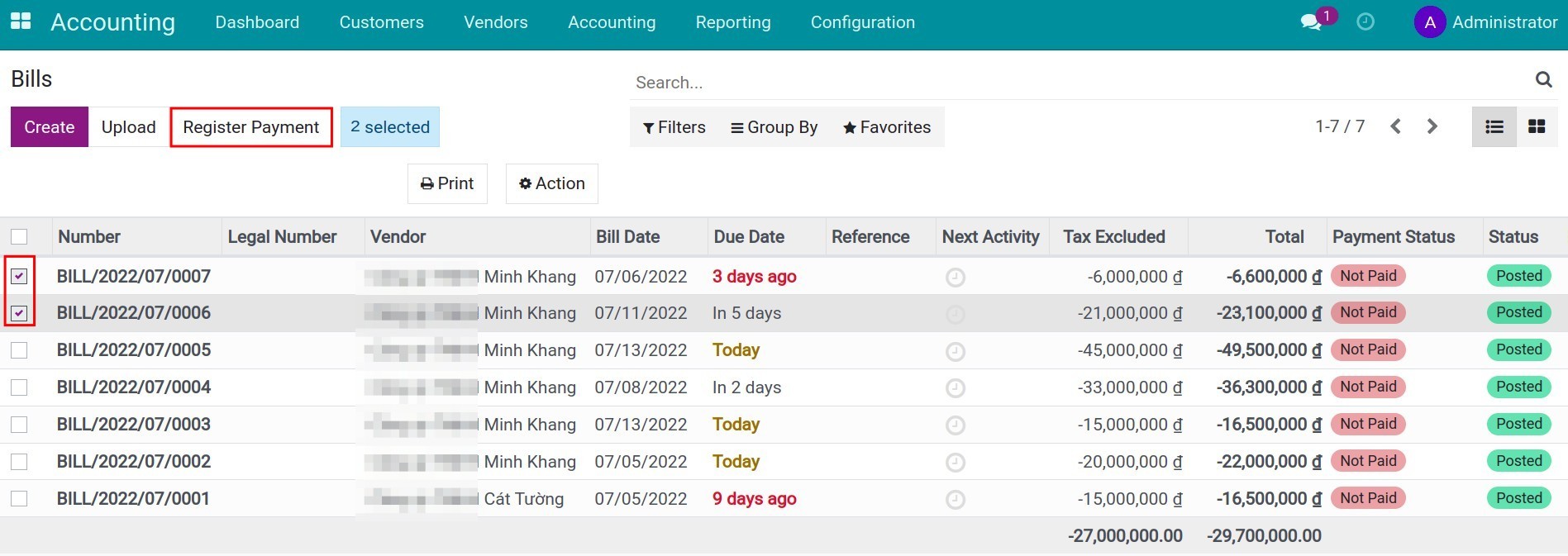

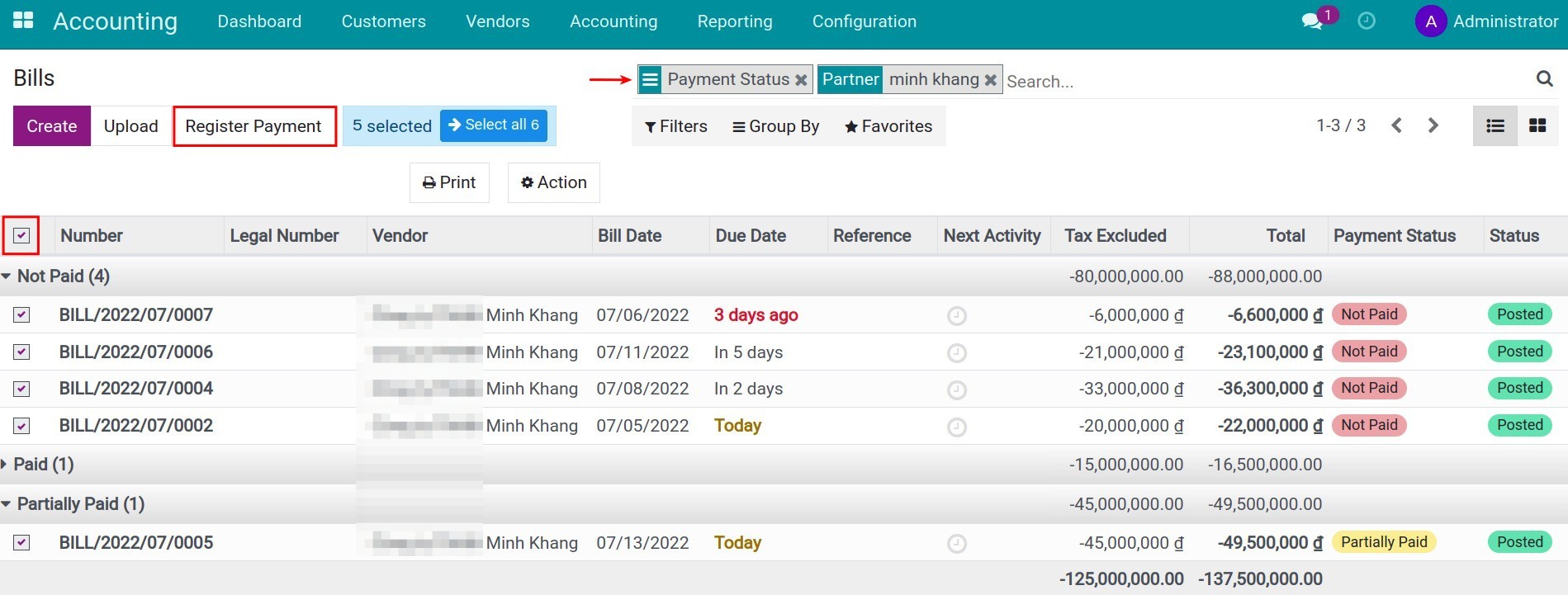

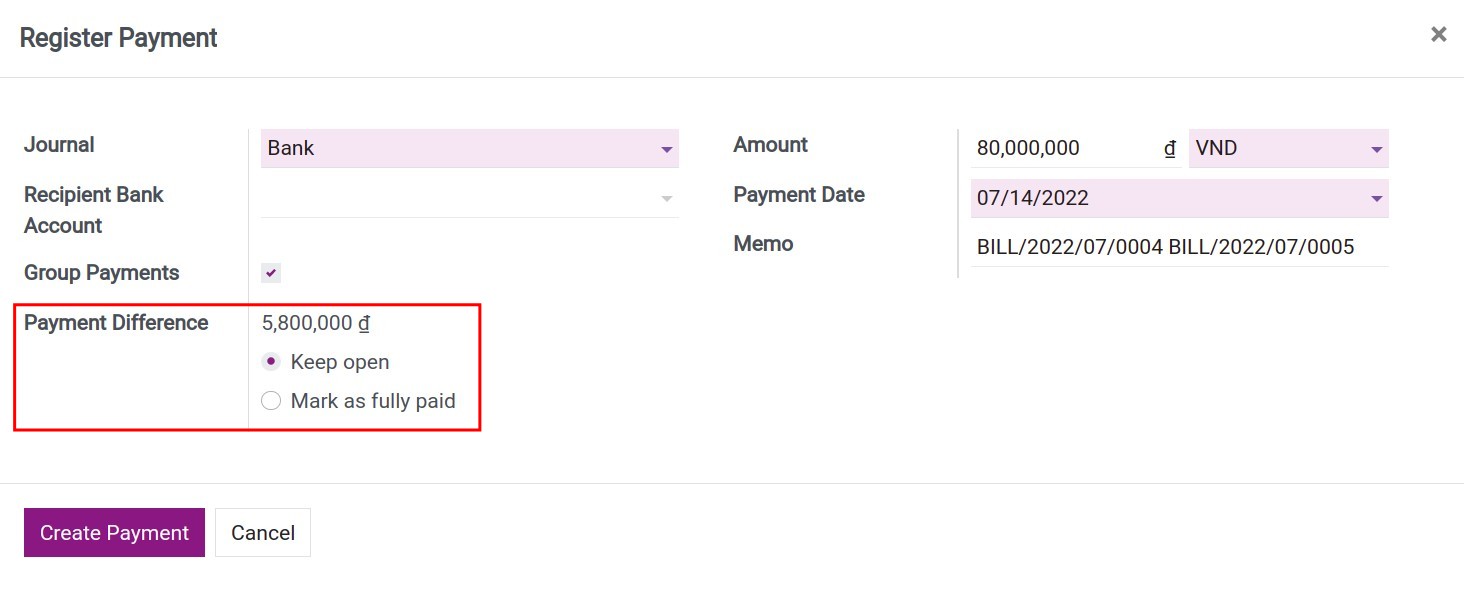

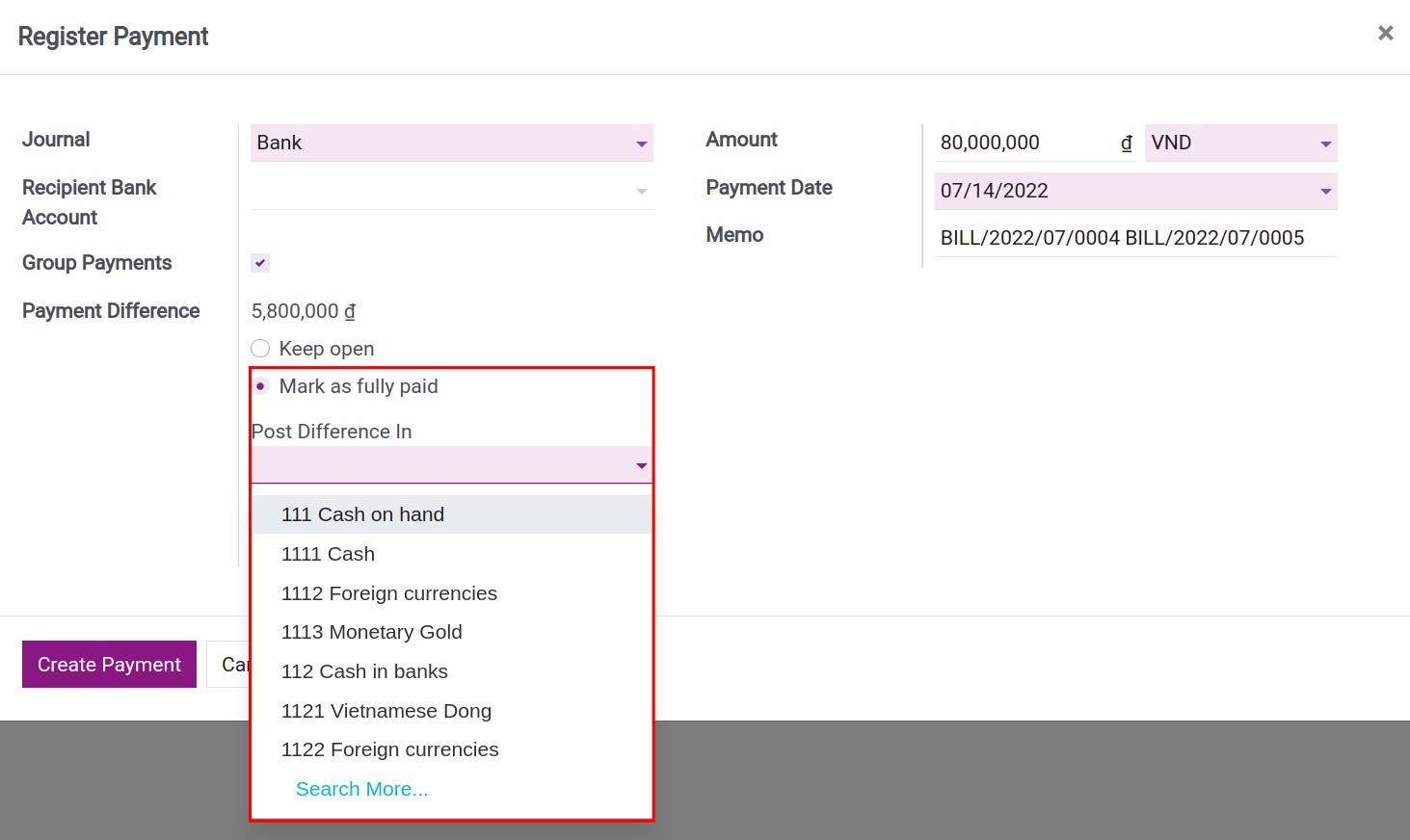

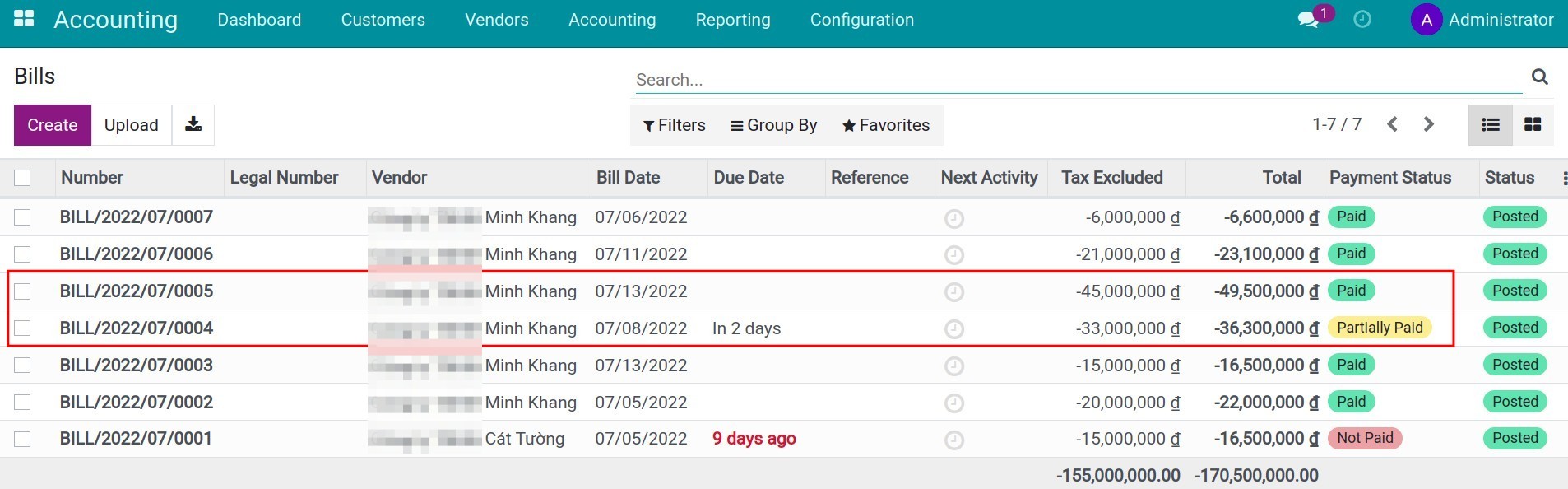

Pay various distinctive bills at the same time

- Pay various distinctive bills at the same time

-

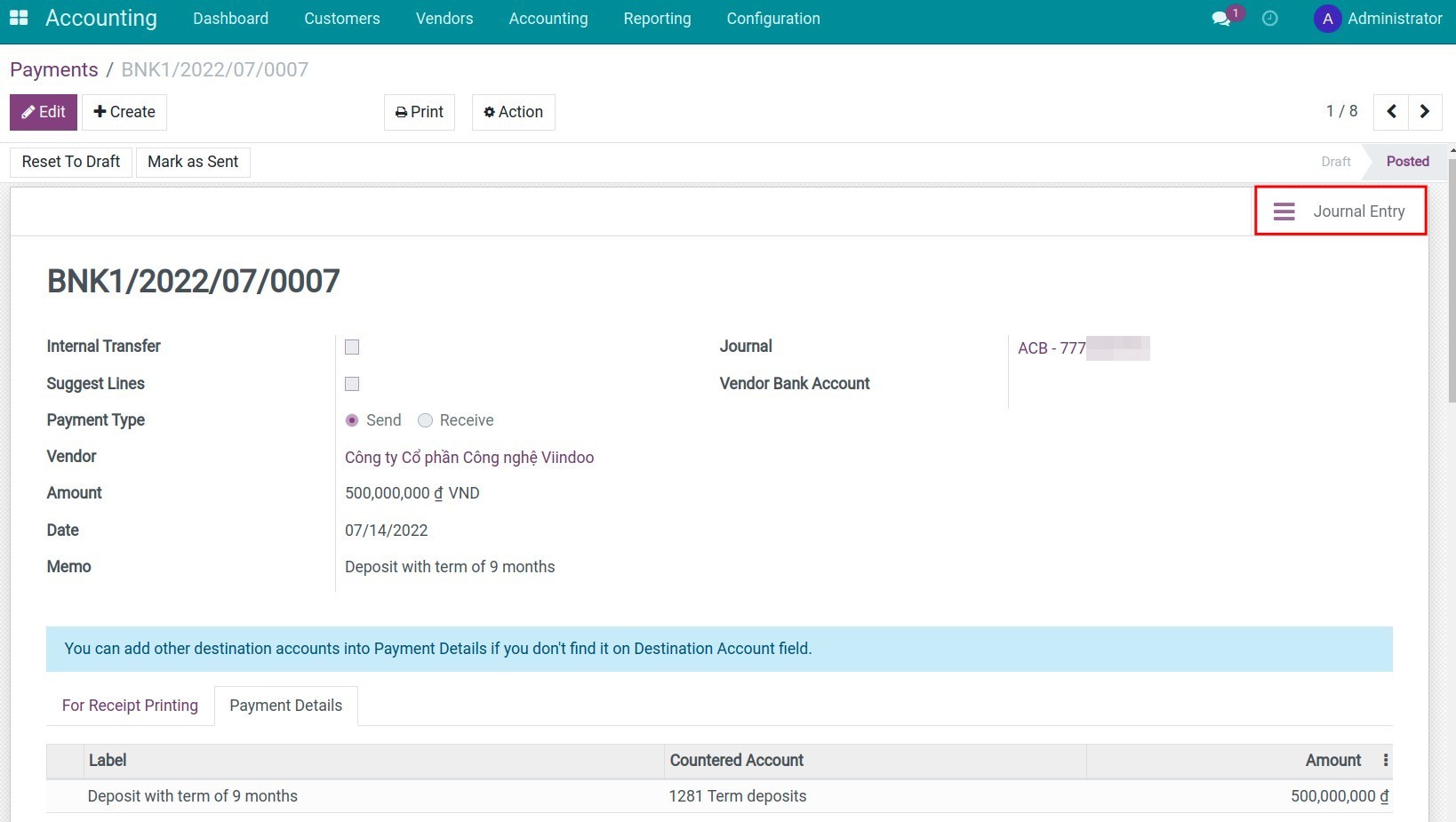

Time deposit transactions

-

Time deposit transactions

-

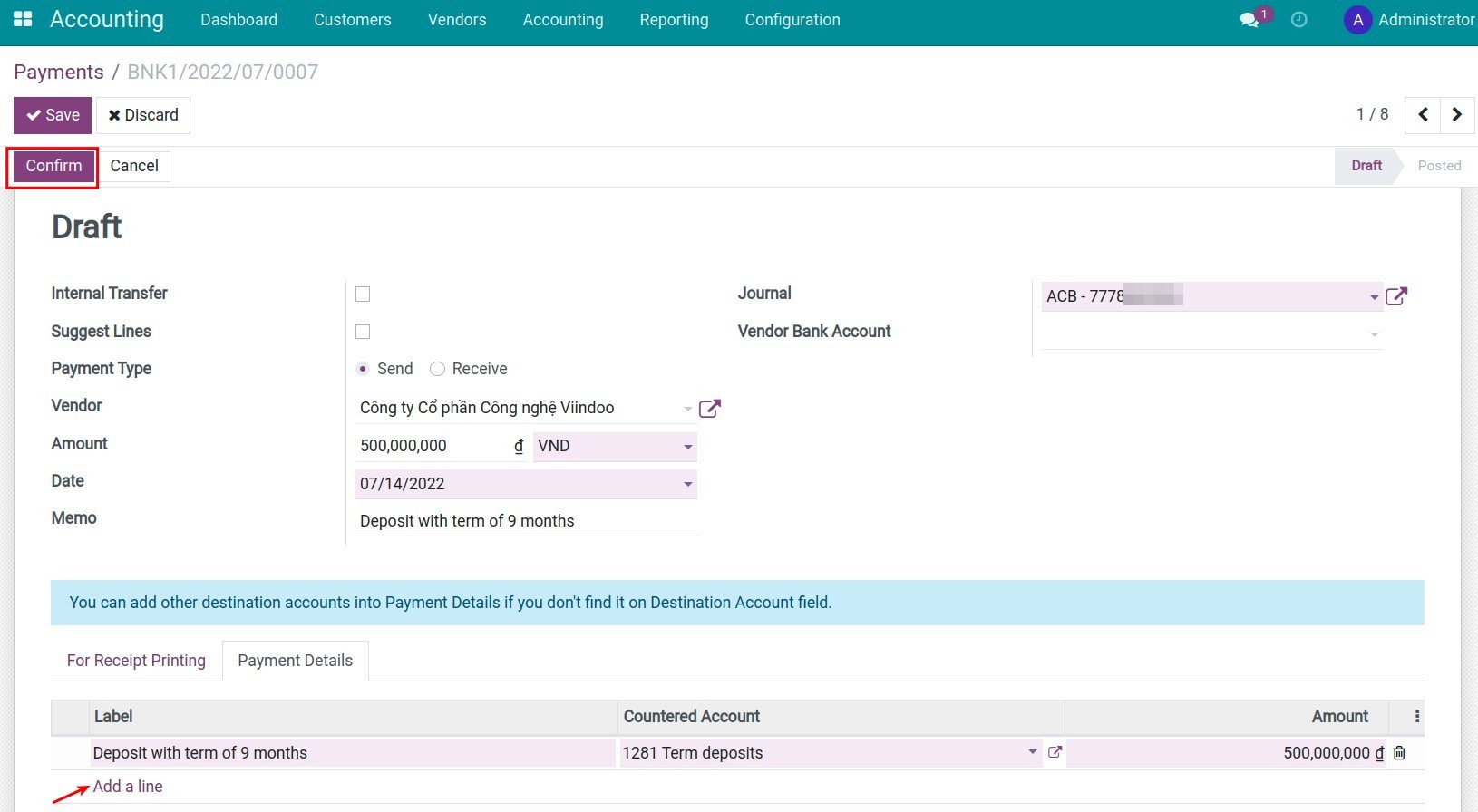

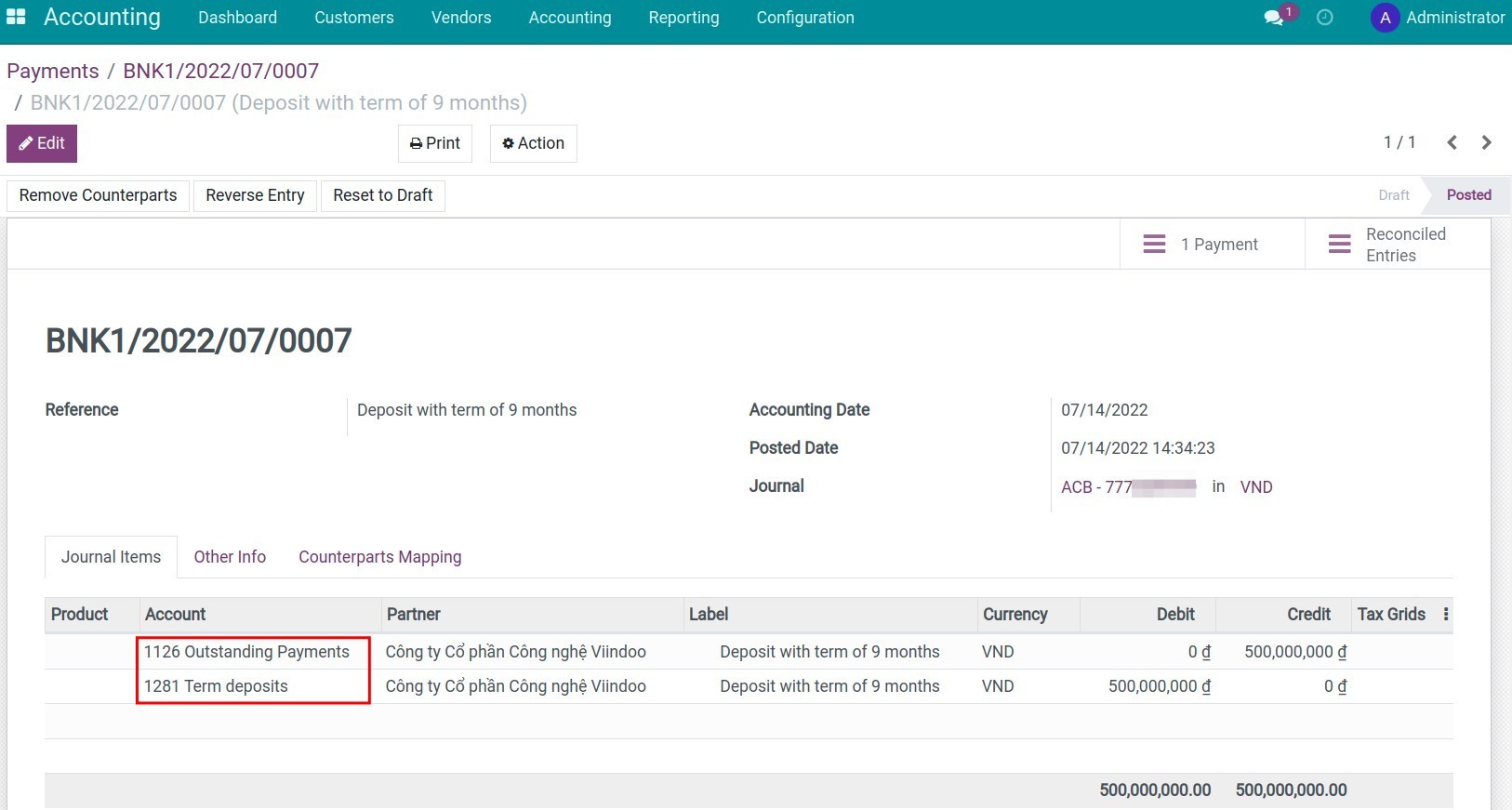

Make a time deposit

- Create a cash-out payment

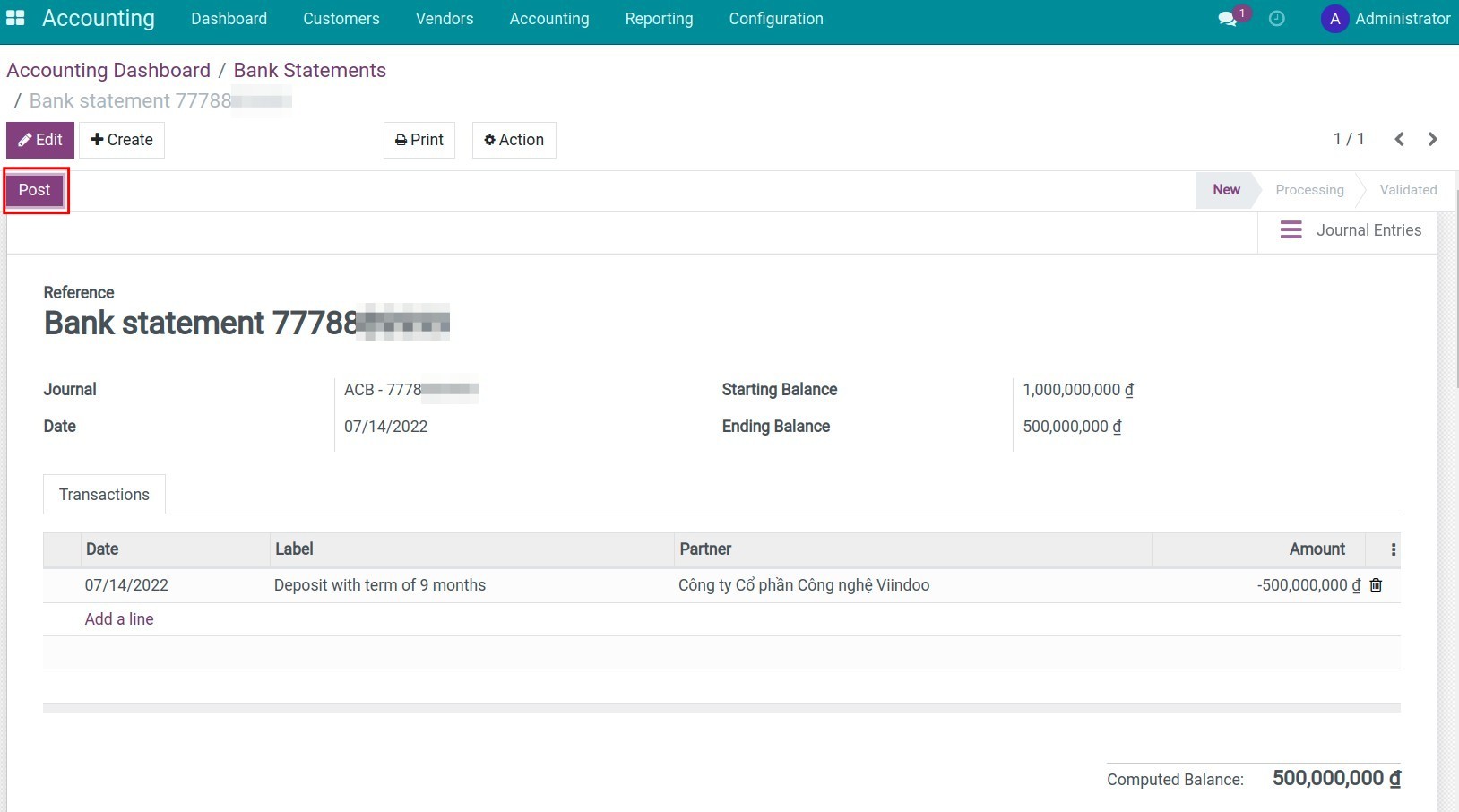

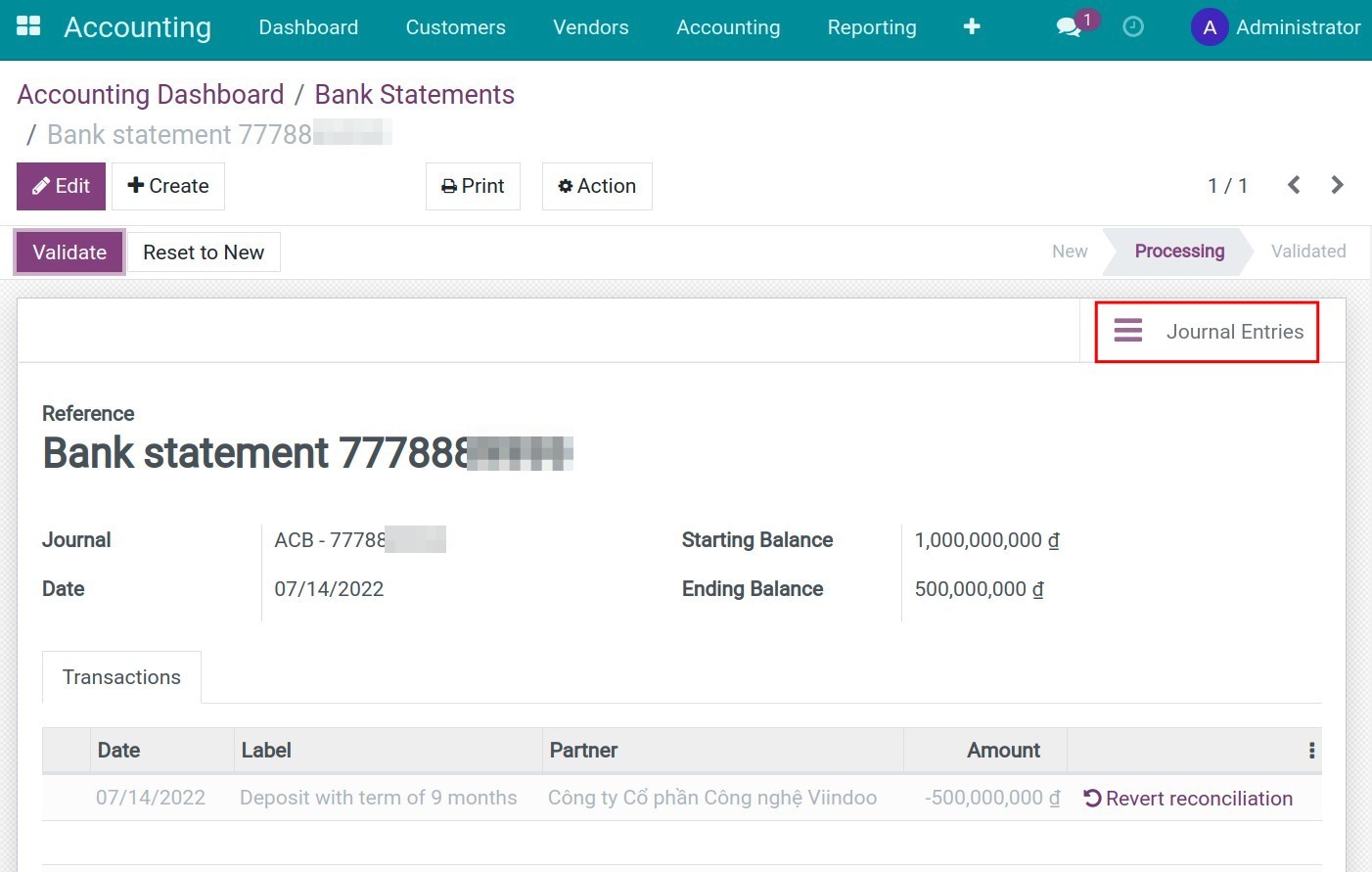

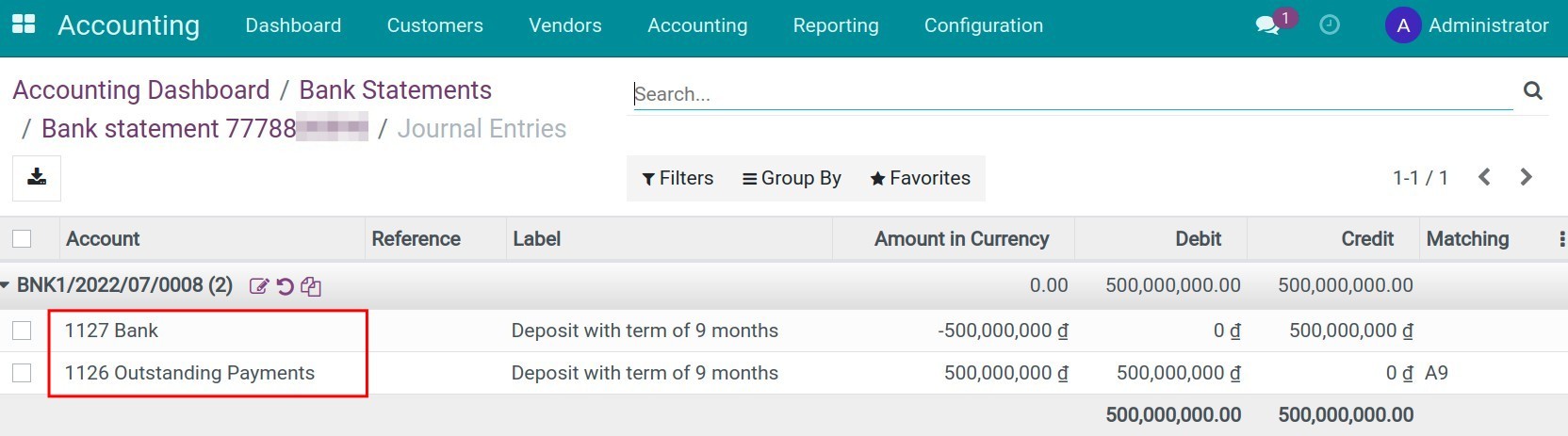

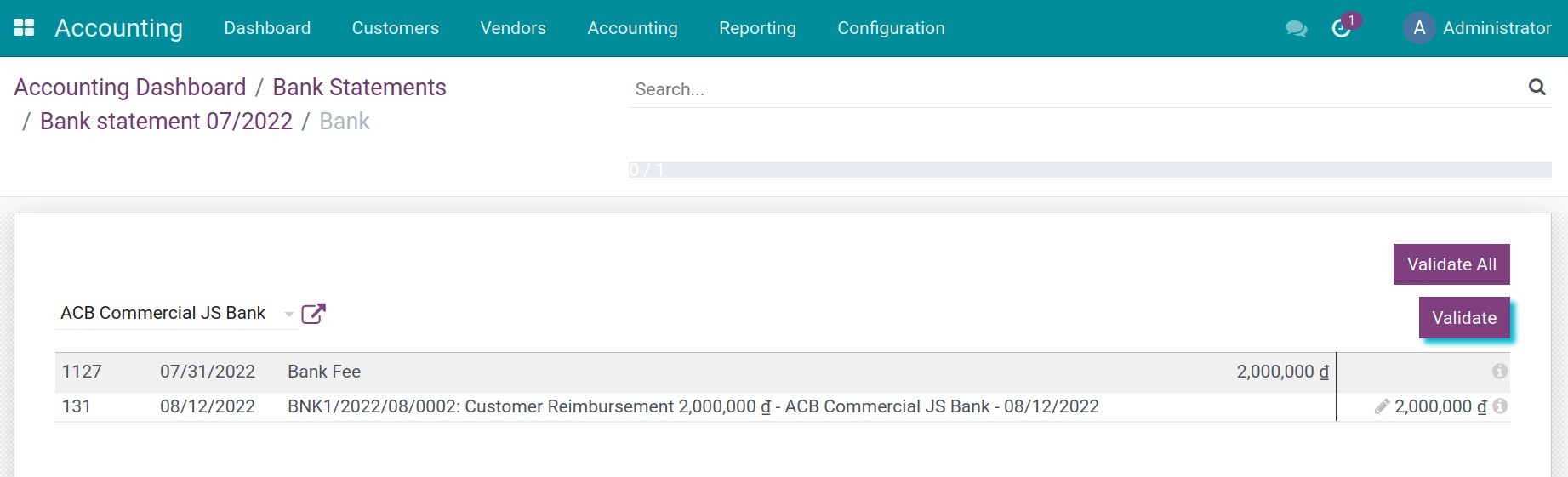

- Create a bank statement and reconciliation

-

Recording deposit interest

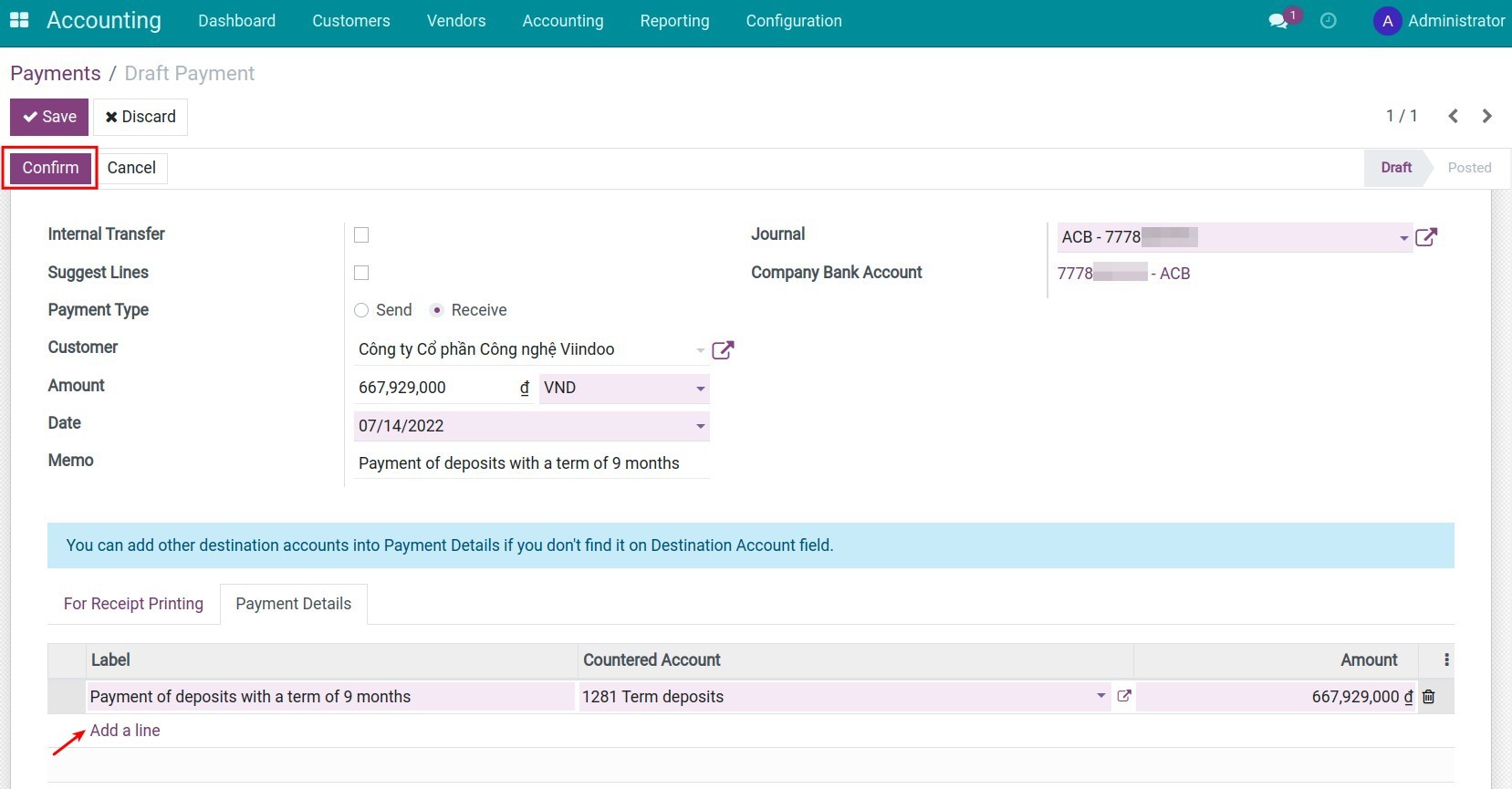

- Receive the principal amount together with interest

- Receive only interest on maturity date at the current bank account

-

Time deposit settlement

- Create a cash-in payment

- Create a bank statement and reconciliation

-

Manage Bank Statements

-

Manage Bank Statements

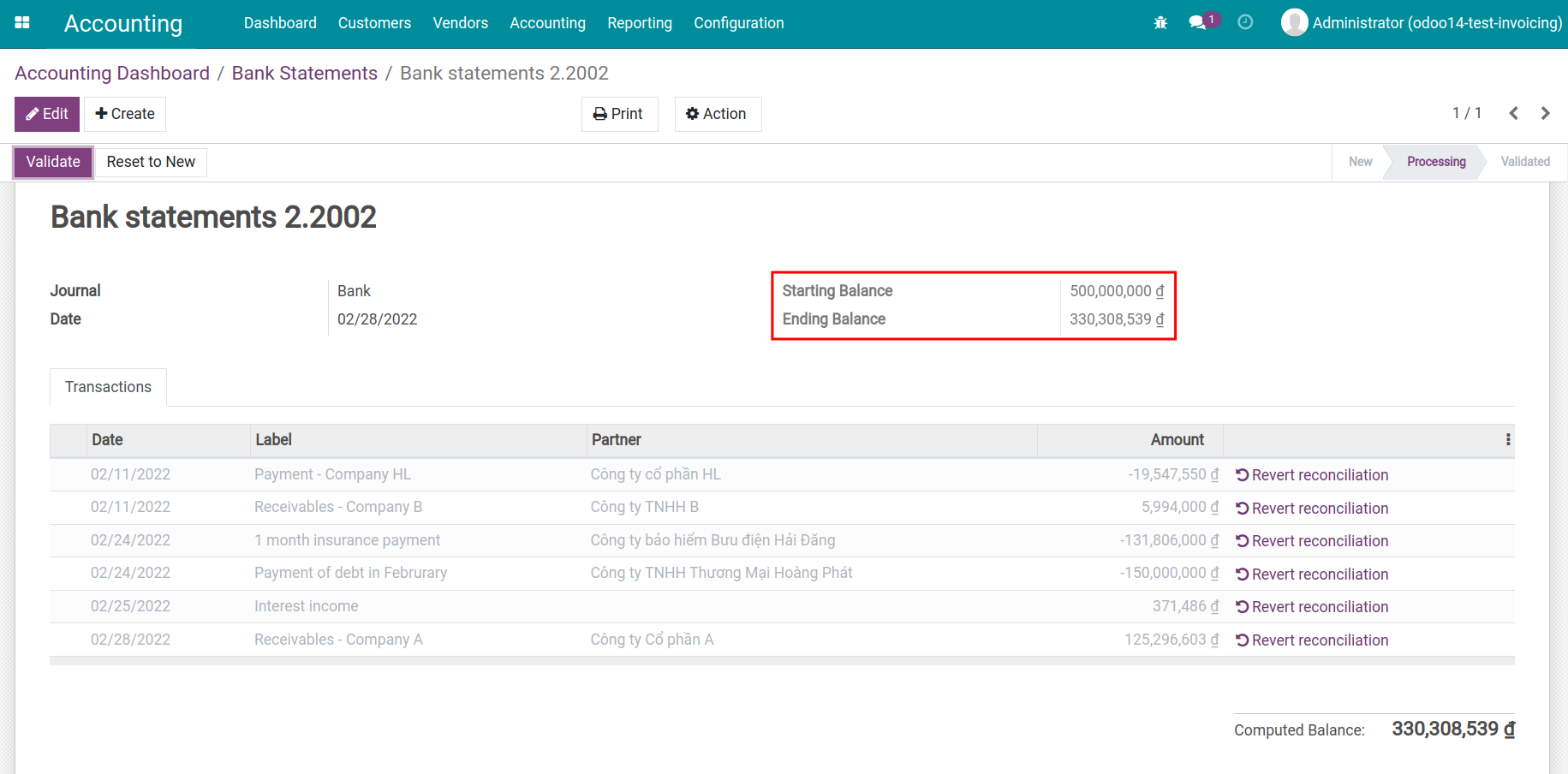

- Manually create a bank statement

- Import a bank statements file

-

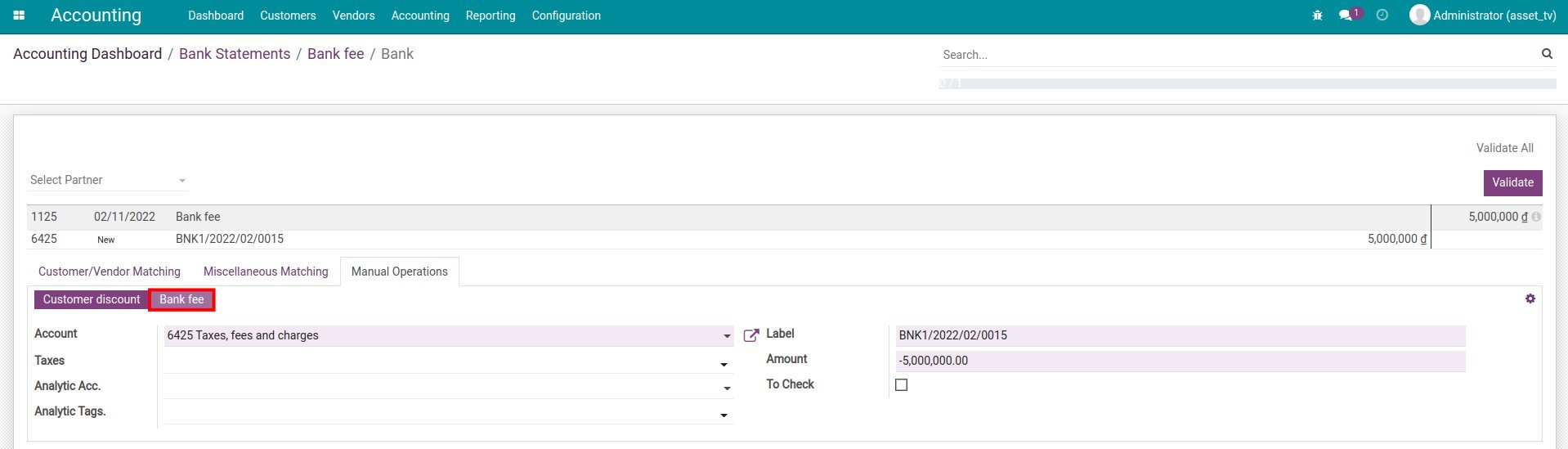

Create reconciliation model for deposit interest and bank fees

-

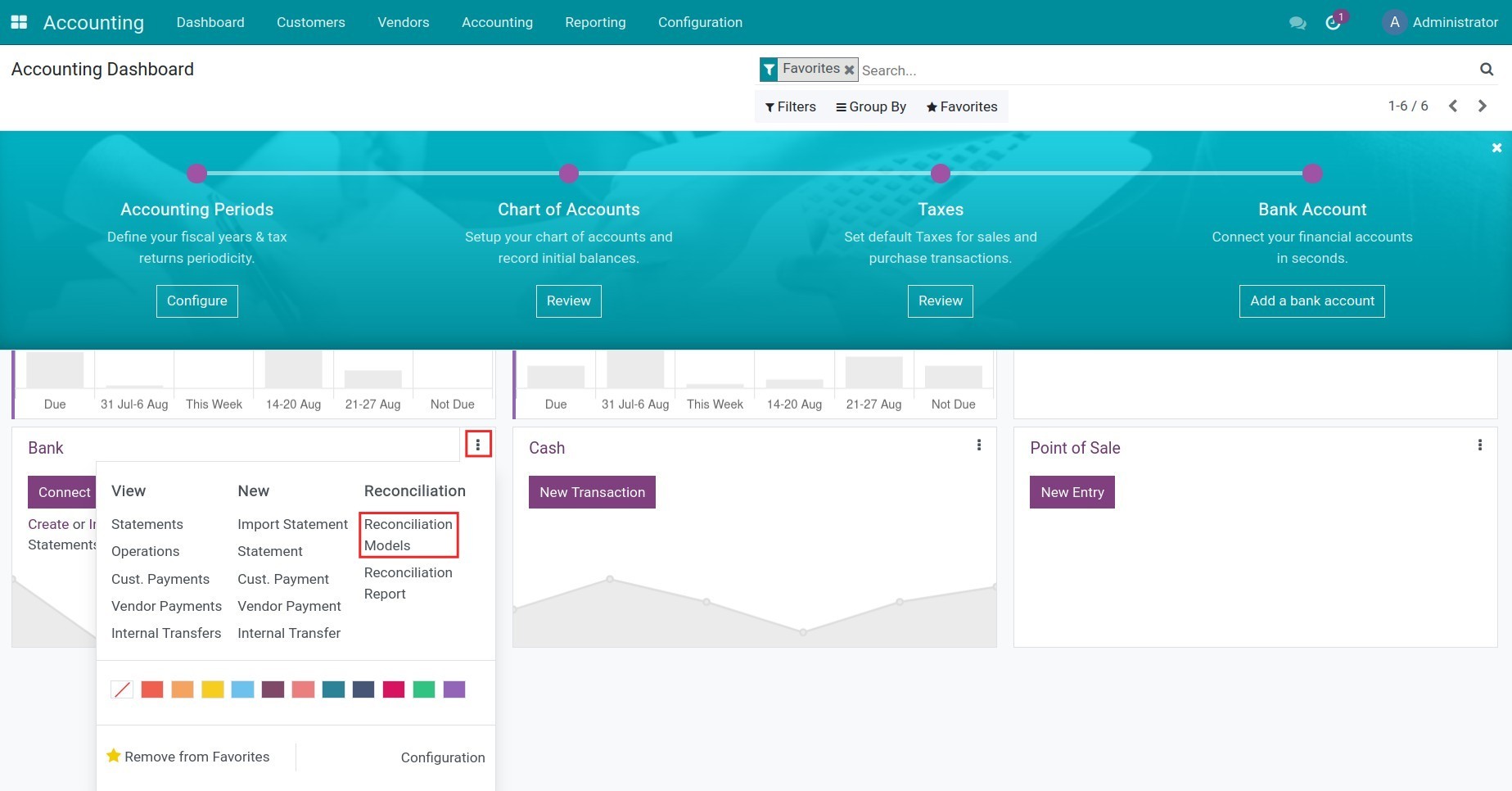

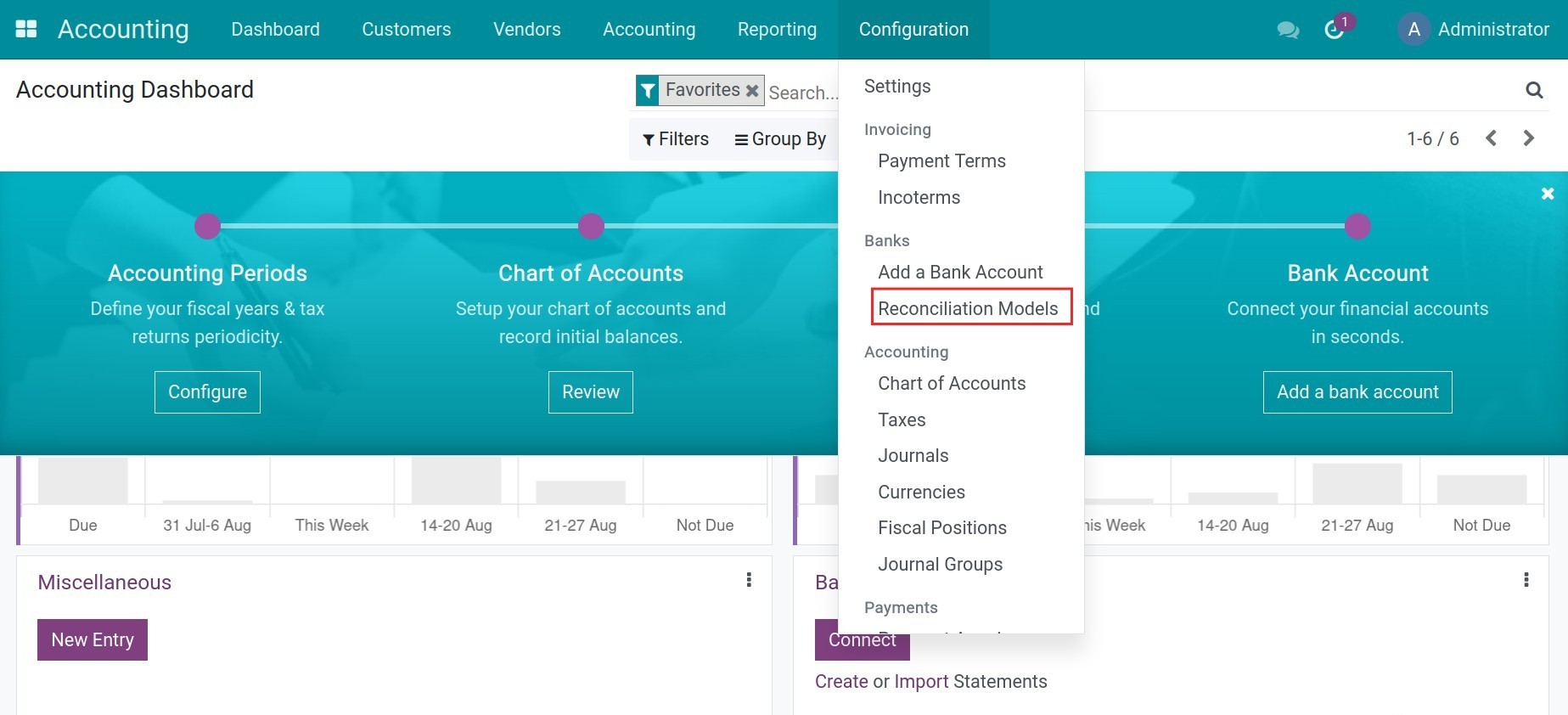

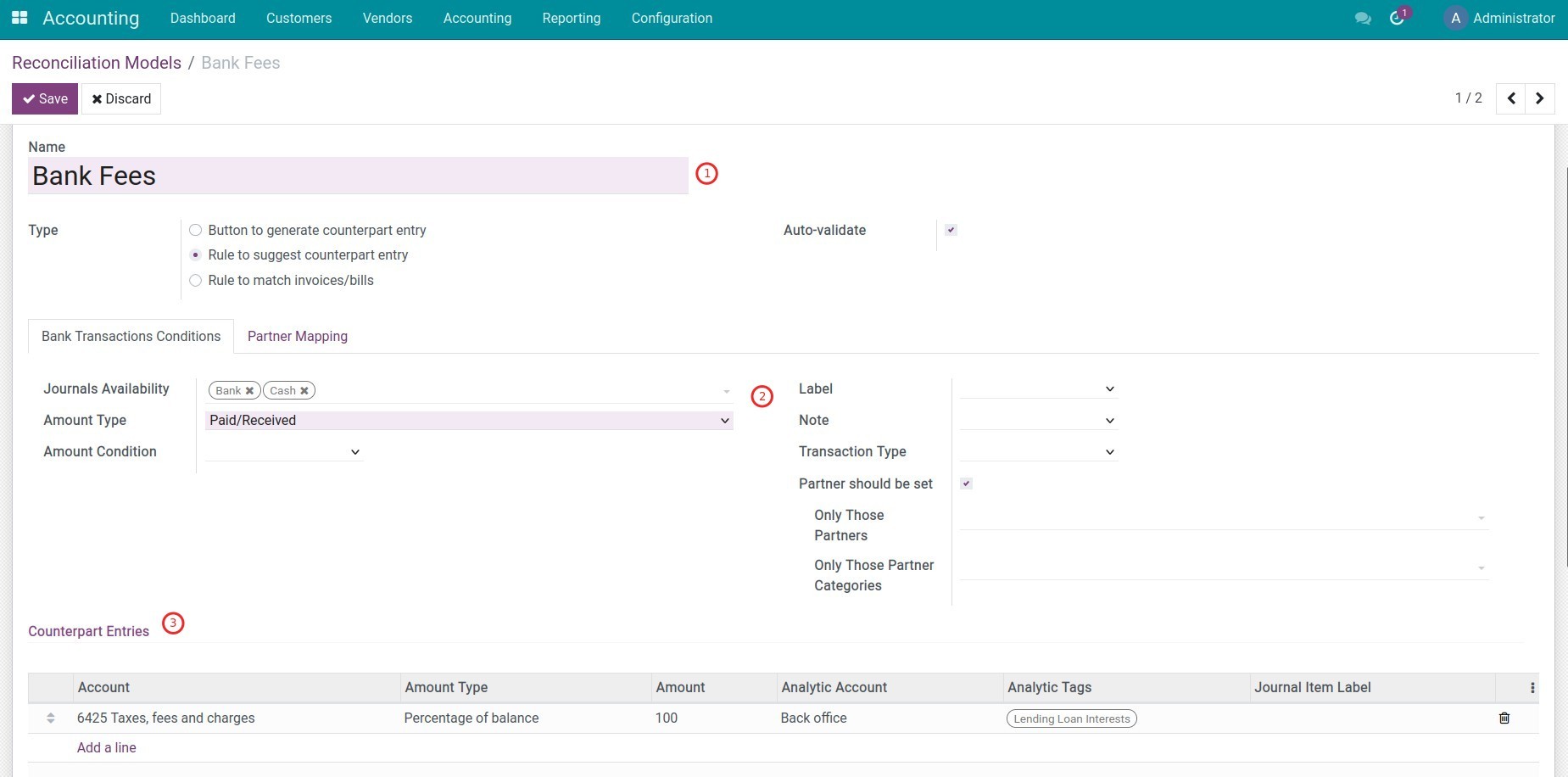

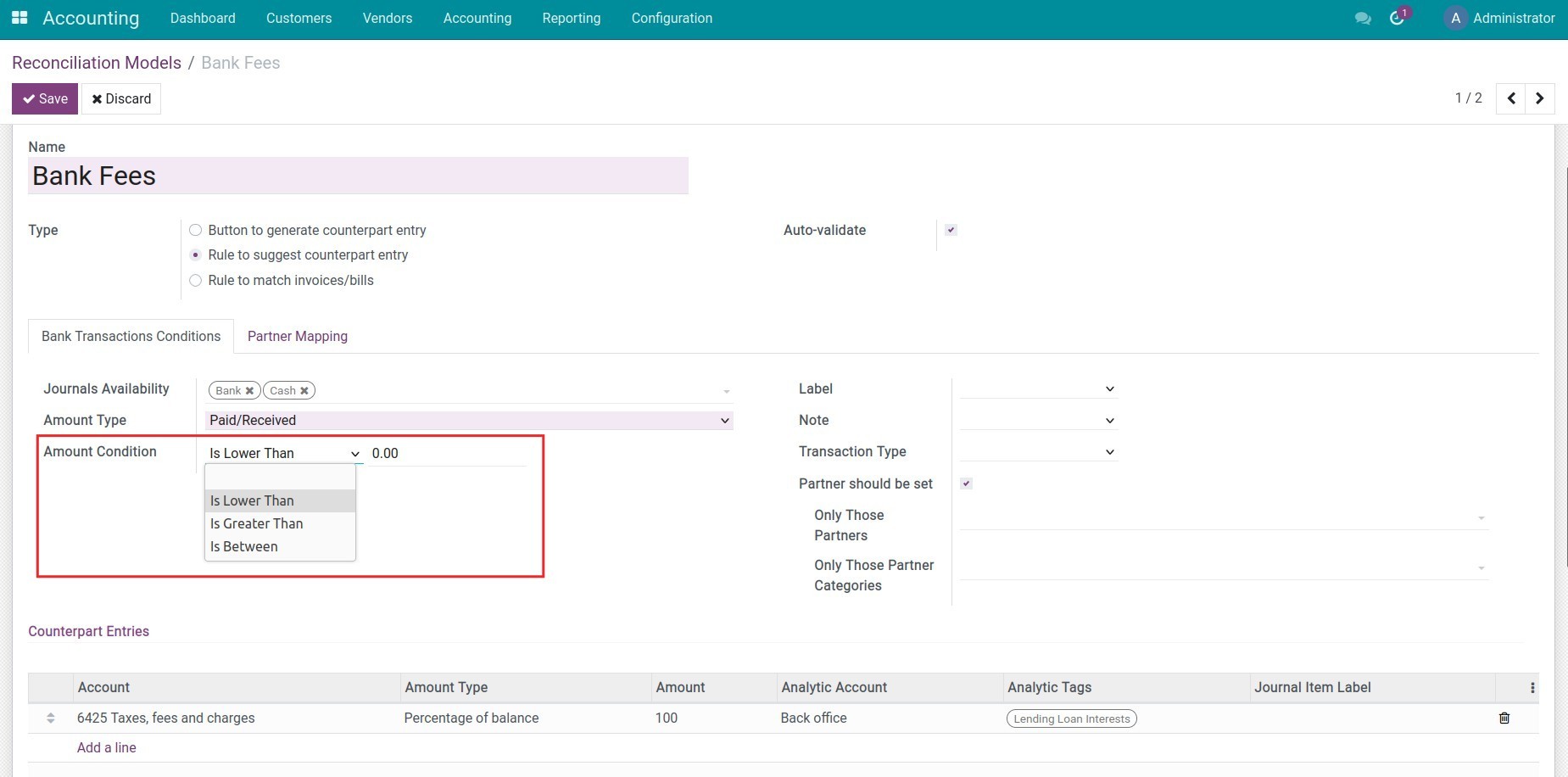

Create reconciliation model for deposit interest and bank fees

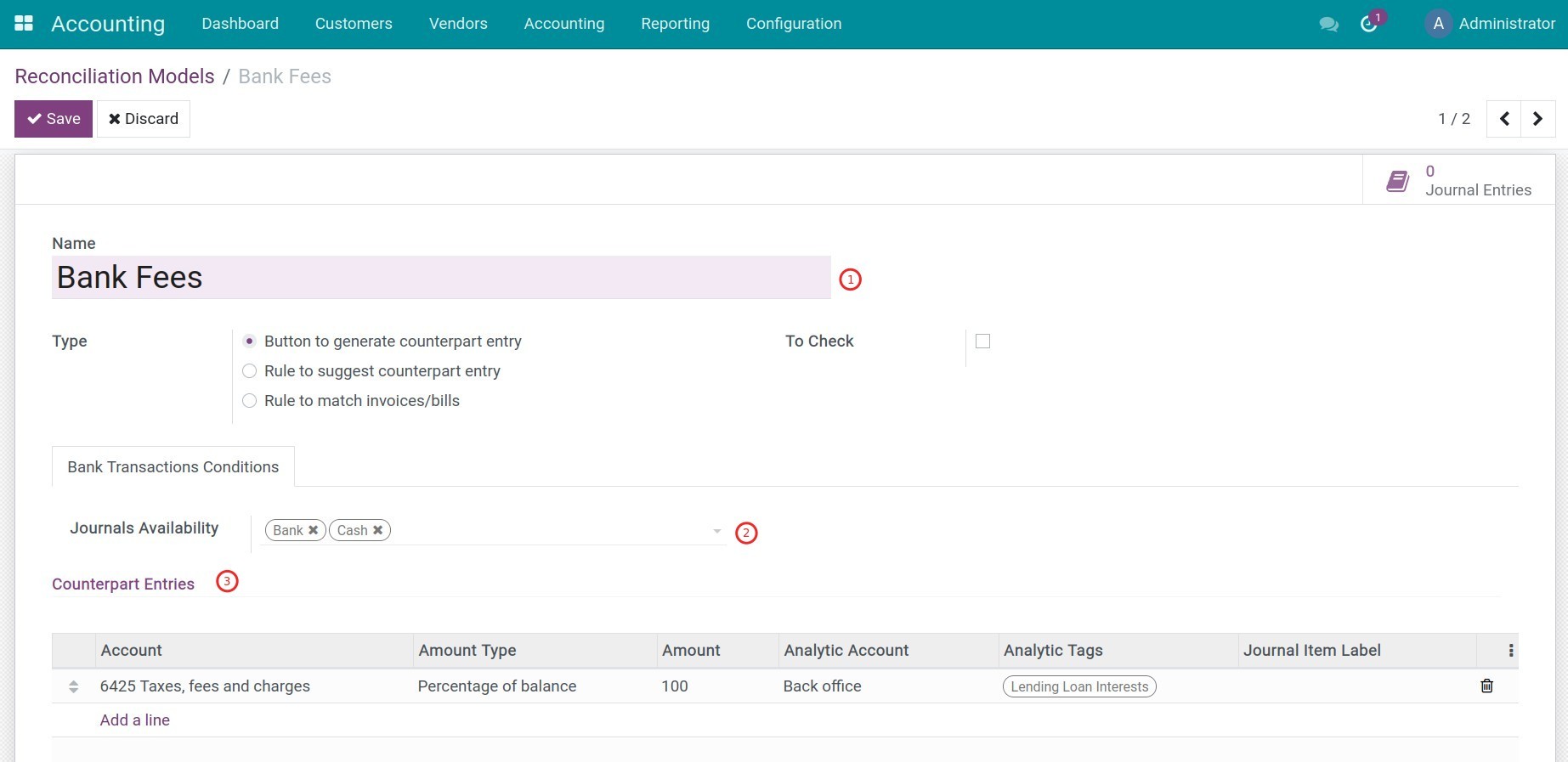

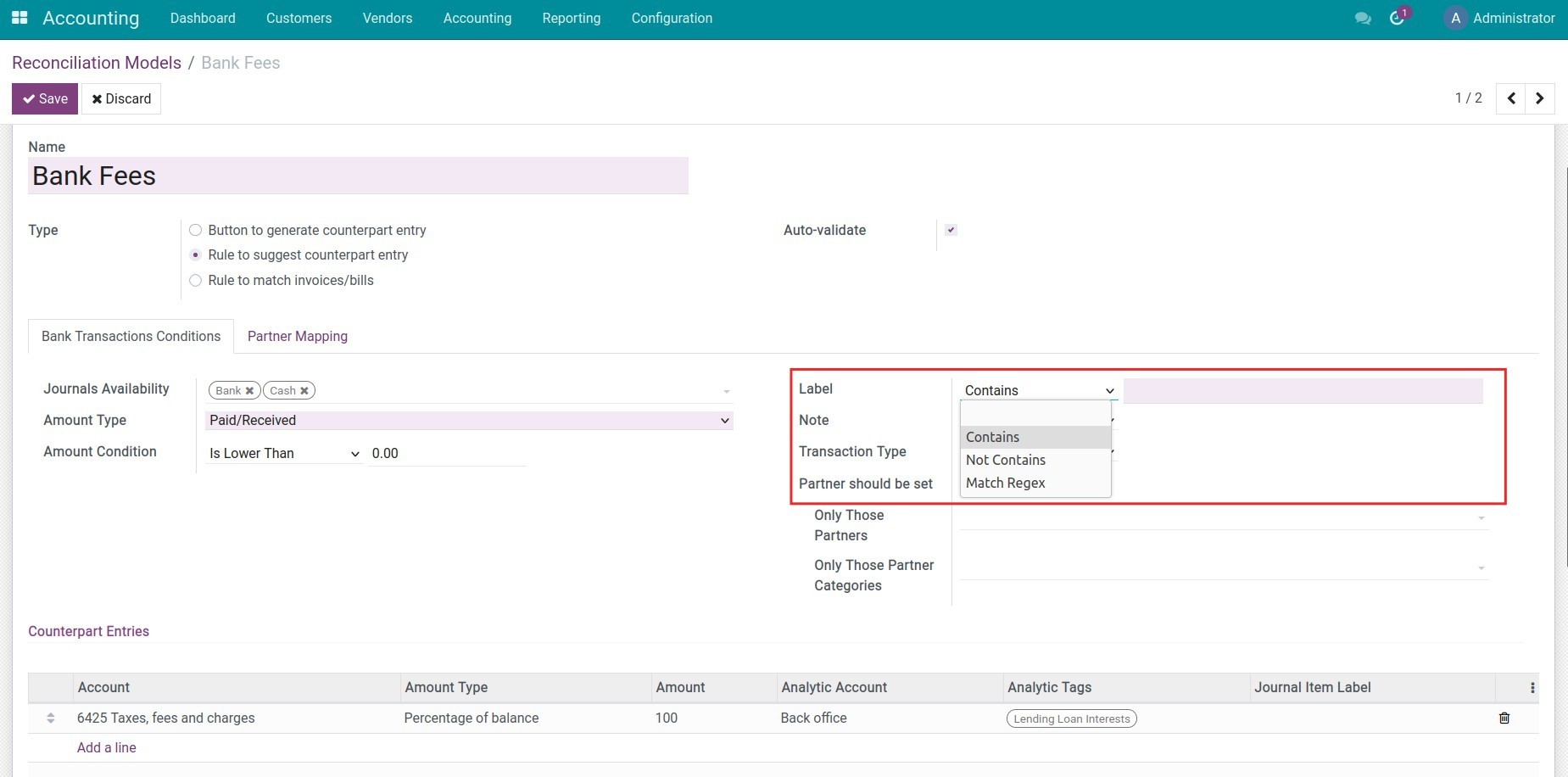

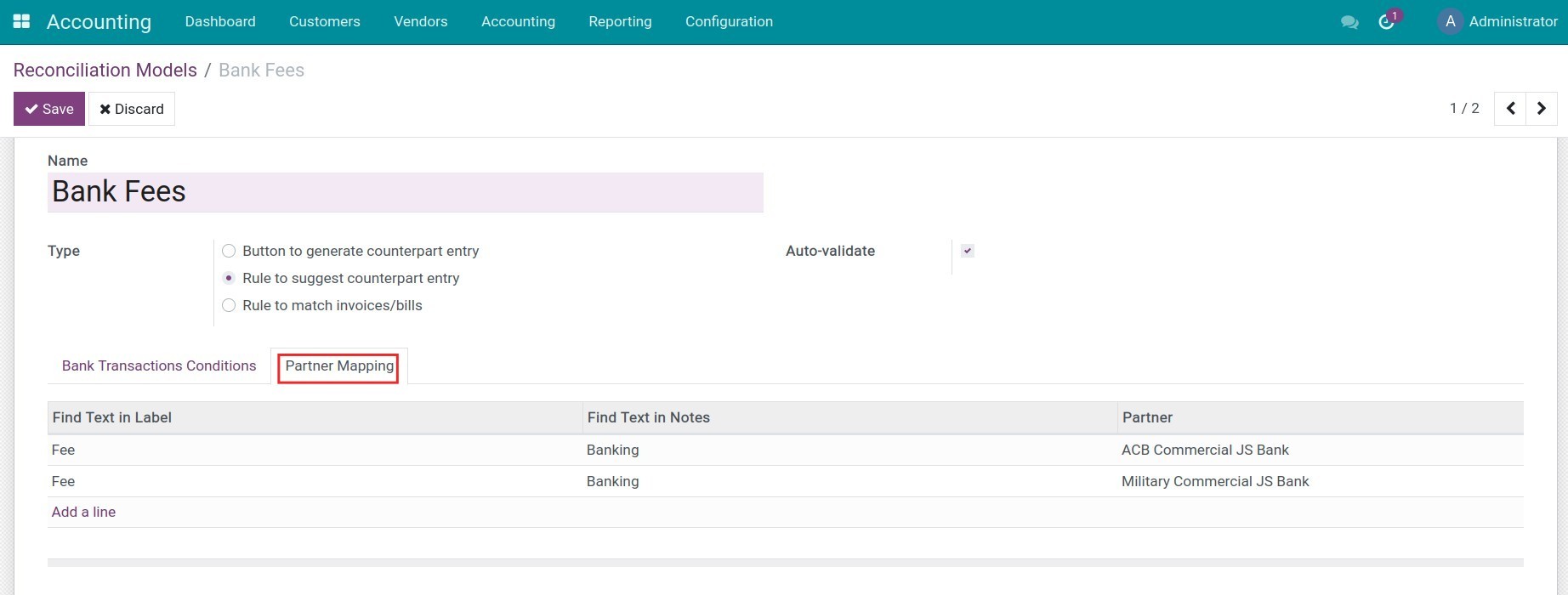

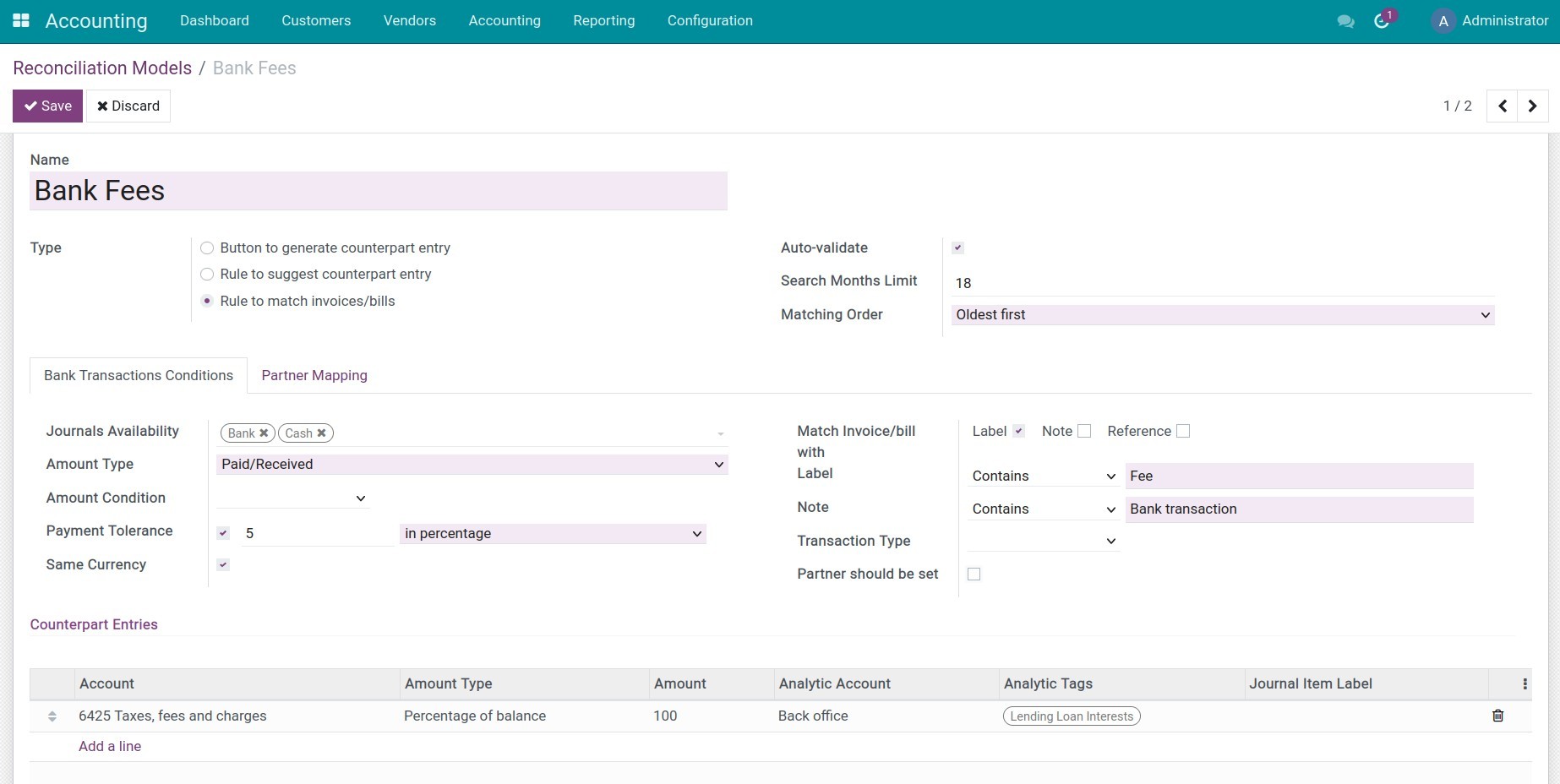

- Reconciliation models

- Button to generate counterpart entry

- Rule to suggest counterpart entry

- Rule to match invoices/bills

-

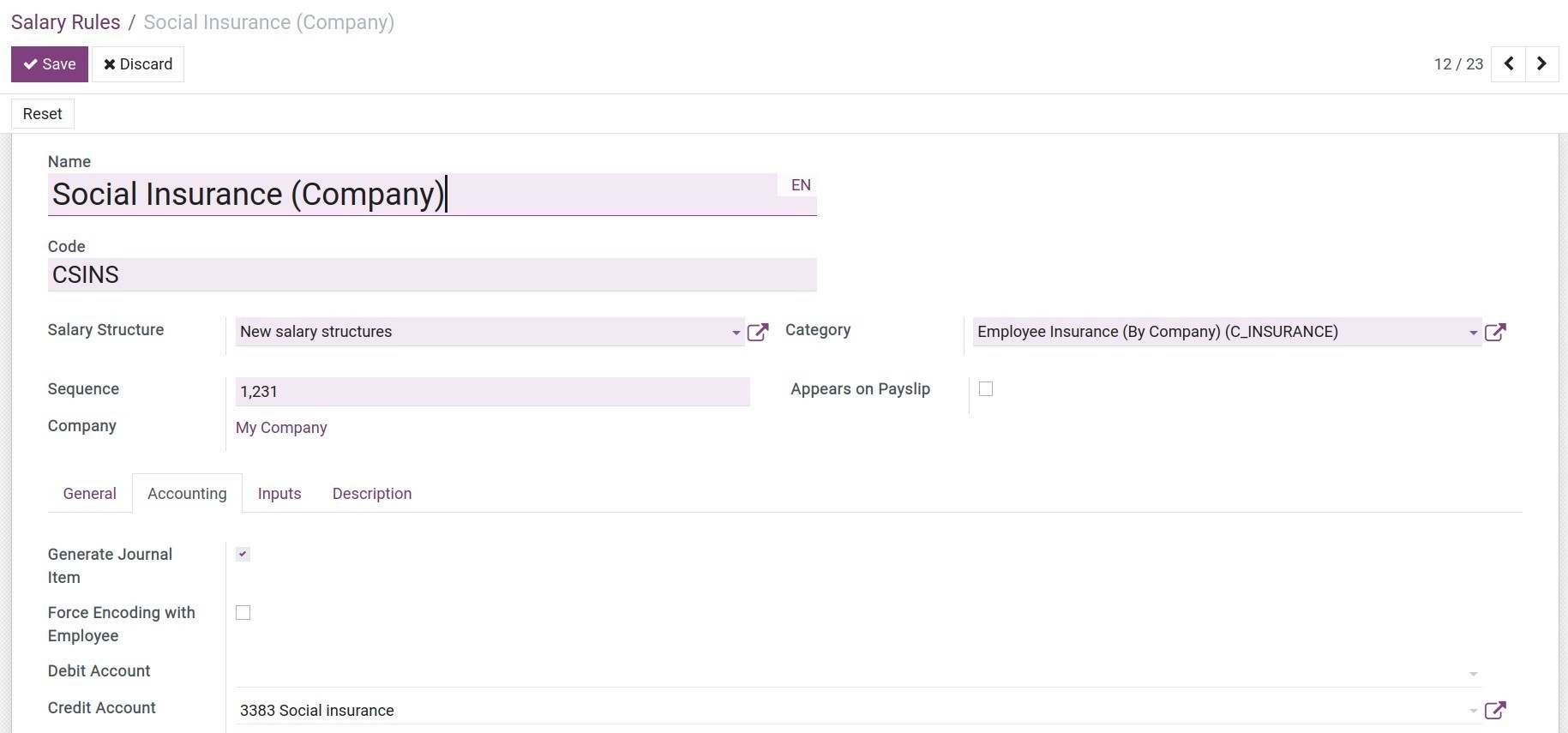

Accounting configuration for salary rules

-

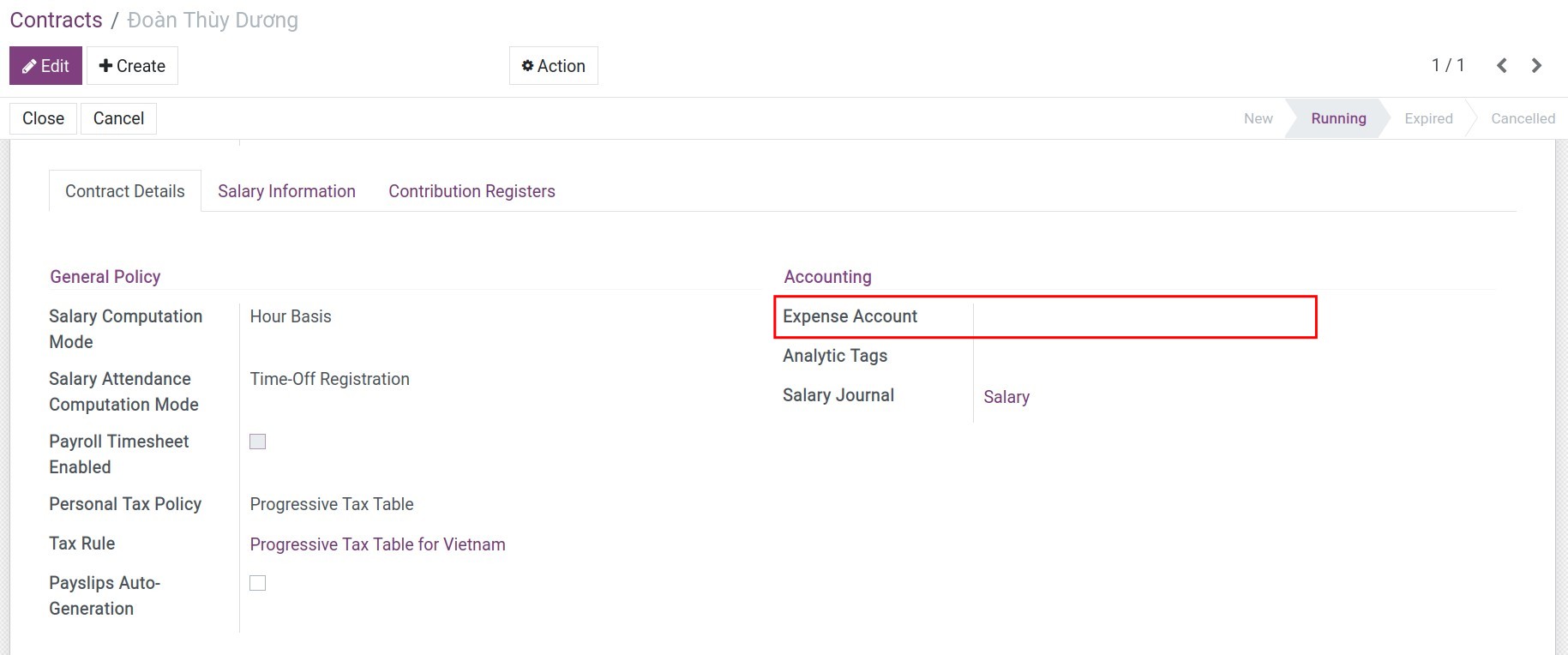

Accounting configuration for salary rules

- General settings

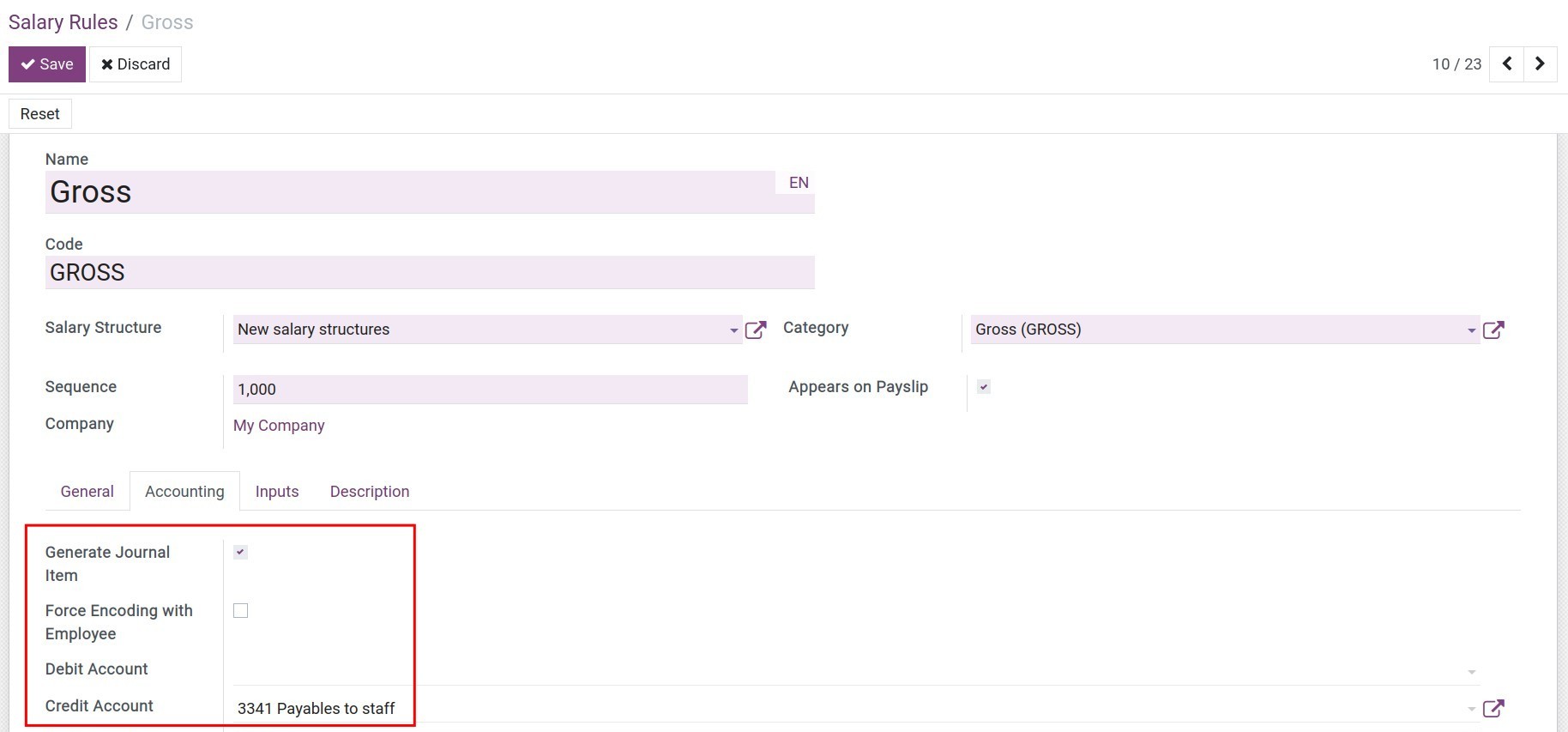

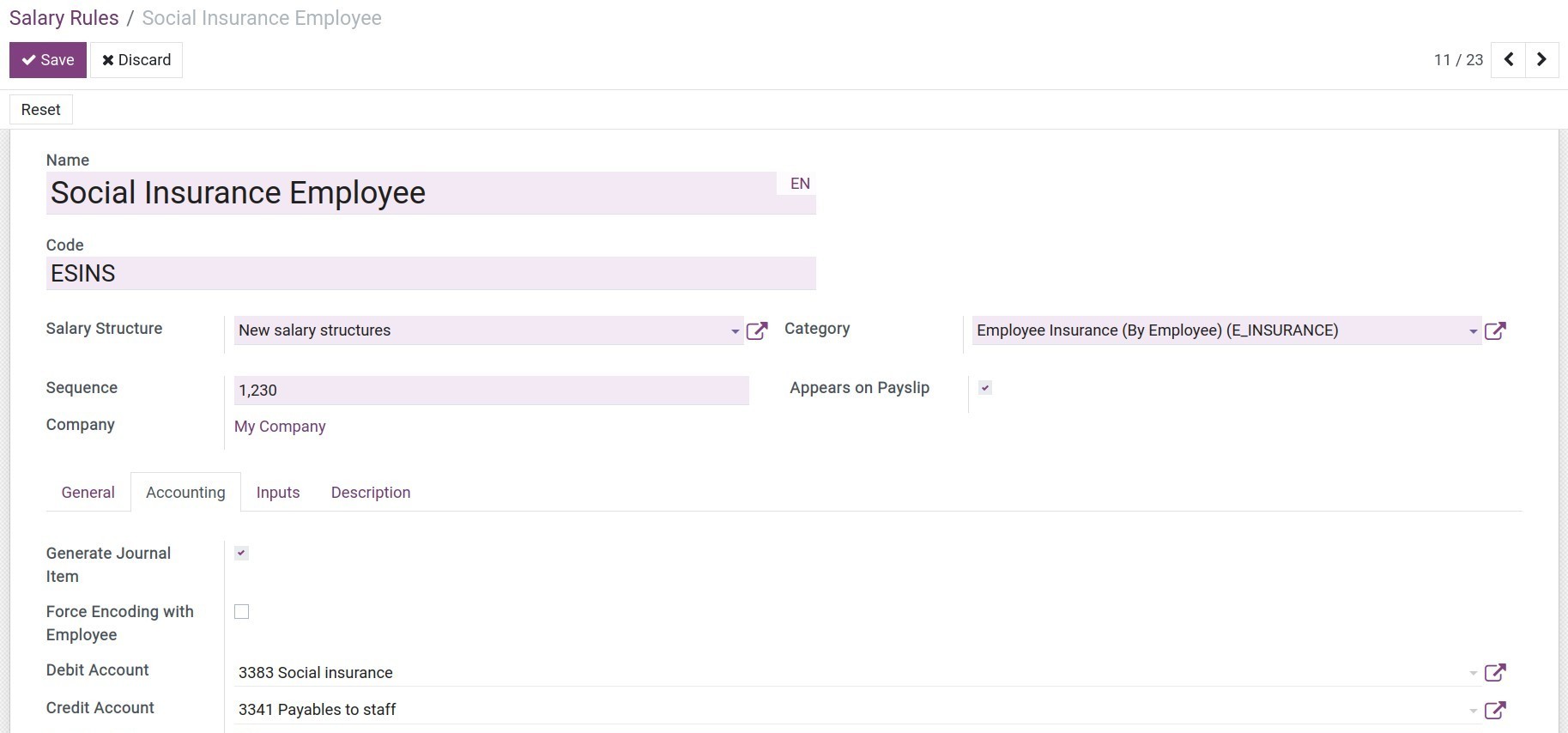

- Configure salary rules

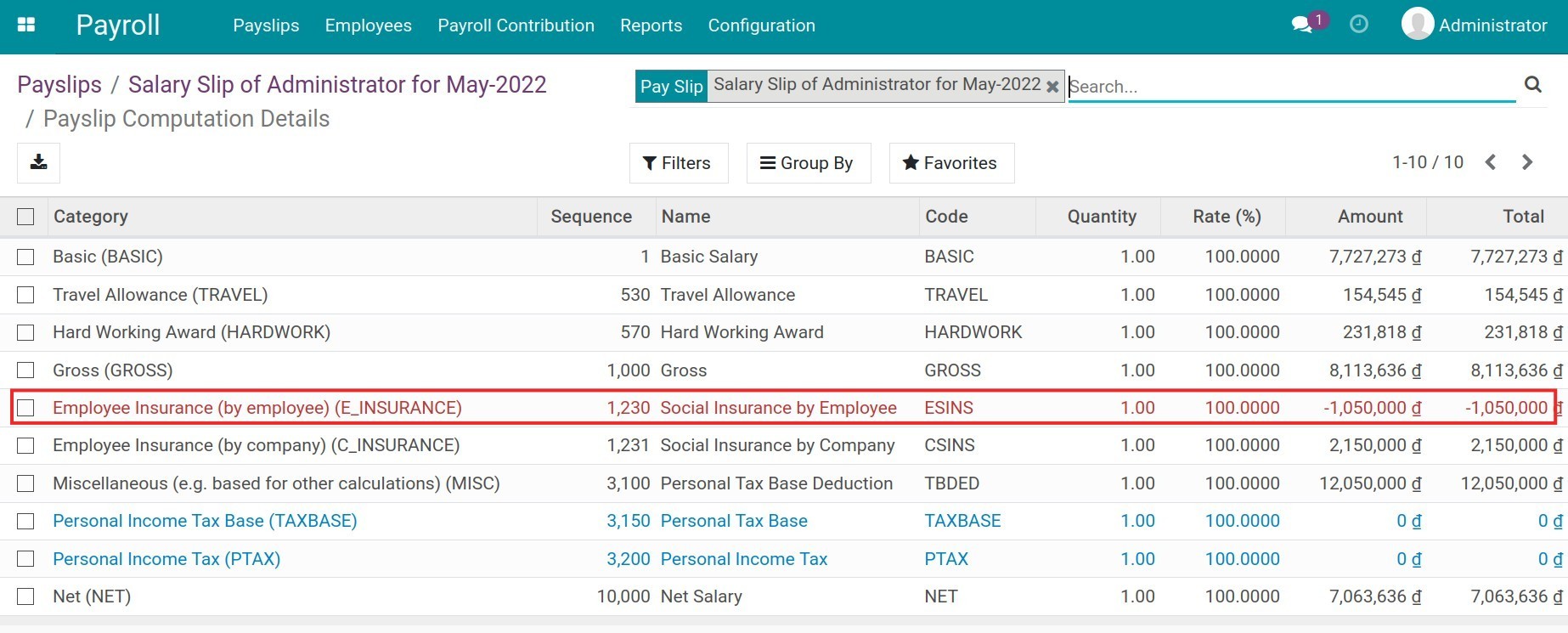

- Salary rules examples

-

Analytic account in iSuite

-

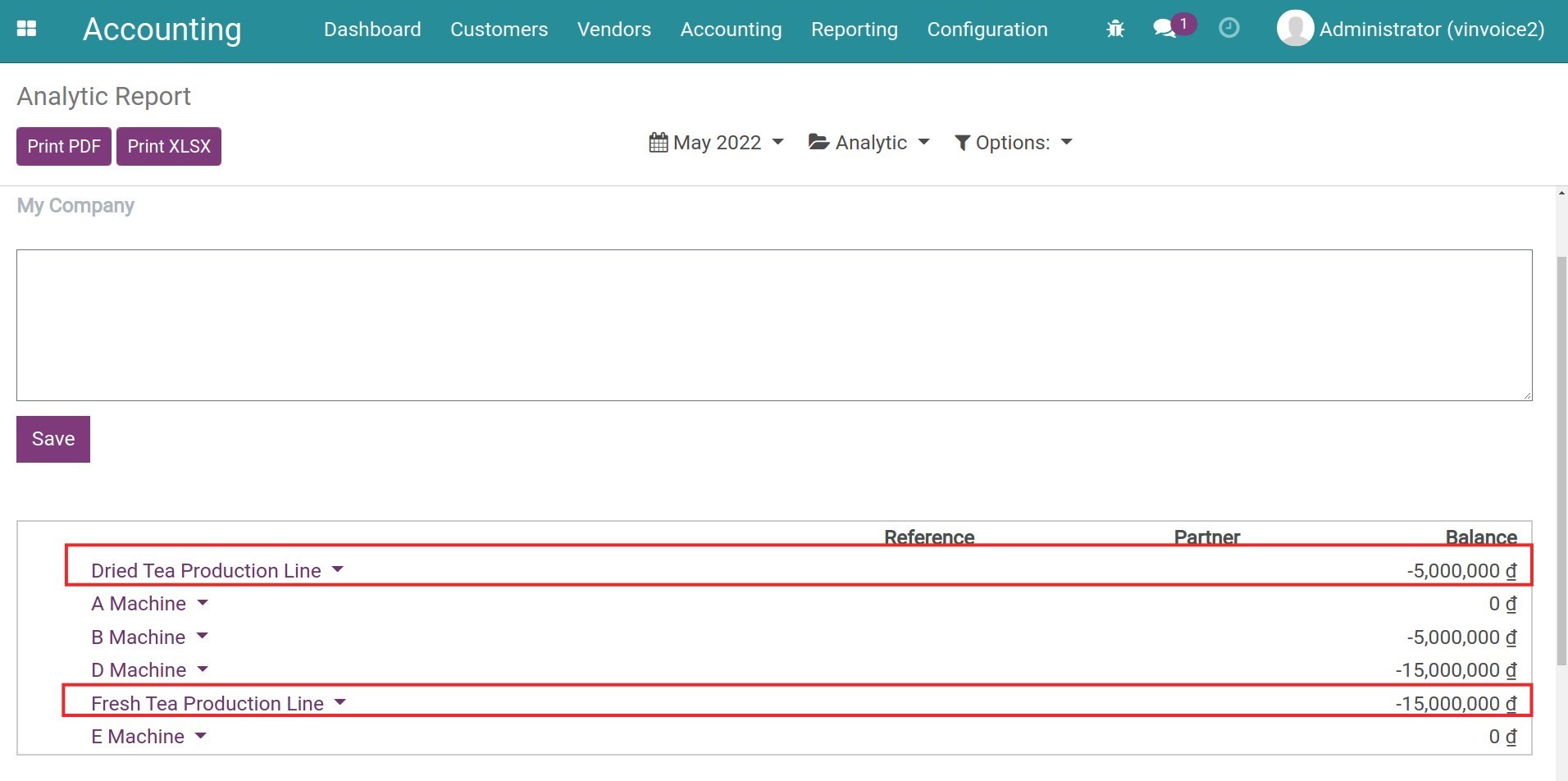

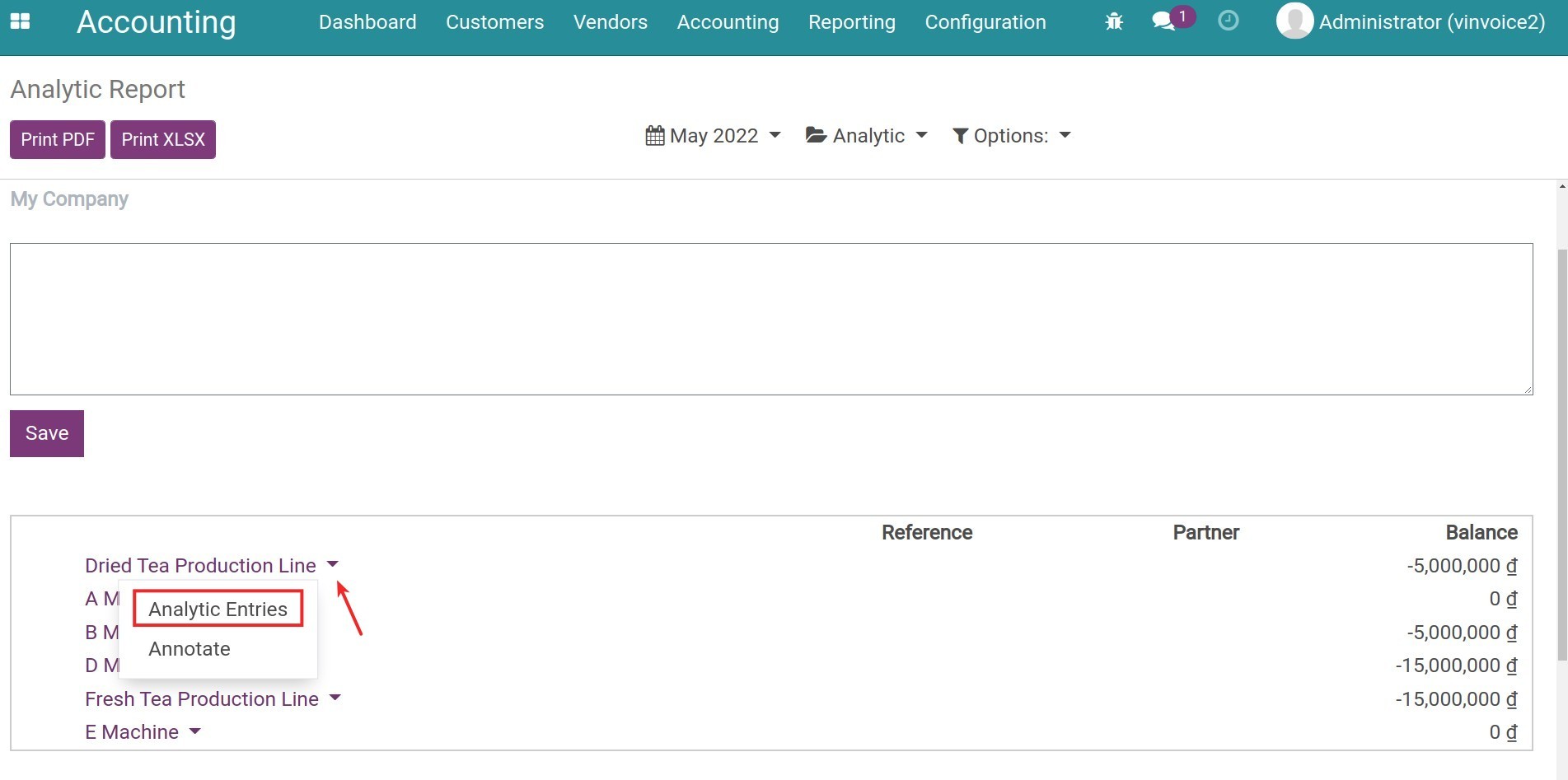

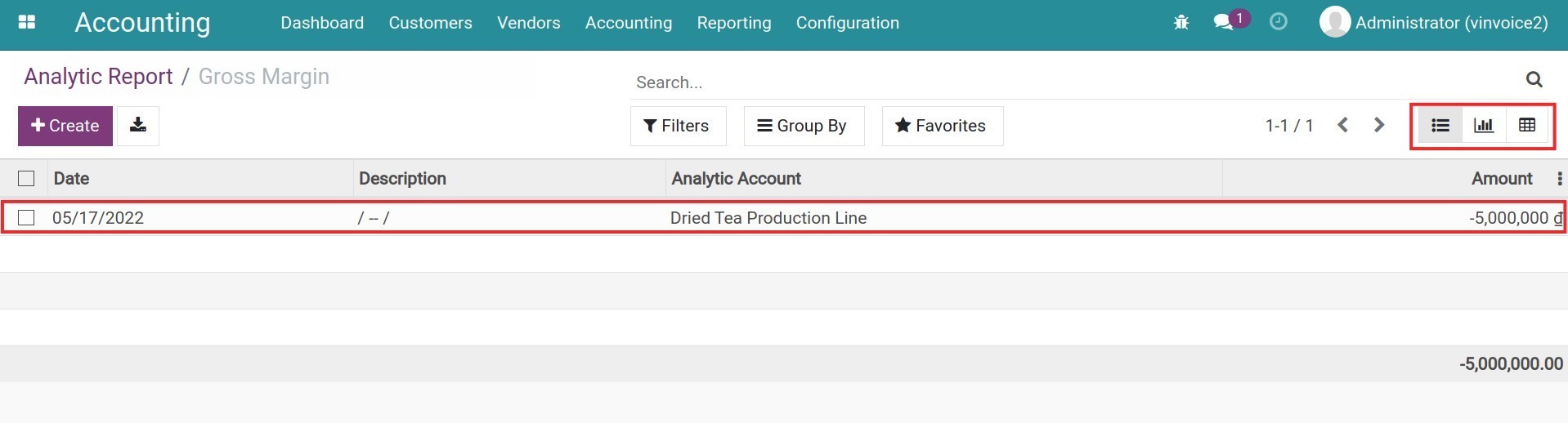

Analytic account in iSuite

- Case 1: Production costs analysis of each department in an industrial company

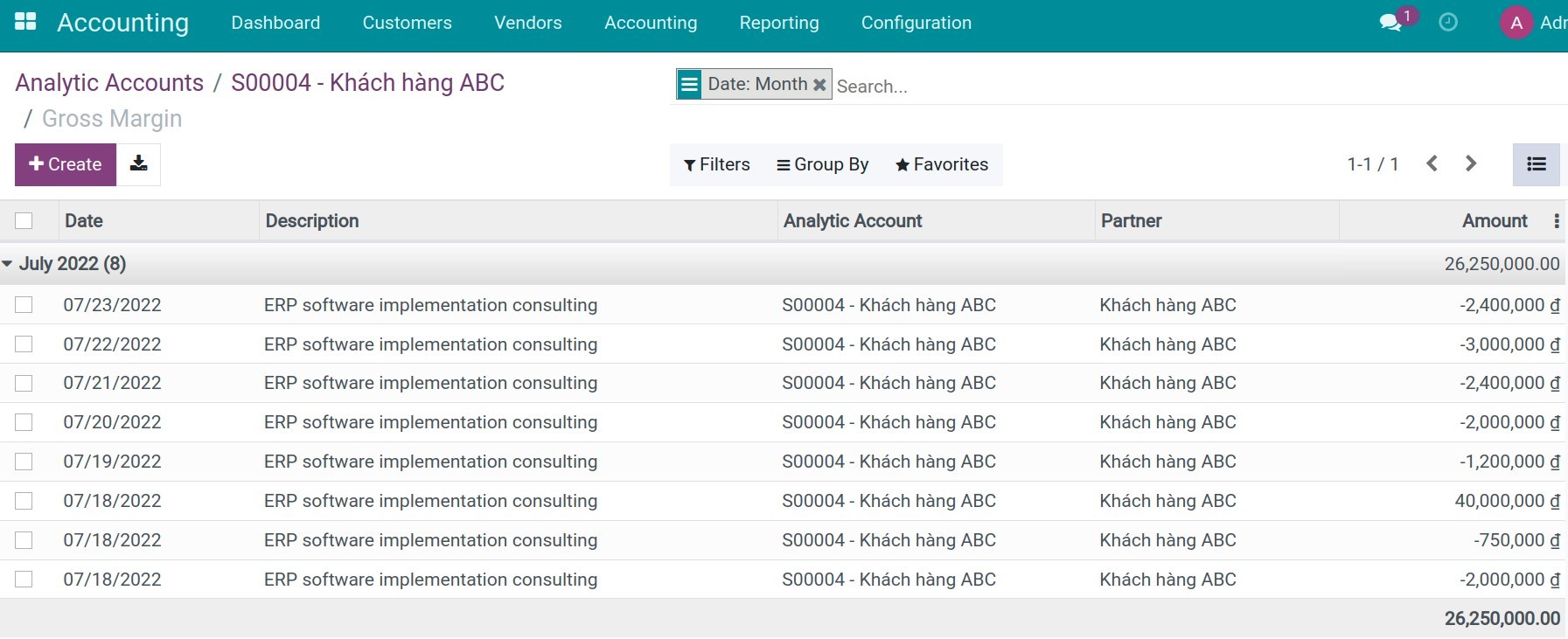

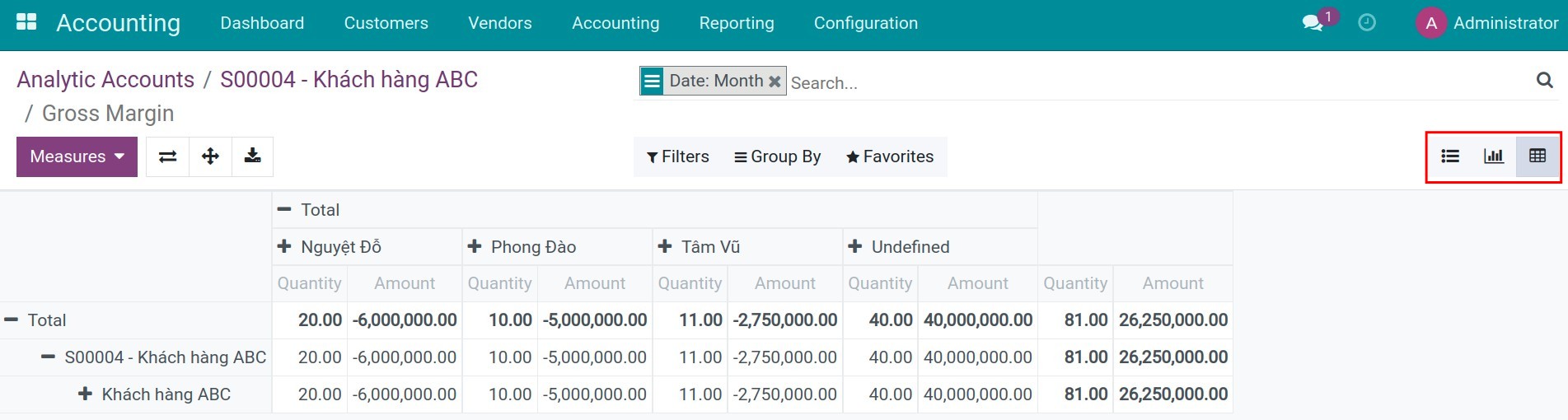

- Case 2: Performance analysis of employees in an ERP software consulting company

- Conclusion

-

Invoice delivery notes

- Invoice delivery notes

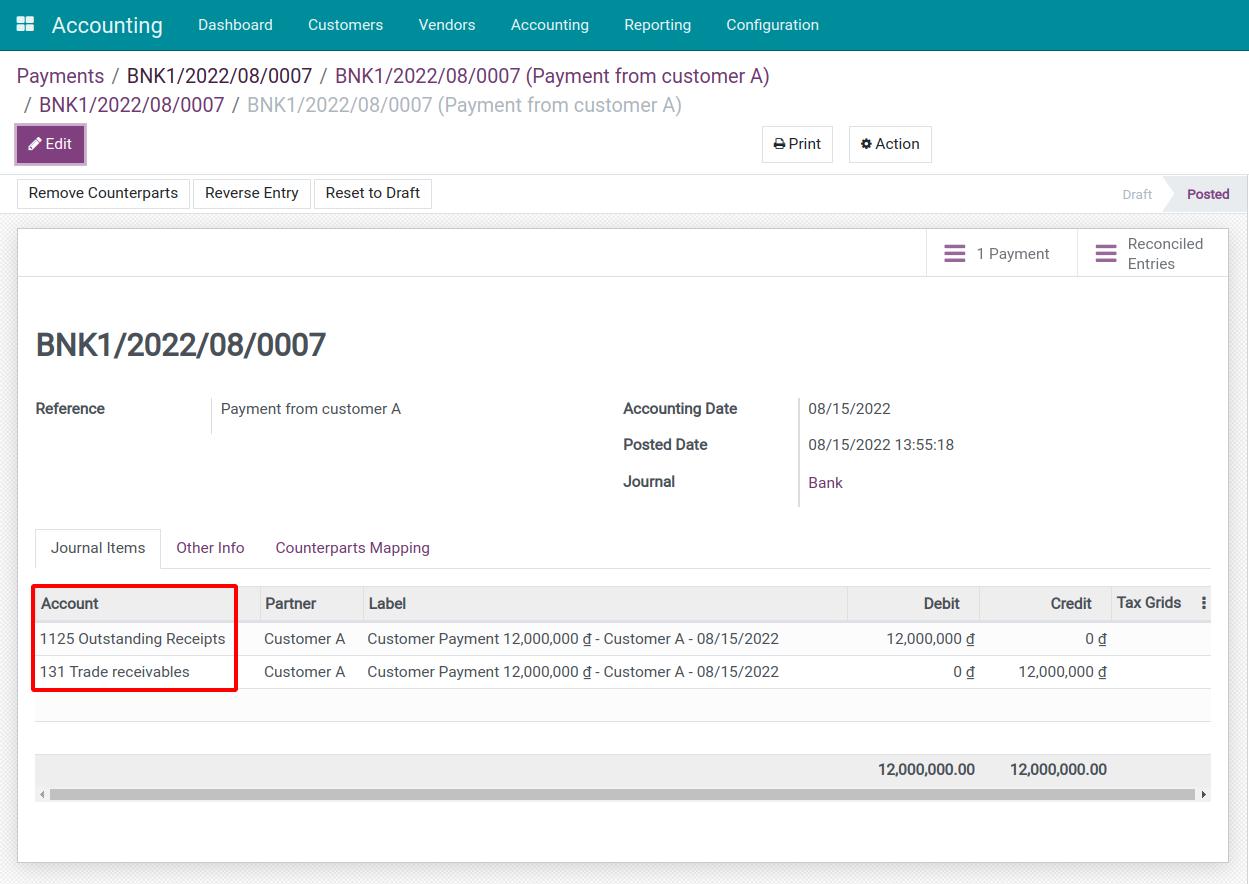

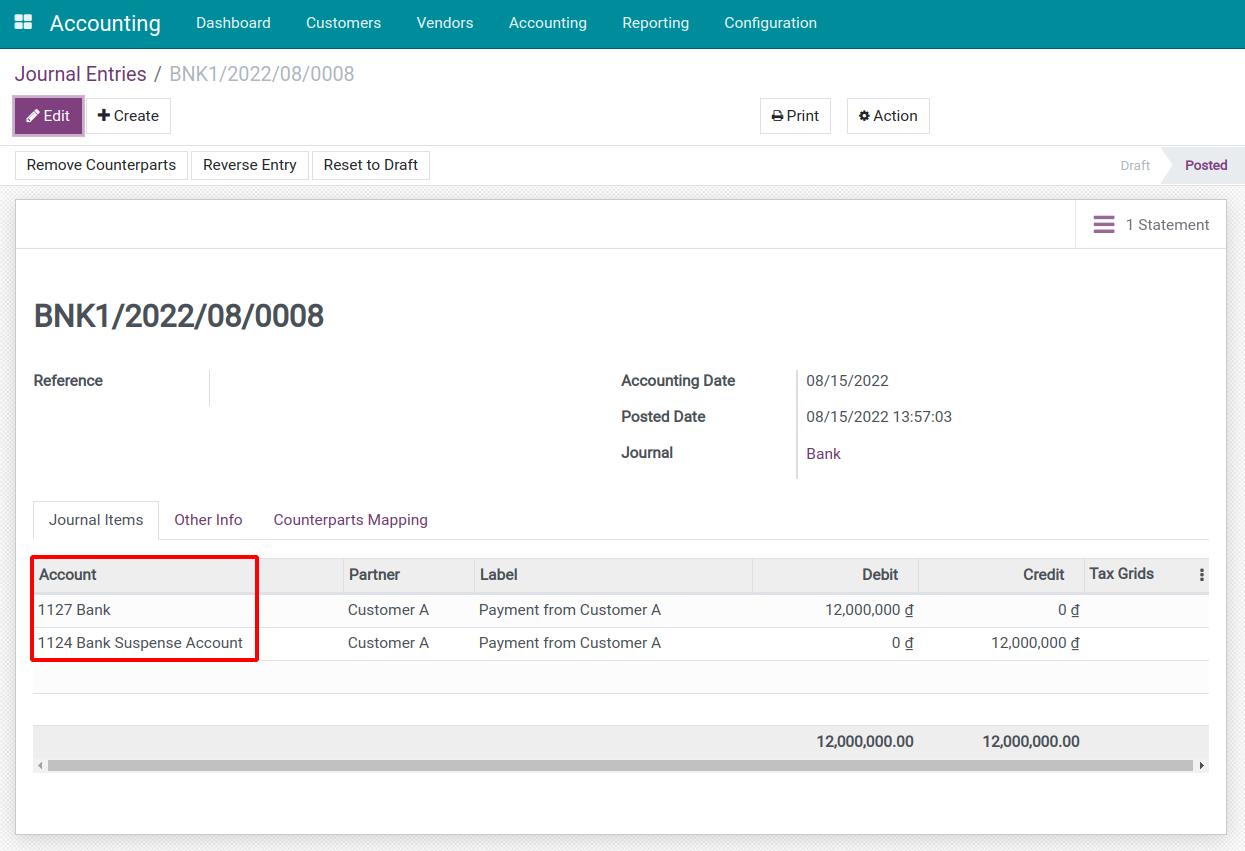

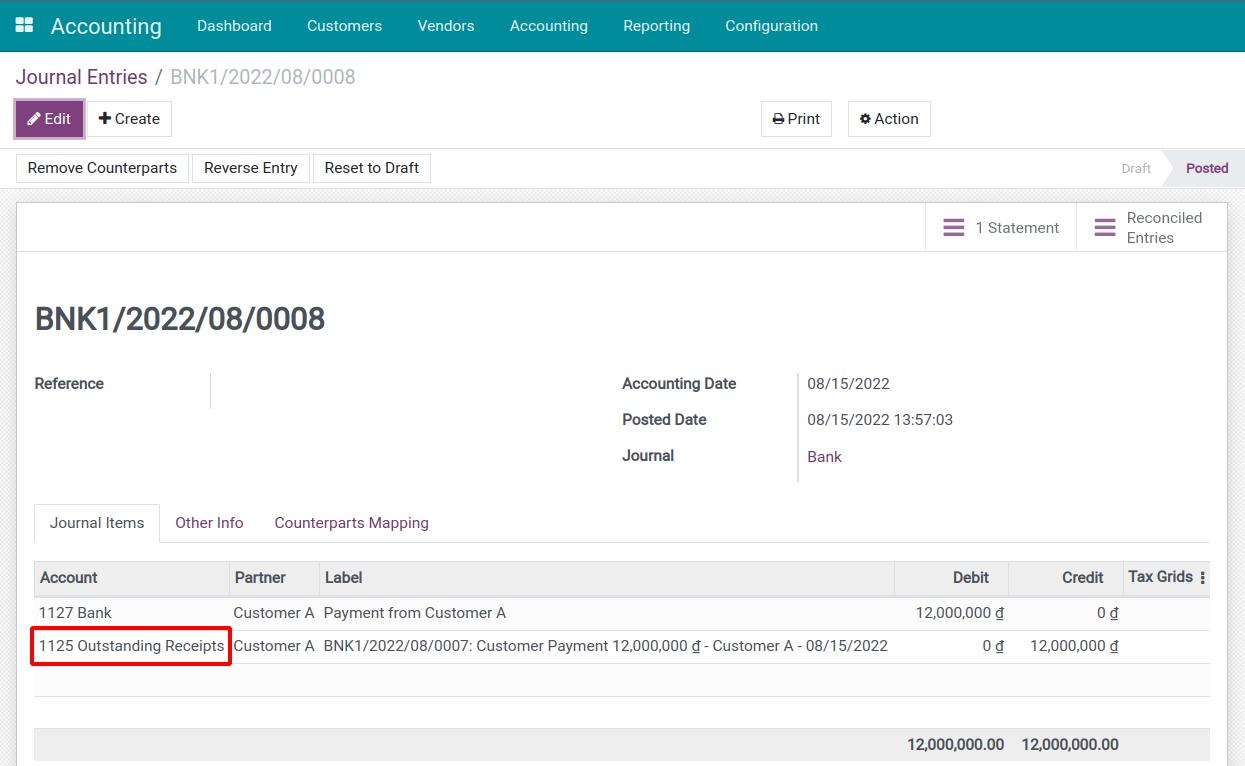

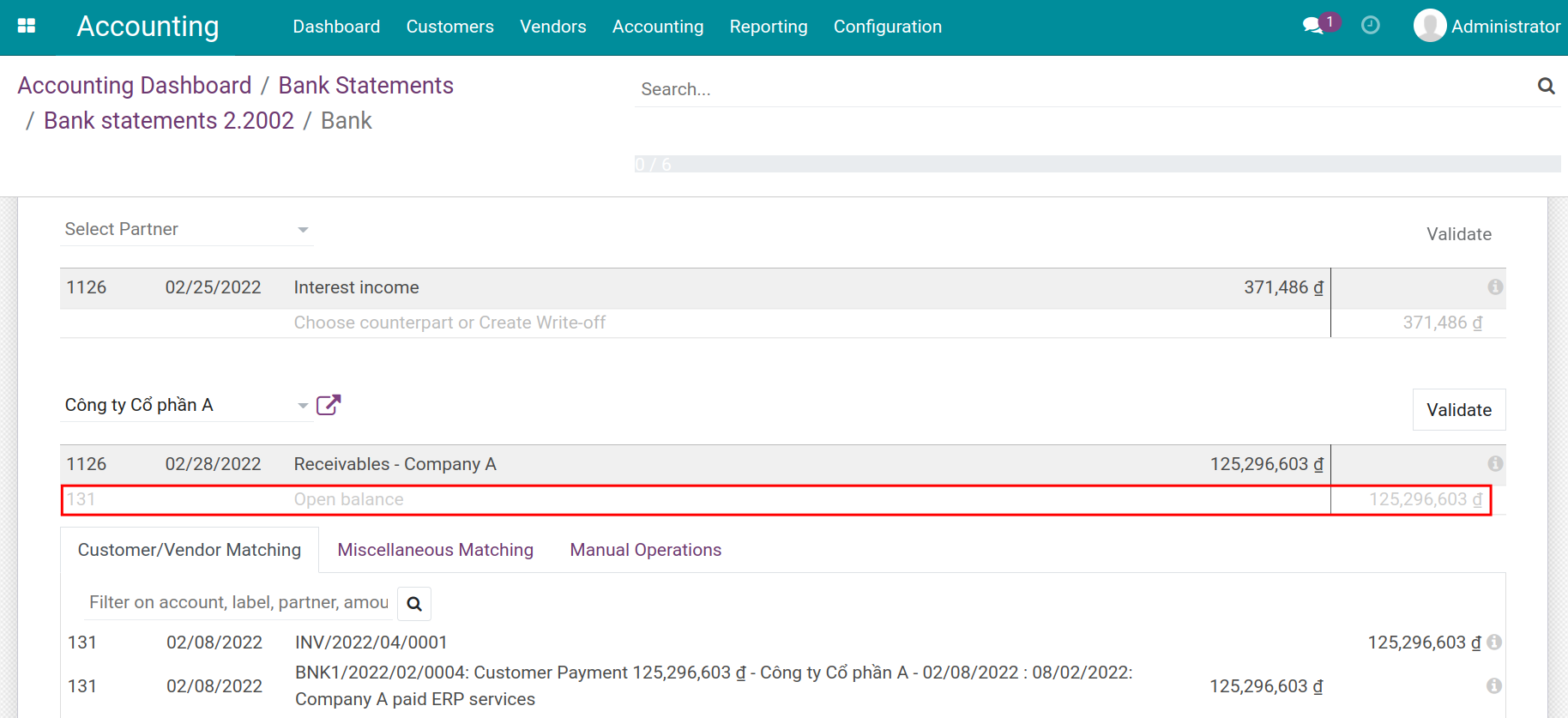

- How do the Suspense and Outstanding Payment accounts change the Journal Entries posted?

-

Current Year Earnings

-

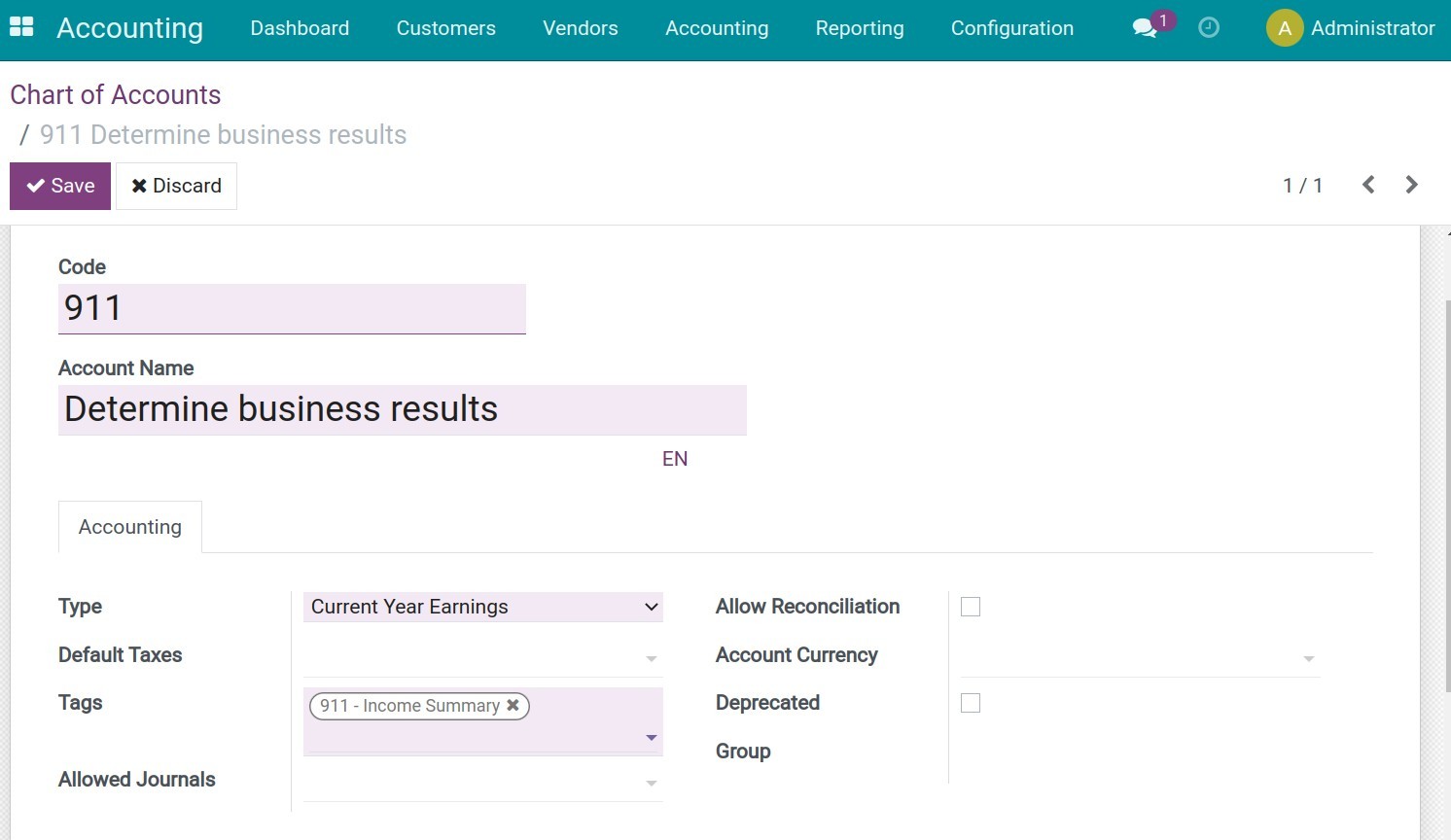

Current Year Earnings

- How the "Current Year Earnings" Account Type Works

- Example of "Current Year Earnings" in Practice

- Key Points to Remember

-

Manually create an Asset in Viindoo

-

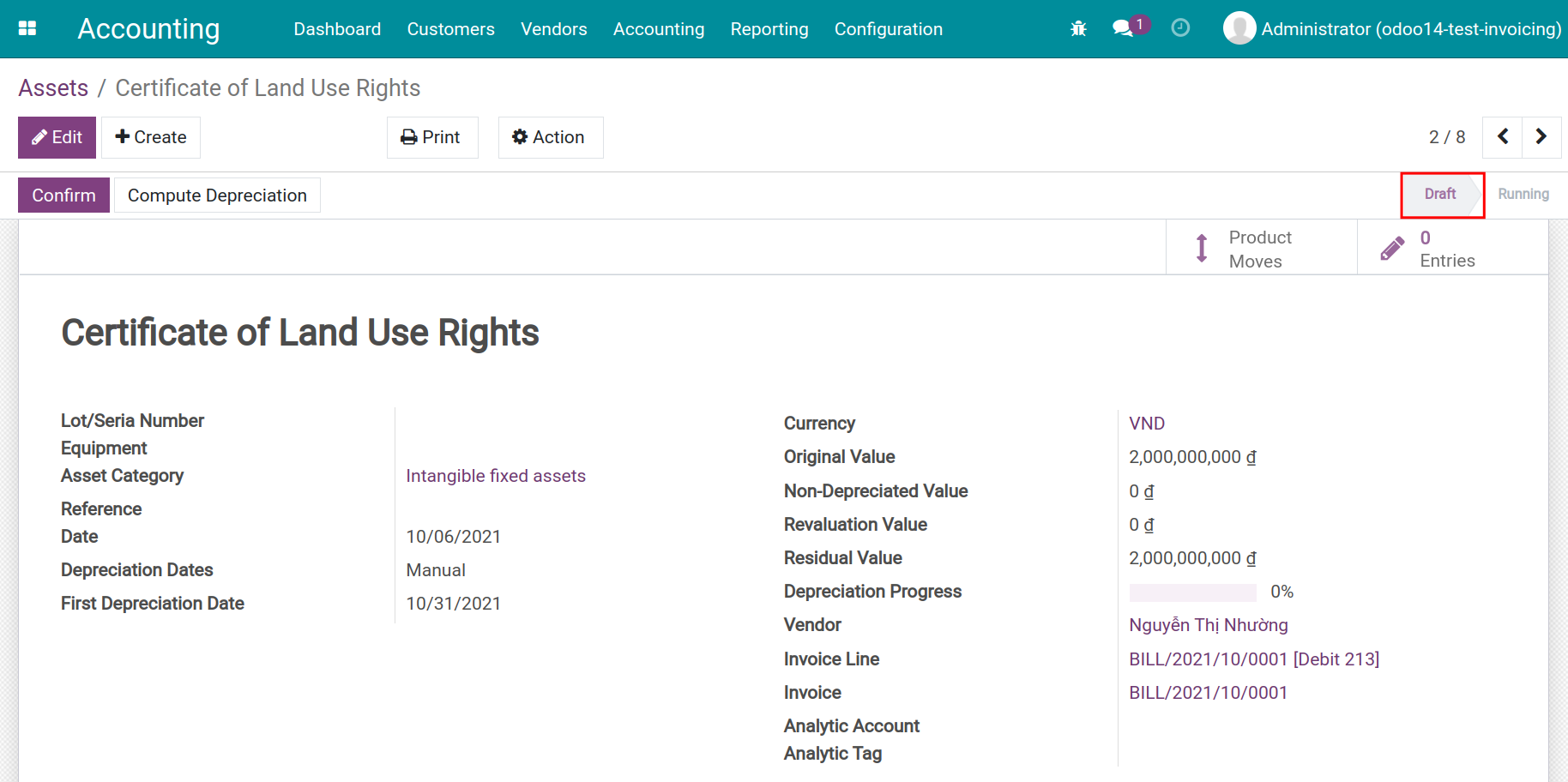

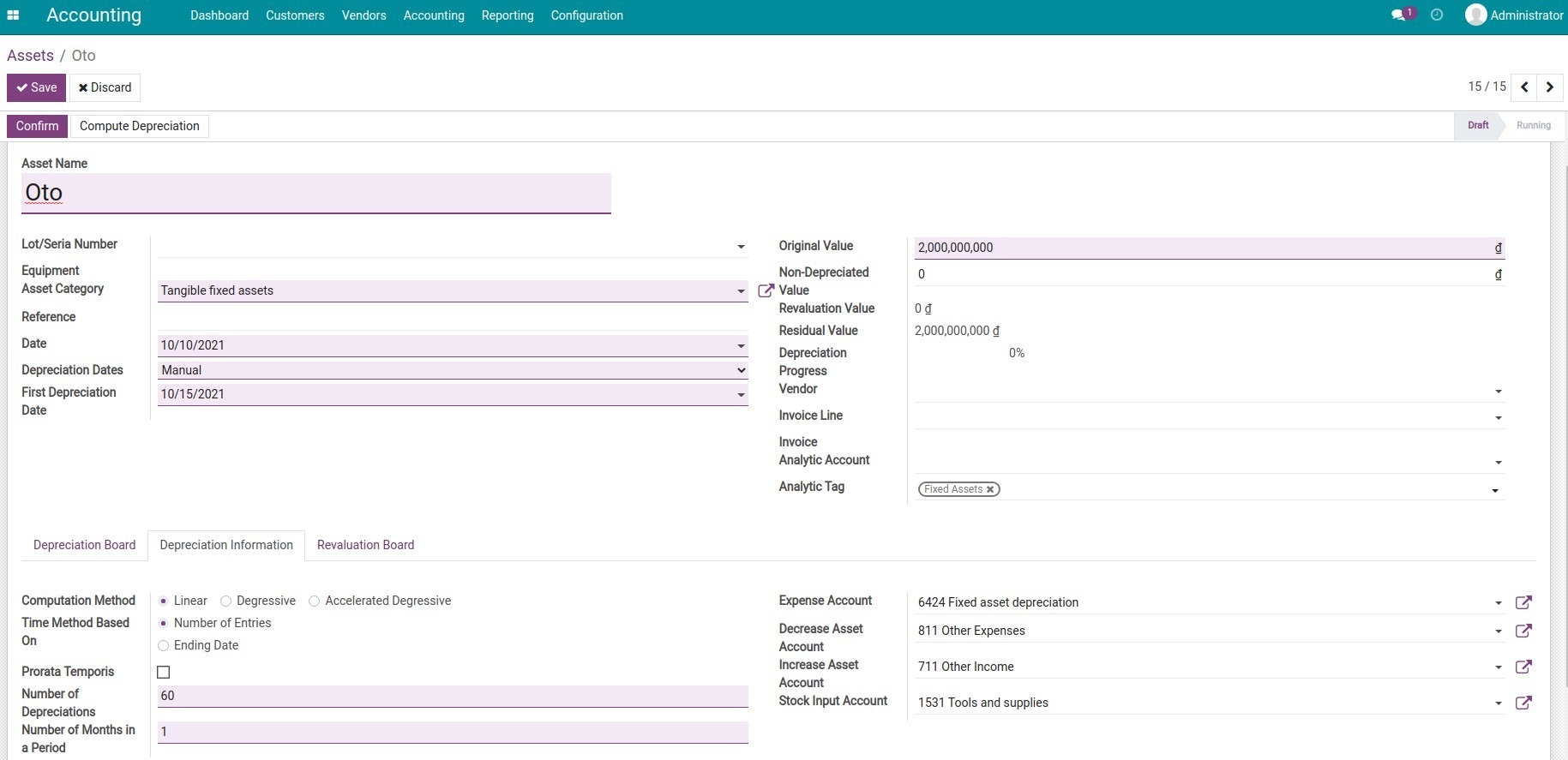

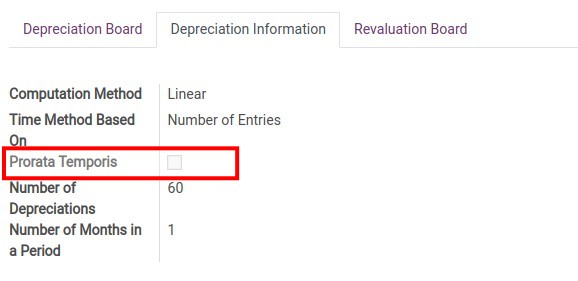

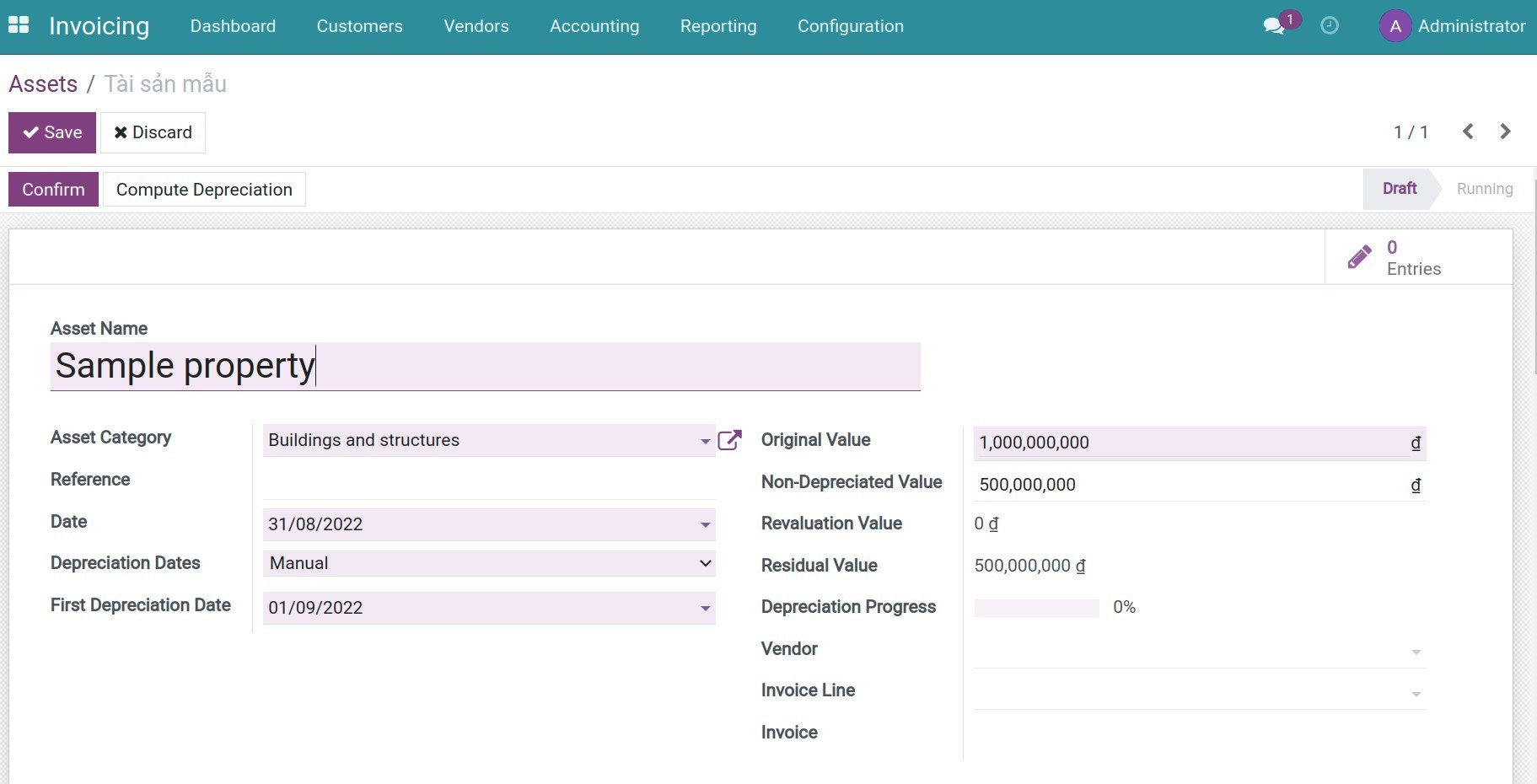

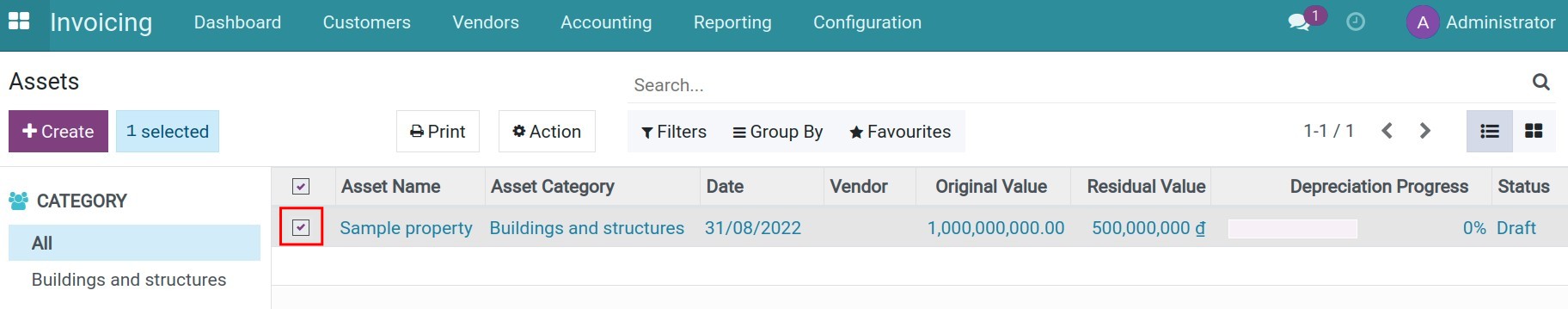

Requirements

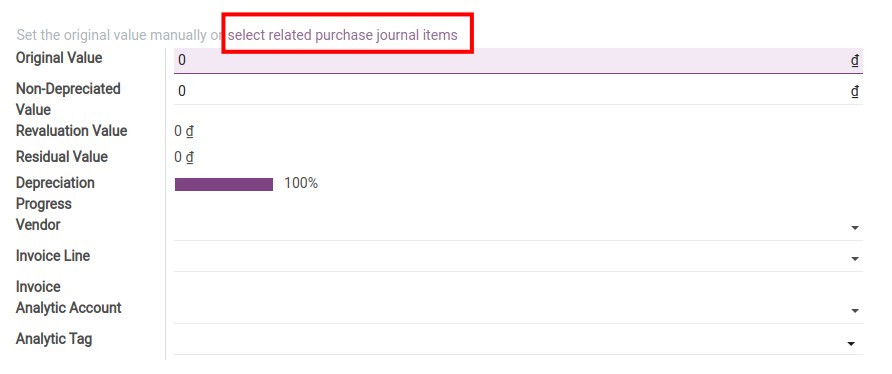

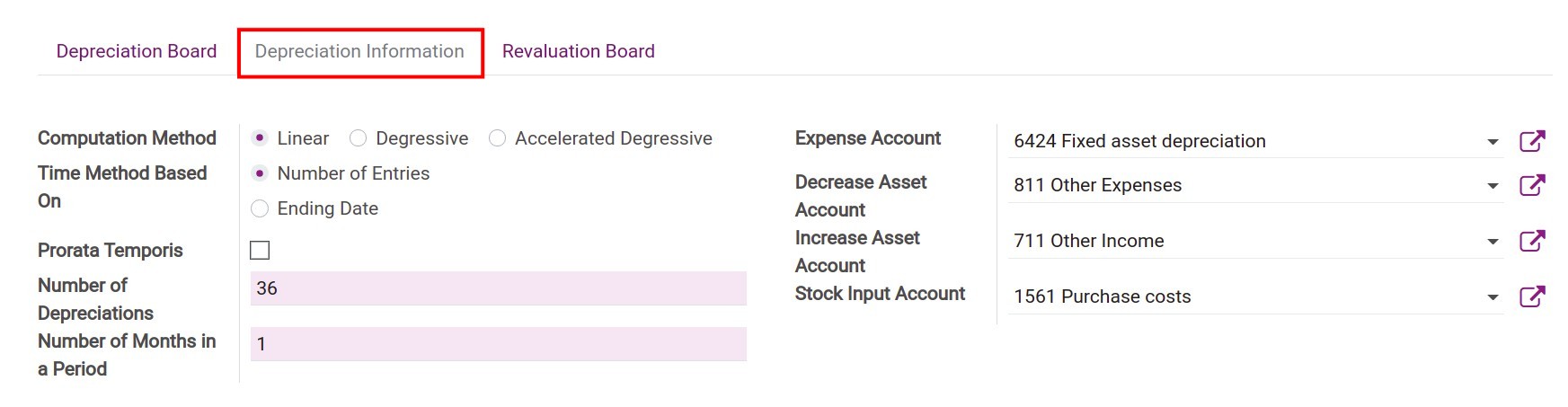

- Configure Asset information

- Configure Asset Depreciation Information

-

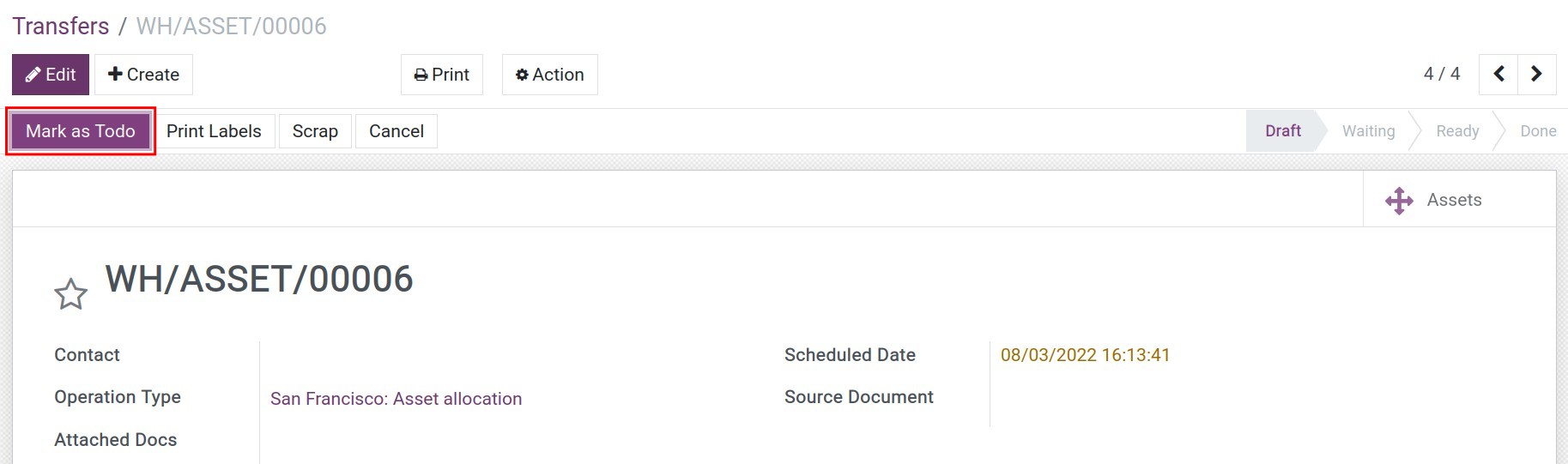

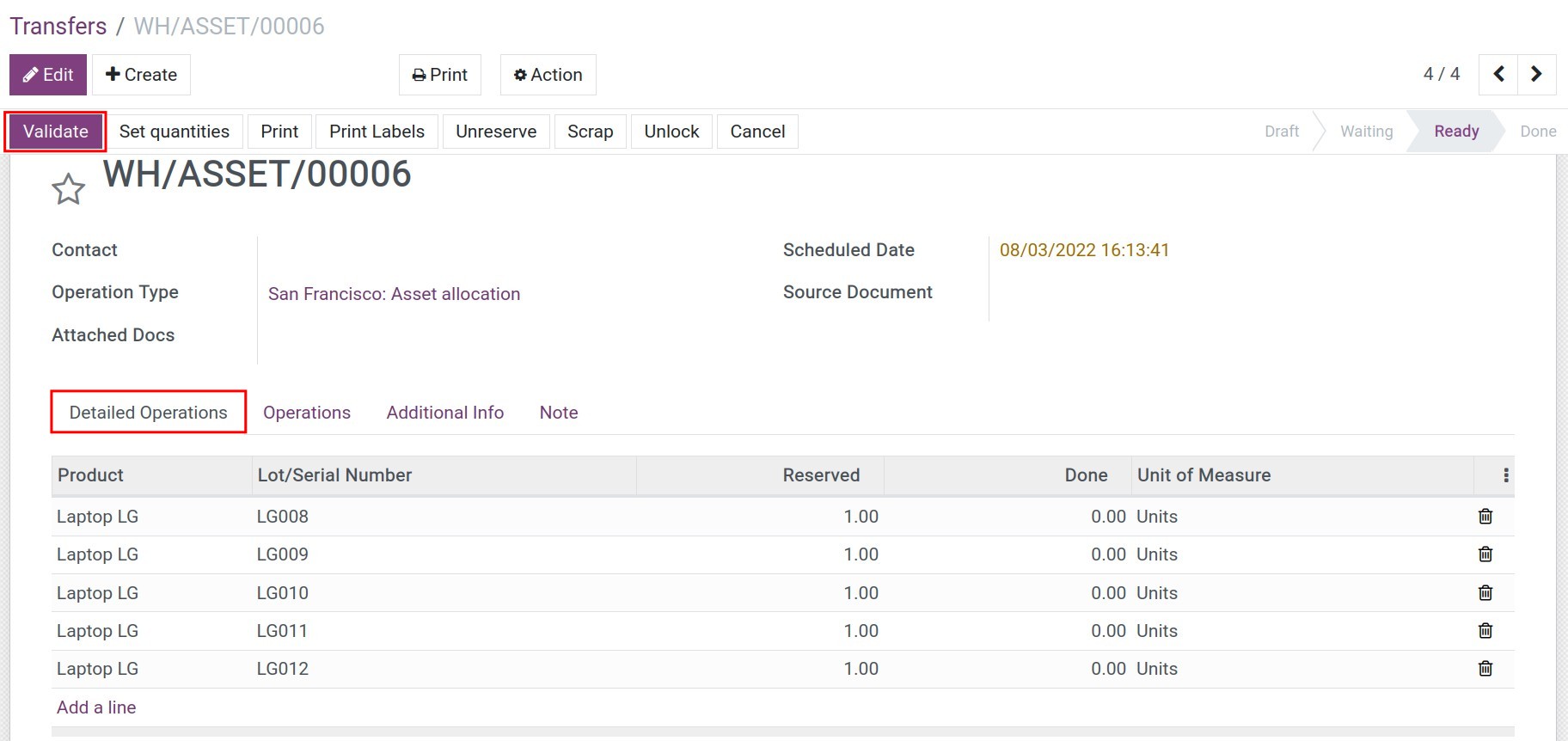

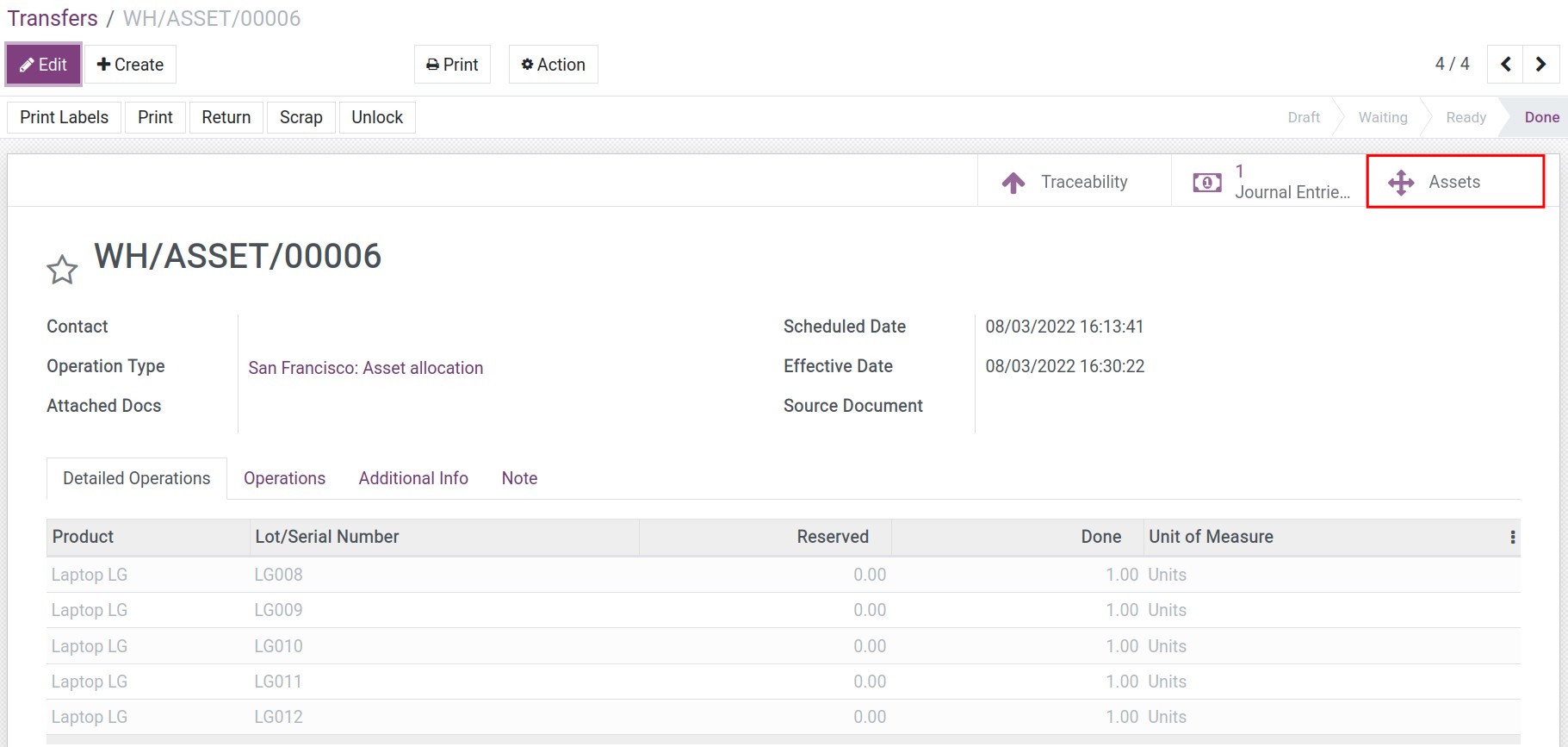

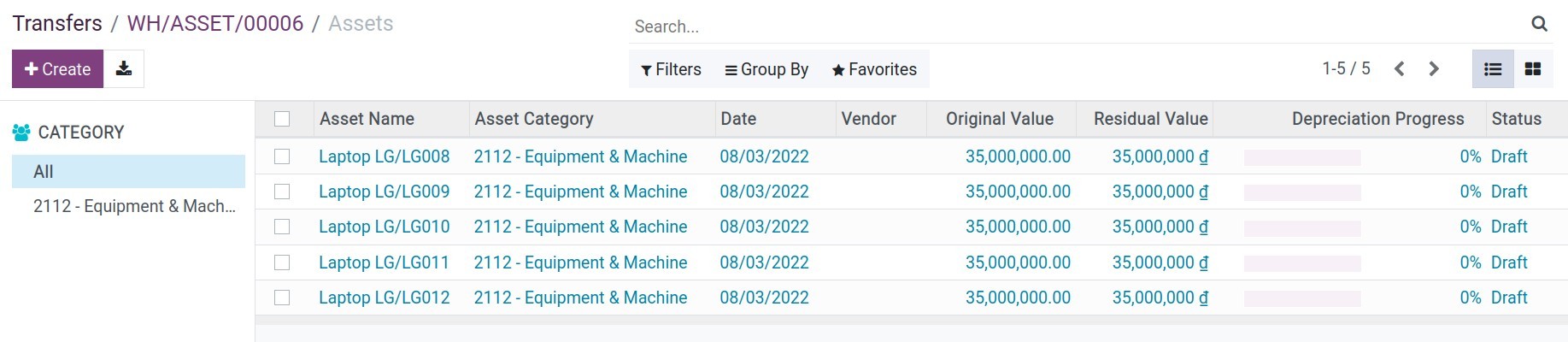

Buying and stocking assets

- Buying and stocking assets

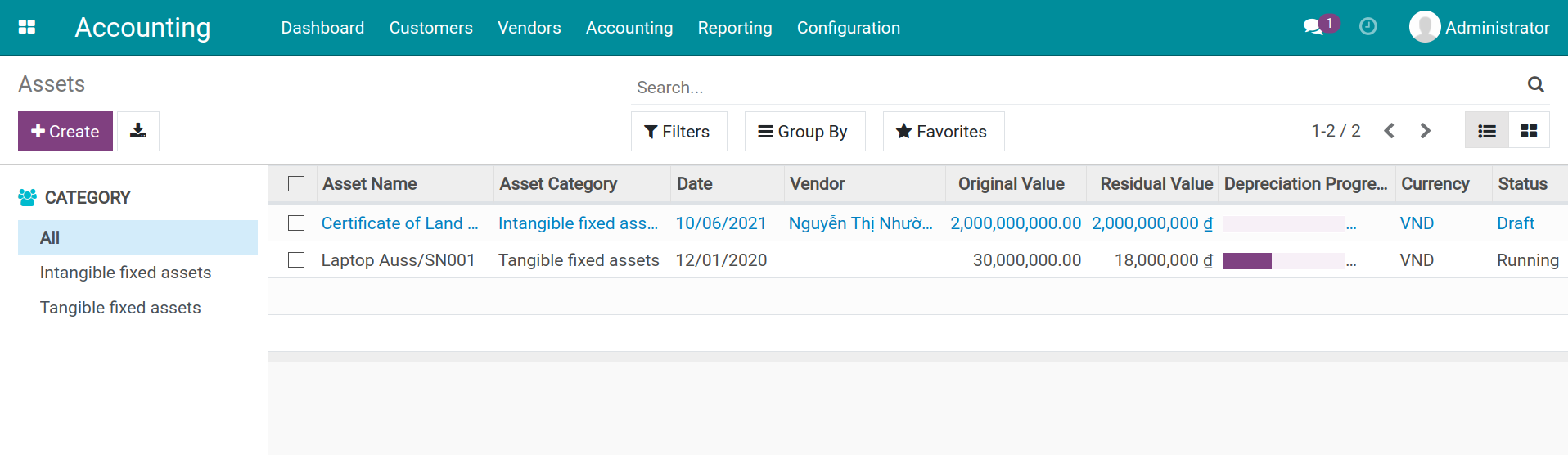

- Create Asset manually

- Create Asset from vendor bill

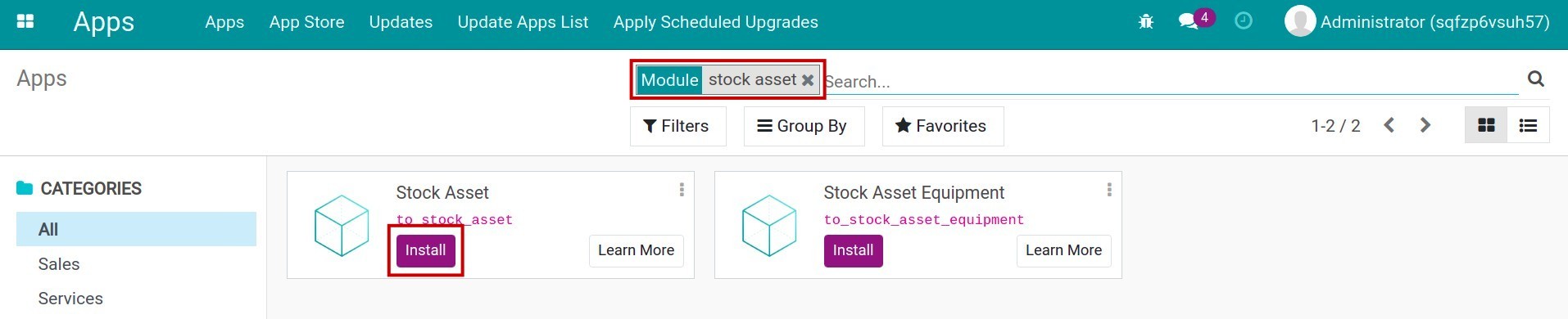

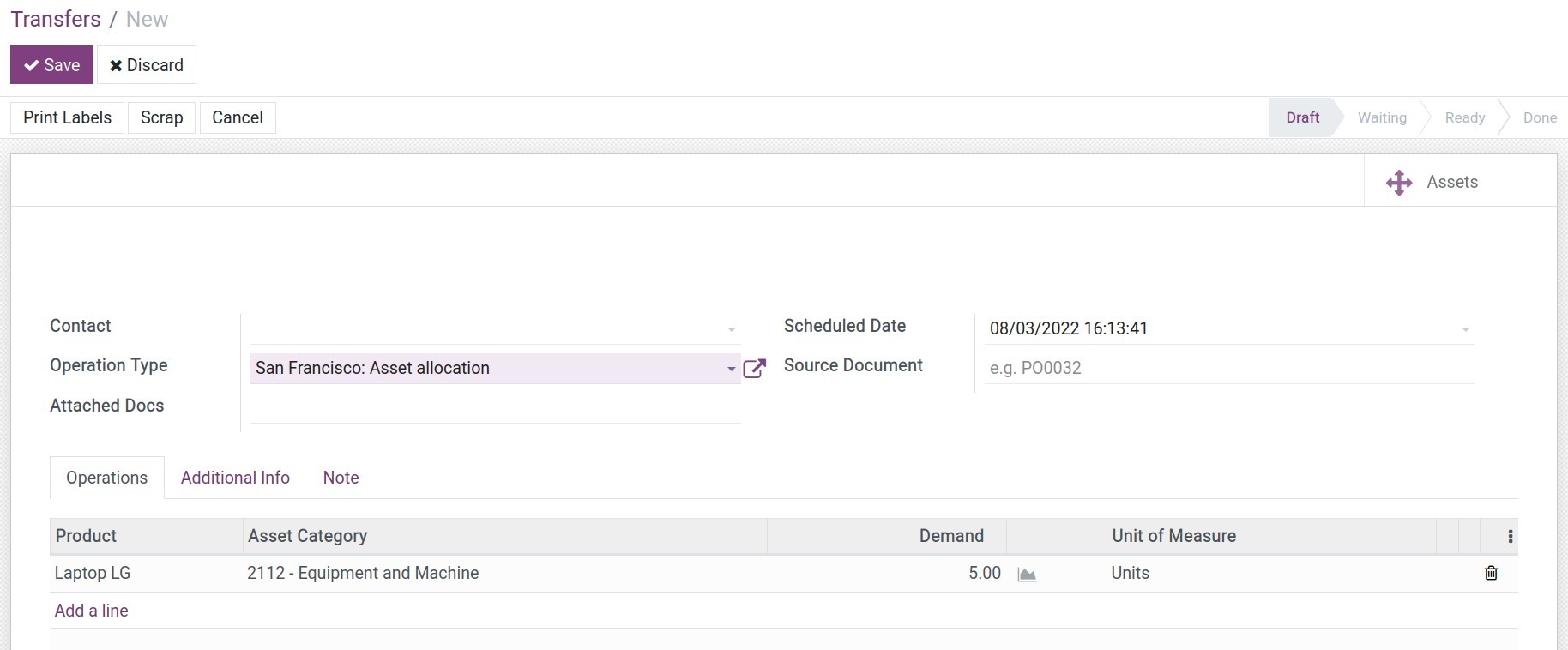

- Create an Asset from a storable product

-

Depreciation of Fixed Assets

- General concept

-

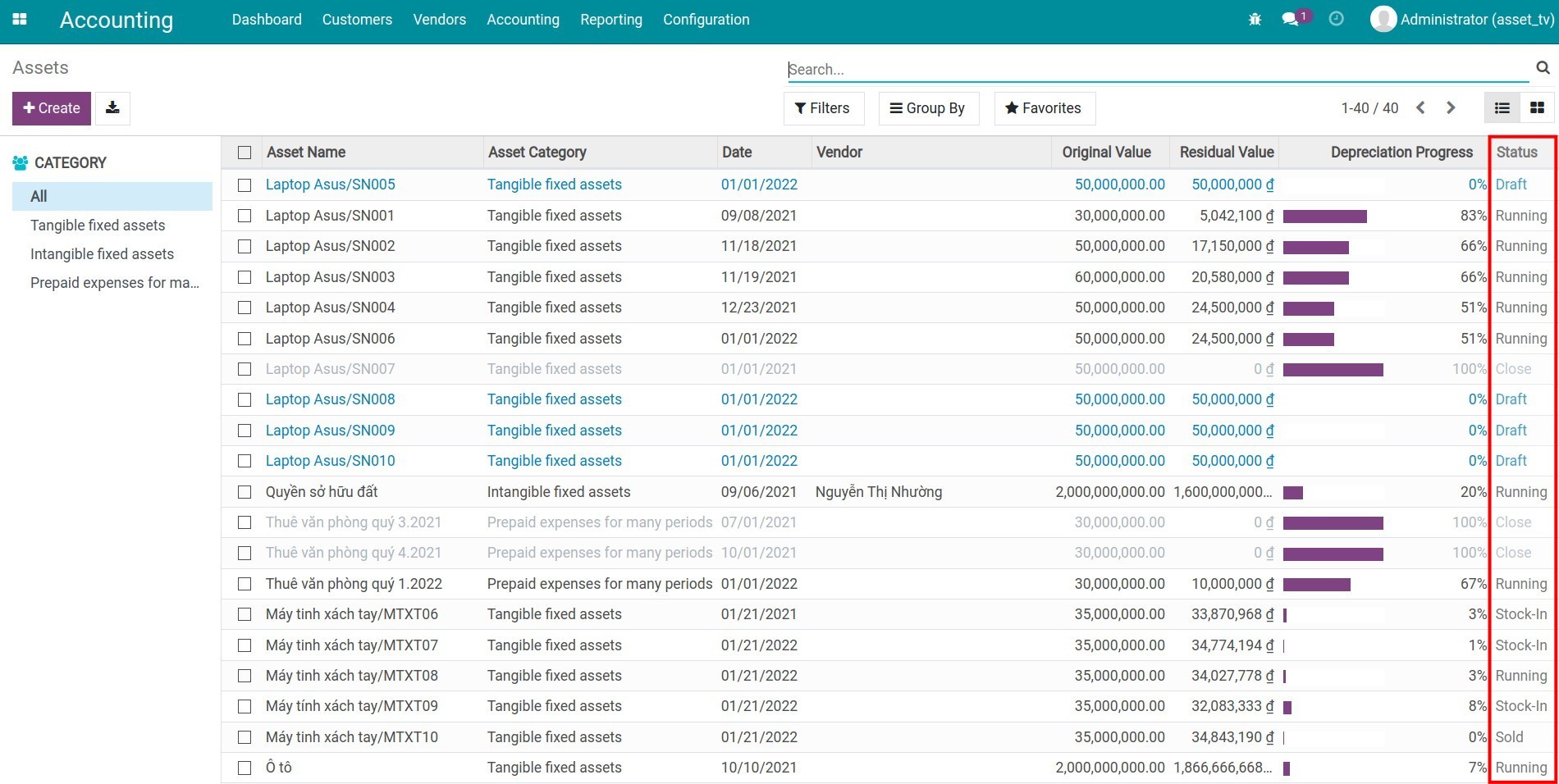

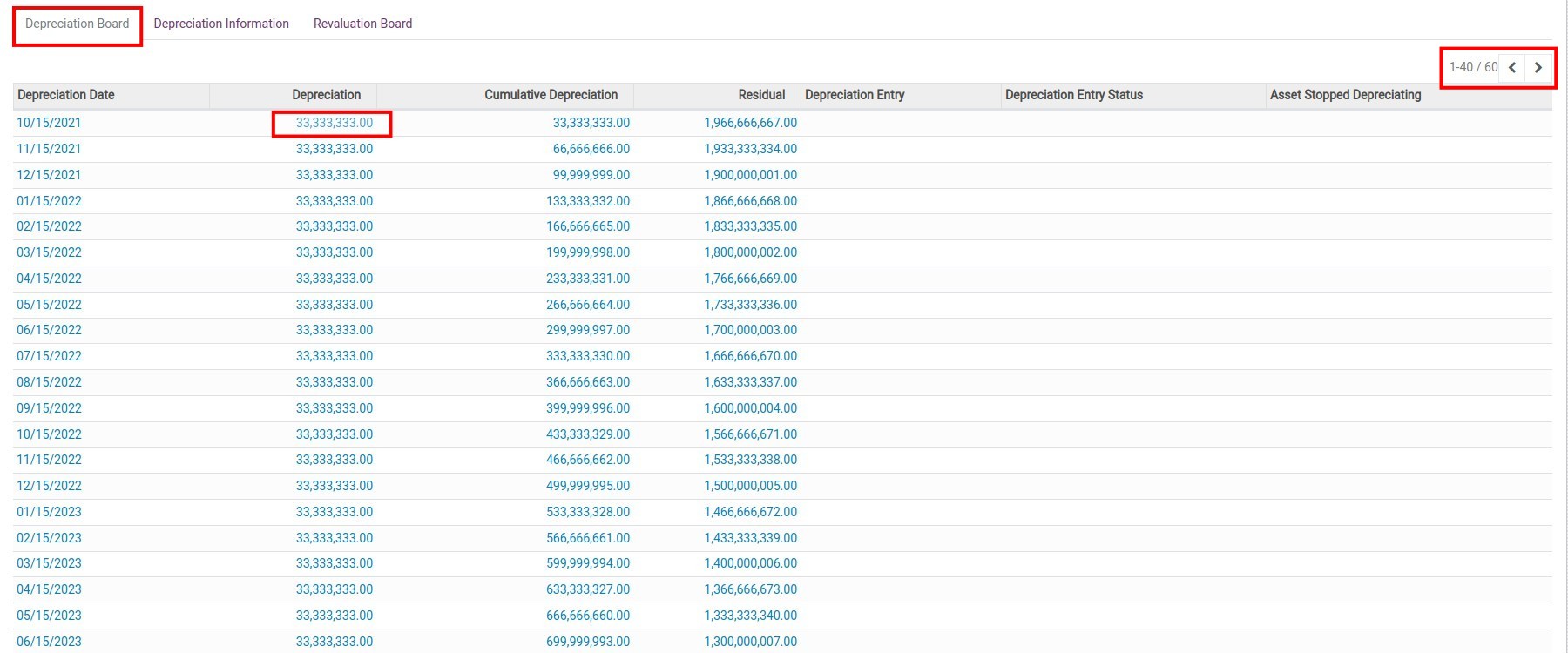

Depreciation of Assets

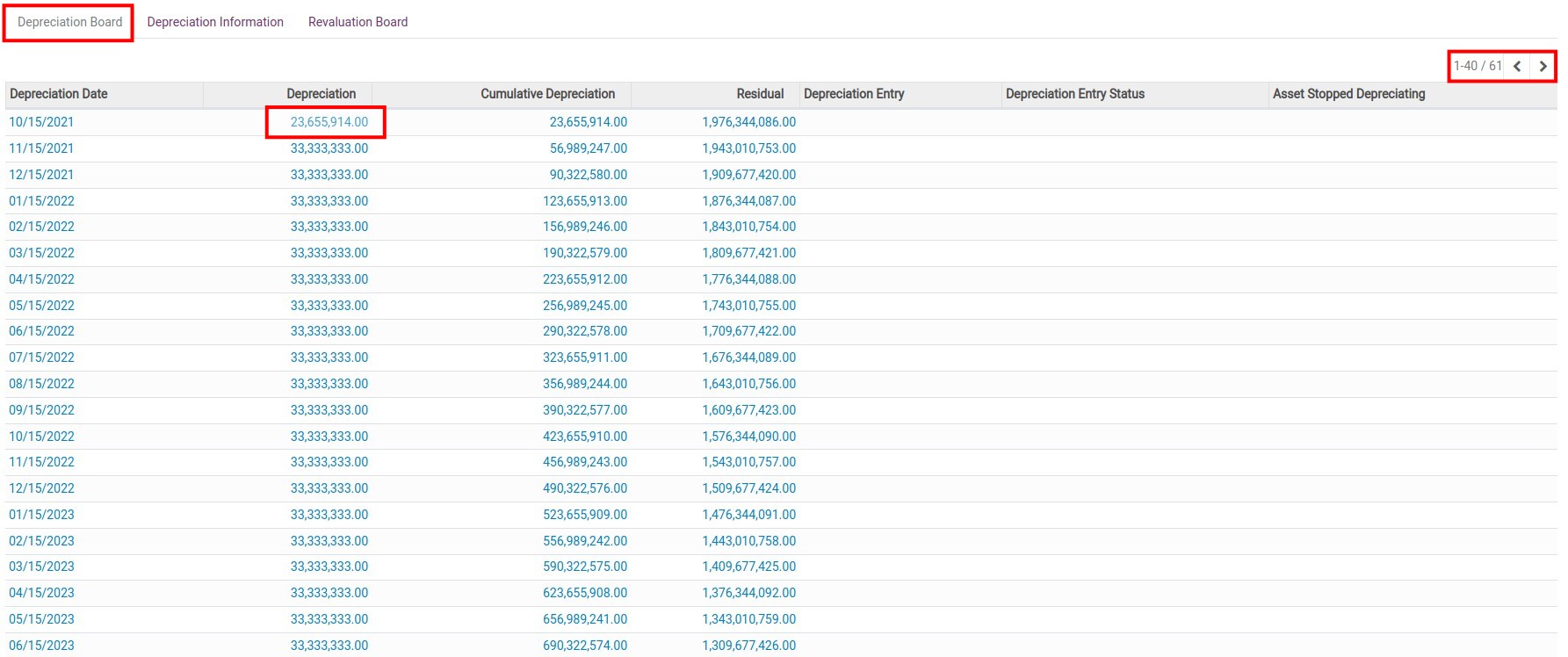

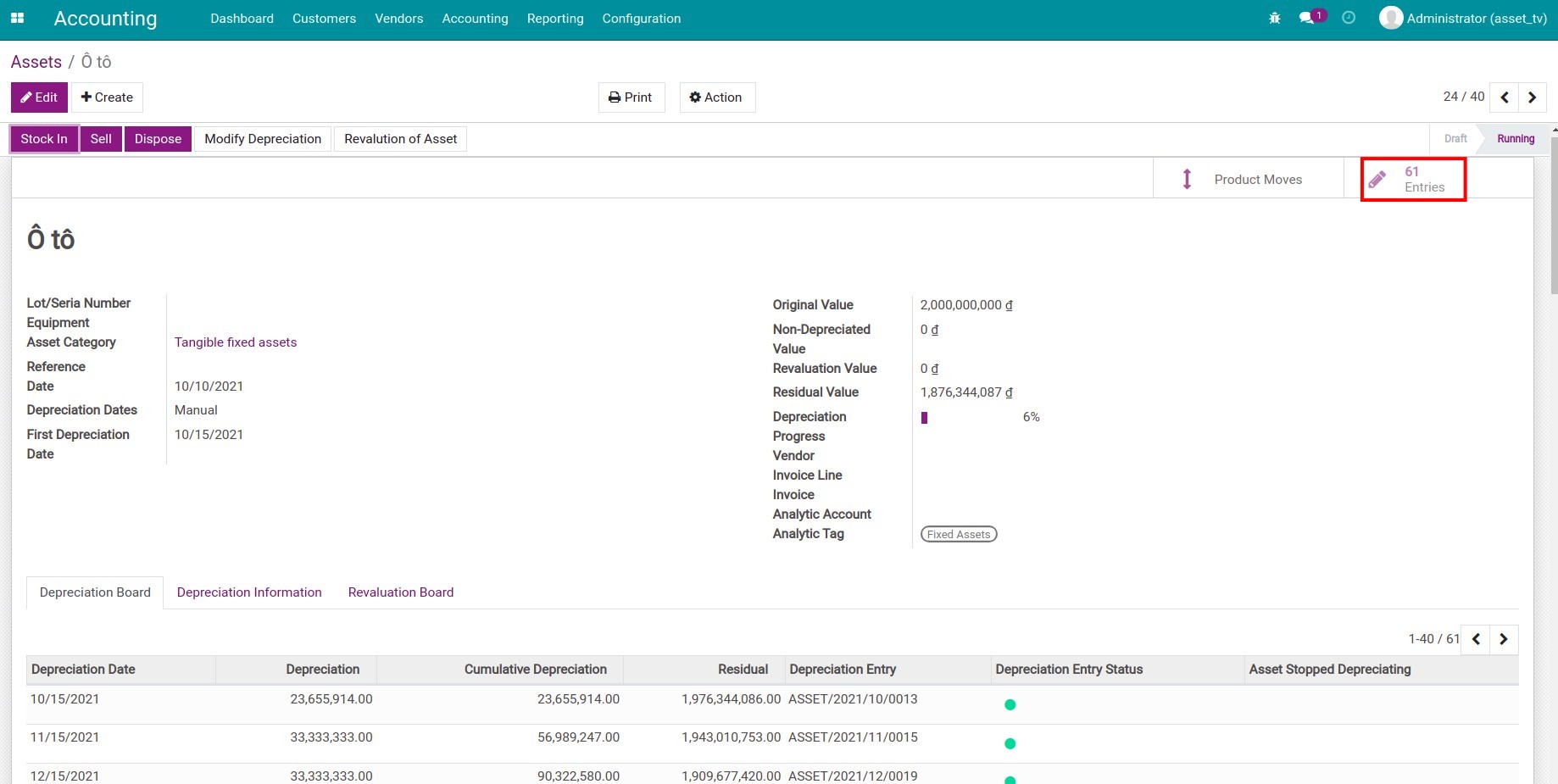

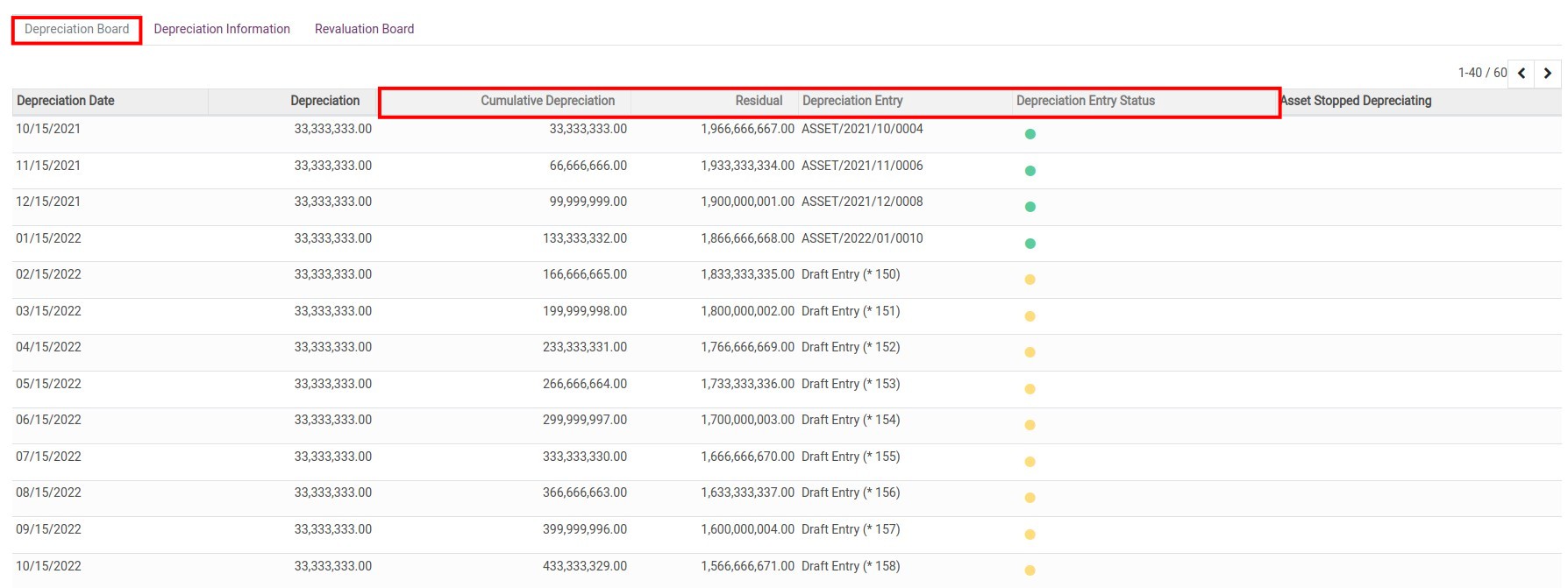

- Check the depreciation of assets

- Start to depreciate

-

Asset disposal

-

Asset disposal

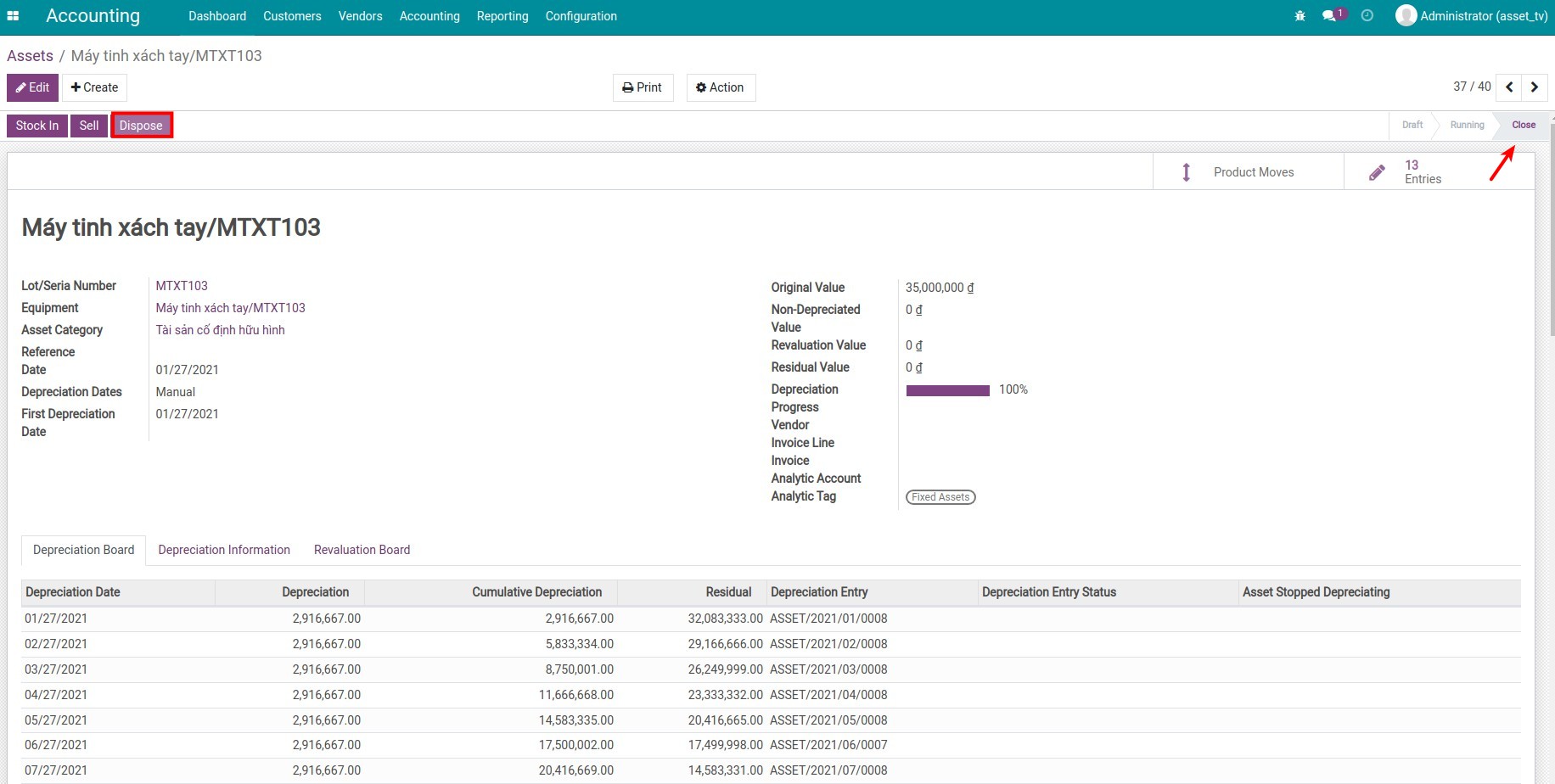

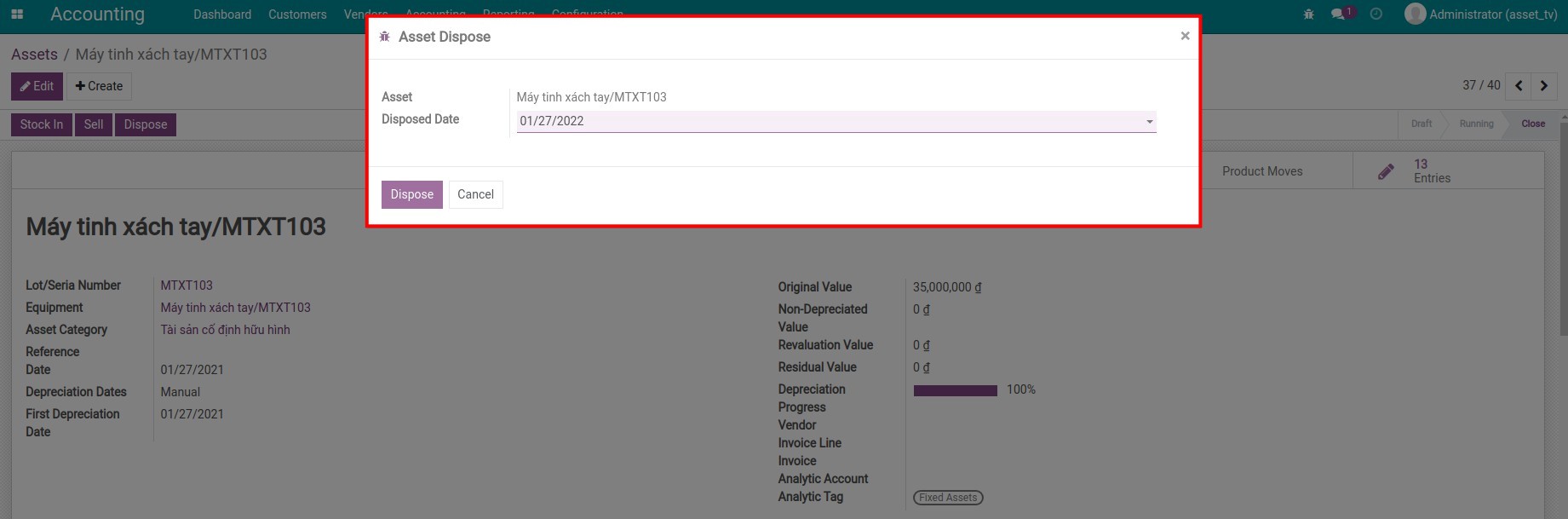

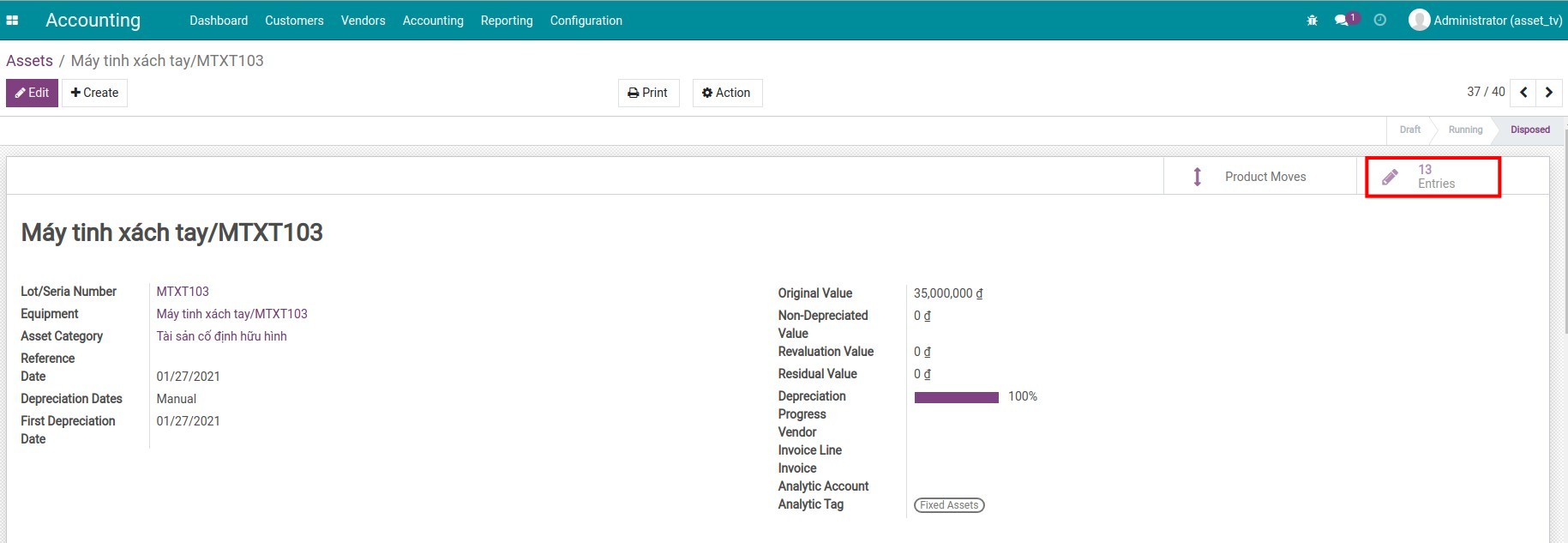

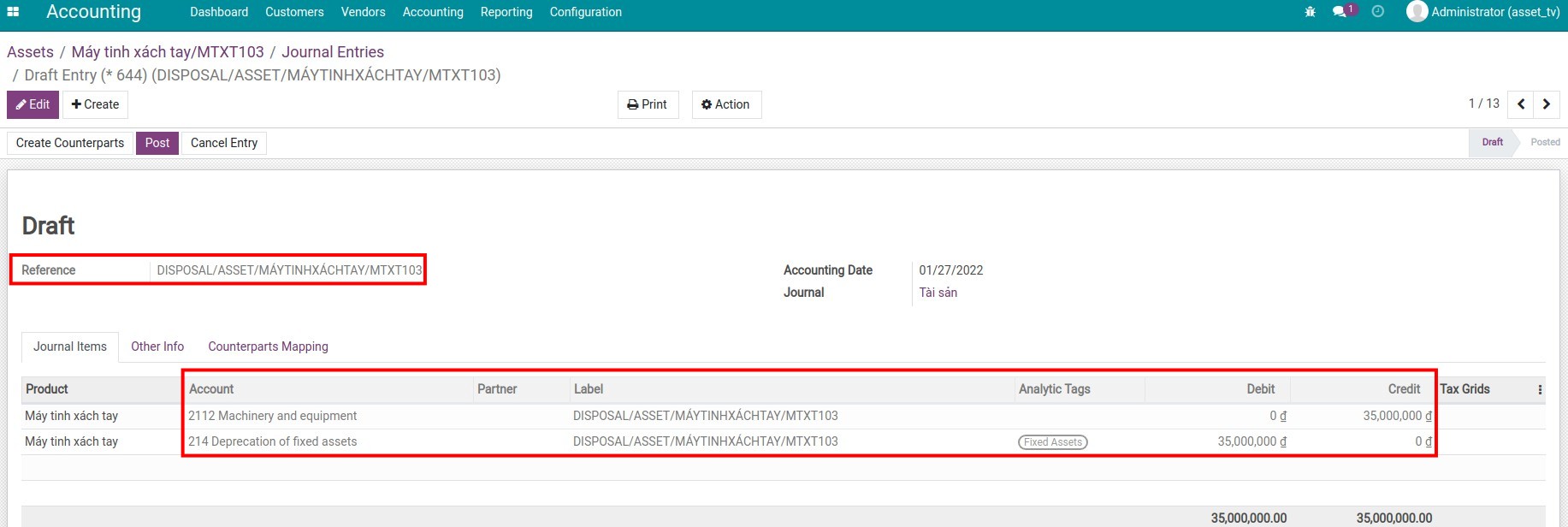

- Case 1: Dispose a depreciated Asset

- Case 2: Dispose an Asset while being depreciated

-

Asset Revaluation

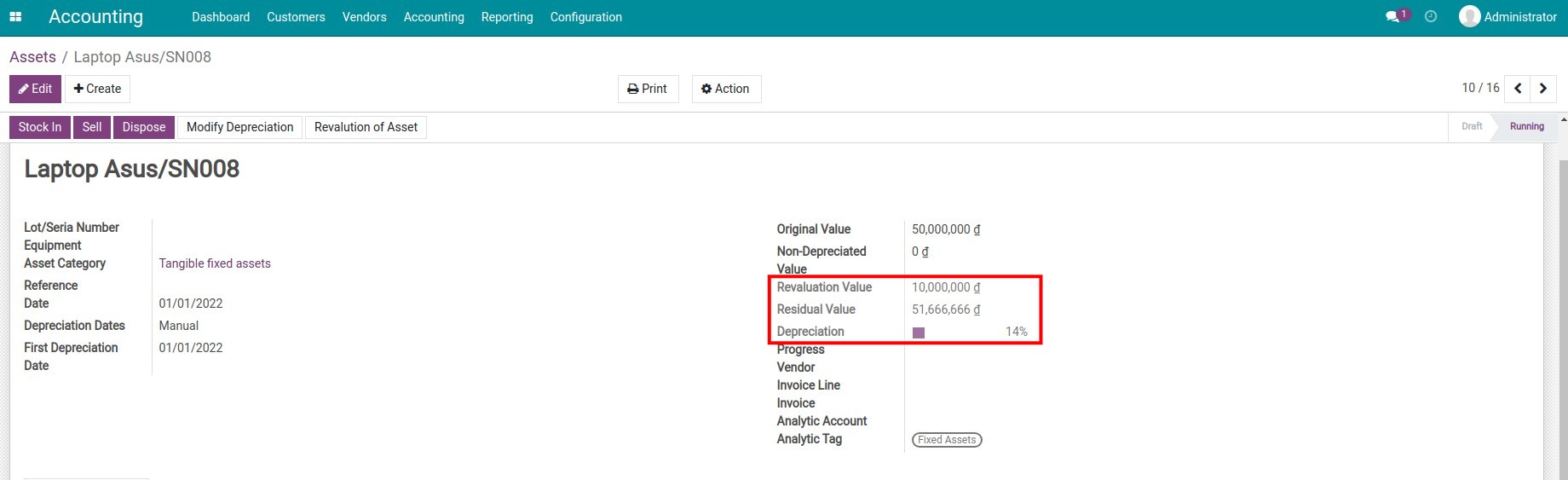

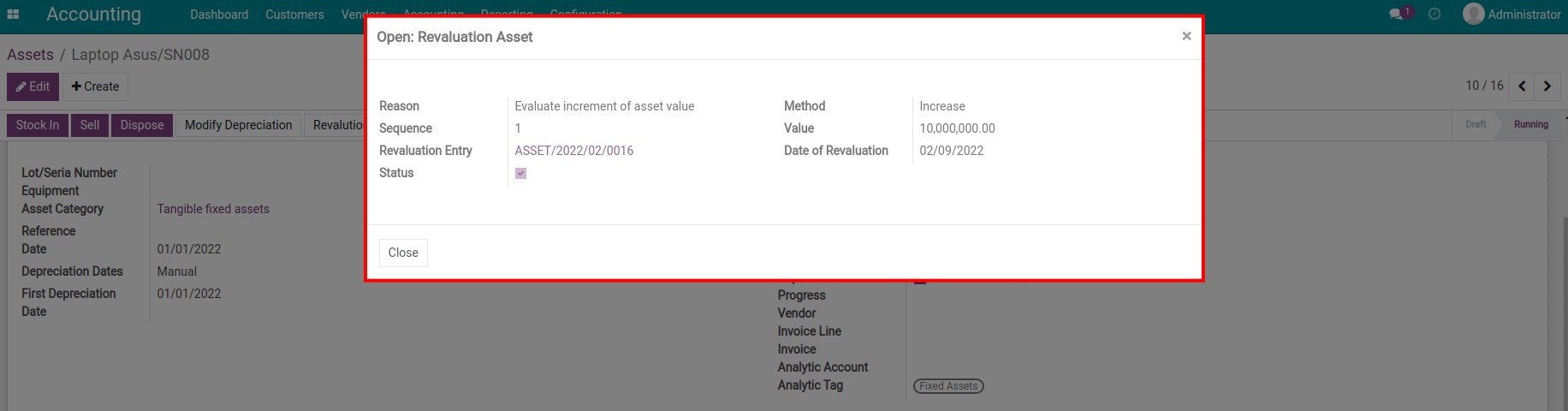

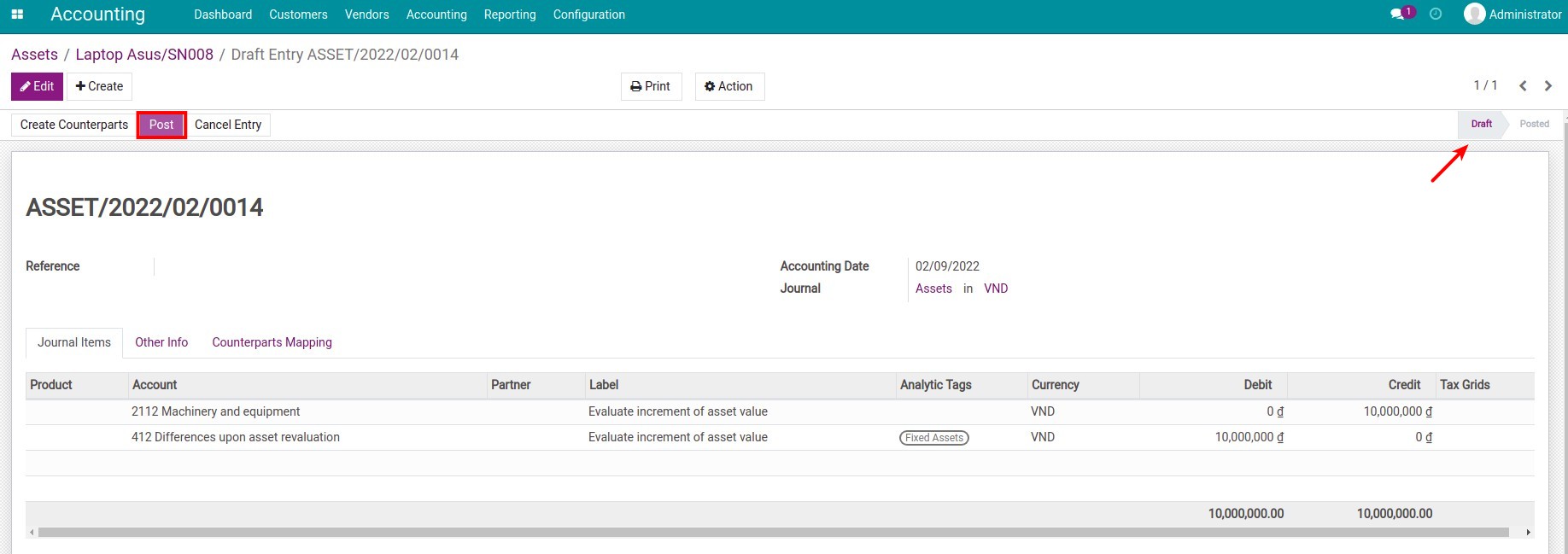

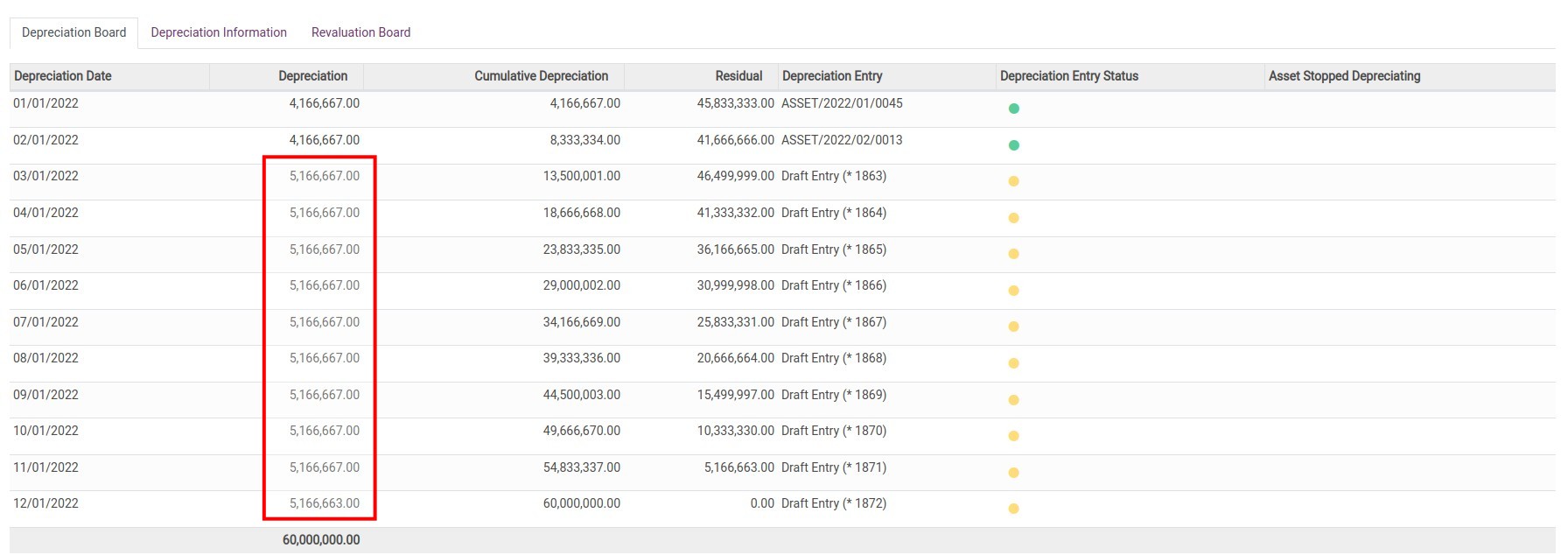

-

Asset Revaluation

- Asset information

- Revaluation Board

- Depreciation Board

-

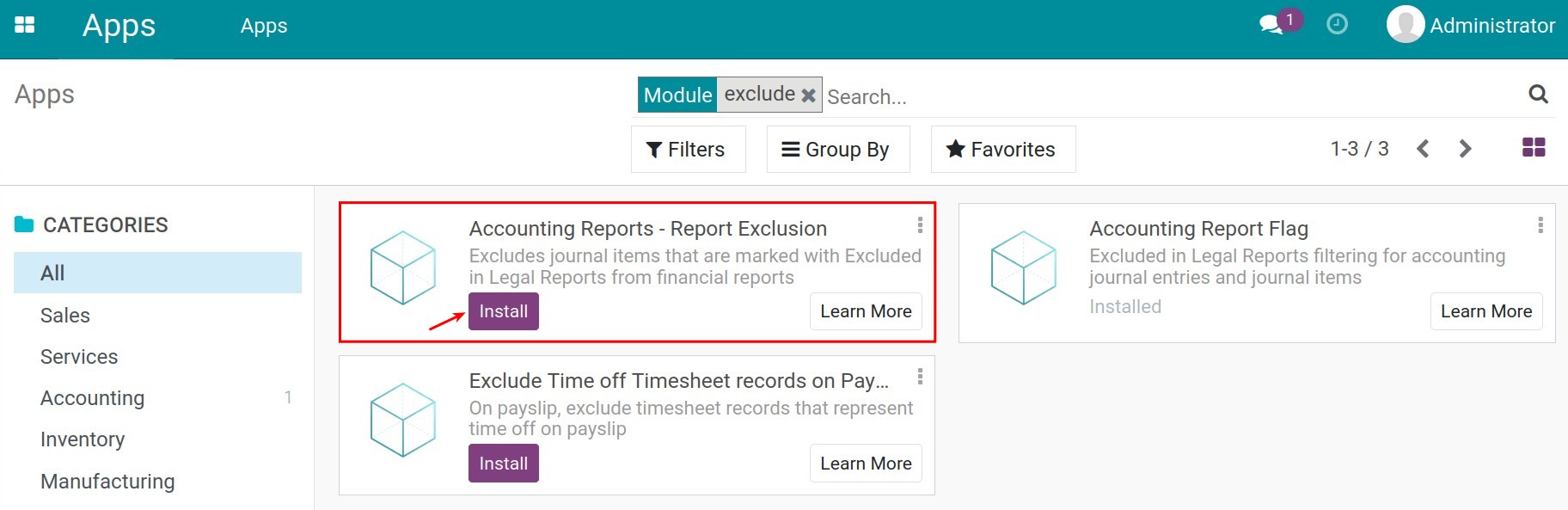

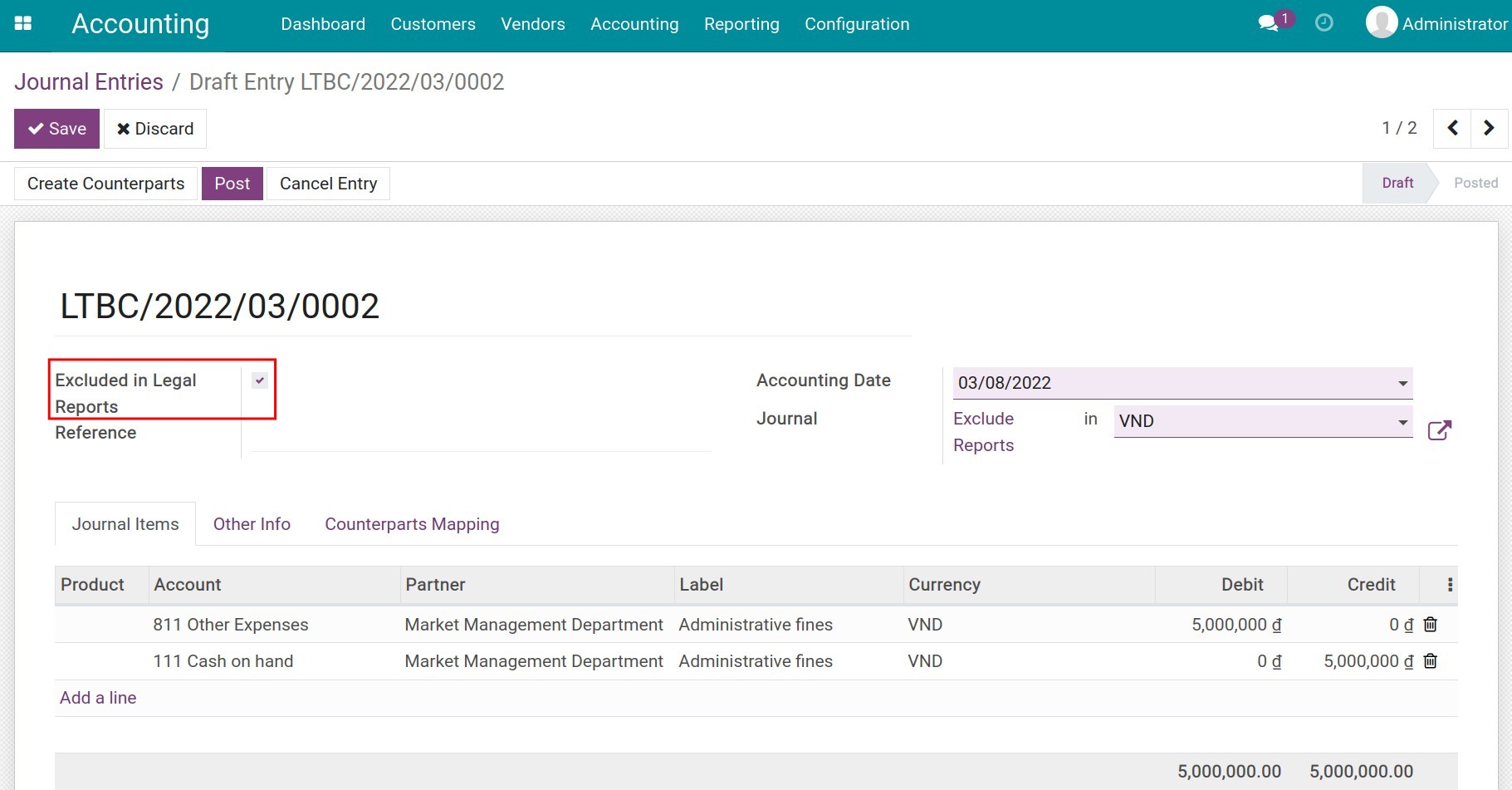

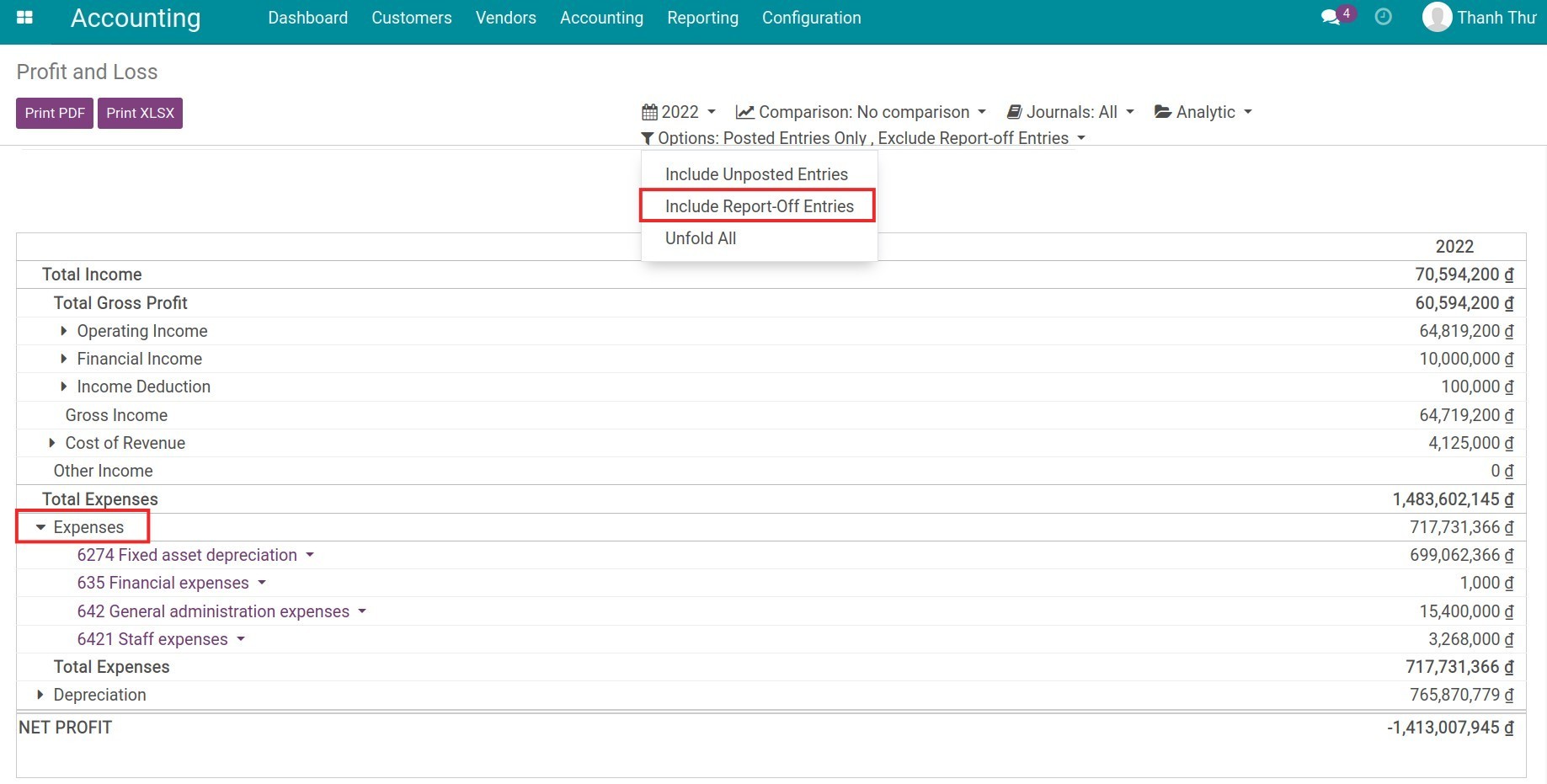

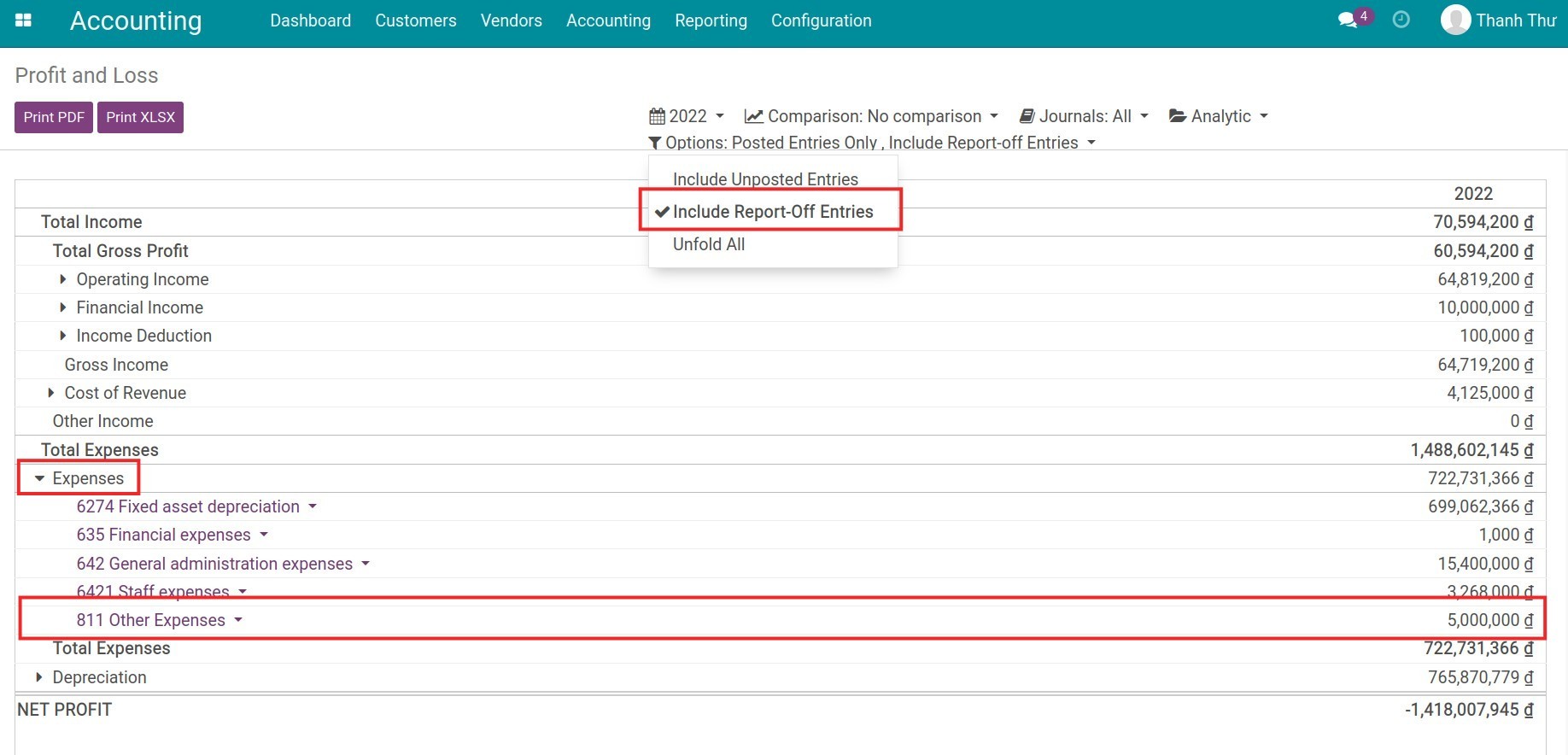

How to exclude journal items from Financial Reports

- How to exclude journal items from Financial Reports

-

Main concepts of Accounting and Invoicing in iSuite

-

Main concepts of Accounting and Invoicing in iSuite

- Double-entry bookkeeping

- Accrual Accounting and Cash Basis Accounting

- Multi-companies

- Multi-currencies

- International Accounting Standards

- Account Receivables and Payables

- Broad-range of financial reports

- Automated bank reconciliation

- Inventory Valuation methods

- Retained earnings

-

How to configure iSuite Accounting and Invoicing before using

-

How to configure iSuite Accounting and Invoicing before using

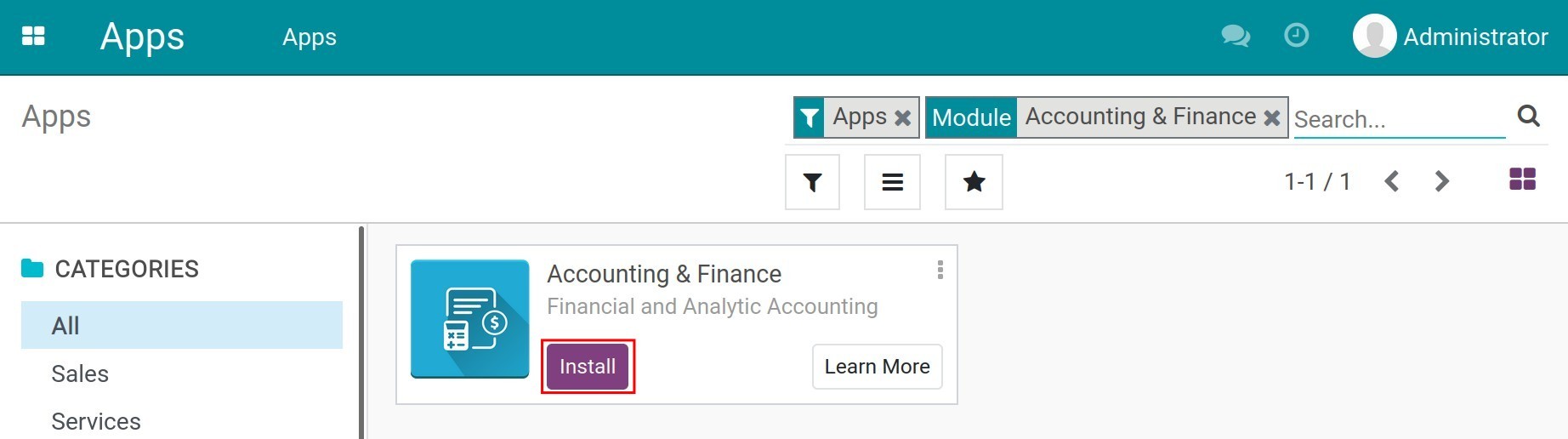

- Install Accounting module

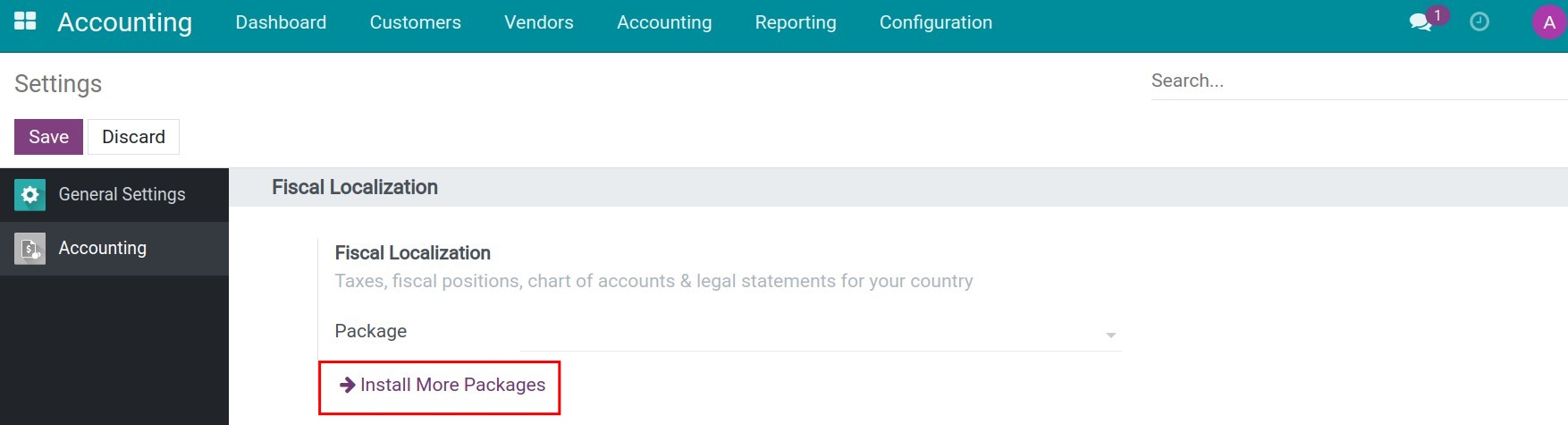

- Configure Fiscal Localization

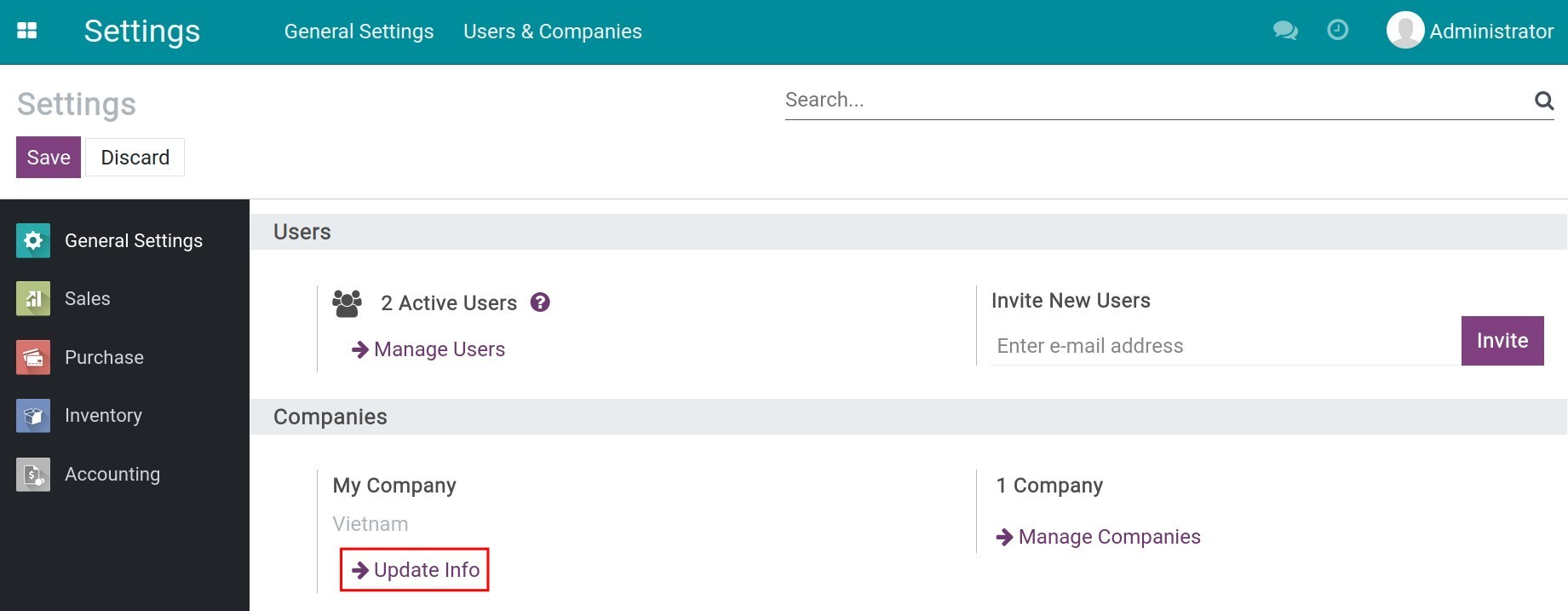

- Configure Company’s information

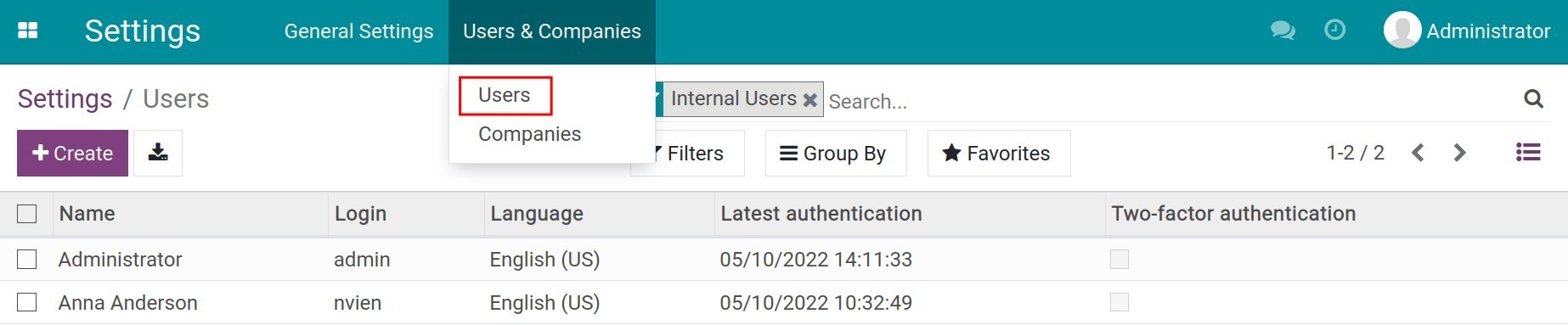

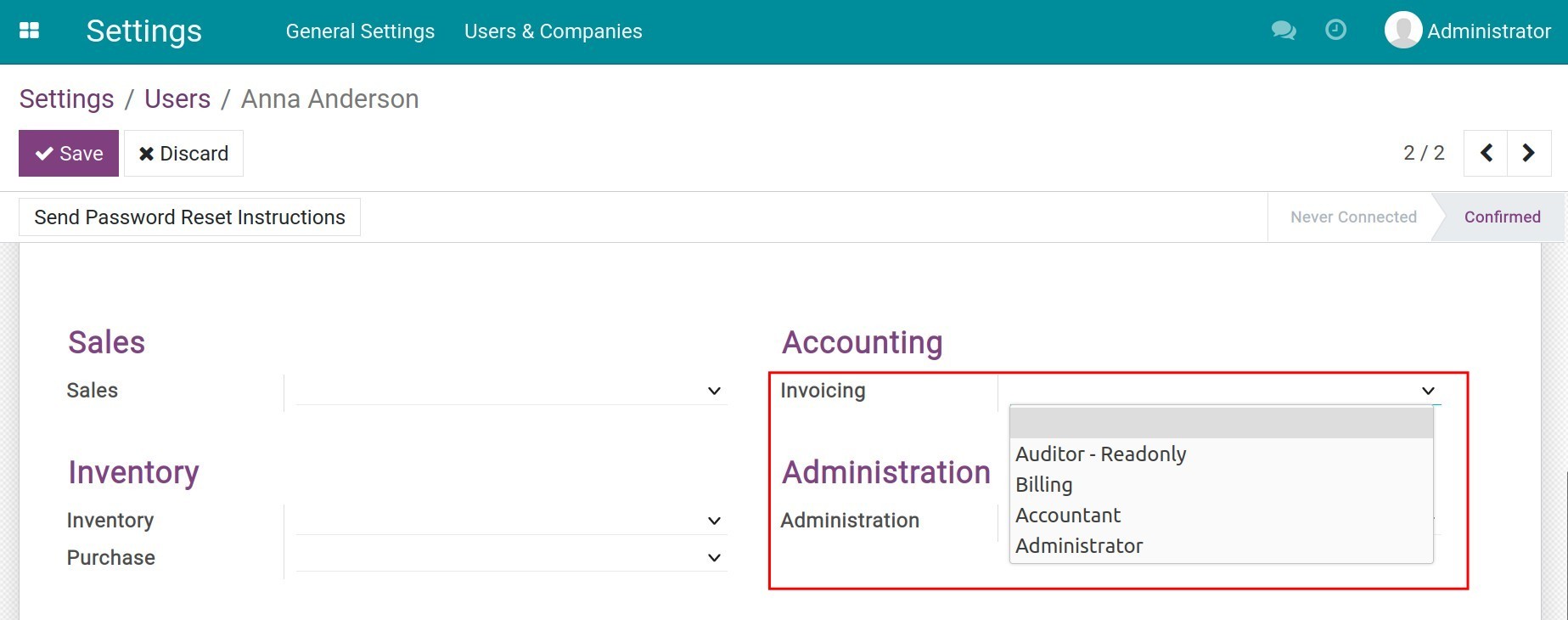

- Configure User access right

-

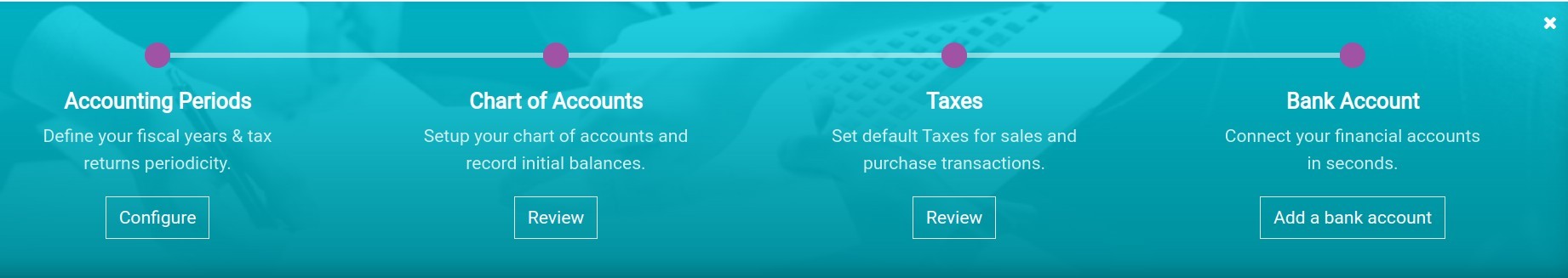

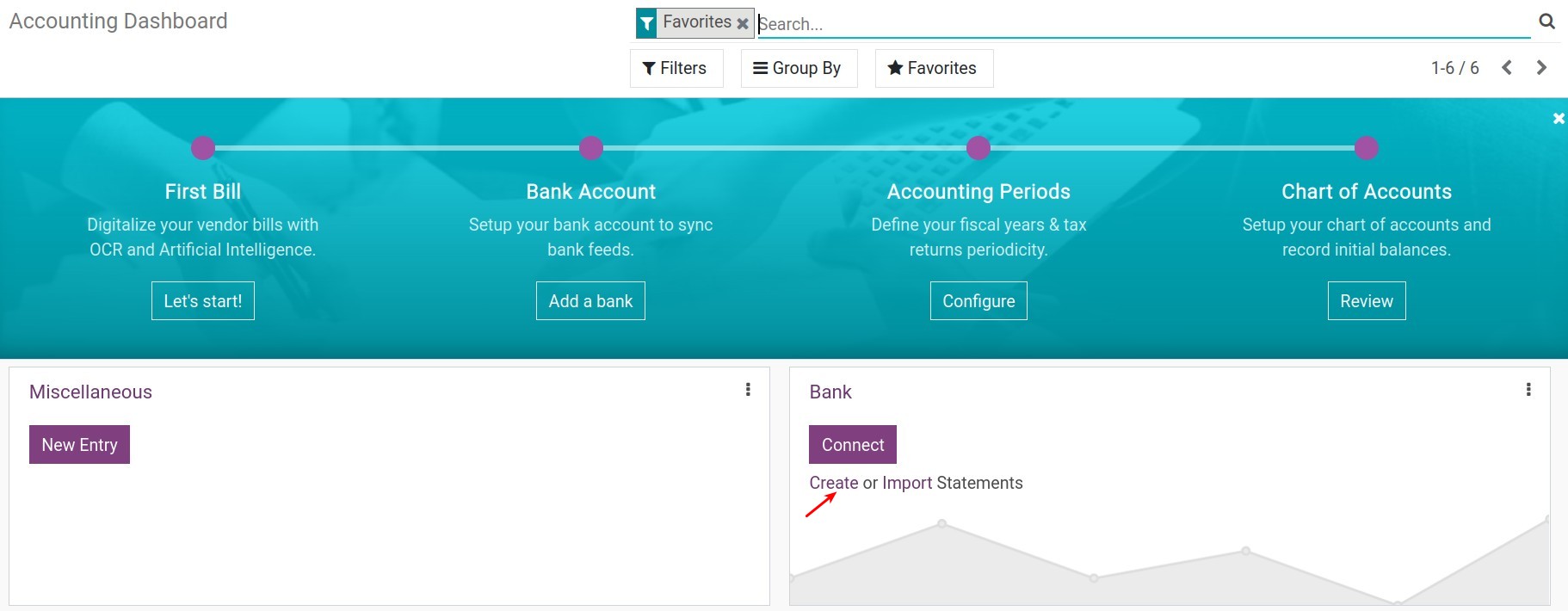

Configuration Tips panel

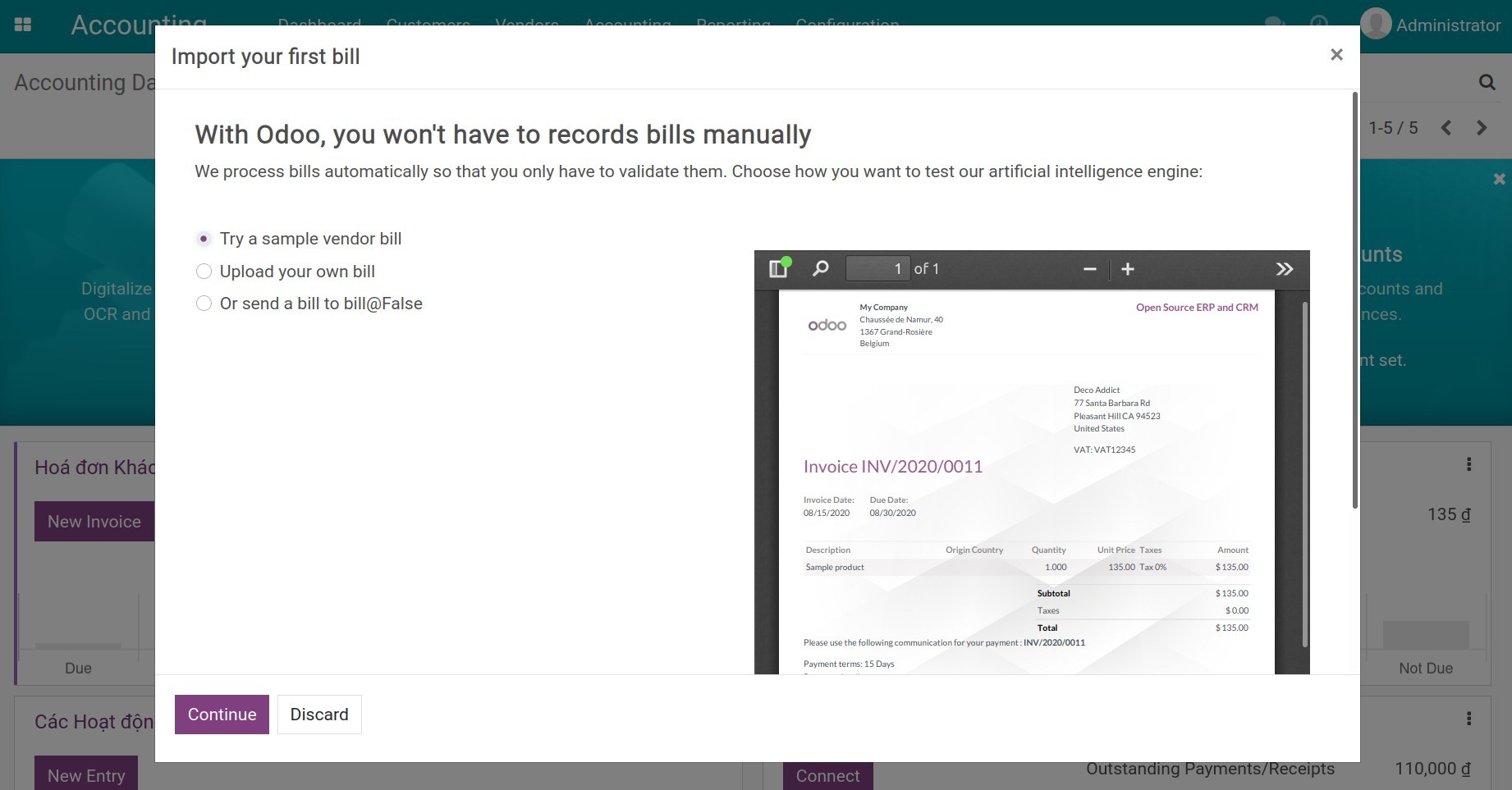

- Create the First Bill

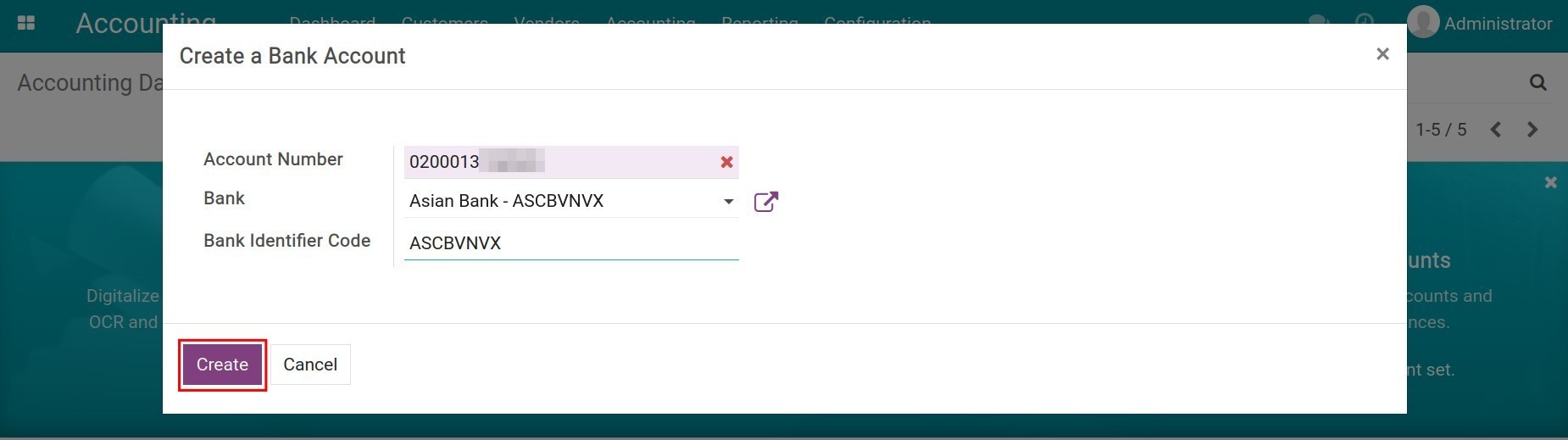

- Add a Bank Account

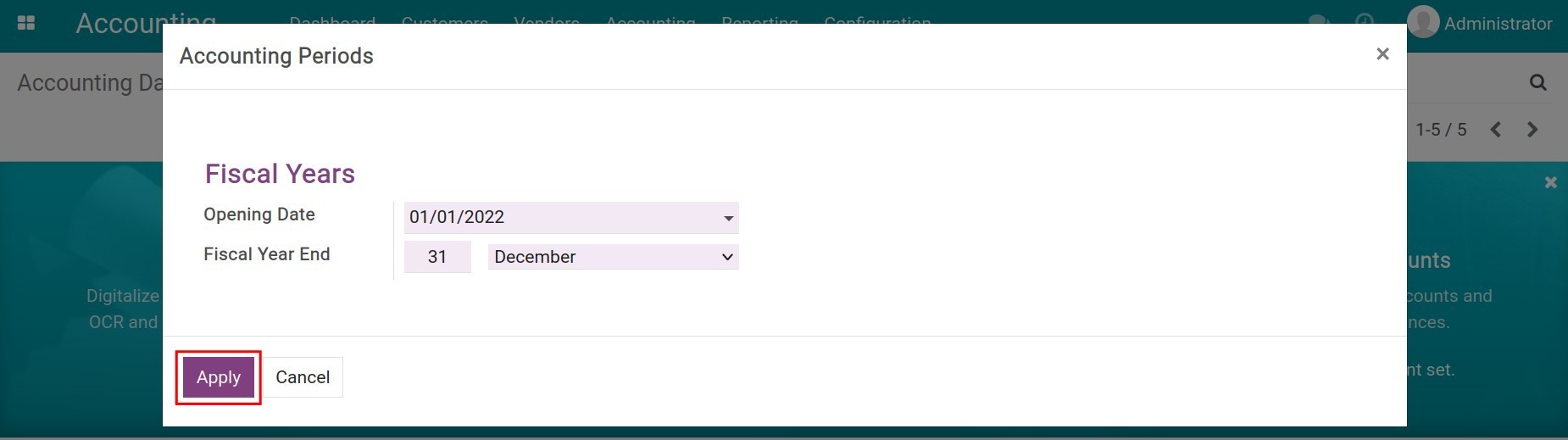

- Accounting Periods

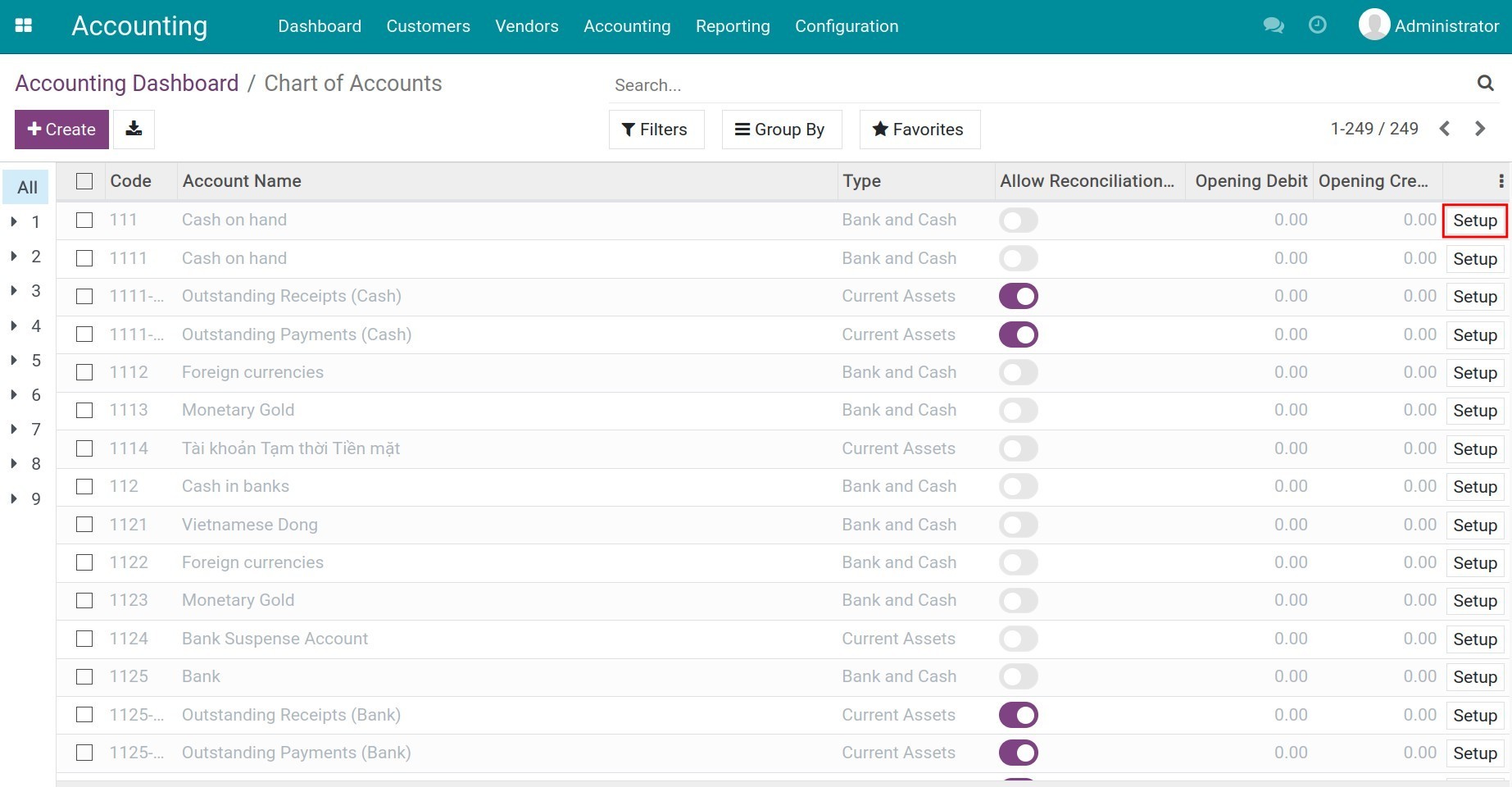

- Chart of Accounts

-

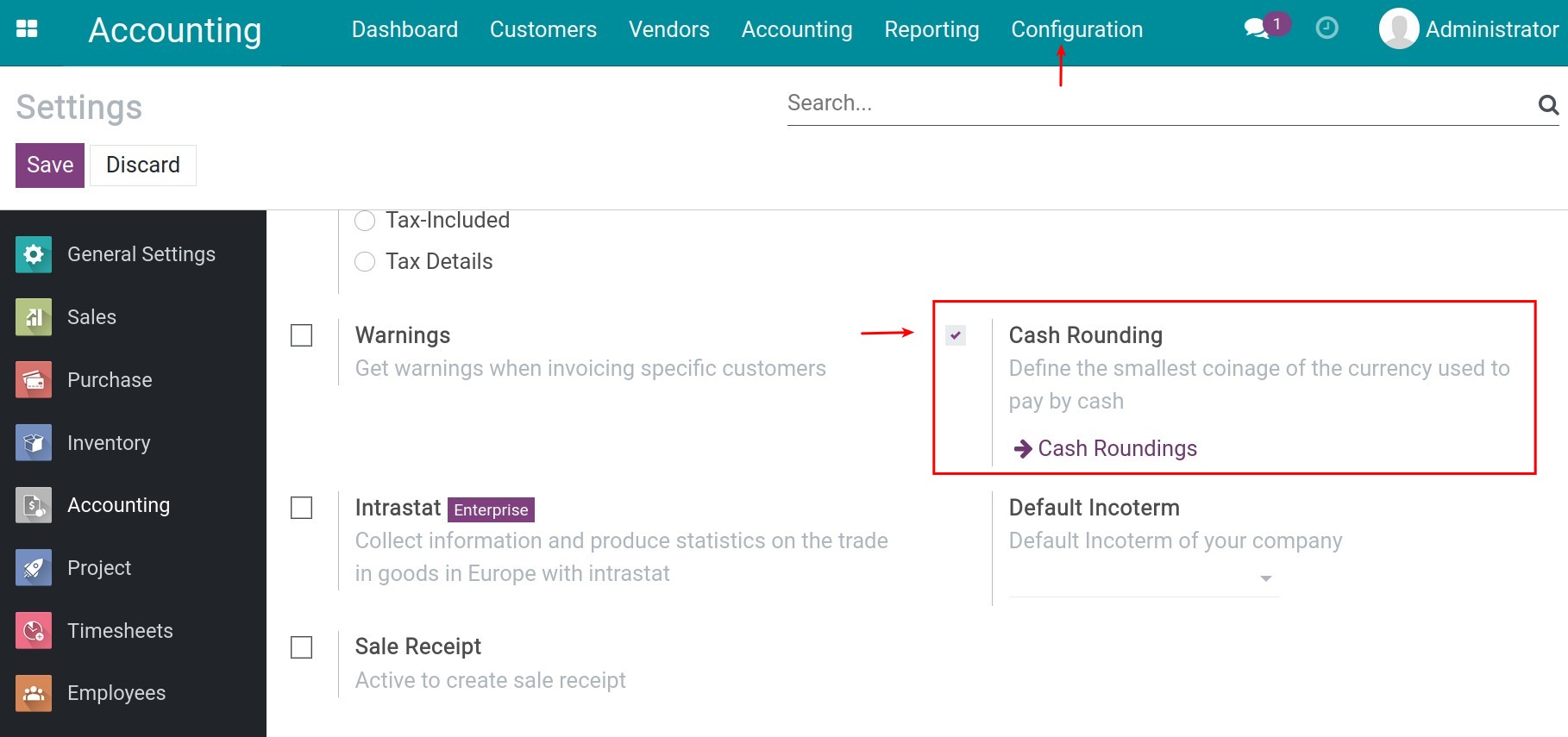

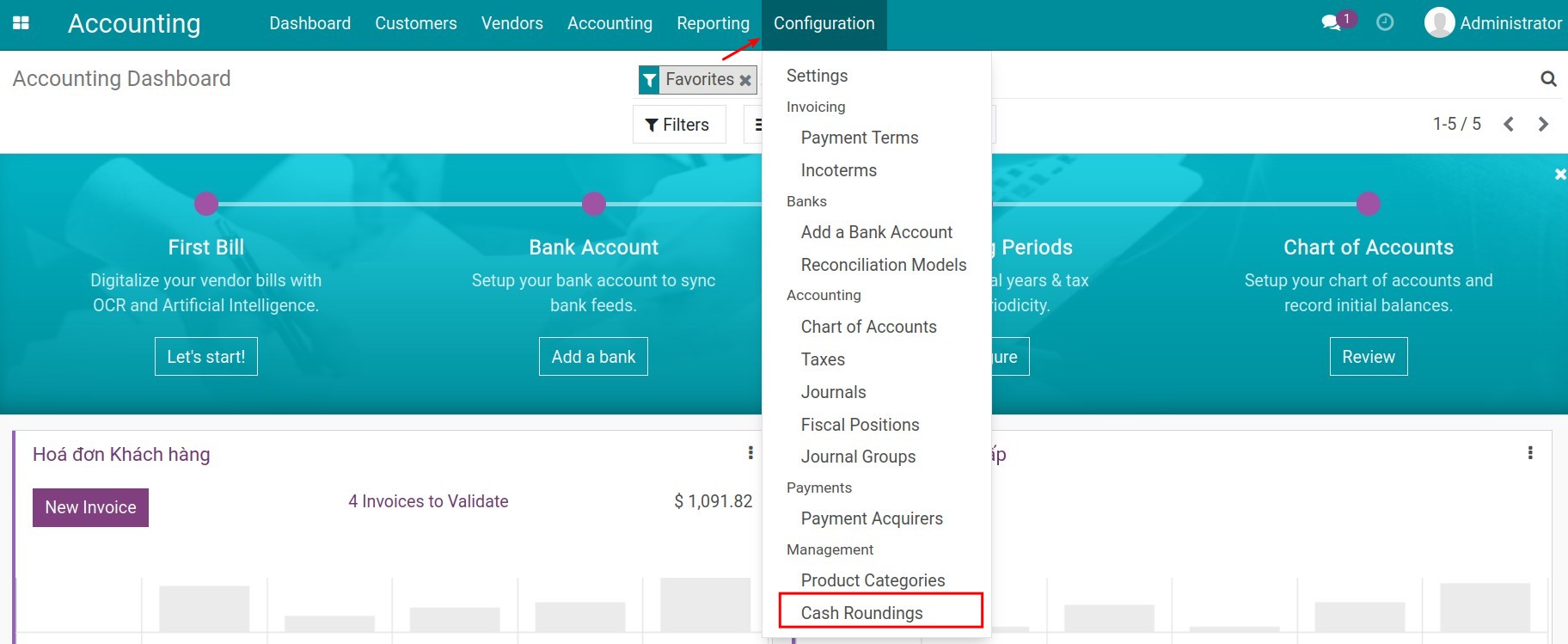

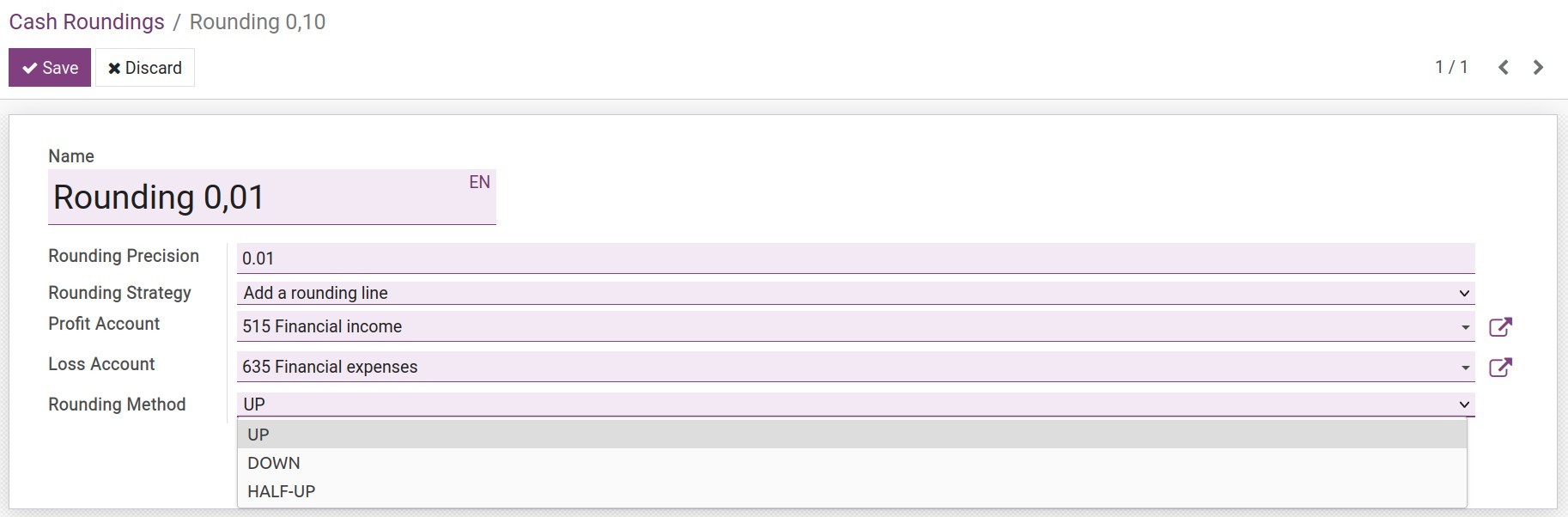

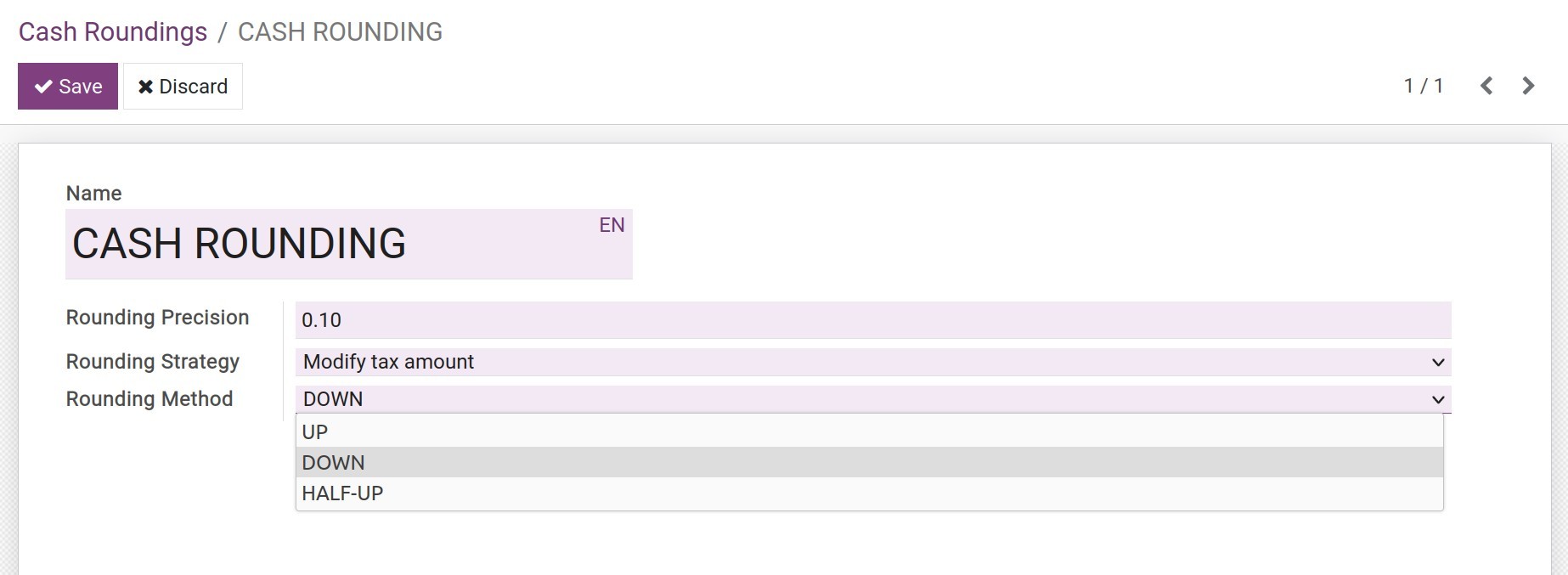

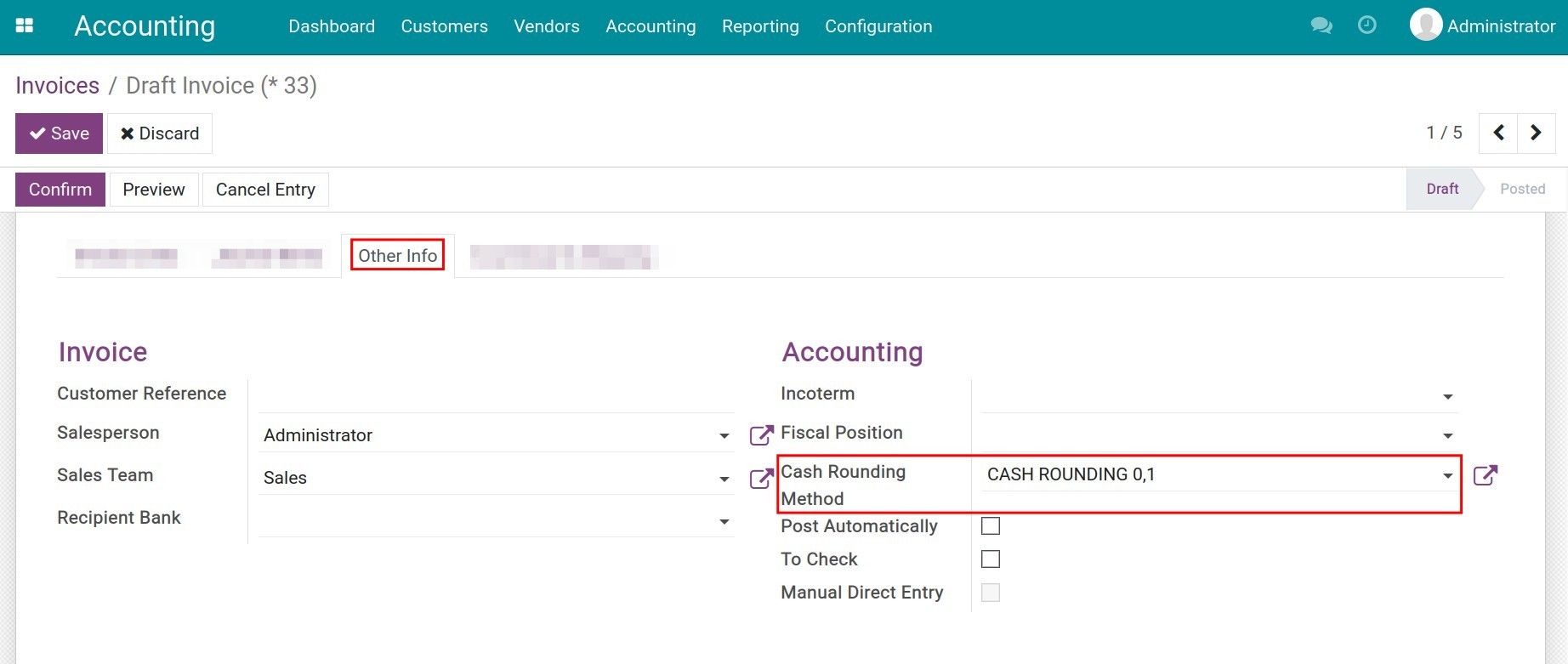

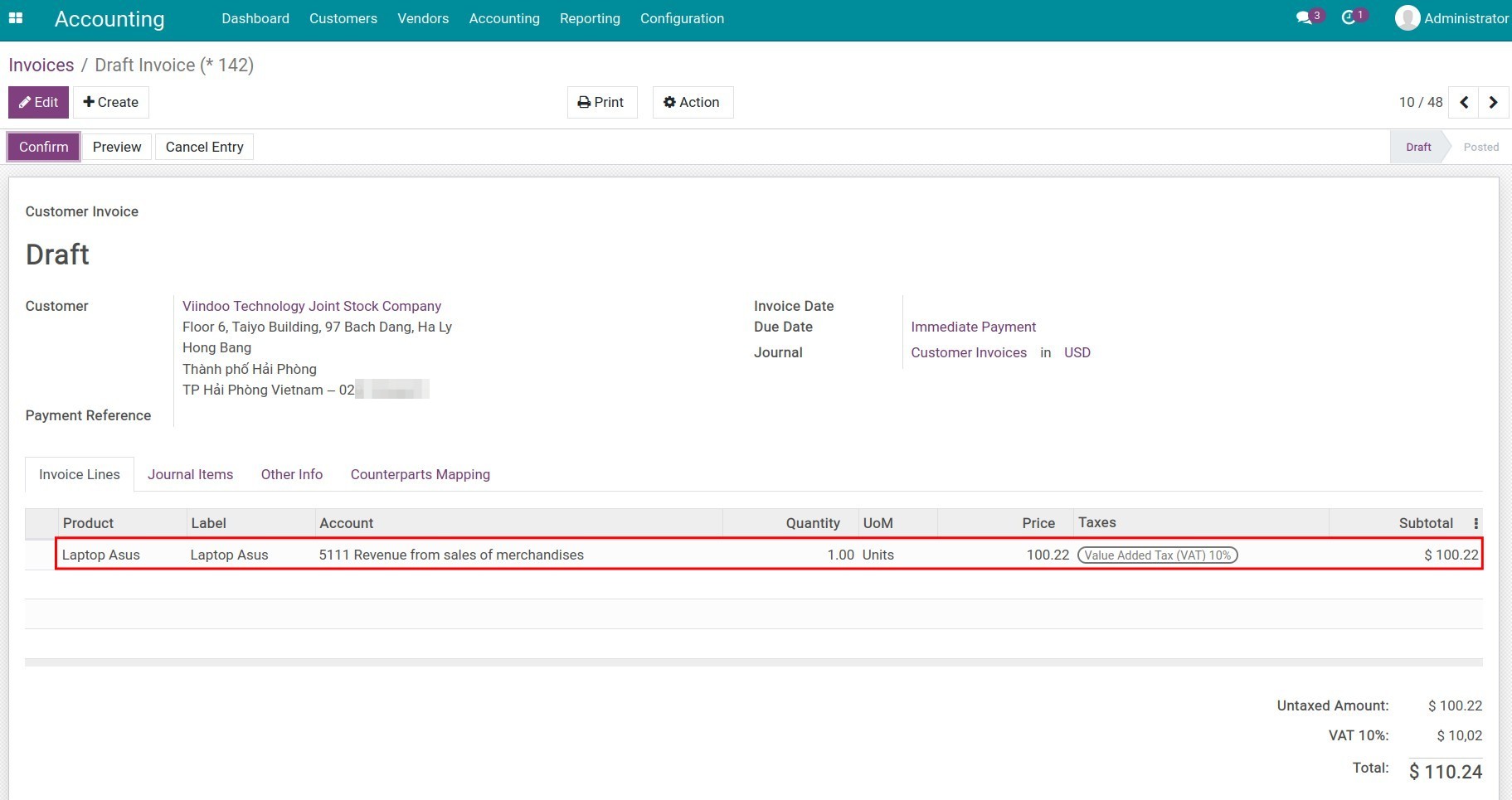

Configure Cash Rounding method

-

Configure Cash Rounding method

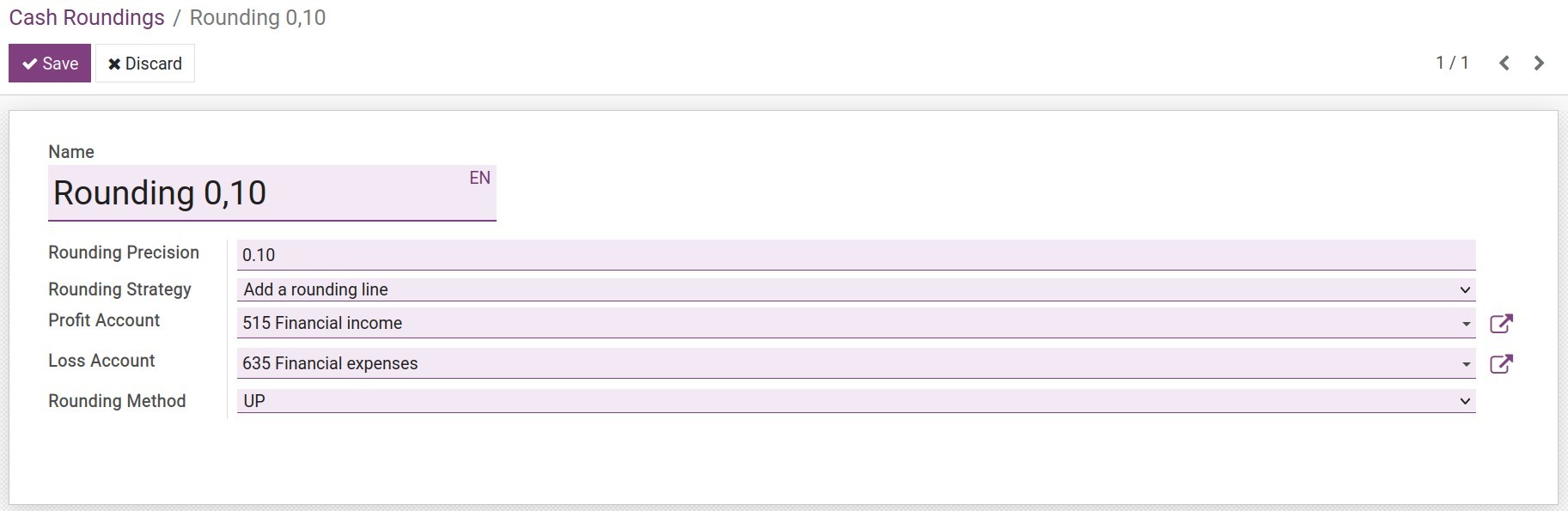

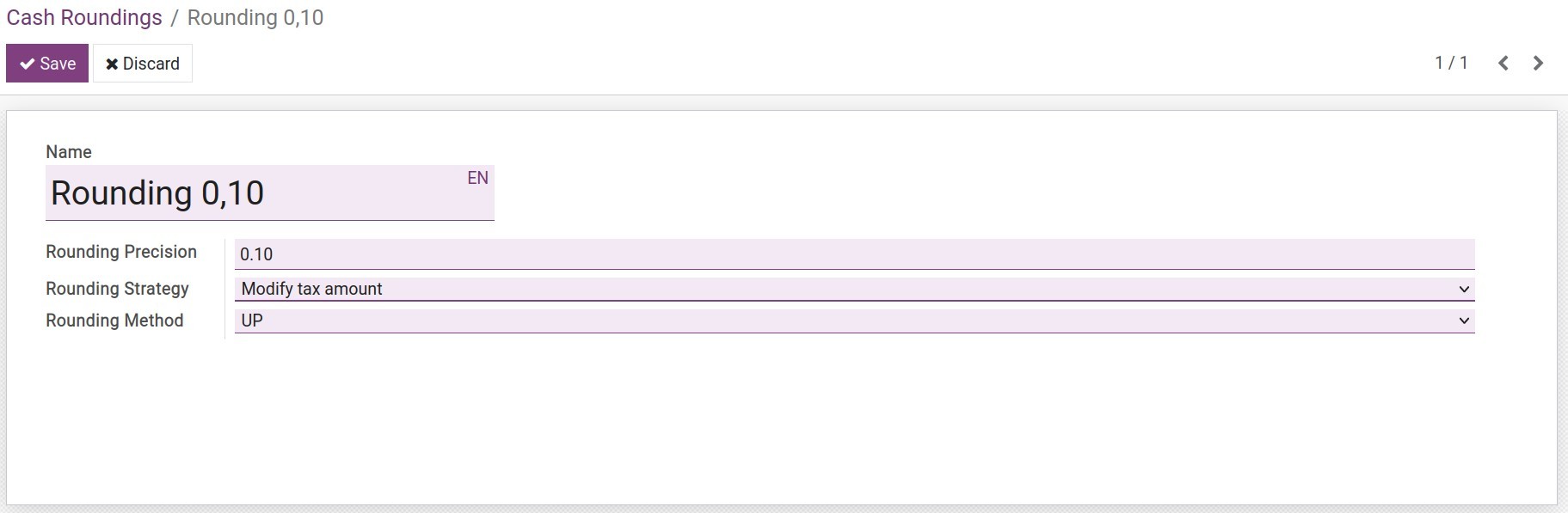

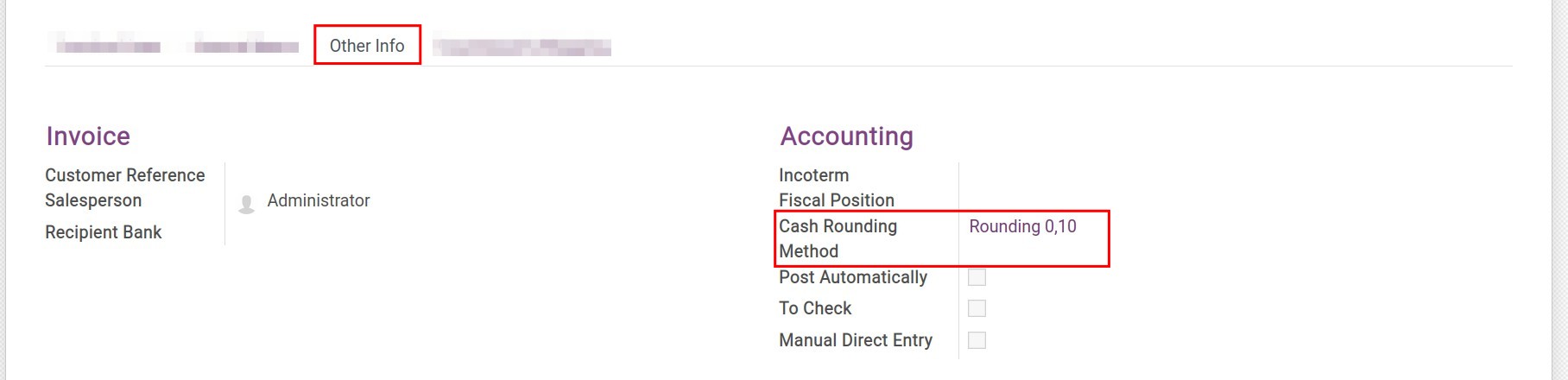

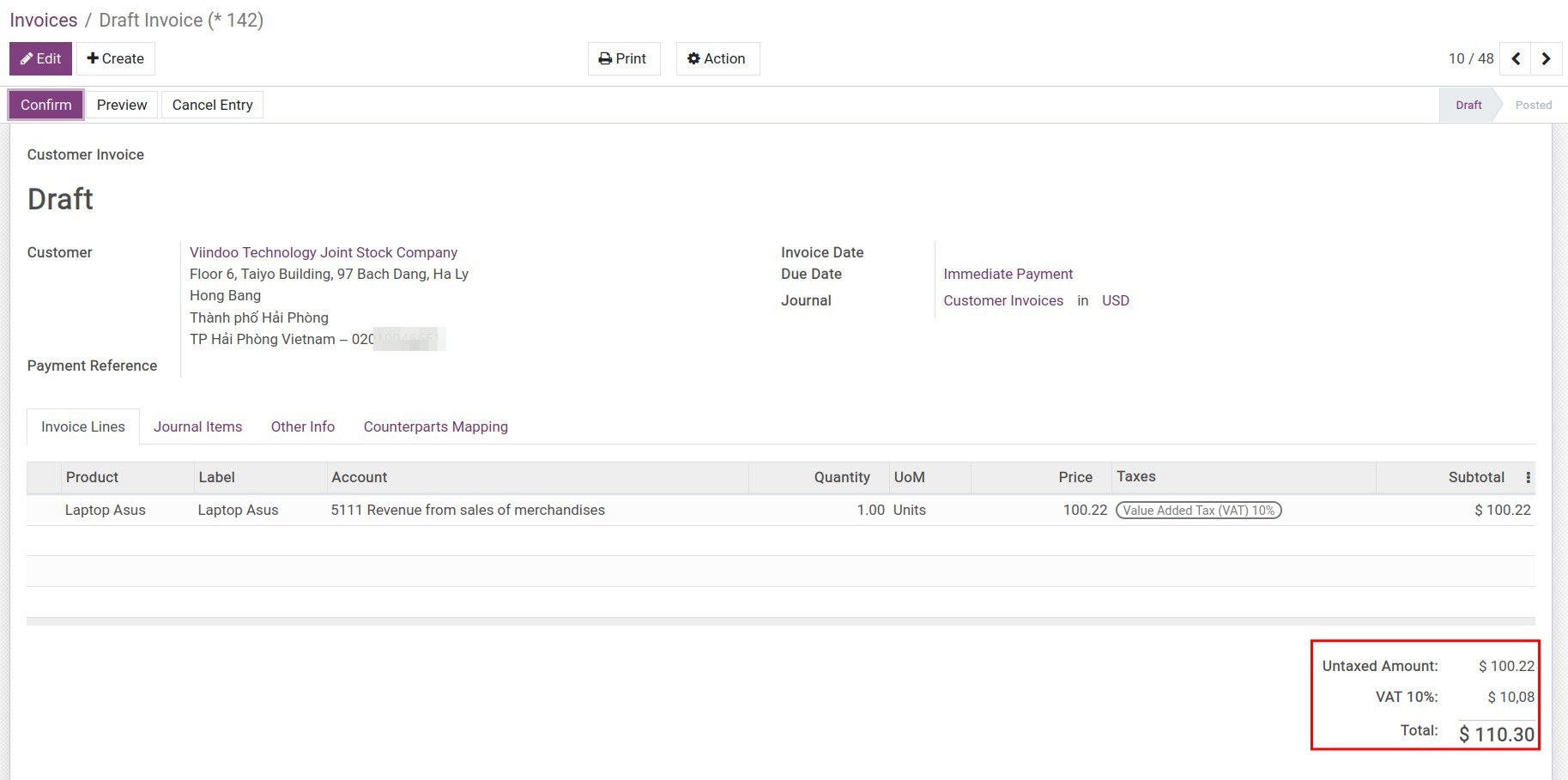

- Cash rounding configuration

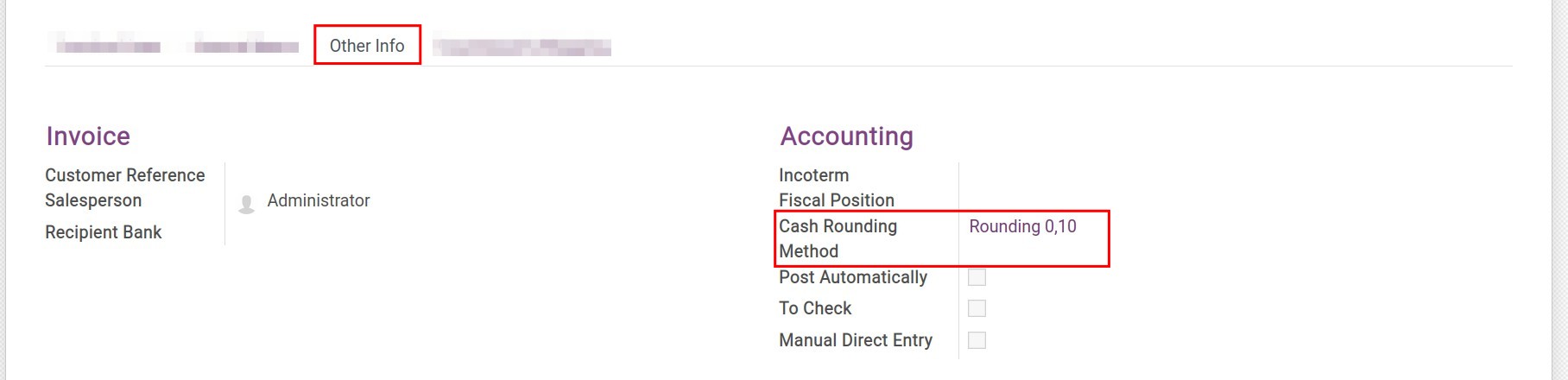

- Apply cash roundings on invoices

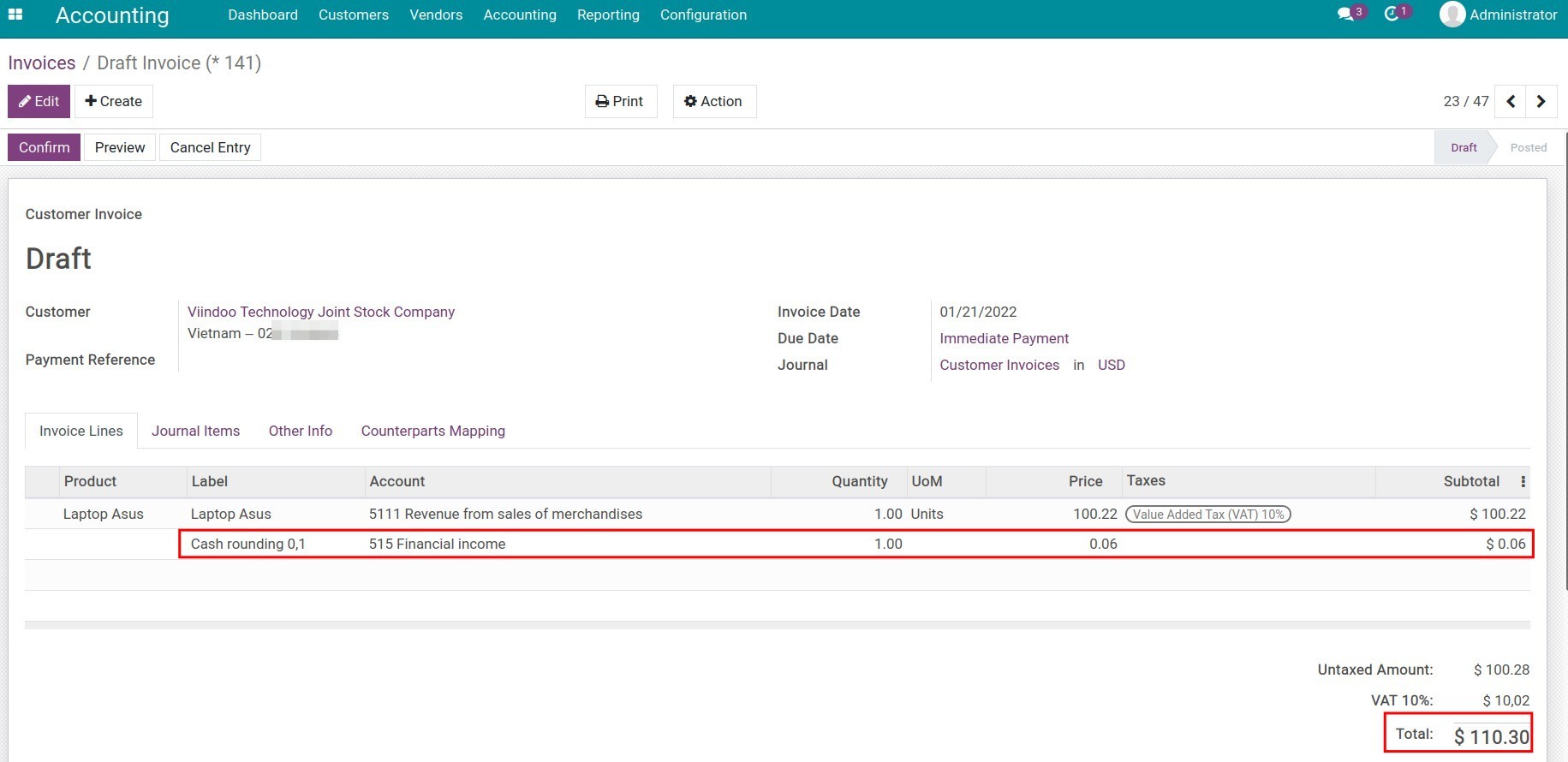

- Examples

-

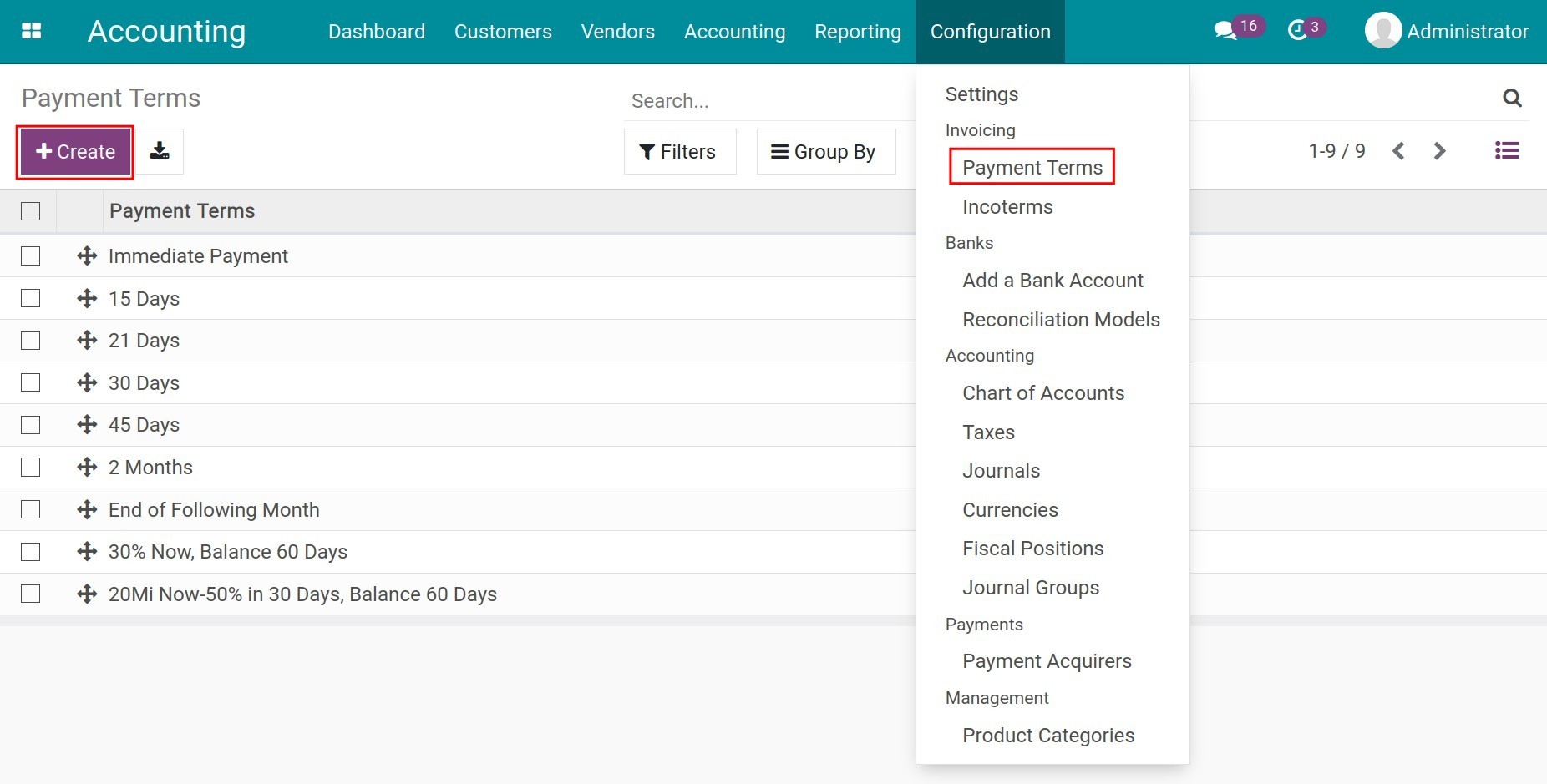

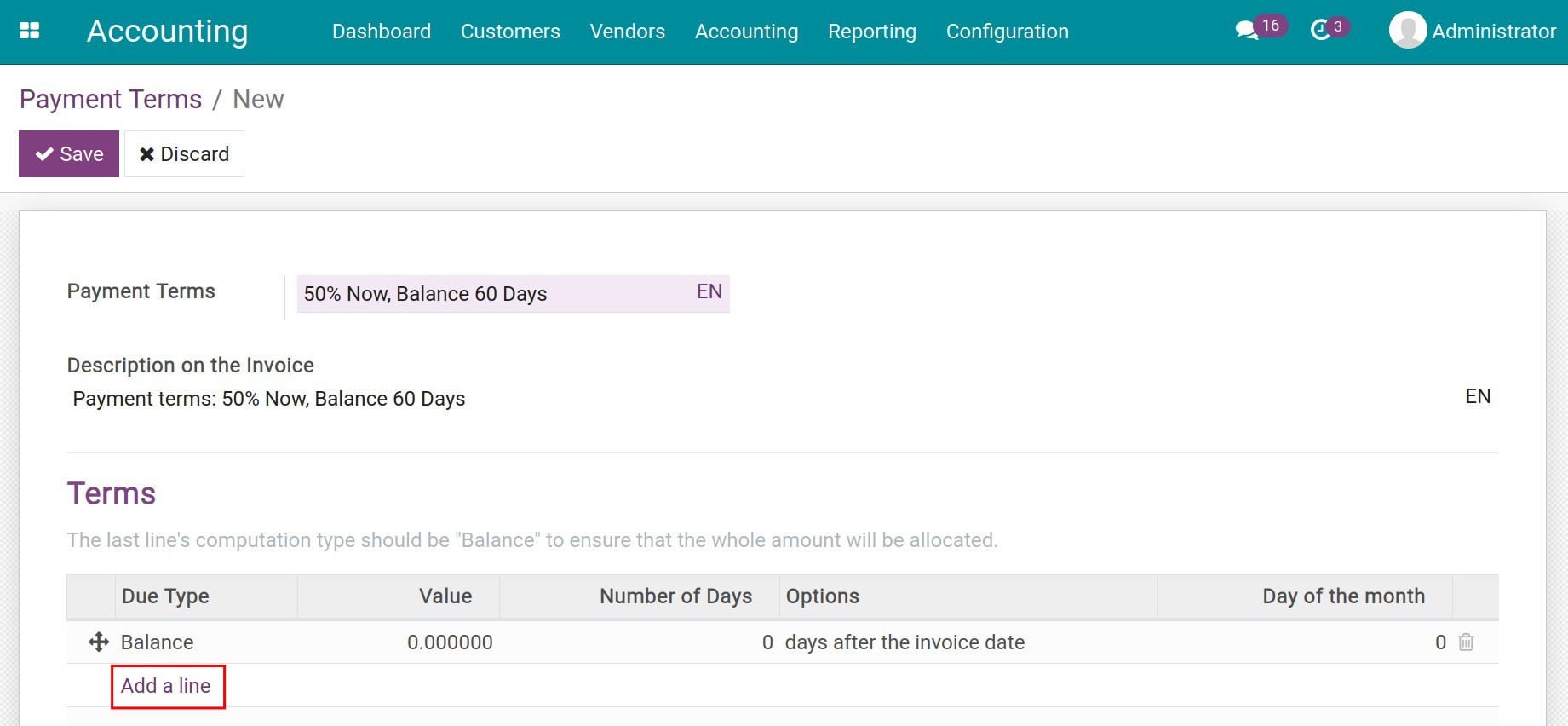

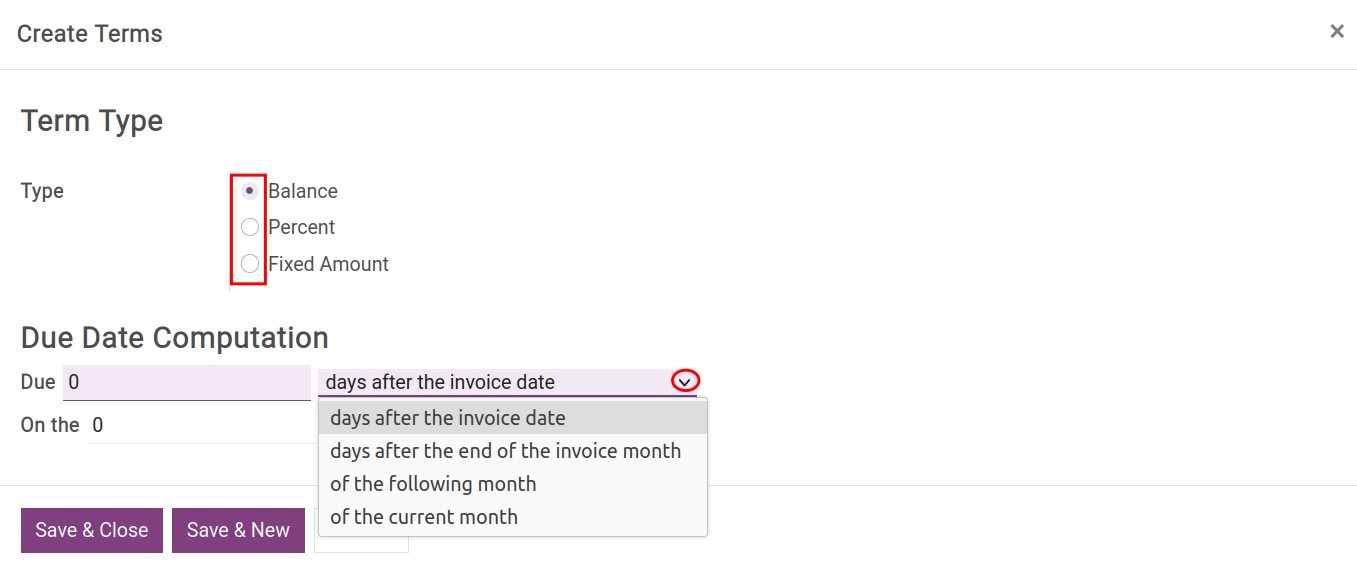

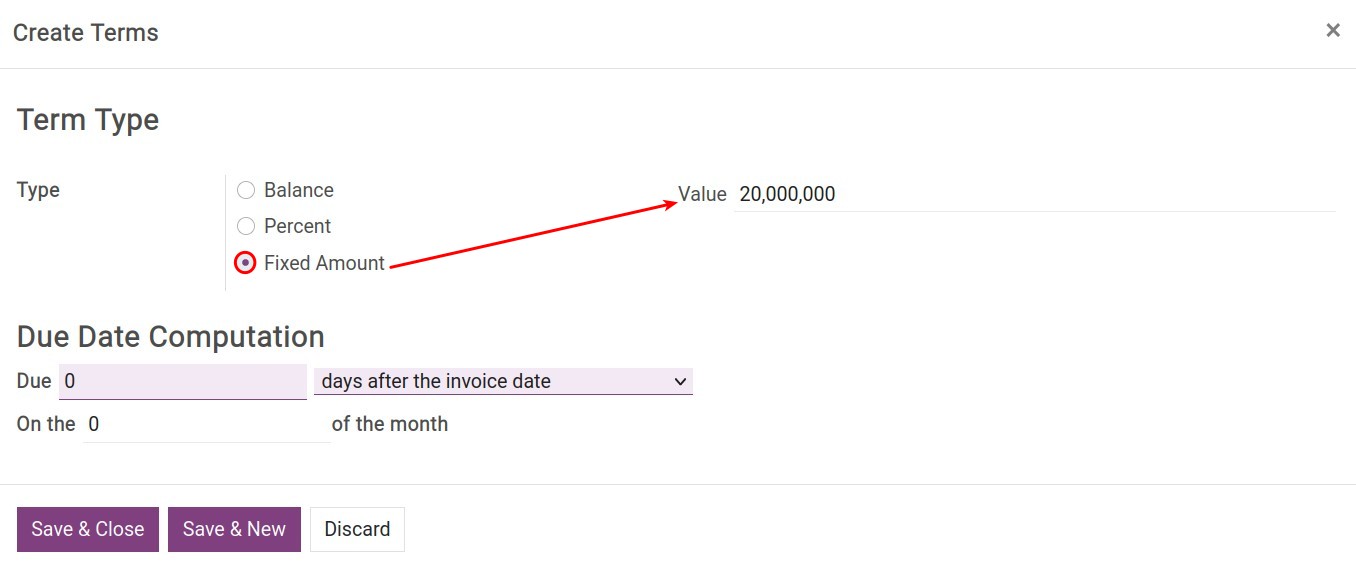

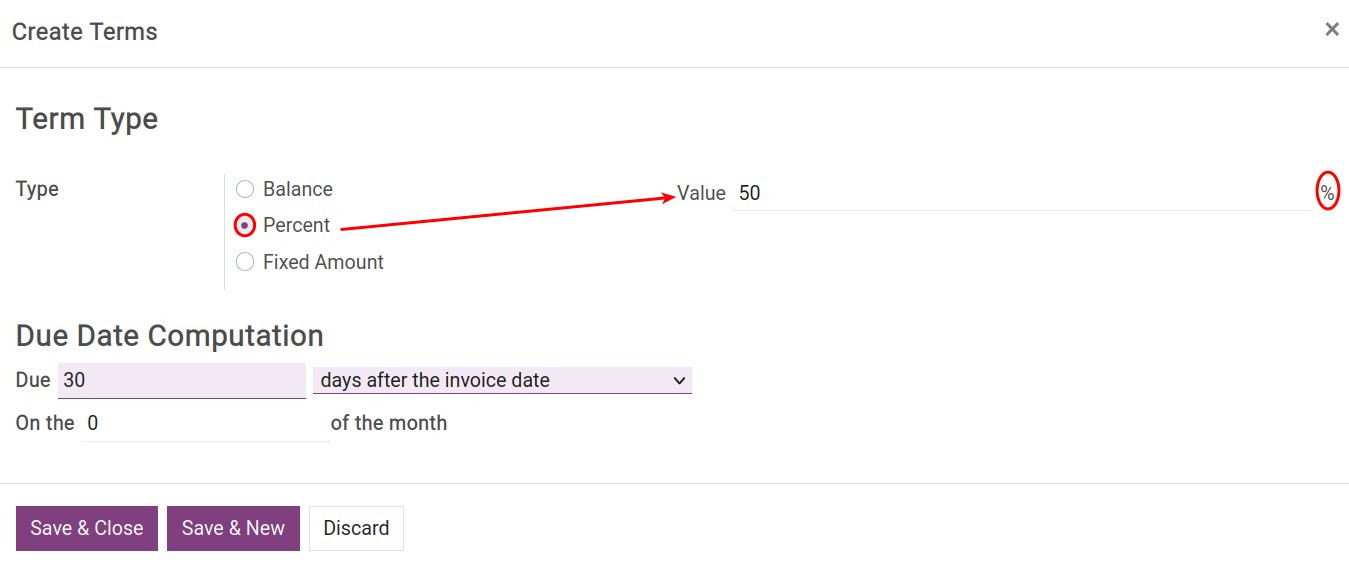

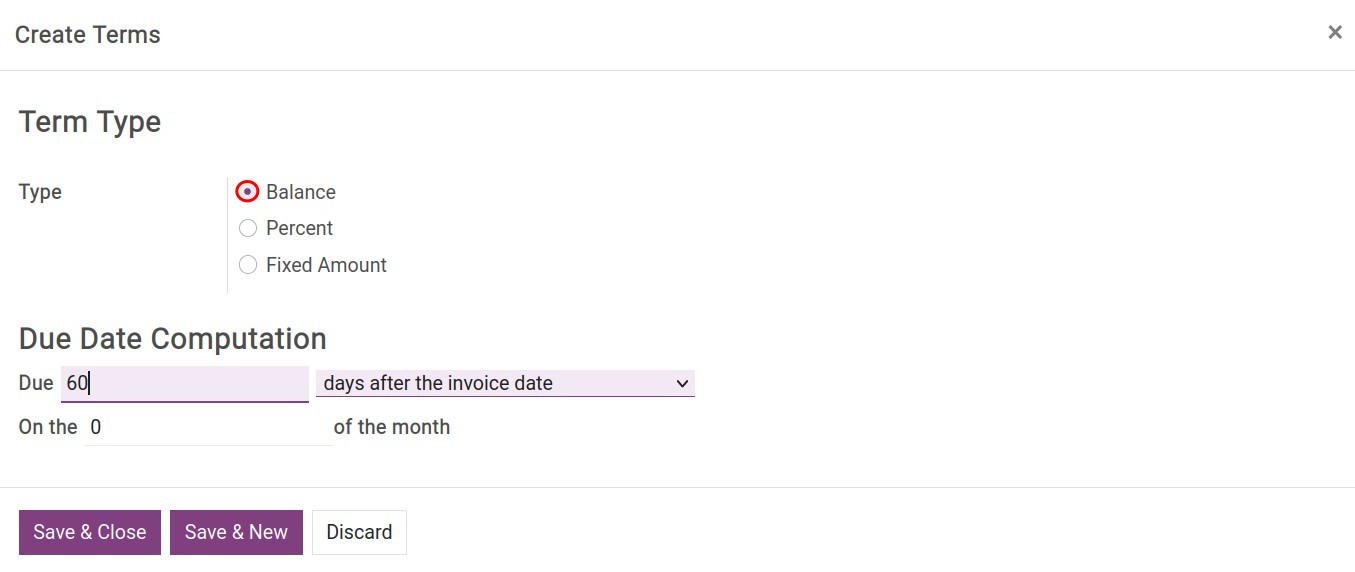

Configure Payment Terms

-

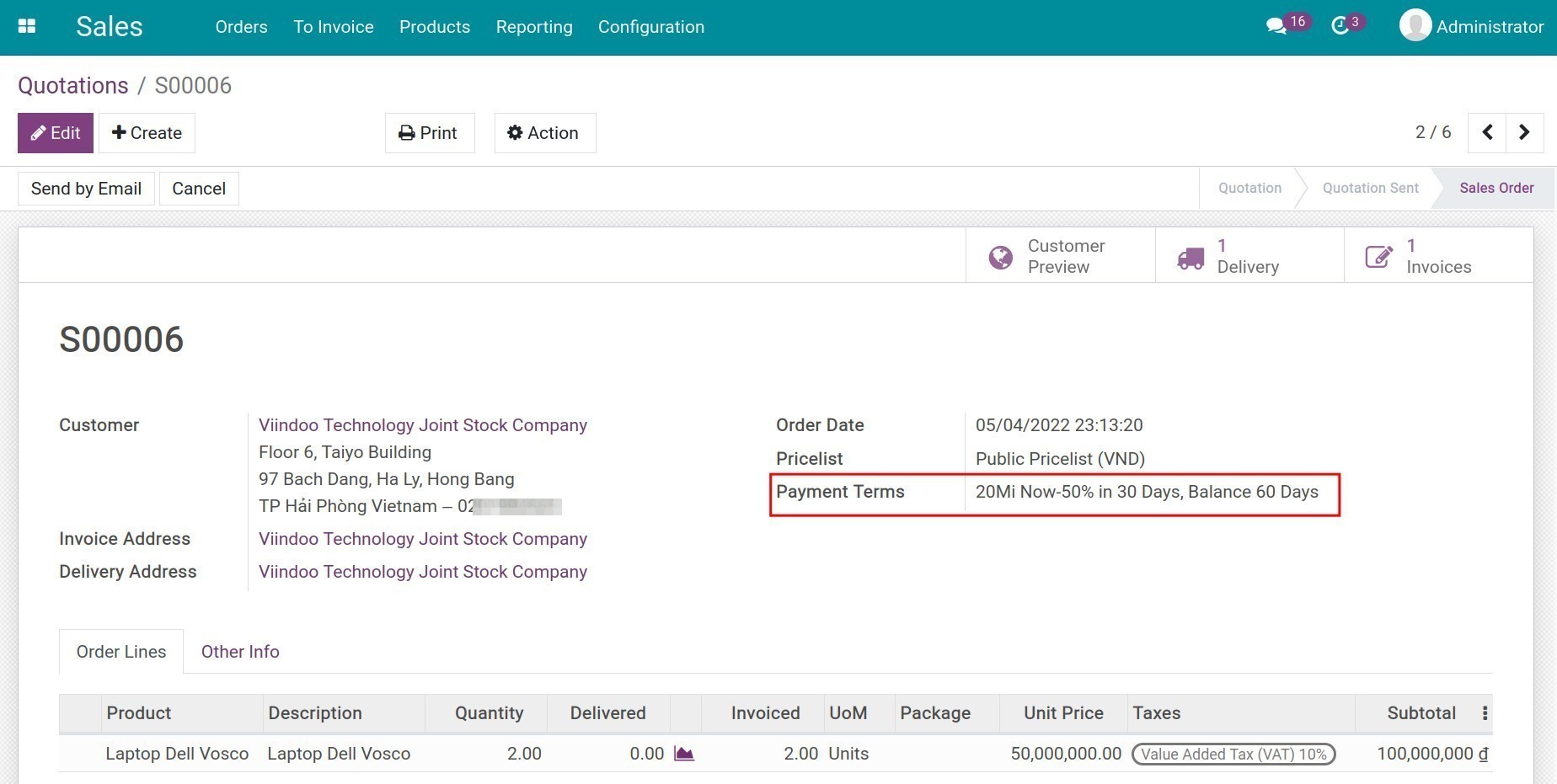

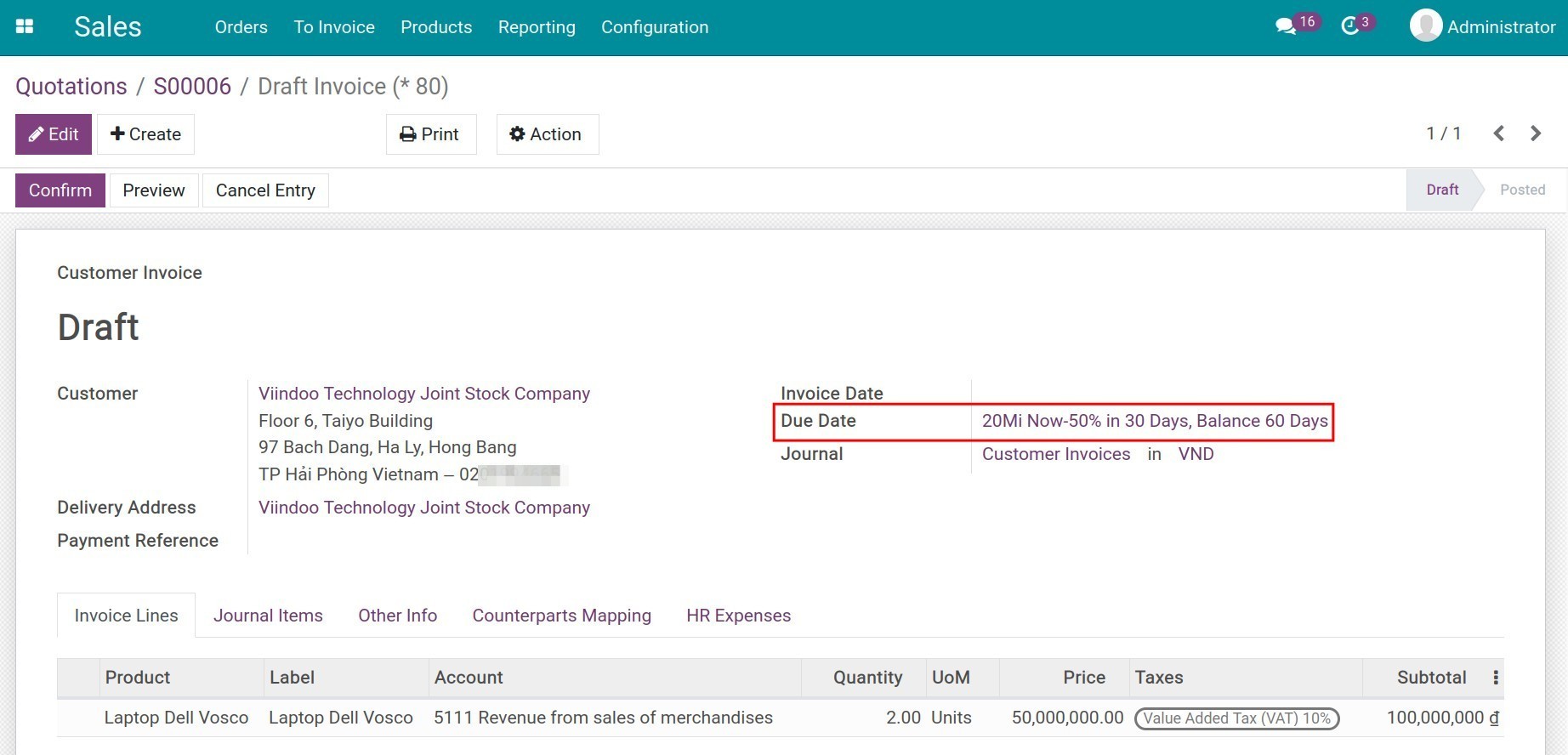

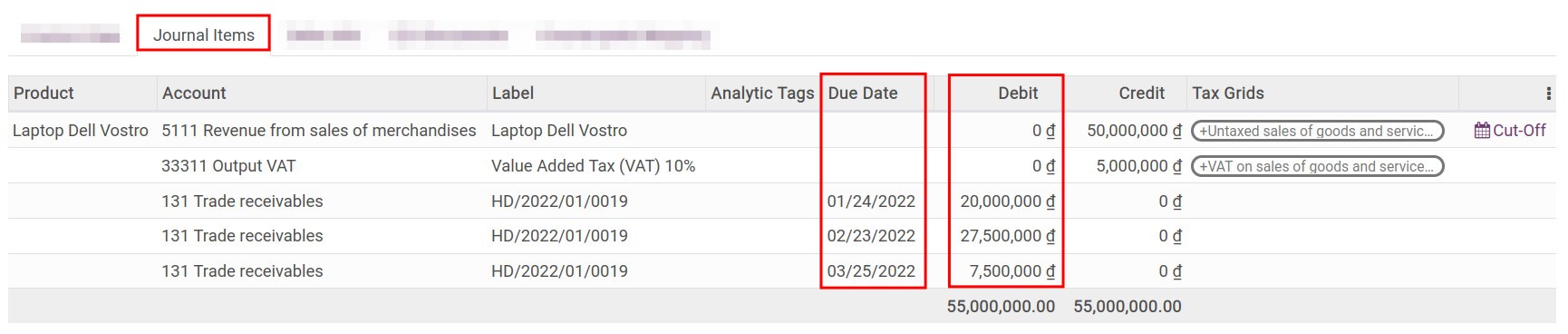

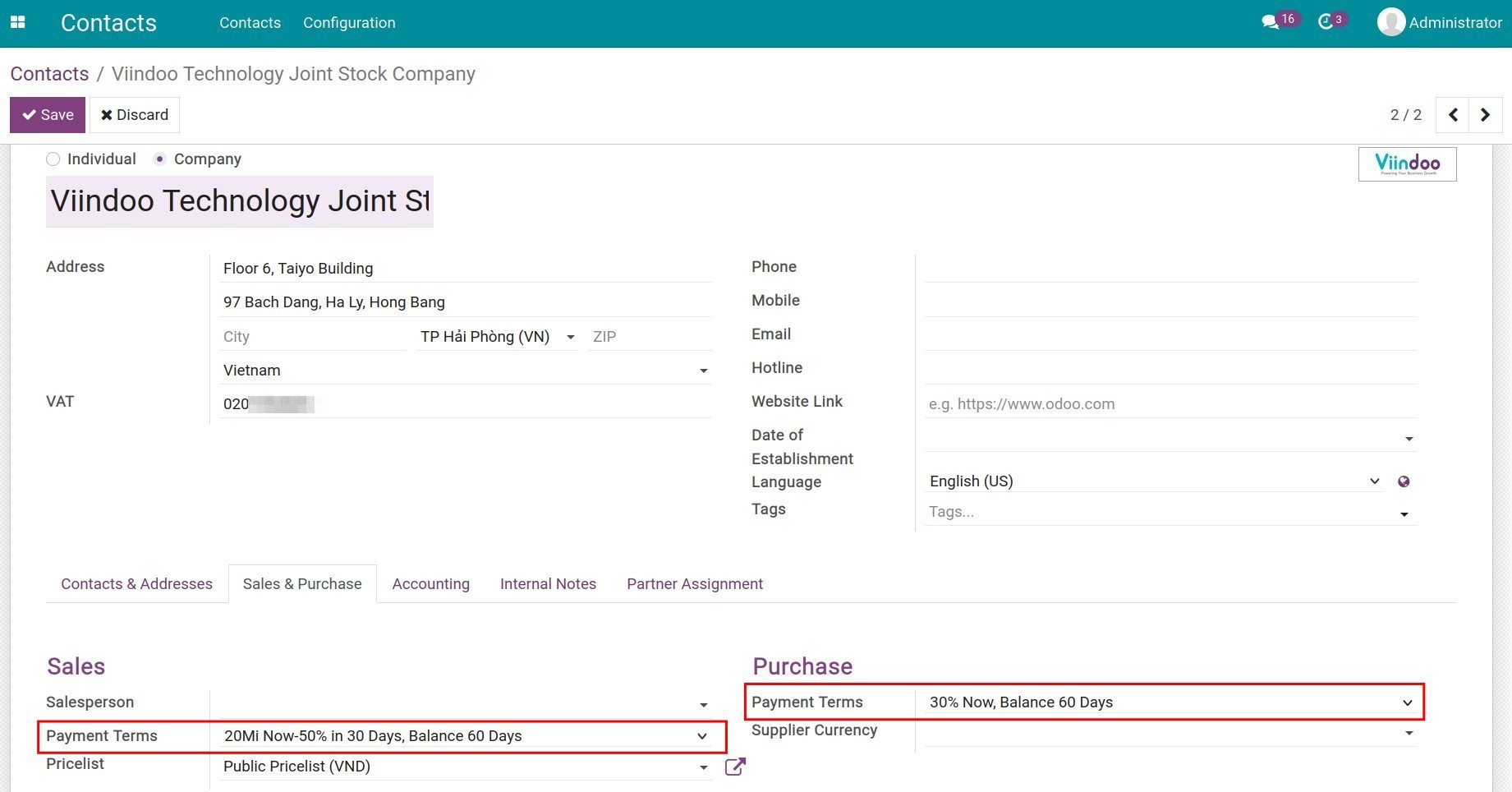

Configure Payment Terms

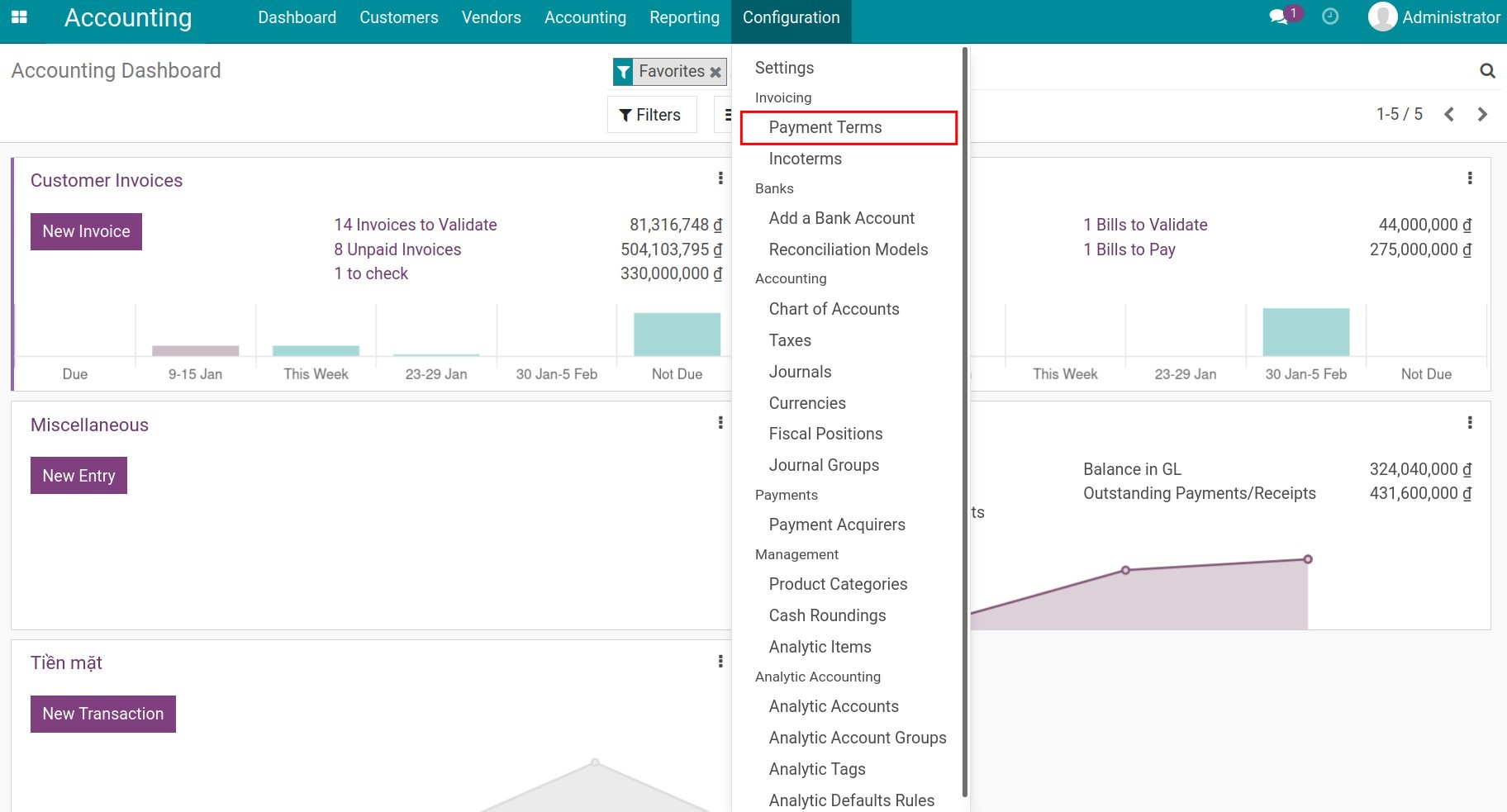

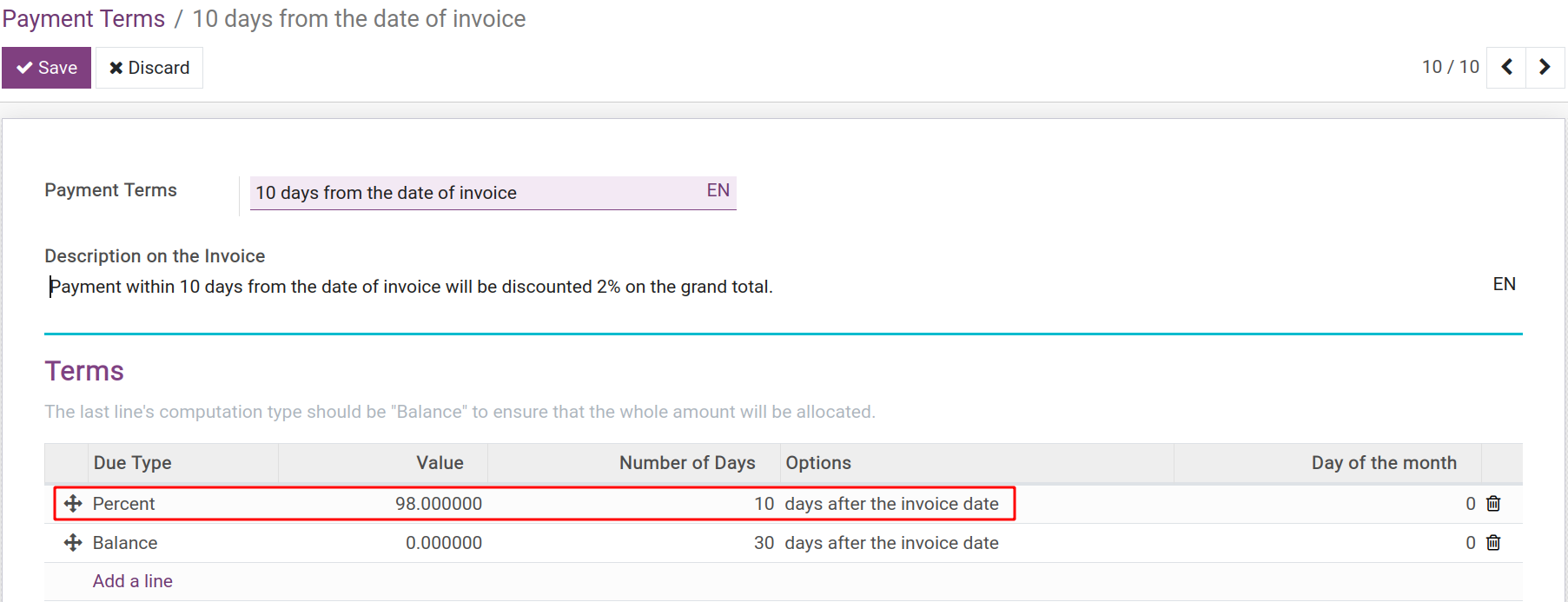

- Configure Payment Terms

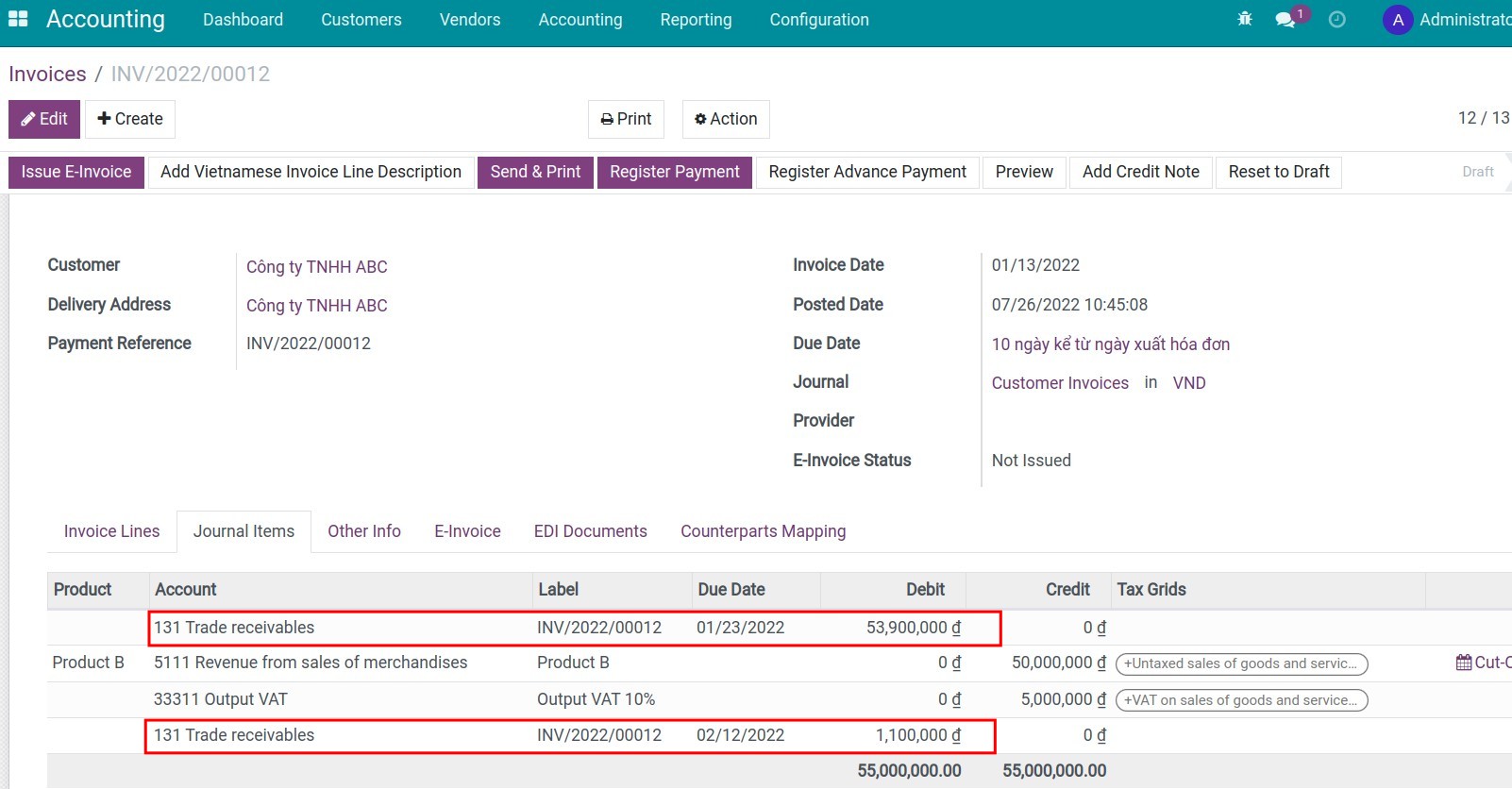

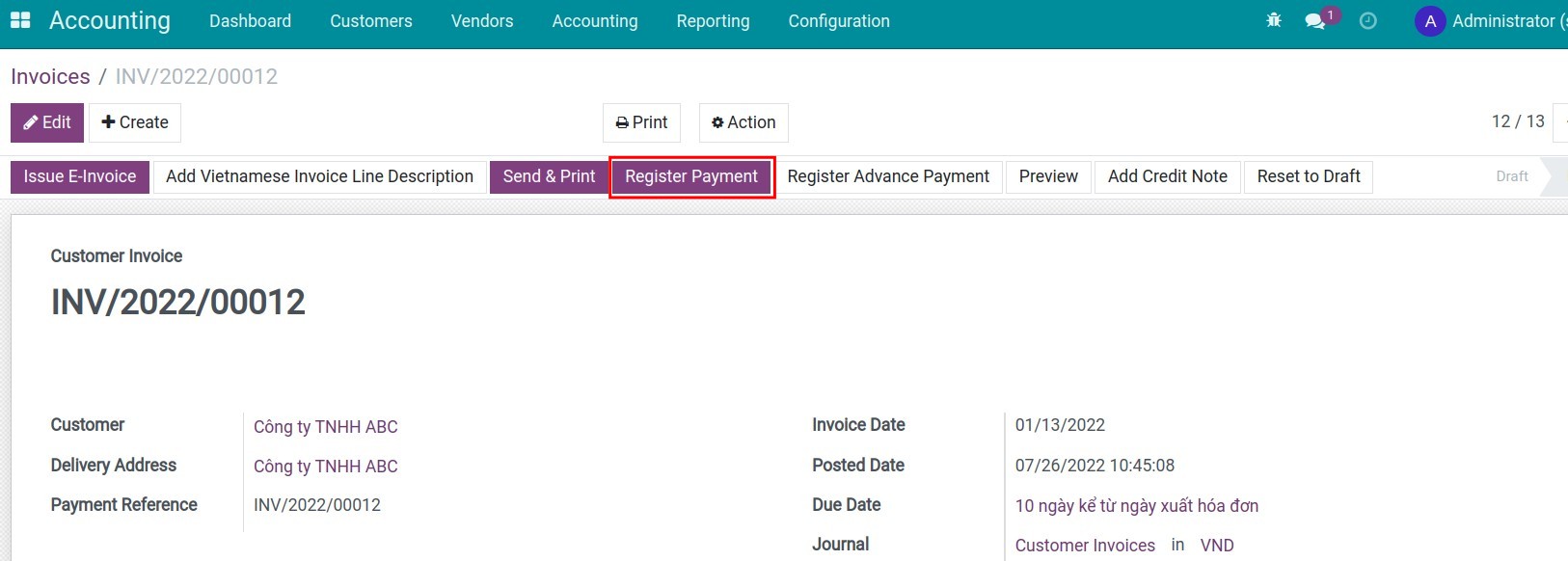

- Payment terms usage

-

Process a cash discount

-

Process a cash discount

- Set up cash discounts

- When a transaction occurs

-

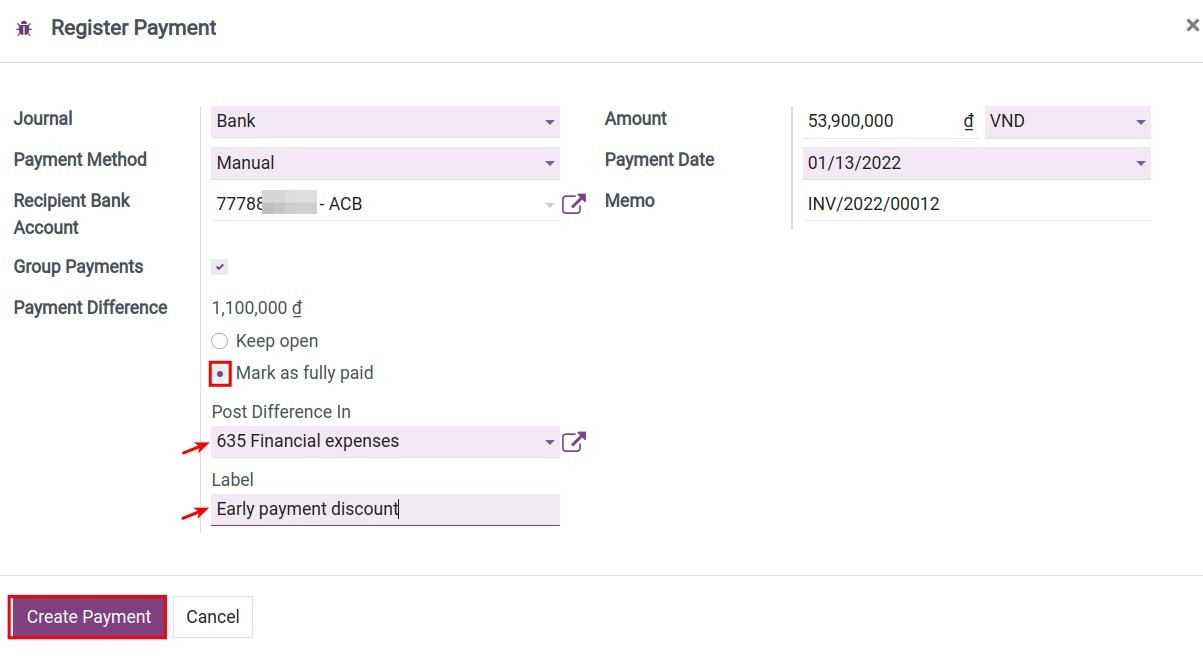

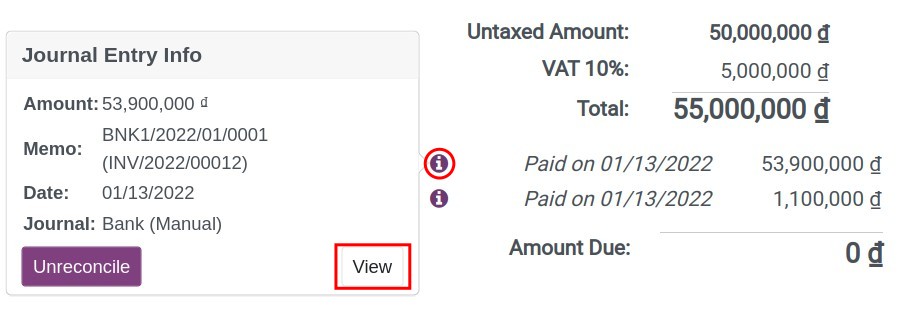

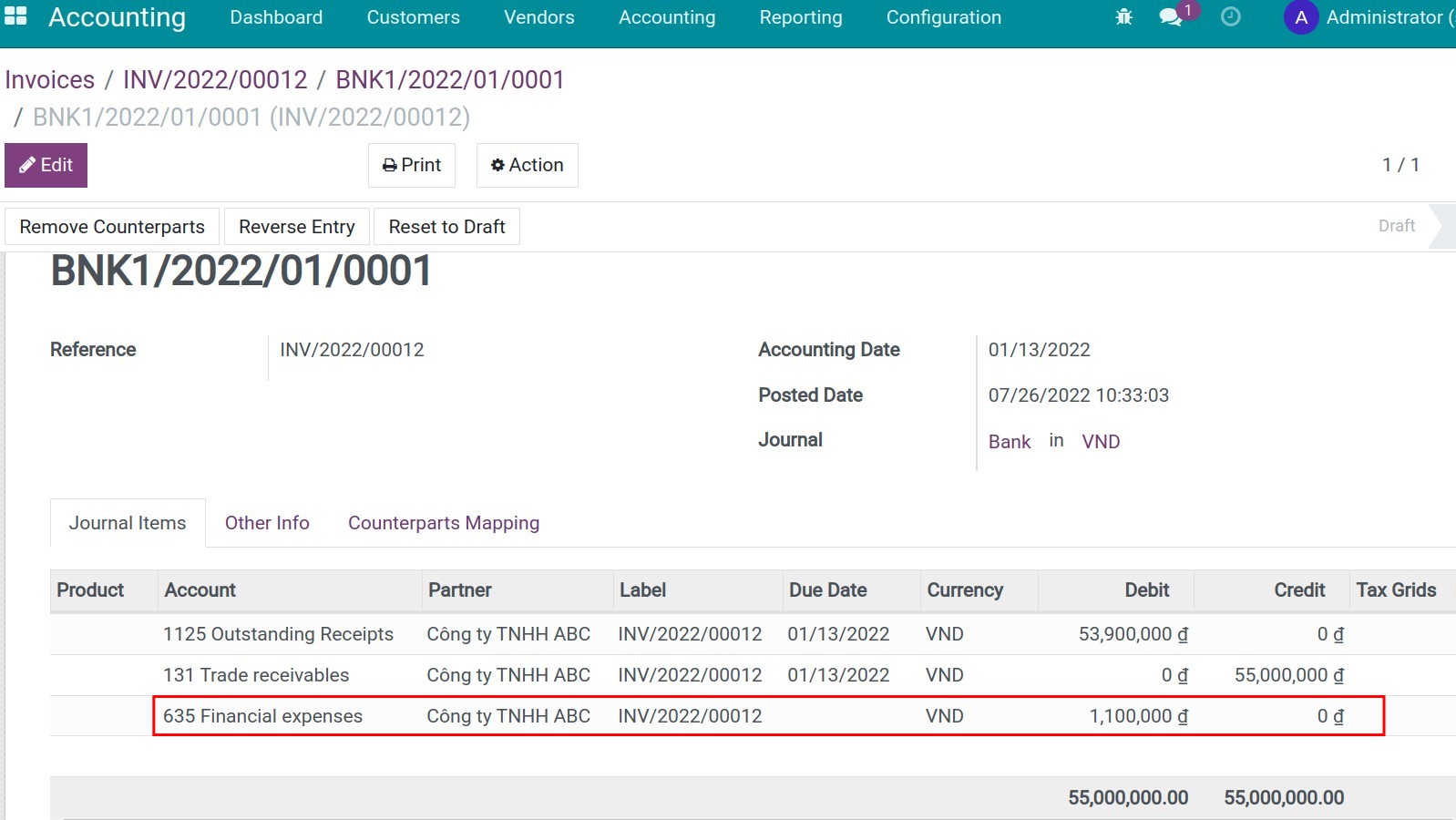

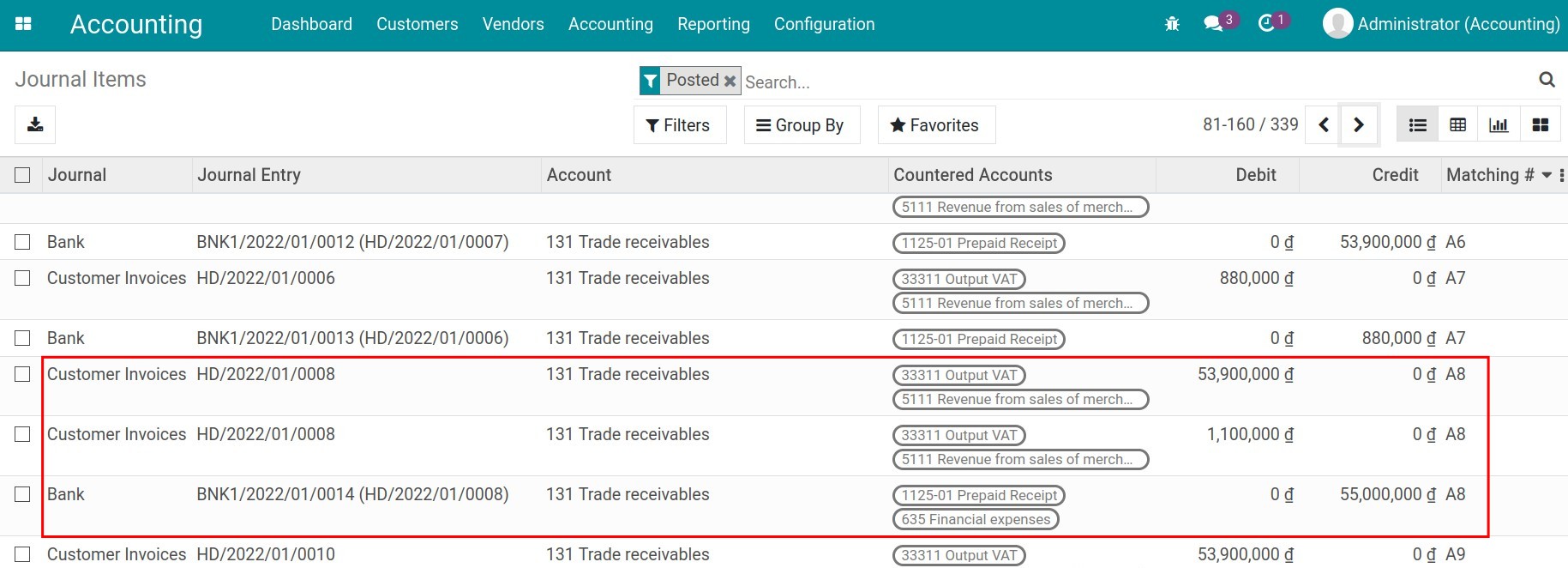

Register payment and cash discount

- Customer pays before the due date and receives a discount

- Customer pays after the due date and doesn’t receive discount

-

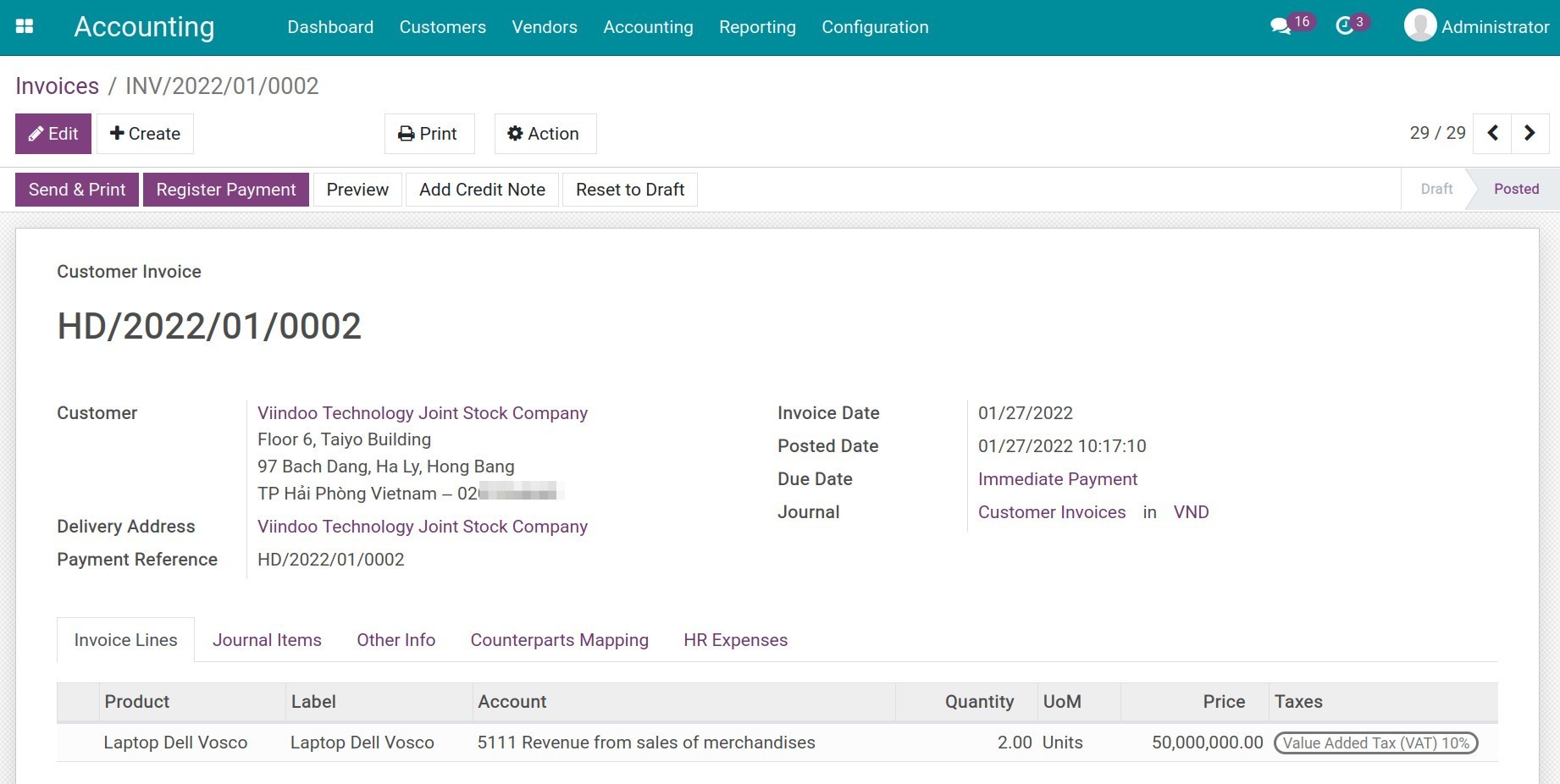

Steps to create customer invoices

-

Steps to create customer invoices

- Configure invoicing policy

- Create an invoice from an order

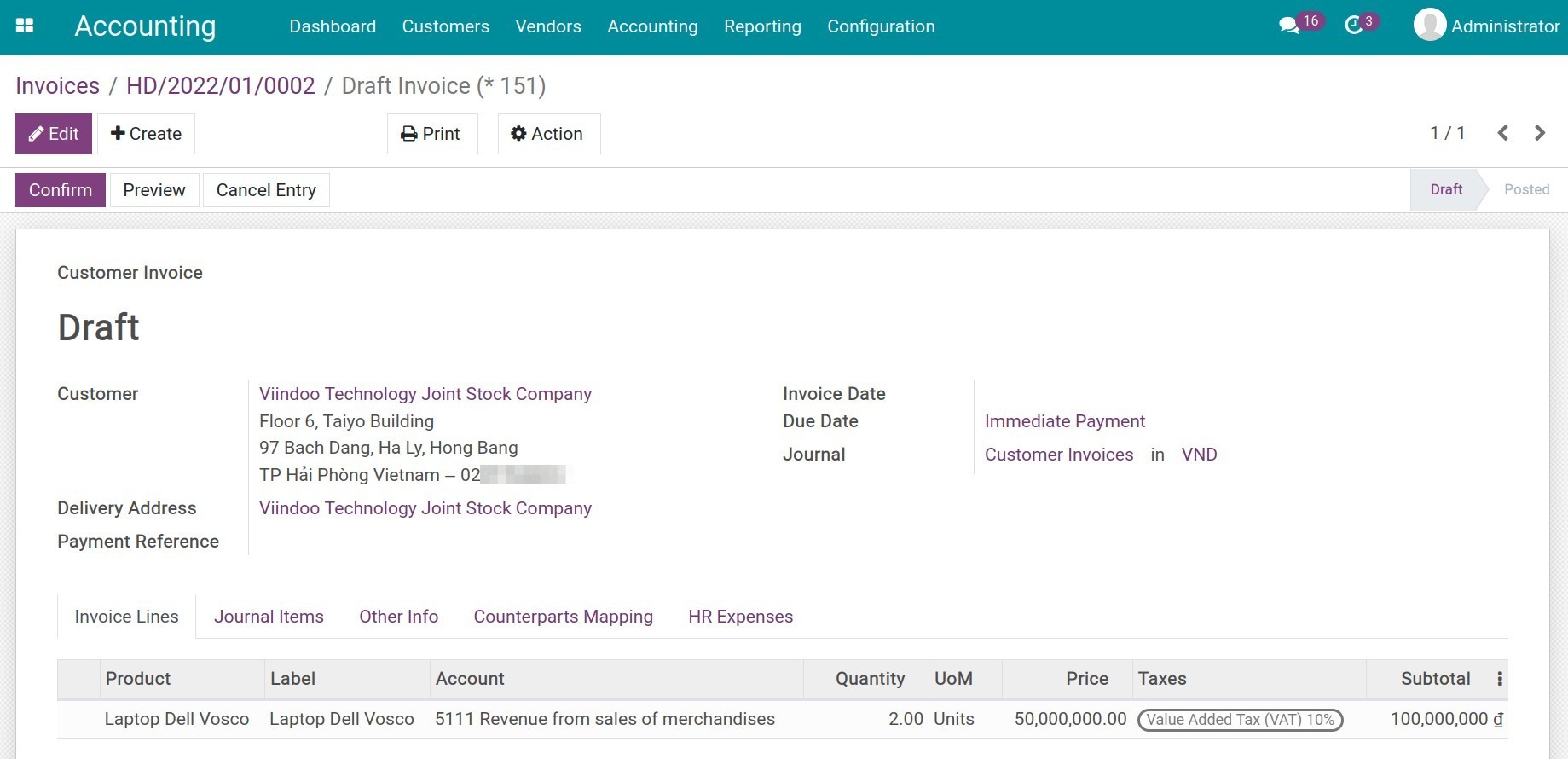

- Create an invoice directly

-

How to use Credit Notes in Viindoo Accounting

-

How to use Credit Notes in iSuite Accounting

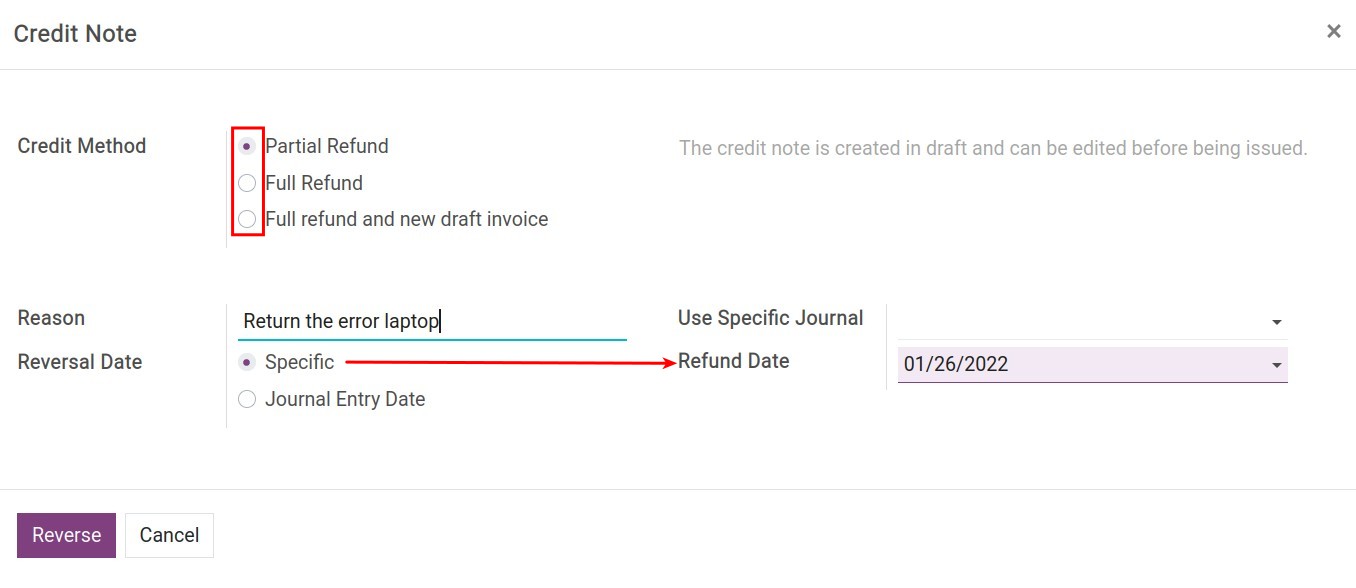

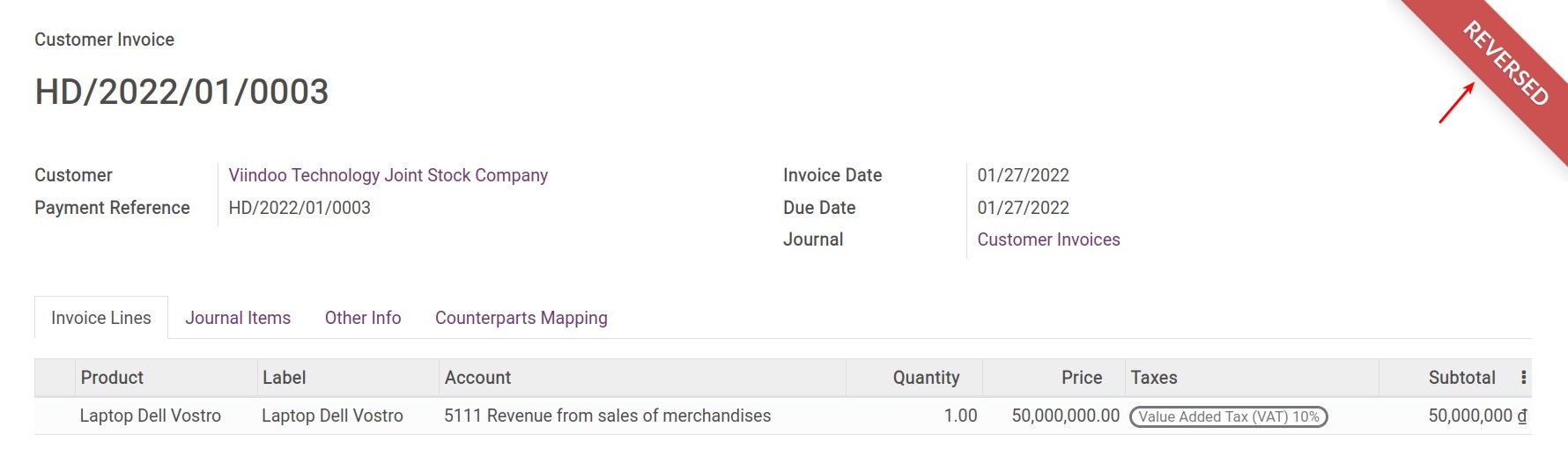

- Create a credit note directly on the invoice

- Create a credit note manually

-

How to record customer payments

-

How to record customer payments

- Create payment from an invoice

- Create stand-alone payment

-

Taxes and tax rules configuration

-

Taxes and tax rules configuration

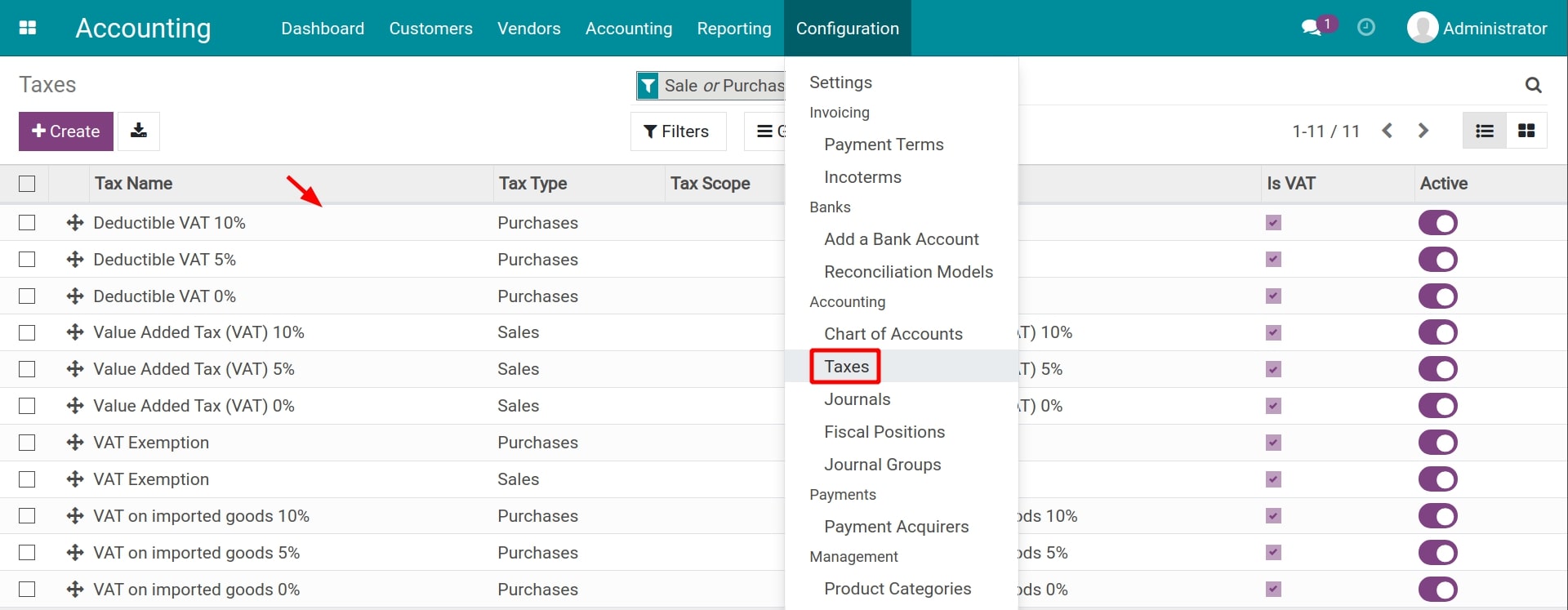

- Tax activation

-

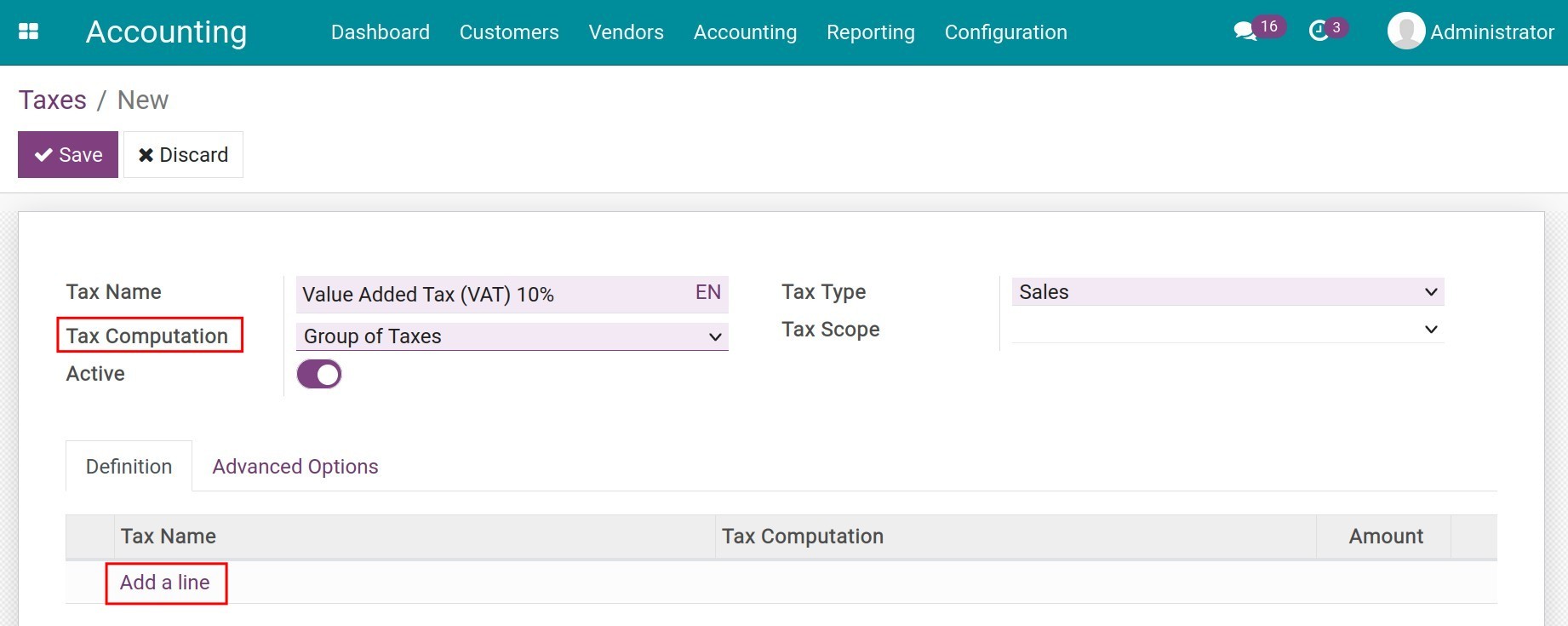

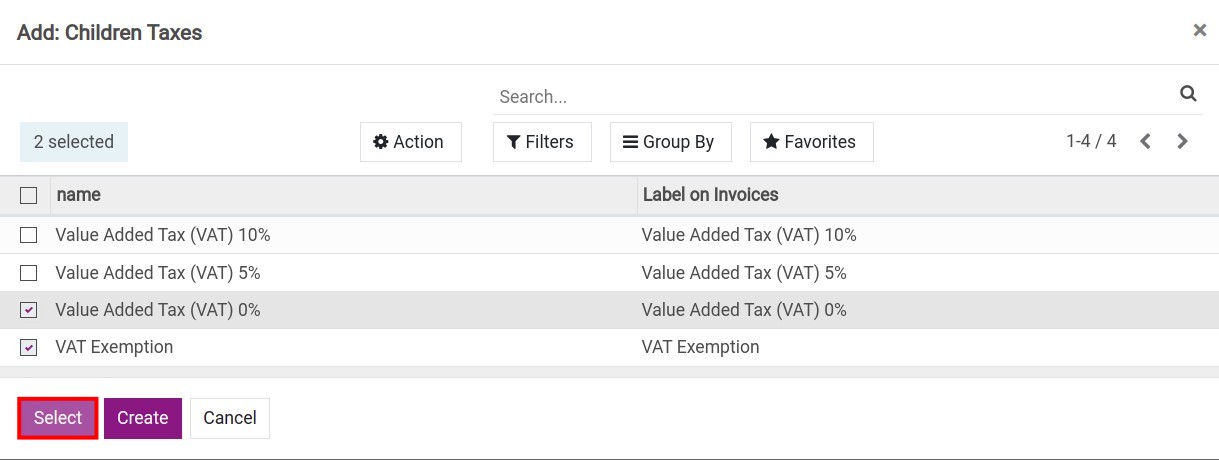

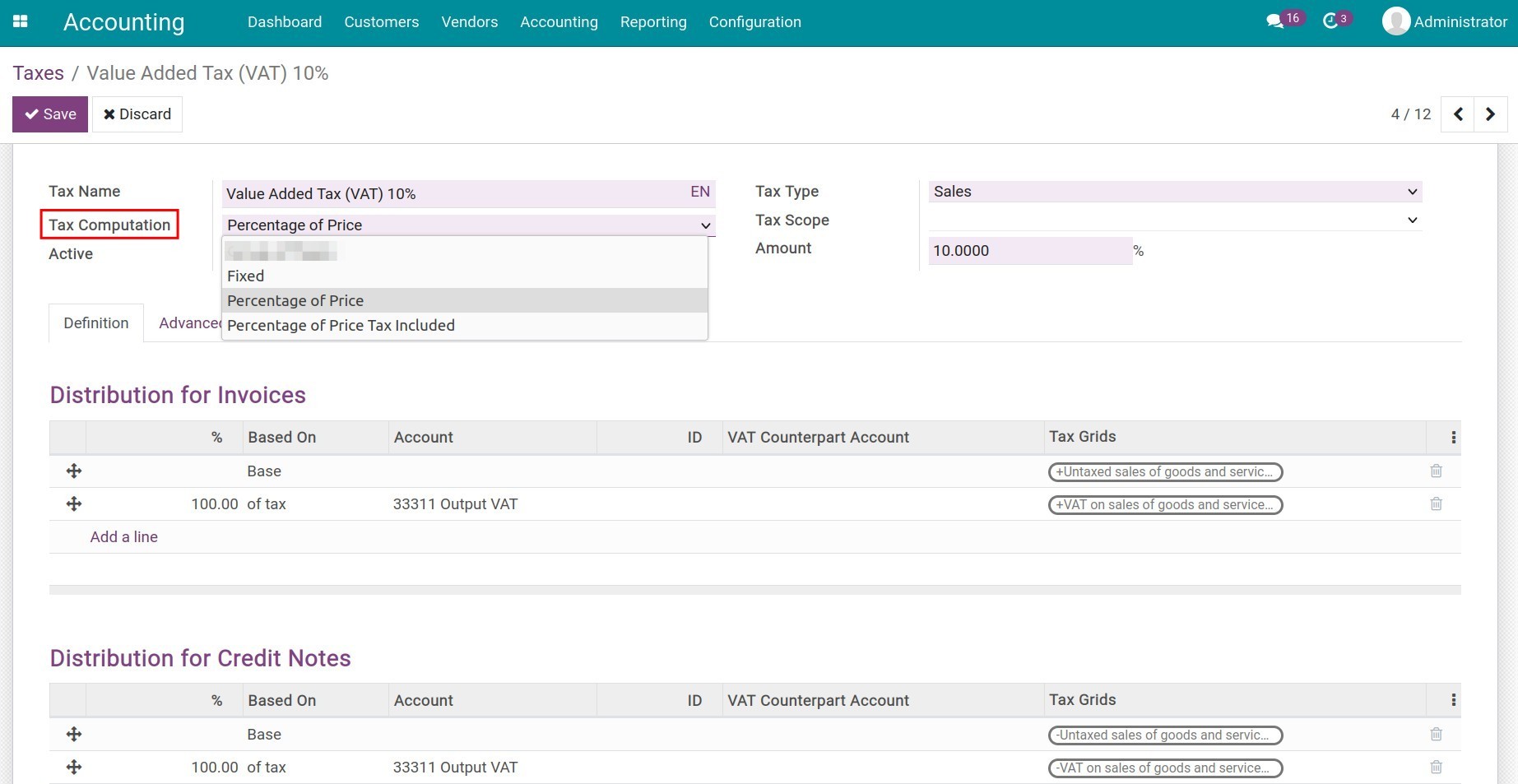

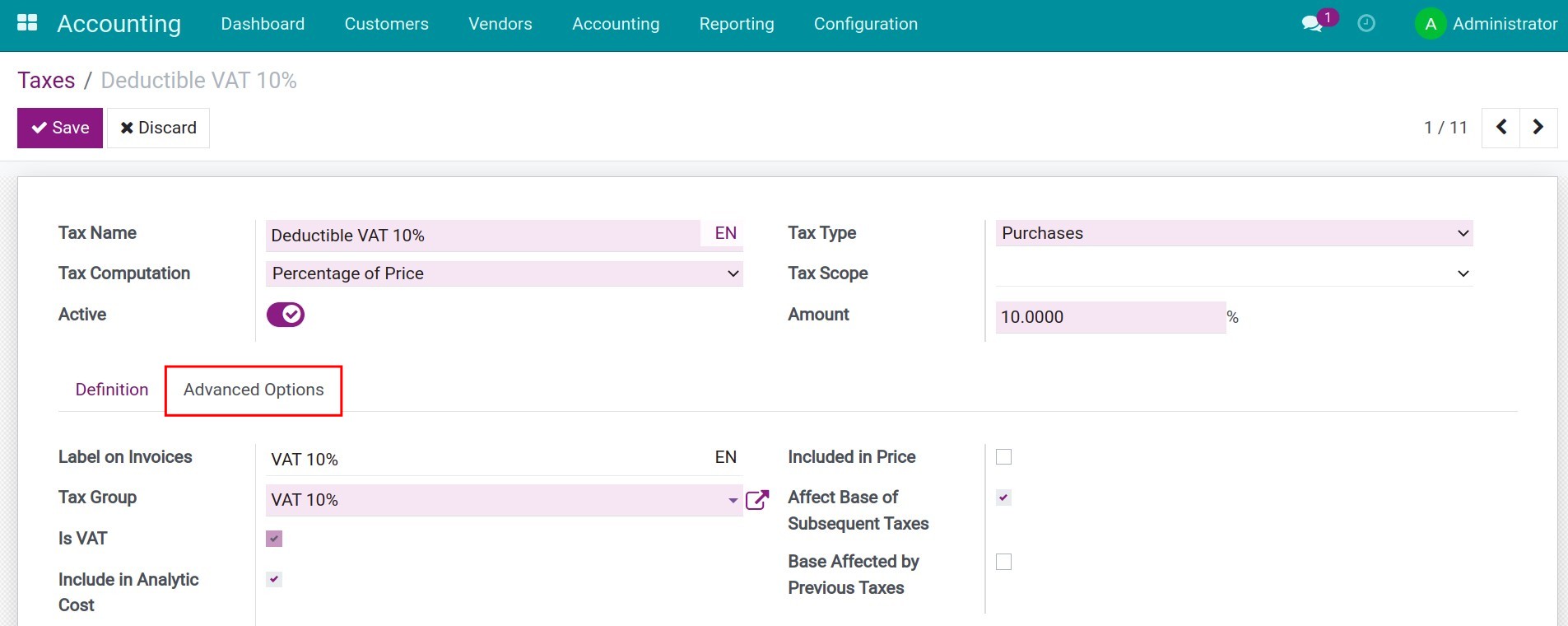

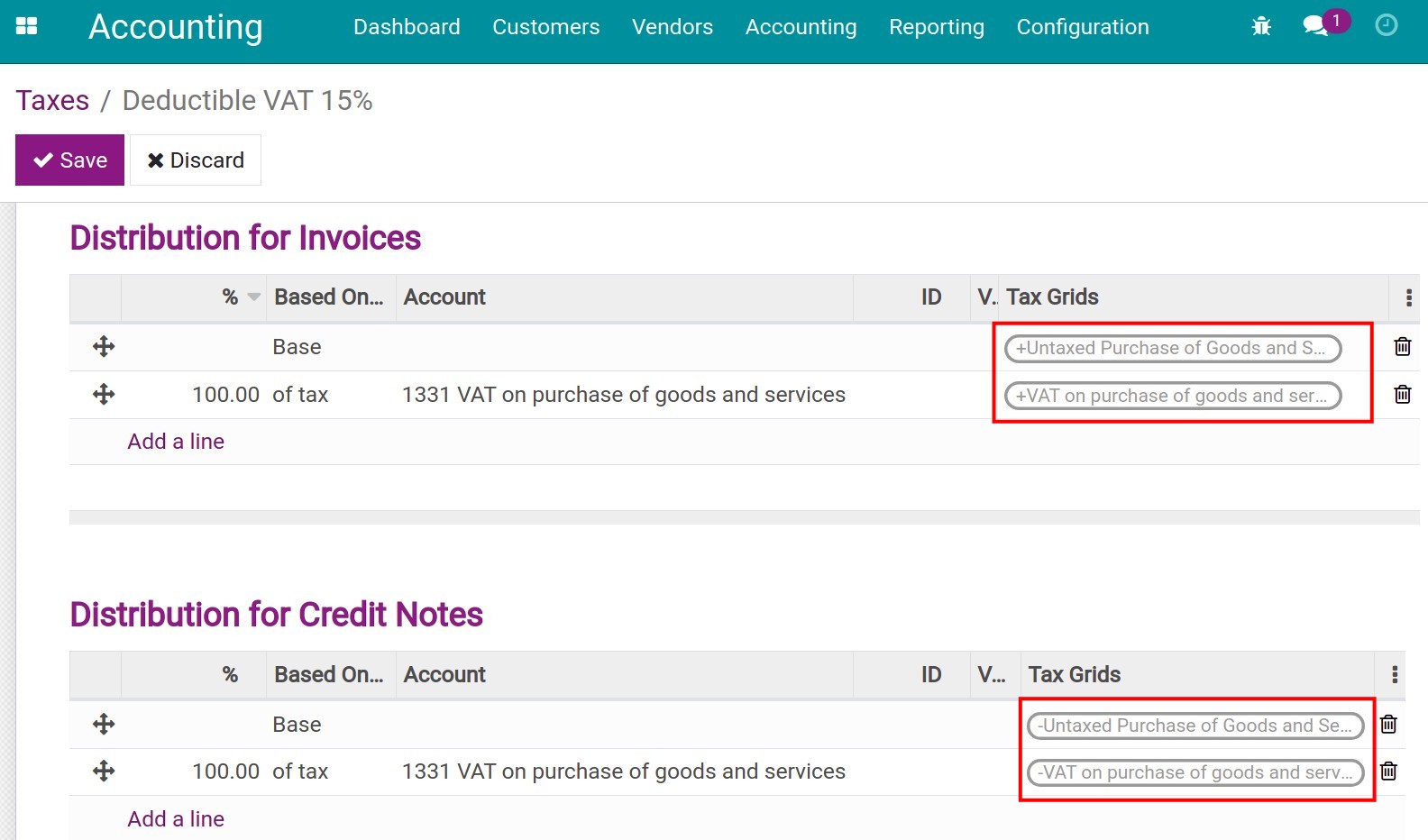

Tax configuration

- 1. Basic information

- 2. Definition tab

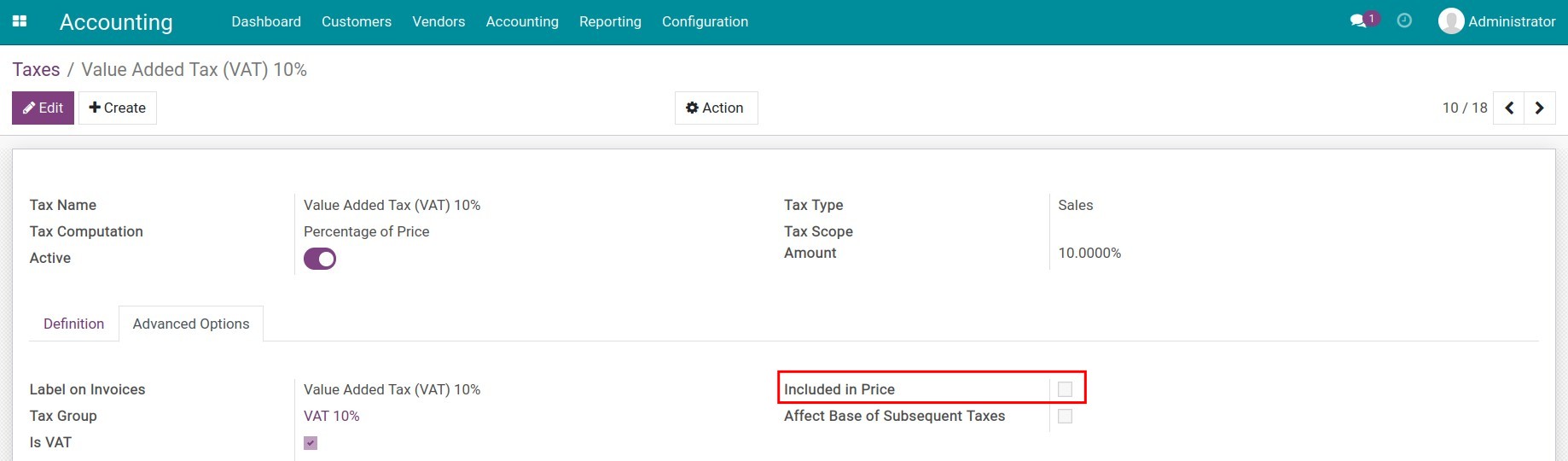

- 3. Advanced Options tab

-

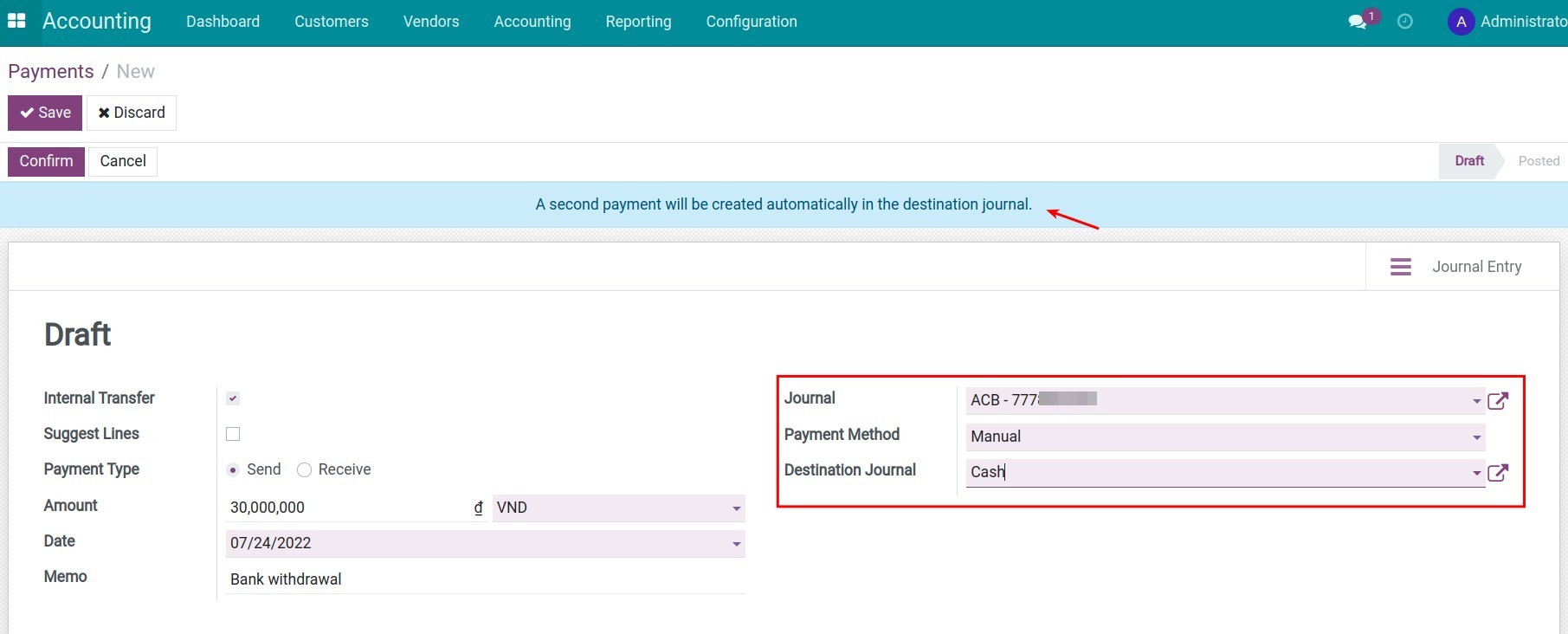

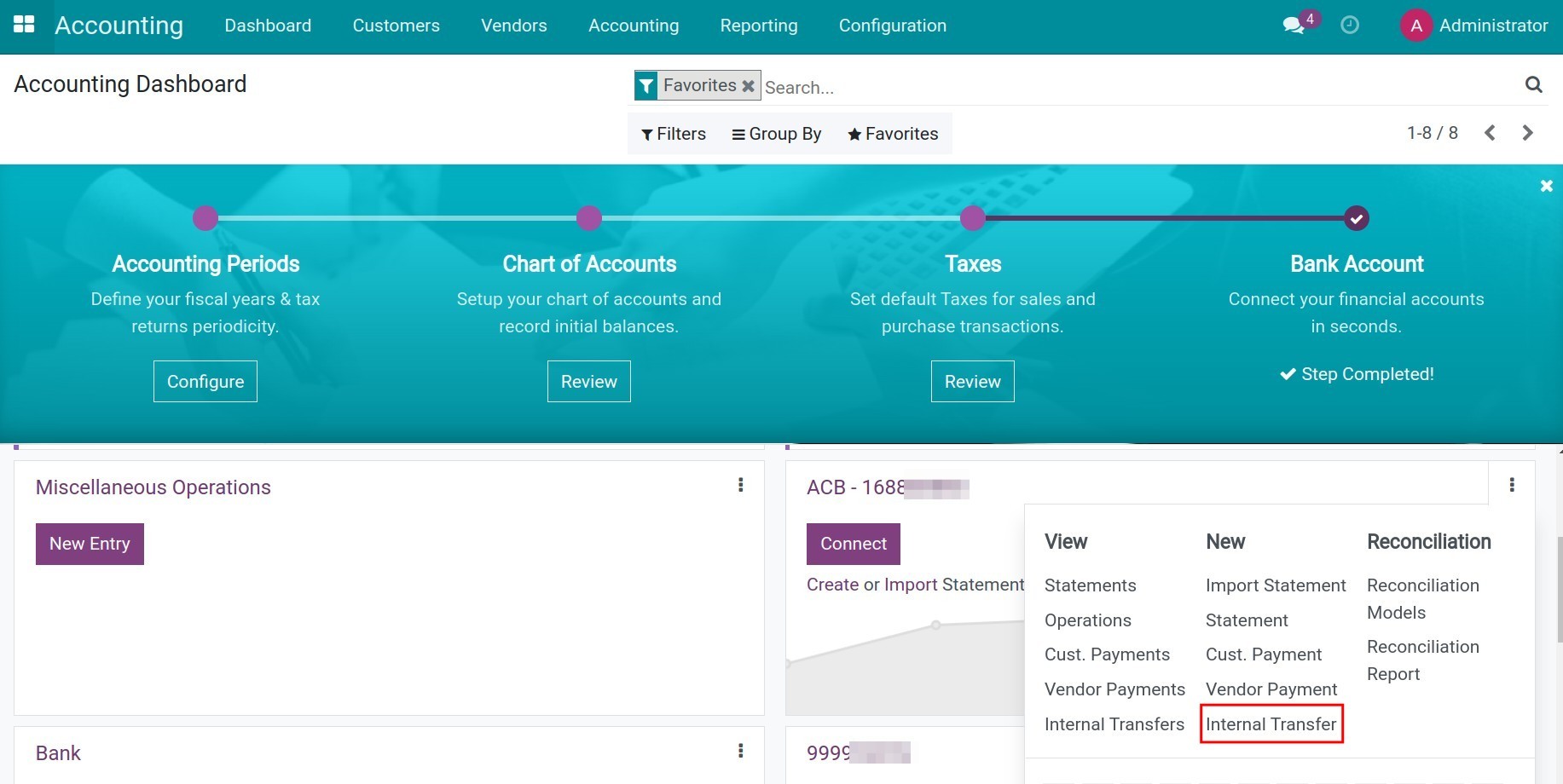

Transfer between internal bank accounts

-

Transfer between internal bank accounts

-

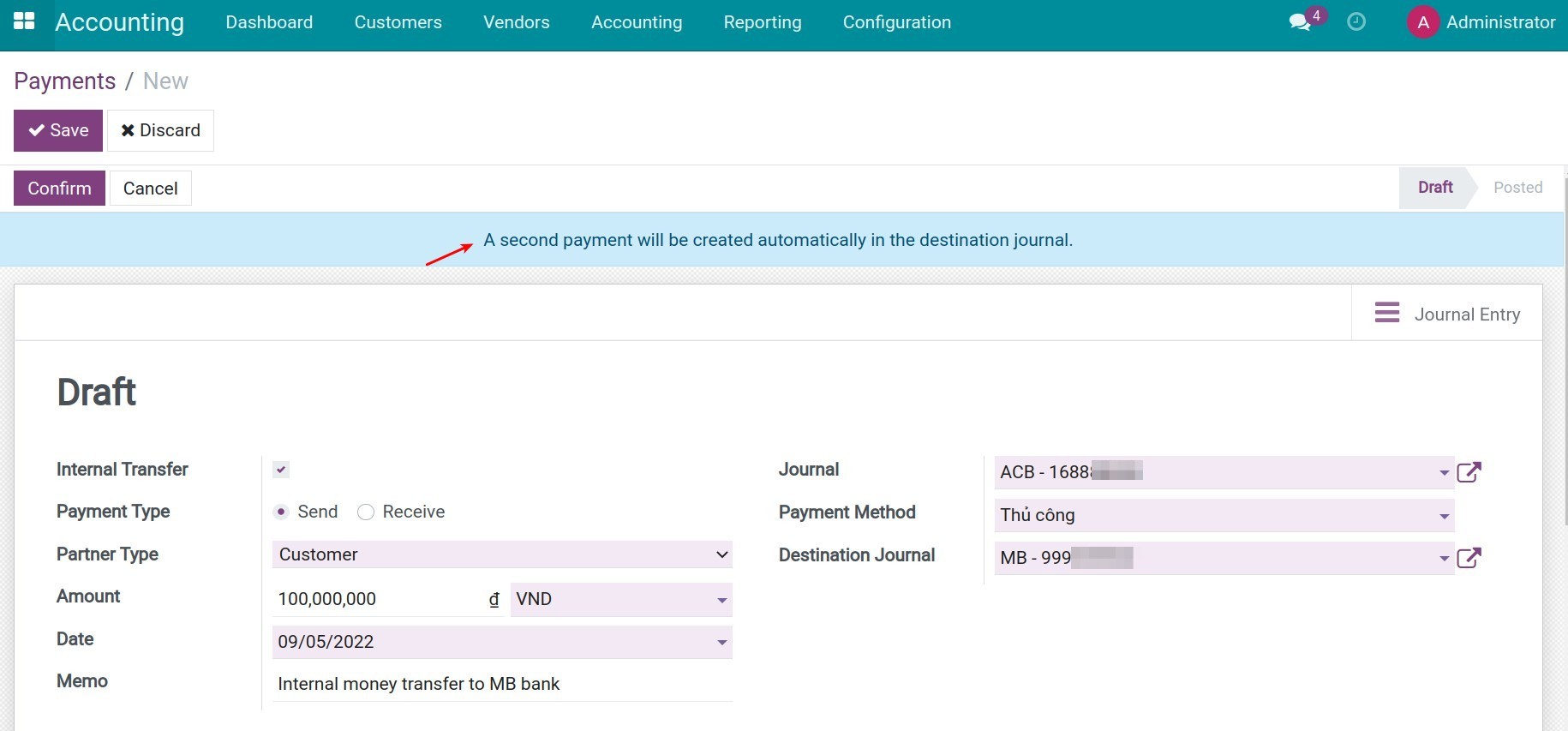

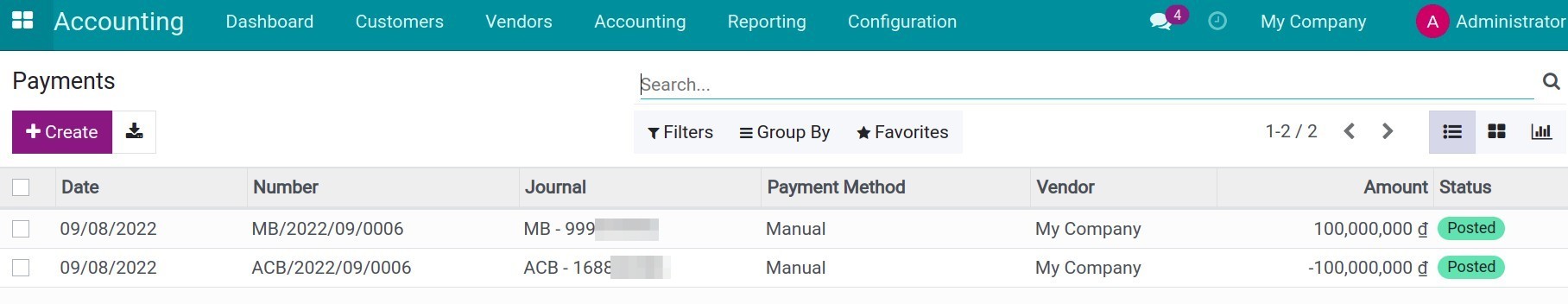

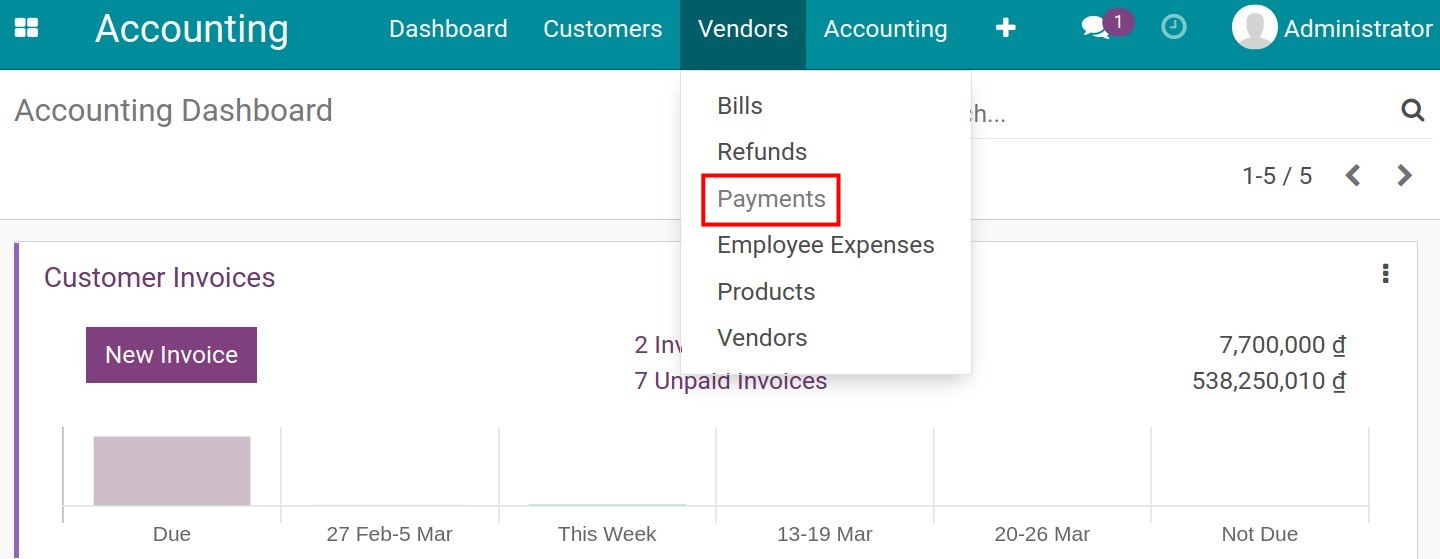

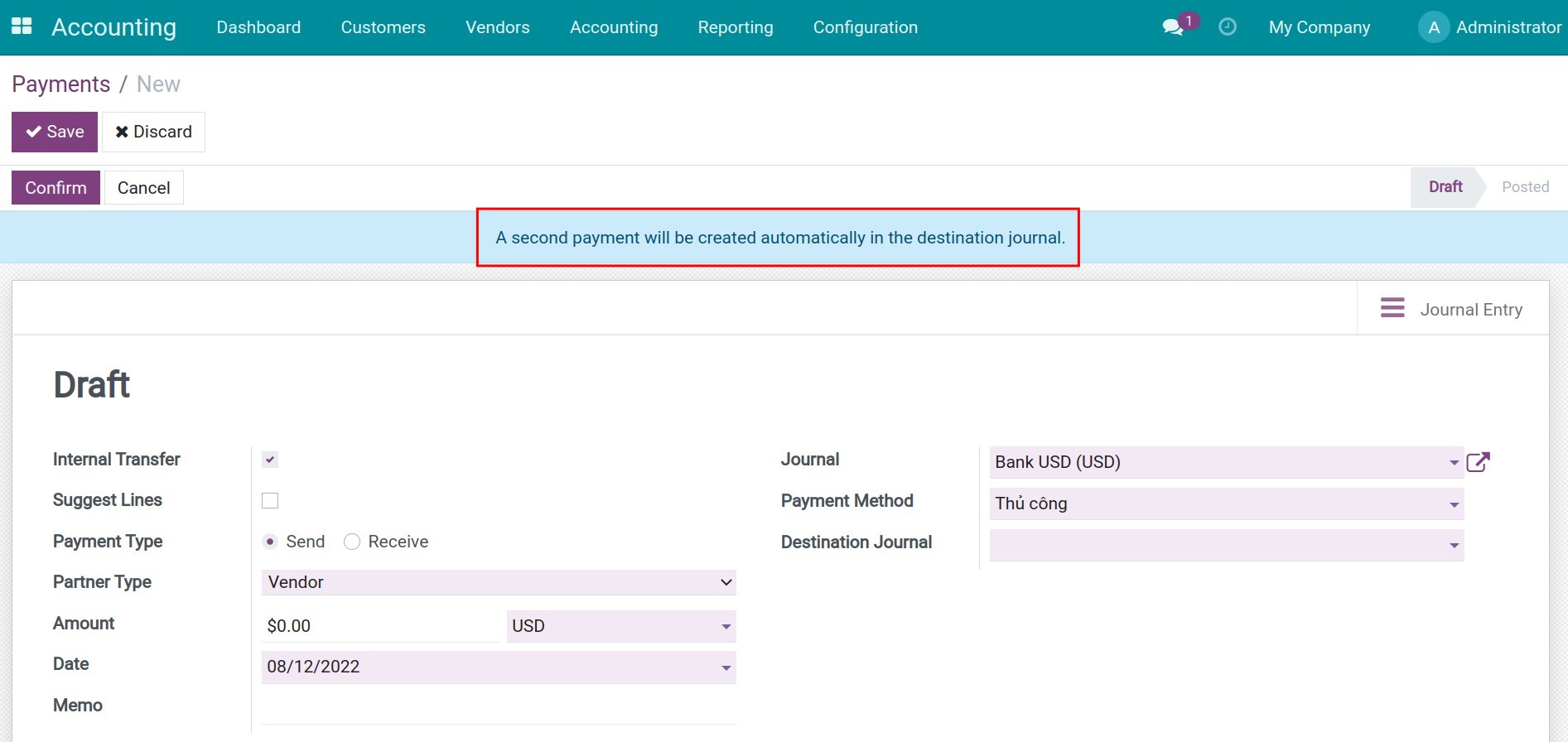

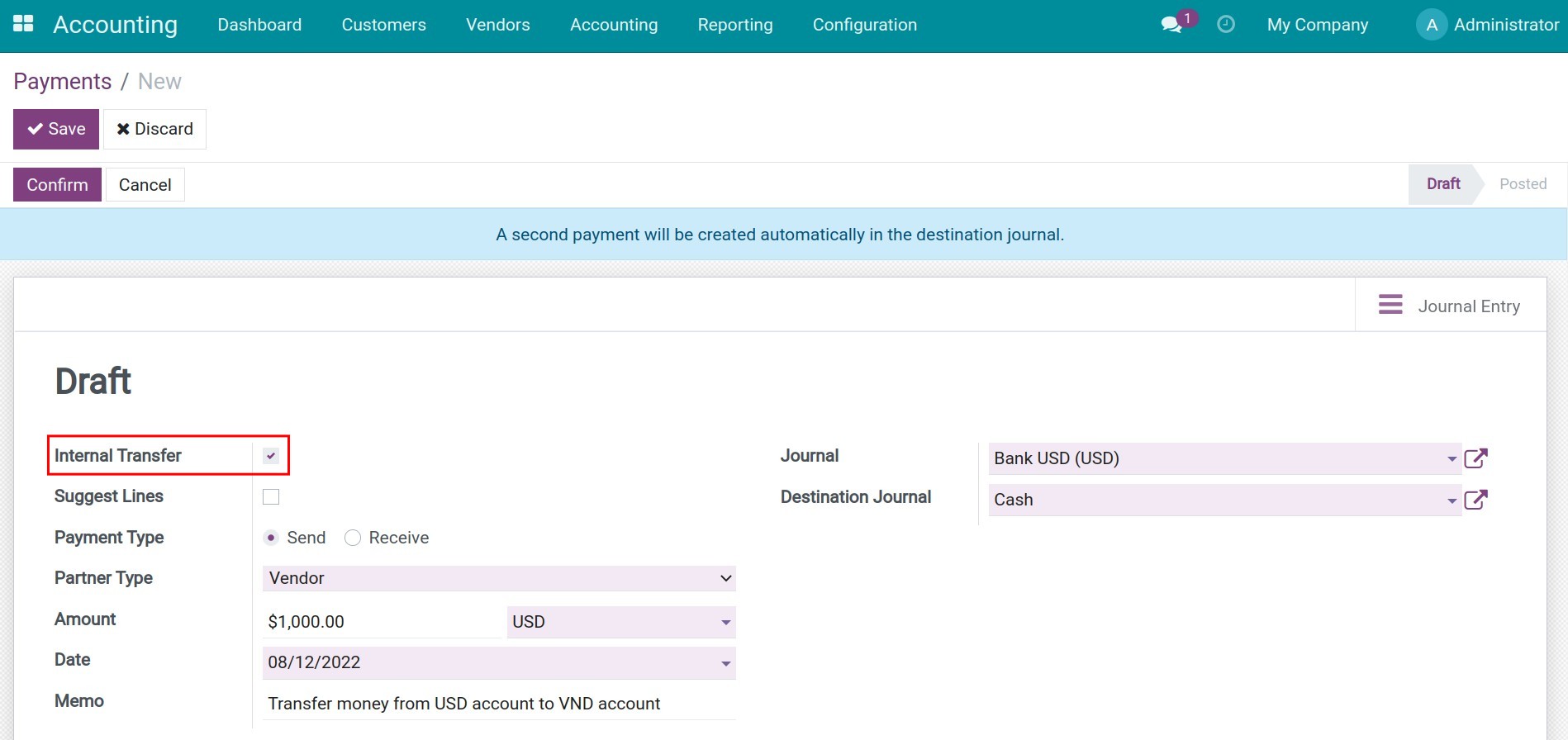

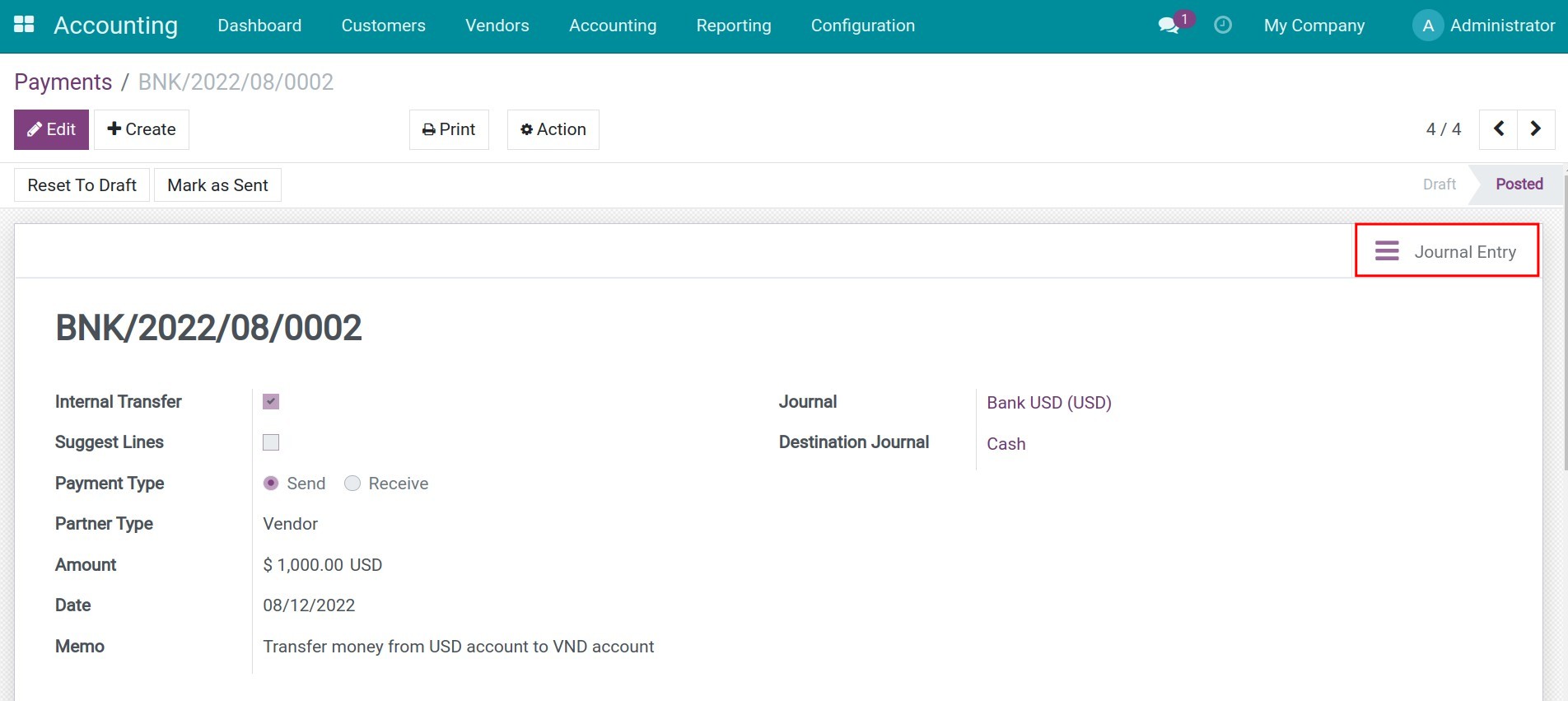

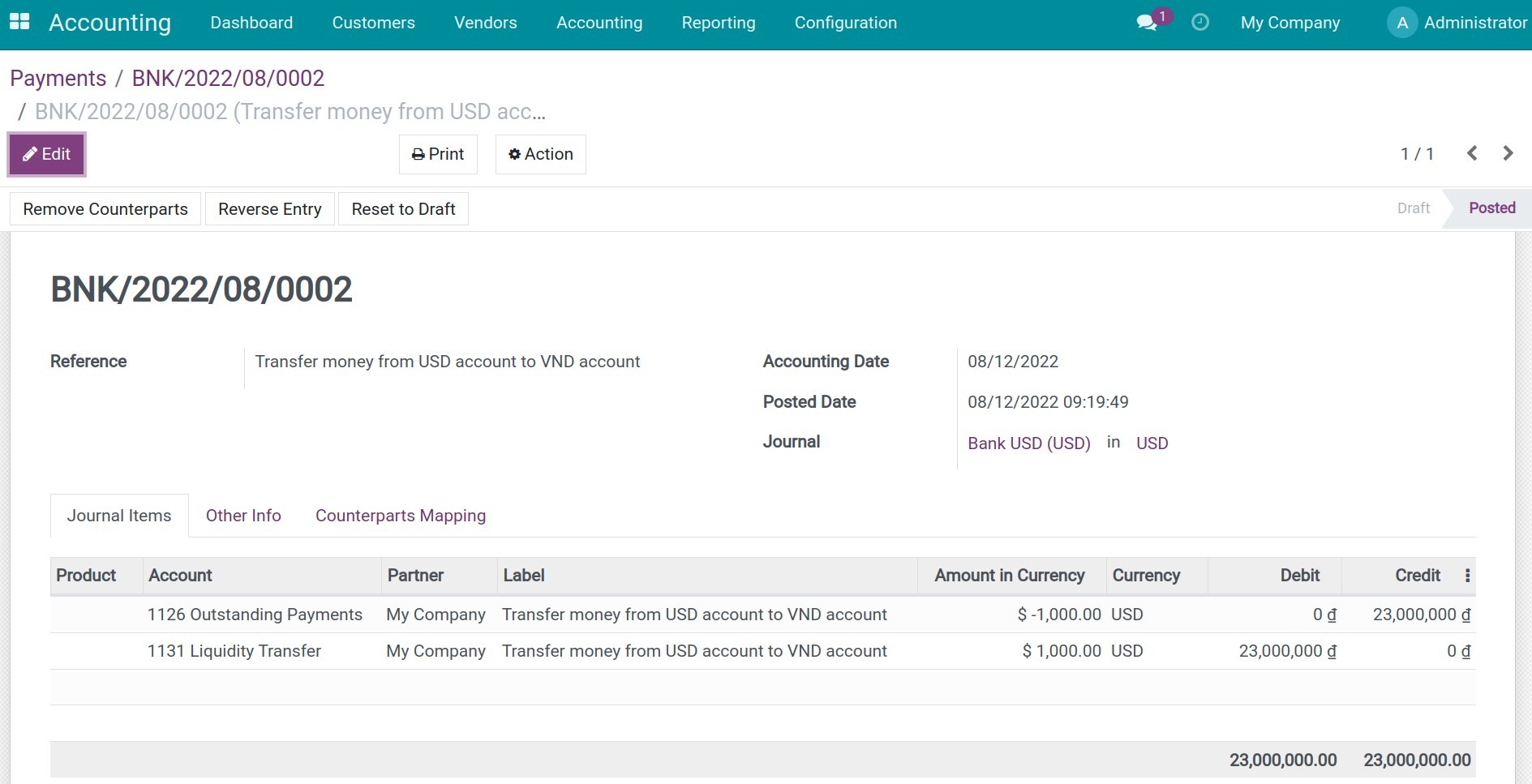

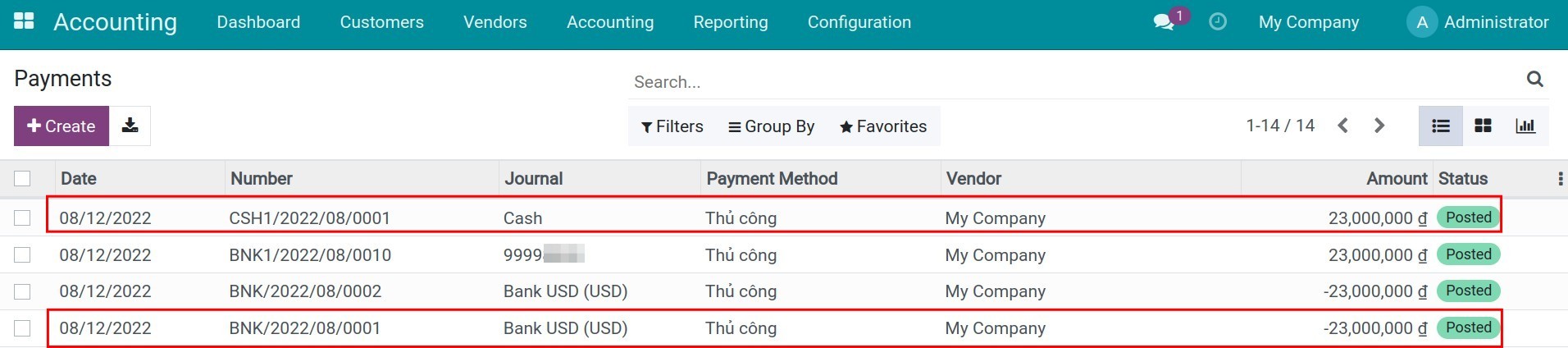

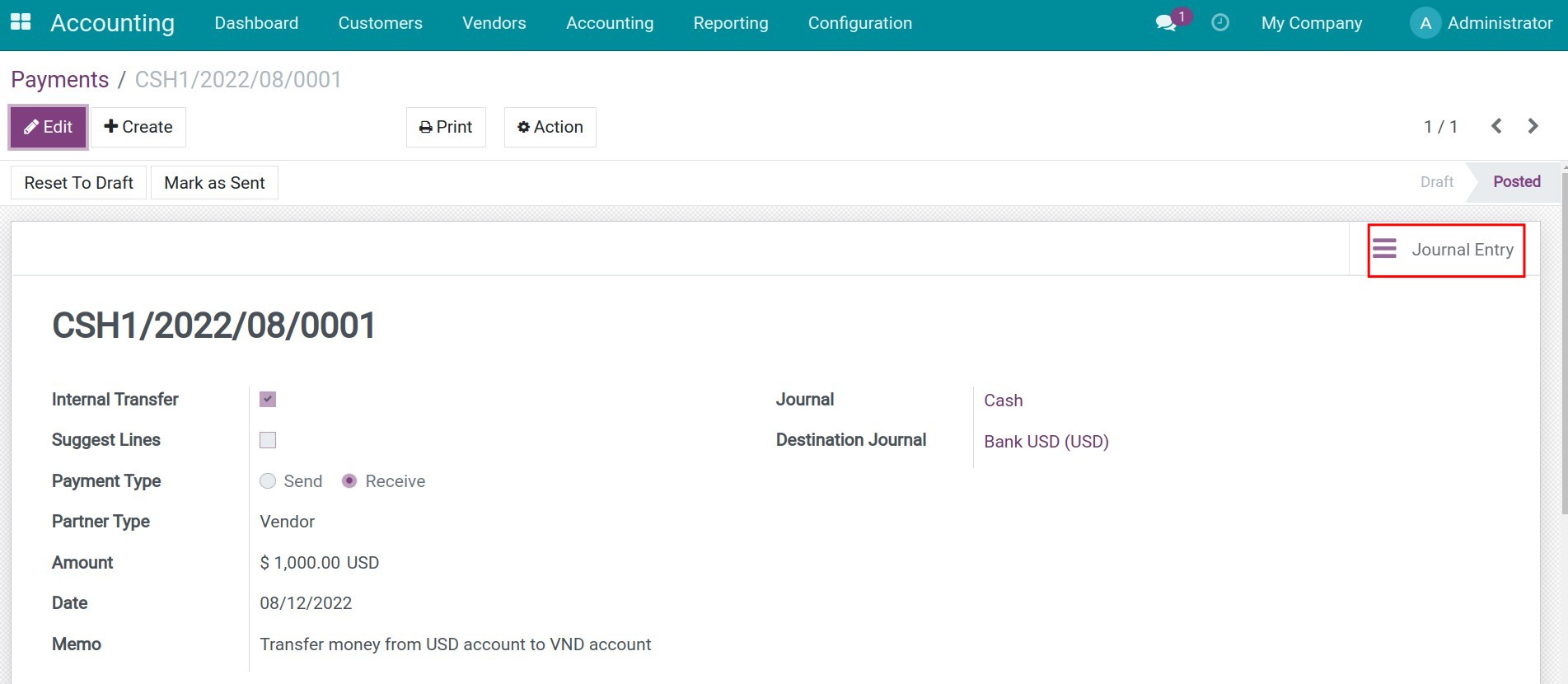

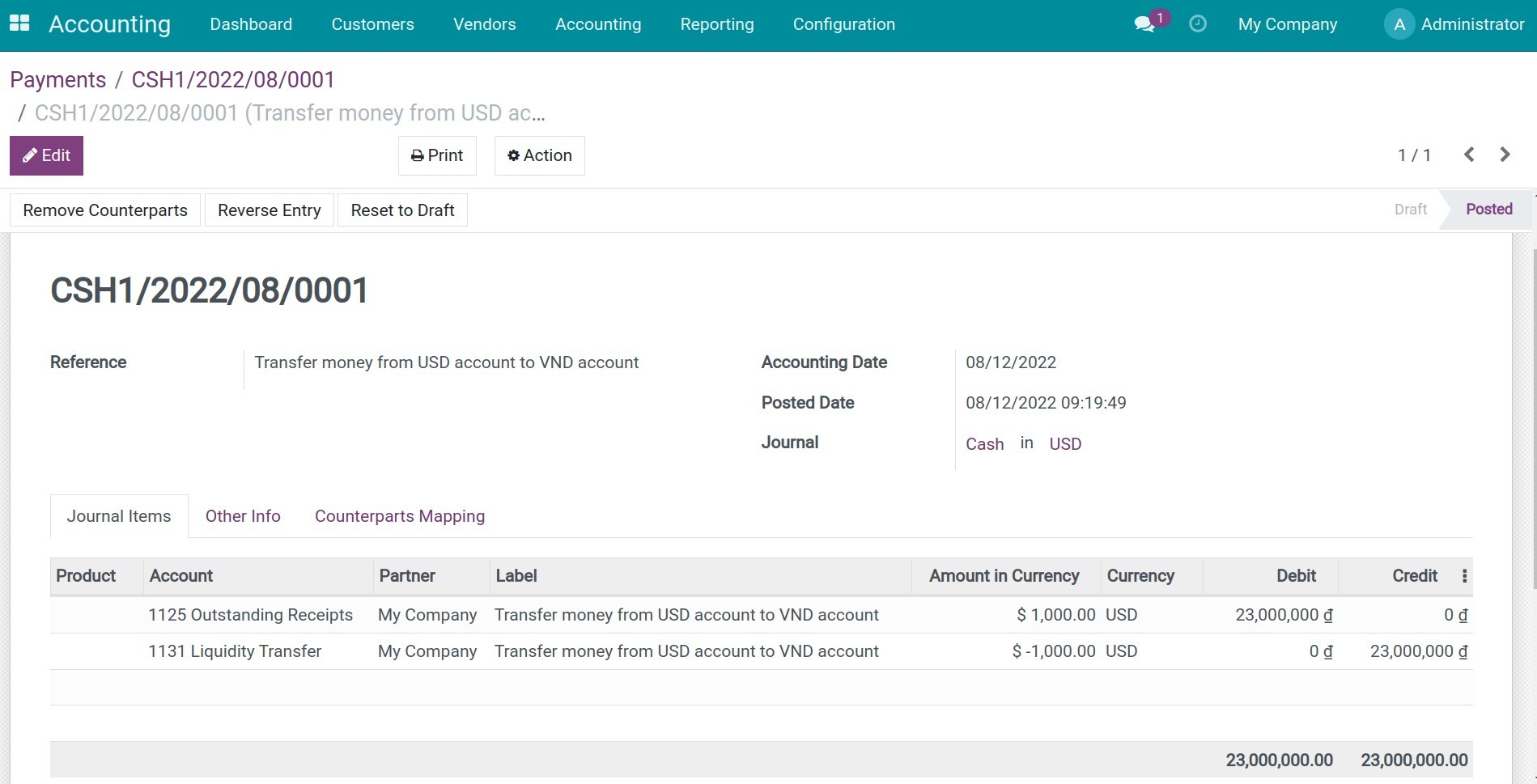

Record payments between bank accounts

- Create Send money payment

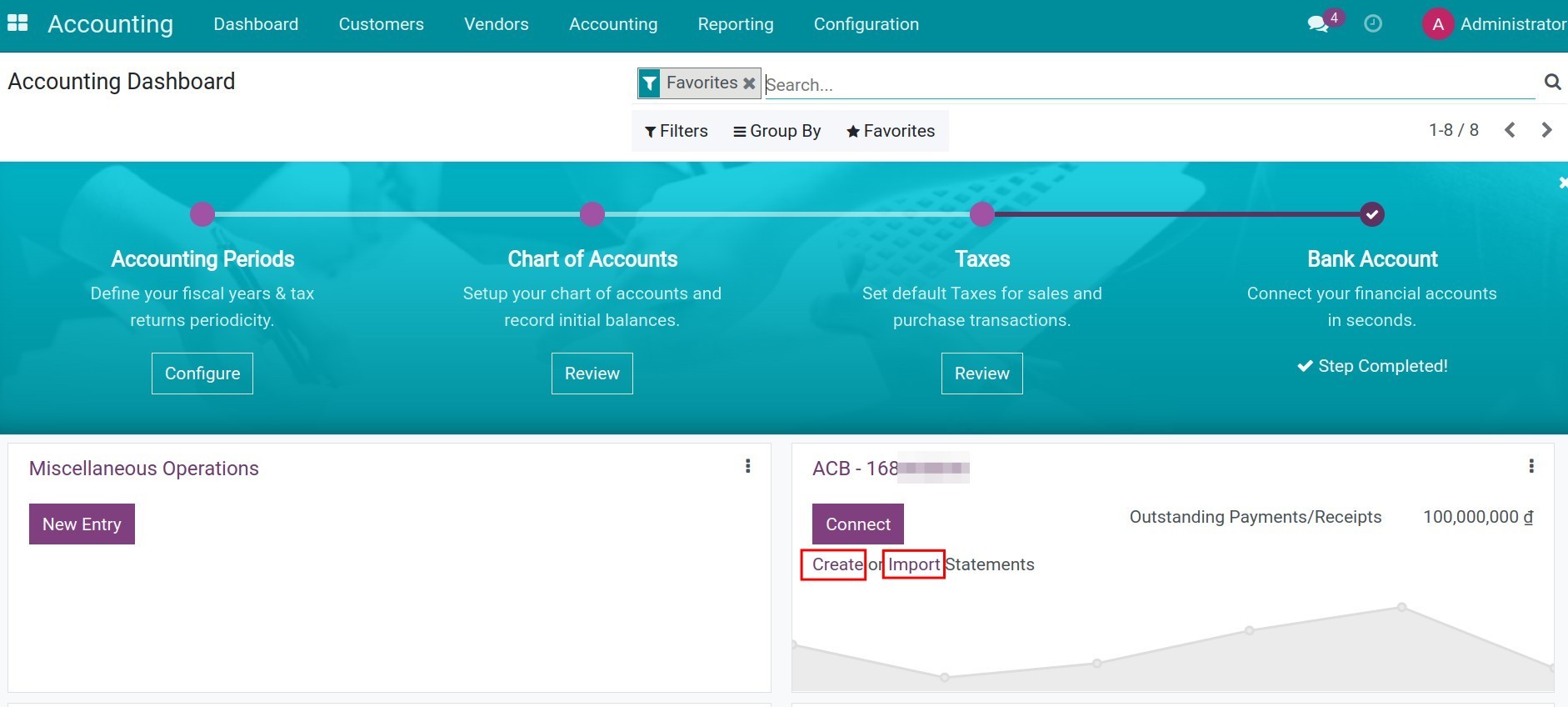

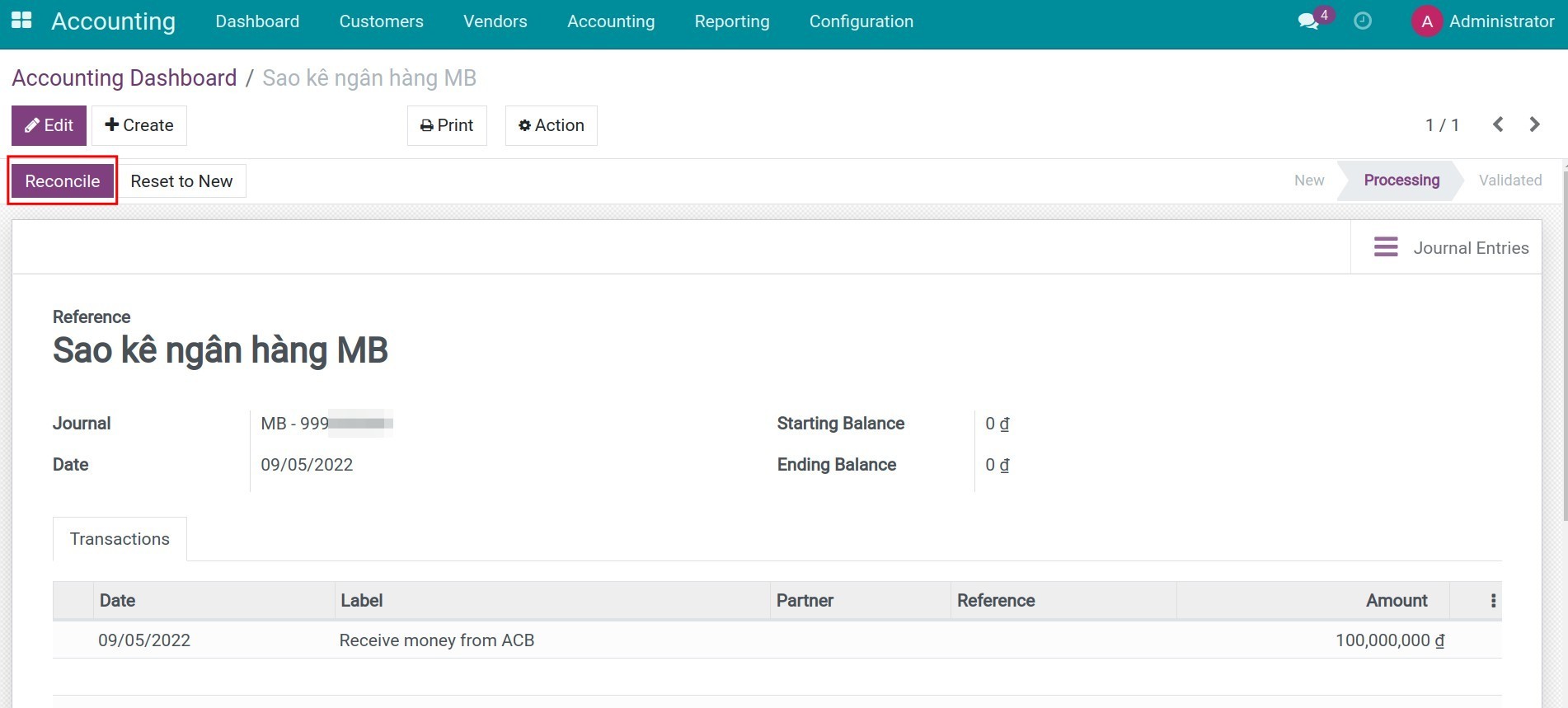

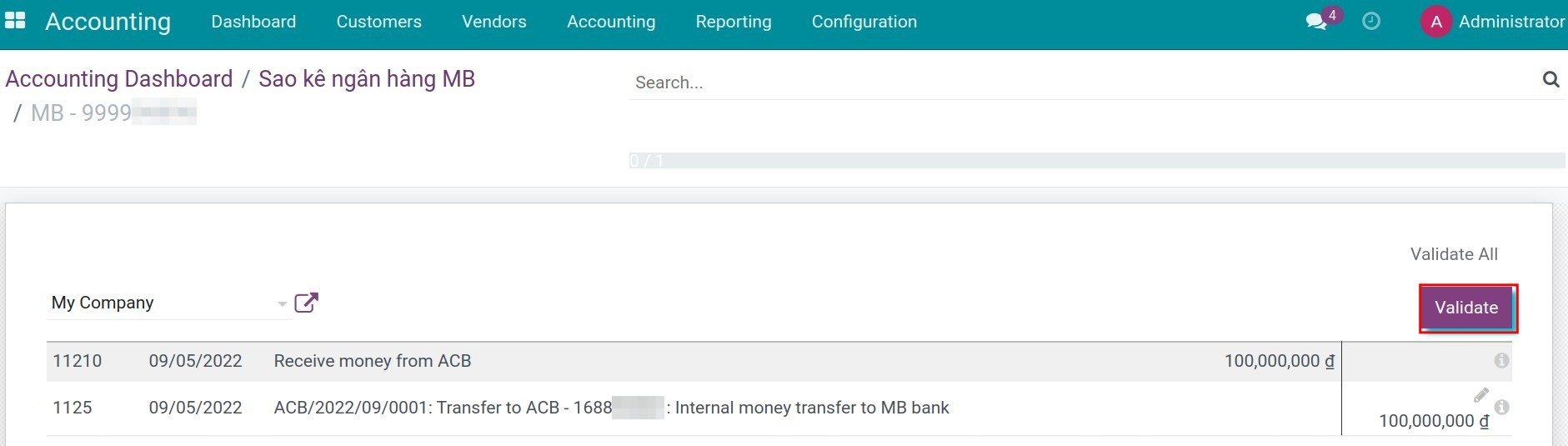

- Create bank statements

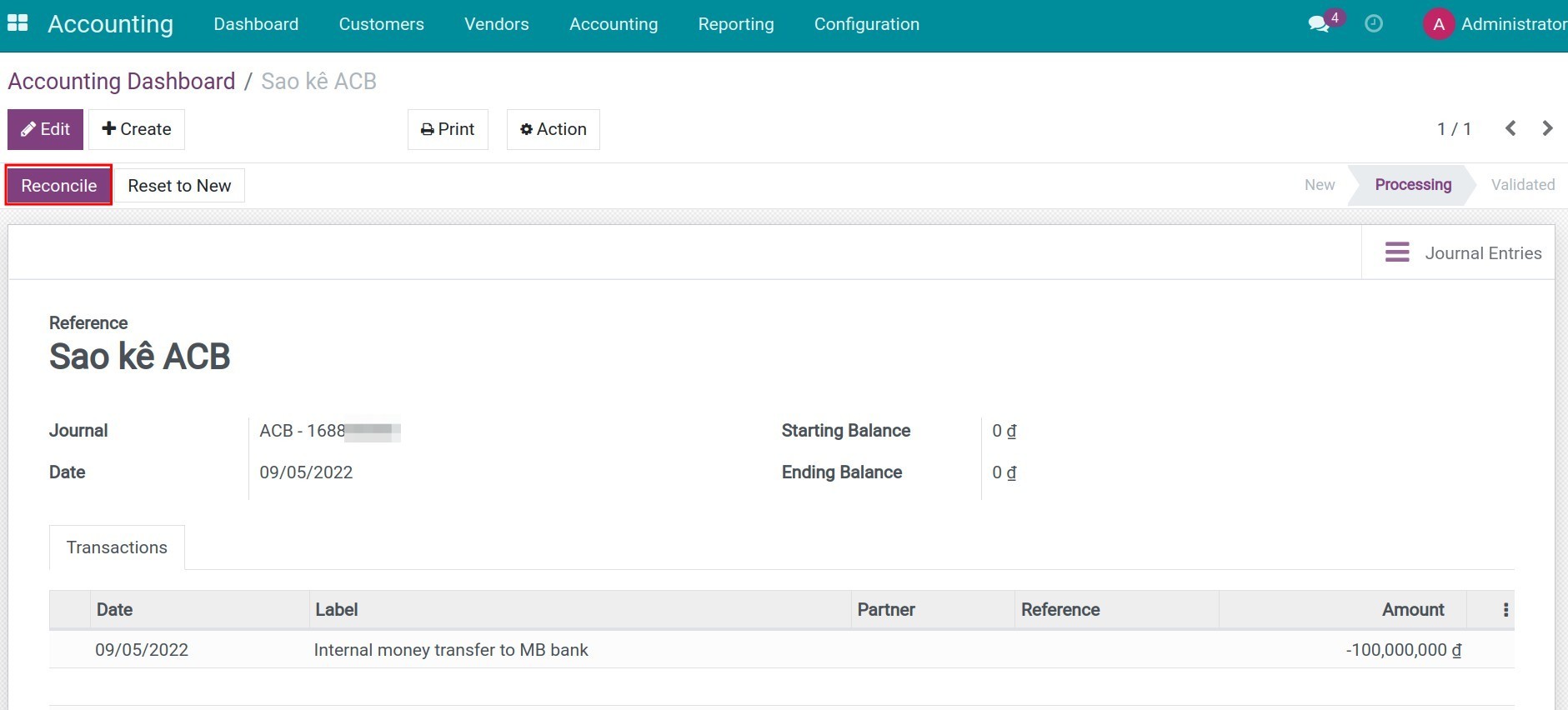

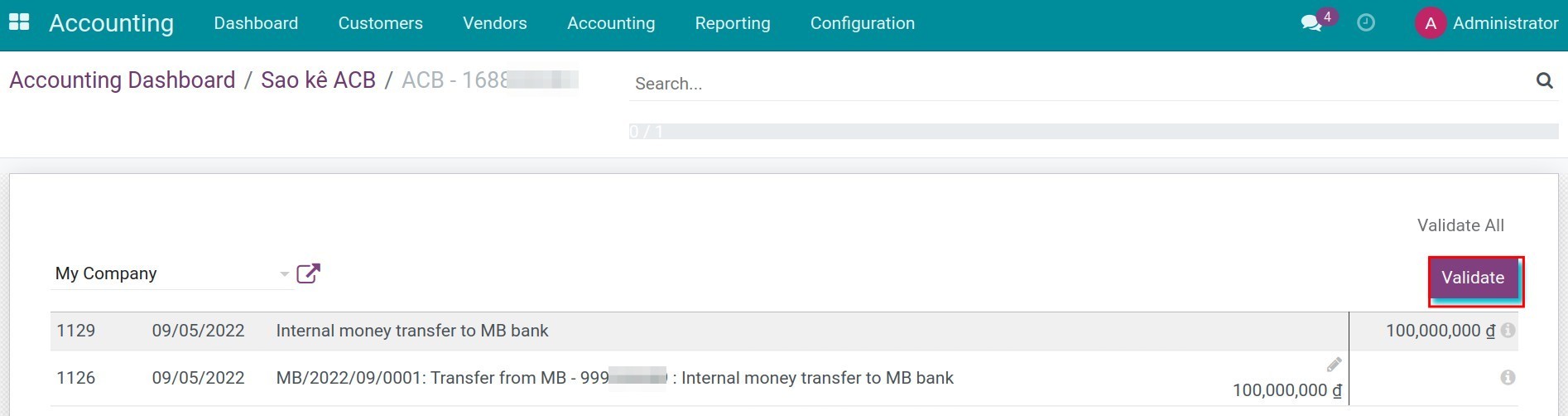

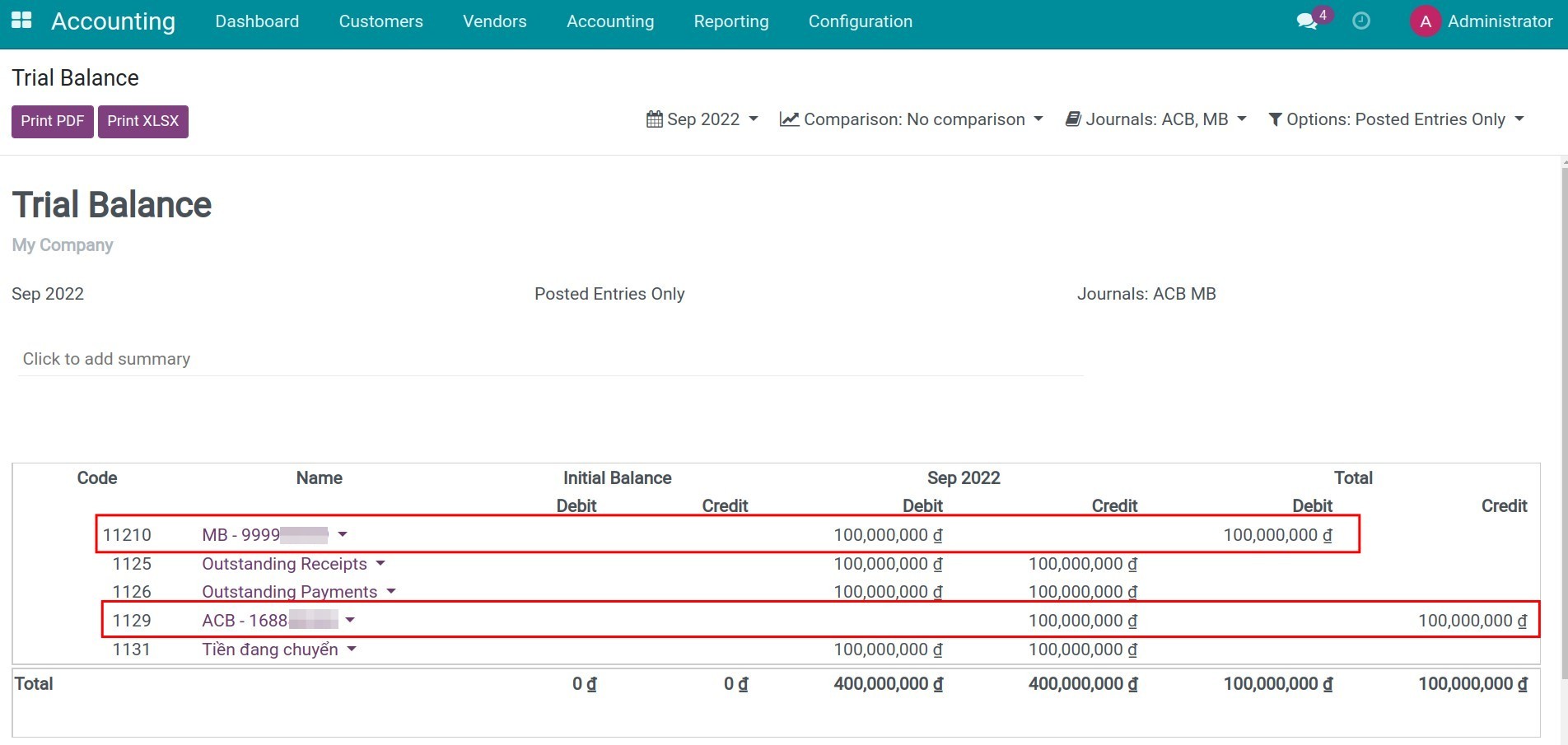

- Reconcile bank statements

-

Transfer between Bank account and Cash on hand

-

Transfer between Bank account and Cash on hand

-

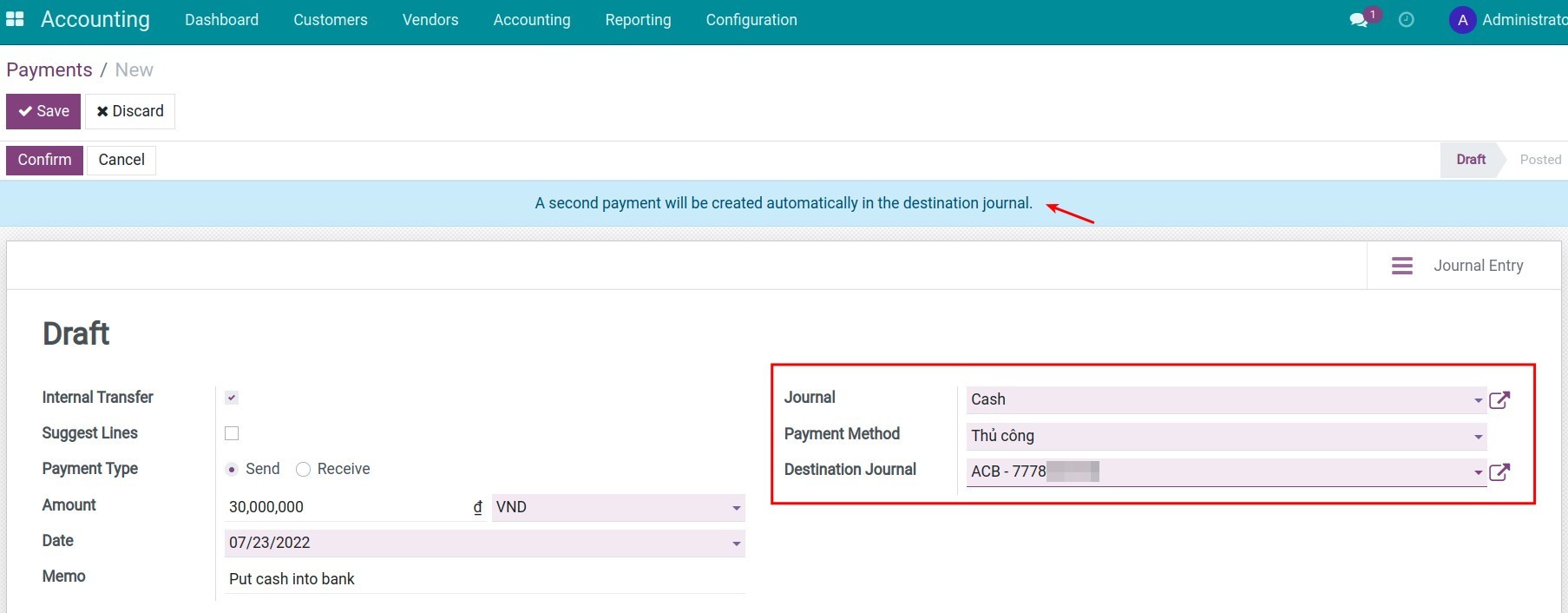

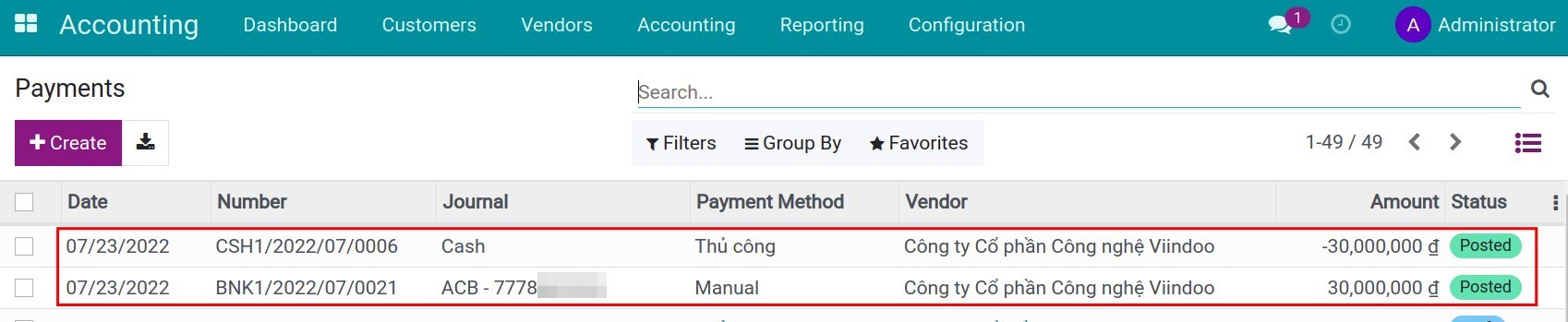

Deposit money into a bank account

- Cash disbursement

-

Withdraw money from the bank account and send it to cash on hand

- Withdraw money

- Register deposit interest

-

Steps in the bank reconciliation process

-

Steps in the bank reconciliation process

- Steps in the bank reconciliation process

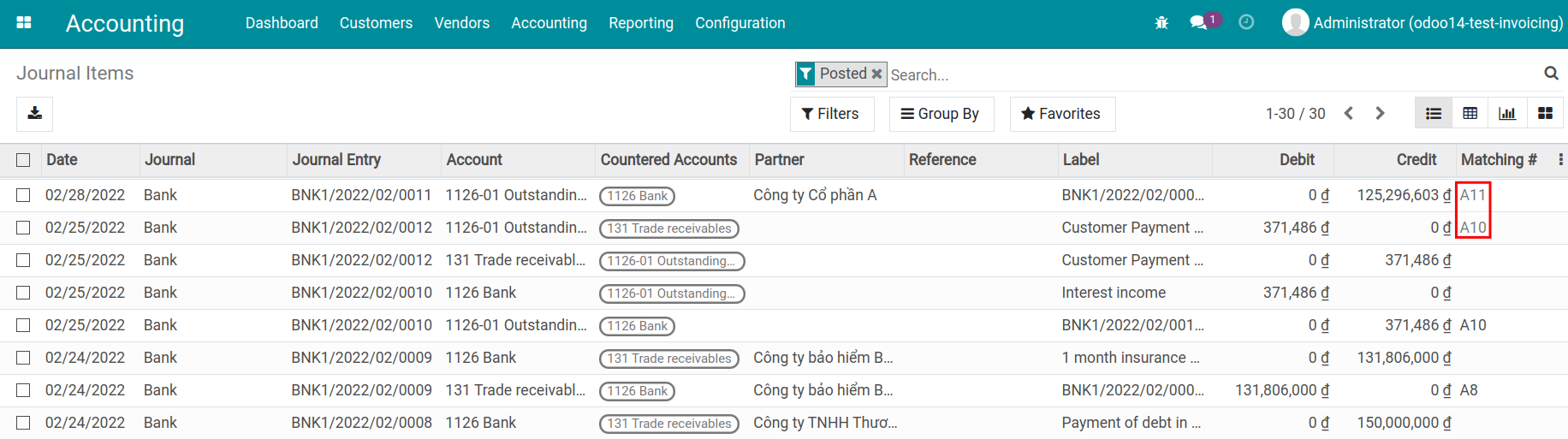

- Journal entries of the bank statements

- Some use cases in the reconciliation process

-

Foreign currencies management

-

Foreign currencies management

- Create a foreign currency bank account

-

Foreign currency transactions in Viindoo

- Payment on foreign currency invoices

- Currency exchange

-

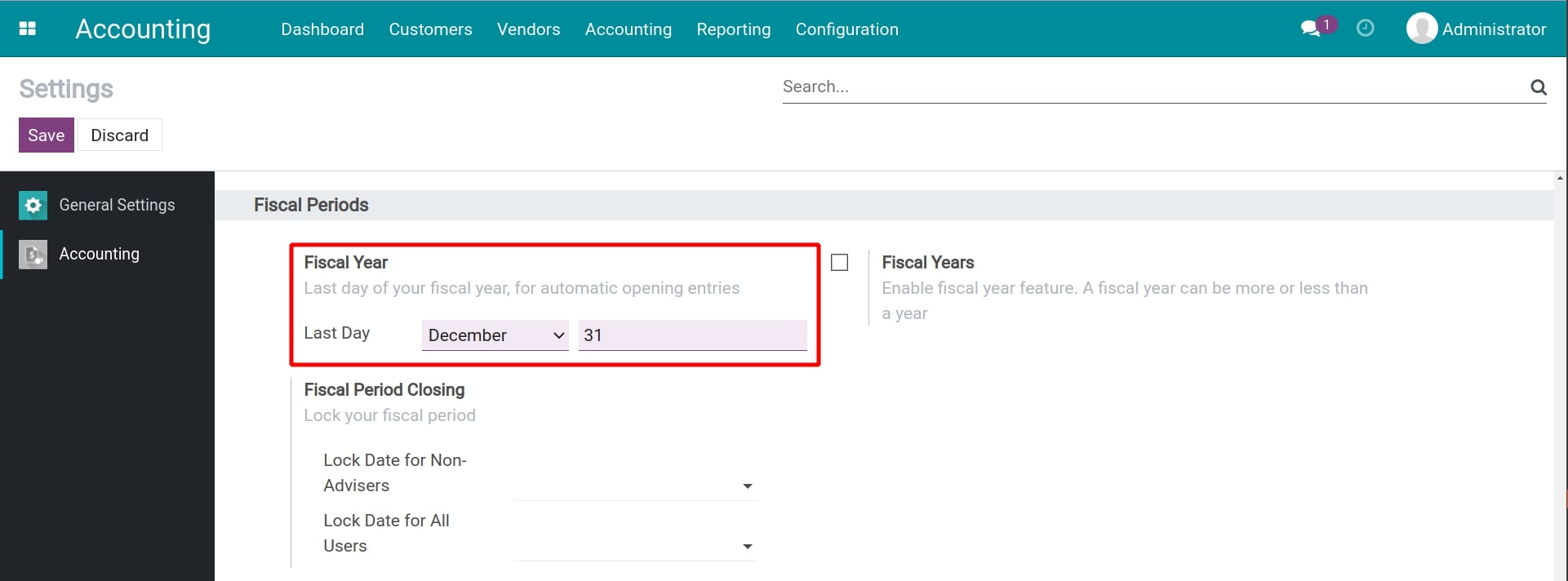

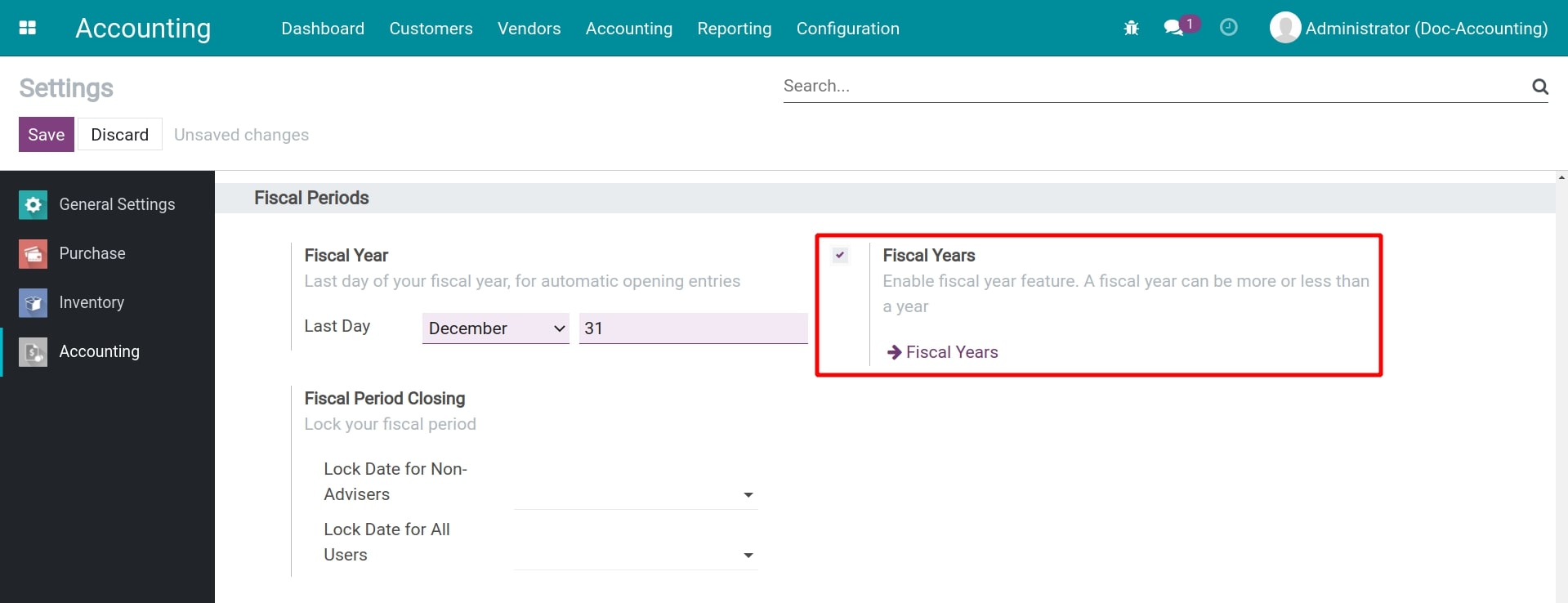

Define your Fiscal Year

- Define your Fiscal Years

-

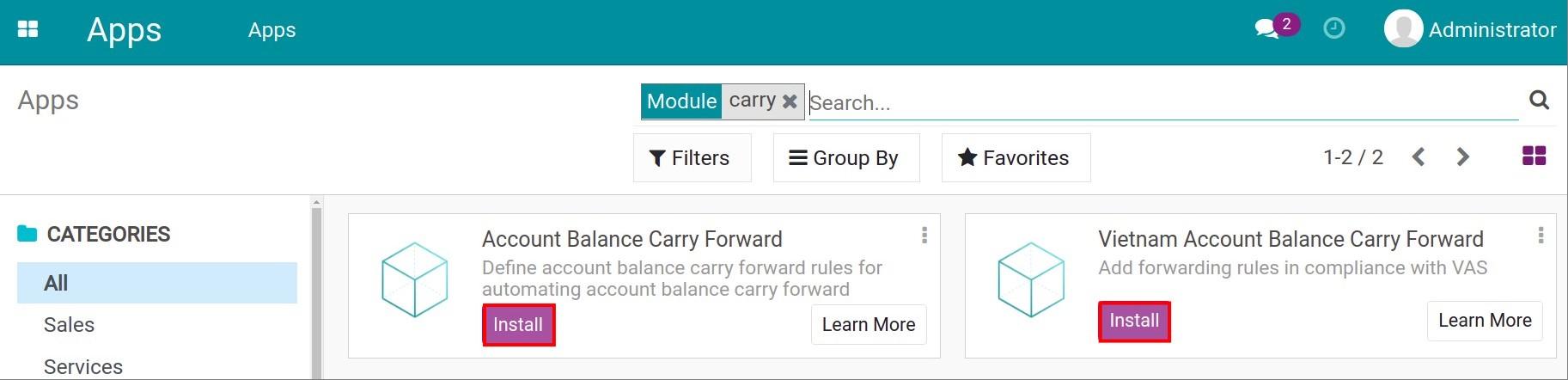

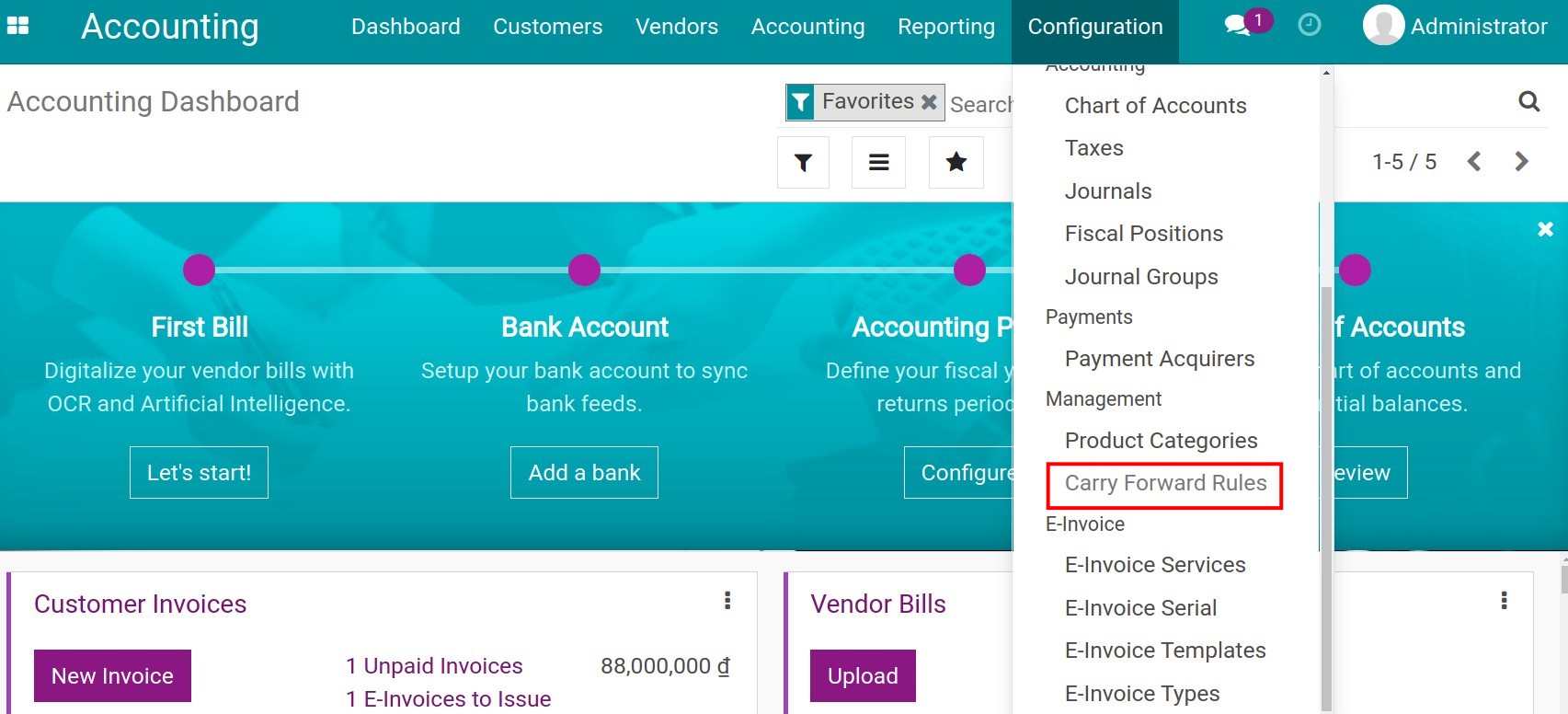

Balance carrying forward

-

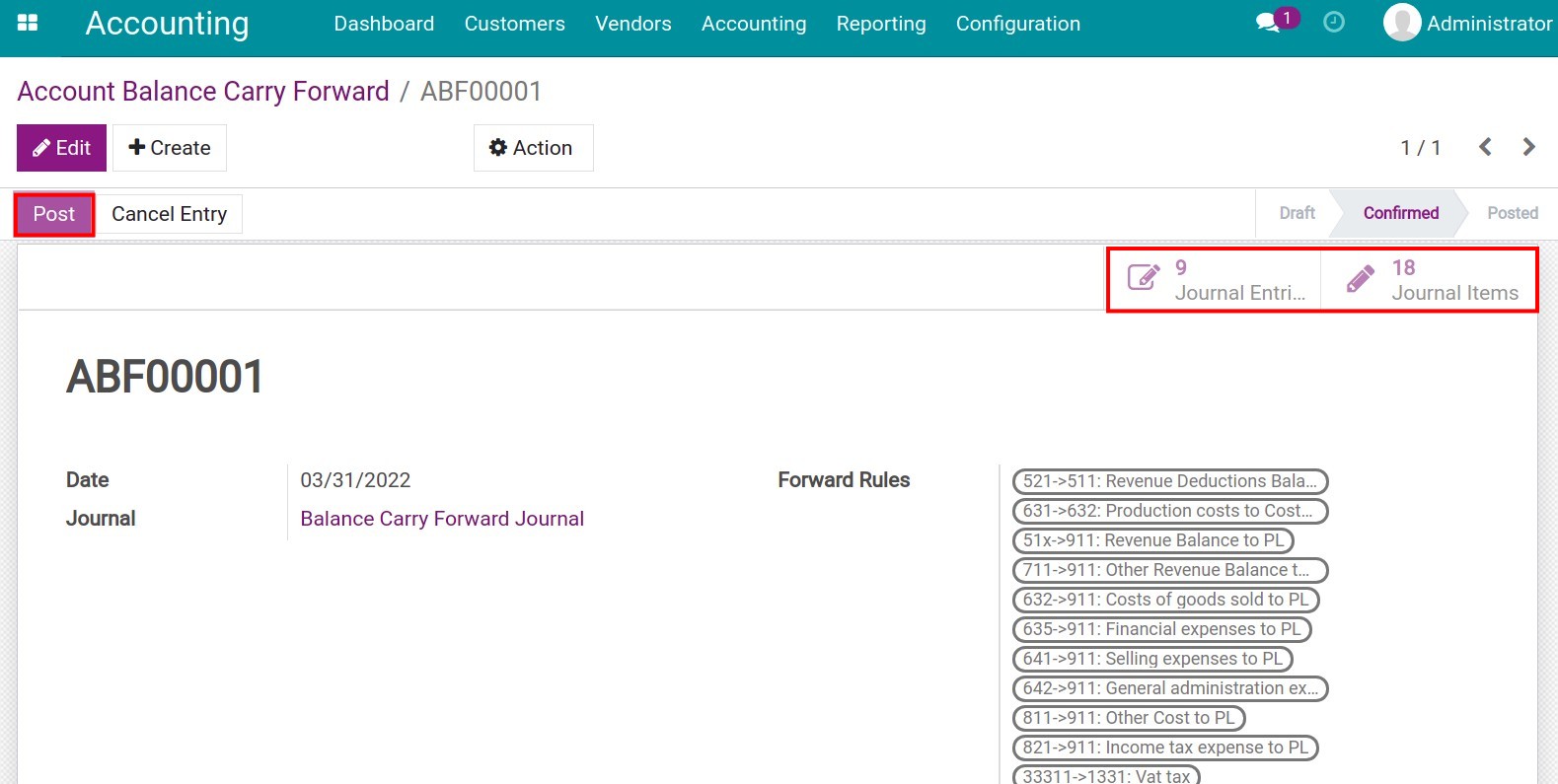

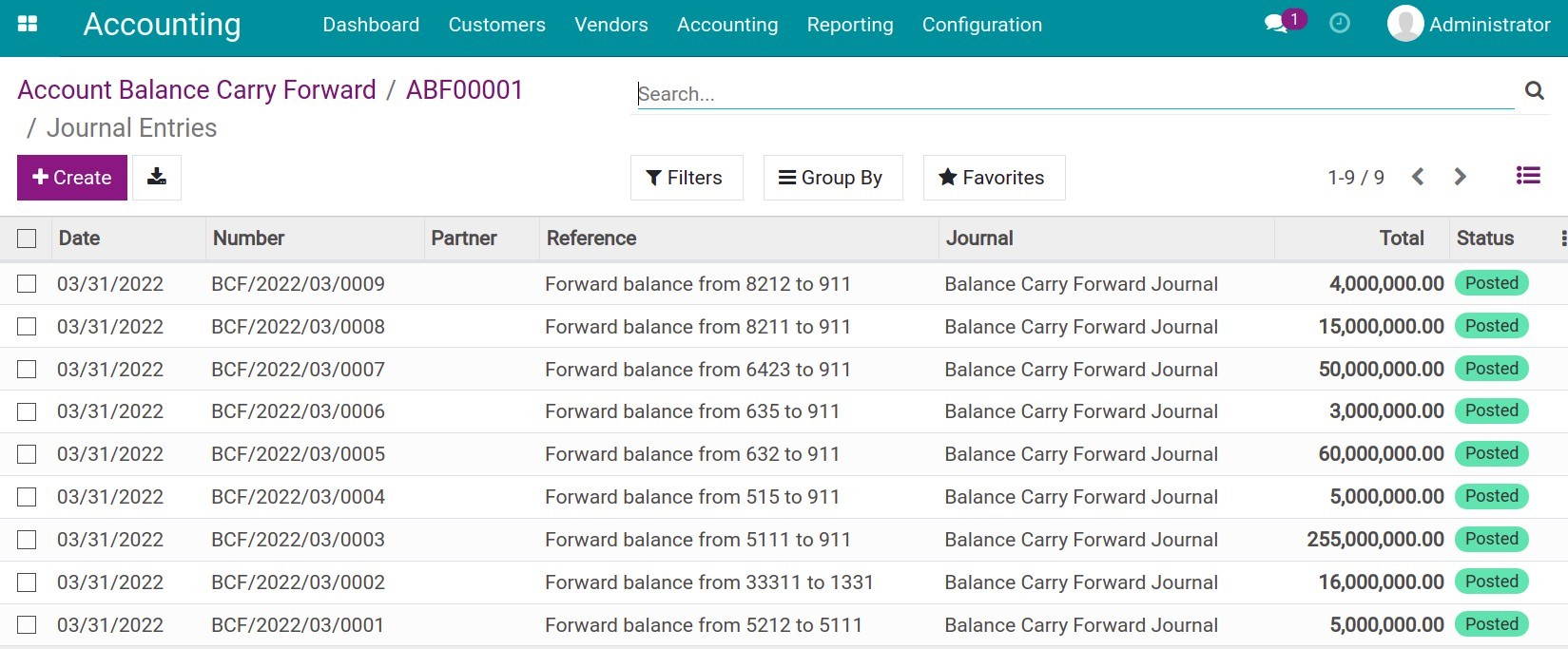

Balance carrying forward

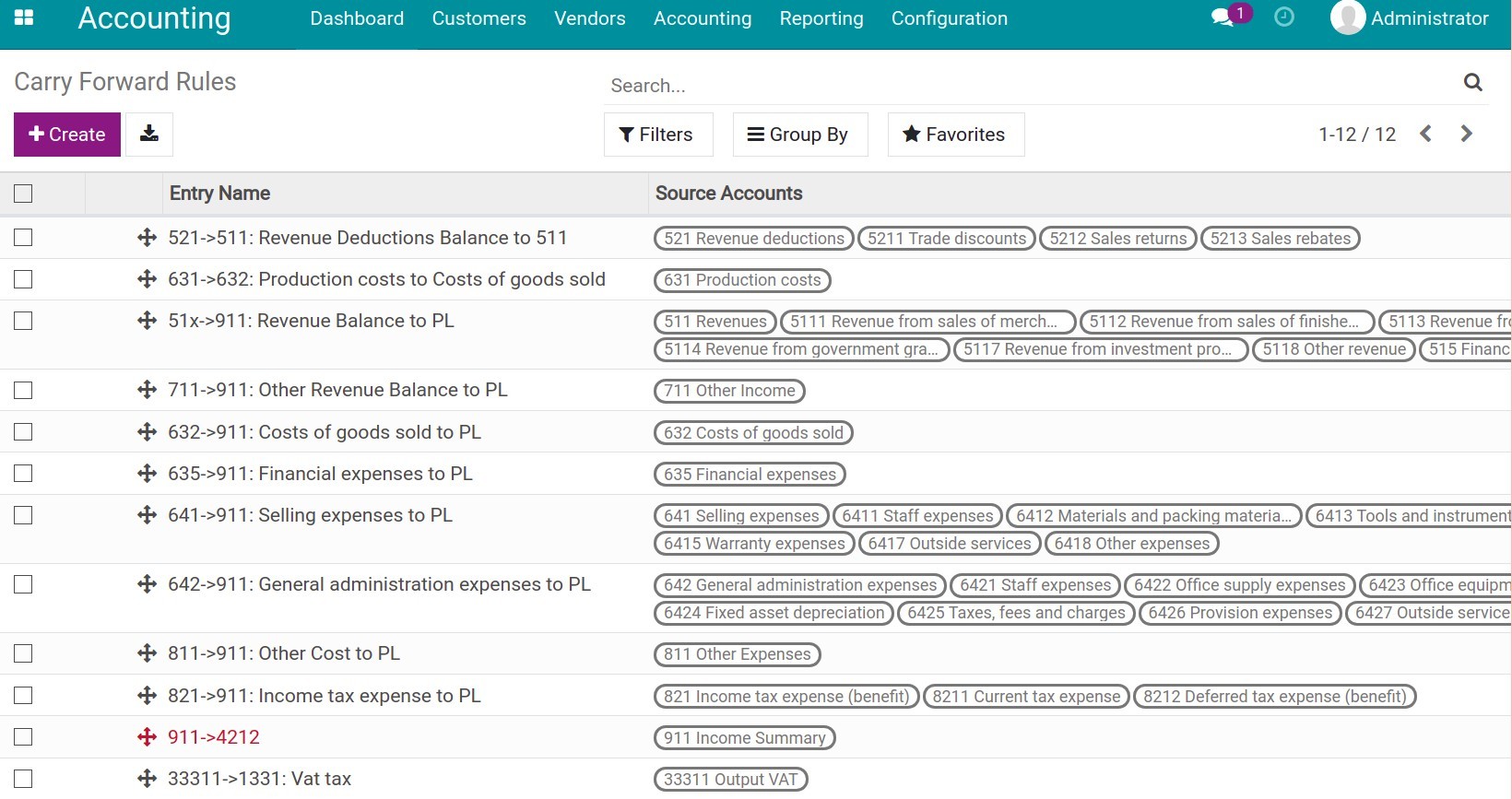

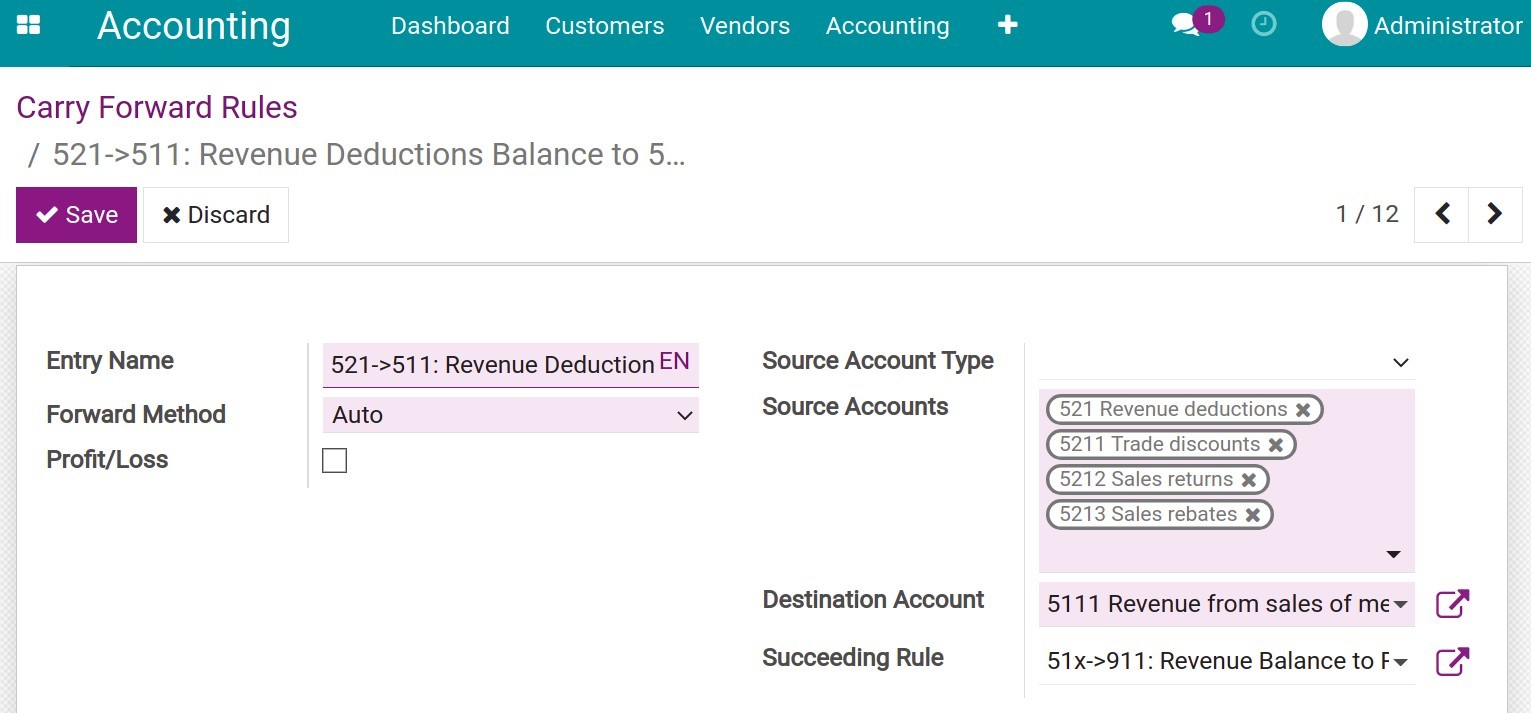

- Configure balance carry forward rules in Viindoo

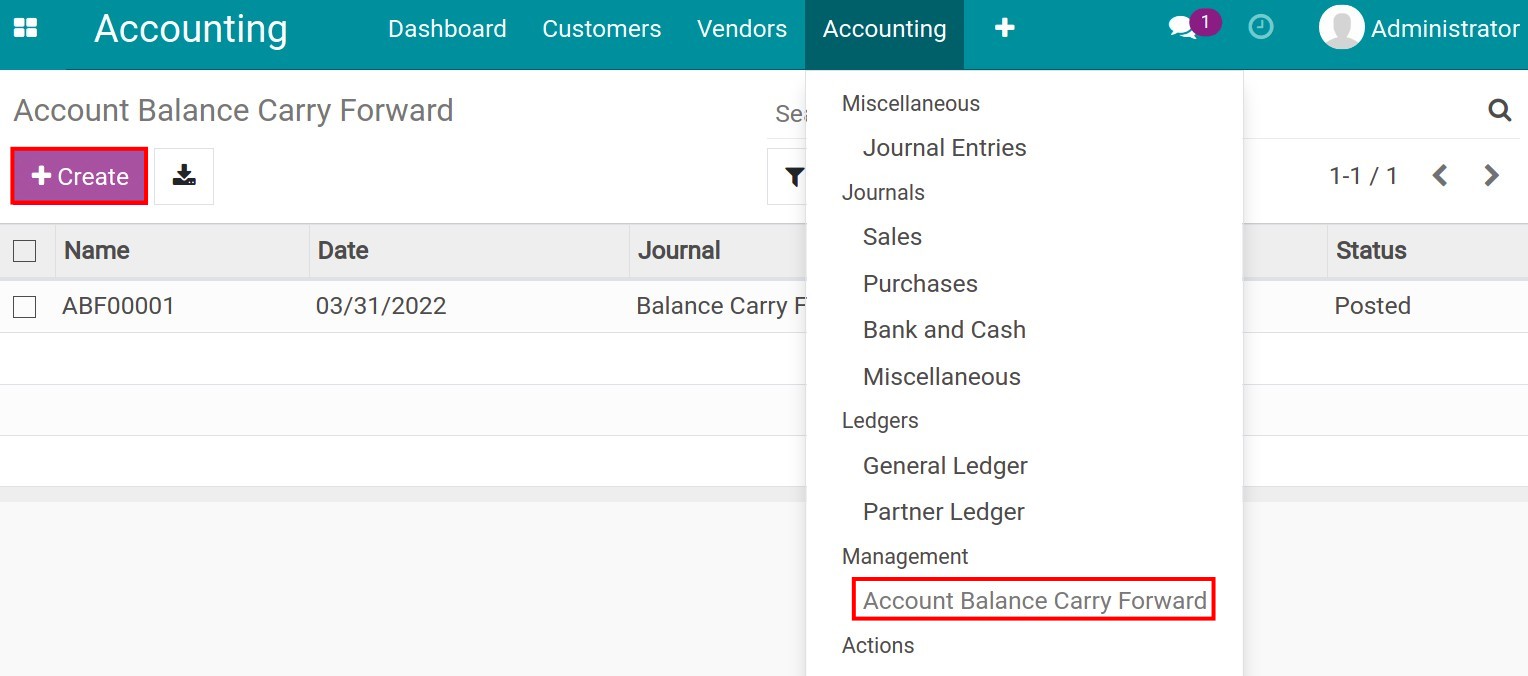

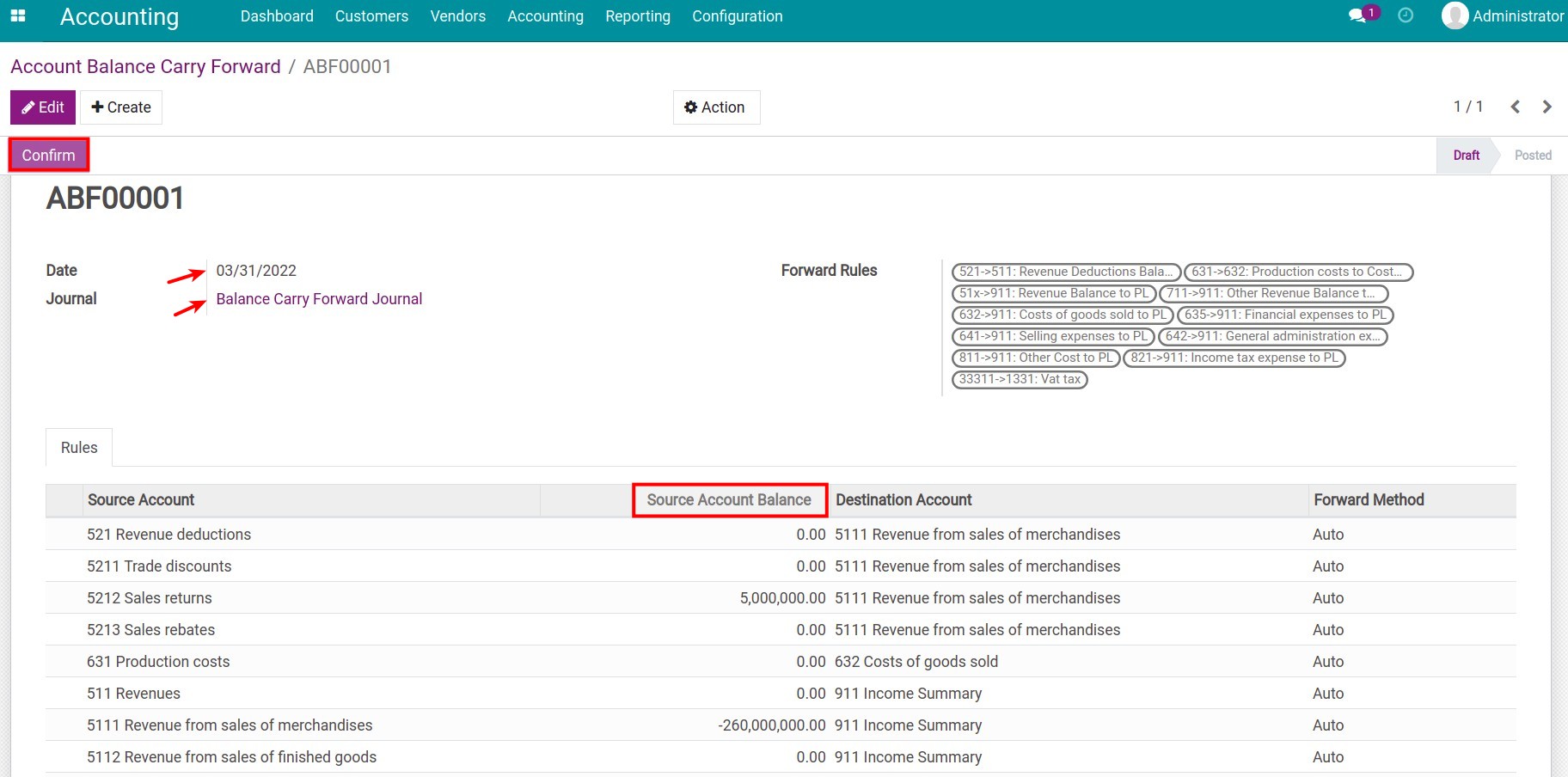

- Account balance carry forward

-

Accounting Analysis

- Summary

- Key Features

-

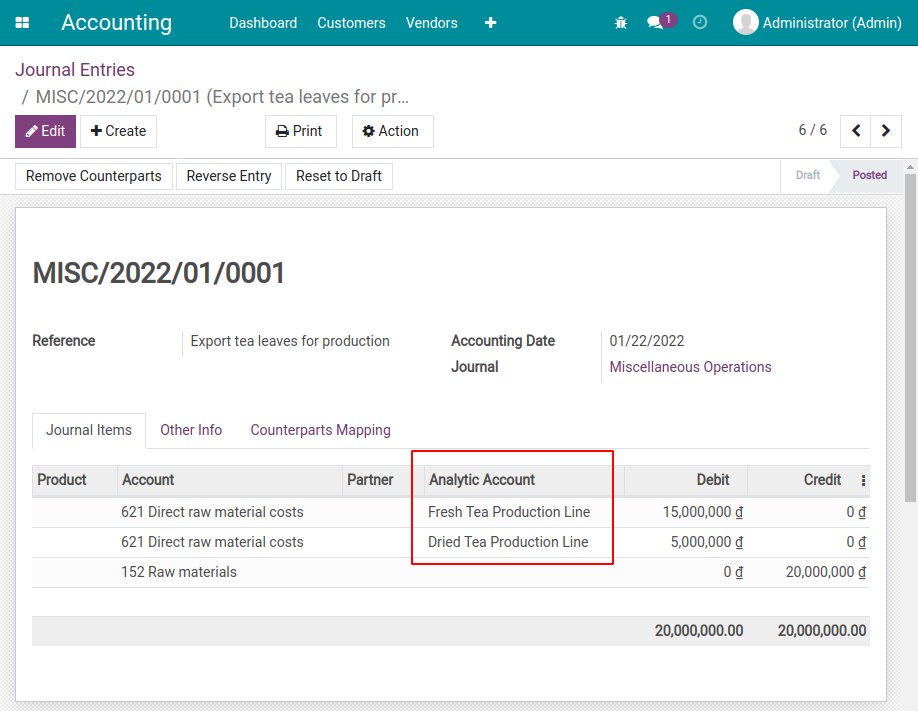

Dual Journal Entries with Analytic Account Association

- Dual Journal Entries with Analytic Account Association

-

Create an accounting journal entry

-

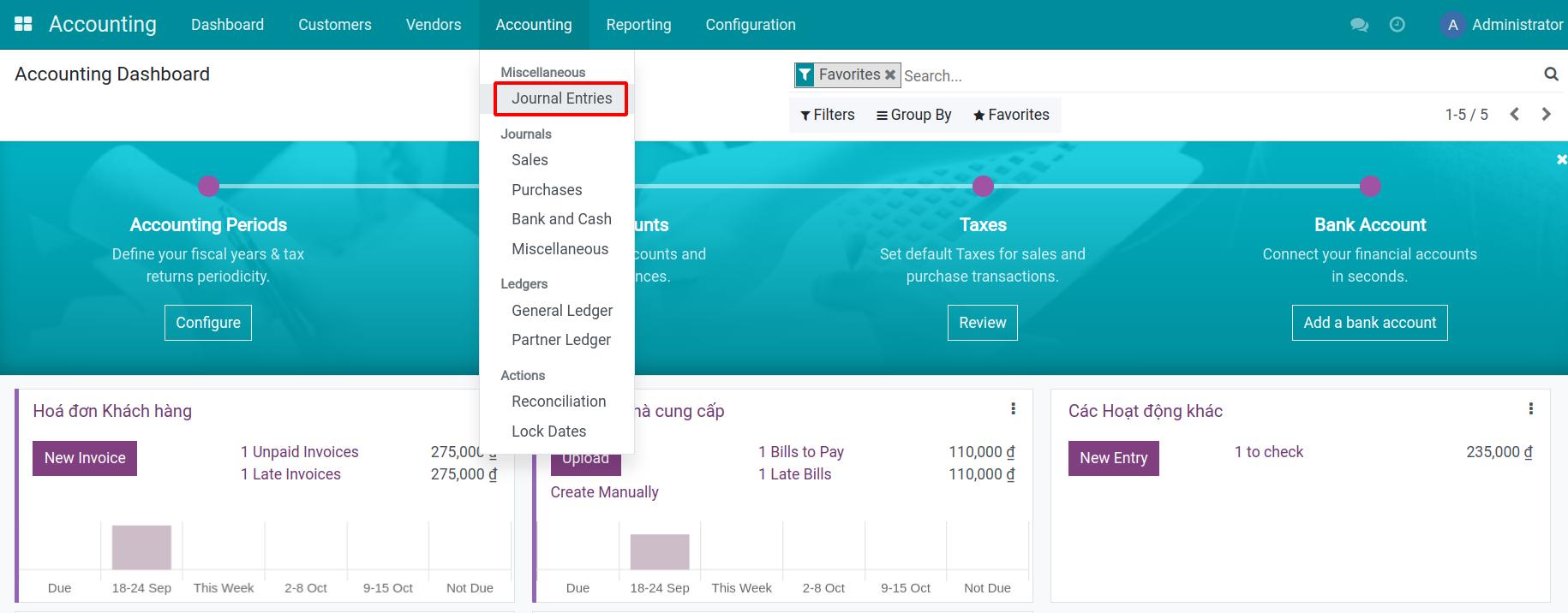

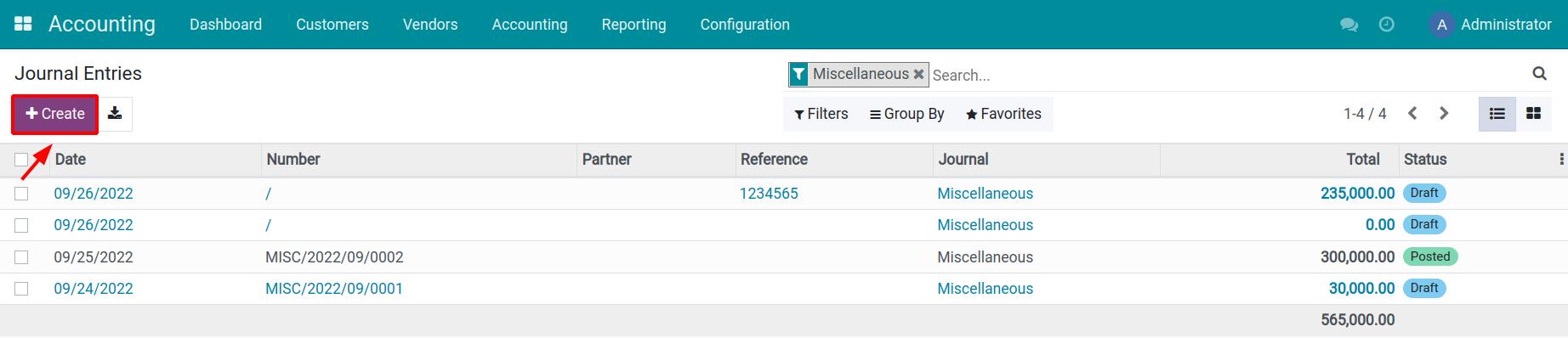

Create an accounting journal entry

-

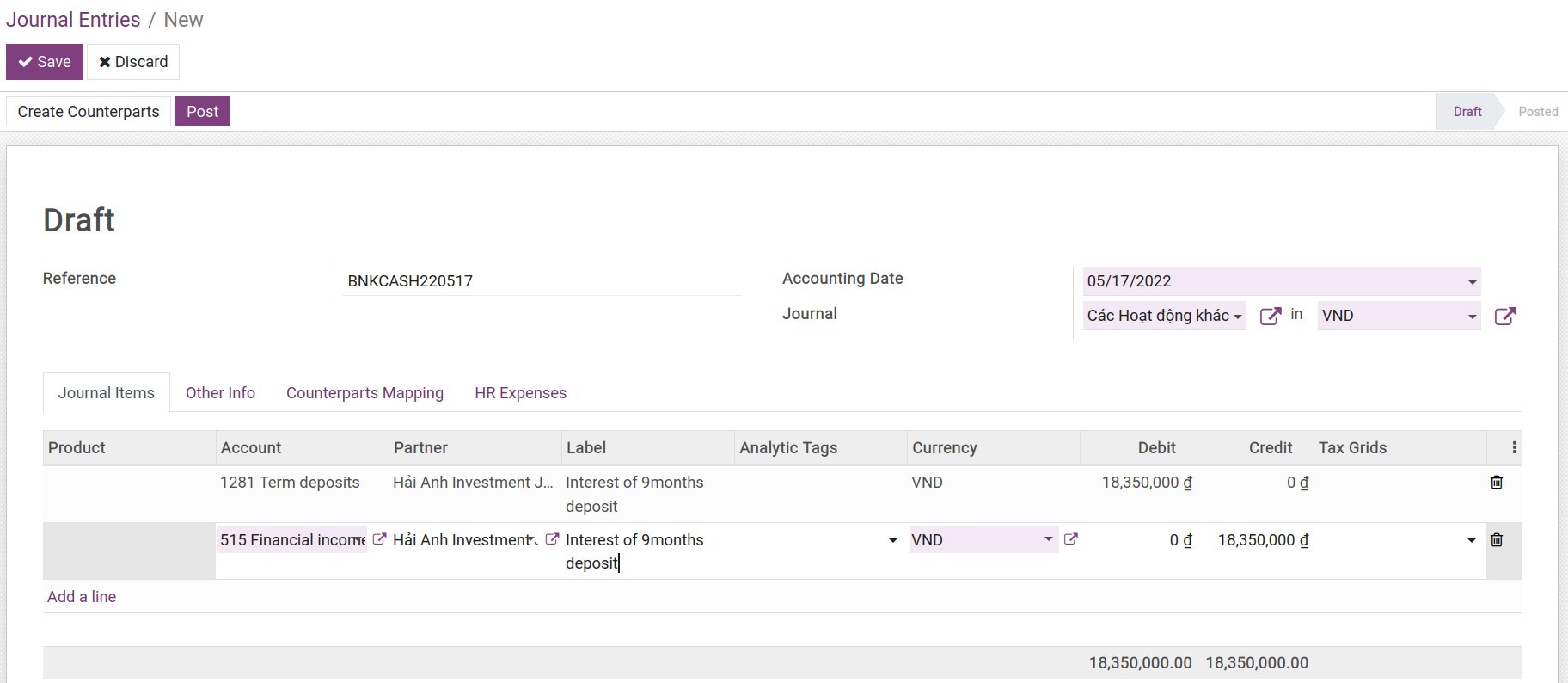

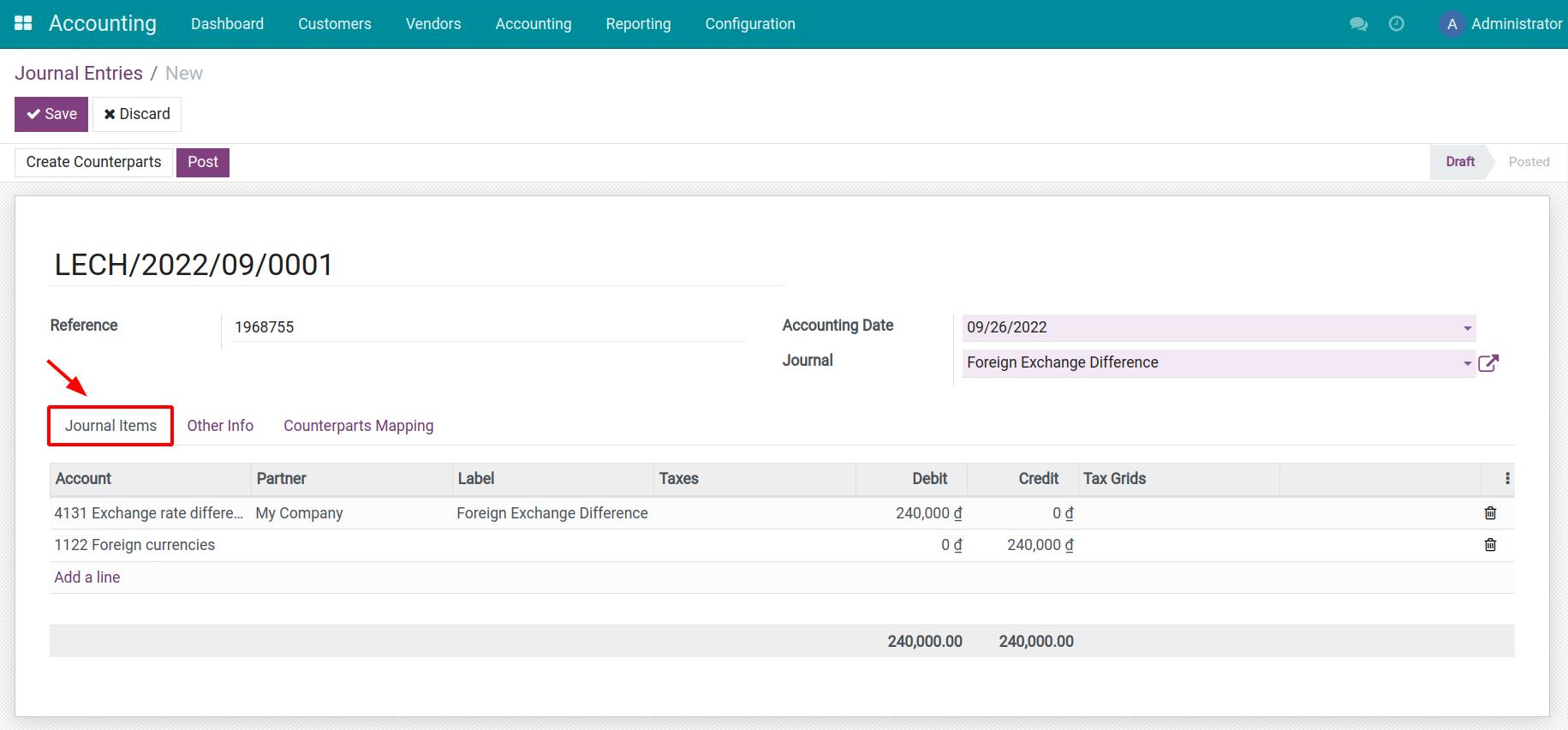

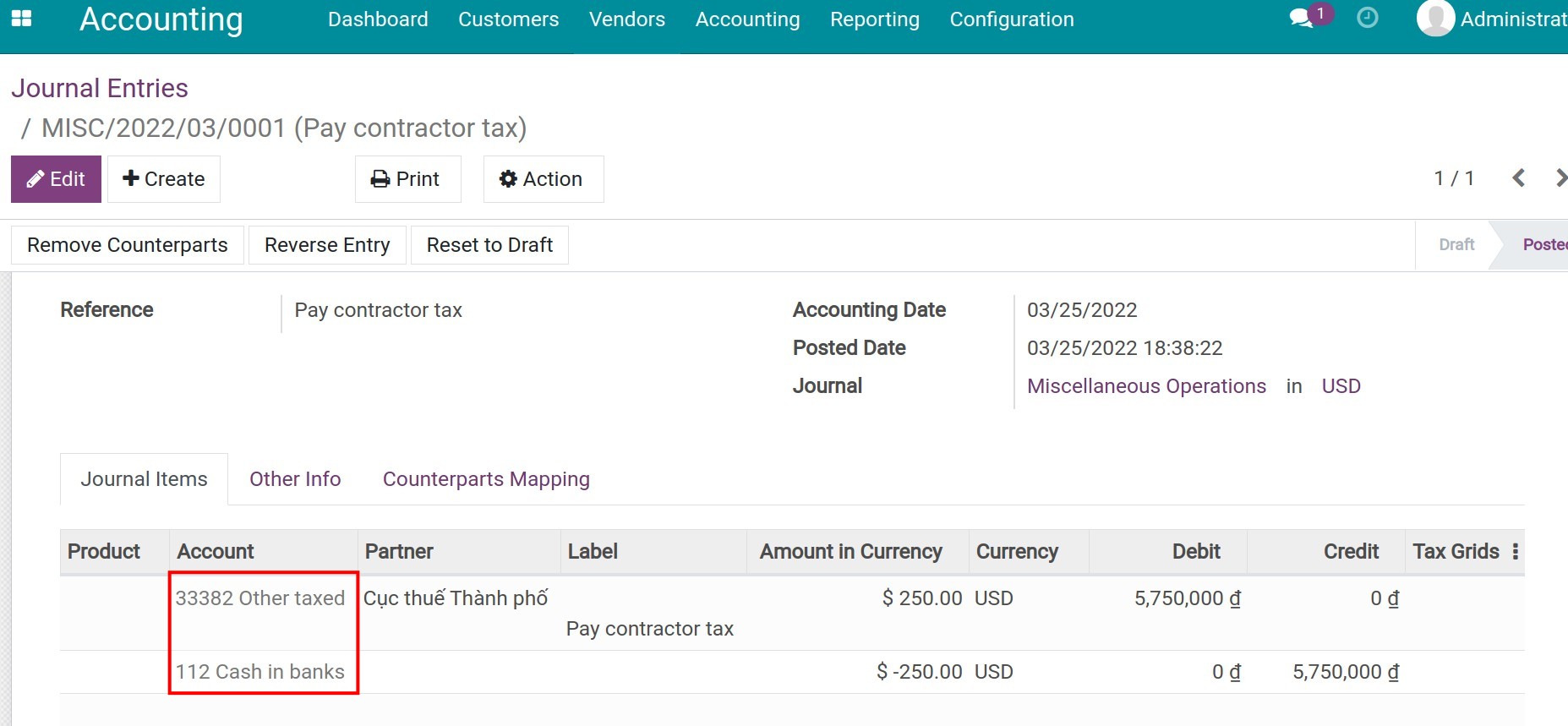

Create a journal entry

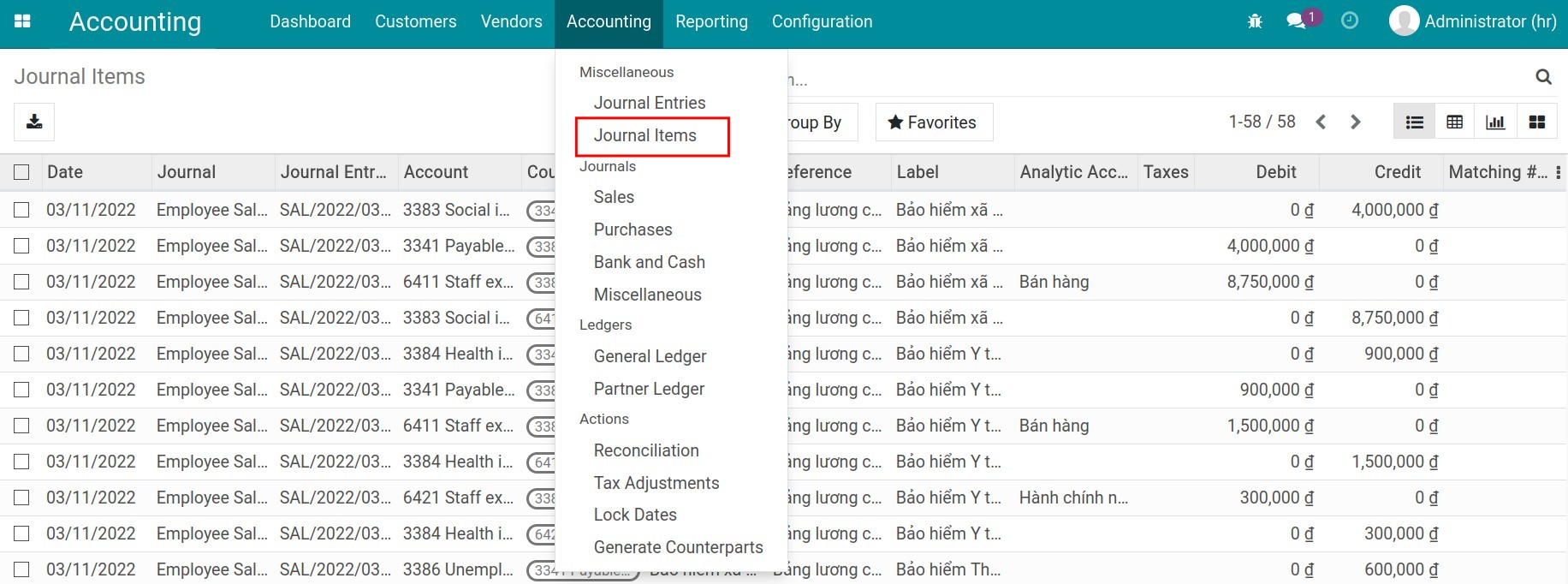

- Journal Items

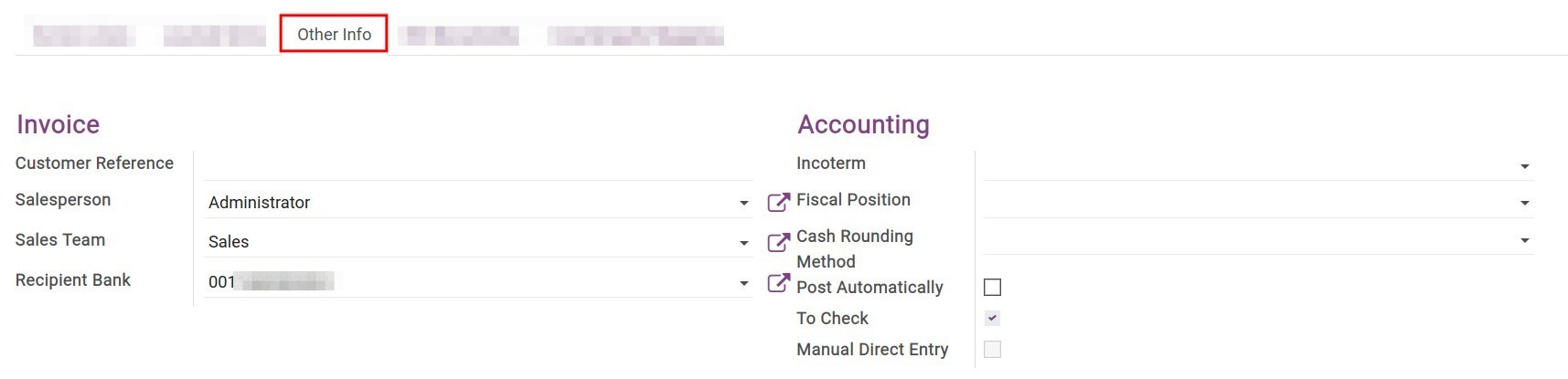

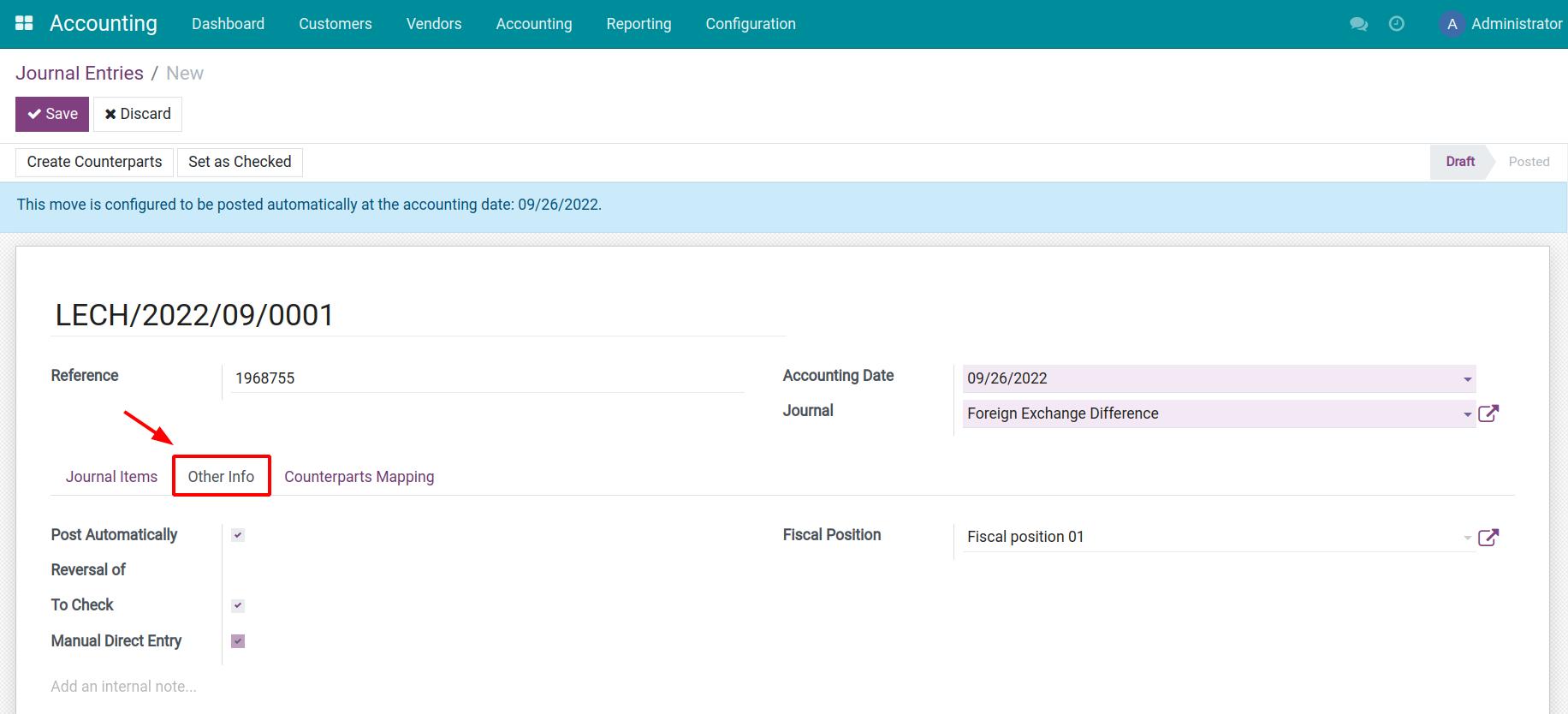

- Other Info

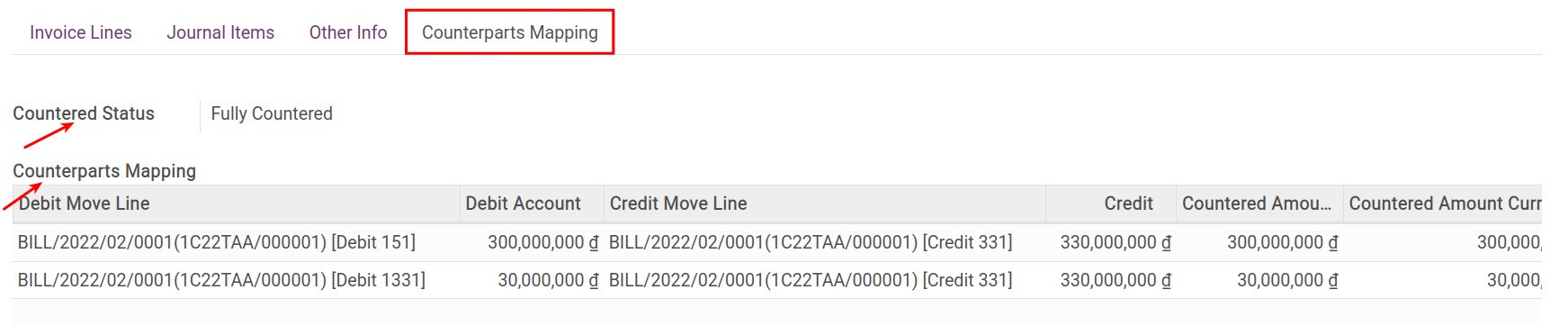

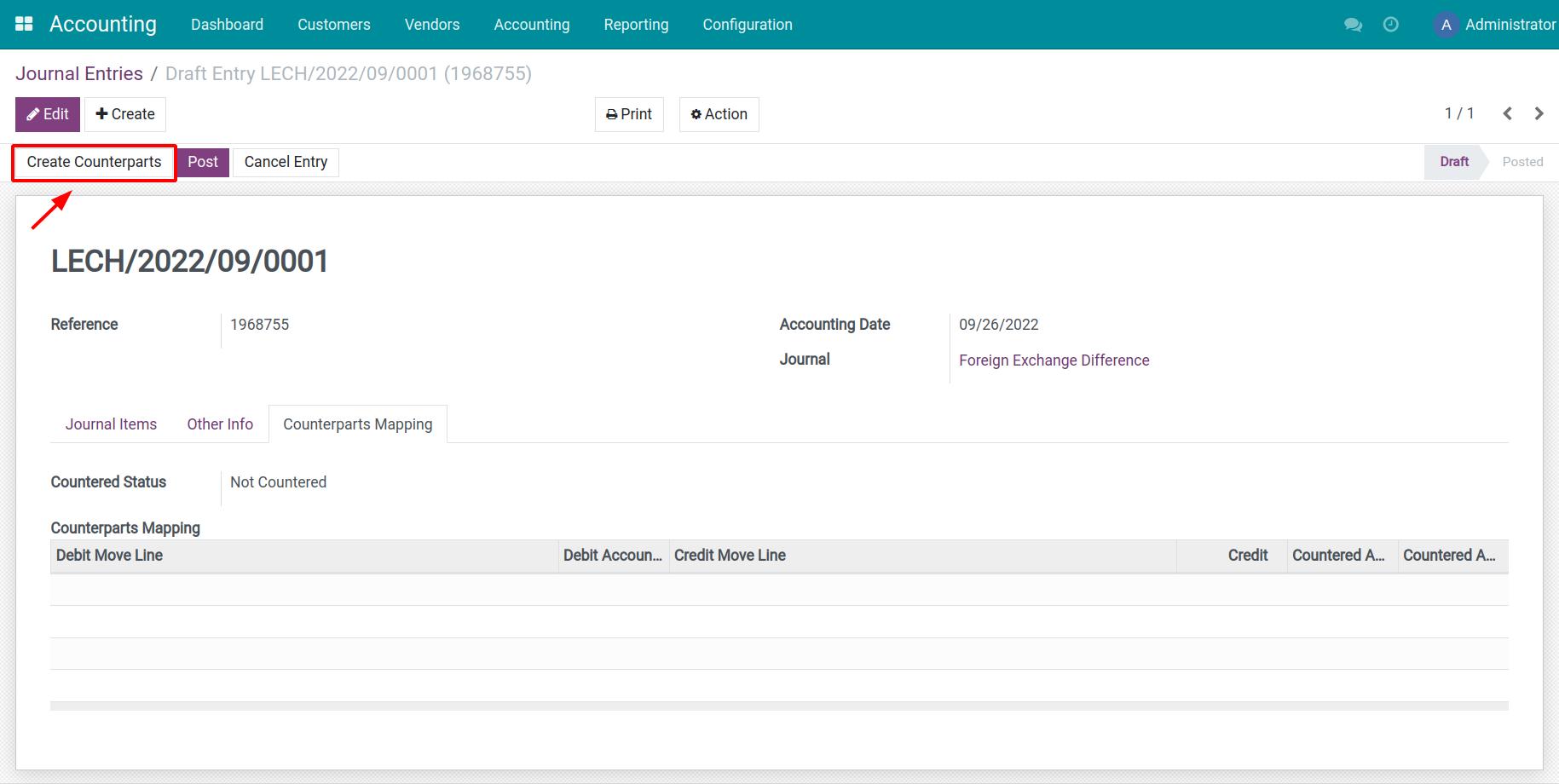

- Counterparts Mapping

-

Steps to import opening balance for Asset

-

Steps to import opening balance for Asset

- Prepare assets data

-

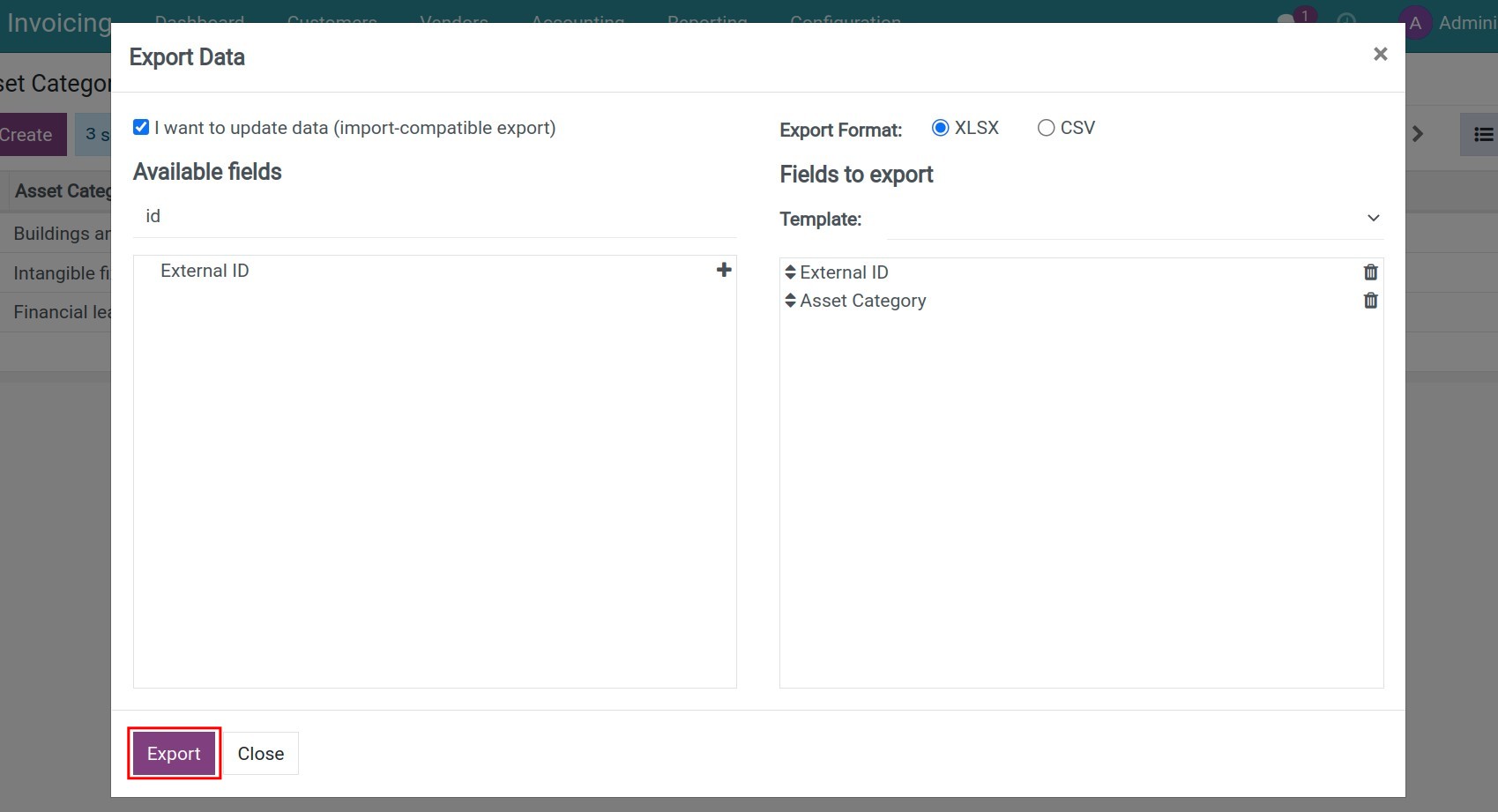

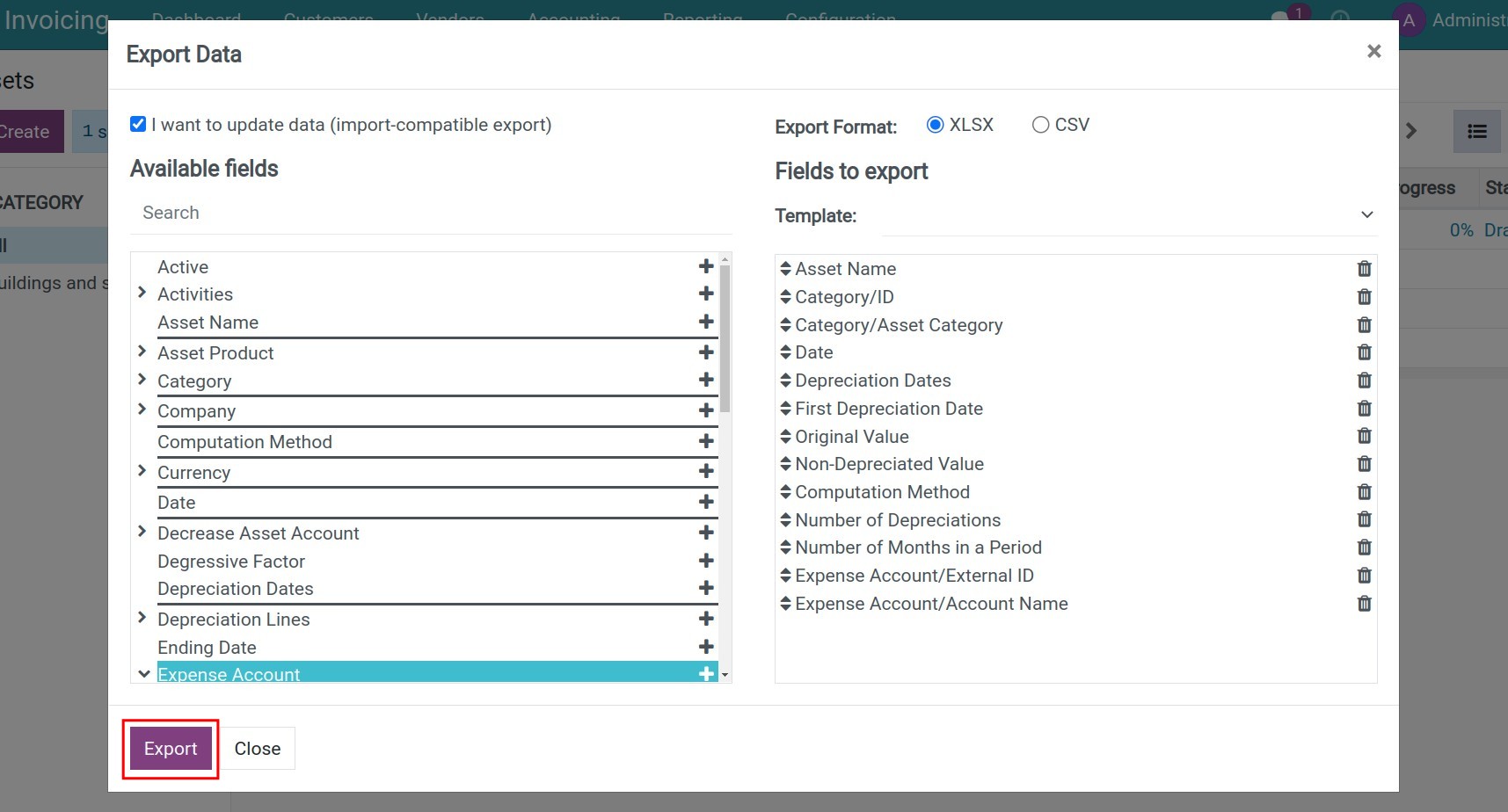

Export system data structure

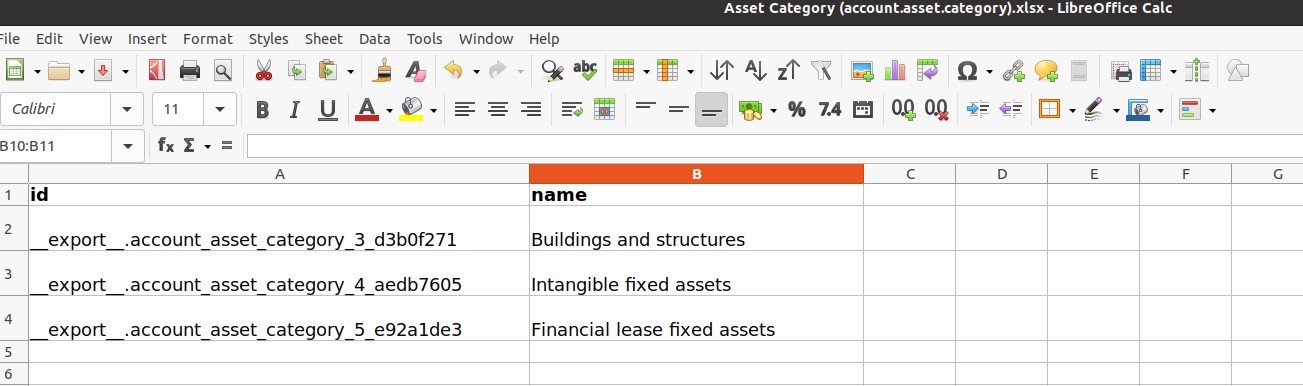

- Export the data structure of asset categories

- Export asset data structure template

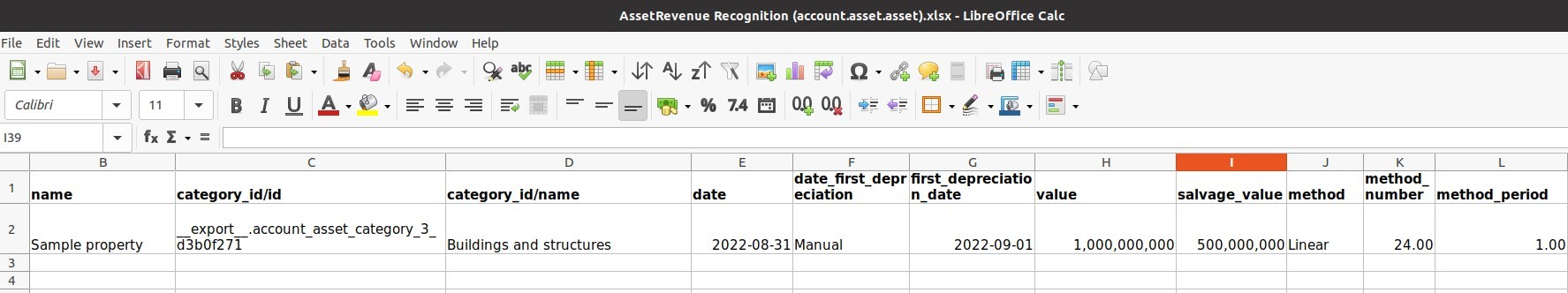

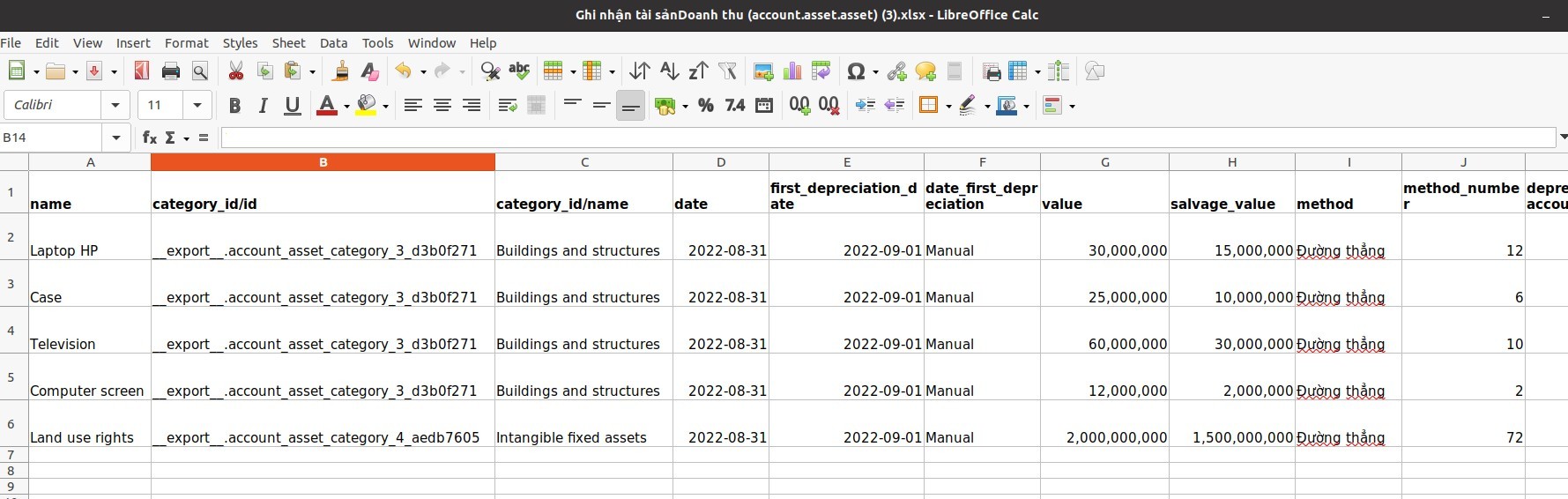

- Add real data to the data template

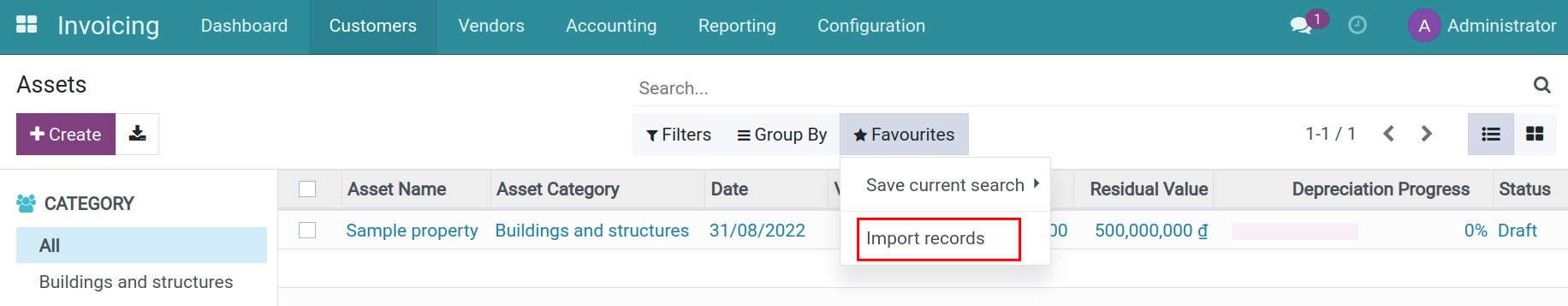

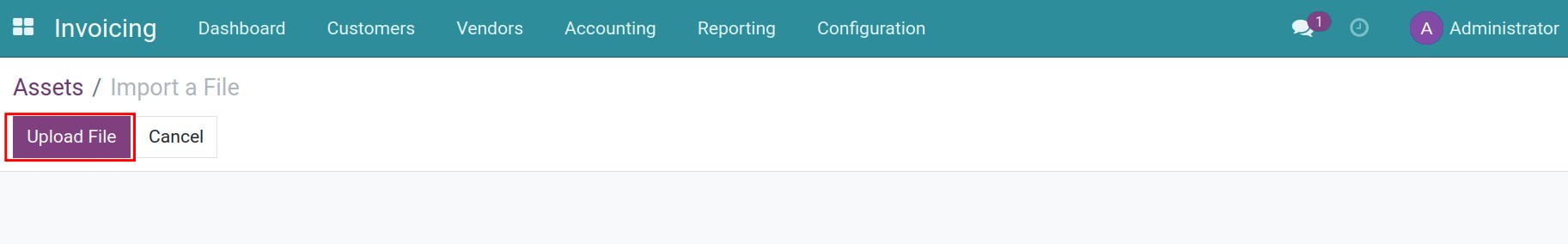

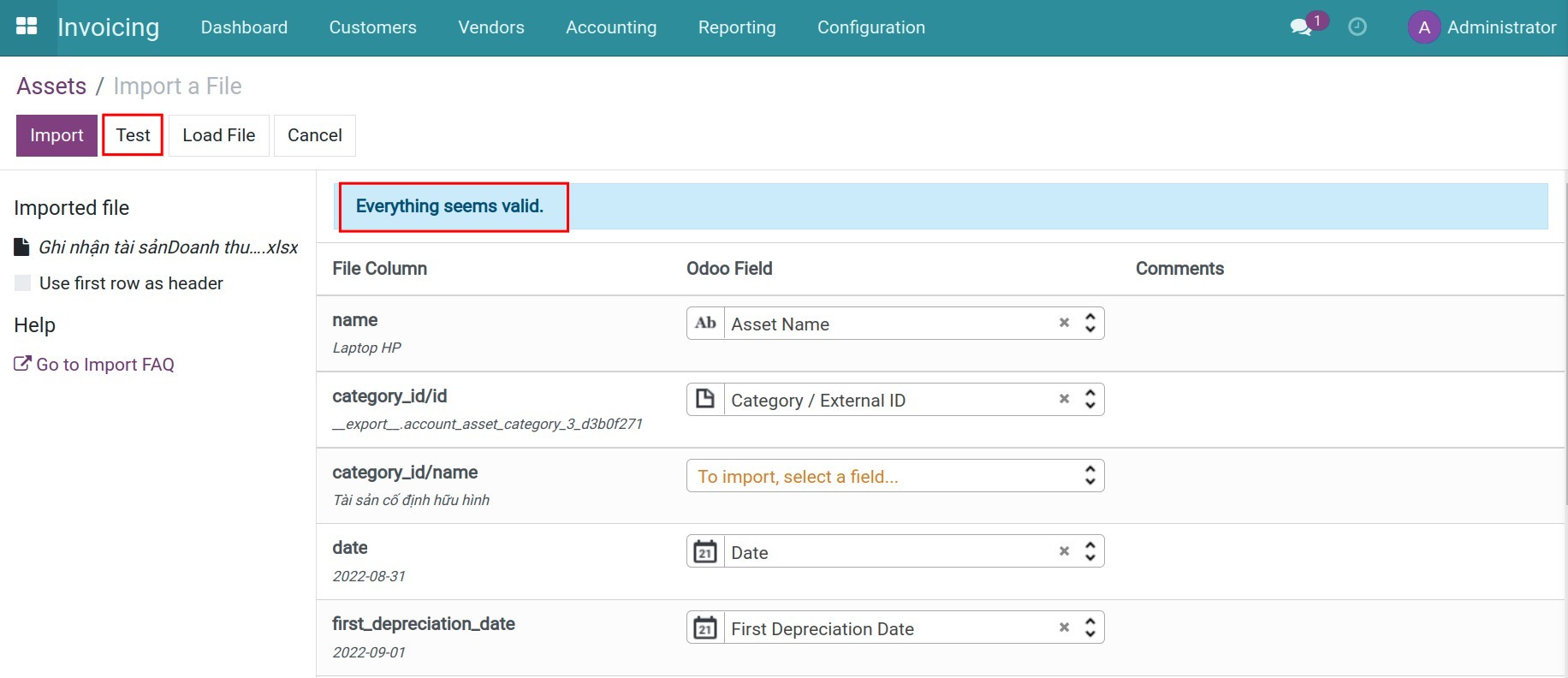

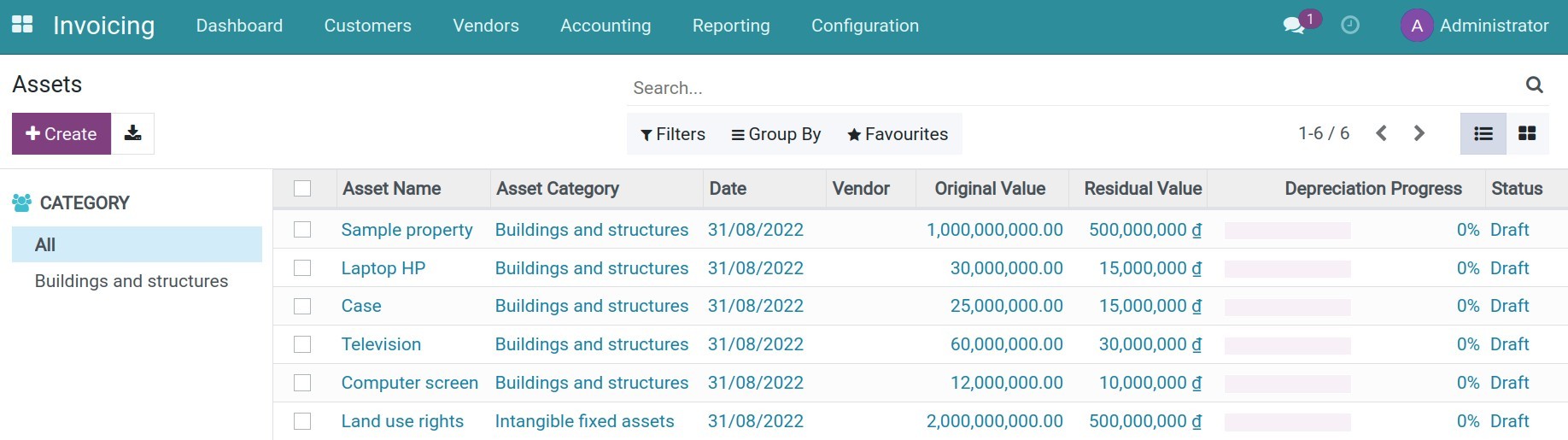

- Import data to the system

-

Default Taxes

-

Default Taxes

- Definition

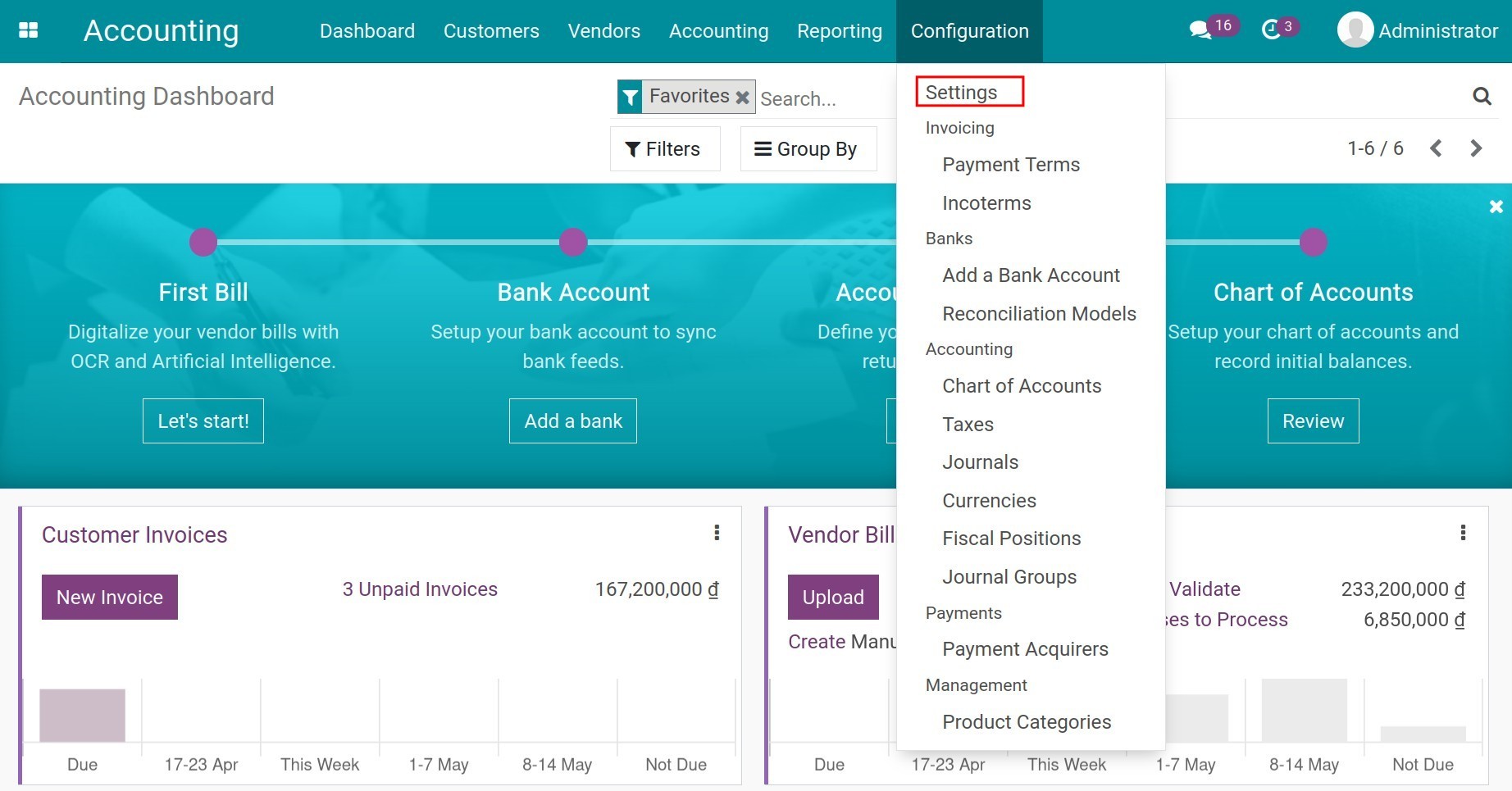

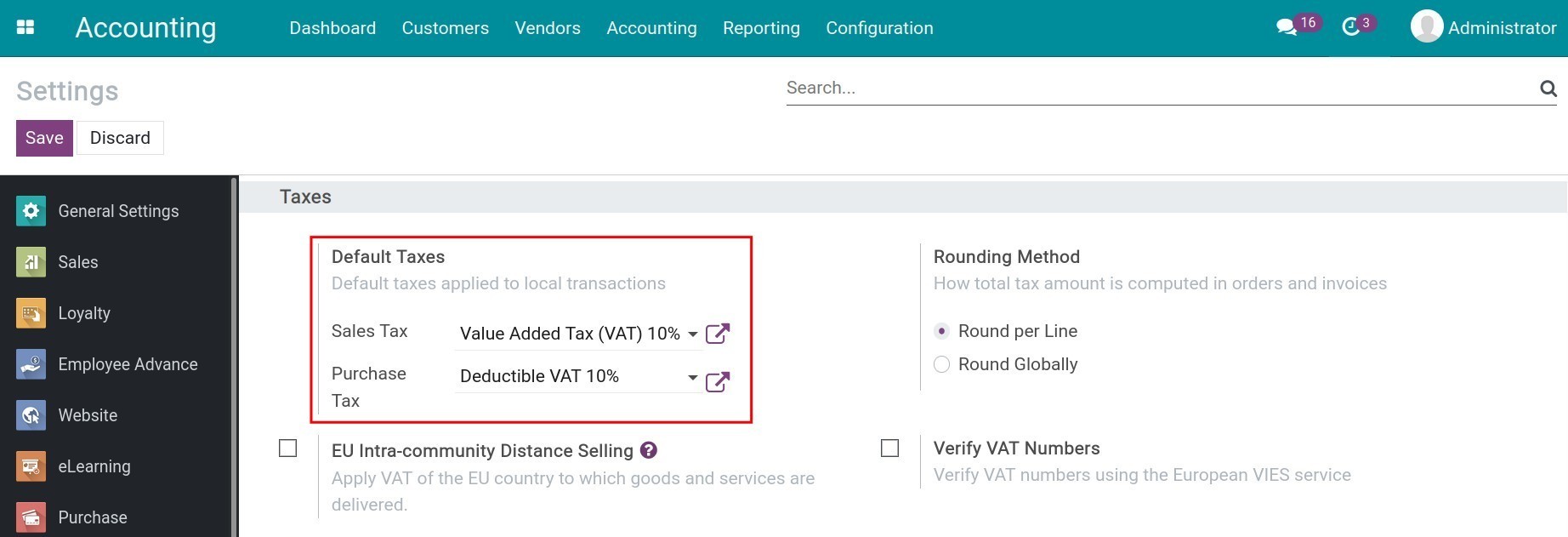

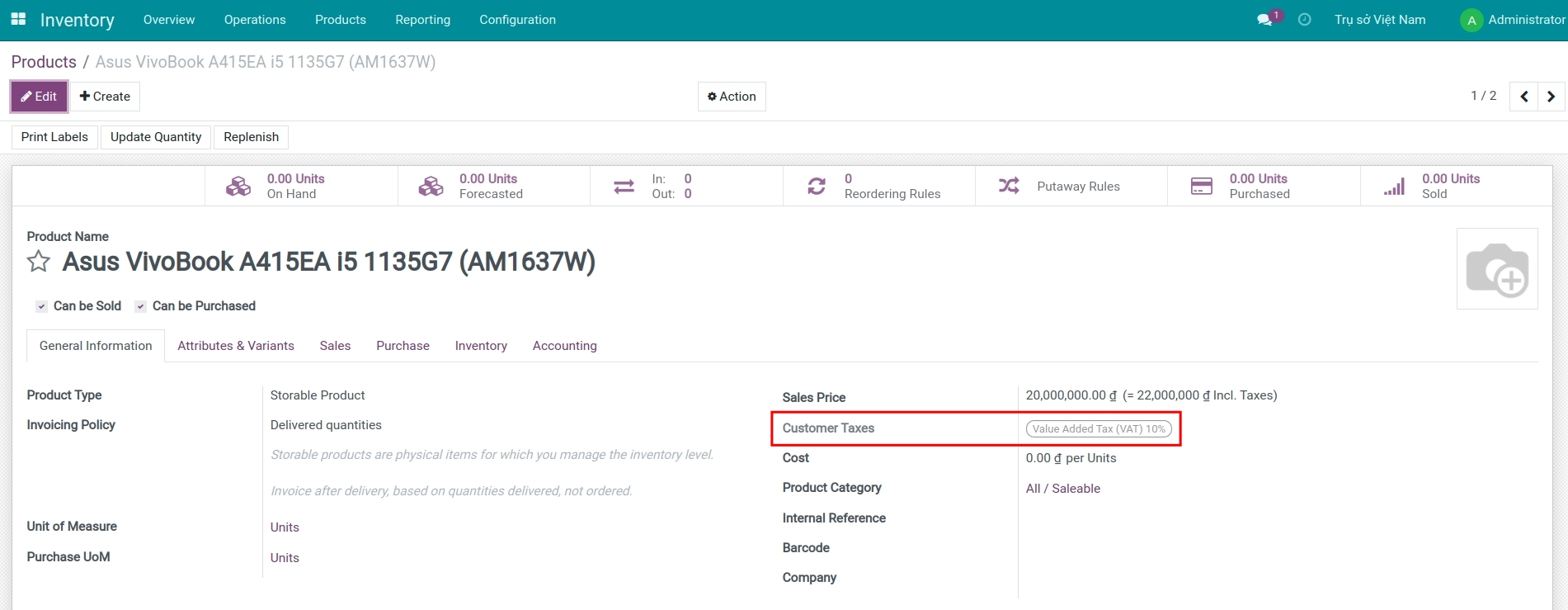

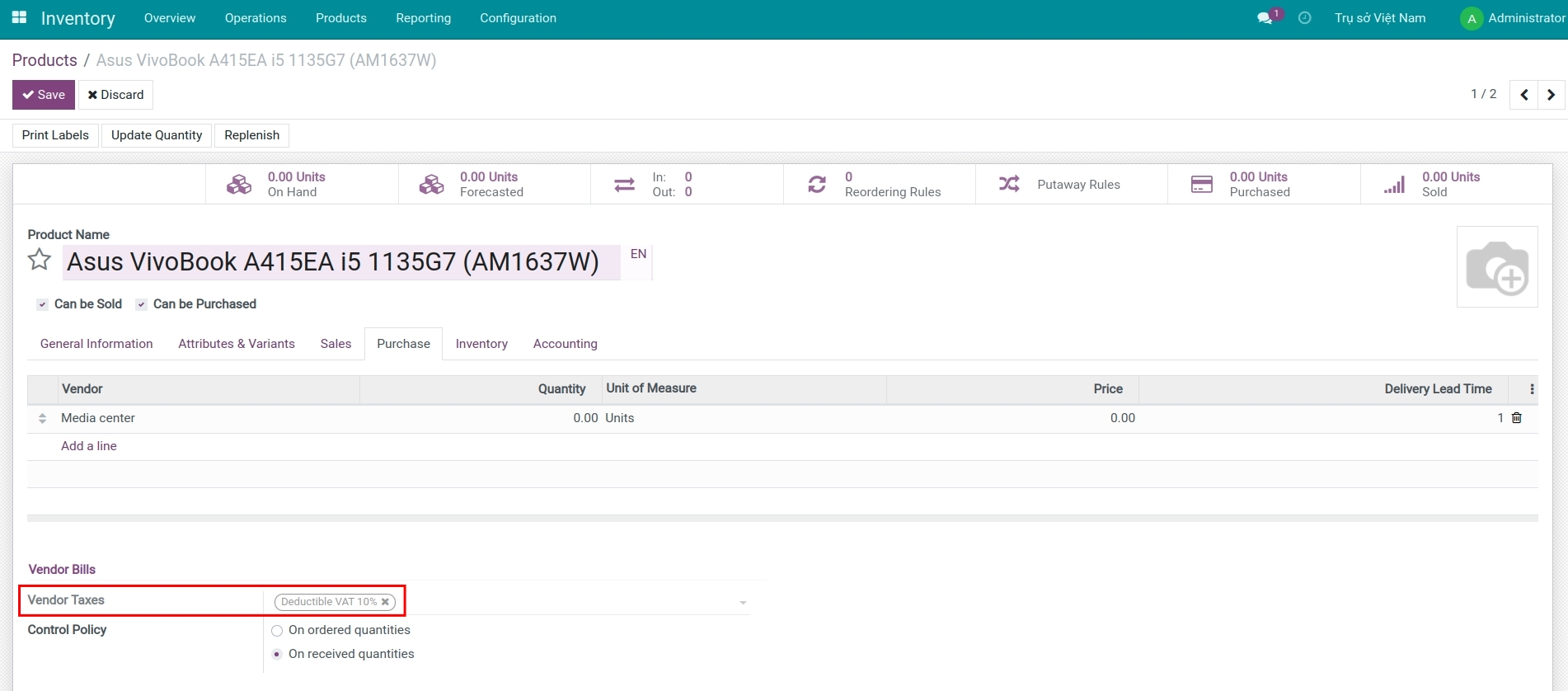

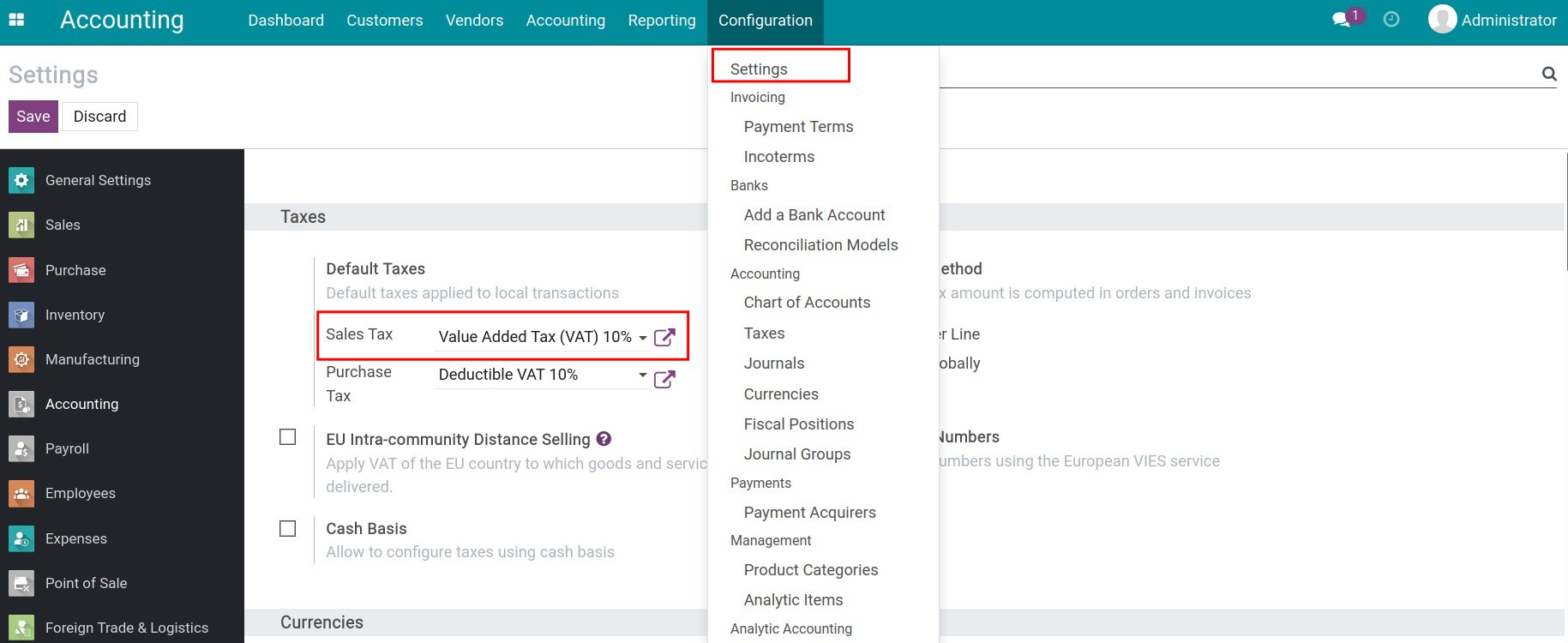

- Configure default taxes

-

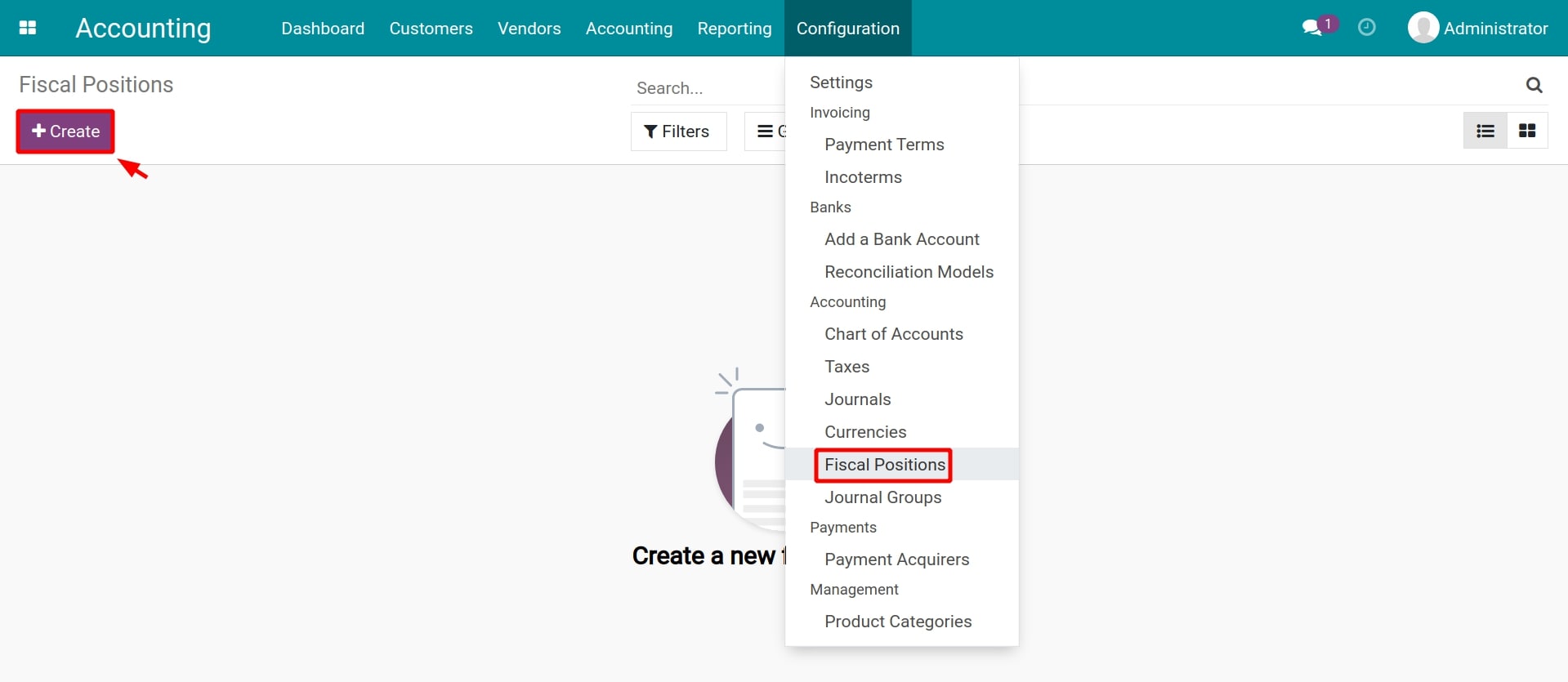

Steps to setup Fiscal Position (Taxes and Accounts)

-

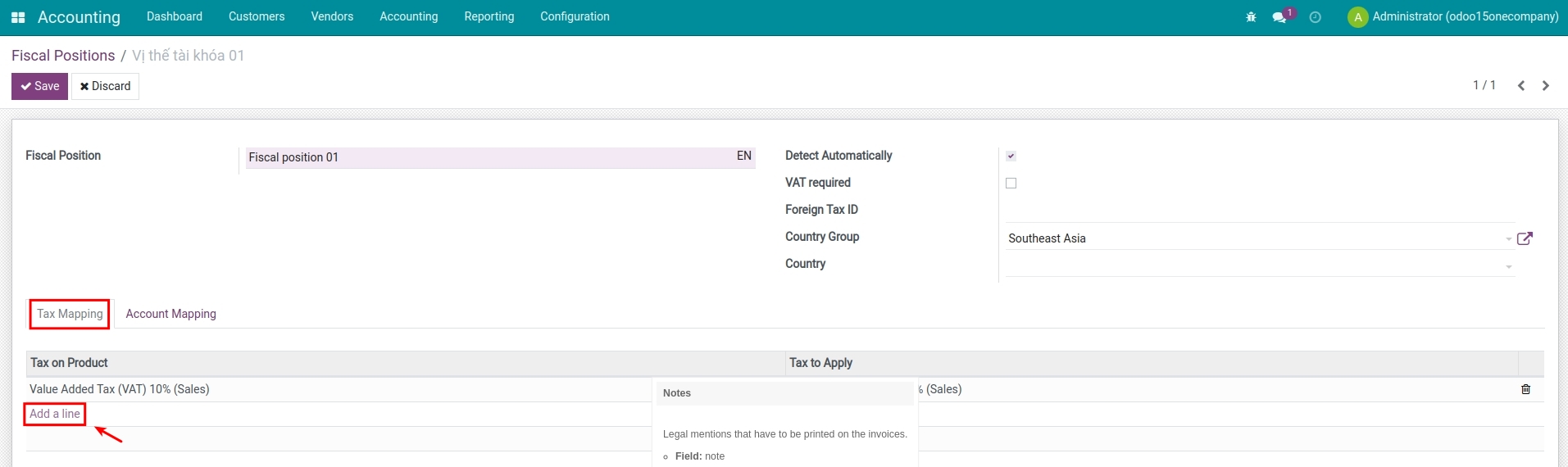

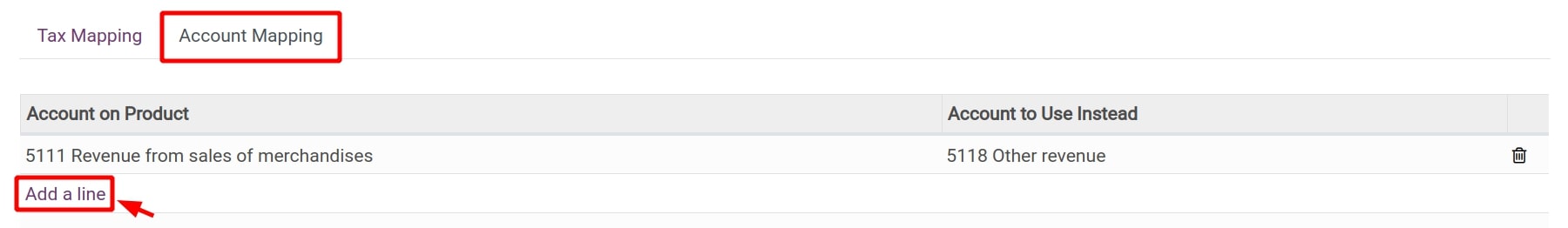

Steps to setup Fiscal Position (Taxes and Accounts)

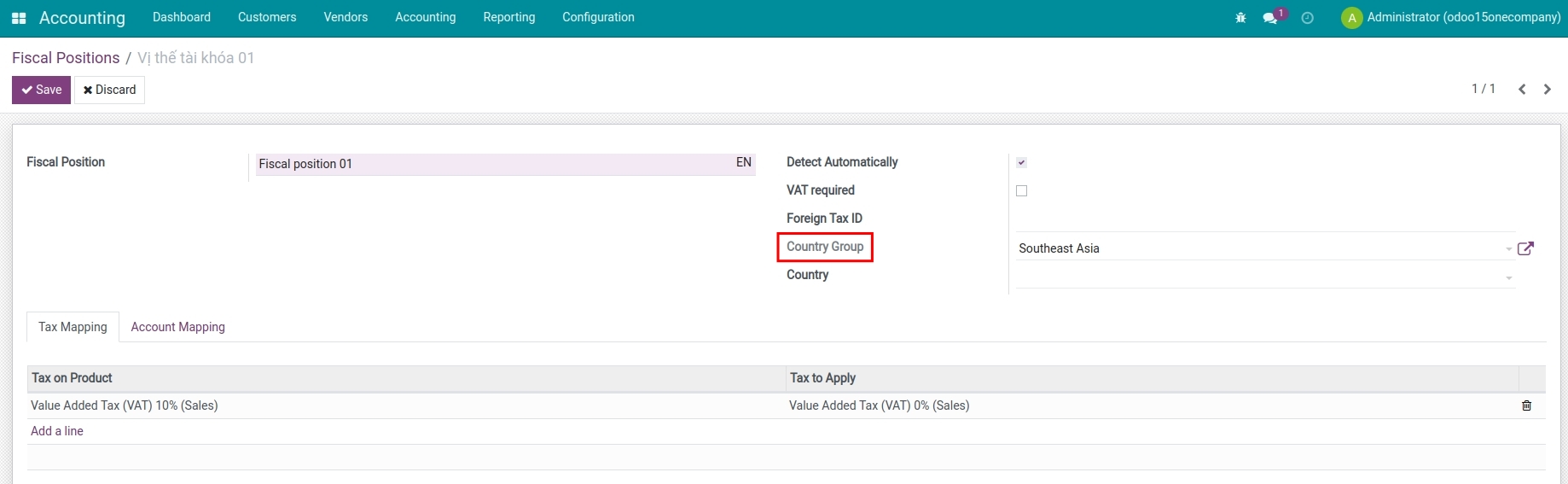

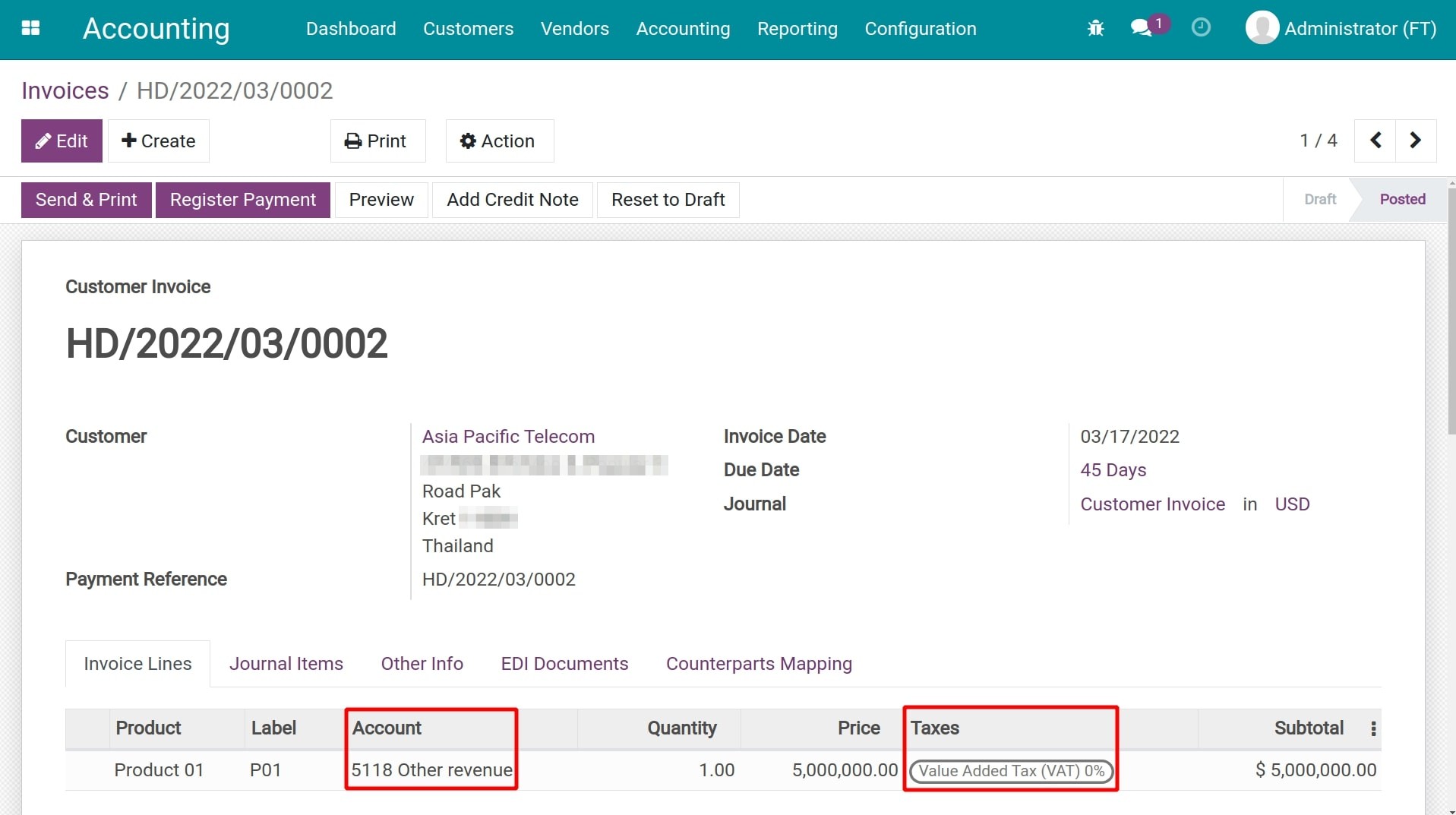

- Configure fiscal position

-

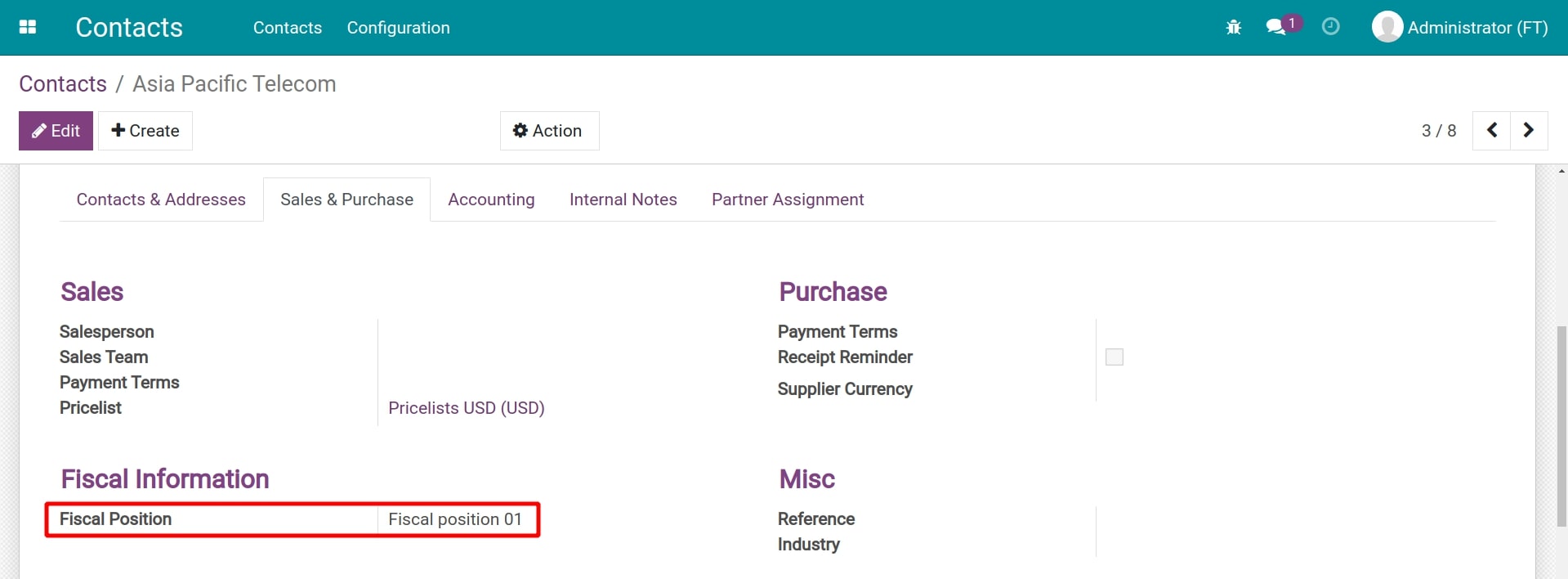

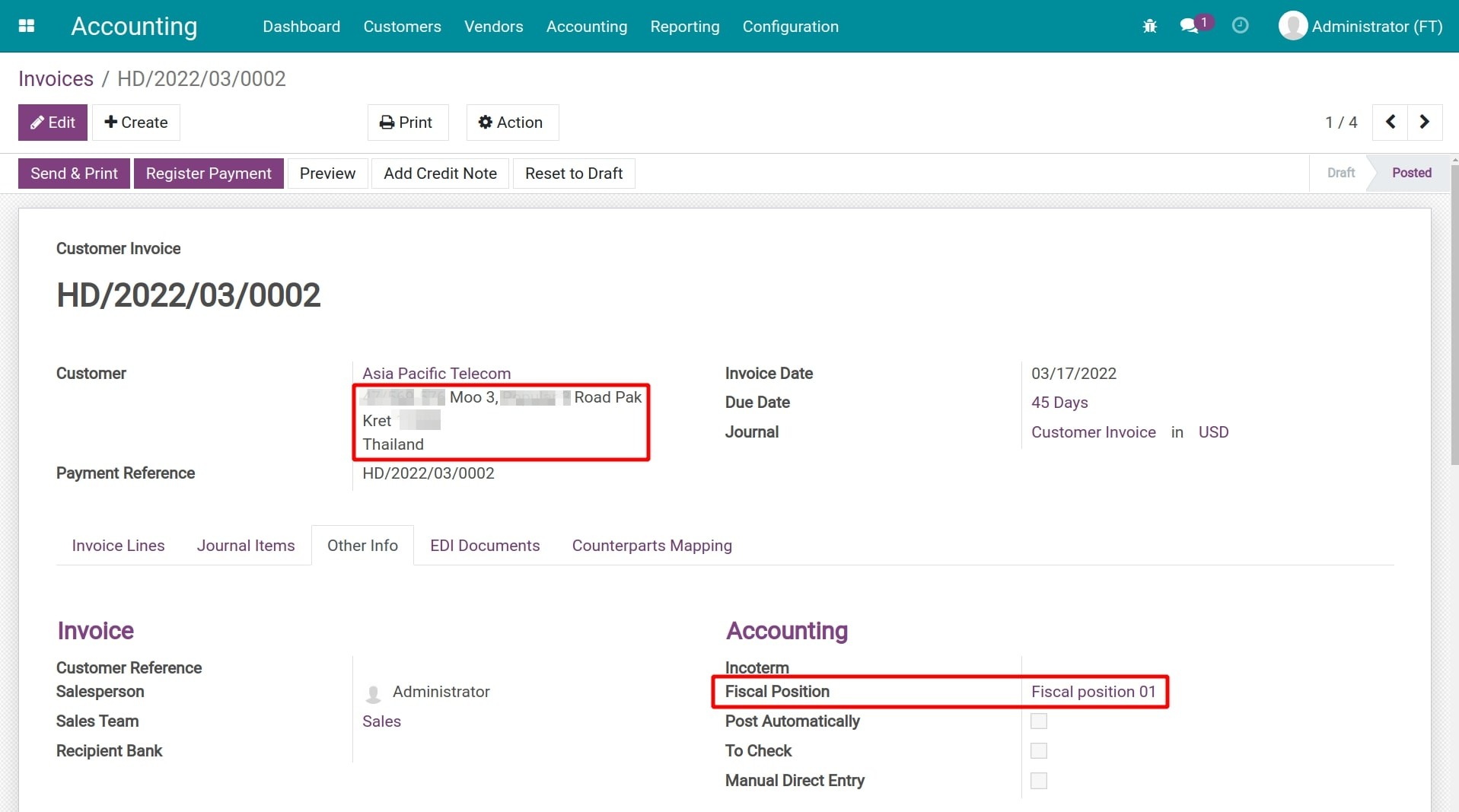

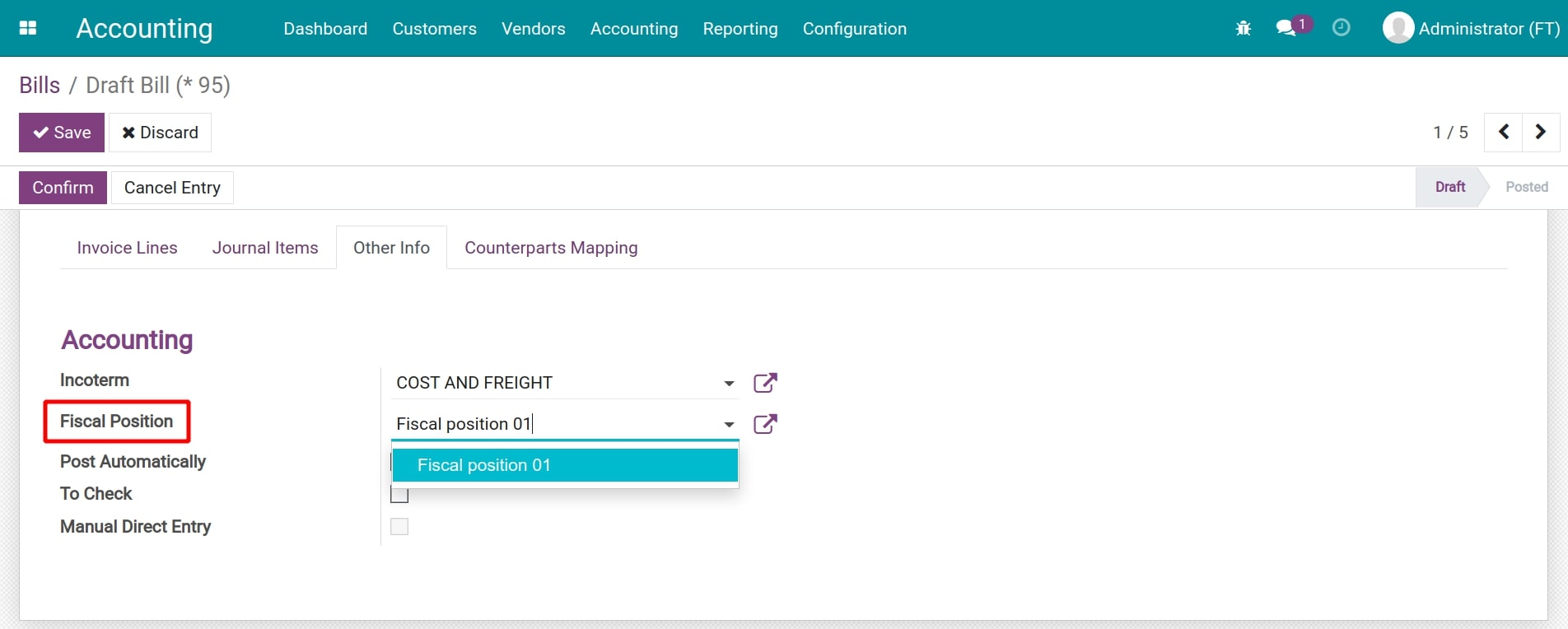

Fiscal position application

- Automatic application

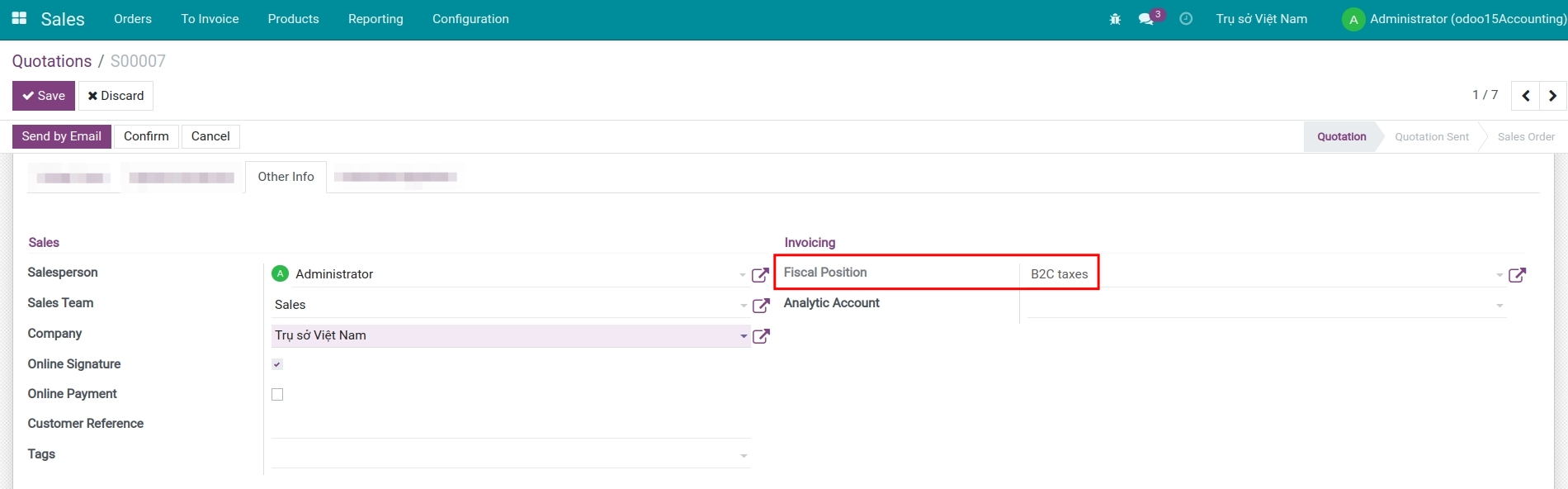

- Manual application

-

Manage the price including or excluding taxes

-

Manage the price including or excluding taxes

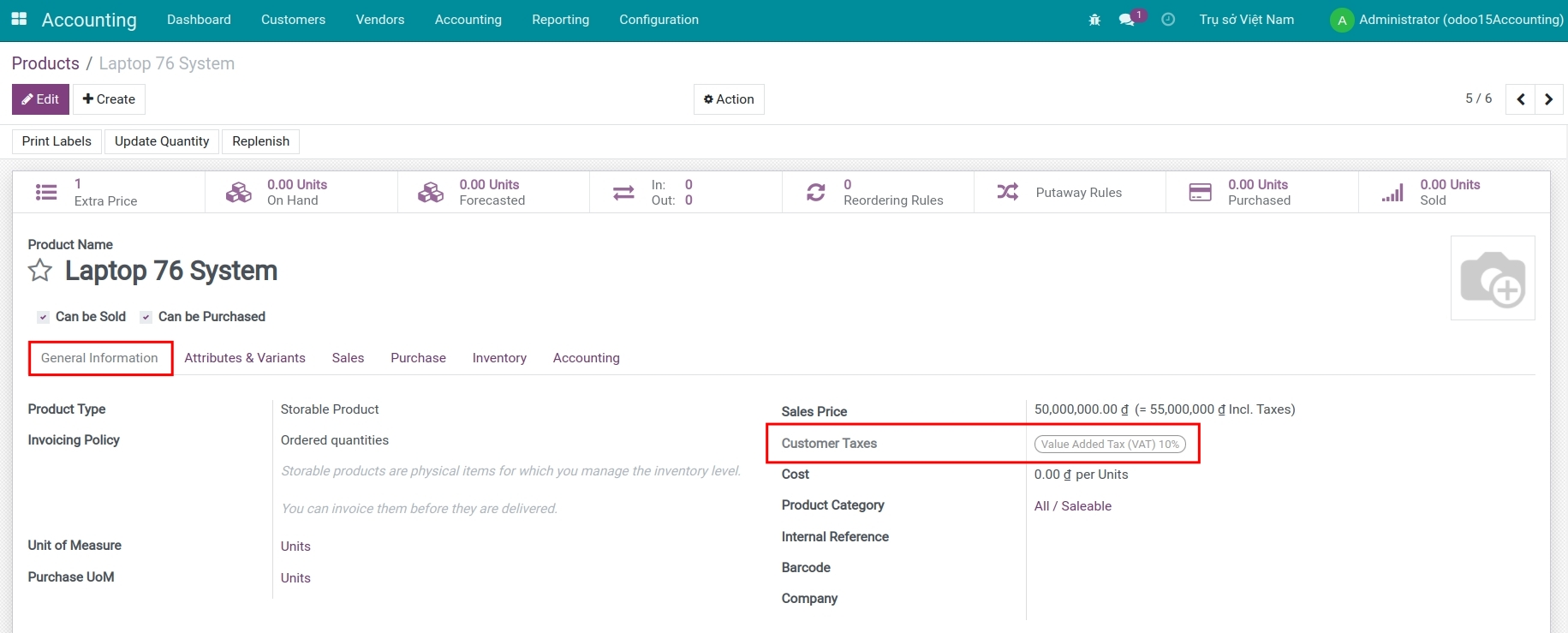

- Default tax configuration

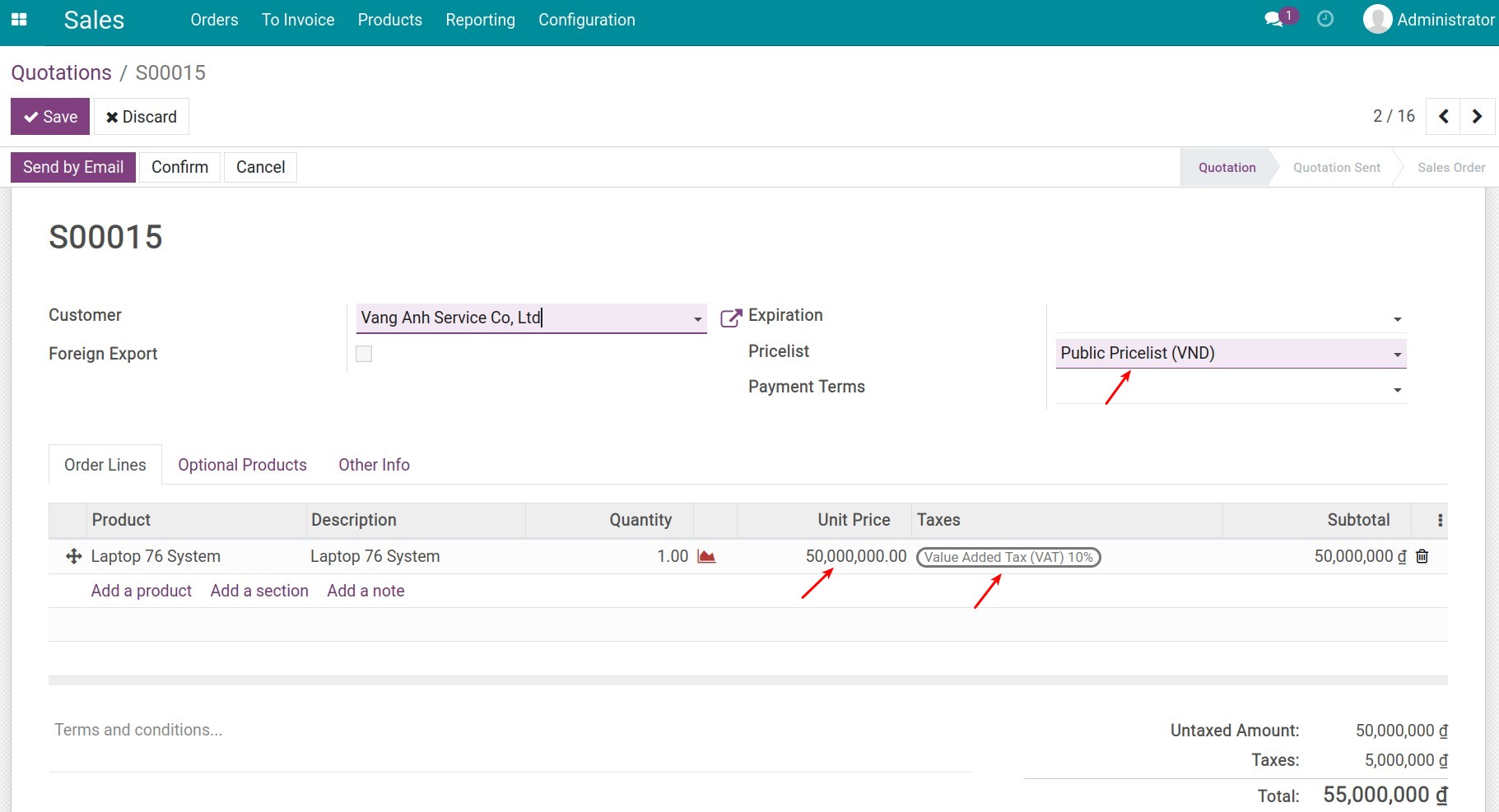

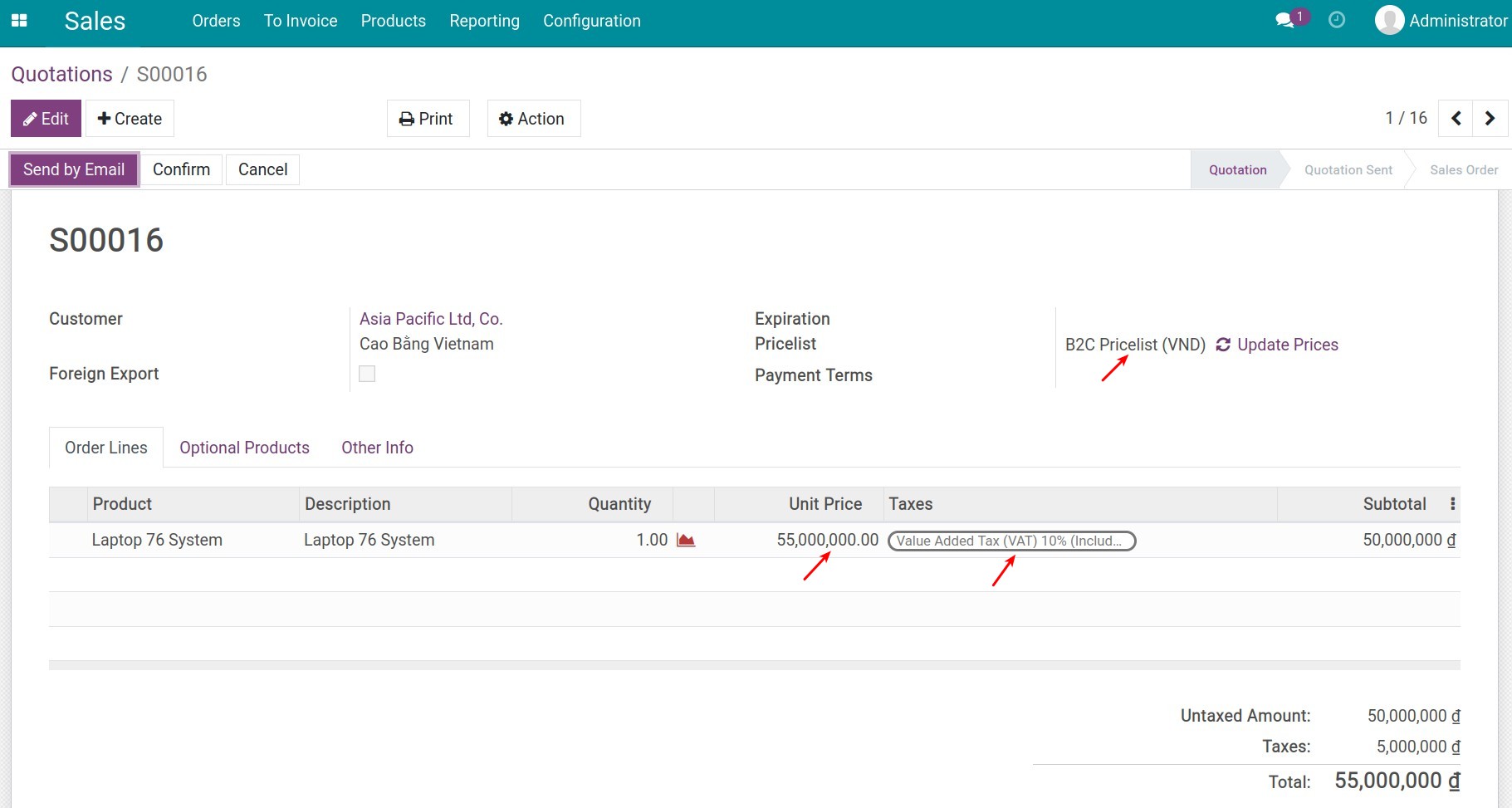

- Create a B2C pricelist with tax-included price

- Configure fiscal position for tax-included price

- Apply to Sales transactions

-

Manage Retention Taxes

-

Manage Retention Taxes

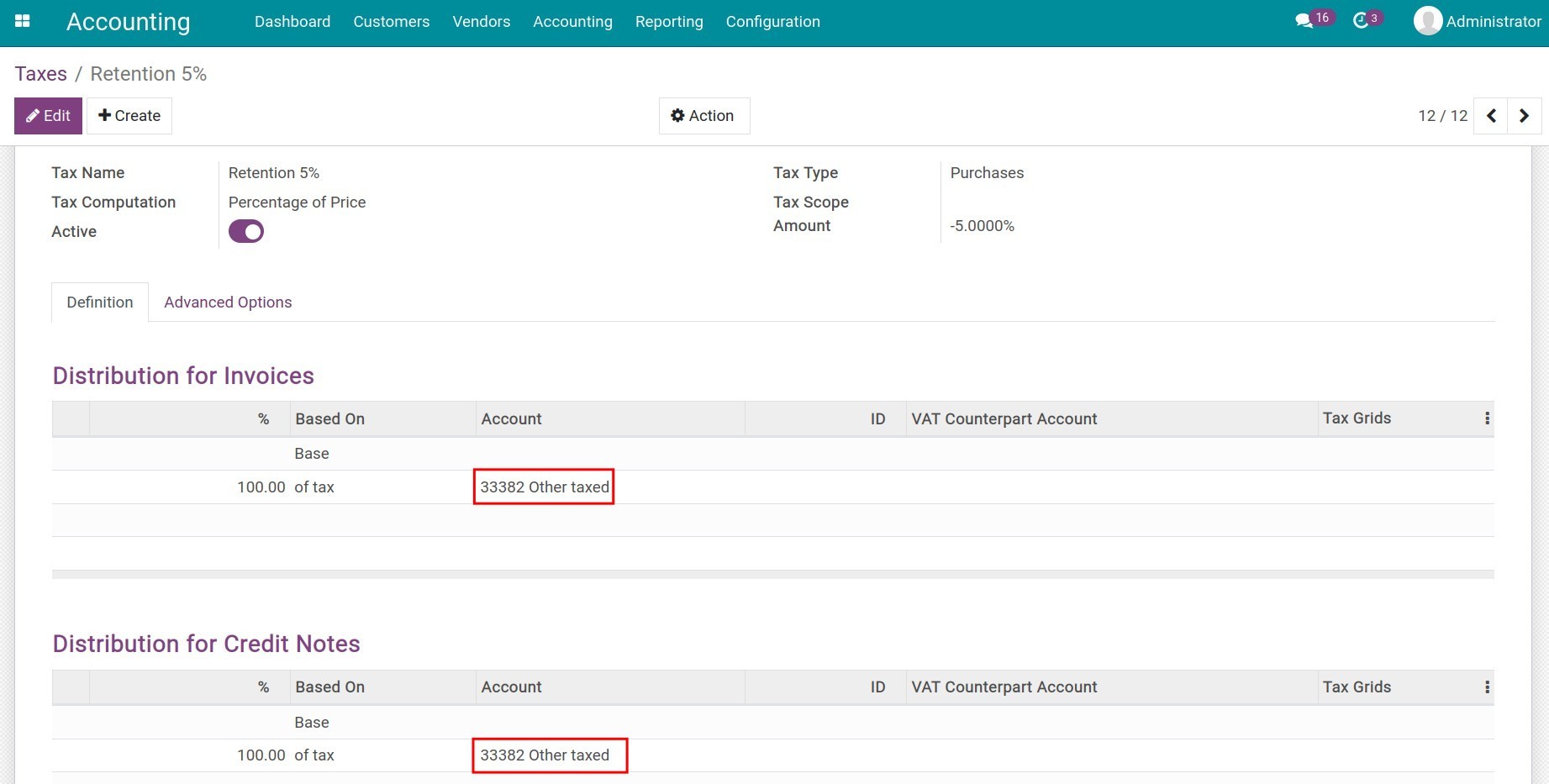

- Retention taxes configuration in Viindoo

- Applying retention taxes on invoices

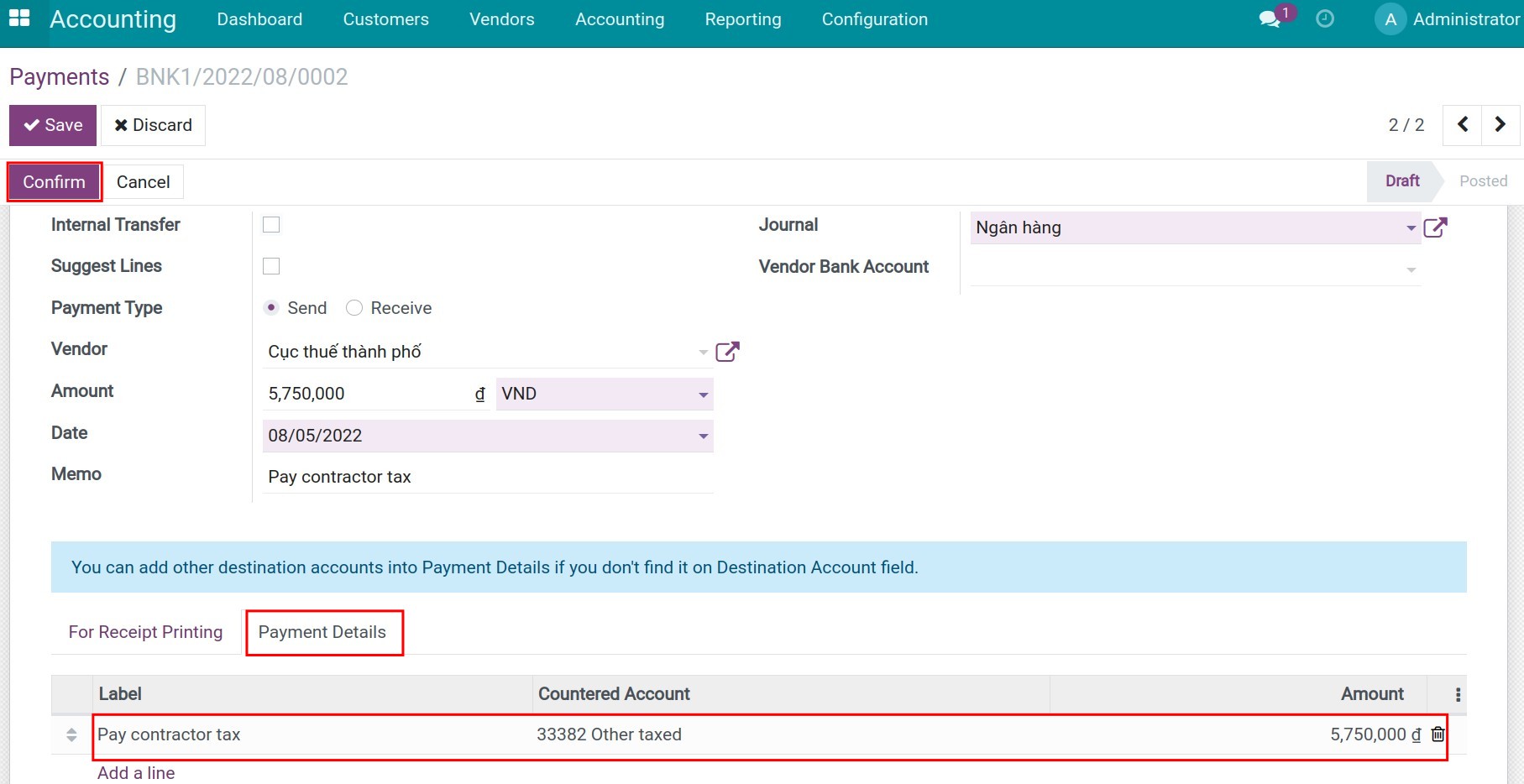

- Pay retention taxes

-

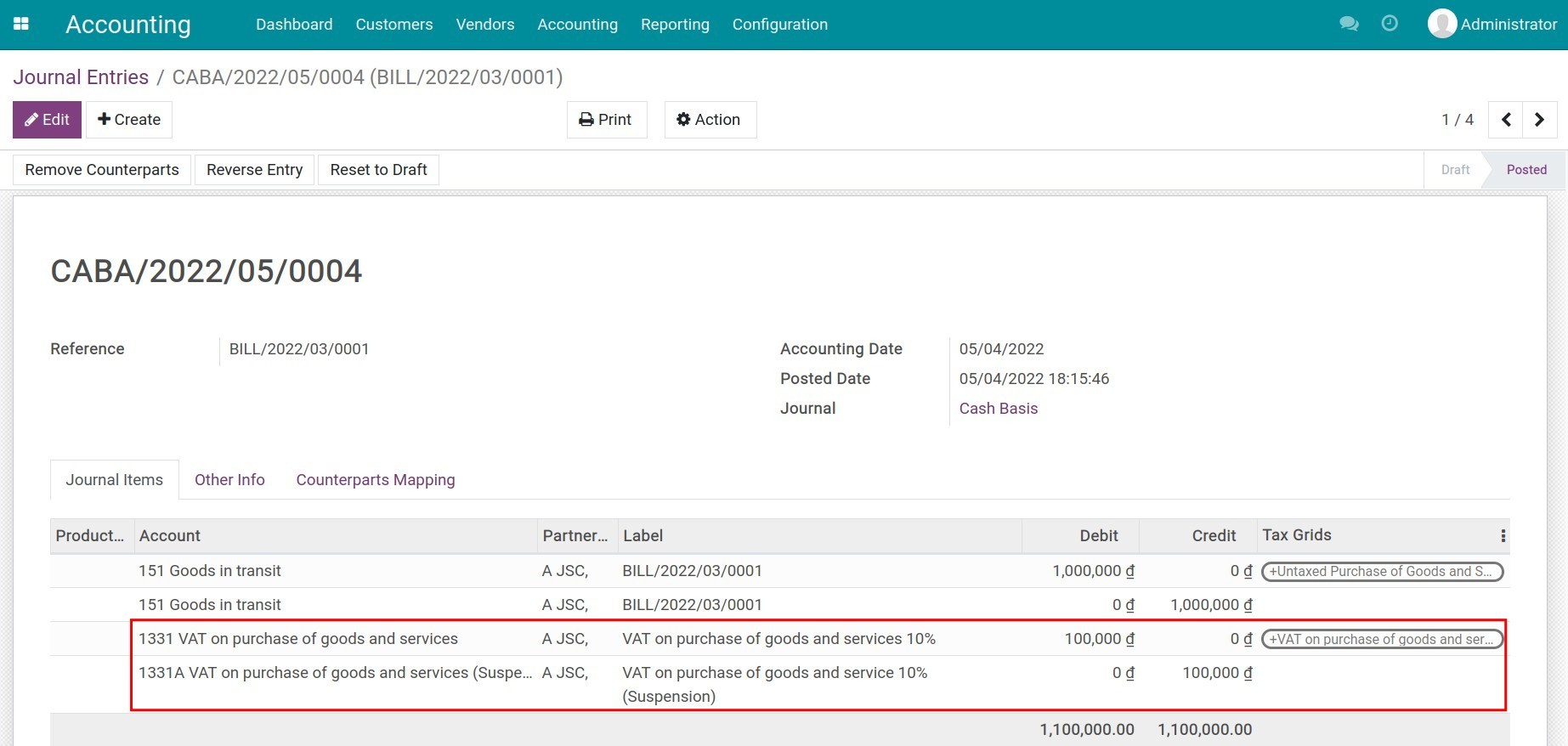

Manage taxes in a cash basis taxpayer

-

Manage taxes in a cash basis taxpayer

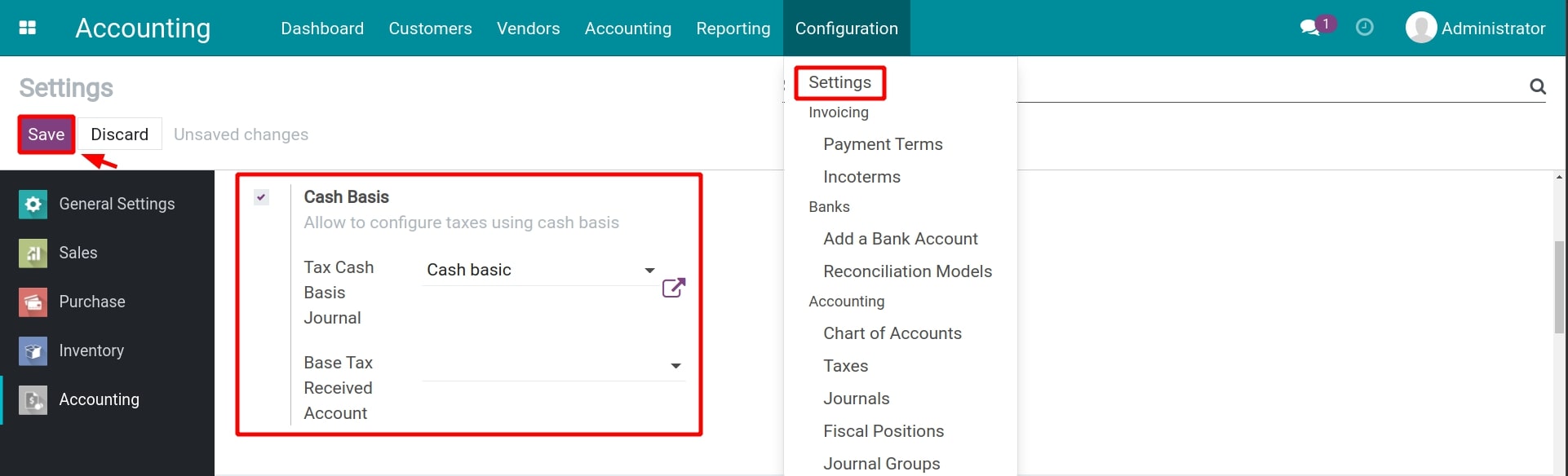

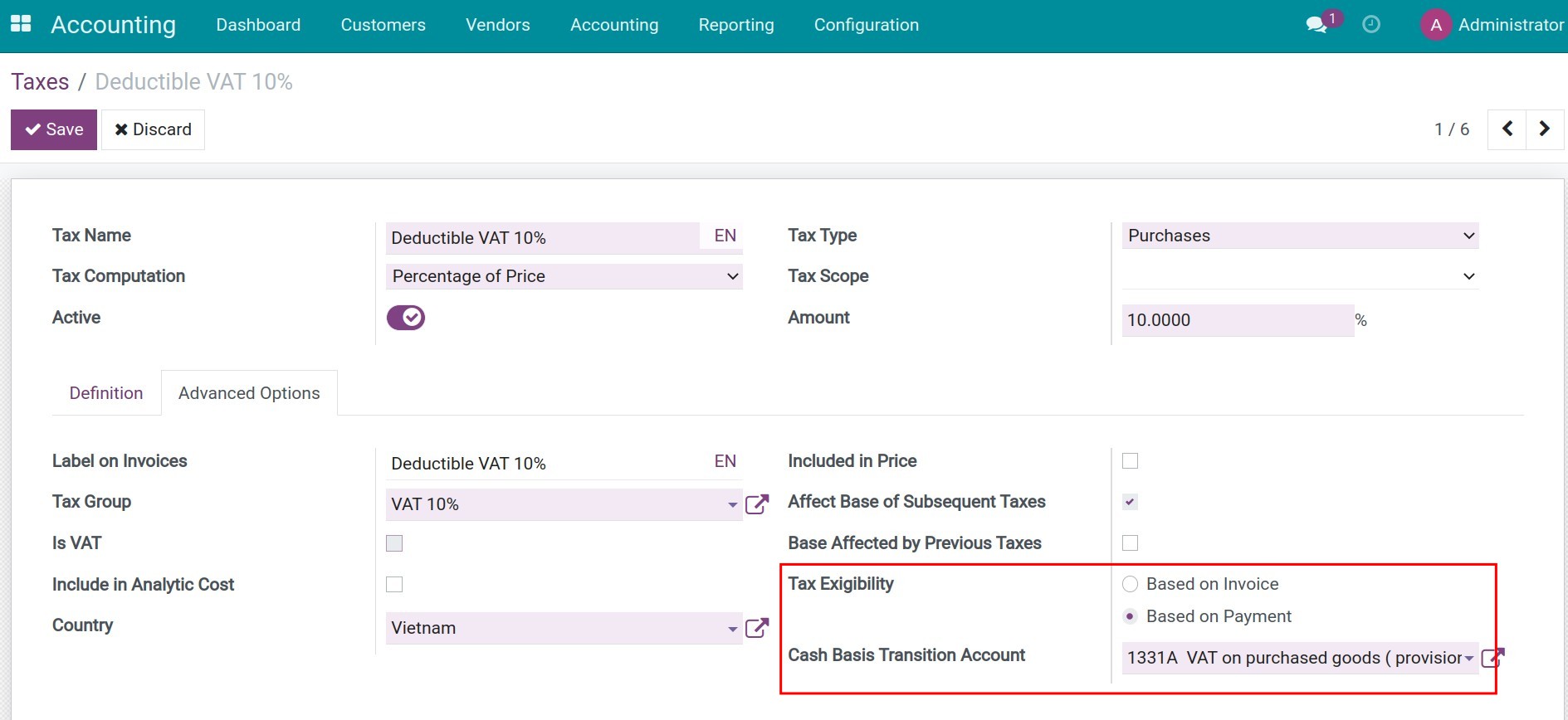

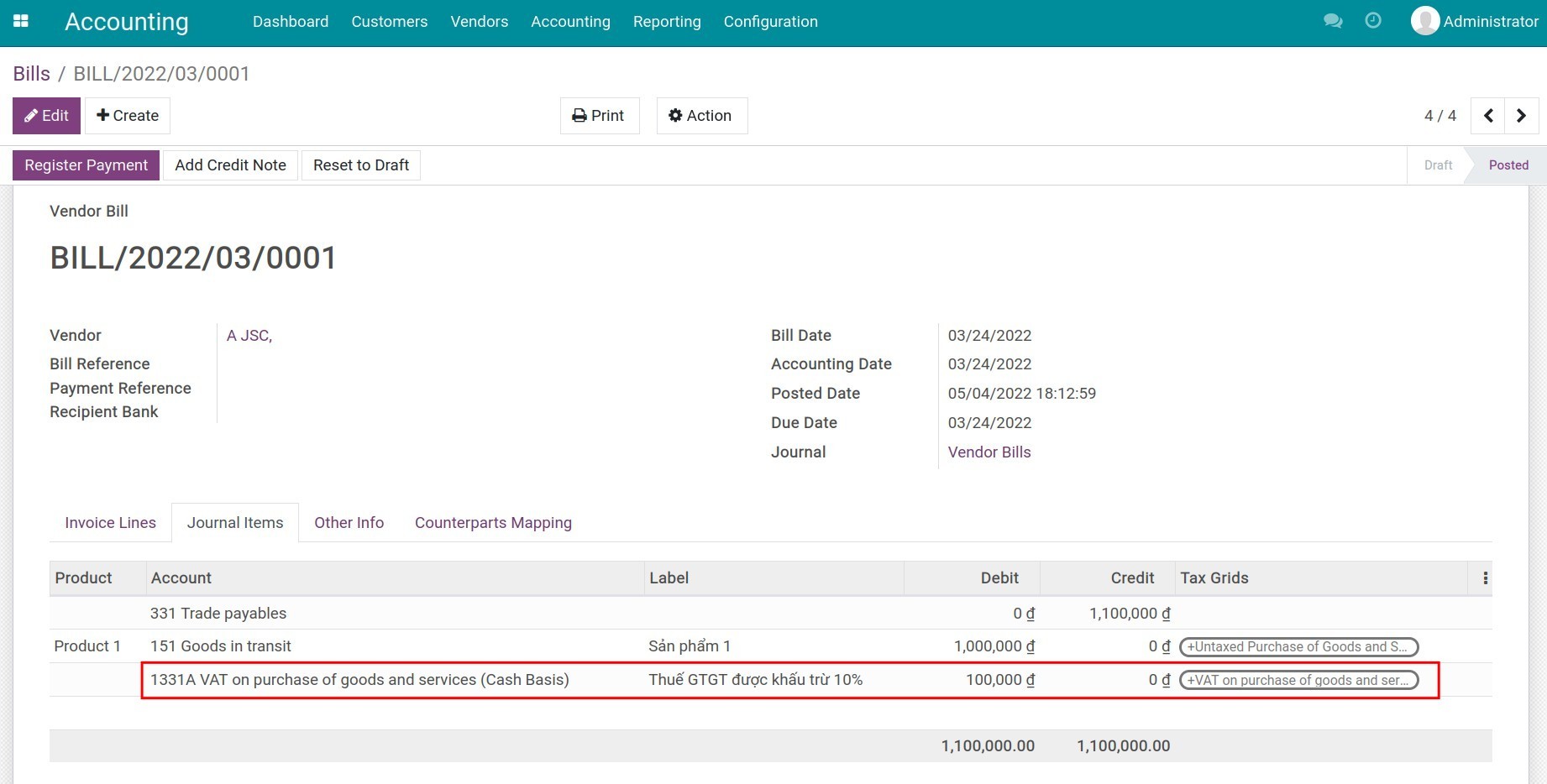

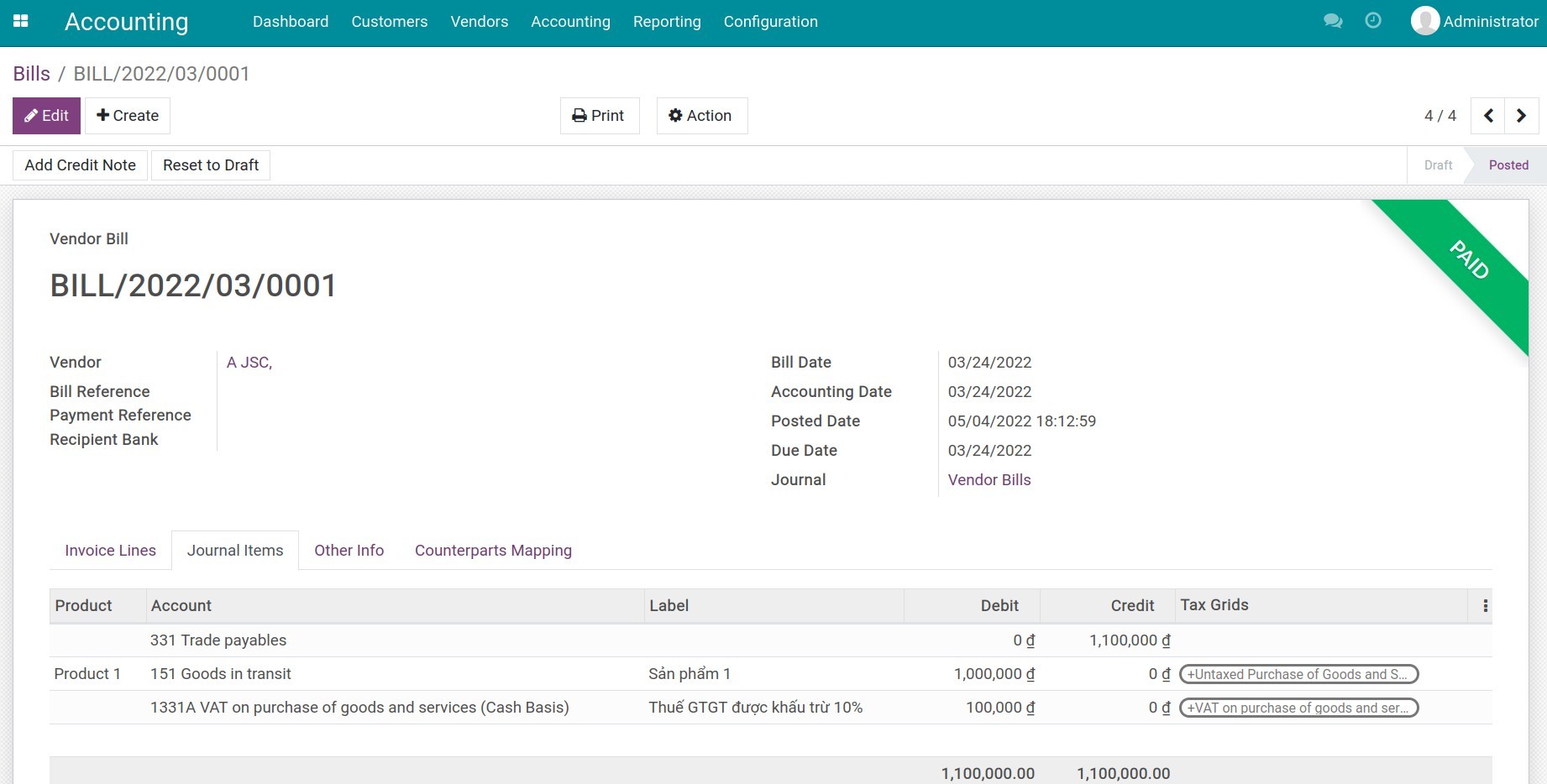

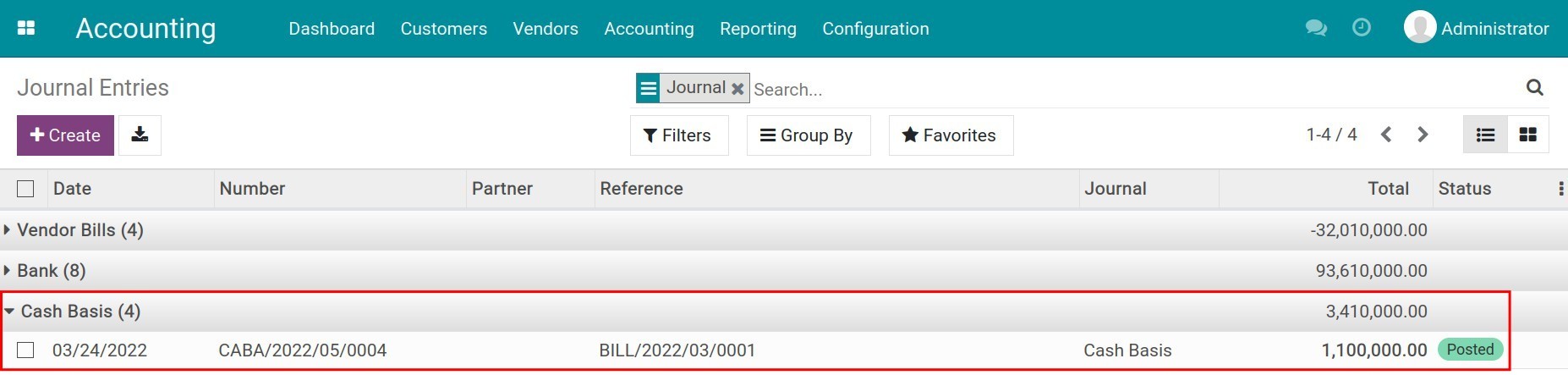

- Related settings

- Manage cash basis taxes

-

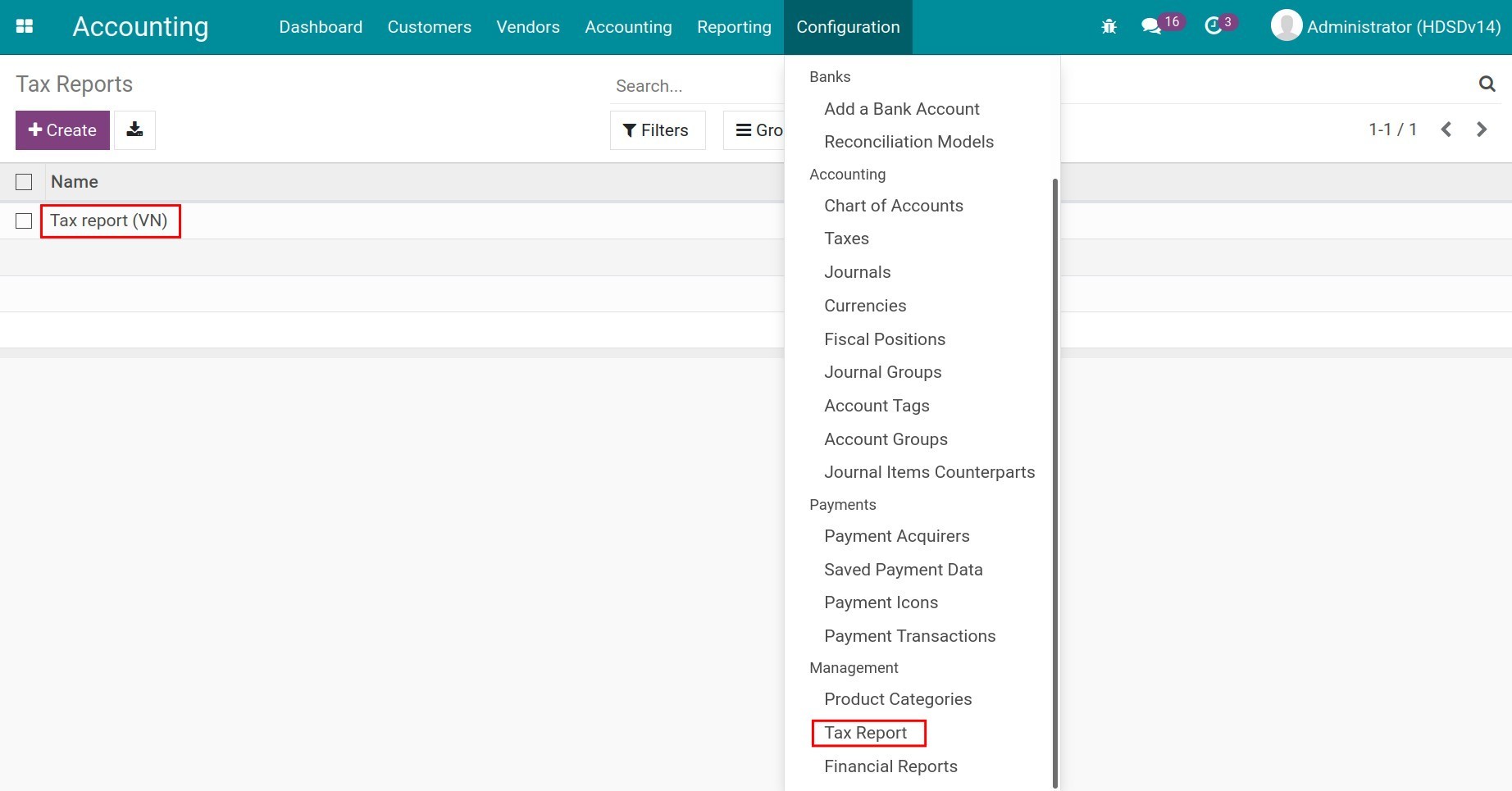

Tax reports using tax grids

-

Tax reports using tax grids

-

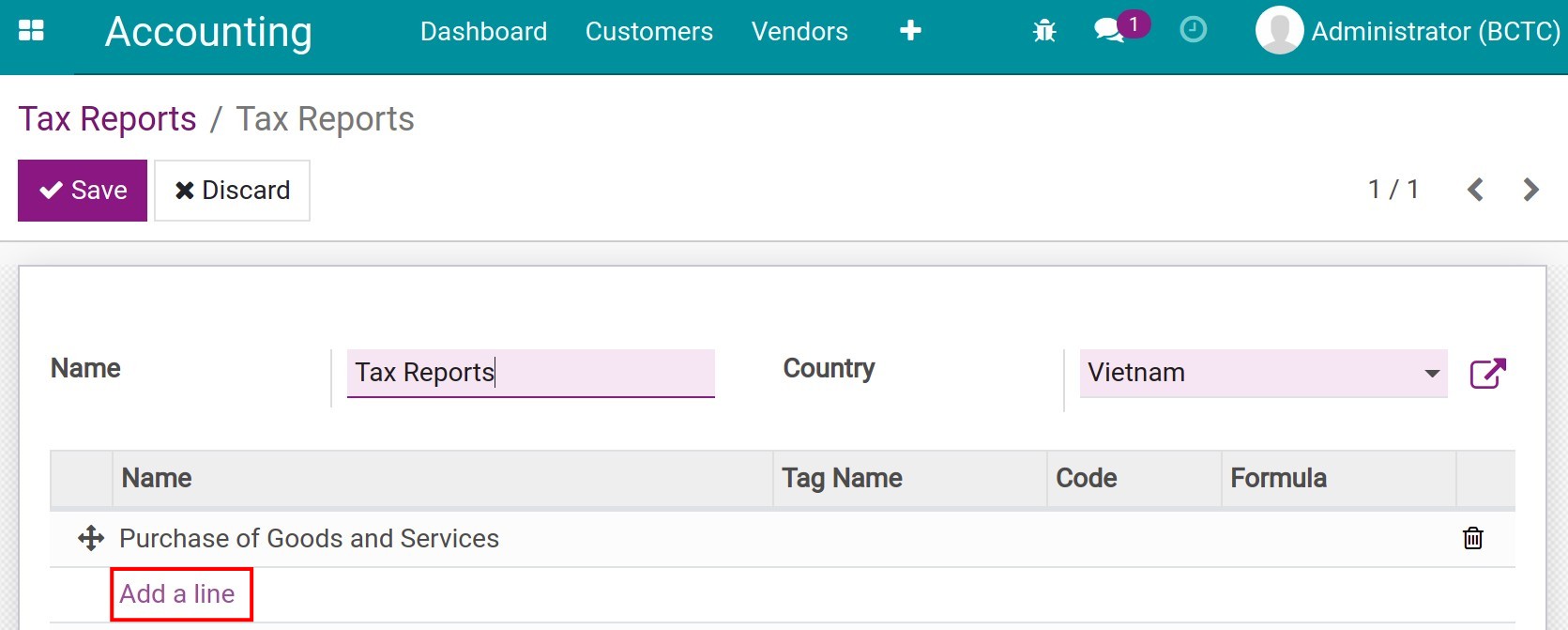

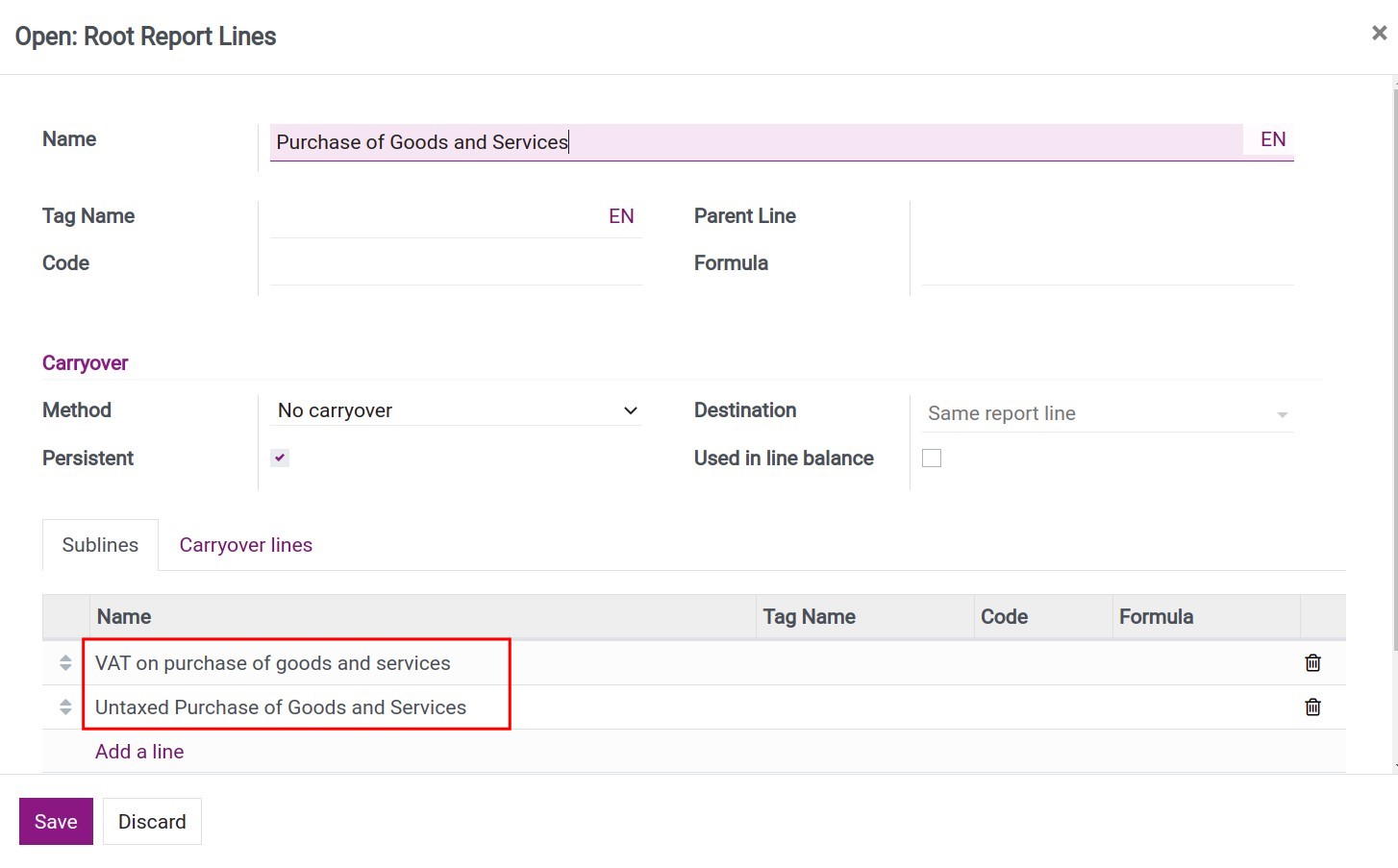

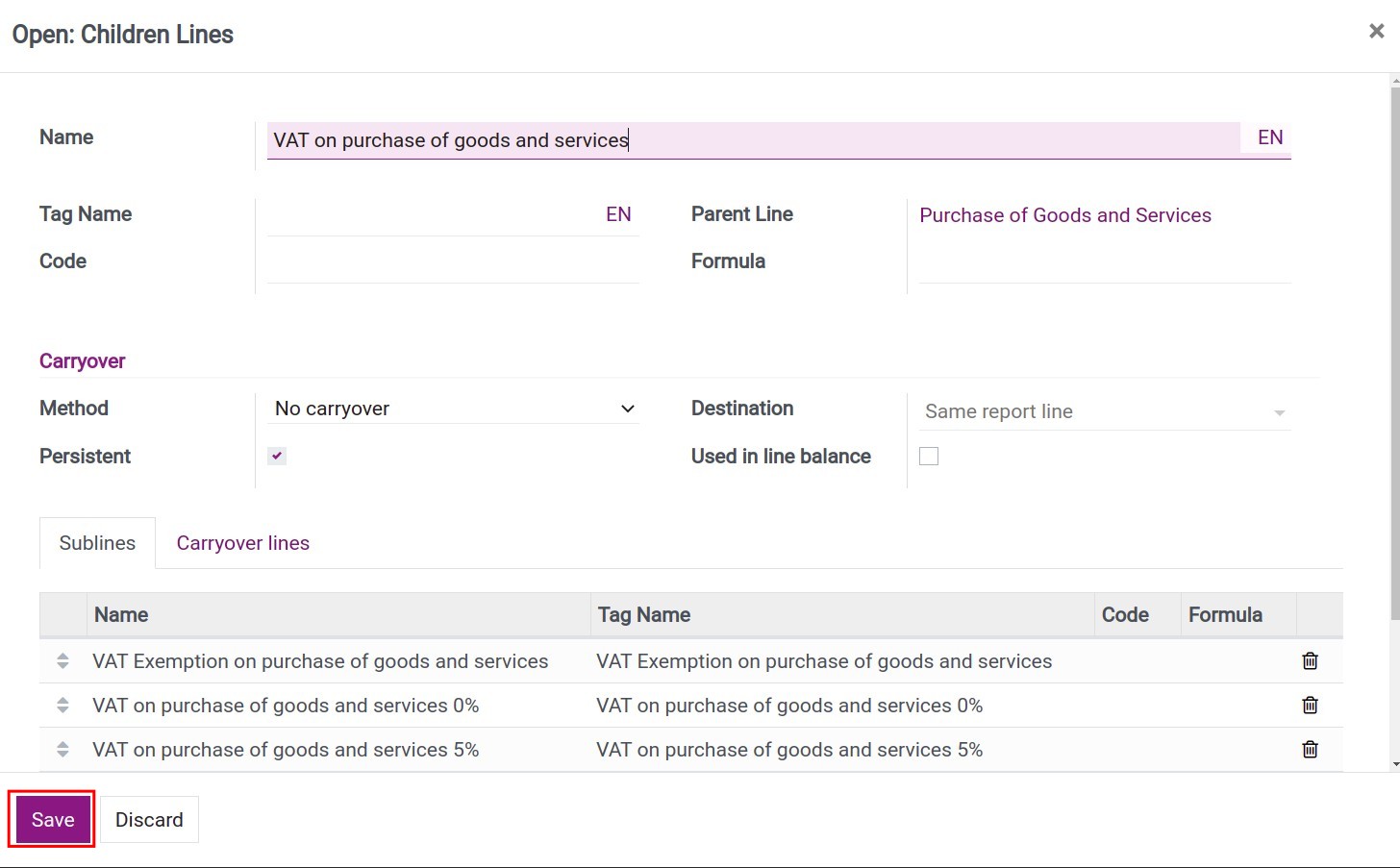

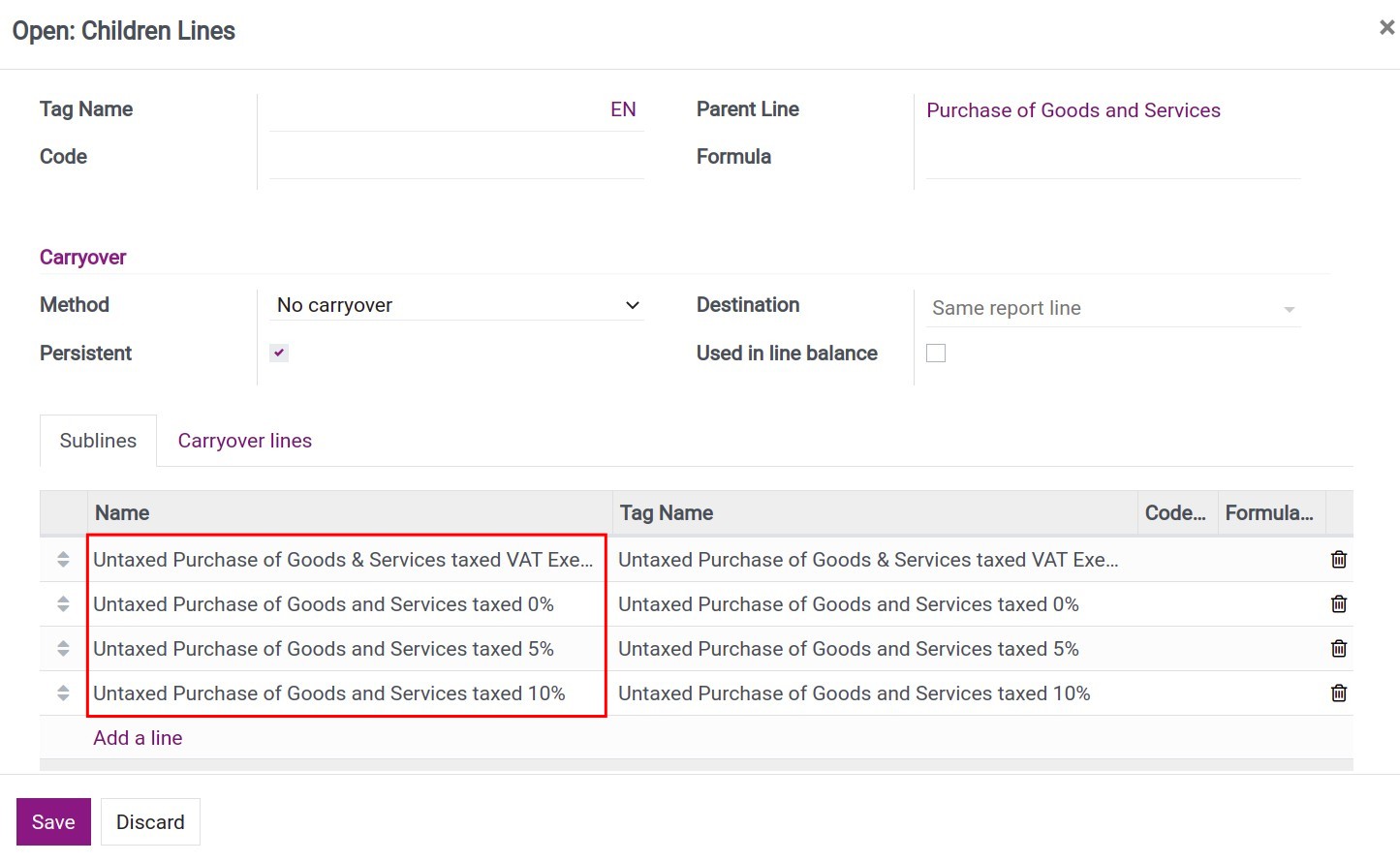

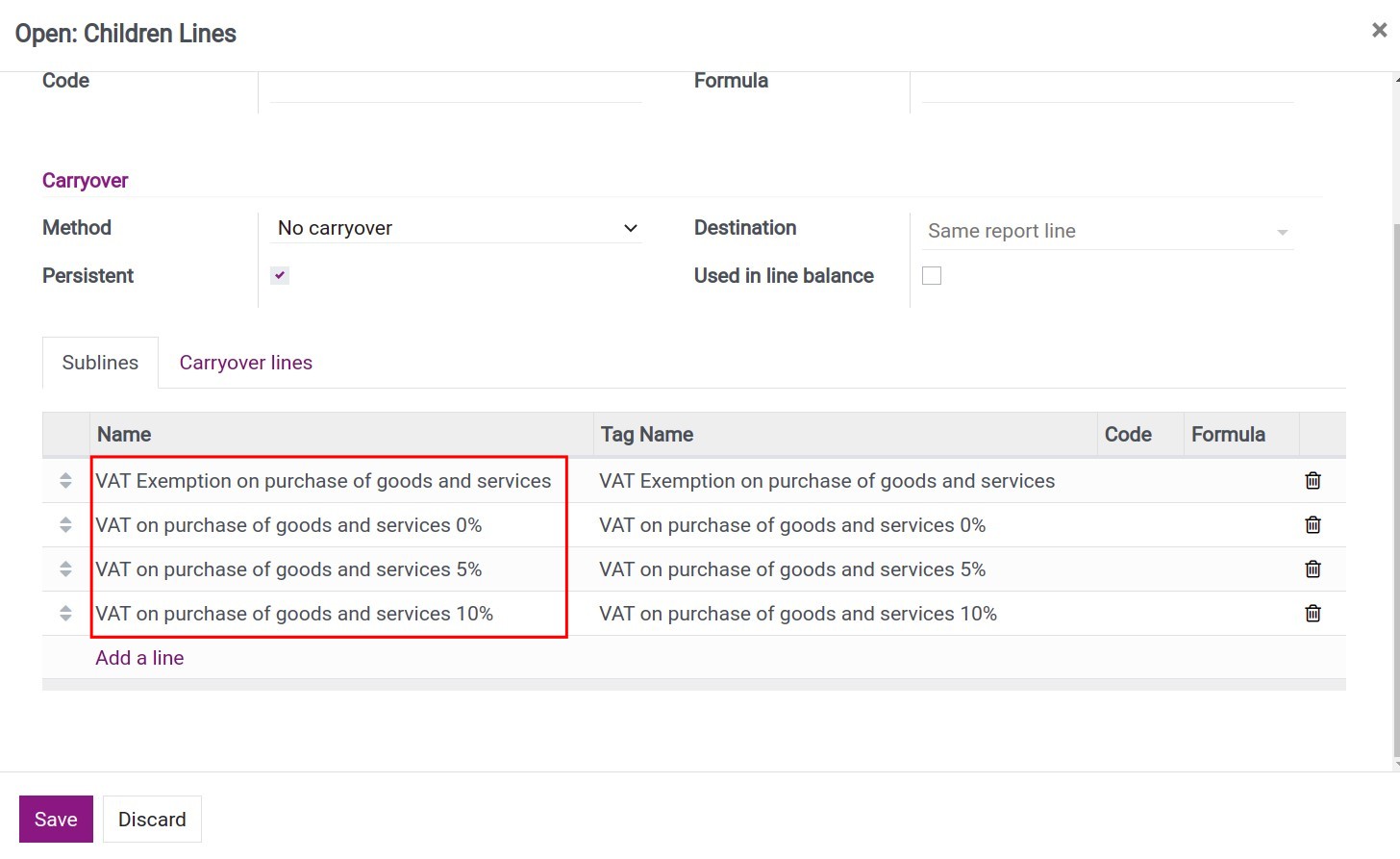

Create a tax grid on the Accounting app

- Create a Tax report

- Create a root report line

- Create a child line to display on the report

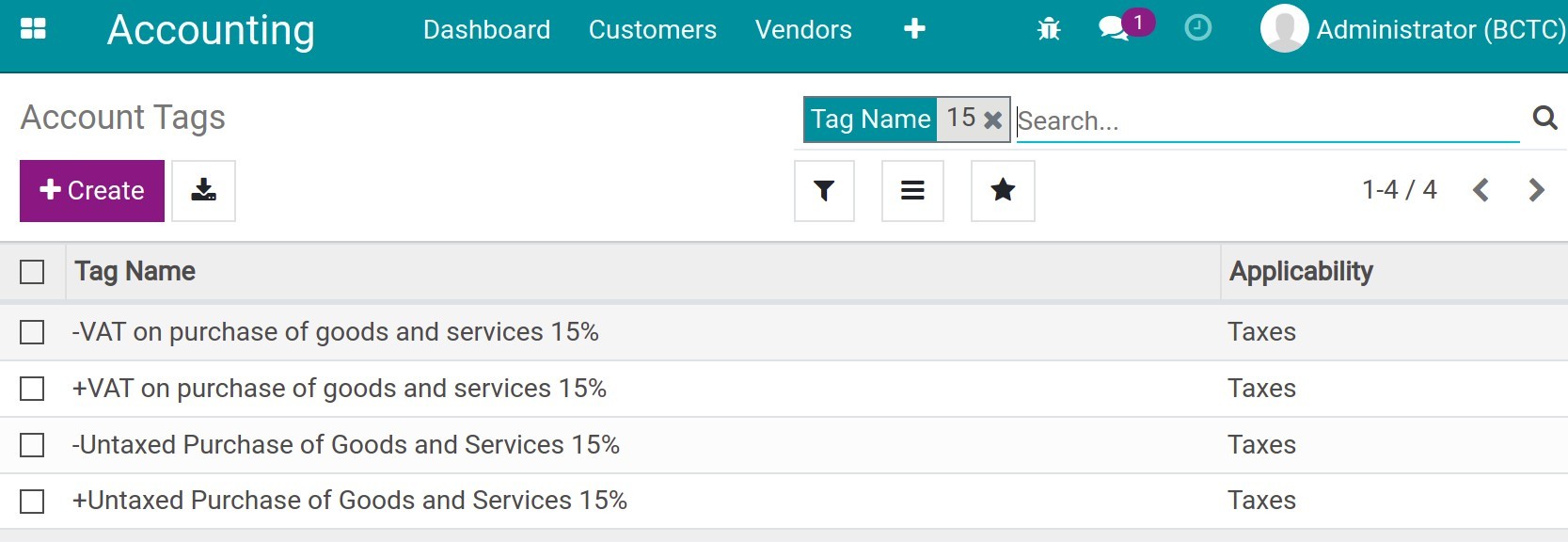

- Connection between taxes and tax grids

- View Tax report

-

How to configure a multi-currencies system

-

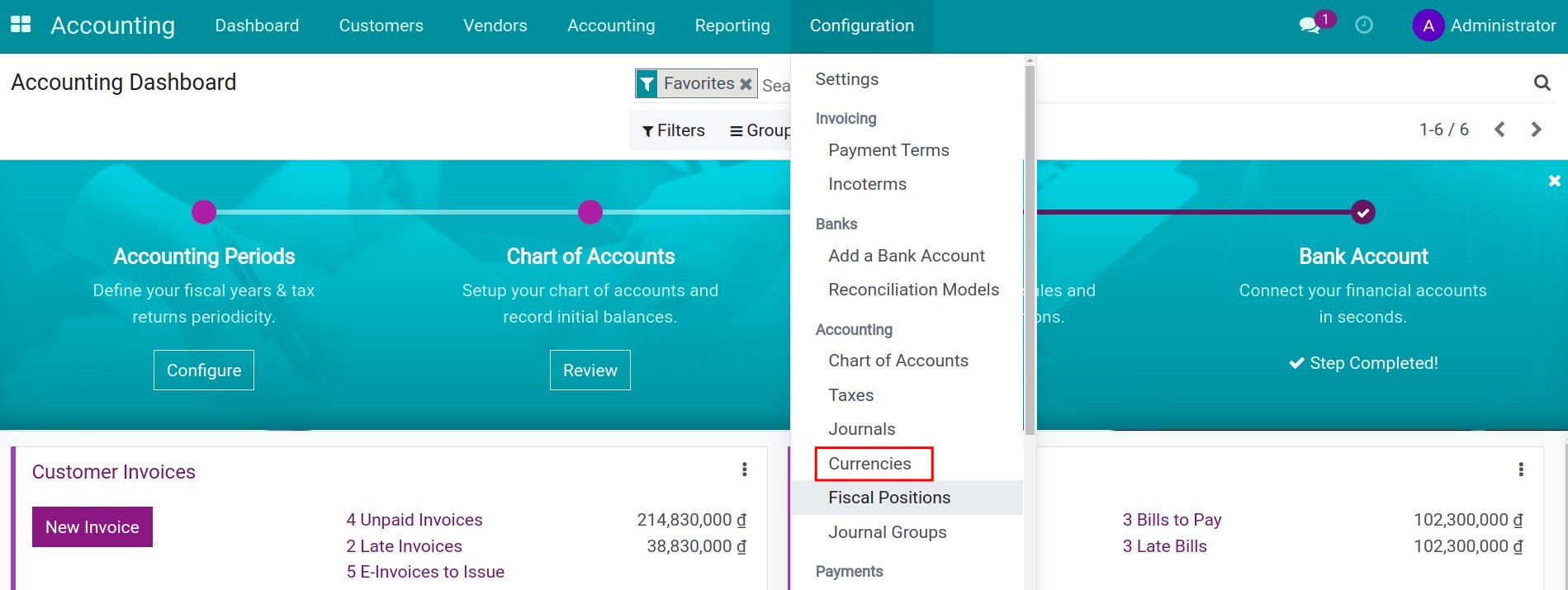

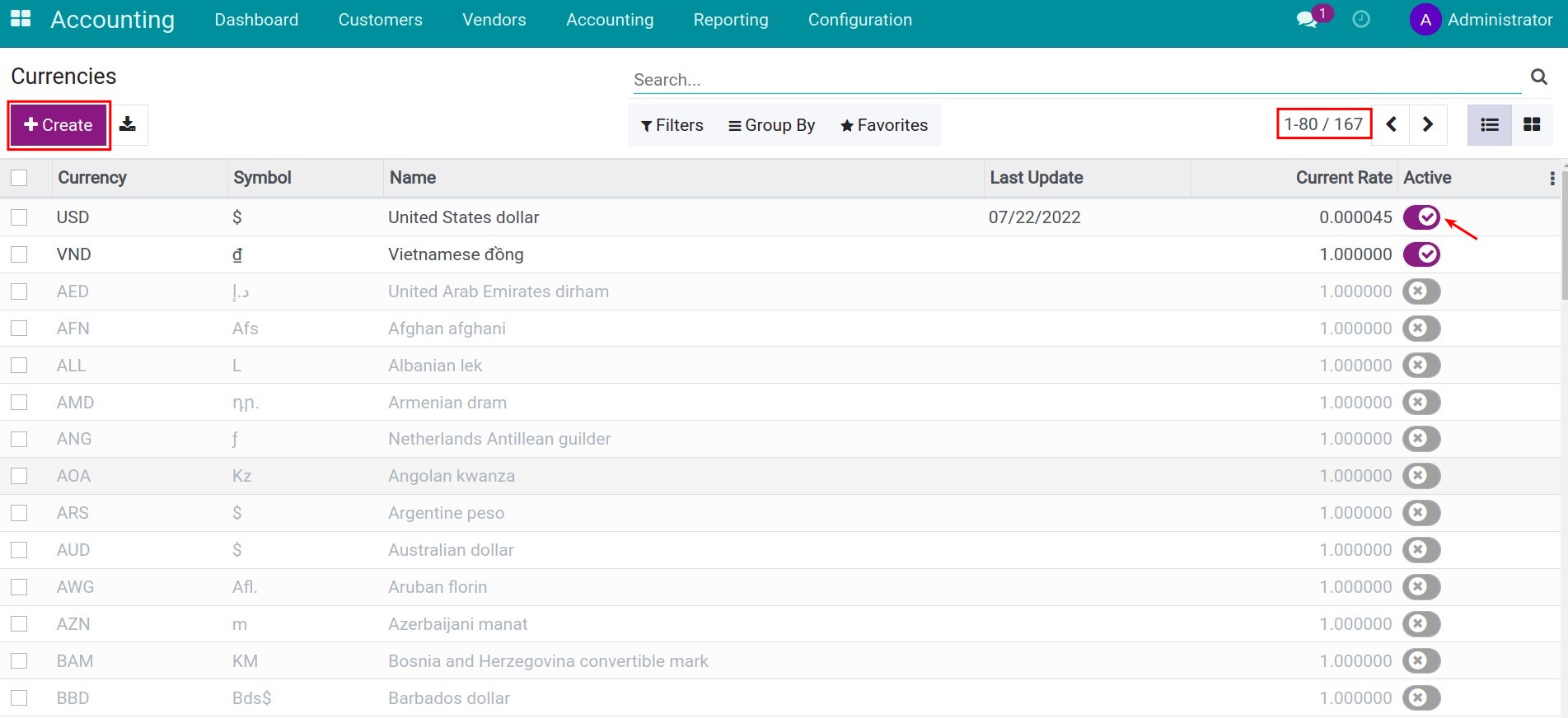

How to configure a multi-currencies system

-

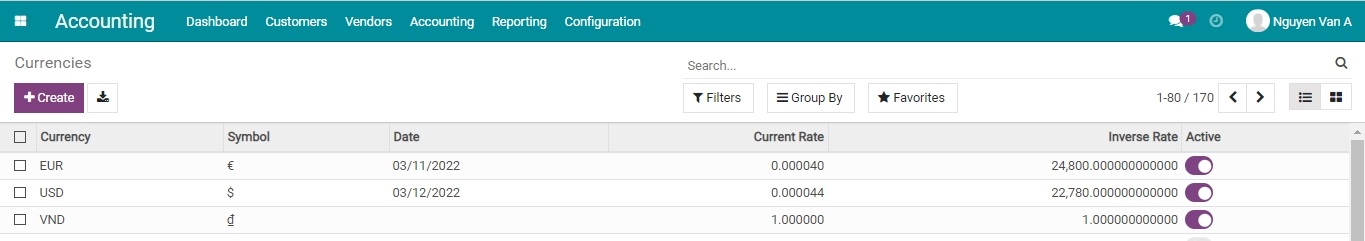

Initial configuration

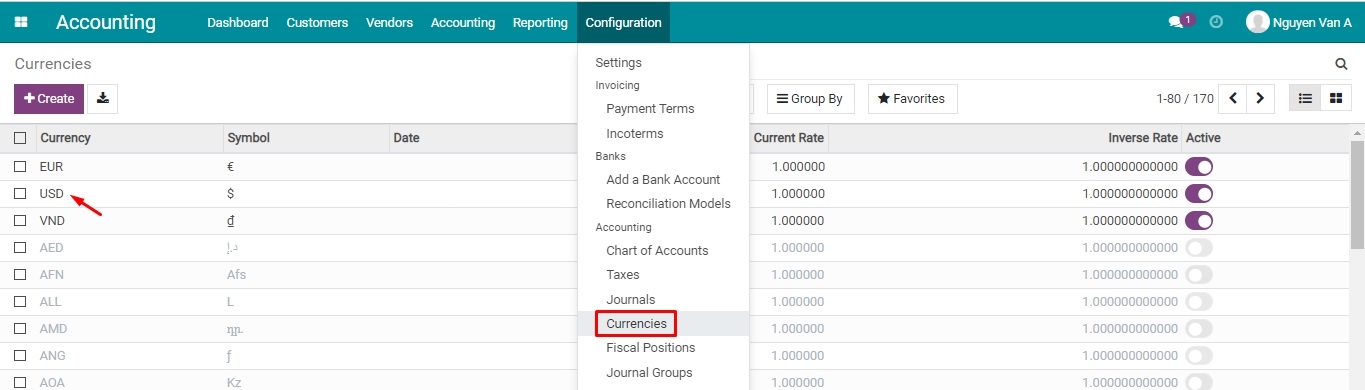

- Enable Multi-Currencies feature

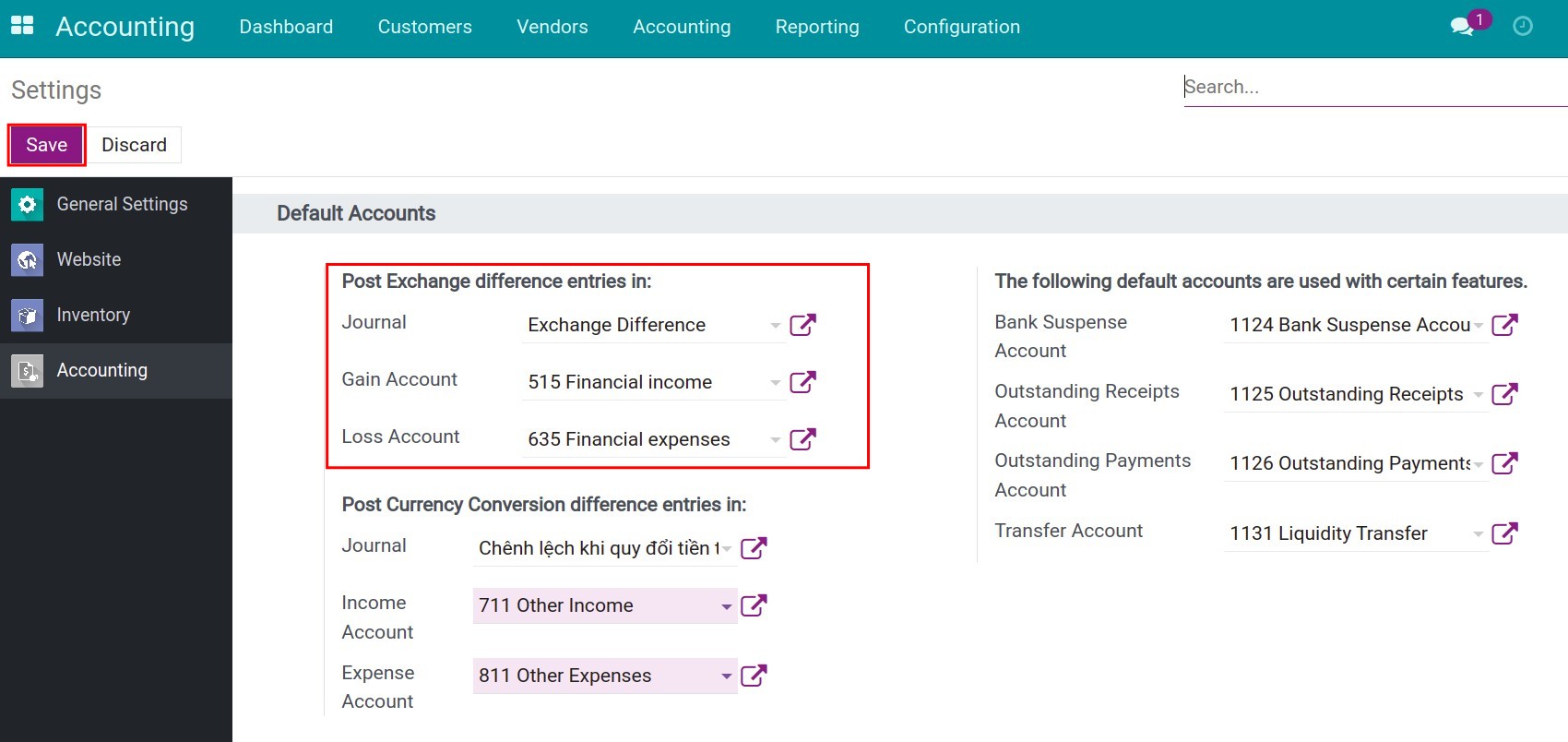

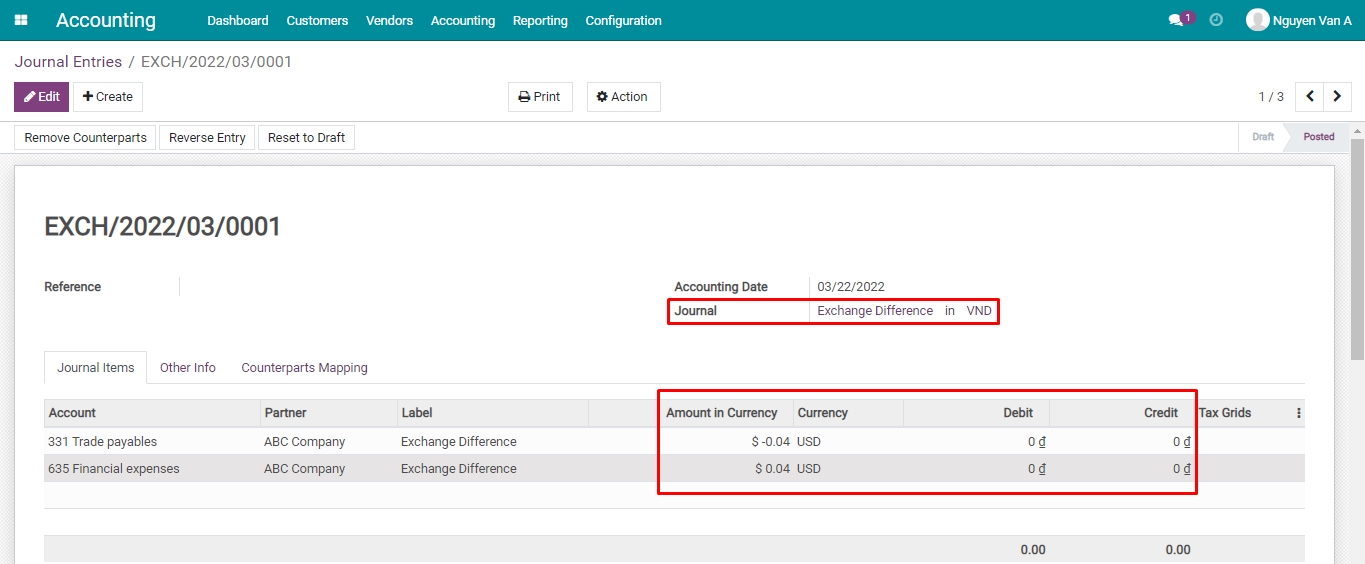

- Exchange Difference journal

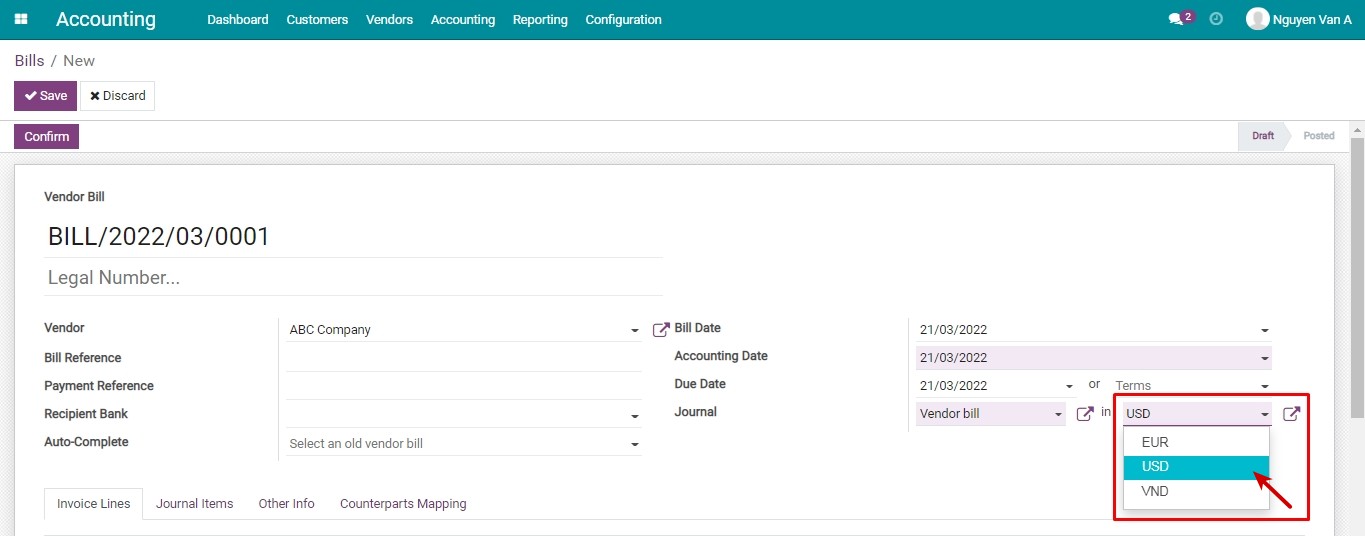

- Journal in foreign currencies

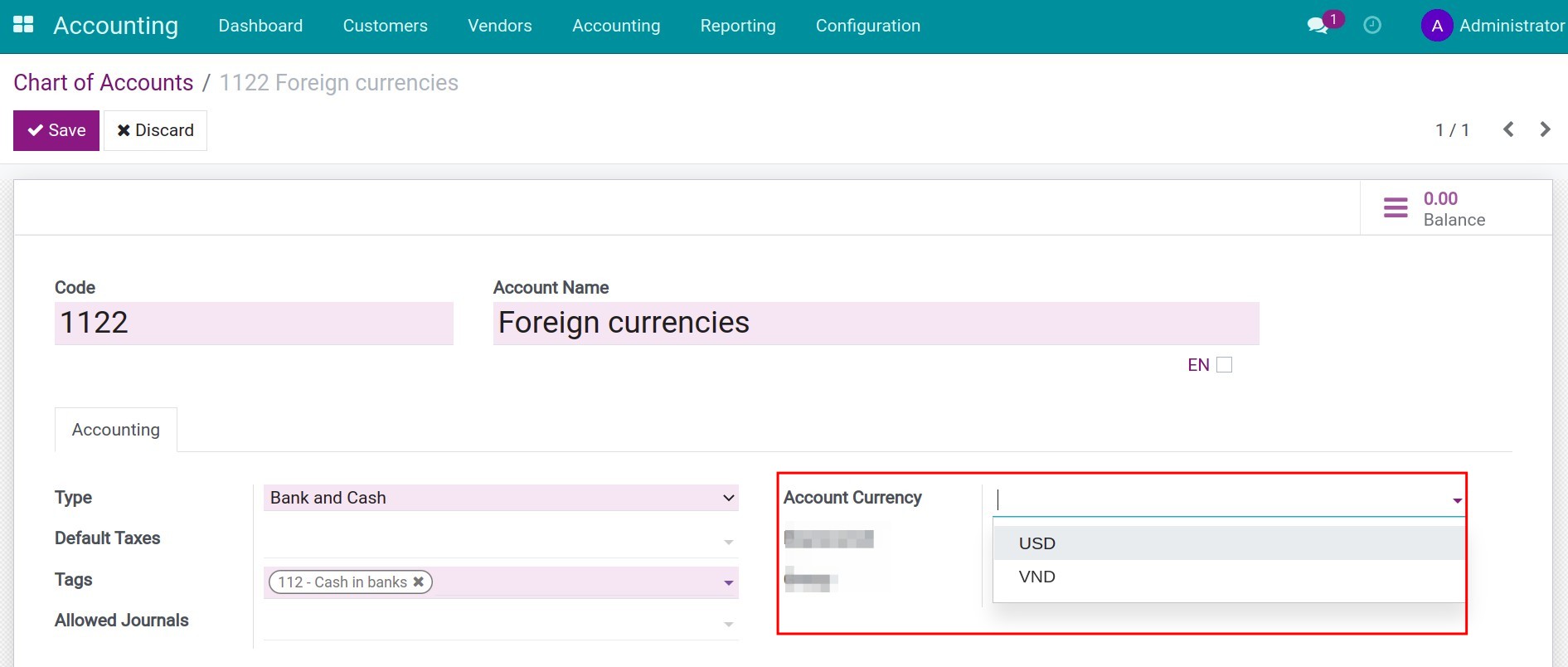

- Set up foreign currency on an Accounting account

-

Multi-Currencies usage

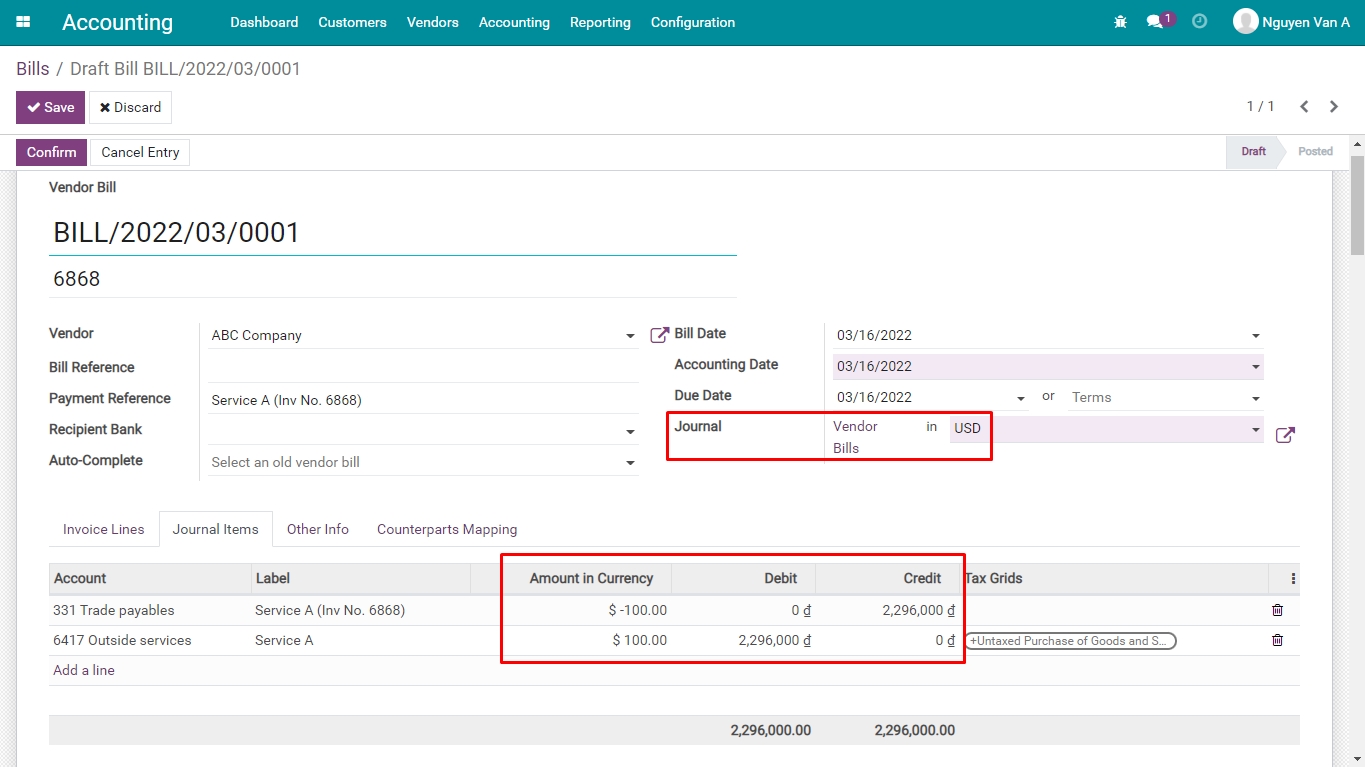

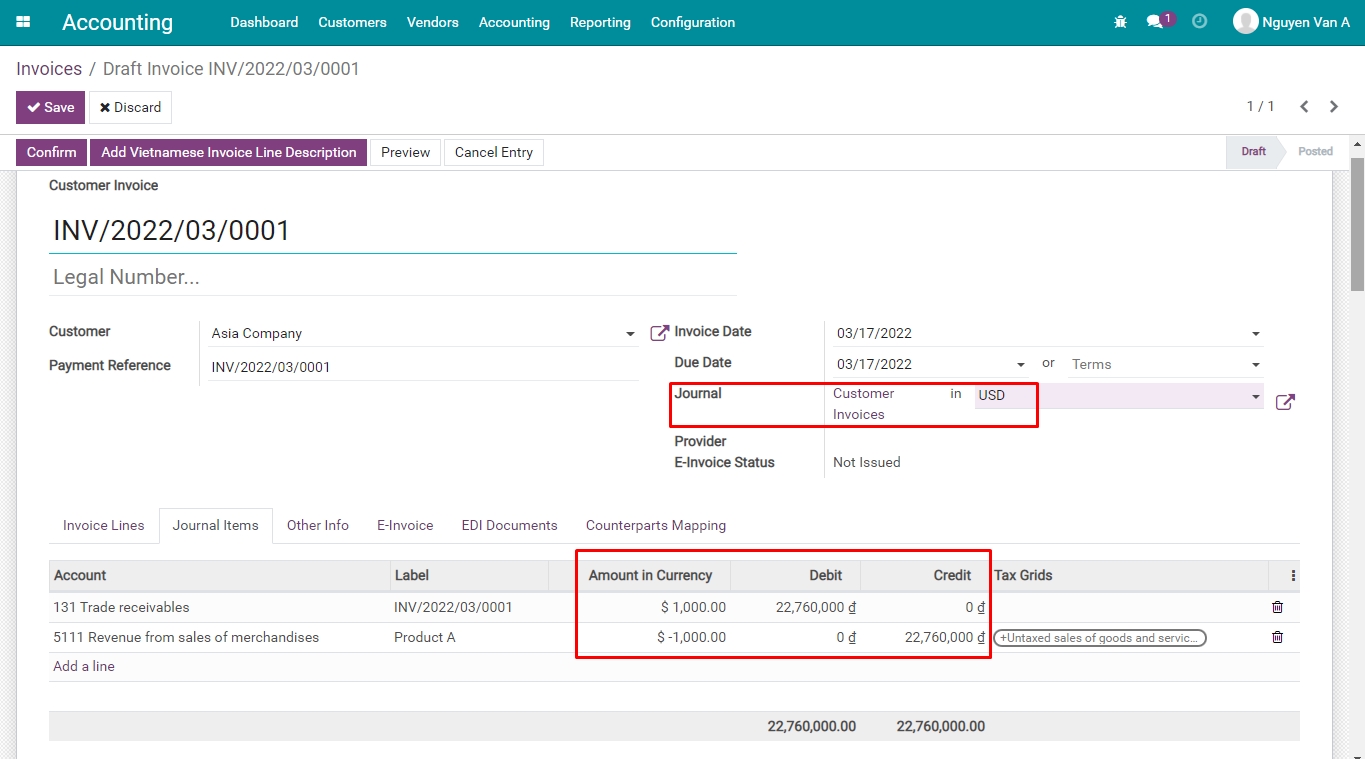

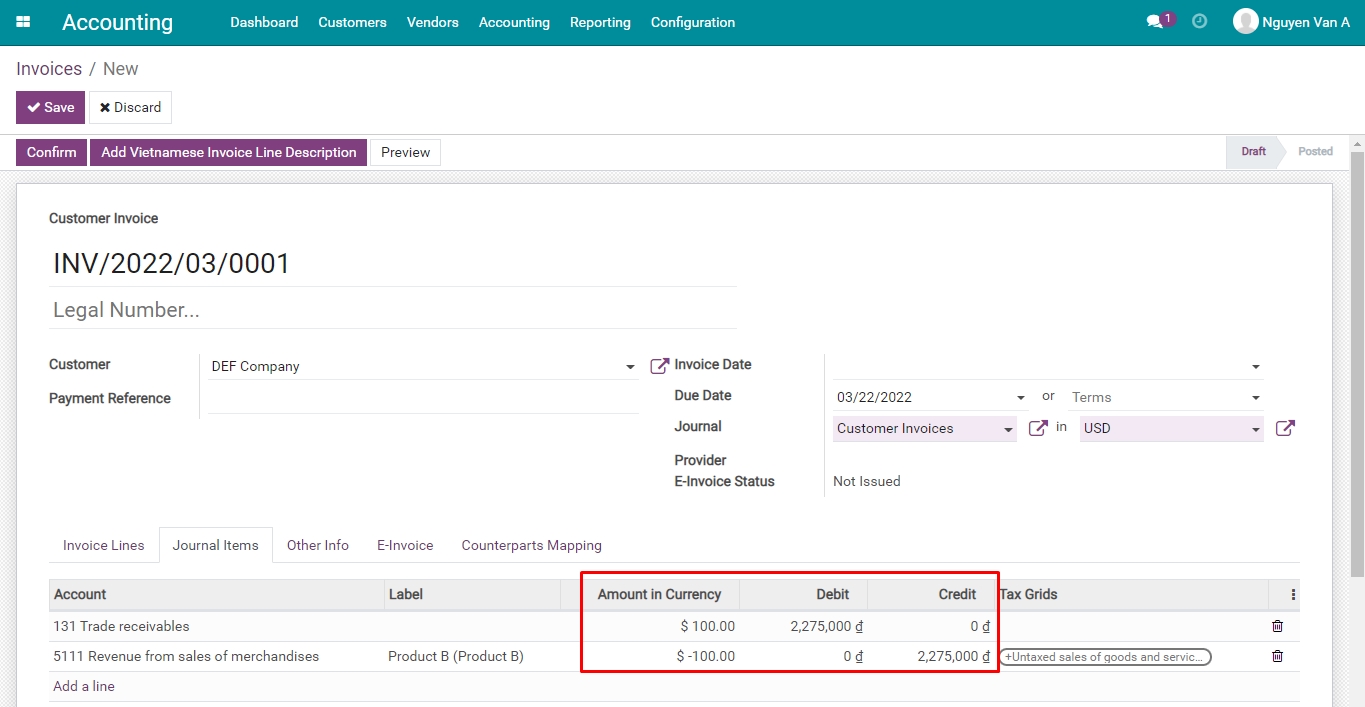

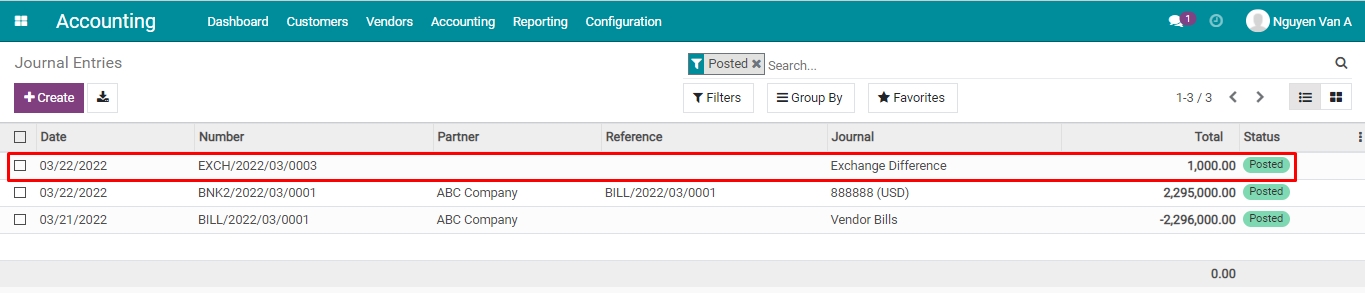

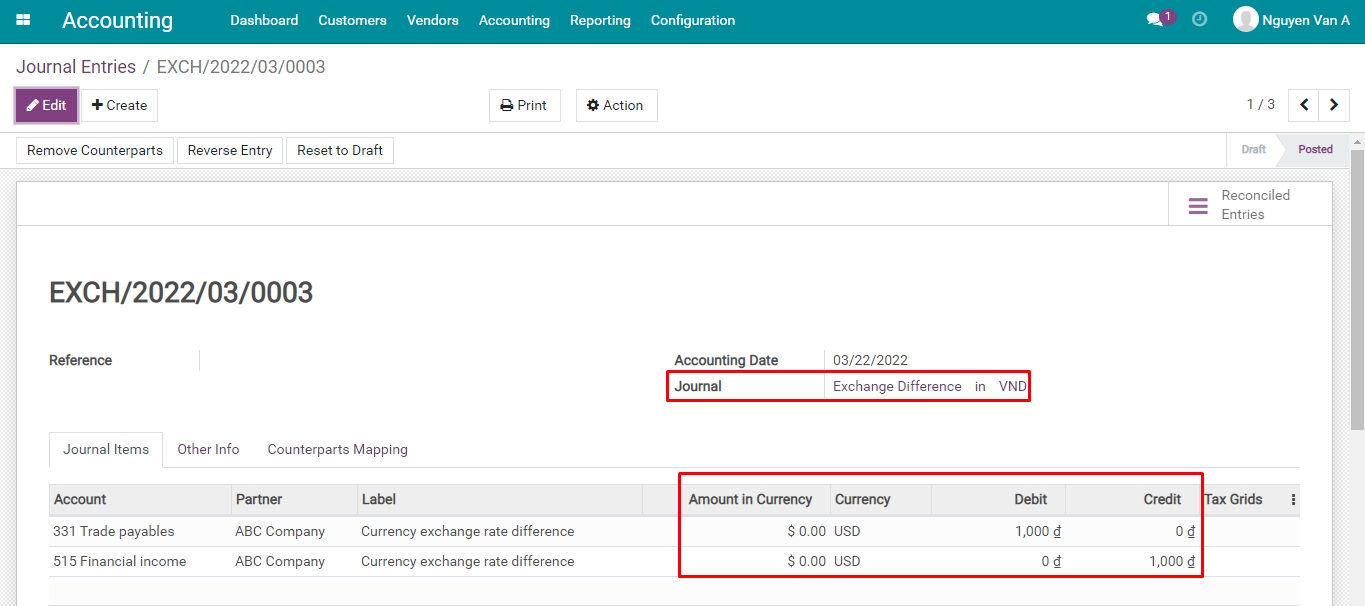

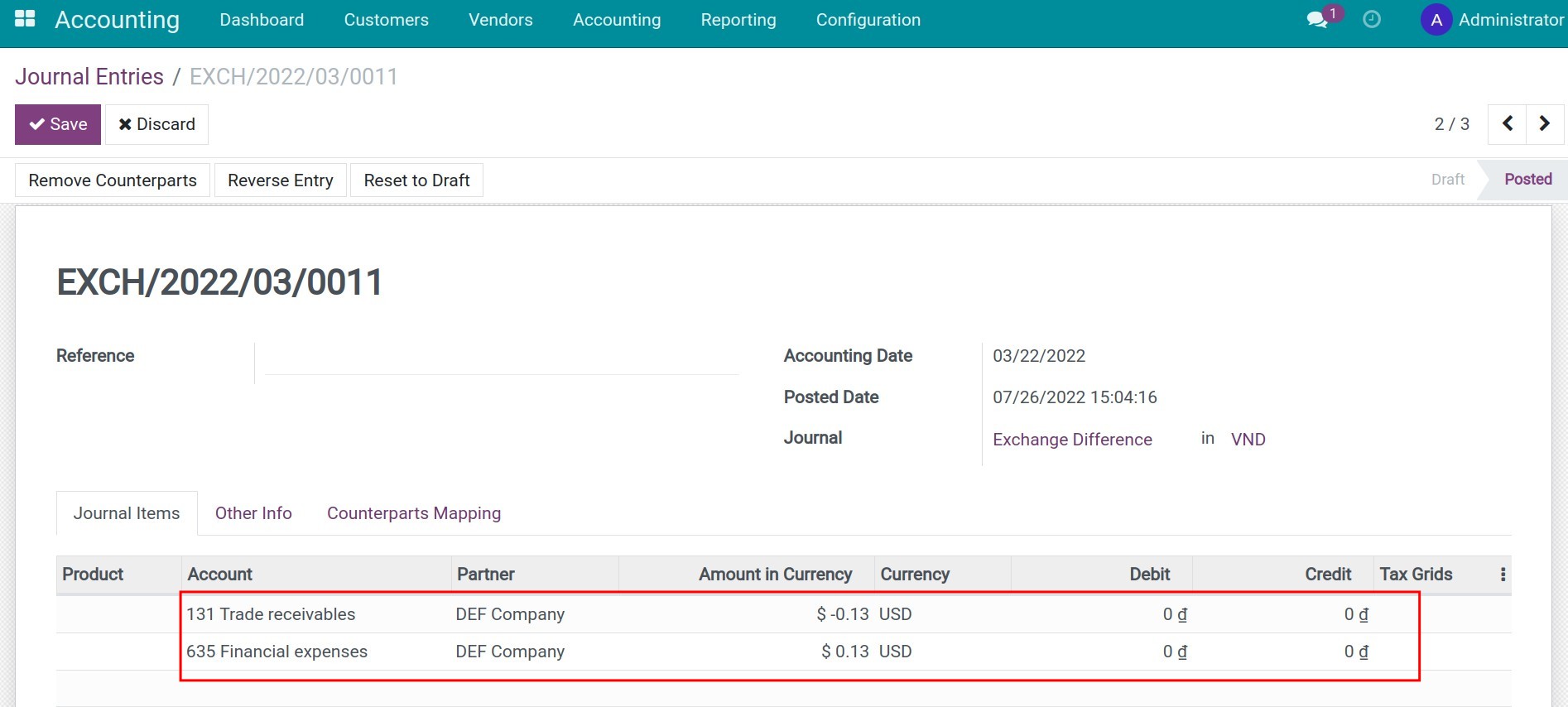

- Create customer invoice/vendor bill, Exchange difference journal entries

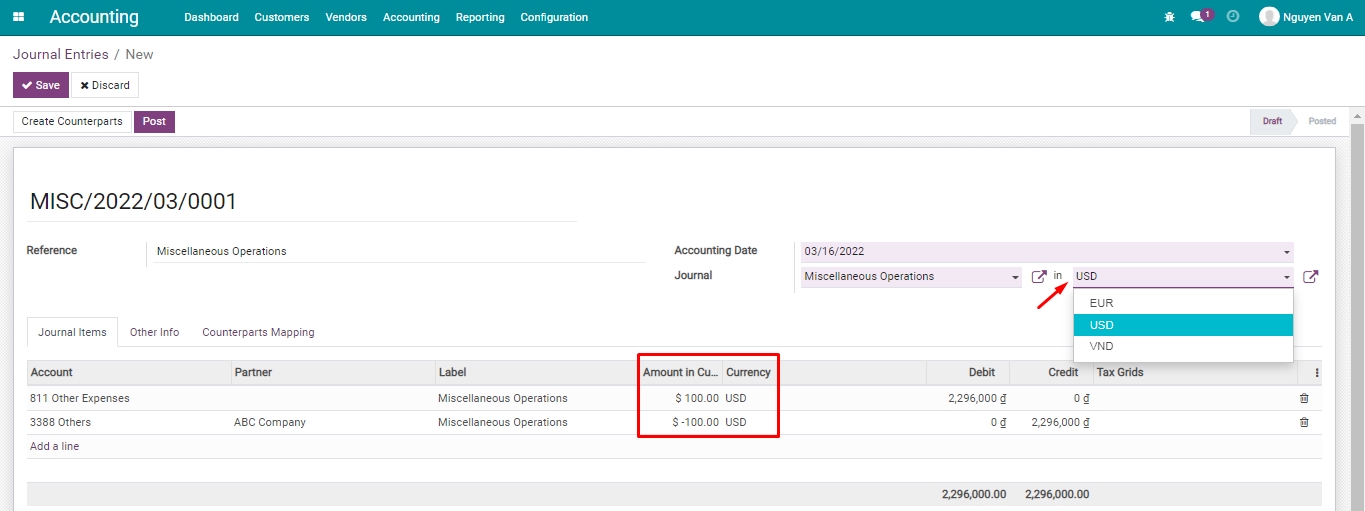

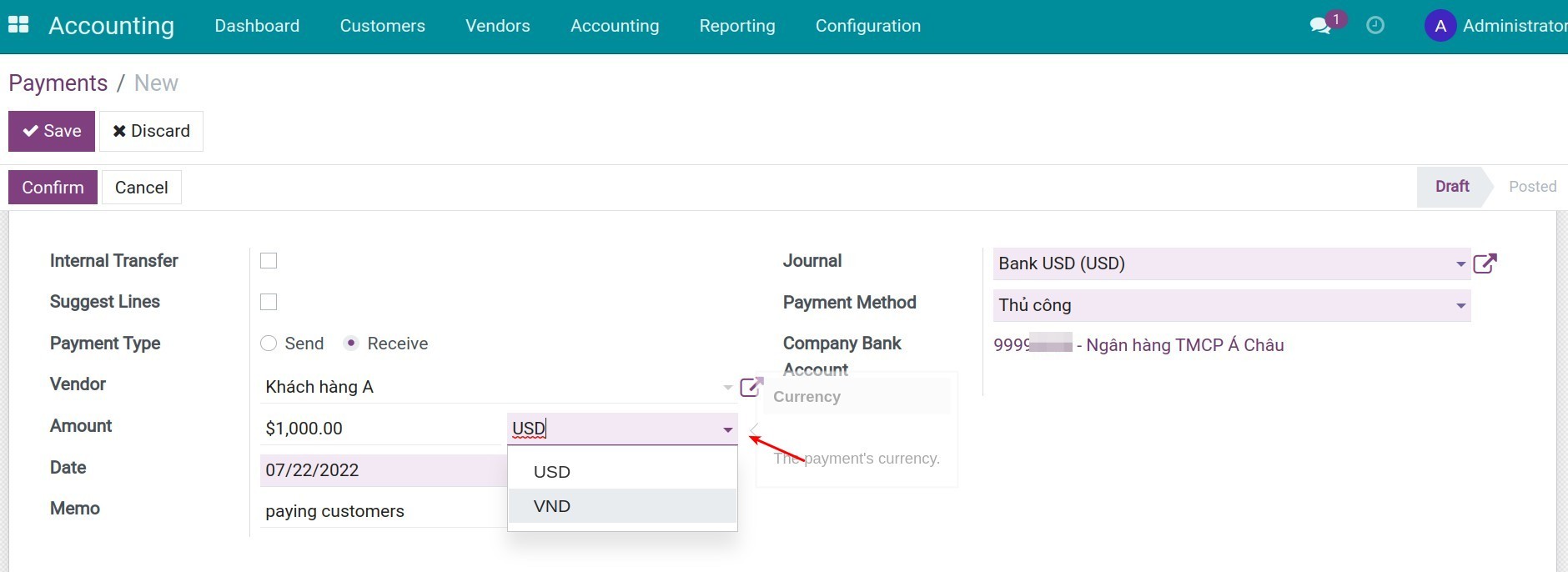

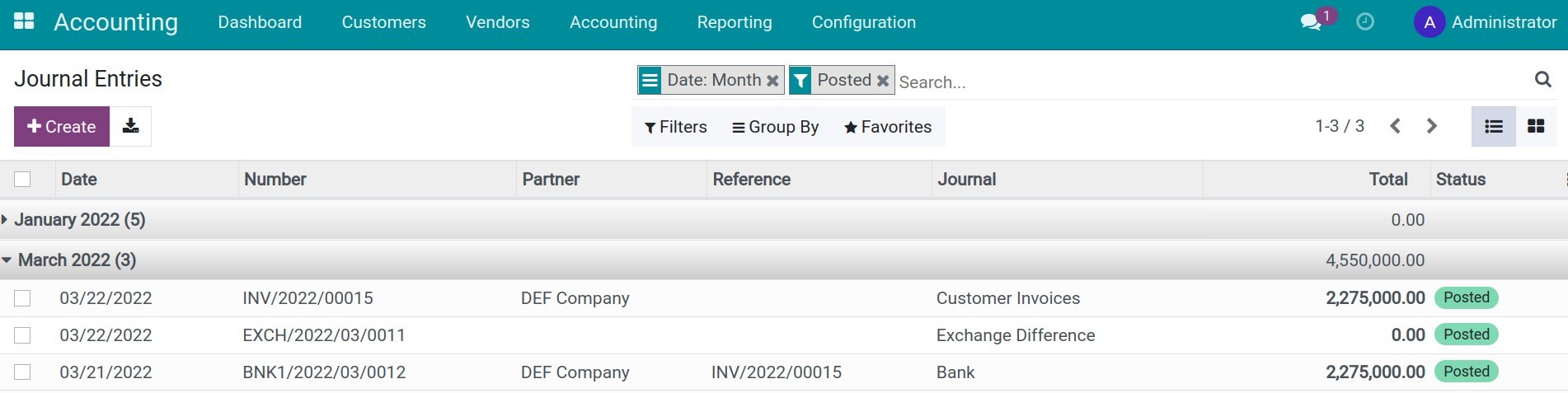

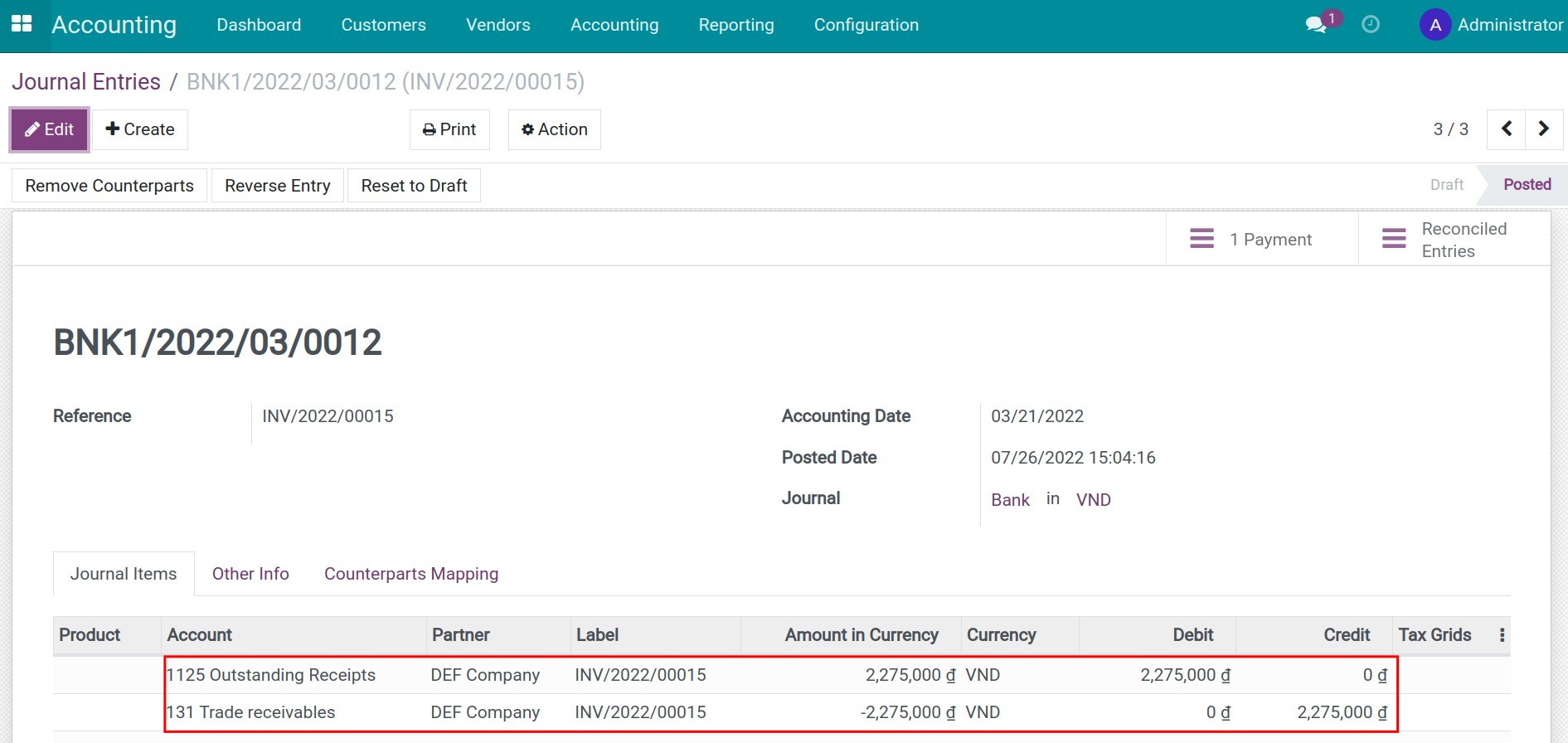

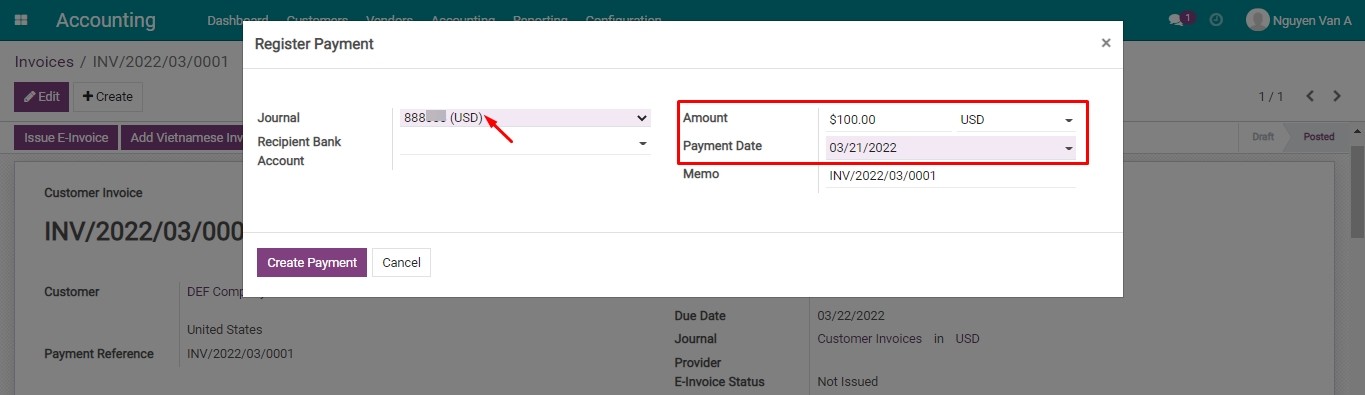

- Create a payment in foreign currency

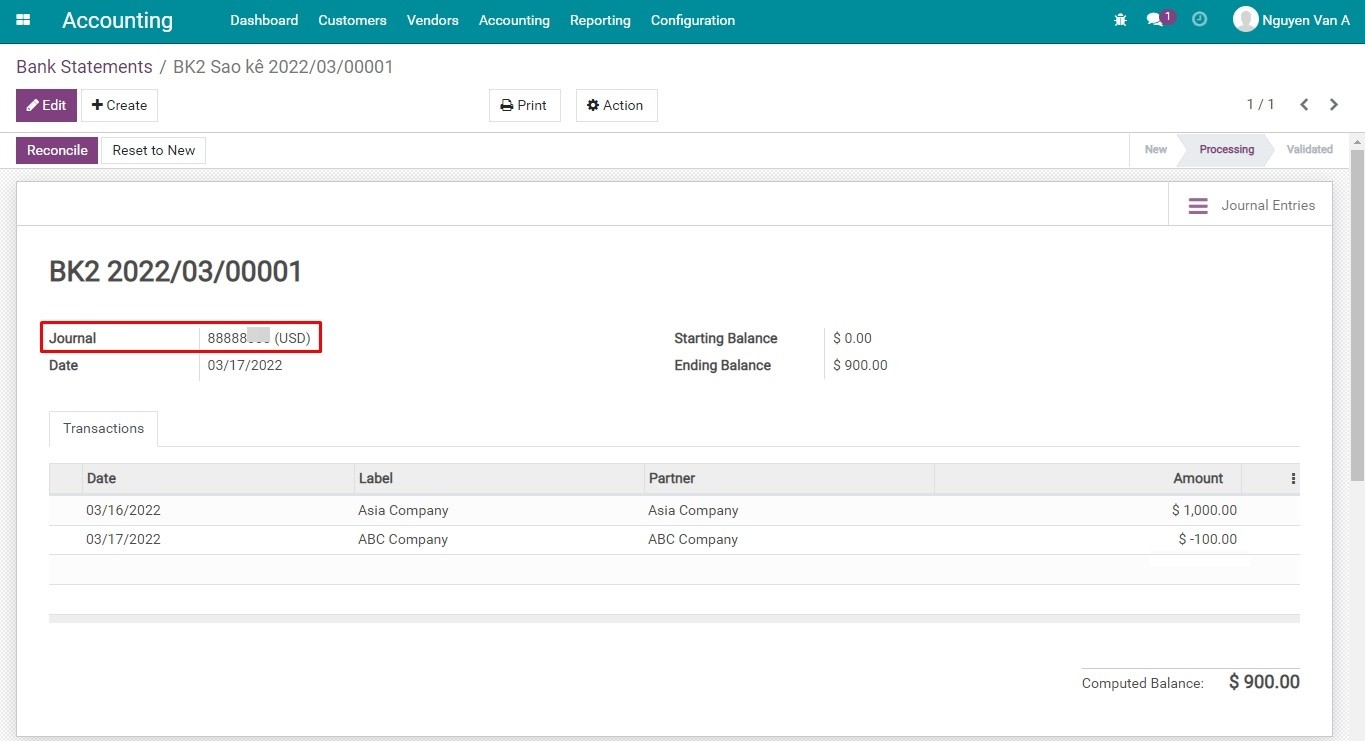

- Create a bank statement in foreign currency

-

Manage invoices and make a payment in a multi-currencies system

-

Manage invoices and make a payment in a multi-currencies system

- The foreign currency invoices in Viindoo

-

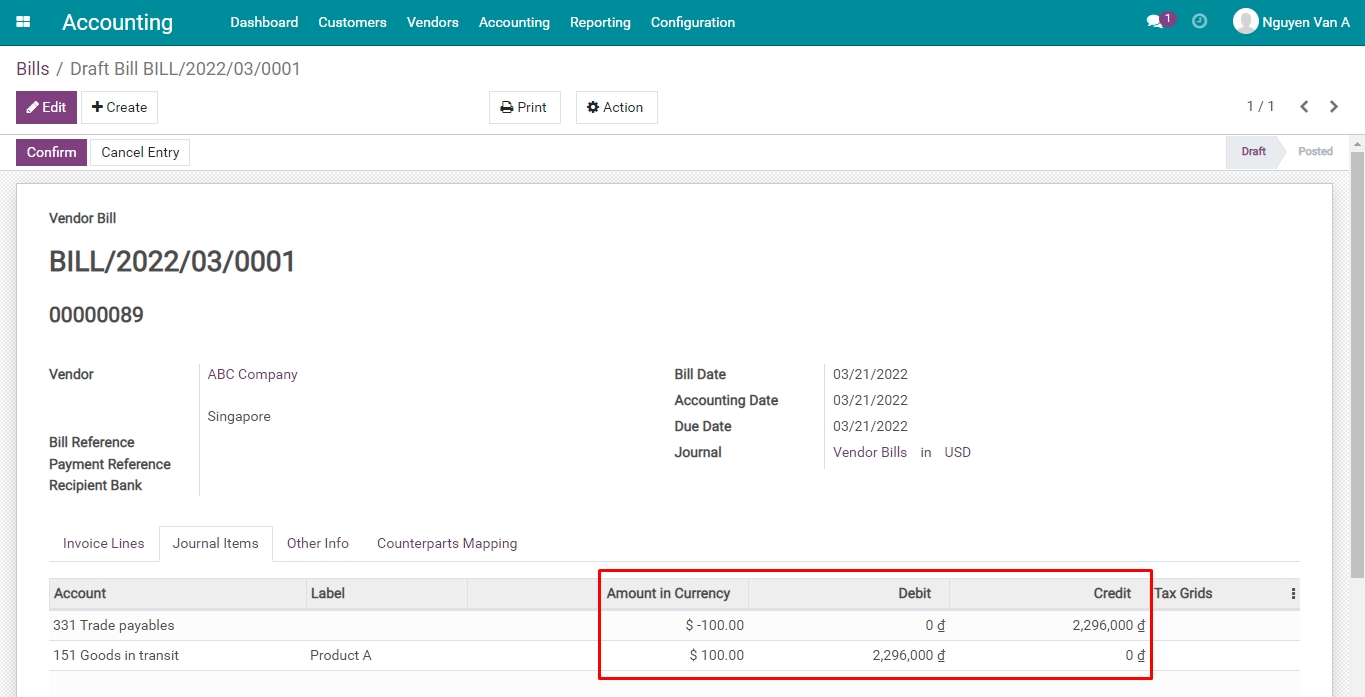

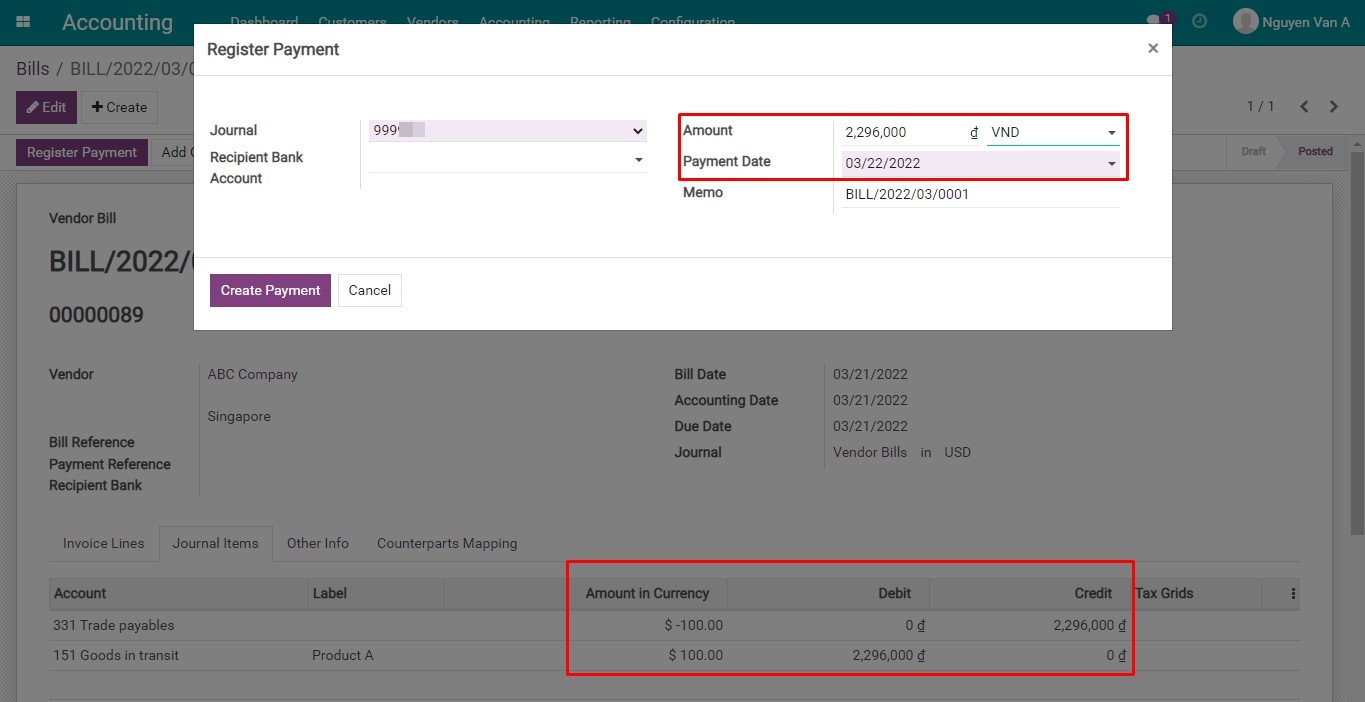

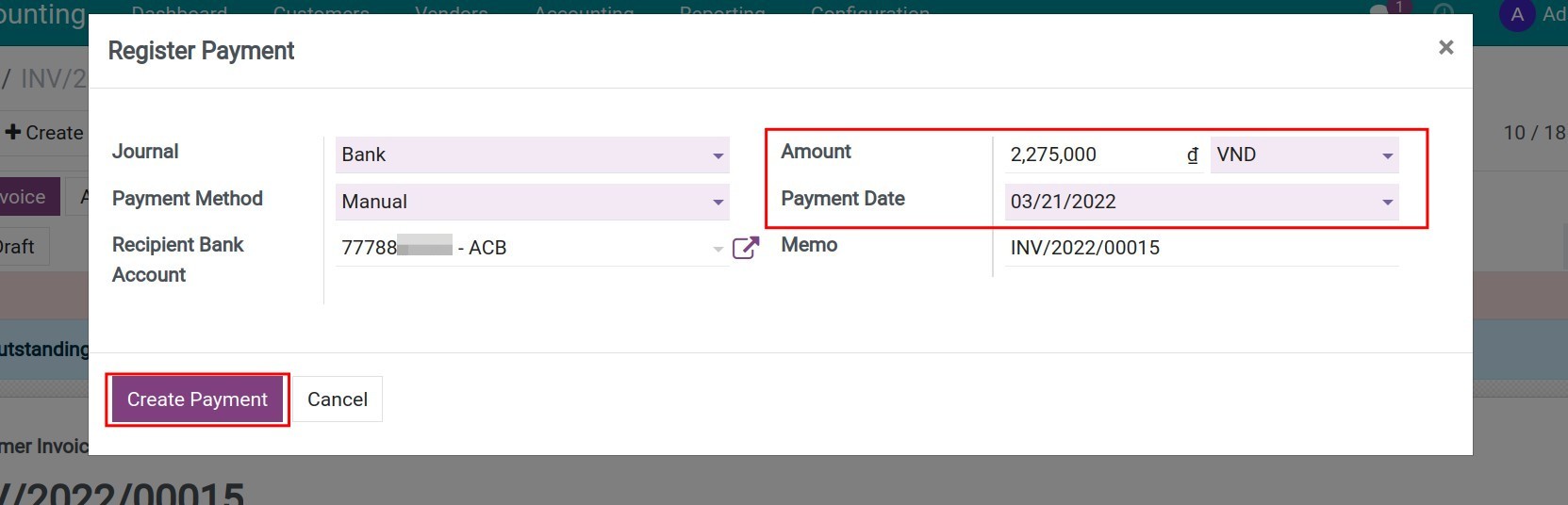

Payment for Vendor bills

- Payment by the main currency of the company

- Payment in foreign currency

-

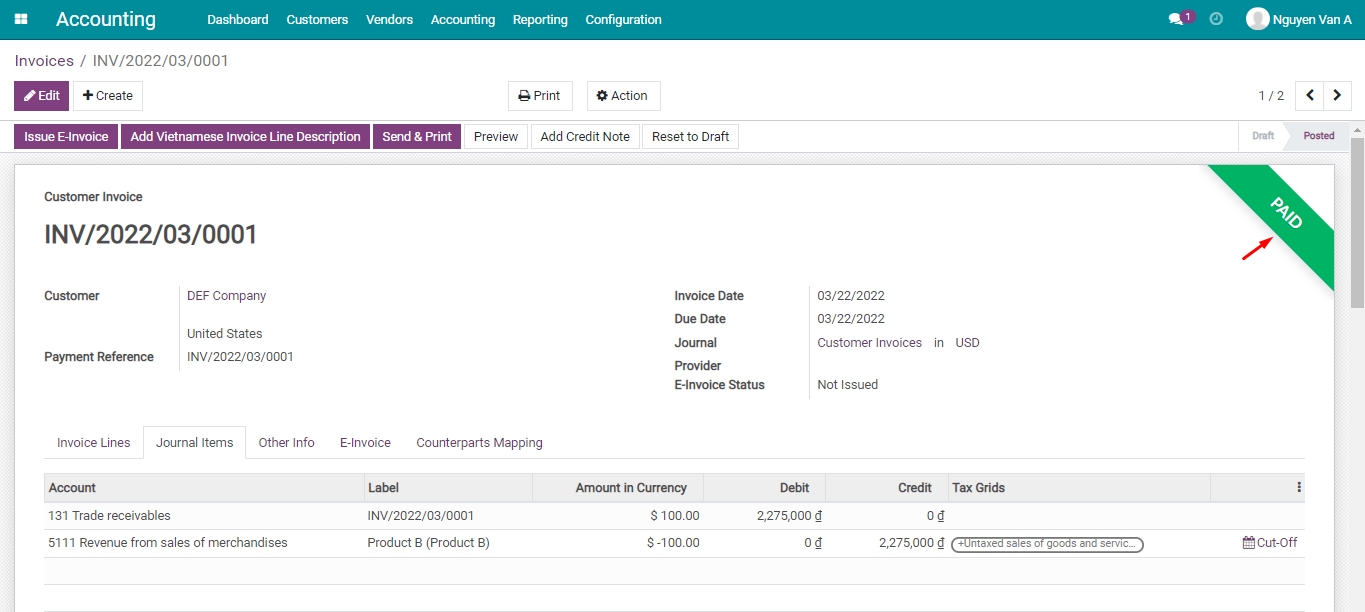

Customer’s payment

- Receiving payment in the company’s main currency

- Receiving payment in foreign currency

-

Automatically recording the exchange rate difference

-

Automatically recording the exchange rate difference

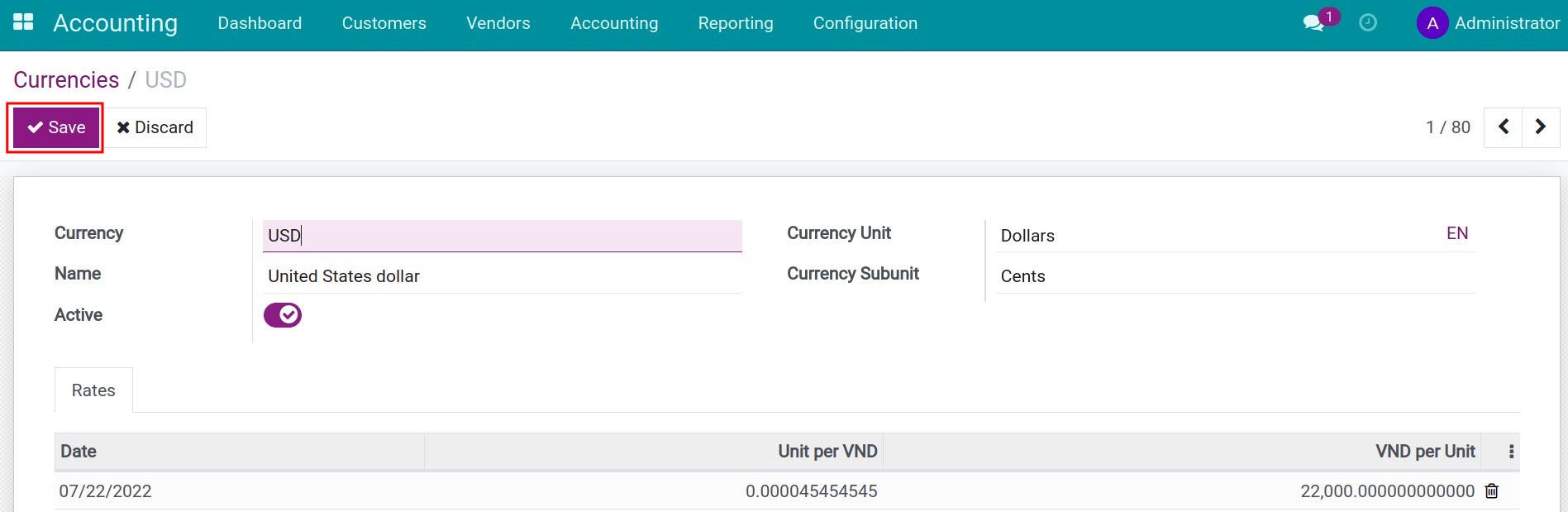

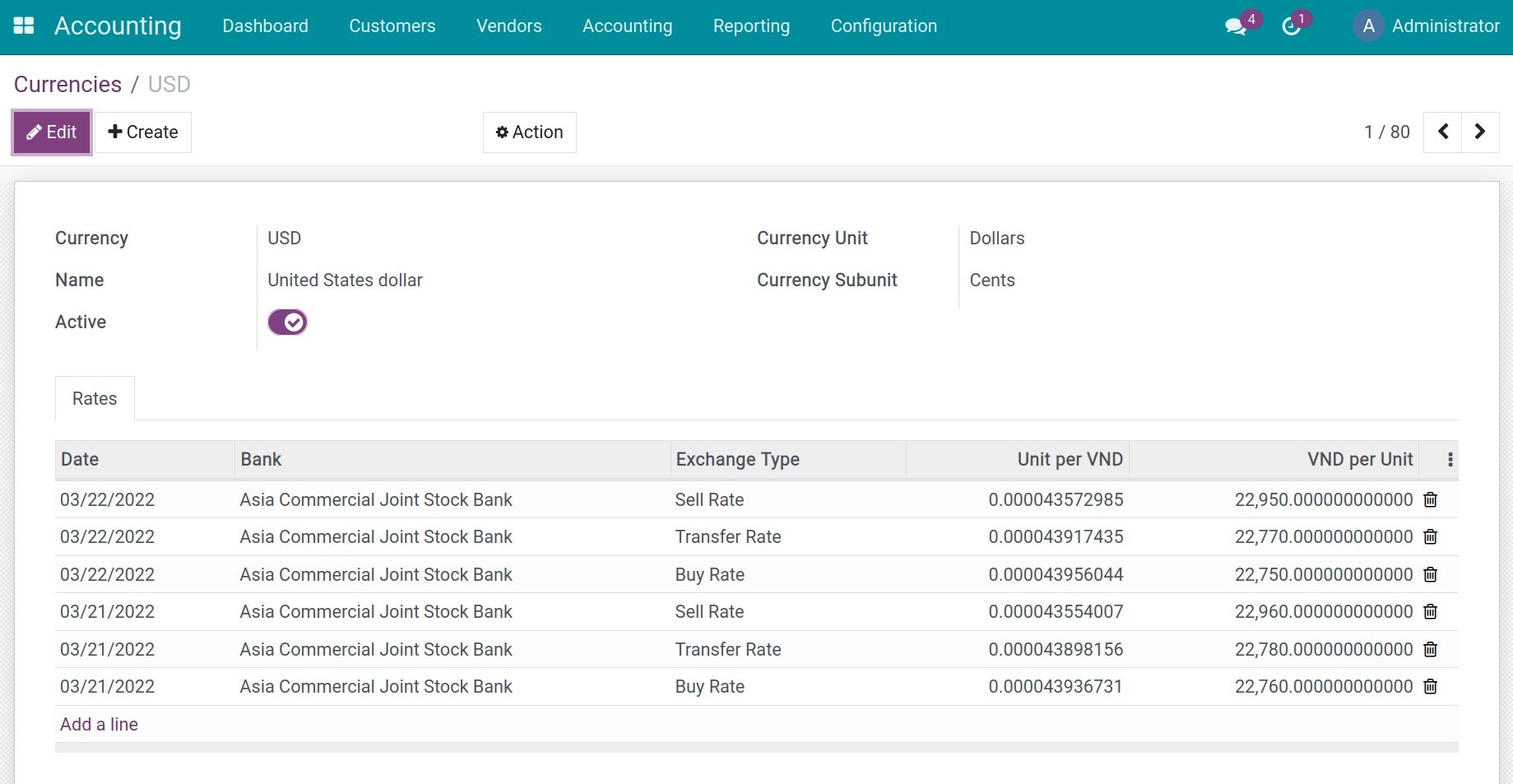

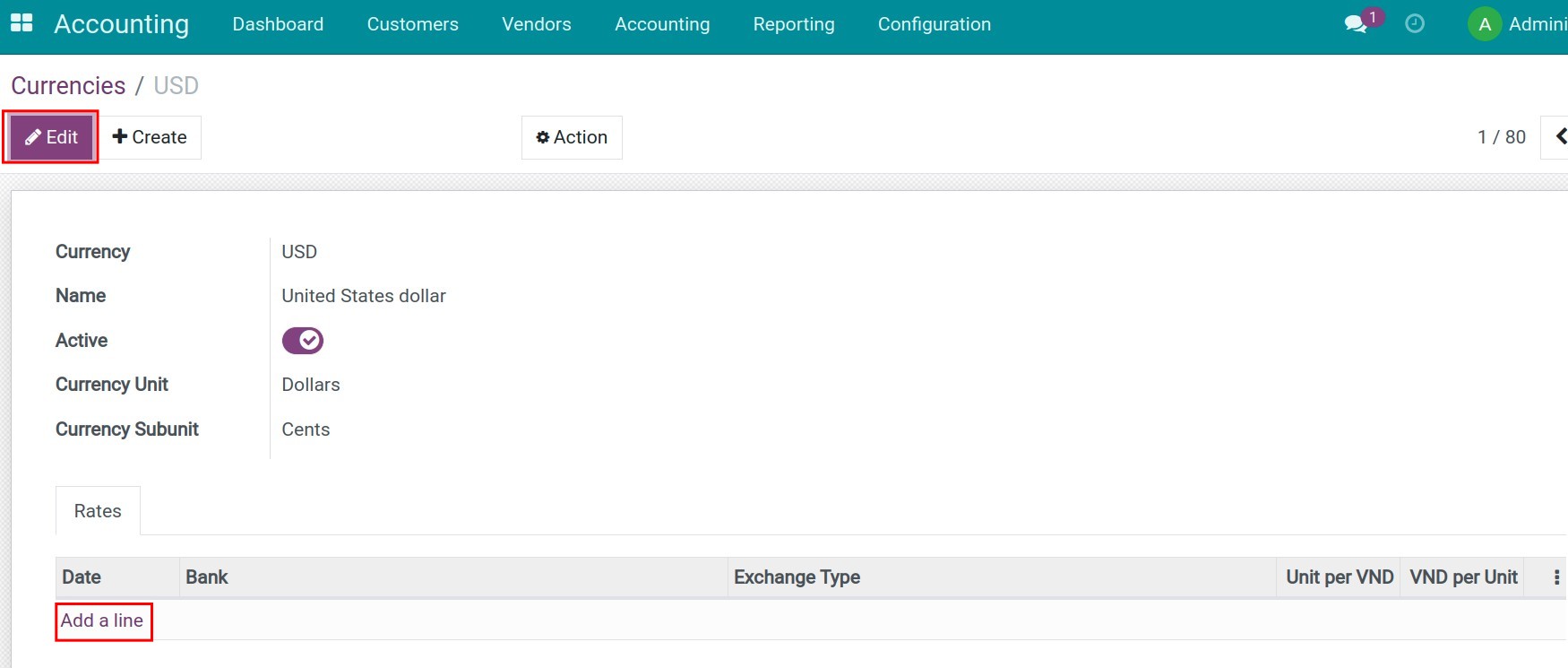

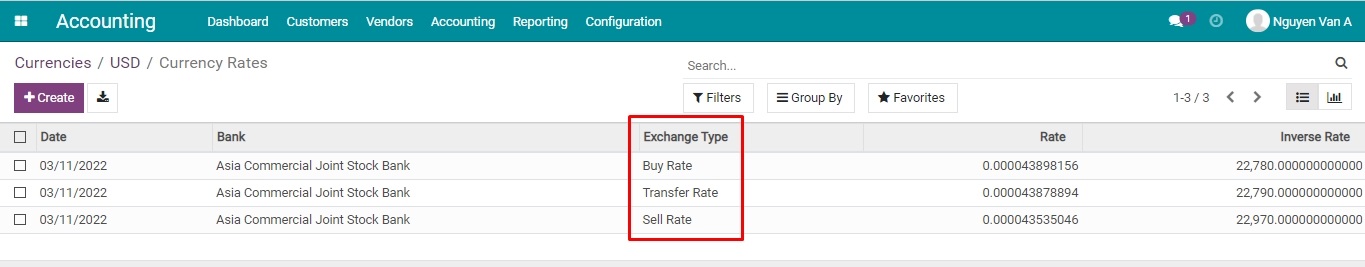

- Manual currency rates update

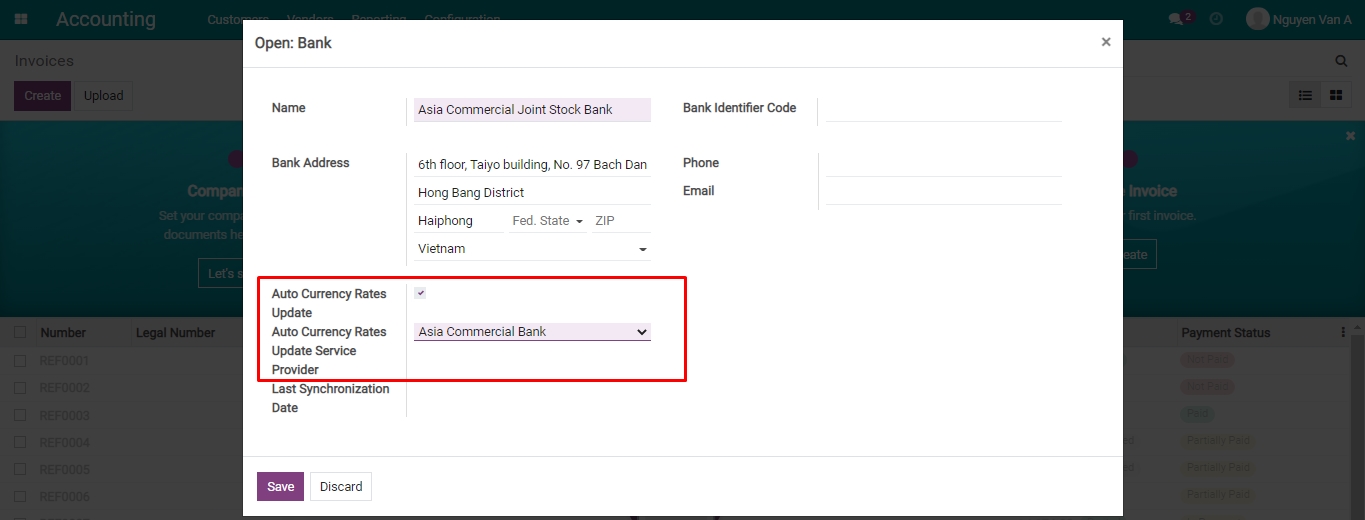

- Automatic currency rates update

-

Salary and the deductions payments

-

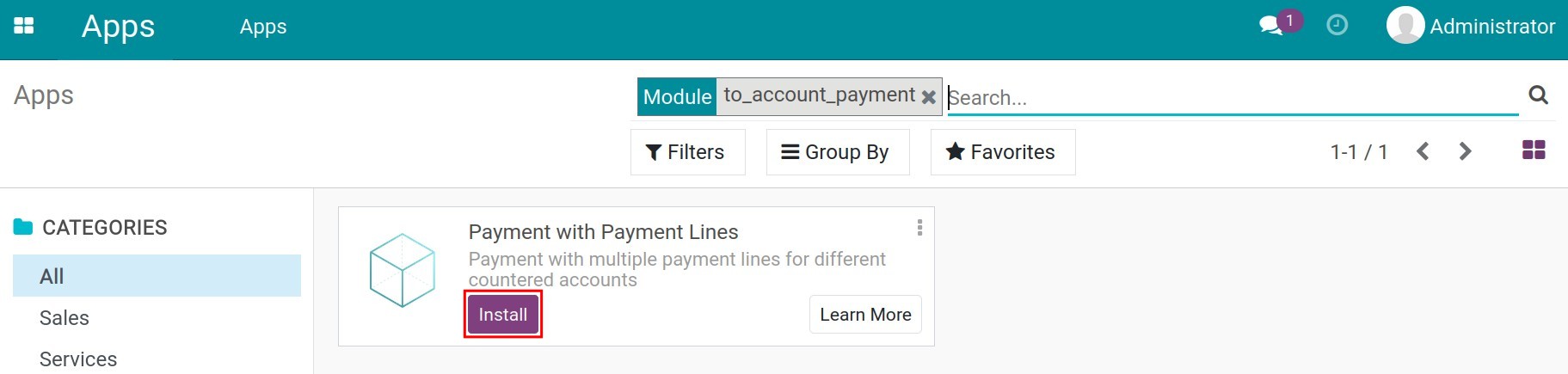

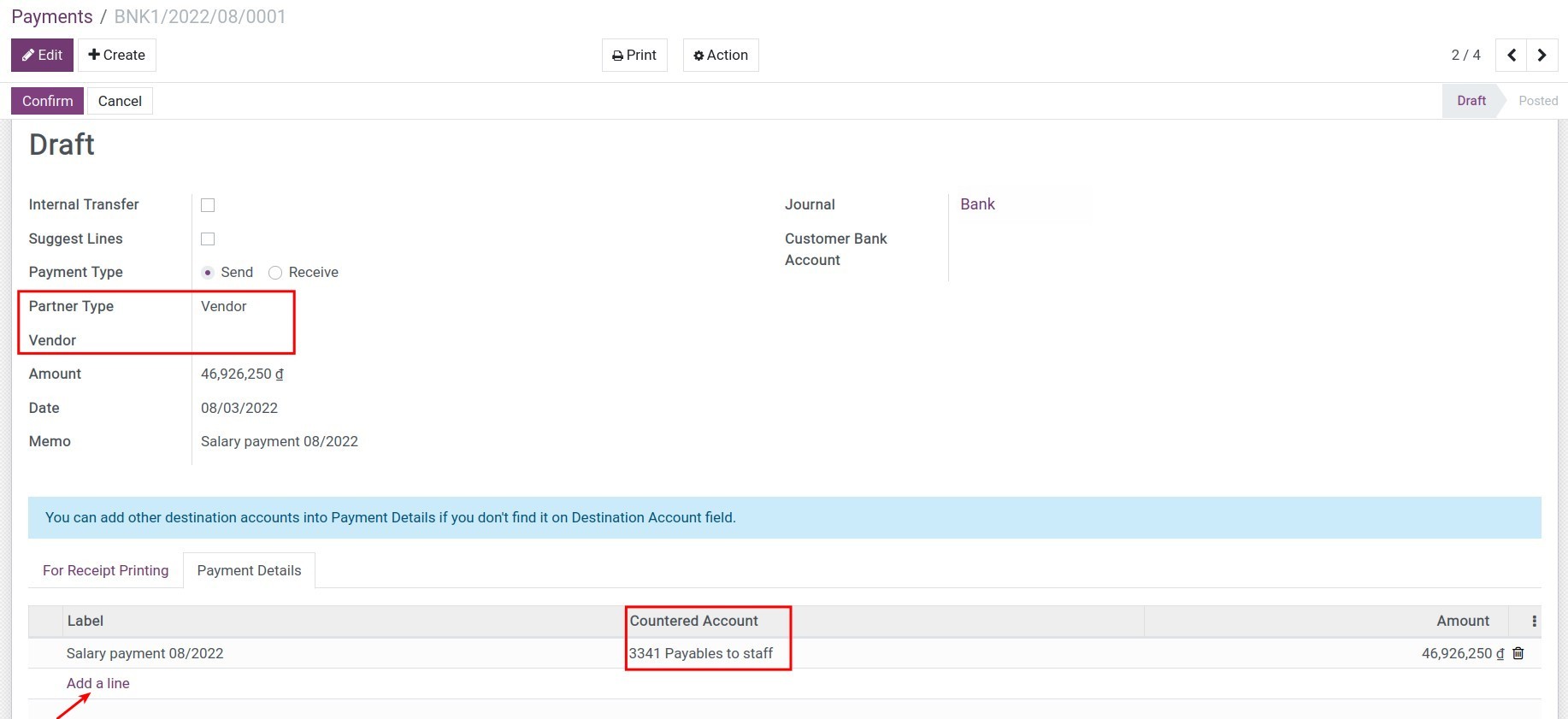

Salary and the deductions payments

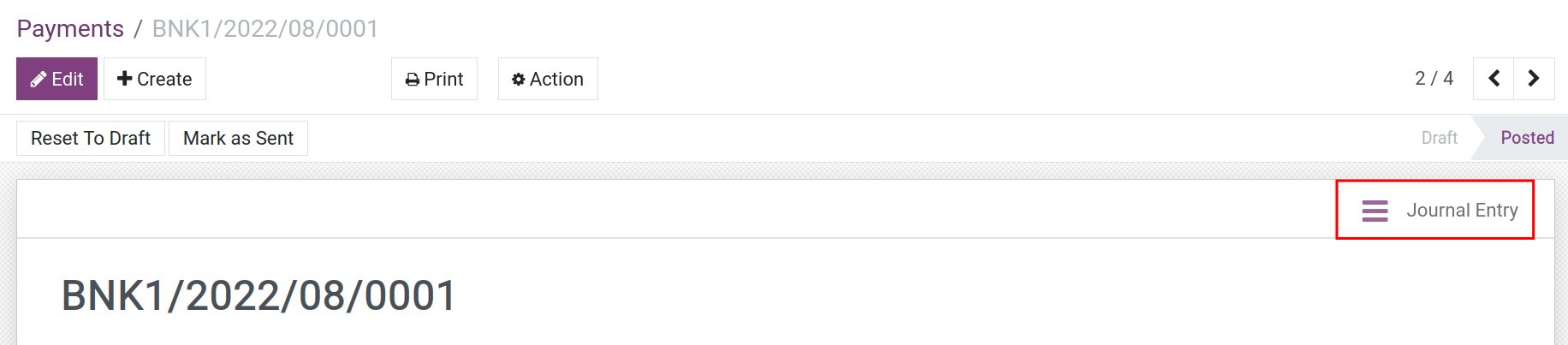

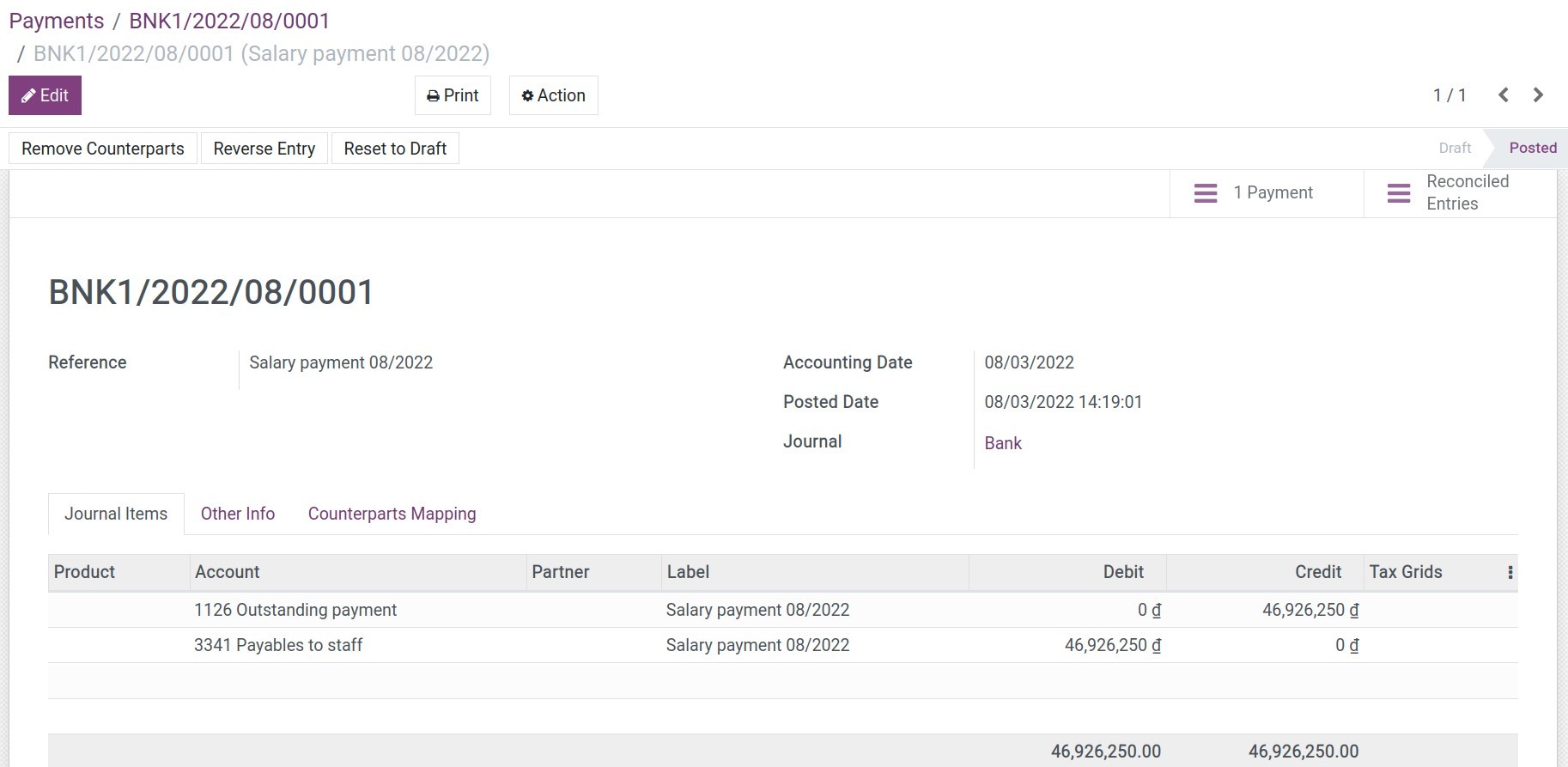

- Salary payments

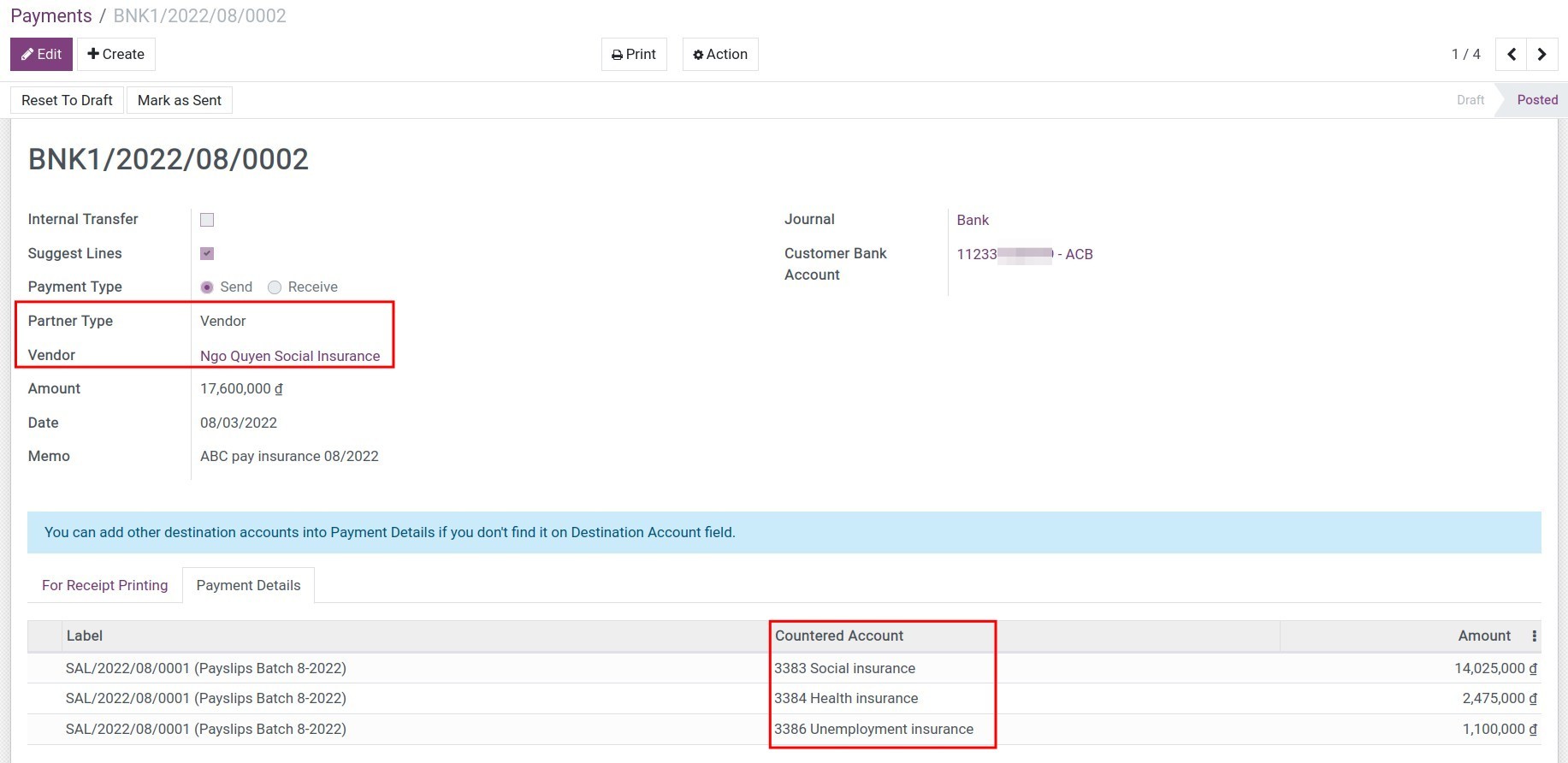

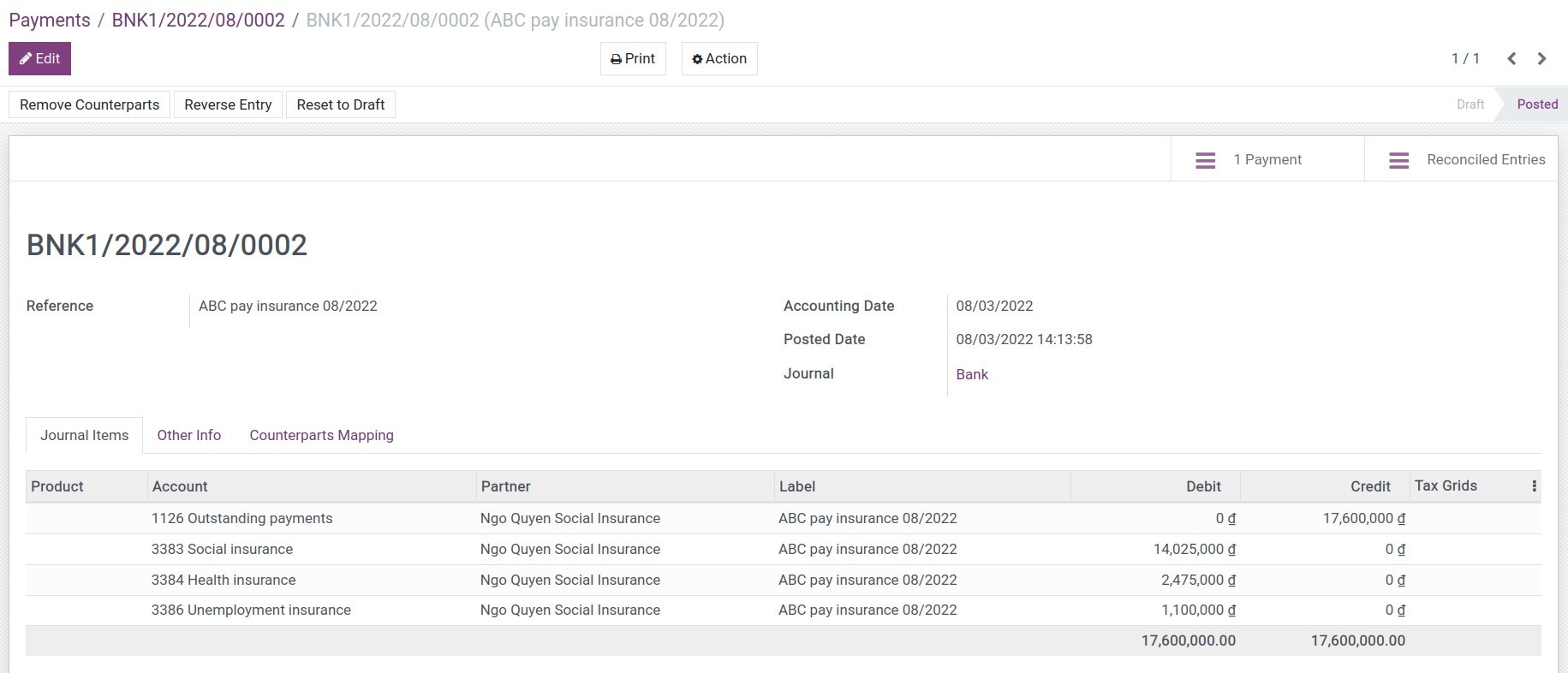

- Salary deductions payment

-

Salary reconciliation

-

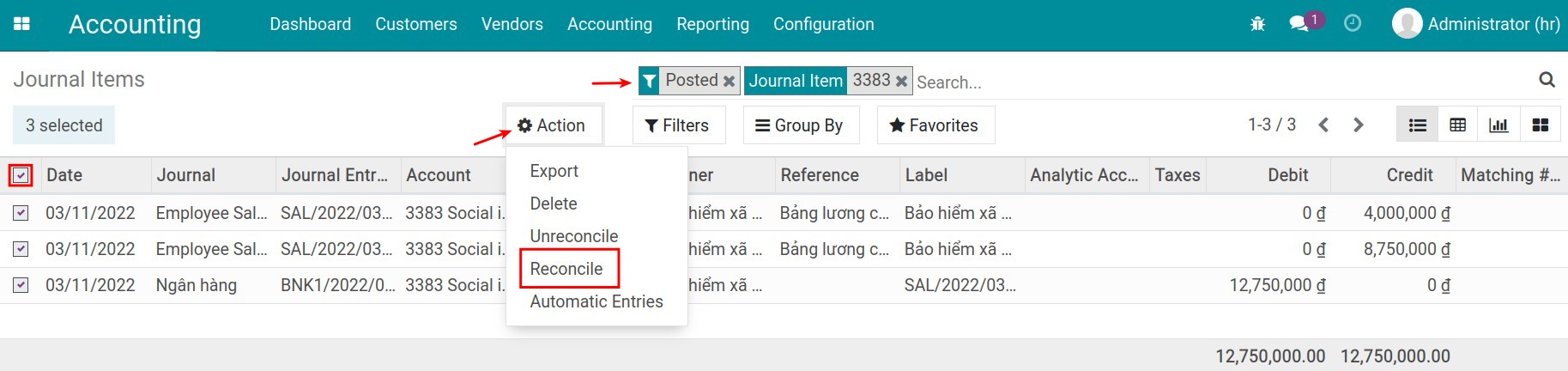

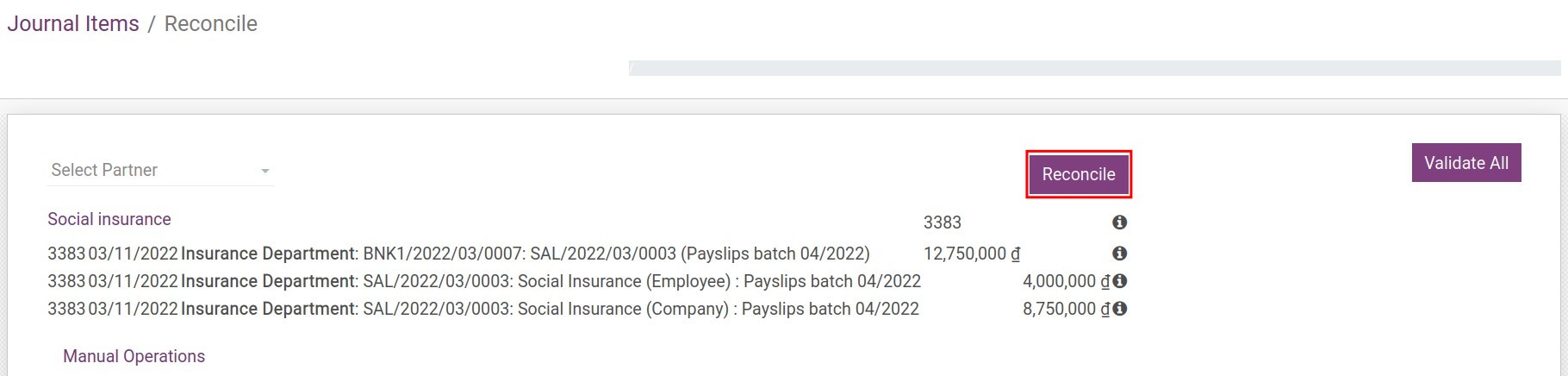

Salary reconciliation

- When you need to create salary payment on the system

- When you don’t need to create a salary payment on the system

-

Accounting for landed cost

-

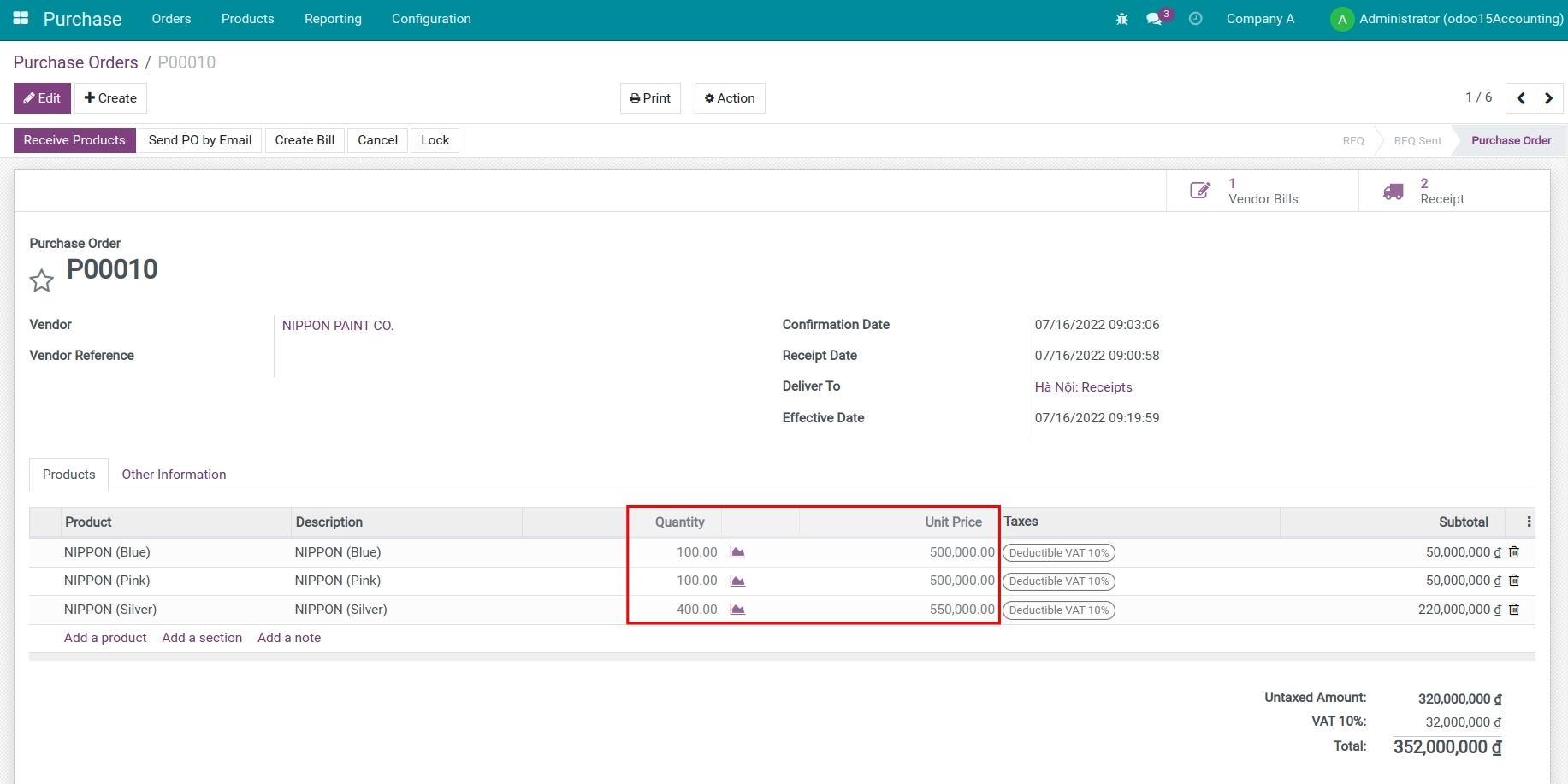

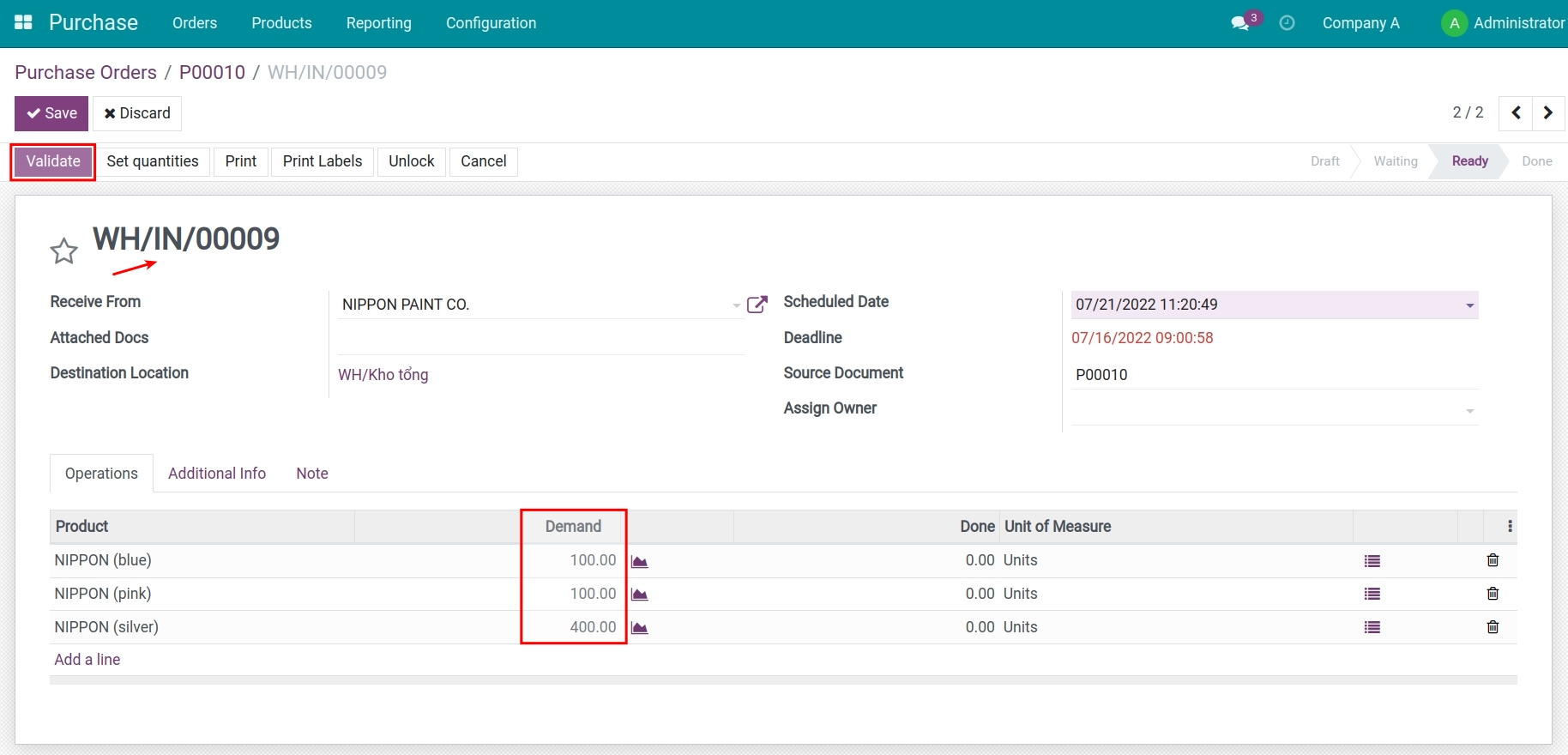

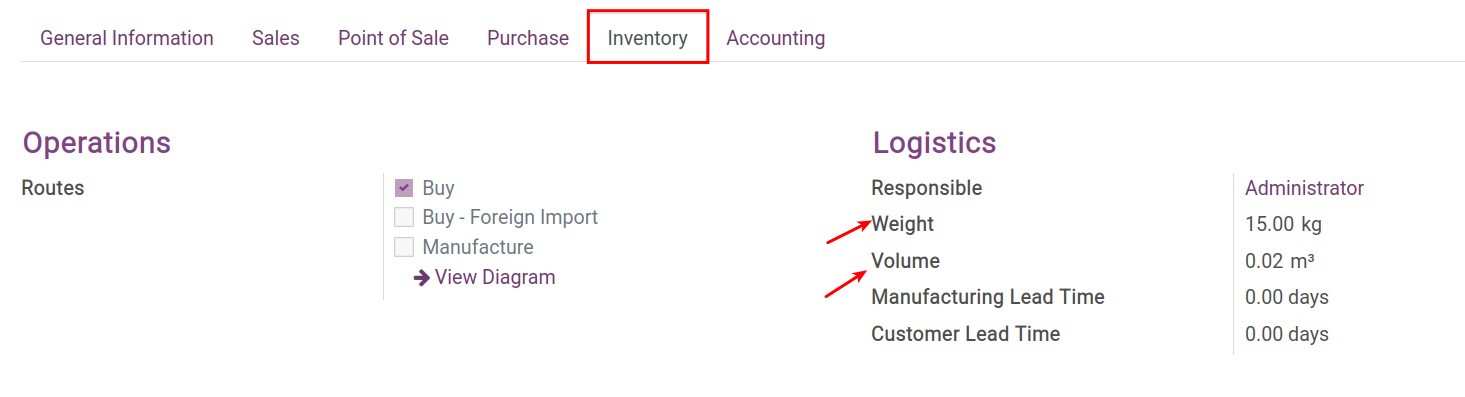

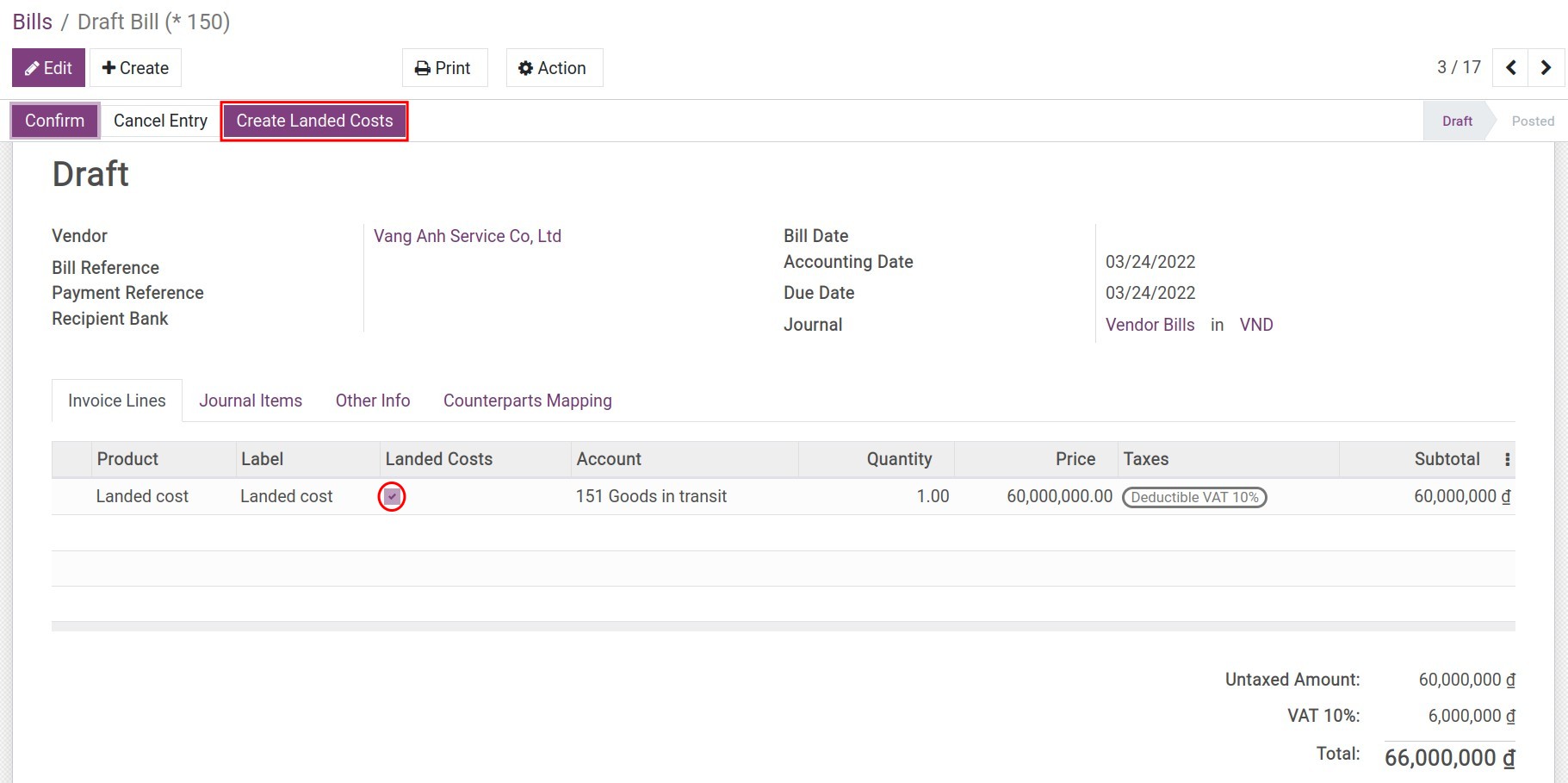

Accounting for landed cost

-

Overview

- Configuration

- Supported landed costs allocation methods

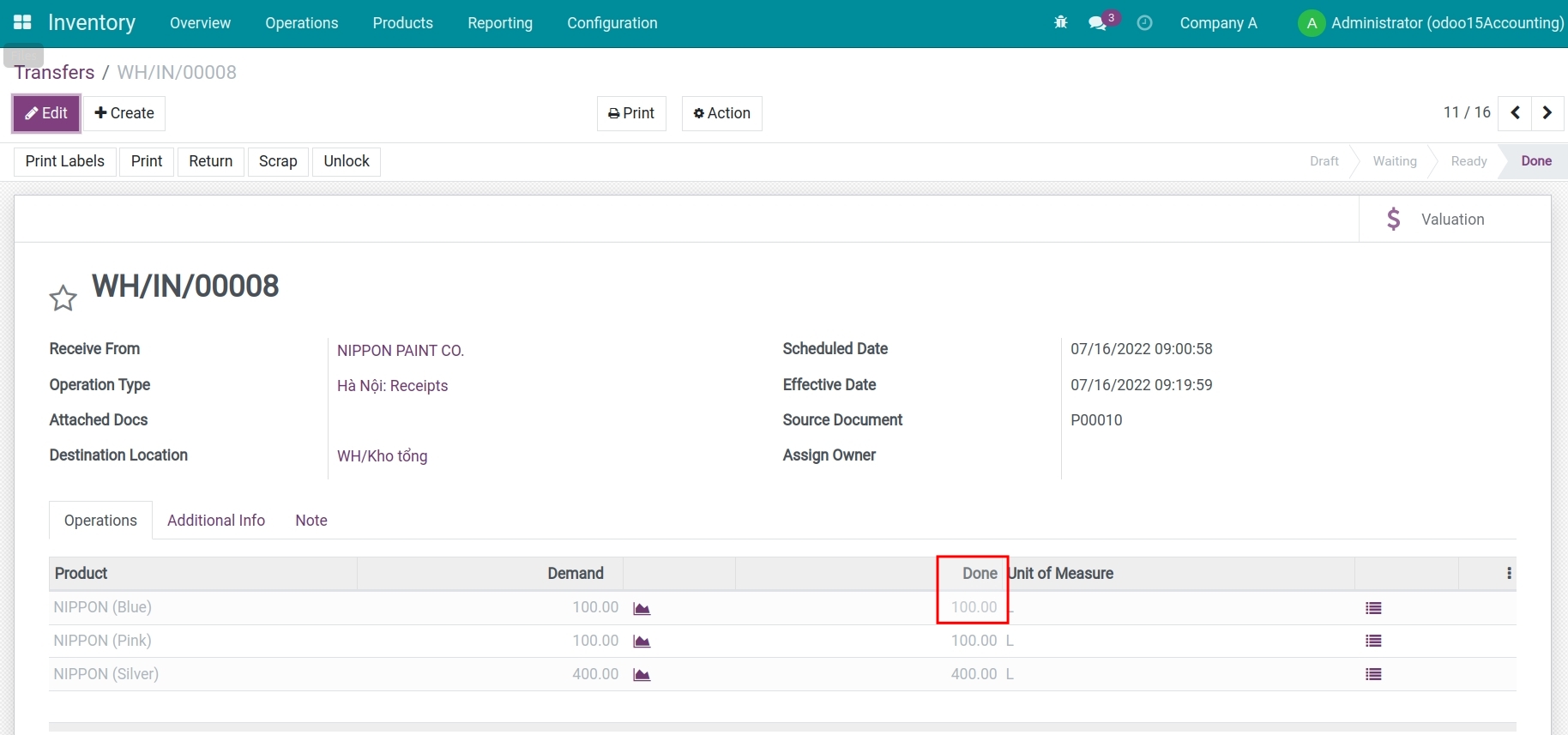

- Accounting for landed cost at the receipt of the goods

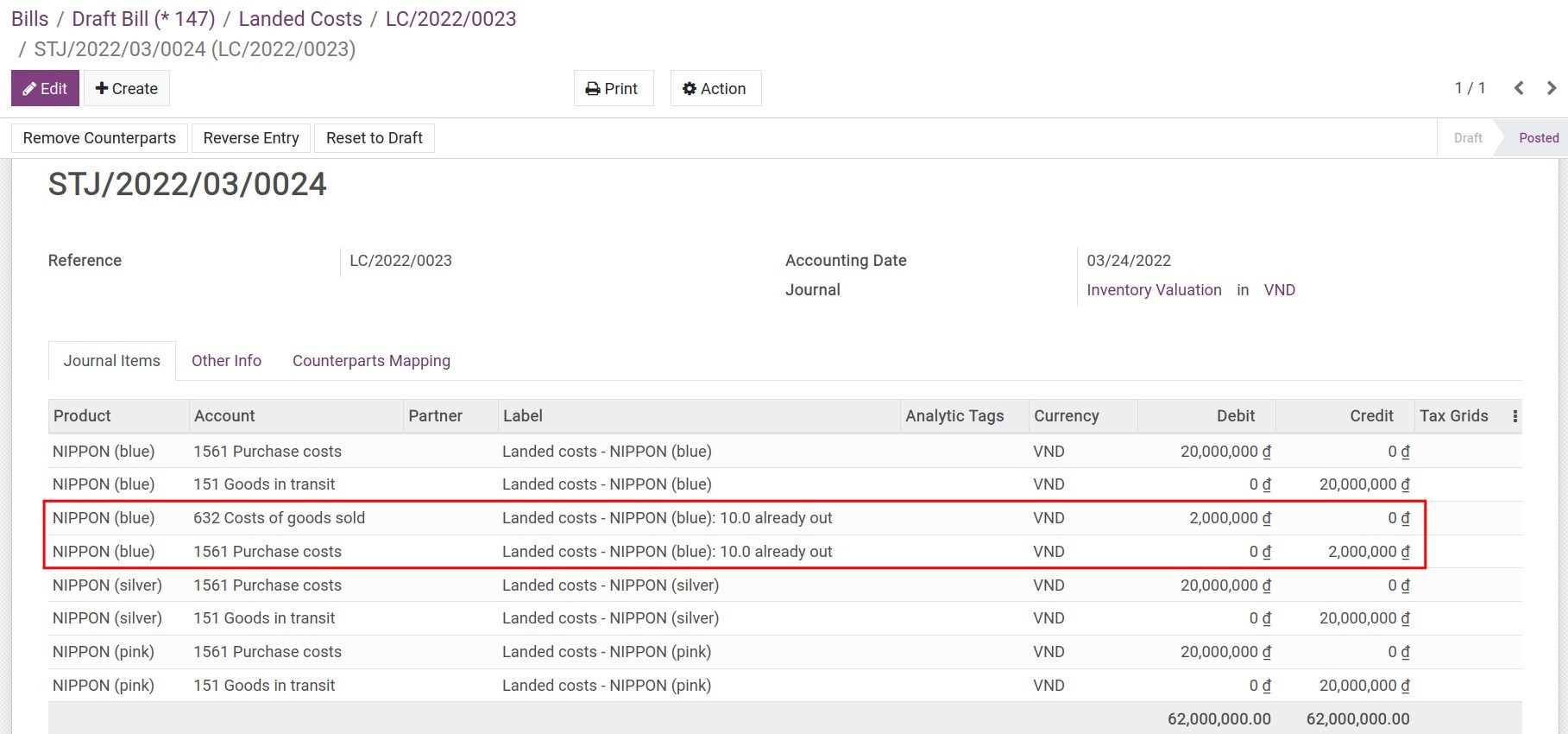

- Accounting for landed cost for sold products

-

Accounting for Stock Valuation

-

Accounting for Stock Valuation

-

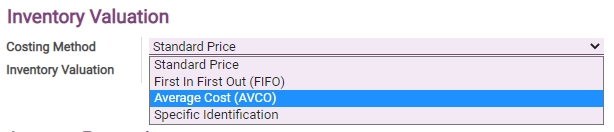

Costing Method

- Standard Price

- First In First Out (FIFO)

- Average Cost (AVCO)

- Specific Identification

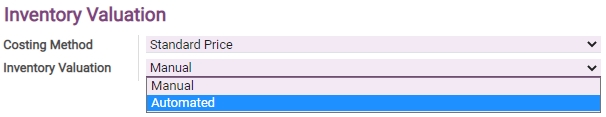

- Inventory Valuation method

-

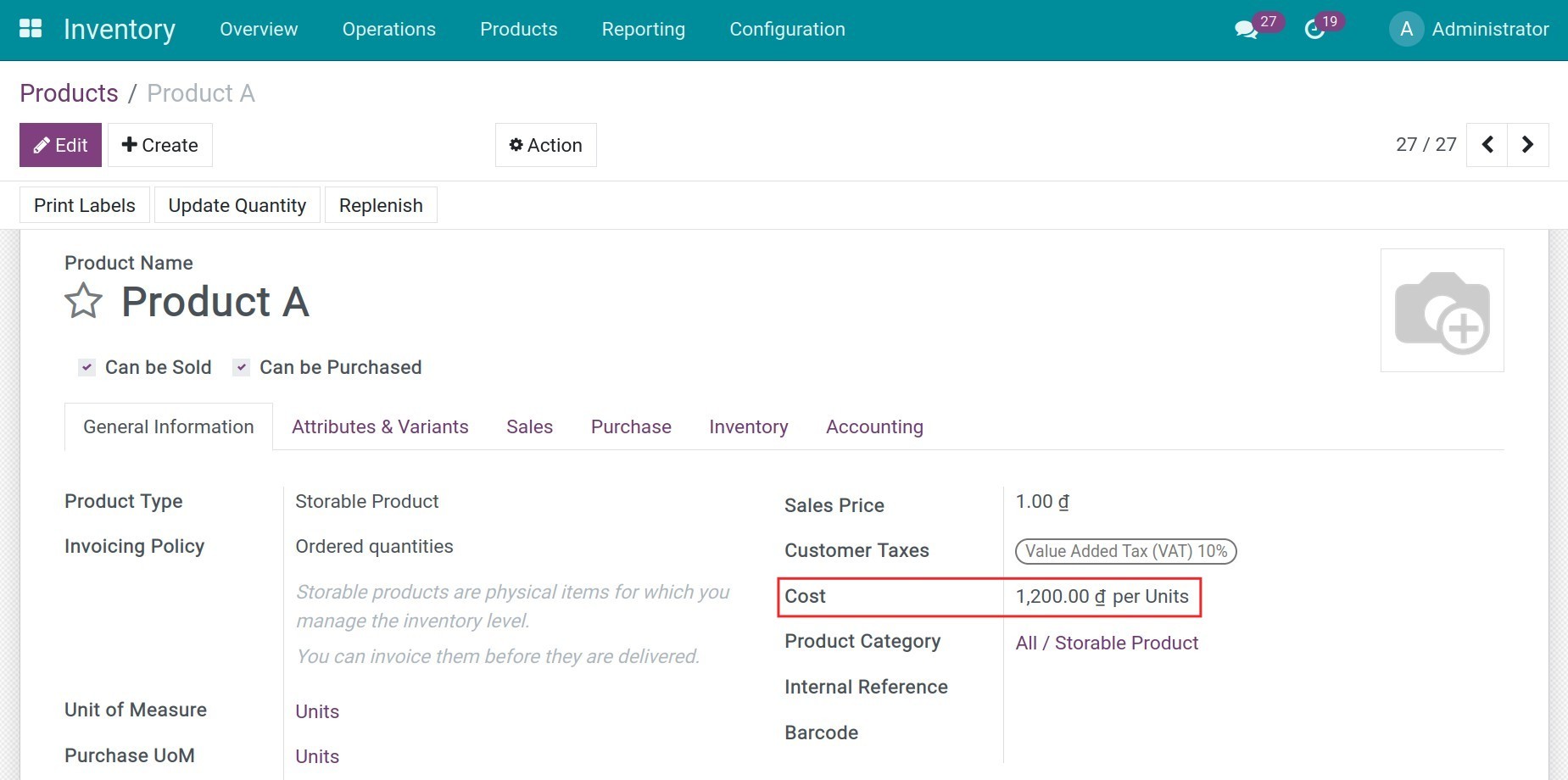

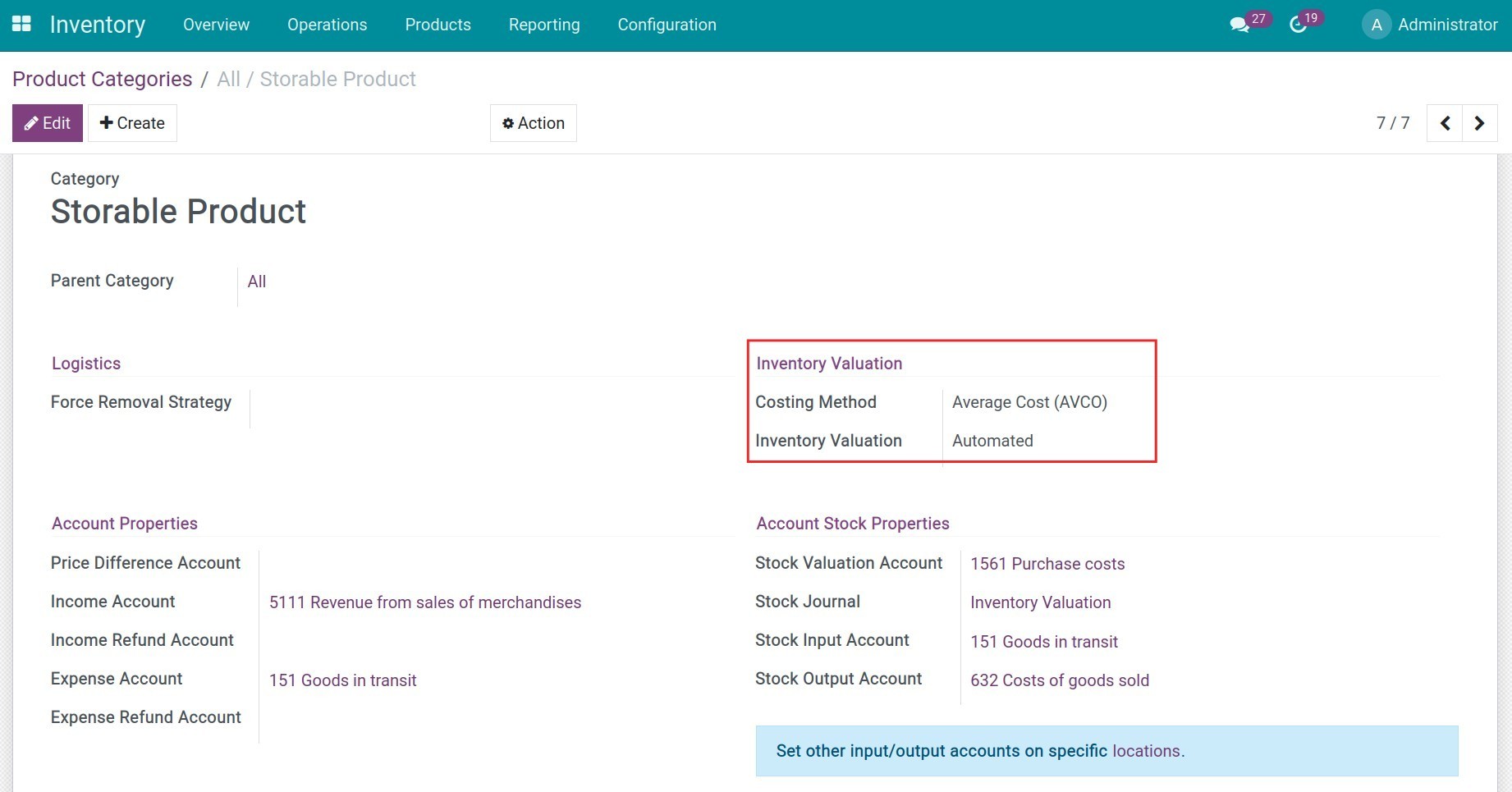

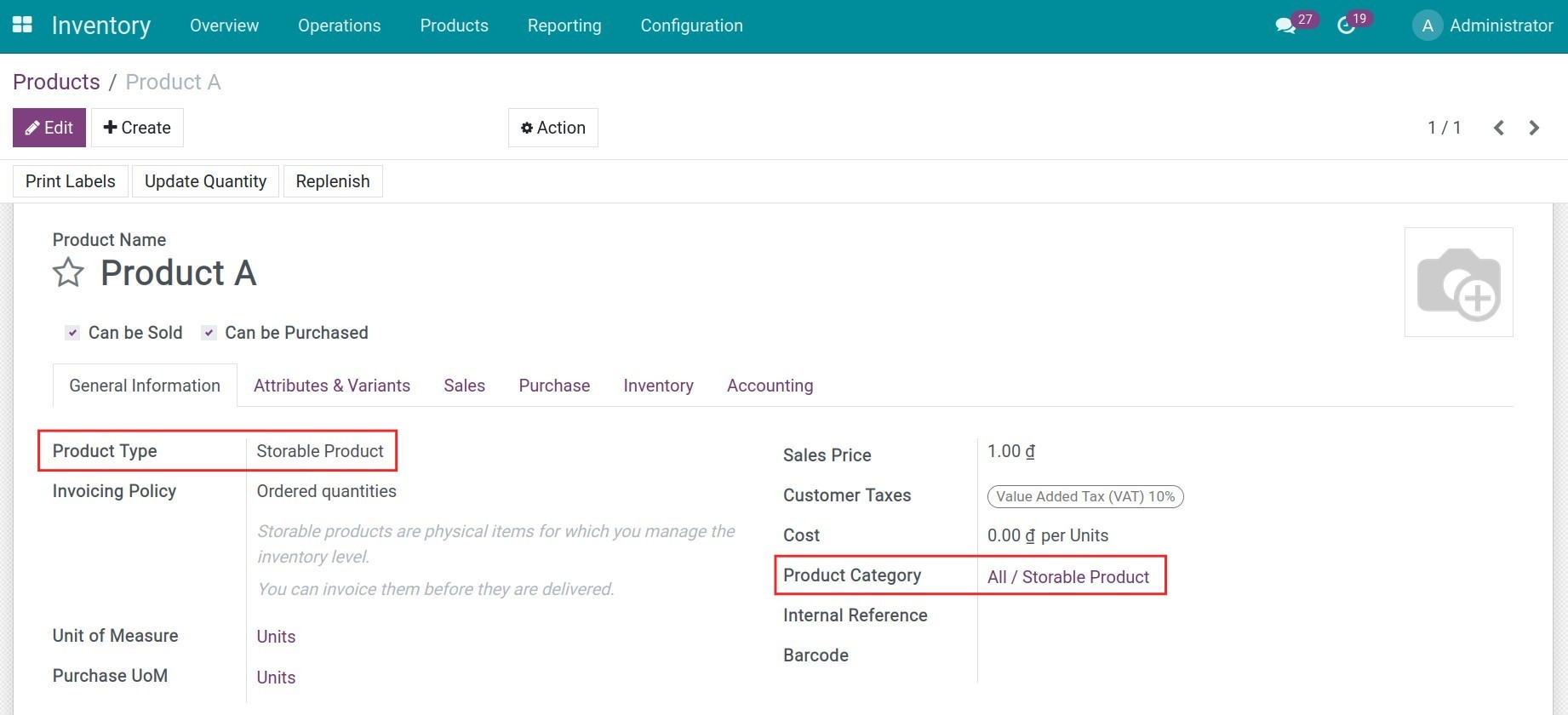

Inventory valuation with Viindoo software

- Configuration of Product Categories

- Configuration on Products

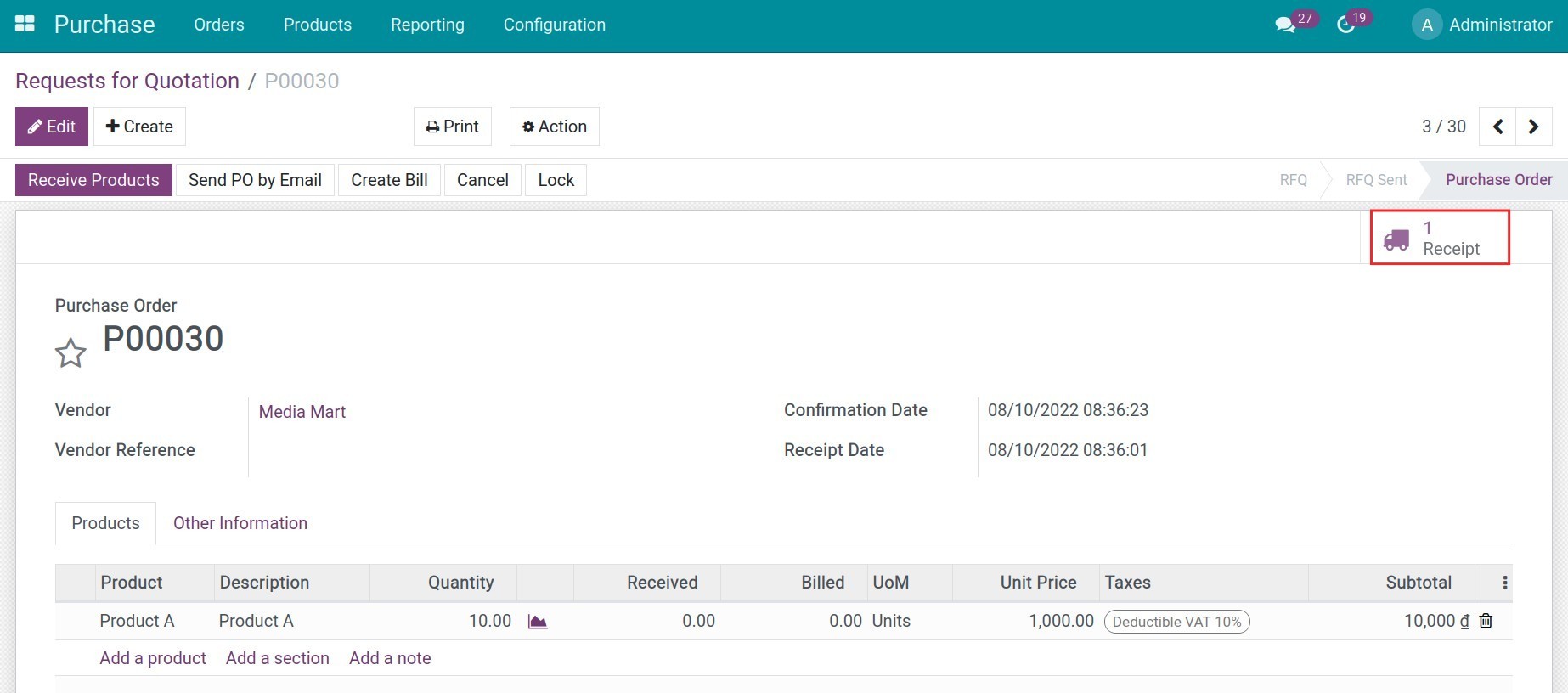

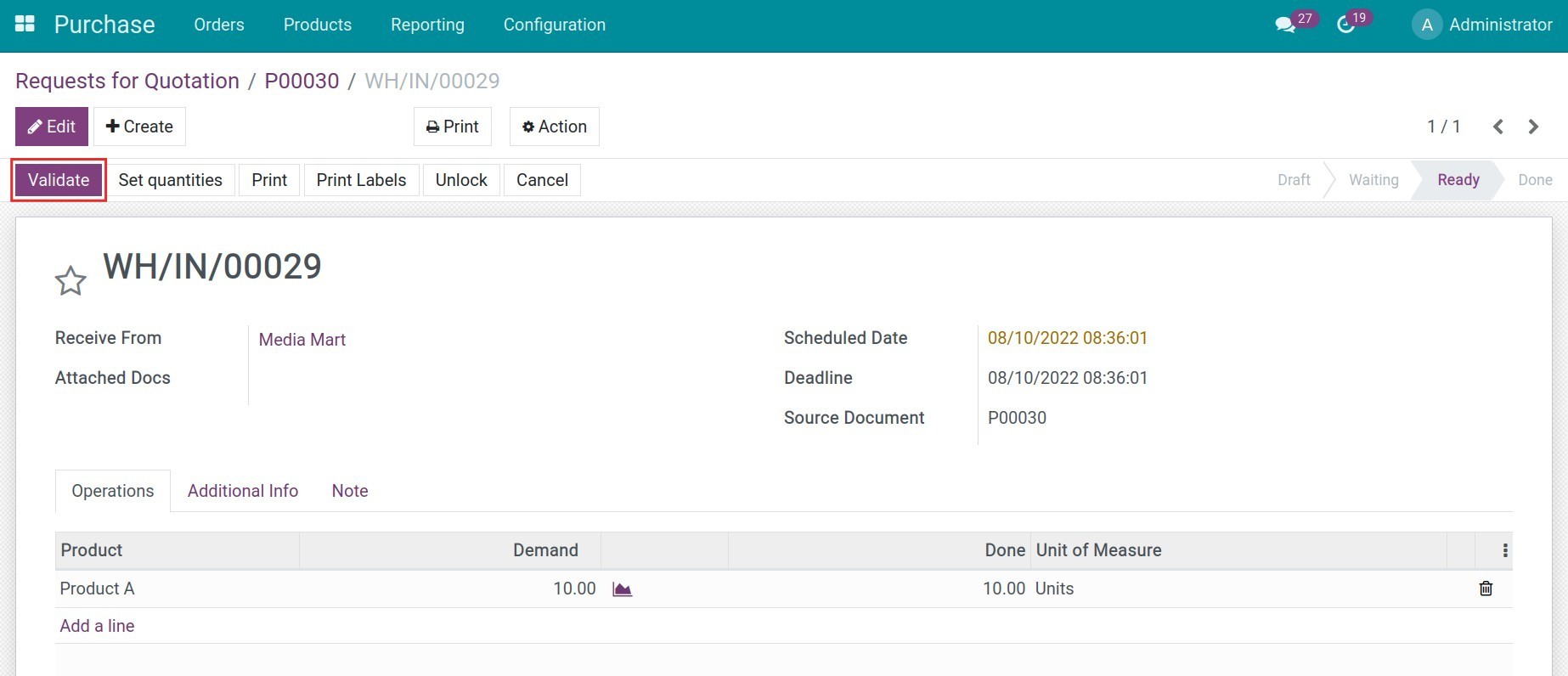

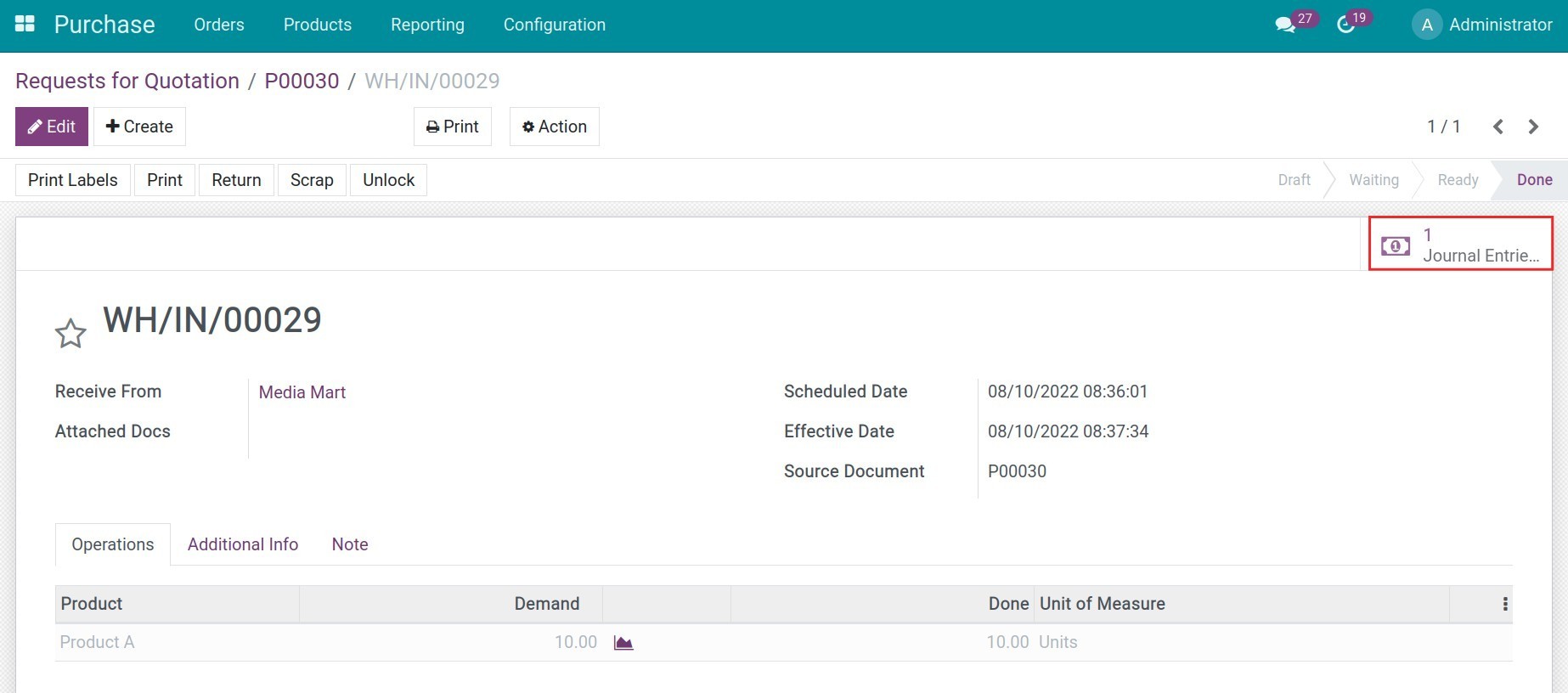

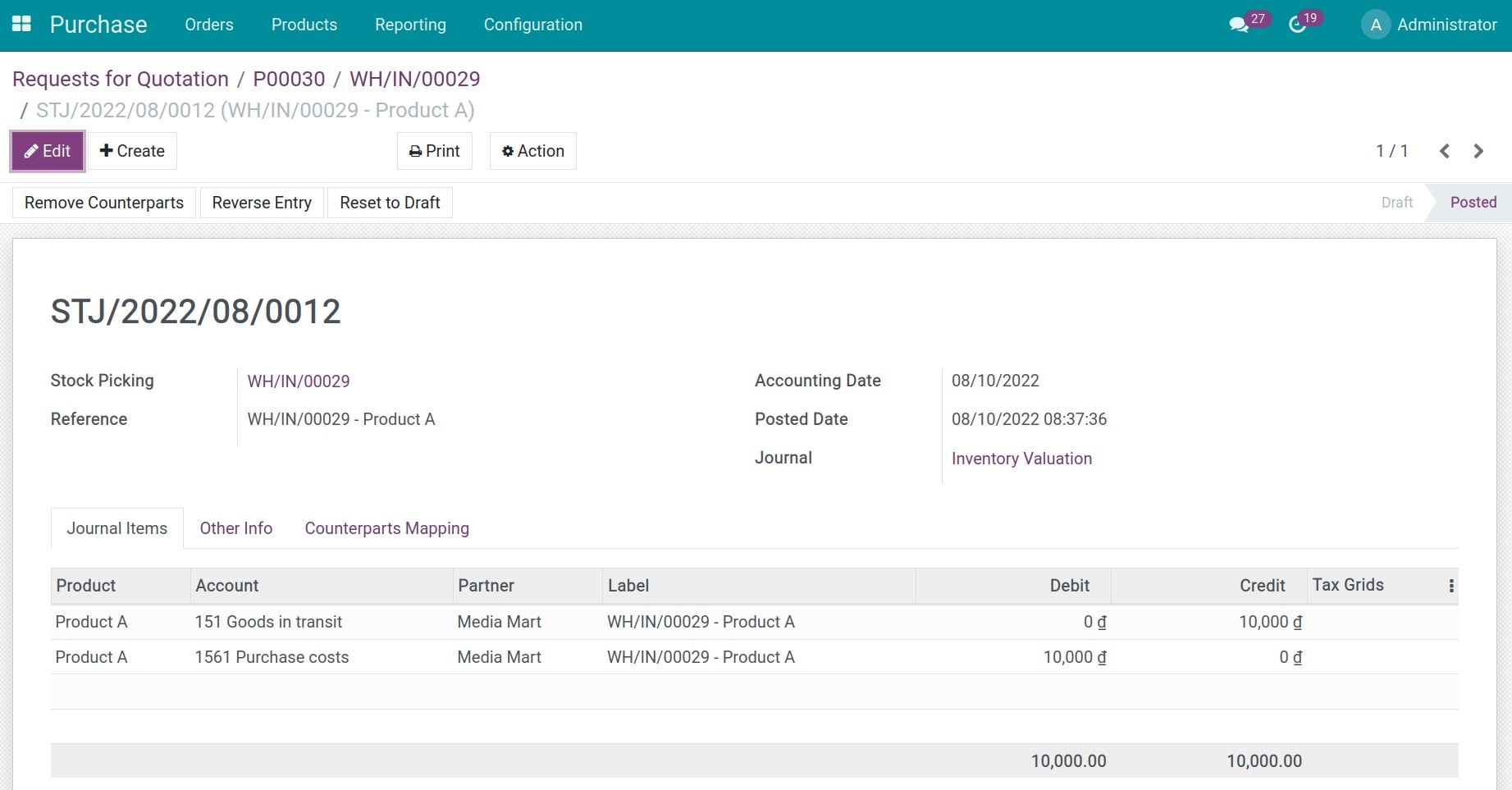

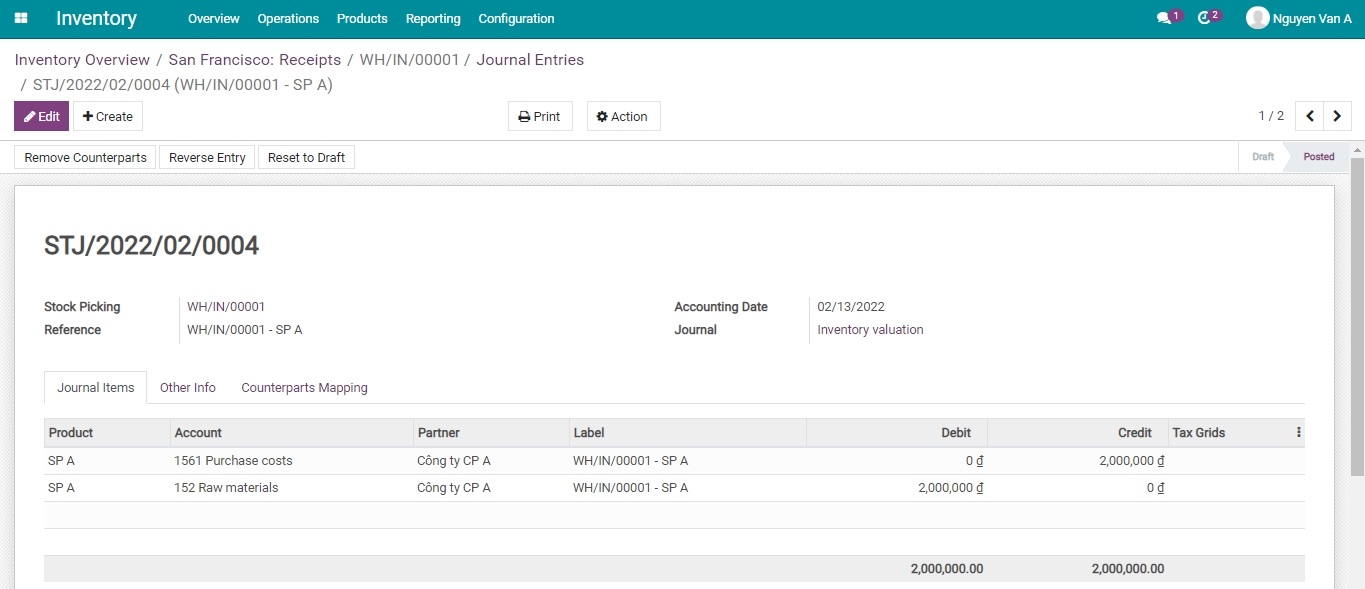

- Journal entries generated from a validated receipt

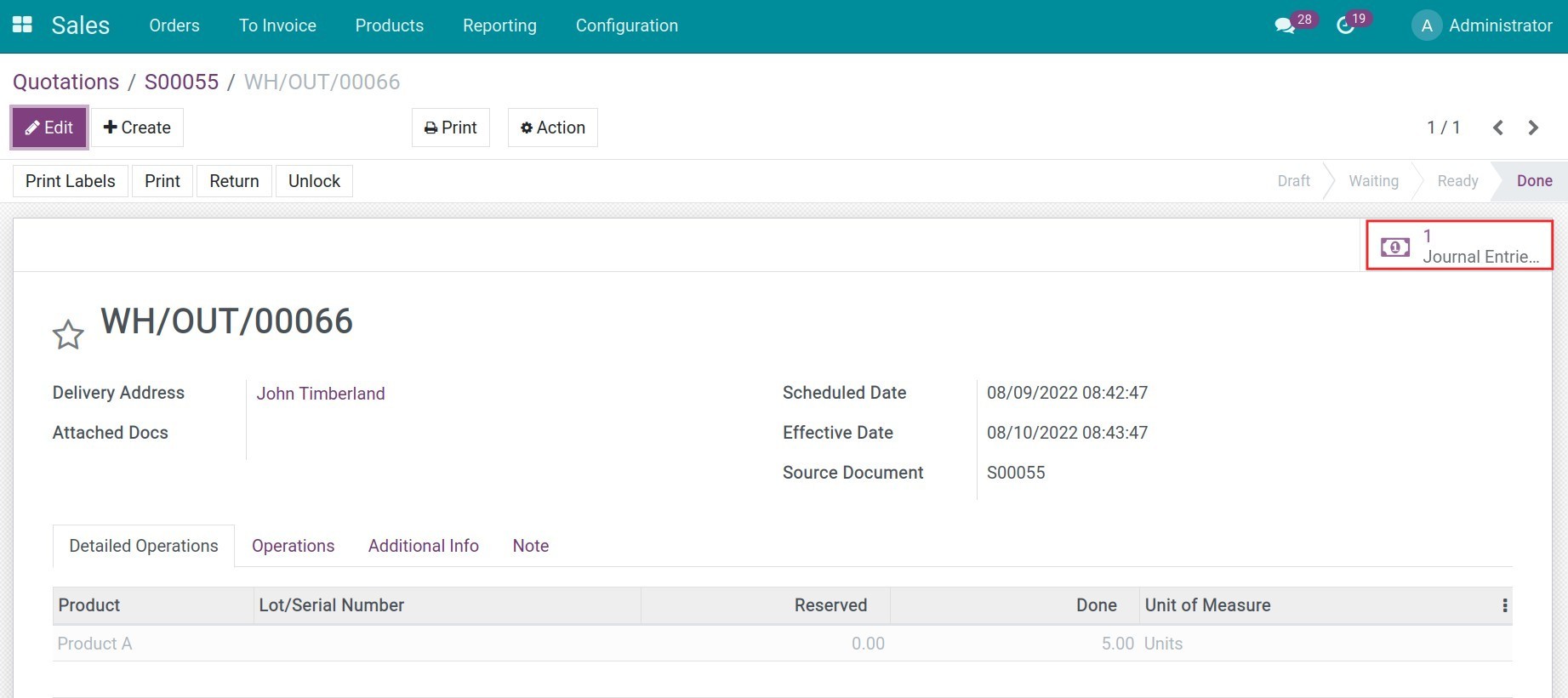

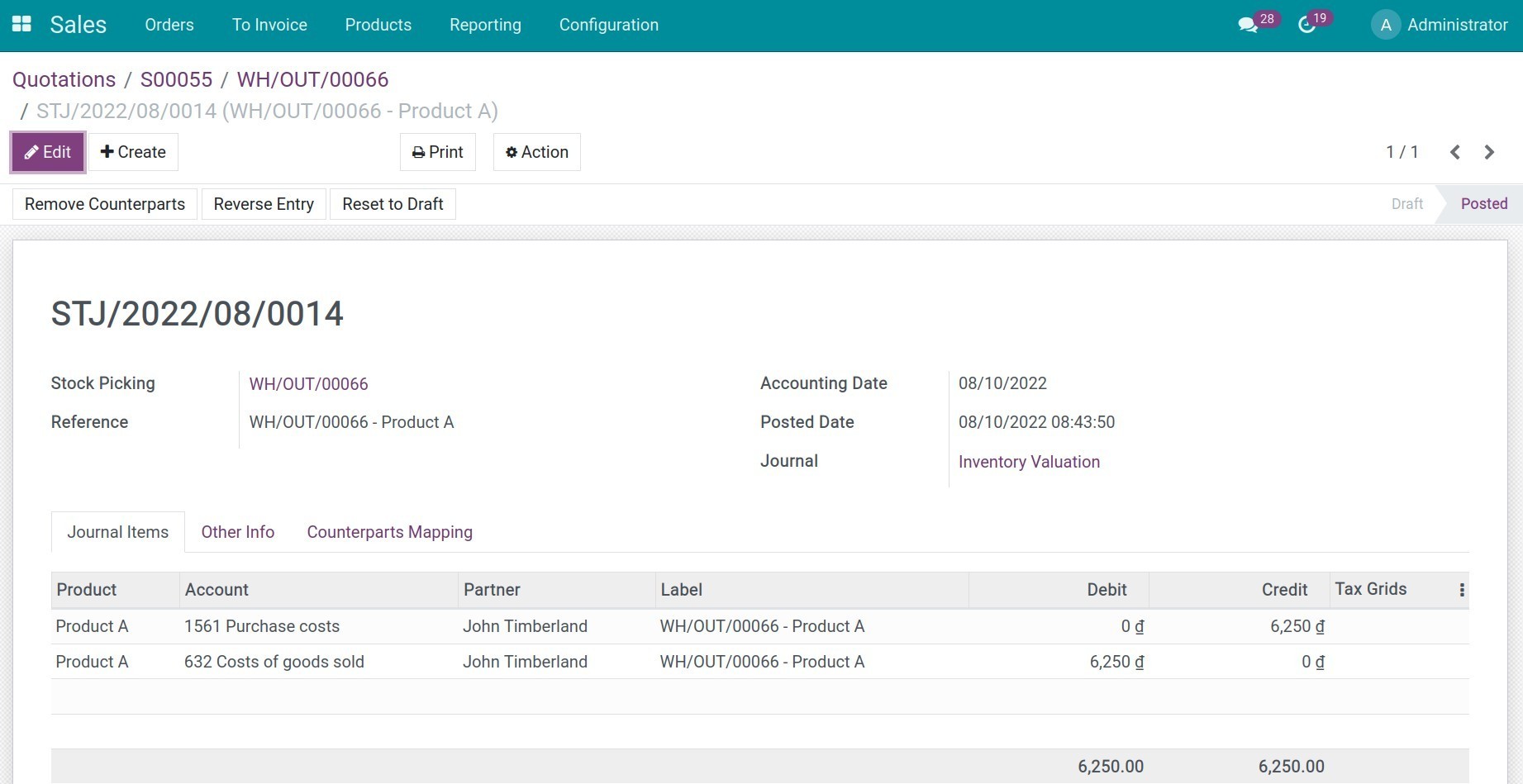

- Journal entries generated from a validated delivery order

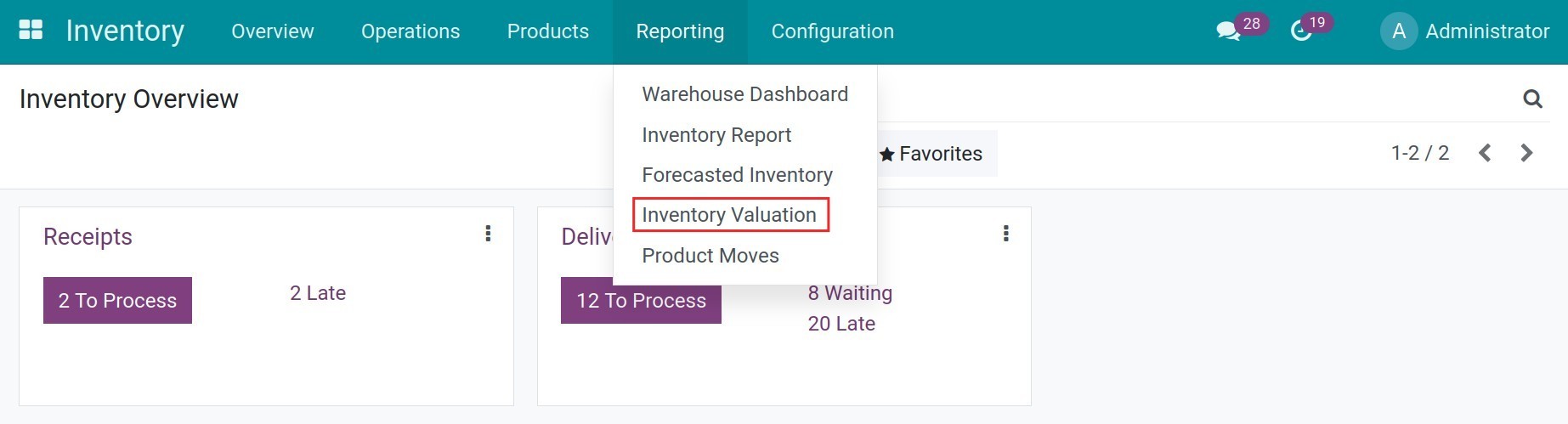

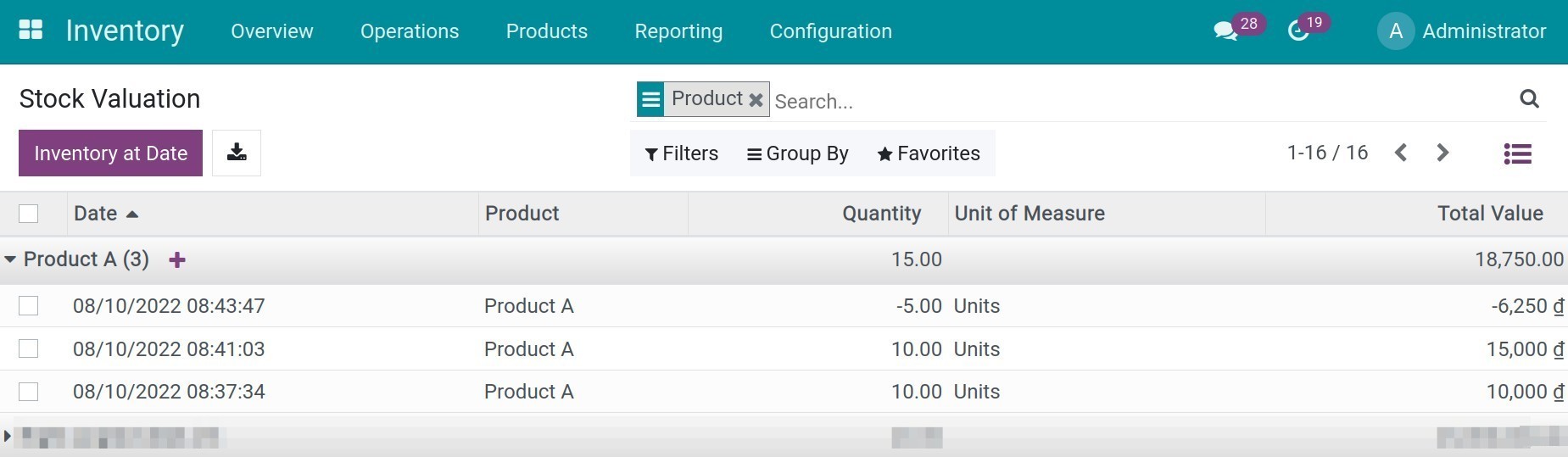

- View Inventory Valuation reports

-

Accounting for Inventory Adjustment

-

Accounting for Inventory Adjustment

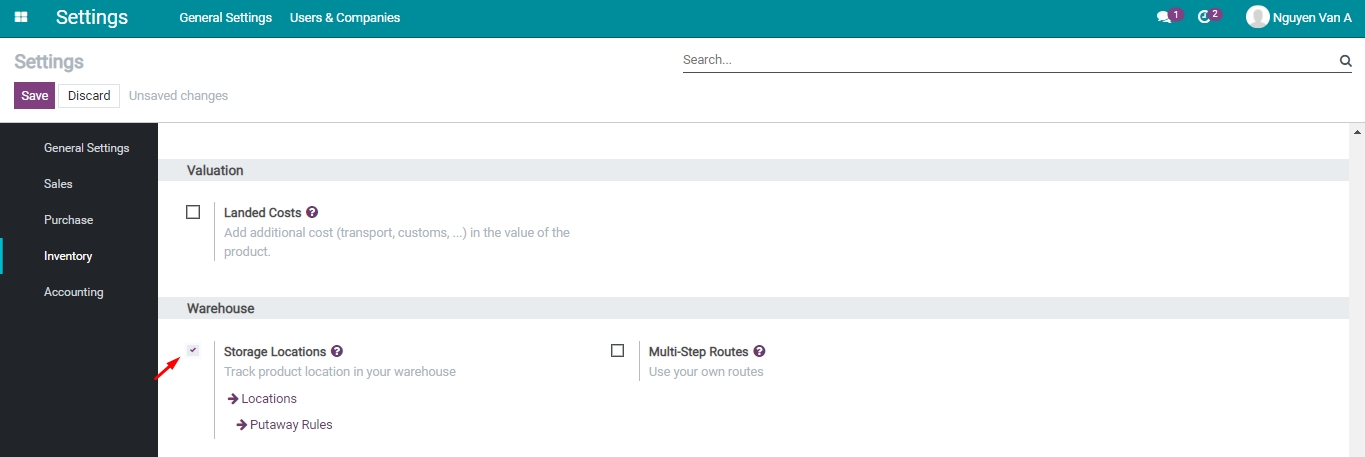

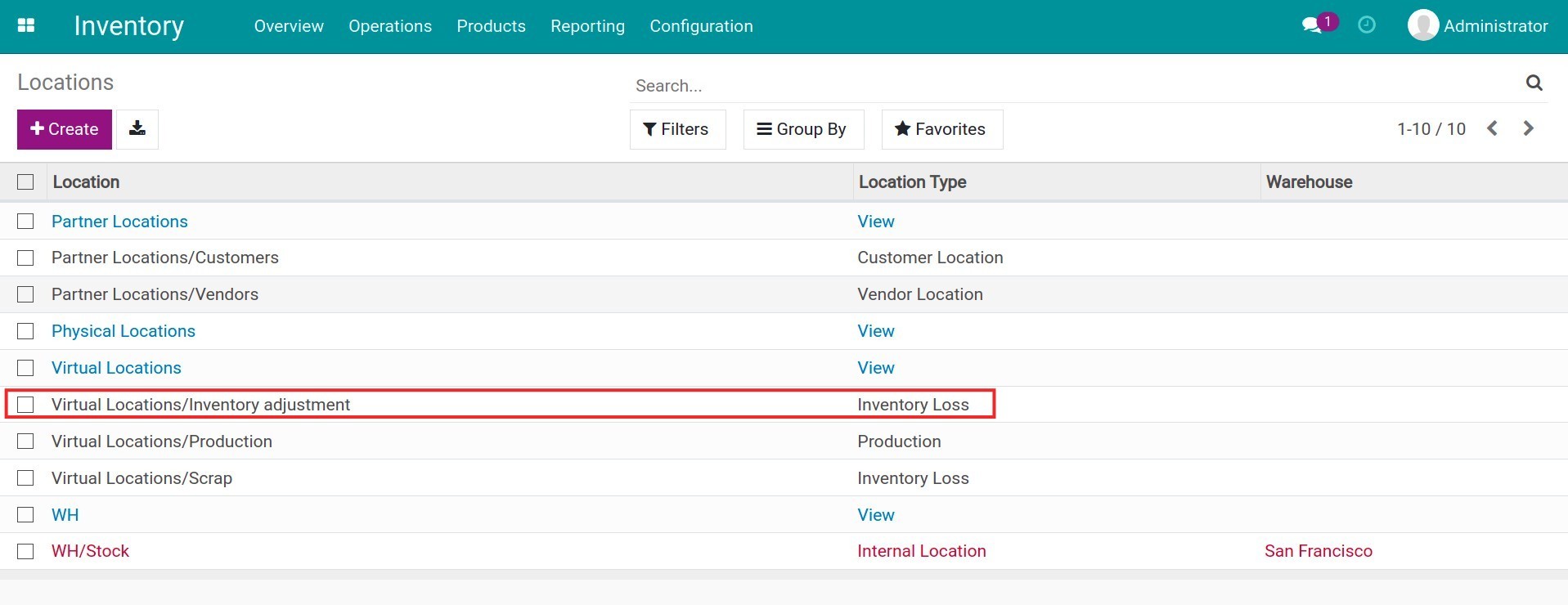

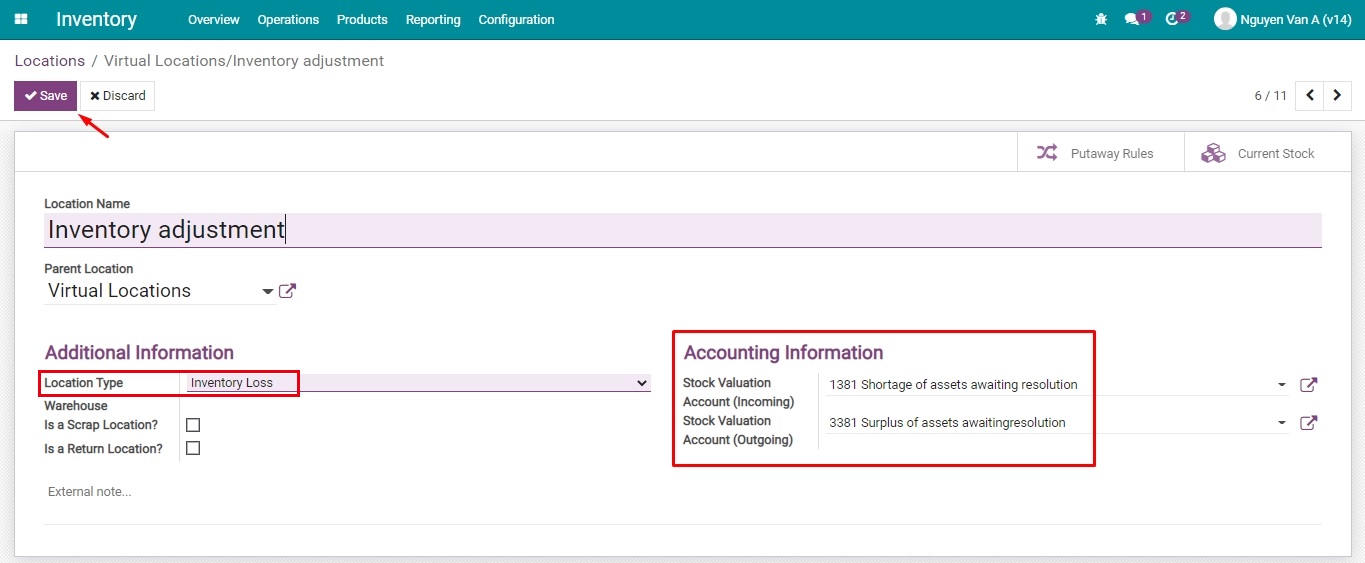

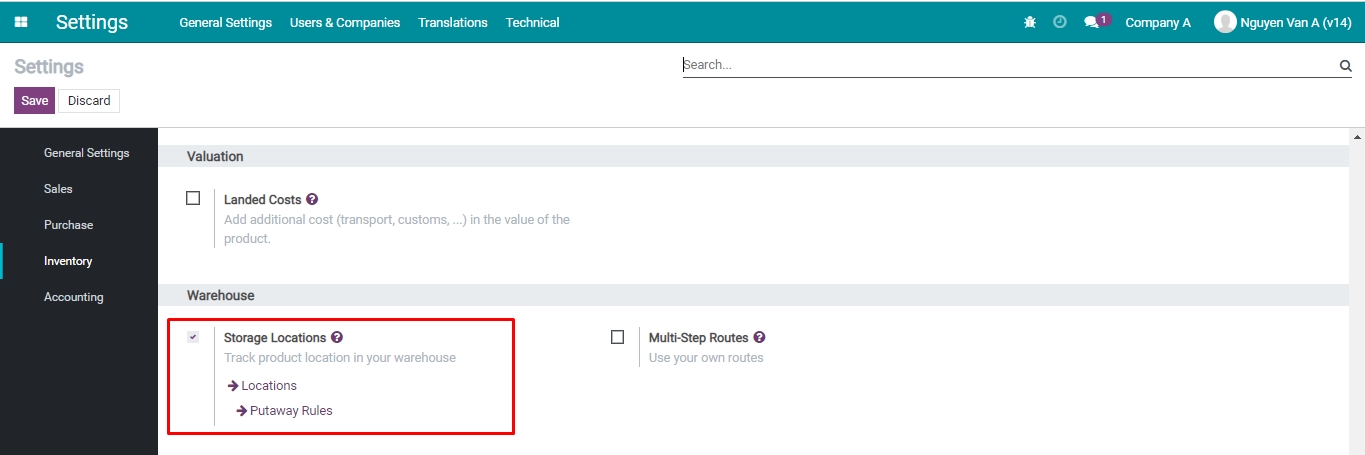

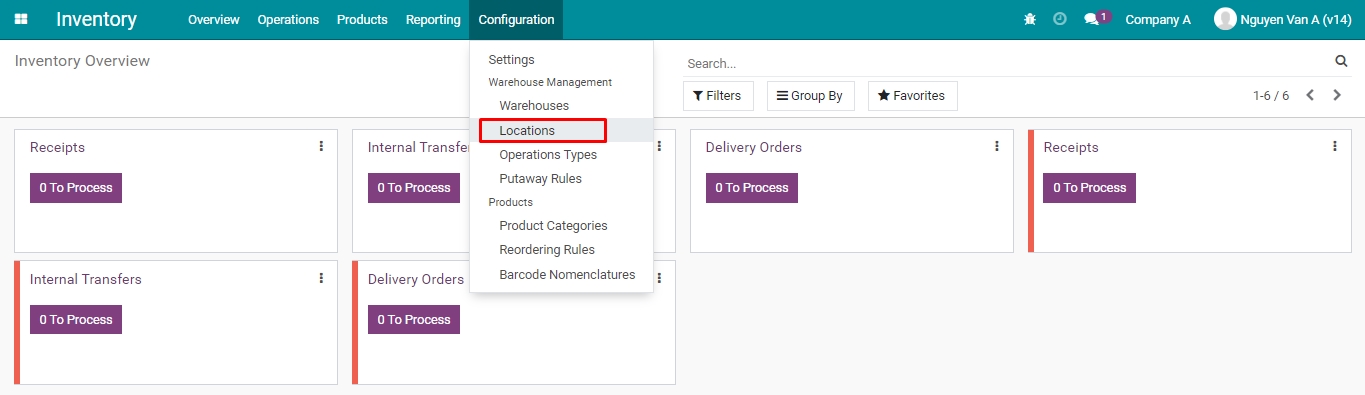

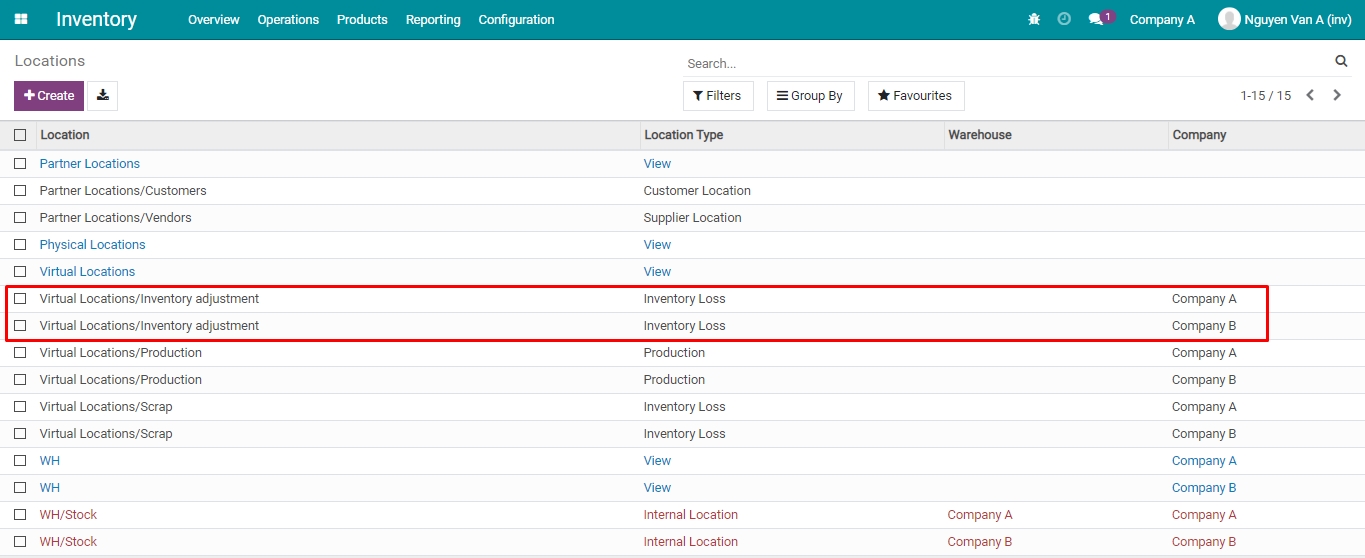

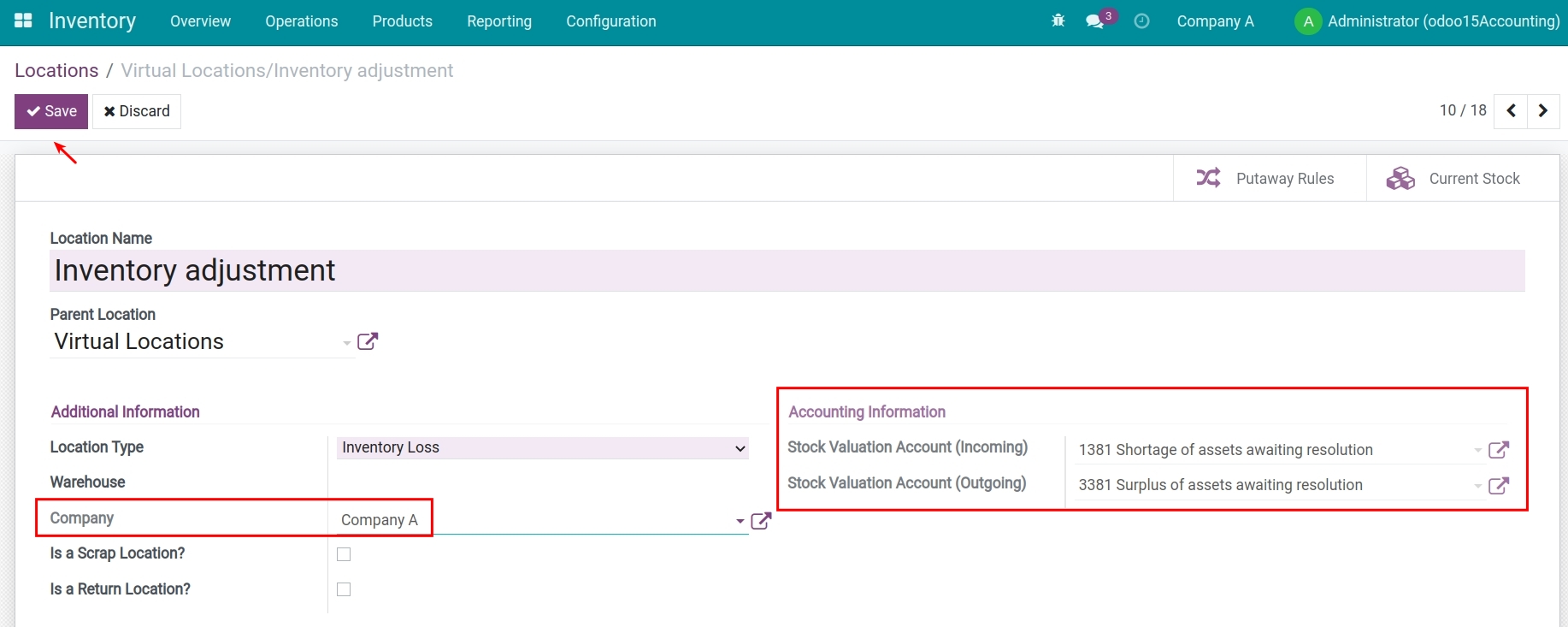

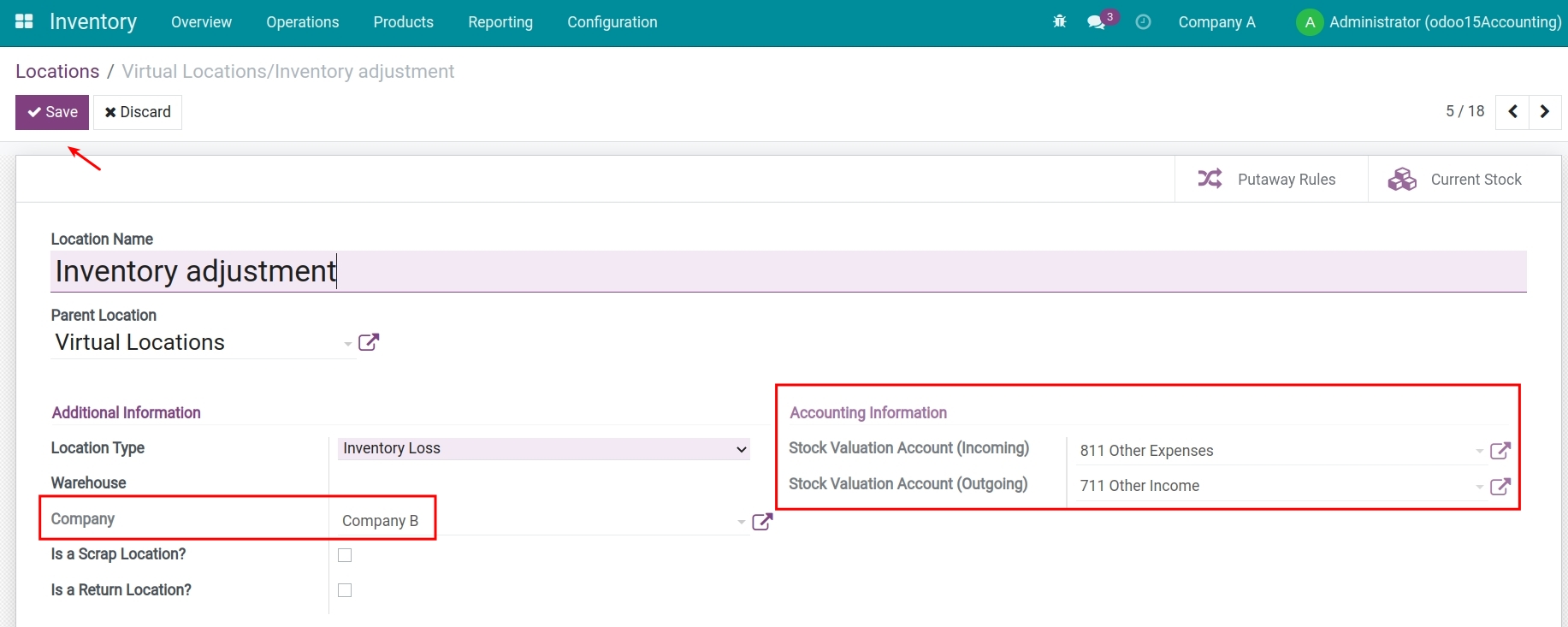

- Configuring Inventory Adjustment Location

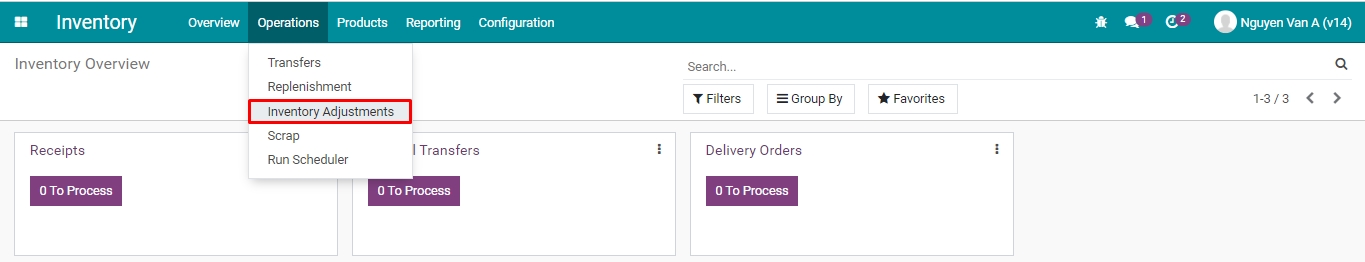

- Accounting for loss/excess of products during Inventory Adjustment

-

Accounting for Inventory Scrap

-

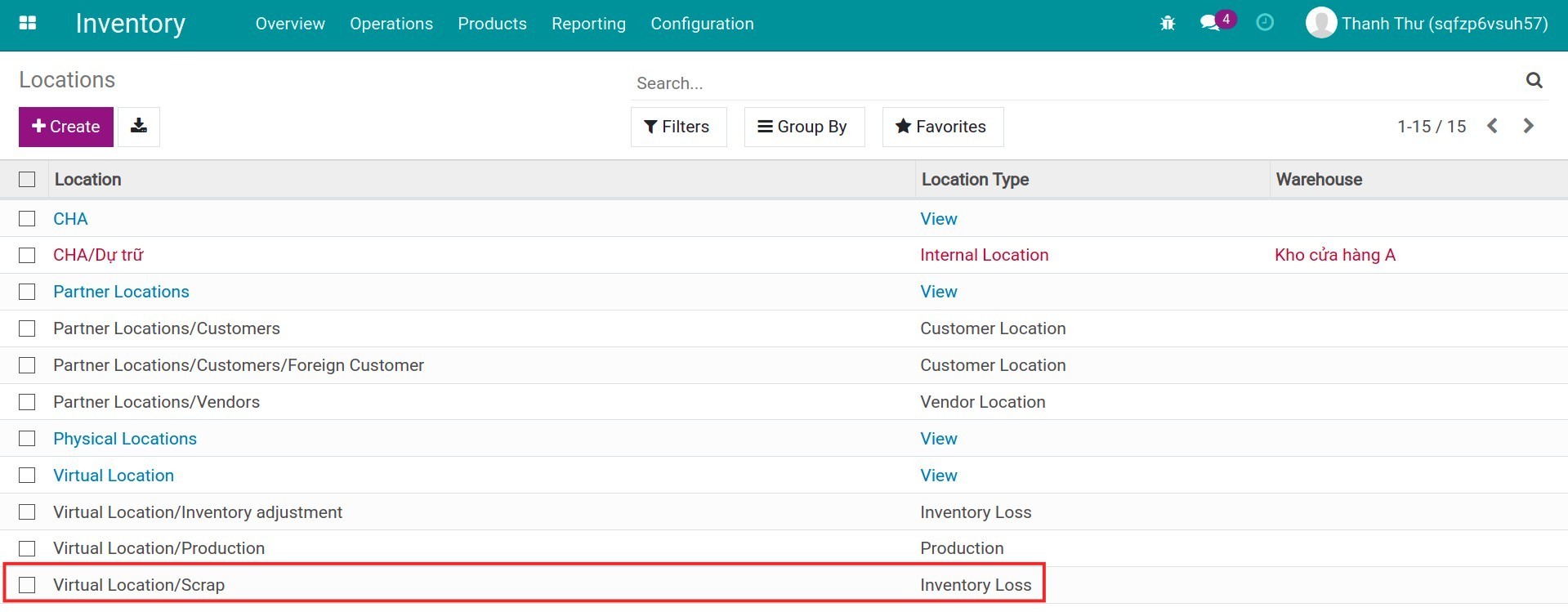

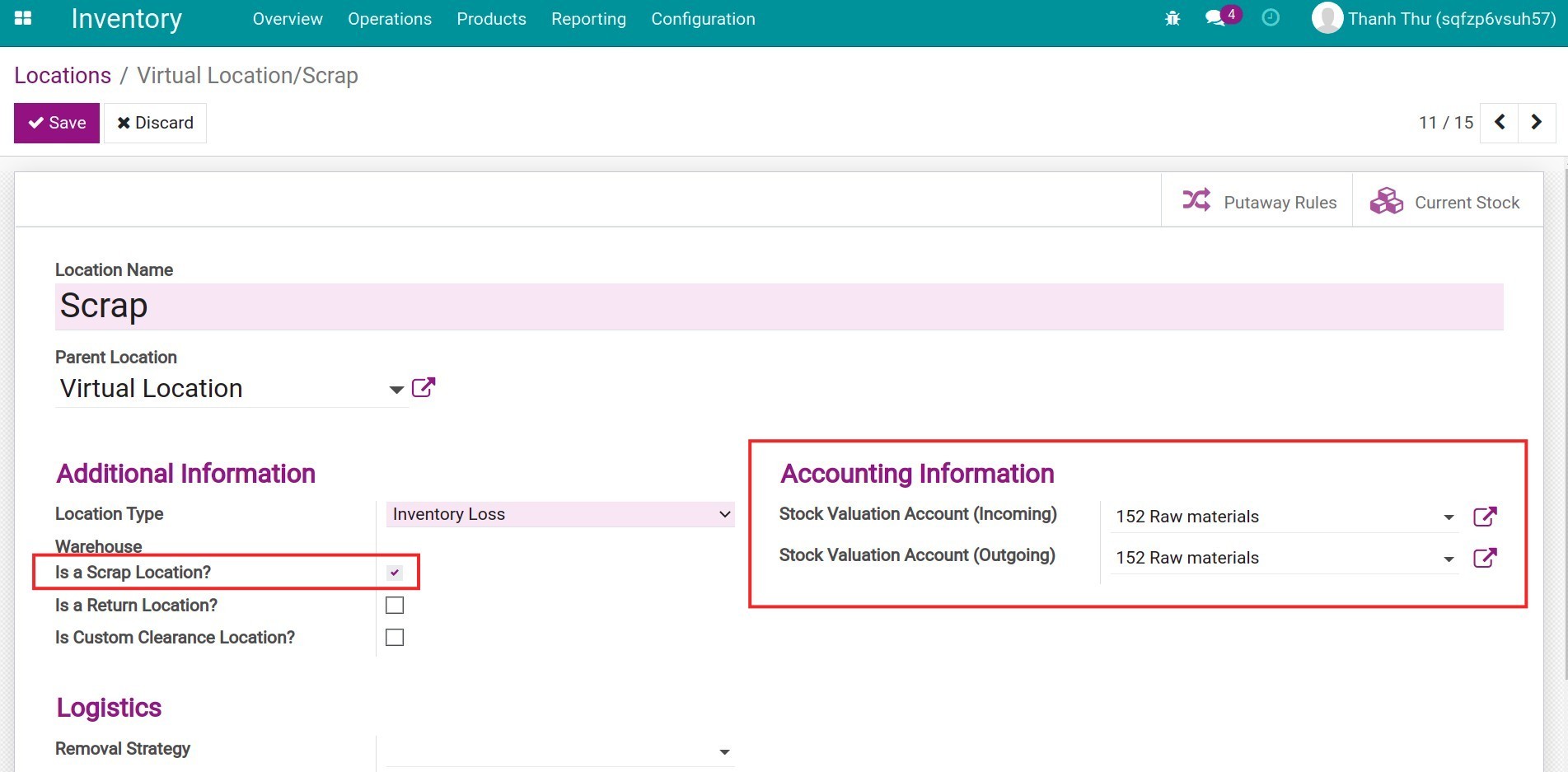

Accounting for Inventory Scrap

- Configure Scrap Location

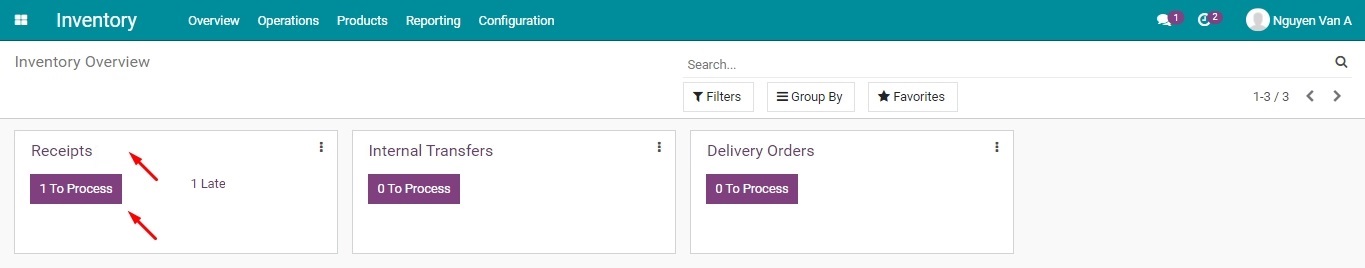

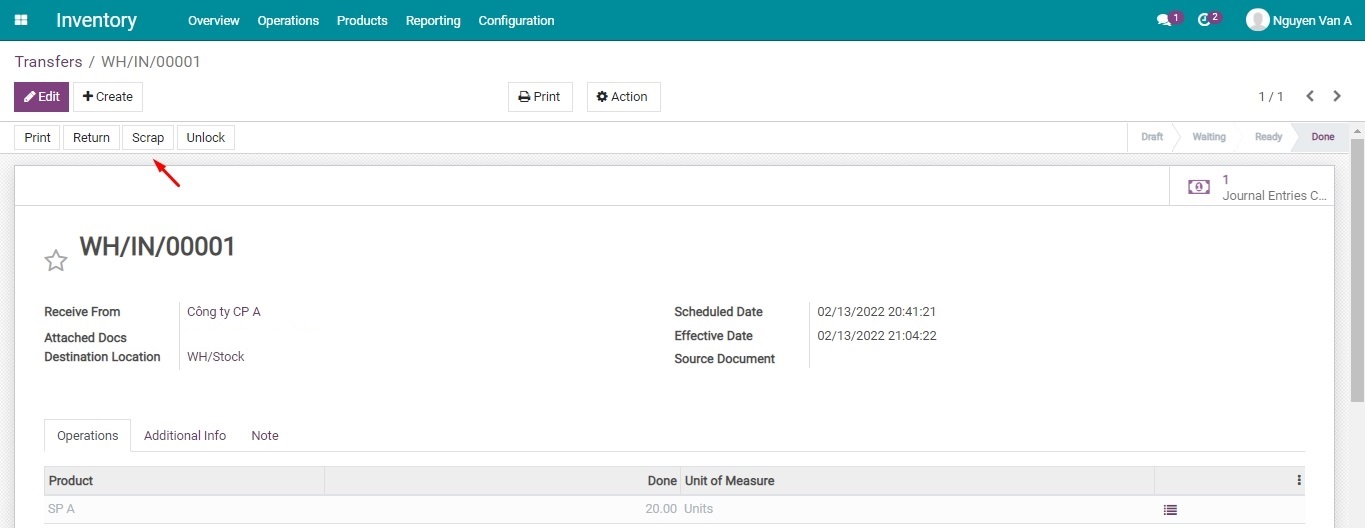

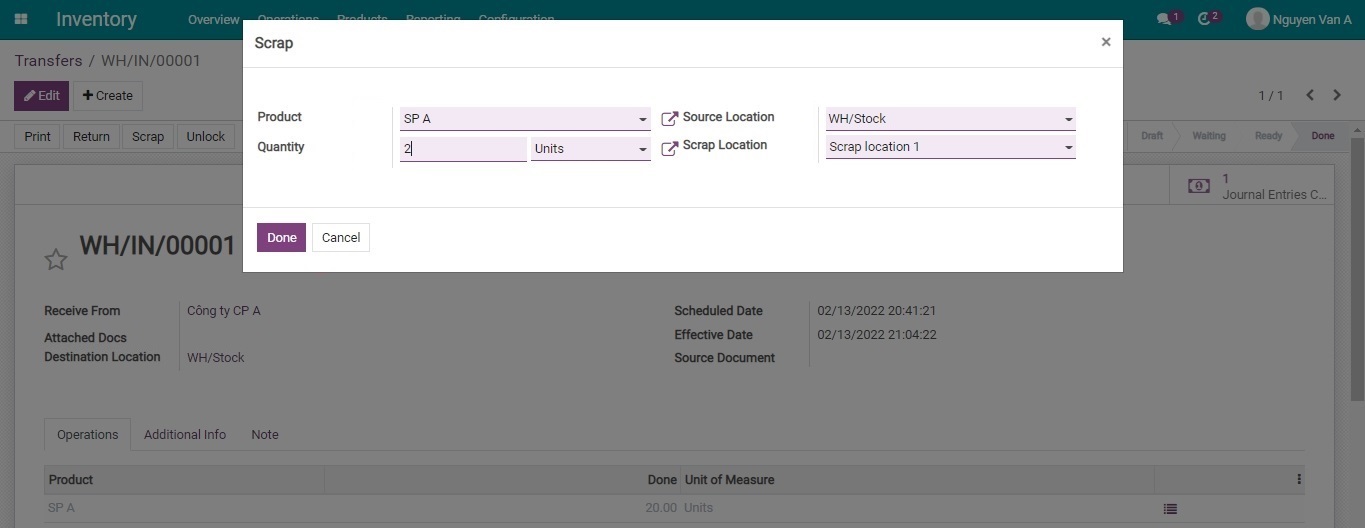

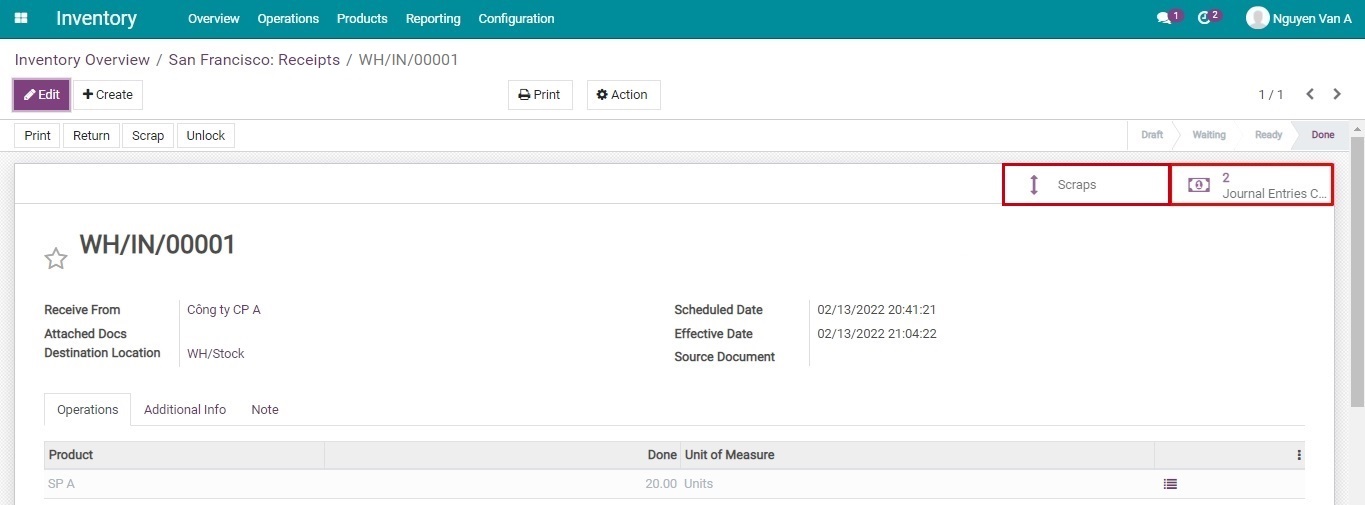

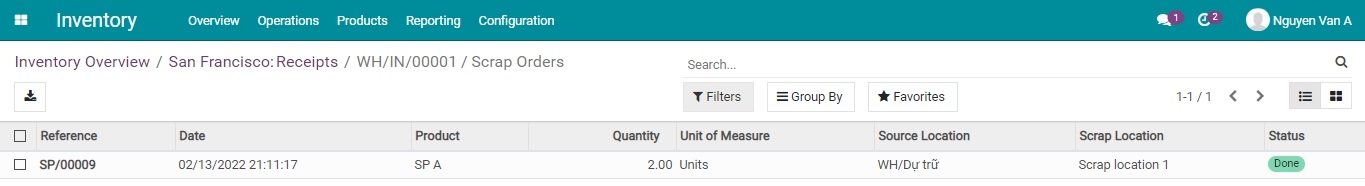

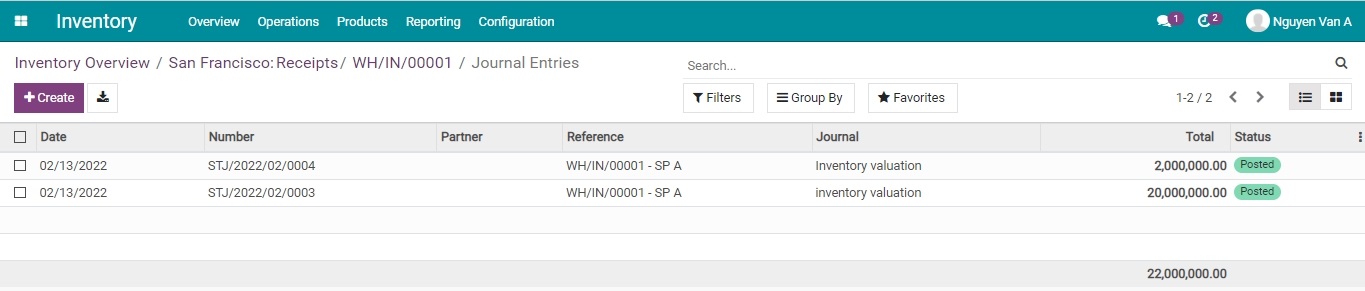

- How to account for scrap in Viindoo?

-

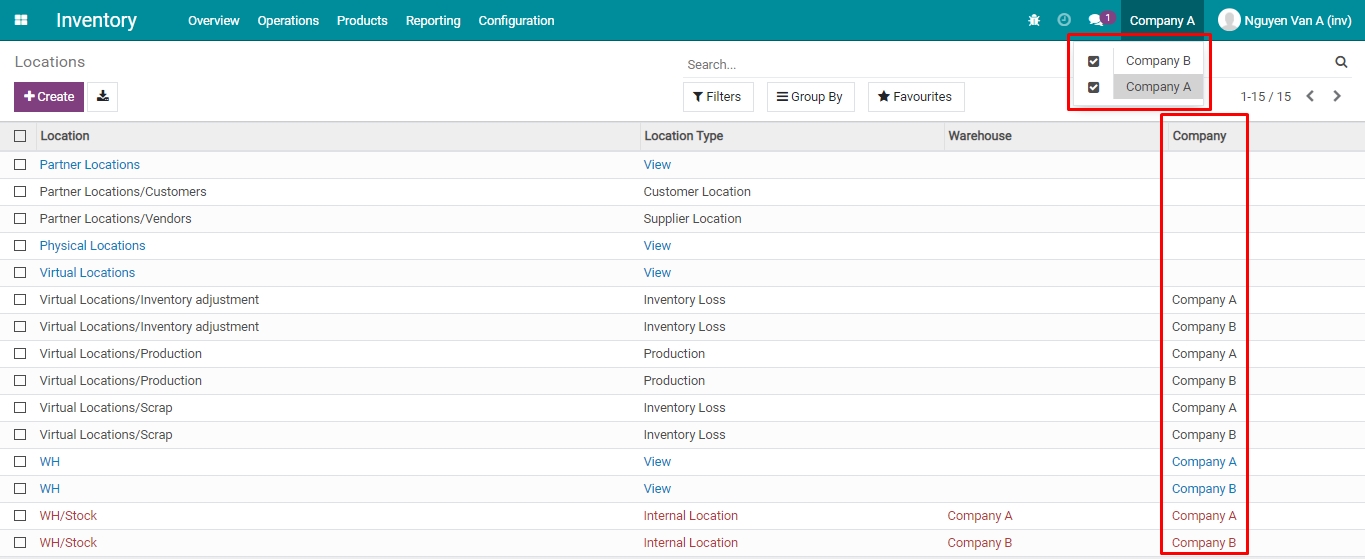

Configure inventory accounting for multi-companies

-

Configure inventory accounting for multi-companies

- Configure accounts for a storage location

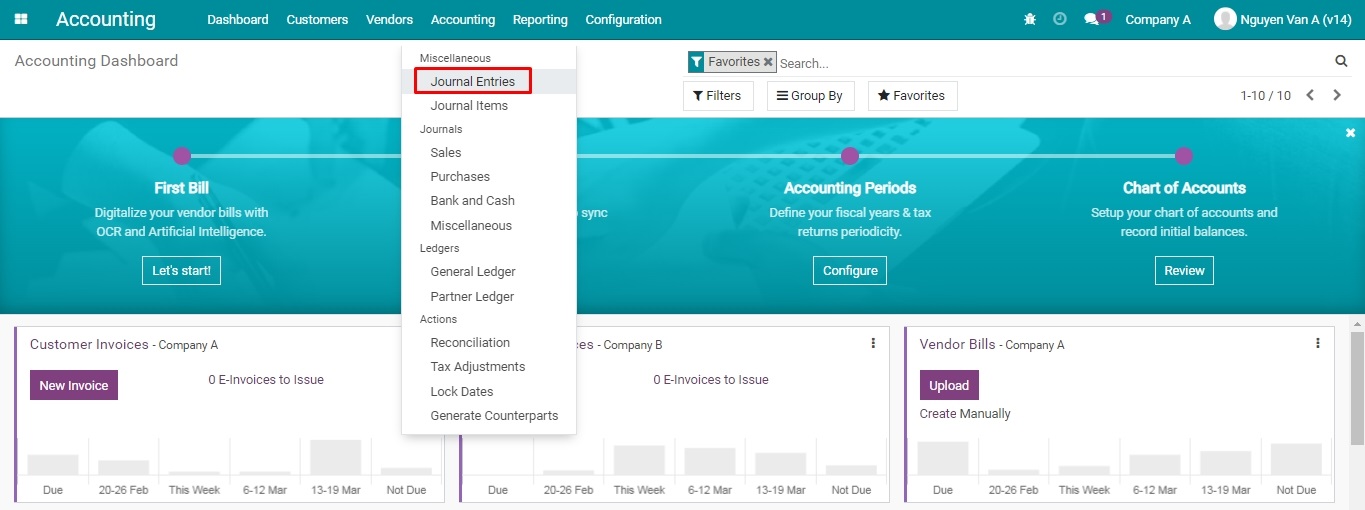

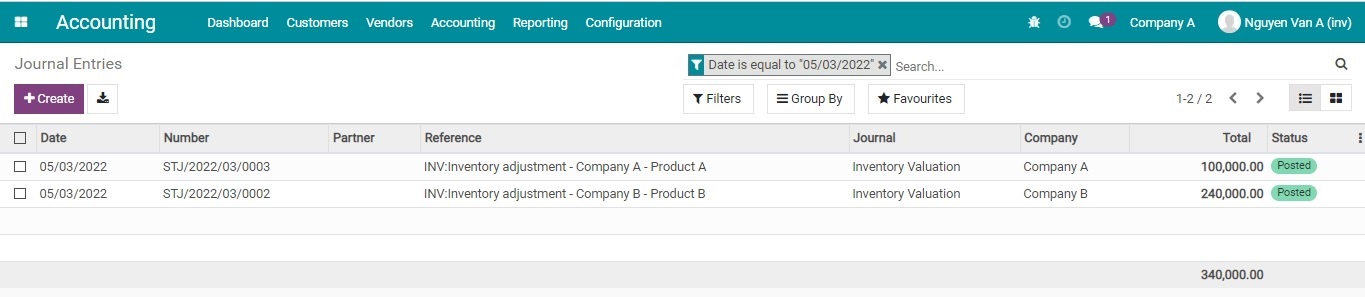

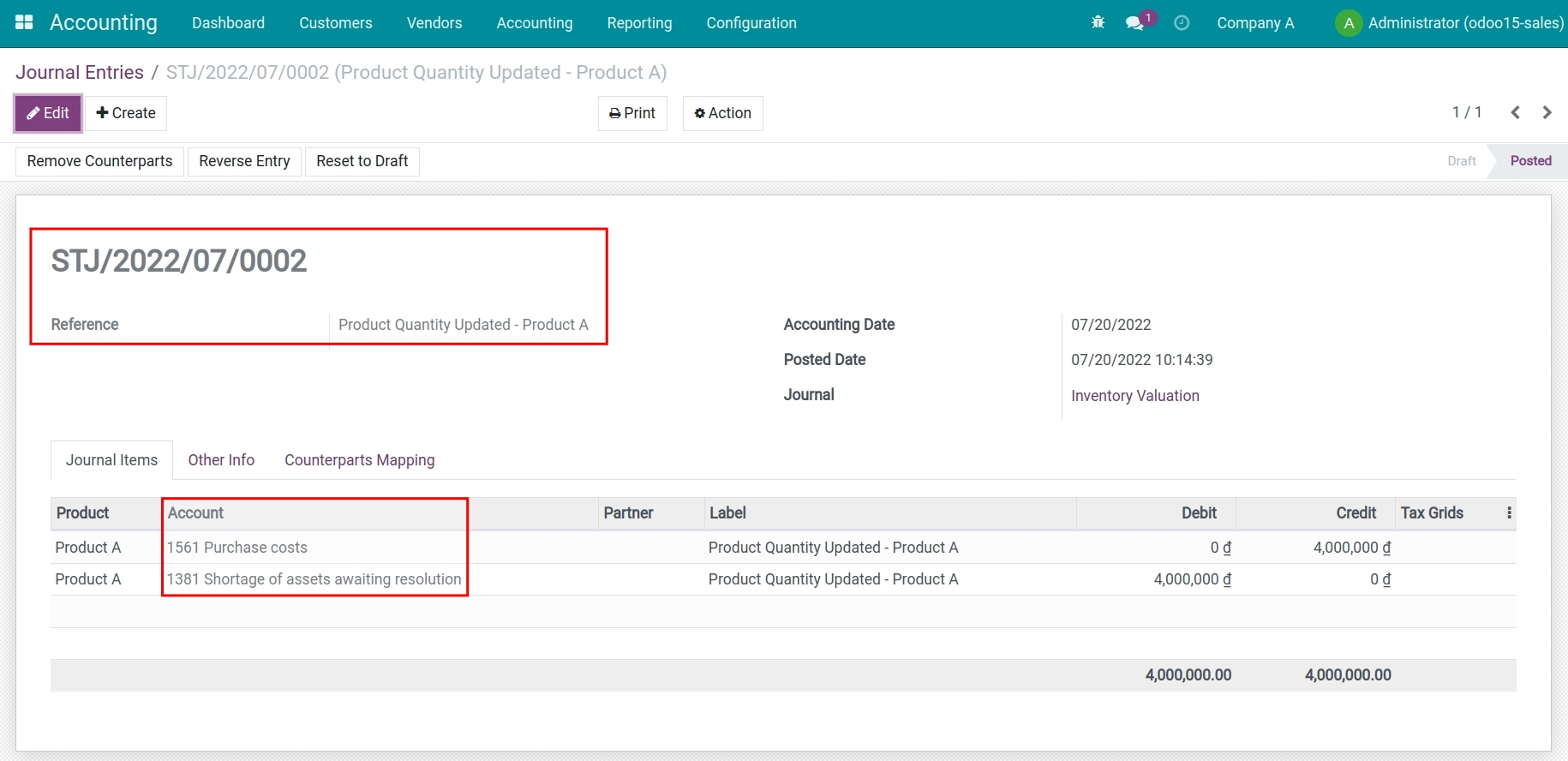

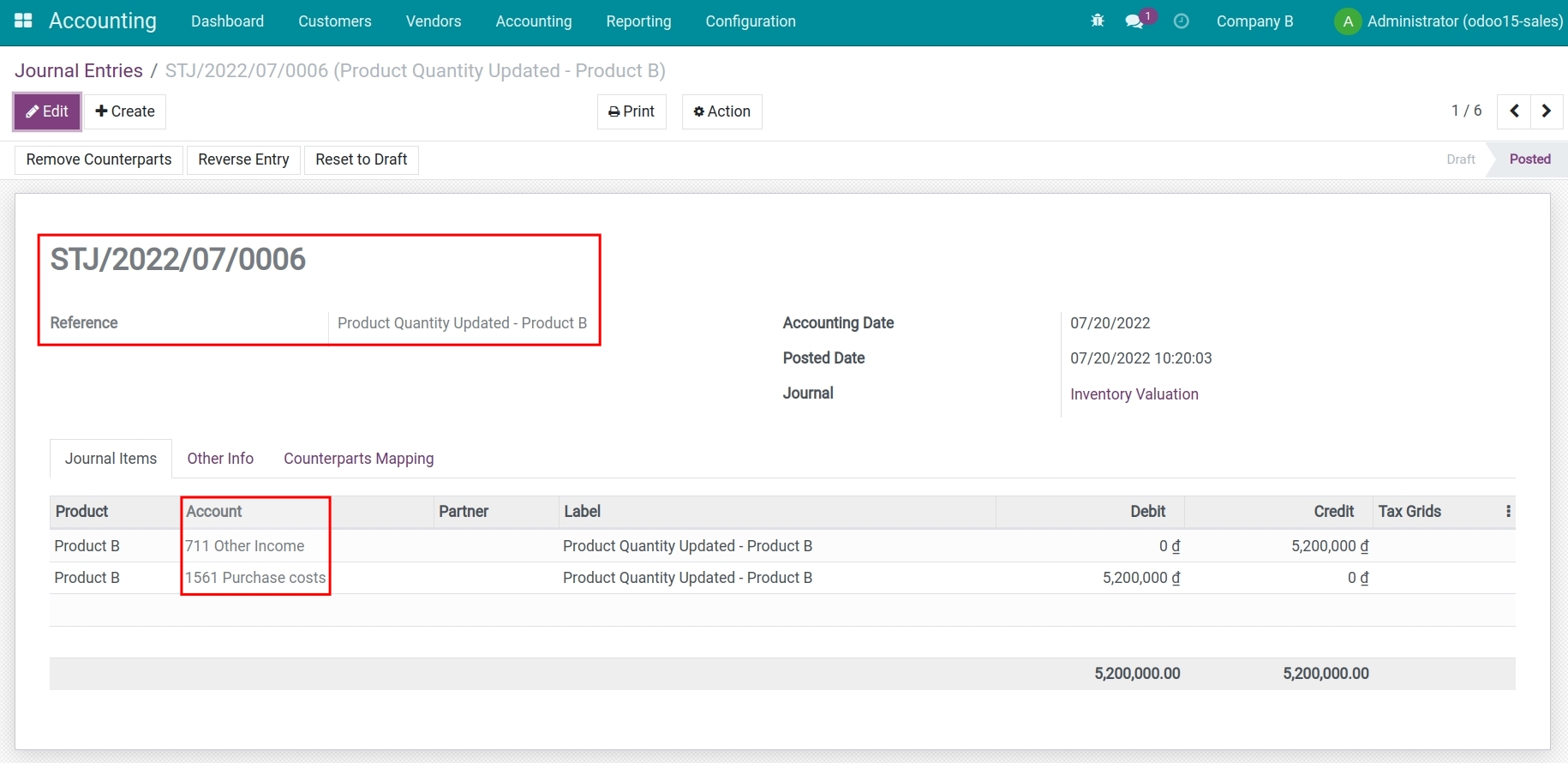

- View journal entries

-

Track employee costs in project management

-

Track employee costs in project management

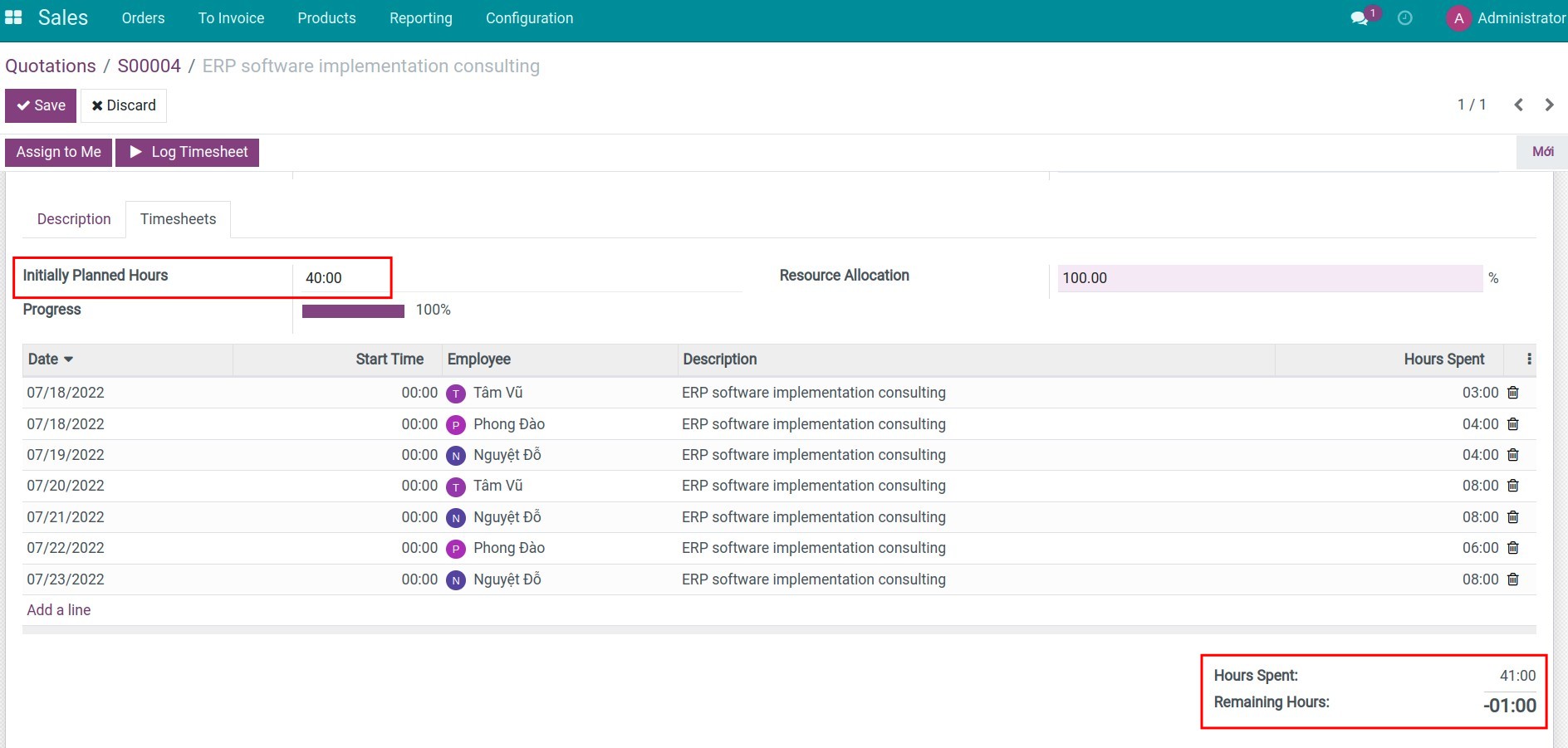

- Configure employee cost

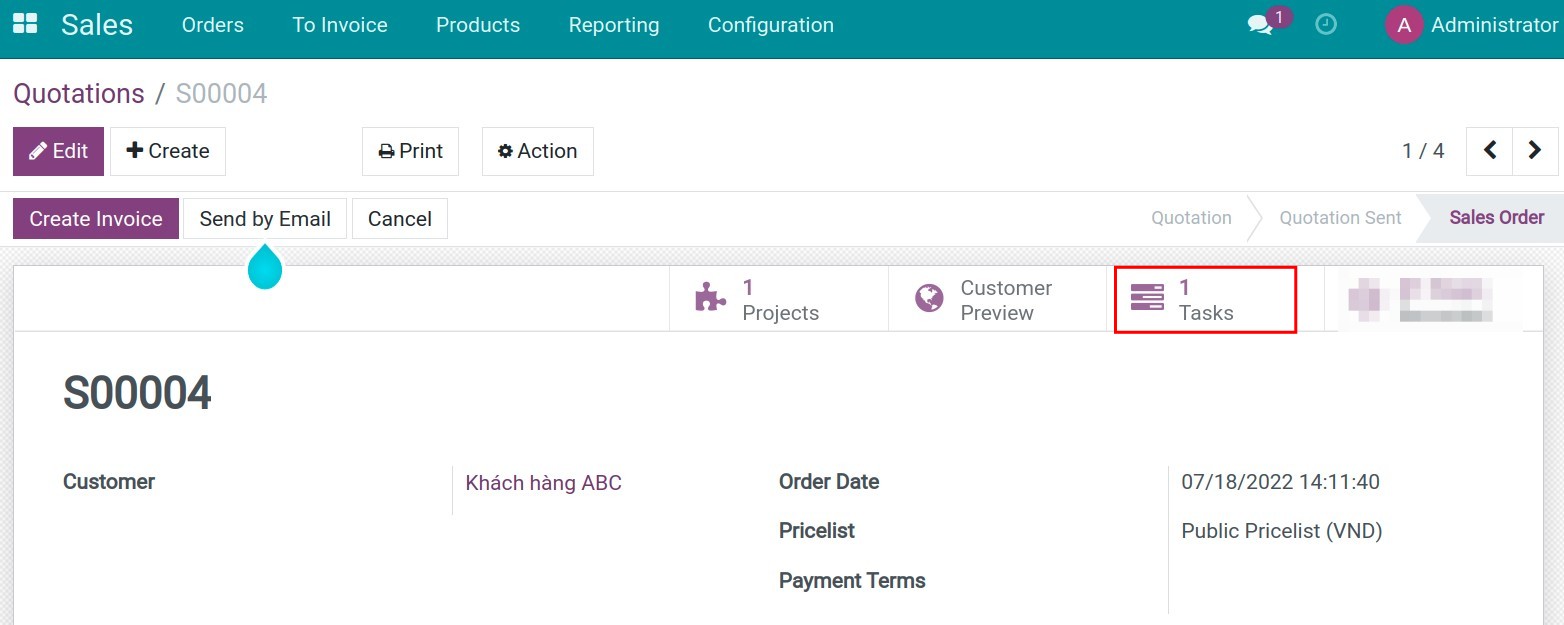

- Create a Quotation

- Cost and Revenue management

-

Expenses and revenue management in Viindoo Accounting

-

Expenses and revenue management in Viindoo Accounting

- Introduction

-

Analytic tools usage

- Record revenue of the contract

- Record and track related costs

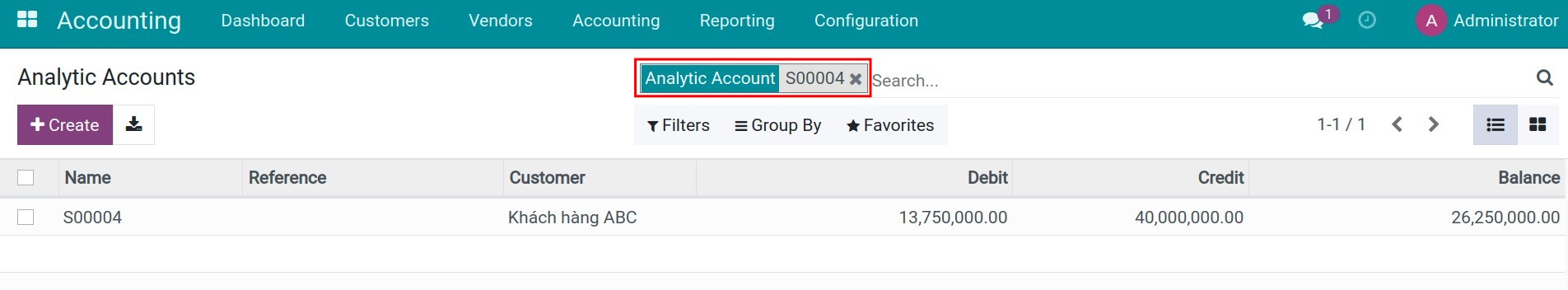

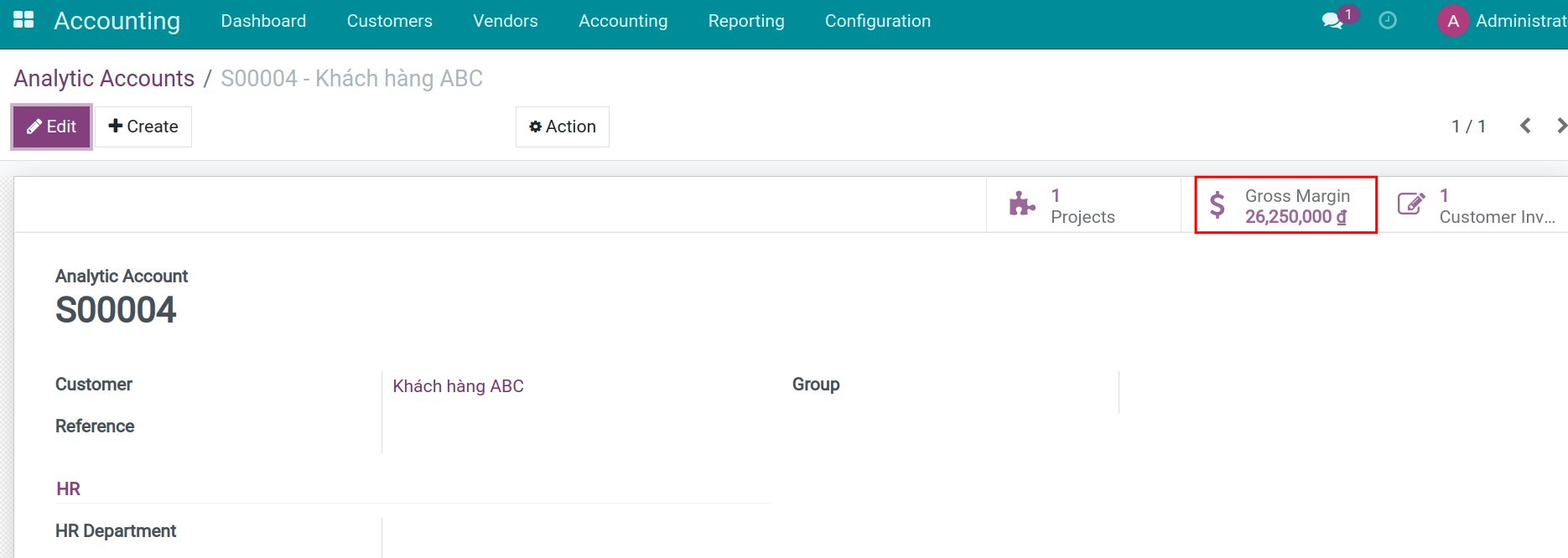

- Analyze revenue/costs

- Odoo Accounting Simplified

-

Contracts

- Contracts Management

- Billing Options

- Configure Bank Accounts

- Configure Bank Accounts

- Create a bank

- Create a new bank account

- Configure Bank account Journal

- Budget Management

- Budget Management

- Install Budget Management app

- User access rights

- Create the tools for managing budget

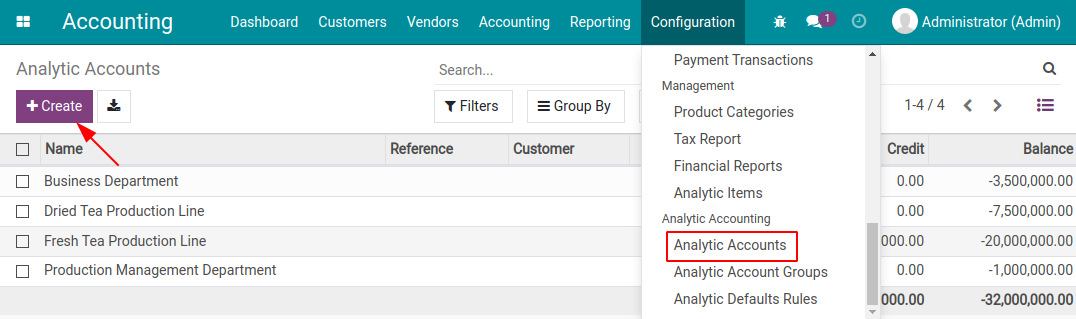

- Analytic Account

- Budgetary Positions

- Budget Management

- Create budget

- Budget Analysis

- Closing a fiscal year in iSuite

- Closing a fiscal year in iSuite

- Creating Default Analytic Account

- Creating Default Analytic Account

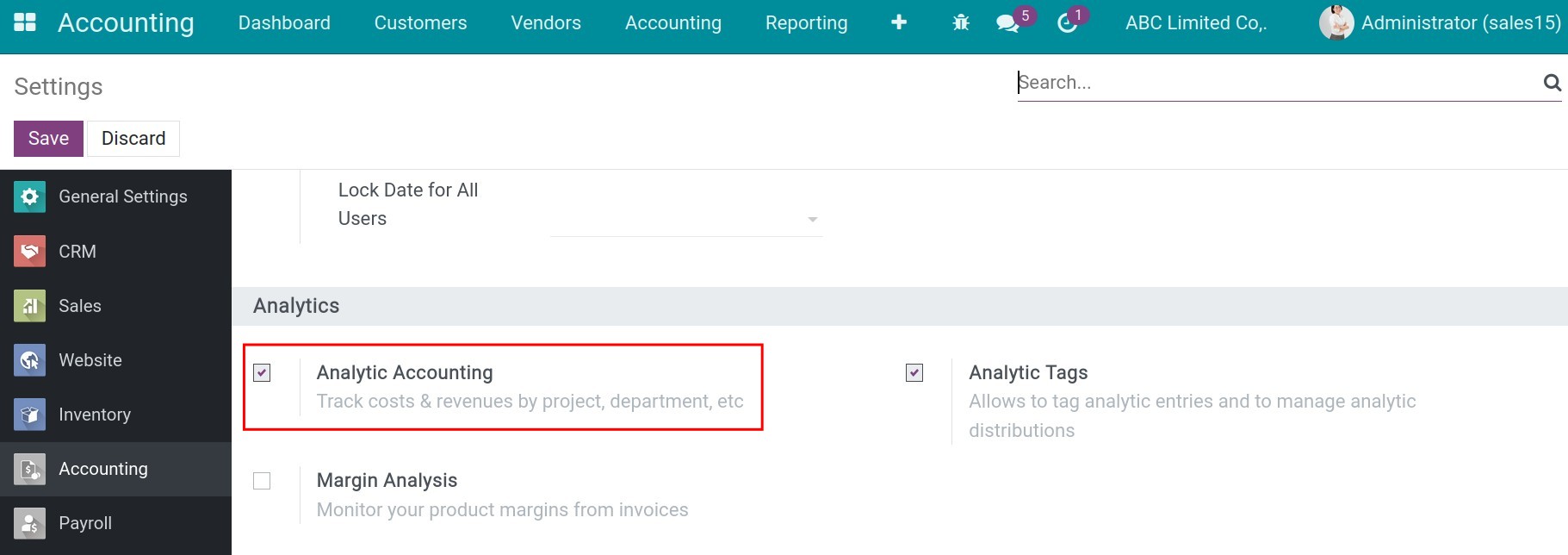

- Analytic Defaults Rules Configuration

- Use the Analytic Default Rules

- Asset liquidation

- Asset liquidation

- Case 1: Liquidize depreciating asset

- Case 2: Liquidize depreciated Asset

- Steps to import opening balance

- Steps to import opening balance

- Data preparation

- Configure basic accounting information

- Prepare compatible input data for iSuite data structure

- Import opening balance

- Import opening balance in Chart of Accounts

- Import data in bulk

- Adjust opening journal entry data

- Title

- Process of customer invoicing, payment and reconciliation

- Process of customer invoicing, payment and reconciliation

- Configure invoicing policies

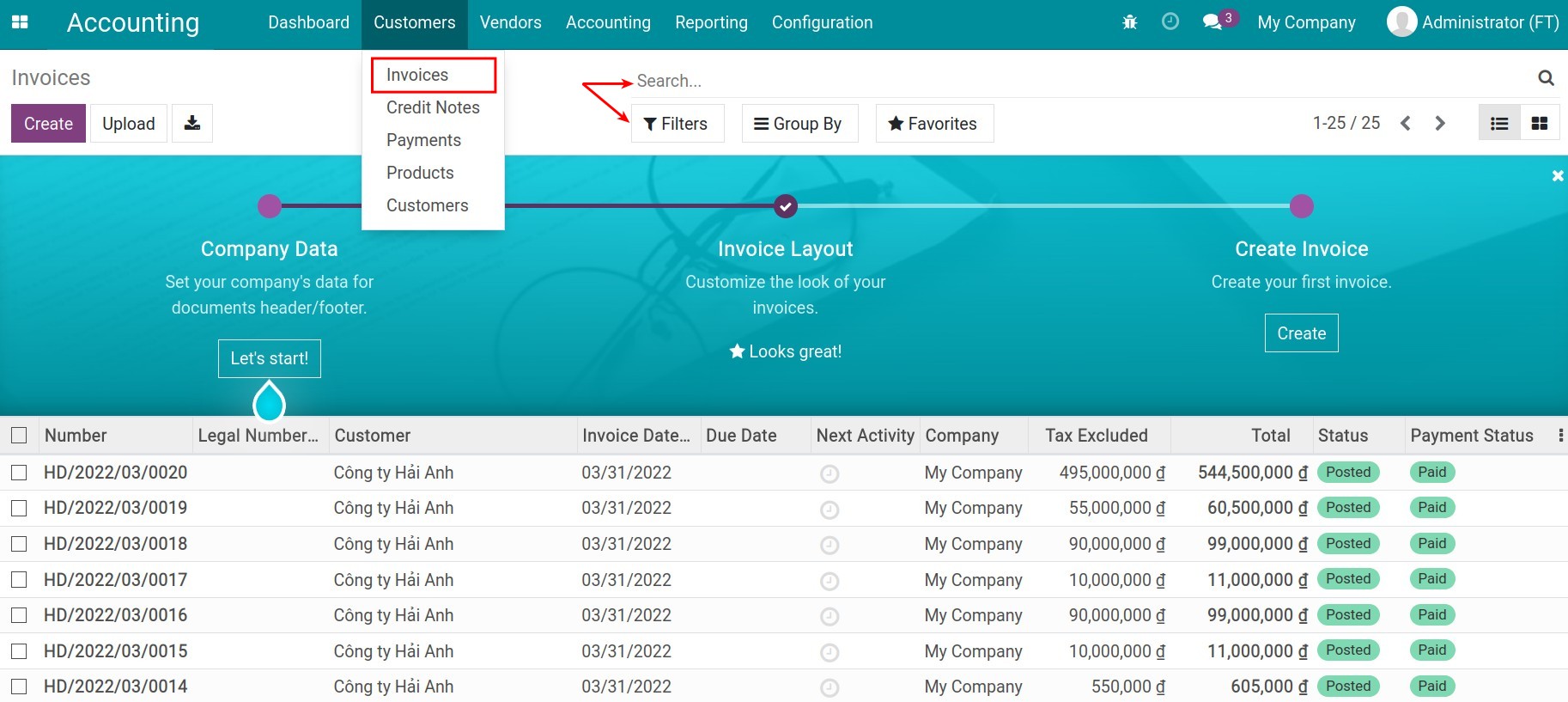

- Create a draft invoice

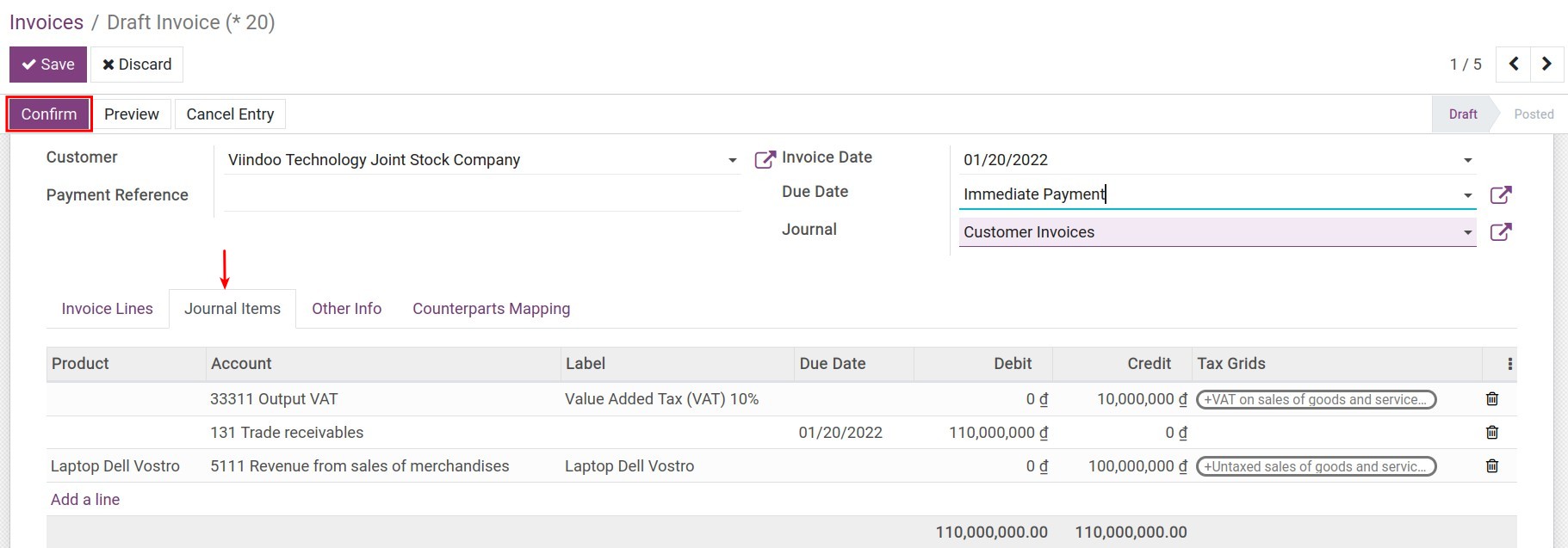

- Confirm an invoice

- Send invoices to customer

- Payments

- Register bank statement & payment reconciliation

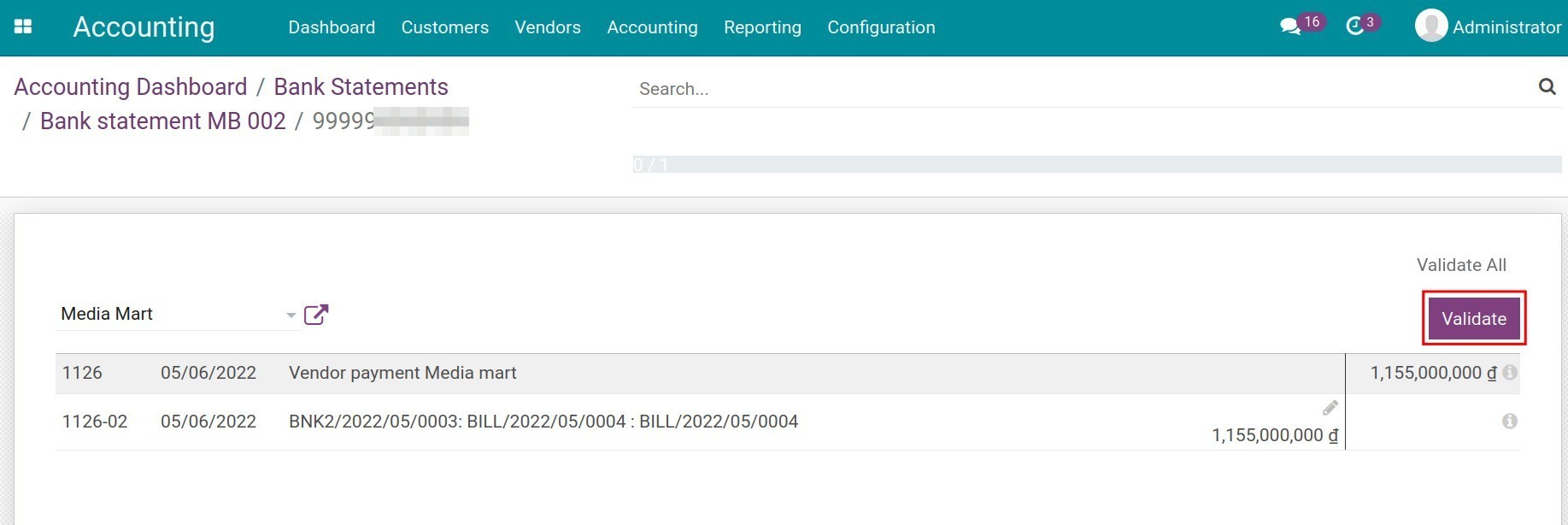

- Register bank statement

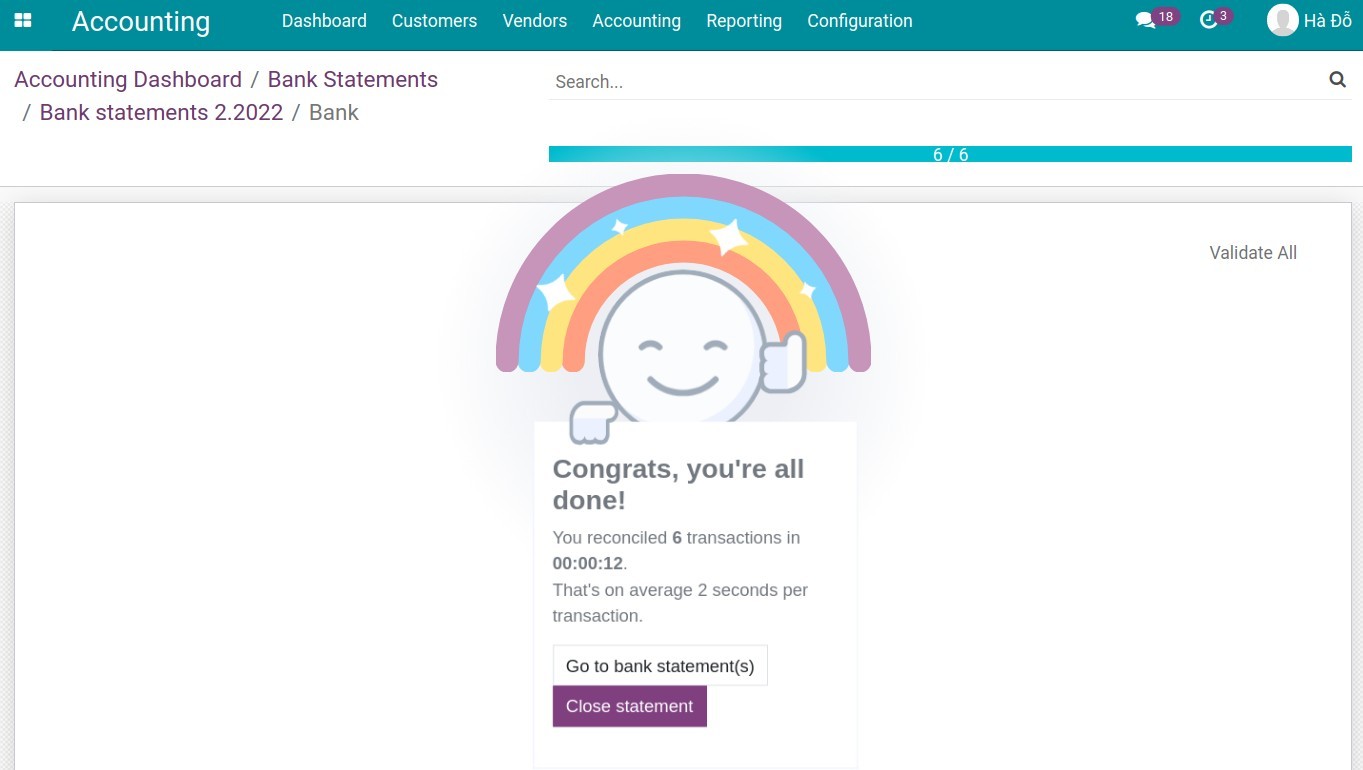

- Payment Reconciliation

- Keep track of a payment

- Reporting

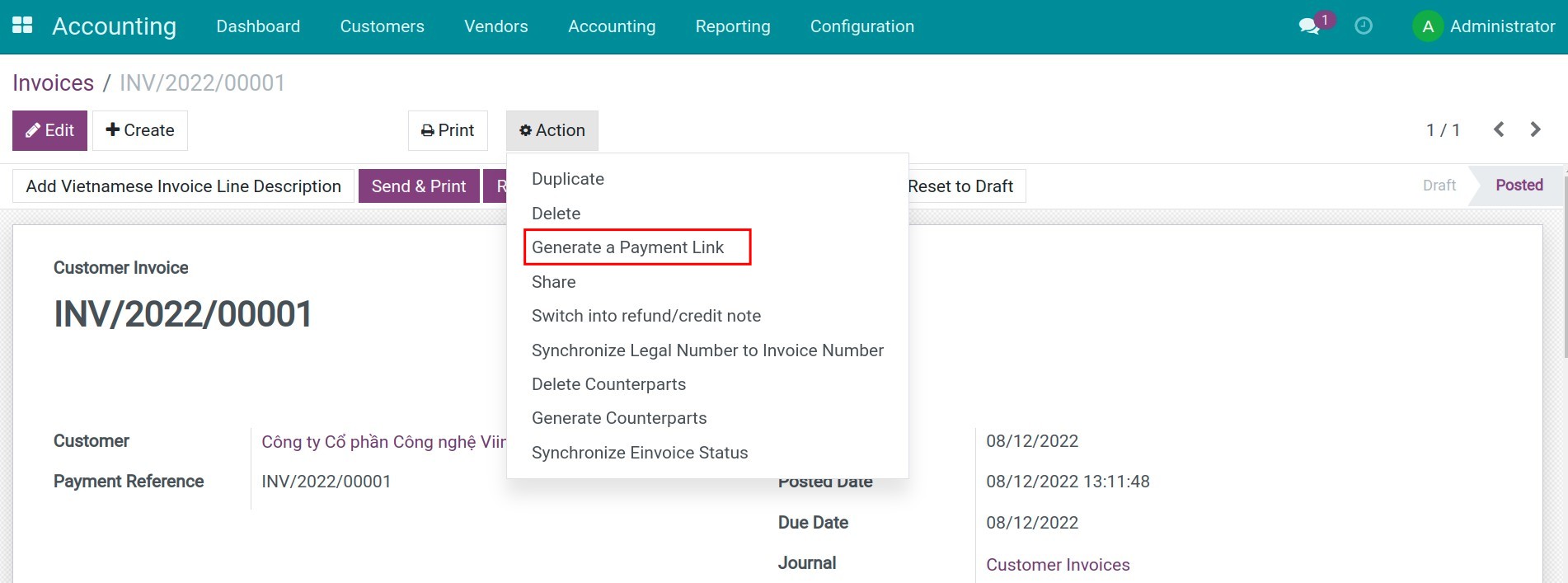

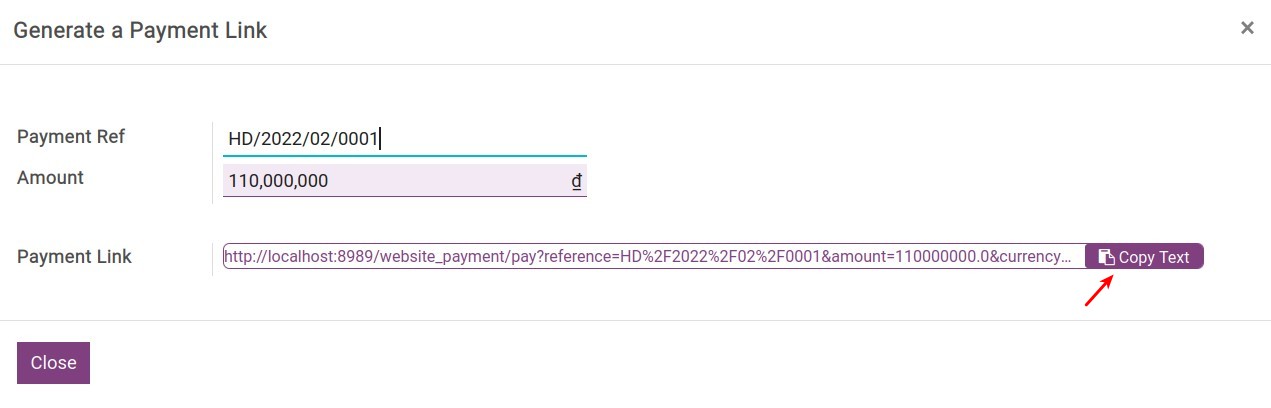

- Set up Payment Service Providers in Viindoo

- Set up Payment Service Providers in iSuite

- Introduction

- Bank transfer

- Payment via Payment acquirers

- Payment acquirer configuration

- Accounting reports available in iSuite

- Accounting reports available in iSuite

- General characteristics of the reports

- General reports in iSuite

- Balance Sheet

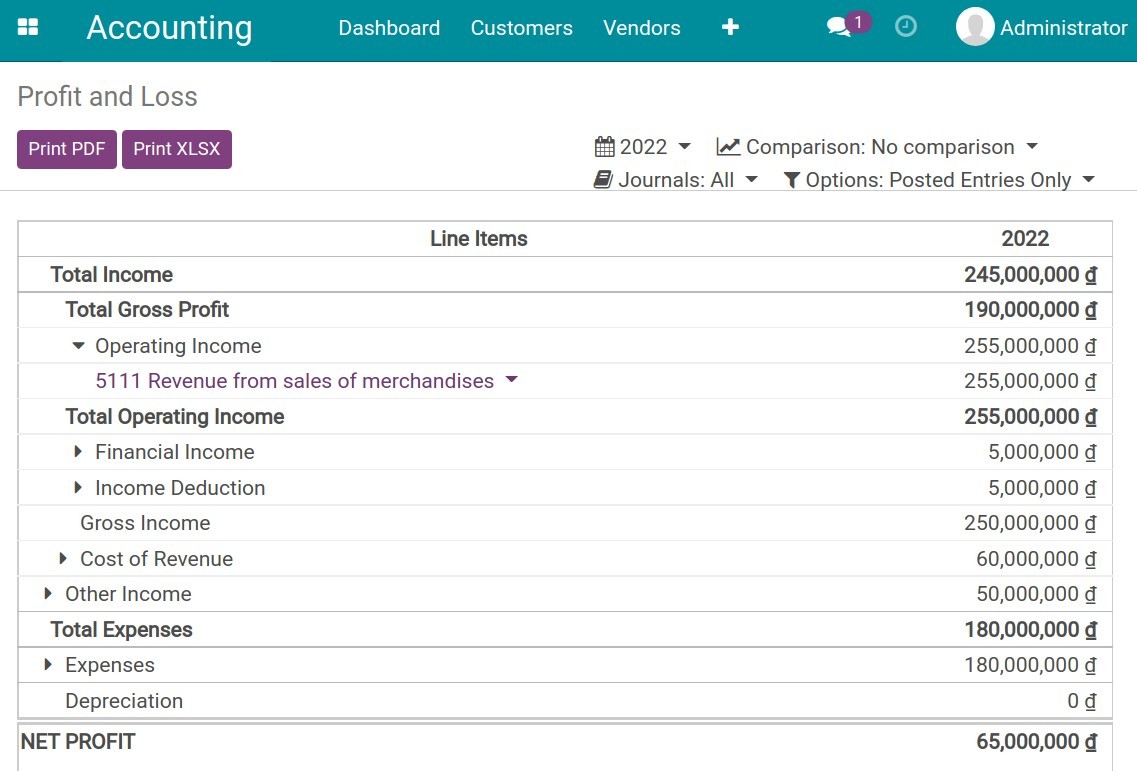

- Profit and Loss

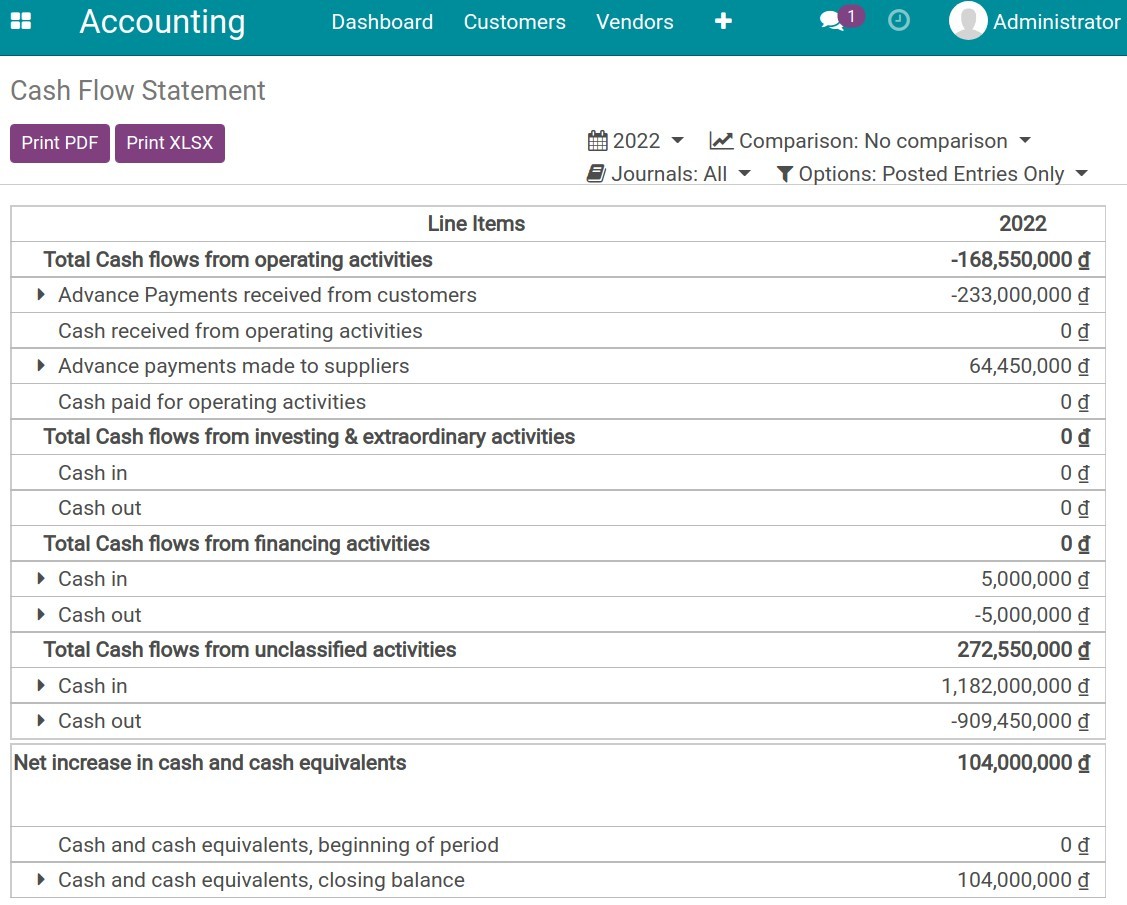

- Cash Flow Statement

- Tax Report

- Aged Payable/Receivable reports

- General Ledger

- Cash on hand management

- Cash on hand management

- Cash statement creation

- Cash on hand Counting

- Cash receipts/payments reconciliation

- Cases occurring when counting cash on hand

- Counting of excess funds

- Counting of shortage of funds

- The difference between the starting balance of this period and the ending balance of the previous period

- How to handle Petty Cash in Odoo

- How to delete an invoice that has already used a sequence

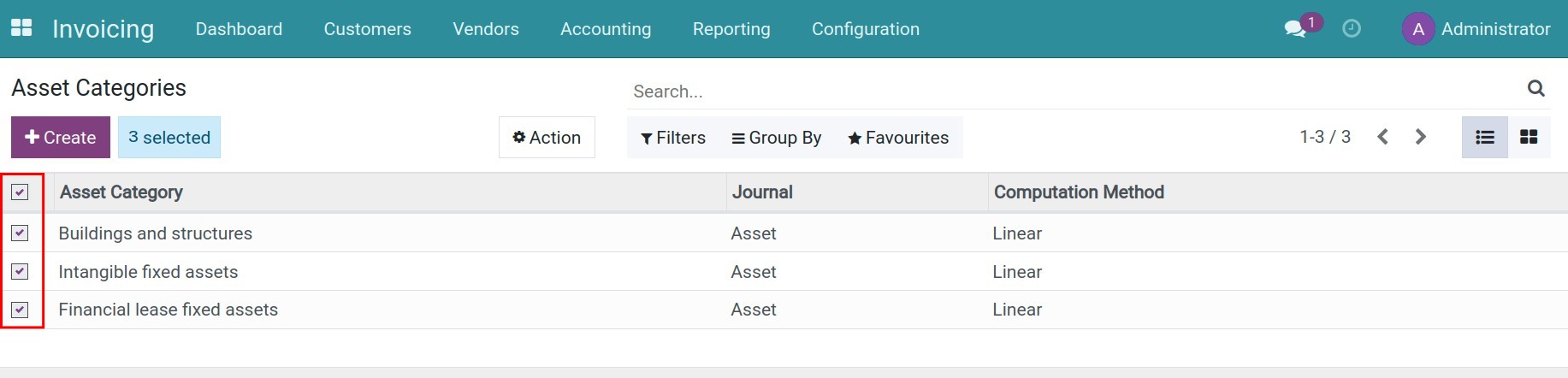

- Configure charts of accounts and depreciation method for Assets Category

- Configure Asset Category

- Asset Category

- Accounting

- Periodicity

- Depreciation Methods

- Additional Options

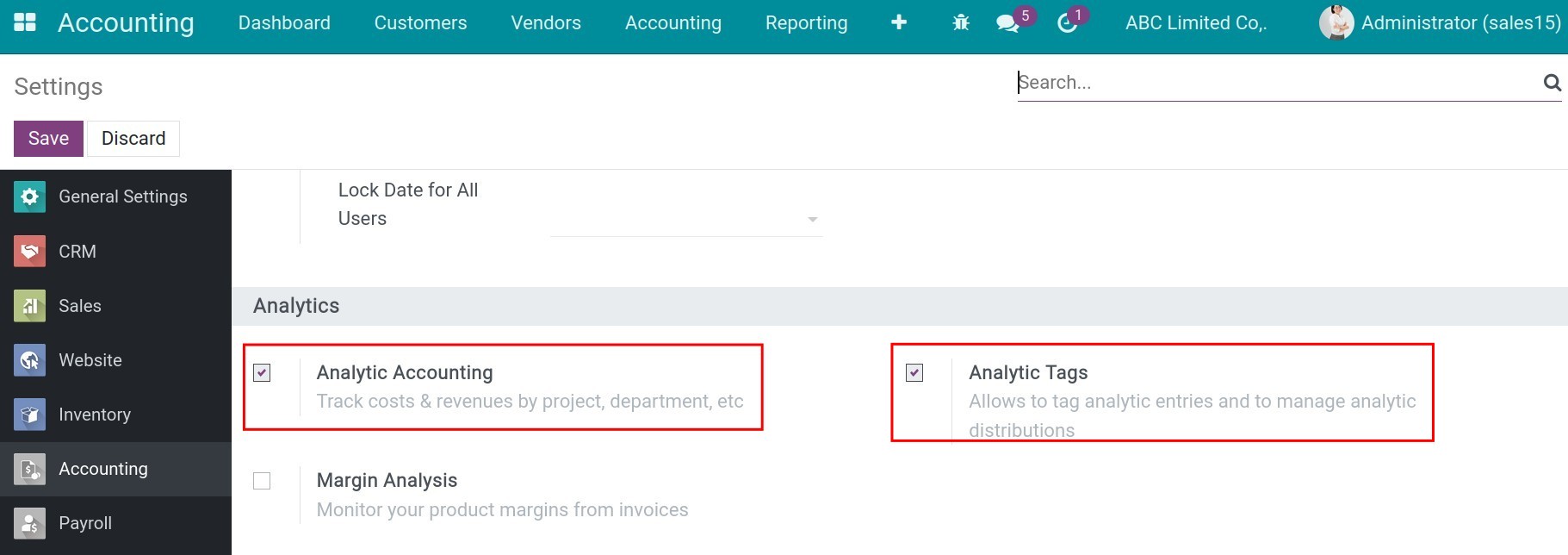

- Visual Accounting Analysis (with Pivot and Graph)

- Visual Accounting Analysis (with Pivot and Graph)

- Entries Analysis Report

- Analytic Entries Analysis Report

- Chart of Accounts

- Chart of Accounts

- Select Chart of Accounts

- Configure Account

- How to apply cut-off in iSuite Accounting

- How to apply cut-off in iSuite Accounting

- Online payment activation and usage

- Online payment activation and usage

- Activate Invoice Online Payment

- Customer online payment view

- How to make a payment with Paypal

- How to make a payment with Paypal

- Paypal payment configuration

- Pay with Paypal

- Process of vendor invoicing, payment and reconciliation

- Process of vendor invoicing, payment and reconciliation

- Create a Vendor bill

- Confirm Vendor bill

- Create Payment

- Register bank statement & payment reconciliation

- Accounts Payable Reports

- Vendor Bills Management

- Vendor Bills Management

- Manage Vendor bills in the Purchase app

- Manage Vendor Bills in the Accounting app

- How to create Purchase Receipts

- How to create Purchase Receipts

- Configure the Purchase Receipts feature

- How to use Purchase Receipt

- How to refund in iSuite Accounting

- How to refund in iSuite Accounting

- How to apply cut-off in iSuite Accounting

- How to apply cut-off in iSuite Accounting

- Pay various distinctive bills at the same time

- Pay various distinctive bills at the same time

- Time deposit transactions

- Time deposit transactions

- Make a time deposit

- Create a cash-out payment

- Create a bank statement and reconciliation

- Recording deposit interest

- Receive the principal amount together with interest

- Receive only interest on maturity date at the current bank account

- Time deposit settlement

- Create a cash-in payment

- Create a bank statement and reconciliation

- Manage Bank Statements

- Manage Bank Statements

- Manually create a bank statement

- Import a bank statements file

- Create reconciliation model for deposit interest and bank fees

- Create reconciliation model for deposit interest and bank fees

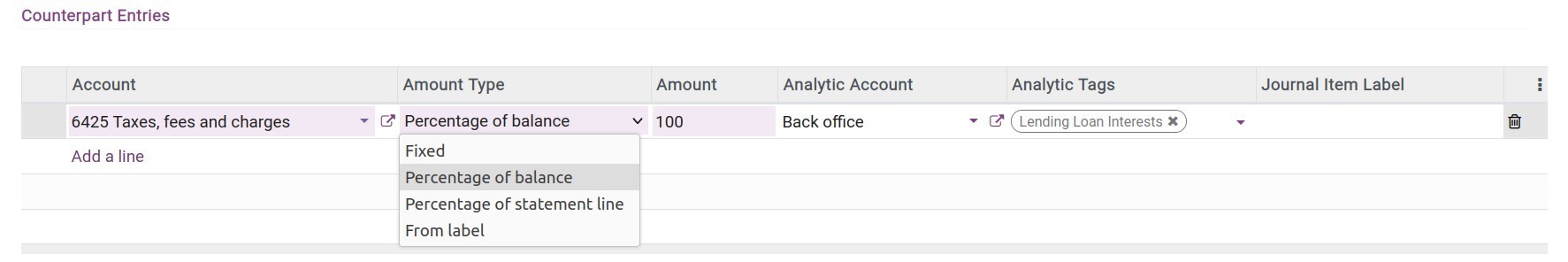

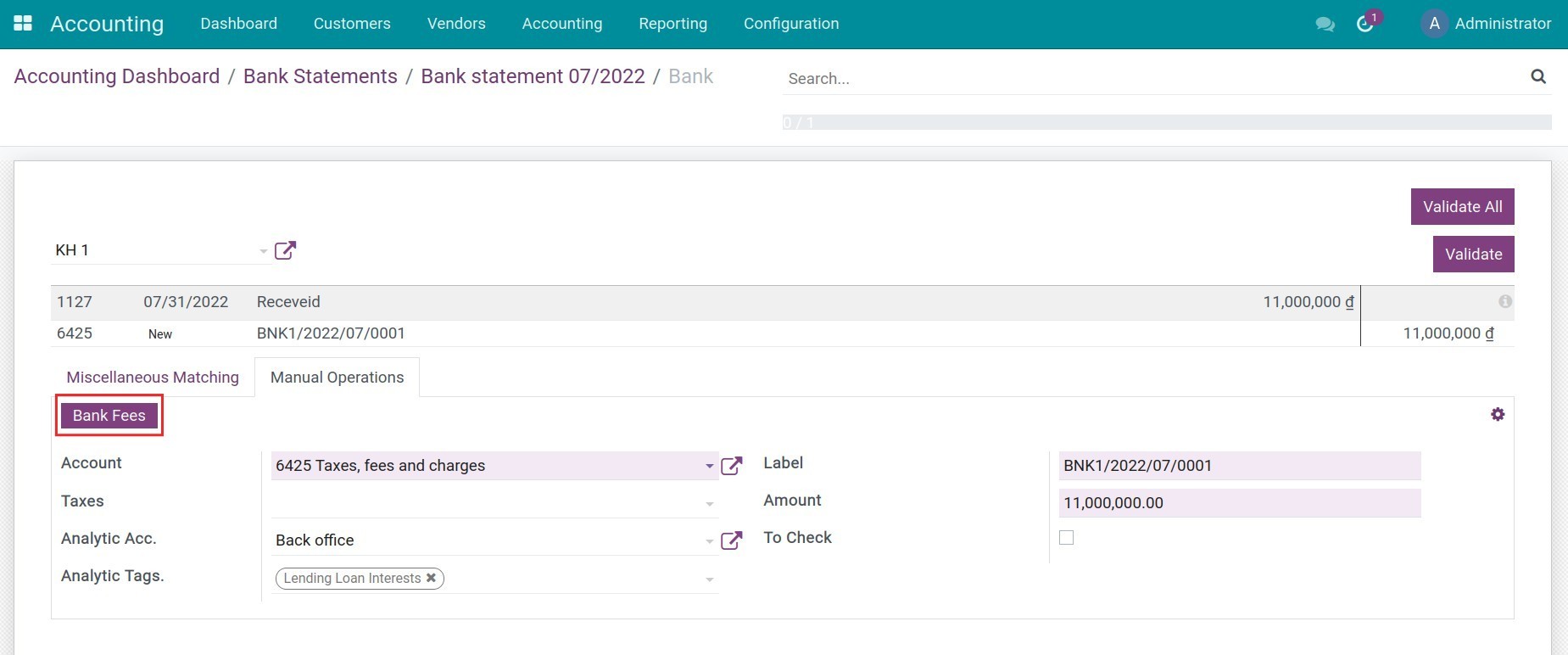

- Reconciliation models

- Button to generate counterpart entry

- Rule to suggest counterpart entry

- Rule to match invoices/bills

- Accounting configuration for salary rules

- Accounting configuration for salary rules

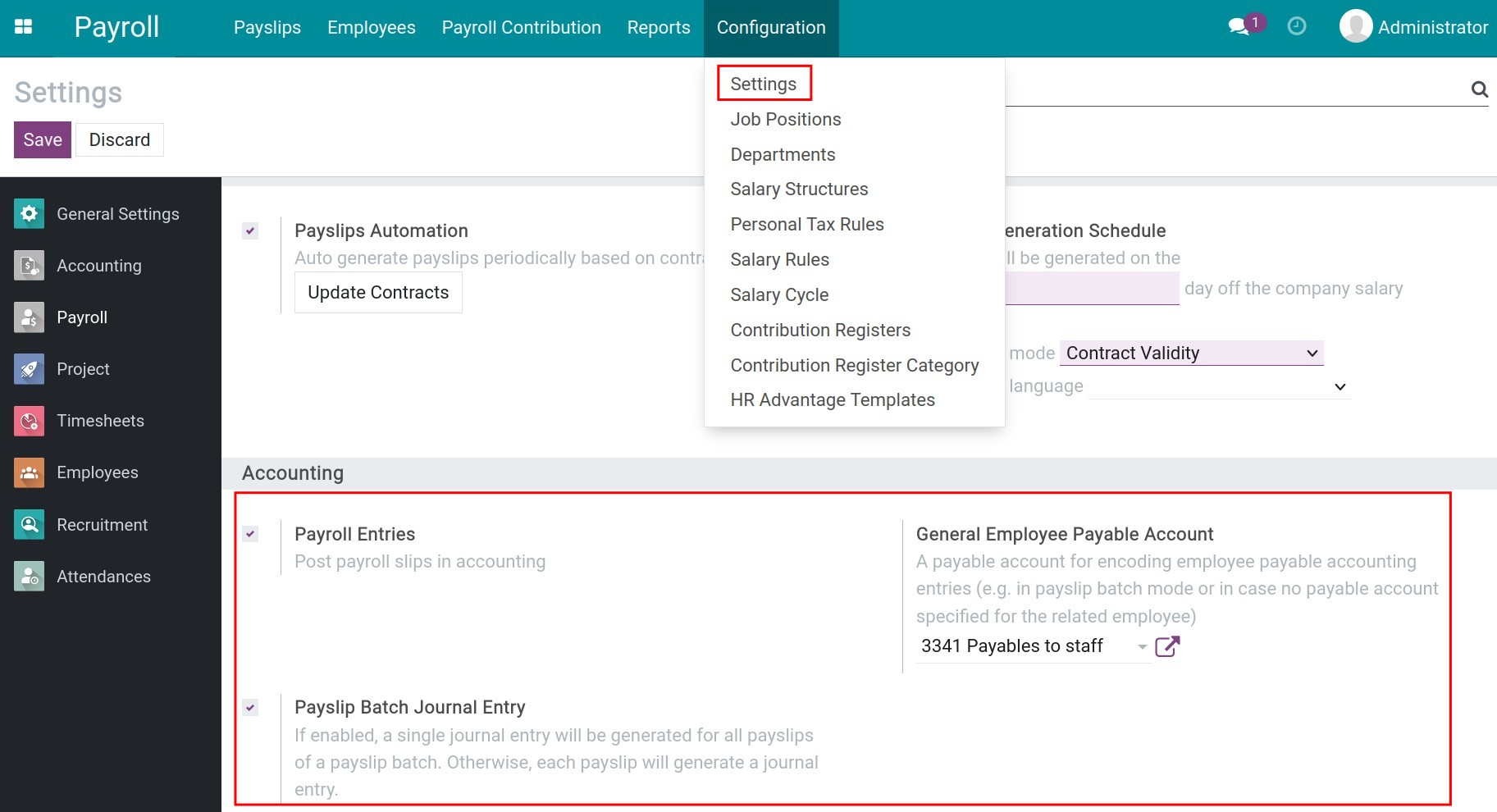

- General settings

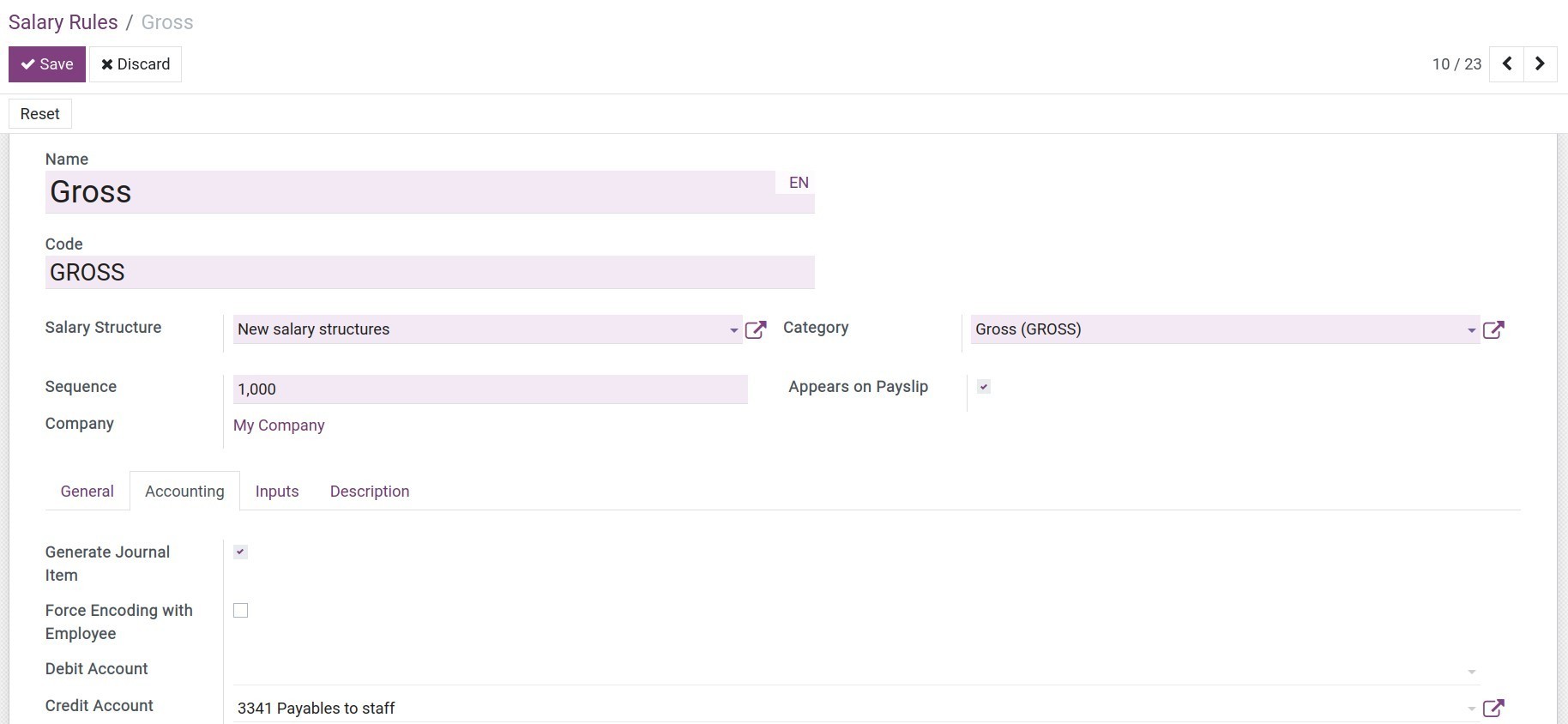

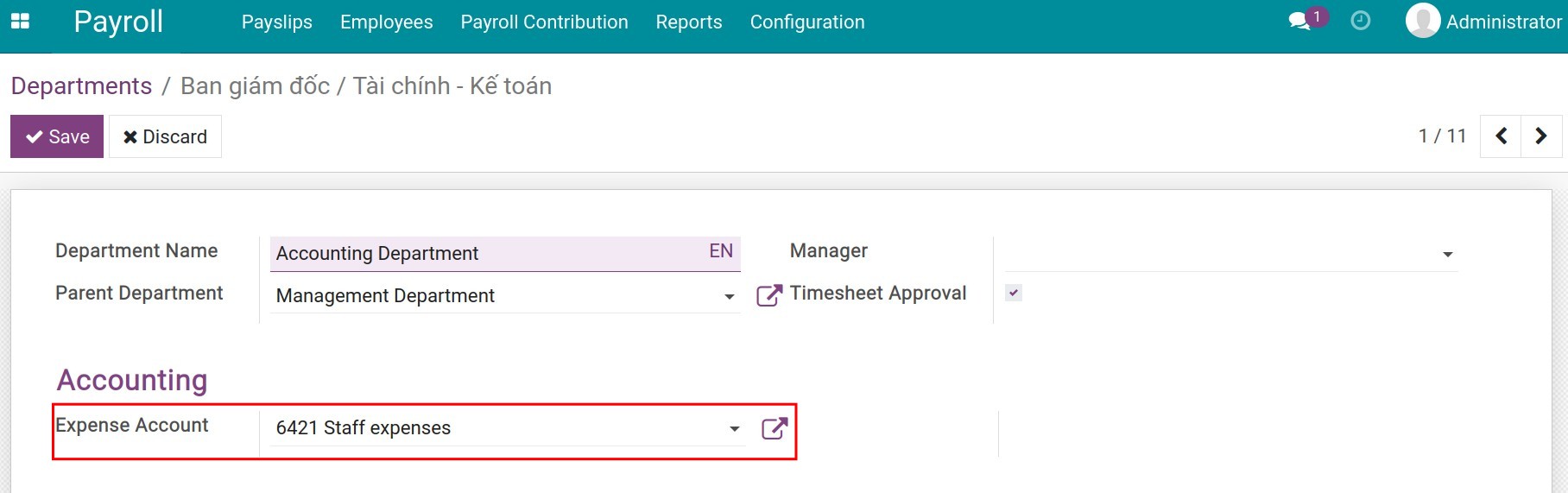

- Configure salary rules

- Salary rules examples

- Analytic account in iSuite

- Analytic account in iSuite

- Case 1: Production costs analysis of each department in an industrial company

- Case 2: Performance analysis of employees in an ERP software consulting company

- Conclusion

- Invoice delivery notes

- Invoice delivery notes

- How do the Suspense and Outstanding Payment accounts change the Journal Entries posted?

- Current Year Earnings

- Current Year Earnings

- How the "Current Year Earnings" Account Type Works

- Example of "Current Year Earnings" in Practice

- Key Points to Remember

- Manually create an Asset in Viindoo

- Requirements

- Configure Asset information

- Configure Asset Depreciation Information

- Buying and stocking assets

- Buying and stocking assets

- Create Asset manually

- Create Asset from vendor bill

- Create an Asset from a storable product

- Depreciation of Fixed Assets

- General concept

- Depreciation of Assets

- Check the depreciation of assets

- Start to depreciate

- Asset disposal

- Asset disposal

- Case 1: Dispose a depreciated Asset

- Case 2: Dispose an Asset while being depreciated

- Asset Revaluation

- Asset Revaluation

- Asset information

- Revaluation Board

- Depreciation Board

- How to exclude journal items from Financial Reports

- How to exclude journal items from Financial Reports

- Main concepts of Accounting and Invoicing in iSuite

- Main concepts of Accounting and Invoicing in iSuite

- Double-entry bookkeeping

- Accrual Accounting and Cash Basis Accounting

- Multi-companies

- Multi-currencies

- International Accounting Standards

- Account Receivables and Payables

- Broad-range of financial reports

- Automated bank reconciliation

- Inventory Valuation methods

- Retained earnings

- How to configure iSuite Accounting and Invoicing before using

- How to configure iSuite Accounting and Invoicing before using

- Install Accounting module

- Configure Fiscal Localization

- Configure Company’s information

- Configure User access right

- Configuration Tips panel

- Create the First Bill

- Add a Bank Account

- Accounting Periods

- Chart of Accounts

- Configure Cash Rounding method

- Configure Cash Rounding method

- Cash rounding configuration

- Apply cash roundings on invoices

- Examples

- Configure Payment Terms

- Configure Payment Terms

- Configure Payment Terms

- Payment terms usage

- Process a cash discount

- Process a cash discount

- Set up cash discounts

- When a transaction occurs

- Register payment and cash discount

- Customer pays before the due date and receives a discount

- Customer pays after the due date and doesn’t receive discount

- Steps to create customer invoices

- Steps to create customer invoices

- Configure invoicing policy

- Create an invoice from an order

- Create an invoice directly

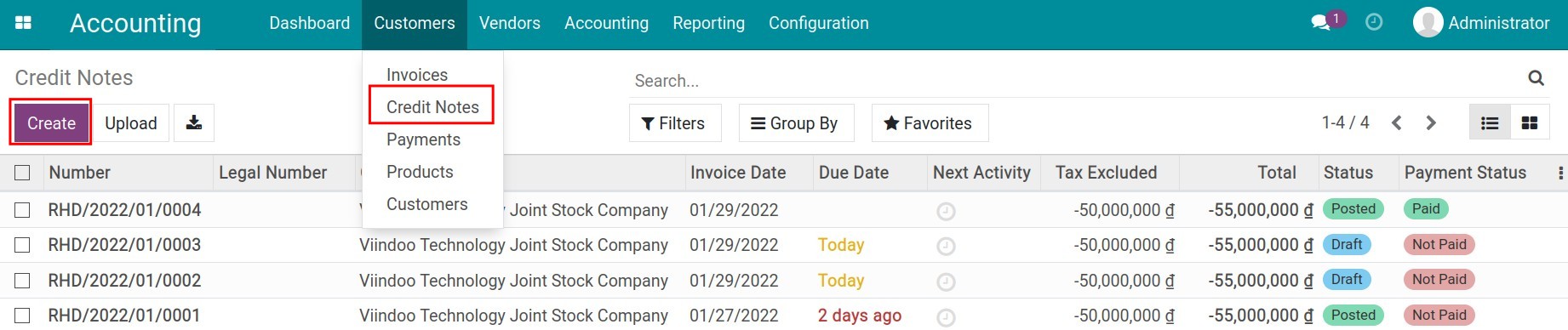

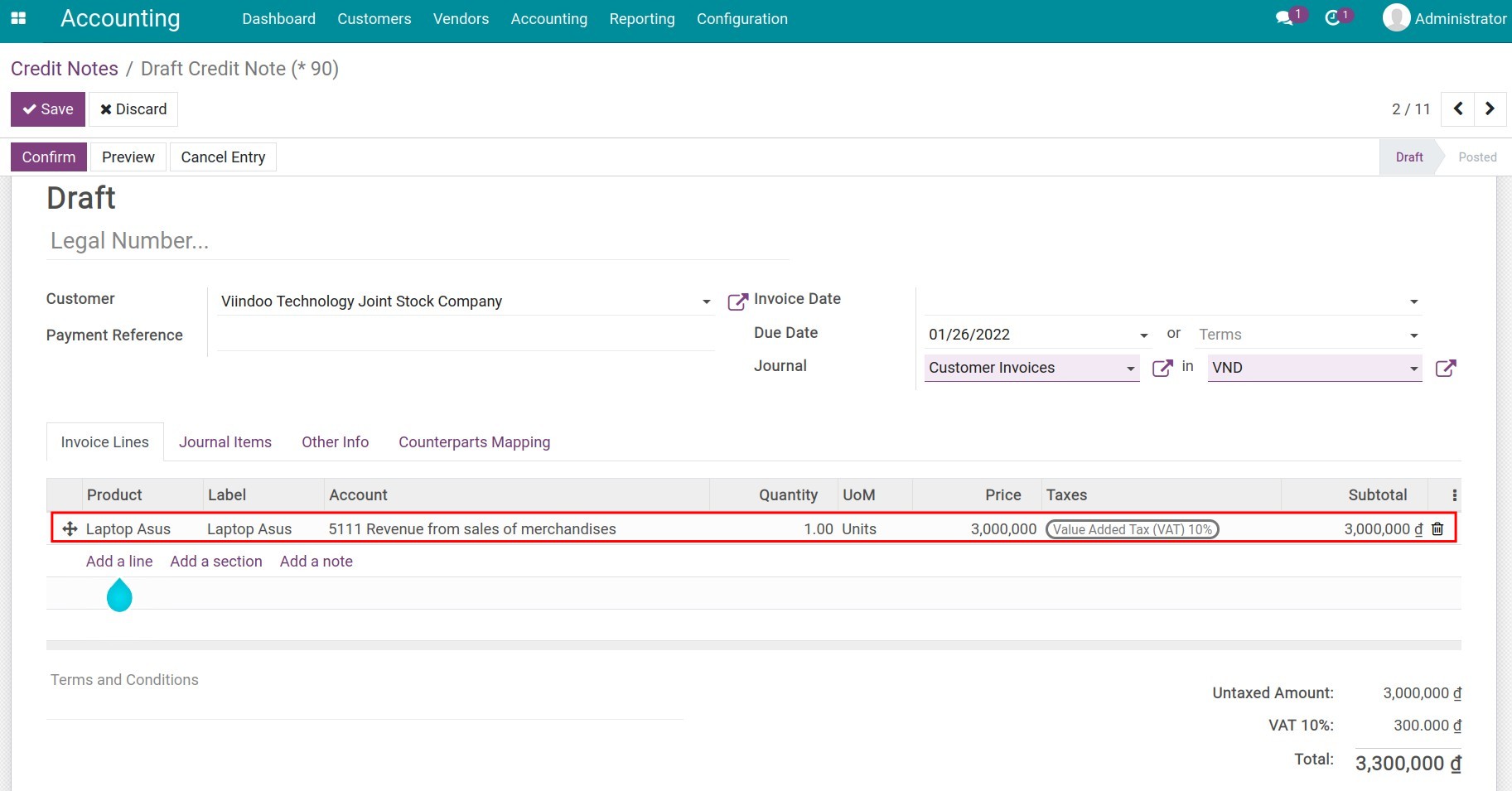

- How to use Credit Notes in Viindoo Accounting

- How to use Credit Notes in iSuite Accounting

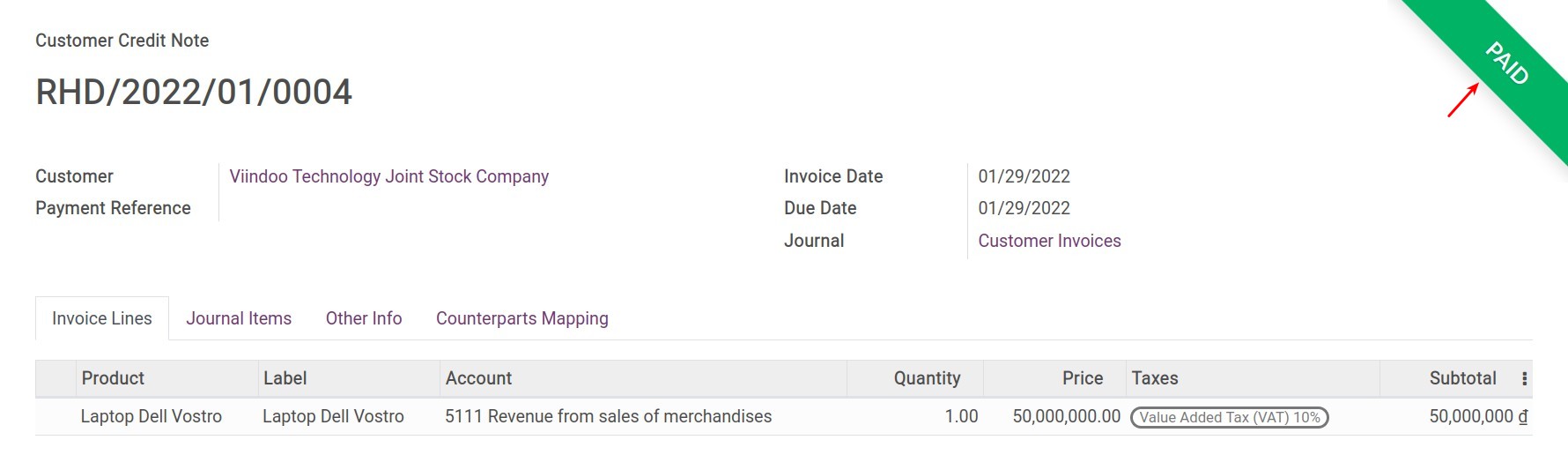

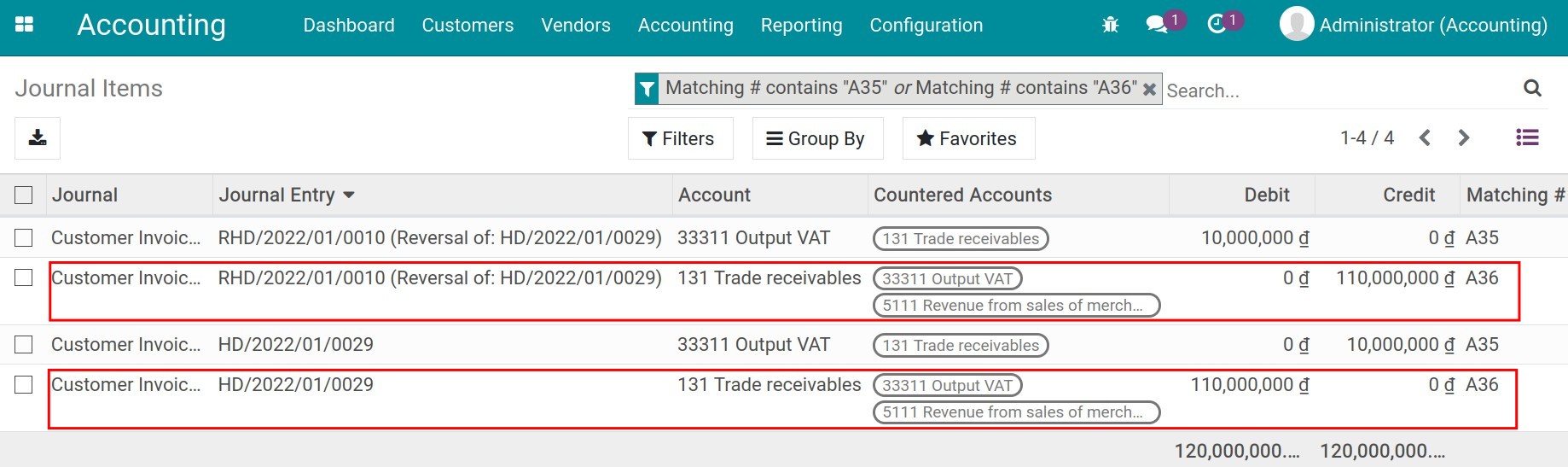

- Create a credit note directly on the invoice

- Create a credit note manually

- How to record customer payments

- How to record customer payments

- Create payment from an invoice

- Create stand-alone payment

- Taxes and tax rules configuration

- Taxes and tax rules configuration

- Tax activation

- Tax configuration

- 1. Basic information

- 2. Definition tab

- 3. Advanced Options tab

- Transfer between internal bank accounts

- Transfer between internal bank accounts

- Record payments between bank accounts

- Create Send money payment

- Create bank statements

- Reconcile bank statements

- Transfer between Bank account and Cash on hand

- Transfer between Bank account and Cash on hand

- Deposit money into a bank account

- Cash disbursement

- Withdraw money from the bank account and send it to cash on hand

- Withdraw money

- Register deposit interest

- Steps in the bank reconciliation process

- Steps in the bank reconciliation process

- Steps in the bank reconciliation process

- Journal entries of the bank statements

- Some use cases in the reconciliation process

- Foreign currencies management

- Foreign currencies management

- Create a foreign currency bank account

- Foreign currency transactions in Viindoo

- Payment on foreign currency invoices

- Currency exchange

- Define your Fiscal Year

- Define your Fiscal Years

- Balance carrying forward

- Balance carrying forward

- Configure balance carry forward rules in Viindoo

- Account balance carry forward

- Accounting Analysis

- Summary

- Key Features

- Dual Journal Entries with Analytic Account Association

- Dual Journal Entries with Analytic Account Association

- Create an accounting journal entry

- Create an accounting journal entry

- Create a journal entry

- Journal Items

- Other Info

- Counterparts Mapping

- Steps to import opening balance for Asset

- Steps to import opening balance for Asset

- Prepare assets data

- Export system data structure

- Export the data structure of asset categories

- Export asset data structure template

- Add real data to the data template

- Import data to the system

- Default Taxes

- Default Taxes

- Definition

- Configure default taxes

- Steps to setup Fiscal Position (Taxes and Accounts)

- Steps to setup Fiscal Position (Taxes and Accounts)

- Configure fiscal position

- Fiscal position application

- Automatic application

- Manual application

- Manage the price including or excluding taxes

- Manage the price including or excluding taxes

- Default tax configuration

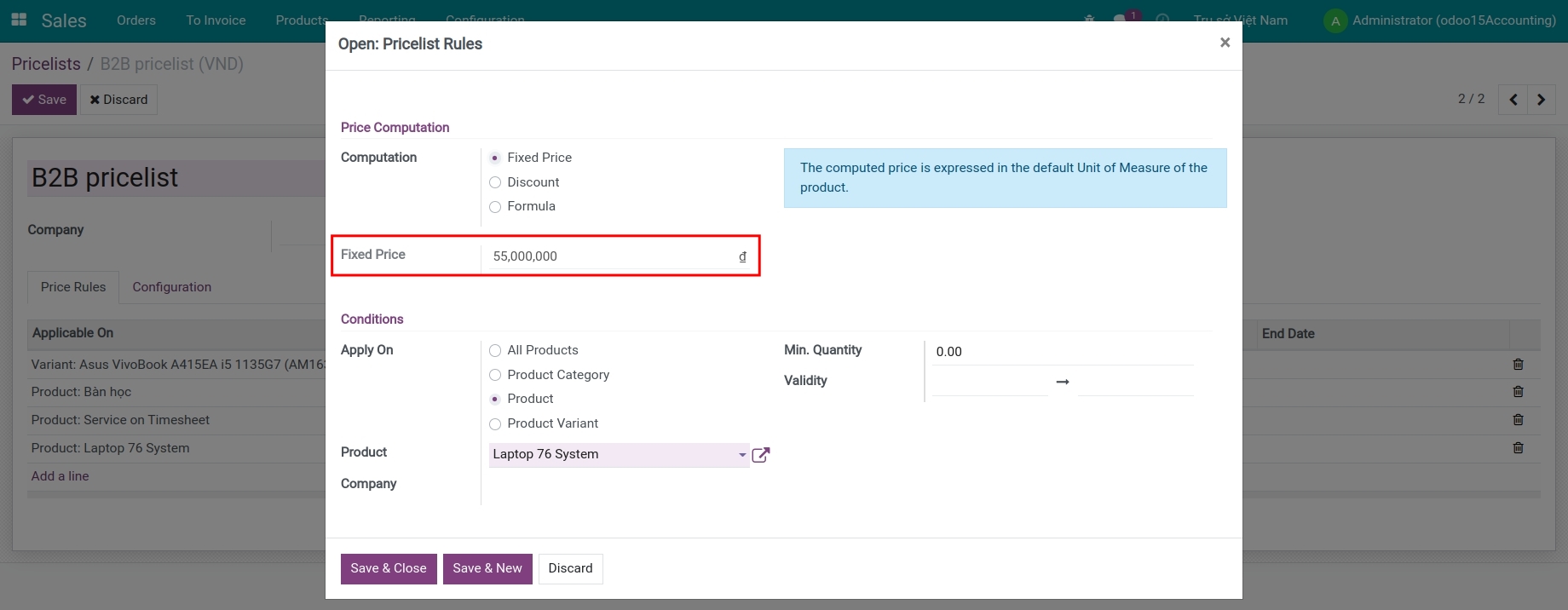

- Create a B2C pricelist with tax-included price

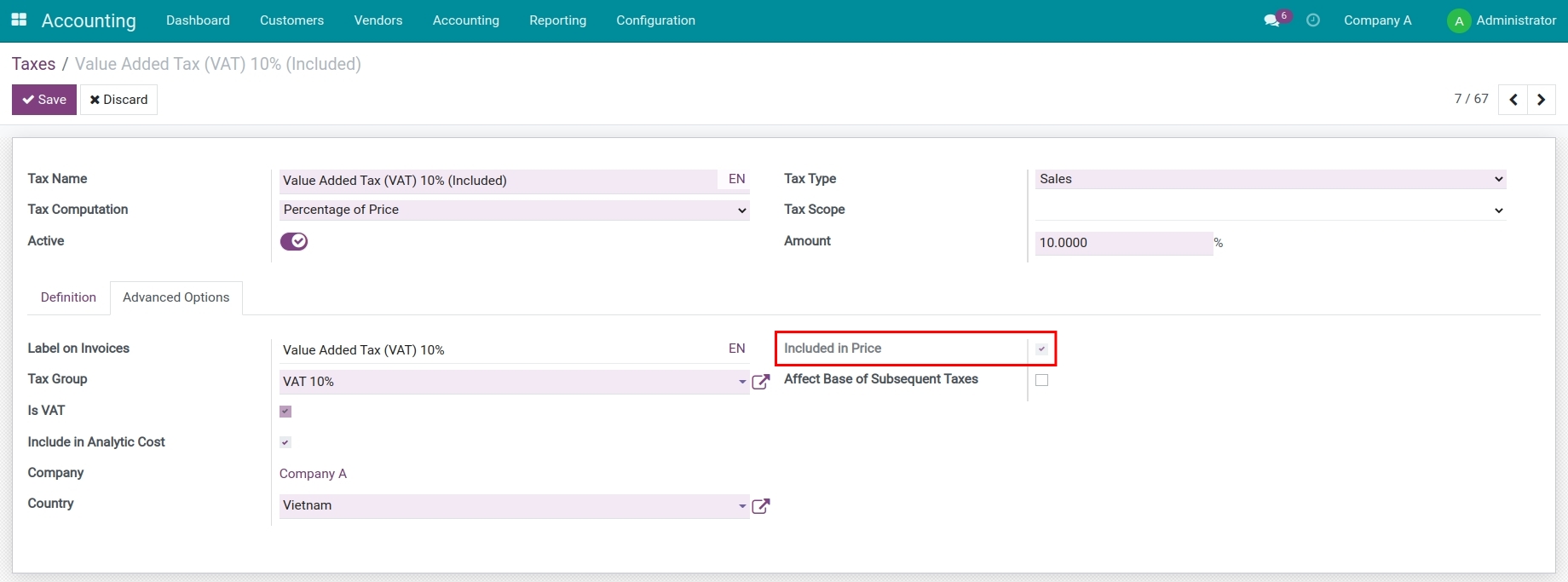

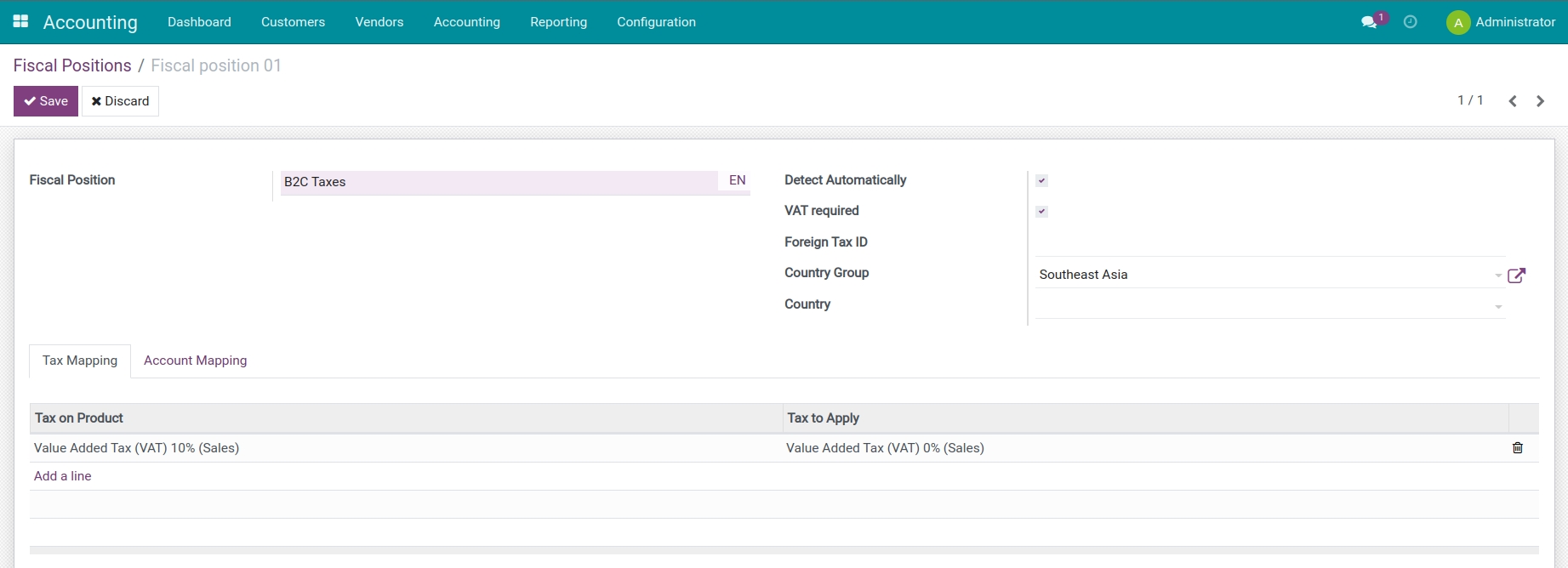

- Configure fiscal position for tax-included price

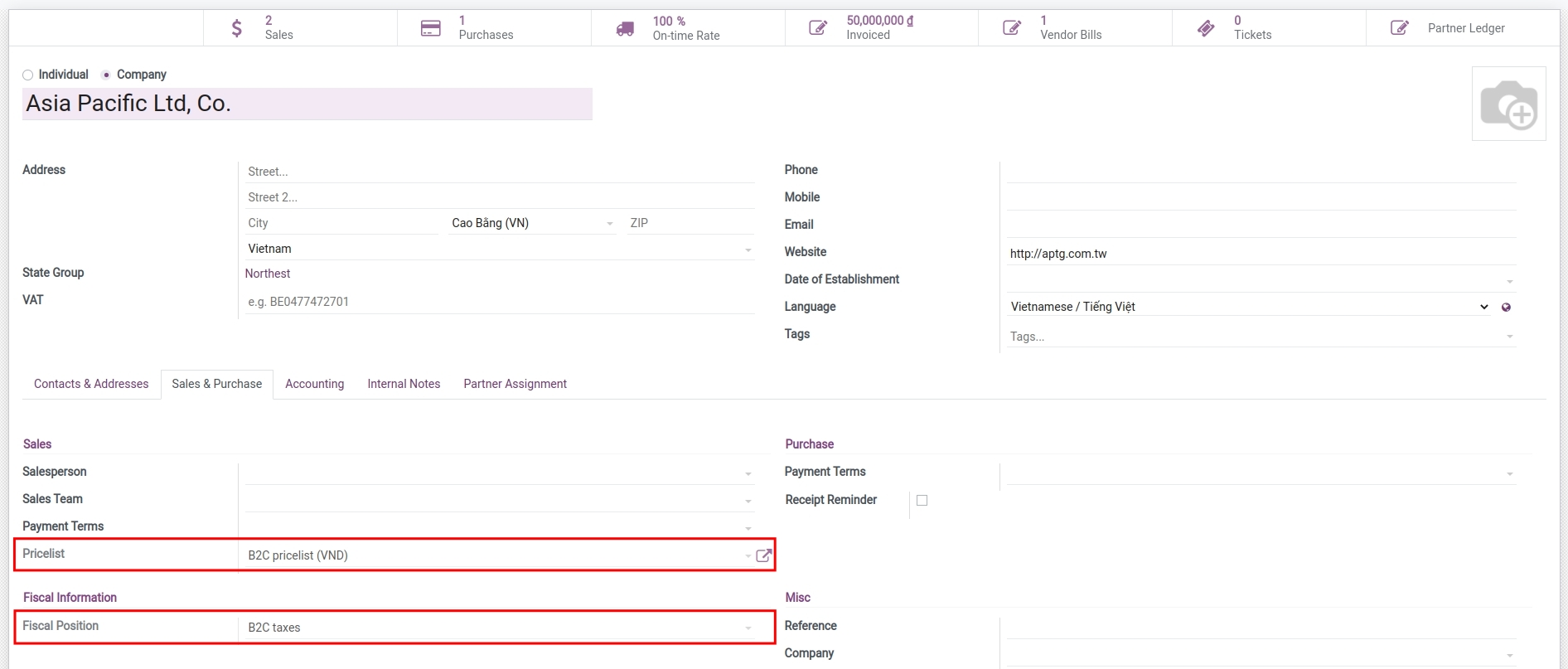

- Apply to Sales transactions

- Manage Retention Taxes

- Manage Retention Taxes

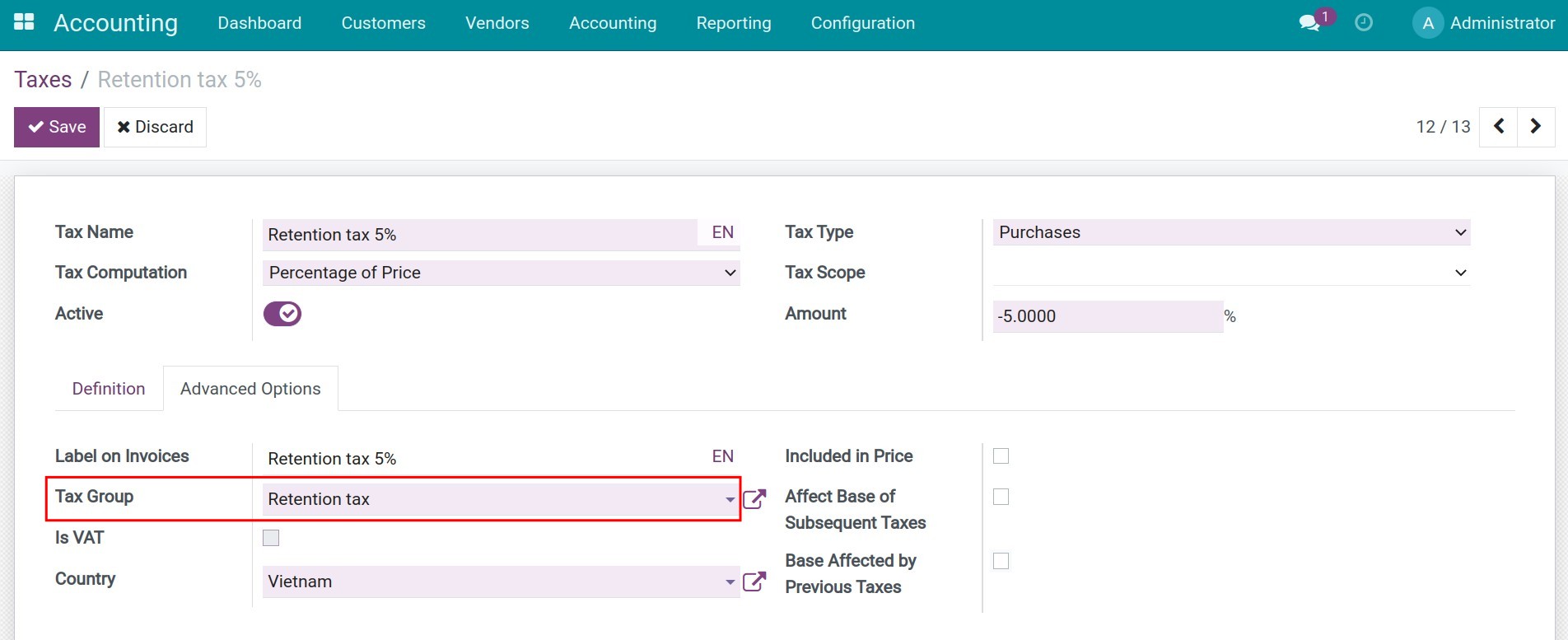

- Retention taxes configuration in Viindoo

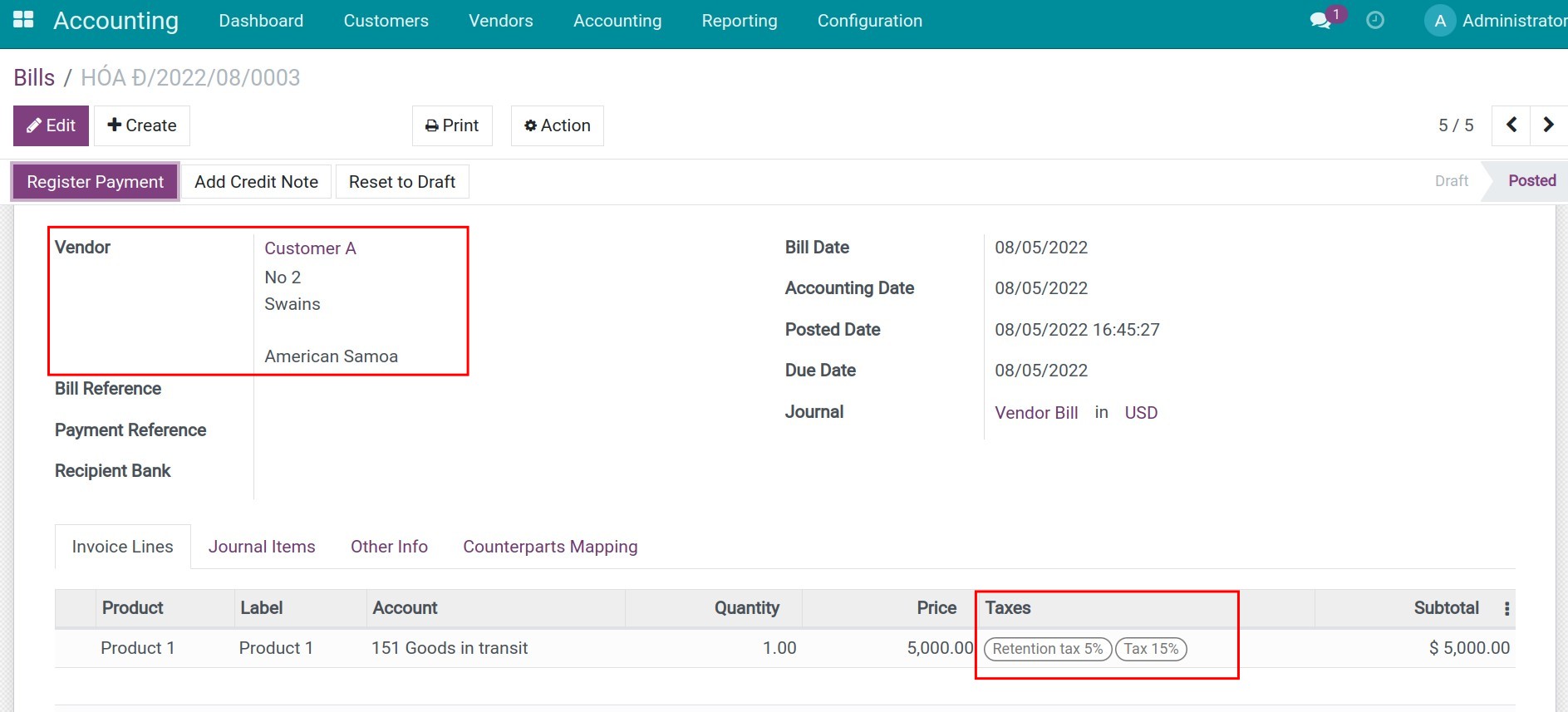

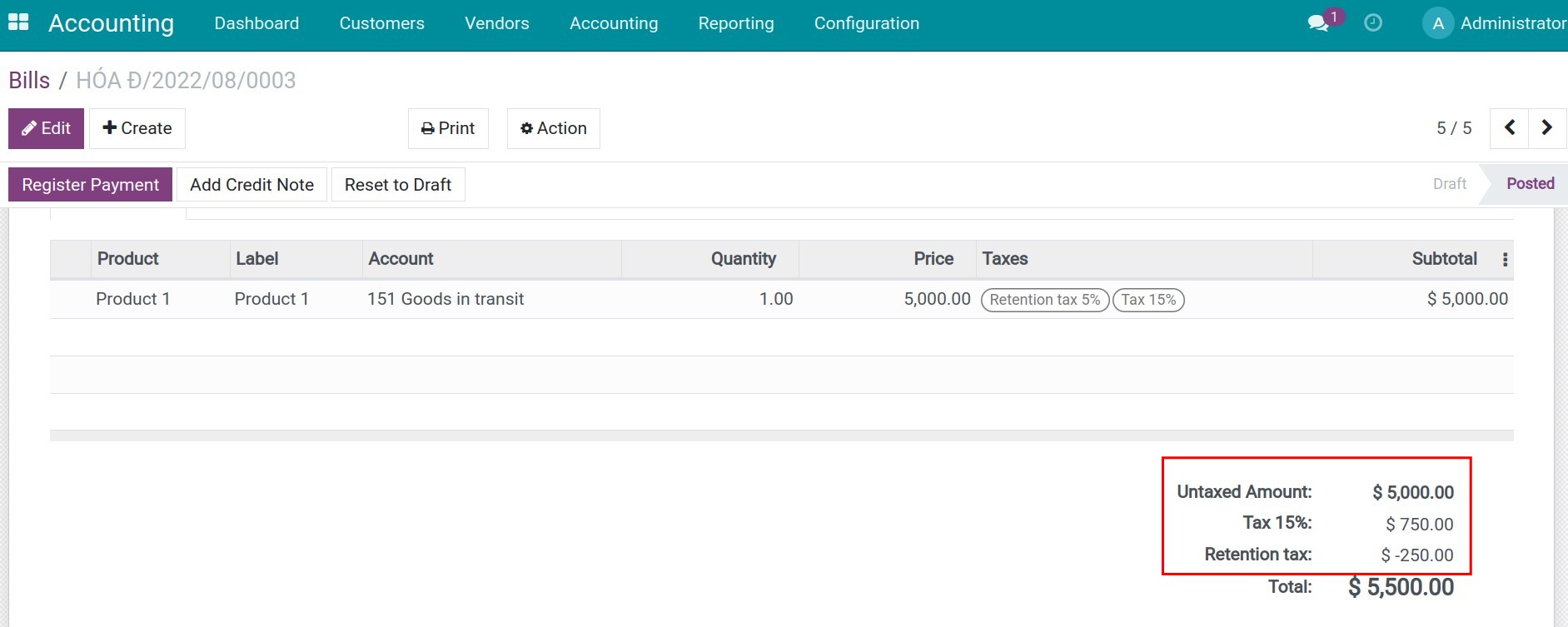

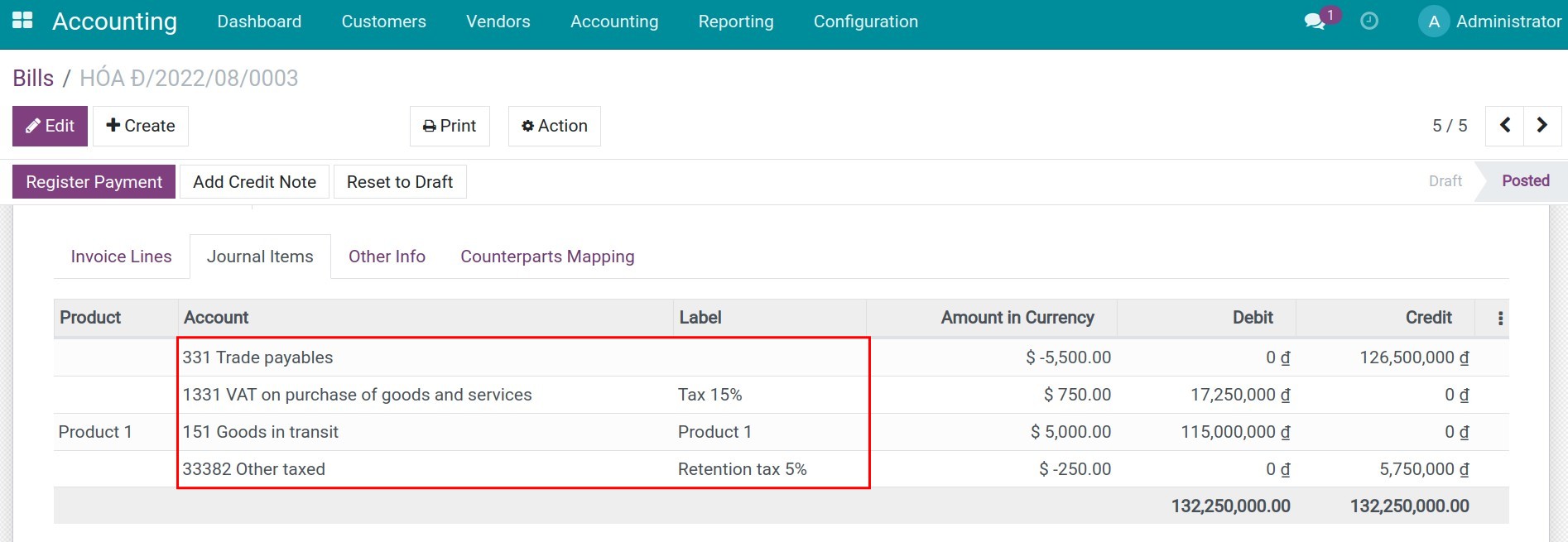

- Applying retention taxes on invoices

- Pay retention taxes

- Manage taxes in a cash basis taxpayer

- Manage taxes in a cash basis taxpayer

- Related settings

- Manage cash basis taxes

- Tax reports using tax grids

- Tax reports using tax grids

- Create a tax grid on the Accounting app

- Create a Tax report

- Create a root report line

- Create a child line to display on the report

- Connection between taxes and tax grids

- View Tax report

- How to configure a multi-currencies system

- How to configure a multi-currencies system

- Initial configuration

- Enable Multi-Currencies feature

- Exchange Difference journal

- Journal in foreign currencies

- Set up foreign currency on an Accounting account

- Multi-Currencies usage

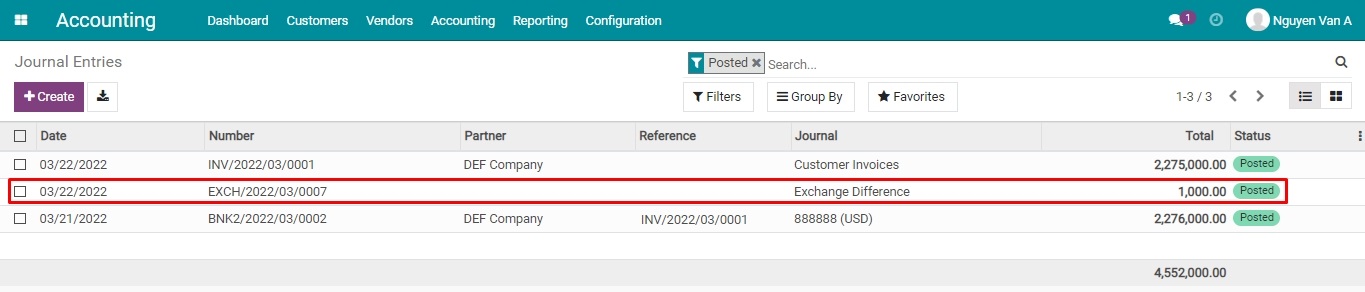

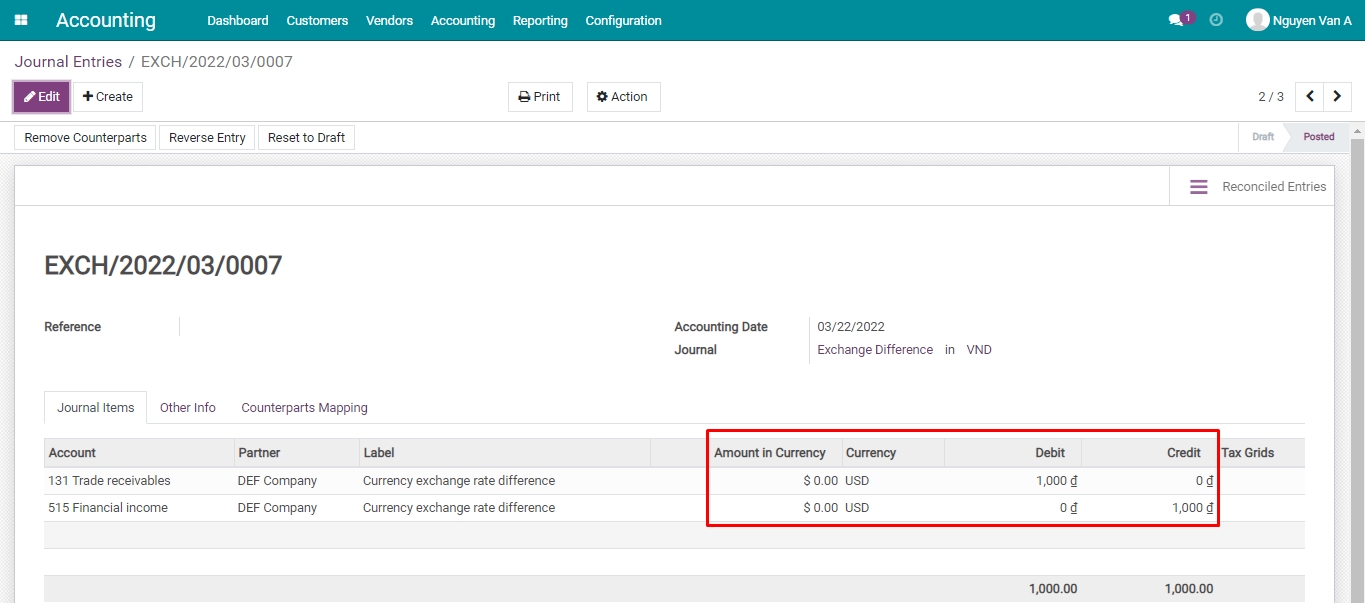

- Create customer invoice/vendor bill, Exchange difference journal entries

- Create a payment in foreign currency

- Create a bank statement in foreign currency

- Manage invoices and make a payment in a multi-currencies system

- Manage invoices and make a payment in a multi-currencies system

- The foreign currency invoices in Viindoo

- Payment for Vendor bills

- Payment by the main currency of the company

- Payment in foreign currency

- Customer’s payment

- Receiving payment in the company’s main currency

- Receiving payment in foreign currency

- Automatically recording the exchange rate difference

- Automatically recording the exchange rate difference

- Manual currency rates update

- Automatic currency rates update

- Salary and the deductions payments

- Salary and the deductions payments

- Salary payments

- Salary deductions payment

- Salary reconciliation

- Salary reconciliation

- When you need to create salary payment on the system

- When you don’t need to create a salary payment on the system

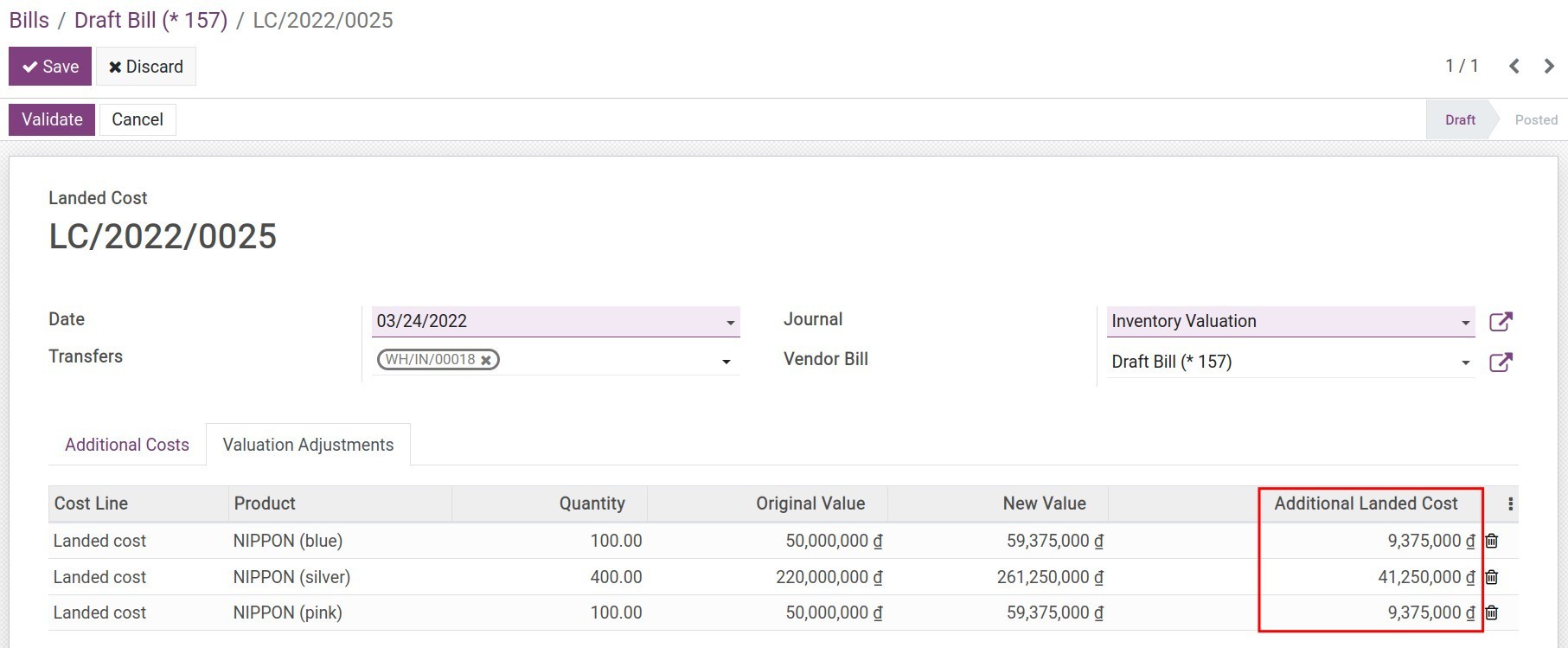

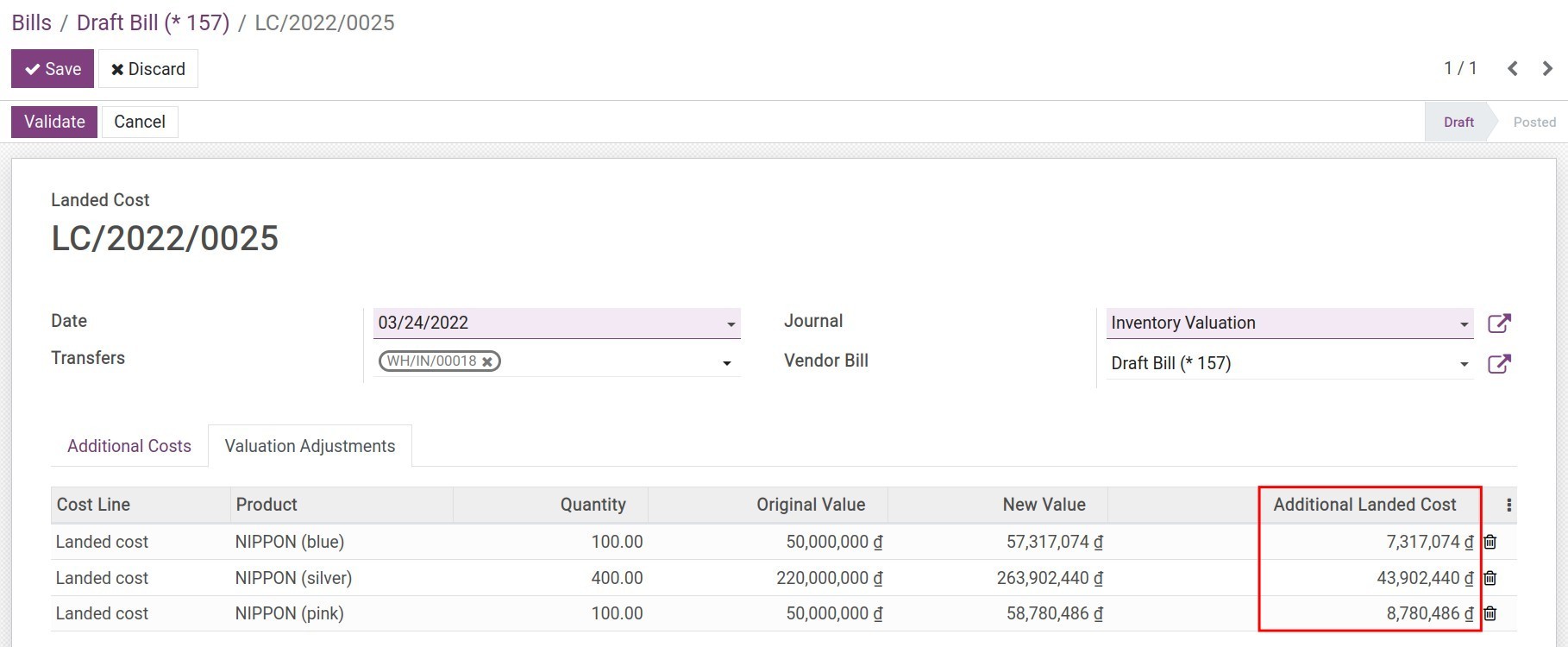

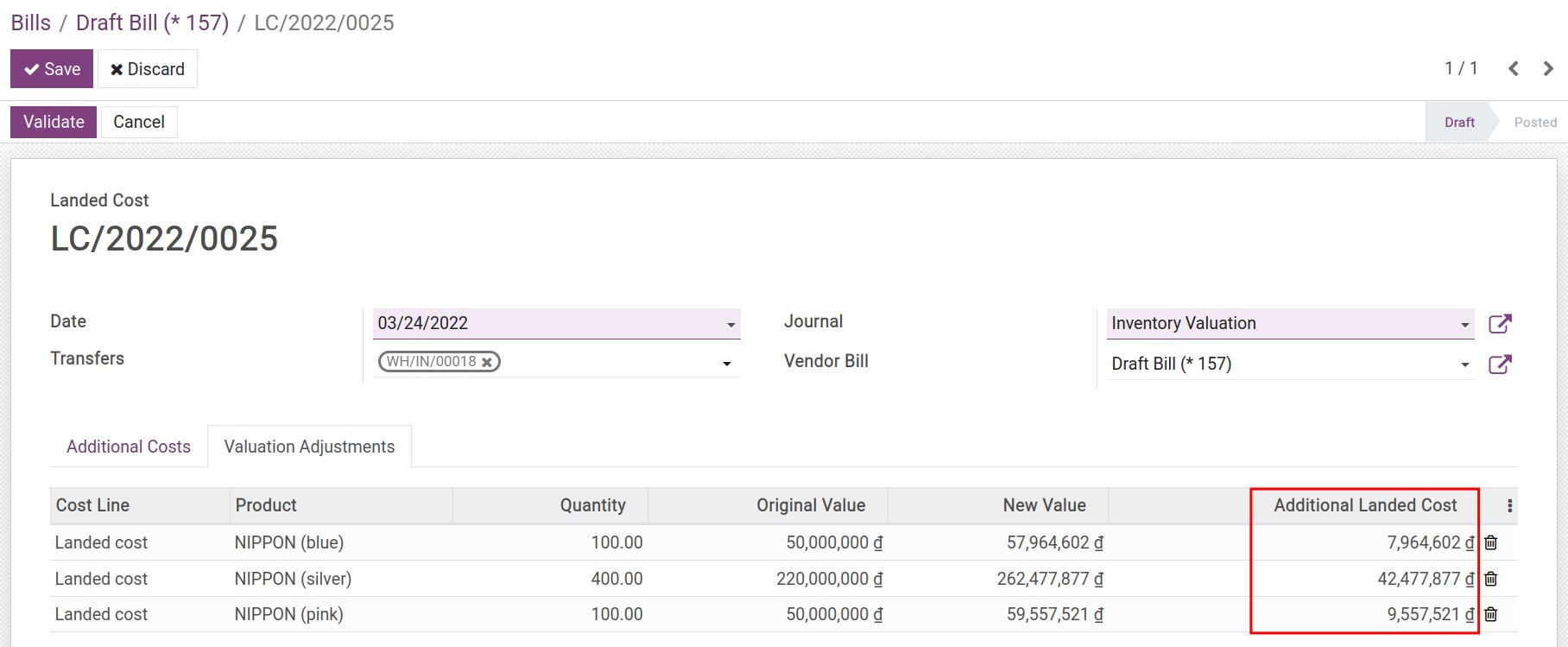

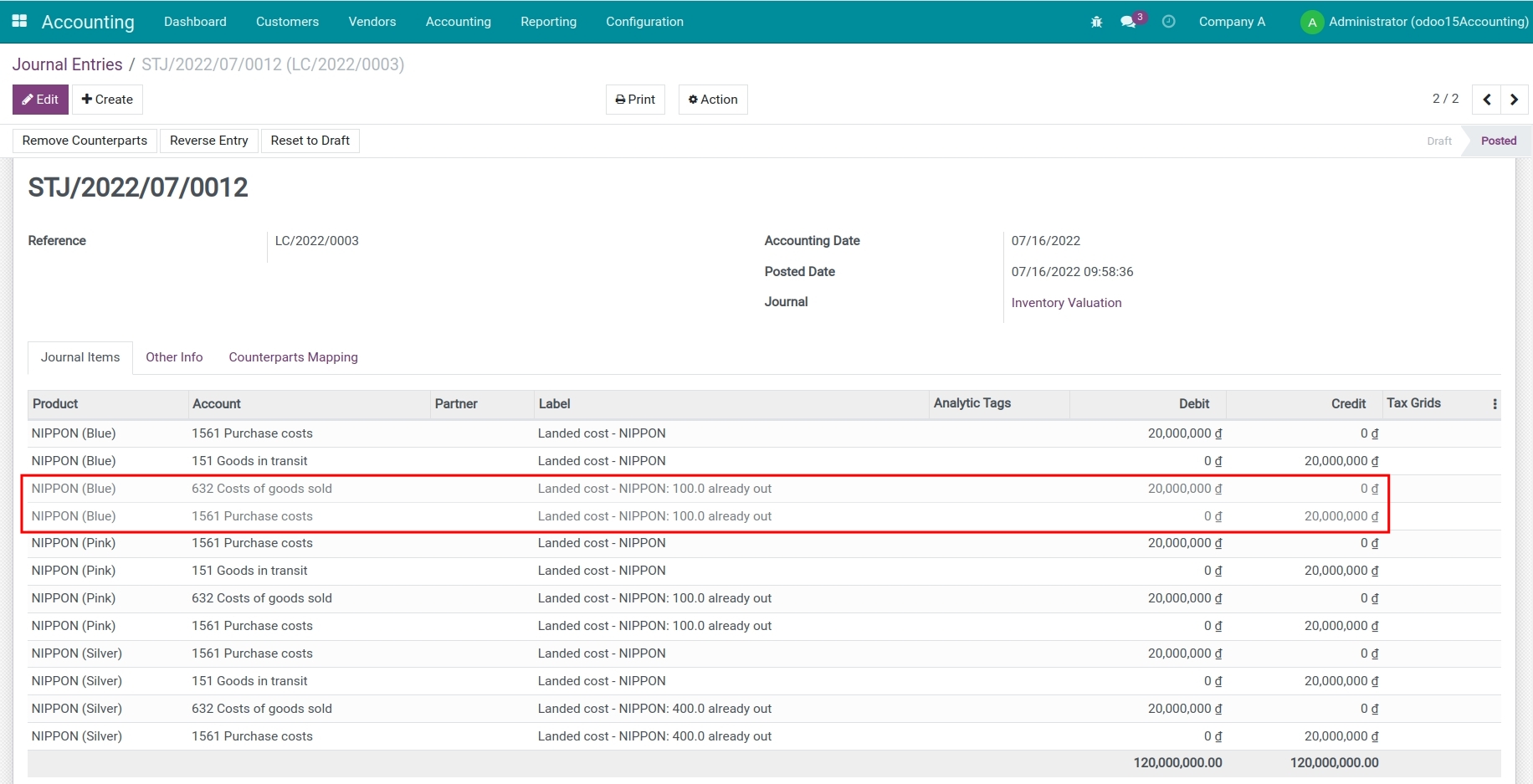

- Accounting for landed cost

- Accounting for landed cost

- Overview

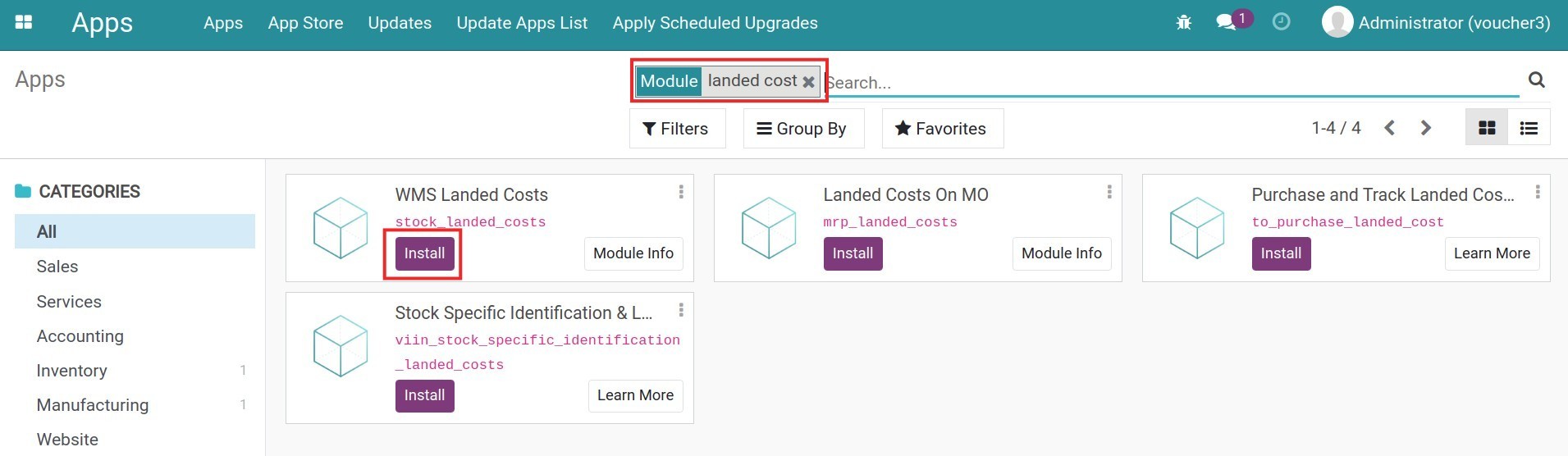

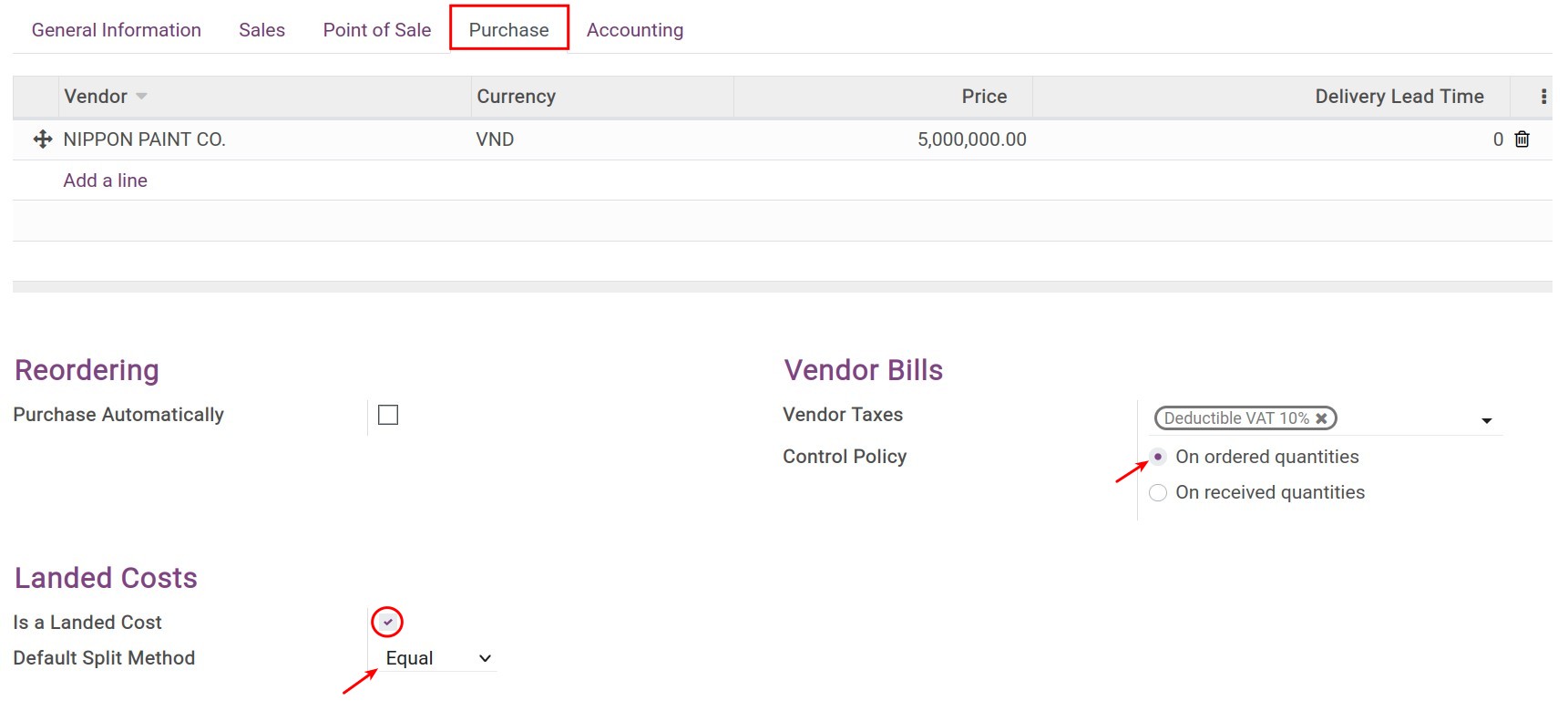

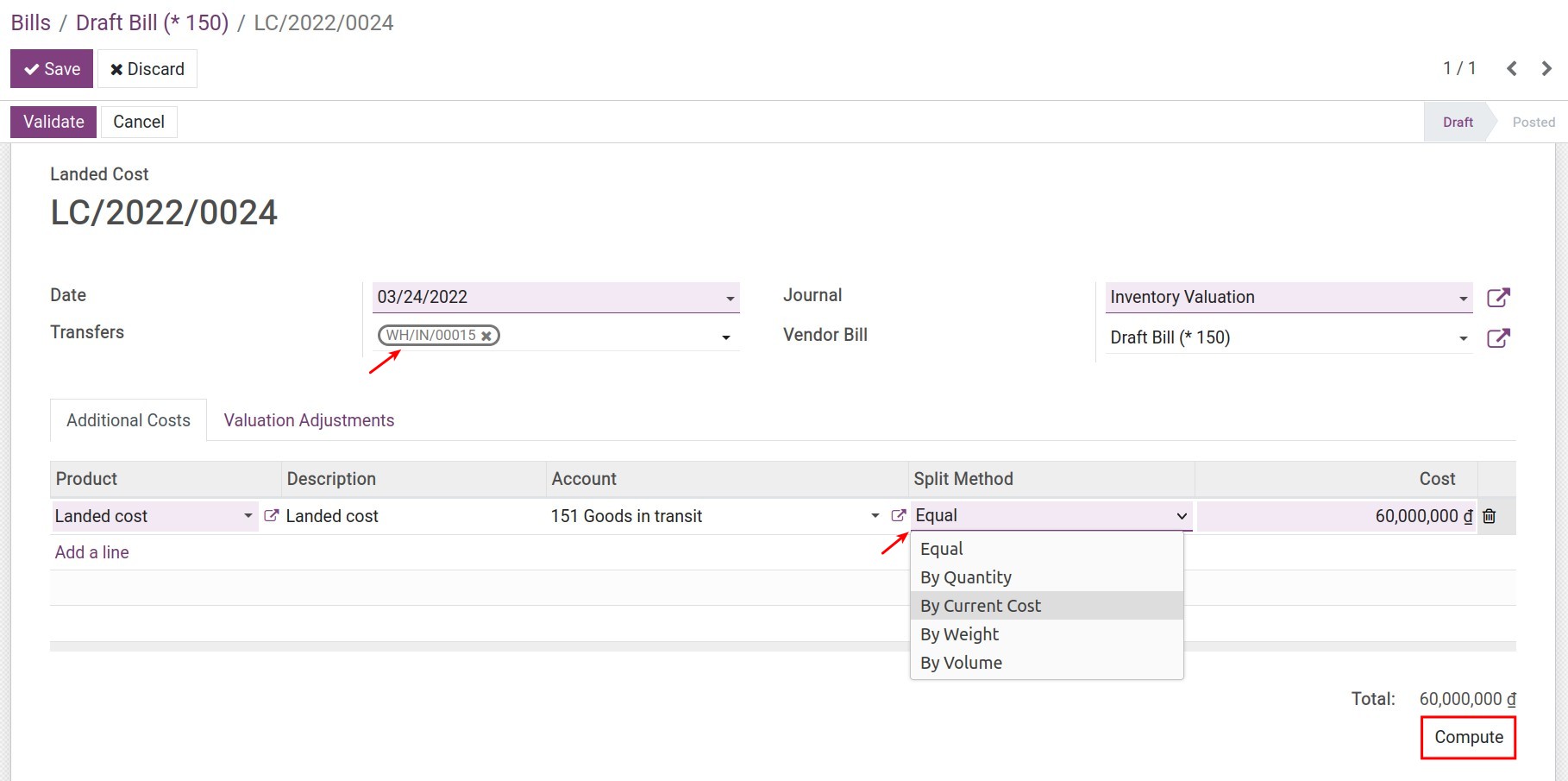

- Configuration

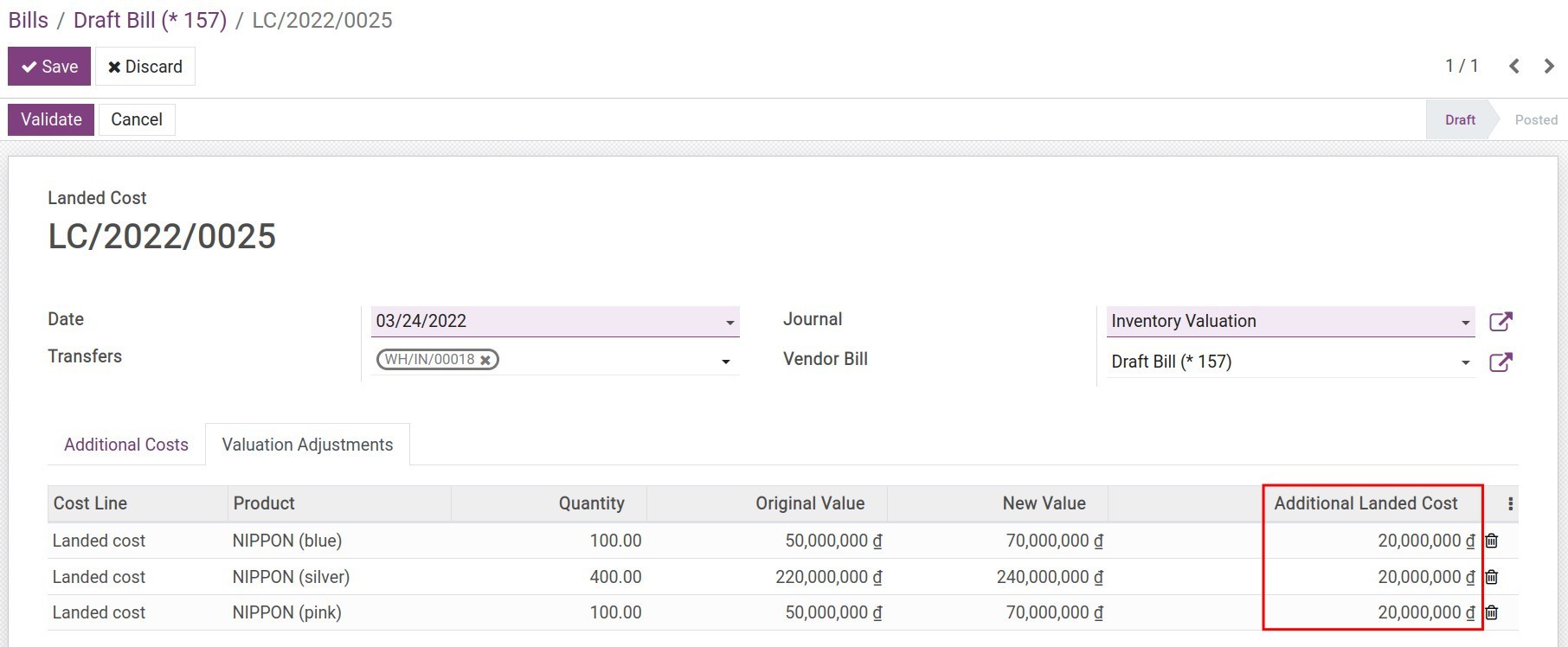

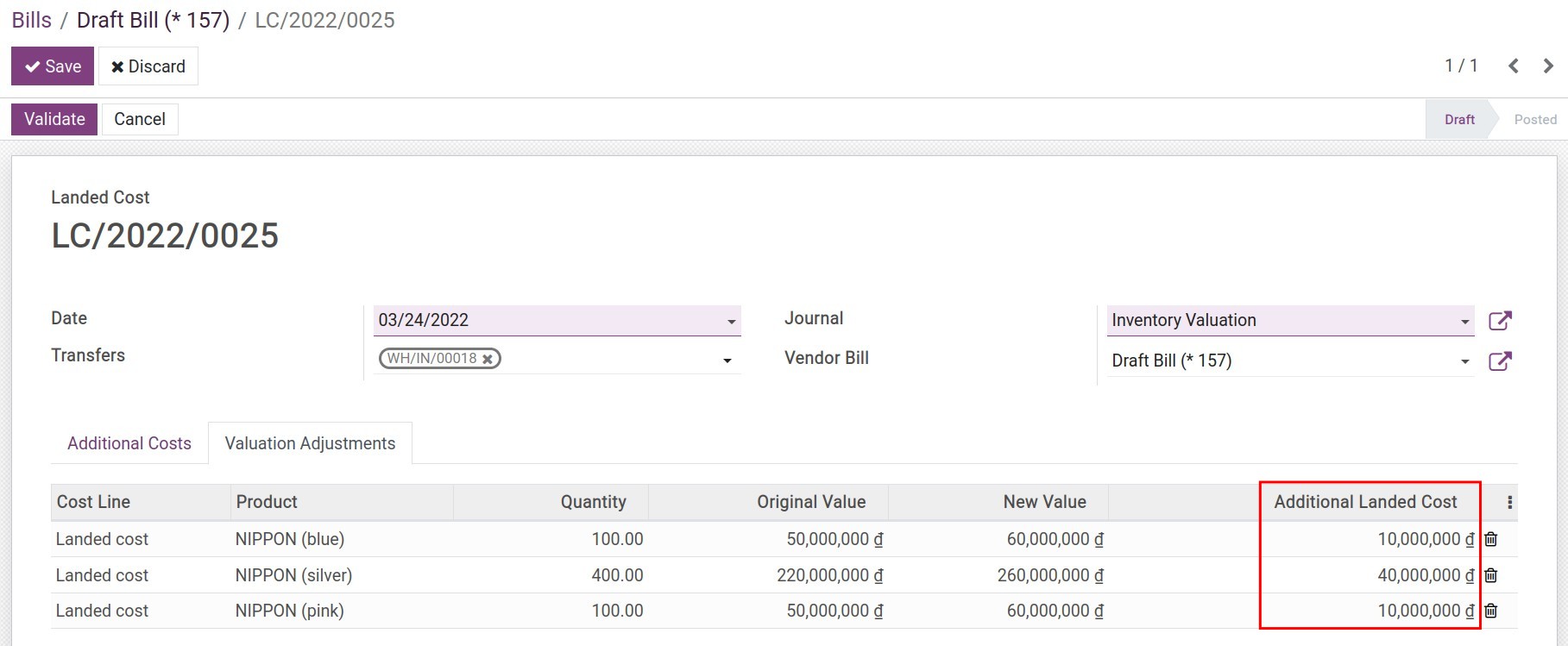

- Supported landed costs allocation methods

- Accounting for landed cost at the receipt of the goods

- Accounting for landed cost for sold products

- Accounting for Stock Valuation

- Accounting for Stock Valuation

- Costing Method

- Standard Price

- First In First Out (FIFO)

- Average Cost (AVCO)

- Specific Identification

- Inventory Valuation method

- Inventory valuation with Viindoo software

- Configuration of Product Categories

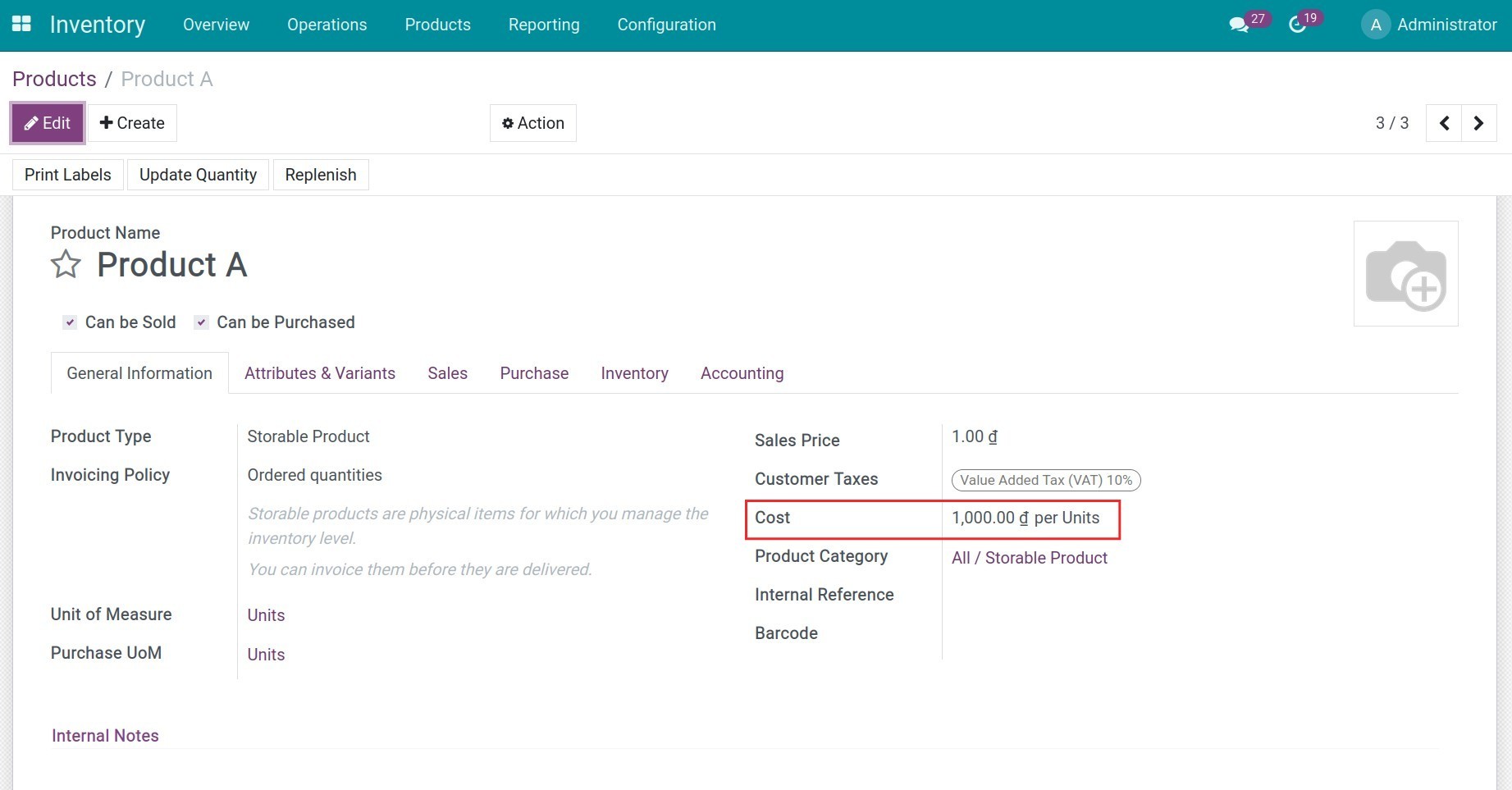

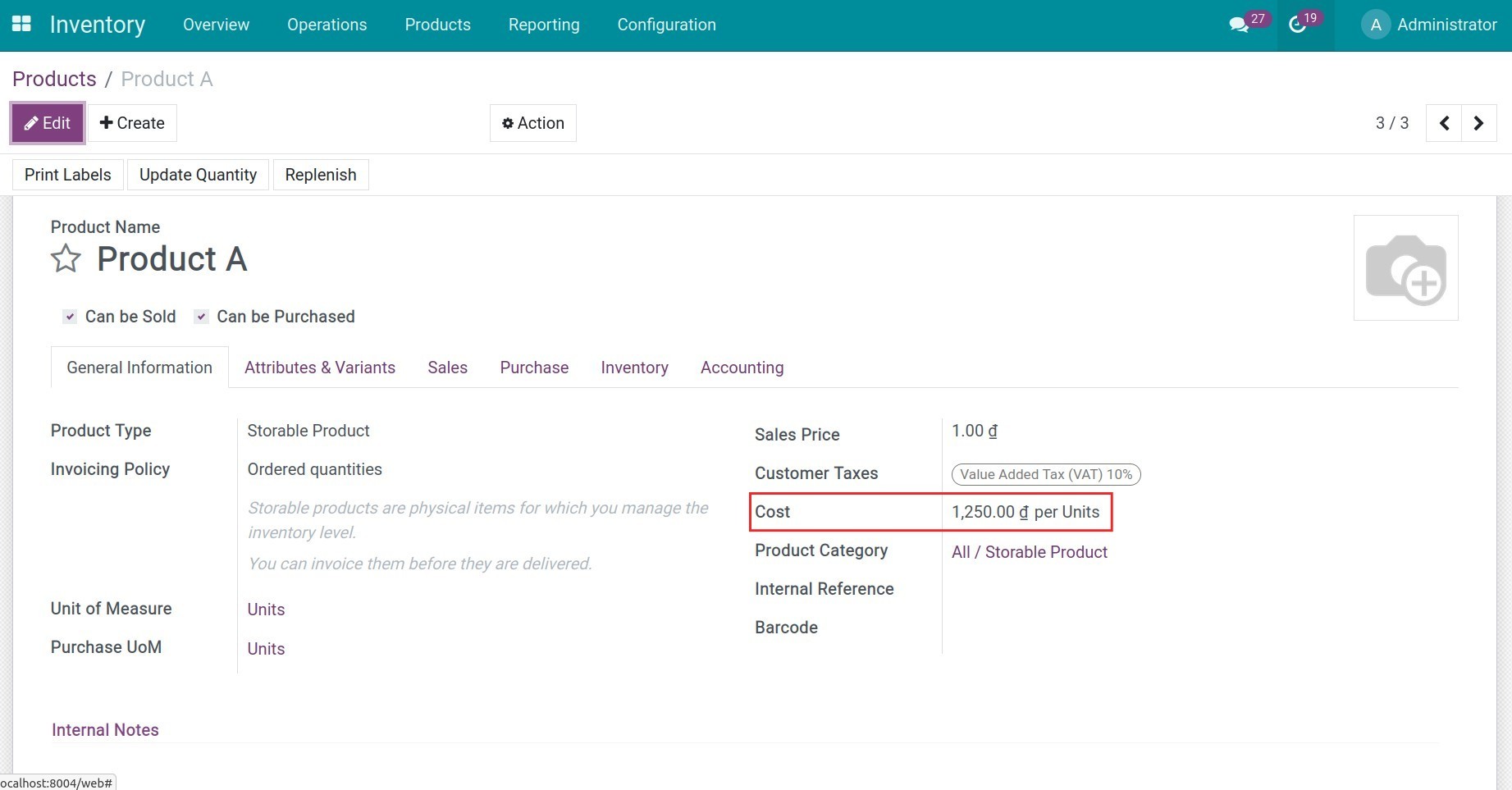

- Configuration on Products

- Journal entries generated from a validated receipt

- Journal entries generated from a validated delivery order

- View Inventory Valuation reports

- Accounting for Inventory Adjustment

- Accounting for Inventory Adjustment

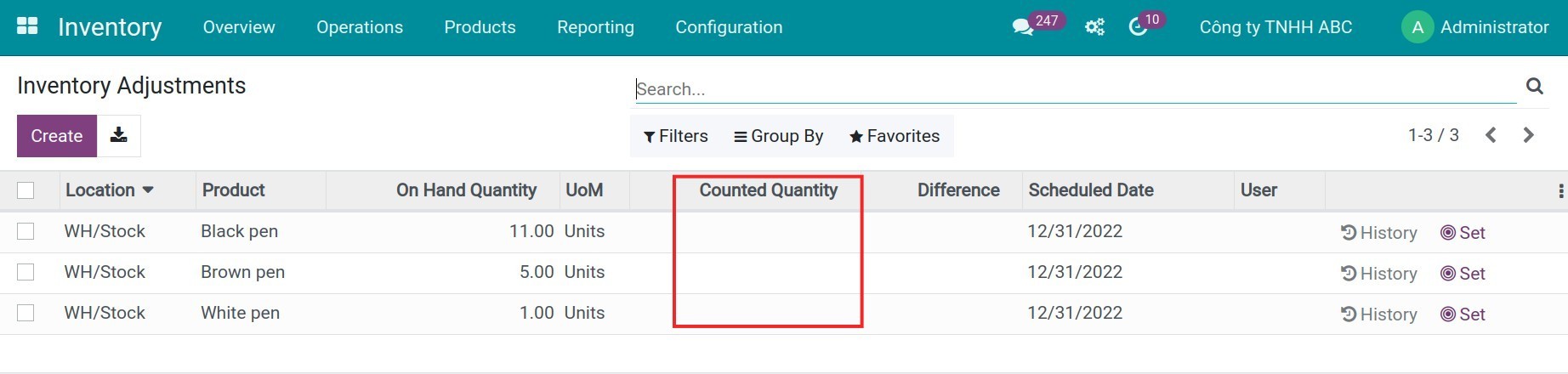

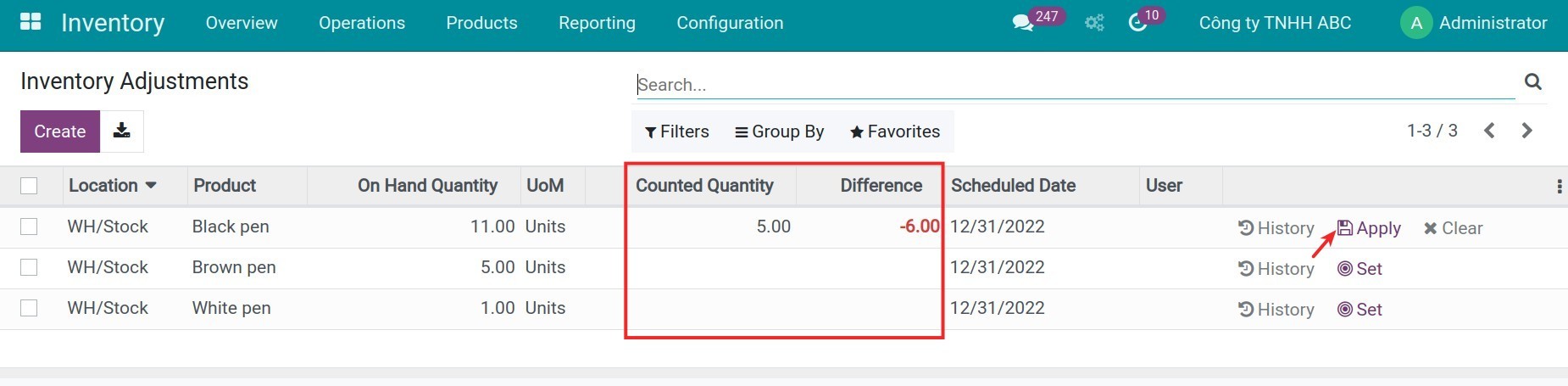

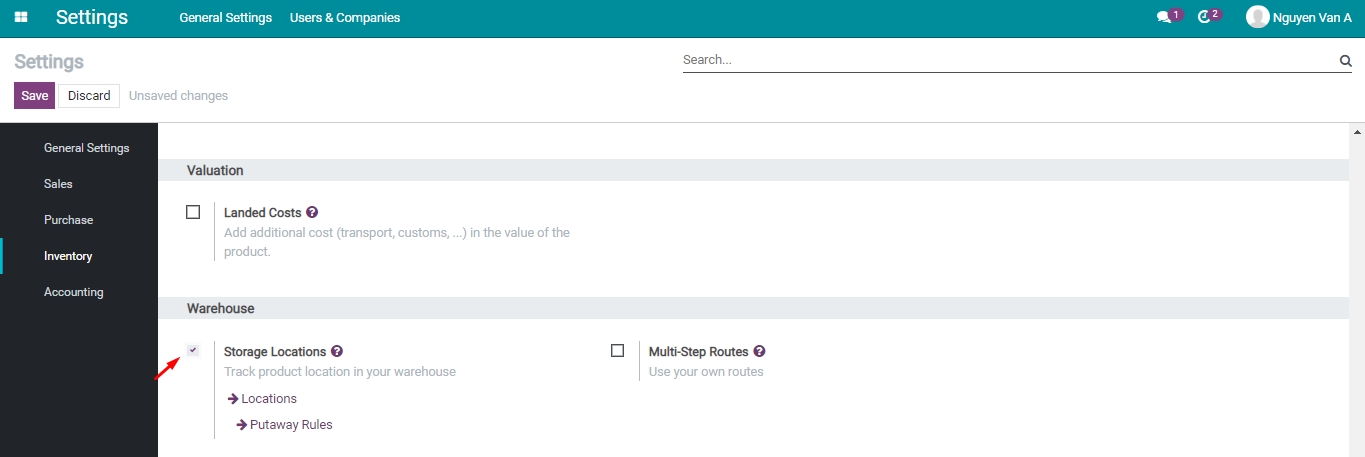

- Configuring Inventory Adjustment Location

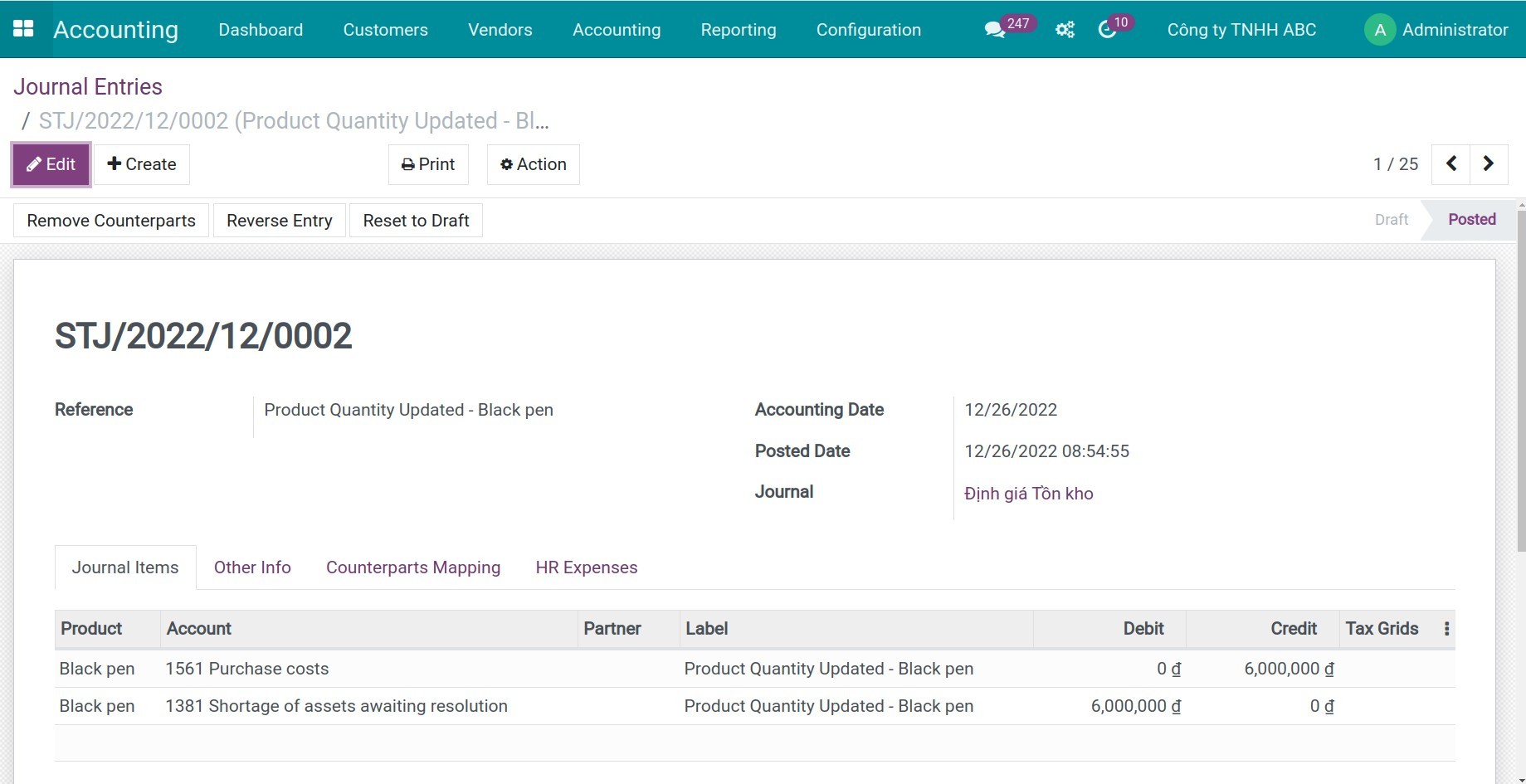

- Accounting for loss/excess of products during Inventory Adjustment

- Accounting for Inventory Scrap

- Accounting for Inventory Scrap

- Configure Scrap Location

- How to account for scrap in Viindoo?

- Configure inventory accounting for multi-companies

- Configure inventory accounting for multi-companies

- Configure accounts for a storage location

- View journal entries

- Track employee costs in project management

- Track employee costs in project management

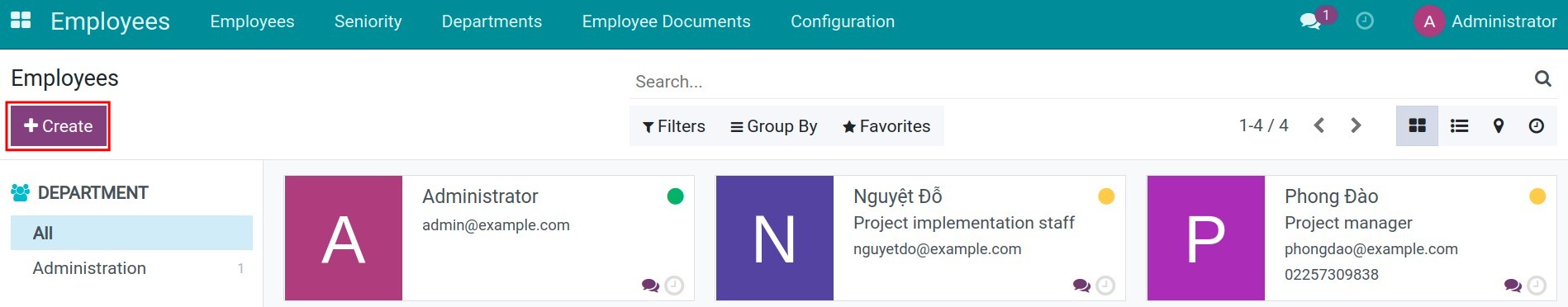

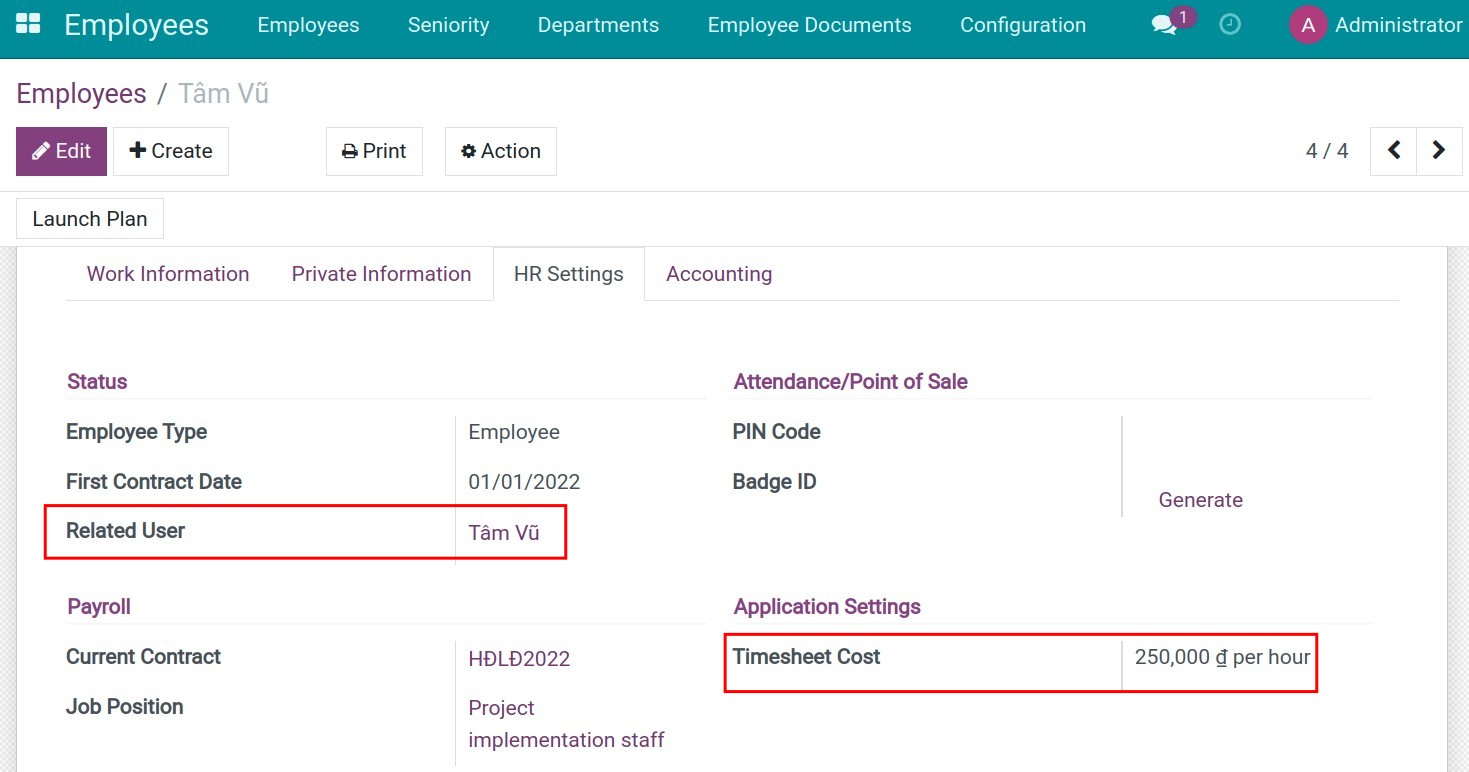

- Configure employee cost

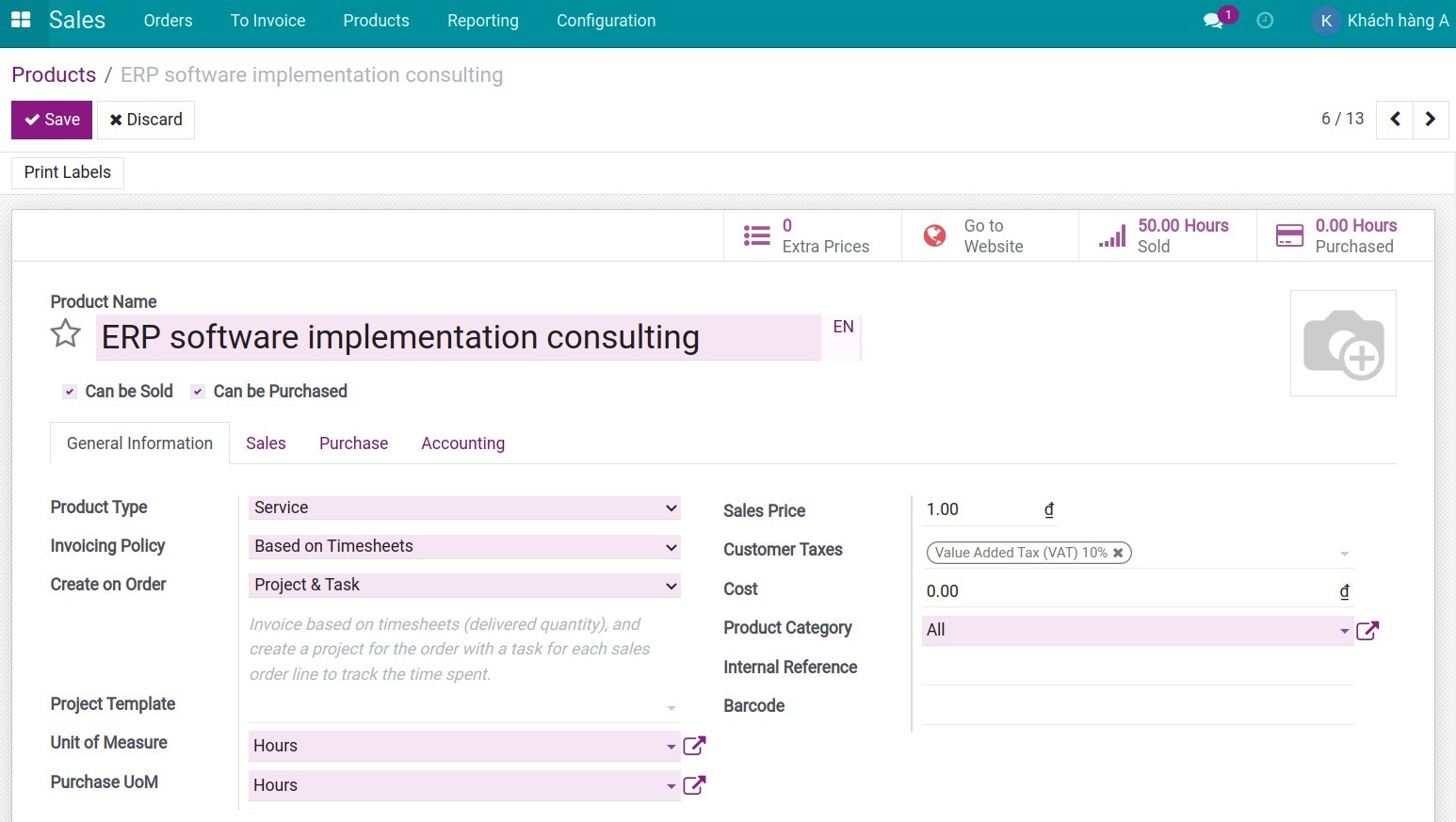

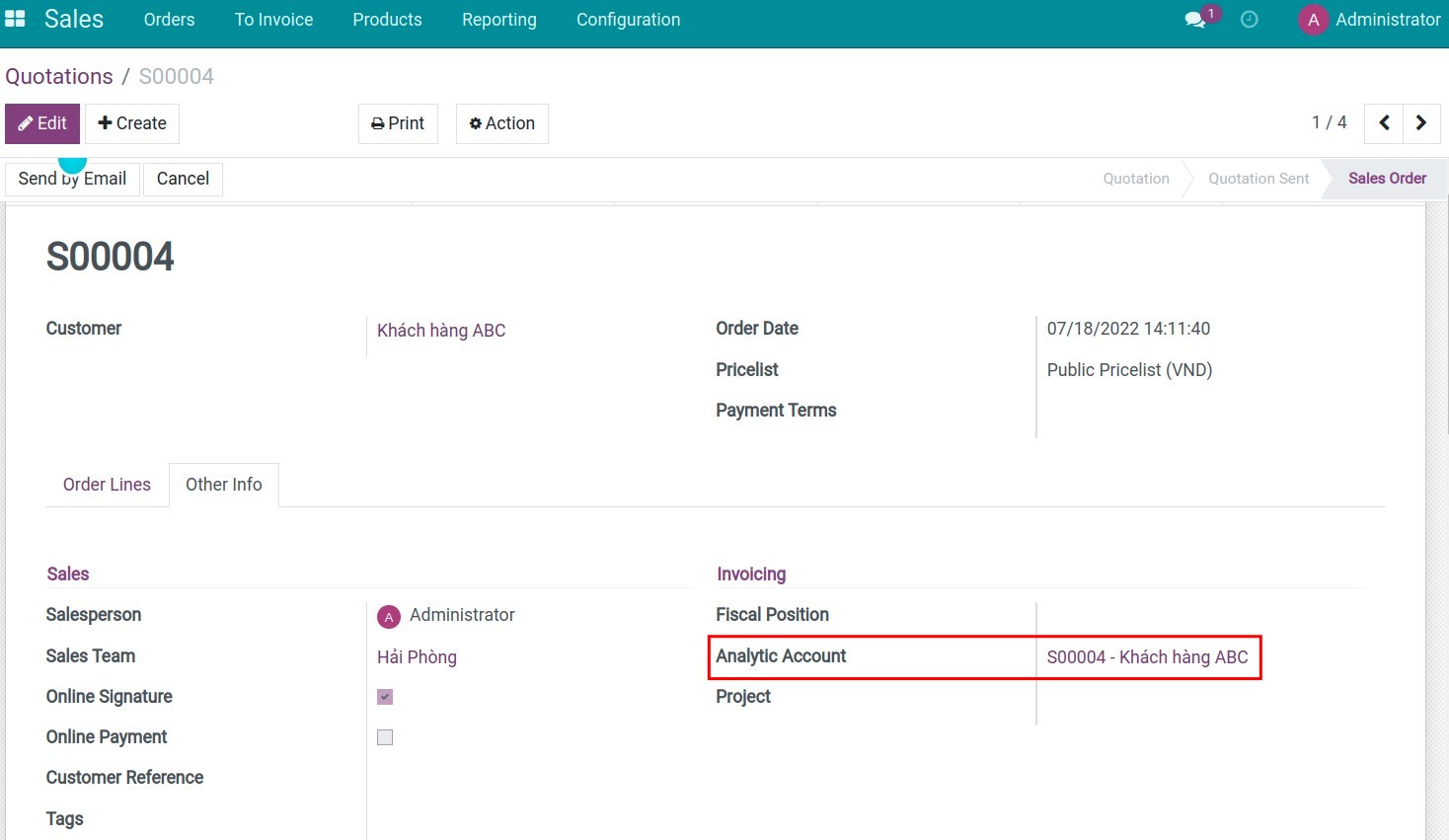

- Create a Quotation

- Cost and Revenue management

- Expenses and revenue management in Viindoo Accounting

- Expenses and revenue management in Viindoo Accounting

- Introduction

- Analytic tools usage

- Record revenue of the contract

- Record and track related costs

- Analyze revenue/costs

- Odoo Accounting Simplified

- Contracts

- Contracts Management

- Billing Options

Configure Bank Accounts

Configure Bank Accounts

Requirements

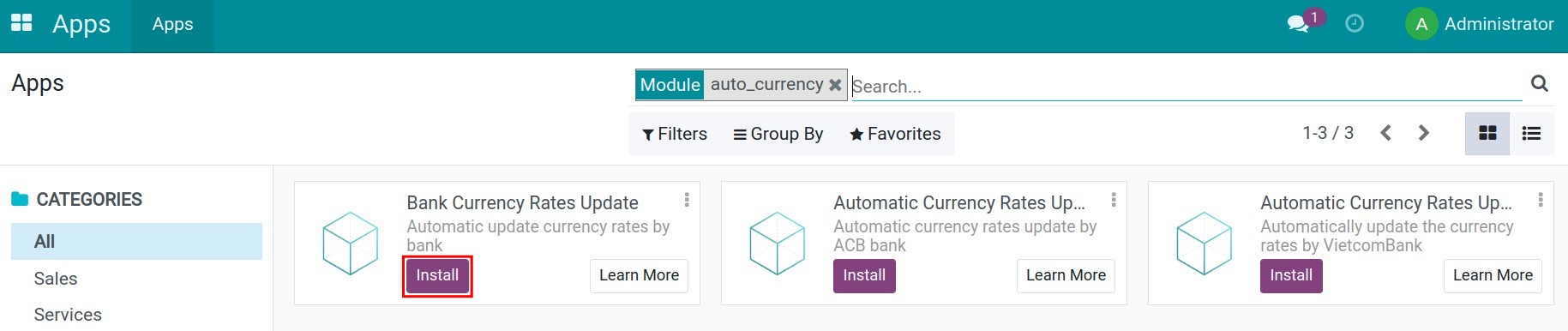

This tutorial requires the installation of the following applications/modules:

Accounting & Finance

Contact

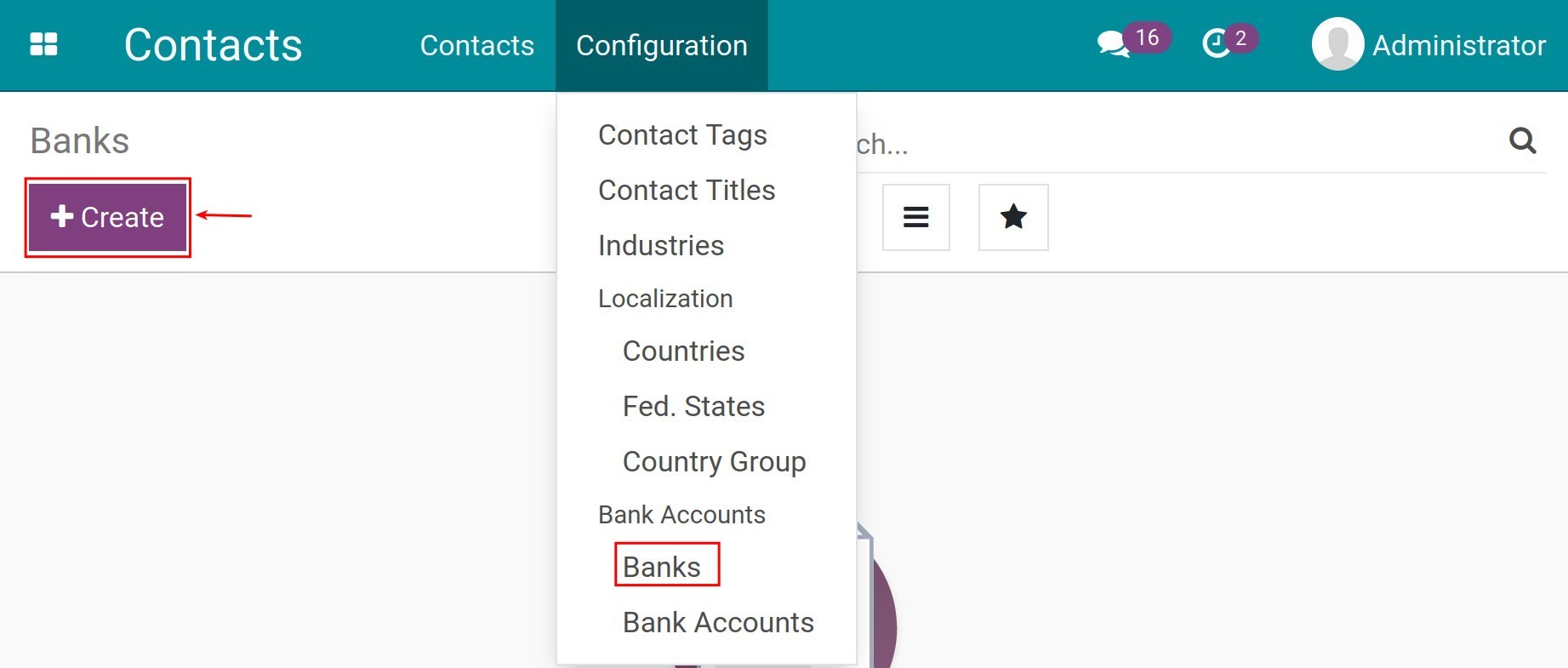

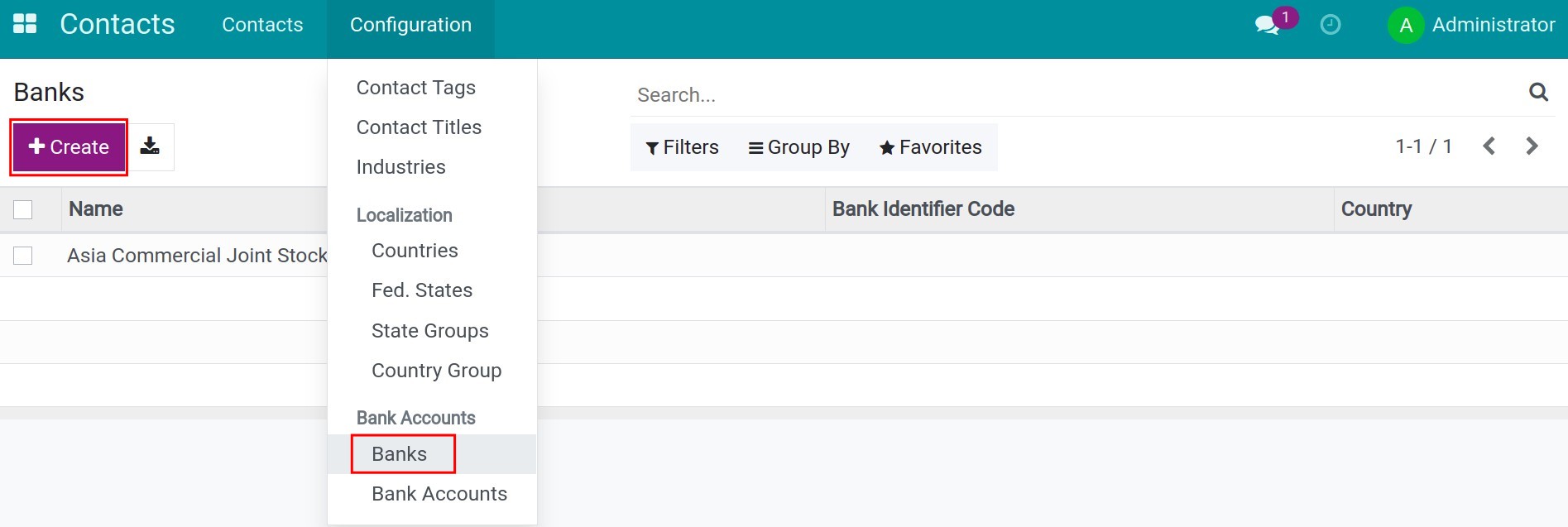

Create a bank

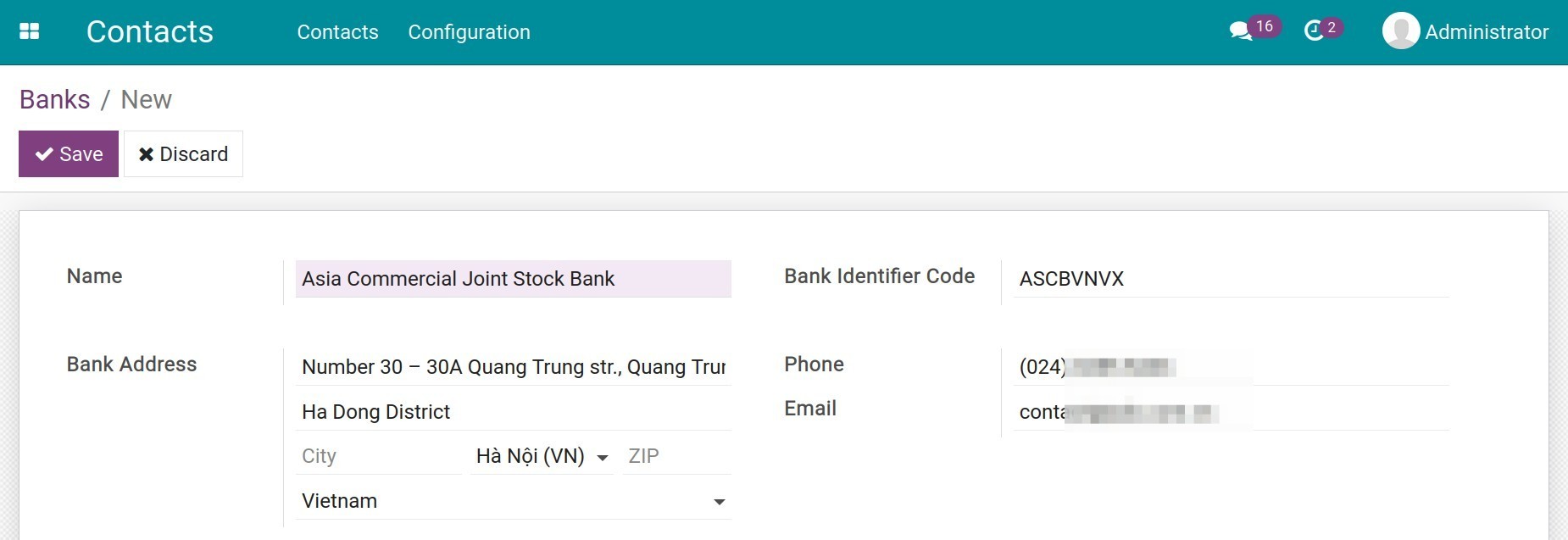

To create a new Bank, navigate to Contacts ‣ Configuration ‣ Banks, click Create to create new bank information.

You need to fill information as follow:

Name: Add your bank name.

Bank Identifier Code: The identifier code according to the international standard convention created by the Society for Worldwide Interbank Financial Telecommunication, also known as the BIC code or SWIFT code.

Bank Address: fully address including street, city, ZIP (if any), country.

Phone/Email: Phone number and email of the bank.

Click Save to save information.

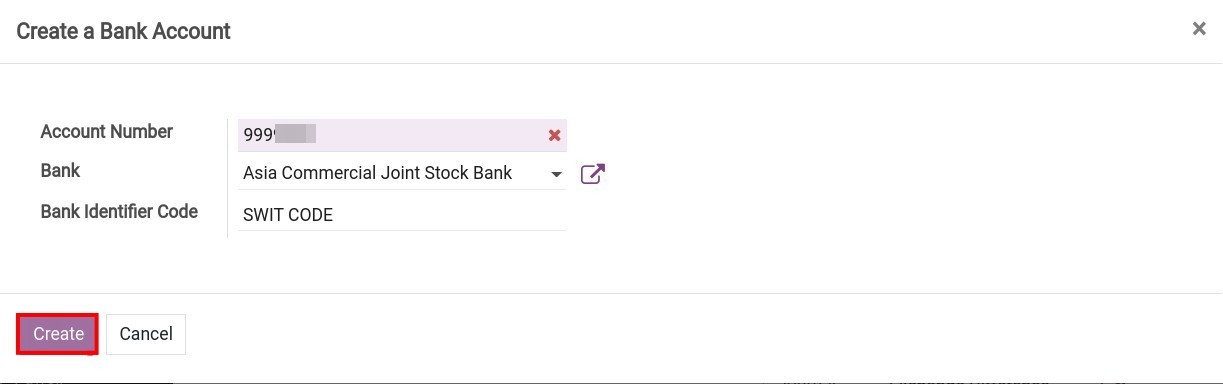

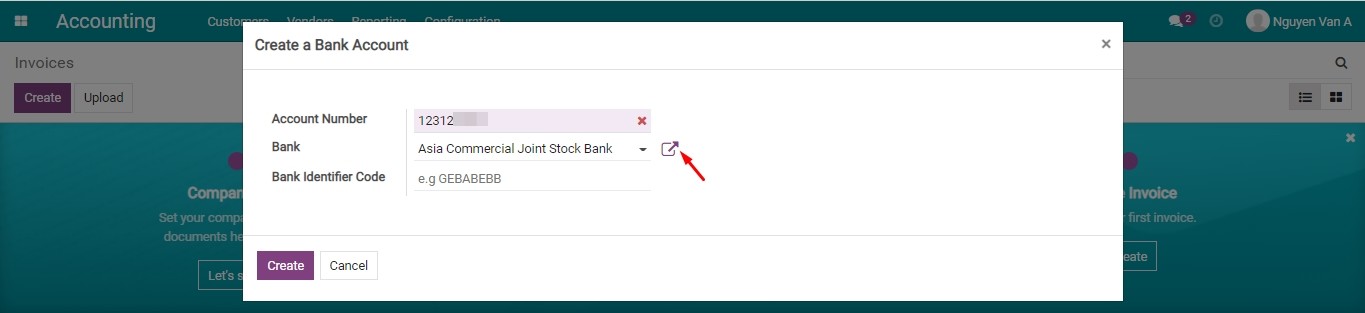

Create a new bank account

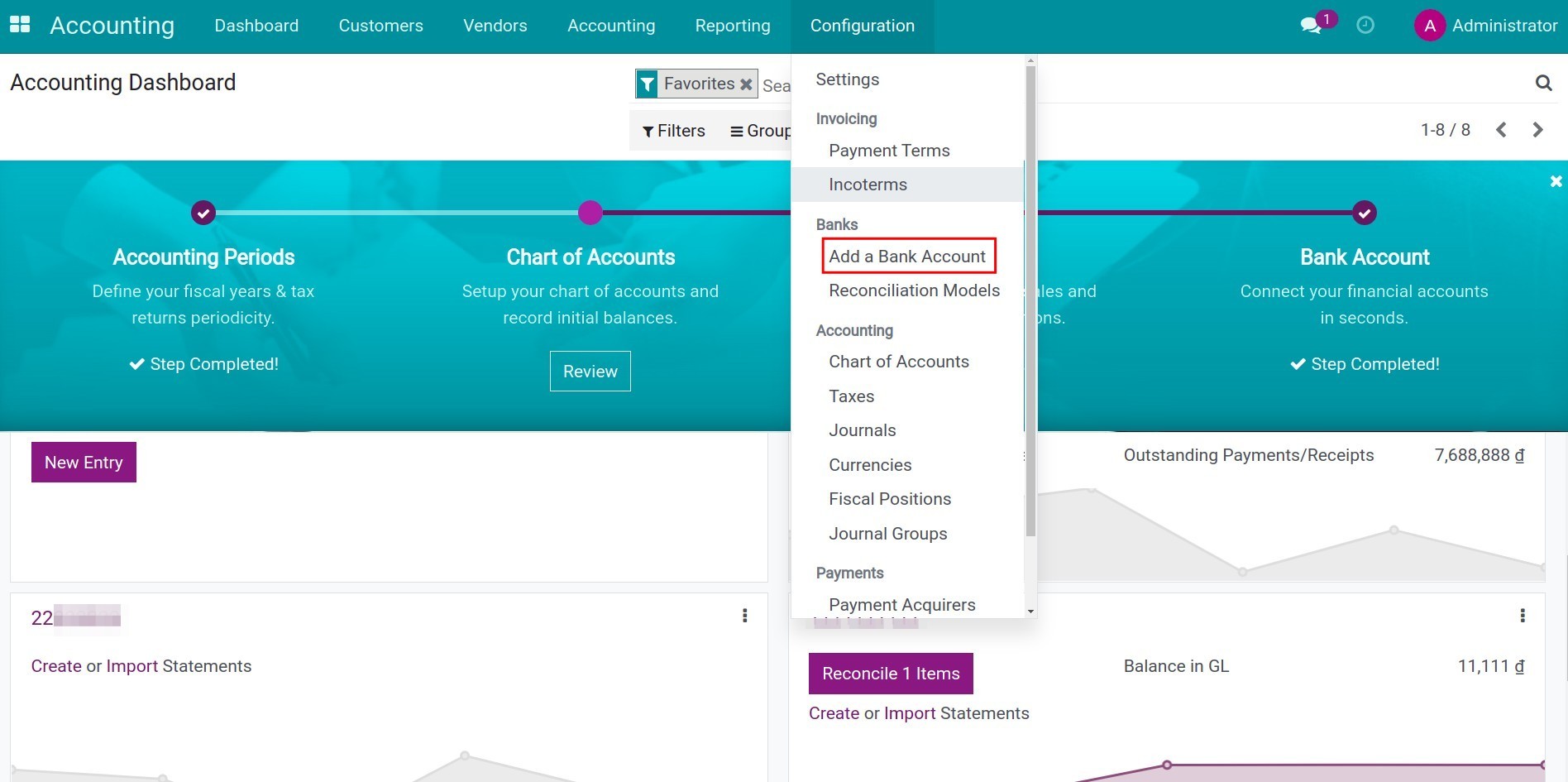

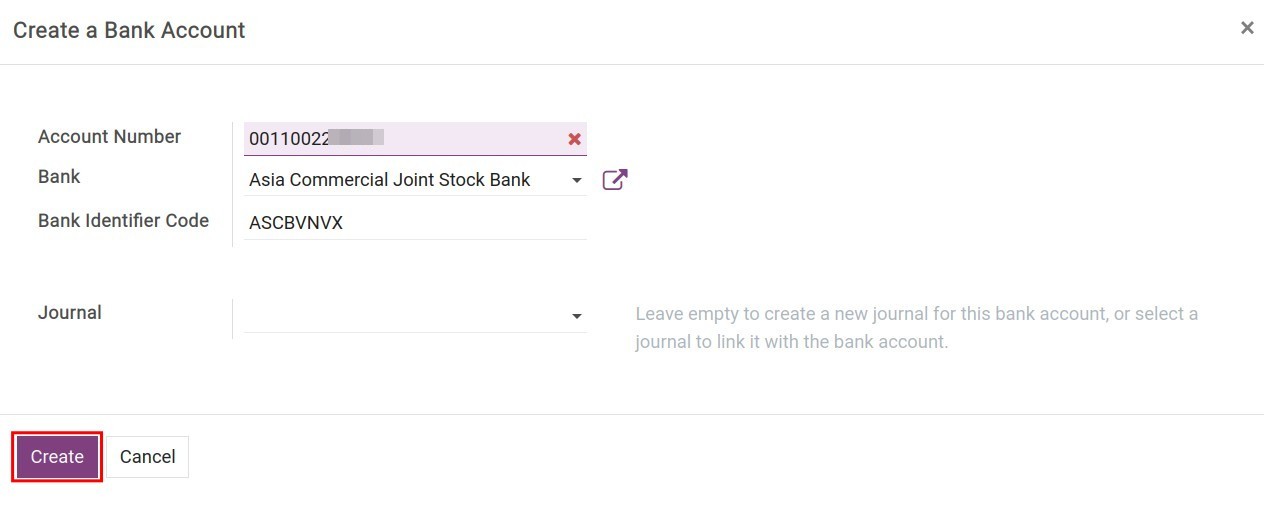

To create a new Bank Account in Accounting & Finance Management software , navigate to Accounting ‣ Configuration ‣ Add a Bank Account :

On the pop-up window, you need to fill in the following information:

Account Number: Add your bank account number.

Bank: Choose a Bank from the existing bank list.

Bank Identified Code: Automatically filled from the setup bank information.

Journals: Choose from the existing Journals to link a Journal to the bank account. In case this field is empty, a new Journal will be automatically created for the new bank account.

Note

You can also create a new Bank Account by navigating to Contacts ‣ Configuration ‣ Bank Accounts. All the existing bank accounts in the system are compiled here, including your company bank accounts and your partners’ ones.

Warning

A Journal is created and linked to a newly created bank account only when said bank account is created from the Accounting app.

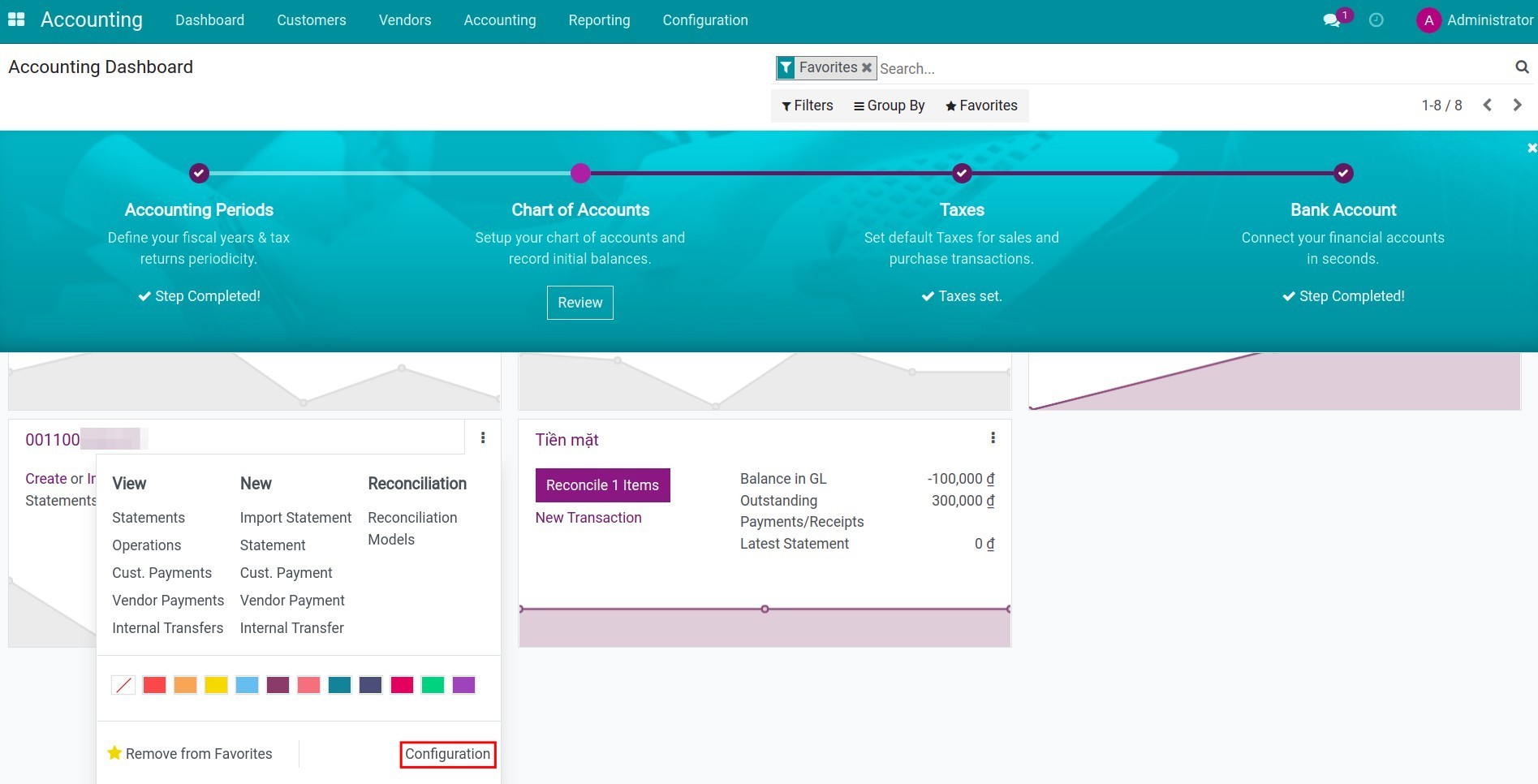

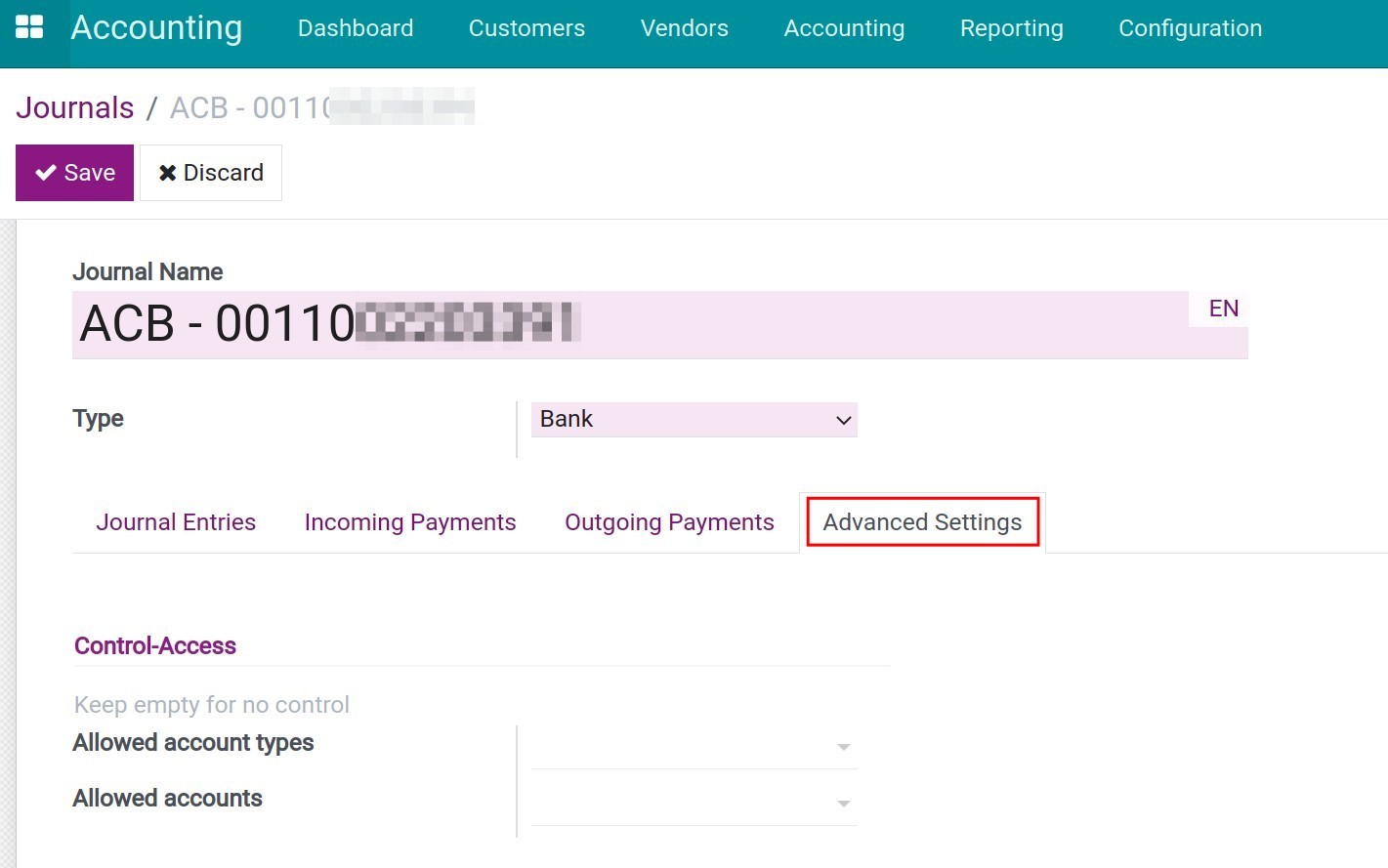

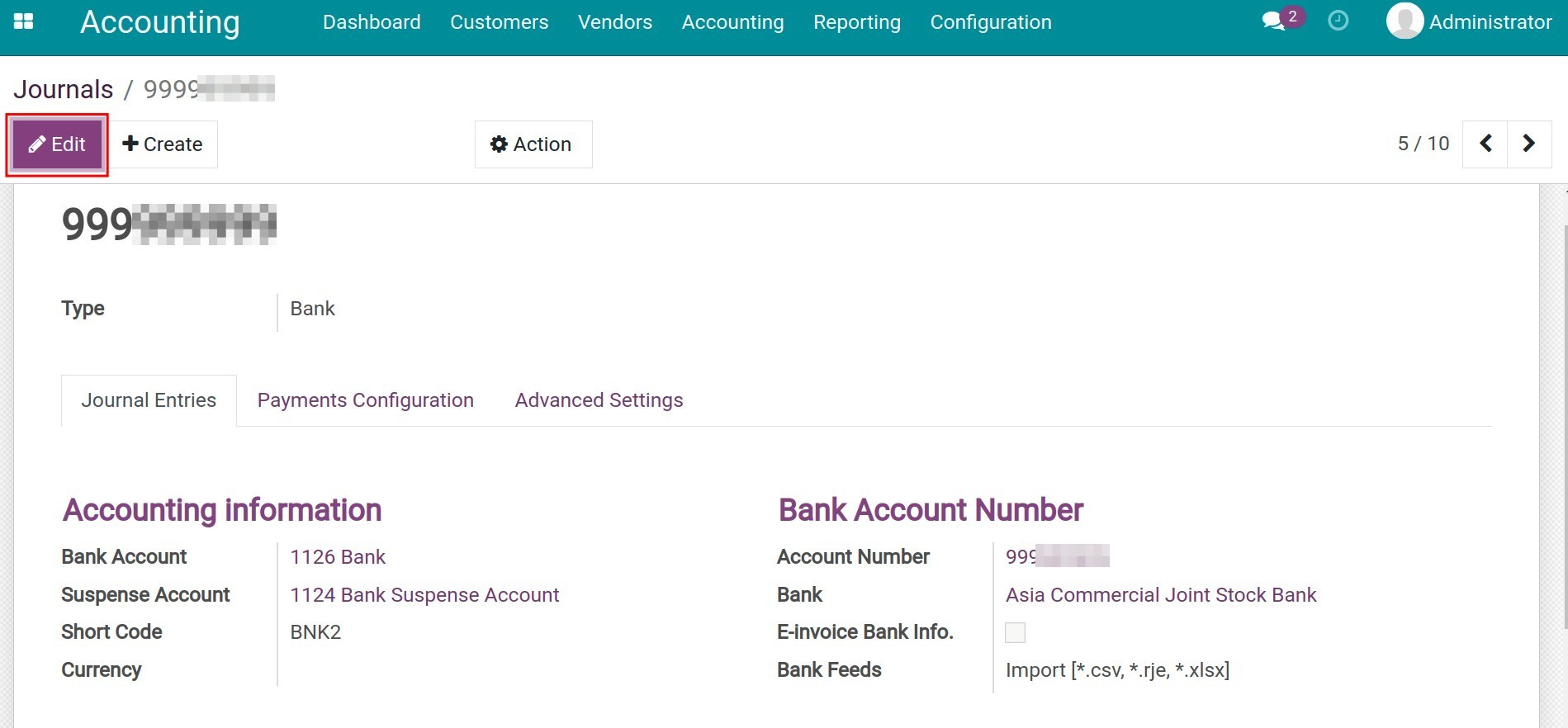

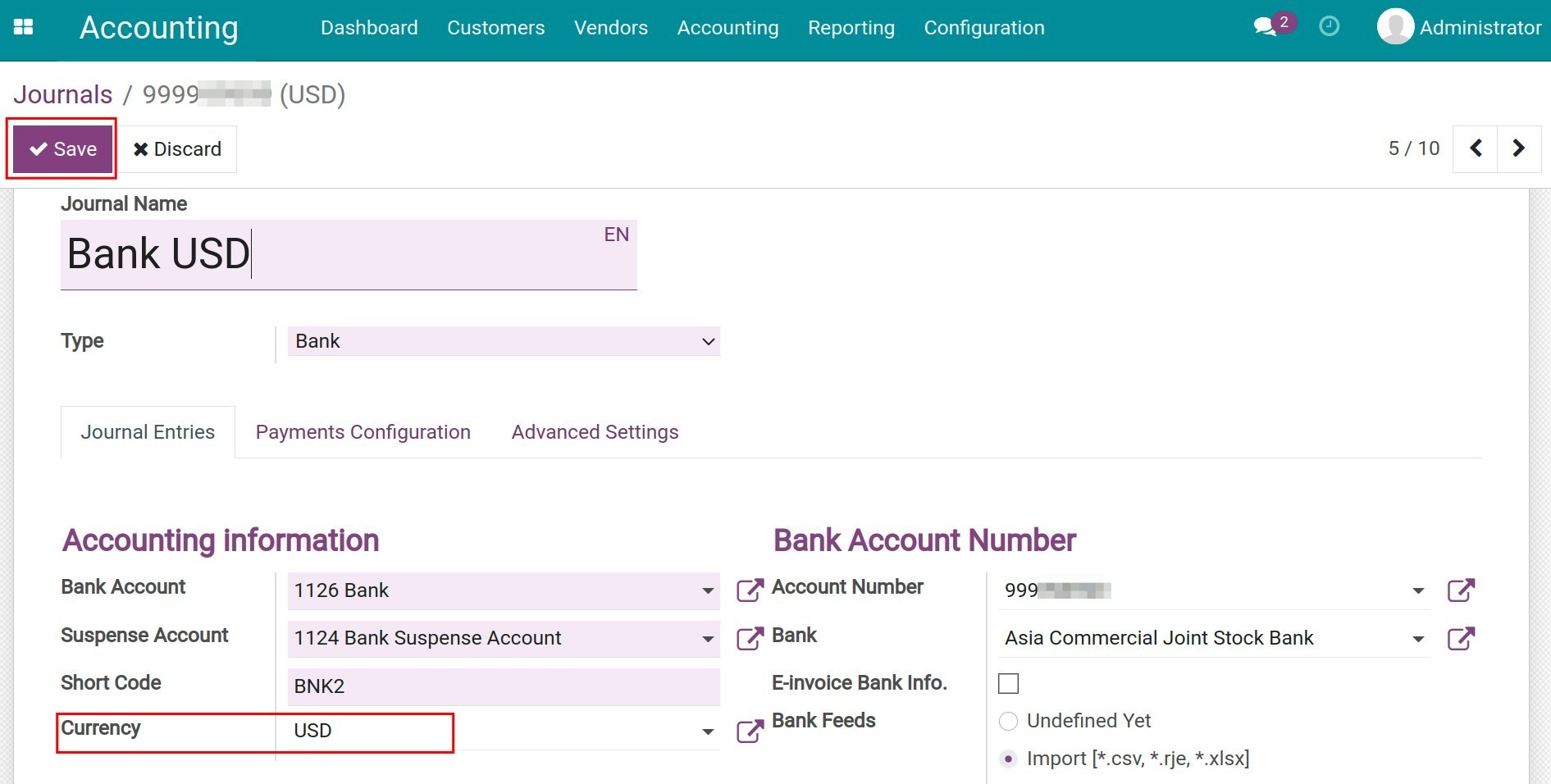

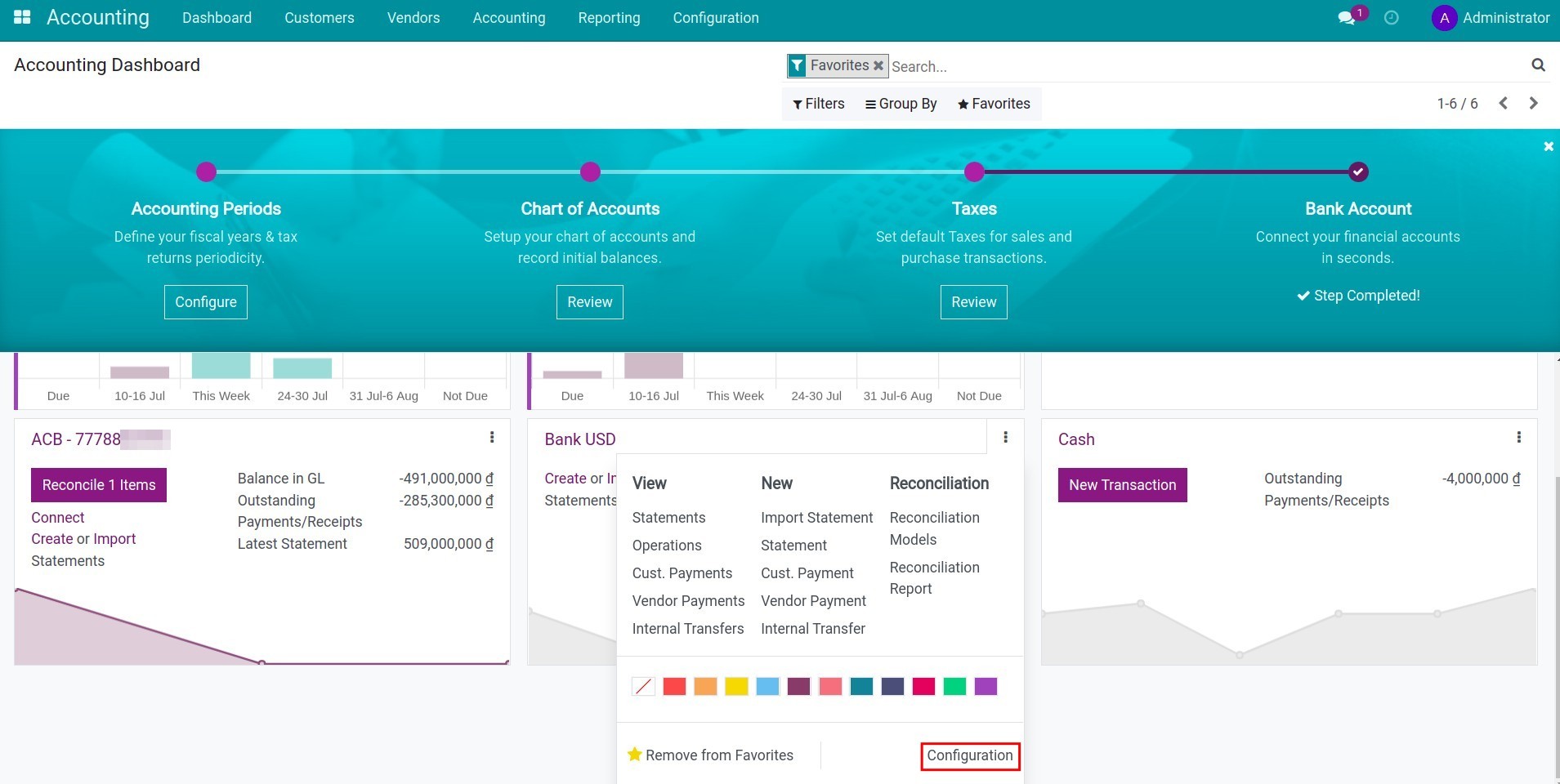

Configure Bank account Journal

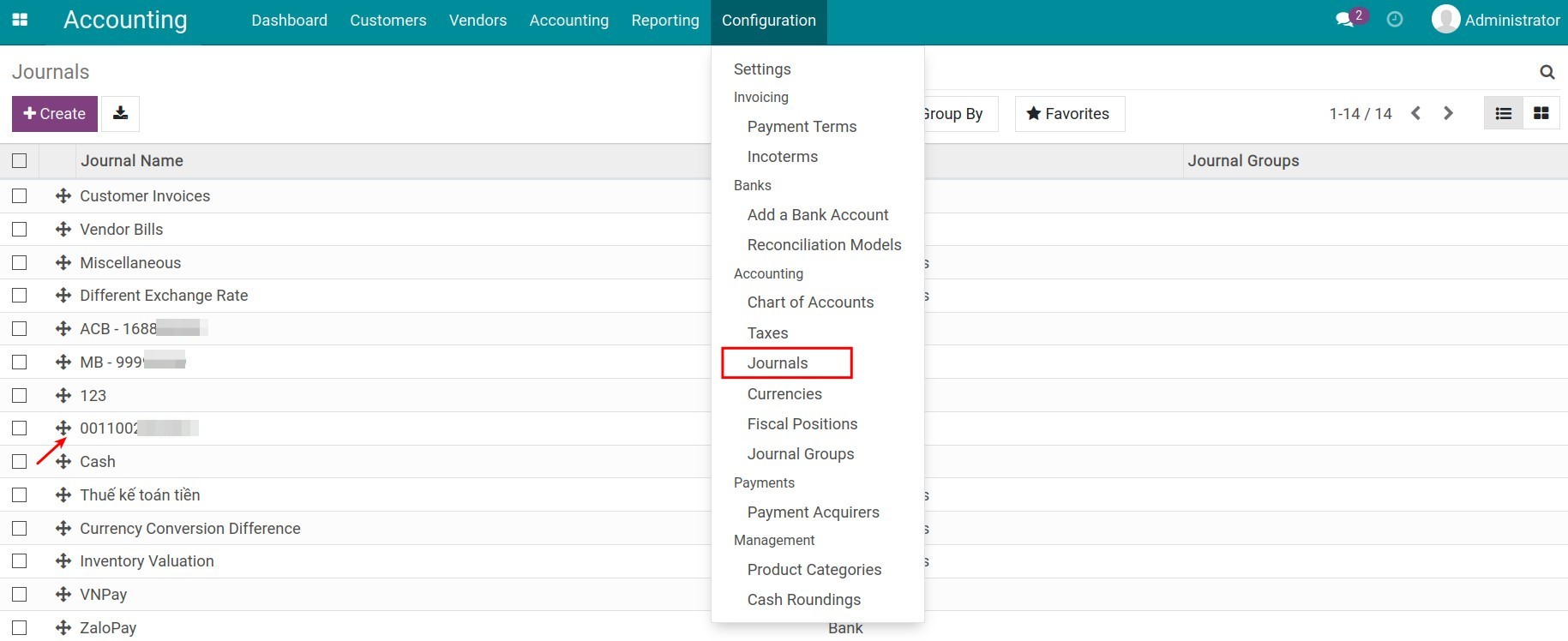

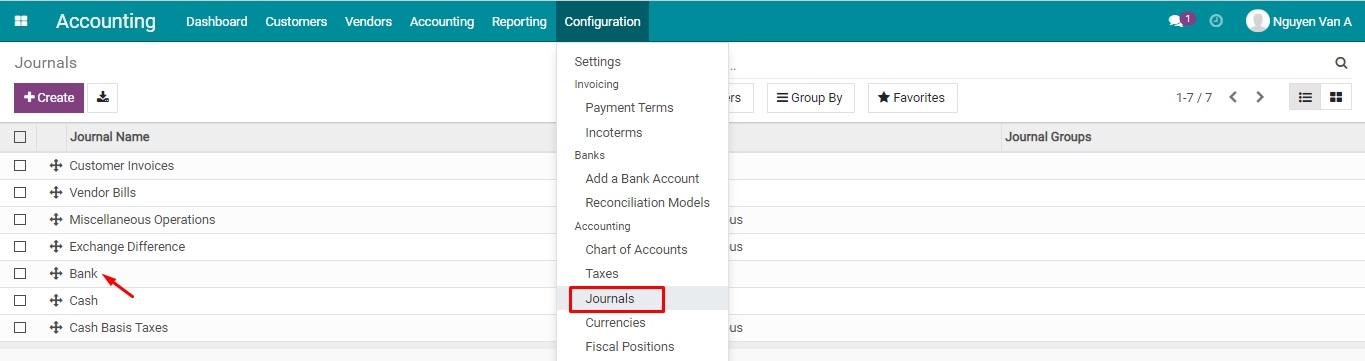

Navigate to Accounting ‣ Configuration ‣ Journals, find the Journal that you want to configure then press Edit:

Or navigate directly from Accounting ‣ Dashboard, find the Journal to work on, and choose Configuration:

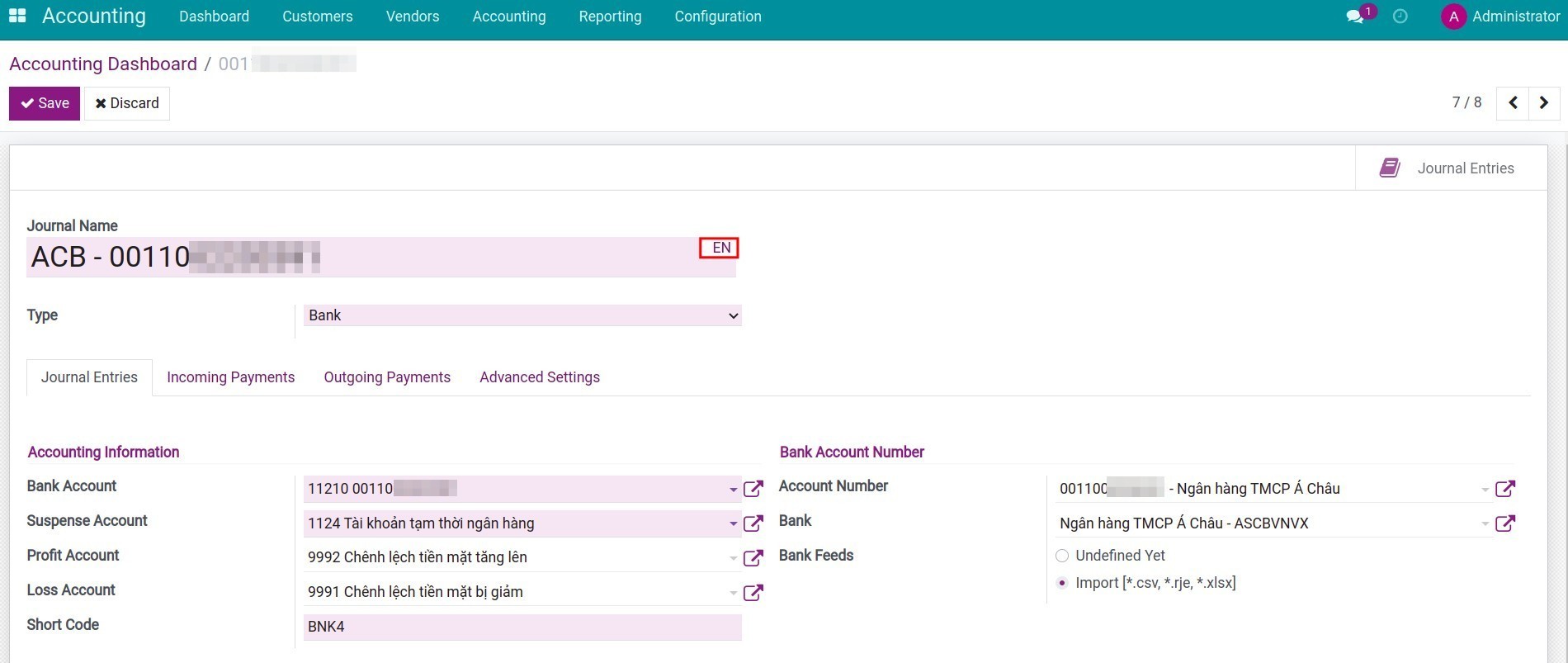

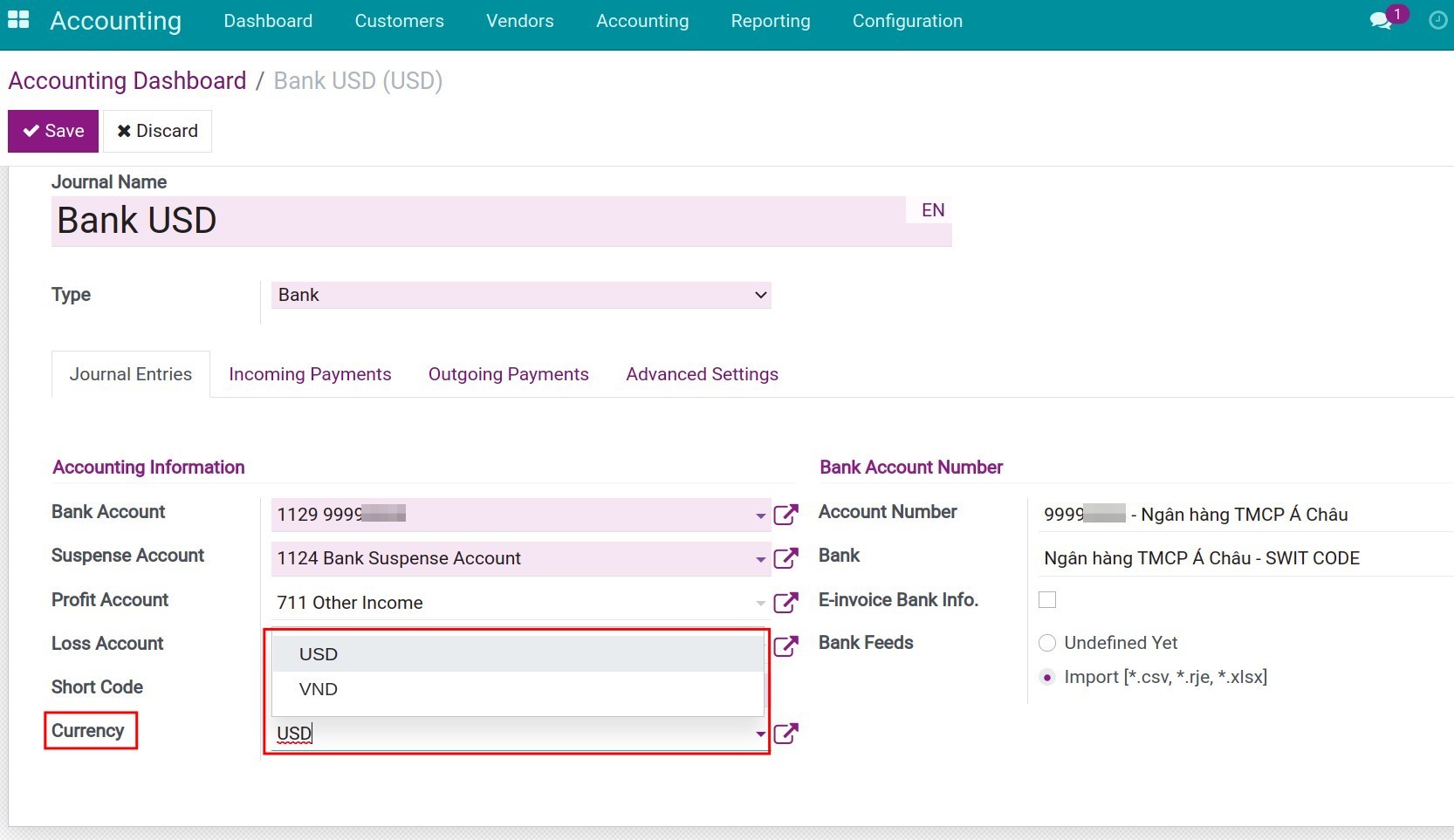

Some important information for the Journal configuration are:

Journal Name: The bank account number is used by default. However, you can modify the Journal name as you desire.

Tip

You can press on the EN letters to translate your Journal name to other languages if you use more than 1 language in your software. To activate new language, see more on Installing & Using multilingual guidelines.

Type: Choose a Journal type fr-om the existing list. Since this Journal is generated from a bank account, the Journal Type is Bank by default.

Journal Entries tab:

Accounting information:

Bank Account: The system automatically generates a unique bank account code (Bank deposits) linked to the bank account number to record all the transactions related to the said bank account. Even so, you can edit the Bank Account label if needed. For further information, read our article on Chart of accounts.

Suspense Account: The default account is Bank Suspense Account: This account temporarily records lines from the bank statement and will be reconciled with payments recorded in the system.

Profit Account: The account is used to record the excess amount due to the difference between the bank statement and the posted data on the system.

Loss Account: The account is used to record the missing amount due to the difference between the bank statement and the posted data on the system.

Short Code: A code for the Journal is suggested here but you also can modify it if needed. However, please bear in mind that it must be a unique code in the system.

Currency: Choose a currency for the Journal. If left empty, the currency will be the default one set up for your company.

Bank Account Number:

Account Number: It’s the information provided when the bank account is created.

Bank: The information is inherited from the bank account creation.

Bank Feeds: Select a tool to import bank statements from CSV; RJE or XLXS format.

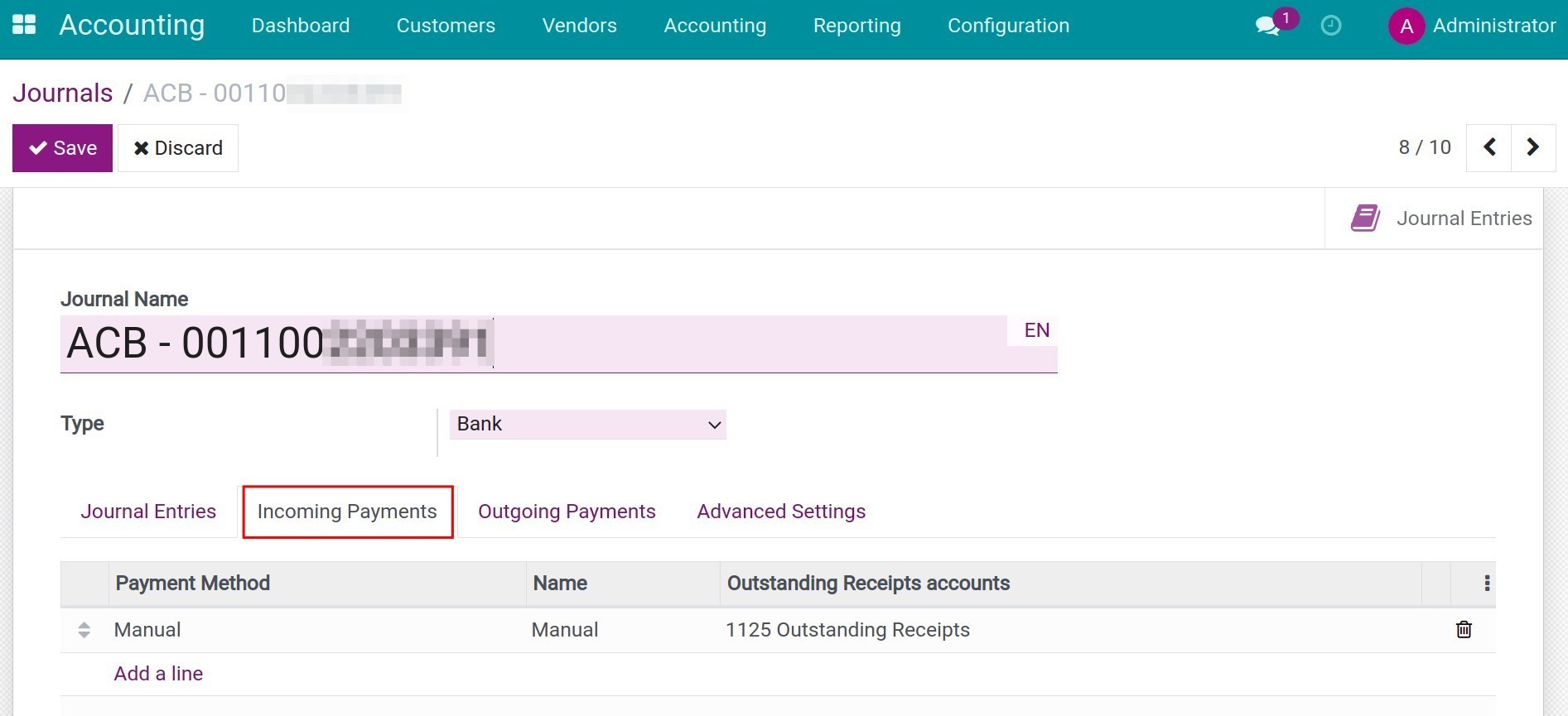

Incoming Payments tab:

Payment method: For the payment transactions outside of the system, such as cash, cheque, or Internet banking, manual payment creation is activated by default. Select Add a line to add other payment methods.

Name: Name of the payment method.

Outstanding receipts account: You choose the Outstanding receipts account to record related transactions such as collecting money from invoices or making payments. In the reconciliation process, the related transactions will be reconciled with the Outstanding receipts account instead of the Receivables account.

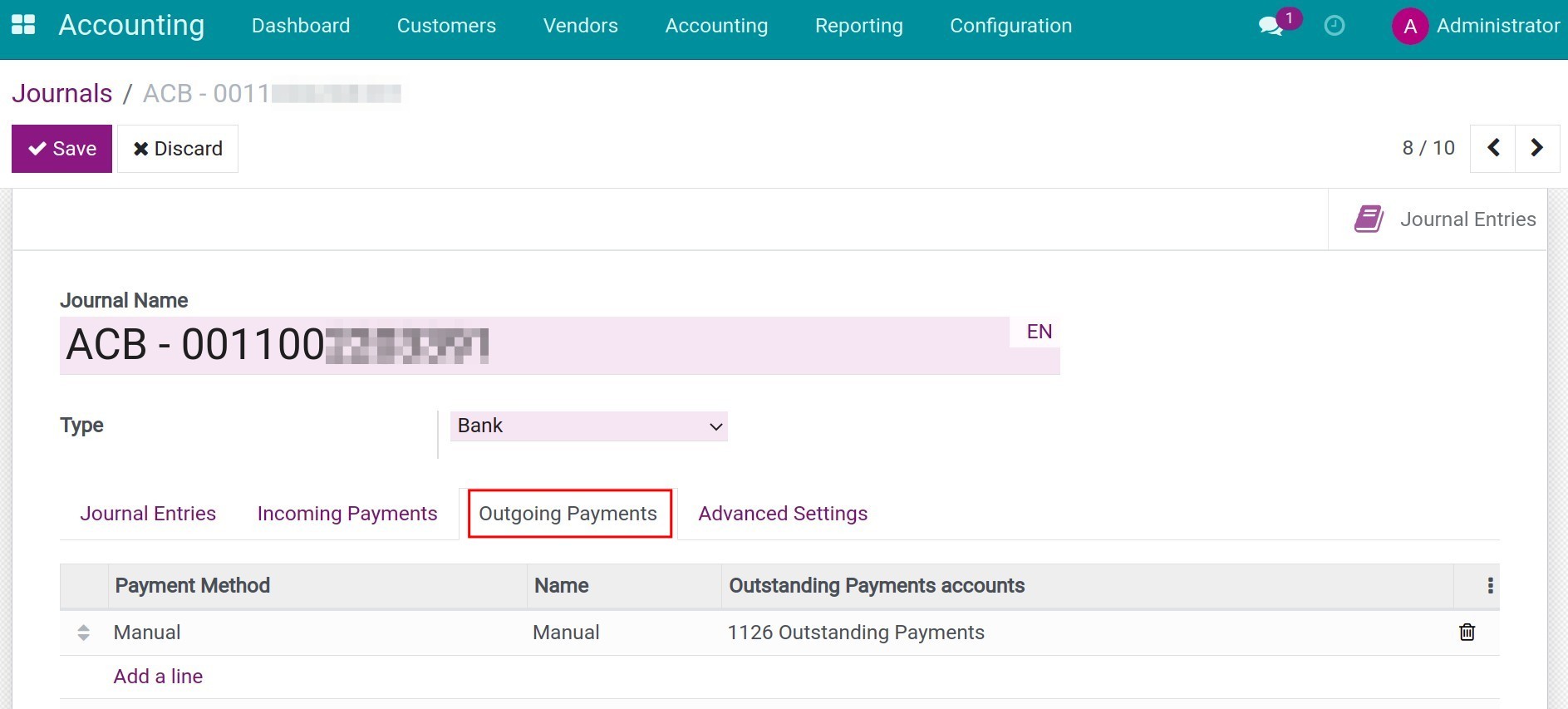

Outgoing Payments tab:

Payments method: For the payment transactions outside of the system, such as cash, cheque, or Internet banking, manual payment creation is activated by default. Select Add a line to add other payment methods.

Name: Name of the payment method.

Outstanding payments accounts: You choose the Outstanding payments accounts to record related transactions such as paying money for a vendor bill or making payments. In the reconciliation process, these transactions are reconciled with the Outstanding Payments account instead of the Payables account.

Note

Outstanding Receipts and Outstanding Payments accounts are used to record accurately the incoming or outgoing payments at the moment such transactions happen.

Example: When you send a payment to a Vendor, you will make a transfer order to your bank and wait for the bank to perform that transaction. This transfer may take some time to move money from your bank account to the Vendor’s bank account. At this moment, your transfer order creation is credited to your Outstanding Payments account. Upon receiving your bank statement regarding this transfer order, you will be able to record and reconcile it to nullify the value of the Outstanding Payments account.

Advanced Settings tab: You can set up allowed account types and account to control selection or keep them empty for no control in this Journal.

Allowed account types: Select the account types that can have access to this Journal.

Allowed accounts: Select the accounts that can use this Journal.

Click Save to save the bank journal setting information.

See also

Related article

Transfer between internal bank accounts

Transfer between Bank account and Cash on hand

Time deposit transactions

Budget Management

Budget Management

Requirements

This tutorial requires the installation of the following applications/modules:

iSuite Accounting & Finance

iSuite Budget

The Budgets app is where you make the necessary configurations, create and keep tracking of the budgets, and view the budgets analysis reports. The management can be done by using:

Budgetary Positions: through accounting accounts;

Analytic Accounts;

Combination of Budgetary Positions and Analytic Accounts.

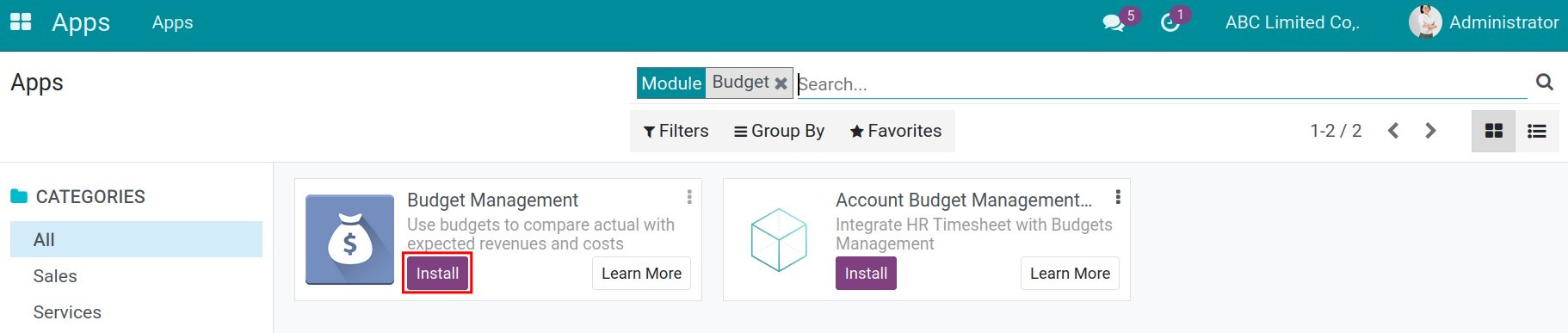

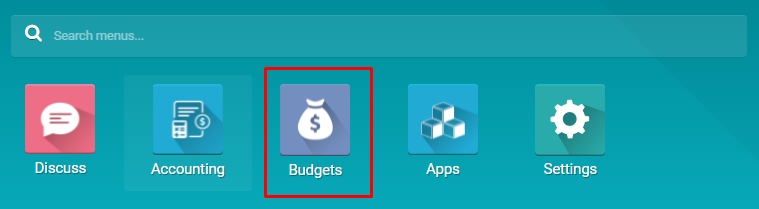

Install Budget Management app

Navigate to Apps, find the Budgets, click on Install.

After installing, the Budgets app will be available on the main menu.

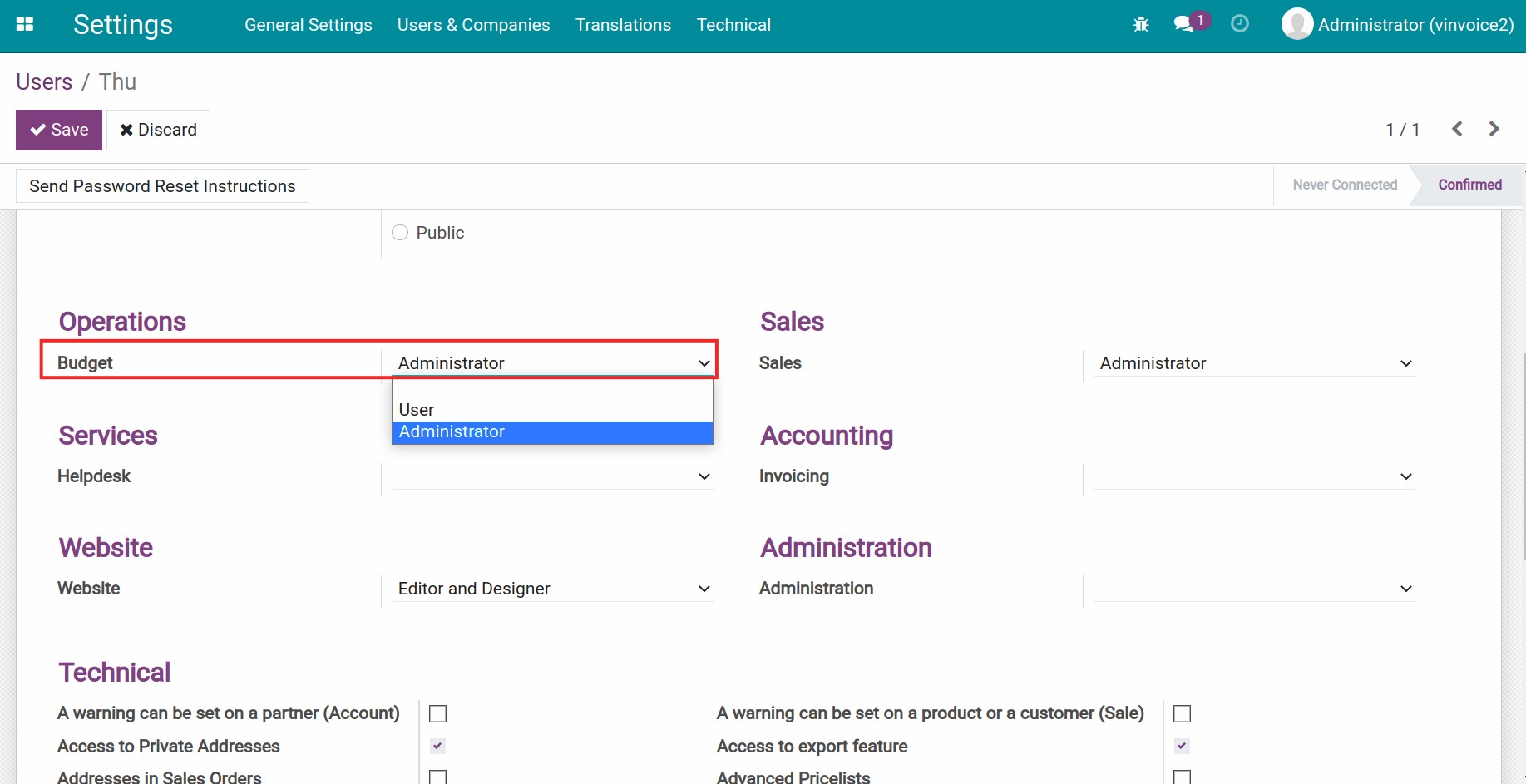

User access rights

With Budget App, iSuite system supplies these user access rights:

Leave it blank: User can’t see or access to Budget App.

User: User can create Budget, edit, delete or see the Budget Analysis reporting of budget that he/she created. User can’t create, edit or delete a Budgetary Positions.

Administrator: User can create, edit or delete a Budgetary Positions, Budget and see the Budget Analysis reporting.

Create the tools for managing budget

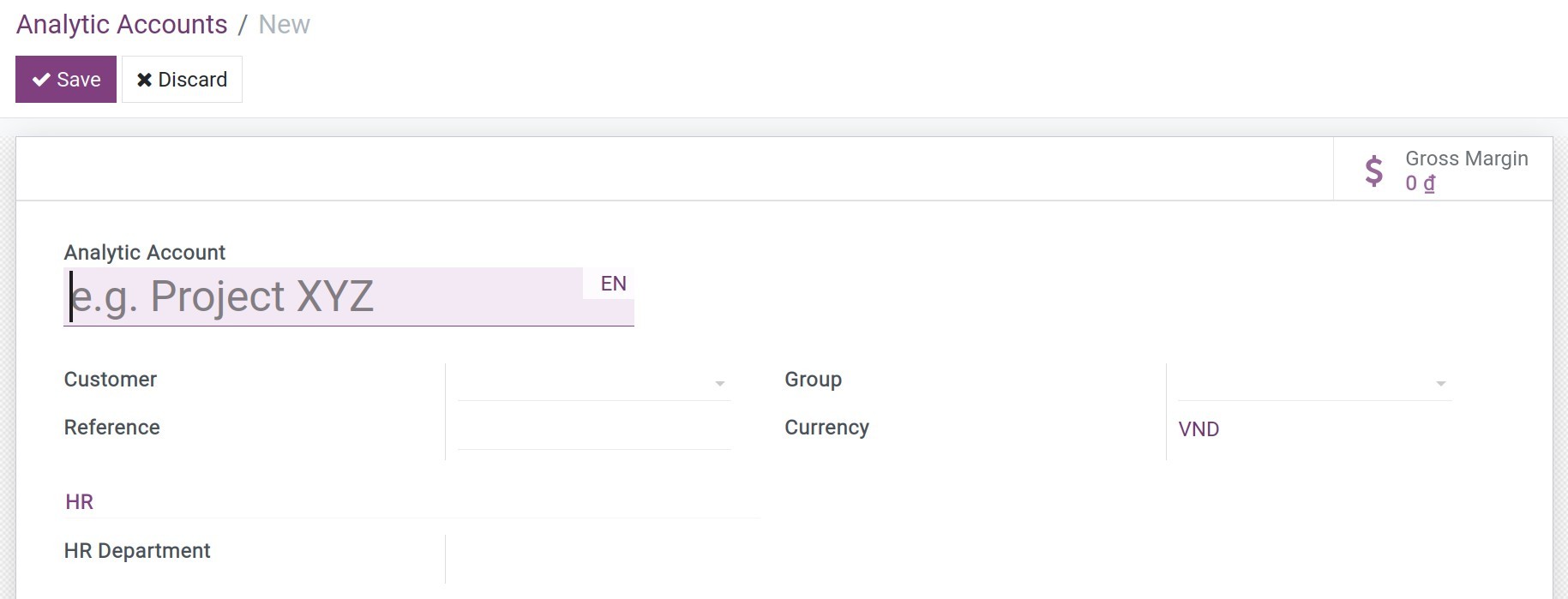

Analytic Account

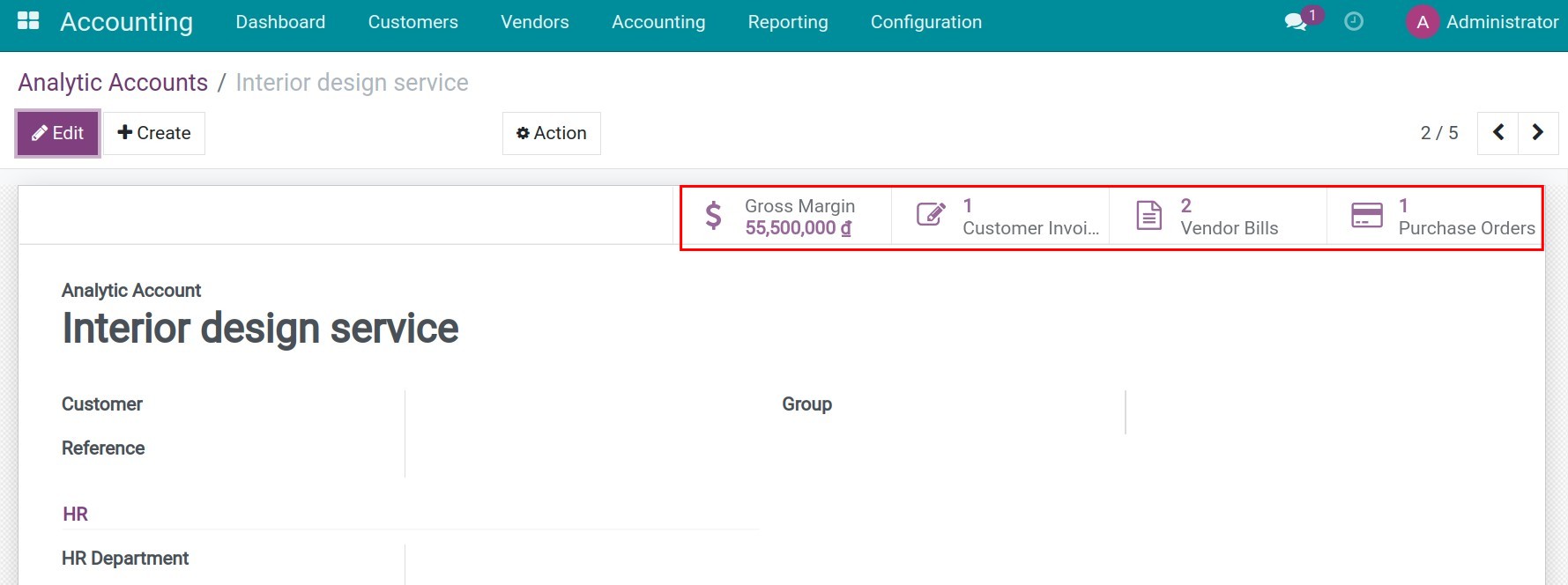

Analytic Account is a tool to collect revenue/expenses related to a specific budget. You need to set an analytic account on the related revenue/expense accounting entries to create links to the budget.

Budgetary Positions

Budgetary Positions is built to help budget managers collect revenue/expenses based on the financial accounting accounts.

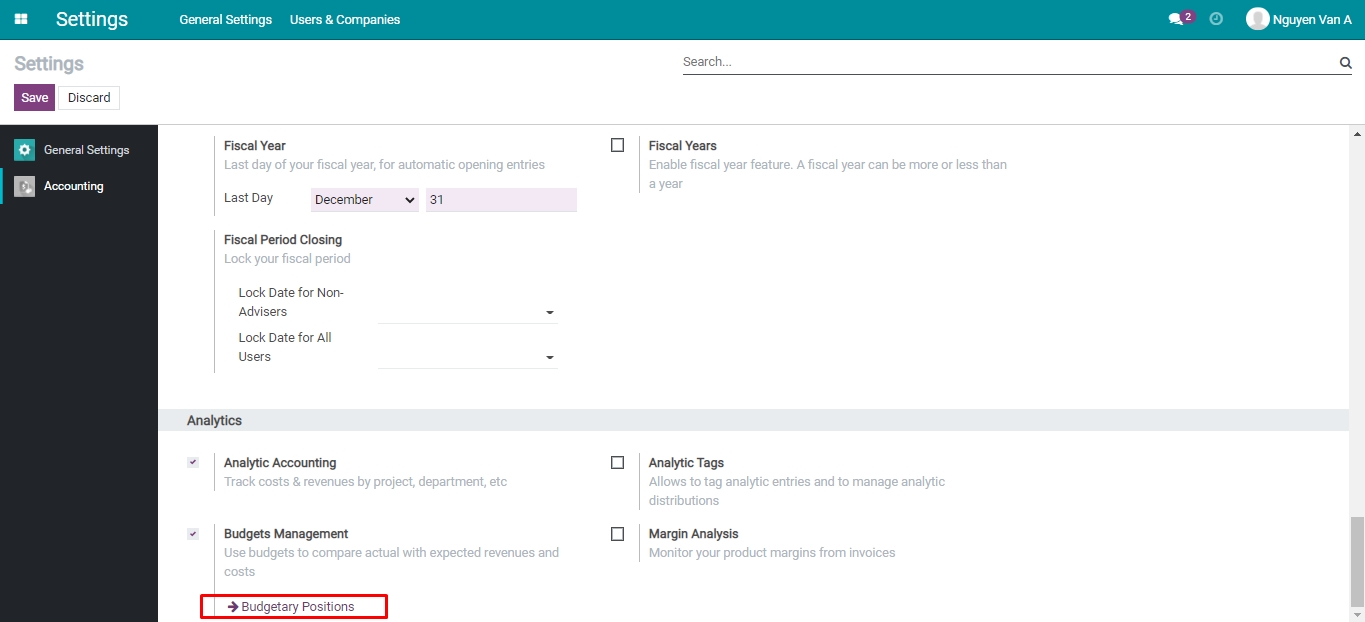

In Settings, on the view to enable the Budgets Management feature, you will see a shortcut for creating Budgetary Positions.

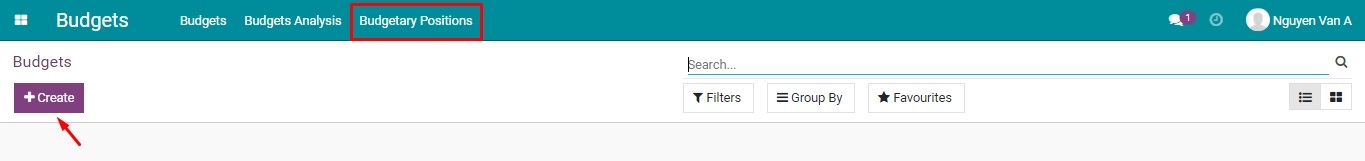

Click on Budgetary Positions to create a budgetary position. Or, you can also do it by navigating to Budgets ‣ Budgetary Positions ‣ Create.

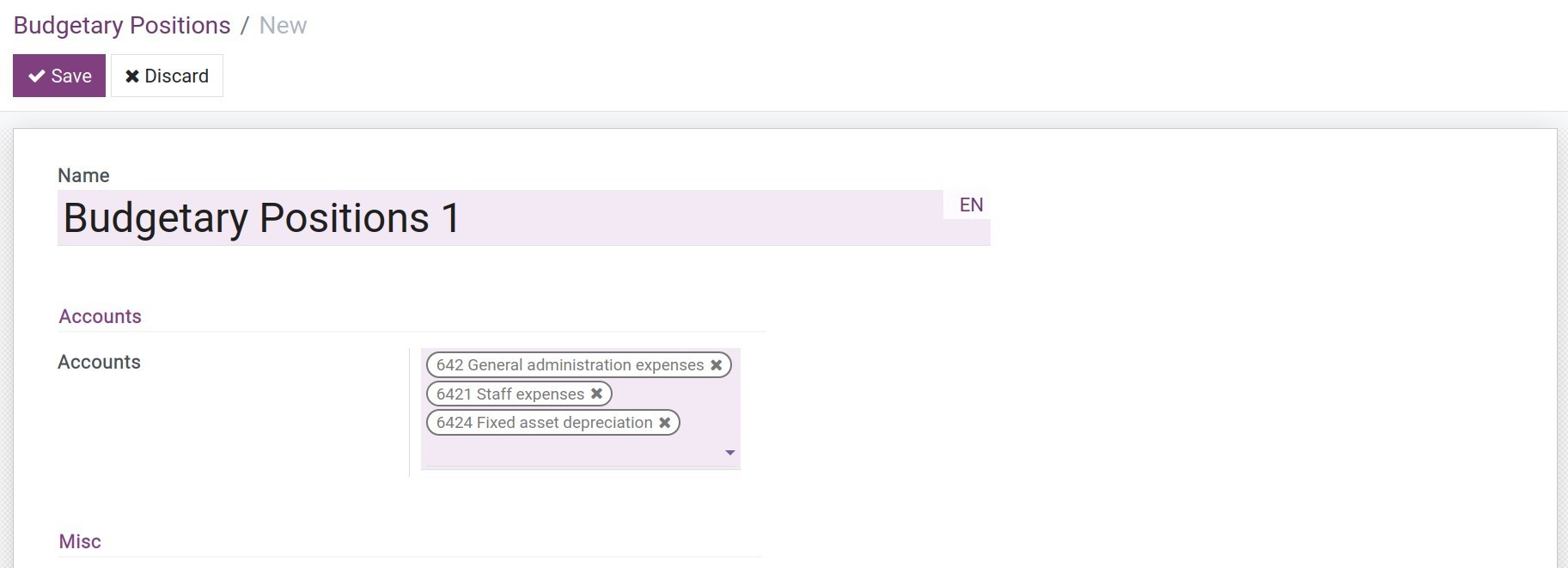

For instance, when creating a budget to track the office expenses. We will create a budgetary position with the name Budgetary Position 1. The expenses will be registered to these accounts:

Account 6421: Staff expenses;

Account 6423: Office equipment expenses;

Account 6424: Fixed asset depreciation.

The information of the Budgetary Position 1 will be entered as follows:

Budget Management

Create budget

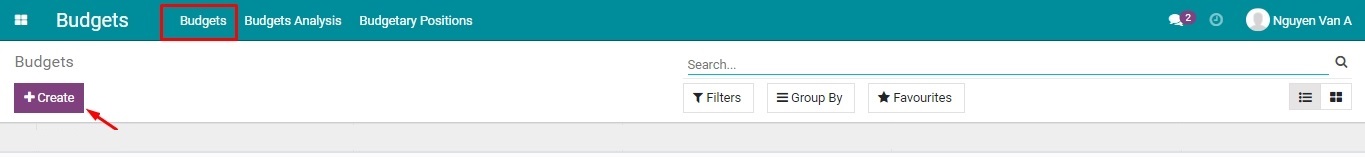

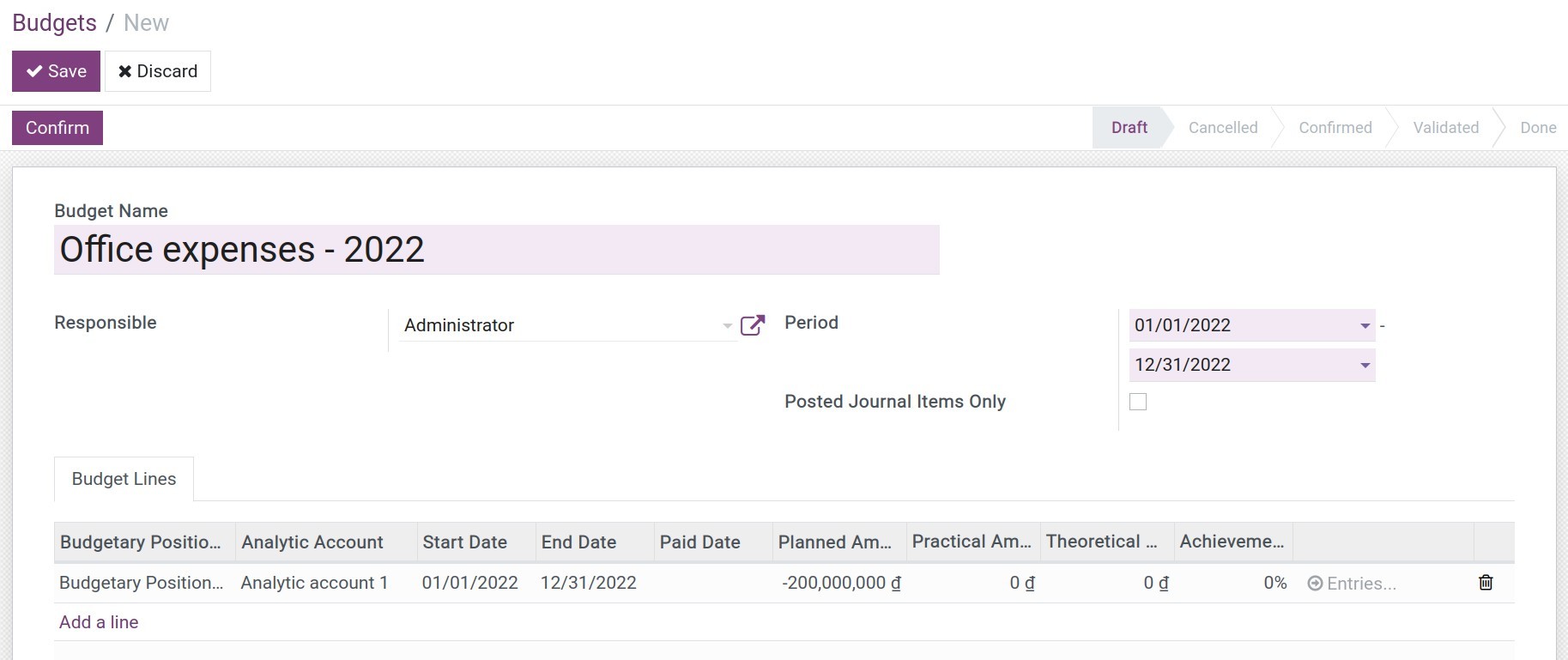

For example, we create a budget for Office expenses in 2022 at 200.000.000 VND. Follow these steps to create a new budget:

Navigate to Budgets > Budgets > Create to create a budget

Fill in General information

Enter the following information:

Budget Name: Name of the budget - Office expenses - 2022;

Period: Planned start date and end date - From 01/01/2022 to 31/12/2022;

Posted Journal Items Only: This feature will affect the way the data is collected to the budget:

- Budget using only Budgetary Positions:

- Checked: Only posted journal entries will be added to the Practical Amount for calculation.

- Not checked: All draft and posted journal entries will be added to the Practical Amount for calculation.

- Budget using only Analytic Accounts:

- Whether this field is checked or not, only posted analytic accounting entries will be added to the Practical Amount.

- Budget using the combination of Budgetary Positions and Analytic Accounts:

- Whether this field is checked or not, only analytic accounting entries that contain posted journal entries will be added to the Practical Amount for calculation.

- Budget using only Budgetary Positions:

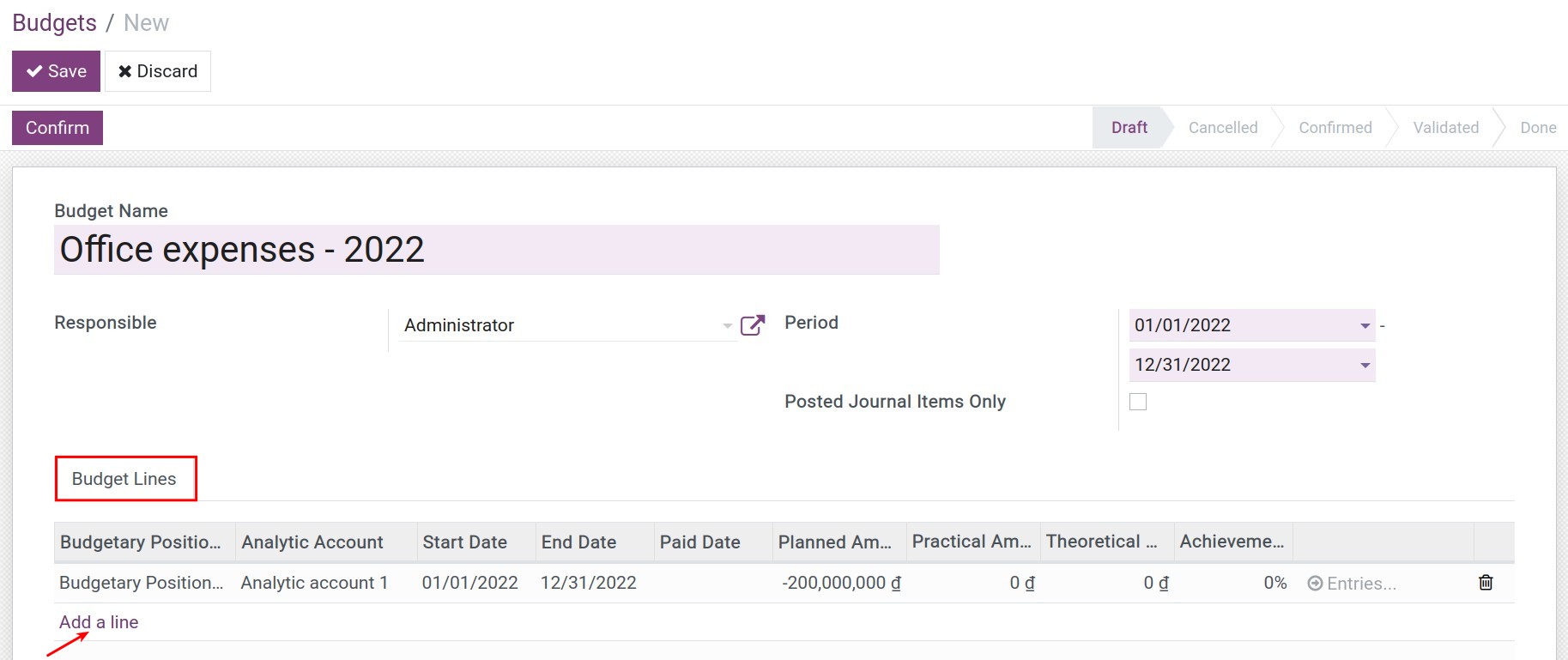

Fill in Budget Lines information

Click on Add a line then enter the following information:

Budgetary Positions: Select the Budgetary Positions if you want to manage your budget by budgetary positions. It can be empty if you manage budget by analytic account.

Analytic Account: Select the Analytic Account if you want to manage your budget by analytic account. It can be empty if you manage budget by budgetary positions.

Note

You can manage a budget by using Budgetary Positions or Analytic Accounts or both of them.

The combination of Budgetary Positions and Analytic Accounts makes budget analysis more detailed and multi-dimensional.

Select both Analytic Account and Budgetary Positions, then fill in the other fields following the instruction above.

Started Date/End Date: Automatically field based on budget Period that you enterd in the above general information. You can edit them if you want.

Paid Date: Paid Date is used for Theoretical Amount computation.

If Paid Date is specified later than today, the Theoretical Amount will be zero.

If Paid Date is earlier than today,the Theoretical Amount will be equal to the Planned Amount.

In case no Paid Date is specified, the Theoretical Amount will be calculated based on the elapsed time counting from the Start Date.

Planned Amount: Enter negative numbers upon money out and positive numbers upon money in.

Practical Amount: Every Journal Item amount, whose accounting date is within the budget period, will be added to this value if satisfy one of the following conditions:

The Journal Item contains the corresponding Analytic Account (if the budget is managed by using Analytic Account).

The Journal Item contains the corresponding accounting account that has been selected in the Budget Position (if the budget is managed by using Budget Position).

Both of the two conditions above (if the budget is managemed by using Analytic Account and Budget Position).

Theoretical Amount: The planned value to be achieved at present. The system will automatically calculate by the following formula:

Theoretical Amount = Planned amount per day * The number of days counted from the start date to the present.

Planned amount per day = Planned Amount / The number of days in the budget period.

Achievement: The percentage of Practical Amount in comparison to Theoretical Amount.

After entering all the information, click on Save. Then, click on Confirm and Approve to enable the budget.

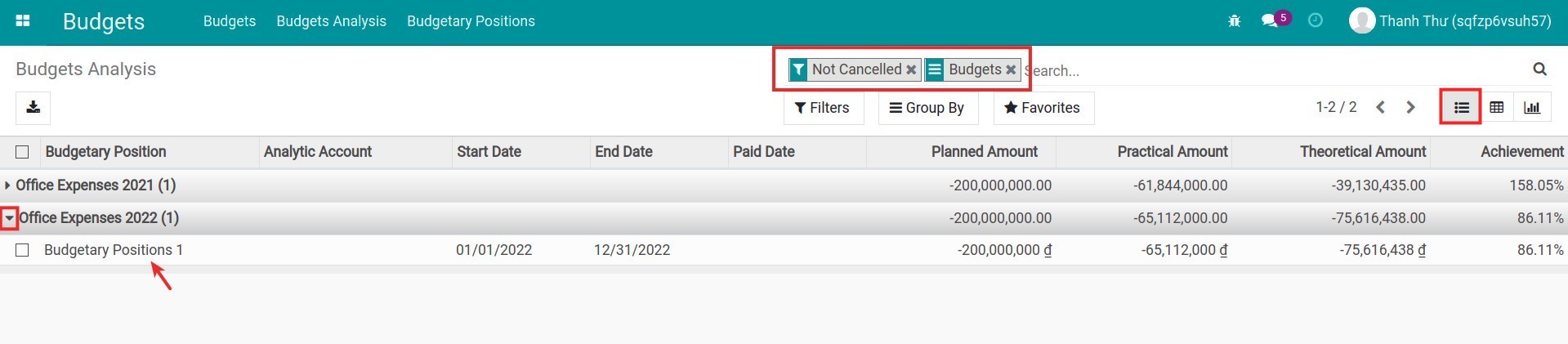

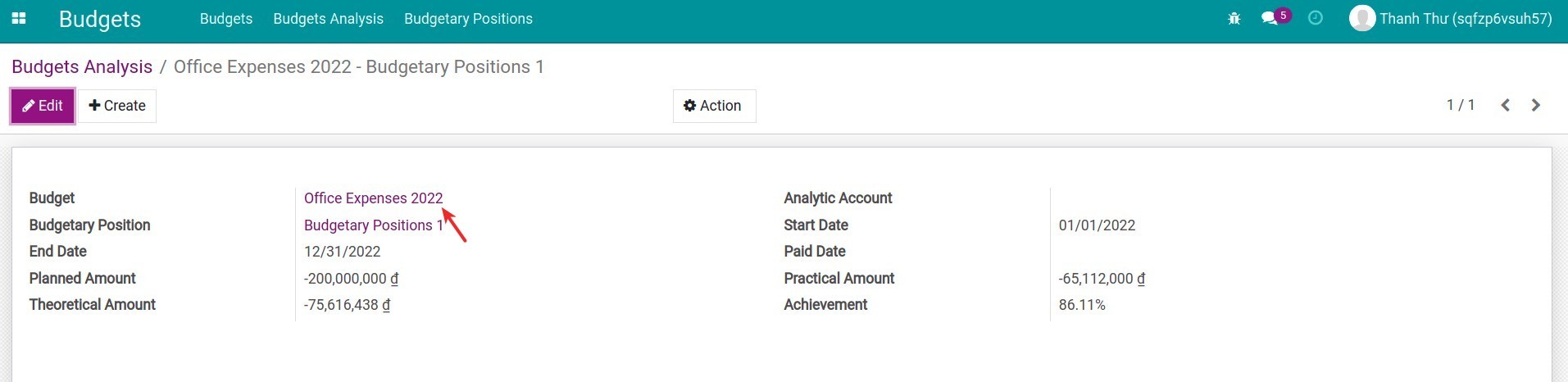

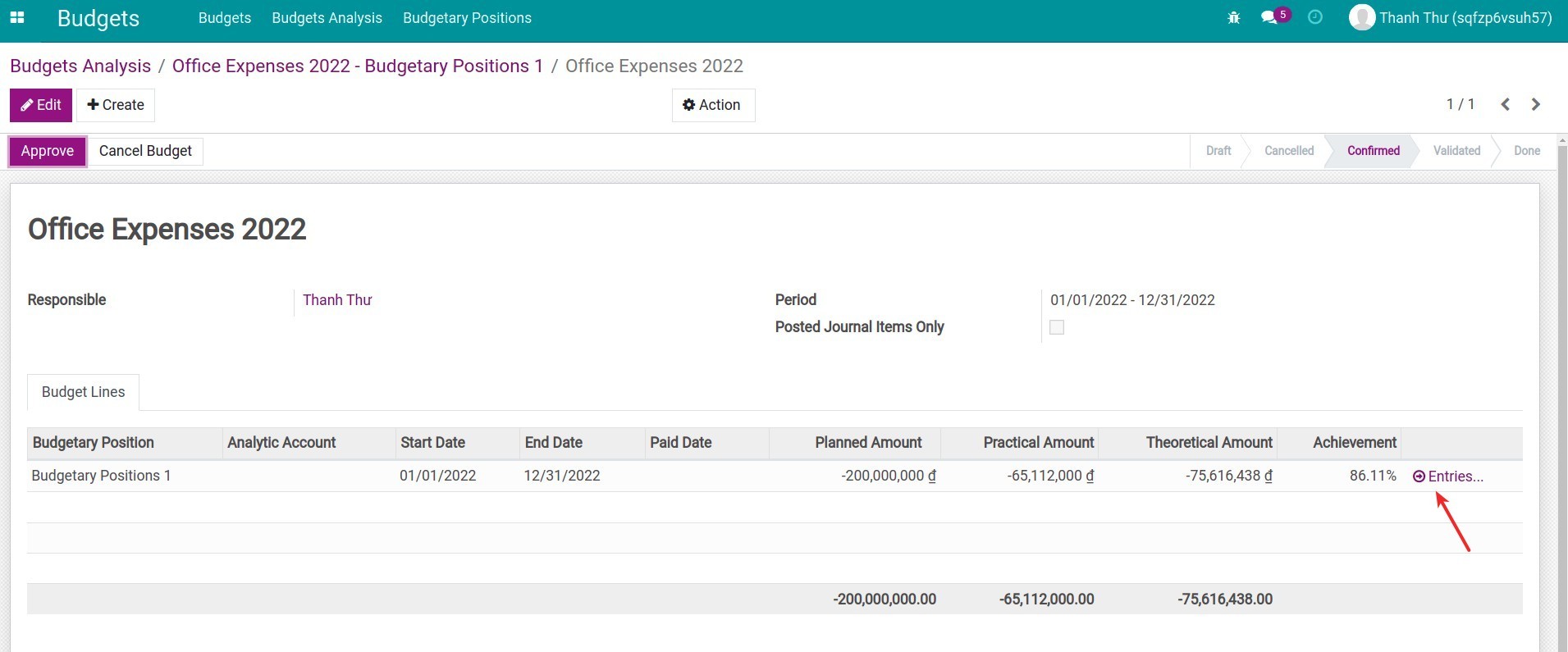

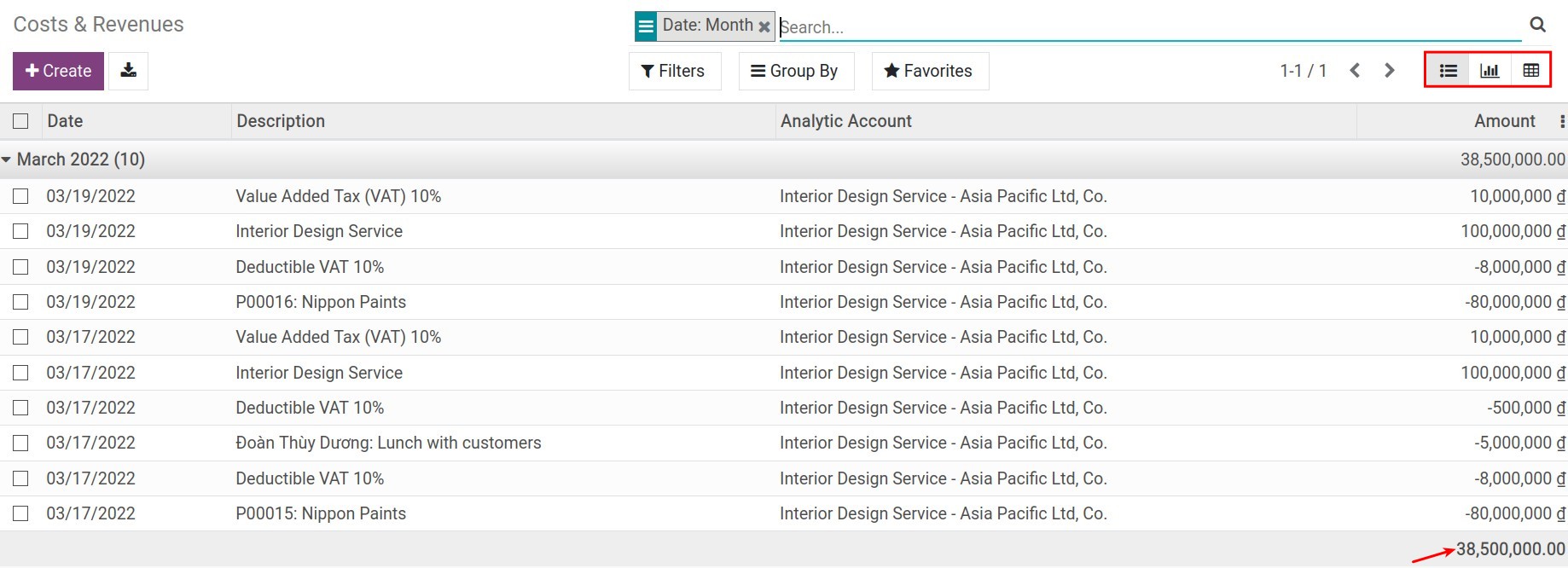

Budget Analysis

To see Budget Analysis Reporting, you go to Budget > Budget Analysis. Here, you can see a list of all the budget with Not Cancelled filter and Budgets group.

Click on the triangle icon to show detail lines and go to Budget view.

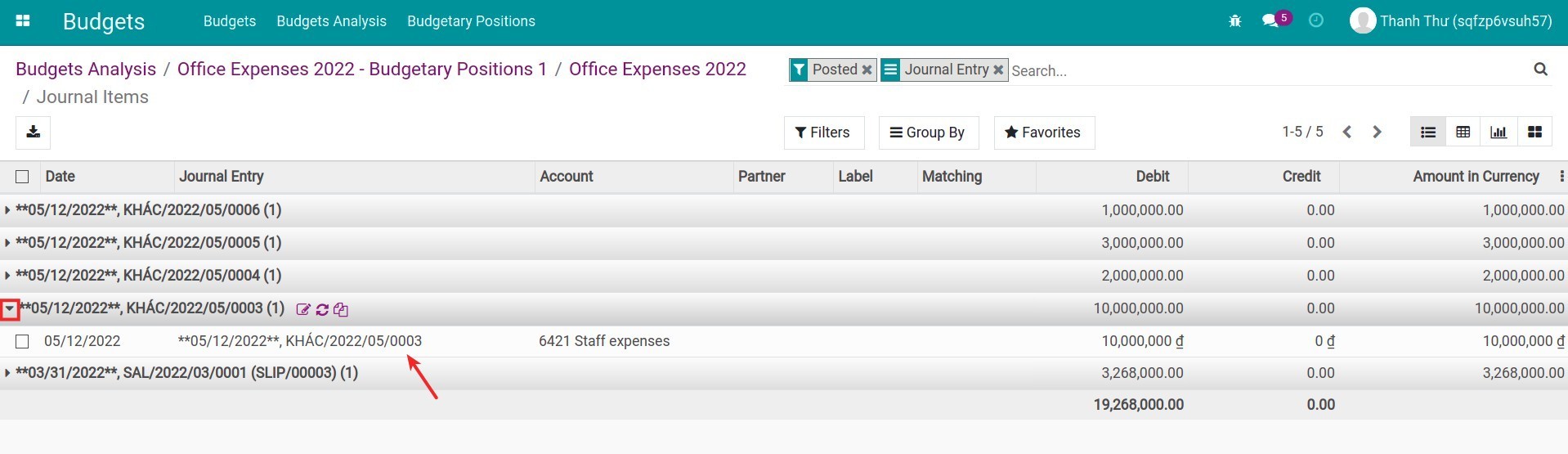

In the budget view, click on Entries to see all the Journal Items.

Budgets in the Viindoo system give you an intuitive, instant view to evaluate the budget, to see if it sticking to the plan and on the right track. From there, you can make adjustments to accomplish your plan for the rest of the time. Based on the old data, you can review, compare and plan more effectively.

See also

Related article

Analytic account in Viindoo

Closing a fiscal year in iSuite

Closing a fiscal year in iSuite

Requirements

This tutorial requires the installation of the following applications/modules:

- isuite Finance & Accounting

One thing that all accountants have to do at the end of the year is to close the fiscal year to prevent adjusting the journal entries when the data of the reports have been closed.

There are two ways to close a fiscal year on the iSuite Accounting app:

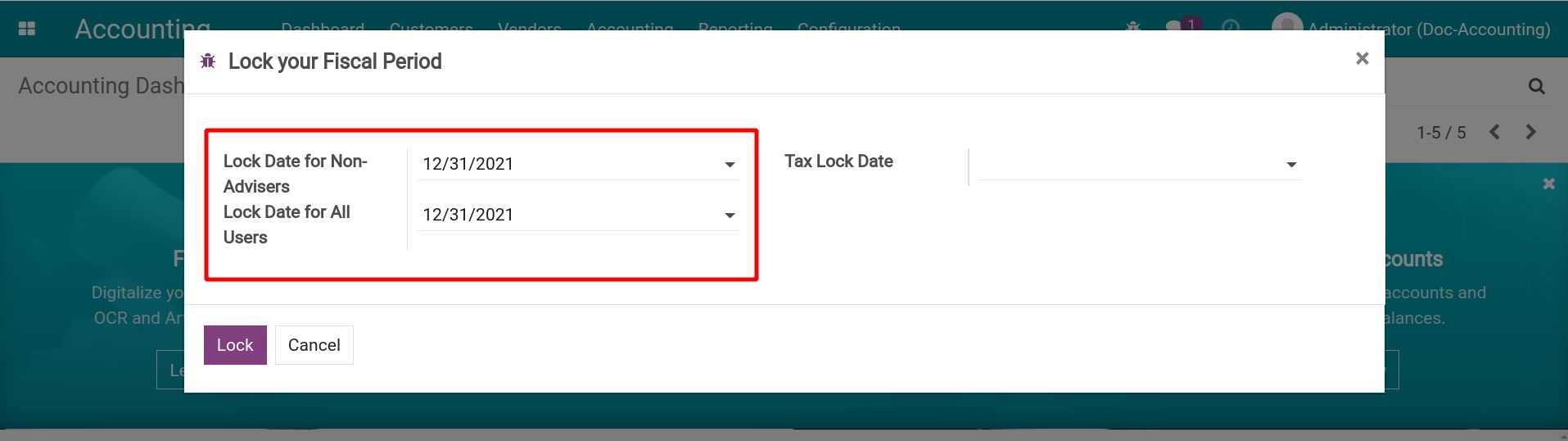

- Navigate to Accounting > Accounting > Lock Dates, the user will be navigated to Lock your Fiscal Period view.

On this view, users enter the lock dates information:

- Lock Date for Non-Advisers: Accounting data with an accounting date before or equal to the date set here will not be edited by users except those who have the Administrator right of the Accounting.

- Lock Date for All Users: All users will not be able to edit accounting data with the accounting dates before or equal to the date set here.

- Tax Lock Date: All users will note be able to edit tax accounting data before or equal to the date set here.

Warning

To enter this view, the user needs to have the Administrator right of Accounting .

After entering the information, press Lock to finish closing the fiscal year.

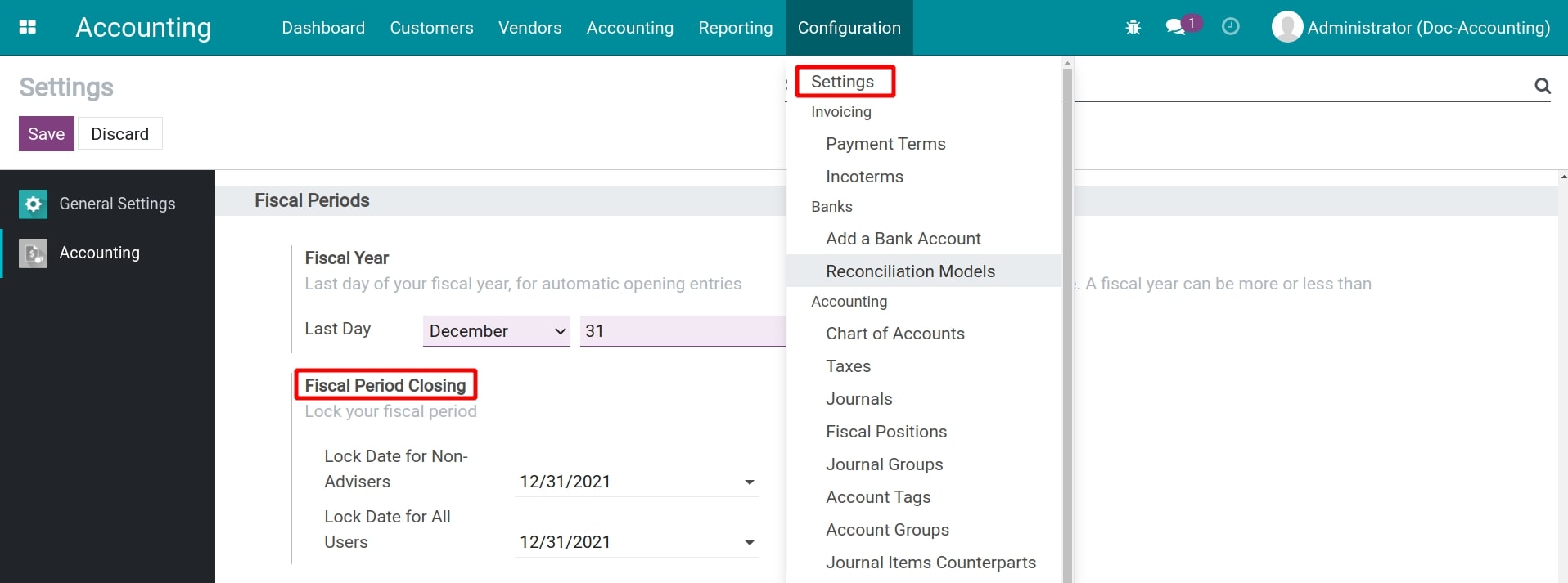

- Navigate to Accounting > Configuration > Settings, find the Fiscal Period Closing field at the Fiscal Periods section.

Enter the information the same way as in the first method.

See also

Related article

Creating Default Analytic Account

Creating Default Analytic Account

Requirements

This tutorial requires the installation of the following applications/modules:

iSuite Accounting & Finance

iSuite Purchase

The analytic default setting rules in iSuite support you in managing the different aspects of business operations more accurately by configuring the rules for automatically identifying the accounting account, the analytic tags by products, partners, user accounts, etc…

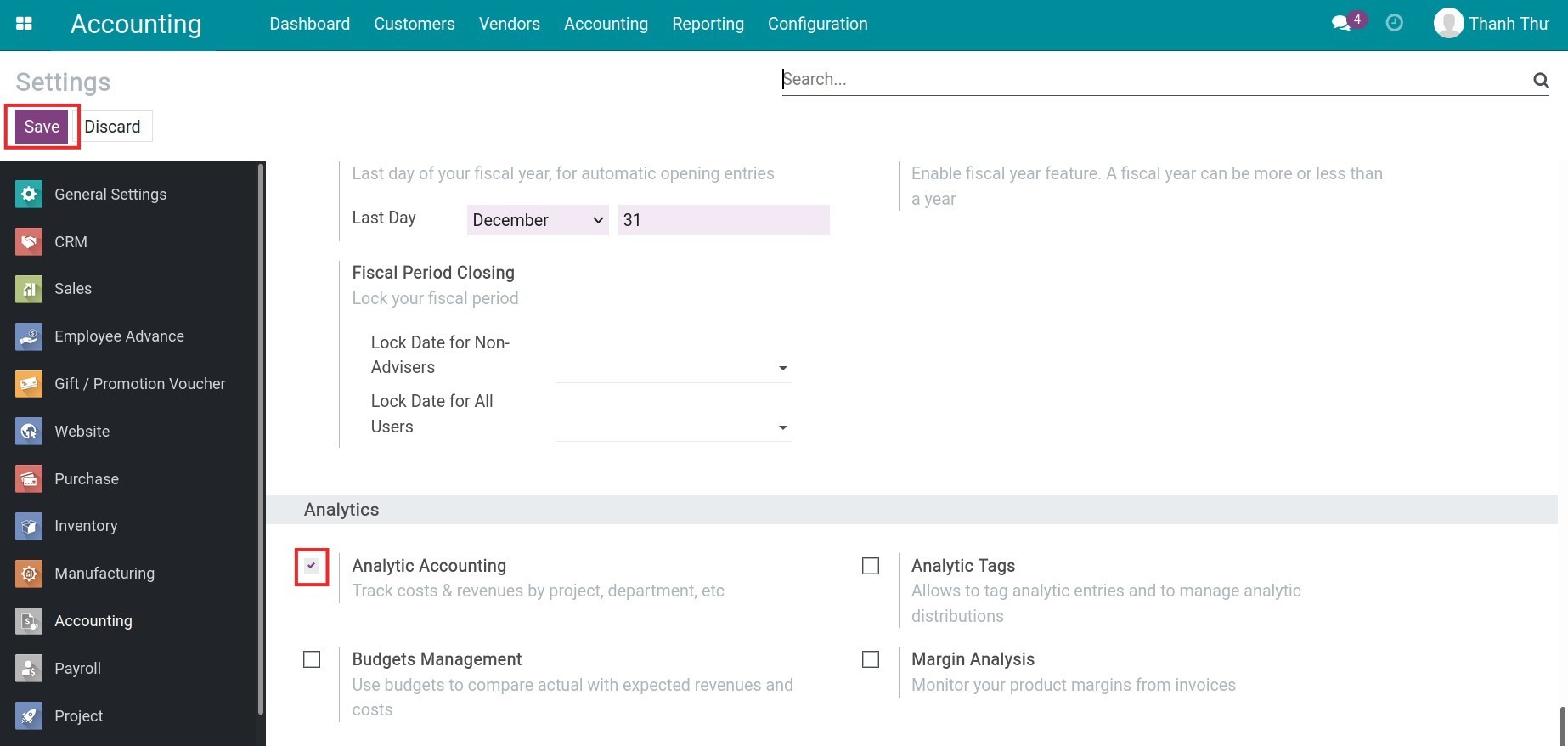

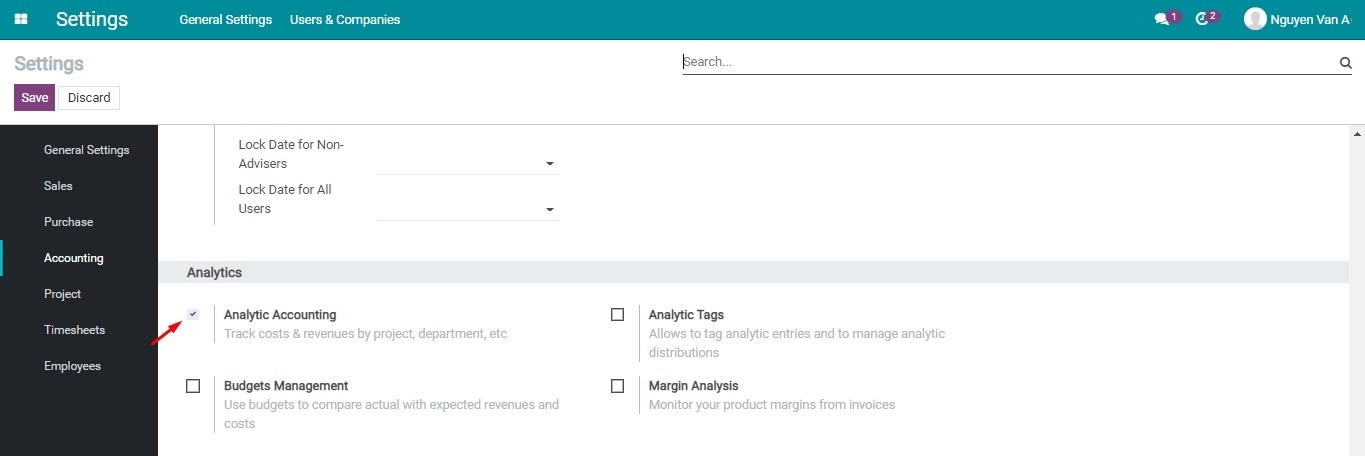

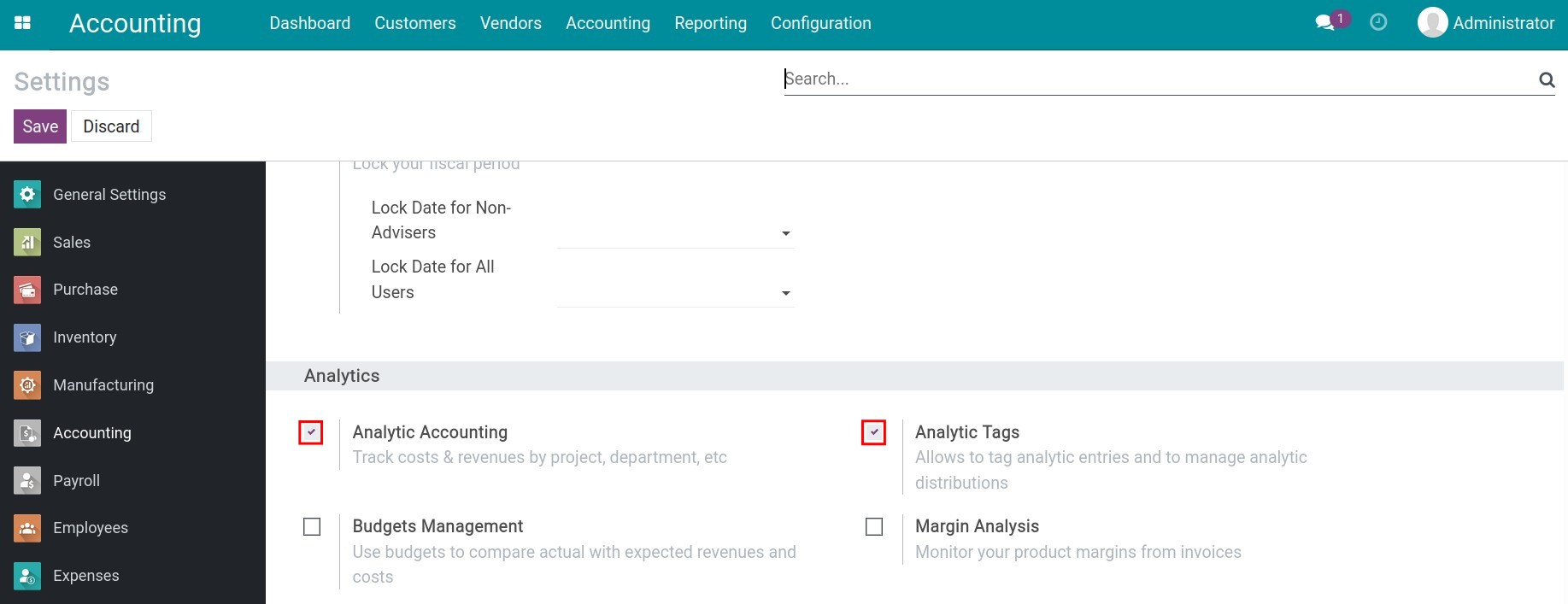

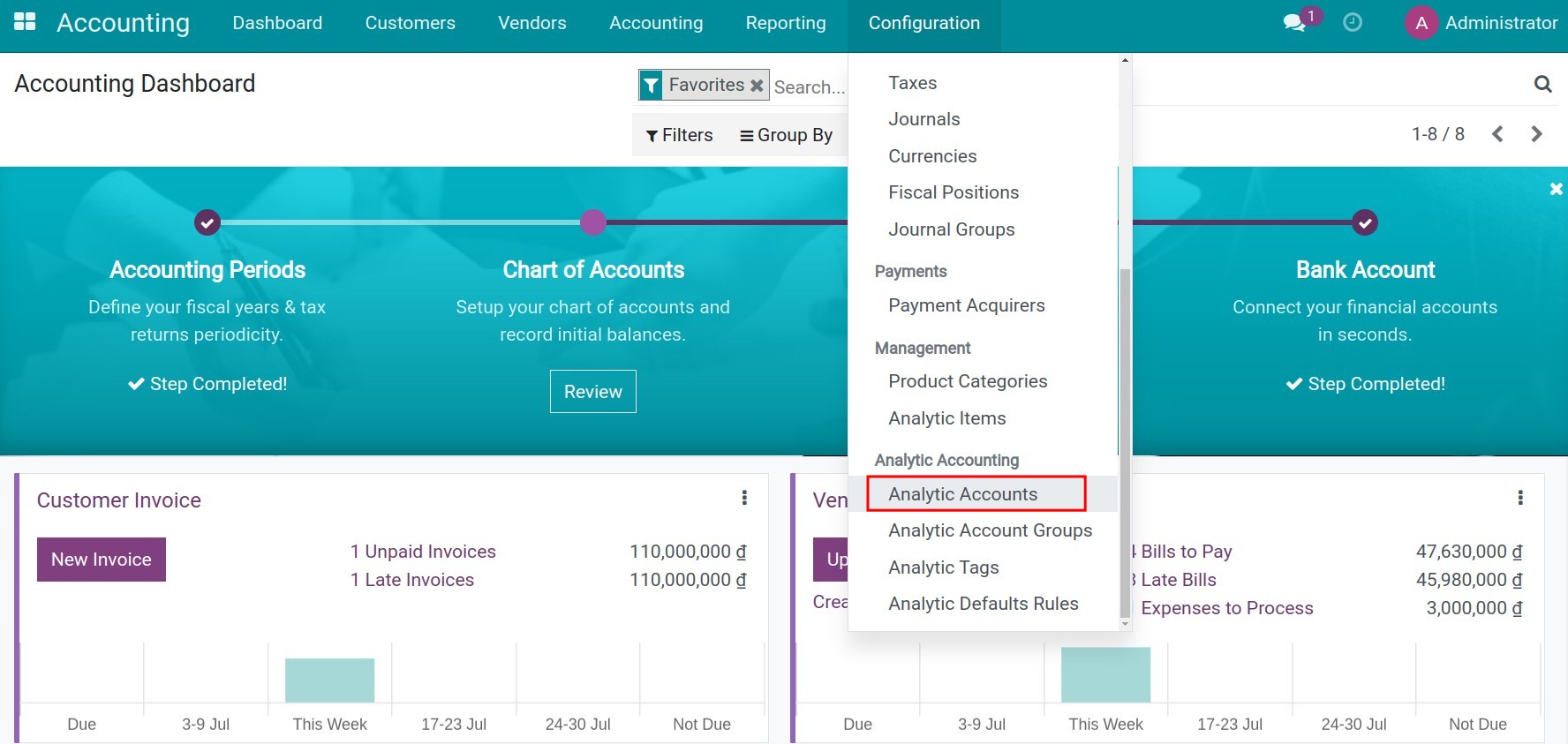

To use this feature, navigate to Accounting > Configuration > Setting, turn on Analytic Accounting and Analytic Tags then press Save.

Analytic Defaults Rules Configuration

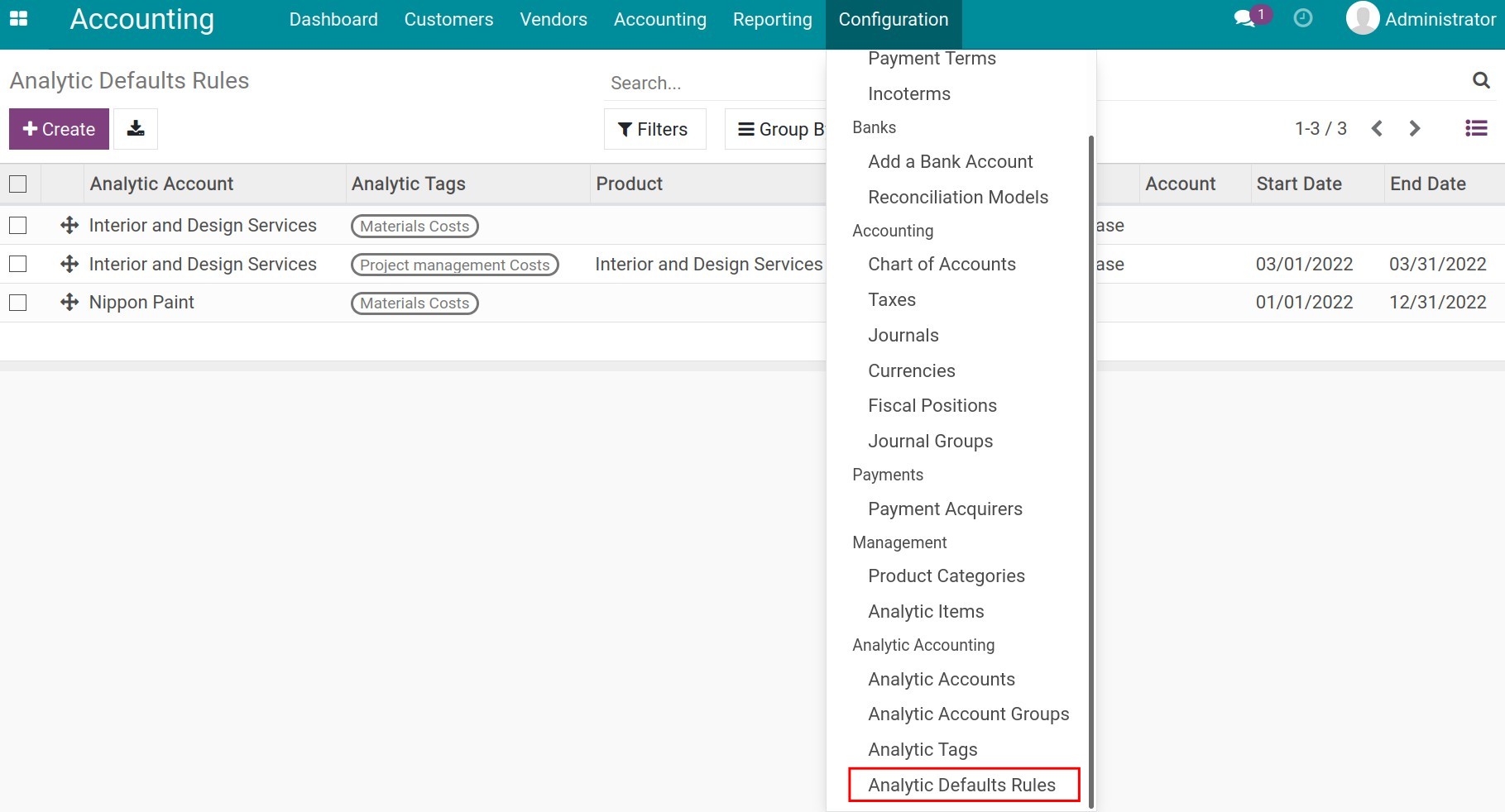

To create a new rule, you navigate to Accounting > Configuration > Analytic Defaults Rules:

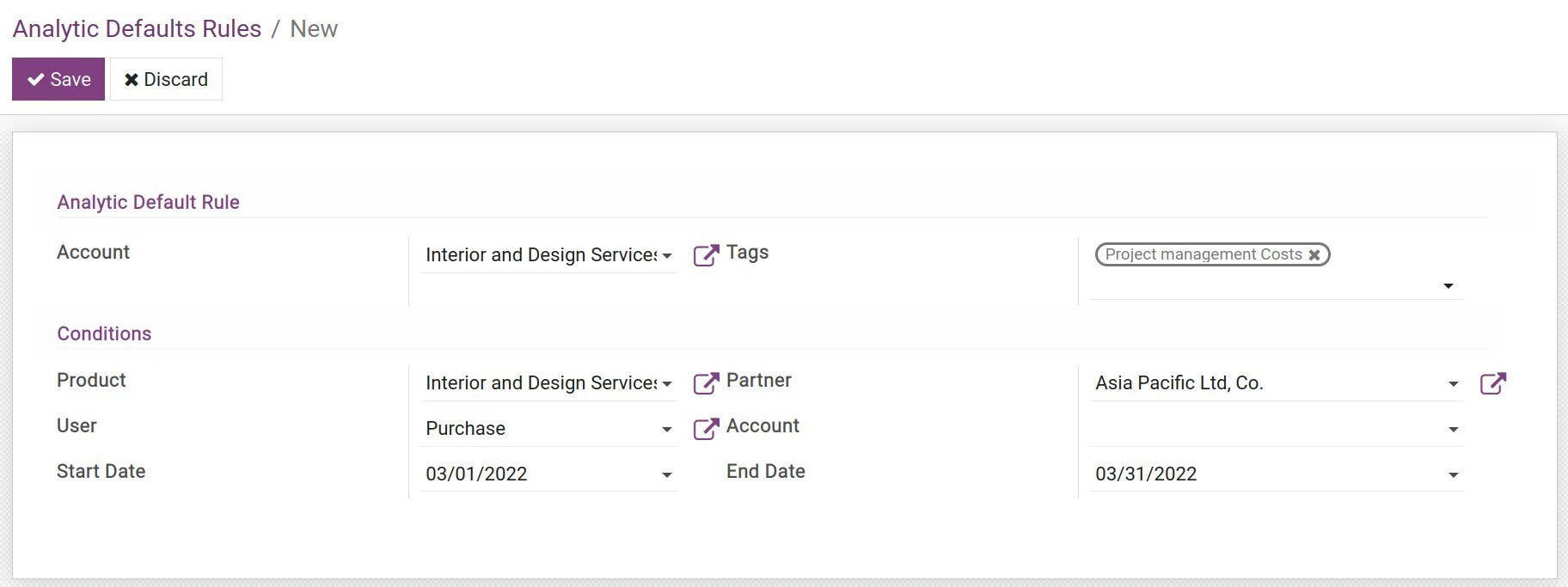

Click on the Create button to open the view for configuring, then you need to enter the following information:

Analytic Default Rule:

Account: Select the analytic account to configure the rules in the list of analytic account in iSuite.

Tags: Select the needed analytic tags to configure.

Conditions:

Product: Select a product from the product list. The related accounting arising from this product will be attached to the above analytic account and the analytic tag by default.

Partner: This analytic account/analytic tag will be attached to all the journal items related to the selected partner.

User: Select a user account in the system. The journal items created by this user will be attached to the chosen analytic tag above.

Account: Select an accounting account that needs to be attached to the analytic account/analytic tags for analysis.

Start Date: Enter the effective start date of the analytic default rule.

End Date: Enter the expiration date of the analytic default rule.

Tip

Depending on your demands and the management purposes, you can flexibly use the above information to create the rules for attaching the default analytic account/analytic tags without filling in all the required fields above.

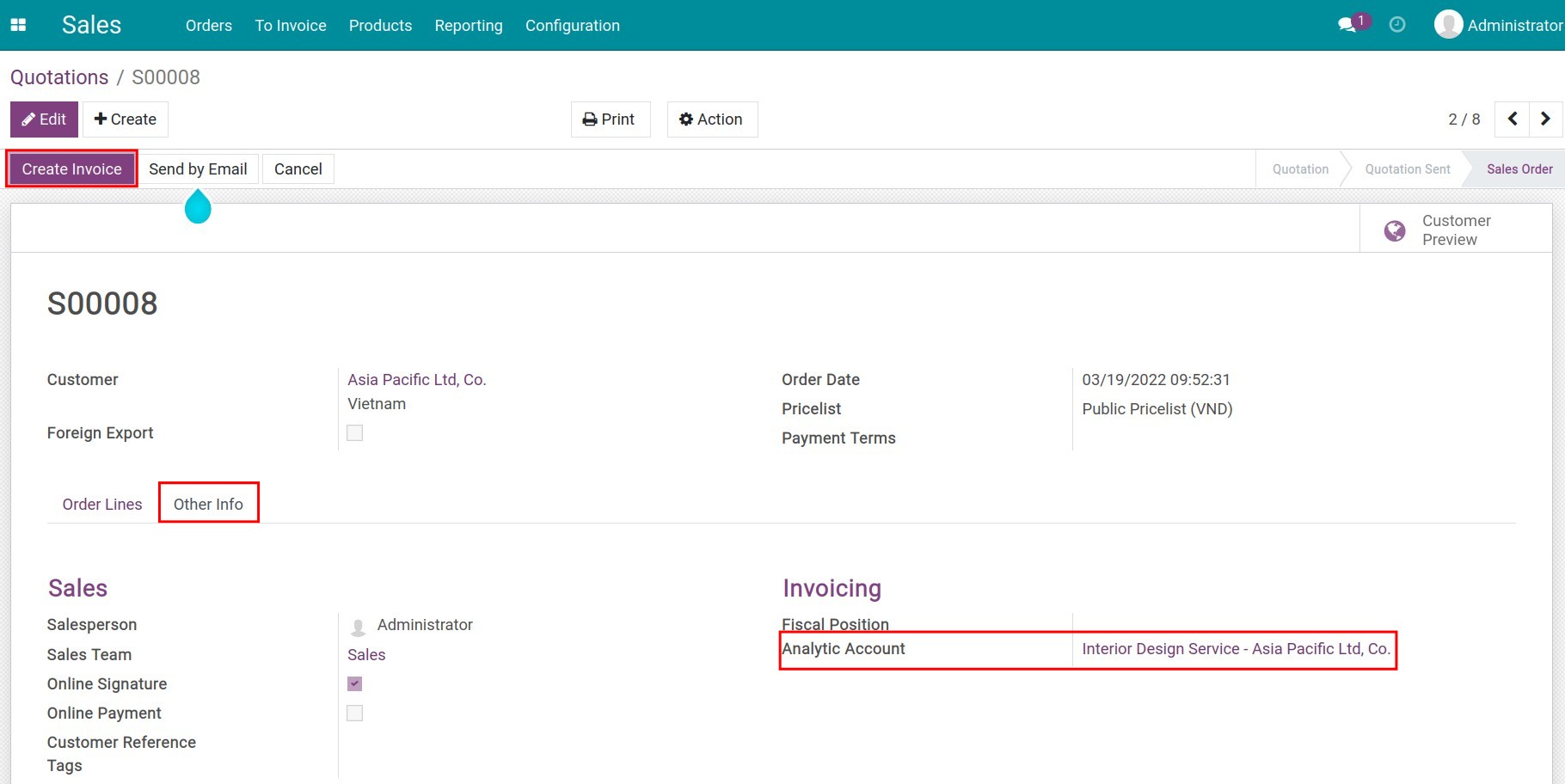

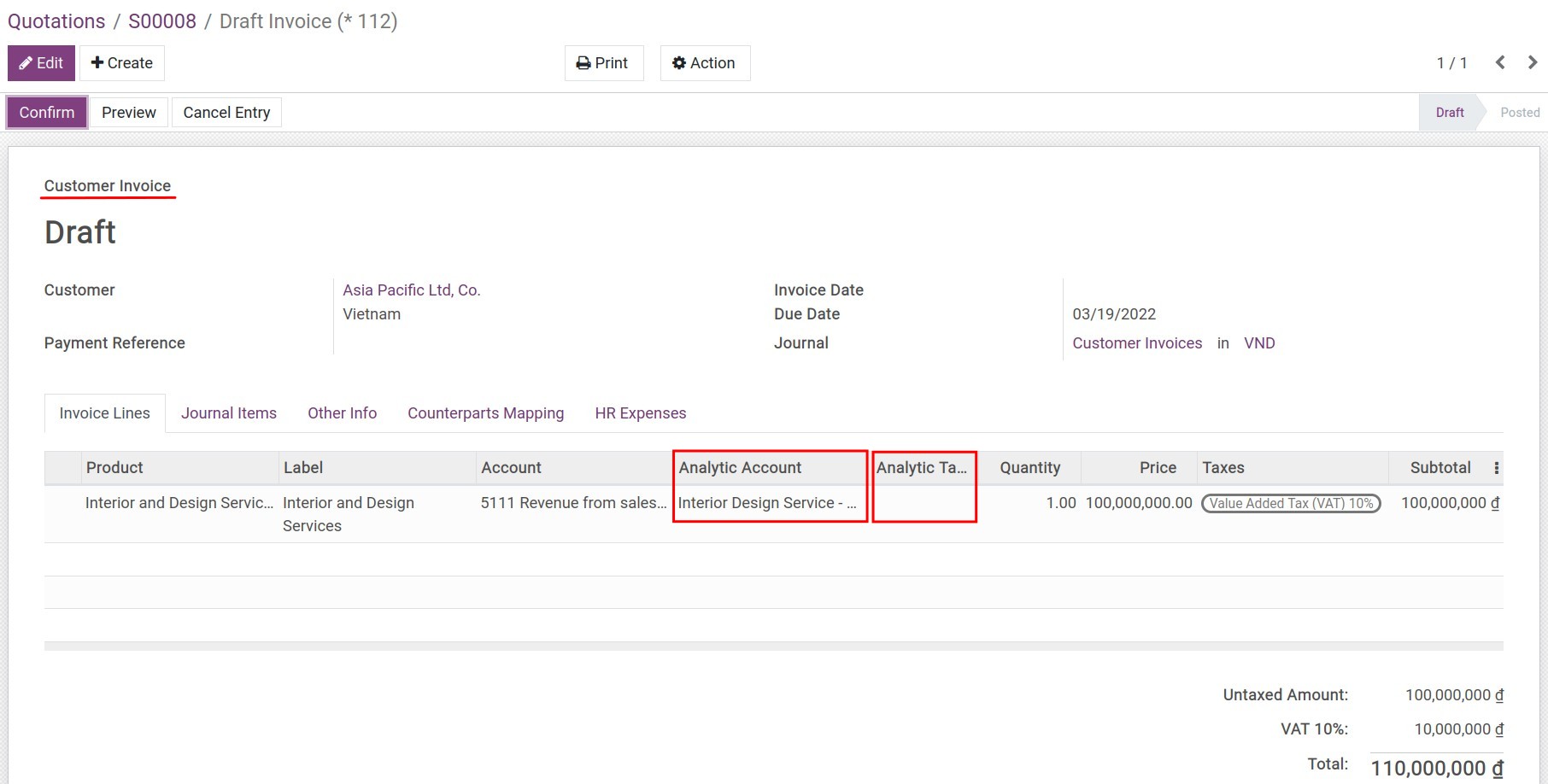

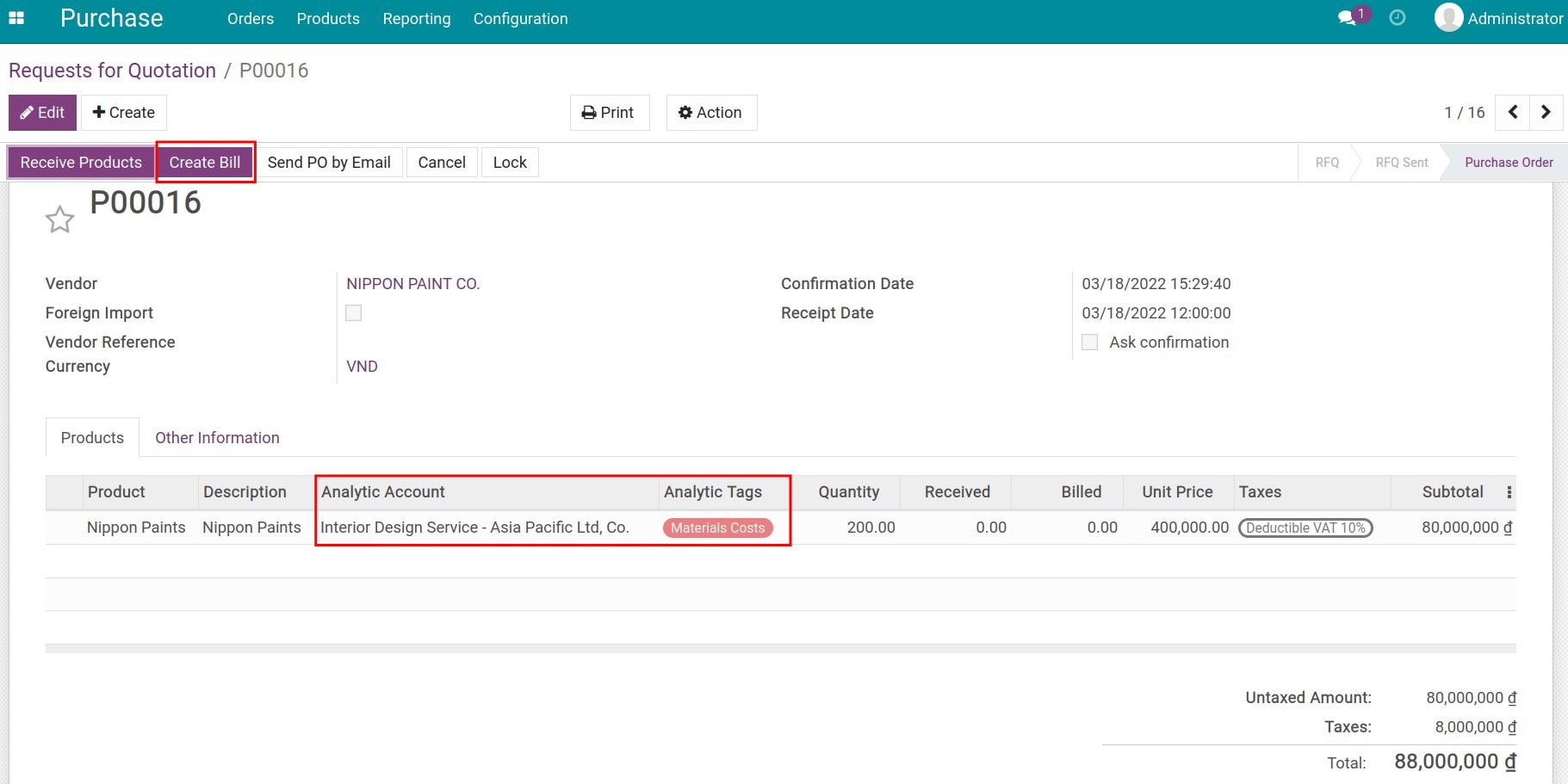

Use the Analytic Default Rules

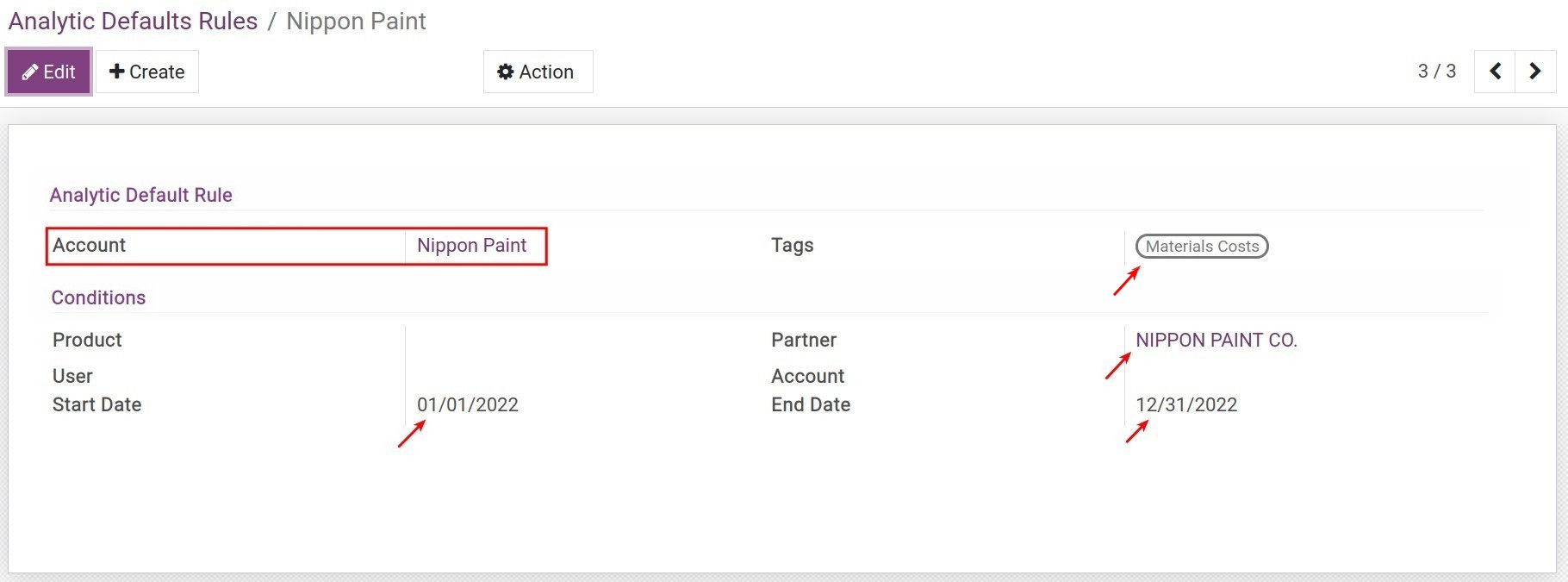

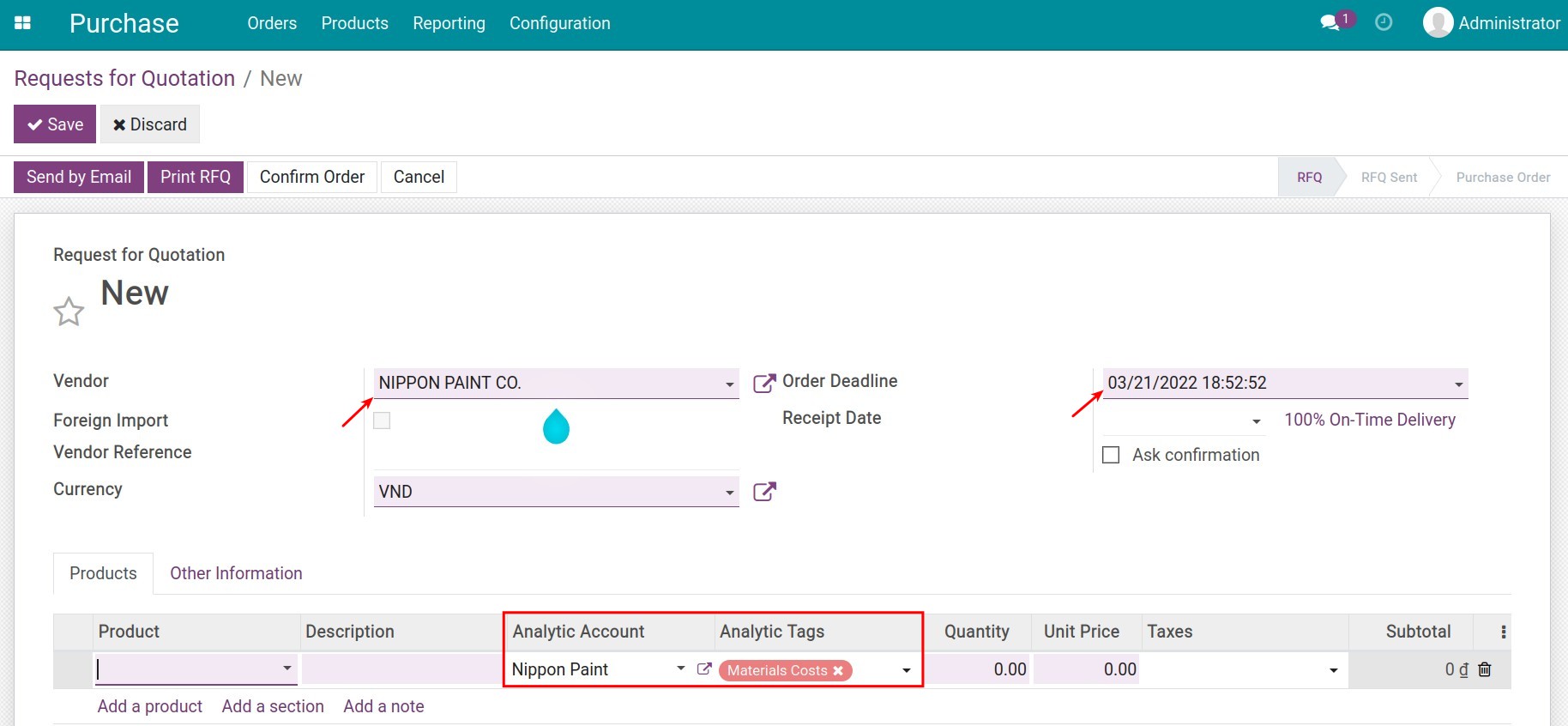

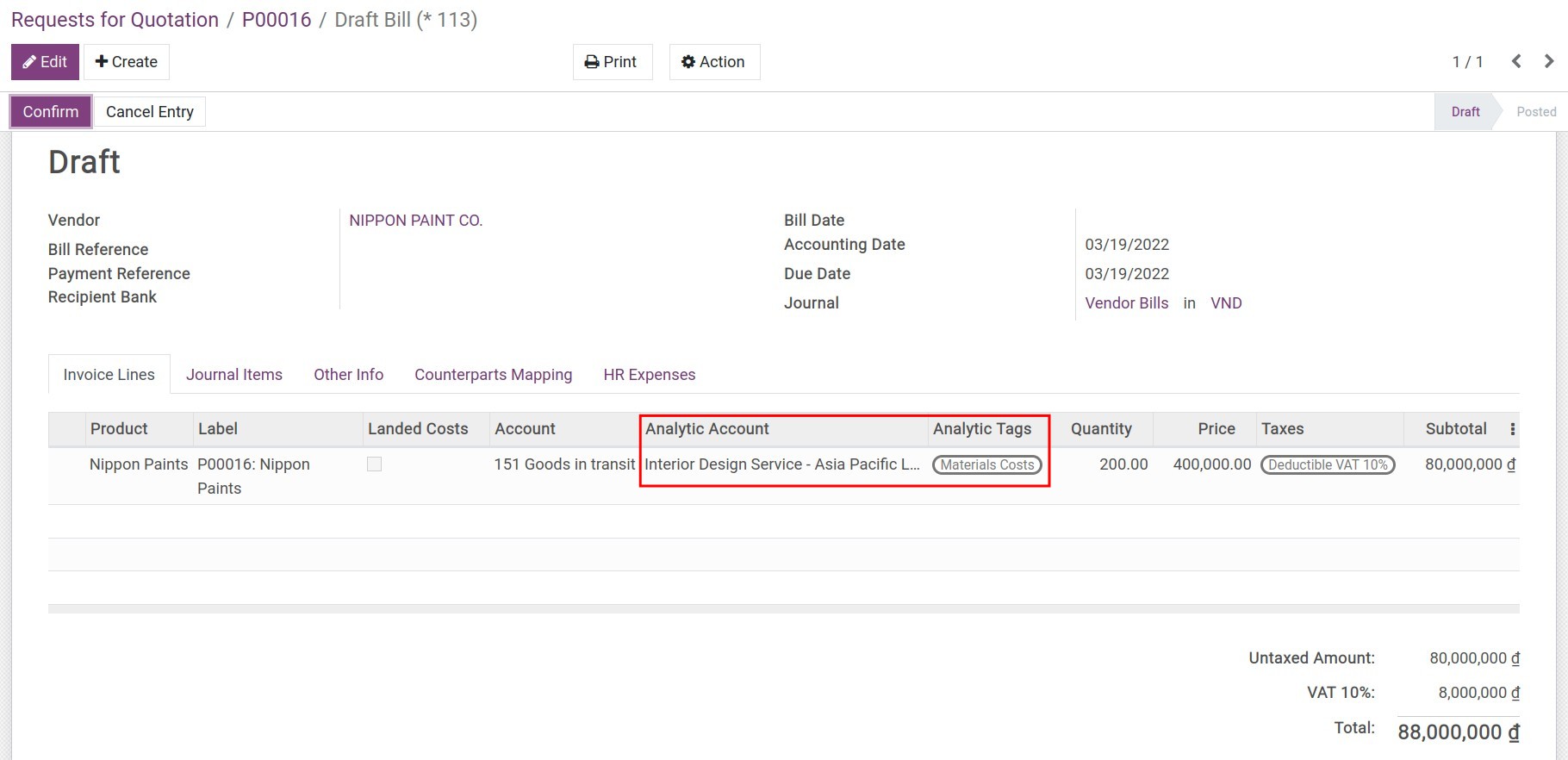

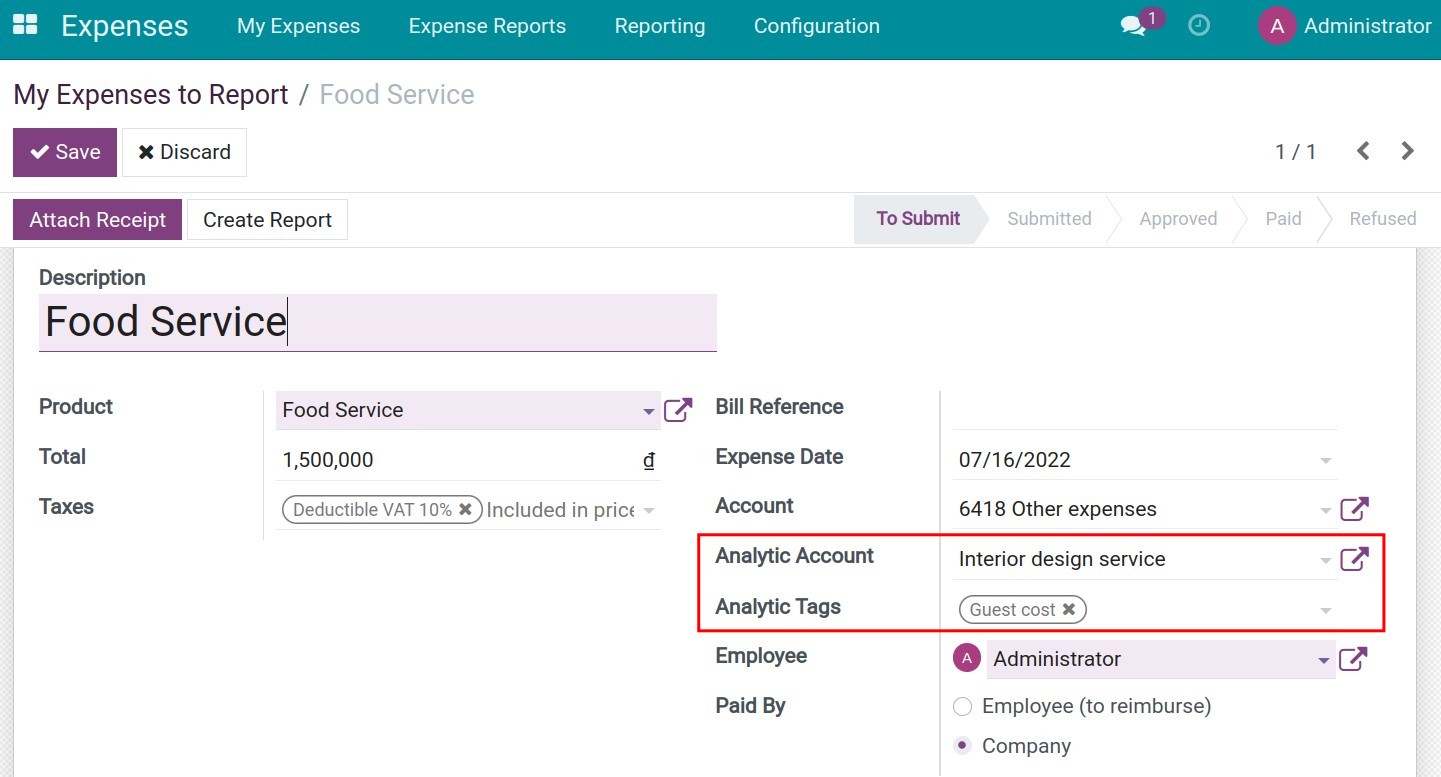

For instance, you need to track and manage the related costs of the vendor Nippon Paint Co, Ltd in 2022. You will create an analytic default rule as below:

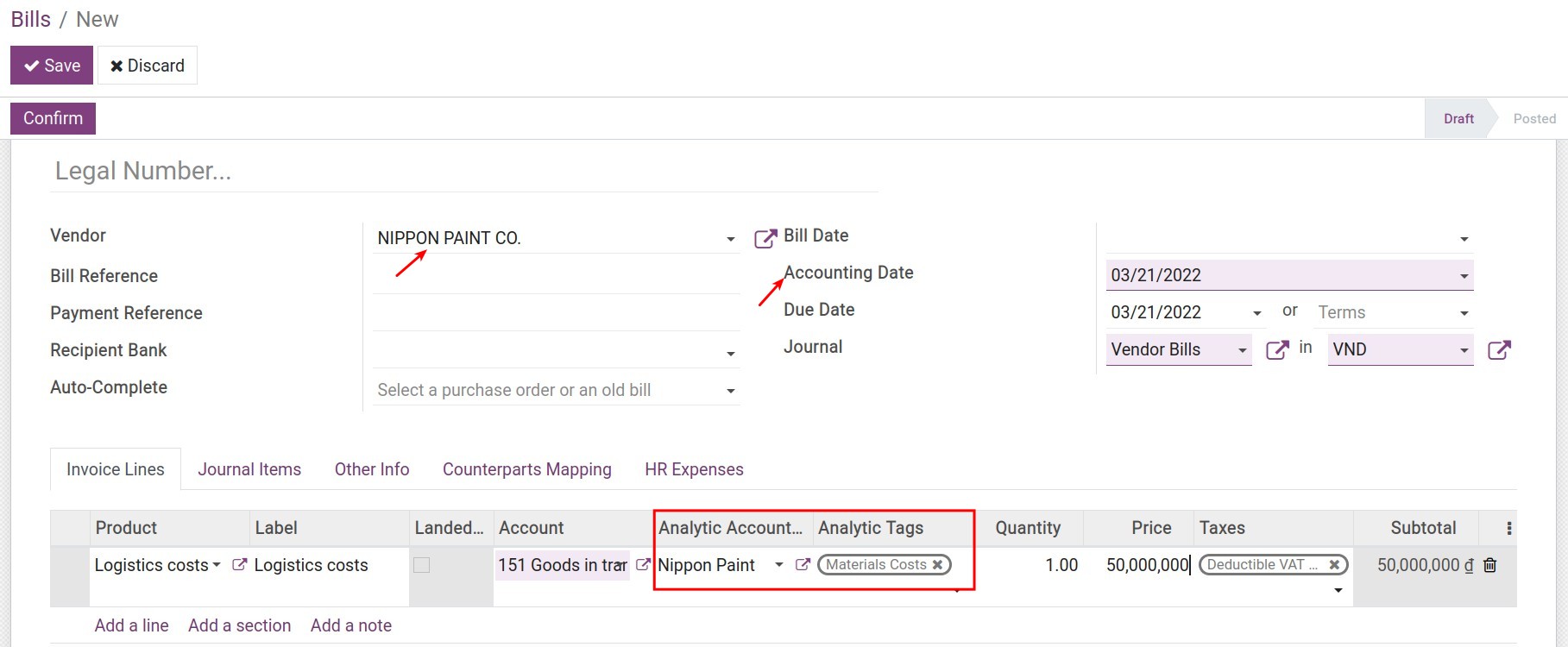

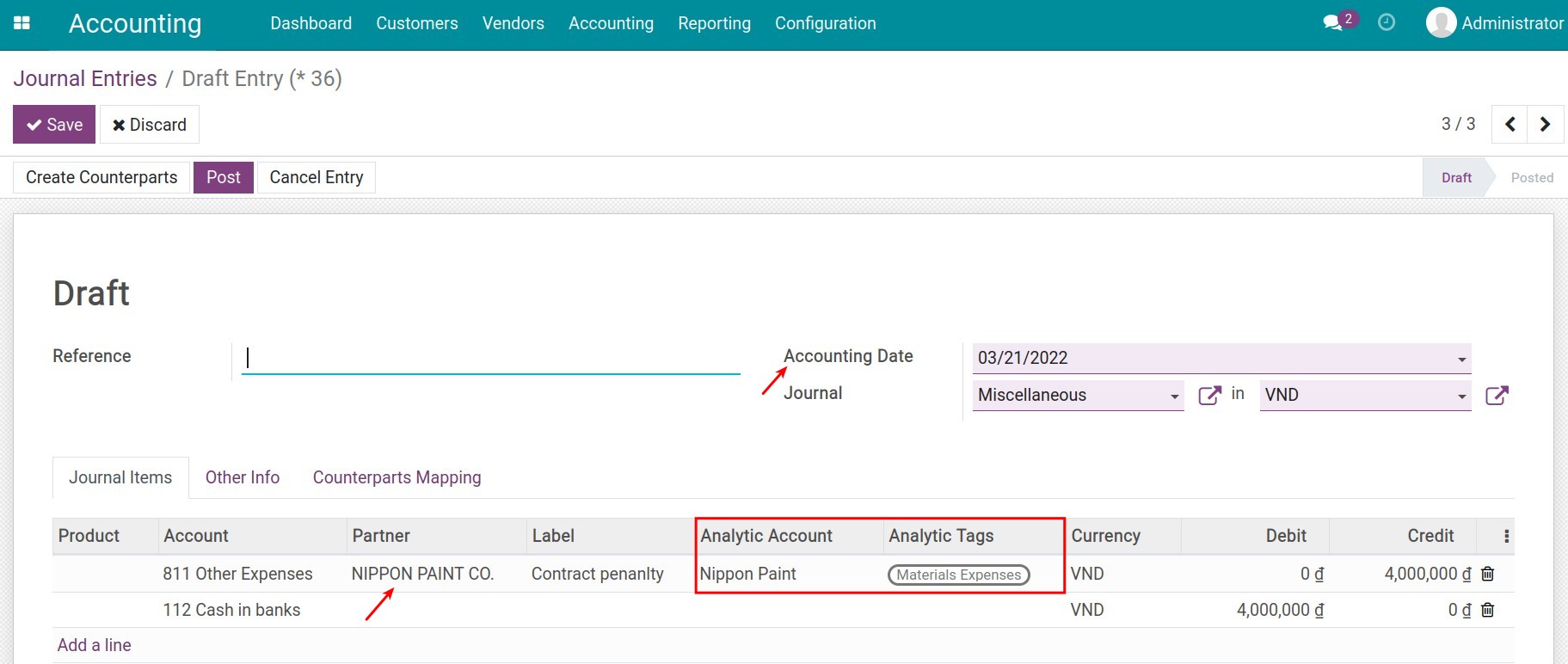

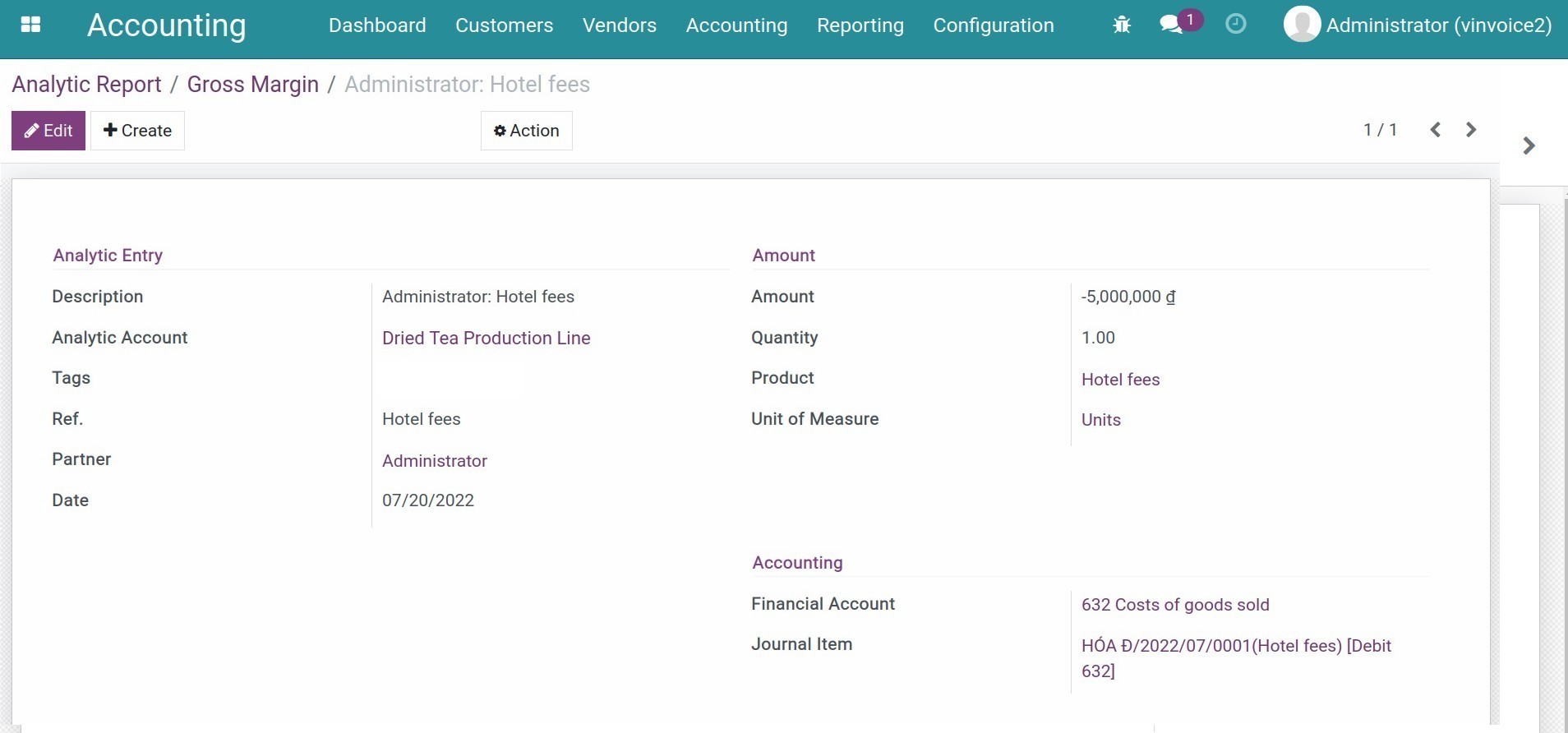

Thus, whenever occurring an expense is related to this vendor, the system will automatically attach the analytic account and the analytic tags as configuration. To illustrate:

Journal entries

See also

Related article

Budget Management

Expenses and revenue management in iSuite Accounting

Track employee costs in project management

Asset liquidation

Asset liquidation

Assets in enterprises constantly changing. In the course of operation, enterprises may arise the need to Liquidize assets. This article guides you through the steps of asset liquidation with iSuite software.

Requirements

This tutorial requires the installation of the following applications/modules:

Accounting & Finance

Assets Management

Chart of Accounts

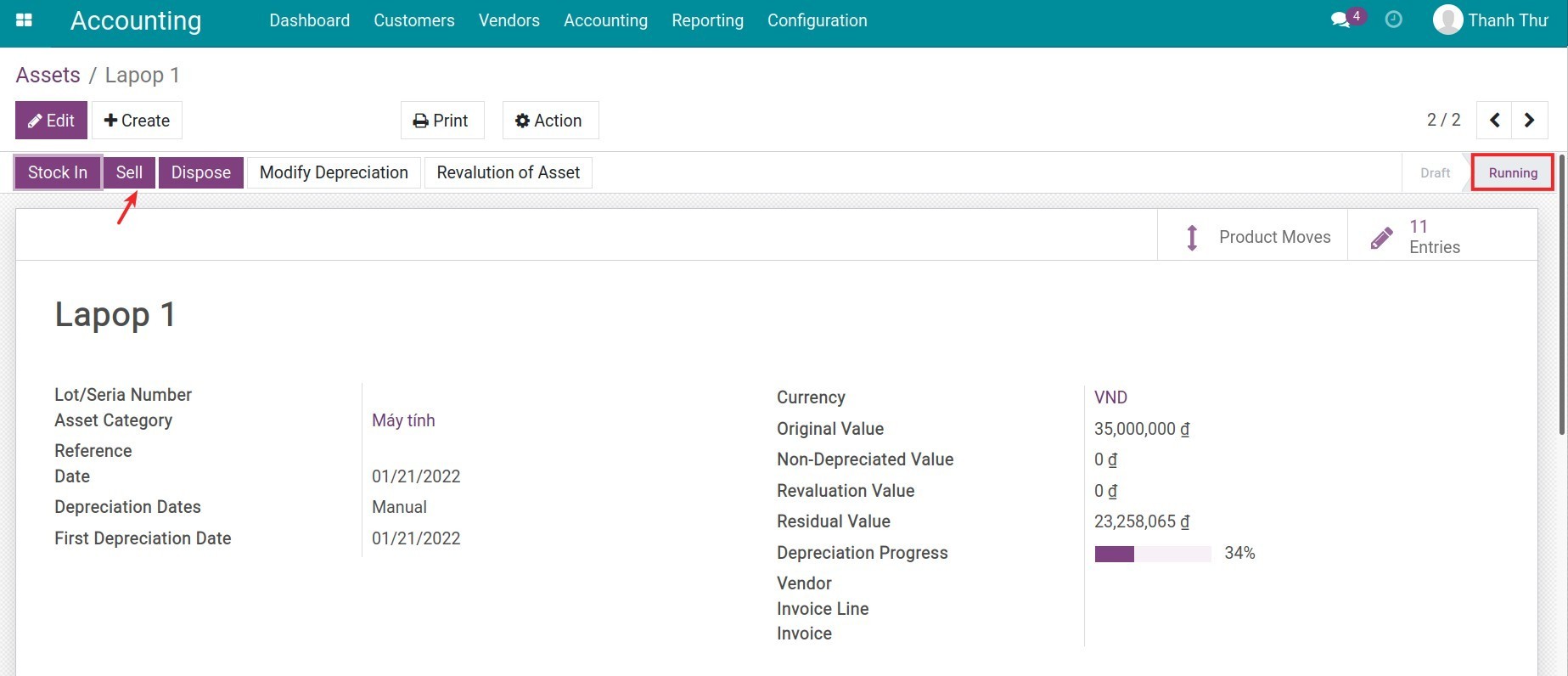

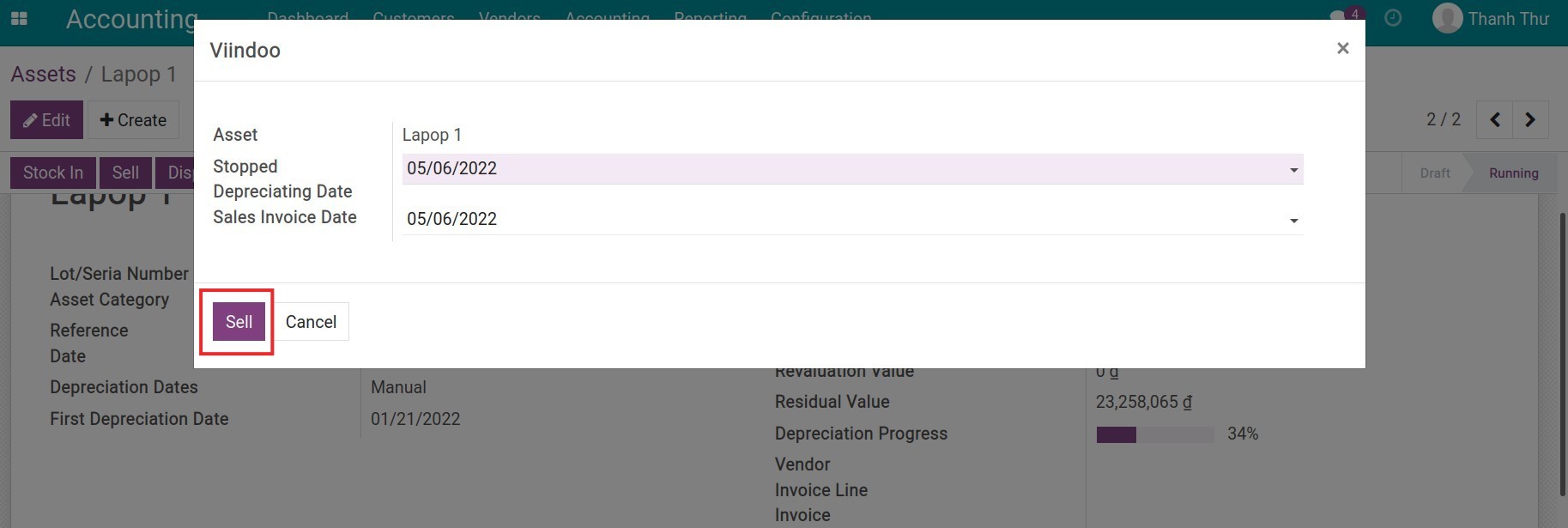

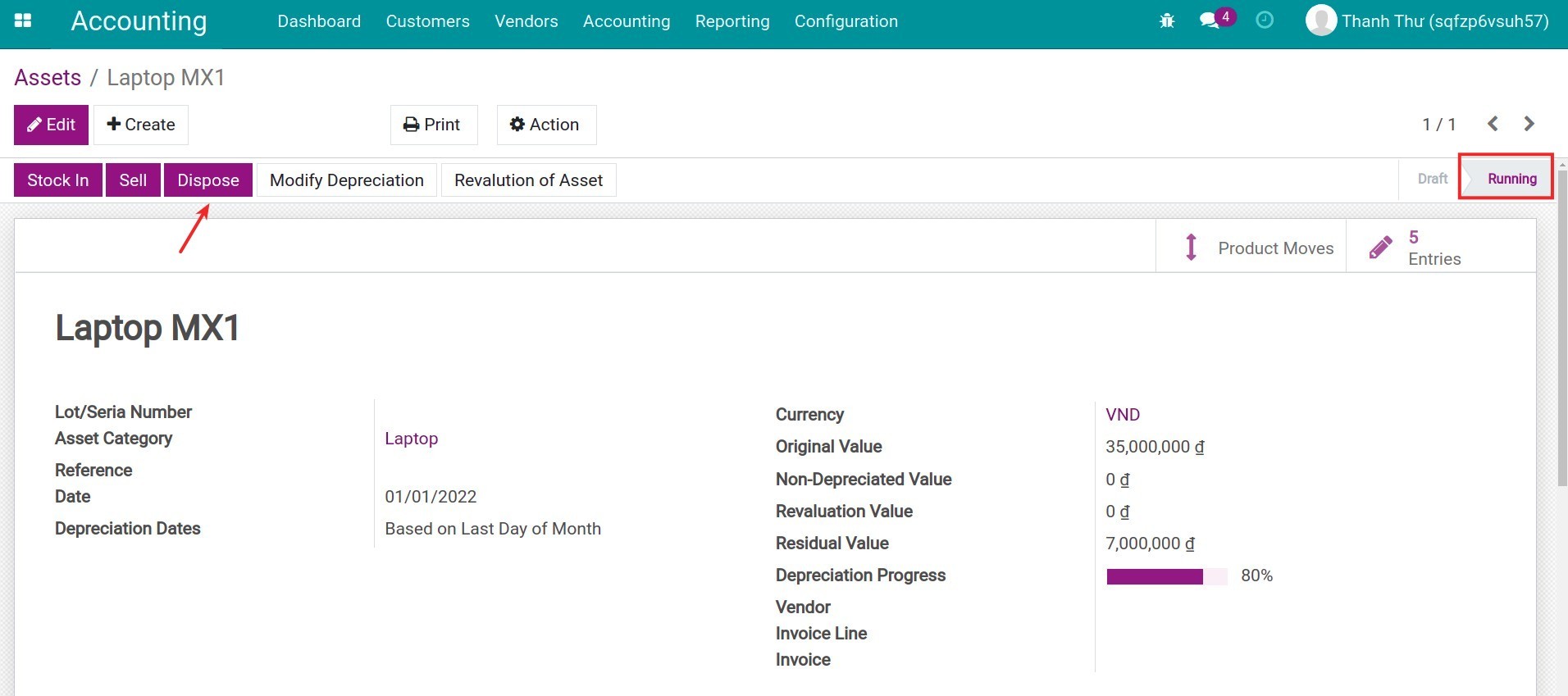

Case 1: Liquidize depreciating asset

On the view of the asset in a running depreciation, choose Sell.

A pop-up window appears, asking for the following information:

Stopped Depreciating Date: The final date of the amortization period, a required field.

Sales Invoice Date: The invoicing date.

Note

Stopped Depreciating Date can be different from the Sales Invoice Date.

It’s necessary to post all the depreciation entries before the liquidation moment.

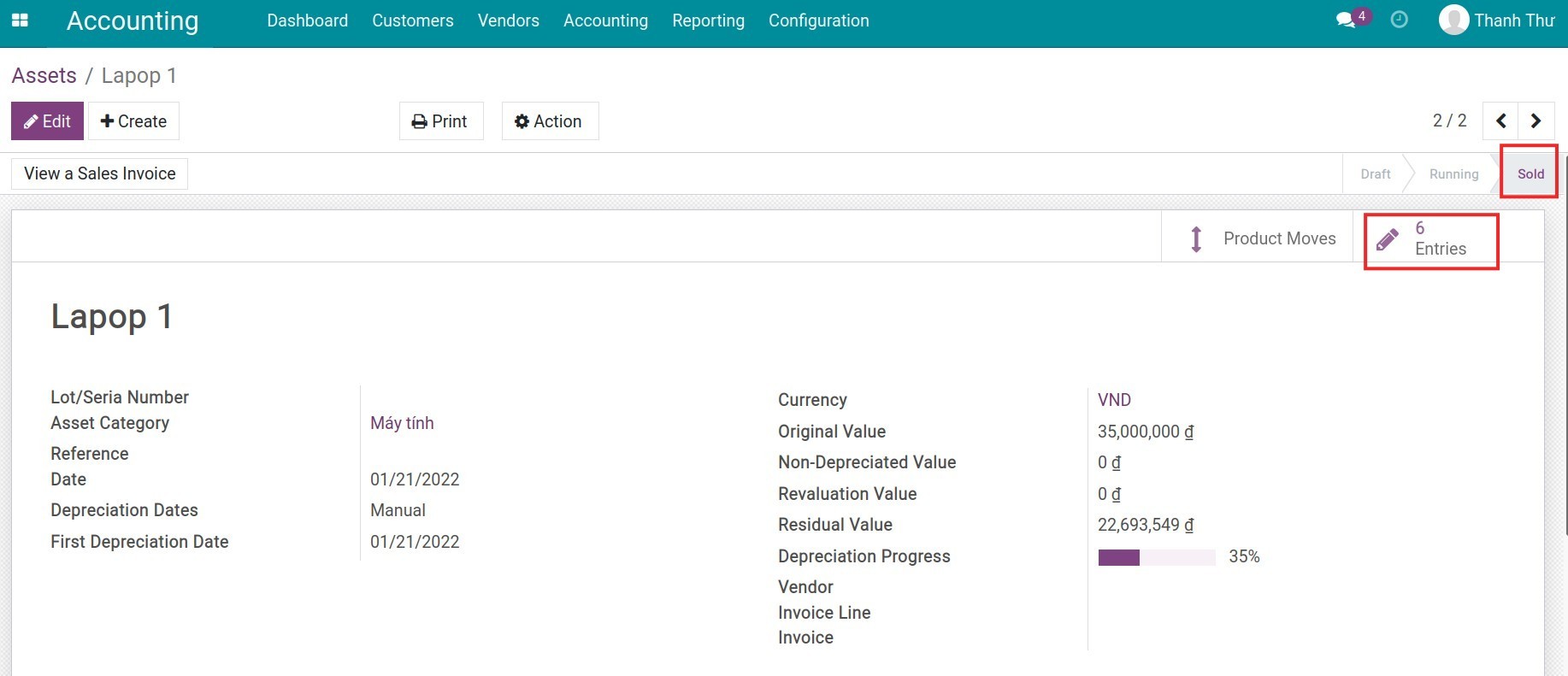

Press Sell. The asset will stop being depreciated, its stage will change from Running to Sold. The system then recalculates the depreciated value at the stopped depreciating moment to create a journal entry to adjust the previously recorded depreciation expense.

Press on Entries to check recalculated data by the system.

See also

Manually create an Asset in iSuite

Example:

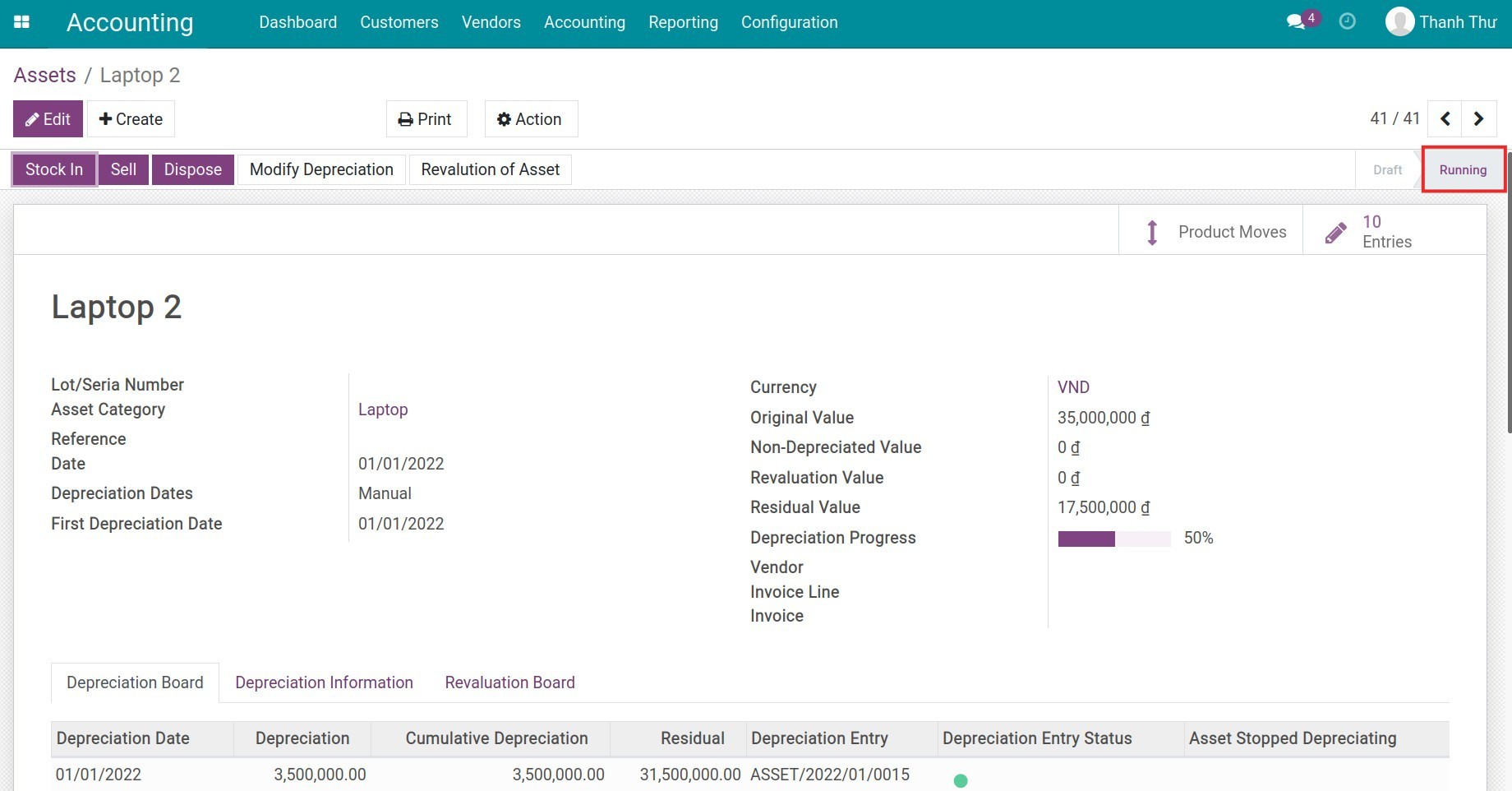

Laptop 2.

Original price: 35.000.000 VND.

First Depreciation Date: 01/01/2022.

Number of Entries: 10.

Depreciation method: Linear.

Recurrent Depreciated Value: 3.500.000 VND.

Recent days journal:

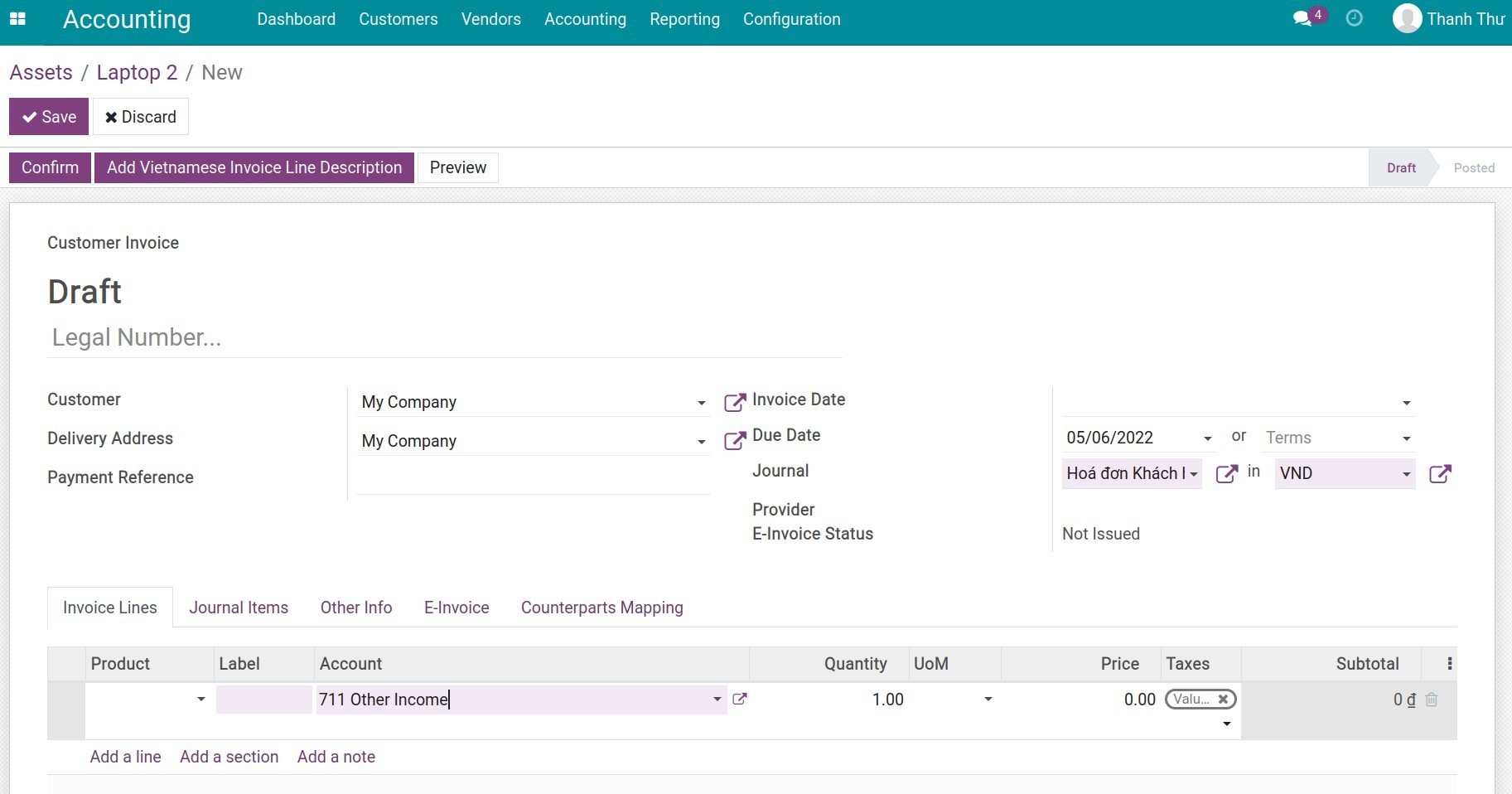

Press Sell, enter Accounting Date: 05/06/2022. The system suggests an invoice for asset liquidation in the Draft stage. You can add more information and record the liquidation profit.

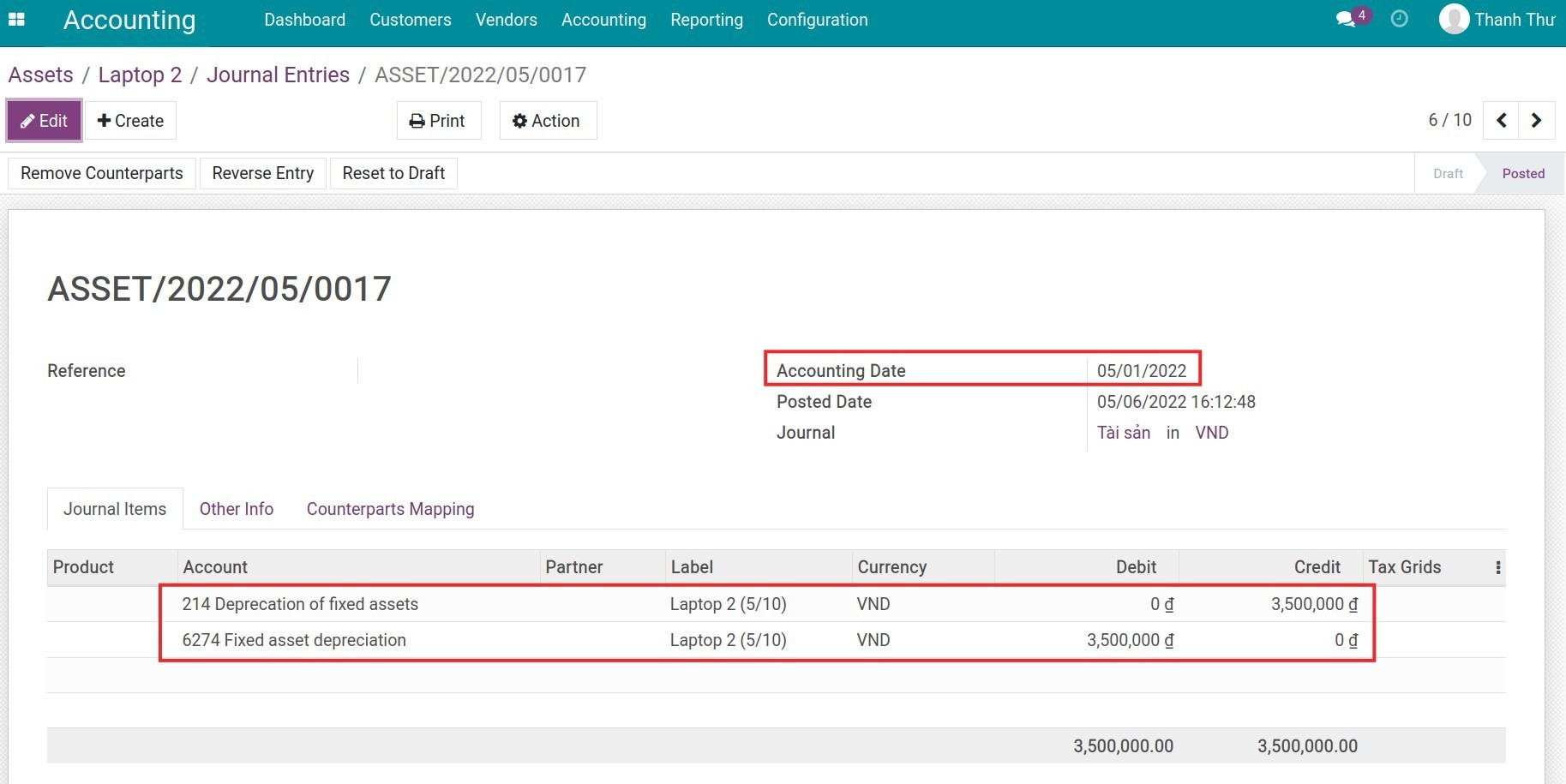

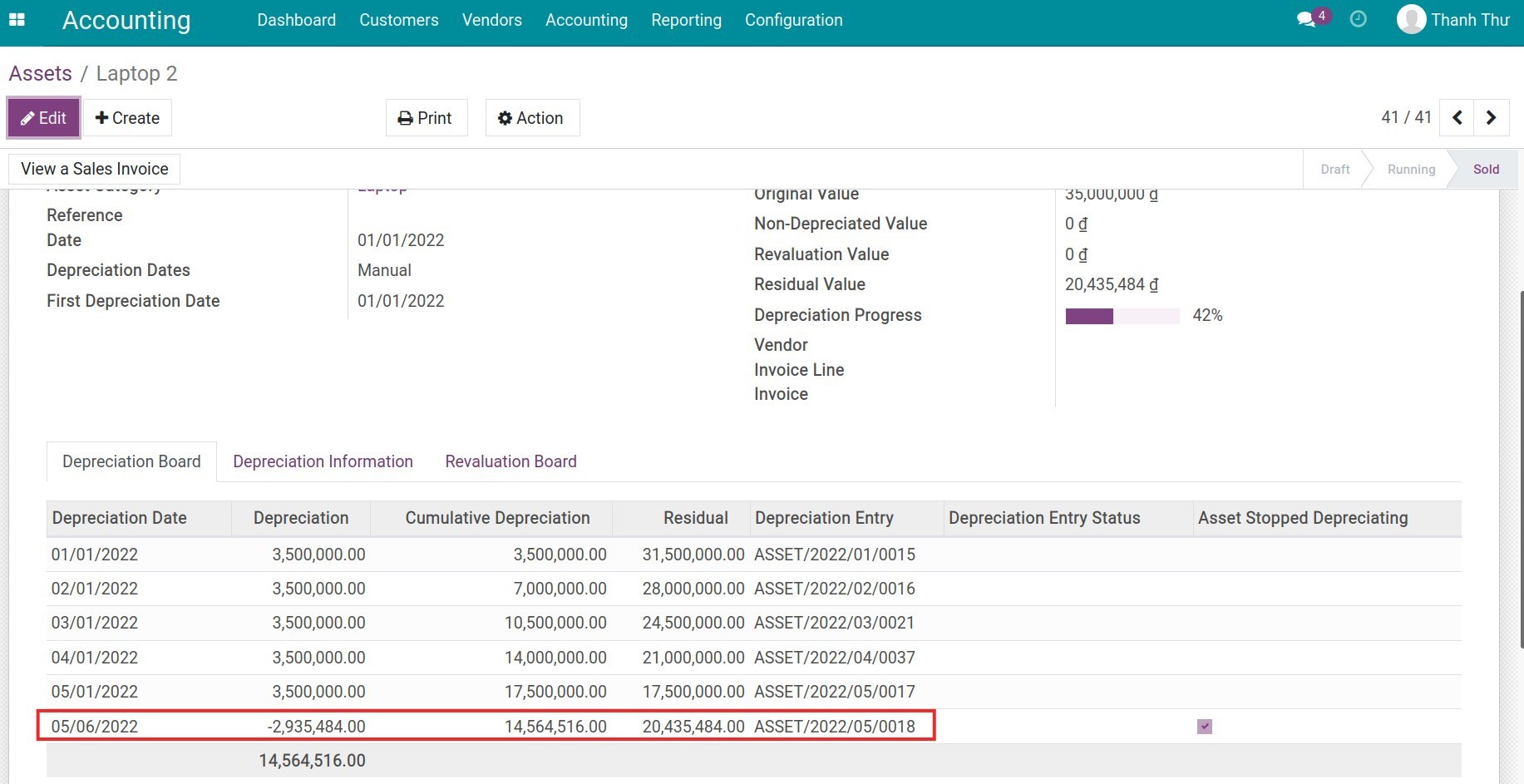

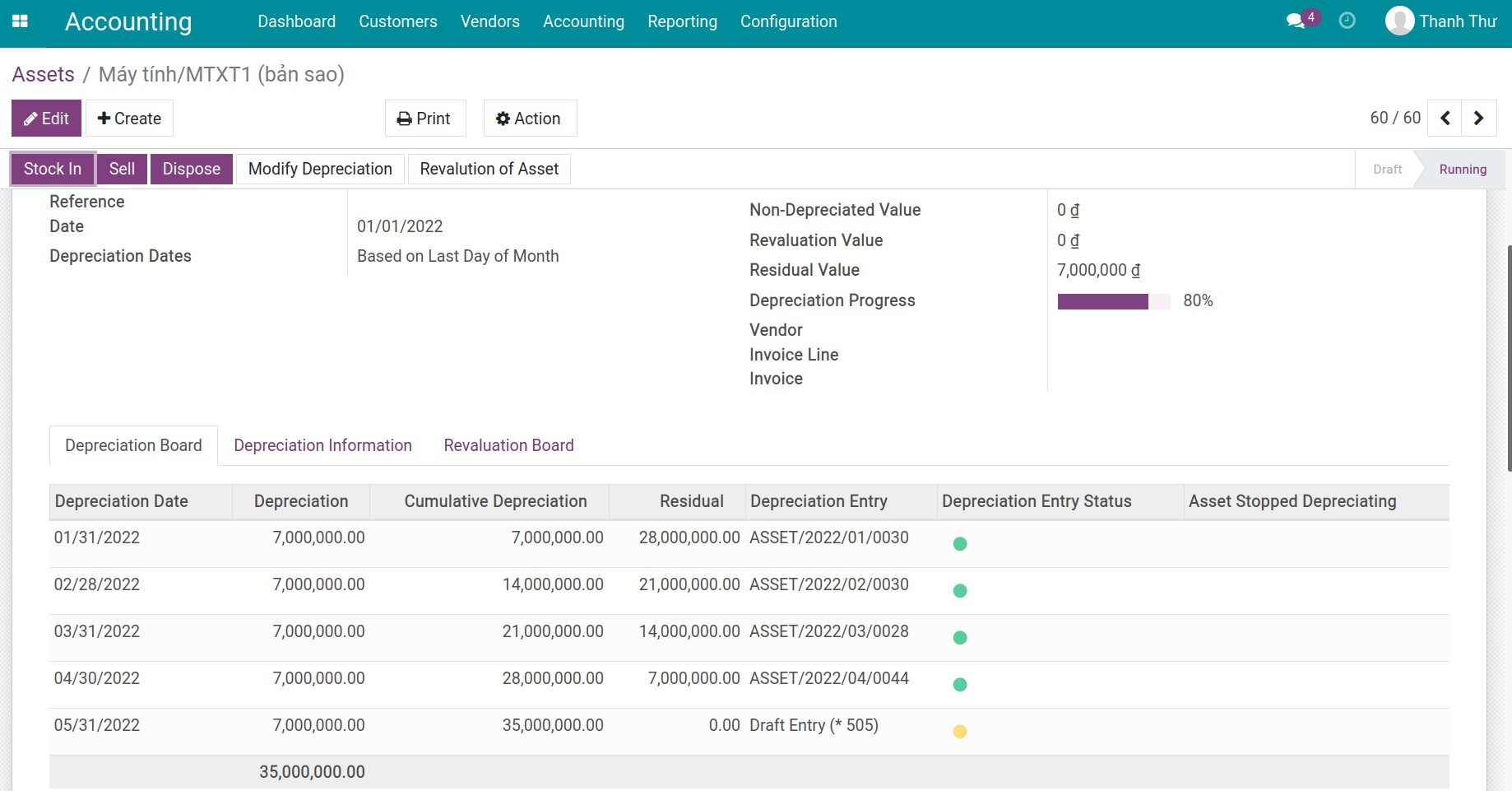

On the Asset view, recalculate the data as below: The Cumulative Depreciation in last entry (from 01/05/2022 to 31/05/2022) is 17.500.000, because you Sell the Asset on 06/05/2022 so the reduction (from 07/05/2022 to 31/05/2022) is 3.500.000 / 31 * (31 - 6 + 1) = 2.935.4838,71 VND (May has 31 days):

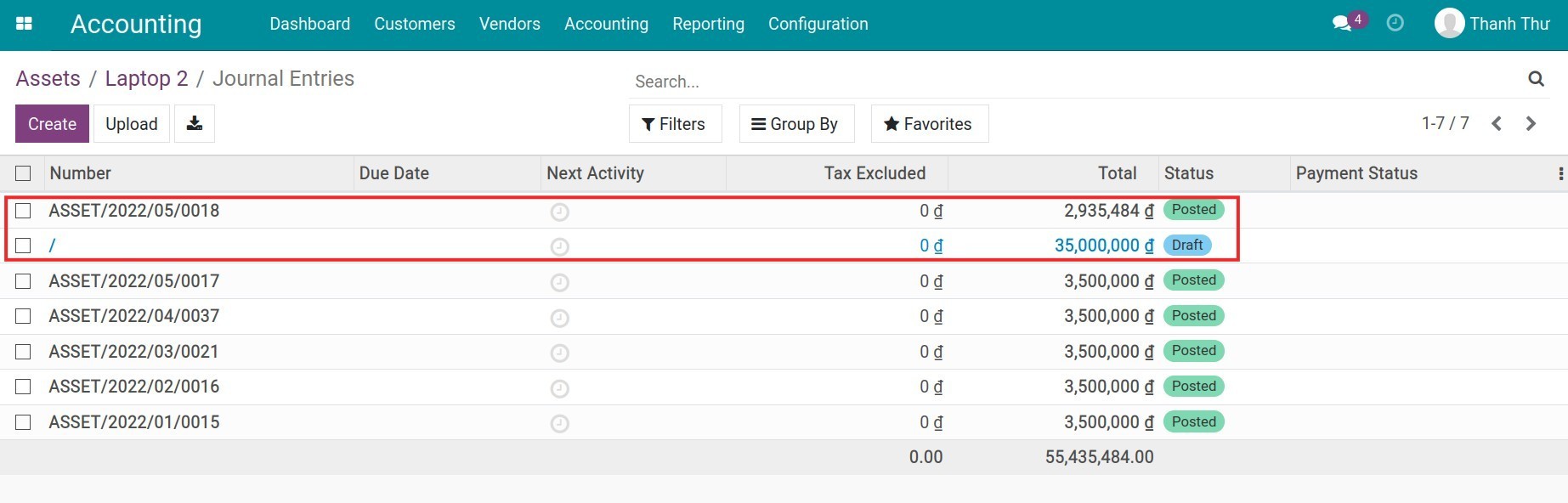

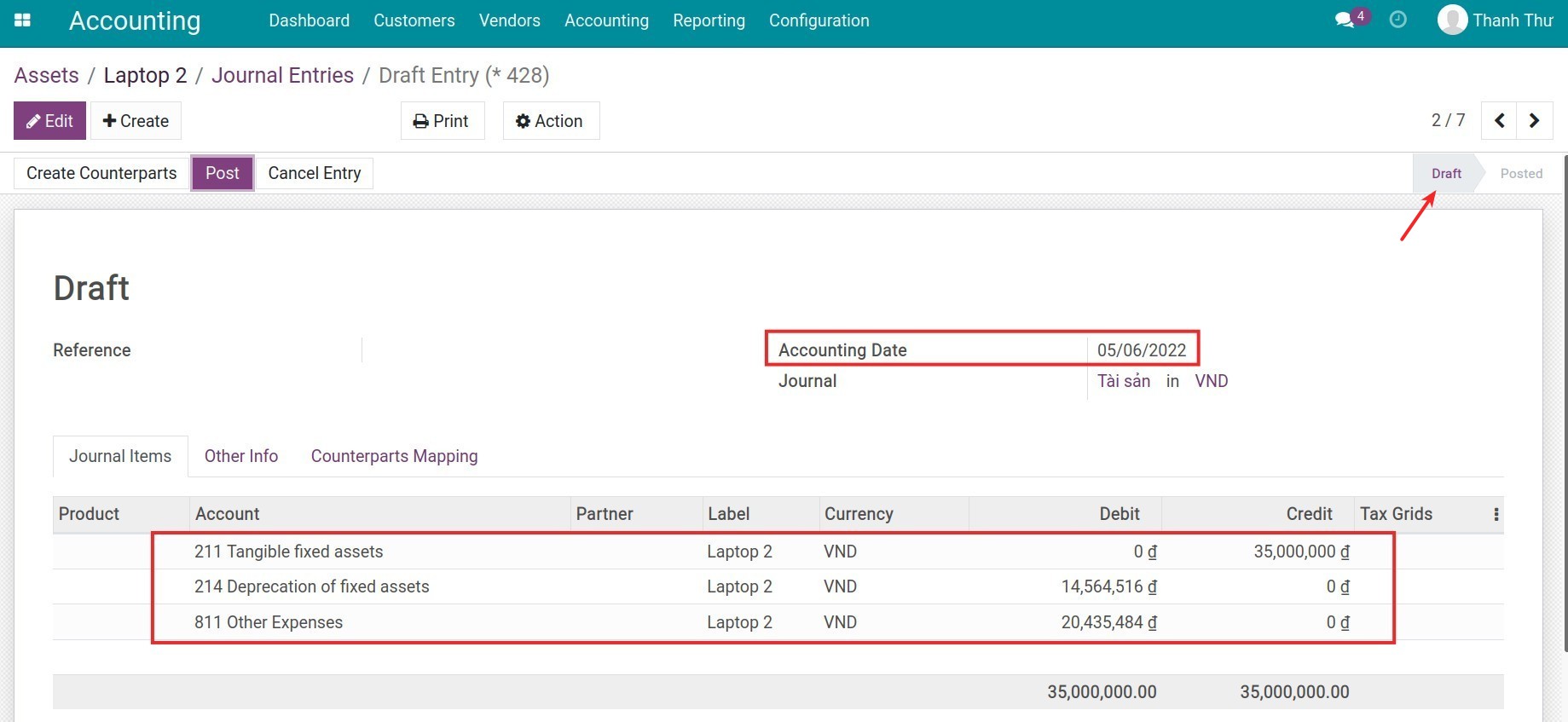

Press on the Entries button on the asset view to see all of the journal entries related to this asset. You can also click on the write-down depreciated value entries and the write-off asset entry to see details of corresponding journal items.

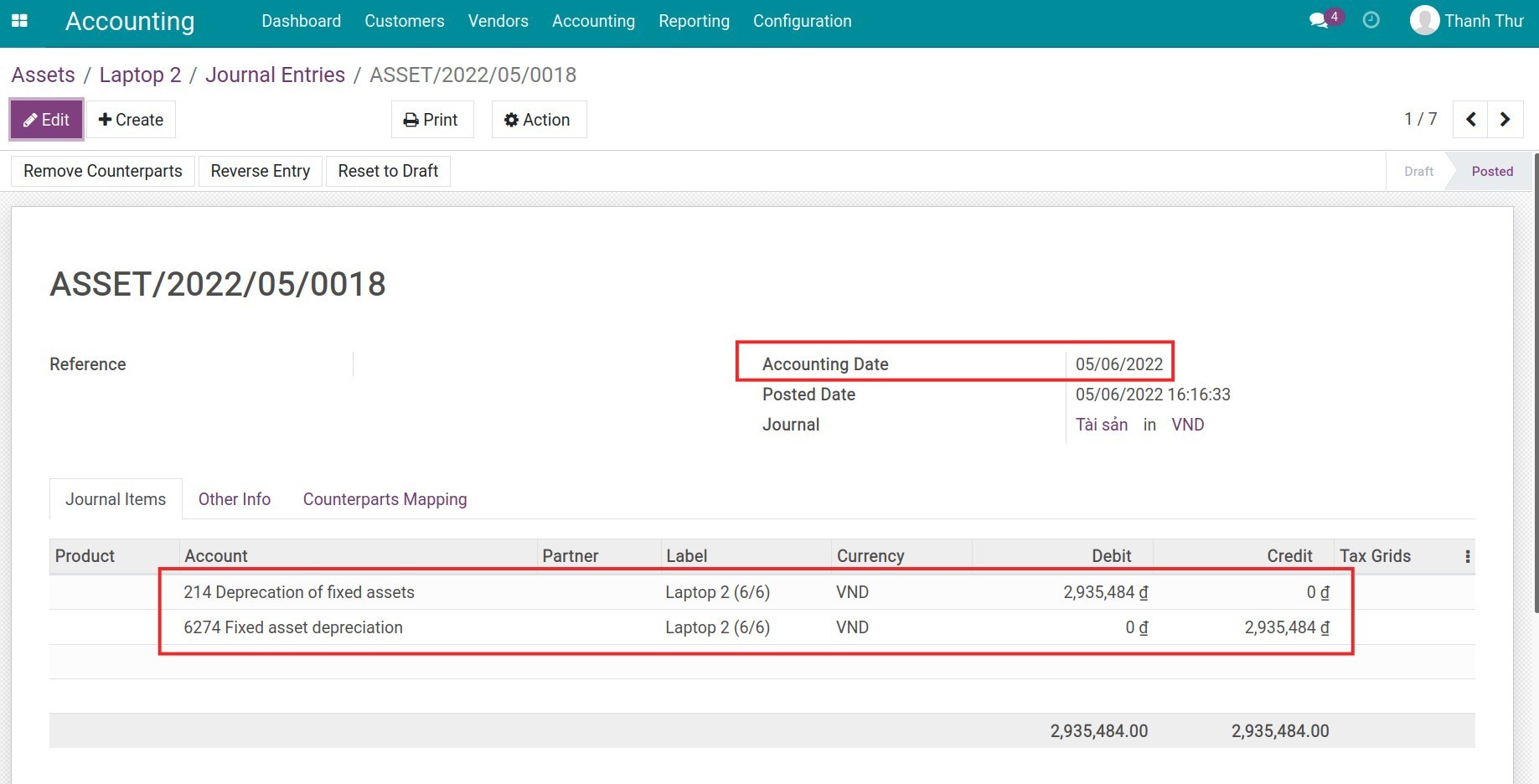

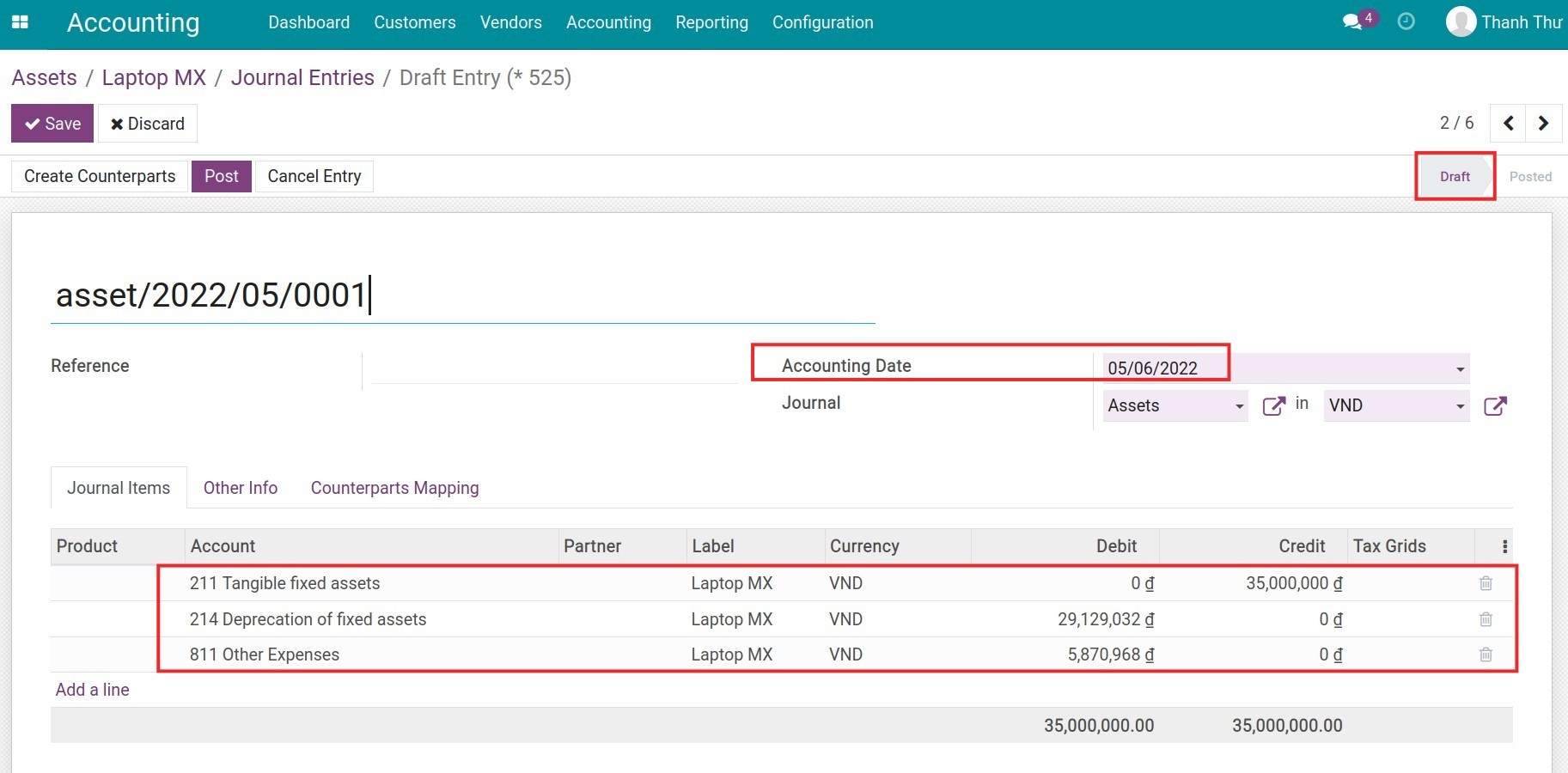

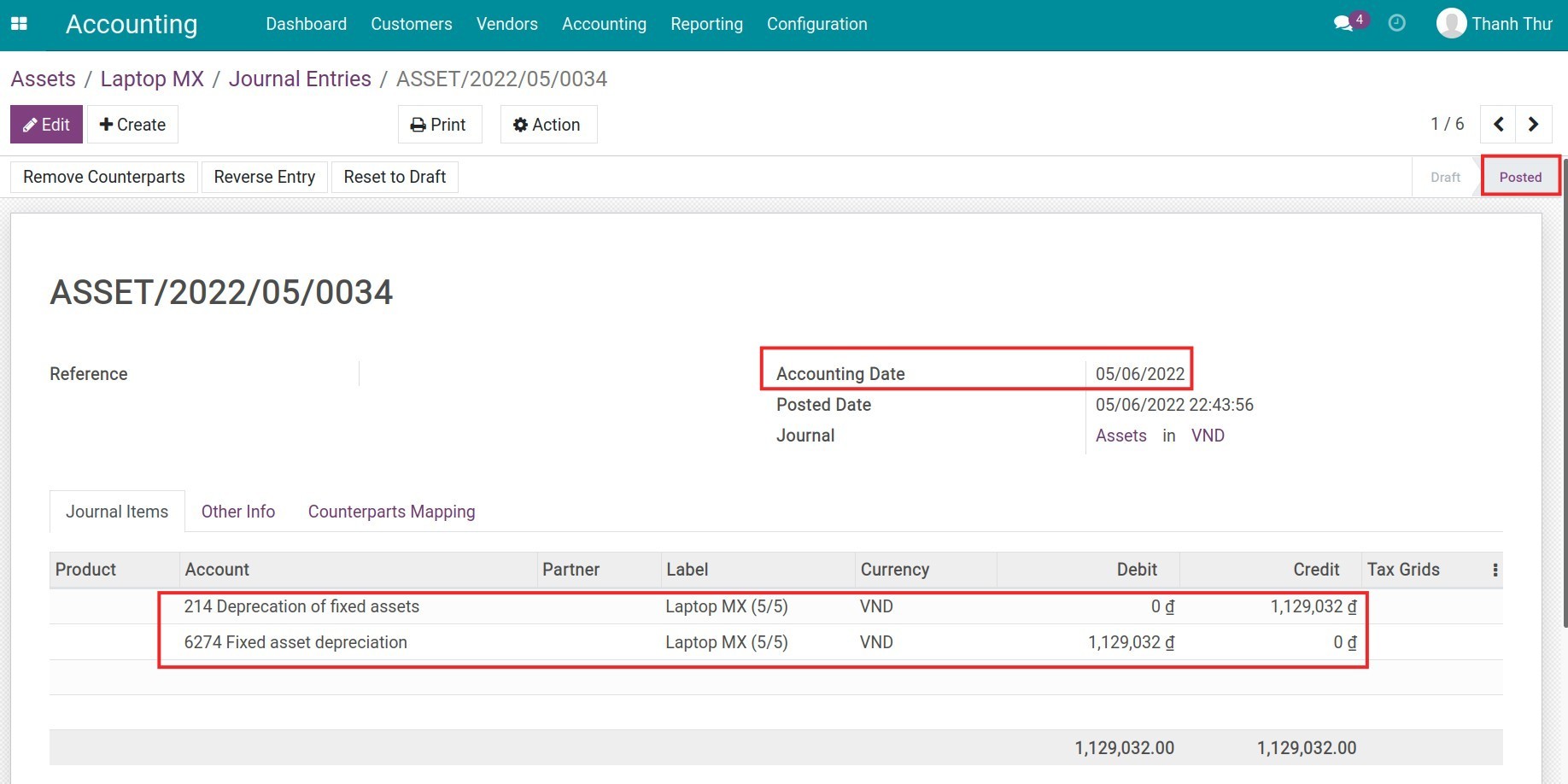

Write-down depreciated value entry:

Write-off asset entry in Draft stage:

See also

Configure charts of accounts and depreciation method for Assets Category

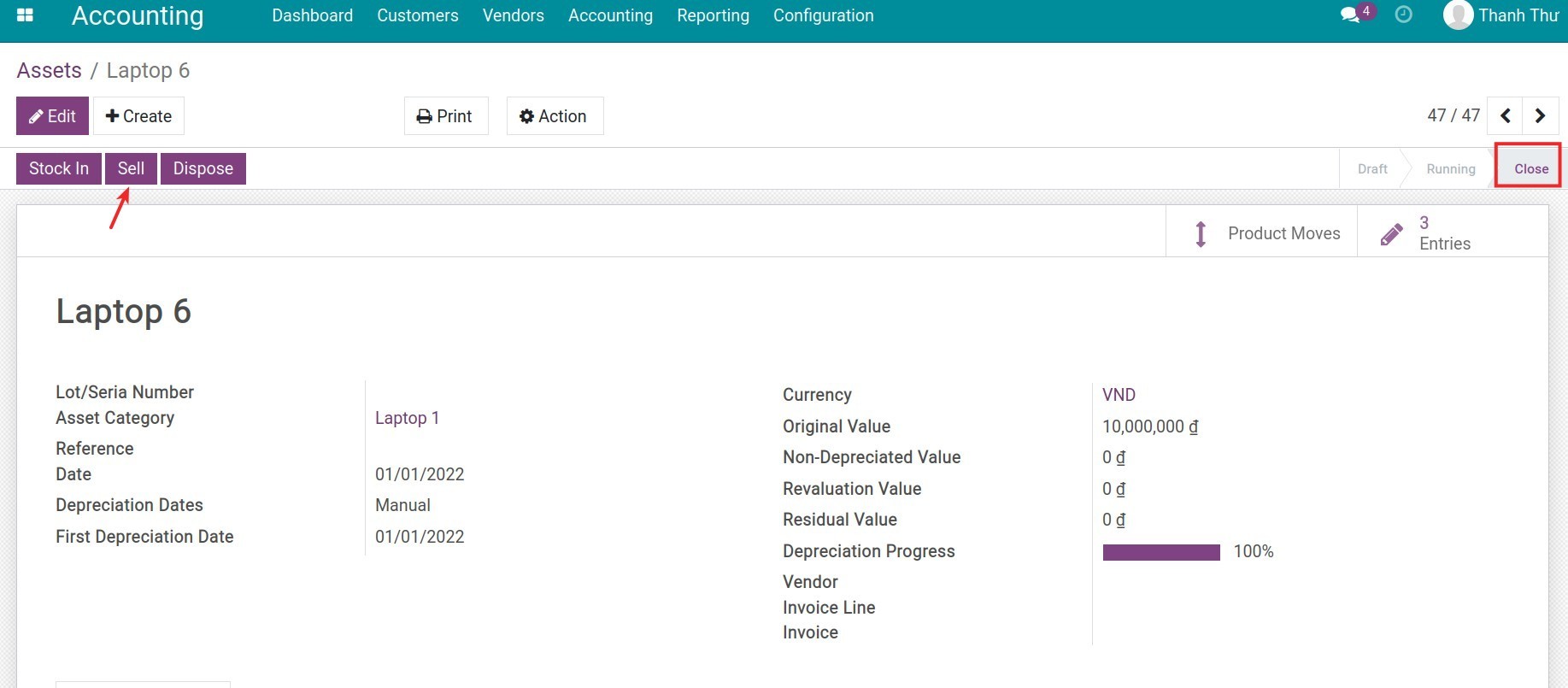

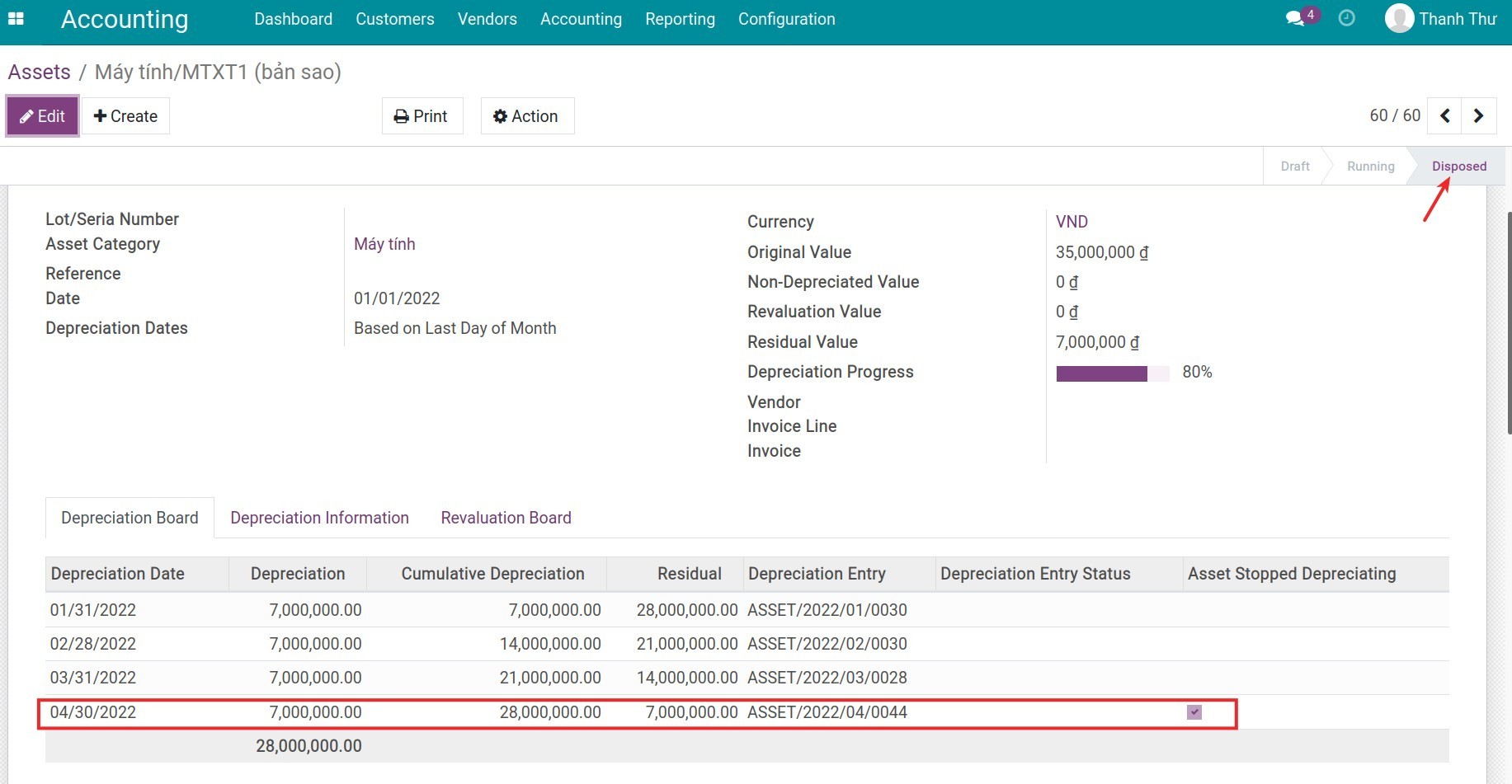

Case 2: Liquidize depreciated Asset

On the asset in stage Close, choose Sell.

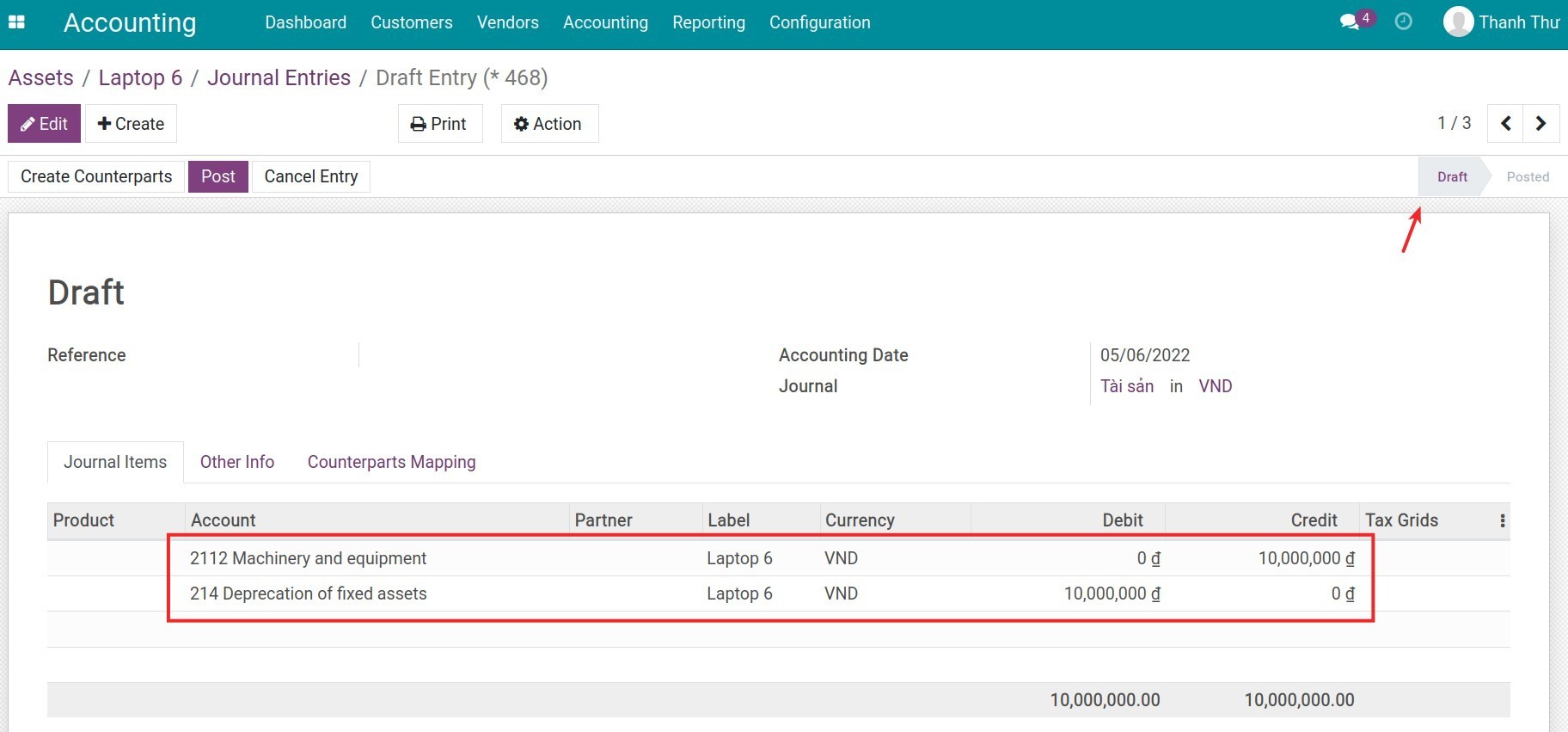

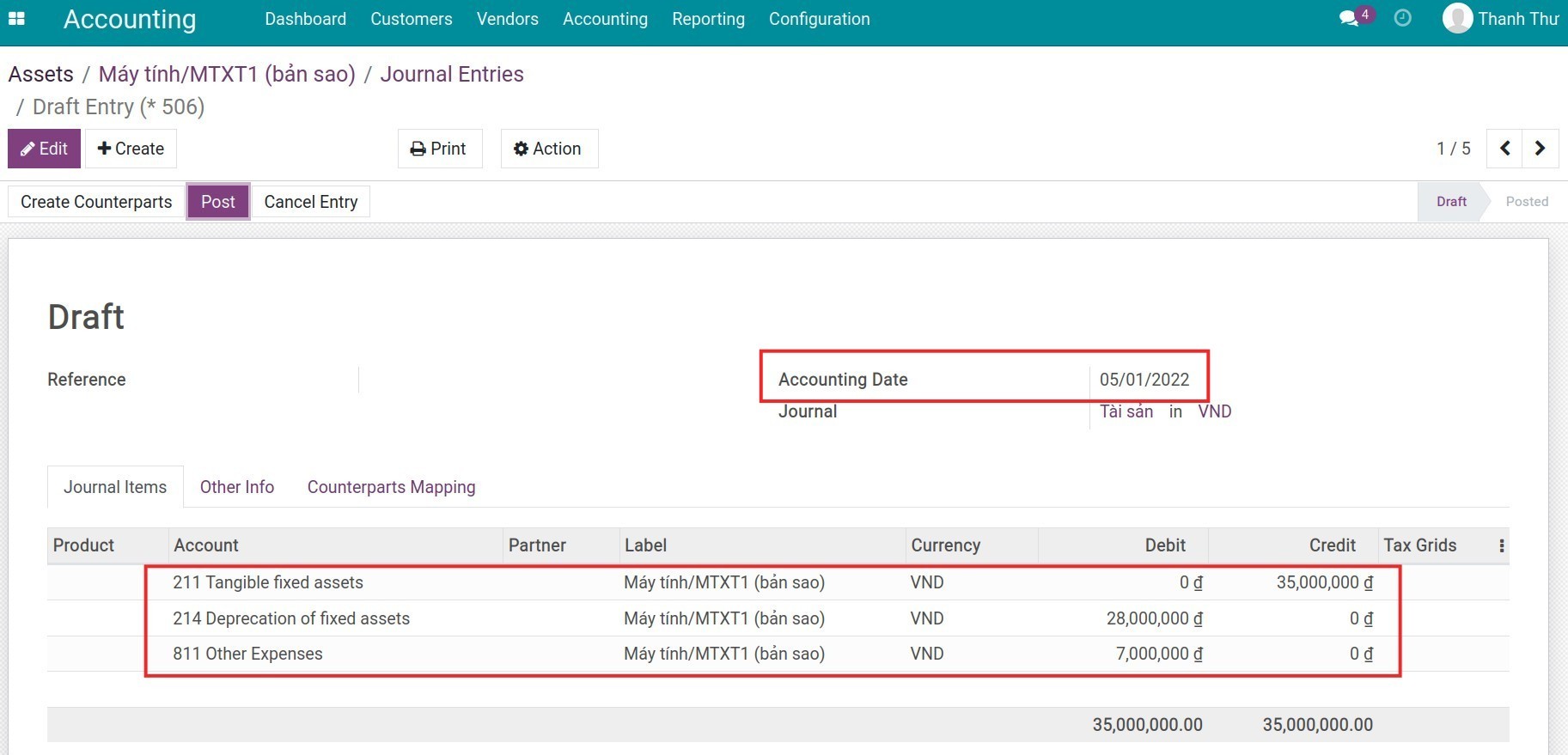

Similar to the previous case, the system asks for Stopped Depreciating Date and Sales Invoice Date to record the asset liquidation. Choose dates accordingly and press Sell. System then suggests a draft invoice for asset liquidation.

Simultaneously, write-off asset journal entries are created. You need to check the data on these entries and post them once done.

Now, the asset stage will change from Close to Sold.

See also

Related article

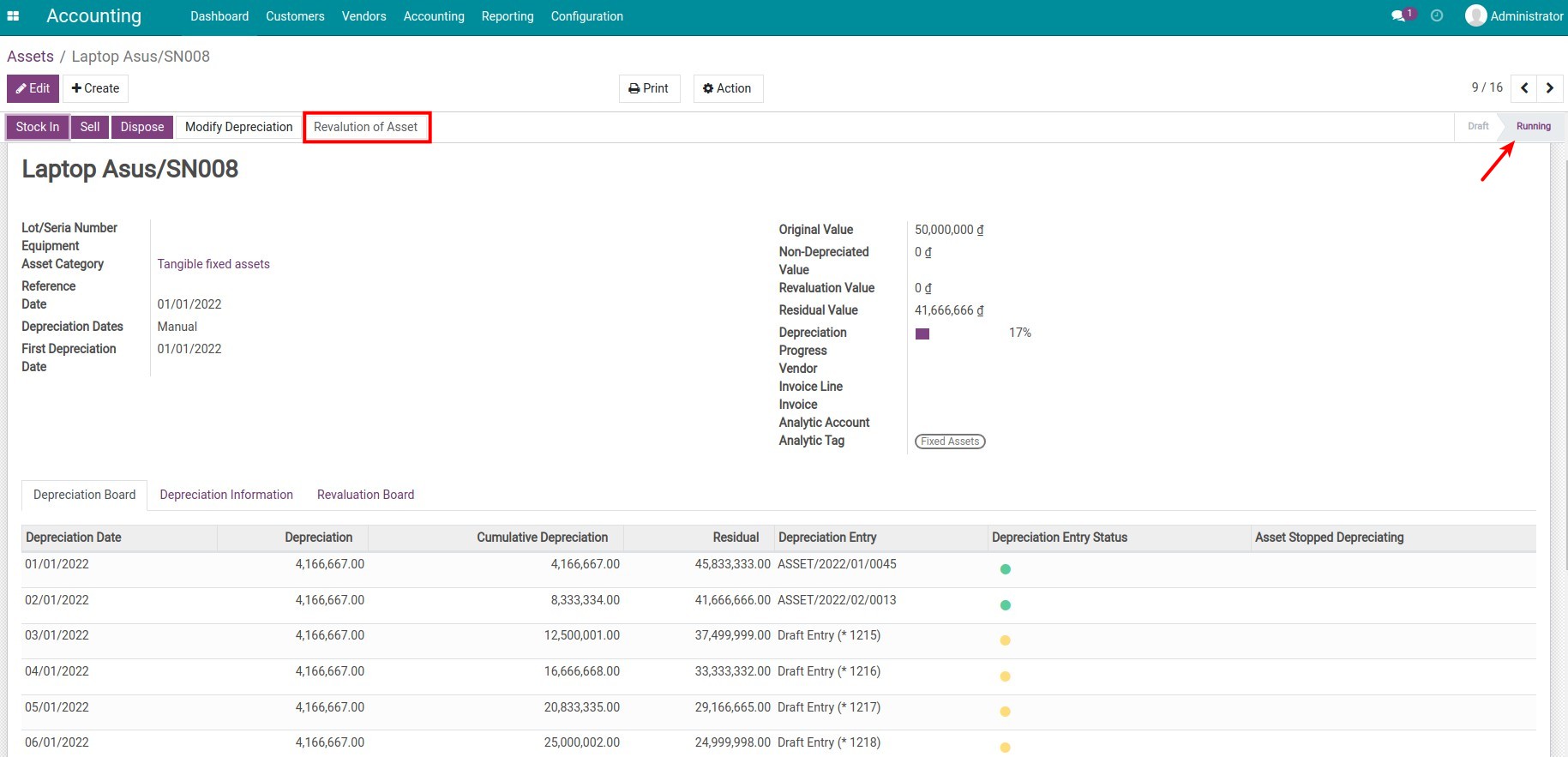

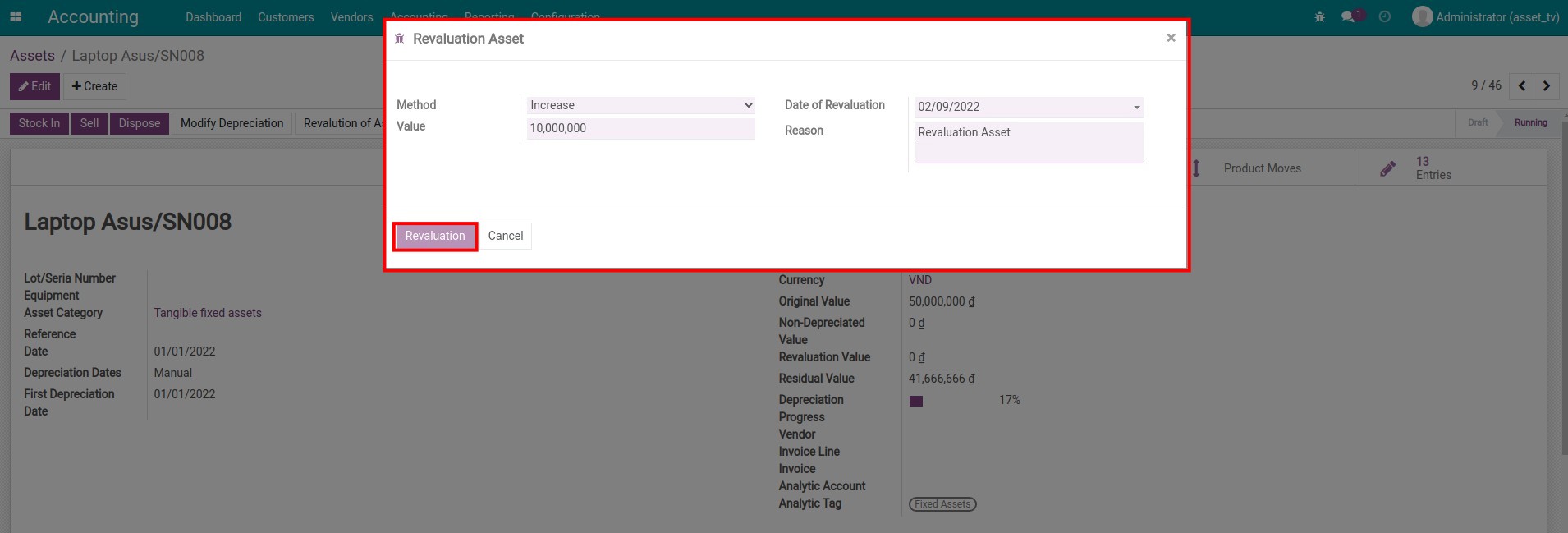

Asset Revaluation

Buying and stocking assets

Optional module

Stock Asset Equipment

Stock Asset

Assets Purchase

Steps to import opening balance

Steps to import opening balance

When you start working on the initial setup of iSuite Accounting management software, one of the most important tasks is importing the opening balance of accounting accounts. This article will show you not only steps to prepare and import the accounting opening balance but also some tips for specific cases that might happen during the importing process.

Requirements

This tutorial requires the installation of the following applications/modules:

Accounting & Finance

Data preparation

Before uploading data to the Viindoo Accounting software, you need to prepare the input data according to the Viindoo data structure. This step helps to reduce the data input time and manual modification later on, avoiding unnecessary mistakes while using the system.

Configure basic accounting information

Depending on your business management needs, you need to configure the basic accounting system before using. Some of the basic information such as: fiscal year, currencies, taxes and tax rules, etc.

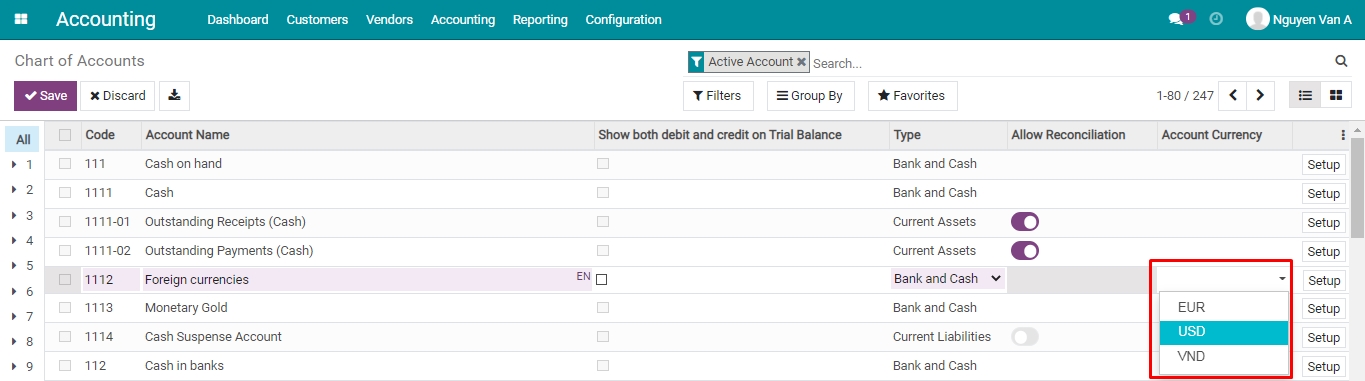

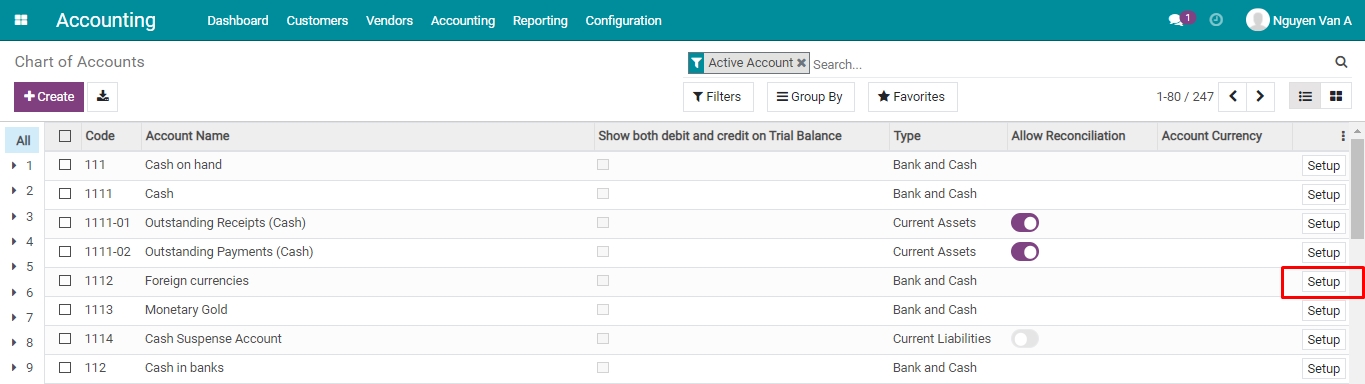

The accountant needs to review the chart of accounts that are being used, compare it with the ones provided by the localization packages in iSuite then create additional accounts according to the management needs.

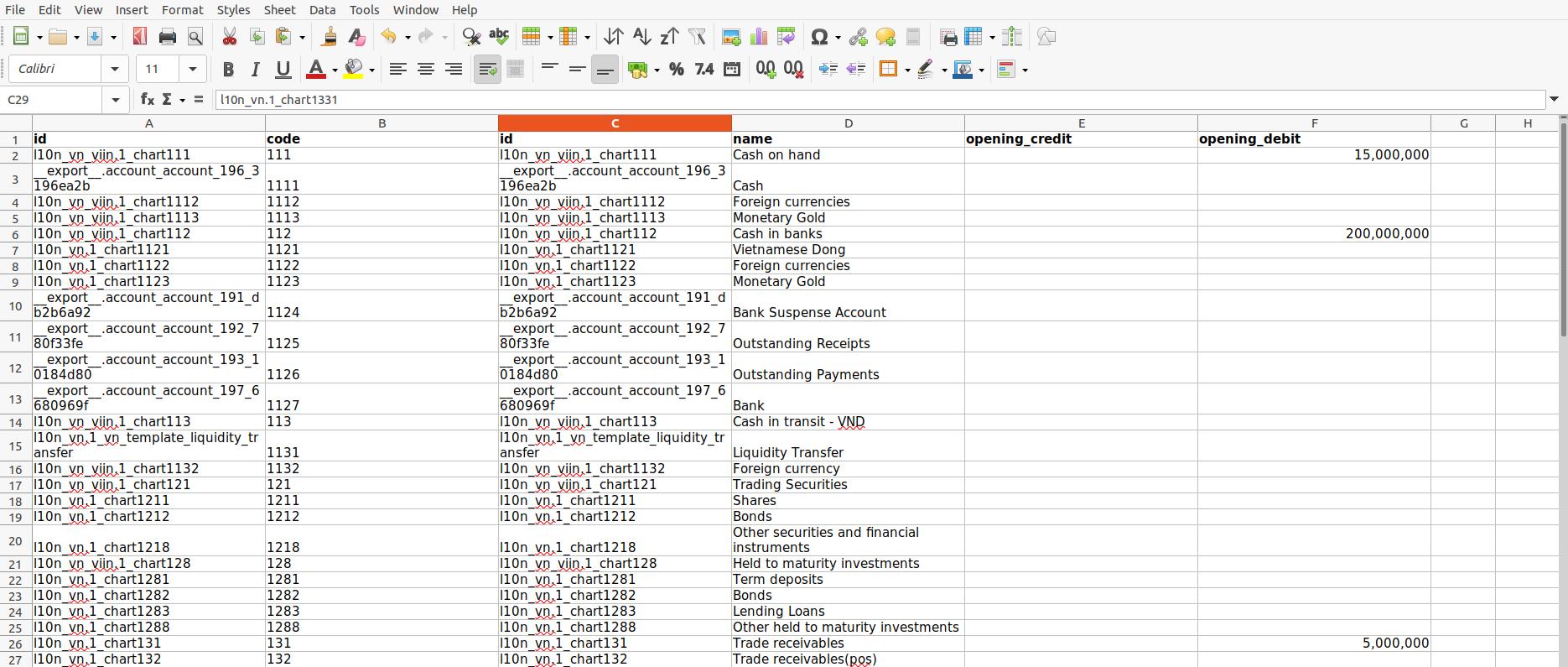

Prepare compatible input data for iSuite data structure

If your business has been in operation for a while, there must be some transactions and accounting data available. At the time of preparation for transfer, accountants need to close operations in the old bookkeeping system and prepare input data that is compatible with the data structure of the Viindoo system.

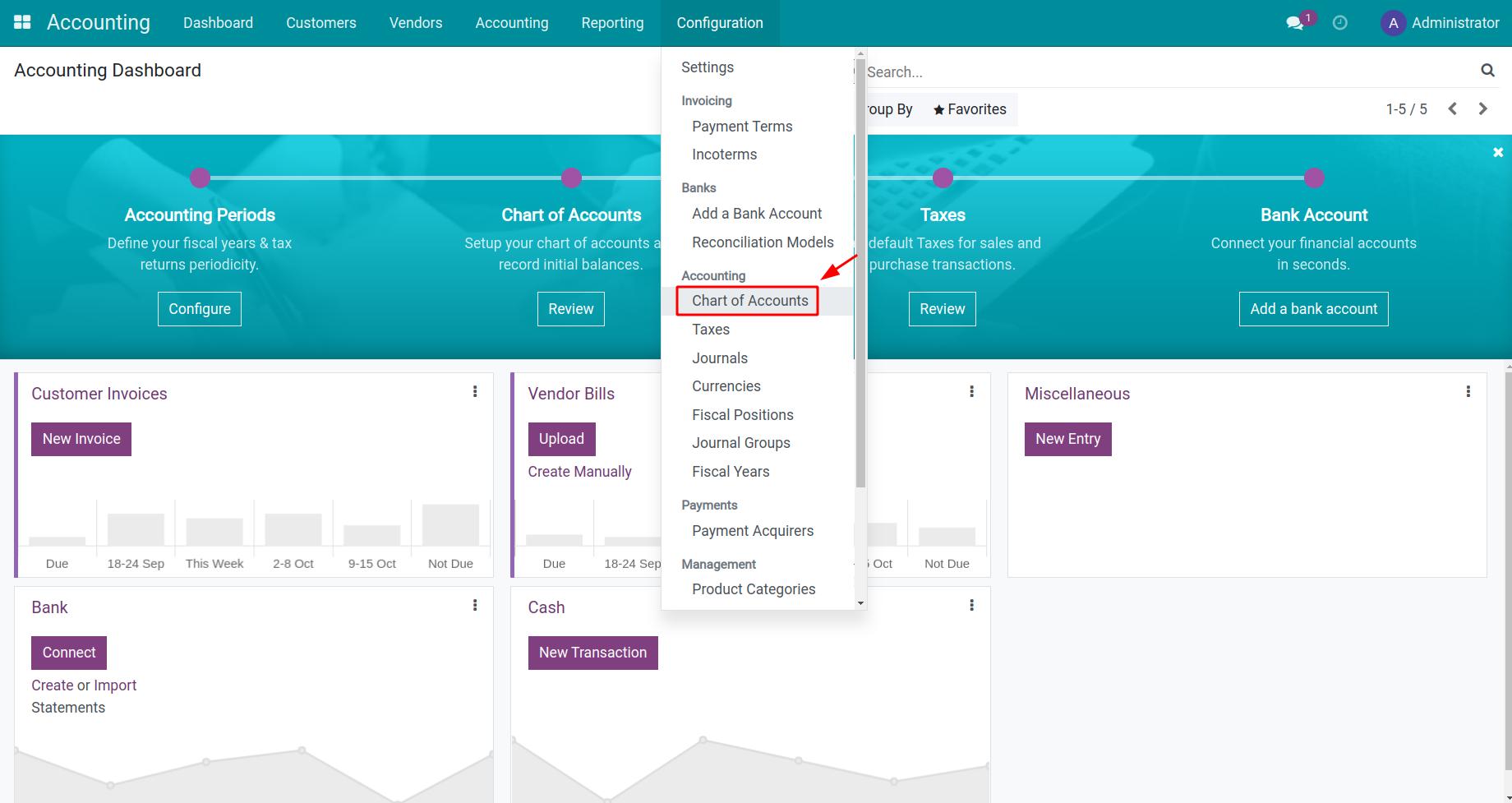

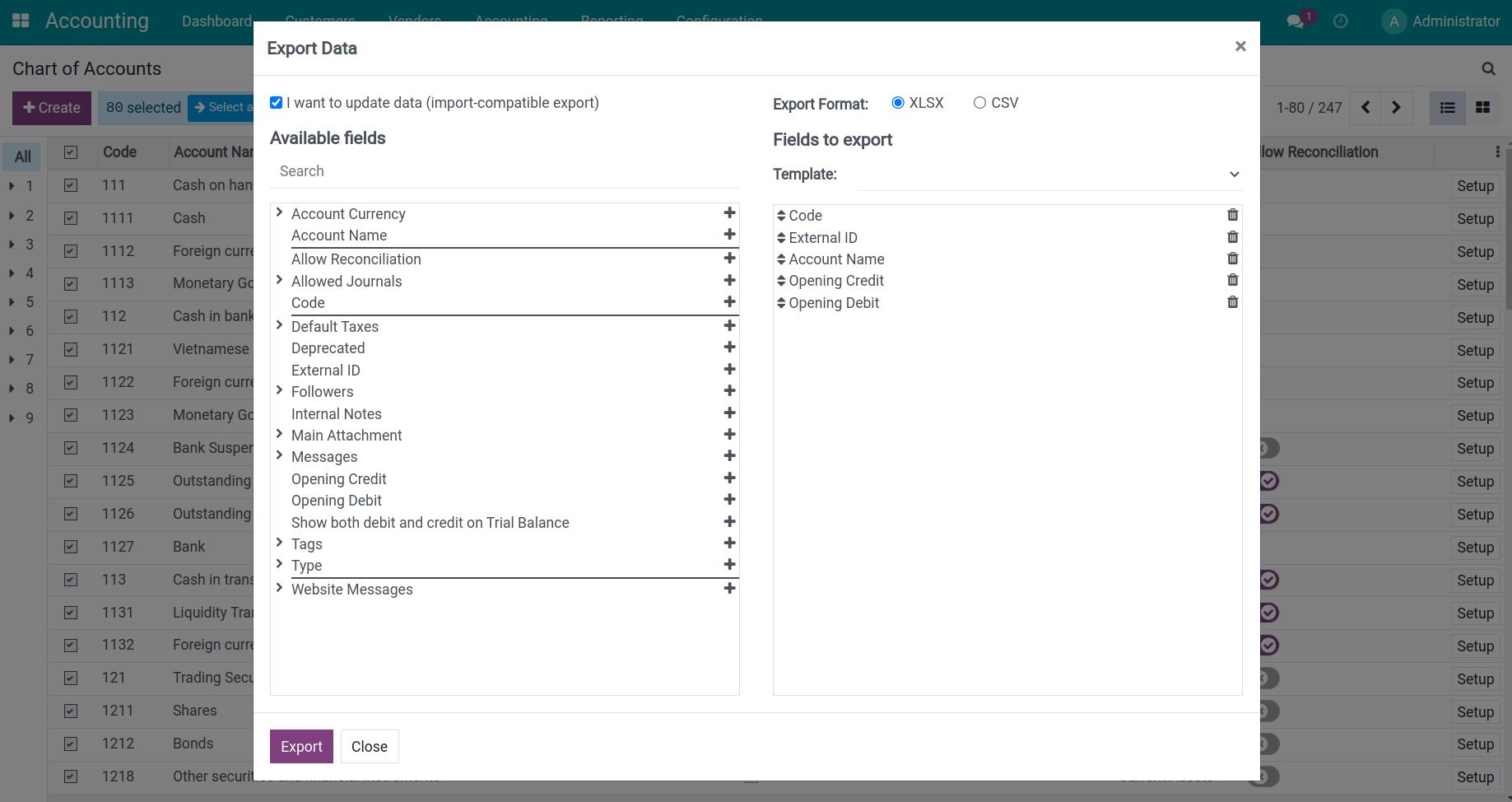

In the Accounting software, navigate to Configuration > Chart of Accounts to see the existing chart of accounts list in your system. From here, you can use the export data feature to download the data structure of the account in the Balance Sheet.

Export the following fields:

Account Code;

Account External ID;

Account Name;

Opening Debit;

Opening Credit.

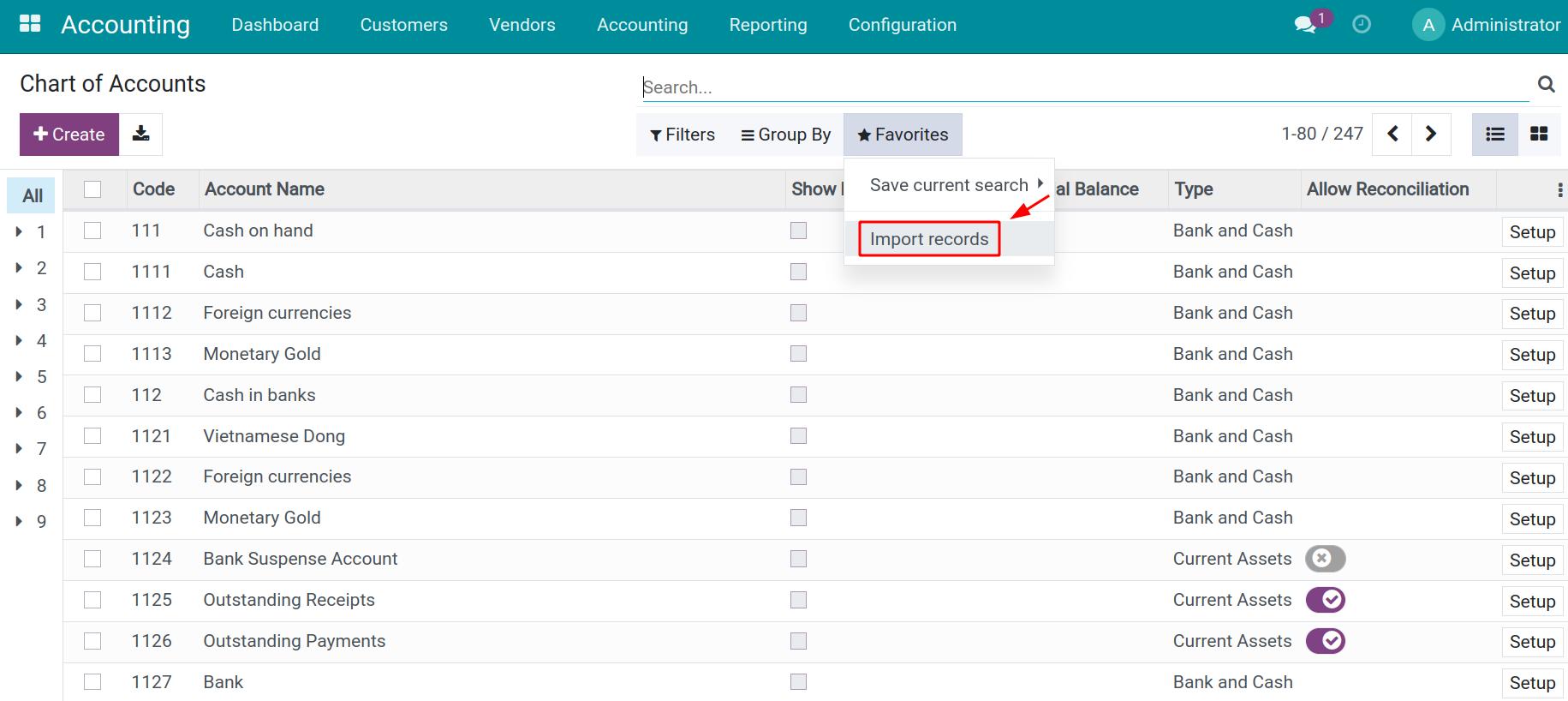

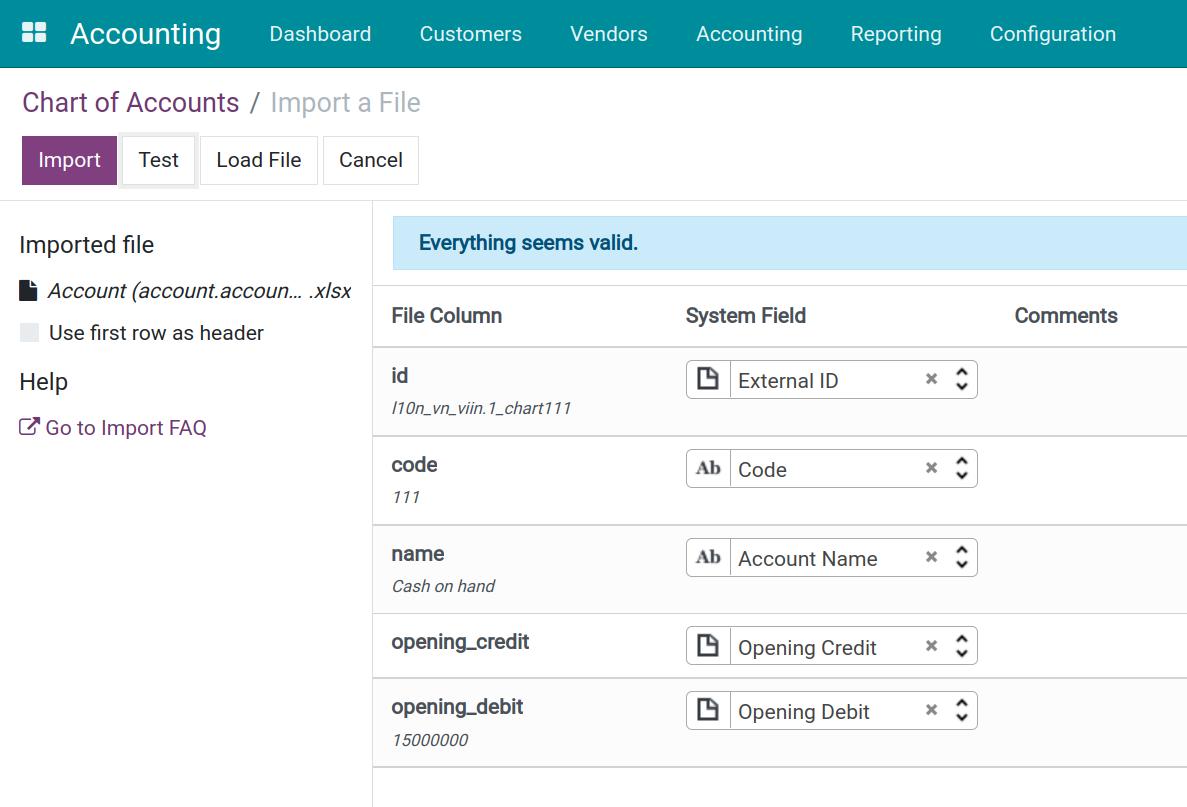

Import opening balance

Import opening balance in Chart of Accounts

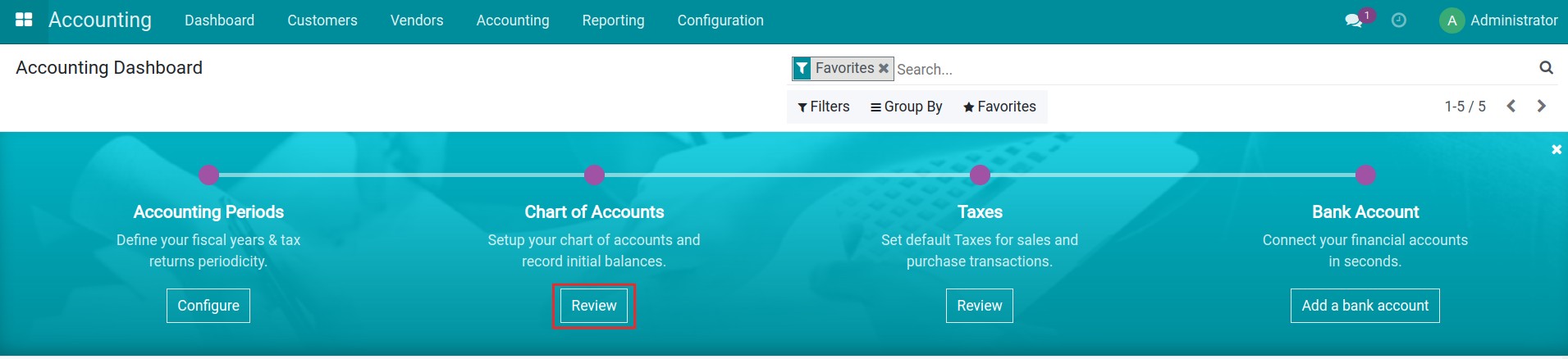

First, you navigate to Accounting > Accounting Dashboard > Chart of Accounts, select Review.

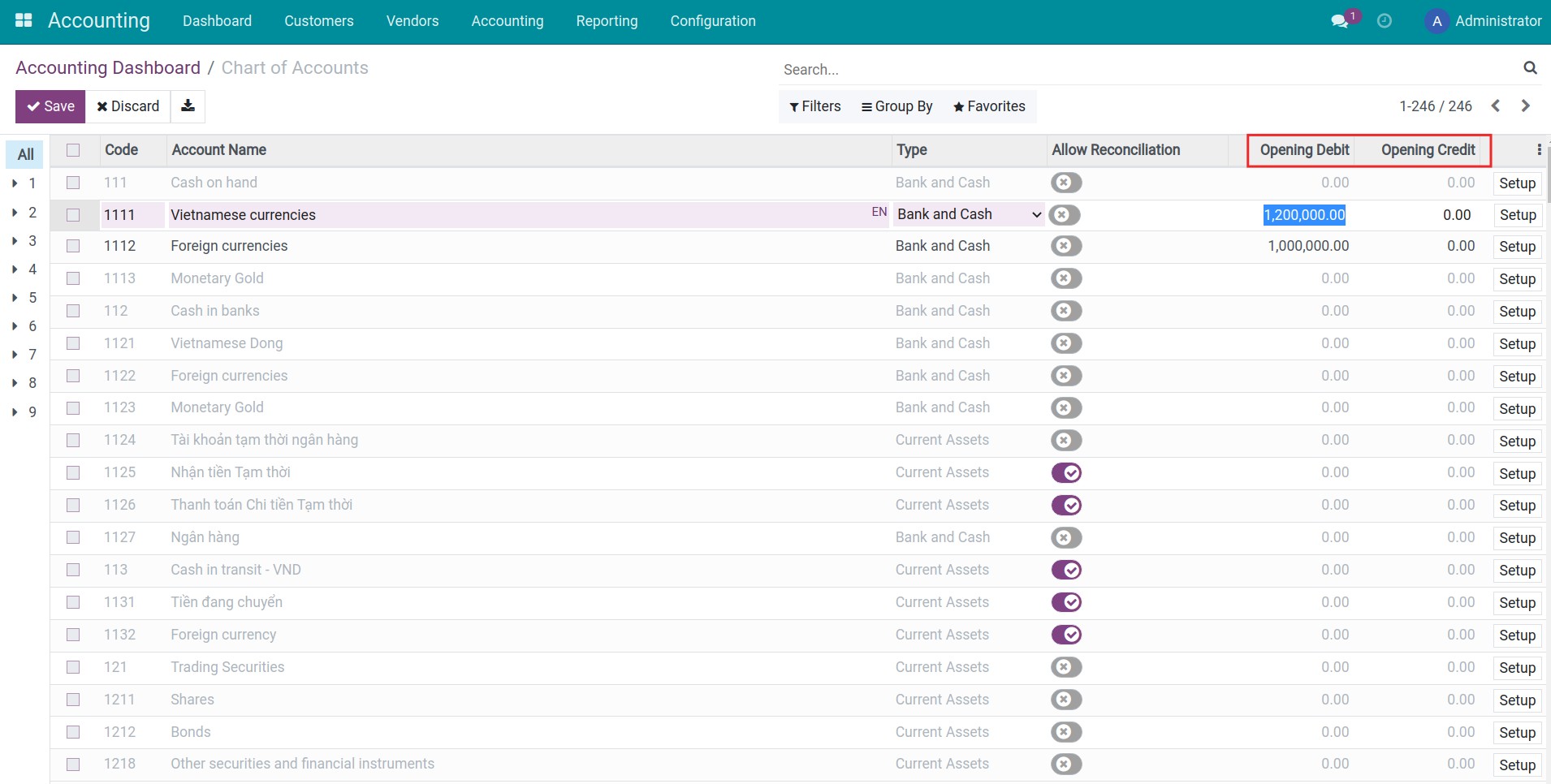

Here, you choose any account and fill in the balance in the field Opening Debit for Accounts with a balance on the Debit side and fill in Opening Credit for Accounts with a balance on the Credit side.

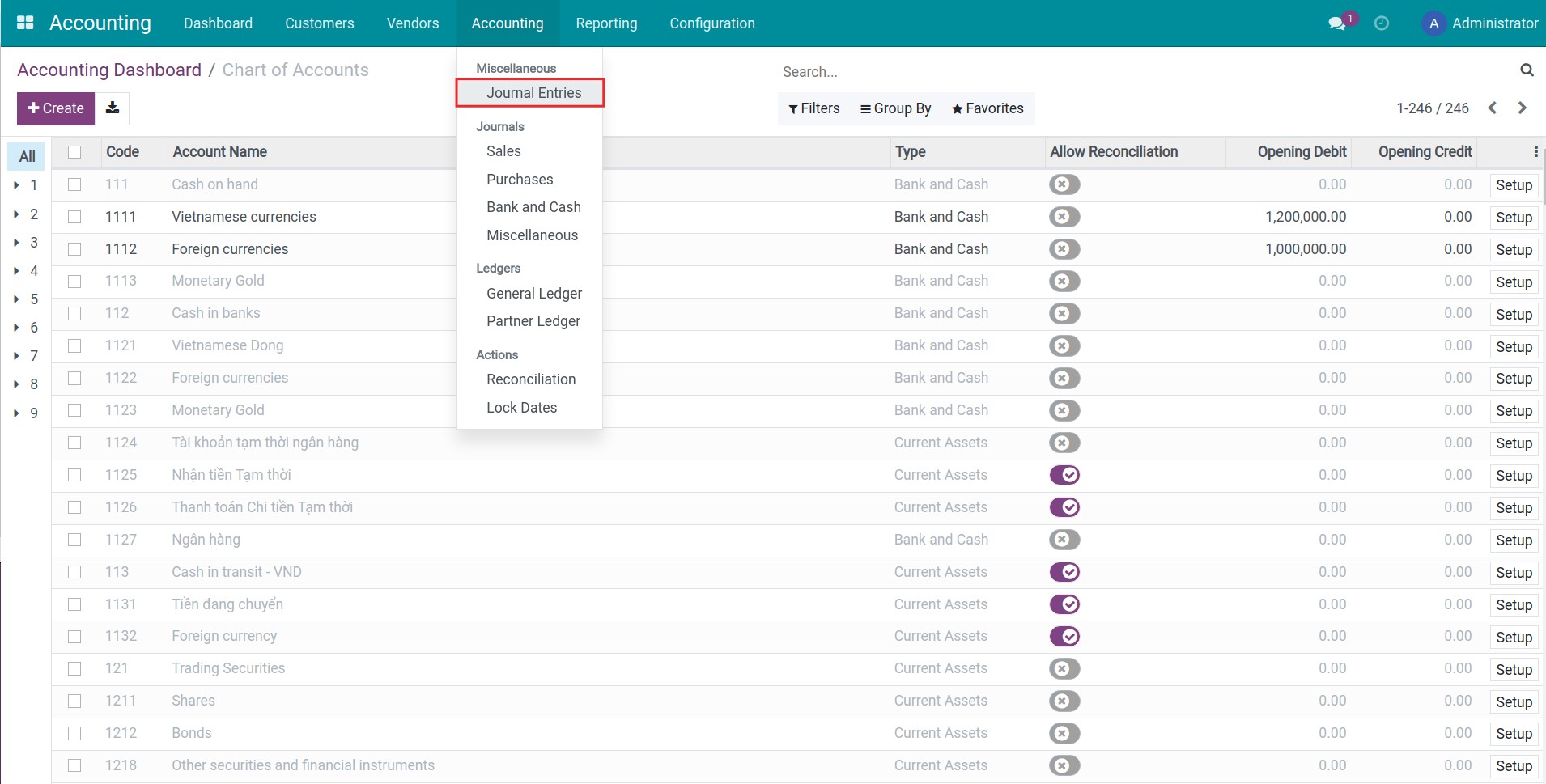

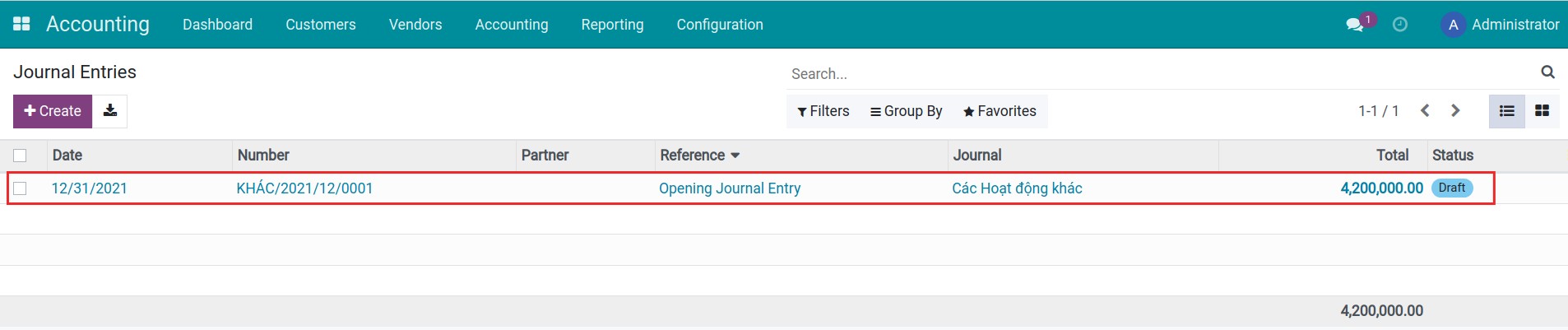

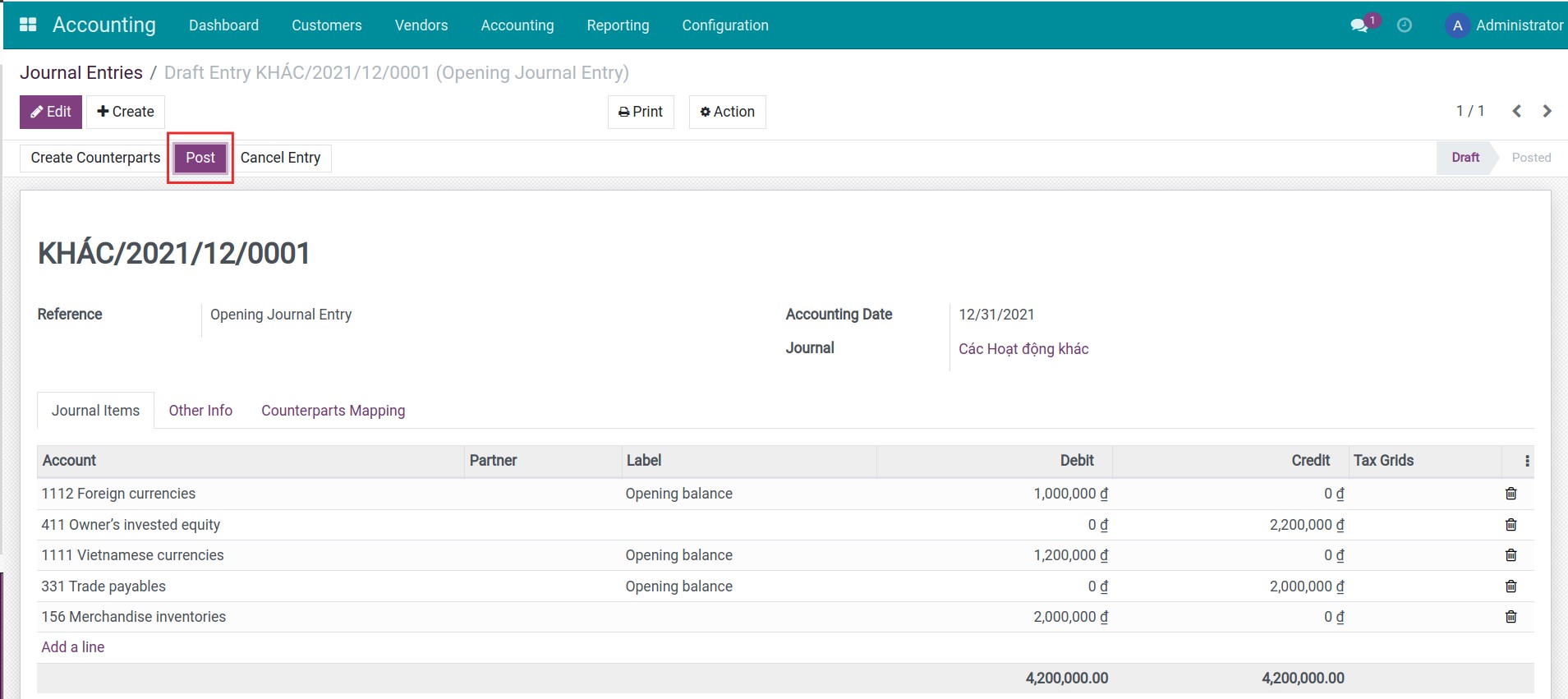

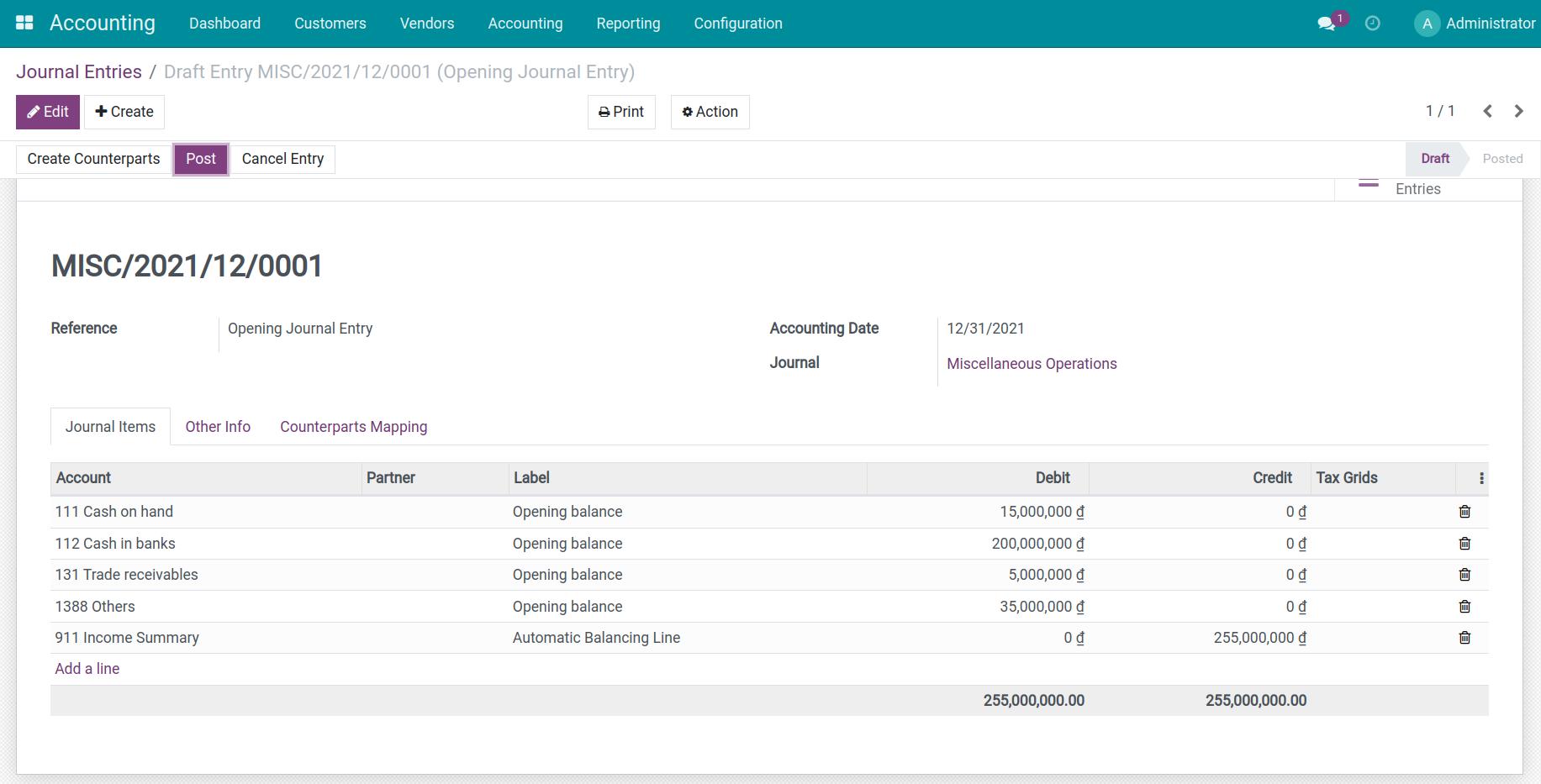

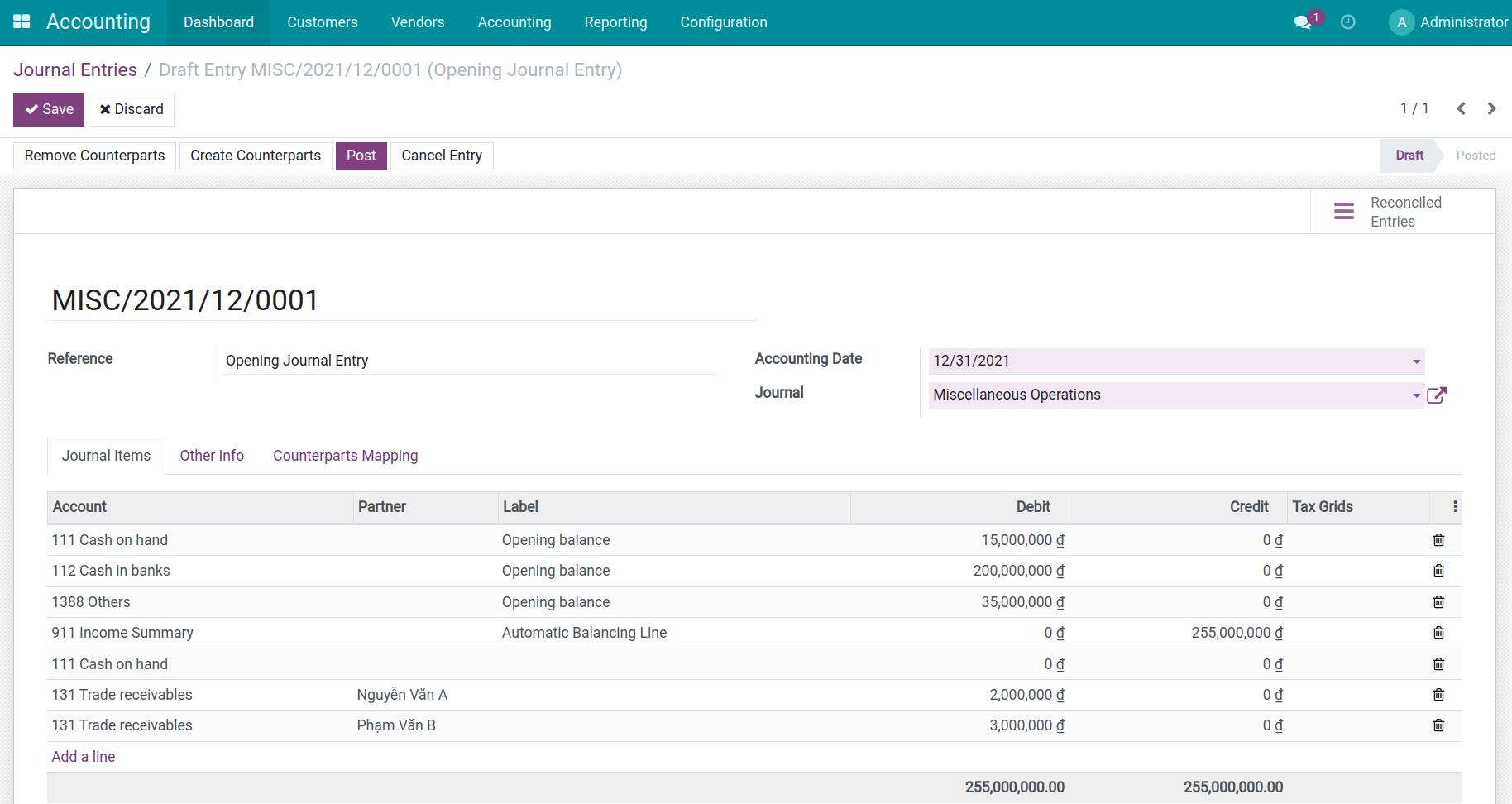

After filling in the opening balance for the Accounts, you navigate to Accounting > Journal Entries, select the entry with Reference as Opening Journal Entry.

You press Post to post the fill in the opening balance entries.

Note

When posting the the fill in the opening balance entries, the Opening Debit and Opening Credit fields in the Chart of Accounts will be hidden. Therefore, you need to add the opening balance of the accounts and then Post entries.

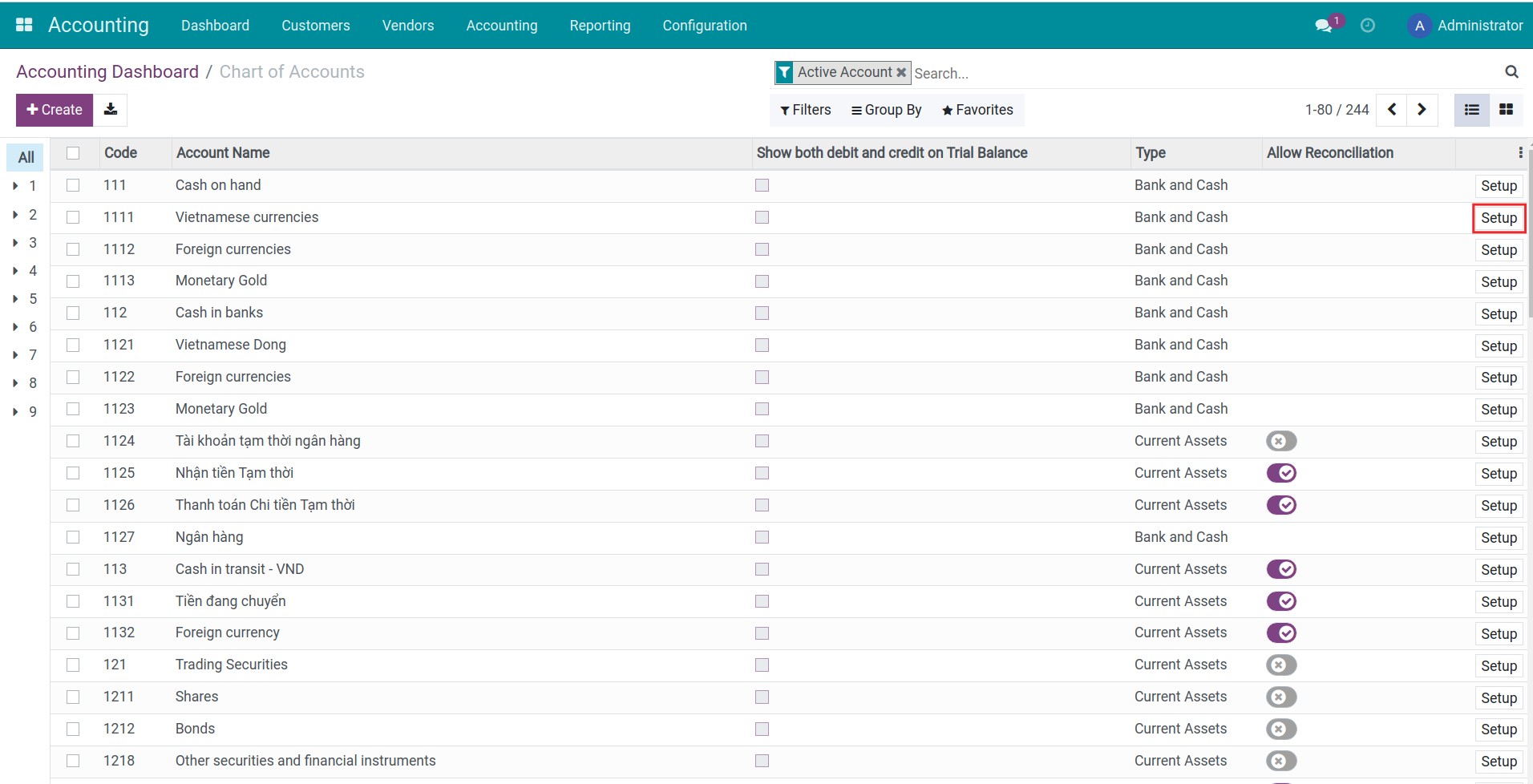

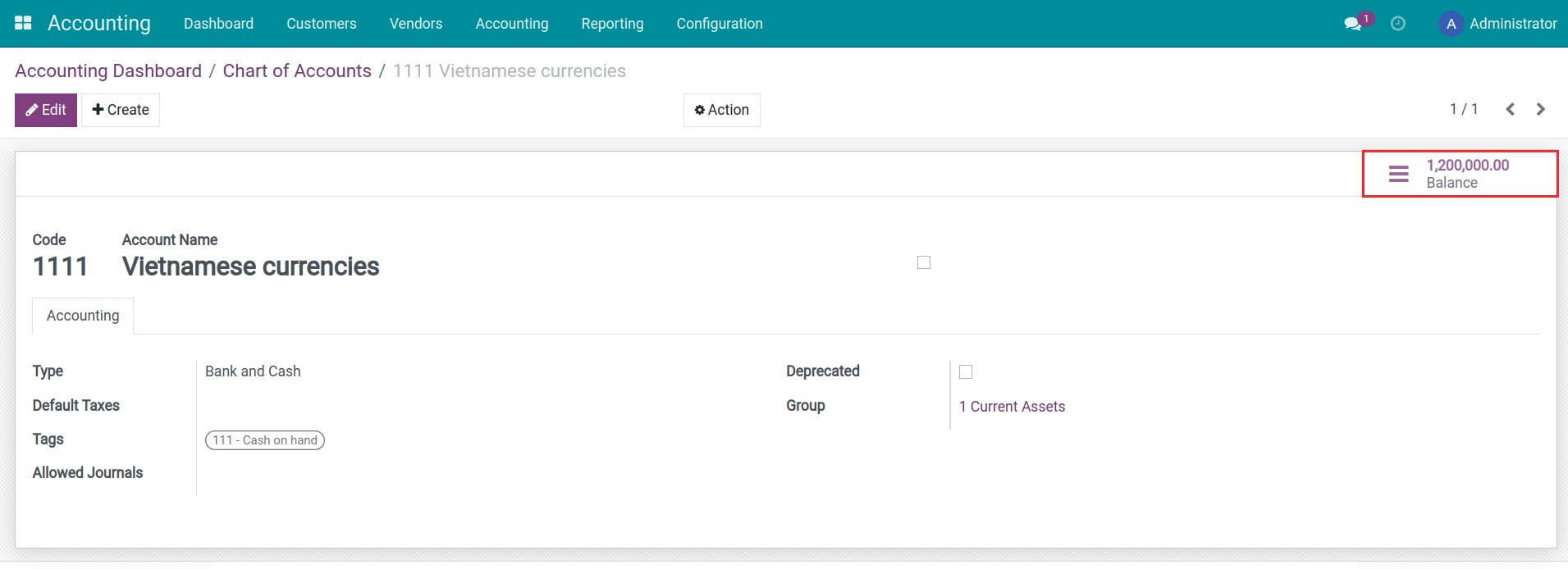

After posting, you navigate to Accounting > Accounting Dashboard > Chart of Accounts and choose Chart of accounts set, press Setup in each Account to see it’s balance.

Import data in bulk

On the data template exported from the system, add the opening debit and credit for each account.

The opening balance of each account should be the total balance until right before the moment your business officially starts using the iSuite Accounting system. On the other hand, pay attention and review the difference between the opening debit and credit, and make sure that Total Debit Balance = Total Credit Balance.

Tips for the data input process:

If your business possesses various bank accounts, you can create one accounting account for each bank account and import the opening balance with the data template.

For aged payable/receivable accounts related to various partners (such as 141 - Advance, 334 - Employee Payables, 131 - Accounts Receivable, etc.), the accountant can add the opening balance of the account, then create a journal entry to register the debit/credit amount of each partner.

The opening balance of inventory accounts (such as inventories in transit, materials, etc.) needs to be imported into the system from the Inventory software.

Note

Any difference between Opening Debit and Opening Credit will be registered in the 911- Income Summary by default. However, if you don’t want to use this account, create a new account named 999 to record this difference.

Account 999 will be reconciled with journal items created from the inventory adjustment and won’t be displayed on accounting reports.

After validating the data quality, from the Chart of Accounts view, upload the final opening balance data file to the system by using the import data feature.

Once finish importing the opening balance to the system, a journal entry with all the journal items is automatically created with an Opening Journal Entry label. To view this entry, navigate to Accounting > Accounting > Journal Entries.

Adjust opening journal entry data

On the opening journal entry, journal item of each receivable/payable account is automatically created with the total balance of that account according to your input data. For accounts that involve various partners at the same time, you need to split the total balance into different journal items, one partner per item with the respective opening balance.

In case there are many accounting transactions related to various vendors, customers, or employees, use the import data input feature to save time.

To accurately import data, include the following fields in the data structure template:

Partner External ID;

Journal items External ID;

Journal External ID;

Journal items/Debit;

Journal items/Credit;

Journal entry reference.

After reviewing the Opening Balance Entry with your real accounting data, press Post to finish the importing opening balance process.

Note

Accounts involving employees (for example 334 - Employee Payables, 138 - Other Receivables, etc.): Use the employee’s personal account as partner information.

Account 141 - Advance: Select the Employee Advance Journal.

See also

Related article

Steps to import opening balance for Asset

Accounting reports available in iSuite

Process of customer invoicing, payment and reconciliation

Title

Text!

Point 1.

Point 2.

Point 3.

Point 4.

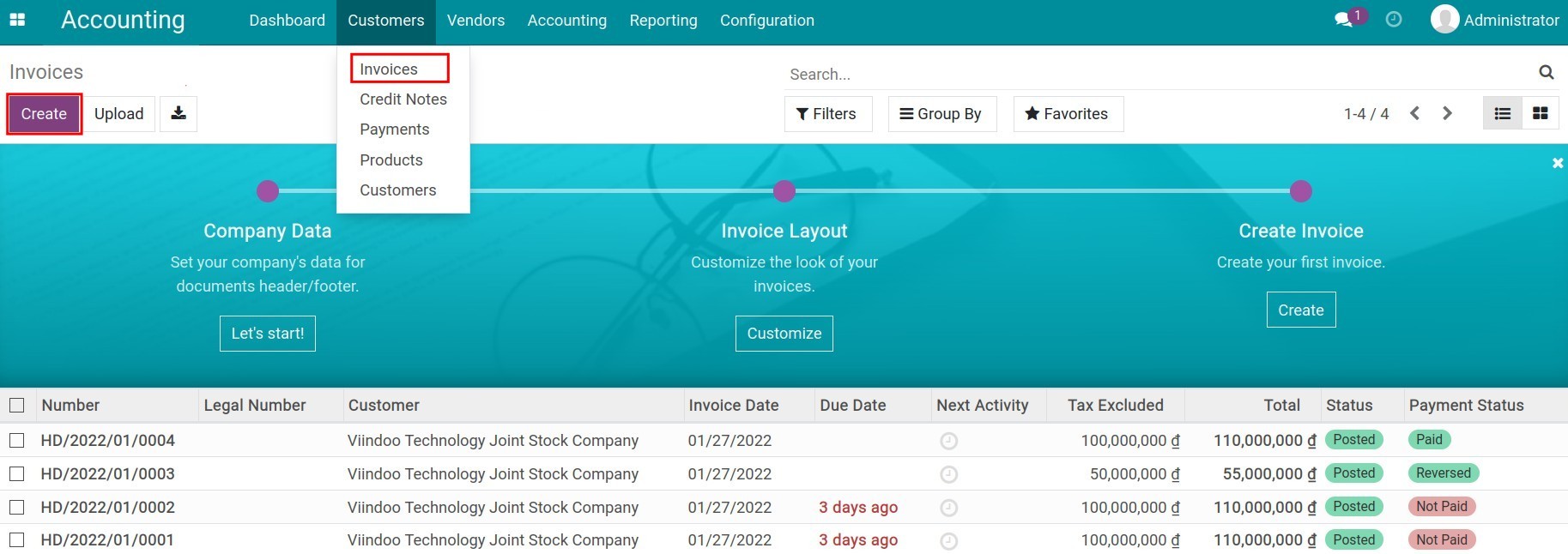

Process of customer invoicing, payment and reconciliation

Process of customer invoicing, payment and reconciliation

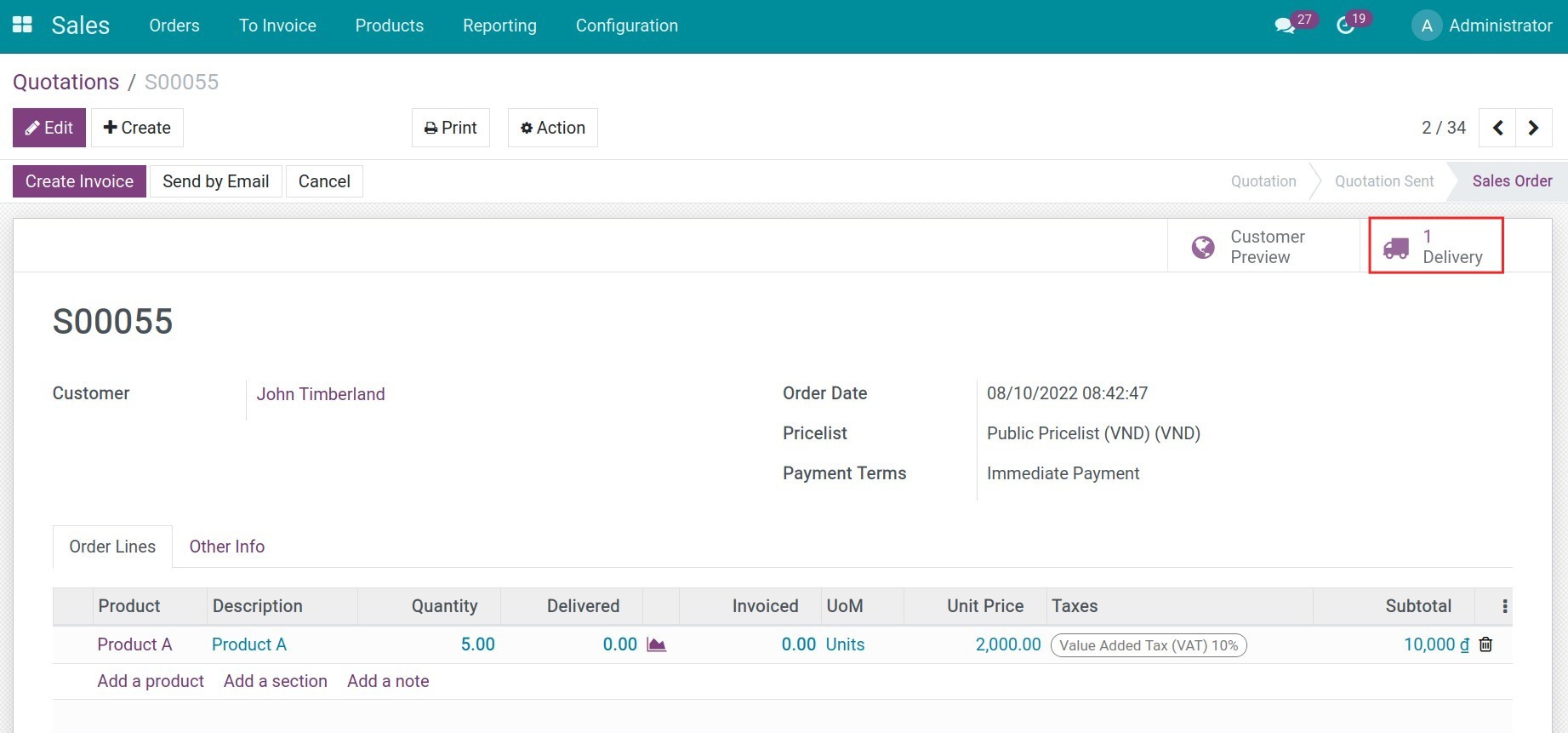

Each company has its own invoicing and payment policies and there might be even more policies applied flexibly on each product or service type. Therefore, in order to facilitate the process, Viindoo offers a versatile flow of invoicing and payments. You can choose to have:

Issue an invoice before delivering products;

Deliver products then issue an invoice;

One order per invoice;

One order split into various invoices;

One order per payment;

One order split into various payments;

One payment for multiple invoices;

etc.

Requirements

This tutorial requires the installation of the following applications/modules:

Accounting & Finance

Account bank statement import

Configure invoicing policies

iSuite Accounting app supports two invoice issuing methods:

Invoice what is ordered : Customers will be invoiced once the sales order is confirmed.

Invoice what is delivered : Customers will be invoiced only when the delivery is done.

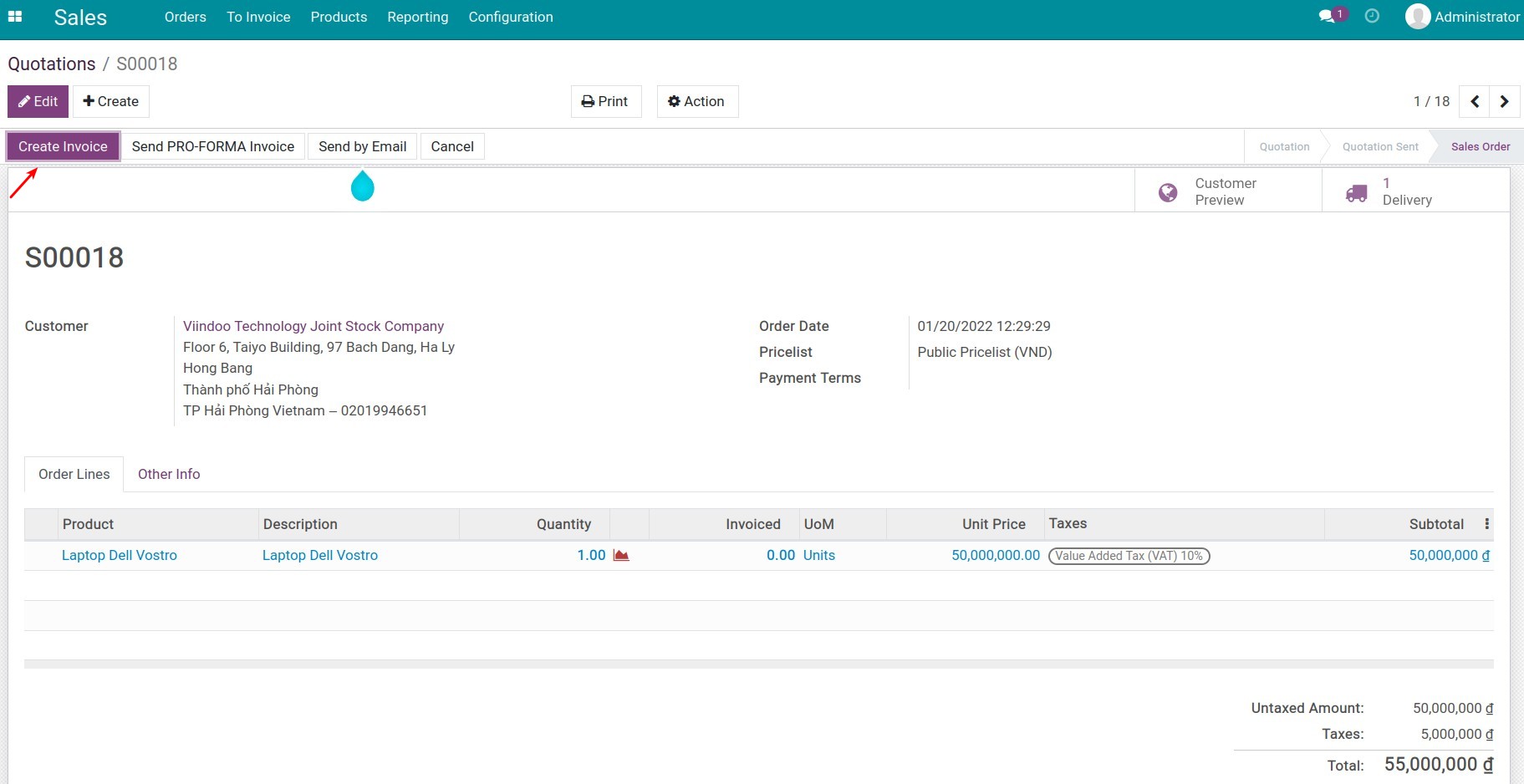

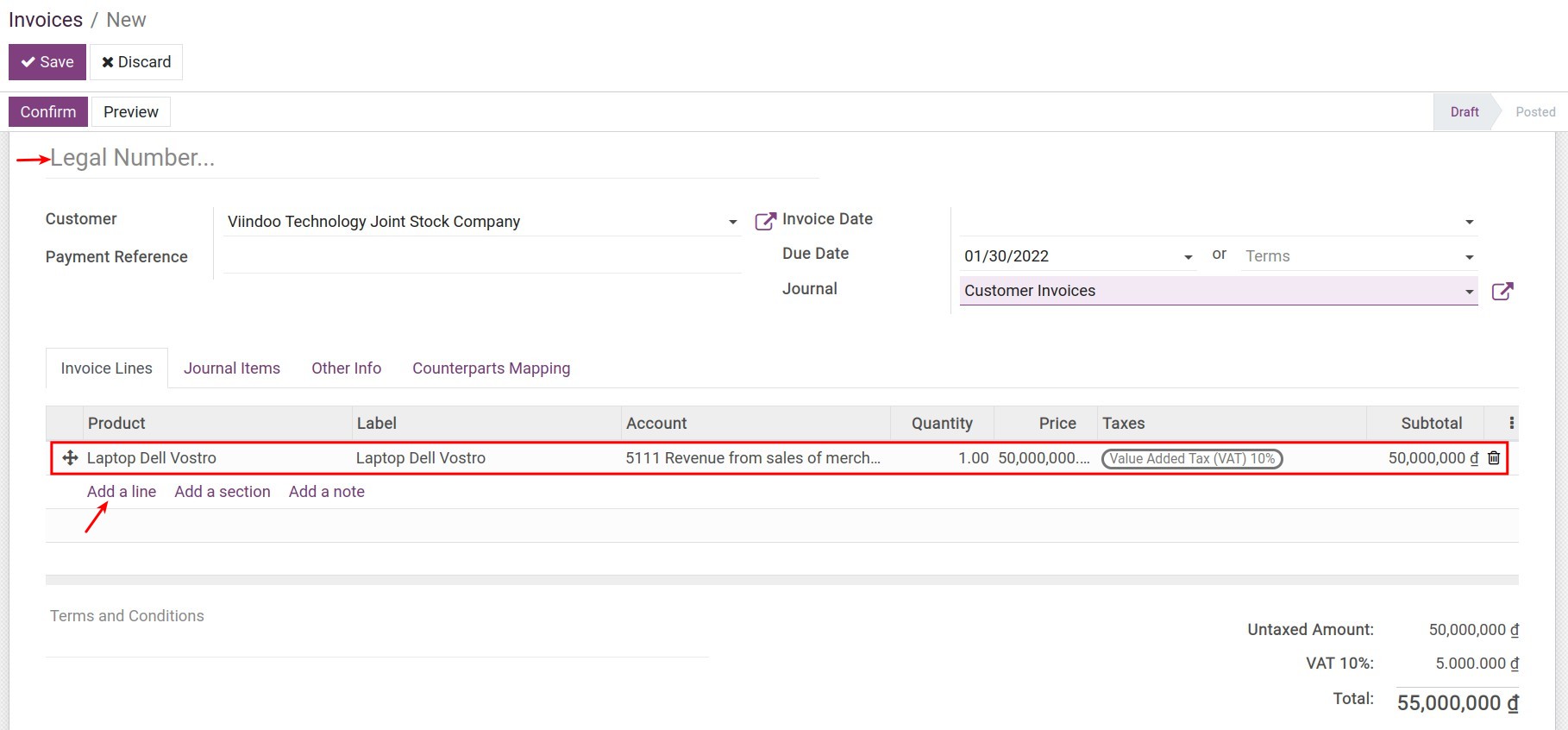

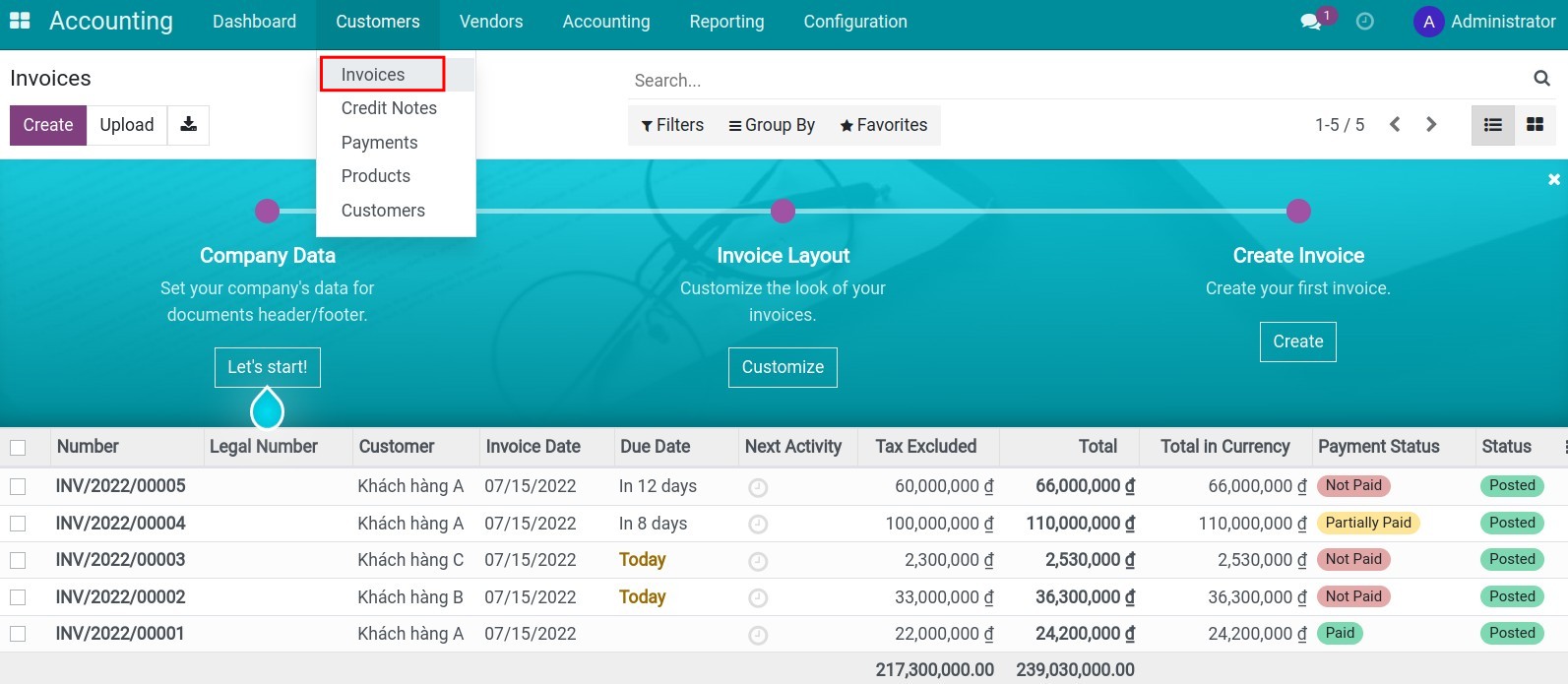

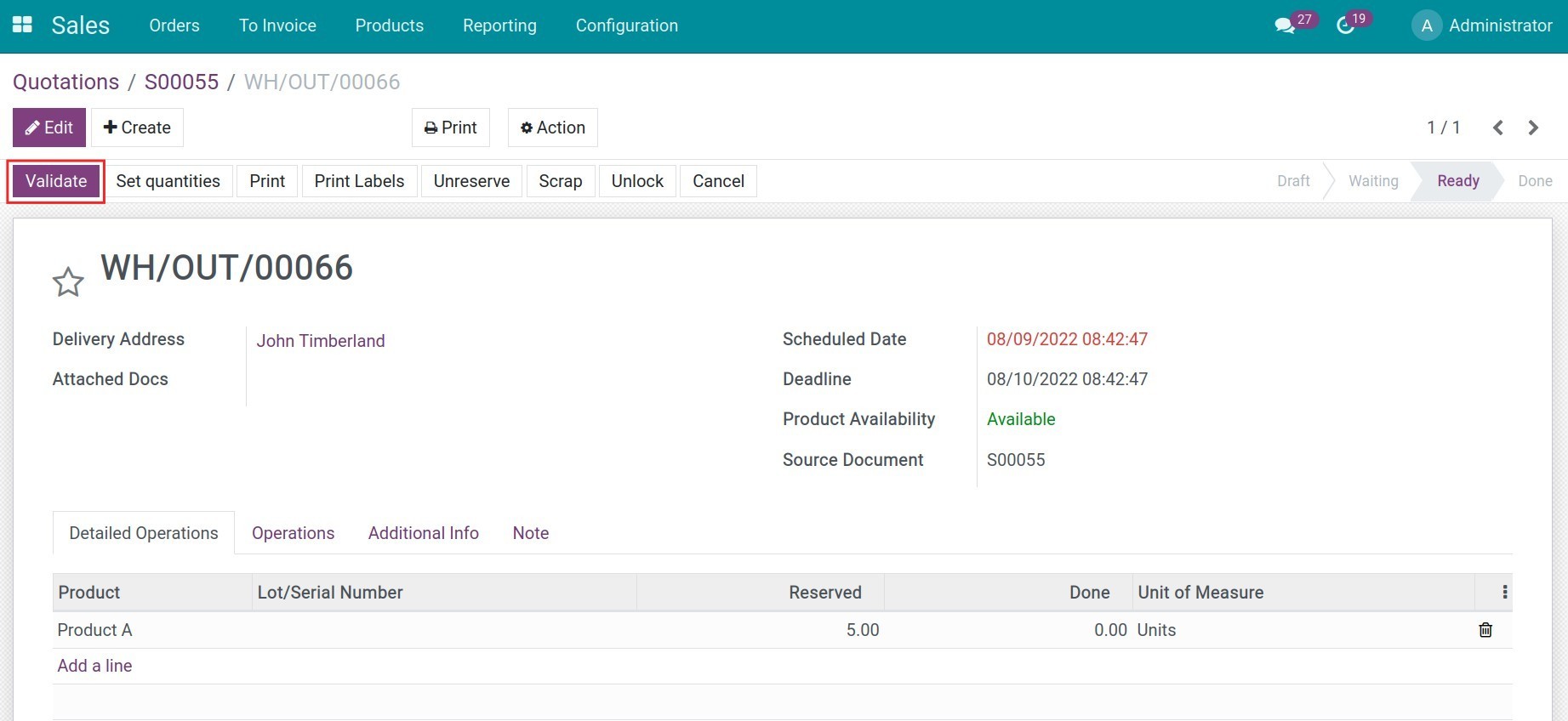

Create a draft invoice

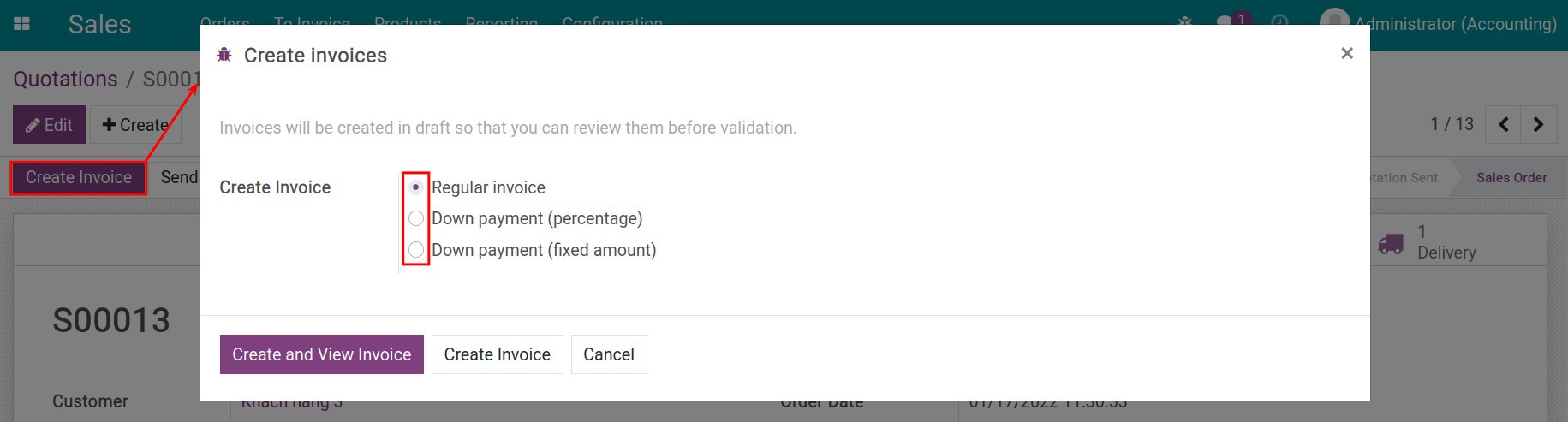

You can create a draft invoice in 2 ways:

Salesperson can create draft invoices right from the sales order interface . In this case, the created draft invoices will inherit all necessary information for payment such as information about the ordered product/service and delivery, information regarding payment terms, etc. from the sales order.

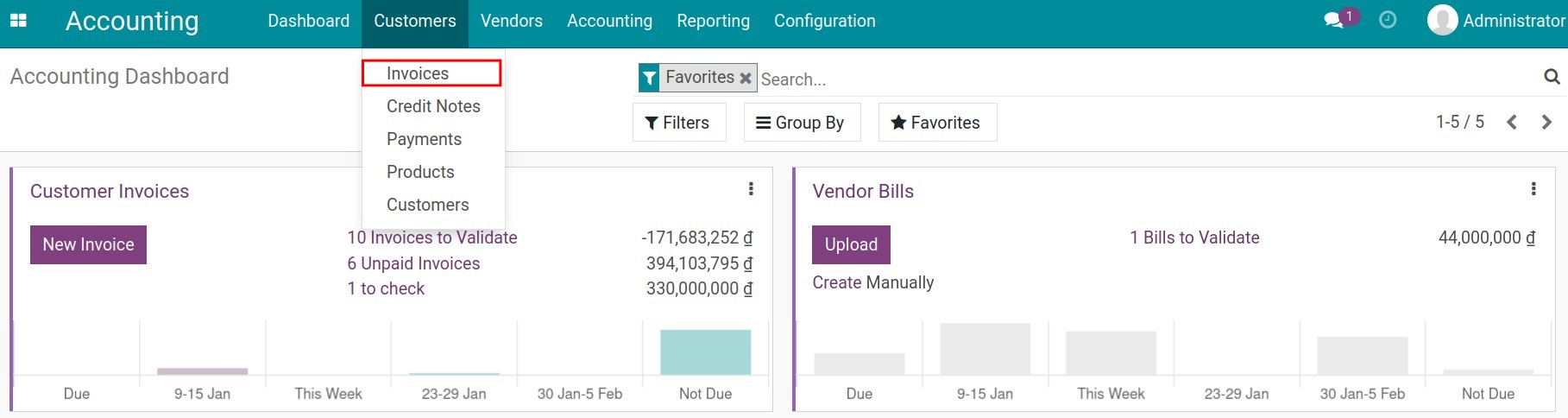

The accountant can also create a draft invoice by navigating to Accounting ‣ Customers ‣ Invoices ‣ Create.

Note

If you create a draft invoice from Accounting app, you can’t link invoice with the sales order.

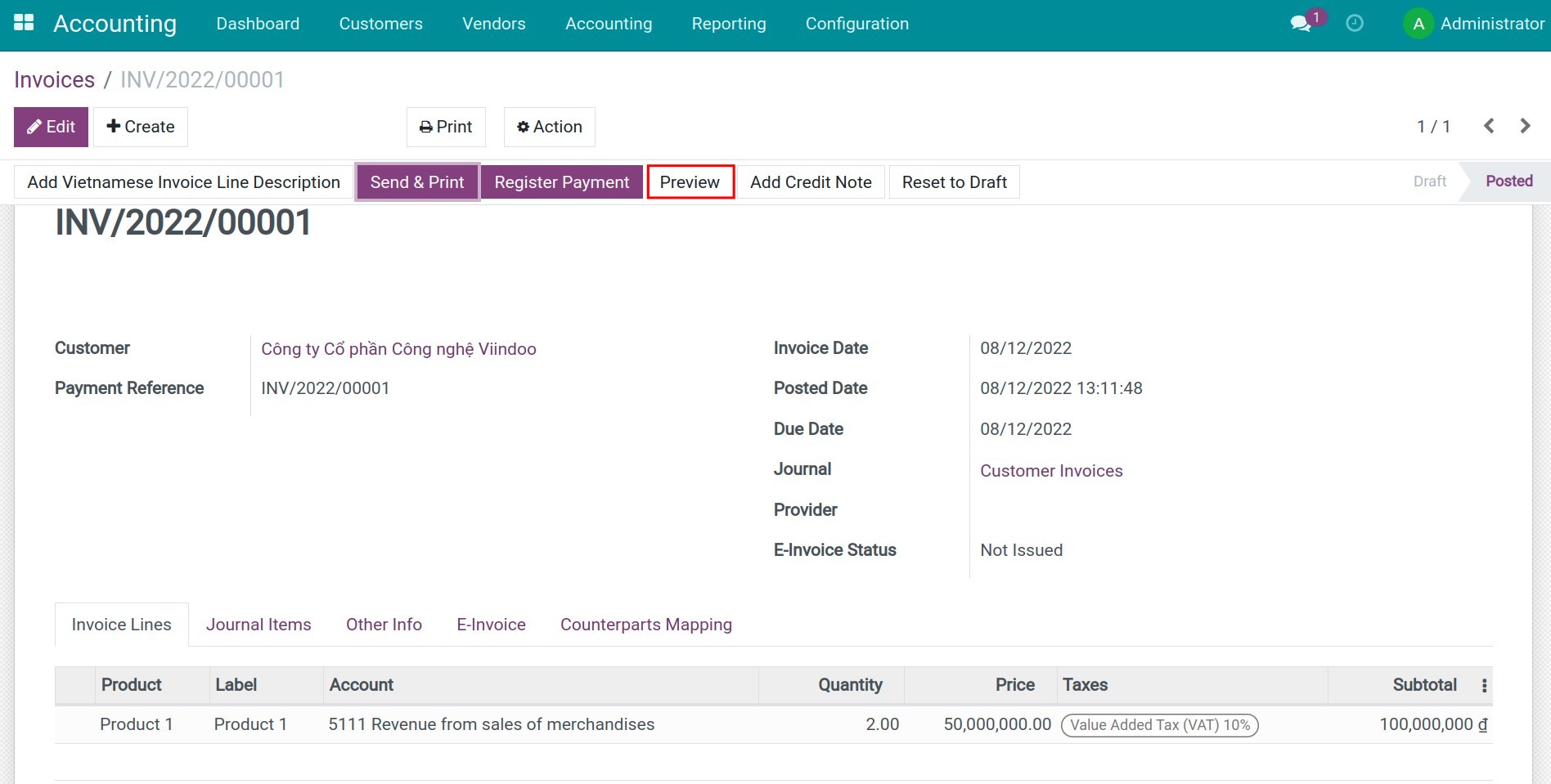

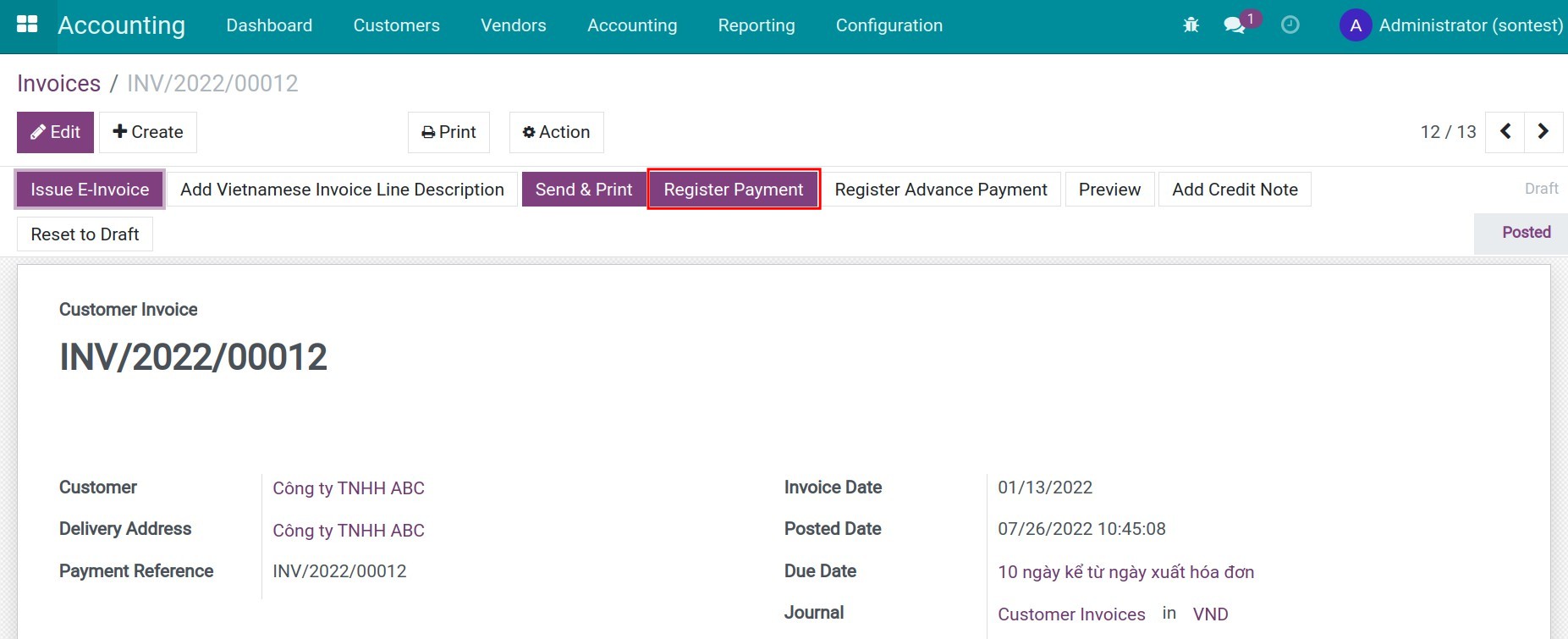

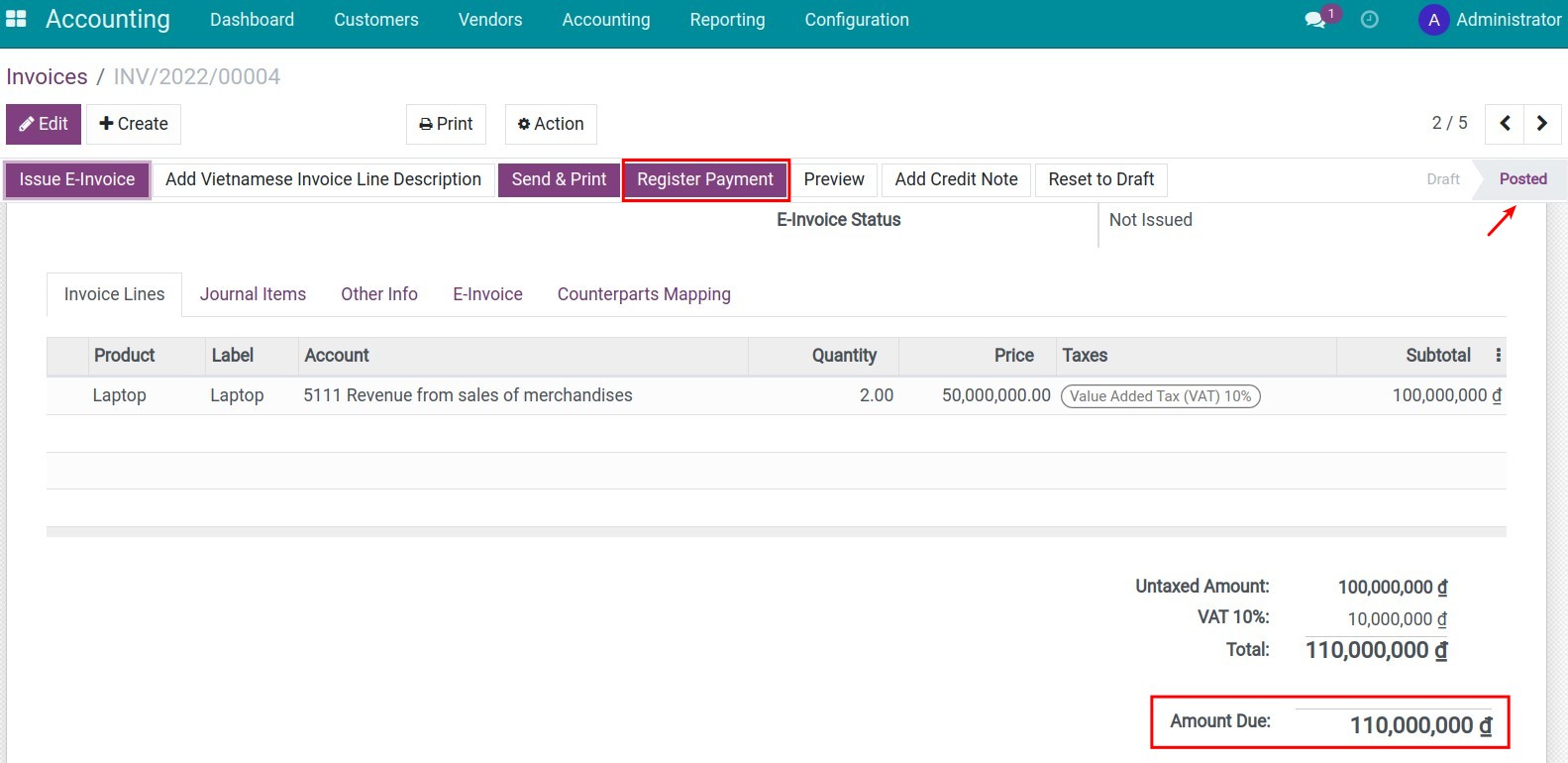

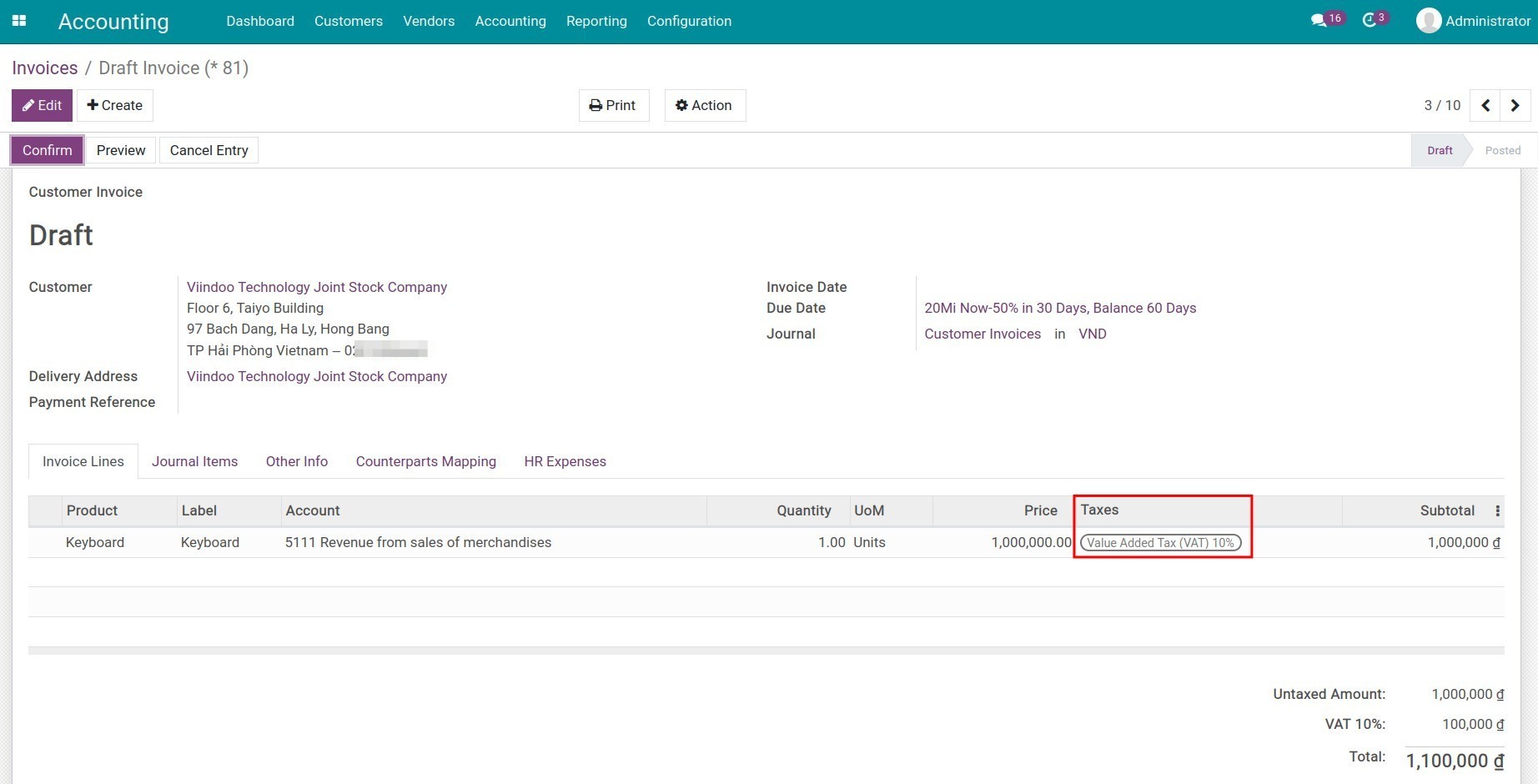

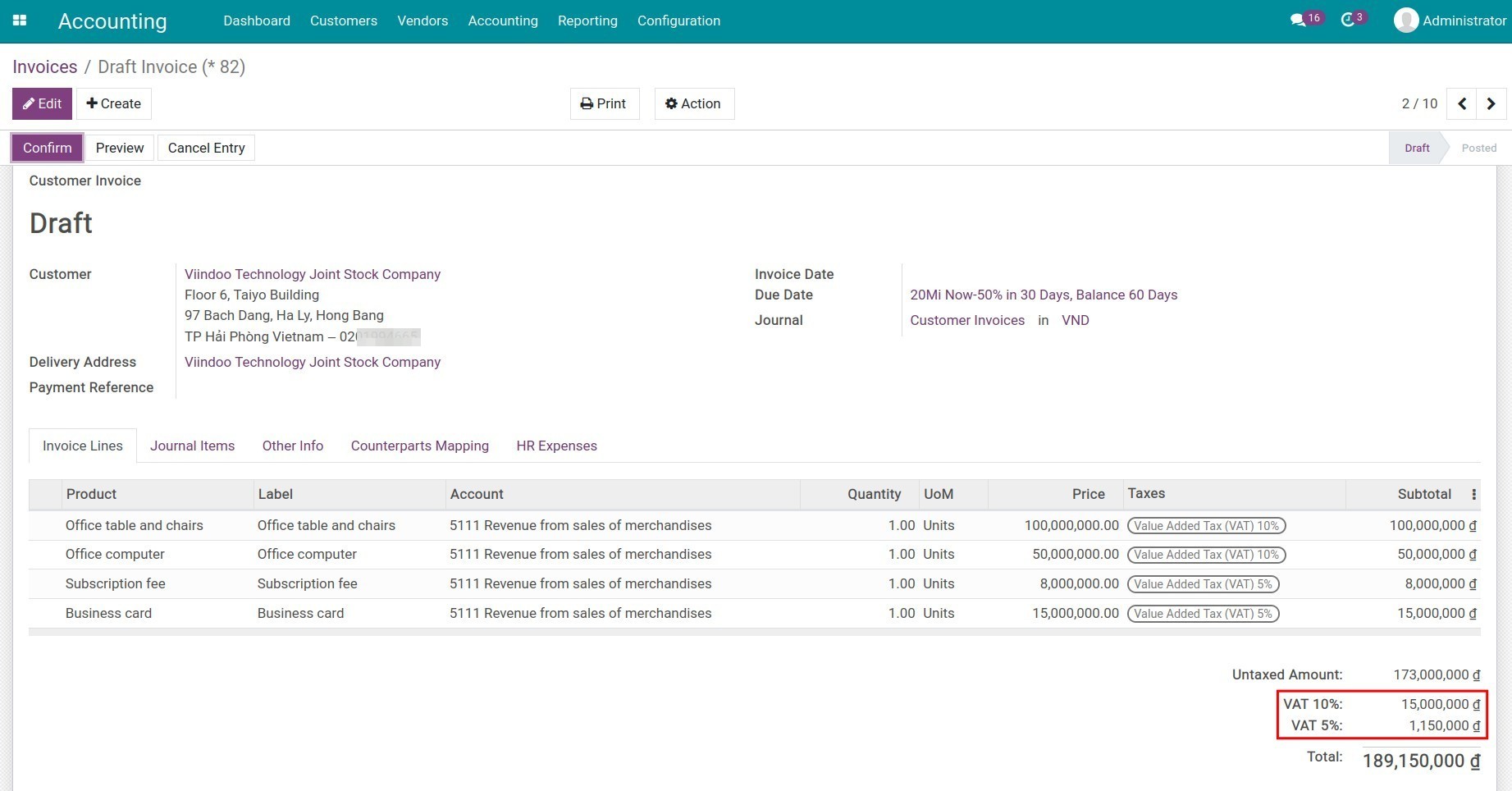

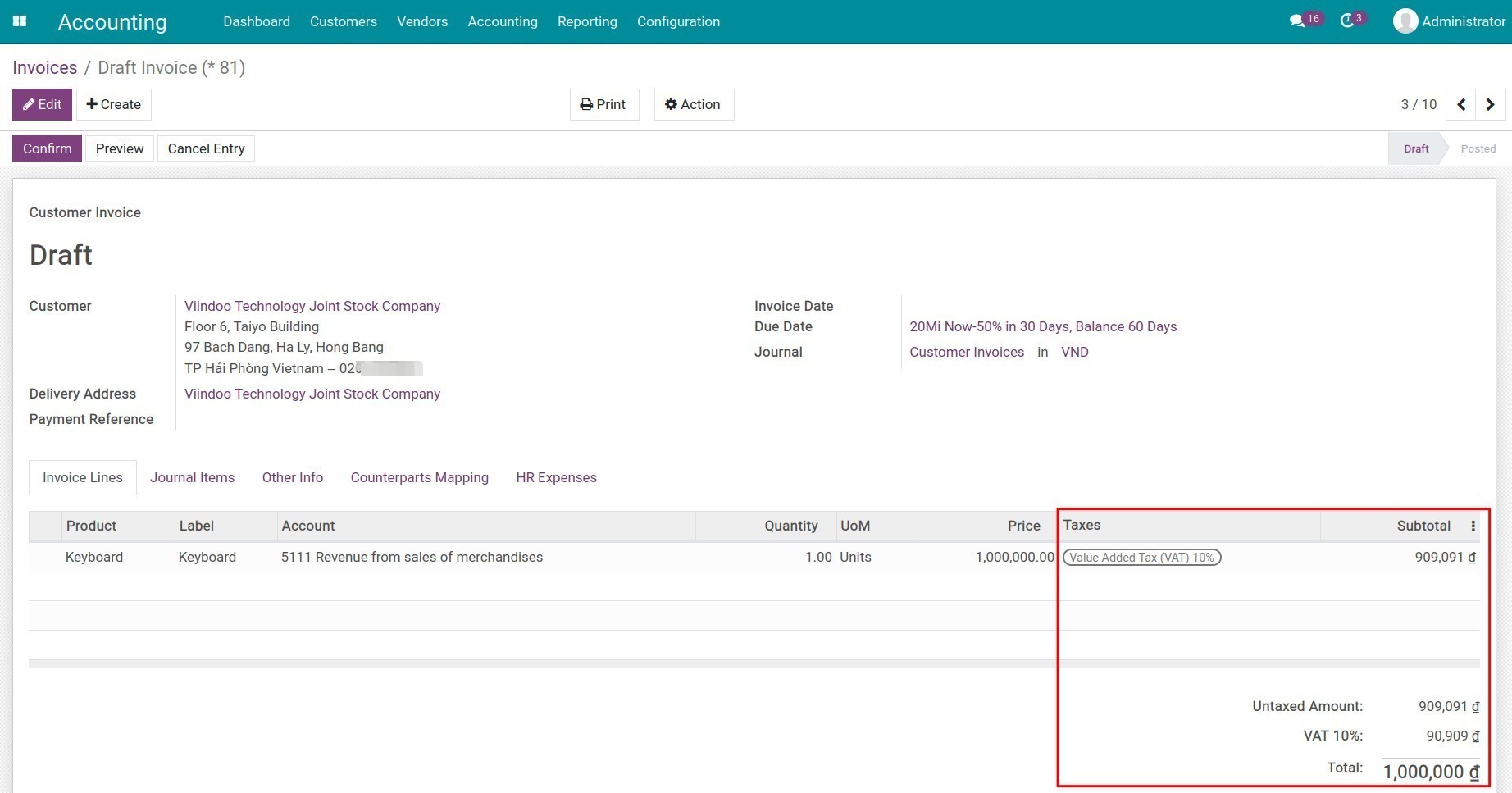

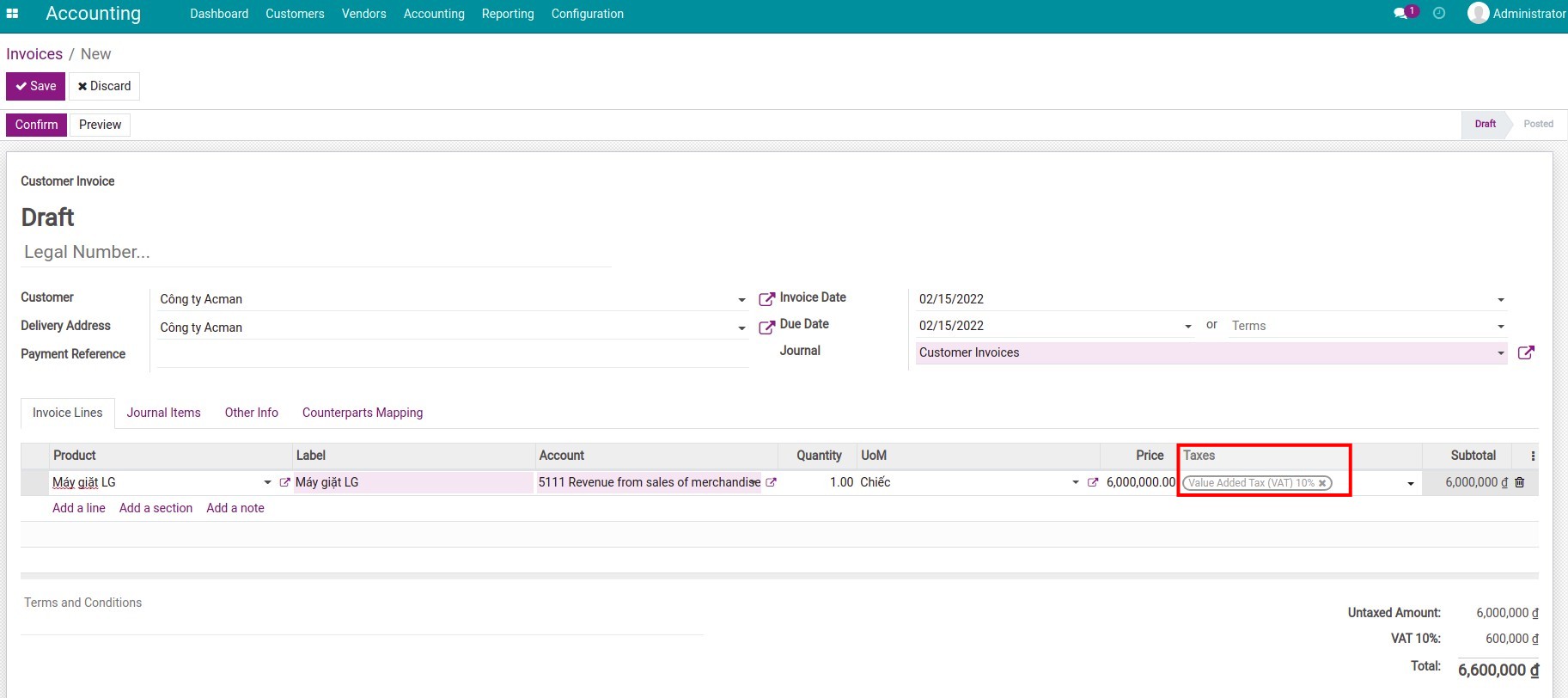

Confirm an invoice

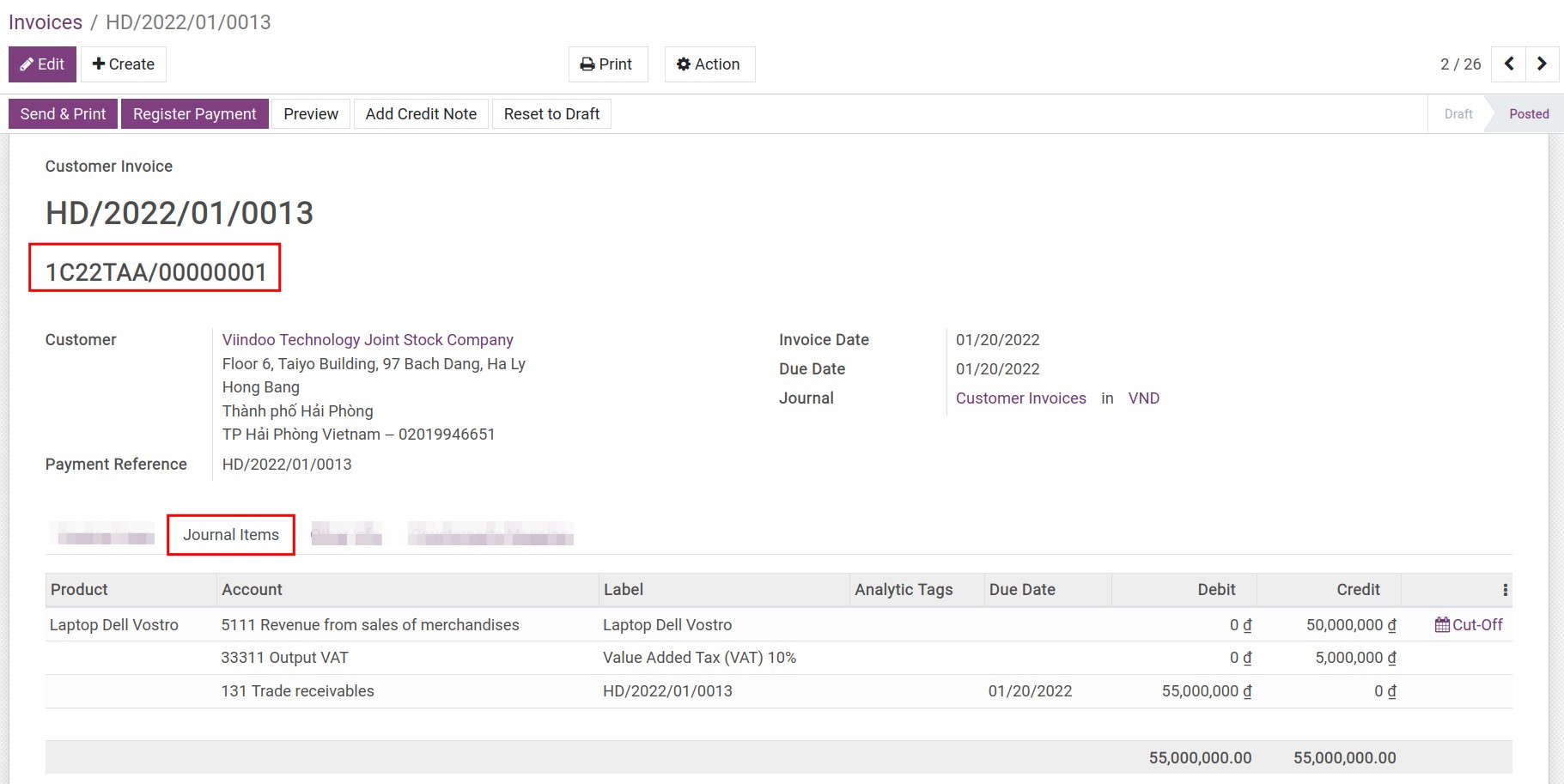

When an invoice is confirmed, a unique invoice number is created in Viindoo. On the other hand, you can also use the invoice number that is registered with your tax authority in order to reflect the transactions on tax reports:

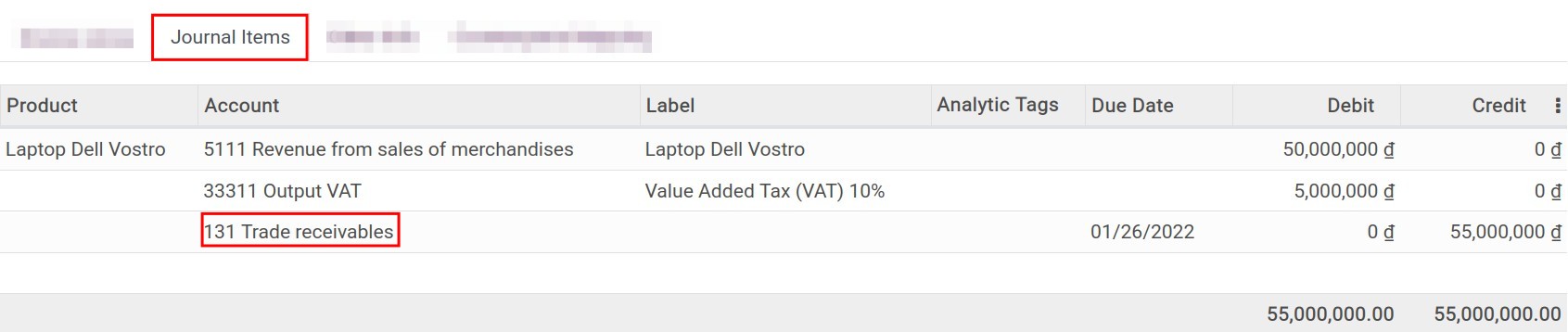

A single journal entry related to this invoice will also be posted once the invoice is validated. You can see more details of the entry from the tab Journal items on the invoice form view.

Note

Invoices in draft state will have no impact on the accounting system numbers. Only when these invoices are validated then the new data is recorded and updated in accounting journals.

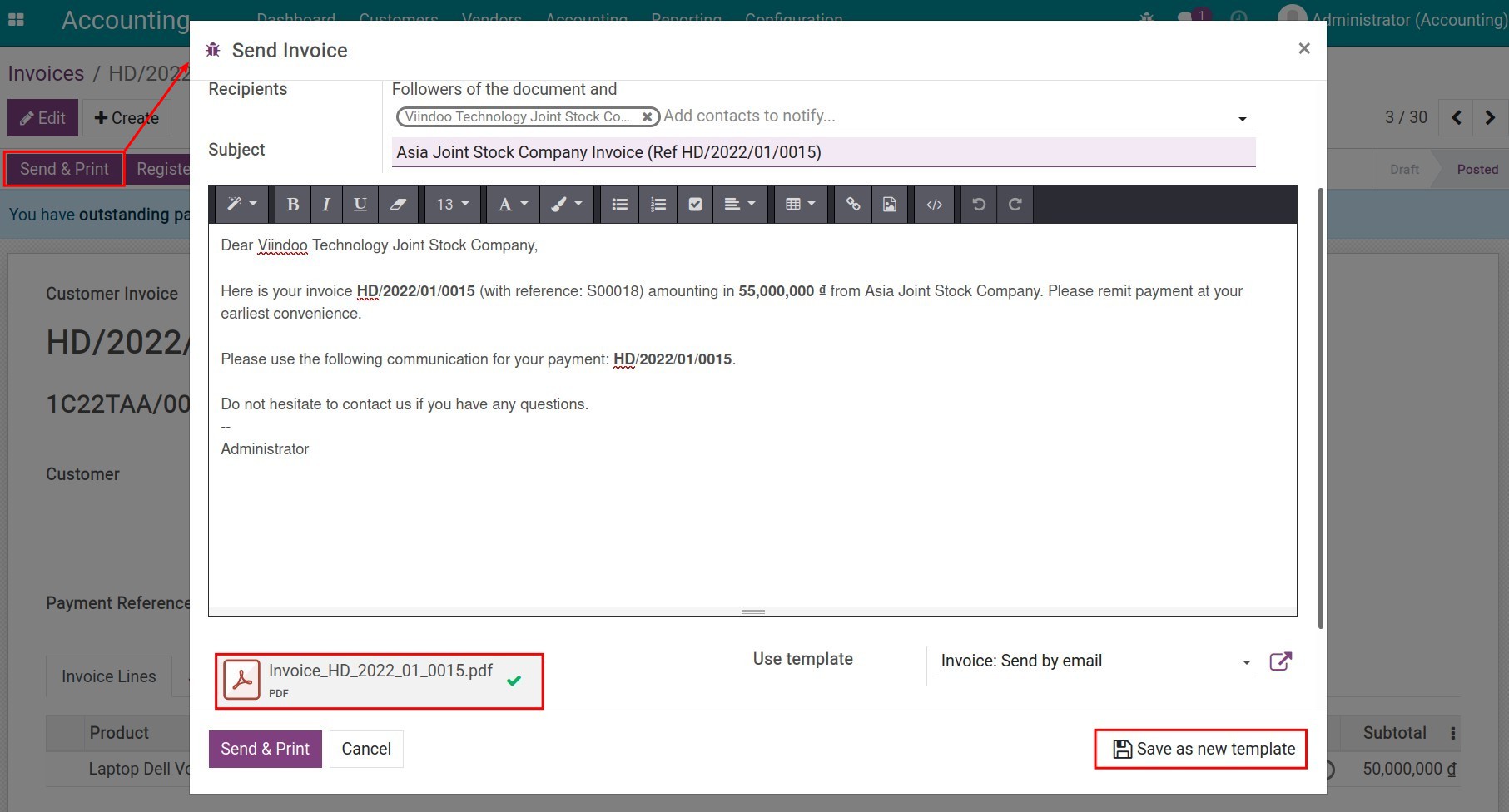

Send invoices to customer

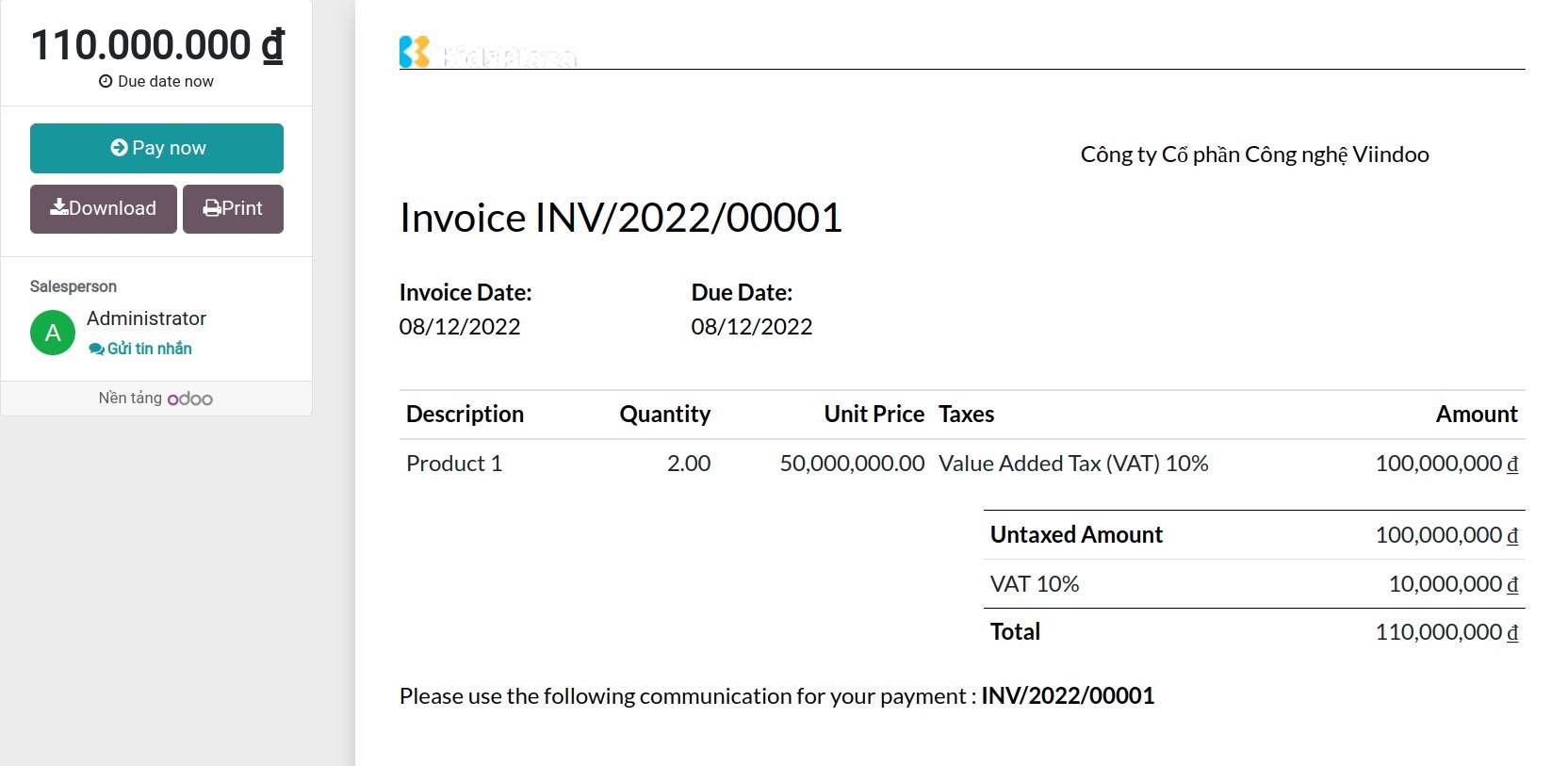

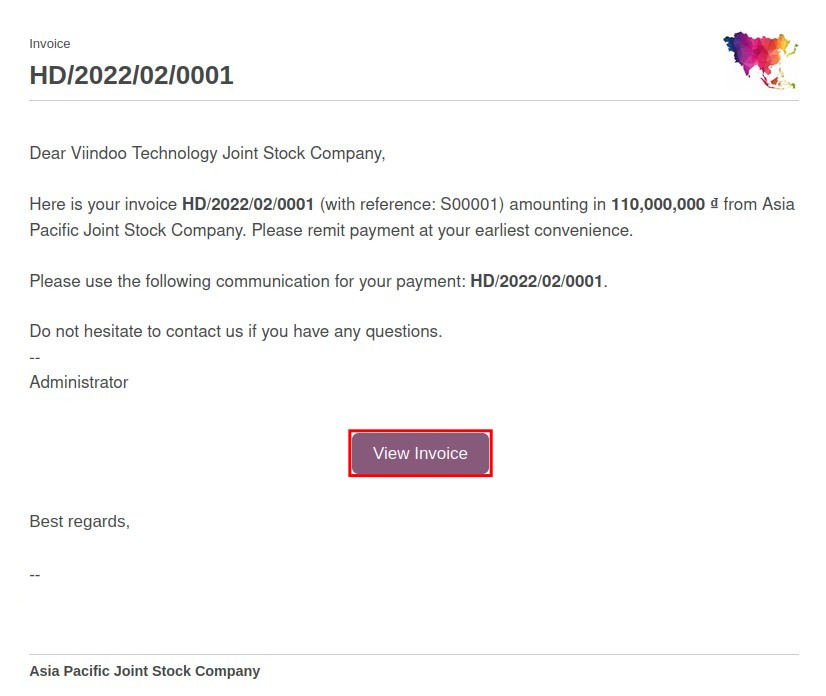

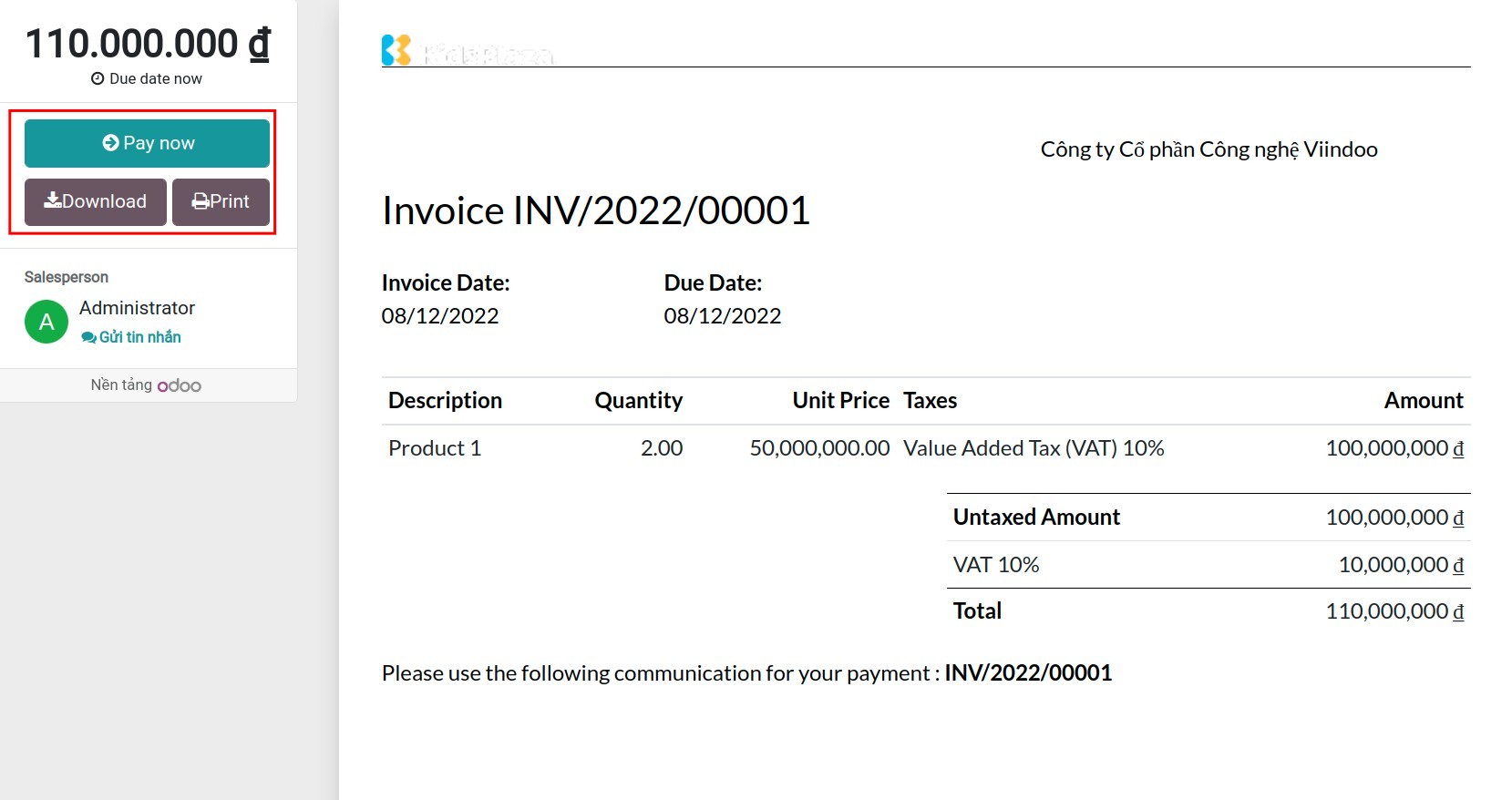

After validating customer invoices, you can send those to your customer directly using Send & Print function from the invoice interface:

From here, you can write or edit the email message (you can also save it as a new email template if you would want to reuse it in the future) and hit Send & Print button to send the message via email with the PDF version of the invoice as an attachment to your customer.

Note

When an email message is generated, the software recognizes customers’ preferred languages set up on their contact details and updates the email template language accordingly.

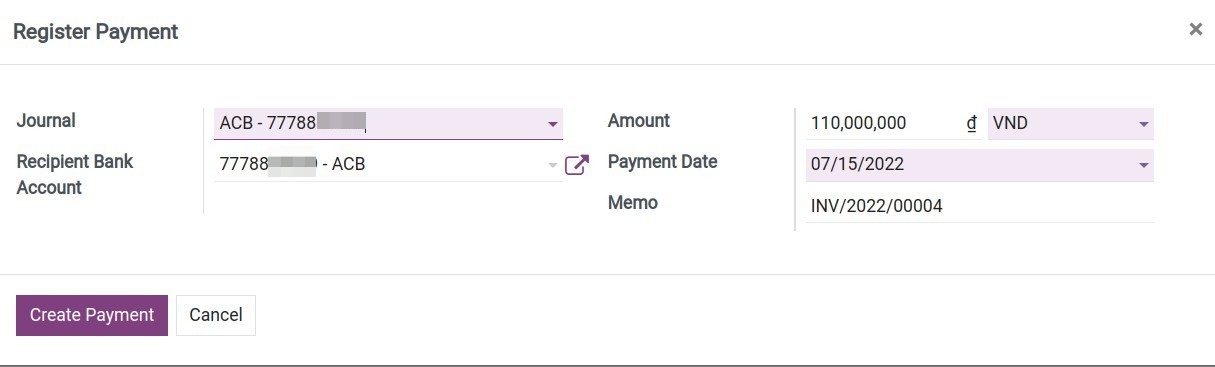

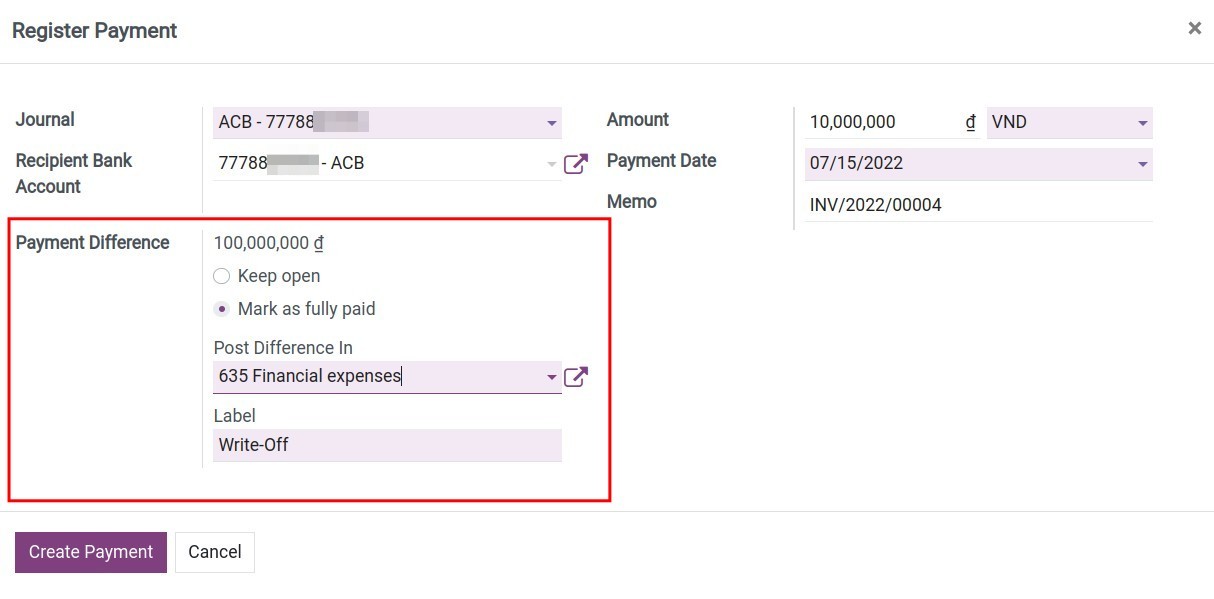

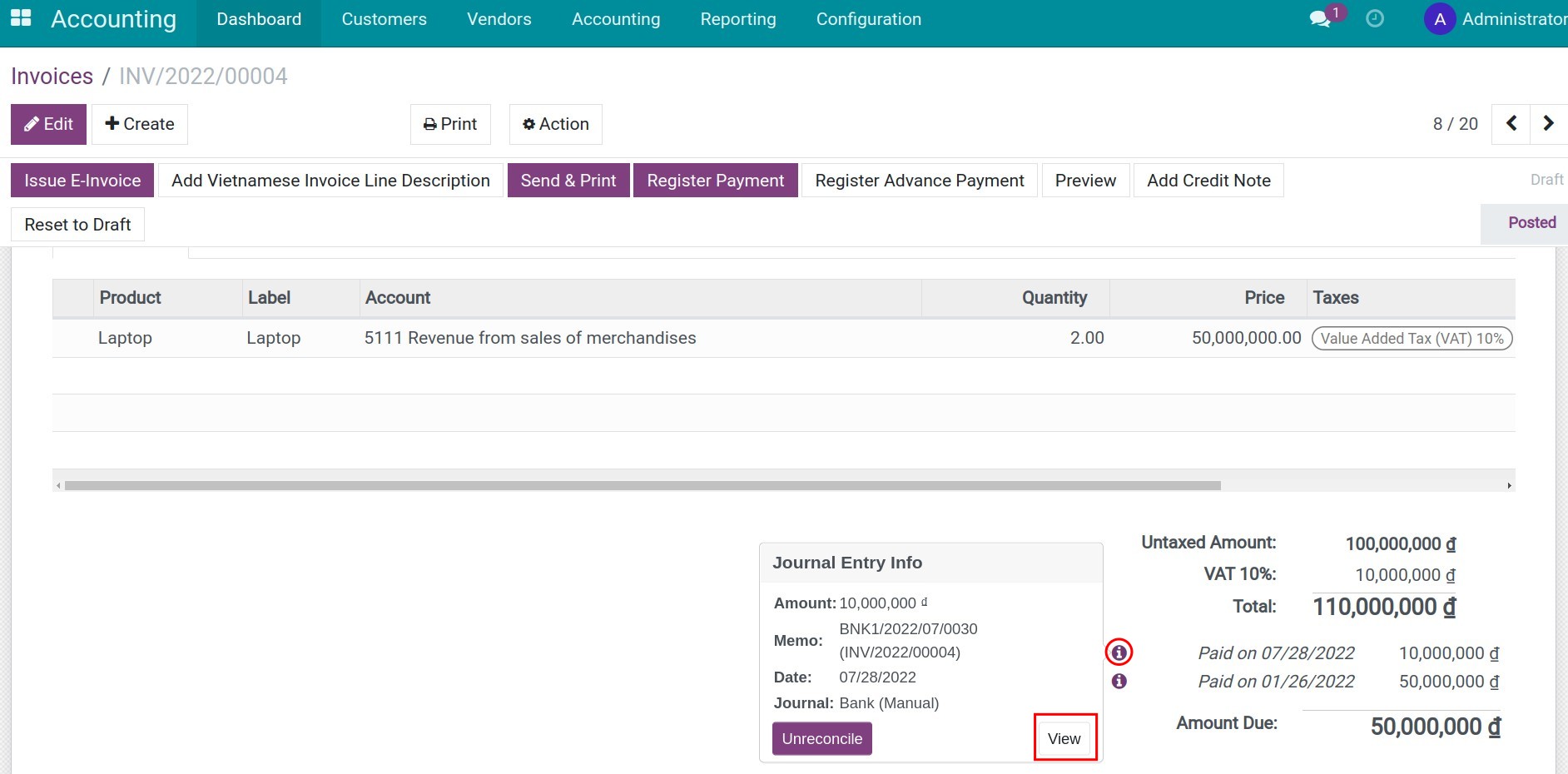

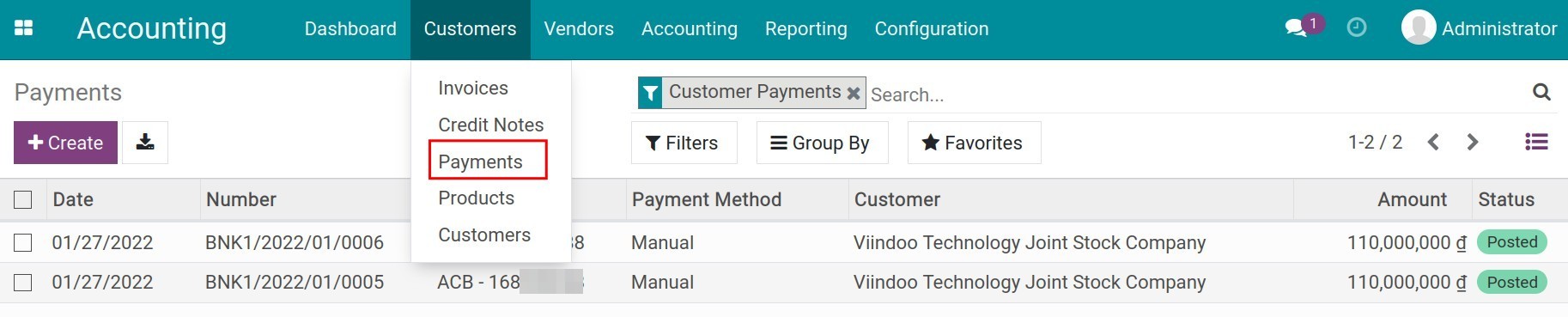

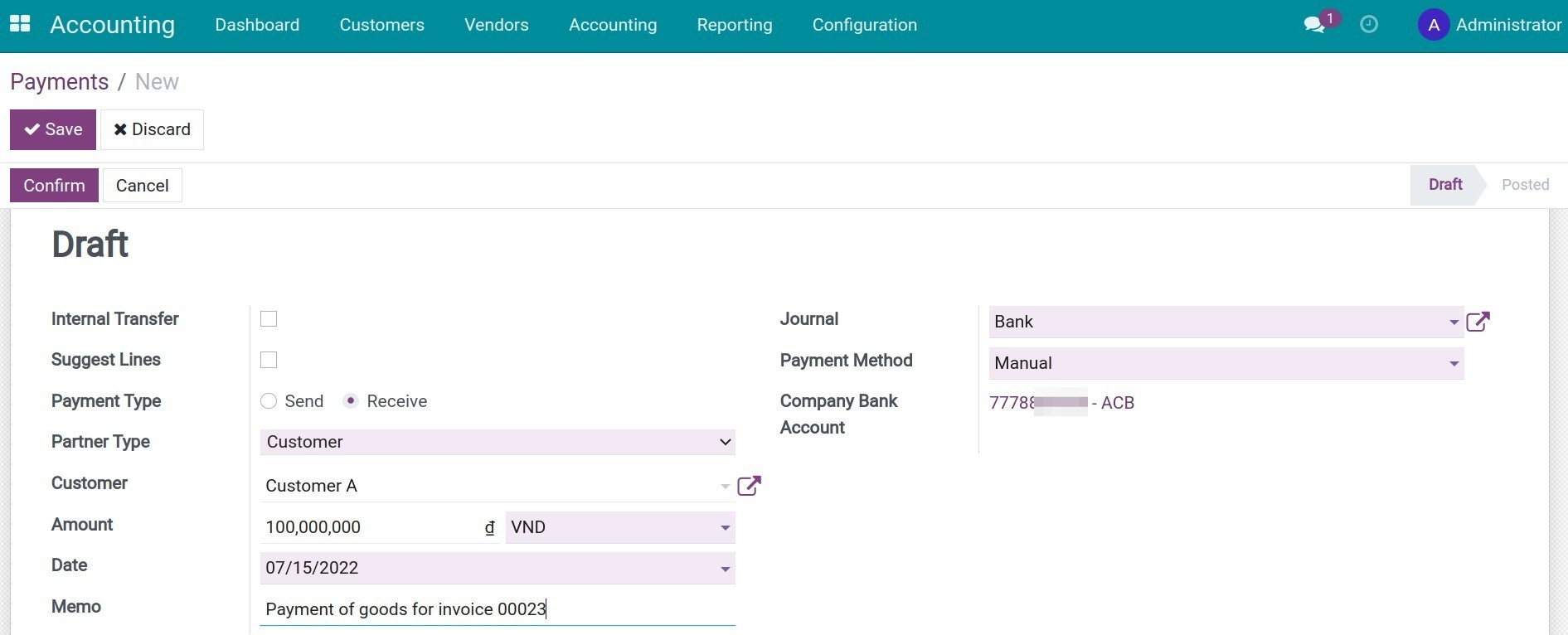

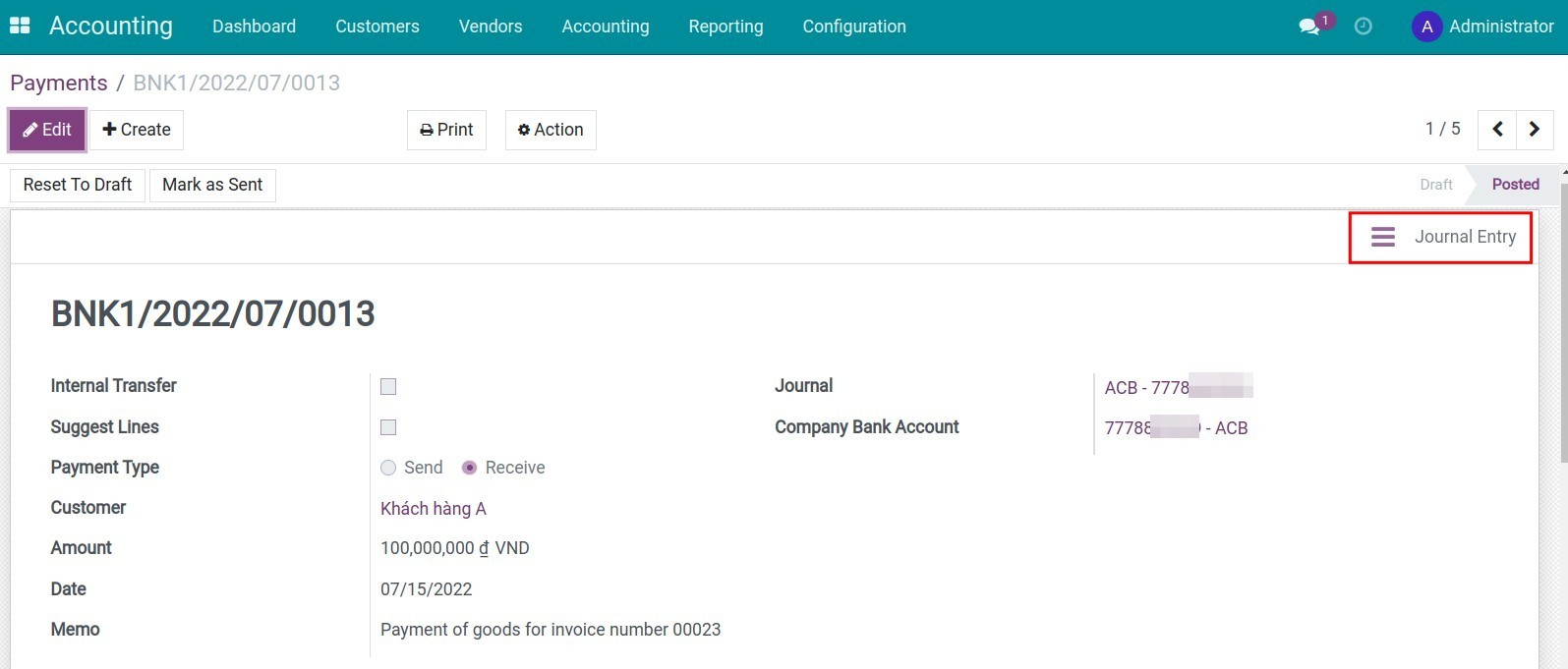

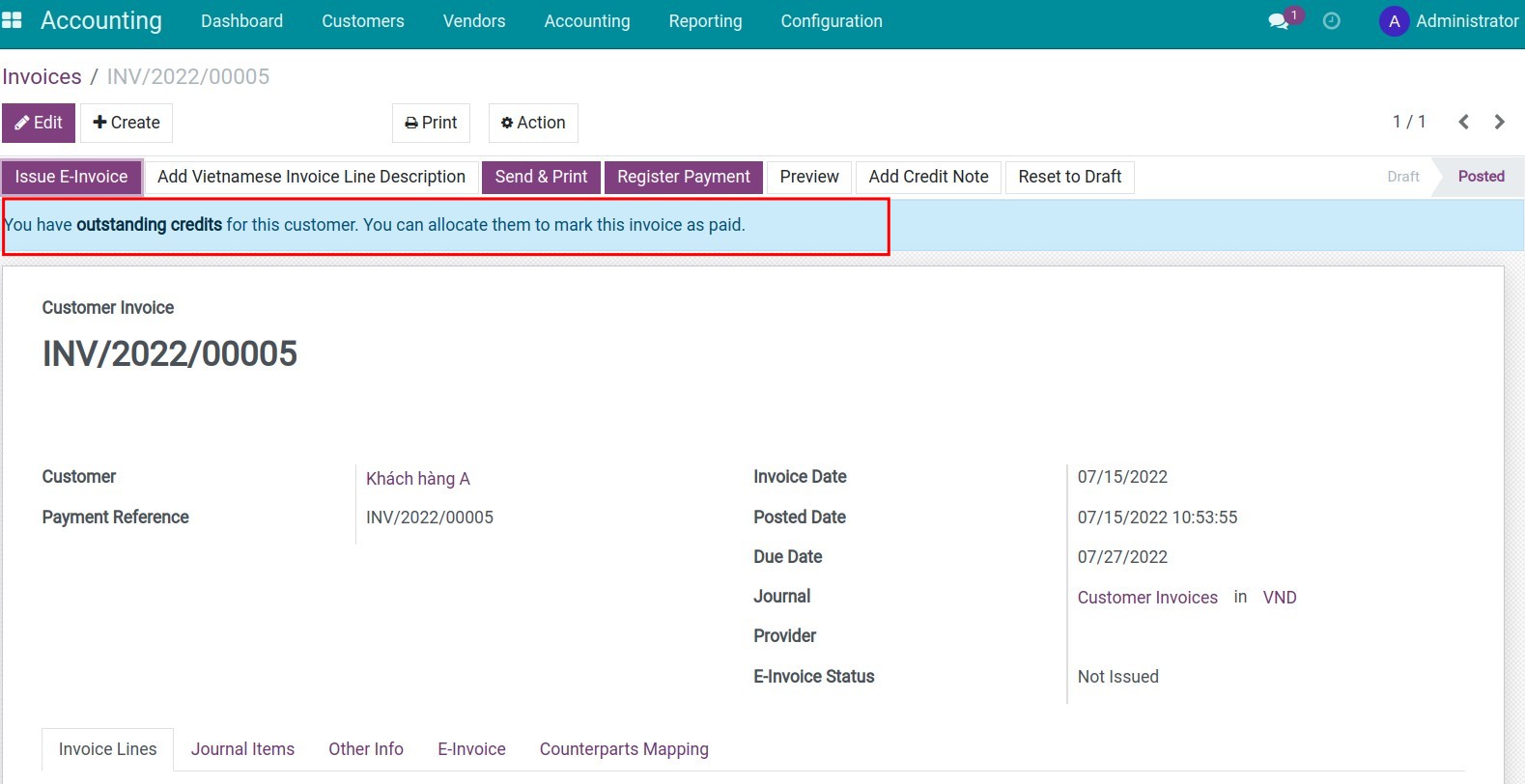

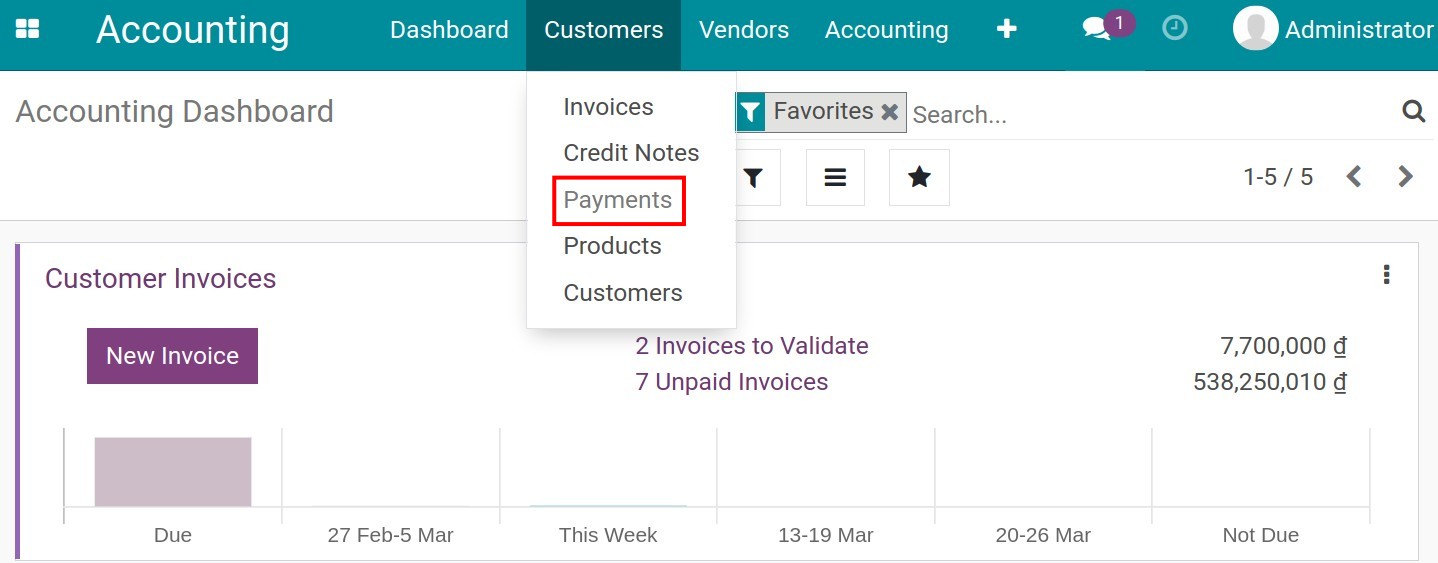

Payments

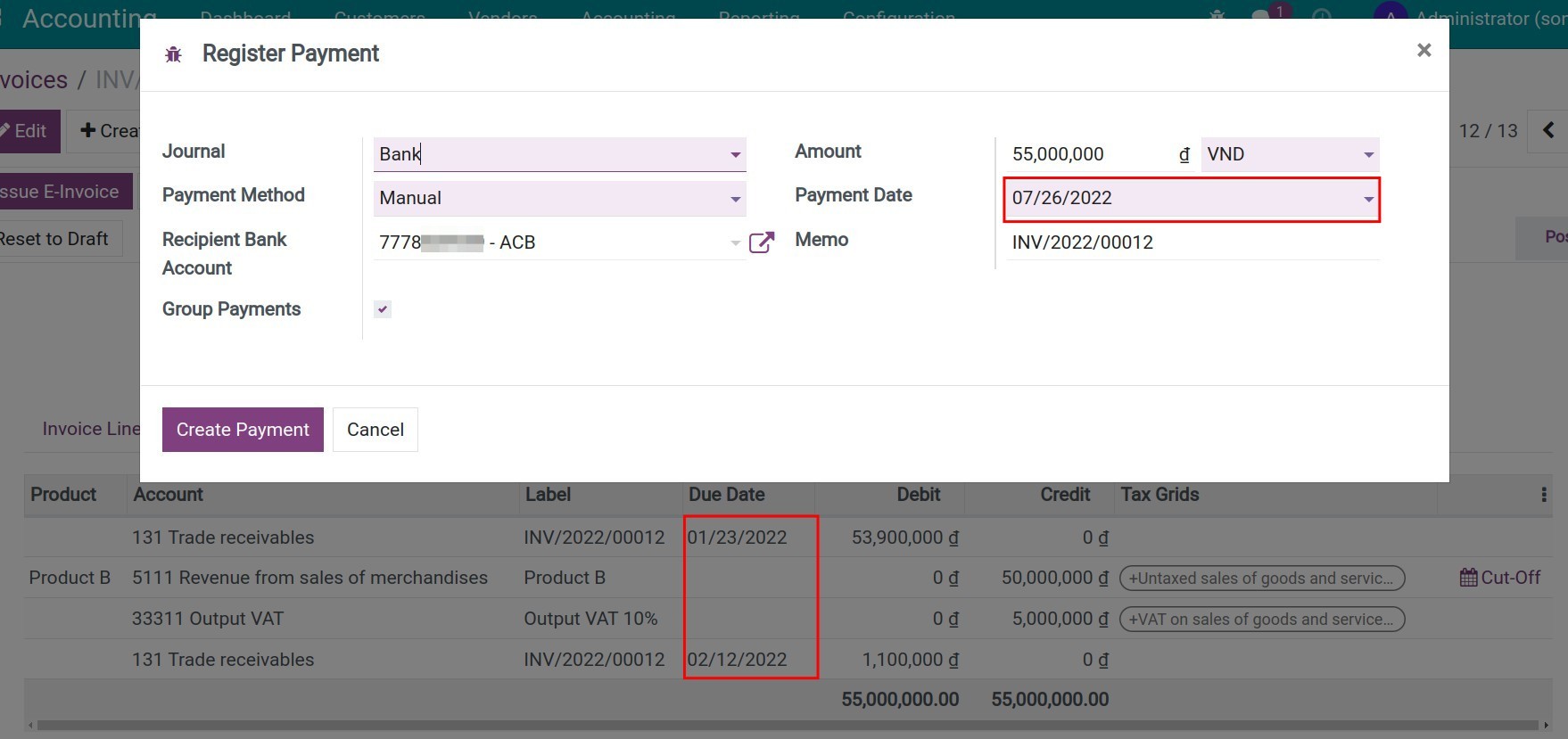

There are two ways to register payments:

Directly from the invoice;

Create a stand-alone payment .

Register bank statement & payment reconciliation

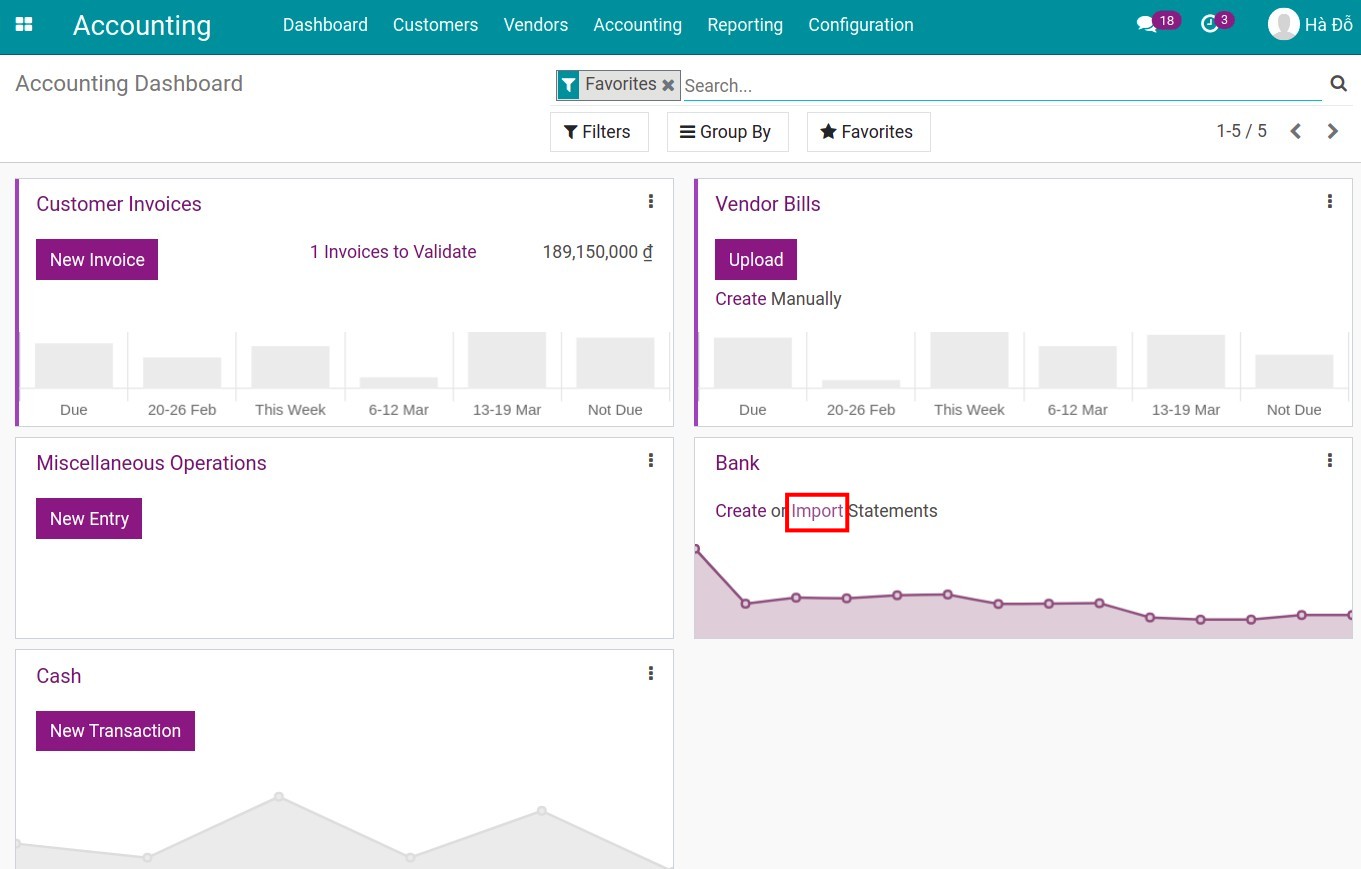

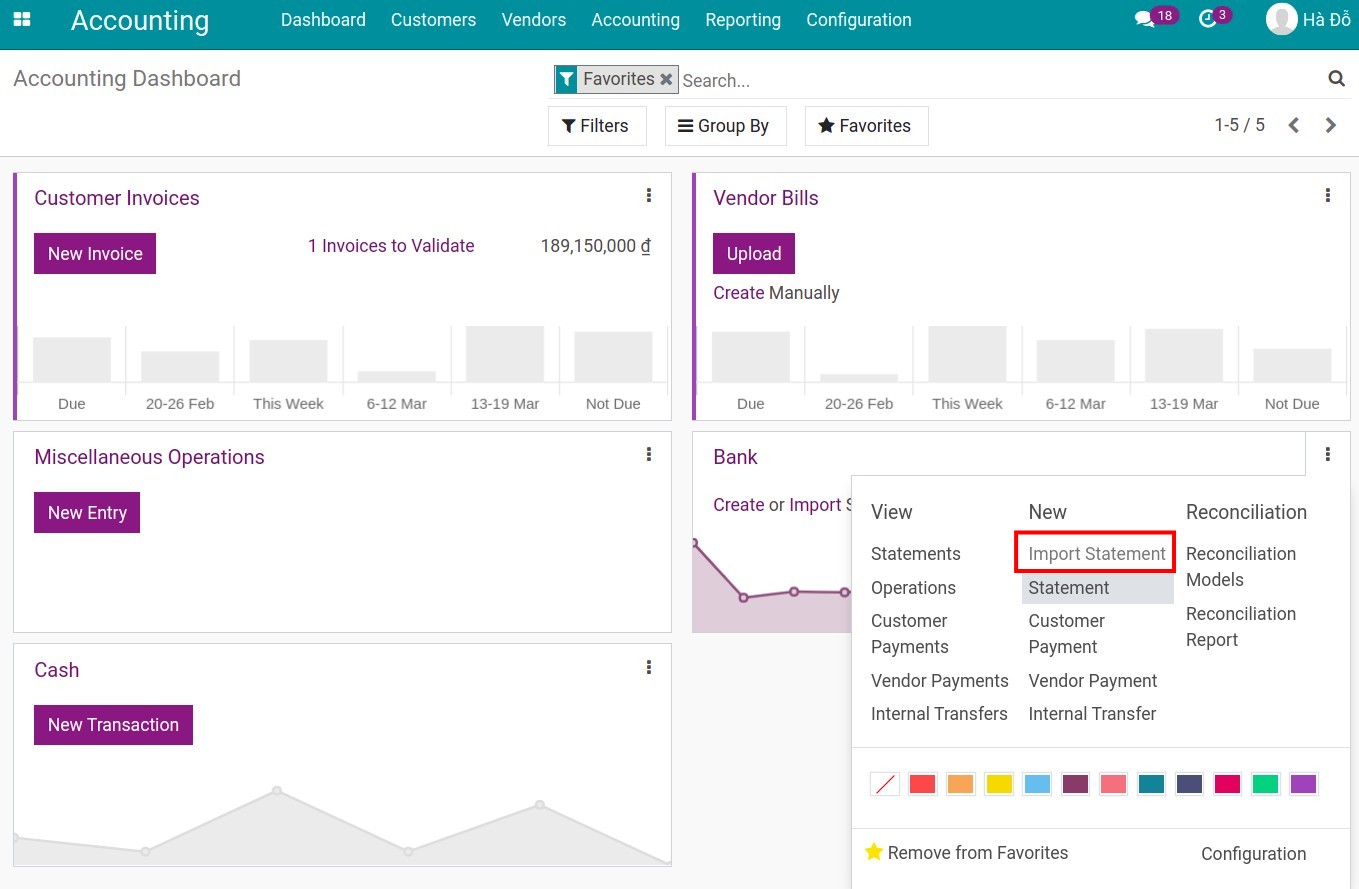

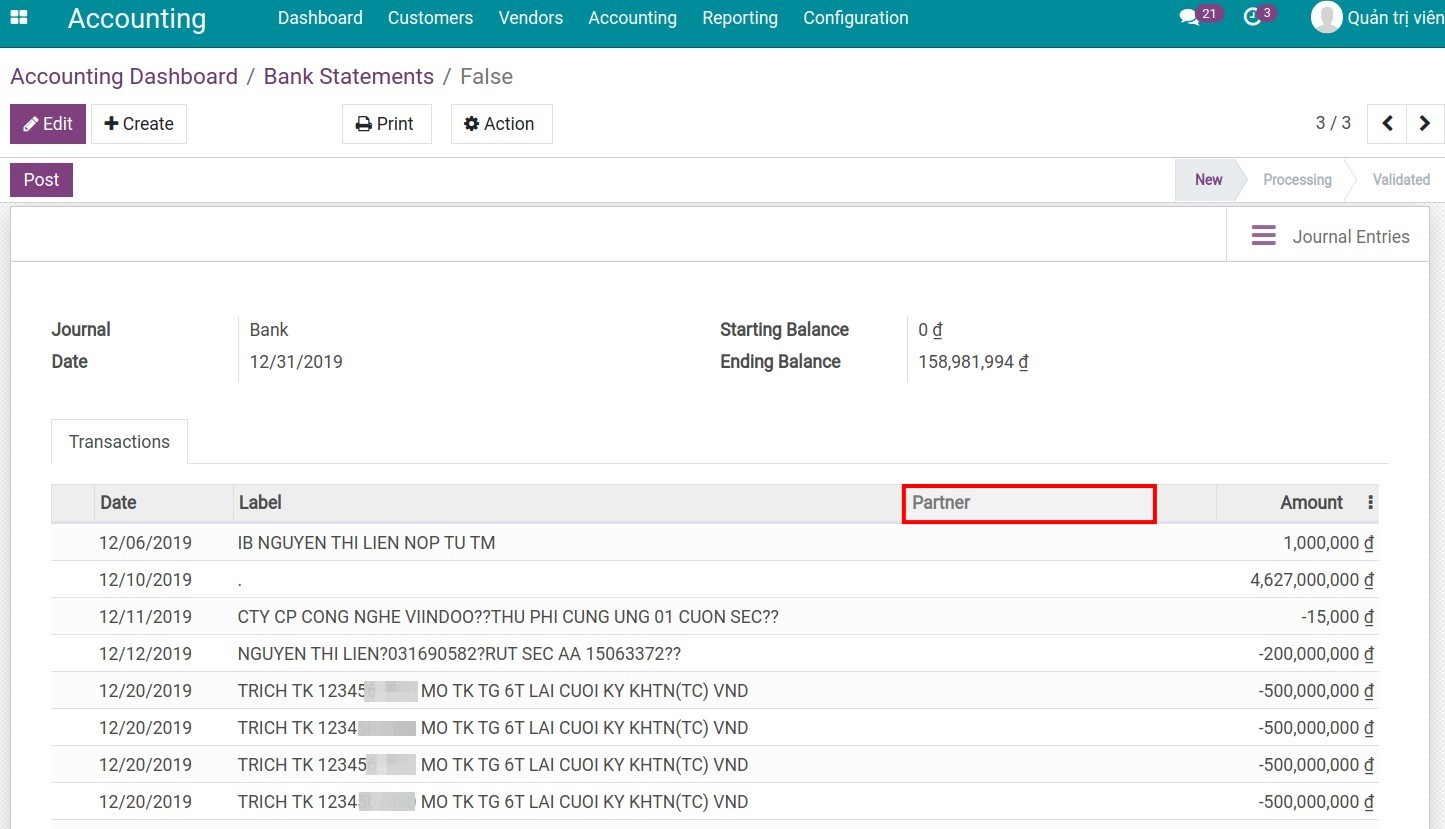

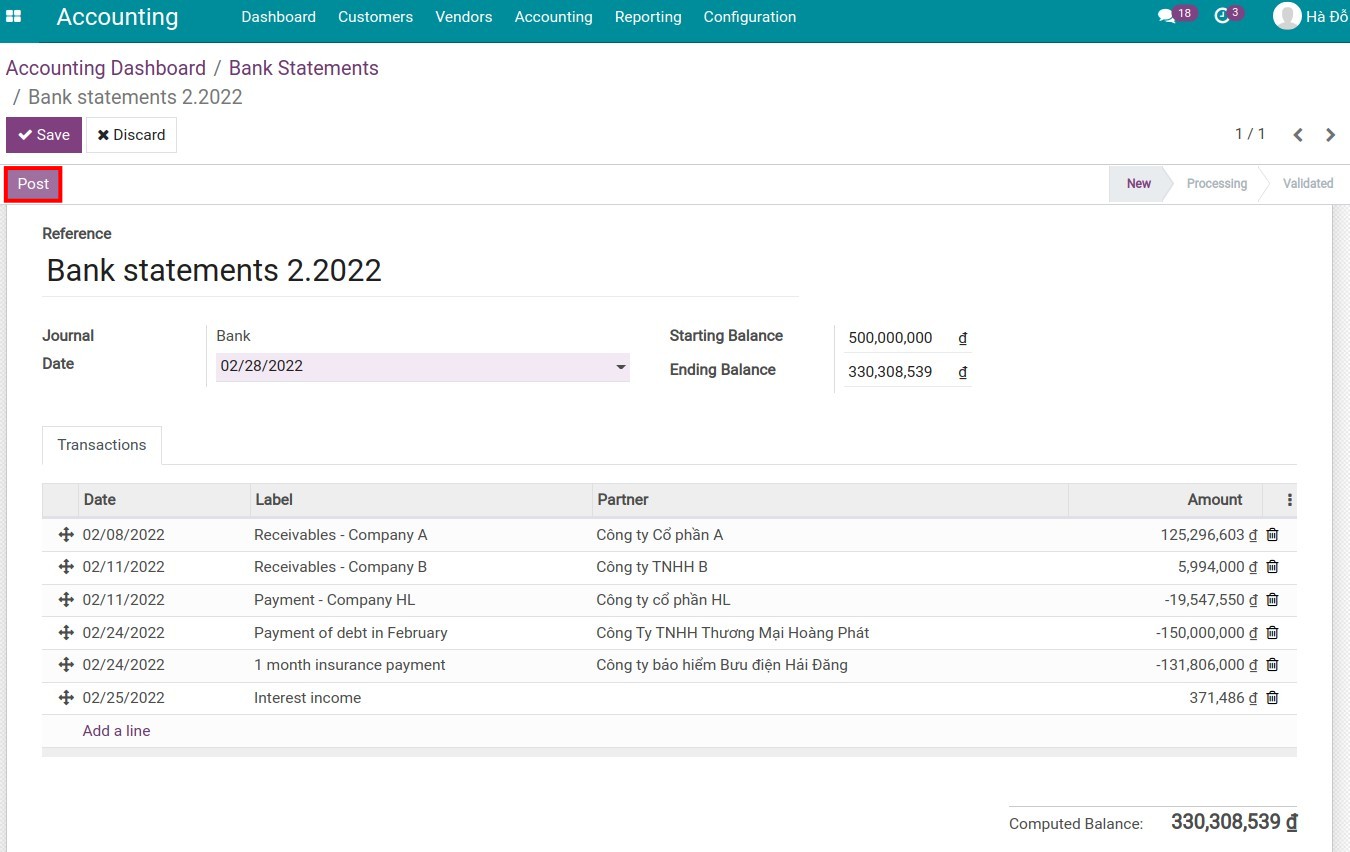

Register bank statement

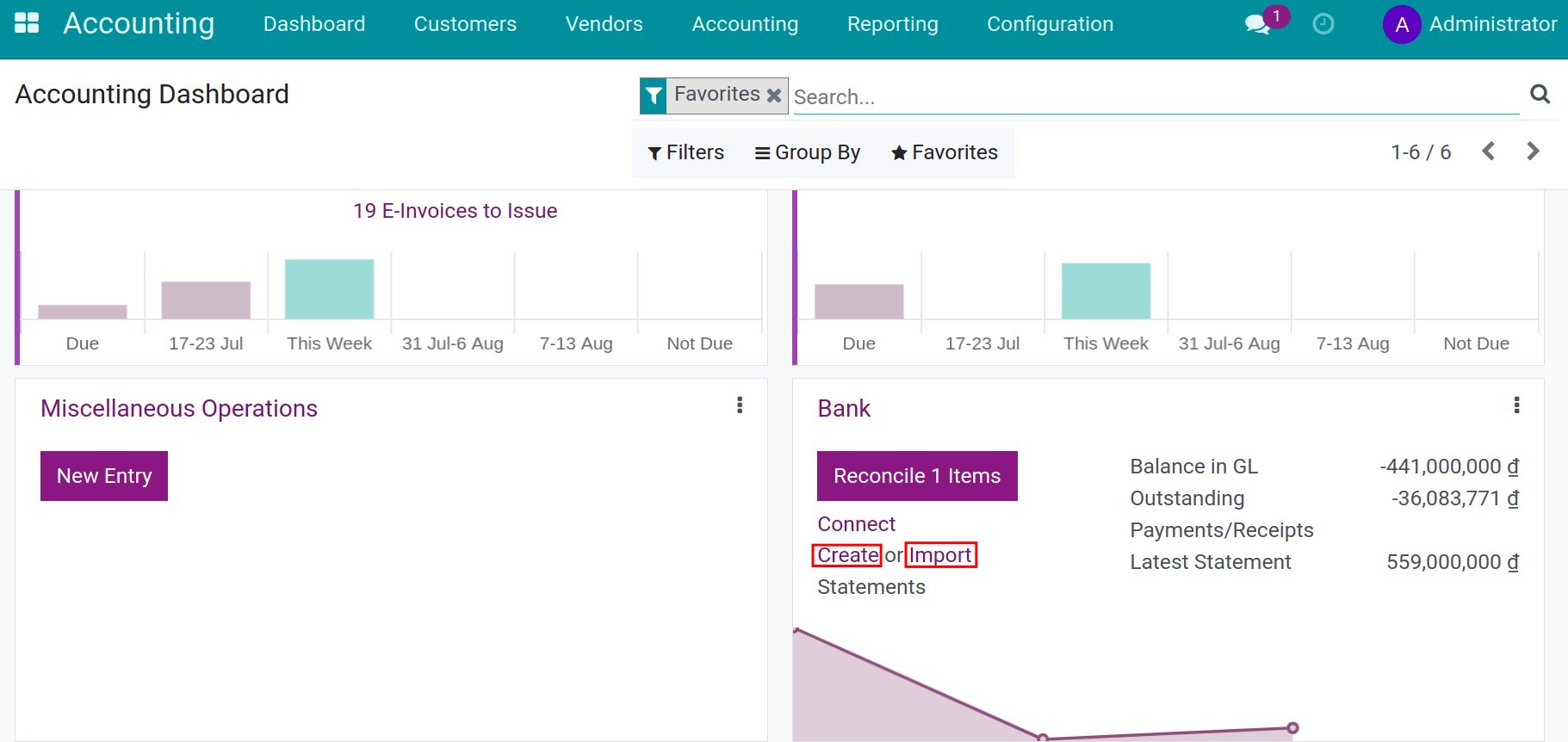

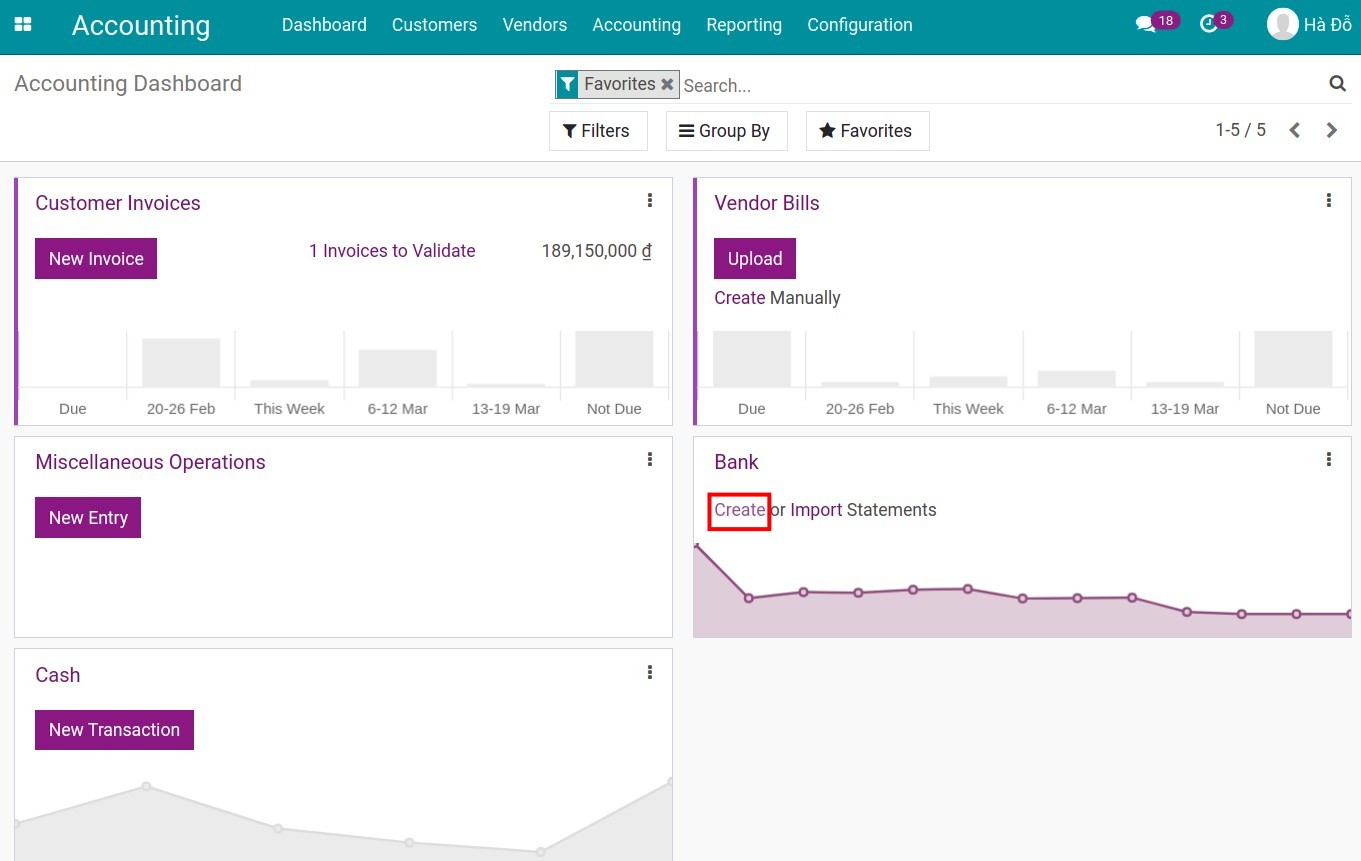

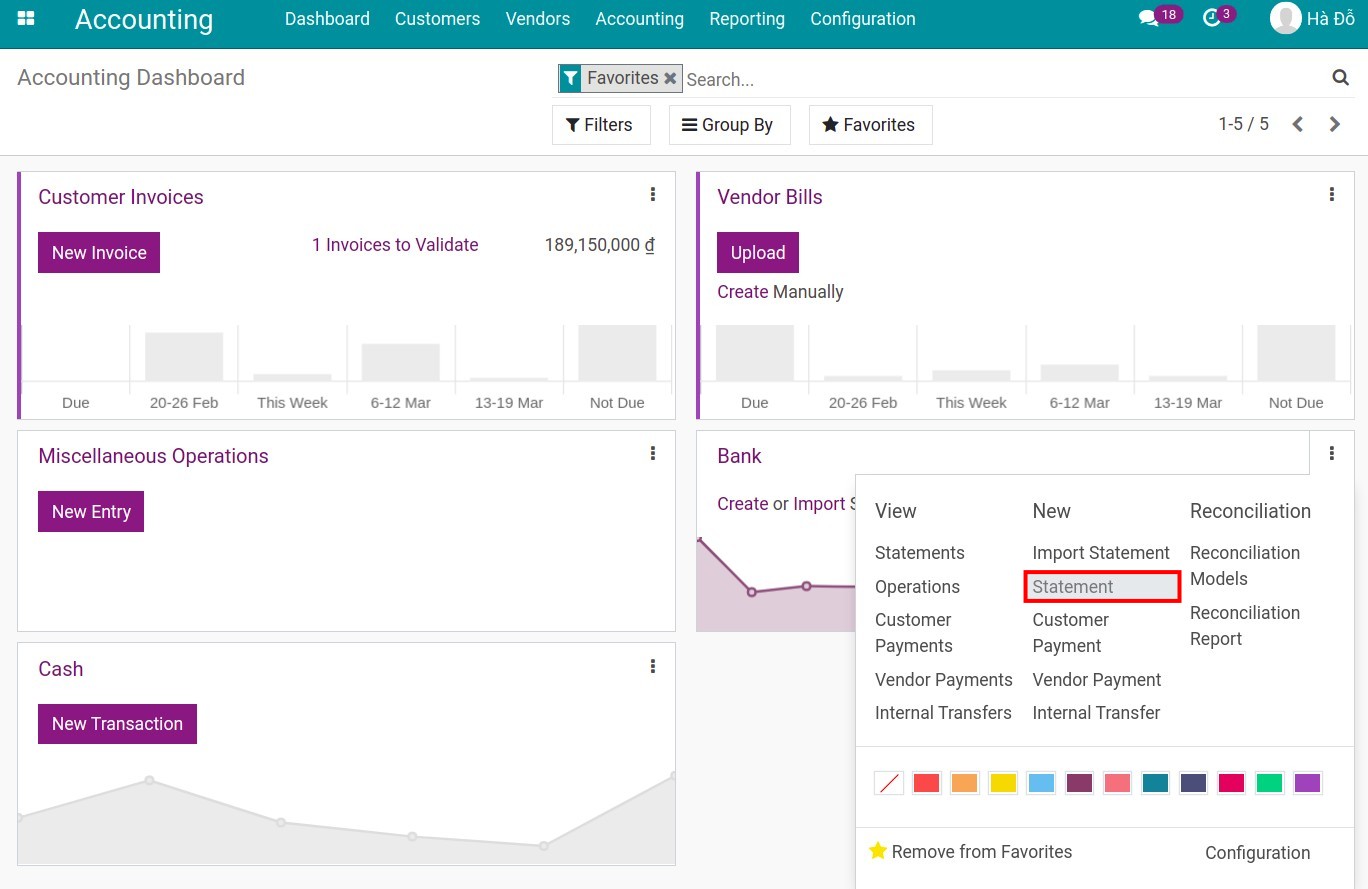

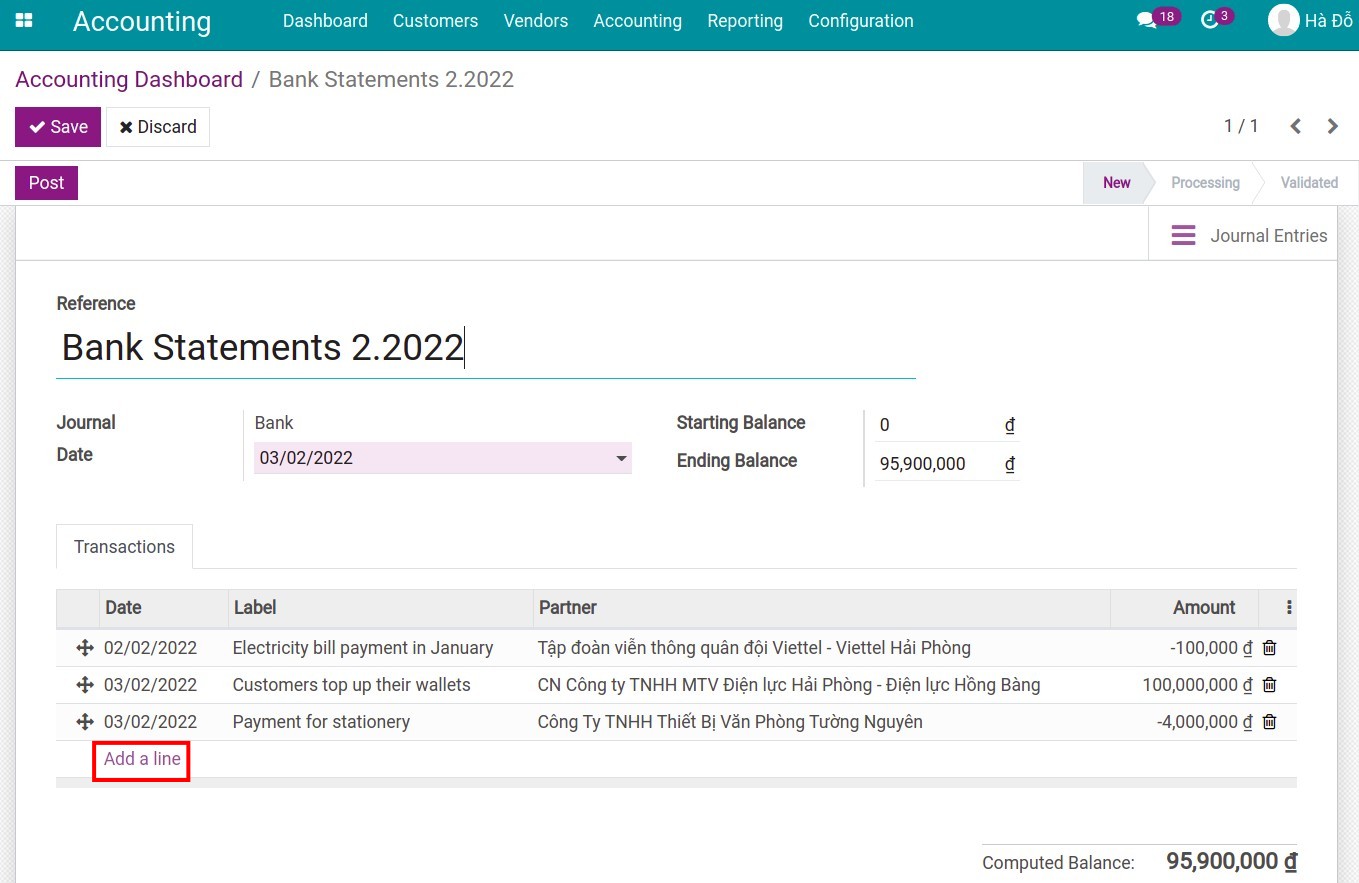

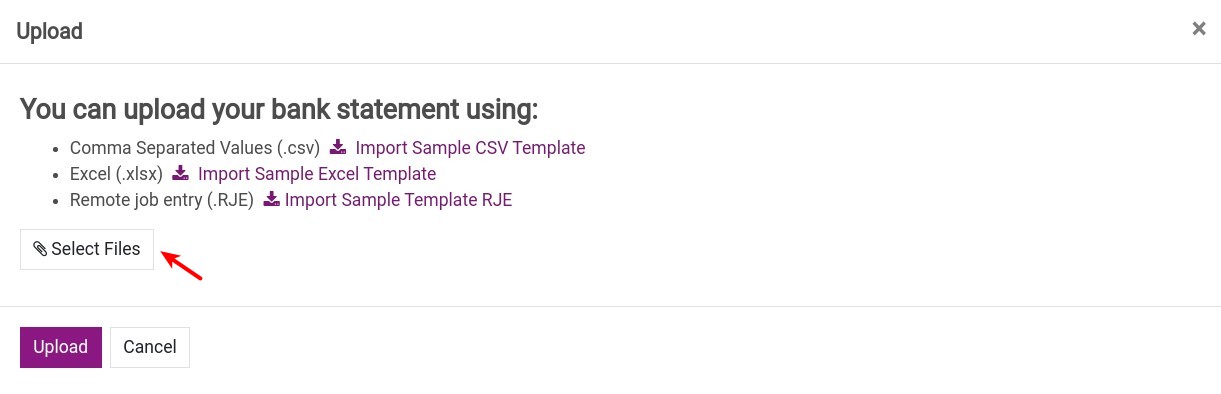

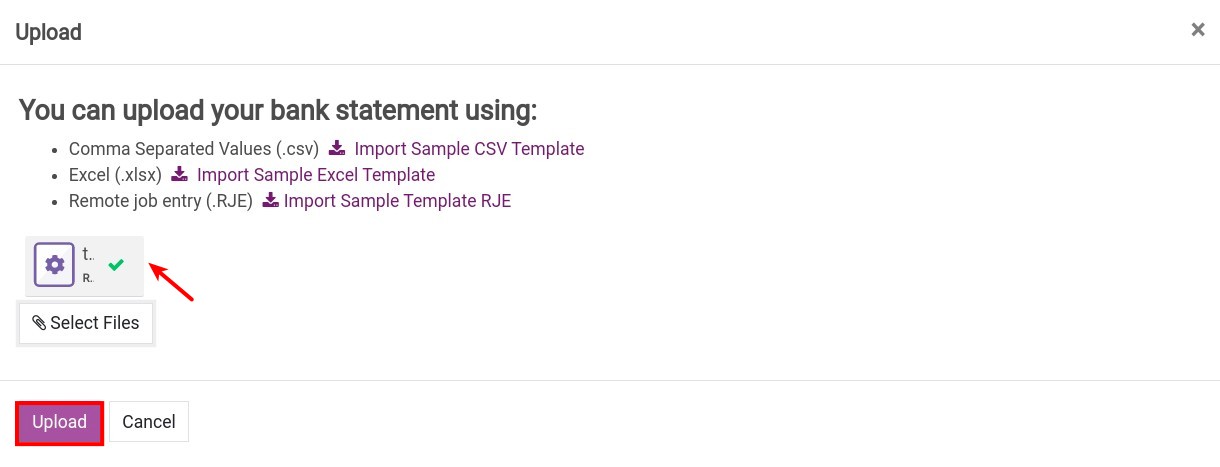

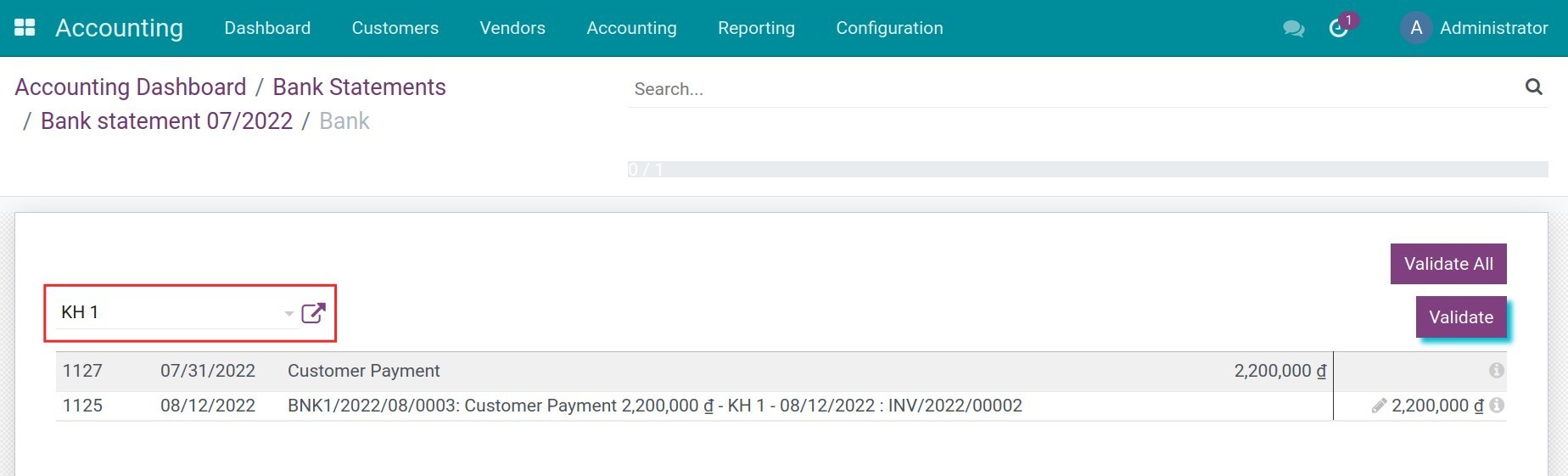

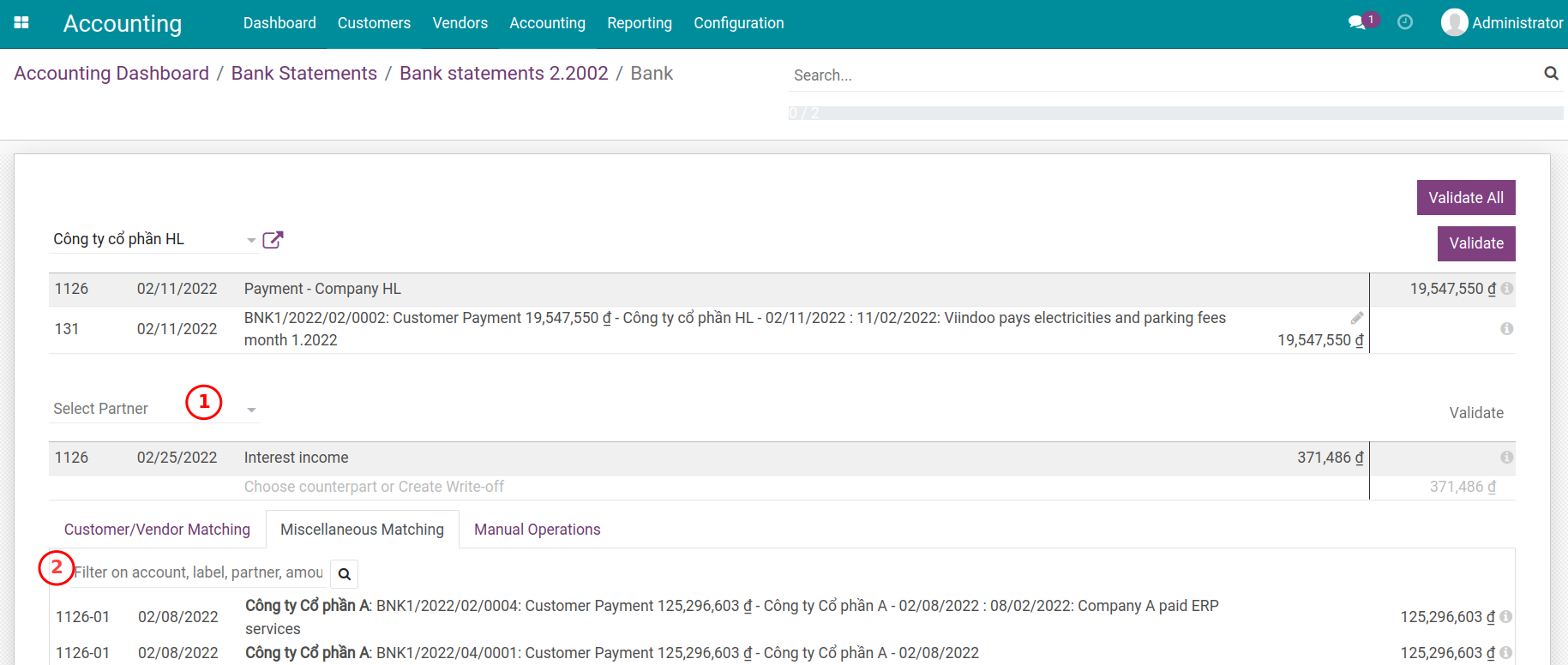

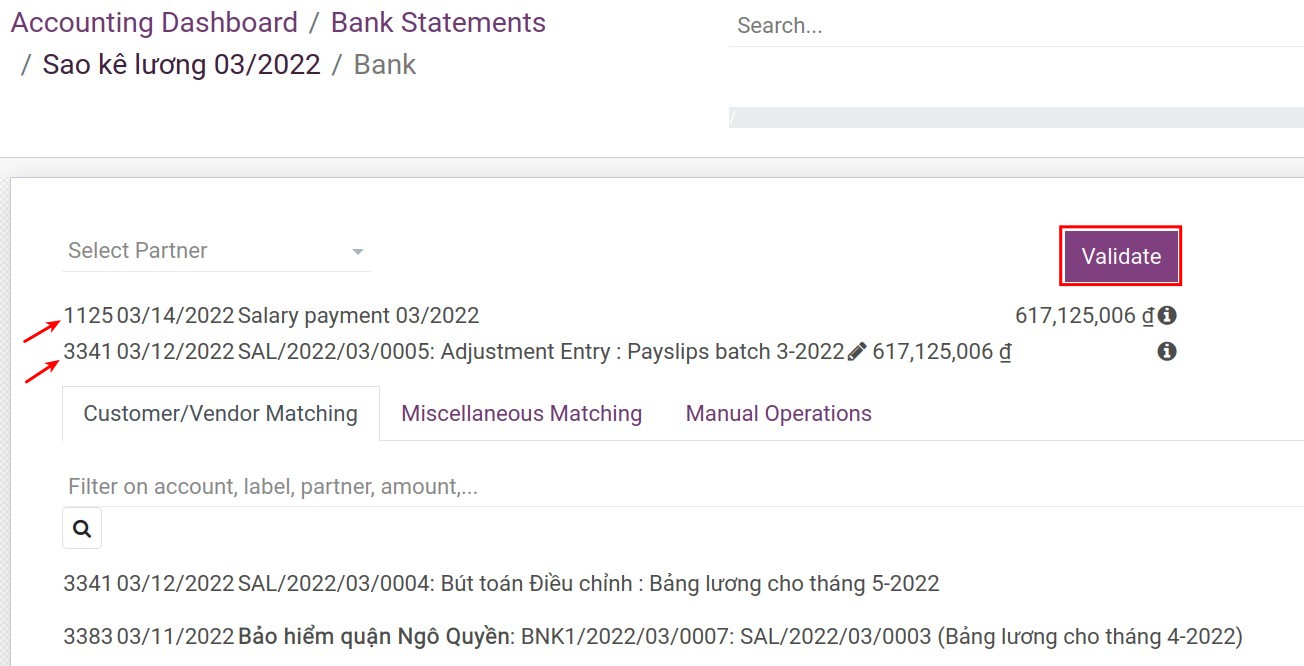

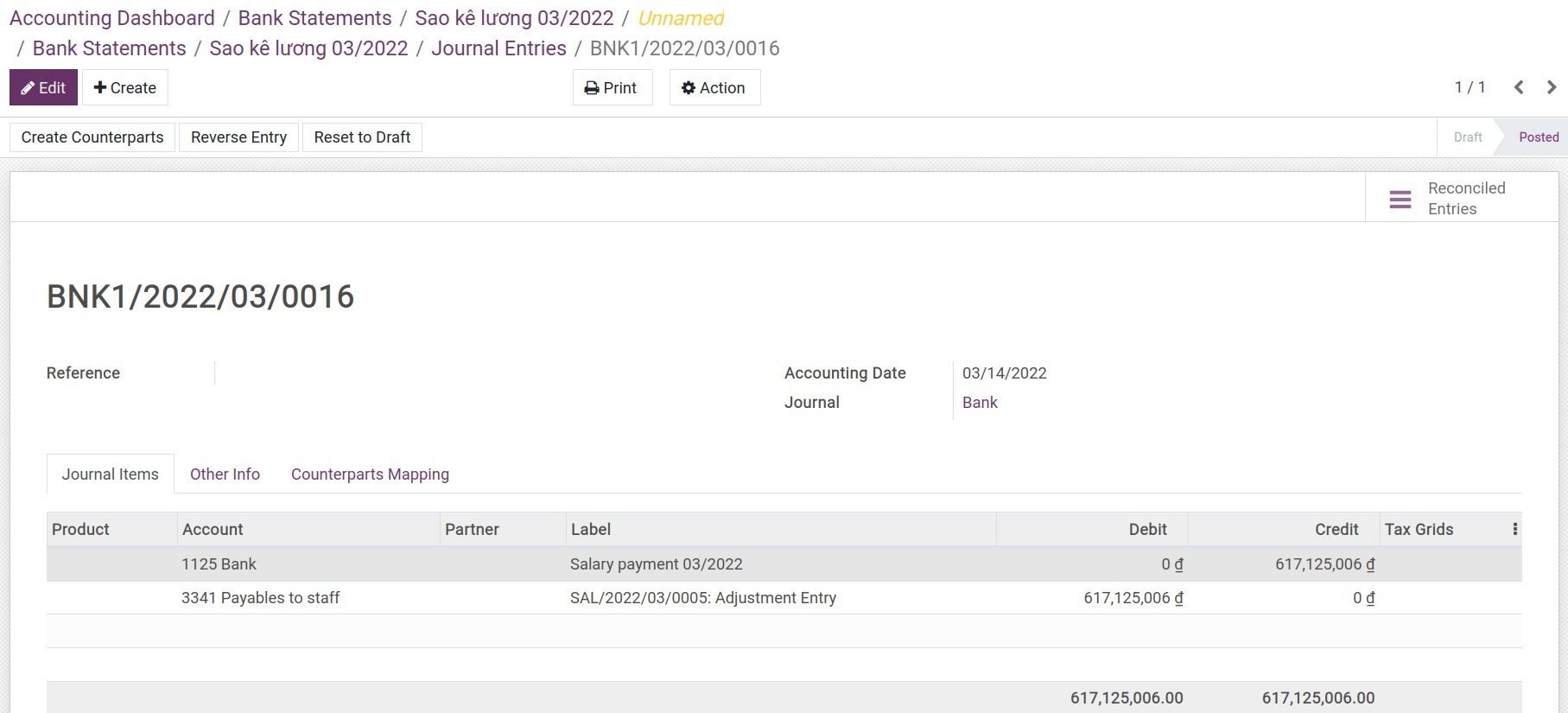

With Viindoo, you can register bank reconciliation manually or import them in bulk from CSV or RJE files. To do so, navigate to Accounting ‣ Dashboard, choose journal of the bank that needs to be reconciled and record the bank statement:

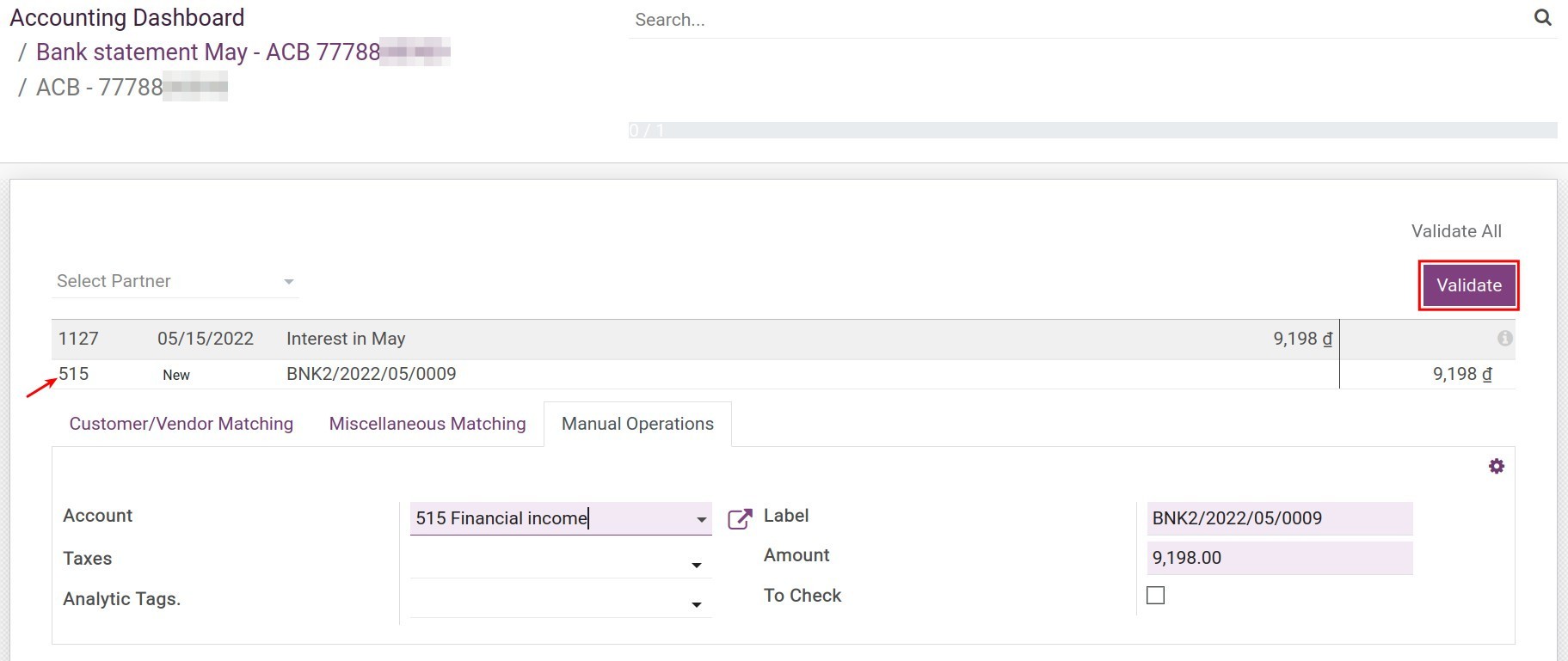

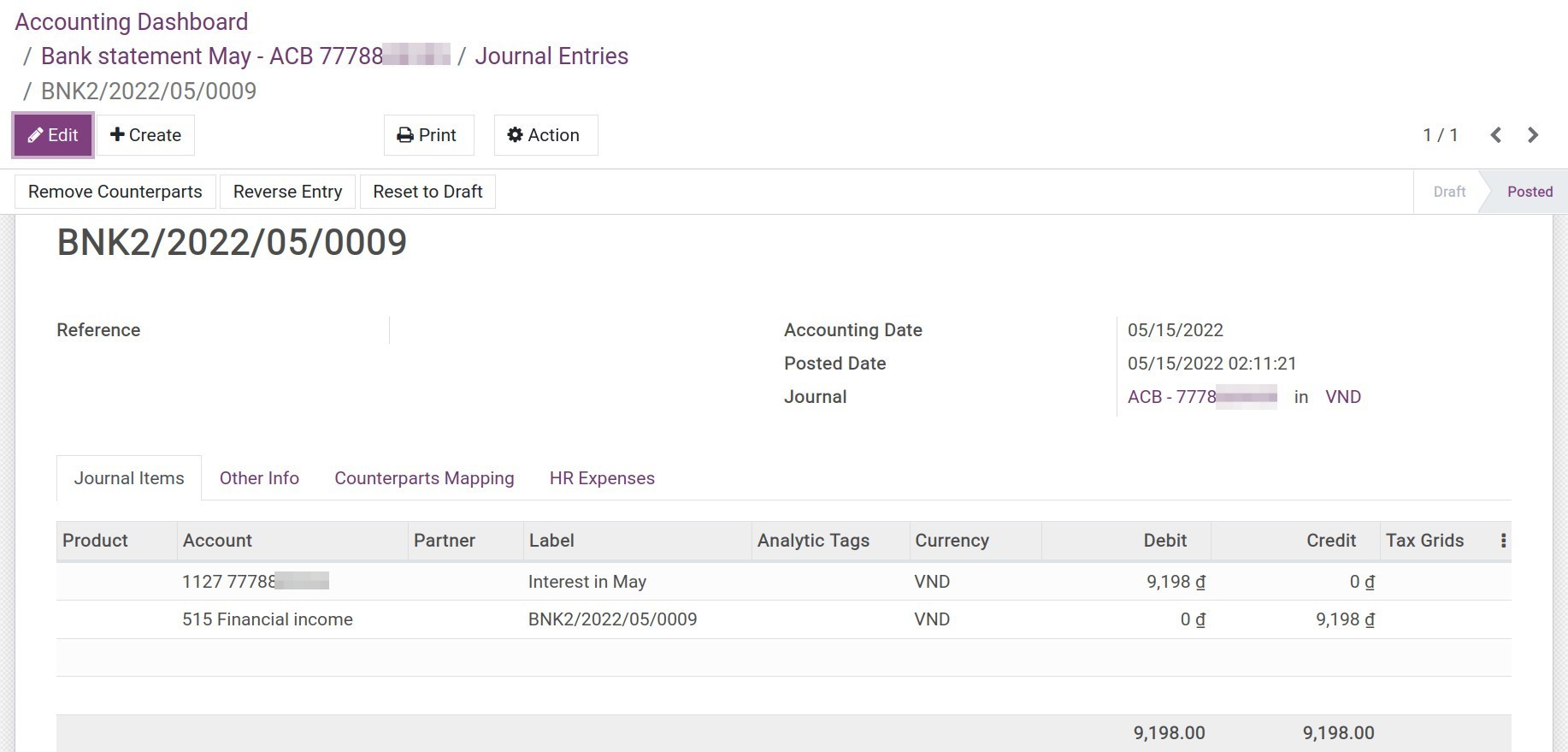

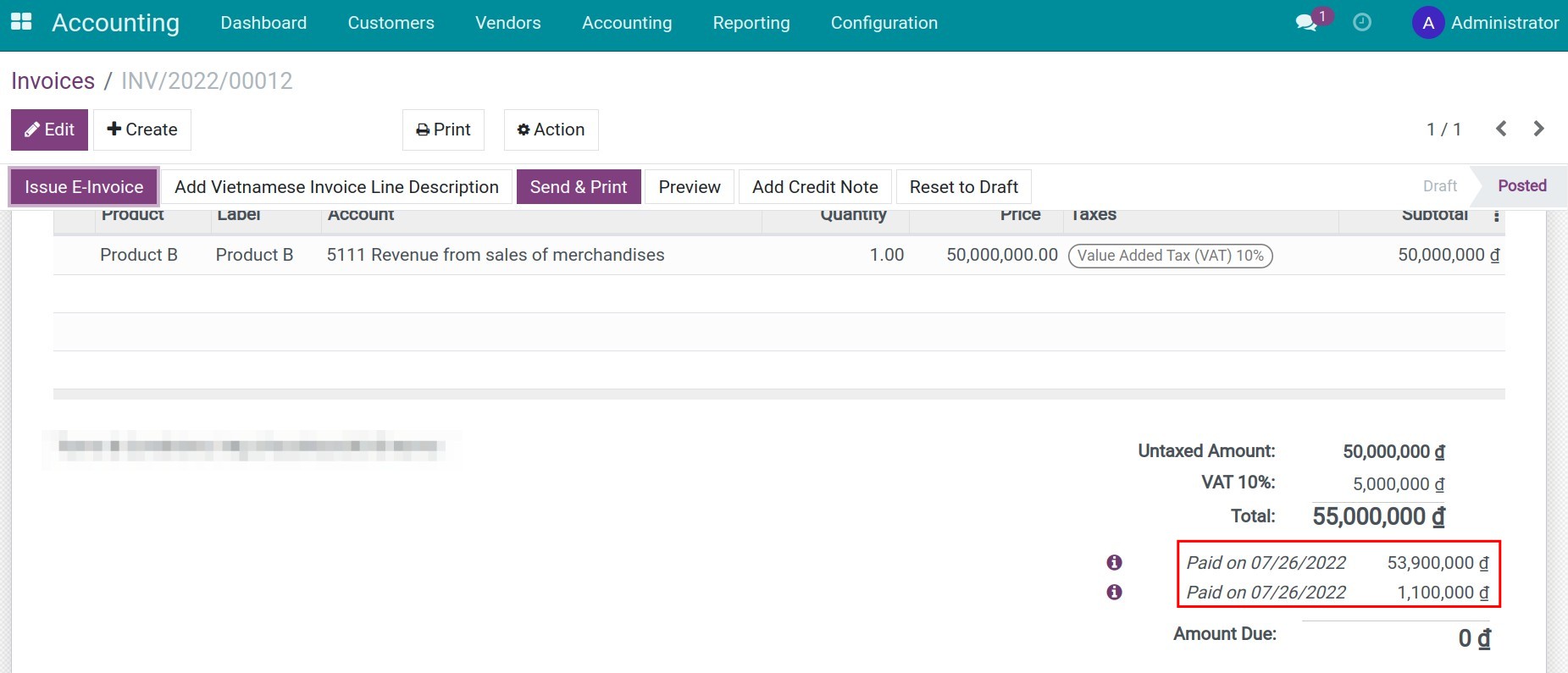

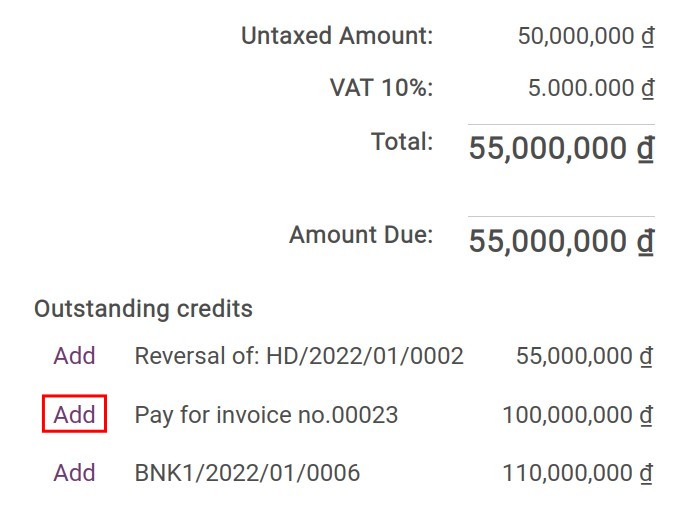

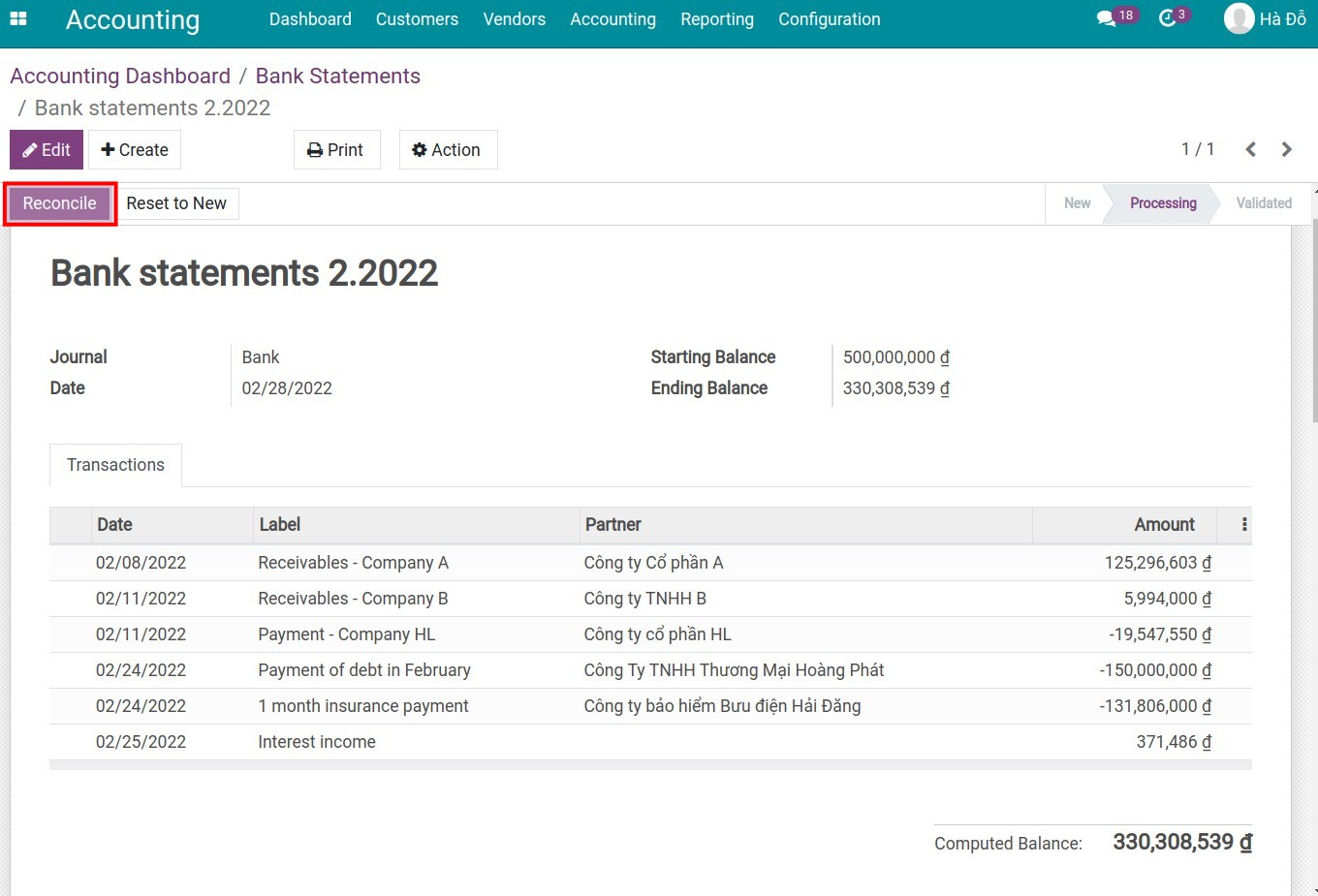

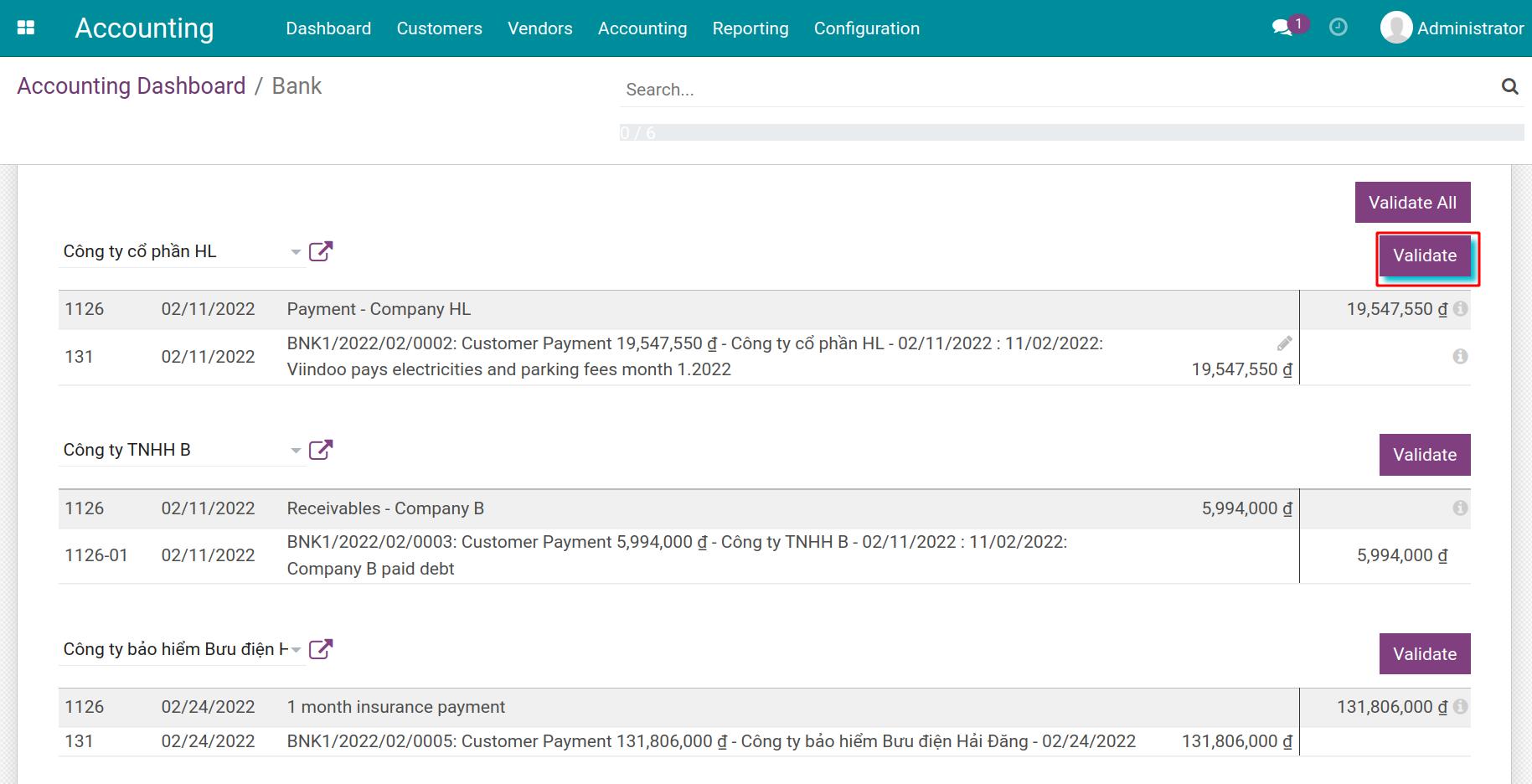

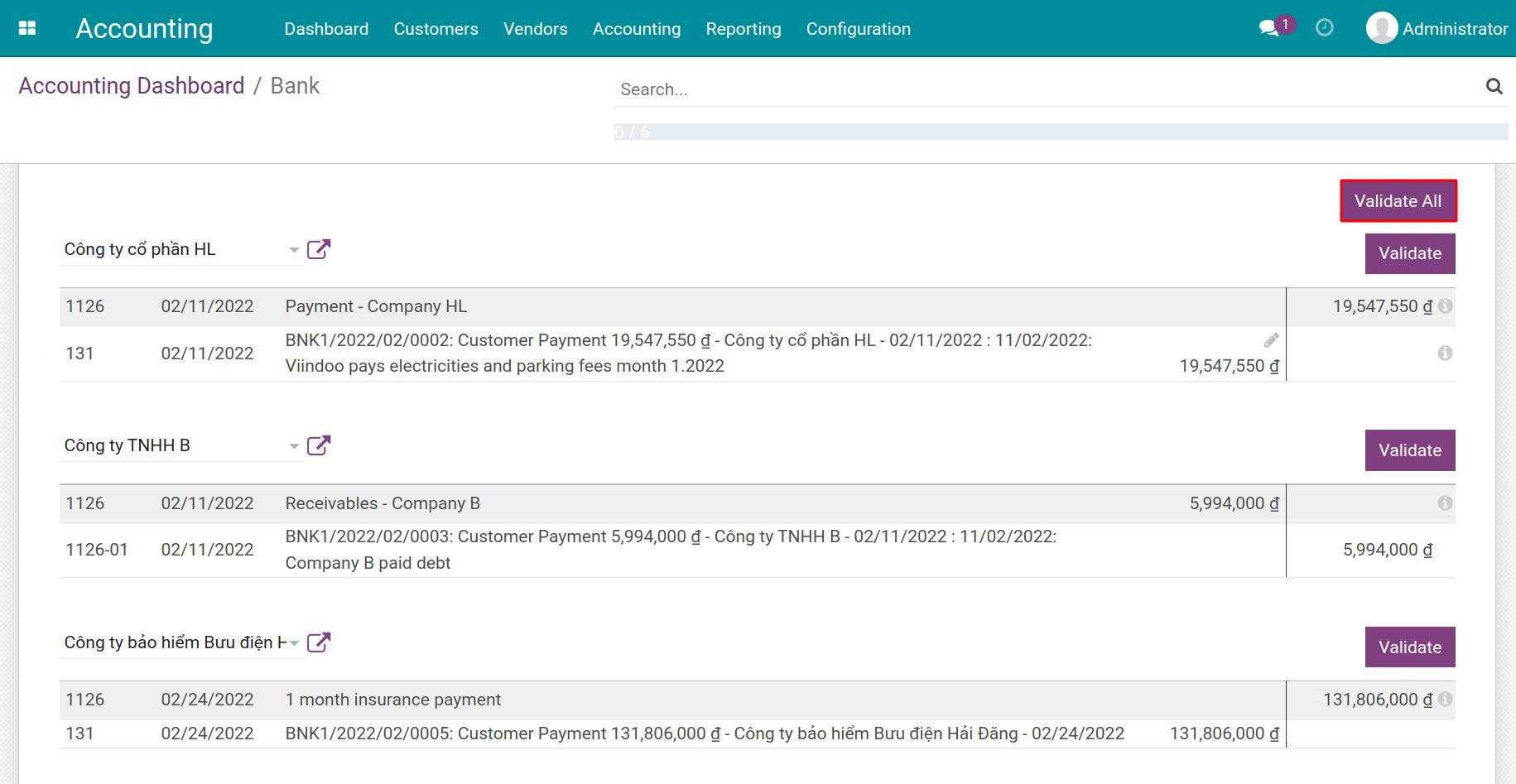

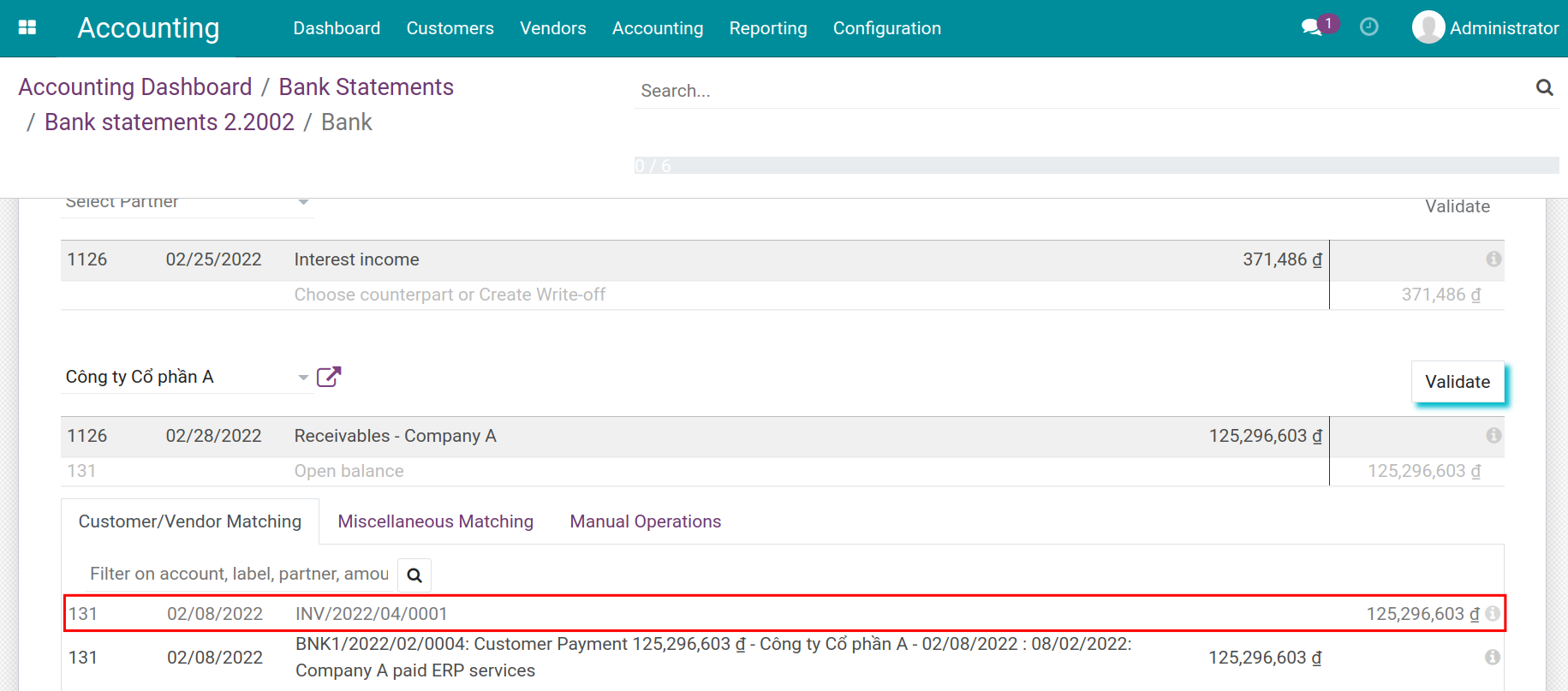

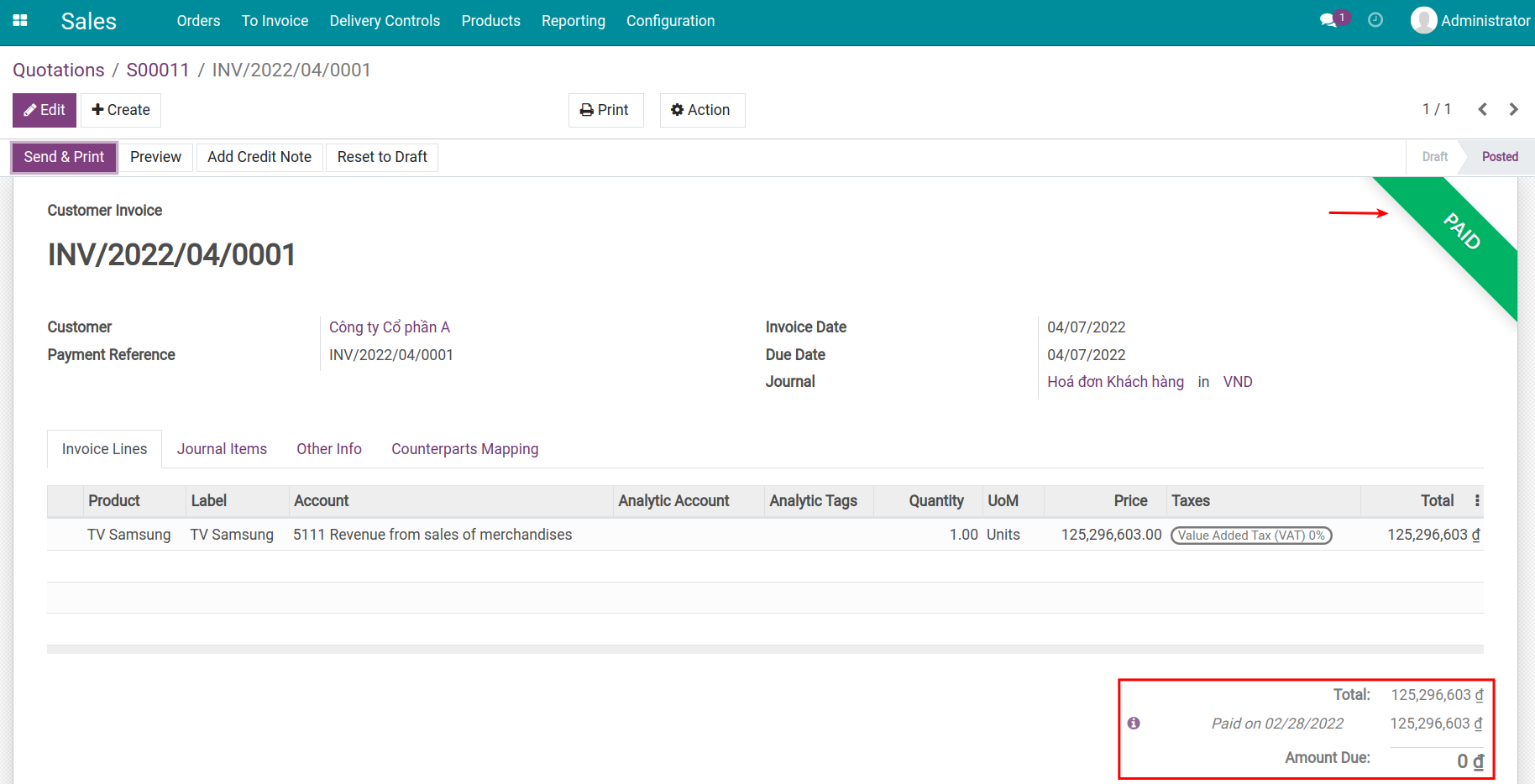

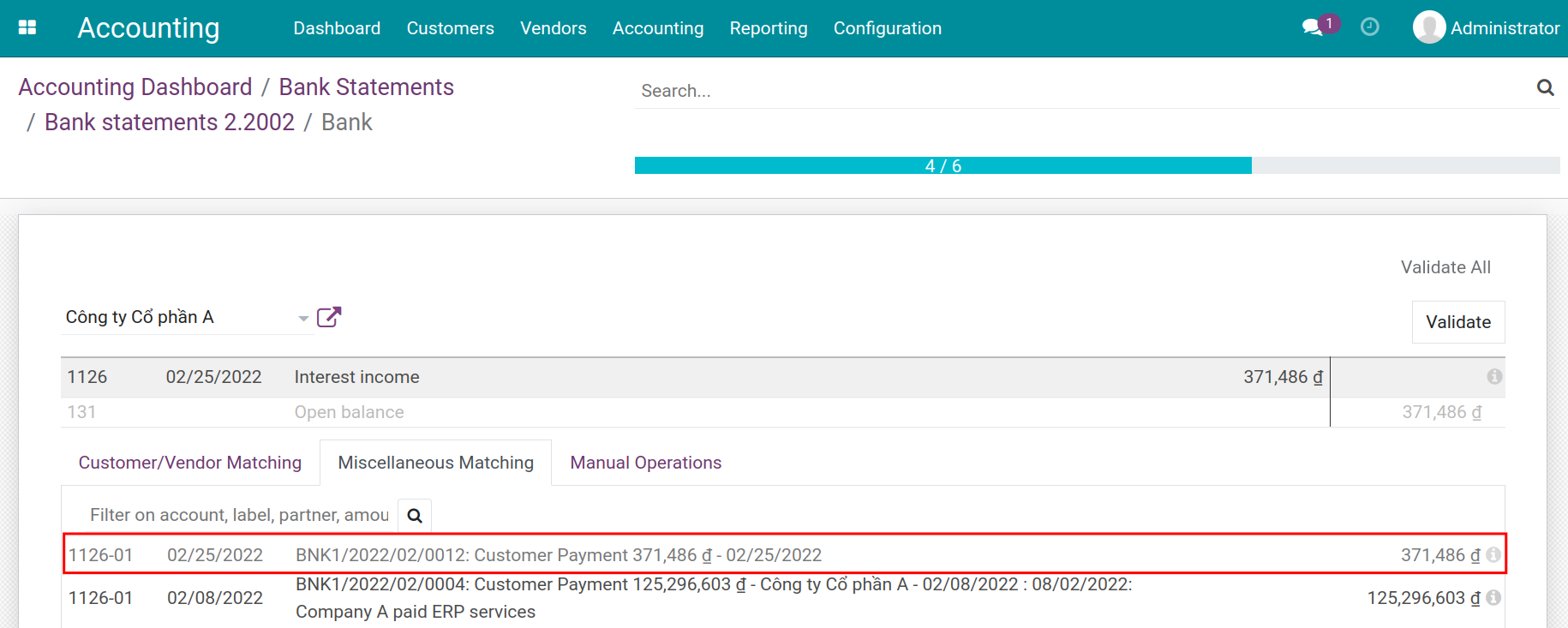

Payment Reconciliation

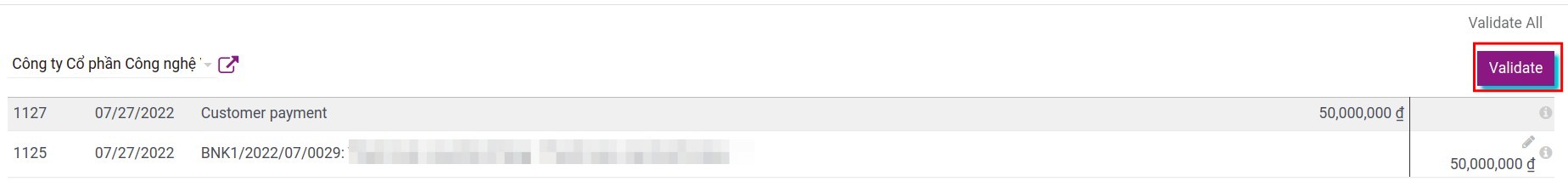

After validating the statement, you can reconcile the amount of money received from payments with this bank statement:

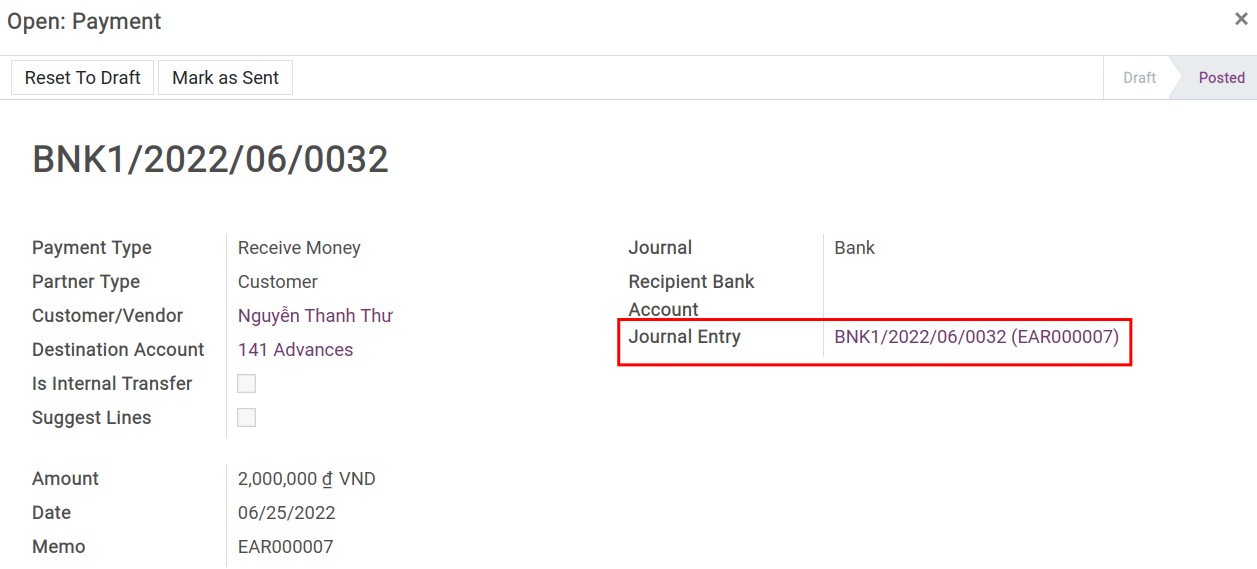

Keep track of a payment

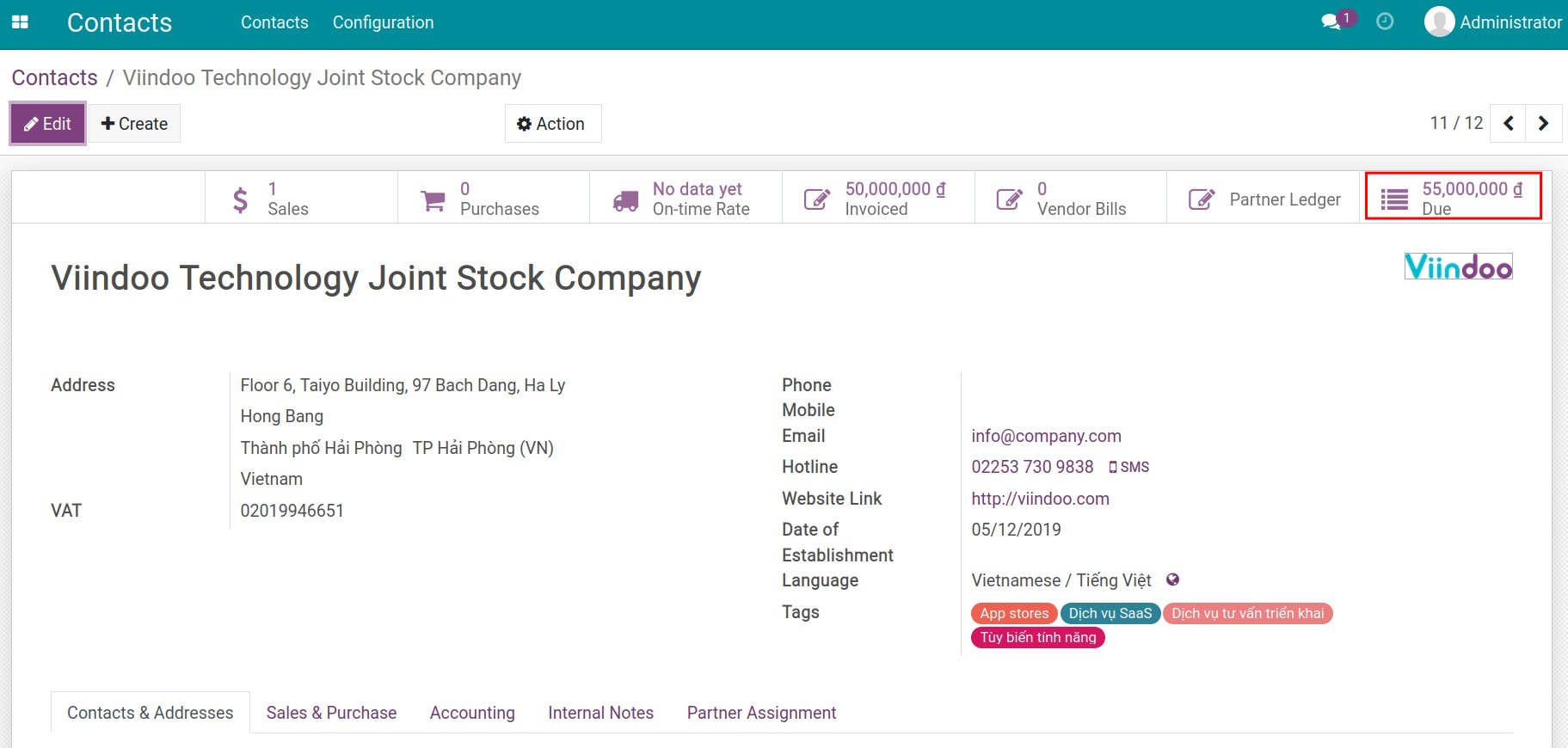

In preparation for reducing the delay of customers’ payments, as a liabilities accountant, you need to closely monitor and regularly stay in touch with customers. With Viindoo, you can track due debt directly on customer’s contact. Navigate to Contacts, then choose a customer’s contact and you can see the due of the customer:

Reporting

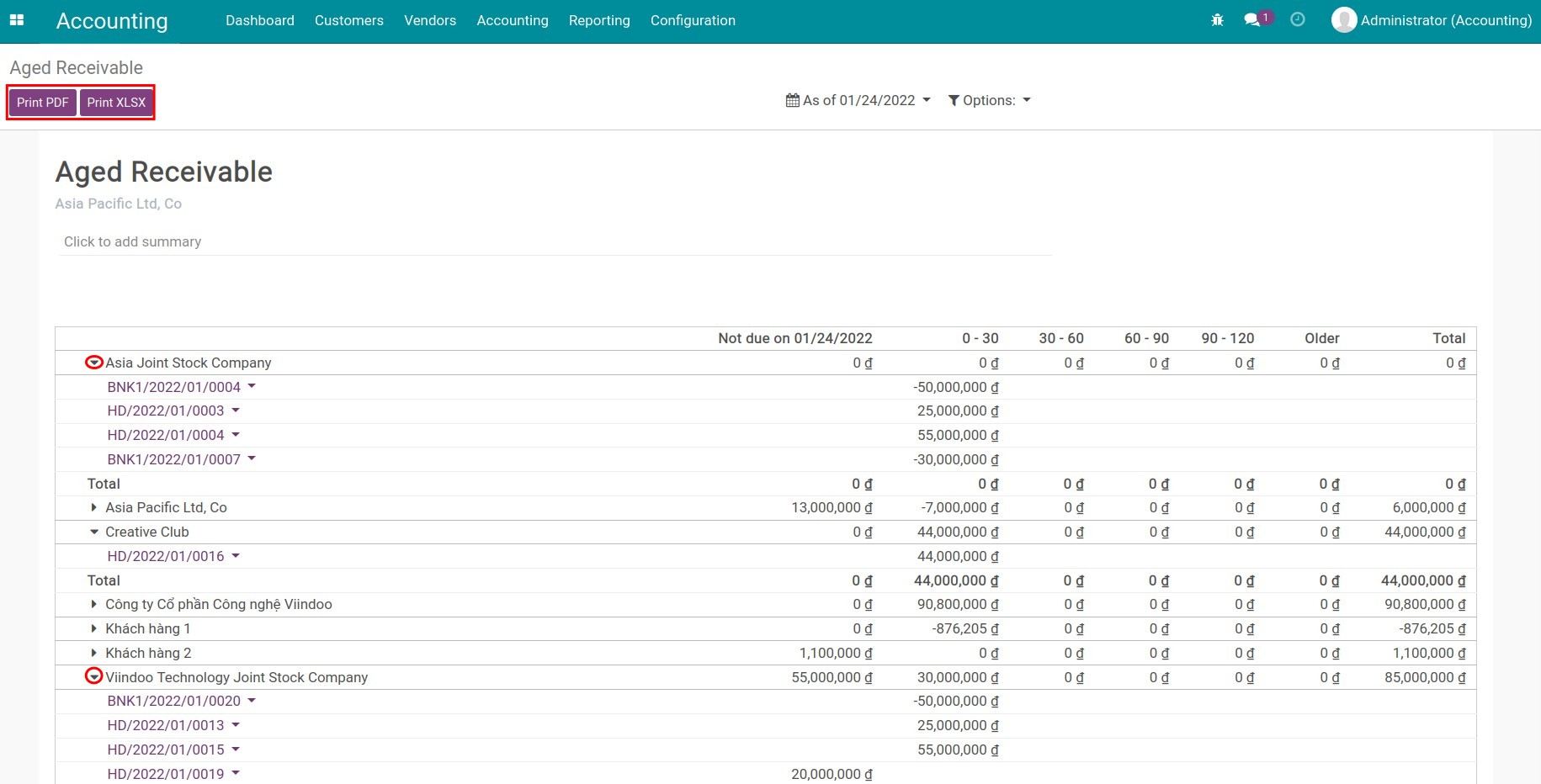

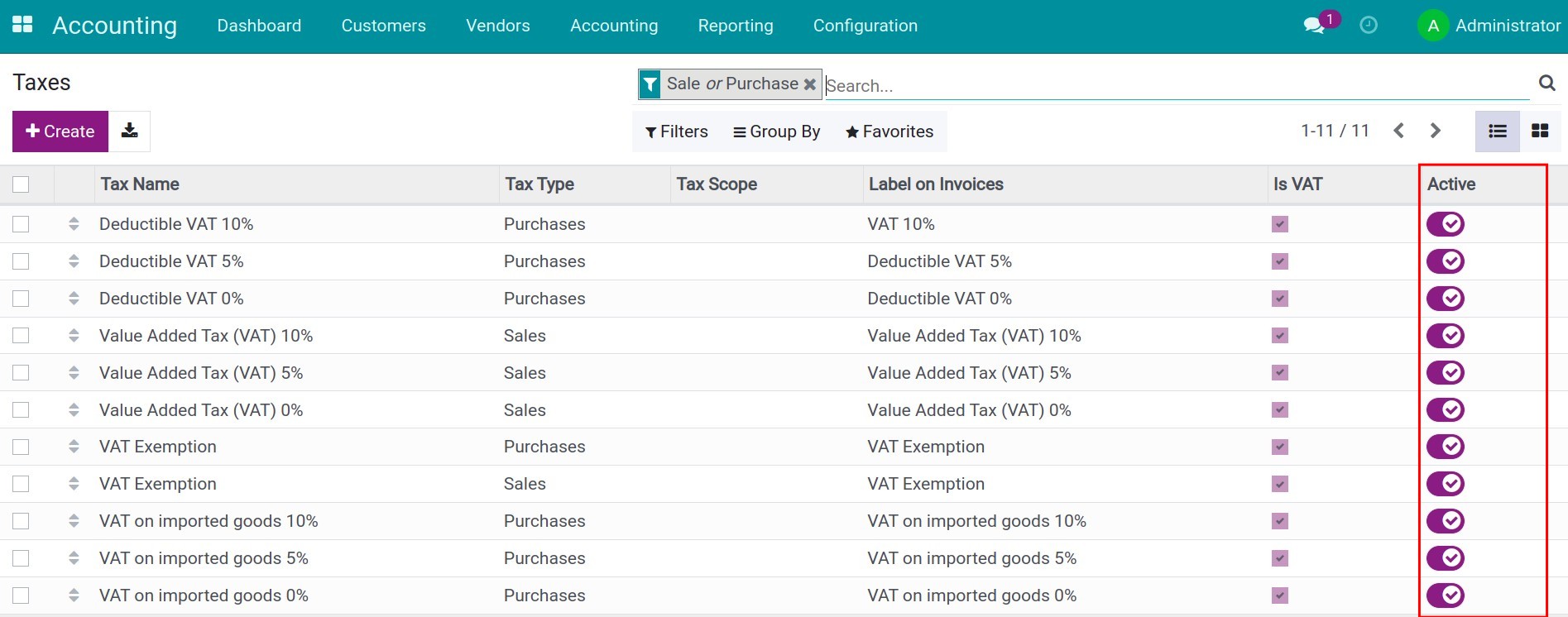

Payments due can be monitored by navigate to Accounting ‣ Reporting ‣ Aged Receivable:

In each report, you can click on the customers’ names to see the details of each transaction.

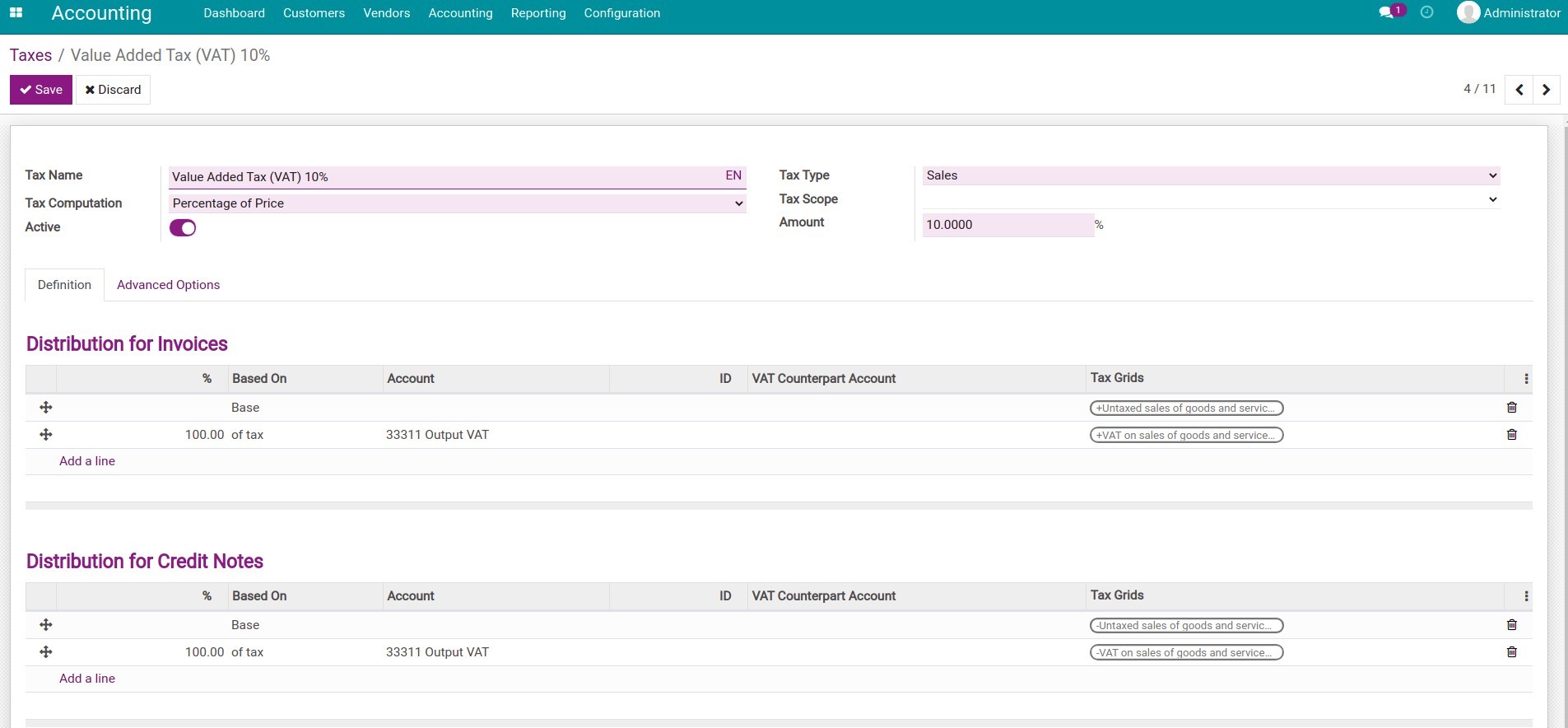

See also

Related article

Configure Cash Rounding method

Configure Payment Terms

Process a cash discount

Set up Payment Service Providers in Viindoo

Set up Payment Service Providers in iSuite

Requirements

This tutorial requires the installation of the following applications/modules:

Accounting & Finance

MoMo payment acquirer

Introduction

In the current context, most economic transactions can be processed online. iSuite Enterprise Management Software provides many online payment methods to help you close sales orders faster, providing more efficient and convenient tools for customers. There are two main types of payment methods: Payment through a third party service (the payment will be kept at the intermediary’s account, then transferred back to your bank account) and the bank transfer (the payment will be transferred directly to your bank account).

Bank transfer

This is the default method when you use online payments. With this method, you will need to provide detailed information on bank accounts on the website and the payment gateway. Then, customers will transfer money directly to your account via internet banking.

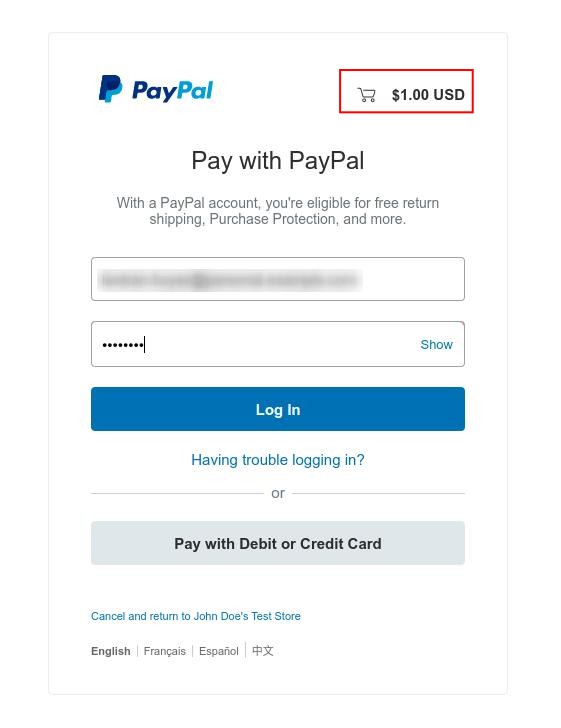

Payment via Payment acquirers

Using this payment method, your customers will be navigated to the payment acquirer interface and proceed to pay. Viindoo has integration with many payment acquirers such as:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

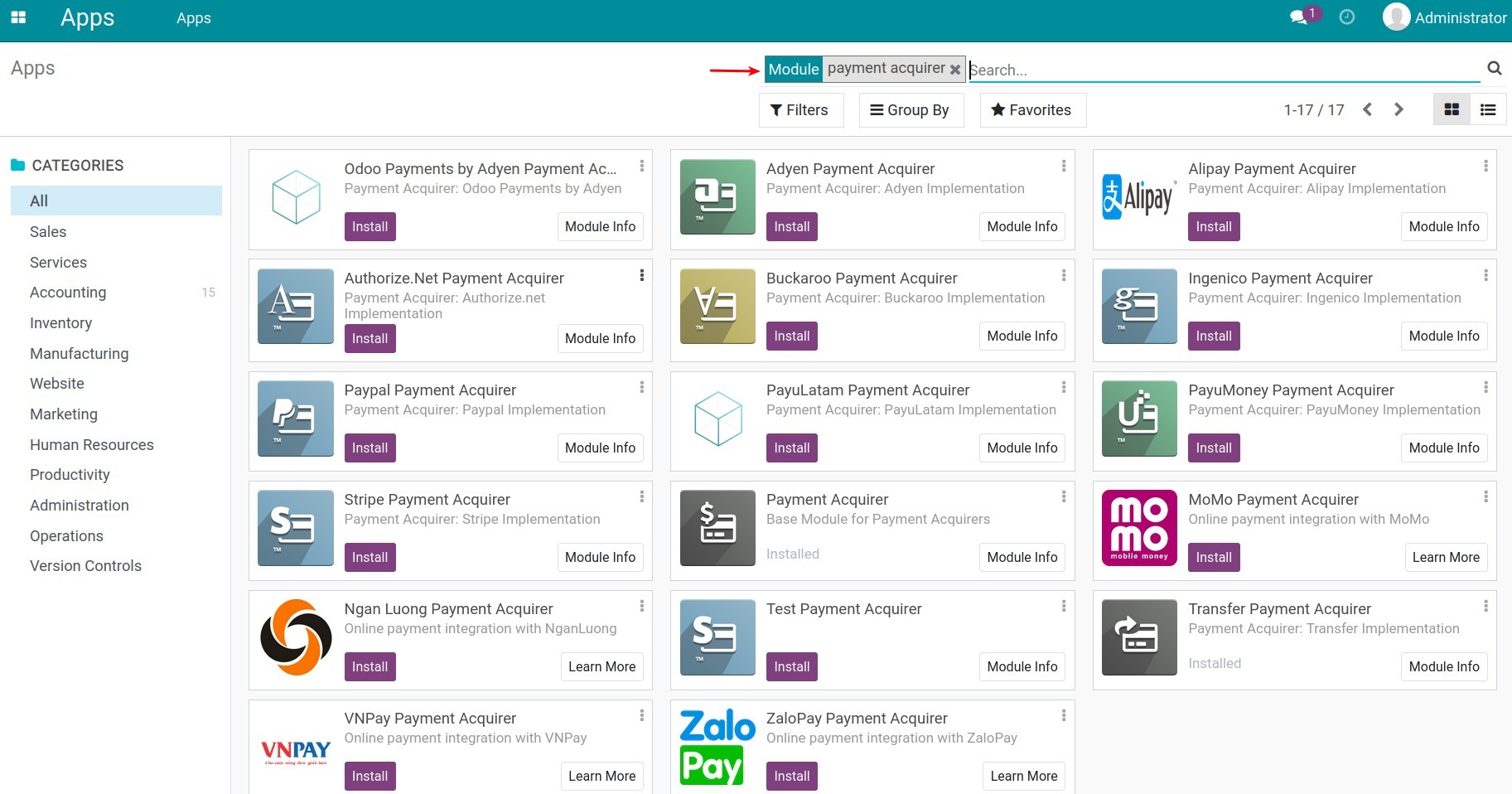

To use these payment services above, you go to iSuite Apps, turn off the Apps filter, and then use the filter tool to search for the suitable payment apps and install:

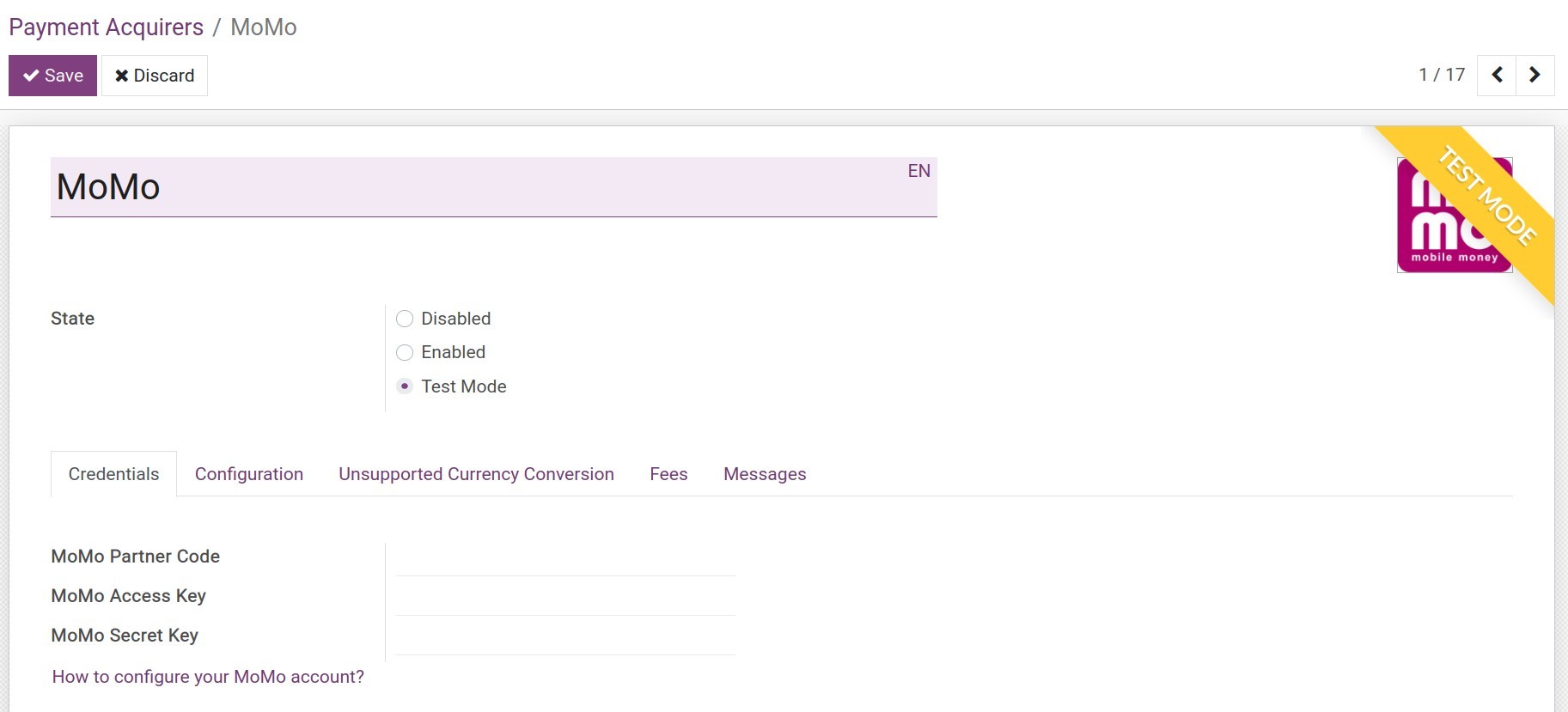

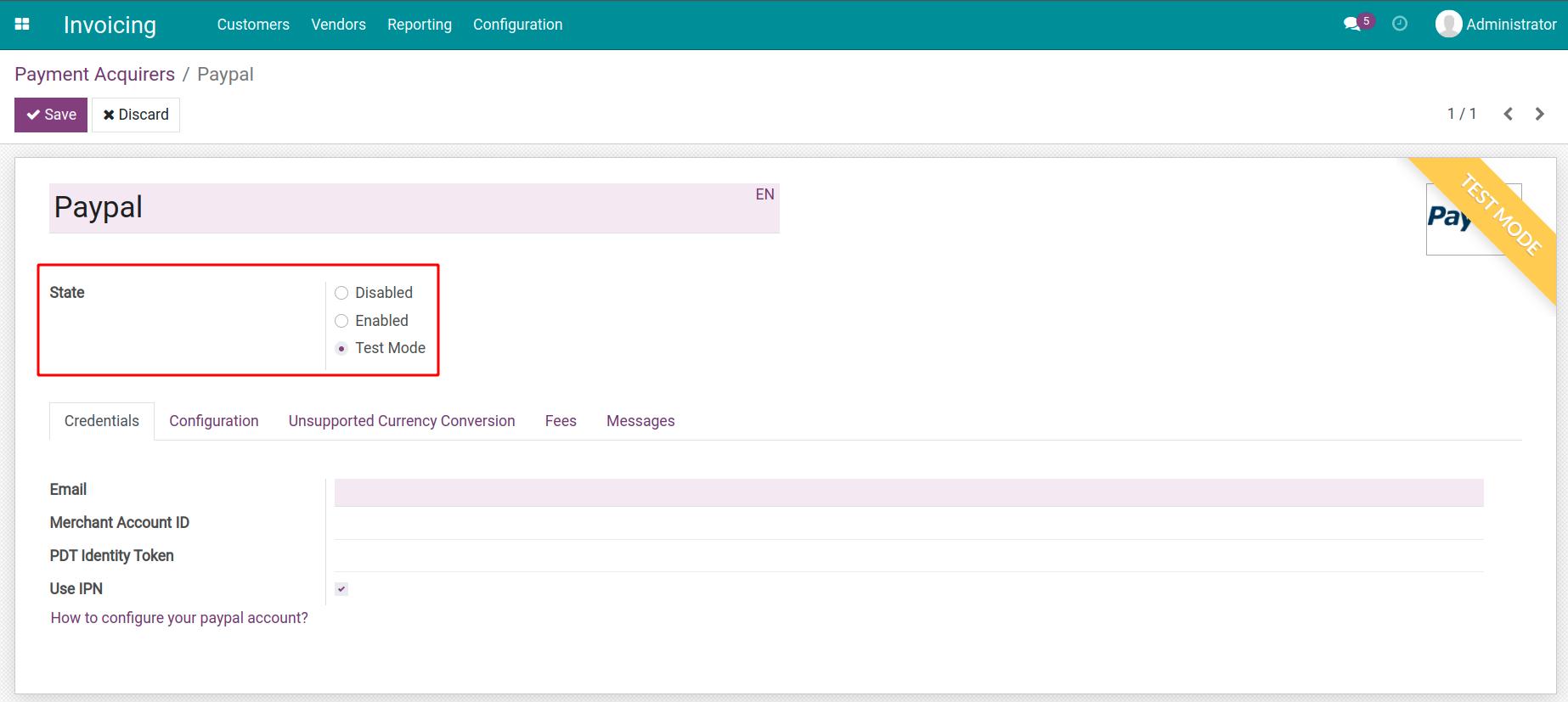

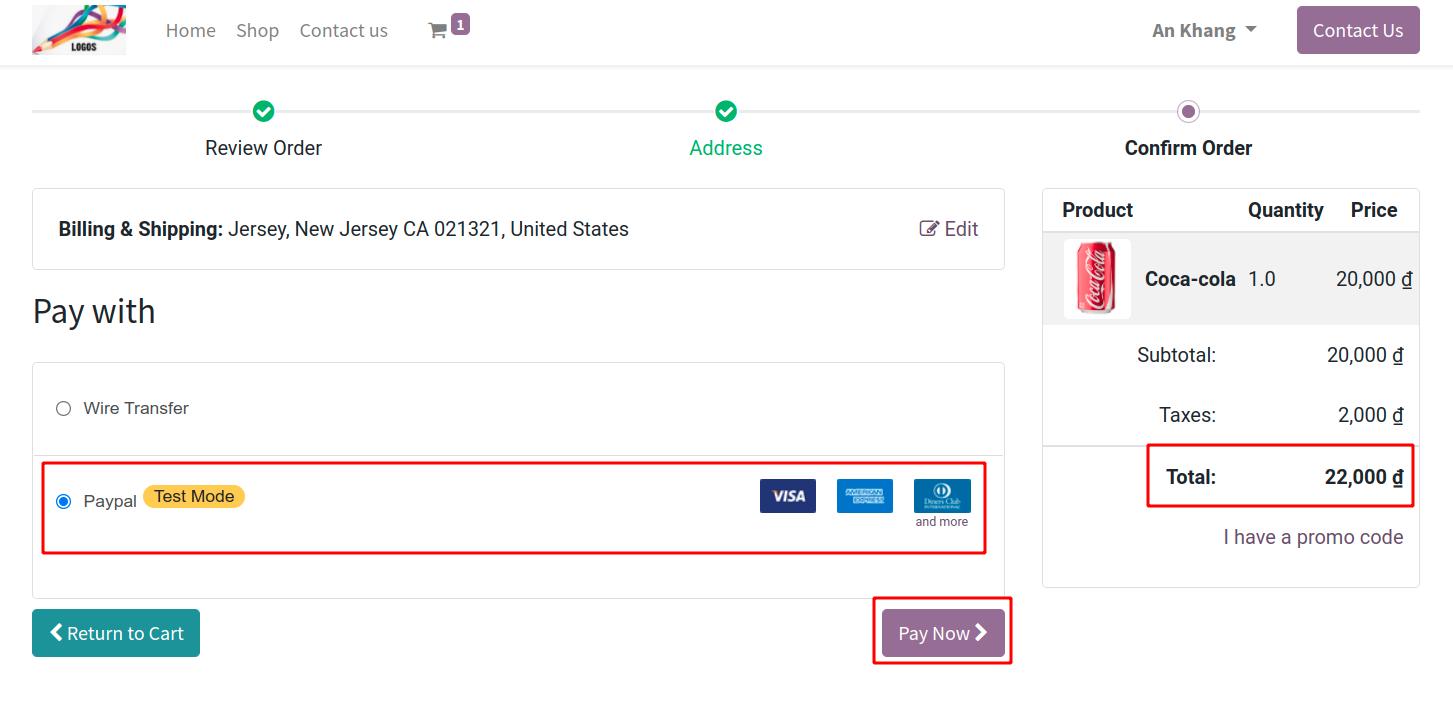

Payment acquirer configuration

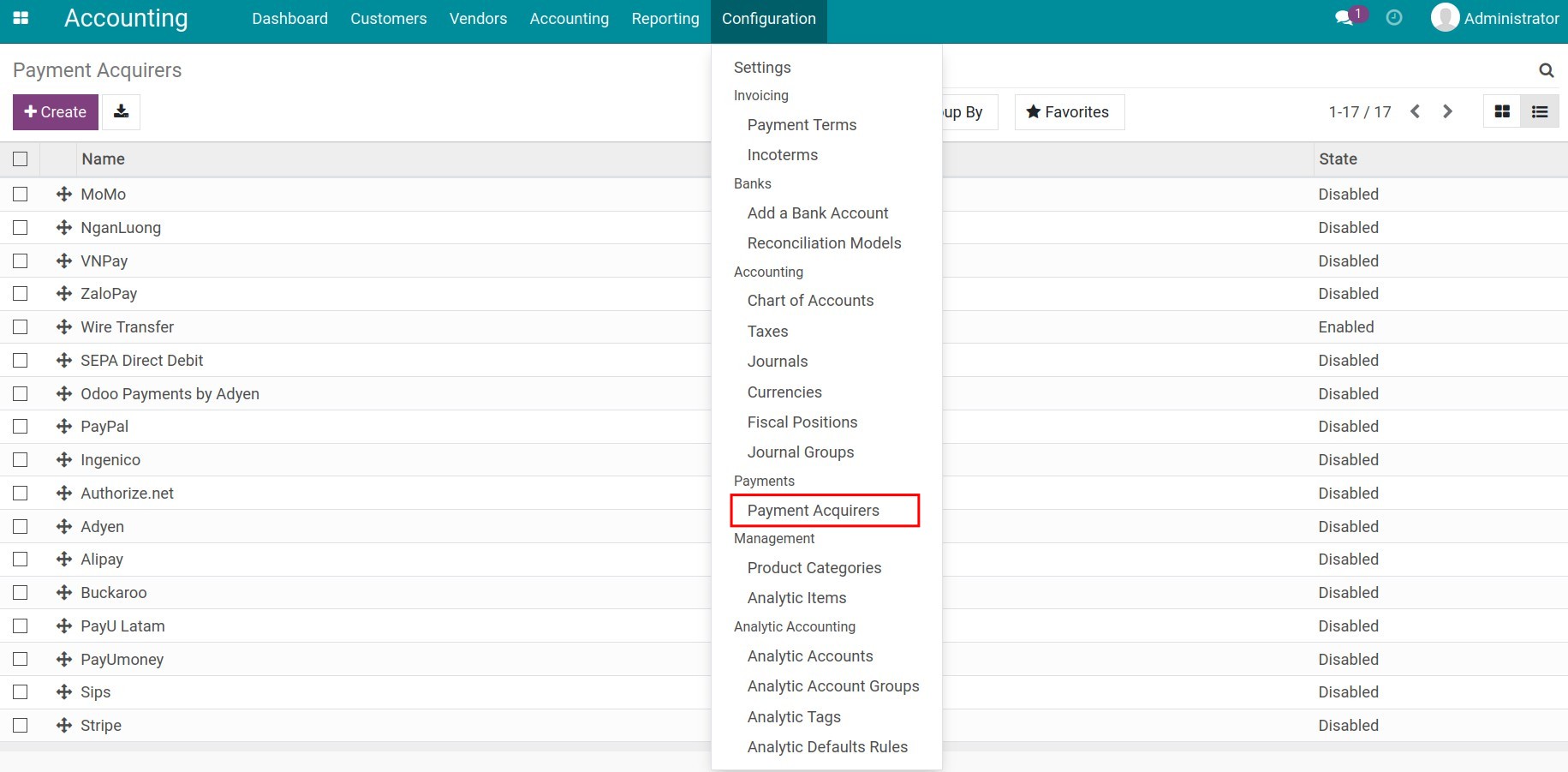

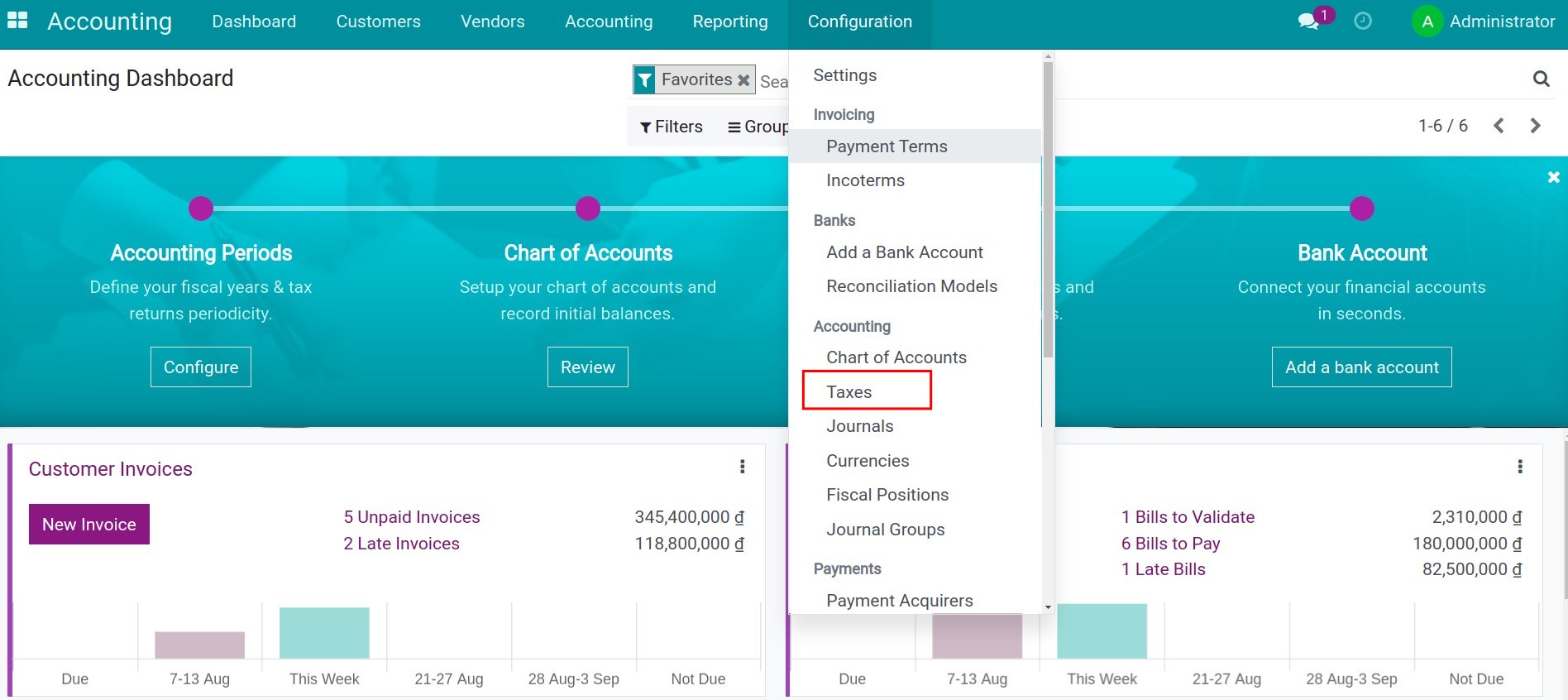

To configure a payment acquirer, navigate to Accounting ‣ Configuration ‣ Payment Acquirers:

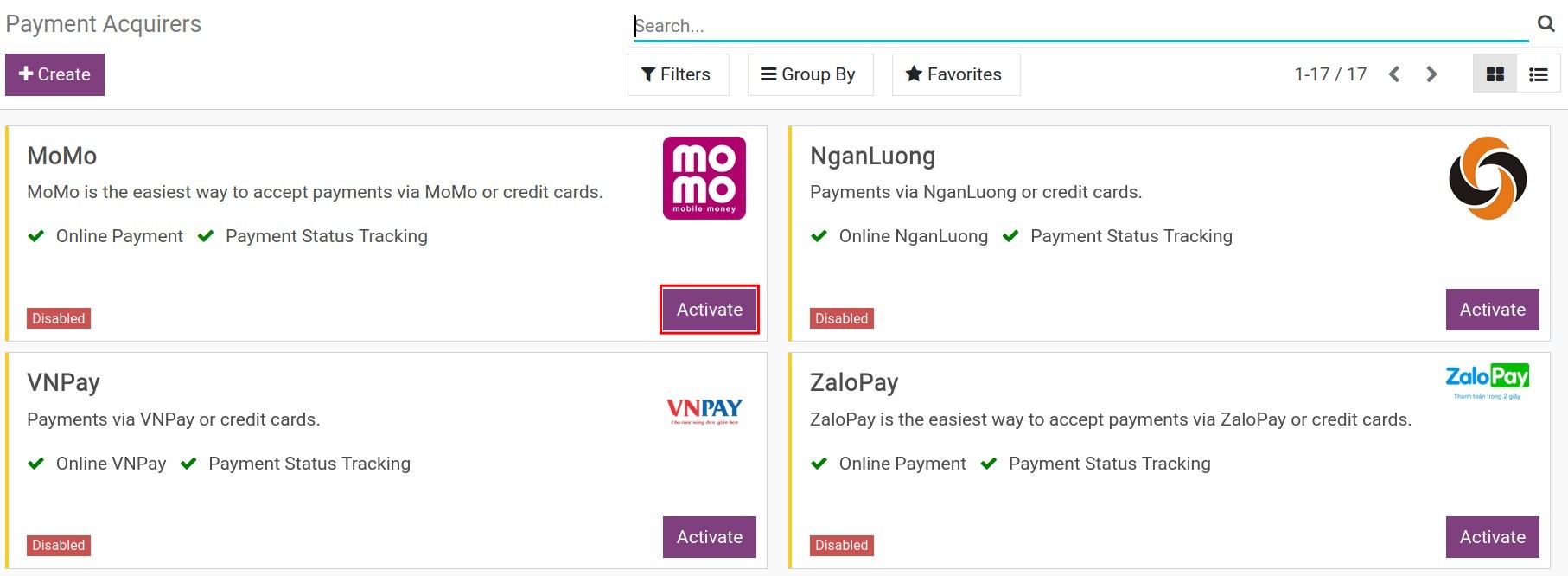

Head to the needed payment acquirer to use, then click on the Activate button.

Now the payment acquirer view is opened for you to configure the information:

State: Select the options below to change the payment service provider’s status:

Disabled: This payment acquirer cannot be used;

Enabled: When you want to use this payment acquirer;

Test Mode: Choose when you want to test this payment acquirer.

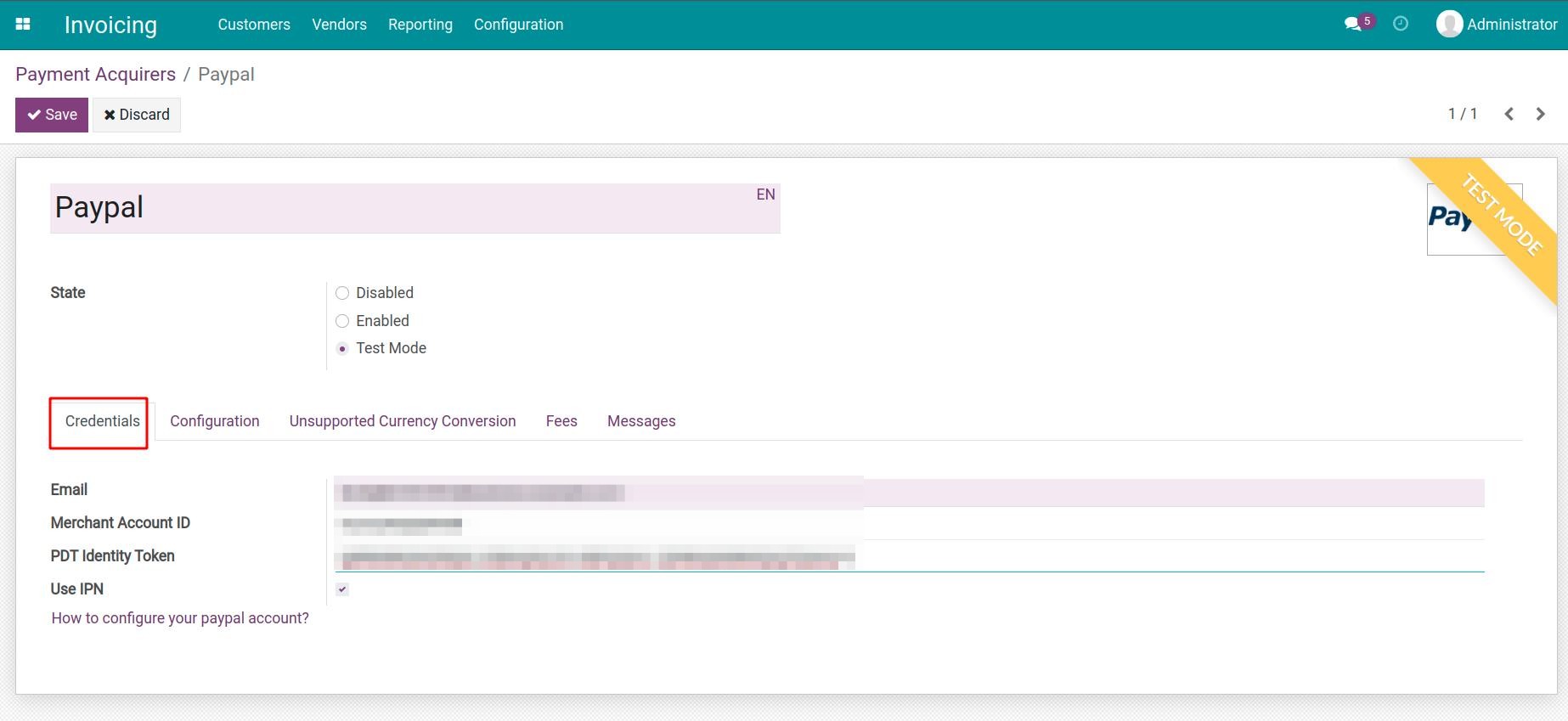

Credentials tab:

A place for declaring the affiliate information that the payment acquirer provides to you;

Click on the link for navigating to the payment acquirer’s instruction page.

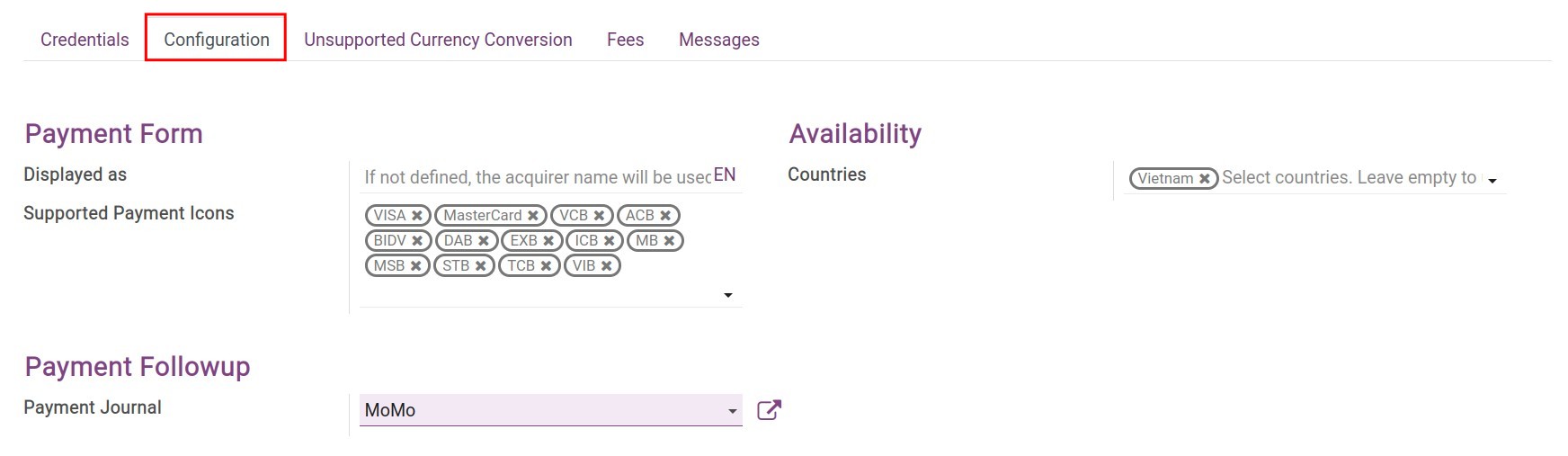

Configuration tab:

Payment Form:

Displayed as: Declare the display name of the payment method. If not, the system will use the name of the payment acquirer;

Supported Payment Icons: Choose from the list of the payment symbols so that customers can see what payment types this acquirer supports.

Payment Followup:

Payment Journal: Select a journal to record the payments from this acquirer.

Availability:

Country: Select the countries in which you want this acquirer to apply.

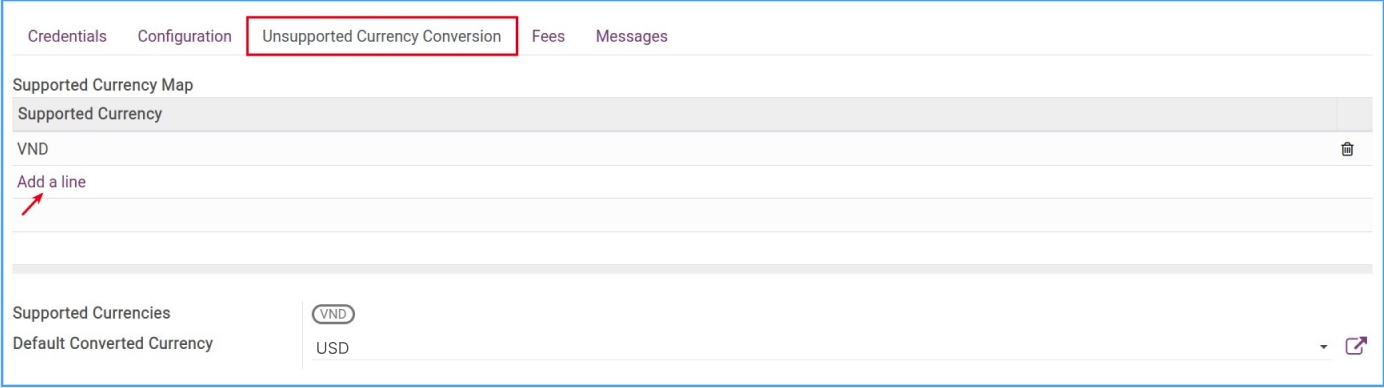

Unsupported Currency Conversion tab:

To add a currency that is supported to payment with this acquirer, click on Add a line and choose from the list of supported currencies (Note: you need to enable the Multi-currencies system to apply multiple currencies to payments).

Default Converted Currency: When occurring the currencies which differ from those supported by the acquirer, the system will convert them to the default currency that is being configured here.

For instance: Your bill is calculated in VND (Vietnamese Dong) while it is not supported by the acquirer. During the online payment process, this currency will be converted to the default currency.

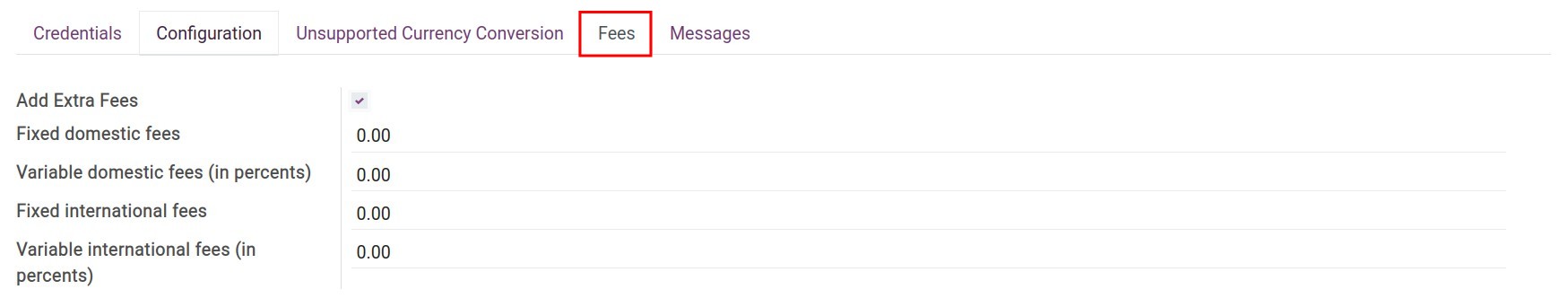

Fees tab:

When enabling the Add Extra Fees feature, the system will allow you to declare the money exchange fees from the payment acquirer to your company’s account.

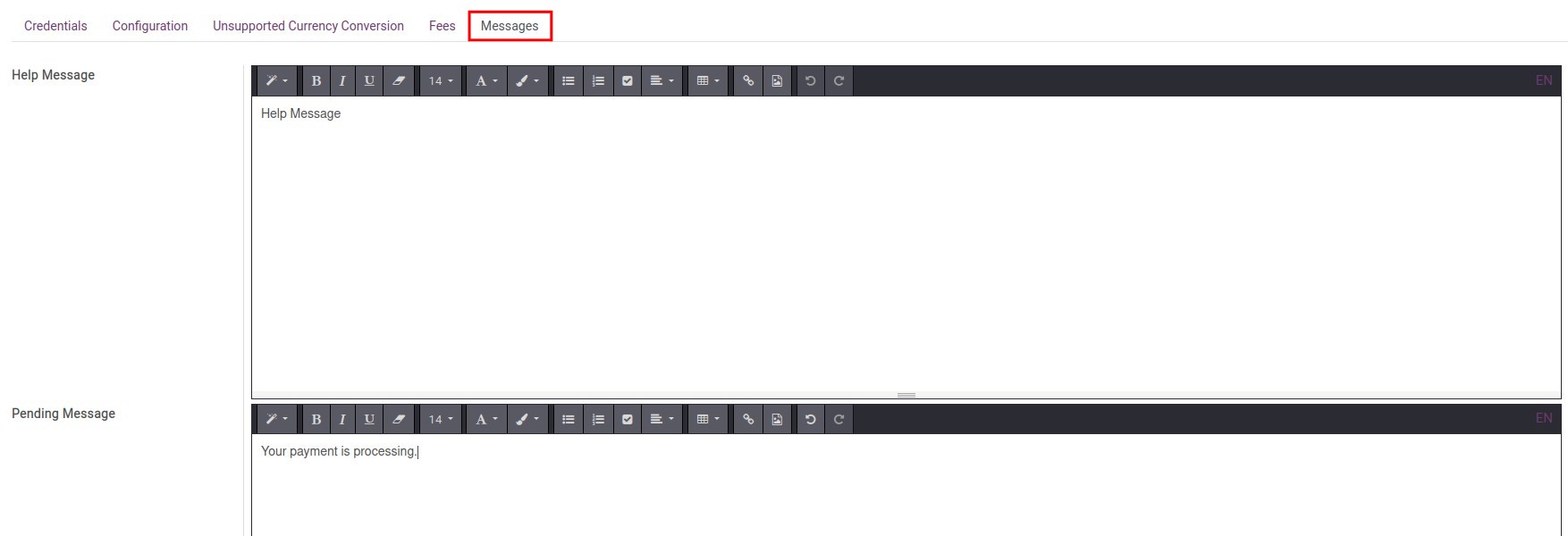

When enabling the Add Extra Fees feature, the system will allow you to declare the money exchange fees from the payment acquirer to your company’s account.Message tab:

A place to declare the messages which are:

A place to declare the messages which are:Help Message;

Pending Message;

Complete Message;

Cancel Message.

Accounting reports available in iSuite

Accounting reports available in iSuite

Requirements

This tutorial requires the installation of the following applications/modules:

iSuite Accounting & Finance

In the iSuite system, you can use a couple of general reports in various countries.

Some featured general reports in iSuite Accounting app:

- GAAP Statements:

Profit and Loss;

Balance Sheet;

Cash Flow Statement.

- Partner Reports:

Aged Payable;

Aged Receivable;

Partner Ledger.

- Business Statements:

Executive Summary.

- Audit Reports:

Tax Report;

General Ledger.

- Trial Balance

etc.

General characteristics of the reports

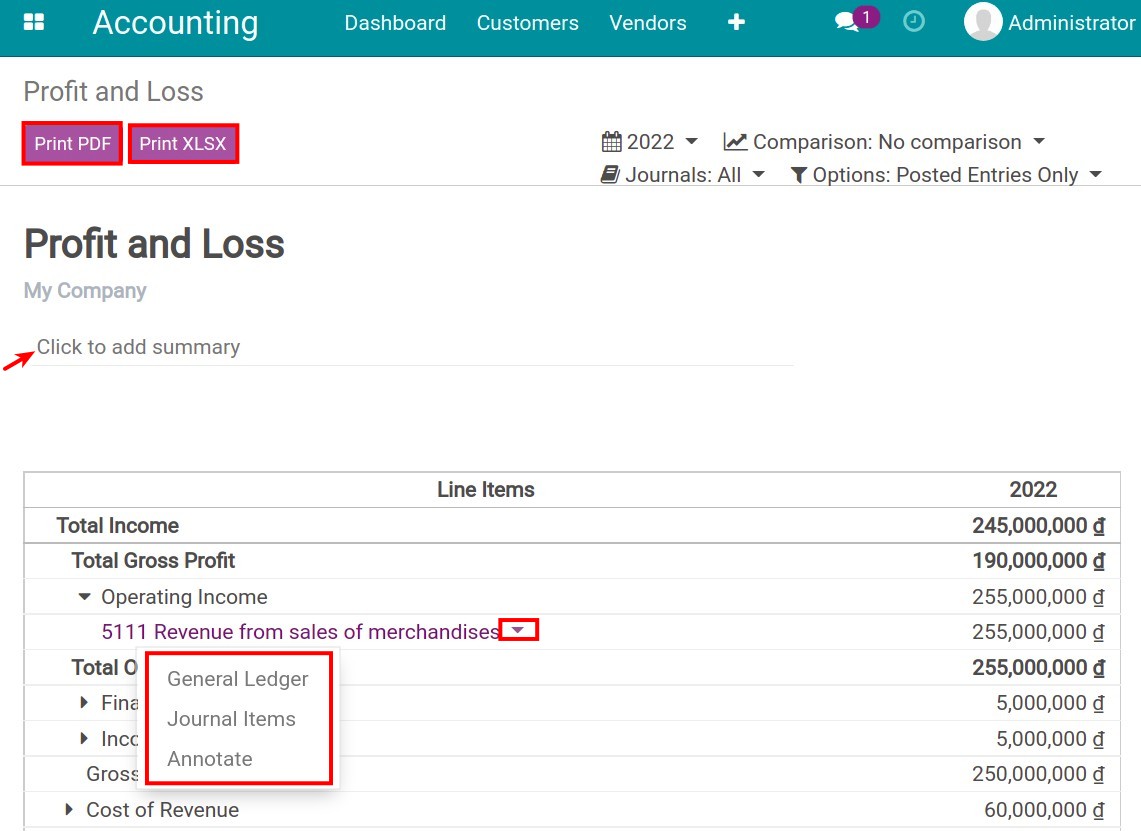

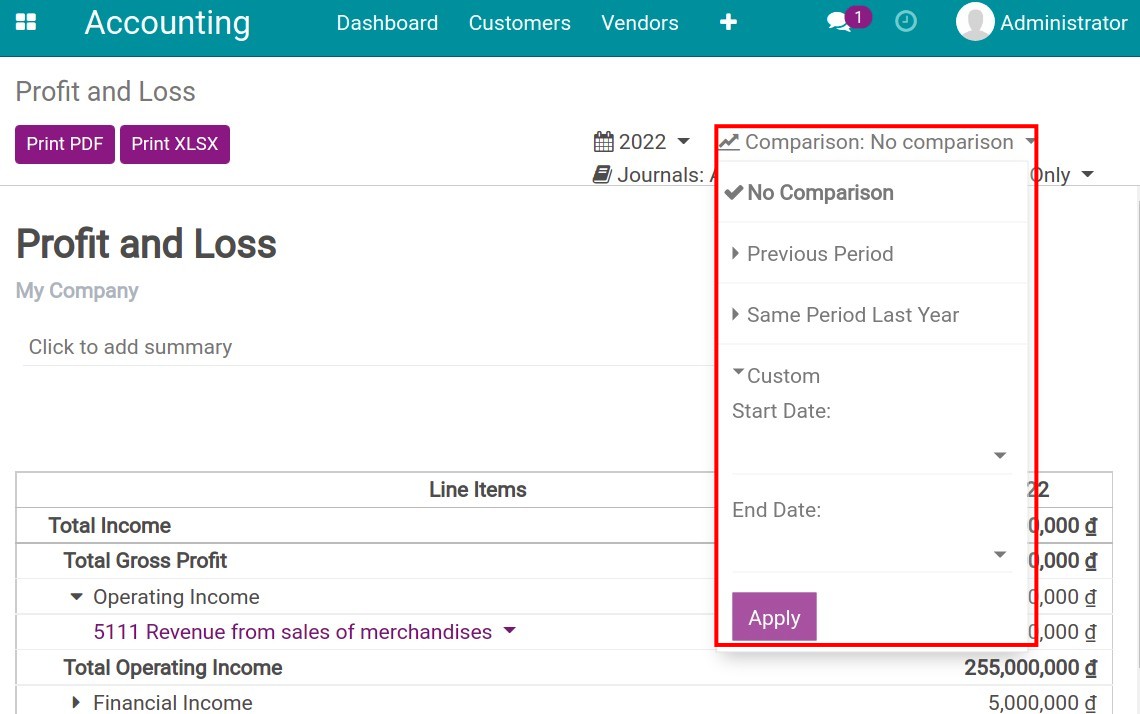

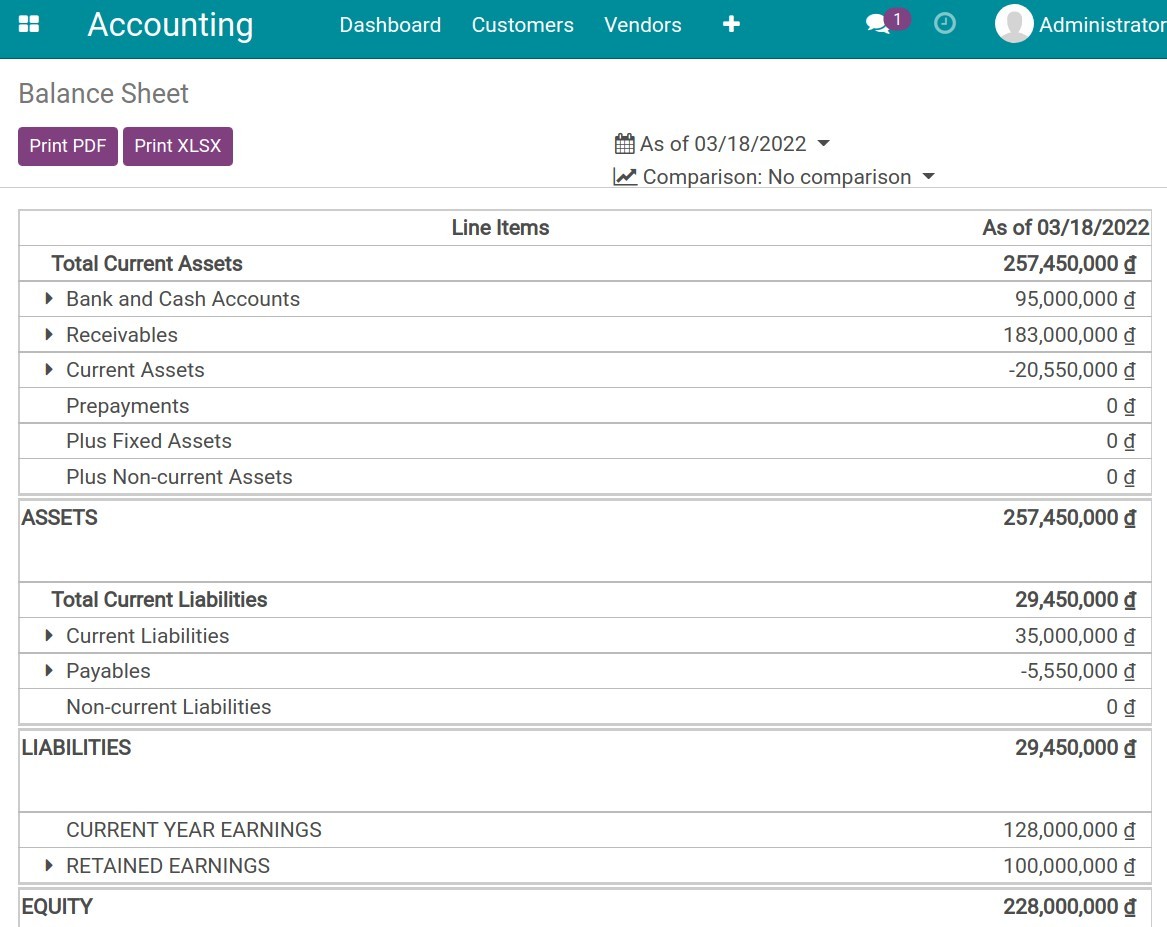

You can add content to the footnotes of report pages and print them to PDF or Excel files. To view specific data, you can click on an item in the report and see details in General Ledger or Journal Items.

You can compare data between different periods of time such as comparing with the previous one, with the same period of last year, or view data of a determined period. It’s a useful tool that helps you compare the fluctuation of each financial indicator, by selecting a certain time period.

General reports in iSuite

To view reports, navigate to Accounting > Reporting and select a report according to your needs:

Balance Sheet

Balance Sheet shows a quick view of assets data, liabilities, and owner’s equity of your business at a certain time.

Note

See details about Balance Sheet according to Vietnam Accounting Standard.

Profit and Loss

The profit/loss statement shows the balance between revenue and expenses in each accounting period. This report is a tool to present the profitability and business operation status of the business.

Note

See details about Profit and Loss according to CEMAC Accounting Standard.

Cash Flow Statement

The Cash Flow Statement is a report that shows the cash inflows and outflows of a business in a determined period. This statement helps managers control the cash flow, balance the revenue and expenditure, and be proactive in finance.

Note

See details about Cash Flow Statement according to CEMAC Accounting Standard.

Tax Report

This report allows you to see the net amount and tax amount grouped by type of purchase and sale.

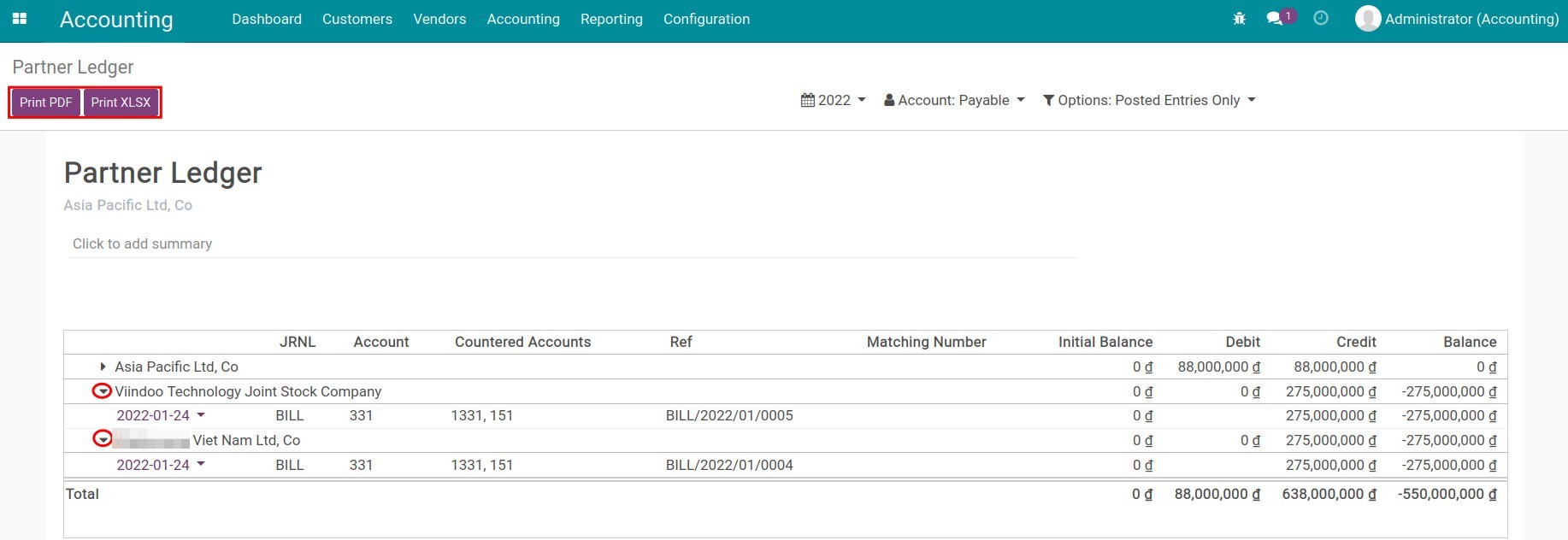

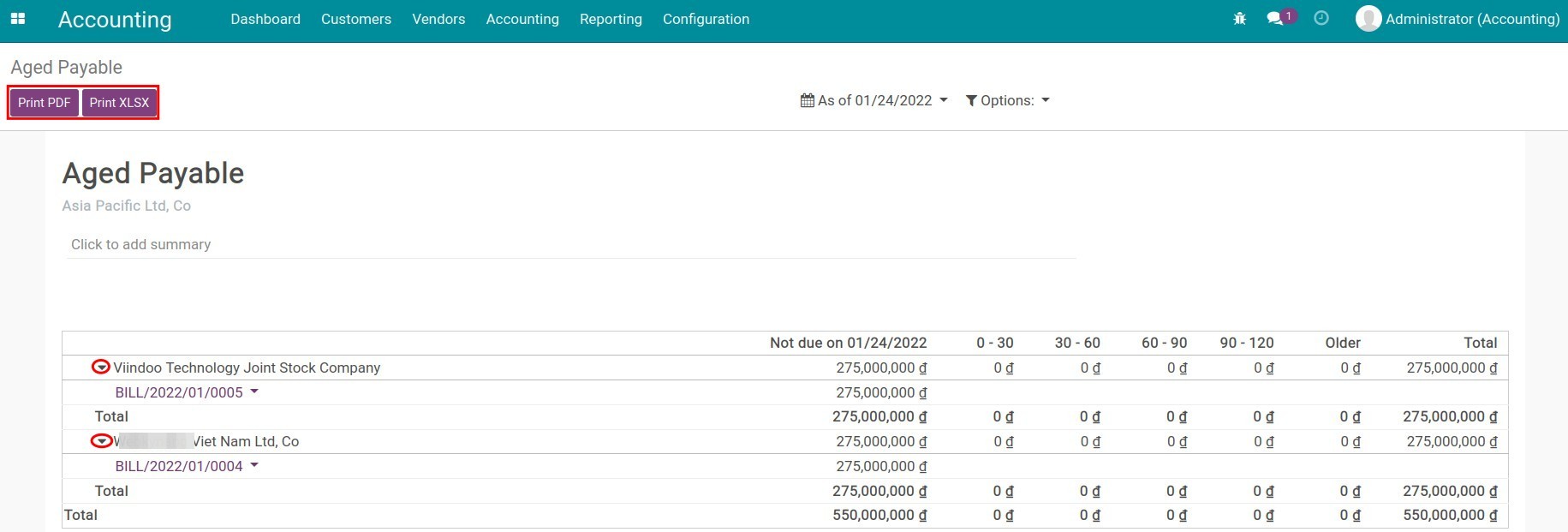

Aged Payable/Receivable reports

This is a type of payables/receivables report , used for tracking the payables/receivables of each customer and vendor by time purpose. There are two types: Aged Receivable and Aged Payable. These reports help businesses understand the due time of each debt for each partner. From there, businesses can come up with a reasonable method to collect the debt from each customer or pay the provider on time. This is the noticeable difference of the aged payable/receivable report compared to other payable/receivable statements.

Aged Receivable

Aged Payable

In which, at a specific time that you configured in this report:

Not due + a specific time: Undue payables/receivables.

0-30: Overdue payables/receivables overdue from 0-30 days ago.

30-60: Overdue payables/receivables from 30-60 days ago.

60-90: Overdue payables/receivables from 60-90 days ago.

90-120: Overdue payables/receivables from 90-120 days ago.

Older: Payables/receivables overdue for more than 120 days.

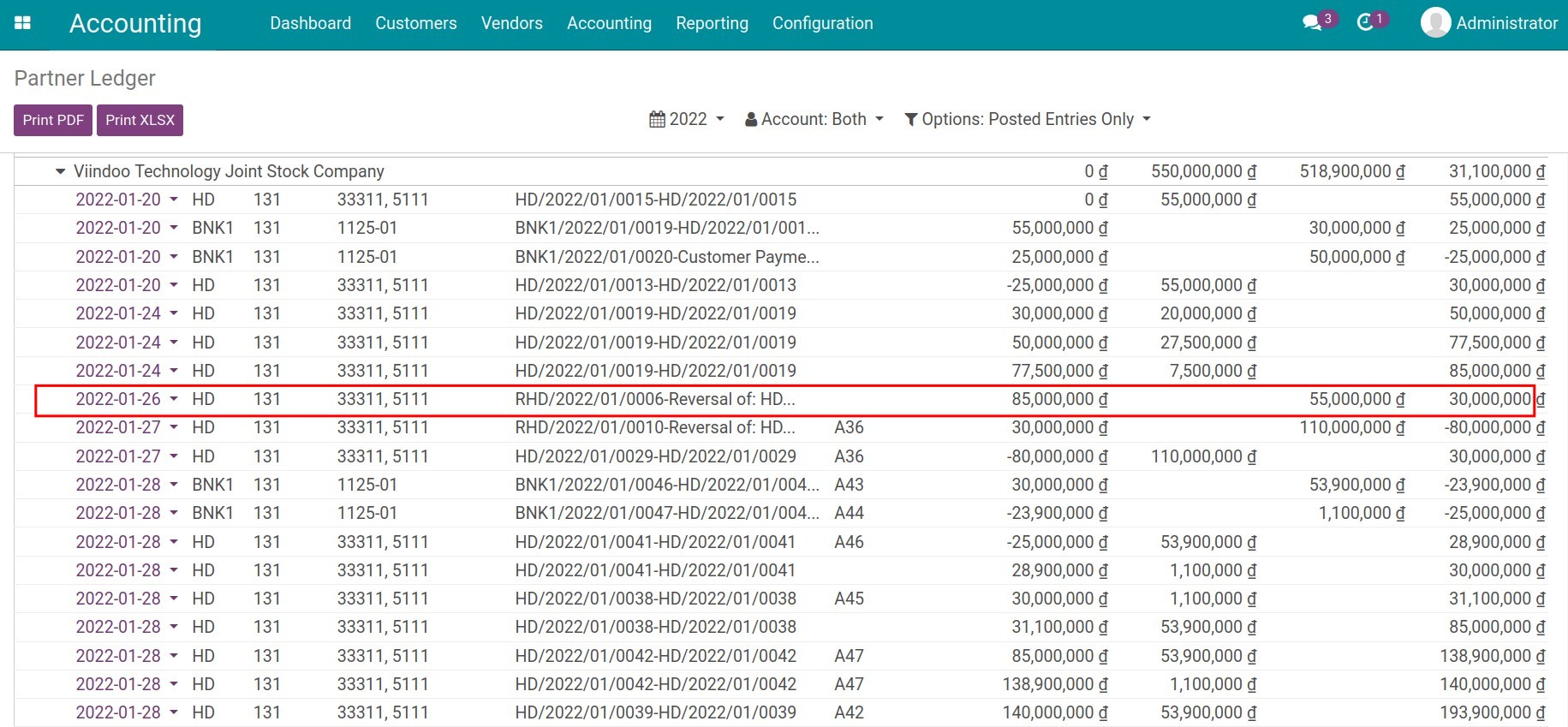

General Ledger

On General Ledger, each account will be displayed on a line and you can see details of each line by clicking on that journal entry.

See also

Related article

Reports according to Vietnam Accounting Standard

How to exclude journal items from Financial Reports

Optional module

Accounting Analysis

Accounting Reports

Assets Management

Account Balance Carry Forward

Account Counterparts

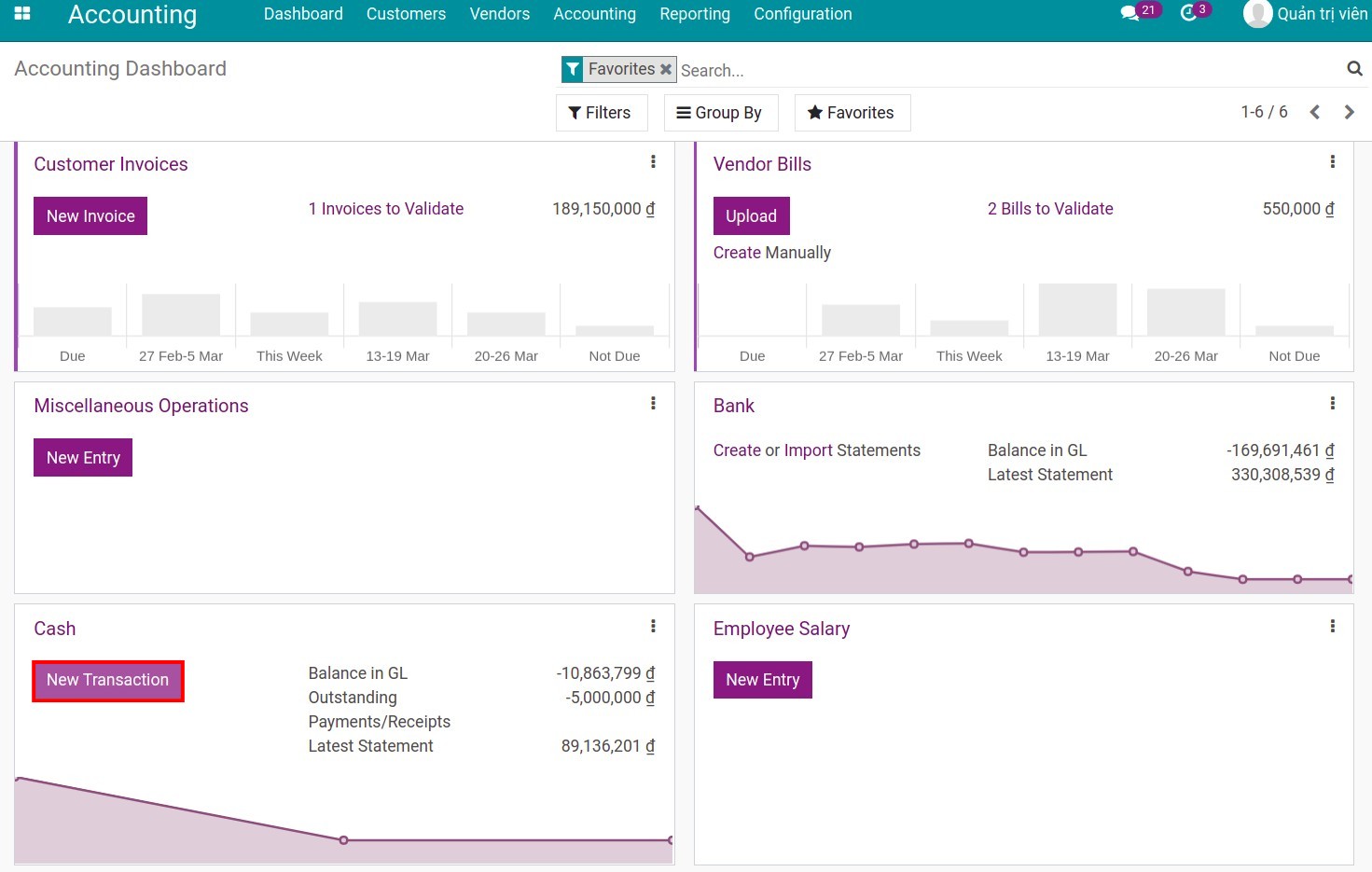

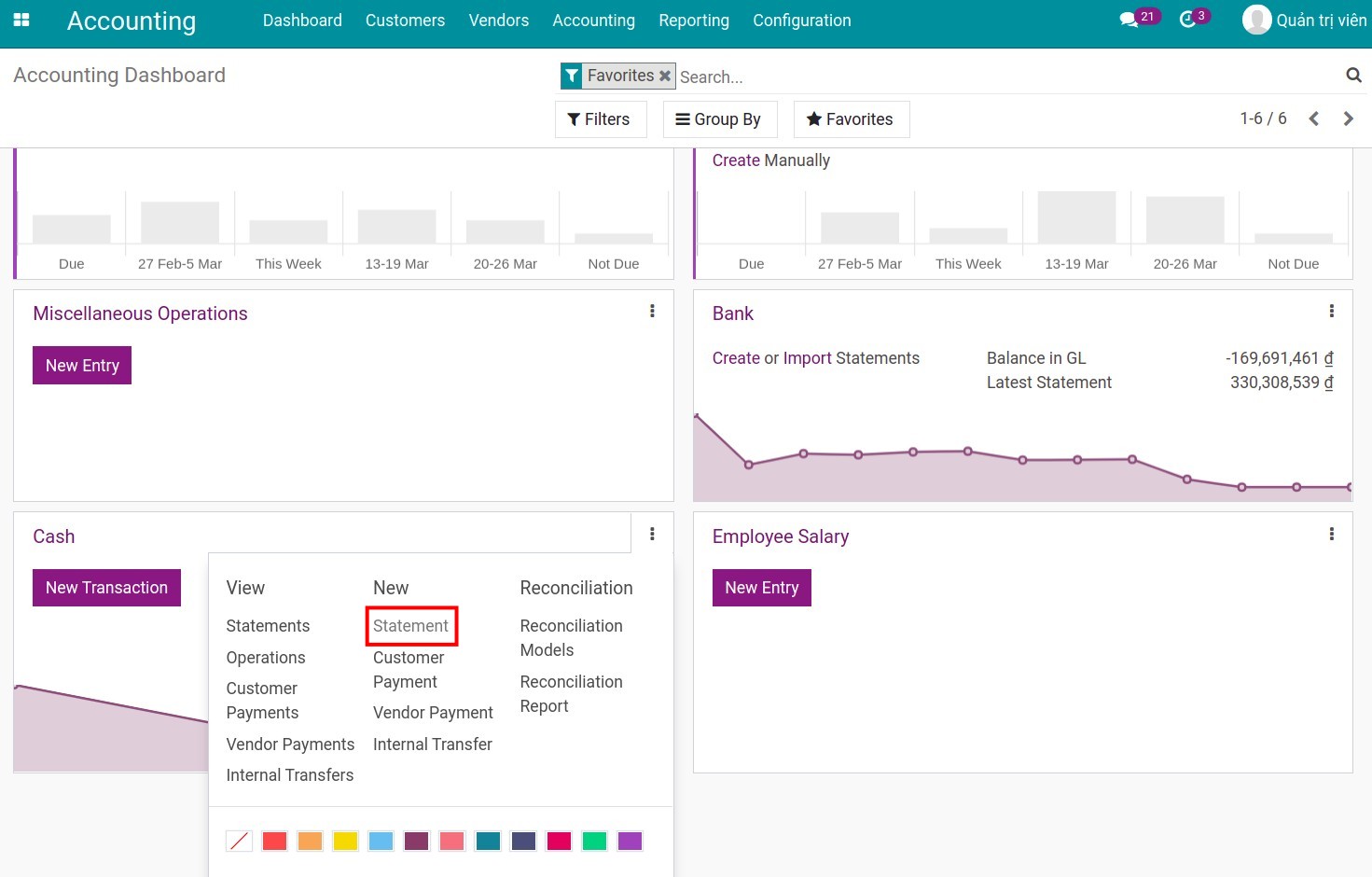

Cash on hand management

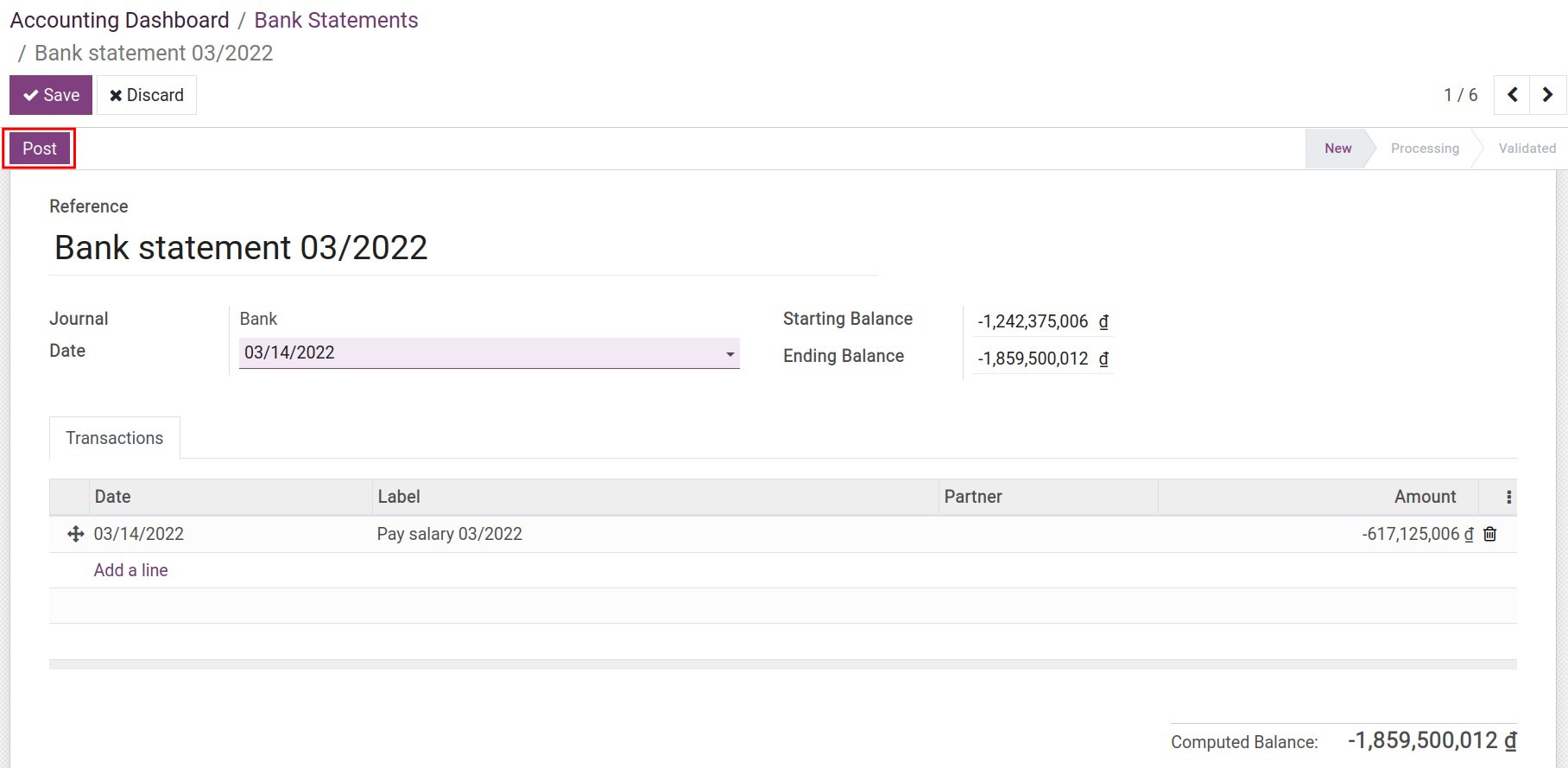

Cash on hand management

Requirements

This tutorial requires the installation of the following applications/modules:

Accounting & Finance

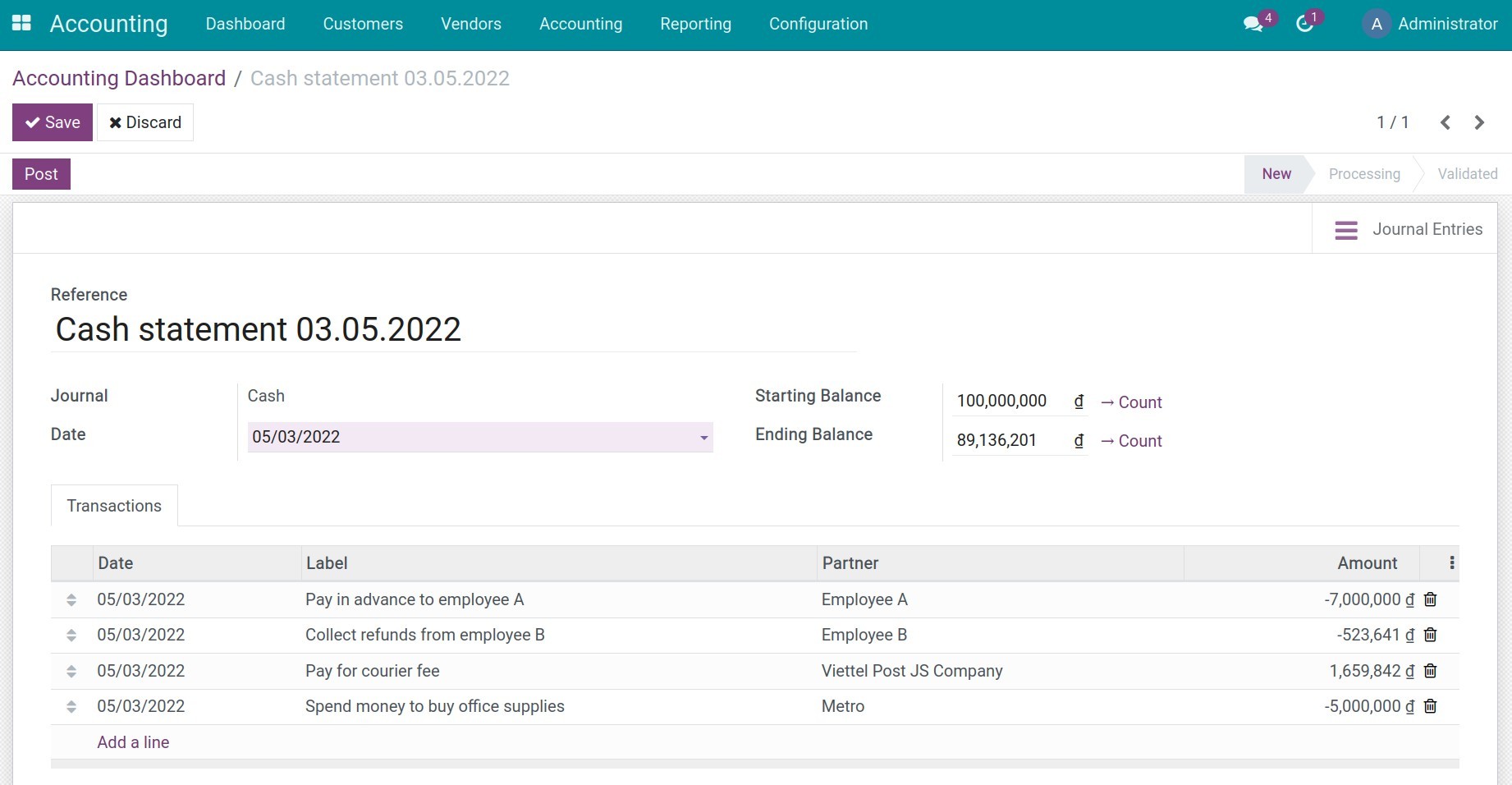

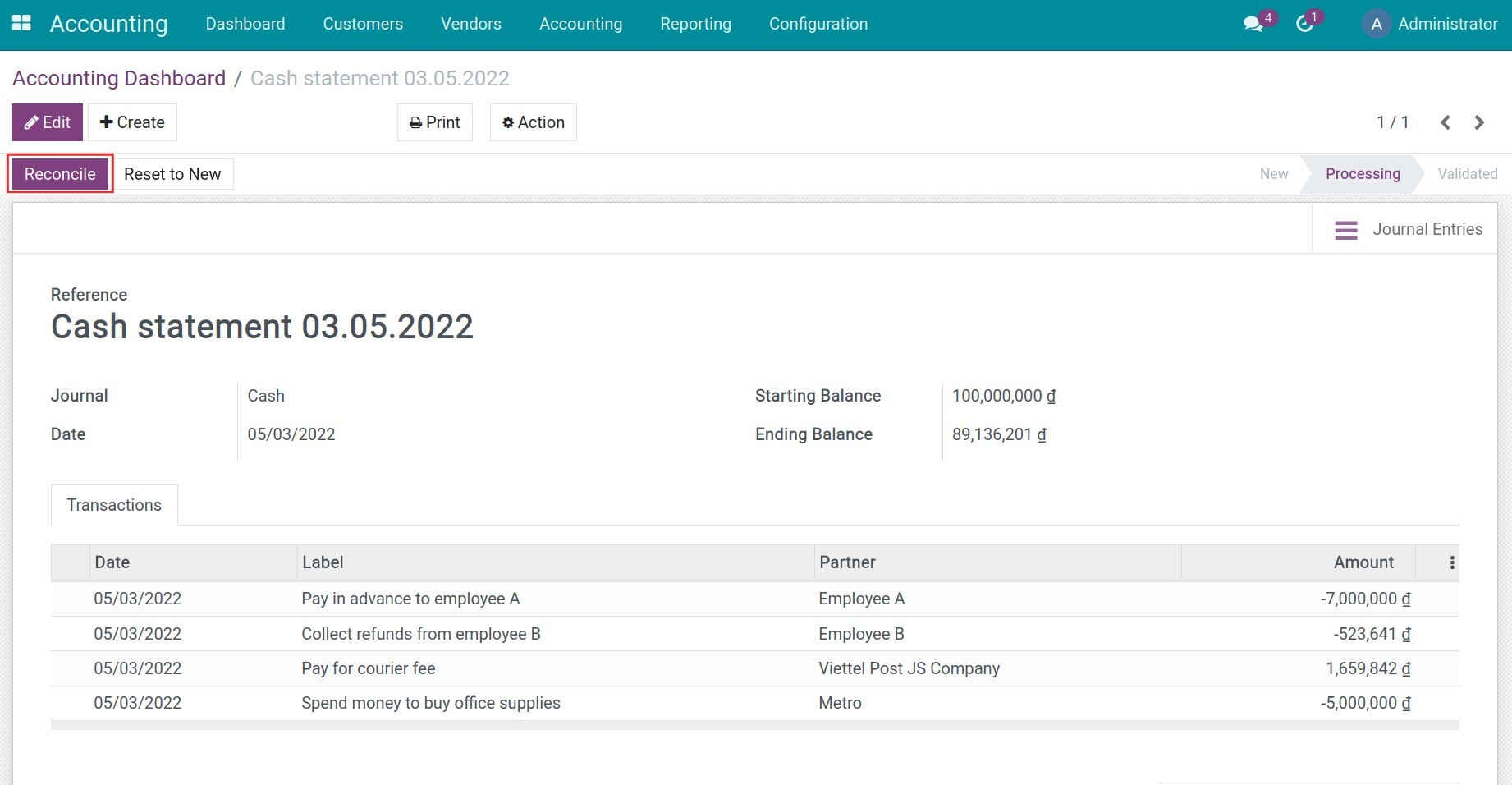

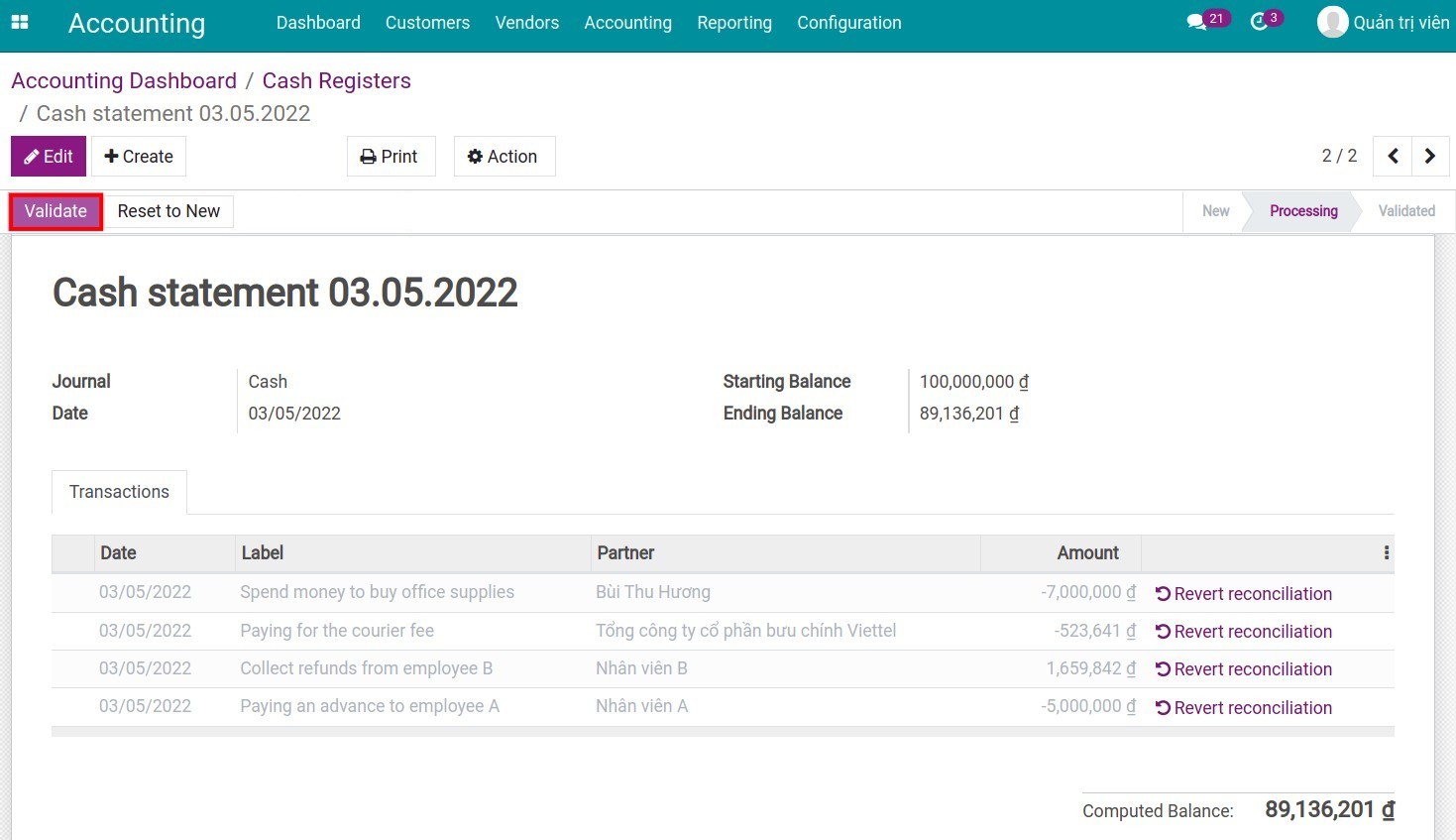

Cash statement creation

On the view Accounting Dashboard of the Accounting app , go to Cash section and hit New transaction.

Alternatively, also in Cash section, hit on the Kebab menu icon (ie. three vertical dots icon) and select Statement on the New column.

Recording on the cash statement is similar to recording cash receipts and cash payments in the cash journal. On this new view, enter the following information:

Reference: for information search purposes. There should be information of the time (e.g. date) so that it is easy to find and easy to read.

Journal: select the accounting journal in which you keep track of each cash on hand fund.

Date: the date the statement was created.

Starting balance: enter the actual balance in the cash on hand fund when the recording of the statement is started.

Ending balance: enter actual balance in cash on hand fund when the recording of the statement is stopped.

Computed balance: the formula is: starting balance + all the amounts of cash in/out transactions. This balance will be compared with the ending balance. When this balance is posted, a journal entry will be created to record the difference, if any.

Transactions tab: enter the details of cash transactions during the day.

Note

Use negative numbers to record the money out. Use positive numbers to record the money in.

On the statement, the partner information must be filled in correctly and completely (the payer/receiver) for monitoring and reconciliation.

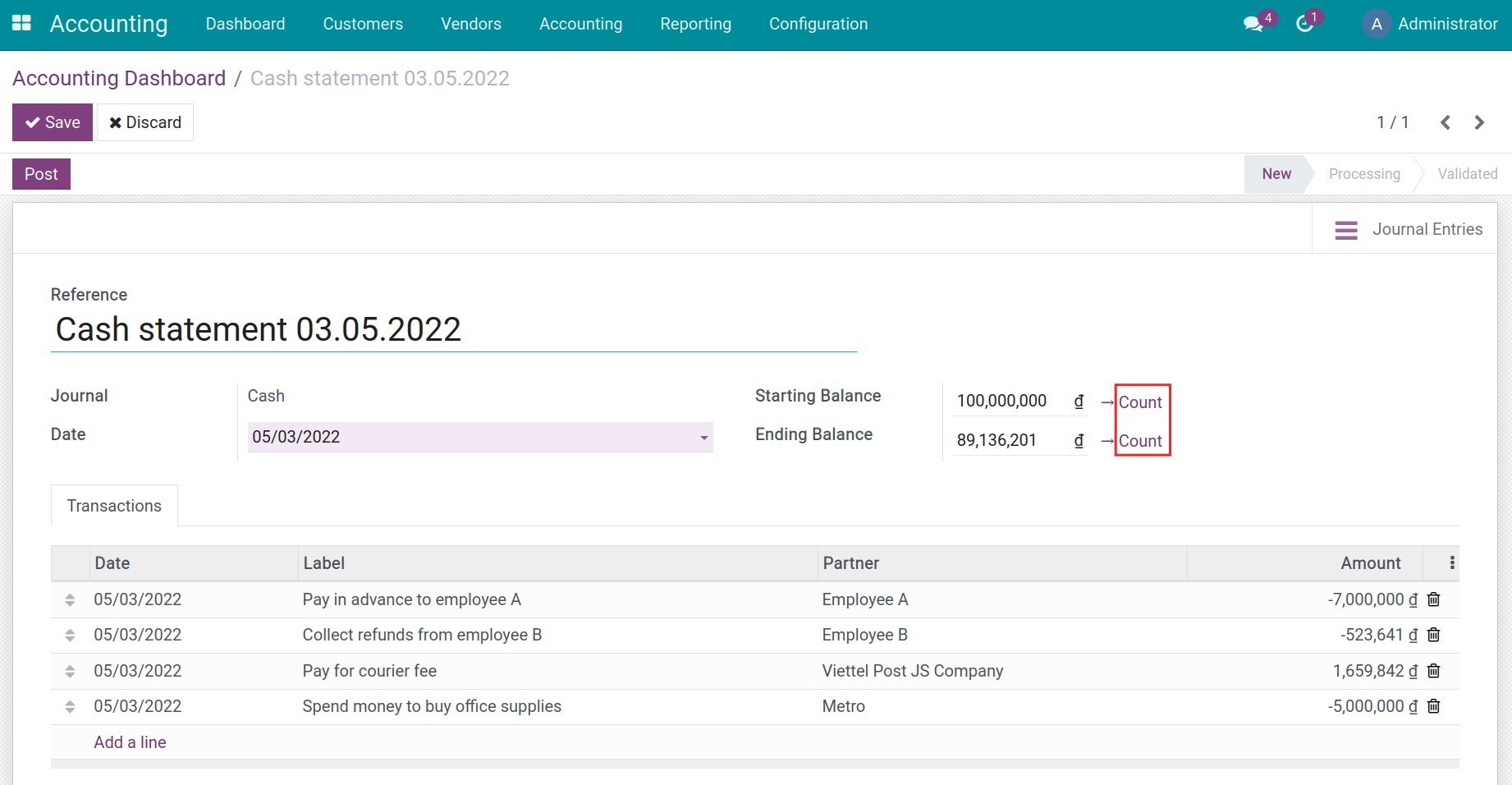

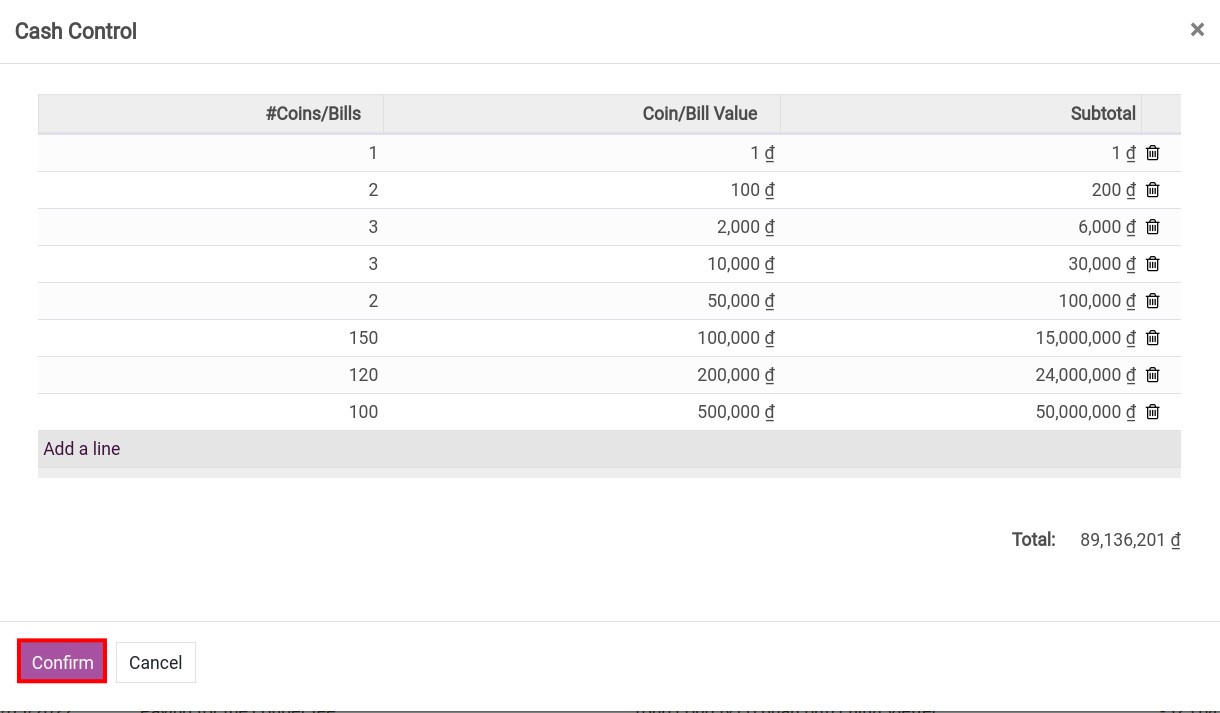

Cash on hand Counting

On the view of creating a statement, hit Count to perform an actual cash counting in the fund, which is based on the face value and the quantity.

Hit Confirm to complete the cash on hand counting.

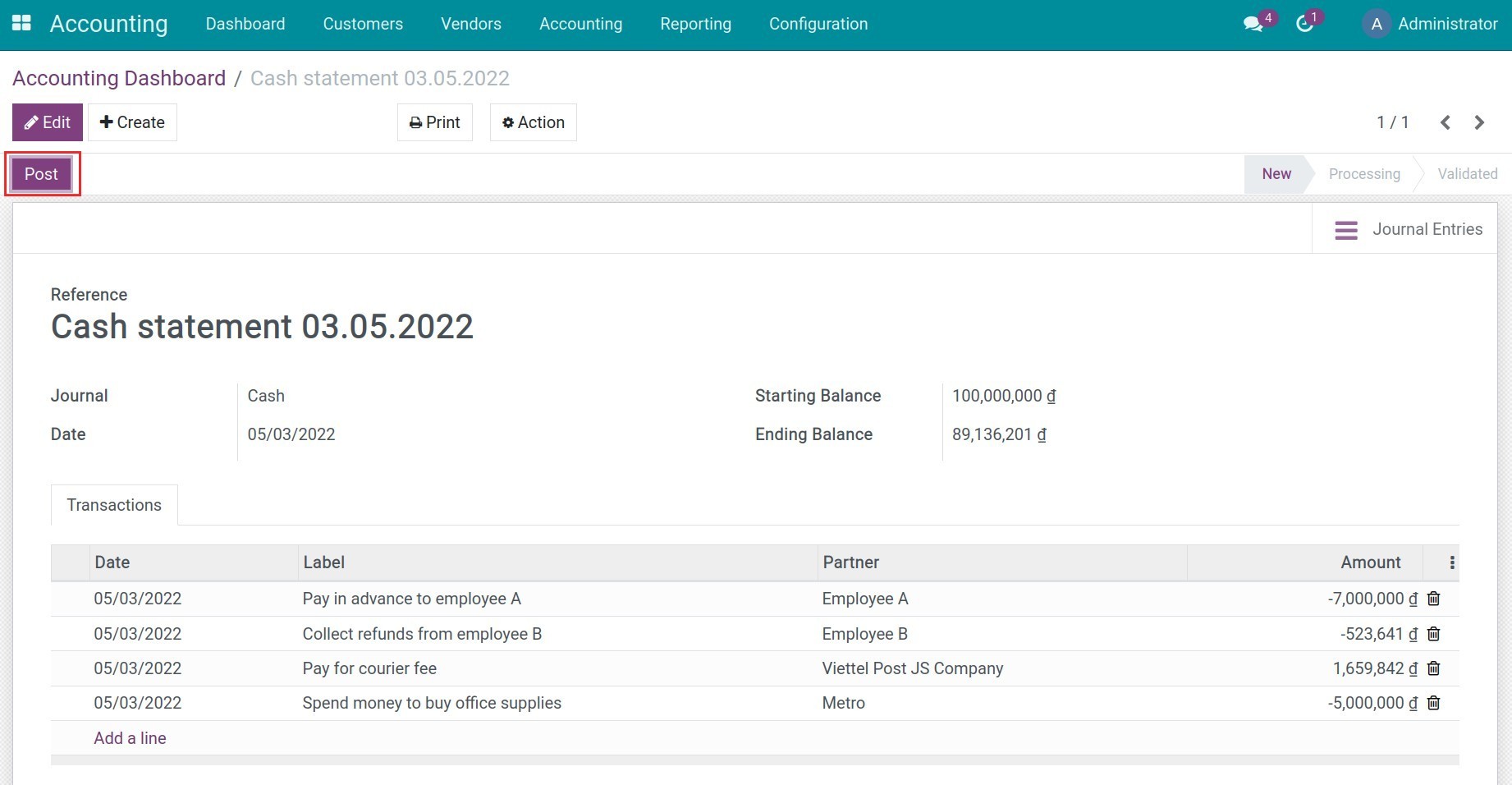

Cash receipts/payments reconciliation

As you know, the reconciliation of the cashier’s statement with the accounting journals is necessary to make the funds transparent.

After entering the statement entry is completed, hit Post.

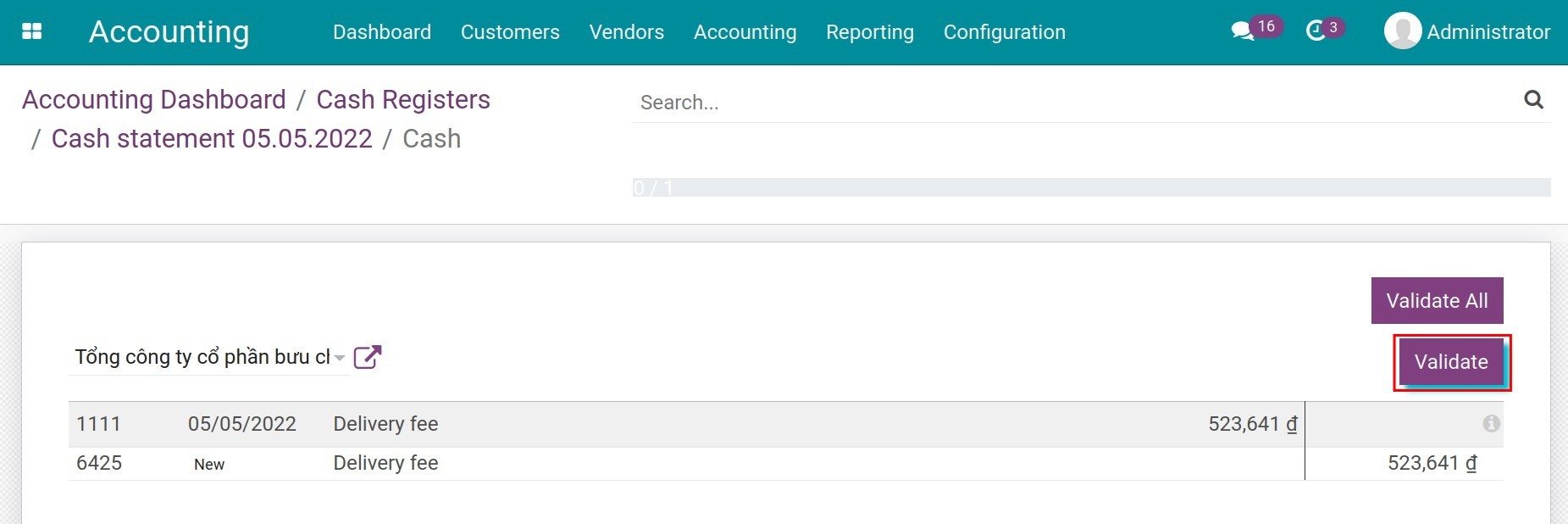

Hit the Reconcile button. The system will automatically identify and suggest the corresponding arising amounts.

Check the information and hit Validate.

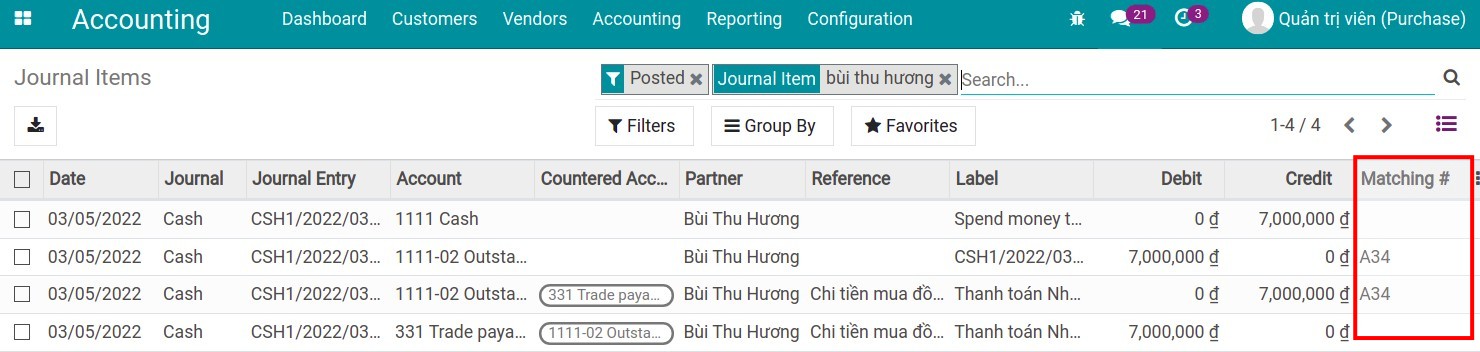

At this step the behaviors of the system will be:

For a transaction that has a payment slip, the system will generate a matching code to identify this transaction as completed.

Note

To see the Journal Item and the matching codes, you must enable the developer mode in the system.

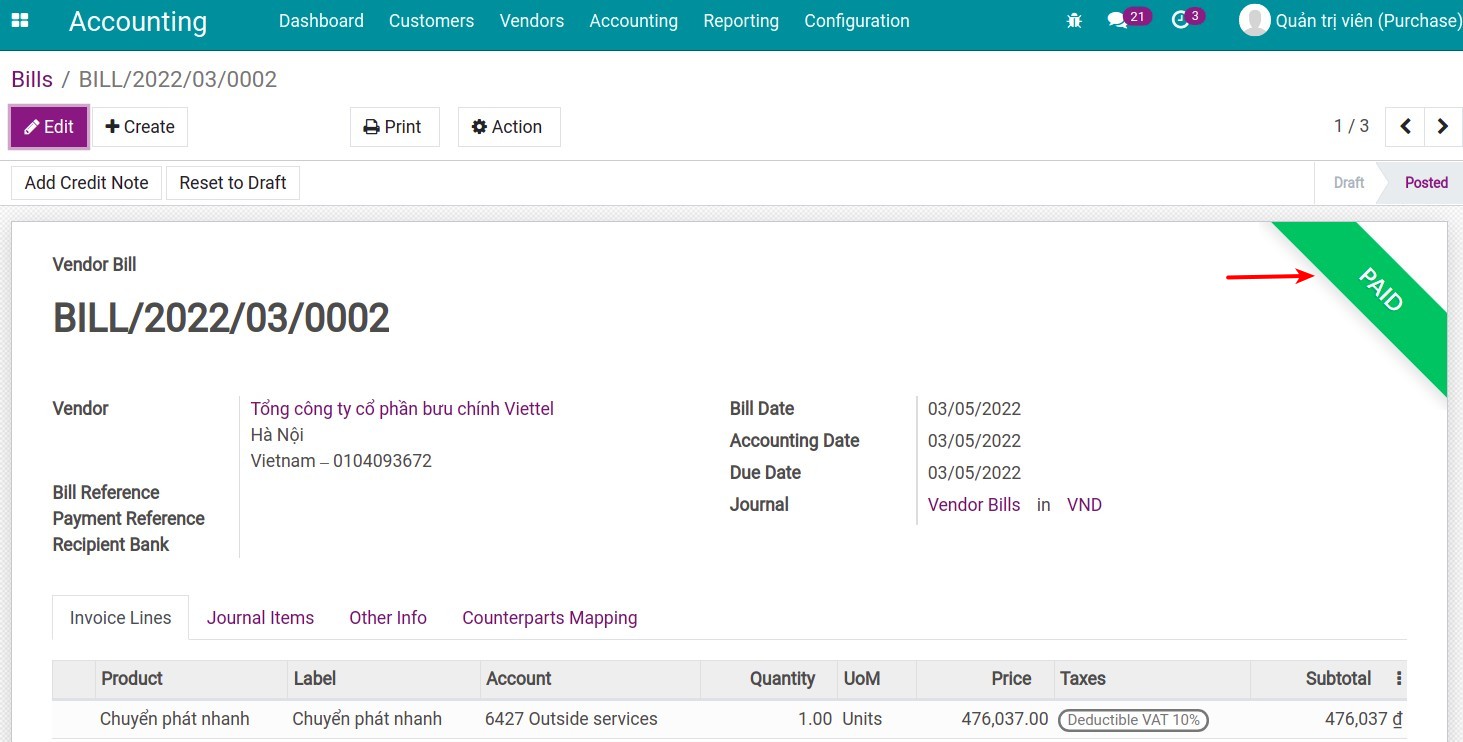

For a transaction that has not yet issued a payment slip but has a Vendor bill, the status of the invoice will be changed to Paid and the debt will be 0. A journal entry will be automatically created to register payment .

After the reconciliation and counting is completed, then do the saving and validation.

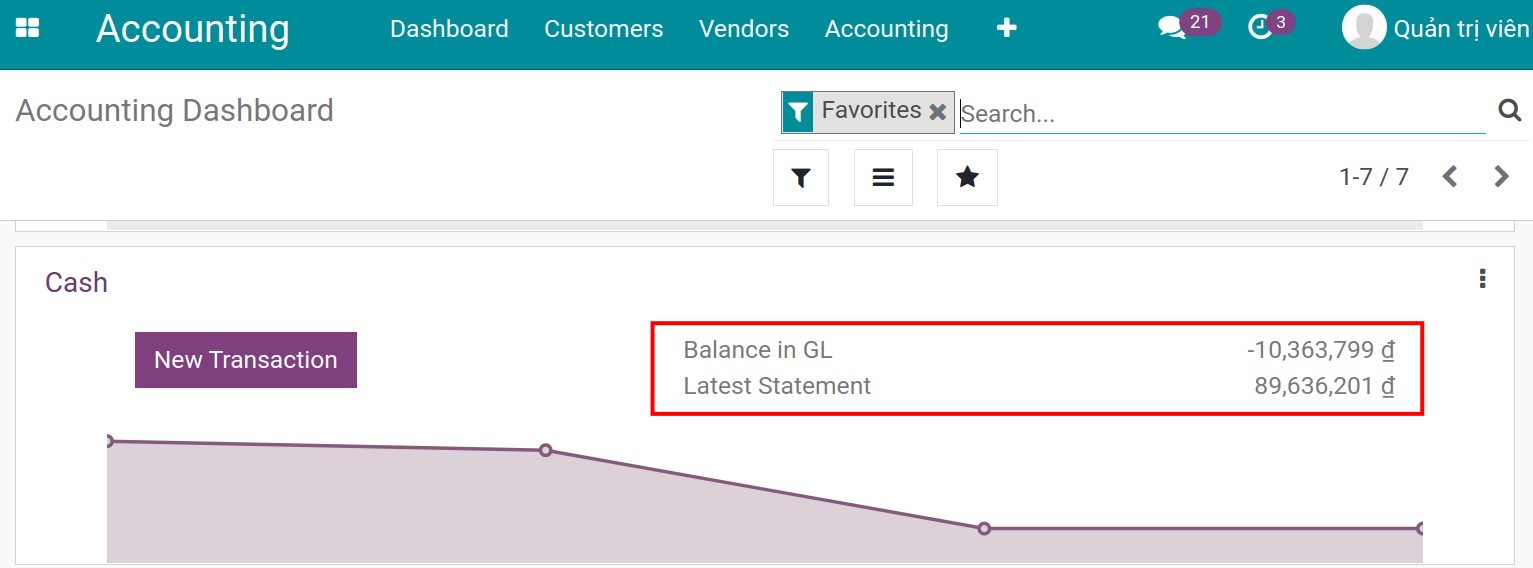

The status of the statement has been changed from Processing to Validated. On the view of the Accounting Dashboard, in the cash journal you will see the balance recorded in the General Ledger and the actual balance of the latest statement. If there is a difference you will also see the information here.

Cases occurring when counting cash on hand

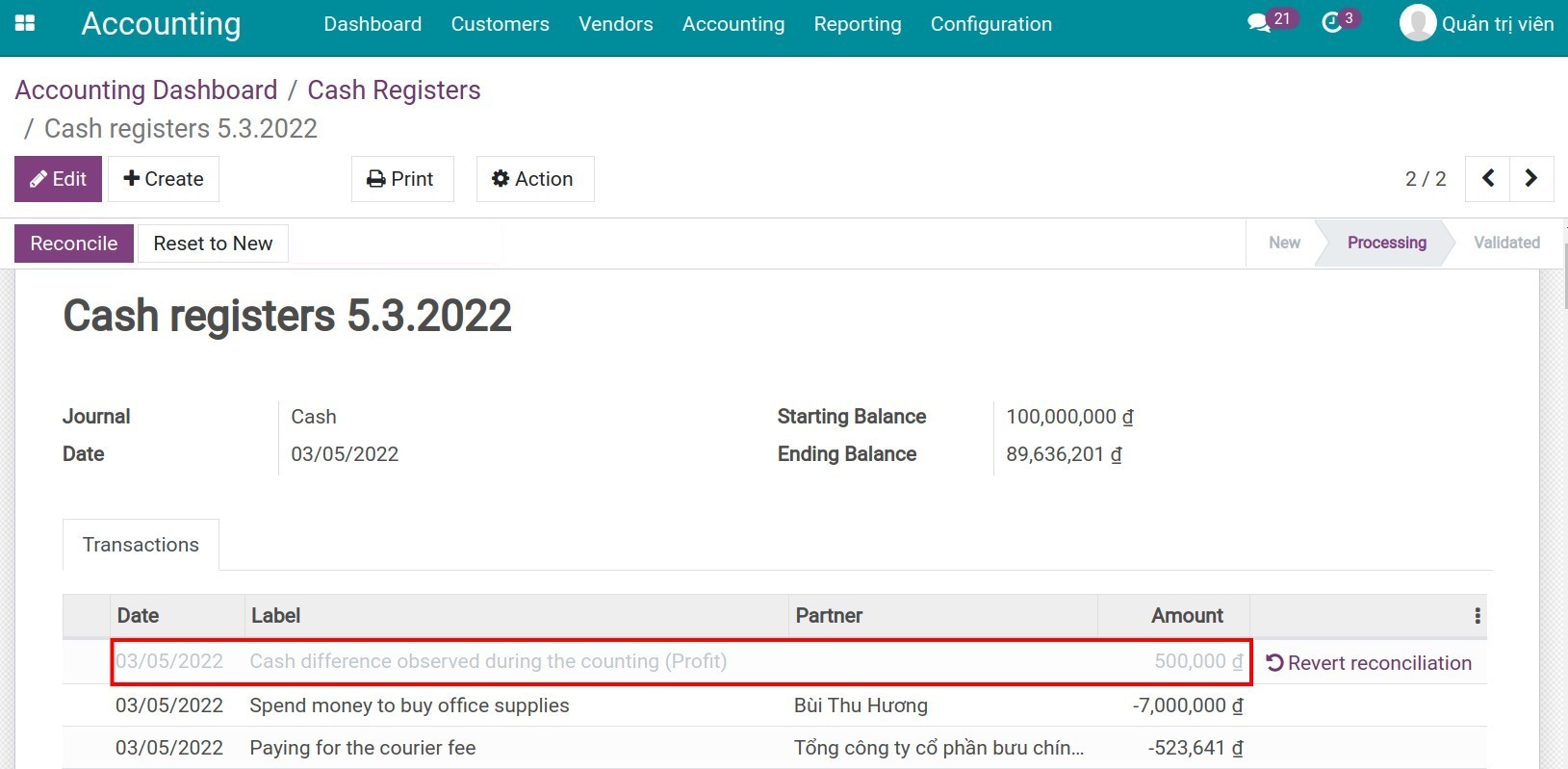

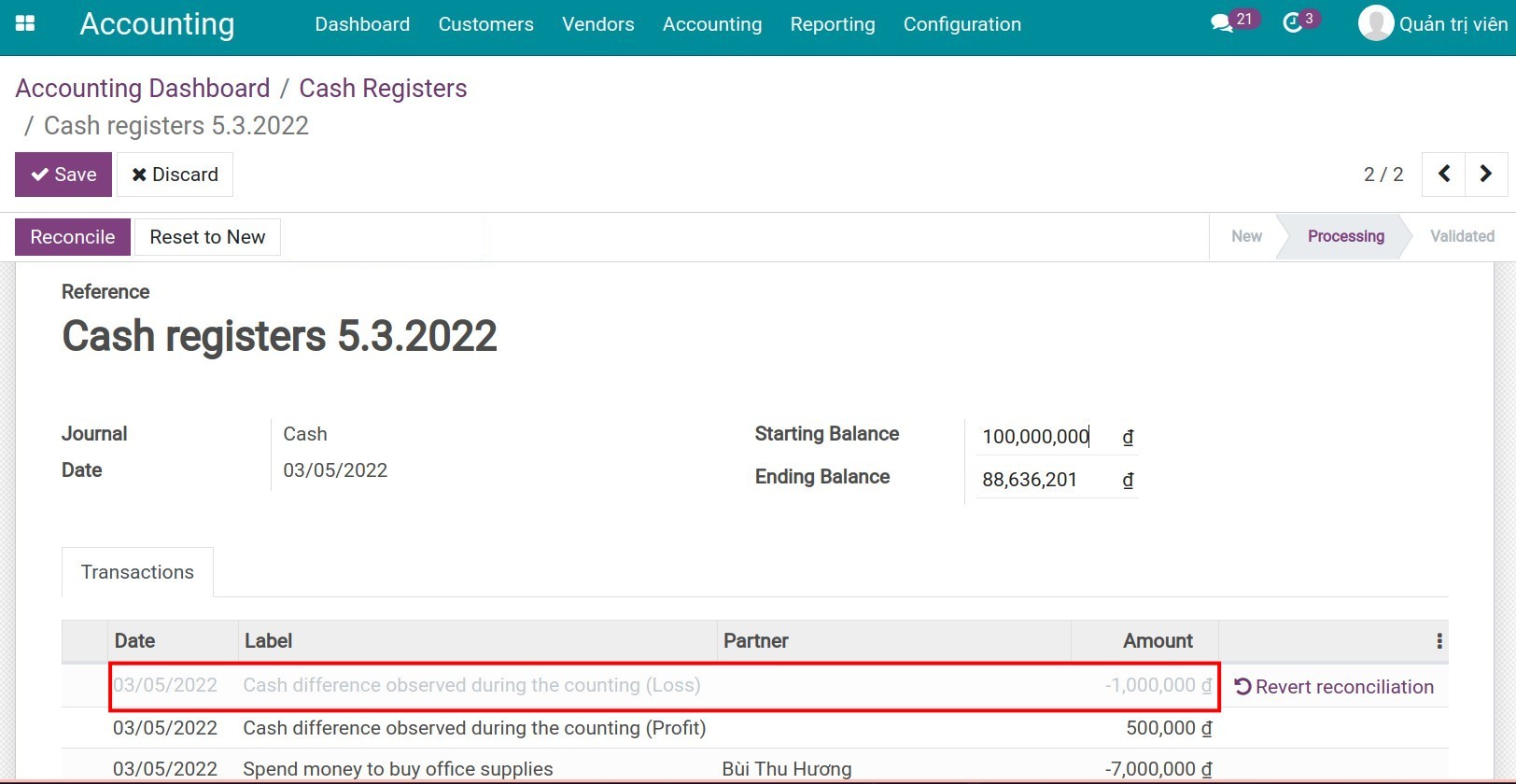

Counting of excess funds

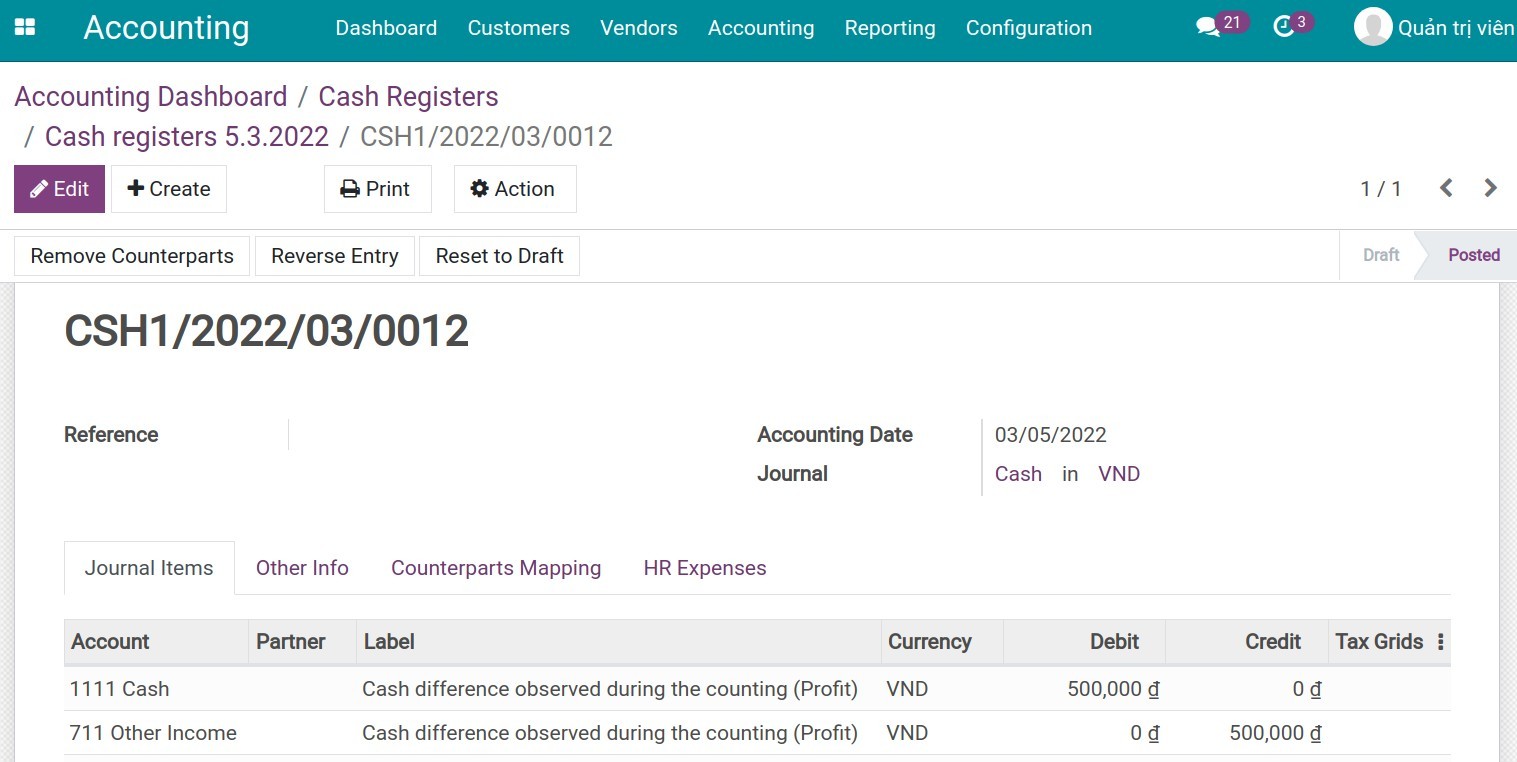

The ending balance after counting in the fund exceeds the computed balance. After saving and posting, the system will automatically generate a statement line recording the amount in excess with the content Cash difference observed during the counting (Profit).

Another accounting entry is generated, recording this cash difference as increase in the cash journal and the status of this entry is now Posted.

Counting of shortage of funds

Similarly, when there is a shortage of funds, the system also automatically generates a statement line recording the missing amount with the content Cash difference observed during the counting (Loss). An accounting entry, which is also automatically generated, records this amount missing in the cash journal.

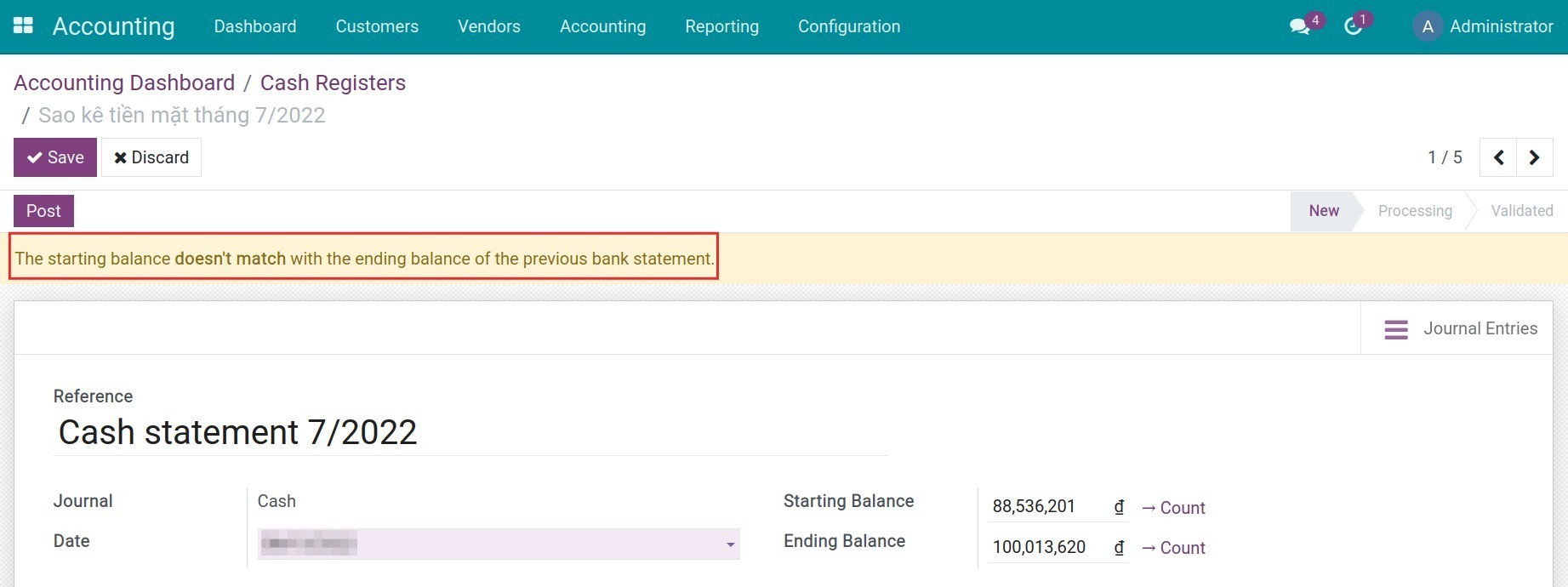

The difference between the starting balance of this period and the ending balance of the previous period

Normally, the system will automatically convert the ending balance of the previous period to the starting balance of the new statement. However, these data can be adjusted and if you do it, it will lead to data heterogeneity (mismatch). The system will display a warning as shown below.

Note

If you want to deactivate the warning, you must find the mistake and solve it by filling the matching starting balance.

See also

Related article

Foreign currencies management

How to handle Petty Cash in Odoo

Configure charts of accounts and depreciation method for Assets Category

Assets of an enterprise are both tangible and intangible resources owned, controlled, and distributed by that enterprise, to create economic value.

iSuite brings to customers different ways to create an asset:

Create assets directly at the Assets menu;

Create assets from Vendor bills;

Create assets from Stock receipts - Stock deliveries.

Whatever the approach you choose, you still need to create an Asset Category first. This is the place to classify and track an asset. An asset belonging to this Asset Category will inherit all configurations of that category. Each asset might have its own characteristics that need to be configured differently from the settings of the asset category. This topic will be explored in other articles. In this article, we will focus on how to set up an Asset Category.

Requirements

This tutorial requires the installation of the following applications/modules:

Assets Management

Accounting & Finance

Chart of Accounts

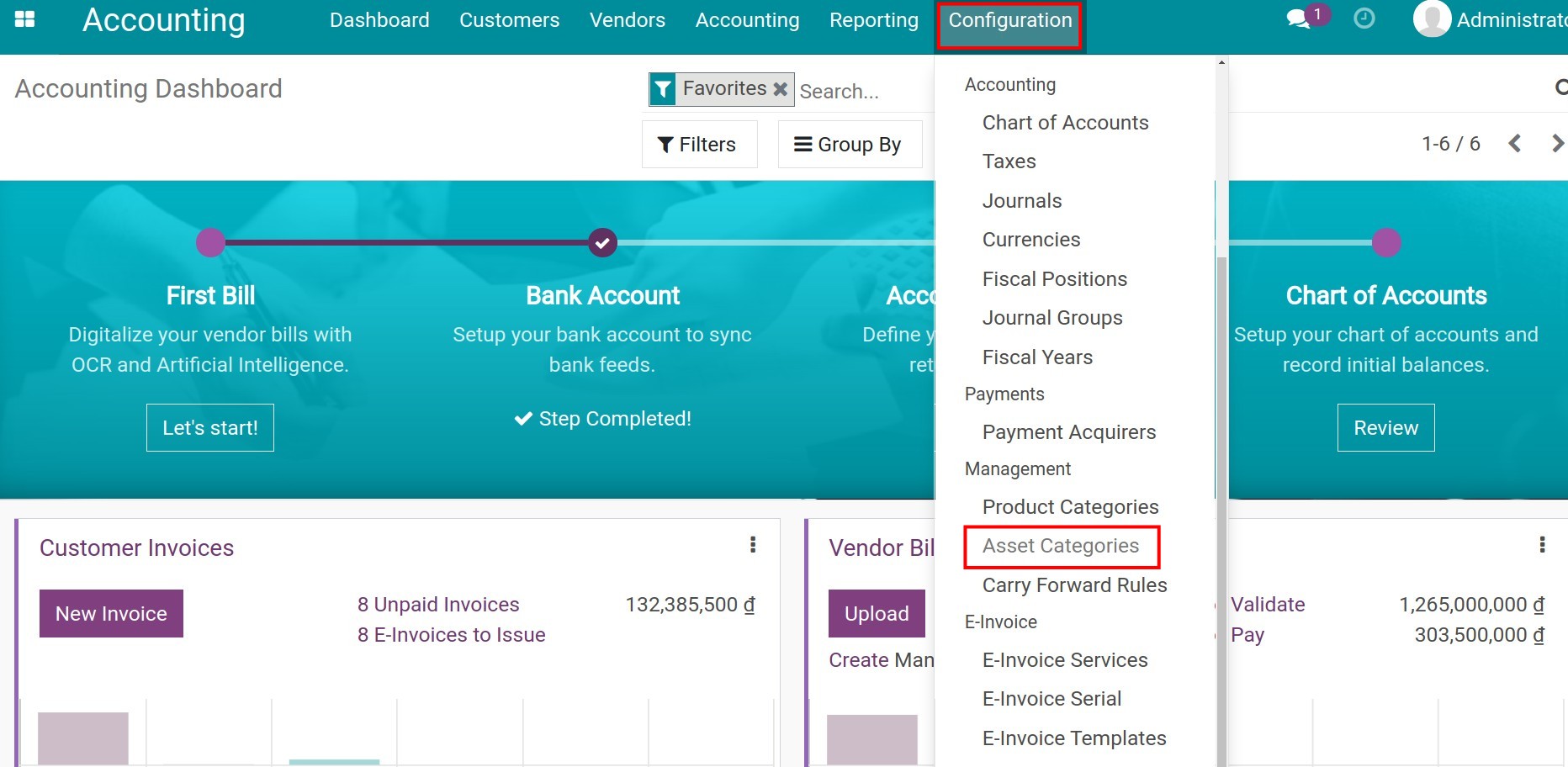

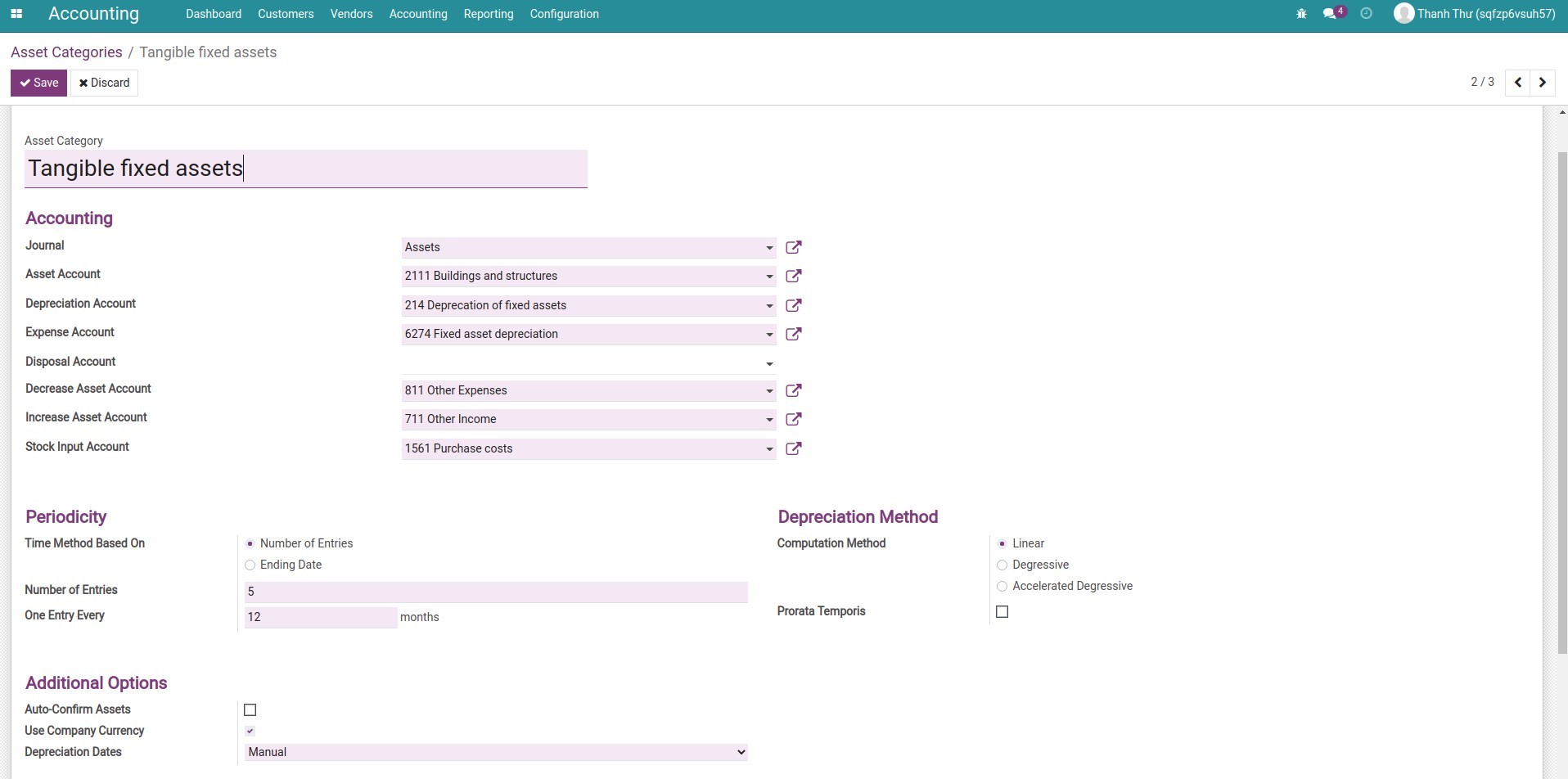

Configure Asset Category